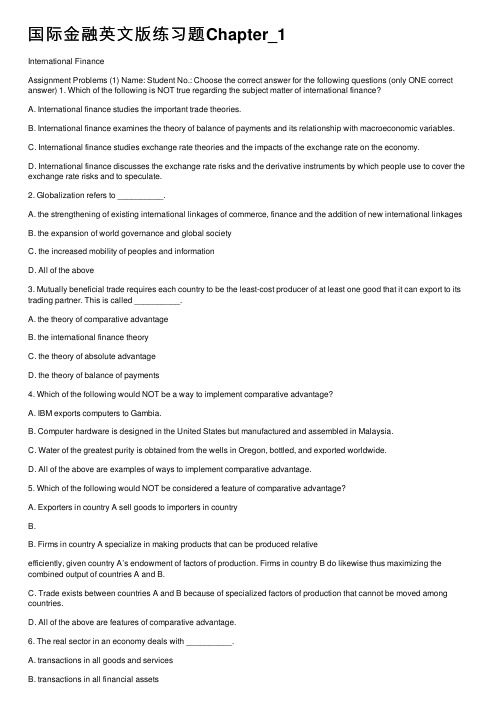

国际金融英文版练习题-Chapter-1

国际金融英文版习题Chapter(精华版)

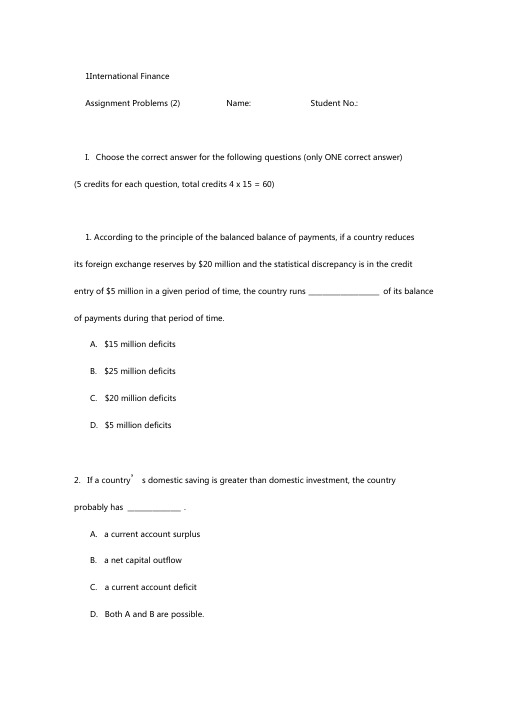

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#:I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the .A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the .A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to .A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market.A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because .A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. earn a profit by a bid-ask spread on currencies they buy and sell.on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as whereas are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote..B. .C. ¥110/.D. . ¥11. Which of the following is true about the foreign exchange market.A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchangerates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculatorsfrom different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be .A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ n RMB were to undergo a 10% depreciation, the new exchange rate in terms ofbe:A. B. C. D.15. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciatesrapidly againstthat of the dollar over a year, this would reducethe dollarvalue of the euro profit made by the European subsidiary. This is a typical .A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The companyhas a (an) .A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchangerisk known as Translation Exposure may bedefined as .A. change in reported owne’r s equity in consolidated financial statements caused bya change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the changein expectedfuture cashflows arisingfrom an unexpectedchangein exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreignexchange risk exposure. So if an American firm expects to receive a dollar-payment from a Chinese company in the next 30 days, the U.S. firm has the possible .A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a position in foreign exchanges can that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japaneseyens for Swissfrancs could be describedeither as or ,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forwardSFr/$21. Dollars are trading at S0=SFr0.7465/$ in the spot market. The 90-dayforwardSFr/$rate is F1=SFr0.7432/$. So the forward on the dollar in basis points is :A. discount,B. discount, 33C. premium,D. premium, 3322. If the spot rate is /. , 3-month forward rate is6./, which of the following is NOT true.A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be .A. –B. –C. ––24. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be .A. 30/25B. 25/30C. –(23/28)D. –(28/23)25. The current U.S. dollar exchange rate is¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum of .A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions1through10are based on the information presented in Table 3.1(2.credits for each question, total credits 2 x 10 = 20)TableCountry Exchange rate(2021) Exchange rate CPI Volume of Volume ofimports from U.S.(2021) (2021)Germany Mexico U.S.. 0.75/$Mex$11.8/$. 0.70/$Mex$12.20/$$200m$120m$350m$240m1. The real exchange rate of the dollar against the euro in 2021 was .2. The real exchange rate of the dollar against the peso in 2021 was .3. The dollar was against the euro in nominal term by .A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was against the dollar in nominal term by.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was .6. The volume of the Mexican foreign trade with the U.S. was .7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2021 against a basket of currencies of euroand Mexican peso, the weight assigned to the euro should be .8. The weight assigned to the peso should be .9. Assumethe 2021 is the baseyear. The dollar effective exchangerate in 2021 was.10. Was the dollar generally stronger or weaker in 2021 according to your calculation.11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥Assume you have an initial SFr10 million. Can you make a profit via triangular arbitrage. If so, show steps and calculate the amount of profit in Swiss fra n8cs c.r e(dit s)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dolla(r5. credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rat e S s Fr/$S= SFr1.7223/$, S$/¥¥/SFr= ¥, and S = ¥unprofitable. Explain(.7 credits14. You are given the following exchange rates:¥/A$S = 67.05 –£/A$S –¥/ £Calculate the bid and ask rate of S : (5 credits)15.Suppose the spot quotation on the Swiss franc (CHF) in New York is4–42–68. Compute the percentage bid-ask spreads on the CHF/EUR quo t(e5. credits)Answers to Assignment Problems (3)Part I1. D2. A3. D4. D5. D6. A7. D8. B9. C 10. C11. A 12. A 13. B 14. D 15. B16. C 17. A 18. D 19. B 20. A21. B 22. B 23. C 24. C 25. D Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 =2. 12.2 x (105.3/110.5) = 12.2 x .9529 =3. B (0.7 /.75)–1 = -6.67%4. D (1/12.2)/(1/11.8) –1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 =9. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.¥/$ $/SFr SFr/ ¥11. Since S S S = 0.946186< 1, there is an arbitrage opportunity.Steps: ①Buy ¥from Deutsche Bank, SFr10 million x =¥950million② m③ mProfit (ignoring transaction fees):–SFr10 = 0.56875 million = 568,75012. (x–1) = 1000%; 1/11 –1 = 90.9%13. S SFr/$ S$/ ¥S¥/SFr = SFr1.7223/$ x x¥¥F=rIf transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.¥/A$14. Given: S = –£/A$S –¥/.(bid)£/.(ask)15. Given: –52/SFr–68/SFrSo, S SRr/ . (bid)S SFr/ . (ask)Bid-ask margin = –1.424) / 1.4264 = 0.1683%。

