外文翻译:应收账款(张从改)

外文翻译-应收账款

earnings, companies can earn a satisfactory profit as well as a return on investment.

EKON. MISAO PRAKSA DBK. GOD XXII. (2013.) BR. 1. (21-38) Kontuš, E.: MANAGEMENT OF ACCOUNTS...

1.

INTRODUCTION

Accounts receivable is the money owed to a company as a result of

Firstly, the purpose of the empirical part of the study is to analyze accounts

receivable and to demonstrate a correlation between the accounts receivable level

Receivables represent credit sales that have not been collected. As the customers

pay these accounts, the firm receives the cash associated with the original sale. If

sales along with the company's credit and thecollection policies.

Accounts receivable management includes establishing a credit and

关于应收账款外文文献和文献中文翻译

上海财经大学浙江学院毕业设计(论文)外文翻译译文:会计帐户应收账款(AR)侯赛因·Pashang瑞典延雪平大学文摘:治理工商管理财务报表的质量是一个关键问题。

经过痛苦的经验与实践的表外会计、应收账款(AR)的概念越来越多地得到了管理层的注意。

这种关注的原因之一是,可以使用基于“增大化现实”的技术,高度灵活的方式,来影响底线和债务/股本比例。

本研究的目的是,通过必要的信息披露和其他一些会计原则和客观性等思想, 重要性、匹配和公允价值批判分析中使用的技术评估和测量的基于“增大化现实”技术。

关键词:会计确认、会计应收账款、会计披露。

1.介绍账户操作的概念,包括“收益管理”,主要是附加的损益表的项目。

例如,科普兰(1968)集中在收入报表和观察到管理影响净利润的大小有目的地。

按照构建三个“否则”不利于收入的概念,“收益极大化者”和“收入smoothers”他把收入作为管理中心的研究重点。

值得注意的是,盈余管理的概念,表示一个特定类型的会计实践,把注意力只在损益表。

然而,账户操作可能分类上的实践,这些相关的平衡负债表和损益表分类。

这些类型的操作不是文学中描述。

也许,这个缺点的原因应该与复杂的会计技术有关,应用于促进盈余管理。

一项研究由理查森et al .(2002)表明,盈余管理主要是根据收入确认,包括基于“增大化现实”技术。

他没有表明,使用基于“增大化现实”技术的方式来操纵帐户。

观察的会计违规和会计错误当局要求重述或修正的年度报告。

AR-related重述的原因应该与所需的“盈余管理”,包括操作的资产负债表和损益表。

看起来,“收益管理”是在路上被安放“管理帐户”的概念。

新概念建构的旧概念收入管理和沟通管理更中性时尚的观点影响会计(见,例如。

金融时报》6月8日,2009年)。

根据定义,收益管理一组通信方式管理人为管理以满足一些预先设定的预期收益水平,如,分析师预期。

跟上一些收入趋势,据分析师估计,它是先验假定可以影响投资者对风险的看法(Riahi-Belkaoui 2005;马修斯和佩雷拉1996)。

应收账款风险管理外文文献翻译2014年译文3530字

文献出处:Michalski G. The Study of Accounts receivable risk management [J]. International Review of Business Research Papers, 2014 (68): 83-96.(声明:本译文归百度文库所有,完整译文请到百度文库。

