Financial Ratios (Accounting)

企业偿债能力文献综述范文

企业偿债能力文献综述范文英文回答:Title: Corporate Solvency and Credit Risk: A Literature Review.Introduction:Corporate solvency, the ability of a firm to meet its financial obligations as they become due, is a critical determinant of its financial health and long-term sustainability. Assessing corporate solvency is crucial for investors, creditors, and other stakeholders to evaluate the risk associated with investing in or lending to a particular firm. This literature review aims to provide a comprehensive overview of the existing research on corporate solvency, focusing on the various approaches used to assess it and the factors that influence it.Approaches to Assessing Corporate Solvency:Researchers have developed numerous approaches to assess corporate solvency, each with its strengths and weaknesses. Some of the most widely used methods include:Financial Ratios: Financial ratios, such as the debt-to-equity ratio and the current ratio, provide insightsinto a firm's financial structure, liquidity, and profitability. A high debt-to-equity ratio, for example, may indicate a higher risk of insolvency.Credit Scoring Models: Credit scoring models, such as the Altman Z-Score and the Moody's KMV EDF Score, use statistical techniques to assign a score to a firm based on various financial and non-financial factors. A higher score generally indicates a lower risk of default.Cash Flow Analysis: Cash flow analysis examines the flow of cash into and out of a firm, providing insightsinto its ability to generate cash from operations and meet its obligations. A negative cash flow from operations can raise concerns about solvency.Going-Concern Assessment: Going-concern assessments consider a firm's future prospects and ability to continue operating as a going concern. Factors such as industry trends, competitive pressures, and management effectiveness are evaluated to assess the likelihood of a firm's survival.Factors Influencing Corporate Solvency:The solvency of a firm is influenced by a wide range of factors, both internal and external. Internal factors include:Management Quality: Effective management, with astrong understanding of financial risk and a commitment to sound financial practices, can enhance corporate solvency.Capital Structure: The composition of a firm's debtand equity financing can impact its solvency. A higher proportion of debt financing increases the risk of insolvency.Business Model: The underlying business model,including industry dynamics, competitive pressures, and operating margins, can affect a firm's ability to generate cash and meet its obligations.External factors influencing corporate solvency include:Economic Environment: Economic downturns, recessions, and market volatility can adversely impact a firm's sales, profits, and cash flow, increasing the risk of insolvency.Regulatory Changes: Changes in regulatory policies, such as increased capital requirements or accounting standards, can impose additional financial burdens on firms and affect their solvency.Competitive Landscape: Intense competition, market share erosion, and technological disruptions can reduce a firm's profitability and weaken its financial position.Implications for Investors and Creditors:Understanding corporate solvency is essential for investors and creditors to make informed decisions.Investors need to assess the risk of insolvency associated with potential investments, while creditors need to assess the creditworthiness of firms to mitigate the risk of default. The findings of this literature review provide insights into the approaches used to assess corporate solvency and the factors that influence it, enabling investors and creditors to make more informed judgments about the financial risks involved.Conclusion:Corporate solvency is a complex and multifacetedconcept that should be evaluated using a comprehensive approach that considers both financial and non-financial factors. By employing appropriate assessment techniques and understanding the factors that influence corporate solvency, investors and creditors can better assess the risk associated with investing in or lending to particular firms, enabling them to make more informed financial decisions.中文回答:企业偿债能力文献综述。

financialratios(accounting)

IntroductionFinancial statements obviously play an important role in a fundamental approach to security analysis. Among the items of potential interest to analysts are financial ratios relating key parts of the financial statement. Financial Ratio is a measure of the relationship which exists between two figures shown in a set of financial statements, which indicates performance and financial situation of a company. Financial ratios could assess the profit of investments during the different years, and it can be also used to analyze trends and to compare the firm’s financials to those of other firms. Thus, financial ratios could compare the benefits and risks of different companies, which help investors and creditors to make rational decision. Moreover, this can evaluate the finance condition, operating results and cash flows for a business as well. Financial ratios can be classified according to the information they provide. There are some types of ratios: Liquidity ratios, Profitability rations, Efficiency ratios and Gearing ratios. However, financial ratios relate to both benefits and limitations in evaluating the performance and management of firms. This assignment is going to analyzing the EasyJet plc annual report and accounts in 2003 to discuss the usefulness and limitations of financial ratios.The ratios analysis is one of the most powerful tools of financial management. It can be computed from any pair of numbers. Given the large quantity of variables included in financial statements, a very long list of meaningful ratios can be derived. A standard list of ratios or standard computation of them does not exist. Financial ratios are used by bankers, investors, and business analysts to assess a company’s financial status. Financial ratio analysis can be used in two different but equally useful ways. Business can use them to examine the current performance of your company in comparison to past periods of time, from the prior quarter two years ago. Frequently, this can help you identify problems that need fixing. Even better, it can direct company attention to potential problems that can be avoided.Financial ratio plays an important role in financial statements, so there are some benefits of financial ratios. First of all, most of the rations become much more meaningful when used as a basis for comparison, which make a company very easy to compare firms against each other. Besides, it also makes possible comparison of the performance of different divisions of the business. Secondly, financial ratio provides information for inter-firm comparison. It highlights the factors associated with successful and unsuccessful firm, and it also reveal strong firms and weak firms, overvalued and undervalued firms. There are no firm has all the strength points, but ratio analysis can create co-ordination between strength points and weak points. Thirdly, it simplifies the comprehension of financial statements, which is able to illustrate the financial condition of a company by the number. For example, a company’s gross profit in 2011 is 25.3% and in 2012, it is 27.5%. According to this ratio, people can understand whether their company is growing or falling. In addition, financial ratio helps in planning and forecasting as well. This means it could be used to assess the risk factor involved for an investor and predict the bankruptcy of acompany. Thus, financial ratio is an early warning system for businesses that are heading into financial distress.Although ratio analysis is an extremely useful and powerful tool for the analysis and interpretation of financial statements, but it still has some limitations. Firstly, there are no two companies are exactly the same. This means many large firms operate different divisions in different industries, so it is difficult to find a meaningful set of industry –average ratios. Additionally, inflation might be damage of balance sheets of a company, which will be affected profits of a company as well. After that, small companies tend to pay more debt than large companies, and this will affect the interest coverage ratio formula as a way needs to be explained. Moreover, ratio analysis explains relationships between past information while users are more concerned about current and future information. Therefore, it is only the reference value for the future decision making. What is more, some accounting ratios might be defined in more than one way. This means, different companies may choose different accounting procedure, and each operators have different calculation methods that lead to different interpretations of data. It is very important that users should be aware of this problem when basing important economic decisions on information provided in the form of ratio analysis. Furthermore, a statement of financial position shows only a snapshot of a company’s financial position on a single date, whilst a statement of comprehensive income covers an entire accounting period. Therefore, if the company’s assets and liabilities end of the period are not typical of the period as a whole, any ratio which combines a figure drawn from the statement of financial position with a figure drawn from the statement of comprehensive income might produce a misleading result. Last but not least, financial ratio just able to show the data of company to the analysts or managers, but it cannot explain the problems and deal with them.EasyJet is a British airline carrier based at London Luton Airport. This is helpful to take a look at what information is obvious from the financial statement. There is some information to interpretation of the ratios, which from the EasyJet plc annual report and accounts in 2013. On the one hand, the non-current assets increased by about 26% (from 2191 pounds to 2964 pounds) between 2009 and 2013. This may be due to the fact that the company invested in some property, such as plane, airline, staffs and so on. Moreover, the number of revenue keep grew up between the 2009 and 2013. Companies use selling products or providing services to achieve the revenue, so the high revenue means the increase of assts or decrease of liabilities in a company. At the same time,there was a significantly increased in the number of profit during the 5 years, which were from 71million pounds in 2009 to 398 million pounds in 2013. Obviously, this means EasyJet Company getting better continually during the year. Return on capital employed is an important ratio expresses a company’s profit as a percentage of the amount of capital invested in the company. This version of ROCE interprets “capital employed”as the total amount of money in the long-term, regardless of whether that money has been supplied by shareholders or lenders. This amount is then compared with the return achieved on that capital. According to theinformation from the EasyJet report, there was a remarkable jumped in the number of the return on capital employed from 3.6% to 17.4% during the five years. Generally, the higher the rate of return on capital employed of the company has more growth in the future.Financial information can be “massaged” in several ways to the figures used for ratios more attractive. For example, many businesses delay payments to trade creditors at the end of the financial year to make the cash balance higher than normal and the creditor days figure higher too.these ratios to compare the performance of the company against that of competitors or other members of same industry Performing a ratio analysis on a single set of financial statements is usually a fairly pointless exercise. For example, if the company's inventory turnover ratio of 1 to 4 this year when it was 1 to 3 last year, this means that inventory levels are building in the current year. The increase in the ratio is an indication that sales are slowing or that inventory levels (which are expensive to maintain) are growing. The ratio change alerts the business manager to a pending cash crunch in time to avert it.If you are evaluating two businesses to hire as subcontractors, their respective debt-to-asset ratios will give you an idea about which of these two companies is the more stable choice. The company with a higher debt-to-asset ratio could be more likely to go out of business as a result of defaulting on interest and principal repayments. However, if your primary objective is investing in a business, and you are seeking high returns, the company with the higher ratio may be a better bet. Firms that borrow heavily are high-risk, high-return investments and tend to do either very well or fail spectacularlyA company can burn through its cash reserves quickly during tough economic times or industry contraction. Financial ratios can operate as an early warning system for businesses that are heading into financial distress. Ratios such as the quick ratio (how much money will there be to pay current debts?), gross margin (how much is the company making on every widget it sells?), and accounts receivable ratio (how quickly are sales being paid for?) tell the company's owners if the money is going to run out and how quickly. The sooner the cash flow problem is identified, the sooner it can be corrected.. The liquidity and non-bank credit ratio are used for assessing the companies going through a hard time. The non-bank ratio is used by a firm where the firm cannot afford to get more credit from banks. This ratio means the greater risk as if the company cannot repay the loan to the bank, it may be charge a higher interest. Therefore, good financial ratio analysing can help business to avoid unnecessary risks.The positive use of financial ratios has been of two types: by accountants and analysts to forecast future financial variables.。