国际金融英文版习题

Chapter1 balance of paymentsBalance of Payments Accounting1Balance of paymentsa)is defined as the statistical record of a country’sinternational transactions over a certain period of timepresented in the form of a double-entry bookkeepingb)provides detailed information concerning the demand and supplyof a country’s currencyc)can be used to evaluate the performance of a country ininternational economic competitiond)all of the aboveAnswer: d2Generally speaking, any transaction that results in a receipt from foreignersa)Will be recorded as a debit, with a negative sign, in the .balance of paymentsb)Will be recorded as a debit, with a positive sign, in the .balance of paymentsc)Will be recorded as a credit, with a negative sign, in the .balance of paymentsd)Will be recorded as a credit, with a positive sign, in the .balance of paymentsAnswer d3 Generally speaking, any transaction that results in a payment to foreignerse)Will be recorded as a debit, with a negative sign, in the .balance of paymentsf)Will be recorded as a debit, with a positive sign, in the .balance of paymentsg)Will be recorded as a credit, with a negative sign, in the .balance of paymentsh)Will be recorded as a credit, with a positive sign, in the .balance of paymentsAnswer a4 Suppose the McDonalds Corporation imports 100 tons of Canadian beef, paying for it by transferring the funds to a New York bank account kept by the Canadian Beef Conglomerate.i)Payment by McDonalds will be recorded as a debitj)The deposit of the funds by the seller will be recorded as a debitk)Payment by McDonalds will be recorded as a creditl)The deposit of the funds by the buyer will be credit Answer: a5Since the balance of payments is presented as a system of double-entry bookkeeping,a)Every credit in the account is balanced by a matching debitb)Every debit in the account is balanced by a matching creditc) a and b are both trued)None of the aboveAnswer c6 A country’s international transactions can be grouped into thefollowing three main types:a)current account, medium term account, and long term capitalaccountb)current account, long term capital account, and officialreserve accountc)current account, capital account, and official reserveaccountd)capital account, official reserve account, trade account Answer: c7Invisible trade refers to:a)services that avoid tax paymentsb)underground economyc)legal, consulting, and engineering servicesd)tourist expenditures, onlyAnswer: c8The current account is divided into four finer categories:a)Merchandise trade, services, income, and statisticaldiscrepancy.b)Merchandise trade, services, income, and unilateraltransfersc)Merchandise trade, services, portfolio investment, andunilateral transfersd)Merchandise trade, services, factor income, and directinvestmentAnswer: b9Factor incomea)Consists largely of interest, dividends, and other incomeon foreign investments.b)Is a theoretical construct of the factors of production,land, labor, capital, and entrepreneurial ability.c)Is generally a very minor part of national income accounting,smaller than the statistical discrepancy.d)None of the aboveAnswer: aUSE THE FOLLOWING INFORMATION TO ANSWER THE NEXT TWO QUESTIONS10 The entries in the “current account” and the “capital account”, combined together, can be outlined in alphabetic order as: i- direct v- other capitalinvestmentii- factor income iii- merchandise iv- official transfer vi- portfolio investmentvii- private transferviii- services11Current account includesa)i, ii, and iiib)ii, iii, and viic)iv, v, and viid)i, v, and viAnswer: b12Capital account includesa)i, ii, and iiib)ii, iii, and viic)iv, v, and viid)i, v, and viAnswer: d13The difference between Foreign Direct Investment and Portfolio Investment is that:a)Portfolio Investment mostly represents the sale and purchaseof foreign financial assets such as stocks and bonds that do not involve a transfer of control.b)Foreign Direct Investment mostly represents the sale andpurchase of foreign financial assets such as stocks whereas Portfolio Investment mostly involves the sales and purchase of foreign bonds.c)Foreign direct investment is about buying land and buildingfactories, whereas portfolio investment is about buying stocks and bonds.d)All of the aboveAnswer: a14In the latter half of the 1980s, with a strong yen, Japanese firmsa)Faced difficulty exportingb)Could better afford to acquire . assets that had become lessexpensive in terms of yen.c)Financed a sharp increase in Japanese FDI in the United Statesd)All of the aboveAnswer: d15International portfolio investments have boomed in recent years, as a result ofa)A depreciating . dollarb)Increased gasoline and other commodity prices.c)The general relaxation of capital controls and regulation inmany countriesd)None of the aboveAnswer: cAnswer: c16The capital account measuresa)The sum of . sales of assets to foreigners and . purchases offoreign assets.b)The difference between . sales of assets to foreigners and .purchases of foreign assets.c)The difference between . sales of manufactured goods toforeigners and . purchases of foreign products.d)None of the aboveAnswer: b page 6417When Honda, a Japanese auto maker, built a factory in Ohio,a)It was engaged in foreign direct investmentb)It was engaged in portfolio investmentc)It was engaged in a cross-border acquisitiond)None of the above.Answer: a page 64.18The capital account may be divided into three categories:a)Cross-border mergers and acquisitions, portfolio investment,and other investmentb)Direct investment, portfolio investment, and Cross-bordermergers and acquisitionsc)Direct investment, mergers and acquisitions, and otherinvestmentd)Direct investment, portfolio investment, and other investment Answer: d19When Nestlé, a Swiss firm, bought the American firm Carn ation, it was engaged in foreign direct investment. If Nestlé had only boughta non-controlling number of shares of the firma)Nestlé would have been engaged in portfolio investmentb)Nestlé would have been engaged in a cross-border acquisitionc)It would depend if they bought the shares from an American ora Canadiand)None of the above.Answer: a20Foreign direct investment FDI occursa)when an investor acquires a measure of control of a foreignbusinessb)when there is an acquisition, by a foreign entity in the ., of10 percent or more of the voting shares of a businessc)with sales and purchases of foreign stocks and bonds that donot involve a transfer of controld)a and bAnswer: d21Statistical