)原文The Study of Accounts receivable risk managementMichalski G.AbstractIn the fierce market competition, enterprises in order to obtain a competitive advantage, in addition to relying on product,price, advertising and other means, basically use credit to credit as the foundation of this marketing means. The development of credit, to a certain extent, to expand the company's market share, improves the competitiveness of enterprises, but on the other hand, the formation of a large number of accounts receivable. Due to the factors of customer, market and many other aspects of existence, accounts receivable is easy to form a bad and doubtful debt. Once the bad and doubtful debts too much,would seriously endanger the development of the enterprise, and even lead to bankruptcy. Therefore, enterprises in the positive use of credit this marketing means to expand market share, we must strengthen the management of accounts receivable using a variety of measures, to reduce the risk of accounts receivable, in order to avoid business dilemma to expand credit and difficult to collect the payment. Under this background, the research of enterprise accounts receivable risk management has a very important significance to reduce enterprise accounts receivable risk.Key words: Accounts receivable; Risk management; Credit management1 IntroductionEnterprise in order to expand product sales, increase product sales, more or less, there are certain goods sell on credit, goods sell on credit is formed the account receivable, thereby increasing the risk of enterprise operation. Therefore, the enterprise must take practical measures, formulate rational and effective managementmethods, such as accounts receivable beforehand prevention, supervision and recycling management, to ensure the reasonable occupied level of accounts receivable and payment security, as far as possible to reduce bad debt losses, reduce business risk. In order to strengthen the management of accounts receivable risk, to revitalize the enterprise funds, increase the risk resistance ability of the enterprise. Through effective management, can guarantee the enterprise production and management normalization, reduce unnecessary financial expenses keep enough cash flow, can be more flexible to respond to market changes, increase the ability to resist risks of enterprises in the market, to better control the market.2 Problems need to be solved2.1Internal control department responsibilities chaos. Internal control system refers to the unit in order to ensure that business activities orderly, ensure the safety and integrity of the assets, prevent fraud, and fraud, and realize the goal of management and develop and implement a series of has the control function of the methods, measures and procedures. In the era of the socialist market economy, the enterprise accounts receivable risks mainly because of the internal system, one-sided pursuit of profit, did not establish the sustained development strategy, lack of communication between sales department and finance department, not assign special personnel to pursue of accounts receivable, no accounts receivable inventory system is established.2.2 Sales staff lack of professional ethics. Some salesman wanted to get rich without considering corporate interests, only to complete performance when selling products, not to take to the customer management by objectives, the lack of effective planning, after the occurrence of credit to the customer pledge no tracking or lack of tracking, collection of easily accept the customer the reason and finish the receivable task. Lack of complete sales idea, don't think the recovery of payment is a part of sales. These behaviors can't provide accurate market information, for the company to mislead the company decision, reduce the company's economic benefit, resulting in enterprise receivables cost increase.2.3 lack of advanced analysis of the accounts receivable risk degree. Enterprise musthave a large number of sales of goods, in order to survive must withdraw the payment at the same time, only in this way can enterprises healthy development, but sometimes in order to expand sales of enterprises by credit, also can produce a large number of accounts receivable, accounts receivable increase directly affect the enterprise's short-term debt paying ability and cash flow. To this, the enterprise must according to the customer in reimbursement dynamics of accounts receivable risk rating, see which companies can return on time, which don't, take action on their payments, in advance to avoid the loss.2.4 Credit management system is not perfect.At present our country has just started to establish the system of credit management, credit management system is almost blank, credit management units are mainly limited to the banking, securities and other financial institutions, enterprises are few. Enterprise is mostly blind credit policy, the result is looser credit policy, easy cause credit long maturity and high cash discount, low credit standards. At the same time, the social credit consciousness is weak, many enterprises do not value their own credit, malicious delinquency, form a vicious circle, causes the credit crisis.3 How to deal with the enterprise accounts receivable risk3.1 Improve accounts receivable internal control system.Set up a perfect credit management, to manage customer credit, to the customer for effective risk management, the purpose is to predict in advance to reduce losses. Understand the customer's credit situation, establish credit files for customers according to collect information for dynamic management. Enterprise financial department should regularly take back, aging of accounts receivable, cost, and so on and so forth, should use the ratio in the analysis, comparison, trend, analysis methods, such as the structure analysis of overdue loans bad debt risk and the impact on the financial condition, to determine bad treatment and the current credit policy. Check the implementation of internal control system, internal audit department to check whether there are accounts receivable cannot be brought back, check whether there is any major mistakes, dereliction of duty on staff, internal fraud, deliberately not withdraw accounts, etc., to ensure the recovery of accounts receivable. Sales department shall establish a perfectmarketing system, and constantly improve the level of sales personnel's professional ethics, strengthen the performance, not to sell, while ignoring the potential risk of receivables.3.2 Perfect sales staff appraisal method. An enterprise to keep accounts receivable is not high, we must strengthen the enterprise staff risk awareness, the operator is the soul of enterprise management and sales personnel, is the direct way to create sales revenue, if in this link problems, will affect the healthy development of the enterprise, the enterprise should enhance the propaganda work for employees, increasing reward, make employees to realize enterprise management state is closely connected with employees, earnestly, completes the labor of duty, improve enterprise economic benefits. Set up payment for goods collection appraisal system.In order to prevent sales staff one-sided pursuit of sales and sales, enterprises should make payment for goods inspection rewards and punishment system, such as accounts receivable, bad debt loss rate index, carries on the inspection of relevant staff, in order to determine the rewards and punishments.3.3 Strengthen the advanced analysis of accounts receivable risk degree. Accounts receivable risk analysis for an enterprise to correct forecast development trend of accounts receivable is very important, is advantageous to the accounts receivable back on time, reduce bad debt losses, therefore the enterprise accounts receivable, enterprises should take various measures to strive for timely recovery of funds, to not withdraw money, should do a good job in the accounts receivable risk degree analysis, when it is necessary to take certain measures, in order to reduce the risk of accounts receivable. In this use ABC classification management of inventory management, to talk about how to analyze the degree of accounts receivable risk.3.4 Enhance the management of enterprise credit system. In order to strengthen the management of accounts receivable, formulate an effective accounts receivable credit policy, not only can save funds advance expenditure, reduce bad debt losses, but also can expand sales, improve the economic benefits of enterprises. Establish customer credit evaluation system, risk aversion. Customer credit evaluation system is carried out on the customer credit evaluation, according to the evaluation results toidentify which customers can give commercial credit, which you can't, control the accounts receivable risk. When the customer credit evaluation, from the two aspects of qualitative and quantitative analysis.Qualitative analysis - credit standards. Qualitative analysis is a kind of credit standards, credit standard is to provide business credit, and minimum requirements, establish standard of credit is the key to consider customer delay the payment, or refuse to pay the payment to the company the possibility of damage. The determination of credit standards, mainly according to the actual situation of enterprises, market competition situation and the customer's credit situation to decide. Enterprises in determining the credit standards to do comprehensive problem. Typically companies can use a standard, in order to measure and compare the customer's credit standing. In addition, the company is necessary to conduct regular customer credit quality inspection and evaluation analysis. We can through to the customer's quality, ability, capital, collateral, makes an analysis of the operating environment, etc, this evaluation method is commonly referred to as 5 c system evaluation method, the system is an important factor to evaluate customers' credit quality.Quantitative analysis --, credit conditions. Quantitative analysis is, in fact, a kind of credit conditions. Credit conditions refers to the enterprise for customer credit payment, including credit term, discount and cash discount, is the customer credit quantitative, according to the quantitative index to evaluate the customer credit risk prevention. Customer credit index quantitative process is first calculated can reflect customer debt paying ability and financial status of the main indexes. These indicators including asset-liability ratio, current ratio, quick ratio, equity ratio, etc., and then reflect the quantitative indicators of customer credit compared with normal indicators divided customers into several categories, and different for different categories of customer credit policy, in order to avoid the blindness of sell on credit.3.5 Intensify receivables collection and cash. Accounts receivable collection is in the customer without payment within the prescribed time limit, after the occurrence of accounts receivable, various measures should be taken, as far as possible the paymentfor goods timely recovery. For overdue accounts receivable, should according to its default time, amount to carry on the analysis, collection measures according to the circumstance, collection measures: 5 days late, a first letter again, we call each other asked, head of the situation and understand their attitude, know the reason why the customer can't pay;30 days overdue, it issued a second again, and immediately stop supply again on the phone, cancel the credit limit and credited to corporate customers credit list; Exceed the time limit of 60 days, the third seal again letter, if possible for customers to visit; Overdue 90 days, a fourth letter again letter, consulting professional institutions, the debt to asset survey;180 days overdue, consider litigation or arbitration. In order to guarantee the normal business activities of enterprises, improve enterprise economic benefits, we should reasonable use of accounts receivable, cash for accounts receivable. Enterprises can use accounts receivable to loan, do so on the one hand, reduce the accounts receivable too much, can get a bank loan at the same time, for the enterprise development, enterprises can also be discounted receivables into commercial paper, use of bill financing, reduce the cost of the loan, enterprises can also use accounts receivable factoring financing. Therefore, when the accounts receivable too much, the enterprise should enhance the cash accounts receivable, reduce the loss.4 ConclusionsAccounts receivable is not merely a kind of credit risk management after the event, but a continuous space on a full time complete process. Should be a process and a full range of management process, is a kind of management thought. Comprehensive reflected in accounts receivable management is not only sales department and finance department's affairs, but the collection of the sales department, finance department, accounting department and legal department affairs and the power of the internal audit department. This paper to prevent and dissolve all kinds of accounts receivable risk, lists the concrete methods of the various measures, some may be in domestic has not implemented, but believe as companies stepped up on accounts receivable risk management, continuous improvement of the primary market, the improvement of domestic credit environment, accounts receivable risk will begreatly reduced. Account of the risk management in the developing process of hard to avoid can appear some new problems, which has yet to be further solved译文应收账款风险管理米科斯基摘要在激烈的市场竞争中,企业为了获取竞争优势,除了依靠产品、价格、广告等手段之外,基本上都釆用了以信用为基础的赊销这一营销手段。