会计的基本英语知识点汇总

会计的基本英语知识点汇总1. Introduction to Accounting会计简介Accounting is the systematic process of identifying, recording, measuring, classifying, summarizing, interpreting, and communicating financial information. It plays a crucial role in the management and decision-making processes of businesses and organizations.会计是一种系统性的流程,用于识别、记录、度量、分类、总结、解释和传达财务信息。

它在企业和组织的管理和决策过程中发挥着至关重要的作用。

2. Basic Accounting Principles基本会计原则There are several fundamental principles that underpin the field of accounting:有几个基本原则支撑着会计领域:a) Accrual Principle: This principle states that financial transactions should be recorded when they occur and not when the cash is received or paid out.应计原则:该原则规定财务交易应在其发生时记录,而不是在现金收到或支付时记录。

b) Matching Principle: This principle states that expenses should be recognized in the same accounting period as the revenues they help generate.配比原则:该原则规定支出应在与其相关的收入产生的同一会计期间内确认。

会计英语 常用词

Account 帐户Accounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室Income statement 损益表Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系Assets 资产Business entity 企业个体Capital stock 股本Corporation 公司Cost principle 成本原则Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设Inflation 通货膨涨Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owners equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设Stockholders 股东Stockholders equity 股东权益Window dressing 门面粉饰Tier1capital一类资本Tier2capital二类资本Totalcreditlimit整体信用限额Totalcurrentassets流动资产总额Trade-off协定Tradecompanies贸易企业Tradecreditors应付账款Tradecredit商业信用Tradecycletimes商业循环周期Tradecycle商业循环Tradedebtors贸易债权人Tradedebt应收账款TradeIndemnity贸易赔偿Tradereferences贸易参考Tradingoutlook交易概况Tradingprofit营业利润Traditionalcashflow传统现金流量TripleA三AUCP跟单信用证统一惯例Uncovereddividend未保障的股利UniformCustoms&Practice跟单信用证统一惯例Unpaidinvoices未付款发票Unsecuredcreditors未担保的债权人Usefulnessofliquidityratios流动性比率的作用Usesofcash现金的使用Usingbankriskinformation使用银行风险信息Usingfinancialassessments使用财务评估Usingratios财务比率的运用Usingretention-of-titleclauses使用所有权保留条款V aluechain价值链V alueofZscoresZ值模型的价值V ariablecosts变动成本V ariableinterest可变利息V arietyoffinancialratios财务比率的种类V ettingprocedures审查程序V olatitlerevenuedynamic收益波动V olumeofsales销售量Warningsignsofcreditrisk信用风险的警示Workingassets营运资产Workingcapitalchanges营运资本变化额Workingcapitalmanagement营运资本管理workingcapitalratios营运资本比率workingcapital营运资本Write-downs资产减值Write-offs勾销ZscoreassessmentsZ值评估zscoremodelsz值模型Zscoresz值ZscoringZ值评分系统2Mmethod2M法3Mmethod3M法Ratioanalysis比率分析Ratioanalystweaknesses~L率分析的缺陷Realinsolvency真实破产Realizationconcept实现原则Realsalesgrowth实际销售收入增长率Receivables应收账款Recession衰退Reducingdebtors冲减应收账款Reducingprofits冲减利润Reducingprovisions冲减准备金Reducingreportedprofits冲减账面利润Reducingstocks减少存货RegistrarofCompanies企业监管局Regulatoryrisk监管风险Releasingprovisions冲回准备金Relocationexpenses费用再分配Reminderletters催缴单Repaymentondemandclause即期偿还条款Replacementofprincipal偿还本金Reportofchairman总裁/董事长报告Reserveaccounting准备金核算Residualcashflows剩余现金流量Restrictingbaddebts限制坏账Restrictionsonsecuredborrowing担保借款限制Retention-of-titleclauses所有权保留条款Revenues总收入Risk-reward风险回报Risk-weightedassets风险加权资产Riskanalysisreports风险分析报告Riskandbanks风险与银行Riskandcompanies风险与企业RiskandReturn风险与回报Riskcapital风险资本ROCE资本收益率Romaplaclauses“一手交钱一手交货”条款Sales销售额Secondaryratios分解比率Securedassets担保资产Securedcreditors有担保债权人Securedloans担保贷款Securemethodsofpayment付款的担保方式SecuritiesandExchangeCommission(美国)证券交易委员会Securitygeneralprinc iples担保的一般原则Securityguarantees抵押担保Securityofpayment付款担保Segmentation细分Settingandpolicingcreditlimits信用限额的设定与政策制定Settlementdiscount(提前)结算折扣Settlementterms结算条款Shareprice股价Short-termborrowing短期借款Short-termcreditors短期负债Short-termism短期化SIC常务诠释委员会Short-termliabilities短期债务Significanceofworkingcapital营运资金的重要性Singlecreditcustomer单一信用客户Singleratioanalysis单一比率分析Sizeofcreditrisk信用风险的大小Slowstockturnover较低的存货周转率Sourcesofassessments评估信息来源Sourcesofcreditinformation信用信息来源Sourcesofrisk风险来源Sovereignrating主权评级Specialistagencies专业机构Specificdebtissue特别债券发行Speculativegrades投机性评级Speculative投机性Splitrating分割评级Spotrate现价(即期比率)Spreadsheets电子数据表Staffredundancies员工遣散费Standard&Poor's标准普尔StandardandPoor标准普尔Standardsecurityclauses标准担保条款Standbycredits备用信用证StandingInterpretationsCommittee证券交易委员会Standingstartingcreditlimits持续更新信用限额Statisticalanalys is统计分析Statisticaltechniques统计技巧Statusreports(企业)状况报告Stocks股票Stockvaluations存货核算Straightlinedepreciationmethod直线折旧法Strategicpositioning战略定位Suplusassets盈余资产Suplusrating盈余评级Supplierpower供应商的力量Supplychain供应链Supportrating支持评级Swapagreement换合约Swaps互换SWOTanalysisSWOT分析Symptomsoffailurequestionnaires企业破产征兆调查表Takeovers收购Taxpayments税务支付Technicalinsolvency技术破产Technologyandchange技术进步Termloan定期贷款Termofborrowing借款期限Thirdpartyguarantees第三方担保Measurementandjudgment计量与判断Measuringrisk风险计量Medium-termloan中期贷款Microcomputermodelling计算机建模Minimumcurrentratiorequirement最低流动比率要求Minimumleverageratio最低举债比率Minimumnet-worthrequirement最低净值要求Minimumnetworth最低净值Minimumriskassetratio最低风险资产比率Monitoringactivity监管活动Monitoringcredit信用监控Monitoringcustomercreditlimits监管客户信贷限额Monitoringrisks监管风险Monitoringtotalcreditlimits监管全部信贷限额Monthlyreports月报Moody'sdebtrating穆迪债券评级Mortgage抵押mpr…ovingbalancesheet改善资产负债表Multiplediscriminateanalysis多元分析Nationaldebt国家债务NCI无信贷间隔天数Near-cashassets近似于现金的资产Negativecashflow负现金流量Negativenetcashflow负净现金流量Negativeoperationalcashflows负的经营性现金流量Negativepledge限制抵押Netbookvalue净账面价值Netcashflow净现金流量Networthtest净值测试Newentrants新的市场进人者Nocreditinterval无信贷间隔天数Non-cashitems非现金项目Non-corebusiness非核心业务Non-operationalitems非经营性项目Obtainingpayment获得支付One-manrule一人原则Openaccountterms无担保条款Operatingleases经营租赁Operatingprofit营业利润Operationalcashflow营性现金流量Operationalflexibility~营弹性Optimalcredit最佳信贷Ordercycle订货环节Ordinarydividendpayments普通股股利支付Organizationofcreditactivities信贷活动的组织Over-trading过度交易Overduepayments逾期支付Overviewofaccounts财务报表概览Parentcompany母公司PA