discrepancy, which by definition represents errors and omissionsa)Cannot be calculated directlyb)Is calculated by taking into account the balance-of-paymentsidentityc)Probably has some elements that are honest mistakes, it can’tall be money laundering and drugs.d)All of the aboveAnswer: d22The statistical discrepancy in the balance-of-payments accountsa)Arise since recordings of payments and receipts are done atdifferent times, in different places, possibly using different methods.b)Arise since some transactions illegal transactions occur “offthe books”.c)Represents omitted and misrecorded transactions.d)All of the aboveAnswer: d23Regarding the statistical discrepancy in the balance-of-payments accountsa)There is some evidence that financial transactions may be mainlyresponsible for the discrepancy.b)The sum of the balance on the capital account and the statisticaldiscrepancy is very close to the balance of the current accountin magnitude.c)It tends to be positive one year and negative in others, so it’ssafe to ignore itd)a and bAnswer: d24When a country must make a net payment to foreigners because ofa balance-of-payments deficit, the central bank of the countrya)Should do nothingb)Should run down its official reserve assets . gold, foreignexchanges, and SDRsc)Should borrow anew from foreign central banks.d)b or c will workAnswer: d25Continued . trade deficits coupled with foreigners’ desire to diversify their currency holdings away from . dollarsa)could further diminish the position of the dollar as thedominant reserve currencyb)could affect the value of . dollar . through the currencydiversification decisions of Asian central banksc)Could lend steam to the emergence of the euro as a crediblereserve currencyd)All of the aboveAnswer: d26Currently, international reserve assets are comprised ofa)gold, platinum, foreign exchanges, and special drawing rightsSDRsb)gold, foreign exchanges, special drawing rights SDRs, andreserve positions in the International Monetary Fund IMFc)gold, diamonds, foreign exchanges, and special drawing rightsSDRsd)reserve positions in the International Monetary Fund IMF, only Answer: b27International reserve assets include “foreign exchanges”. These area)Special Drawing Rights SDRs at the IMFb)reserve positions in the International Monetary Fund IMFc)Foreign currency held by a country’s central bankd)None of the aboveAnswer: c28The most important international reserve asset, comprising 94 percent of the total reserve assets held by IMF member countriesisa)Goldb)Foreign exchangesc)Special Drawing Rights SDRsd)Reserve positions in the International Monetary Fund IMF Answer: b29The vast majority of the foreign-exchange reserves held by central banks are denominated ina)Local currenciesb). dollarsc)Yend)EuroAnswer: b30The . Trade Deficita)Is a capital account surplusb)Is a current account deficitc)Is both a capital account surplus and a current account deficitd)None of the aboveAnswer: c31Over the last several years the . has run persistenta)Balance-of-payments deficitsb)Balance-of-payments surplusesc)Current Account deficitsd)Capital Account deficitsAnswer: c32More important than he absolute size of a country’sbalance-of-payments disequilibriuma)is the nature and cause of the disequilibriumb)is whether it is a trade surplus or deficitc)is whether the local government is mercantilist or notd)Nothi ng is more important than he absolute size of a country’sbalance-of-payments disequilibriumAnswer: aThe Relationship between Balance of Payments and National Income Accounting For questions in this section, the notation isY = GNP = national incomeC = consumptionI = private investmentG = government spendingX = exportsM = imports33National income, or Gross National Product is given by:a)GNP = Y = C + I + G + X + Mb)GNP = Y = C + I + G + X – Mc)GNP = I = C + Y + G + X – Md)GNP = Y = C + I + X + M – GAnswer: b34Which of the following is a true statementa)BCA ≡ X – Mb)BKA ≡ X – Mc)BKA –BCA ≡ X – Md)BKA ≡ X – MAnswer a35There is an intimate relationship between a country’s BCA and how the country finances its domestic investment and pays forgovernment expendi tures. This relationship is given by BCA ≡ X –M ≡ S – I + T – G. Given this, which of the following is a true statementa)If S –I < 0, it implies that a country’s domestic savingsis insufficient to finance domestic investment.b) If T –G < 0, it implies that a country’s tax revenue isinsufficient to finance government spendingc)both a and b are trued)none of the aboveAnswer c36There is an intimate relationship between a country’s BCA and howthe country finances its domestic investment and pays forgovernment expenditures. This relationship is given by BCA ≡ X –M ≡ S – I + T – G. Given this, which of the following is a true statementa)If S –I < 0, it implies that a country’s domestic savingsis insufficient to finance domestic investment.b) If T –G < 0, it implies that a country’s tax revenue isinsufficient to finance government spendingc)when BCA is negative, it implies that government budget deficitsan/or part of domestic investment are being finance withforeign-controlled capitald)all of the above are trueAnswer d37There is an intimate relationship between a country’s BCA and how the country finances its domestic investment and pays forgovernment expenditures. This relationship is given by BCA ≡ X –M ≡ S –I + T –G. Given this, in order for a country to reducea BCA deficit, which of the following must occura)For a given level of S and I, the government budget deficit T– G must be reducedb)For a given level of I and T – G, S must be increasedc)For a given level of S and T – G, I must falld)All of the above would work to reduce a BCA deficitAnswer dExplain how each of the following transactions will be classified and recorded in the debit and credit of the . balance of payments:1 A Japanese insurance company purchases . Treasury bonds and paysout of its bank account kept in New York City.2 A . citizen consumes a meal at a restaurant in Paris and pays withher American Express card.3 A Indian immigrant living in Los Angeles sends a check drawn onhis . bank account as a gift to his parents living in Bombay.4 A . computer programmer is hired by a British company for consulting andgets paid from the . bank account maintained by the British company.In contrast to the ., Japan has realized continuous current account surpluses. What could be the main causes for these surpluses Is it desirable to have continuous current account surpluses。