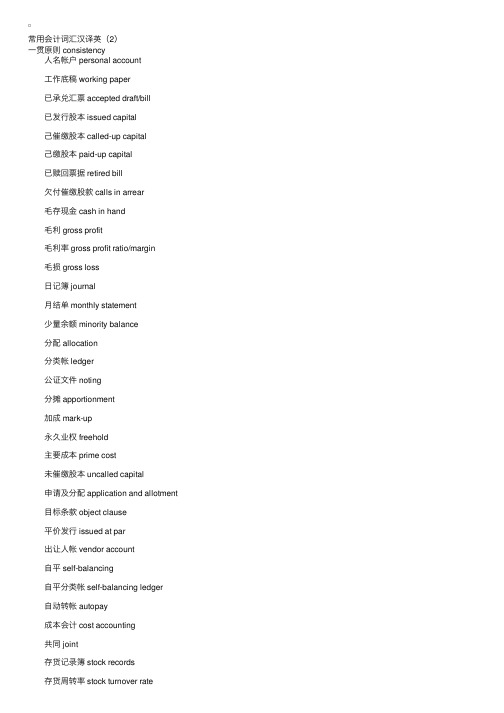

财务英语词典_财务术语中英文对照

财务英语词典_财务术语中英文对照A:abandoned property废弃财产面abandonment废弃、放弃货载(海运保险中遇有损失,货主放弃原货,取得全额赔偿)abandonment charges废弃费用abatement折扣abnormal depreciation特别折旧above par超出票面价格absorbed burden (同applied expenses)已吸收负荷absorbed costs已吸收成本absorbed declination已吸收跌价absorbed expenses (同applied burden)已吸收费用absorption吸收abstract book收支撮要簿abstracts撮要表acceptable accounting principle可岁接受会计原理acceptable principle可接受原理acceptance承兑;承兑汇票acceptance maturity record承兑票据到期记录acceptance payable应付承兑票据acceptance receivable承竞票据登记簿accepted accounting principles已接受会计原理accepted draft (bills) 已承兑汇票Accepter 受票人Accommodation bill; accommodation note (kite); accommodation paper欠单Account帐;帐户;会计科目Accountability会计责任Accountable warrant责任支出的支付命令(即事前未经审计的支付命令)Accountancy 会计官;会计学;会计工作Accountant 会计员Accountant general 会计长;会计主任Accountant in bankruptcy破产核算员Account balanced 结平的帐户Account bill帐单Account books 帐簿(同books of accounts)Account classification 帐户分类(同classification of accounts)Account current 往来帐Account form 帐户式Account form of balance sheet 帐户式资产负债表Account form of profit and loss statement 帐户式损益表Account payable 应付未付帐Account (fiscal) year会计年度Account year 帐户年度Accounting 会计;会计学Accounting books会计簿册Accounting control会计统制Accounting convention会计惯例Accounting department会计部Accounting documents会计凭证Accounting item会计科目Accounting machines 会计机器Accounting on the accrual basis 权责发生会计制Accounting on the cash basis 现金收付会计制Accounting organization 会计组织Accounting period 会计期间Accounting personnel 会计人员Accounting practice 会计实务Accounting principles 会计原理Accounting procedure 会计程序Accounting reports 会计报告Accounting standards 会计准则Accounting statement 会计报表Accounting system 会计制度Accounting theory 会计理论Accounting unit 会计单位Accounting year 会计年度Account of bankruptcy破产帐Account of executors遗产清册Account of payments 支出表Account of proceedings 遗产会计报告Account of receipts 收入表Account of receipts and payments 收支表Account of the exchequer国库帐Account receivable 应收帐款Accounts sales 承销清单Accounts if treasury 公库帐;金库帐Accounts payable 应付帐款Accounts payable ledger 应付帐款分类帐;应付帐款分户帐Accounts payable register 应付帐款登记簿Accounts receivable 应收帐款Accounts receivable assigned 应收帐款转让Accounts receivable discounted 应收帐款内贴现Accounts receivable ledger 应收帐款分类帐;应收帐款分户帐Accounts receivable register 应收帐款登记簿Account title 收户名称;会计科目Account titles for annual expenditures 岁入科目Account to give, giving account 支出帐目Accrual basis 权责应计制;权现发生制;应计制;发生制Accrued assets 流动资产;应收未收款项Accrued bond interest 应收未收债券利息Accrued cumulativedividends 应收未收股利Accrued depreciation 应摊未摊折旧Accrued dividends 应计股利Accrued expenses 应计费用Accrued income 应计收益Accrued interest payable 应付应计利息Accrued interest receivable 应收应计利息Accounts items 应计项目Accounts liabilities 流动负责Accounts payables 应付应计项目Accounts payroll 应计薪工Accounts profits 应计利益Accounts receivables 应收应计项目Accounts rent 应计租费Accounts taxes 应计税捐Accounts wages 应计工资Accumulated deficit 累积亏绌Accumulated depreciation 累积折旧Accumulated dividends 未发累积股利Accumulated profits 滚存利益;累积利益Accumulated surplus 滚存盈馀;累积盈馀Accumulation 累积Accumulation of discount 折价的累积Accumulation schedule 累积表Accumulative sinking fund 累积偿债基金Accursed items 期前债务Acquisition cost 取得成本Active assets 活动资产(指常有本利出入的资产)Active debt 活动债务Actual partner 普通股东Actual cost 实际成本Actual debts 实际债务Actual depreciation 实际折旧Actual liabilities 实际负值Actual value 实际价值Actual machine 加数机Additional budget 追加预算Additional order 添办定货;增加定货Additional part of a bill 期票附件Additional payment 追加支付Additions 增加固定资产Additions to property through surplus 由盈馀增加的财产Adjunct account 附加帐户Adjusting entries整理帐Adjustment account 整理帐目Adjustment memo 高整凭单Administration account 管理科目Administration budget 行政预算Administration expenses 管理费用Administration section 管理之部(分部损益表的一部分)Administrative accounting 管理会计(为供给管理员管理上所需资料的会计) Administrative expenses管理费用Administrator 遗产管理人Admissible assets 可税资产Ad valued duty 从价税Advame freight 预付运费Advance department 放款部Advances 预付;垫款Advances to officers and employees 职工预支Adventure 短期投机买卖Adventure accounts 短期投机买卖帐Advertising expenses (fee) 广告费Advertising expenses prepaid 预付广告费Advice note 通知书Advice of audit 审核通知书。