T税后利润Paymentinadvance提前付款Paymentobligations付款义务Paymentrecords付款记录Paymentscore还款评分PBIT息税前利润PBT息后税前利润Percentagechange百分比变动Performancebonds履约保证Personalguarantees个人担保Planningsystems计划系统Pledge典押Points-scoringsystem评分系统Policysetting政策制定Politicalrisk政治风险Potentialbaddebt潜在坏账Potentialcreditrisk潜在信用风险Potentialvalue潜在价值Predictingcorporatefailures企业破产预测Preferencedividends优先股股息Preferredstockholders优先股股东Preliminaryassessment预备评估Premiums溢价Primaryratios基础比率Priorchargecapital优先偿付资本Prioritycashflows优先性现金流量Priorityforcreditors债权人的清偿顺序Prioritypayments优先支付Productlifecycle产品生命周期Productmarketanalysis产品市场分析Productrange产品范围Products产品Professionalfees专业费用Profitabilitymanagement盈利能力管理Profitabilityratios盈利能力比率Profitability盈利能力Profitandlossaccount损益账户Profitmargin利润率Profit利润Promissorynotes本票Propertyvalues所有权价值Providersofcredit授信者Provisionaccounting准备金会计处理Prudenceconcept谨慎原则Publicinformation公共信息Publicrelations公共关系Purposeofcreditratings信用评级的目的Purposeofratios计算比率的目的Qualitativecovenants定性条款Quantitativecovenants定量条款Querycontrol质疑控制Quickratio速动比率Ratingexercise评级实践Ratingprocessforacompany企业评级程序Implieddebtrating隐含债务评级Importanceofcreditcontrol信贷控制的重要性Improvedproducts改进的产品In-housecreditratings内部信用评级Incomebonds收入债券Incomestatement损益表Increasingprofits提高利润Increasingreportedprofits提高账面利润Indemnityclause赔偿条款Indicatorsofcreditdeterioration信用恶化征兆Indirectloss间接损失Individualcredittransactions个人信用交易Individualrating个体评级Industrialreports行业报告Industrialunrest行业动荡Industrylimit行业限额Industryriskanalysis行业风险分析Industryrisk行业风险Inflow现金流入Informationinfinancialstatements财务报表中的信息Inhouseassessment内部评估Inhousecreditanalysis内部信用分析Inhousecreditassessments内部信用评估Inhousecreditratings内部信用评级Initialpayment初始支付Insolvencies破产Institutionalinvestors机构投资者Insureddebt投保债务Intangiblefixedasset无形固定资产Inter-companycomparisons企业间比较Inter-companyloans企业间借款Interestcost利息成本Interestcoverratio利息保障倍数Interestcovertest利息保障倍数测试Interestholiday免息期Interestpayments利息支付Interestrates利率Interest利息Interimstatements中报(中期报表)Internalassessmentmethods内部评估方法Internalfinancingratio内部融资率InternalRevenueService美国国税局InternationalAccountingStandards(IAS)国际会计准则InternationalAccountingStandardsCommittee国际会计准则委员会InternationalChamberofCommerce国际商会Internationalcreditratings国际信用评级InternationalFactoringAssociation国际代理商协会Internationalsettlements国际结算Inventory存货Inverseofcurrentratio反转流动比率Investmentanalysts投资分析人员Investmentpolicy投资政策Investmentrisk投资风险Investmentspending投资支出Invoicediscounting发票贴现Issueddebtcapital发行债务资本Issueofbonds债券的发行Junkbondstatus垃圾债券状况Just-in-timesystem(JIT)适时系统Keycashflowratios主要现金流量指标Laborunrest劳动力市场动荡Large.Scaleborrower大额借贷者Legalguarantee法律担保Legalinsolvency法律破产Lendingagreements贷款合约Lendingcovenants贷款保证契约Lendingdecisions贷款决策Lendingproposals贷款申请Lendingproposition贷款申请Lendingtransactions贷款交易Lettersofcredit信用证Leverage财务杠杆率LIBOR伦敦同业拆借利率Lien留置Liquidassets速动资产Liquidationexpenses清算费Liquidation清算Liquidityandworkingcapital流动性与营运资金Liquidityratios流动比率Liquidityrun流动性危机Liquidityshortage流动性短缺Liquidity流动性Loancovenants贷款合约Loanguarantees贷款担保Loanprincipalrepayments贷款本金偿还Loanprincipal贷款本金Loanreview贷款审查LondonInter-bankOfferedRate伦敦同业拆借利率Long-termfunding长期融资Long-termrisk长期风险Long…termdebt长期负债Management管理层Marginallending边际贷款Marginaltradecredit边际交易信贷Marketing市场营销Marketsurveys市场调查Markets市场Matchingconcept配比原则Materialadverse-changeclause重大不利变动条款Maximumleveragelevel最高财务杠杆率限制Electronicdatainterchange(EDI)电子数据交换Environmentalfactors环境因素Equitycapital权益资本Equityfinance权益融资Equitystake股权Eucountries欧盟国家Eudirectives欧盟法规Eulaw欧盟法律Eurobonds欧洲债券Europeanparliament欧洲议会EuropeanUnion欧盟Evergreenloan常年贷款Exceptionalitem例外项目Excessivecapitalcommitments过多的资本承付款项Exchange-controlregulations外汇管制条例Exchangecontrols外汇管制Exhaustmethod排空法Existingcompetitors现有竞争对手Existingdebt未清偿债务Exportcreditagencies出口信贷代理机构Exportcreditinsurance出口信贷保险Exportfactoring出口代理Exportsales出口额ExportsCreditGuaranteeDepartment出口信贷担保局Extendingcredit信贷展期Externalagency外部机构Externalassessmentmethods外部评估方式Externalassessments外部评估Externalinformationsources外部信息来源Extraordinaryitems非经常性项目Extras附加条件Facilityaccount便利账户Factoringdebts代理收账Factoringdiscounting代理折扣Factoring代理FactorsChainInternational国际代理连锁Failurepredictionscores财务恶化预测分值FASB(美国)财务会计准则委员会Faultycreditanalysis破产信用分析Fees费用Finance,workingcapital为营运资金融资Finance,newbusinessventures为新兴业务融资Finance,repayexistingdebt为偿还现有债务融资Financialassessment财务评估Financialcashflows融资性现金流量Financialcollapse财务危机Financialflexibility财务弹性Financialforecast财务预测Financialinstability财务的不稳定性Financialratinganalysis财务评级分析Financialratios财务比率Financialriskratios财务风险比率Financialrisk财务风险FitchIBCAratings惠誉评级FitchIBCA惠誉评级Fixedassets固定资产Fixedchargecover固定费用保障倍数Fixedcharge固定费用Fixedcosts固定成本Floatingassets浮动资产Floatingcharge浮动抵押Floorplanning底价协议Focus聚焦Forcedsalerisk强制出售风险Foreignexchangemarkets外汇市场Forfaiting福费廷Formalcreditrating正式信用评级Forwardrateagreements远期利率协议FRAs远期利率协议Fundmanagers基金经理Fxtransaction外汇交易GAAP公认会计准则Gearing财务杠杆率Geographicalspreadofmarkets市场的地理扩展Globaltarget全球目标Goingconcernconcept持续经营原则Goodlending优质贷款Goodtimes良好时期Governmentagencies政府机构Governmentinterference政府干预Grossincome总收入Guaranteedloans担保贷款Guaranteeofpayment支付担保Guarantees担保High-riskloan高风险贷款High-valueloan高价值贷款Highcreditquality高信贷质量Highcreditrisks高信贷风险Highdefaultrisk高违约风险Highinterestrates高利率Highlyspeculative高度投机Highriskregions高风险区域Historicalaccounting历史会计处理Historicalcost历史成本IASC国际会计准则委员会IAS国际会计准则IBTT息税前利润ICE优质贷款原则Idealliquidityratios理想的流动性比率Iimprovingreportedassetvalues改善资产账面价值Creditdeterioration信用恶化Creditexposure信用敞口Creditgrantingprocess授信程序Creditinformationagency信用信息机构Creditinformation信用信息Creditinsuranceadvantages信贷保险的优势Creditinsurancebrokers信贷保险经纪人Creditinsurancelimitations信贷保险的局限Creditinsurance信贷保险Creditlimitsforcurrencyblocs货币集团国家信贷限额Creditlimitsforindividualcountries国家信贷限额Creditlimits信贷限额Creditmanagement信贷管理Creditmanagers信贷经理Creditmonitoring信贷监控Creditnotes欠款单据Creditordays应付账款天数Creditperiod信用期Creditplanning信用计划Creditpolicyissues信用政策发布Creditpolicy信用政策Creditproposals信用申请Creditprotection信贷保护Creditquality信贷质量Creditratingagencies信用评级机构Creditratingprocess信用评级程序Creditratingsystem信用评级系统Creditrating信用评级Creditreferenceagencies信用评级机构Creditreference信用咨询Creditriskassessment信用风险评估Creditriskexposure信用风险敞口Creditriskinsurance信用风险保险Creditrisk.Individualcustomers个体信用风险Creditrisk:bankcredit信用风险:银行信用Creditrisk:tradecredit信用风险:商业信用Creditrisk信用风险Creditscoringmodel信用评分模型Creditscoringsystem信用评分系统Creditscoring信用风险评分Creditsqueeze信贷压缩Credittakenratio受信比率Creditterms信贷条款Creditutilizationreports信贷利用报告Creditvetting信用审查Creditwatch信用观察Creditworthiness信誉Cross-defaultclause交叉违约条款Currencyrisk货币风险Currentassets流动资产Currentdebts流动负债Currentratiorequirement流动比率要求Currentratios流动比率Customercare客户关注Customercreditratings客户信用评级Customerliaison客户联络Customerrisks客户风险Cut-offscores及格线Cycleofcreditmonitoring信用监督循环Cyclicalbusiness周期性行业Dailyoperatingexpenses经营费用Day…ssalesoutstanding收回应收账款的平均天数Debentures债券Debtcapital债务资本Debtcollectionagency债务托收机构Debtissuer债券发行人Debtor'sassets债权人的资产Debtordays应收账款天数Debtprotectionlevels债券保护级别Debtratio负债比率Debtsecurities债券Debtserviceratio还债率Default违约Deferredpayments延期付款Definitionofleverage财务杠杆率定义Depositingmoney储蓄资金Depositlimits储蓄限额Depreciationpolicies折旧政策Depreciation折旧Developmentbudget研发预算Differentiation差别化Directloss直接损失Directorssalaries董事薪酬Discretionarycashflows自决性现金流量Discretionaryoutflows自决性现金流出Distributioncosts分销成本Dividendcover股息保障倍数Dividendpayoutratio股息支付率Dividends股利Documentarycredit跟单信用证DSO应收账款的平均回收期Durationofcreditrisk信用风险期Easternbloccountries东方集团国家EBITDA扣除利息、税收、折旧和摊销之前的收益ECGD出口信贷担保局Economicconditions经济环境Economiccycles经济周期Economicdepression经济萧条Economicgrowth经济增长Economicrisk经济风险Capitalizinginterestcosts利息成本资本化Capitalstrength资本实力Capitalstructure资本结构Cascadeeffect瀑布效应Cash-in-advance预付现金Cashassets现金资产Cashcollectiontargets现金托收目标Cashcycleratios现金循环周期比率Cashcycletimes现金循环周期时间Cashcycle现金循环周期Cashdeposit现金储蓄Cashflowadjustments现金流调整Cashflowanalysis现金流量分析Cashflowcrisis现金流危机Cashflowcycle现金流量周期Cashflowforecasts现金流量预测Cashflowlending现金流贷出Cashflowprofile现金流概况Cashflowprojections现金流预测Cashflowstatements现金流量表Cashflows现金流量Cashposition现金头寸CashpositiveJE现金流量Cashrichcompanies现金充足的企业Cashsurplus现金盈余Cashtank现金水槽Categorizedcashflow现金流量分类CEO首席执行官CE优质贷款原则Chairman董事长,总裁Chapter11rules第十一章条款Chargedassets抵押资产Charge抵押Chiefexecutiveofficer首席执行官Collateralsecurity抵押证券Collectingpayments收取付款Collectionactivitv收款活动Collectioncycle收款环节Collectionprocedures收款程序Collectivecreditrisks集合信用风险Comfortableliquiditypositi9n适当的流动性水平Commercialmortgage商业抵押Commercialpaper商业票据Commission佣金Commitmentfees承诺费Commonstockholders普通股股东Commonstock普通股Companyanditsindustry企业与所处行业Companyassets企业资产Companyliabilities企业负债Companyloans企业借款Competitiveadvantage竞争优势Competitiveforces竞争力Competitiveproducts竞争产品Complaintprocedures申诉程序Computerizedcreditinformation计算机化信用信息Computerizeddiaries计算机化日志Confirmedletterofcredit承兑信用证Confirmedlettersofcredit保兑信用证Confirmingbank确认银行Conservatismconcept谨慎原则Consistencyconcept一贯性原则Consolidatedaccounts合并报表Consolidatedbalancesheets合并资产负债表Contingentliabilities或有负债Continuingsecurityclause连续抵押条款Contractualpayments合同规定支出Controllimits控制限度Controllingcreditrisk控制信用风险Controllingcredit控制信贷Controlofcreditactivities信用活动控制Corporatecreditanalysis企业信用分析Corporatecreditcontroller企业信用控制人员Corporatecreditriskanalysis企业信用风险分析Corporatecustomer企业客户Corporatefailurepredictionmodels企业破产预测模型Corporatelending企业贷款Costleadership成本领先型Costofsales销售成本Costs成本Countrylimit国家限额Countryrisk国家风险Courtjudgments法院判决Covenants保证契约Covenant贷款保证契约Creativeaccounting寻机性会计Creditanalysisofcustomers客户信用分析Creditanalysisofsuppliers供应商的信用分析Creditanalysisonbanks银行信用分析Creditanalysis信用分析Creditanalysts信用分析Creditassessment信用评估Creditbureaureports信用咨询公司报告Creditbureaux信用机构Creditcontrolactivities信贷控制活动Creditcontrollers信贷控制人员Creditcontrolperformancereports信贷控制绩效报告Creditcontrol信贷控制Creditcycle信用循环Creditdecisions信贷决策Accountingconvention会计惯例Accountingforacquisitions购并的会计处理Accountingfordebtors应收账款核算Accountingfordepreciation折旧核算Accountingforforeigncurrencies外汇核算Accountingforgoodwill商誉核算Accountingforstocks存货核算Accountingpolicies会计政策Accountingstandards会计准则Accrualsconcept权责发生原则Achievingcreditcontrol实现信用控制Acidtestratio酸性测试比率Actualcashflow实际现金流量Adjustingcompanyprofits企业利润调整Advancepaymentguarantee提前偿还保金Adversetrading不利交易Advertisingbudget广告预算Advisingbank通告银行Ageanalysis账龄分析Ageddebtorsanalysis逾期账款分析Ageddebtors…exceptionreport逾期应收款的特殊报告Ageddebtors…exceptionreport逾期账款特别报告Ageddebtors…report逾期应收款报告Ageddebtors…report逾期账款报告All—moniesclause全额支付条款Amortization摊销Analyticalquestionnaire调查表分析Analyticalskills分析技巧Analyzingfinancialrisk财务风险分析Analyzingfinancialstatements财务报表分析Analyzingliquidity流动性分析Analyzingprofitability盈利能力分析Analyzingworkingcapital营运资本分析Annualexpenditure年度支出Anticipatingfutureincome预估未来收入Areasoffinancialratios财务比率分析的对象Articlesofincorporation合并条款AscoresA值Asiancrisis亚洲(金融)危机Assessingcompanies企业评估Assessingcountryrisk国家风险评估Assessingcreditrisks信用风险评估Assessingstrategicpower战略地位评估Assessmentofbanks银行的评估Assetconversionlending资产转换贷款Assetprotectionlending资产担保贷款Assetsale资产出售Assets资产Assetturnover资产周转率AssociationofBritishFactorsandDiscounters英国代理人与贴现商协会Auditor'sreport审计报告A val物权担保Baddebtlevel坏账等级Baddebtrisk坏账风险Baddebtsperformance坏账发生情况Baddebt坏账Badloans坏账Balancesheetstructure资产负债表结构Balancesheet资产负债表Bankcredit银行信贷Bankfailures银行破产Bankloans.A vailability银行贷款的可获得性Bankruptcycode破产法Bankruptcypetition破产申请书Bankruptcy破产Bankstatusreports银行状况报告BasleAgreement《巴塞尔协议》Basleagreement塞尔协议Behavorialscoring行为评分Billofexchange汇票Billoflading提单BISagreement国际清算银行协定BIS国际清算银行Bluechip蓝筹股Bonds债券Bookreceivables账面应收账款Borrowingmoney借人资金Borrowingproposition借款申请Breakthroughproducts创新产品Budgets预算Buildingcompanyprofiles勾画企业轮廓Bureaux(信用咨询)公司Businessdevelopmentloan商业开发贷款Businessfailure破产Businessplan经营计划Businessrisk经营风险Buyercredits买方信贷Buyerpower购买方力量Buyerrisks买方风险CAMPARI优质贷款原则Canonsoflending贷款原则Capex资本支出Capitaladequacyrules资本充足性原则Capitaladequacy资本充足性Capitalcommitments资本承付款项Capitalexpenditure资本支出Capitalfunding资本融资Capitalinvestment资本投资Capitalizationofinterest利息资本化Capitalizingdevelopmentcosts研发费用资本化Capitalizingdevelopmentexpenditures研发费用资本化。