金融市场学双语题库及答案(第一章)米什金金融市场与机构

Financial Markets and Institutions^ 8e (Mishkin)Chapter 1 Why Study Financial Markets and Institutions?1.1 Multiple Choice1)Financial markets and institutionsA)involve the movement of huge quantities of money.B)affect the profits of businesses.C)affect the types of goods and seivices produced ill an economy.D)do all of the above.E)do only A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition2)Financial market activities affectA)personal wealth.B)spending decisions by individuals and business firms.C)the economy's location in the business cycle.D)all of the above.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition3)Markets in wliich funds are tiansfeired from those who have excess funds available to those who have a shortage of available funds are calledA)commodity markets.B)funds markets.C)derivative exchange markets.D)financial markets.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition4)The price paid for the rental of bonowed funds (usually expressed as a percentage of the rental of $100 per year) is conmionly referred to as theA)inflation rate.B)exchange late.C)interest rate.D)aggiegate price level.Answer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition5)The bond maikets are impoitant becauseA)they are easily the most widely followed financial markets in the United States.B)they are the maikets where interest rates are deteimined.C)they are the markets where foreign exchange rates are determined.D)all of the above.Answer: BTopic: Chapter 1.1 Why Study Financial MaiketsQuestion Status: Previous Edition6)Interest rates are impoitant to financial institutions since an interest rate uicrease the cost of acquiring funds and the income fiom assets.A)decreases; decreasesB)increases; increasesC)decreases; increasesD)increases; decreasesAnswer: BTopic: Chapter 1.1 Why Study Financial MaiketsQuestion Status: Previous Edition7)Typically, increasing interest ratesA)discourages individuals fiom saving.B)discourages corporate investments.C)encourages coipoiate expansion.D)encourages coipoiate borrowing.E)none of the above.Answer: BTopic: Chapter 1.1 Why Study Financial MaiketsQuestion Status: Previous Edition8)Compared to interest rates on long-tenn U.S. govenmient bonds, interest rates onfluctuate more and are lower on average.A)medium-quality coipoiate bondsB)low-quality corporate bondsC)high-quality coipoiate bondsD)tluee-month Treasuiy billsE)none of the aboveAnswer: DTopic: Chapter 1.1 Why Study Financial MaiketsQuestion Status: Previous Edition9)Compared to interest rates on long-tenn U.S. govenmient bonds, interest rates on tluee-month Tieasuiy bills fluctuate and are on average.A)moie; lowerB)less; lowerC)moie; liigherD)less; higherAnswer: ATopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition10)The stock market is important becauseA)it is where interest rates are determined.B)it is the most widely followed financial market in the United States.C)it is where foreign exchange rates are deteimined.D)all of the above.Answer: BTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition11)Stock prices since the 1980s have beenA)relatively stable, trending upward at a steady pace.B)relatively stable, tiending downward at a moderate rate.C)extremely volatile.D)unstable, trending downward at a moderate late.Answer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition12)The largest one-day drop in the liistoiy of the Ainei ican stock markets occuii ed inA)1929.B)1987.C)2000.D)2001.Answer: BTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition13) A declining stock market index due to lower share pricesA)reduces people's wealth and as a result may reduce theii willingness to spend.B)increases people's wealth and as a result may increase their willingness to spend.C)decreases the amount of fiinds that business firms can raise by selling newly issued stock.D)both A and C of the above.E)both B and C of the above.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition14)Changes in stock pricesA)affect people's wealth and their willingness to spend.B)affect films' decisions to sell stock to finance investment spending.C)are characterized by considerable fluctuations.D)all of the above.E)only A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition15)(I) Debt markets are often referred to generically as the bond market.(II) A bond is a security that is a claim on the earnings and assets of a coiporation.A)(I) is true, (II) false.B)(I) is false, (II) true.C)Both are true.D)Both are false.Answer: ATopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition16)(I) A bond is a debt security that promises to make paymen's periodically fbr a specified peiiod of time. (II) A stock is a security that is a claim on the earnings and assets of a corporation.A)(I) is true, (II) false.B)(I) is false, (II) true.C)Both are true.D)Both are false.Answer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition17)The price of one countiy's currency in terms of another's is calledA)the foreign exchange rate.B)the interest rate.C)the Dow Jones industrial average.D)none of the above.Answer: ATopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition18) A stronger dollar benefits and hurts .A)American businesses; American consumersB)American businesses; foreign businessesC)American consumers; American businessesD)foreign businesses; American consumersAnswer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition19) A weaker dollar benefits and hurts .A)American businesses; American consumersB)American businesses; foreign consumersC)American consumers; American businessesD)foreign businesses; American consumersAnswer: ATopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition20)From 1980 to early 1985 the dollar in value, thereby benefiting American.A)appreciated; businessesB)appreciated; consumeisC)depreciated; businessesD)depreciated; consumersAnswer: BTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition21)In general, from 2001 tluougli 2013, the dollar in value relative to major foreign cunencies.A)appreciatedB)depreciatedC)remained about the sameAnswer: BTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: New Question22)Money is defined asA)anything that is generally accepted in payment for goods and seivices or in the repayment of debt.B)bills of exchange.C) a riskless repositoiy of spending power.D)all of the above.E)only A and B of the above.Answer: ATopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition23)The organization responsible foi the conduct of monetary policy in the United States is theA)Compti oiler of the Currency.B)U.S. Tieasuiy.C)Federal Reserve System.D)Bureau of Monetaiy Affairs.Answer: CTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition24)The central bank of the United States isA)Citicoip.B)The Fed.C)Bank of America.D)The Tieasuiy.E)none of the above.Answer: BTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition25)Monetaiy policy is chiefly conceined withA)how much money businesses earn.B)the level of interest rates and the nation's money supply.C)how much money people pay in taxes.D)whether people have saved enough money fbr letiiement.Answer: BTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition26)Economists gioup commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaiies. Financial intermediaiies A)act as middlemen, borrowing funds fiom those who have saved and lending these funds to others.B)produce notliing of value and are therefore a drain on society's resources.C)help piomote a more efficient and dynamic economy.D)do all of the above.E)do only A and C of the above.Answer: ETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition27)Economists gioup commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaiies. Financial intermediariesA)act as middlemen, borrowing funds fiom those who have saved and lending these funds to