企业应收账款管理外文翻译文献

企业应收账款管理外文翻译文献(文档含英文原文和中文翻译)原文:Enterprise receivables management analysedFenXi mining chemical company zhaoAiping【abstract 】in order to meet the expanding sales and increase the competitiveness of the enterprises, reduce inventory, reduce inventory risk and management expenses need, the business activities in El often created accounts receivable. Accounts receivable is the enterprise is an important, the risk is bigger liquid assets, its quality is good or bad for a business often has had a significant impact. Because of the important account receivable, according to some accounts receivable management and accounting, points out the existing problems in the disadvantages of account receivable mismanagement, and puts forward some to strengthen the management of accounts receivable practices.【keywords 】receivables; The provision for; Management riskAccounts receivable is the enterprise is an important, the risk is bigger liquid assets, its quality is good or bad for a business often has had a significant impact. These long-term difficult to recover the accounts receivable existence, seriously affected the enterprise. The normal production and business enterprise management costs, increased to different extent some enterprise into a financial crisis.The role of account receivable. Expand sales, increase the competitiveness of the enterprises in the fierce market competition situation, is to promote the sales of credit is an important way. Enterprise credit is actually to provide customers with the two transactions, to customer selling products, and in a limited period introverted customers funds. In credit-tightening, market weakness, lack of money, the promotion with obvious credit for enterprise sales role. New products and explore new market is more important significance.Reduce inventory, reduce inventory risk and management costs. To the enterprise to hold finished goods inventory additional fee, warehousing costs and insurance expenses; Instead, the enterprise to hold accounts receivable, you do not need the spending. Therefore, when the enterprise products inventory more for long time,generally can use more favorable credit conditions, the inventory into pipes receivable and reduce finished goods in stock, save related expenses.Accounts receivable in the management of the existing problemsAccounts receivable is broad, fixed number of year long. AmountsEnterprise to accounts receivable accounting is not standard. According to the provisions of the state financial and accounting systems. Accounts receivable is accounting enterprise for selling goods or services to happen to purchase unit shall be recovered or accept labor unit payments. But the enterprise did not strictly according to the provisions of the accounting enterprise receivables. Cause some should not be in the project accounting money also included in the project, cause accounts receivable accounting has no reality.The account receivable NPLS not timely, to the enterprise confirmed the appearance of virtually increased asset caused. Because enterprise to accounts receivable slackened management, especially some enterprise also to accounts receivable as means of adjusting profit. So on the account receivable SiZhang confirmation on staying there ~ some problems. Is mainly to stay SiZhang has already formed the receivables confirm fast enough, for many years in the accounts receivable formed account long-term, eased some already can't withdraw, this provision for the provision for no provision of virtual enterprise assets, causing thickening.Because some of the managers and operators enterprise financial management consciousness and lack of management concept. To accounts receivable is lack of effective management and collect investigation the author feel. In Shanxi Province in the part of the province tube enterprise still exist serious planned economy of ideas, these people to the market economy can't say don't understand, also cannot say don't understand, the main thing is not starts from oneself, and in practical work is often said the much, do less. Thought is drunk on the production and business operation this center, not how to do well management finance the primacy, failed to do the business management financial management as the center. Financial management to fund management as the center. The management of funds and use only paying attention to how to borrow and spend money, not for existing resources and capital for effective configuration and mobilize. Cause enterprise produced a considerable amount of receivables, also do not actively from the Angle of strengthening management, so lots of money to clean up the long-term retention outside. Affected the enterprise normalproduction and operation activities and the efficient use of the funds.The drawbacks of the receivable mismanagementReduce enterprise funds use efficiency, make enterprise profits down because of enterprise logistics and cash flow not consistent, merchandise shipped, prescribing sales invoices. Payment is not keeping pace recovery, and sales have established, this not up recovery entry sales. Certainly will cause no cash inflow generated sales tax on profits and losses, and sales income paid and years be paid in advance. If involves span more than to sales revenue account receivable. Then can produce enterprise by current assets paid annual shareholders dividend. Enterprise for such pursuit arising from the pad surface benefits and tax payment paid shareholders take up a lot of liquidity, as time passes will influence enterprise capital turnover. Which led to the enterprise actual operation situation veiled. Influence enterprise production plan and sales plan, etc, can't realize the set benefit goal.Exaggerated enterprise operating results. Because our country enterprise executes accounting foundation is the accrual (receivable meet system). The current credit happened all to write down current income. Therefore, the enterprise account profit increase does not mean that can meet the schedule of realizing cash inflows. Accounting system requires the enterprise in accordance with the percentage of account receivable balance to extract the provision for, the provision for a 5% rates generally for 3% (special enterprise except). If the actual loss of bad happened more than extract the provision for, will give enterprise to bring the great loss. Therefore, the enterprise of account receivable existence. On the TAB virtually increased sales income. In oerstate enterprise operation results. Increased risks of an enterprise cost.Speeding up the enterprise's cash outflows. Sell on credit although can make the enterprise produces more profits, but did not make enterprise cash inflows increase, on the contrary make enterprise had to use limited liquidity to various taxes and fees paid, accelerate the enterprise's cash outflows, main performance for:Enterprise tax payments. Accounts receivable bring sales income. Not actually receive cash, turnover is computational basis with sales, the enterprise must on time pay by cash. Enterprise pay tax as value added tax, business tax, consumption tax, resources tax and urban construction tax, inevitable meeting with sales revenue increases.Income tax payments. Accounts receivable generate revenue, but not in cashincome tax, and realizing cash payment must on time.Cash the distribution of the profits. Also exist such problems. In addition, the cost of the management of accounts receivable and accounts receivable recycling costs will accelerate enterprise cash outflows.The business cycle has influence on enterprise. Operating cycle from obtain inventory to the sales that inventory and withdraw cash this time so far. Operating cycle depends on inventory turnover days and accounts receivable turnover days, the business cycle is combined. From that. Unreasonable accounts receivable existence, make business cycle extended, affected the enterprise capital circulation, make a lot of liquidity precipitation in non-productive link. Cause enterprise cash shortage, influence salaries and raw material purchasing, serious impact on the enterprise normal production and operation.Increased receivables management process. Error probability, brings to the enterprise enterprise to face the additional loss accounts receivable account, possibly to the timely discovery, accounting errors can prompt understanding and other receivables accounts receivable dynamic enterprise details. Cause responsibility unclear. Accounts receivable contract, Taiwan about, commitments, the formalities of examination and approval of such material scattered, lost may make the enterprise has happened on the account receivable unable to receive the full recovery of repayment, the only partially withdraw through legal means. Can recover, but due to material not whole and cannot be recovered, until eventually form the enterprise assets loss.To strengthen the management of accounts receivable methodComprehensive comb, and establish material parameter. For enterprise all kinds of receivables launch a comprehensive system of comb, queuing, check the work. Because in past economic activity business minority, inefficient pattern. Hard to adapt to the market economy requirement, the law of development in the increasingly fierce market competition gradually be eliminated, the enterprise is in production, BanTingChan, failed state, has formed a widespread accounts receivable account for a long (most age 3 years), former party leave the state of operation and the debtor changes etc. Phenomenon, to clear a check increase the difficulty. Workers should browse a large number of original documents, traced back to carefully each individual accounts receivable from the nature, time, happened contents, amount. According to zhang age, systems, area and the possibility of recovery of accounts receivable areclassified. Carefully analyzed collection verify each sum of money and amount. And this system, more likely way back near the door check account receivable; Way to outside the system, and is unlikely to far back of receivables through telephone enquiries, enterprise sent a letter, lawyers sent a letter way to undertake checking: some not so clear accounts receivable multilateral bug verification. Please go back to the original sales personnel, agent help check to ensure that the data obtained by the accurate, reliable and accurate data collected in the visiting for the future of written-off receivables smoothly provide effective legal evidence. More importantly, with the debtor written-off receivables personnel and check accounts concerning the debtor family residence, operation sites, property status, income level made a comprehensive and detailed understanding, and according to the command of the debtor to evaluate solvency debt-repaying possibility. Judge, lock key goals for the next great written-off receivables smoothly and lay the foundation.Multi-pronged approach.we great effort, increase. After the preparation work or do. Accounts receivable written-off receivables entered the substantial "punish collect" crucial stage. In actual work, in order to give attention to collect the magnificence of the enterprise with benefit, one of the debtor to classify, different properties analysis of the debtor to adopt targeted collect method, in order to make the whole written-off receivables achieved good effect. The debtor to business clients. To possess management qualification, sound system, assets in good condition of customers, after consultations communication with the other, try to take groovy gathering way, so that both the collect keep good business cooperation relations; But for malicious long-term default behavior, used first lawyer in demand for collection, correspondence is invalid cases, still choose be representative of the debtor to court, apply for a court for compulsory execution. In the majesty of the law, the other group of a deterrent to repay the debtor will repay arrears, self-consciously plays to the whole written-off receivables to point the impetus with. On the system internal worker arrears. For system inside worker due to illness, life difficult, and many other reason formed non-business temporary loan, first of all, issued a document, clearly stipulates that deadline repossessed; Secondly, a large amount of arrears. Indeed, in a difficult to pay off after consultation with staff. Payment agreement signed. Divide second month in salary charged or deduct; Finally, the internal to laid-off employees and have extra-large disease worker, its economy is really difficult to repay embarrassment. In a humane treatment, offer certain debt relief. Such already make whole written-off receivables reach the expected effect, also can let laid-off workersto their real challenges organization care. Adopting property preservation measures. In the actual collect process. Often encountered some have the repayment ability but reimbursement conditions or timing immature the obligor, collect personnel can cooperate actively court on the debtor's property implement preservation, making cdo in court, under the help of the relevant accounting units and individuals to impose preservation of property. For property preservation at the same time. Appoint our wealth pipe center visit regularly the obligor, closely watching the debtor whereabouts, understand their property status. Once found the debtor reimbursement conditions mature, immediately notify the court, suspend the property preservation, reactivated cases. Applied to the court for compulsory execution withdraw arrears.Establish customer credit system. Strict credit business formalities for examination and approval from years of written-off receivables accounts receivable see. A few enterprises in experience increased sales push credit sales policy. Did not establish a complete customer credit system, to the customer assets status, reimbursement ability, financial situation, the credit rating don't know much. Even after receivable formation. Find the debtor to punish frequently occurred. There are a few enterprise to the customer credit conditions are too broad. Credit approval rights too scattered, sometimes a sales personnel can decided to sell on credit business formation. Cause some credit rating is low customers easily get credit, increasing the risk of bad loans.Earnestly implement post responsibility system, strict appraisal, rewards and punishments and trenchantSome enterprise although also established a comparatively perfect accounts receivable credit sales, management, a great responsibility and internal control system, but in actual work but become a mere formality, non-existing. Cause the enterprise internal responsibility unclear, the reward is unknown situation. To a certain extent, encourages the formation of large receivables, increasing the operating risk of an enterprise. So only with a good set of system doesn't solve all the problems in the practical work, the key still need to implement these system will reach the designated position, achieves truly in the bud.Foreign source :Friends of the accounting, in 2009 (30) 84 85译文:企业应收账款管理存在的问题及对策汾西矿业化工公司赵爱萍【摘要】公司为了满足扩大销售、增加企业的竞争力、减少库存、降低存货风险和管理开支等的需要,在El常的经营活动中产生了应收账款。

应收账款外文文献

应收账款外文文献本科毕业论文外文原文及译文题目 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 系别管理系专业会计学班级学号学生姓名指导老师外文原文外文原文Enterprise receivables management analysedFenXi mining chemical company zhaoAiping【 abstract 】 in order to meet the expanding sales and increase the competitiveness of the enterprises, reduce inventory, reduce inventory risk and management expenses need, the business activities in El often created accounts receivable. Accounts receivable is the enterprise is an important, the risk is bigger liquid assets, its quality is good or bad for a business often has had a significant impact. Because of the important account receivable, according to some accounts receivable management and accounting, points out the existing problems in the disadvantages of account receivable mismanagement, and puts forward some to strengthen the management of accounts receivable practices.【 keywords 】 receivables; The provision for; Management riskAccounts receivable is the enterprise is an important, the risk is bigger liquid assets, its quality is good or bad for a business oftenhas had a significant impact. These long-term difficult to recover the accounts receivable existence, seriously affected the enterprise. The normal production and business enterprise management costs, increased to different extent some enterprise into a financial crisis.The role of account receivable. Expand sales, increase the competitiveness of the enterprises in the fierce market competition situation, is to promote the sales of credit is an important way. Enterprise credit is actually to provide customers with the two transactions, to customer selling products, and in a limited period introverted customers funds. In credit-tightening, market weakness, lack of money, the promotion with obvious credit for enterprise sales role. New products and explore new market is more important significance.Reduce inventory, reduce inventory risk and management costs. To the enterprise to hold finished goods inventory additional fee, warehousing costs and insurance expenses; Instead, the enterprise to hold accounts receivable, you do not need the spending. Therefore, when the enterprise products inventory more for long time, generally can use more favorable credit conditions, the inventory into pipes receivable and reduce finished goods in stock, save related expenses.1Accounts receivable in the management of the existing problemsAccounts receivable is broad, fixed number of year long. Amounts Enterprise to accounts receivable accounting is not standard. According to the provisions of the state financial and accountingsystems. Accounts receivable is accounting enterprise for selling goods or services to happen to purchase unit shall be recovered or acceptlabor unit payments. But the enterprise did not strictly according tothe provisions of the accounting enterprise receivables. Cause some should not be in the project accounting money also included in the project, cause accounts receivable accounting has no reality.The account receivable NPLS not timely, to the enterprise confirmed the appearance of virtually increased asset caused. Because enterpriseto accounts receivable slackened management, especially some enterprise also to accounts receivable as means of adjusting profit. So on the account receivable SiZhang confirmation on staying there ~ some problems. Is mainly to stay SiZhang has already formed the receivables confirmfast enough, for many years in the accounts receivable formed account long-term, eased some already can't withdraw, this provision for the provision for no provision of virtual enterprise assets, causing thickening.Because some of the managers and operators enterprise financial management consciousness and lack of management concept. To accounts receivable is lack of effective management and collect investigation the author feel. In Shanxi Province in the part of the province tube enterprise still exist serious planned economy of ideas, these people to the market economy can't say don't understand, also cannot say don't understand, the main thing is not starts from oneself, and in practical work is often said the much, do less. Thought is drunk on the productionand business operation this center, not how to do well management finance the primacy, failed to do the business management financial management as the center. Financial management to fund management as the center. The management of funds and use only paying attention to how to borrow and spend money, not for existing resources and capital for effective configuration and mobilize. Cause enterprise produced a considerable amount of receivables, also do not actively from the Angle of strengthening management, so lots of money to clean up the long-term retention outside. Affected the enterprise normal production and operation activities and the efficient use of the funds.The drawbacks of the receivable mismanagement2外文原文Reduce enterprise funds use efficiency, make enterprise profits down because of enterprise logistics and cash flow not consistent, merchandise shipped, prescribing sales invoices. Payment is not keeping pace recovery, and sales have established, this not up recovery entry sales. Certainly will cause no cash inflow generated sales tax onprofits and losses, and sales income paid and years be paid in advance. If involves span more than to sales revenue account receivable. Then can produce enterprise by current assets paid annual shareholders dividend. Enterprise for such pursuit arising from the pad surface benefits and tax payment paid shareholders take up a lot of liquidity, as time passes will influence enterprise capital turnover. Which led to the enterpriseactual operation situation veiled. Influence enterprise production plan and sales plan, etc, can't realize the set benefit goal.Exaggerated enterprise operating results. Because our country enterprise executes accounting foundation is the accrual (receivable meet system). The current credit happened all to write down current income. Therefore, the enterprise account profit increase does not mean that can meet the schedule of realizing cash inflows. Accounting system requires the enterprise in accordance with the percentage of account receivable balance to extract the provision for, the provision for a 5% rates generally for 3% (special enterprise except). If the actual loss of bad happened more than extract the provision for, will give enterprise to bring the great loss. Therefore, the enterprise of account receivable existence. On the TAB virtually increased sales income. In oerstate enterprise operation results. Increased risks of an enterprise cost.Speeding up the enterprise's cash outflows. Sell on credit although can make the enterprise produces more profits, but did not make enterprise cash inflows increase, on the contrary make enterprise had to use limited liquidity to various taxes and fees paid, accelerate the enterprise's cash outflows, main performance for:Enterprise tax payments. Accounts receivable bring sales income. Not actually receive cash, turnover is computational basis with sales, the enterprise must on time pay by cash. Enterprise pay tax as value addedtax, business tax, consumption tax, resources tax and urban construction tax, inevitable meeting with sales revenue increases.Income tax payments. Accounts receivable generate revenue, but notin cash income tax, and realizing cash payment must on time.Cash the distribution of the profits. Also exist such problems. In addition, the3cost of the management of accounts receivable and accountsreceivable recycling costs will accelerate enterprise cash outflows.The business cycle has influence on enterprise. Operating cycle from obtain inventory to the sales that inventory and withdraw cash this time so far. Operating cycle depends on inventory turnover days and accounts receivable turnover days, the business cycle is combined. From that. Unreasonable accounts receivable existence, make business cycle extended, affected the enterprise capital circulation, make a lot of liquidity precipitation in non-productive link. Cause enterprise cash shortage, influence salaries and raw material purchasing, serious impact on the enterprise normal production and operation.Increased receivables management process. Error probability, bringsto the enterprise enterprise to face the additional loss accounts receivable account, possibly to the timely discovery, accounting errors can prompt understanding and other receivables accounts receivable dynamic enterprise details. Cause responsibility unclear. Accounts receivable contract, Taiwan about, commitments, the formalities ofexamination and approval of such material scattered, lost may make the enterprise has happened on the account receivable unable to receive the full recovery of repayment, the only partially withdraw through legal means. Can recover, but due to material not whole and cannot be recovered, until eventually form the enterprise assets loss.To strengthen the management of accounts receivable methodComprehensive comb, and establish material parameter. For enterprise all kinds of receivables launch a comprehensive system of comb, queuing, check the work. Because in past economic activity business minority, inefficient pattern. Hard to adapt to the market economy requirement,the law of development in the increasingly fierce market competition gradually be eliminated, the enterprise is in production, BanTingChan, failed state, has formed a widespread accounts receivable account for a long (most age 3 years), former party leave the state of operation and the debtor changes etc. Phenomenon, to clear a check increase the difficulty. Workers should browse a large number of original documents, traced back to carefully each individual accounts receivable from the nature, time, happened contents, amount. According to zhang age, systems, area and the possibility of recovery of accounts receivable are classified. Carefully analyzed collection verify each sum of money and amount. And this system, more likely way back near the door checkaccount receivable; Way to outside the system, and is unlikely to far back of receivables through telephone 4外文原文enquiries, enterprise sent a letter, lawyers sent a letter way to undertake checking: some not so clear accounts receivable multilateral bug verification. Please go back to the original sales personnel, agent help check to ensure that the data obtained by the accurate, reliable and accurate data collected in the visiting for the future of written-off receivables smoothly provide effective legal evidence. More importantly, with the debtor written-off receivables personnel and check accounts concerning the debtor family residence, operation sites, property status, income level made a comprehensive and detailed understanding, and according to the command of the debtor to evaluate solvency debt-repaying possibility. Judge, lock key goals for the next great written-off receivables smoothly and lay the foundation.Multi-pronged approach.we great effort, increase. After the preparation work or do. Accounts receivable written-off receivables entered the substantial "punish collect" crucial stage. In actual work, in order to give attention to collect the magnificence of the enterprise with benefit, one of the debtor to classify, different properties analysis of the debtor to adopt targeted collect method, in order to make the whole written-off receivables achieved good effect. The debtor to business clients. To possess management qualification, sound system, assets in good condition of customers, after consultations communication with the other, try to take groovy gathering way, so that both the collect keep good business cooperation relations; But for maliciouslong-term default behavior, used first lawyer in demand for collection,correspondence is invalid cases, still choose be representative of the debtor to court, apply for a court for compulsory execution. In the majesty of the law, the other group of a deterrent to repay the debtor will repay arrears, self-consciously plays to the whole written-off receivables to point the impetus with. On the system internal worker arrears. For system inside worker due to illness, life difficult, and many other reason formed non-business temporary loan, first of all, issued a document, clearly stipulates that deadline repossessed; Secondly, a large amount of arrears. Indeed, in a difficult to pay off after consultation with staff. Payment agreement signed. Divide second month in salary charged or deduct; Finally, the internal to laid-off employees and have extra-large disease worker, its economy is really difficult to repay embarrassment. In a humane treatment, offer certain debt relief. Such already make whole written-off receivables reach the expected effect, also can let laid-off workers to their real challenges organization care. Adopting property preservation measures. In the actual collect process. Often encountered some have the repaymentability but reimbursement conditions or timing immature the obligor, collect personnel can5cooperate actively court on the debtor's property implement preservation, making cdo in court, under the help of the relevant accounting units and individuals to impose preservation of property. For property preservation at the same time. Appoint our wealth pipe centervisit regularly the obligor, closely watching the debtor whereabouts, understand their property status. Once found the debtor reimbursement conditions mature, immediately notify the court, suspend the property preservation, reactivated cases. Applied to the court for compulsory execution withdraw arrears.Establish customer credit system. Strict credit business formalities for examination and approval from years of written-off receivables accounts receivable see. A few enterprises in experience increased sales push credit sales policy. Did not establish a complete customer credit system, to the customer assets status, reimbursement ability, financial situation, the credit rating don't know much. Even after receivable formation. Find the debtor to punish frequently occurred. There are a few enterprise to the customer credit conditions are too broad. Credit approval rights too scattered, sometimes a sales personnel can decided to sell on credit business formation. Cause some credit rating is low customers easily get credit, increasing the risk of bad loans.Earnestly implement post responsibility system, strict appraisal, rewards and punishments and trenchantSome enterprise although also established a comparatively perfect accounts receivable credit sales, management, a great responsibility and internal control system, but in actual work but become a mere formality, non-existing. Cause the enterprise internal responsibility unclear, the reward is unknown situation. To a certain extent, encourages the formation of large receivables, increasing the operating risk of anenterprise. So only with a good set of system doesn't solve all the problems in the practical work, the key still need to implement these system will reach the designated position, achieves truly in the bud.Foreign source :Friends of the accounting, in 2009 (30) 84 856外文译文外文译文企业应收账款管理存在的问题及对策汾西矿业化工公司赵爱萍【摘要】公司为了满足扩大销售、增加企业的竞争力、减少库存、降低存货风险和管理开支等的需要,在El常的经营活动中产生了应收账款。