会计英语知识点汇总

会计英语知识点汇总会计英语是指与会计相关的英语词汇、表达方式以及专业术语。

随着国际间经济交流的日益频繁和全球化进程的加快,掌握会计英语成为了很多专业人士的必备技能。

本文将梳理一些常见的会计英语知识点,以帮助读者更好地理解和运用这些术语。

一、财务报表1. Balance Sheet(资产负债表):用于反映企业在特定日期的资产、负债和所有者权益的情况。

2. Income Statement(利润表):反映企业在一定期间内的收入、费用和净利润。

3. Cash Flow Statement(现金流量表):按照企业的经营、投资和筹资活动分类,反映现金的流入和流出。

4. Statement of Retained Earnings(留存收益表):展示企业在一定期间内的净利润留存情况。

二、会计核算1. Accounting Equation(会计等式):Assets(资产)= Liabilities(负债)+ Owner's Equity(所有者权益),反映了企业财务状况的基本平衡关系。

2. Depreciation(折旧费用):用于反映资产价值随时间的减少。

3. Accrual Accounting(权责发生制):将收入和费用与实际发生的时间匹配,而非支付和收入的时间。

4. Double-entry Bookkeeping(复式记账法):每笔交易必须同时记录借方和贷方的金额。

5. Financial Ratios(财务比率):用于分析企业财务状况和经营绩效的指标,包括盈利能力、杠杆比率、偿债能力等。

三、财务分析1. Liquidity(流动性):反映企业偿付短期债务的能力。

2. Solvency(偿债能力):反映企业偿付长期债务的能力。

3. Profitability(盈利能力):反映企业获取利润的能力。

4. Efficiency(效率):反映企业运营资源利用的程度。

5. DuPont Analysis(杜邦分析):将利润率、资产周转率和资本结构相互关联,分析企业绩效因素。

会计名词解释大全

会计名词解释大全1. 会计 (Accounting): 记录、分析和报告财务信息的过程,用于决策、评估和监控经济实体的财务状况。

2. 会计师 (Accountant): 专门从事会计工作的人员,负责处理和管理财务数据,并生成财务报表。

3. 会计准则 (Accounting Standards): 规范会计和财务报告的准则和原则,以确保财务信息的准确、可比性和透明度。

4. 资产 (Assets): 具有经济价值的资源或财产,可带给公司未来经济利益。

5. 负债 (Liabilities): 公司所欠他人的债务或义务,需要在未来偿还或履行。

6. 所有者权益 (Owner's Equity): 公司所有者对其资产的权益,是公司净资产和所有欠他人的债务之差。

7. 收入 (Revenue): 公司在日常经营活动中产生的现金流入或收入,源于销售产品或提供服务等。

8. 成本 (Cost): 公司为生产或销售产品或服务所发生的费用,包括直接成本和间接成本。

9. 费用 (Expense): 公司在日常经营活动中发生的费用,包括人力资源、办公设备维护、运输等。

10. 现金流量 (Cash Flow): 公司在一定时间内的现金流入和流出的记录,反映公司的现金状况和运营活动。

11. 财务报表 (Financial Statements): 反映公司财务状况和经营业绩的文件,包括利润表、资产负债表和现金流量表等。

12. 利润表(Income Statement): 反映公司在一定时间内的收入、成本和利润的报表,也称为损益表或结果表。

13. 资产负债表 (Balance Sheet): 反映公司在特定日期的资产、负债和所有者权益的报表,也称为财务状况表。

14. 现金流量表 (Cash Flow Statement): 反映公司在一定时间内现金流入和流出情况的报表,用于评估公司的现金状况和运营活动。

15. 财务比率 (Financial Ratios): 使用财务数据计算的比率,用于评估公司的财务稳定性、赢利能力和运营效率等。

注册会计师考试英语加试会计英语词汇汇总

注册会计师考试英语加试会计英语词汇汇总注册会计师考试是一项具有很高难度和专业性的考试,其中英语加试是会计专业学习的重要组成部分。

以下是一个关于会计英语词汇的汇总。

1. 财务会计(Financial Accounting):财务会计是记录和报告一个组织或个人财务状况的过程。

2. 管理会计(Management Accounting):管理会计是为管理层提供决策支持和资源分配的信息的过程。

3. 税务会计(Tax Accounting):税务会计是为了遵守税法和报税目的而记录和报告税务事项的过程。

4. 审计(Auditing):审计是对财务记录和报告的独立审查,以评估其准确性和合规性。

5. 资产(Assets):资产是指一个组织或个人拥有的具有经济价值的资源。

6. 负债(Liabilities):负债是指一个组织或个人对他人的经济债务。

7. 所有者权益(Owner's Equity):所有者权益是一个组织或个人净资产的部分,表示对资产的所有权和控制权。

8. 收入(Revenue):收入是指一个组织或个人在经营活动中获得的资源或增加了所有者权益的经济利益。

9. 成本(Cost):成本是指用于生产或获得产品或服务的资源的金额。

10. 费用(Expense):费用是指用于经营活动的支出,通常与产品或服务的生产或销售有关。

11. 利润(Profit):利润是指一个组织或个人在销售产品或提供服务后获得的经济利益。

12. 财务比率(Financial Ratios):财务比率是通过比较一个组织的不同财务指标来评估管理层的财务绩效。

13. 资本预算(Capital Budgeting):资本预算是一种决策过程,用于评估和选择投资项目,以确定最有利可图的项目。

14. 风险管理(Risk Management):风险管理是一种评估和管理一个组织面临的潜在风险的过程,以减少损失和不确定性。

15. 现金流量(Cash Flow):现金流量是一个组织或个人在一段时间内收入和支出现金的净量。

财务会计学常见的名词解释

财务会计学常见的名词解释财务会计学是一门研究财务报表与会计记录的学科,它通过规范的会计原则和方法,记录和分析企业的经济活动,并生成财务报表以供利益相关者参考。

在财务会计学中,有许多常见的名词需要解释,下面将对其中一些重要的名词进行解析。

1. 资产(Assets)资产是指企业所拥有的经济资源,预期能为企业带来未来收益的物品或权益。

资产可以分为流动资产和非流动资产。

流动资产包括现金、应收账款等可以在一年内变现的资产,而非流动资产则包括固定资产、土地等不能迅速变现的长期资产。

2. 负债(Liabilities)负债是指企业对外部债权人所承担的义务或责任。

负债可以分为流动负债和非流动负债。

流动负债包括应付账款、短期借款等一年内需要偿还的债务,而非流动负债则包括长期债务等在一年以上需要偿还的债务。

3. 所有者权益(Owner's Equity)所有者权益也被称为净资产或股东权益,是指企业所有者对企业净资产的权益。

它表示企业实际上归属于股东的部分。

所有者权益可以分为股本和留存收益两部分。

股东的资本投入构成了股本部分,而企业自身创造的盈余或利润则构成了留存收益部分。

4. 财务报表(Financial Statements)财务报表是企业按照会计准则编制的定期报告,用于向利益相关者提供企业财务状况和经营成果的信息。

常见的财务报表包括资产负债表(或称平衡表)、利润表和现金流量表。

资产负债表展示了企业在特定日期的资产、负债和所有者权益情况;利润表反映了企业在一定期间内的收入和费用,并计算出净利润;现金流量表记录了企业现金流动的来源和去向。

5. 会计准则(Accounting Standards)会计准则是制定和规范财务会计记录和报告的准则和原则。

它是为了确保企业的财务报表能在全球范围内进行比较和理解。

国际上最常用的会计准则是国际财务报告准则(IFRS)和美国通用会计准则(GAAP)。

6. 净利润(Net Income)净利润是企业在一个会计周期内的总收入减去总费用后的金额。

信贷基本词汇英汉对照(1)-译国译民

信贷基本词汇英汉对照(1)-译国译民翻译公司2M method 2M法3M method 3M法A scores A值Accounting convention 会计惯例Accounting for acquisitions 购并的会计处理Accounting for debtors 应收账款核算Accounting for depreciation 折旧核算Accounting for foreign currencies 外汇核算Accounting for goodwill 商誉核算Accounting for stocks 存货核算Accounting policies 会计政策Accounting standards 会计准则Accruals concept 权责发生原则Achieving credit control 实现信用控制Acid test ratio 酸性测试比率Actual cash flow 实际现金流量Adjusting company profits 企业利润调整Advance payment guarantee 提前偿还保金Adverse trading 不利交易Advertising budget 广告预算Advising bank 通告银行Age analysis 账龄分析Aged debtors analysis 逾期账款分析Aged debtors’ exception report 逾期应收款的特殊报告Aged debtors’ exception report 逾期账款特别报告Aged debtors’ report逾期应收款报告Aged debtors’ report逾期账款报告All—monies clause 全额支付条款Amortization 摊销Analytical questionnaire 调查表分析Analytical skills 分析技巧Analyzing financial risk 财务风险分析Analyzing financial statements 财务报表分析Analyzing liquidity 流动性分析Analyzing profitability 盈利能力分析Analyzing working capital 营运资本分析Annual expenditure 年度支出Anticipating future income 预估未来收入Areas of financial ratios 财务比率分析的对象Articles of incorporation 合并条款Asian crisis 亚洲(金融)危机Assessing companies 企业评估Assessing country risk 国家风险评估Assessing credit risks 信用风险评估Assessing strategic power 战略地位评估Assessment of banks 银行的评估Asset conversion lending 资产转换贷款Asset protection lending 资产担保贷款Asset sale 资产出售Asset turnover 资产周转率Assets 资产Association of British Factors and Discounters 英国代理人与贴现商协会Auditor's report 审计报告Aval 物权担保Bad debt 坏账Bad debt level 坏账等级Bad debt risk 坏账风险Bad debts performance 坏账发生情况Bad loans 坏账Balance sheet 资产负债表Balance sheet structure 资产负债表结构Bank credit 银行信贷Bank failures 银行破产Bank loans.availability 银行贷款的可获得性Bank status reports 银行状况报告Bankruptcy 破产Bankruptcy code 破产法Bankruptcy petition 破产申请书Basle agreement 塞尔协议Basle Agreement 《巴塞尔协议》Behavioral scoring 行为评分Bill of exchange 汇票Bill of lading 提单BIS 国际清算银行BIS agreement 国际清算银行协定Blue chip 蓝筹股Bonds 债券Book receivables 账面应收账款Borrowing money 借人资金Borrowing proposition 借款申请Breakthrough products 创新产品Budgets 预算Building company profiles 勾画企业轮廓Bureaux (信用咨询)公司Business development loan 商业开发贷款Business failure 破产Business plan 经营计划Business risk 经营风险Buyer credits 买方信贷Buyer power 购买方力量Buyer risks 买方风险CAMPARI 优质贷款原则Canons of lending 贷款原则Capex 资本支出Capital adequacy 资本充足性Capital adequacy rules 资本充足性原则Capital commitments 资本承付款项Capital expenditure 资本支出Capital funding 资本融资Capital investment 资本投资Capital