others.B)play an impoilant role in determining the quantity of money in the economy.C)help promote a more efficient and dynamic economy.D)do all of the above.E)do only A and C of the above.Answer: DTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition28)Banks are important to the study of money and the economy because theyA)provide a channel for linking those who want to save with those who want to invest.B)have been a source of financial innovation that is expanding the alternatives available to those wanting to invest theii money.C)are the only financial institution to play a role in determining tlie quantity of money in the economy.D)do all of the above.E)do only A and B of the above.Answer: ETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition29)Banks, savings and loan associations, mutual savings banks, and credit unionsA)are no longer inipoitant players ill financial inteimediation.B)have been providing seivices only to small depositors since deregulation.C)have been adept at innovating in response to changes in the regulatoiy environment.D)all of the above.E)only A and C of the above.Answer: CTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition30)(I) Banks are financial inteimediaries that accept deposits and make loans.(II) The tenn "banks" includes firms such as commercial banks, savings and loan associations, mutual savings banks, credit unions, insurance companies, and pension funds.A)(I) is true, (II) false.B)(I) is false, (II) true.C)Both are true.D) Both are false.Answer: ATopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous EditionA)Black FridayB)Black MondayC)Blackout DayD)none of the aboveAnswer: BTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition32)The largest financial intennediaiies areA)insurance companies.B)finance companies.C)banks.D)all of the above.Answer: CTopic: Chapter 1.2 Why Study Financial ListitutionsQuestion Status: Previous Edition33)In recent yearsA)interest rates have remained constant.B)the success of financial institutions has reached levels unpiecedented since the Great Depiession.C)stock markets have crashed.D)all of the above.Answer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition34) A securityA)is a claim oi price of property that is subject to ownei sliip.B)promises that payments will be made peiiodically fbr a specified peiiod of time.C)is the price paid fbr the usage of funds.D)is a claim on the issuers future income.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous EditionA)BanksB)Insurance companiesC)Finance companiesD)All of the aboveAnswer: DTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition36)Monetaiy policy affectsA)interest rates.B)inflation.C)business cycles.D)all of the above.Answer: DTopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition37) A rising stock market index due to higher share pricesA)incieases people's wealth and as a result may inciease their willingness to spend.B)increases the amount of funds that business films can raise by selling newly issued stock.C)decreases the amount of fiinds that business firms can raise by selling newly issued stock.D)both A and B of the above.Answer: DTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition38)From the peak of the high-tech bubble in 2000, the stock market by overby late 2002.A)collapsed; 75%B)rose; 35%C)collapsed; 30%D)rose; 50%Answer: CTopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition39)The Dow fell below 7,000 in 2009, only to stall a bull market inn, reaching new highs above in 2013.A)12,000B)10,000C)15,000D)19,000Answer: CTopic: Chapter 1.1 Why Study Financial Markets Question Status: New Question1.2 Tme/False1)Money is anything accepted by anyone as payment for sendees or goods.Answer: TRUETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition2)Interest rates are determined in the bond markets.Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition3) A stock is a debt security that promises to make periodic payments fbr a specific period of time.Answer: FALSETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition4)Monetaiy policy affects interest rates but has little effect on inflation or business cycles. Answer: FALSETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition5)The govenunent organization responsible fbr the conduct of monetaiy policy in the United States is the U.S. Treasury.Answer: FALSETopic: Chapter 1.2 Why Study Financial ListitutionsQuestion Status: Previous Edition6)Interest rates can be accurately described as the rental price of money.Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition7)Holding eveiytliiiig else constant, as the dollar weakens vacations abroad become less attractive.Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition8)In recent years, financial markets have become more stable and less risky. Answer: FALSETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition9)Financial innovation has provided moie options to both investors and borrowers. Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition10) A financial inteimediaiy bonows funds fiom people who have saved.Answer: TRUETopic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition11)Holding everything else constant, as the dollar stiengtliens fbreigiieis will buy more U.S. exports.Answer: FALSETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition12)In a bull market stock prices are rising, on average.Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition13)Financial institutions are among the largest employers in the countiy and frequently pay very high salaries.Answer: TRUETopic: Chapter 1.3 Applied Managerial PerspectiveQuestion Status: Previous Edition14)Different interest rates have a tendency to move in unison.Answer: TRUETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition15)Financial markets are what makes financial institutions work.Answer: FALSETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition16)In recent years, financial markets have become more risky. However, only a limited number of tools (such as derivatives) are available to assist in managing this risk. Answer: FALSETopic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition17)Although the internet lias changed many aspects of our lives, it hasn't proven very useful for collecting and/or analyzing financial and economic data.Answer: FALSETopic: Chapter 1.4 How We Study Financial Markets and Institutions Question Status: New Question1.3 Essay1)Have interest rates been more or less volatile in recent years? Why?Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition2)Why should consumers be concerned with movements in fbreign exchange rates? Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition3)How does the value of the dollar affect the competitiveness of American businesses? Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition4)What is monetary policy and who is responsible fbr its implementation?Topic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition5)What are financial intermediaiies and what do they do?Topic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition6)What is money?Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition7)How does a bond differ fiom a stock?Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition8)Why is the stock market so important to individuals, films, and the economy? Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition9)What is the cential bank and what does it do?Topic: Chapter 1.2 Why Study Financial InstitutionsQuestion Status: Previous Edition10)If you are plamiing a vacation to Europe, do you prefer a strong dollar 01 weak dollar relative to the euio? Why?Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: Previous Edition11)How has the stock market perfoimed since 2000?Topic: Chapter 1.1 Why Study Financial MarketsQuestion Status: New Question。