应收账款外文翻译

应收账款外文翻译Accounts XXX part of a company's financial assets。

It refers to the amount of money owed to a business by XXX is essentialfor any n since it is the primary source of cash flow。

Therefore。

it is XXX person to handle credit and XXX.The Importance of Accounts Receivable ManagementEffective management of accounts receivable is critical for a company's financial XXX that the business has XXX receivables。

identifying delinquent accounts。

and XXX.The Role of Credit PoliciesXXX。

such as credit limits。

payment terms。

and interest rates。

A well-designed credit policy can help minimize the risk of bad debts XXX。

It is essential to review and update credit XXX.n Strategiesn XXX strategies may include sending reminders。

making phone calls。

or using a n agency。

The goal is to XXX.nIn n。

accounts XXX for any business。

企业应收账款管理中英文对照外文翻译文献

企业应收账款管理中英文对照外文翻译文献企业应收账款管理是企业财务管理的重要组成部分。

应收账款管理直接影响公司的盈利能力。

应收账款管理包括建立信用和收款政策。

信用政策包括信用期、早期付款、信用标准和征收政策的折扣。

应收账款的主要决定是对信用额度的确定和对客户的信用额度的确定。

在任何特定时间内的应收账款总额是由两个因素决定的:信用销售数量和销售和收集的平均时间长度。

应收账款的管理需要考虑信用证应扩展、信用证的条款和应用于收款的程序等三个主要问题。

2.2应收账款水平和盈利能力的相关性本文样本公司实证研究的一部分,目的是分析应收账款和证明应收账款水平和盈利能力在资产收益表现之间的相关性。

应收账款水平的高低直接影响公司的盈利能力。

如果应收账款管理不当,将导致公司的盈利能力下降。

因此,企业需要对应收账款进行有效的管理,以提高其盈利能力。

2.3信贷政策变化的成本和收益理论研究的目的是探索信贷政策变化的成本和收益,确定影响净储蓄的独立变量,并建立了它们之间的关系,以开发一个新的数学模型,计算修订后的信贷政策的净储蓄。