strength 资本实力Capital structure 资本结构Capitalization of interest 利息资本化Capitalizing development costs 研发费用资本化Capitalizing development expenditures 研发费用资本化Capitalizing interest costs 利息成本资本化Cascade effect 瀑布效应Cash assets 现金资产Cash collection targets 现金托收目标Cash cycle 现金循环周期Cash cycle ratios 现金循环周期比率Cash cycle times 现金循环周期时间Cash deposit 现金储蓄Cash flow adjustments 现金流调整Cash flow analysis 现金流量分析Cash flow crisis 现金流危机Cash flow cycle 现金流量周期Cash flow forecasts 现金流量预测Cash flow lending 现金流贷出Cash flow profile 现金流概况Cash flow projections 现金流预测Cash flow statements 现金流量表Cash flows 现金流量Cash position 现金头寸Cash positive JE现金流量Cash rich companies 现金充足的企业Cash surplus 现金盈余Cash tank 现金水槽Cash-in-advance 预付现金Categorized cash flow 现金流量分类CE 优质贷款原则CEO 首席执行官Chairman 董事长,总裁Chapter 11 rules 第十一章条款Charge 抵押Charged assets 抵押资产Chief executive officer 首席执行官Collateral security 抵押证券Collecting payments 收取付款Collection activity收款活动Collection cycle 收款环节Collection procedures 收款程序Collective credit risks 集合信用风险Comfortable liquidity positi9n 适当的流动性水平Commercial mortgage 商业抵押Commercial paper 商业票据Commission 佣金Commitment fees 承诺费Common stock 普通股Common stockholders 普通股股东Company and its industry 企业与所处行业Company assets 企业资产Company liabilities 企业负债Company loans 企业借款Competitive advantage 竞争优势Competitive forces 竞争力Competitive products 竞争产品Complaint procedures 申诉程序Computerized credit information 计算机化信用信息Computerized diaries 计算机化日志Confirmed letter of credit 承兑信用证Confirmed letters of credit 保兑信用证Confirming bank 确认银行Conservatism concept 谨慎原则Consistency concept 一贯性原则Consolidated accounts 合并报表Consolidated balance sheets 合并资产负债表Contingent liabilities 或有负债Continuing security clause 连续抵押条款Contractual payments 合同规定支出Control limits 控制限度Control of credit activities 信用活动控制Controlling credit 控制信贷Controlling credit risk 控制信用风险Corporate credit analysis 企业信用分析Corporate credit controller 企业信用控制人员Corporate credit risk analysis 企业信用风险分析Corporate customer 企业客户Corporate failure prediction models 企业破产预测模型Corporate lending 企业贷款Cost leadership 成本领先型Cost of sales 销售成本Costs 成本Country limit 国家限额Country risk 国家风险Court judgments 法院判决Covenant 贷款保证契约Covenants 保证契约Creative accounting 寻机性会计Credit analysis 信用分析Credit analysis of customers 客户信用分析Credit analysis of suppliers 供应商的信用分析Credit analysis on banks 银行信用分析Credit analysts 信用分析Credit assessment 信用评估Credit bureau reports 信用咨询公司报告Credit bureaux 信用机构Credit control 信贷控制Credit control activities 信贷控制活动Credit control performance reports 信贷控制绩效报告Credit controllers 信贷控制人员Credit cycle 信用循环Credit decisions 信贷决策Credit deterioration 信用恶化Credit exposure 信用敞口Credit granting process 授信程序Credit information 信用信息Credit information agency 信用信息机构Credit insurance 信贷保险Credit insurance advantages 信贷保险的优势Credit insurance brokers 信贷保险经纪人Credit insurance limitations 信贷保险的局限Credit limits 信贷限额Credit limits for currency blocs 货币集团国家信贷限额Credit limits for individual countries 国家信贷限额Credit management 信贷管理Credit managers 信贷经理Credit monitoring 信贷监控Credit notes 欠款单据Credit period 信用期Credit planning 信用计划Credit policy 信用政策Credit policy issues 信用政策发布Credit proposals 信用申请Credit protection 信贷保护Credit quality 信贷质量Credit rating 信用评级Credit rating agencies 信用评级机构Credit rating process 信用评级程序Credit rating system 信用评级系统Credit reference 信用咨询Credit reference agencies 信用评级机构Credit risk 信用风险Credit risk assessment 信用风险评估Credit risk exposure 信用风险敞口Credit risk insurance 信用风险保险Credit risk.individual customers 个体信用风险Credit risk:bank credit 信用风险:银行信用Credit risk:trade credit 信用风险:商业信用Credit scoring 信用风险评分Credit scoring model 信用评分模型Credit scoring system 信用评分系统Credit squeeze 信贷压缩Credit taken ratio 受信比率Credit terms 信贷条款Credit utilization reports 信贷利用报告Credit vetting 信用审查Credit watch 信用观察Credit worthiness 信誉Creditor days 应付账款天数Cross-default clause 交叉违约条款Currency risk 货币风险Current assets 流动资产Current debts 流动负债Current ratio requirement 流动比率要求Current ratios 流动比率Customer care 客户关注Customer credit ratings 客户信用评级Customer liaison 客户联络Customer risks 客户风险Cut-off scores 及格线Cycle of credit monitoring 信用监督循环Cyclical business 周期性行业Daily operating expenses 经营费用Day’s sales outstanding 收回应收账款的平均天数Debentures 债券Debt capital 债务资本Debt collection agency 债务托收机构Debt issuer 债券发行人Debt protection levels 债券保护级别Debt ratio 负债比率Debt securities 债券Debt service ratio 还债率Debtor days 应收账款天数Debtor's assets 债权人的资产Default 违约Deferred payments 延期付款Definition of leverage 财务杠杆率定义Deposit limits 储蓄限额Depositing money 储蓄资金Depreciation 折旧Depreciation policies 折旧政策Development budget 研发预算Differentiation 差别化Direct loss 直接损失Directors salaries 董事薪酬Discretionary cash flows 自决性现金流量Discretionary outflows 自决性现金流出Distribution costs 分销成本Dividend cover 股息保障倍数Dividend payout ratio 股息支付率Dividends 股利Documentary credit 跟单信用证DSO 应收账款的平均回收期Duration of credit risk 信用风险期Eastern bloc countries 东方集团国家EBITDA 扣除利息、税收、折旧和摊销之前的收益ECGD 出口信贷担保局Economic conditions 经济环境Economic cycles 经济周期Economic depression 经济萧条Economic growth 经济增长Economic risk 经济风险Electronic data interchange(EDI) 电子数据交换Environmental factors 环境因素Equity capital 权益资本Equity finance 权益融资Equity stake 股权EU countries 欧盟国家EU directives 欧盟法规EU law 欧盟法律Eurobonds 欧洲债券European parliament 欧洲议会European Union 欧盟Evergreen loan 常年贷款Exceptional item 例外项目Excessive capital commitments 过多的资本承付款项Exchange controls 外汇管制Exchange-control regulations 外汇管制条例Exhaust method 排空法Existing competitors 现有竞争对手Existing debt 未清偿债务Export credit agencies 出口信贷代理机构Export credit insurance 出口信贷保险Export factoring 出口代理Export sales 出口额Exports Credit Guarantee Department 出口信贷担保局Extending credit 信贷展期External agency 外部机构External assessment methods 外部评估方式External assessments 外部评估External information sources 外部信息来源Extraordinary items 非经常性项目Extras 附加条件Facility account 便利账户Factoring 代理Factoring debts 代理收账Factoring discounting 代理折扣Factors Chain International 国际代理连锁Failure prediction scores 财务恶化预测分值FASB (美国)财务会计准则委员会Faulty credit analysis 破产信用分析Fees 费用Finance,new business ventures 为新兴业务融资Finance,repay existing debt 为偿还现有债务融资Finance, working capital 为营运资金融资Financial assessment 财务评估Financial cash flows 融资性现金流量Financial collapse 财务危机。