《国际经济学》练习1

Chapter 1 An Introduction to International TradeMultiple-Choice Questions1) C ountries of the world differ in terms of theirA) g eographic size.B) p opulation size.C) s tandards of living.D) A ll of the above.2) T he difference between a country's Gross National Product (GNP) and its Gross Domesticproduct (GDP) is thatA) G NP refers to production within the nation while GDP refers to production by domesticfactors no matter where they are located.B) G NP is always bigger than GDP.C) G DP refers to production within the nation while GNP refers to production by domesticfactors no matter where they are located.D) T wo of the above are true.3) P er capita GNP is defined as a country's GNP divided by itsA) p opulation.B) l abor force.C) c apitalists.D) N one of the above.4) W hich of the following statements is false?A) R icher countries tend to be found in North America, Western Europe, and Japan.B) C ountries with large populations tend to be rich.C) G rowth of per capita GNP tends to be quite stable about 1.5-3 percent per year inindustrialized countries.D) O ver the past several decades, growth of per capita GNP tends to be higher on averagein industrialized countries than in low or middle-income countries.5) T he ratio of a country's exports to its total output (GNP or GDP)A) i s known as the index of openness.B) p rovides a rough measure of the importance of international trade to that economy.C) i f calculated for the United States would be quite low.D) A ll of the above.6) W hich of the following statements is false?A) B etween 1980 and 2000, the index of openness has risen for most countries.B) S ince 1950, international trade has been growing faster than the growth of world output.C) A country cannot be a leading world exporter without a high index of openness.D) T wo of the above are true.7) B arriers to tradeA) i nclude government policies such as tariffs and quotas.B) h ave been falling with technological improvements in transportation andcommunication.C) h ave risen since World War II as many countries have imposed higher tariffs.D) T wo of the above are true.8) W hich of the following is true?A) M uch of the trade of the European Union (EU) countries is with EU countries.B) I ndustrialized countries tend to trade relatively little and largely with developingcountries.C) D eveloping countries in Africa and South America tend to trade the most and largelywith themselves.D) A ll of the above are true.9) T he leading trading partner of the United States isA) C anada.B) J apan.C) G ermany.D) M exico.10) W hich of the following statements is true?A) C ountries tend to trade extensively with their neighbors.B) T he United States is an important trading partner for many countries.C) T he largest amount of international trade occurs between industrialized countries.D) A ll of the above are true.11) T he most commonly traded product (by value) in recent years has beenA) a utomobiles.B) w heat.C) t elevisions, stereos, and VCRs.D) s teel.12) T he United States tends to exportA) o nly a narrow range of products such as wheat.B) a wide set of products, primarily manufactured goods.C) v ery little.D) N one of the above.13) J apanese exports are heavily concentrated inA) a gricultural products such as rice.B) n atural resource products such as coal.C) m anufactured products including motor vehicles.D) B oth A and C.14) T he types of goods Japan exports and imports appear to be well explained byA) J apanese endowments of factors of production (e.g. land, labor, capital, naturalresources).B) h igh and rising Japanese tariffs.C) a dvertising and other sales promotion efforts.D) A ll of the above.15) I nternational tradeA) a ccounts for more than 90 percent of world economic activity.B) i s a relatively small (about 30 percent of world output) but growing part of worldeconomic activity.C) h as been growing at about the same rate as the world economy.D) B oth A and C.True or False Questions1) A country's GNP is always larger than its GDP.2) A country's index of openness can never exceed 100 in value.3) G rowth in per capita GNP in developing countries has tended to be much more variable inrecent years than per capita GNP growth rates in industrialized countries.4) I f a country is industrialized then prolonged periods of negative growth in GNP per capitashould not be a cause for concern.5) B etween 1980 and 2000, virtually all countries have become more open.6) L arge countries tend to be more open than small countries.7) A s measured by the index of openness, the United States is relatively closed, and yet, it wasthe world's largest exporter in 2000.8) T ravel services include purchases of items by residents of one country when they travel toanother country.9) C ountries have trade surpluses when they export more than they import.10) M ost of world trade is in the form of manufactured consumer goods such as TVs, stereos,VCRs, and running shoes.。

英文版国际金融试题和答案

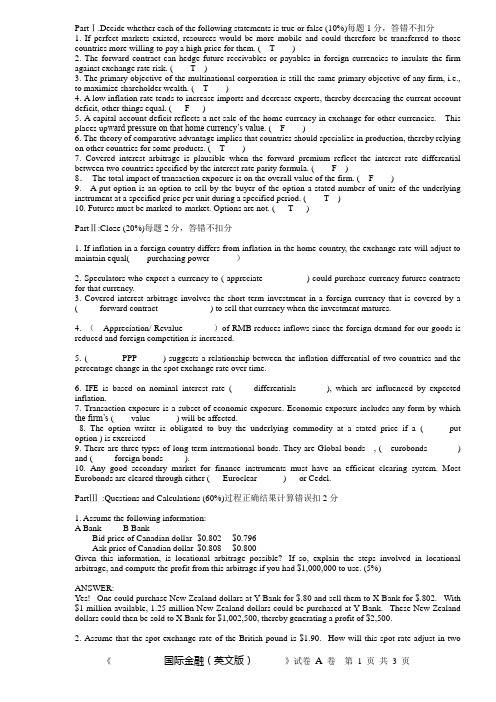

Part Ⅰ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分分,答错不扣分1. 1. If If If perfect perfect perfect markets markets markets existed, existed, existed, resources resources resources would would would be be be more more more mobile mobile mobile and and and could could could therefore therefore therefore be transferred be transferred to to those those countries more willing to pay a high price for them. ( T ) 2. The forward contract can h edge hedge hedge future receivables future receivables or or payables payables payables in in in foreign currencies to foreign currencies to i nsulate insulate insulate the the the firm firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. 7. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage is is is plausible plausible plausible when when when the the the forward forward forward premium premium premium reflect reflect reflect the the the interest interest interest rate rate rate differential differential between two countries specified by the interest rate parity formula. ( F ) 8. The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) Part Ⅱ:Cloze (20%)每题2分,答错不扣分分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. 3. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage involves involves involves the short-term the short-term investment investment in in in a a a foreign foreign foreign currency currency currency that that that is covered is covered by by a a ( forward contract ) to sell that currency when the investment matures. 4. ( Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. 6. IFE IFE IFE is is is based based based on on on nominal nominal nominal interest interest interest rate rate rate ( ( differentials ), ), which which which are are are influenced influenced influenced by by by expected expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( ( value ) will be affected. 8. 8. The The The option option option writer writer writer is is is obligated obligated obligated to to to buy buy buy the the the underlying underlying underlying commodity commodity commodity at at at a a a stated stated stated price price price if if if a a a ( ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. 10. Any Any Any good good good secondary secondary secondary market market market for for for finance finance finance instruments instruments instruments must must must have have have an an an efficient efficient efficient clearing clearing clearing system. system. system. Most Most Eurobonds are cleared through either ( Euroclear ) or Cedel. Part Ⅲ :Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given Given this this this information, information, information, is is is locational locational locational arbitrage arbitrage arbitrage possible? possible? If If so, so, so, explain explain explain the the the steps steps steps involved involved involved in in in locational locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two years if if the the the United United United Kingdom Kingdom Kingdom experiences experiences experiences an an an inflation inflation inflation rate rate rate of of of 7 7 7 percent percent percent per per per year year year while while while the the the United United United States States experiences an inflation rate of 2 percent per year?(10%) ANSWER: According to PPP , forward rate/spot=indexdom/indexfor the exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 × [1 + (–.047)] = $1.8107 3. 3. Assume Assume Assume that that that the spot the spot exchange exchange rate rate rate of the of the Singapore Singapore dollar dollar dollar is is is $0.70. $0.70. The The one-year one-year one-year interest interest interest rate rate rate is is is 11 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%) (5%) ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf) $.70 × (1 + .04) = $0.728 4. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%) ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be be received received received could could could be be be used used used to to to pay pay pay off off off the the the loan. loan. This This amounts amounts amounts to to to (100,000/1.02) (100,000/1.02) (100,000/1.02) = = = about about about S$98,039, which S$98,039, which could could be be be converted converted converted to to to about about about $49,020 $49,020 $49,020 and and and invested. invested. The The borrowing borrowing borrowing of of of Singapore Singapore Singapore dollars dollars dollars has has has offset offset offset the the transaction exposure due to the future receivables in Singapore dollars. 5. 5. A A U.S. company ordered ordered a a a Jaguar Jaguar Jaguar sedan. In sedan. In 6 6 months , months , it will pay pay ££30,000 30,000 for for for the the the car. car. car. It It worried worried that that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£. (1)Is hedging in the options market better if the £ rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even?(15%)Solution: (1)If the £ rose to $1.92 in 6 months, the U.S. company would rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is $1.90 + $0.023 = $1.9230/£This is bigger than $1.92. So hedging in the options market is not better. (2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate , hedging or not doesn’t matter. So, the exchange rate =$1.923/£. 6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%) textbook page50 答案以教材第50 页为准页为准P AR T Ⅳ: Diagram(10%) The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call option Solution: Following diagram shows the profit and loss potential, and the break-even price of this put option: P AR T Ⅴ:Additional Question Suppose Suppose that that that you you you are are are expecting expecting expecting revenues revenues revenues of of of Y Y 100,000 100,000 from from from Japan Japan Japan in in in one one one month. month. Currently, Currently, 1 1 1 month month forward contracts are trading at $1 = $105 Y en. Y ou have the following estimate of the Y en/$ exchange rate in one month. Price Probability 90 Y en/$ 4% 95 Y en/$ 25% 100 Y/$ 45% 105 Y en/$ 20% 110 Y en/$ 6% a) What position in forward contracts would you take to hedge your exchange risk? b) Calculate the expected value of the hedge. c) How could you replicate this hedge in the money market? Y ou are expecting revenues of Y100,000 in one month that you will need to covert to dollars. Y ou could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Y en). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to be Y100,000/ 105 = $952 On the other hand, you can wait and use the spot markets. Exchange Rate Probability Revenue w/Hedge Revenue w/out Hedge V alue of Hedge 90 Y/$ 4% $1,111 $952 -$159 95 Y/$ 25% $1,052 $952 -$100 100 Y/$ 45% $1,000 $952 -$48 105 Y/$ 20% $952 $952 $0 110 Y/$ 6% $909 $952 $43 Expected V alue = (.02)(-159) + (.25)(-100) + (.45)(-48) + (.20)(0) + (.08)(43) = -$24 Y ou could replicate this hedge by using the following: a) Borrow in Japan b) Convert the Y en to dollars c) Invest the dollars in the US d) Pay back the loan when you receive the Y100,000 。