如果一家公司正在考虑改变其信贷政策来提高其收入,增量盈利能力必须与折扣和机会成本相比较,应收账款投资和相关的机会成本的关系。

根据此模型,公司可以根据信贷政策的变化考虑不同的信贷政策,以提高其收入和盈利能力,最终获取最大净利润。

3.结论本研究的目的是确定如何找到一个最佳的应收账款的水平,并利用不同的信贷政策,在一个可以接受的风险水平以达到最大的回报。

通过应用科学的应收账款管理,并通过建立一个信贷政策来获取最高的净利润,公司可以获得利润最大化,以及投资回报率最大化。

企业应重视应收账款管理,建立科学合理的信贷政策,以提高其收入和盈利能力,最终获取最大净利润。

应收账款是企业资产中占比相当大的一部分。

对于制造业企业而言,应收账款是短期财务管理的重要组成部分。

企业通常以现金和信用为基础销售商品和服务。

尽管企业更倾向于以现金出售,但由于竞争压力,大多数企业不得不提供信贷。

企业应收账款风险控制外文翻译文献

企业应收账款风险控制外文翻译文献(文档含中英文对照即英文原文和中文翻译)原文:On Risk Control Accounts Receivable Abstract:Accounts receivable credit enterprise by way of sale of goods or services but to the cust o mers received, accounts receivable management directly affect the capital flow and economic operation of the article pointed out that enterprises should combine their actual situation, the establishment of receivables Accounts of the risk prevention mechanism, from the source control and take preventive measures not only the accounts receivable of enterprises face the risk of recovery, but also the existence of operating risks to the enterprise, from the status of receivables management business to start Analyze accounts receivable management business problems. Accounts receivable is the product of credit, credit on the one hand can improve the market competitiveness of enterprises, to expand sales, but on the other hand delayed the cash recovery time and increases the cost of collection of trade receivables, receivables from the paper The causes and management of money in terms of how to prevent the risk of accounts receivable.Key words:accounts receivable,controlIntroductionAccounts receivable is a result of external business credit products,materials, supplies, labor, etc. to purchase or receive services units to receive the funds. Enterprises can sell two basic forms, namely, credit method is way off. Cash sales approach is themost expected a sales settlement. However, in the fierce market economy, totally dependent on marketing approach is often unrealistic. Under the credit method, the enterprise in sales of products, can be provided to the buyer within a certain period of time free use of money the business of credit funds in an amount equal to the price of goods, which for the purchaser in terms of great attractive. For the enterprise is an important promotional tool, the enterprise product sales are sluggish, the market decline, the case of weak competition, or in enterprise sales of new products, new markets, in order to meet the needs of market competition and adopting various effective the credit method, it is wise for businesses. In the current market economic conditions, increased competition, with the continuous development of commercial credit, business credit sales of products means more favor. However, a large number of accounts receivable resulting in sales revenue growth can only book profits to the enterprise, can not bring business to maintain and expand the scale of production necessary for cash flow, and with the continued increase in the amount of accounts receivable, growing an average of aging, accounts receivable aging structure tends to deteriorate, may be more and more bad debt losses, to the huge enterprise production and management of potential risks. Therefore, how to effectively enhance the control and management of accounts receivable is a enterprises financial imperative.First, the business performance of accounts receivable riskAccounts receivable is an enterprise in the normal course of business, from selling goods, products or services or receive services to purchase units of a unit charge or debit the accounts of the transport fees. It is the business generated by the short-term credit product claims to offer the enterprise a commercial credit. Accounts receivable in an expanding market, increase sales revenue while also forming a receivables risk, mainly reflected in:1, accounts receivable possession of large amounts of liquidity, adding to the difficulties of shortage of working capital business. Enterprise credit products, issue stock, but can not recover the money, and enterprise customers on overdue payments can not take appropriate measures, resulting in a large number of corporate working capital was occupied by the long run will affect the flow of liquidity to enable enterprises to monetary shortage of funds, which affect the normal cost and normal production operations.2, exaggerated accounts receivable business results, so that the existence of hidden losses or loss of business. At present, revenue is recognized when the company followed the principle of accrual accounting, the accounting treatment for the occurrence of credit, debit "accounts receivable" account, credited "business income" subject to credit all revenue credited to current income, , the increase in corporate profits and the current period can not be achieved, said the cash income. According to the precautionary principle, the actual situation of enterprises according to their own accounts receivable Provision for bad debts, but in practice, in order to facilitate tax, the tax laws, administrative regulations expressly provides that the proportion of the general provision of 0.3% to 0.5%. If there is a lot of business accounts receivable, there is increased likelihood of bad debts, bad debts that actual extraction of the bad debts far exceeded. This is equal to exaggerate the company's operating results, andthe losses that may occur can not be fully estimated.3, accounts receivable increased by the loss of corporate cash flow. From handling the accounts of credit can be seen that although the company had a credit more revenue, increase profits, but did not make the cash inflow, but the company had to advance funds to pay various taxes and payment of costs and accelerate the enterprise's cash outflows.4, accounts receivable increased the opportunity cost of corporate capital losses. First of all, occupied by accounts receivable financing, which calls for accelerated turnover in the business, be rewarded, but because there are a lot of accounts receivable, in particular, the proportion of overdue accounts receivable on the rise (at present, China's late accounts receivable accounts receivable as high as 60%, while the Western countries, less than 10%), resulting in accounts receivable on the occupied capital lost its time value. Second, because the accounts receivable arising in the collection process, forcing the enterprises have to invest a lot of manpower, material and financial resources, and increased collection costs; the same time, because a lot of money by settling, the borrower time to be extended, increased interest expense. A variety of cost increase, making funds lost profit opportunities and increase the opportunity cost of capital.Third, how to control the risk of accounts receivable1, credit risk prevention policyWith the further development of China's market economy and increasing business competition, commercial credit receivables of the objective to be a competitive necessity of issuing commercial credit companies that do not attract customers to lose the competitiveness of the credit offers; course, the payment of business inevitably bring credit offers credit risk and credit policies on the manage receivables plays an important role. Credit policies include the following:(1) Credit standards. Credit standards are the company to provide commercial credit made the minimum requirements for the development of credit standards is the key to consider the customer to delay payment or refuse to pay money to bring the possibility of loss to the company size. To this end, companies need credit to customers for regular inspection and assessment of the quality of analysis on the credit quality of the testing and evaluation standards, there are three commonly used methods.First, 5C system evaluation. The system is to assess the important factor in customer credit quality, the following five aspects.①Quality: Quality is the customers and reputation, that is, the possibility of obligation, this factor is critical, it is a moral credit of the subjective factor, which is required to have the management of corporate credit experience, the right to judge and keen insight.②capacity: Capacity is the customers ability to pay when the credit expires, it is according to customer financial information, especially under the regular income and expenditure data be analyzed to determine their ability to pay the purchase price.③Capital: capital refers to the customer's financial strength and financial status, indicating that the background of the customer may pay the debt, usually reflect thefinancial position of the ratio of customers include: debt ratio, current ratio, earnings coverage ratio, fixed charges coverage ratio.④collateral: collateral or credit status on the bottom line I do not know the customer and requires a disputed credit guarantee of a variety of assets.⑤economic environment: mainly refers to the economic environment can affect the ability of customers to fulfill financial responsibility of economic development trends, it is beyond the control of the customer. Corporate credit managers in considering this factor, the analysis should focus on regional economic conditions and business products related to the development of industry-specific.Second, the credit analysis. According to customer's credit information, credit screening of several major factors, the number of statistical methods used for processing classified and quantified to calculate the weights, assessment of credit quality, enterprise credit management section based on credit scores to determine the weighted credit rating .Third, credit risk model method. According to the customer's financial business risk and receivables management company's own risk to determine credit risk, the use of the principle of mathematical statistics to establish a credit risk model, which ARC (credit risk) = PR risk customers can not pay the creditors × MR (accounts receivable risk management), MR (accounts receivable risk management) is the company's own accounts receivable management system, measures methods, control and supervision, the quality of personnel and other internal factors, can affect the risk of a few accounts receivable management major factors in assessing the scores of each factor and the weights, the weighted scores obtained MR values; Similarly, PR value is the major risk factors based on ratios of financial position (cash ratio, inventory turnover, quick ratio, etc.) to assess the score of each factor, calculated using the principle of mathematical statistics weight each factor, then the integrated value is calculated PR value. Several standard methods of the above can apply for credit credit offer credit quality of customers to predict, analyze, judge, to determine whether to grant credit offers.(2) credit terms. Corporate credit conditions is the need to pay money on credit conditions, including credit terms, discounts, terms and cash discounts. Credit period is the longest business requirements to the customer time to pay; discount period is required for customers to enjoy the time of payment cash discounts; cash discount to encourage customers in the period of early payment discounts given preferential treatment. Generally provide more favorable credit terms to increase sales, but it can also bring additional burdens, such as accounts receivable will increase the opportunity cost of bad debts, cash discounts and other costs, so companies must be carefully weighed. I think we can grasp the following principles: the principle of prudence, risk principle (the principle of loose-type), the principle of cooperation. Prudence two possibilities: First, companies in the market weakness, deteriorating economic environment, companies should make a negative decision management sales strategy, market risk should be taken to avoid the principle of prudence. Second, the customer, without the ability to pay low credit quality, and poor financial situation, or do not understand the ins and outs and the dispute by the credit quality to theprecautionary principle of justice.The principle of risk can be divided into two situations: First, companies in the economic recovery increased, the product in the industry or the District of merchantability good, corporate decision-making authorities should take active sales policy. Second, the customer, the credit quality is high, financial condition, ability to pay, credit managers should be taken when issuing credit risk principles.The principle of cooperation: For SMEs, the capital less strength is poor, the general financial situation, ability to resist market risk is small, it should be taken in the aggregate principle.2, accounts receivable, risk prevention intervalSince the formation of the company credit accounts receivable, the sales and billing between the two acts of a settlement time, the interval. Interval of the recovered funds back in time to enable enterprises to have more liquidity to carry out production and service activities, and actively take the initiative to debt collection units or individuals. Bad debt losses will be reduced to a minimum, strengthen the recognition that not justify the amount of time being to let the other know and recognize the debt, in practice, can be sent to the business or personal debts confirmation or destroy a single paragraph, so that Check the arrears owed the content of individual units or signature confirmation mail, so that companies understand the availability of debt, repayment intentions each other, urging each other timely repayment, but also easy to check the authenticity of accounts receivables.For the other debts but delays longer recognized or return the book debts owed to strengthen preventive work is to understand the delay in repayment, arrears mail confirmation is not the reason to visit the other units in the field, to identify the existence of the other units or individuals, whether deliberately delayed payments, if unable to pay the debt, is facing bankruptcy, whether the cases escaping with money, etc., will cause a timely manner to the departments concerned to jointly study measures, do everything possible to receivables, reduce bad debts, bad loss account, but also to prevent blindness in future credit. If the payment has been made to identify the other party, shall immediately identify the whereabouts of, would have been diverted, whether the corruption of the unit personnel, wrong billing, etc., to ensure timely detection of errors were corrected.Even for the reputation, business or reputation has always been very high against individuals should not be relaxed, because "the portal does not close tightly, sages from the Pirates of the Heart", the unit if not often to learn about, mission, and it will part of the business or reputation of high prestige individual to ill-gotten gains, regardless of honor towards the idea of development, trust, reputation has been misused, to the unit causing serious economic losses.3, the daily management of accounts receivable risk prevention(1) enterprises in order to accelerate the turnover rate of accounts receivable, factoring risk reduction, you must do the following basic work. We must first place the accounts receivable should be registered in time, the household accounts receivable detailing the time, amount, reason, and the billing period to recover the situation and so on, and collect credit information about customers, such as access to Customerrecent balance sheet and income statement and other statements, analyze liquidity, ability to pay and the rate of business performance; second request to the customer's bank credit certificate of the client to understand the customer's deposit balance, loan conditions and settlement status; the last customer-related exchange of other suppliers of credit information companies to understand the timely payment of the customer and so on. These measures, analysis of customer's credit status in order to detect and propose a solution.(2) To strengthen management and total management of a single customer. (1) make the basis of records, level of understanding of customer payments in a timely manner.(2) Check whether the customers break through credit. (3) grasp the customer's debt credit period has expired, customers have been closely monitoring the dynamic changes in debt maturity. (4) analysis of accounts receivable turnover and average billing period, to see whether at the normal level of liquidity. (5) to strengthen aging analysis of accounts receivable. Aging analysis of accounts receivable accounts receivable ledger should be based on the setting business case may be, the general ledger accounts receivable business sales region and sales by the household setting. (3) to strengthen the management of accounts receivable ledger. Screening of the accounts receivable ledger, aging analysis to determine which needs and which does not require, or purchase a unit occurs only a few pen and the amount outstanding, as a result of product quality, dispute, or disputes resulting from breach of contract Such accounts receivable should be shown separately case by case basis and specify the reasons put forward to resolve issues.4, accounting, risk prevention(1) Select the correct extractionChina's current accounting system to prepare low corporate law provides that only accounted for bad debts, this is an accounts receivable effective risk prevention measures. 2006 "Enterprise Accounting Standards" provides enterprises the ratio of provision for bad debts 0.3% -0.5%, specifically determined by the enterprises themselves, so that different companies to solve practical problems opened up a new way. The company shall state the specific circumstances under the scope of provision for bad debts, extraction method, the division of aging and extraction ratio, in accordance with administrative privileges, general meeting of shareholders or managers (the director) or similar approval, and in accordance with the laws and administrative regulations report to the relevant provisions of the parties to the record, the extraction method for bad debts has been determined shall not be changed, you need to change, based upon the above procedures, and report to the parties approved the record, and be stated in the accounting statements.(2) Select the correct method of settlement. The right of settlement to reduce the risk of accounts receivable is also very important. Settlement between the Bank of China's enterprises are mainly the following: check settlement, foreign exchange settlement, commission collection settlement, settlement and other bank draft, corporate customers operating according to ability, capacity to repay and credit status, select the appropriate settlement of strong profitability and solvency, credit risk of large customers to choose a good way, this will help the two sides establish a relationship ofmutual trust, expand the sales network and improve competitiveness.5, accounts receivable factoring risk preventionIf the enterprise is the work done against accounts receivable in the former, and effective, will be able to grasp the size of the risk of accounts receivable, then the problem will be greatly reduced workload. But a business in the ordinary course of business can be without accounts receivable, and its purpose is simply to do preventive work is to control the line of credit and change the overall aging structure, increasing the recoverability of the existing accounts receivable. Therefore, enterprises must conduct research into prevention of accounts receivable, to establish their own processing methods and principles.First, the analysis of total receivables. Look at the accounts receivable balance is reasonable, whether the enterprise's production and management has become a burden, whether the compression of the needs and possibilities, what basis. Based on the analysis in the total amount, further the balance of accounts receivable aging analysis carried out by detailed subjects. Accounts receivable aging analysis is the quality and value of the total re-evaluation is to determine the recoverability of the account balance and determine what measures to use to resolve basis. Aging in general the smaller the longer the greater the risk the possibility of recovery.Second is to determine the collection process. According to aging analysis to determine needs and special circumstances of the customer billing, the normal billing procedures: submit a letter - Telephone collection - send people to interview - legal action. First, analysis of the causes of default, such as customer due to poor management, inability to pay, the should be further analysis is temporary or has reached bankruptcy. The reason for the temporary relaxation of the repayment period should be appropriate to help clients through difficult times. This is more compatible with the aging short, good reputation, part of the customer accounts receivable. But should also seek to extend the normal part of the total share. In order to recover more money, but the two sides can establish good business relationship.For the already bankrupt state, can not be revitalized, it should be in a timely manner to the court to be liquidated in bankruptcy pay off some debt.Third, the customer has repayment ability, but refuses to pay, the enterprises should adopt appropriate methods of debt collection. Consultation method: with the debt repayment customers, deadlines, payment methods and friendly consultations. 1, the probation law: clarifying the position of creditors or debt collection proud of the hard to move the debtor, moved their compassion. 2, the carrot and stick method: two people with debt collection, hard unwilling to compromise, soft in the stone, complement each other. Make payment by debtors. $ Fatigue War and attempting to rally: the main leaders of business debt pegged to fight a protracted war, it will collapse. Or language stimulation, so as to save face and dignity and had to pay. 3, the storm Law: explicitly tell the debtor to its proceedings. For repayment in any case fail to reach an agreement negotiations have had a lawyer to take legal action.Before taking legal action against the principle of cost-effectiveness should be considered, do not face prosecution following conditions: 1, court costs exceed the amount of the debt claim; 2, the customer value of the collateral can not write off debt,it has a wide range of social relations, prosecution may be hurt the business operation or cause damage, even if successful, the possibility of recovery of receivables is extremely limited.In short, the establishment of sound policies and effective debt collection, collection costs and to reduce the trade-off between bad debt, effective debt collection policies to a large extent by the experience of the management staff, the enterprise should have a professional knowledge is solid, experienced, responsible and accounts receivable management team can do a better job to Collection.本文摘自《黑龙江科技信息》2010年第4期,作者:孙丽译文:论企业应收账款风险的控制摘要:应收账款是企业采用赊销方式销售商品或劳务而应向顾客收取的款项,应收账款管理直接影响企业营运资金的周转和经济效益文章指出,企业要结合自身的实际情况,建立应收账款的风险防范机制,从源头控制,防患于未然企业的应收账款不仅面临着回收的风险,同时其存在也会给企业带来经营风险,从企业应收账款管理的现状入手,分析企业应收账款管理中面临的问题。