常用会计英语词汇大全

常用会计英语词汇大全IntroductionIn the field of accounting, it is essential to have a good command of the English language as many of the terms and concepts are expressed in English. This comprehensive list of commonly used accounting terms in English will help you build your vocabulary and enhance your understanding of the subject. Whether you are an accounting professional or a student, this list will be a valuable resource in your work or studies.1. Basic Accounting Terms1.1 AssetsAssets refer to the economic resources owned or controlled by a company. These can include cash, accounts receivable, inventory, and property.1.2 LiabilitiesLiabilities are the obligations or debts that a company owes to external parties. This can include loans, accounts payable, and accrued expenses.1.3 EquityEquity represents the owners’ clm to the assets of a company. It is calculated as the difference between assets and liabilities.1.4 RevenueRevenue refers to the income generated from the sale of goods or services. It is also known as sales or turnover.1.5 ExpensesExpenses are the costs incurred in the process of generating revenue. This can include salaries, rent, utilities, and depreciation.1.6 ProfitProfit is the financial gn obtned when revenue exceeds expenses. It is often referred to as net income or earnings.1.7 Balance SheetA balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the assets, liabilities, and equity of the company.1.8 Income StatementAn income statement, also known as a profit and loss statement, shows the revenues and expenses incurred over a specific period of time. It provides a summary of a company’s financial performance.1.9 Cash Flow StatementA cash flow statement shows the inflows and outflows of cash during a specific period. It provides information about a company’s cash position and its ability to generate cash.2. Financial Reporting and Analysis2.1 Generally Accepted Accounting Principles (GAAP)GAAP refers to the standards and guidelines that companies are required to follow when preparing their financial statements. These principles ensure consistency and comparability in financial reporting.2.2 International Financial Reporting Standards (IFRS)IFRS is a global accounting framework used in many countries. It provides a common set of accounting standards to facilitate international financial reporting and analysis.2.3 Financial RatiosFinancial ratios are used to analyze a company’s financial performance and its ability to meet its financial obligations. Some common financial ratios include liquidity ratios, profitability ratios, and solvency ratios.2.4 Financial Statement AnalysisFinancial statement analysis involves examining a company’s financial statements to assess its financial health and performance. This analysis is used by investors, creditors, and other stakeholders to make informed decisions.3. Auditing and Assurance3.1 AuditingAuditing is the process of examining a company’s financial records, transactions, and statements to ensure their accuracy and compliance with relevant laws and regulations.3.2 Internal ControlInternal control refers to the systems and procedures implemented by a company to safeguard its assets, ensure the accuracy of its financial records, and prevent fraud.3.3 External AuditAn external audit is conducted by an independent auditor to provide an objective opinion on the frness and reliability of a company’s financial statements.3.4 Assurance ServicesAssurance services are professional services that improve the quality and reliability of information used by investors, creditors, and other stakeholders. These services include financial statement audit, review, and other related services.ConclusionThis comprehensive list of commonly used accounting terms in English covers the basic accounting principles, financial reporting and analysis, and auditing and assurance. By familiarizing yourself with these terms, you will be well-equipped to navigate the world of accounting and contribute to the financial success of your organization or business.。