(完整word版)国际金融题库(英文版).doc

(完整word版)国际⾦融题库(英⽂版).doc Multiple-choice test(only one is correct):1.Gresham’ s Law states thata)Bad money drives good money out of circulation.b)Good money drives bad money out of circulationc)If a country bases its currency on both gold and silver, at an official exchange rate, it will be themore valuable of the two metals that circulate.d)None of the above.2.Balance of paymentsa) is defined as the statistical record of a country’ s international transactions over a certain period oftime presented in the form of a double-entry bookkeepingb) provides detailed information concerning the demand and supply of a country’ s currencyc)can be used to evaluate the performance of a country in international economic competitiond)all of the above3.If the United States imports more than it exports, thena)The supply of dollars is likely to exceed the demand in the foreign exchange market, ceteris paribus.b)One can infer that the U.S. dollar would be under pressure to depreciate against other currenciesc)a) and b)d)None of the above4. The current spot exchange rate is $1.55/ and the three-£month forward rate is $1.50/. You enter into£ a short position on 1,000£.At maturity, the spot exchange rate is $1.60/. How much have£ you made or lost?a) Lost $100b) Made £100c) Lost $50d) Made $1505. The sensitivity of“ realized” domestic currency values of the firm denomi’scontractualated cash flowsin foreign currency to unexpected changes in the exchange rate is:a)Transaction exposureb)Translation exposurec)Economic exposured)None of the above6.Three days ago, you ente red into a futures contract to sell ?62,500 at $1.20 per ?. Over the past three days the contract has settled at $1.20, $1.22, and $1.24. How much have you made or lost?a)Lost $0.04 per ? or $2,500b)Made $0.04 per ? or $2,500c)Lost $0.06 per ? or $3,750d)None of the above7.A swap banka)Can act as a broker, bringing together counterparties to a swapb)Can act as a dealer, standing ready to buy and sell swapsc)Both a) and b)d)Only sometimes a) but never ever b)8.Suppose that the one-year interest rate is 5.0 percent in the United States, the spot exchange rate is$1.20/?, and the one -year forward exchange rate is $1.16/?. What must one -year interest rate be in the euro zone?a) 5.0%b) 1.09%c) 8.62%d) None of the above.a b$1.89 =1£.00. If you were to buy $10,000,000 worth of British pounds and then sell them five minutes later, how much of your $10,000,000 would be“ eaten-ask”spread?bythe bida)$1,000,000b)$52,910.05c)$100,000d)$52,631.5810.Under the gold standard, international imbalances of payment will be corrected automatically underthea)Gresham Exchange Rate regimeb)European Monetary Systemc)Price-specie-flow mechanismd)Bretton Woods Accord11.With any hedgea)Your losses on one side should about equal your gains on the other sideb)You should try to make money on both sides of the transaction: that way you make money comingand goingc)You should spend at least as much time working the hedge as working the underlying deal itselfd)You should agree to anything your banker puts in front of your face12. Comparing“ forward” and“ futures” exchange contracts, we can say that:a)They are both“ marked-to-market” daily.b)Their major difference is in the way the underlying asset is priced for future purchase or sale:futures settle daily and forwards settle at maturity.c) A futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC.d)b) and c)13.An “ option ” isa) a contract giving the seller (writer) the right, but not the obligation, to buy or sell a given quantityof an asset at a specified price at some time in the futureb) a contract giving the owner (buyer) the right, but not the obligation, to buy or sell a given quantity of an asset at a specified price at some time in the futurec)not a derivative, nor a contingent claim, securityd)unlike a futures or forward contract14.Economic exposure refers toa)the sensitivity of realized domestic currency values of the firm ’contractuals cash flows denominated in foreign currencies to unexpected exchange rate changesb)the extent to which the value of the firm would be affected by unanticipated changes in exchange ratec) the potential that the firm ’consolidated financial statement can be affected by changes in exchange ratesd)ex post and ex ante currency exposures15.Under a purely flexible exchange rate systema)Supply and demand set the exchange ratesb)Governments can set the exchange rate by buying or selling reservesc)Governments can set exchange rates with fiscal policyb) and c) are correct.。