外文-应收账款相关材料(有翻译)

The term receivables refer to amounts due from individuals and companies. Receivables are claims that are expected to be collected in cash. The management of receivables is a vary important activity for any company that sells goods on credit. Receivables are important because they represent one of a company’s most liquid assets. For many companies receivables are also one of the largest assets.Receivables这个单词是指应收账款欠款的个人和公司。

应收账款是指预计将收集到的现金。

应收款的管理对任何一个通过信贷方式销售货物的公司而言都是一项重要的活动。

应收款很重要的,因为他们代表一个公司的最具流动性的资产。

对于许多公司而言,应收账款也是其中最大的资产之一。

Management Receivables应收账款的管理Receivables are a significant asset on the many books. As a consequence, companies must pay close attention to their receivables balances and manage them carefully.应收款是在很多书籍中都表明是一项很重要的资产。

因此,企业必须密切关注其应收款余额并且进行谨慎的管理。

Managing accounts receivables involves five steps:1.Determine to whom to extend credit2.Establish a payment period3.Monitor collections4.Evaluate the receivables balances5.Accelerate cash receipts from receivables when necessary应收账款的管理可分为五步来进行:1.决定谁可以提供信贷2.建立付款期限3.监测收回4.评价应收账款余额5.必要时加快应收账款的现金收回Extending Credit提供信贷A critical part of managing receivables is determining who should be extended credit and who should not. Many companies increase sales by being generous with their credit policy, but they may end up extending credit to risky customers who do not pay. If the credit policy is too tight, you will lose sales; If it is too loose, you may sell to “deadbeats” who will pay either very late or not at all. One CEO noted that prior to getting his credit and collection department in order, his salespeople had 300 square feet of office space per person, while the people in credit and collections had six people crammed into a single 300-square-foot space. Although this arrangement boosted sales, it had vary expensive consequences in bad debts expense.应收账款管理中一个决定性的部分就是确定谁应扩大信贷,谁不应该扩大。

应收账款管理外文文献 应收账款管理外文文献翻译