国际金融英文版练习题Chapter_1

国际⾦融英⽂版练习题Chapter_1International FinanceAssignment Problems (1) Name: Student No.: Choose the correct answer for the following questions (only ONE correct answer) 1. Which of the following is NOT true regarding the subject matter of international finance?A. International finance studies the important trade theories.B. International finance examines the theory of balance of payments and its relationship with macroeconomic variables.C. International finance studies exchange rate theories and the impacts of the exchange rate on the economy.D. International finance discusses the exchange rate risks and the derivative instruments by which people use to cover the exchange rate risks and to speculate.2. Globalization refers to __________.A. the strengthening of existing international linkages of commerce, finance and the addition of new international linkagesB. the expansion of world governance and global societyC. the increased mobility of peoples and informationD. All of the above3. Mutually beneficial trade requires each country to be the least-cost producer of at least one good that it can export to its trading partner. This is called __________.A. the theory of comparative advantageB. the international finance theoryC. the theory of absolute advantageD. the theory of balance of payments4. Which of the following would NOT be a way to implement comparative advantage?A. IBM exports computers to Gambia.B. Computer hardware is designed in the United States but manufactured and assembled in Malaysia.C. Water of the greatest purity is obtained from the wells in Oregon, bottled, and exported worldwide.D. All of the above are examples of ways to implement comparative advantage.5. Which of the following would NOT be considered a feature of comparative advantage?A. Exporters in country A sell goods to importers in countryB.B. Firms in country A specialize in making products that can be produced relativeefficiently, given country A’s endowment of factors of production. Firms in country B do likewise thus maximizing the combined output of countries A and B.C. Trade exists between countries A and B because of specialized factors of production that cannot be moved among countries.D. All of the above are features of comparative advantage.6. The real sector in an economy deals with __________.A. transactions in all goods and servicesB. transactions in all financial assetsC. transactions in goods, services and financial assetsD. transactions in new technological products only7. Of the following, which would NOT be considered a way that government interferes with comparative advantage?A. tariffsB. quotasC. managerial skillsD. other non-tariff restrictions8. A firm with operations in more than one country is called a (an) _________.A. big firmB. multinational corporationC. international firmD. all of the above9. The primary goal of an MNC comes down to __________.A. seek marketsB. improve its production efficiencyC. gain access to technology or managerial expertiseD. maximize shareholder wealth10. World trade of goods and services has expanded in a remarkable pace because of the __________.A. reduction in trade barriersB. lower transportation costsC. advances in telecommunications, information technology and financial servicesD. All of the above are the reasons of rapid growth in international trade.11. Nowadays the world trade in goods and services is important __________.A. only to developed countriesB. only to less developed countriesC. to both developed and less developed countriesD. to neither developed nor less developed counties12. Which of the following is NOT a characteristic of the nowadays financial markets?A. Increasingly interdependent national financial marketsB. the global trend toward free-market economiesC. An increasingly number of cross-border partnerships, including many international merges, acquisitions, and joint venturesD. An increasing number of cooperative linkages among securities exchange13. __________ indicates that mutually beneficial trade can occur even when one nation is absolutely more efficient in the production of all goods.A. The theory of comparative advantageB. The theory of absolute advantageC. The theory of balance of paymentsD. The theory of exchange rate determination14. A well-established multinational company needs __________ to maximize its firm value.A. an open market placeB. high quality strategic managementC. access to capitalD. all of the aboveQuestions 15 through 20 are based on the information presented in table 1.1:Table 1.1Production capabilityContainers of snowboards Containers of digital cameras Austria has 1,000 units 15 containers/unit 8 containers/unitof production factorsRussia has 1,000 units 12 containers/unit 3 containers/unitof production factors15. One production factor in Austria has a (an) __________ over one production factor in Russia in _________.A. absolute disadvantage; digital camerasB. absolute disadvantage; snowboardsC. absolute advantage; both digital cameras and snowboardsD. none of the above16. Austria has a large comparative advantage over Russia in the production of __________ at a ratio of __________.A. snowboards; 5:4B. digital cameras; 8:3C. snowboards; 8:3D. digital cameras; 5:417. Assume no trade between Austria and Russia. If each country puts 50% of their factors into each product, the total number of snowboards and digital cameras produced by the two countries combined are __________ and _________.A. 13,500 snowboards; 5,500 camerasB. 12,000 snowboards; 8,000 camerasC. 5,500 snowboards; 13,500 camerasD. 3,000 cameras; 15,000 snowboards18. If trade takes place at Russia’s domestic price, __________ snowboards will be required to obtain 1 digital camera.A. 4B. 2.5C. 1.25D. 0.2519. If each country specializes in production with Austria producing only digital cameras and Russia producing only snowboards, at a trading rate of 3 snowboards per digital camera, how many cameras and snowboards will be available to be consumed in Austria if they trade 3,000 cameras to Russia?A. 9,000 snowboards and 5,000 camerasB. 3,000 snowboards and 3,000 camerasC. 3,000 snowboards and 9,000 camerasD. There is not enough information to answer this question20. If each country specializes in production with Austria producing only digital cameras and Russia producing only snowboards, at a trading rate of 3 snowboards per digital camera, how many cameras and snowboards will be available to be consumed in Russia if they trade 9,000 snowboards to Austria?A. 9,000 snowboards and 5,000 camerasB. 3,000 snowboards and 3,000 camerasC. 3,000 snowboards and 9,000 camerasD. There is not enough information to answer this questionAnswers to Assignment Problems (1)1. A2. D3. C4. D5. D6. A7. C8. B9. D 10. D11.C 12.B 13.A 14.D 15. C 16. B 17. A 18. A 19. A 20. B。

金融学第二版(英文版)Chapter 1

Typical organizational chart

CFO (chief financial officer)

Def.: Senior vice president with responsibility for all the financial functions in the company Reports directly to the chief executive officer (CEO) 3 departments report to him:

savings (asset allocation) – Financing decisions: income or borrowing (liability) – Risk-management decisions: how to reduce financial uncertainties

Household’s wealth

Financial decisions of companies

Def.: Companies are entities that have the primary function to produce goods and services In order to produce companies use capital (physical and financial) Companies have an access to the financial capital through the financial markets Come in different shapes and sizes The branch of finance dealing with them is called corporate finance

(完整word版)英文版国际金融试题和答案

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

国际金融习题集英语版