初级金融英语 简要 单词表

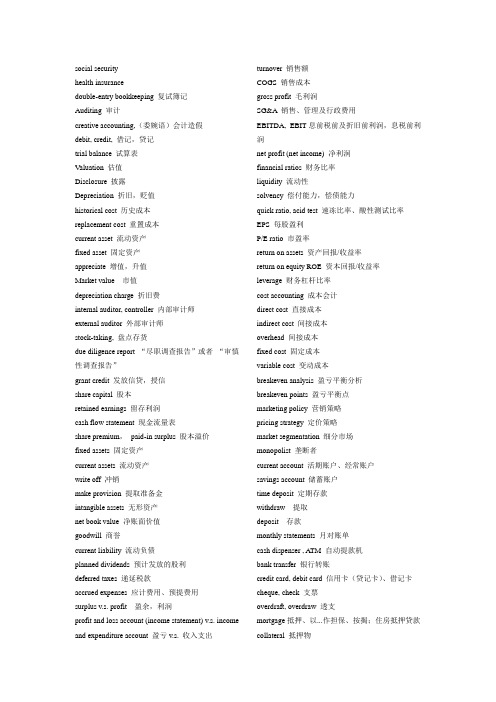

social securityhealth insurancedouble-entry bookkeeping 复试簿记Auditing 审计creative accounting,(委婉语)会计造假debit, credit, 借记,贷记trial balance 试算表Valuation 估值Disclosure 披露Depreciation 折旧,贬值historical cost 历史成本replacement cost 重置成本current asset 流动资产fixed asset 固定资产appreciate 增值,升值Market value 市值depreciation charge 折旧费internal auditor, controller 内部审计师external auditor 外部审计师stock-taking, 盘点存货due diligence report “尽职调查报告”或者“审慎性调查报告”grant credit 发放信贷,授信share capital 股本retained earnings 留存利润cash flow statement 现金流量表share premium,paid-in surplus 股本溢价fixed assets 固定资产current assets 流动资产write off 冲销make provision 提取准备金intangible assets 无形资产net book value 净账面价值goodwill 商誉current liability 流动负债planned dividends 预计发放的股利deferred taxes 递延税款accrued expenses 应计费用、预提费用surplus v.s. profit 盈余,利润profit and loss account (income statement) v.s. income and expenditure account 盈亏v.s. 收入支出turnover 销售额COGS 销售成本gross profit 毛利润SG&A 销售、管理及行政费用EBITDA, EBIT息前税前及折旧前利润,息税前利润net profit (net income) 净利润financial ratios 财务比率liquidity 流动性solvency 偿付能力,偿债能力quick ratio, acid test 速冻比率、酸性测试比率EPS 每股盈利P/E ratio 市盈率return on assets 资产回报/收益率return on equity ROE 资本回报/收益率leverage 财务杠杆比率cost accounting 成本会计direct cost 直接成本indirect cost 间接成本overhead 间接成本fixed cost 固定成本variable cost 变动成本breakeven analysis 盈亏平衡分析breakeven points 盈亏平衡点marketing policy 营销策略pricing strategy 定价策略market segmentation 细分市场monopolist 垄断者current account 活期账户、经常账户savings account 储蓄账户time deposit 定期存款withdraw 提取deposit 存款monthly statements 月对账单cash dispenser , A TM 自动提款机bank transfer 银行转账credit card, debit card 信用卡(贷记卡)、借记卡cheque, check 支票overdraft, overdraw 透支mortgage抵押、以...作担保、按揭;住房抵押贷款collateral 抵押物foreclosure 抵押权人按规定拍卖抵押物以受偿pension plan 养老金计划transfer 转账remit 汇款wire transfer 电汇reserve requirement (对银行的)准备金要求standardized product 标准化产品risk assessment 风险评估maturity, maturity date 到期日、持续期yield 收益率intermediary 中介retail bank 零售银行investment bank 投资银行merchant bank 商人银行insurance company 保险公司deregulation 解除管制conglomerate 大企业集团、联合企业central bank 中央银行clearing bank 清算行non-bank financial intermediaries 非银行金融机构issue, floate 发行underwrite 承销IPOs 首次公开发行raise capital/funds 筹集资金acquire, merge 收购,兼并broking, dealing 经济业务、自营业务financial restructuring 财务重组spin off 从原有公司分出一部分成立一个独立的公司divestiture: the sale, liquidation, or spinoff of a corporate division or subsidiary.出售公司的分部、分公司或任何一整块业务被称为剥离monetary policy 货币政策regulate 管理,监管issue currency 发行货币reserve-asset ratio, reserve requirementbail out 救助inflation 通货膨胀deflation 通货紧缩output 产出unemployment rate 失业率base rate/prime rate 基准/优惠利率credit rating 信用评级fixed rate v.s. floating rate (variable rate) 固定/浮动利率financial instrument 金融工具Treasury bills 国库券payables, receivables 应付账款,应收账款nominal value, par value, face value 账面价值commercial paper 商业票据CDs, certificates of deposit 大额存款单Repo, repurchase agreement 回购协议secure, unsecured 有担保的、无担保的venture capital/capitalist 风险资本working capital 流动资金、营业资金money supply 货币供给time deposit 定期存款sight deposit 活期存款monetary authority 货币当局discount rate 贴现率monetary growth 货币供应增长(速度)risk-averse 风险厌恶private company, public companyexit strategy 退出计划public limited company 上市的有限责任公司prospectus 招股说明书goes into liquidation 清算primary market 一级市场secondary market 二级市场OTC market 柜台市场spread 价差place orders 下订单,下指令broker 经纪人rights issue 配售新股own shares/ treasury stock 回购股份,库藏股scrip issue,capitalization issue,bonus issue发放红利股blue chips 蓝筹股growth stocks 成长型股票income stocks 收益型股票defensive stocks 防御型股票value stocks 价值型股票stock index 股票价格指数market crash 市场崩溃,崩盘stags 遇有利机会即出售新购入股票的认股者over-subscribe 超额认购capital gain 资本利得cum div 附息ex div 除息speculator 投机者day trader, day trading strategy 当日交易settlement day 结算日commission 佣金take a short position 做空long position 多头、持有technical analysis 技术分析fundamental analysis 基本面分析systematic risk, unsystematic risk 系统风险diversify, diversified portfolio 分散投资market risk 市场风险principal 本金treasury bond, note 长期国债、中期国债corporate bond 公司债券credit rating 信用评级default 违约insolvent 无清偿能力zero-coupon bond 零息债券junk bond 垃圾债券fallen angels 折翼天使leveraged buyouts 杠杆收购forward, futures 远期,期货commodity 大宗商品hedge 避险Fluctuate 波动Interest rate futures 利率期货stock futures 股票期货stock index futures 股指期货zero-sum 零和derivative 衍生品option, call option, put option 期货allocate asset, asset allocation 资产配置asset management 资产管理unit trust 单位信托volatile, adj. 波动剧烈;fluctuate 波动outperform the market,跑赢市场,比大盘表现出色hedge fund 对冲基金hedging 避险arbitrage 套利Merger 合并takeover bid 要约收购,tender offerM&A department 兼并收购部门joint venture 合资企业friendly/hostile takeover 善意、恶意收购parent company, subsidiary 母公司,子公司core business 核心业务Synergy 协同效应market capitalization 市值asset-stripping 资产剥离Undervalued 被低估MBO 管理层收购financial planning 财务规划,理财规划rate of return 收益率internal rate of return 内部报酬率cost of capital 资本成本purchasing power 购买力opportunity cost 机会成本time value of money 货币的时间价值net present value 净现值discount rate 贴现率compliance officer 合规专员,合规经理major financial centres 主要金融中心Deregulation 解除管制Information Disclosure 信息披露insider trading/dealing 内幕交易conflicts of interest 利益冲突money laundering 洗钱free trade 自由贸易economics of scale 规模经济balance of trade 贸易收支余额trade surplus, deficit 贸易顺差、逆差merchandise trade, service trade 商品贸易、服务贸易balance of payments 国际收支平衡表protectionist, protectionism 贸易保护主义者,贸易保护主义tariffs, non-tariff barriers 关税,非关税壁垒Quotas 份额exchange rate, exchange market 汇率、外汇市场PPP ,purchasing power parity 购买力平价depreciate, appreciate 贬值,升值currency speculation 货币投机convertibility, convertible (货币)可兑换性,可兑换common/single currency 单一货币exporter, importer 出口方,进口方letter of credit 信用证bill of exchange, draft 汇票endorse, accept, endorsed, accepted 承兑commercial invoice 发票bill of lading 提货单Insurance 保险Premiums 保费Policy 保单make a claim 索赔life insurance 人身保险tax shelters 避税Underwriter 承保人unlimited liability 无限责任bear risk 承担风险Consumption 消费business cycle 商业周期,经济周期upturn, expansion, boom, contraction, recession, depression, slump, recovery 经济上行,经济下行,繁荣,衰退income tax 收入税capital gain tax 资本利得税corporation tax 公司所得税V A T 增值税。

会计100个经典术语

会计100个经典术语1. 资产(Assets):企业拥有的资源,包括现金、应收账款、固定资产等。

2. 负债 (Liabilities):企业所欠的债务,包括应付账款、贷款等。

3. 所有者权益 (Owner's equity):企业所有者对企业的投资,等于资产减去负债。

4. 收入 (Revenue):企业从销售产品或提供服务中获得的金钱。

5. 成本 (Cost):企业从生产产品或提供服务中发生的费用。

6. 费用 (Expense):企业在日常运营中发生的费用,如租金、工资等。

7. 利润 (Profit):企业收入减去成本和费用后的剩余金额。

8. 财务报表(Financial statements):反映企业财务状况和经营业绩的报告,包括资产负债表、利润表、现金流量表等。

9. 会计准则(Accounting standards):规范会计信息披露和报告的准则和原则。

10. 会计周期 (Accounting period):用于编制财务报表的一段时间,通常为一年。

11. 会计师 (Accountant):从事会计工作的专业人士。

12. 现金流量 (Cash flow):企业现金流入和流出的量,用于评估企业的偿付能力。

13. 应收账款(Accounts receivable):企业向客户出售产品或提供服务后未收到的款项。

14. 应付账款(Accounts payable):企业购买商品或接受服务后尚未支付的款项。

15. 固定资产 (Fixed assets):企业长期持有和使用的资产,如土地、建筑物、机器设备等。

16. 折旧 (Depreciation):固定资产在使用过程中价值的减少。

17. 净利润 (Net profit):企业收入减去成本、费用和税费后的剩余金额。

18. 资本 (Capital):企业所有者投入企业的资金。

19. 市场价格 (Market value):资产或负债的估计现值。

信贷基本词汇英汉对照(2)-上海译国译民

信贷基本词汇英汉对照(2)-译国译民翻译公司Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfeiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Ideal liquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品 IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出Invoice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押improving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Surplus assets 盈余资产Surplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保。

会计英文常用词汇

会计英文常用词汇引言在全球化的时代,掌握英语已经成为一项必备技能。

对于从事会计工作的人来说,熟悉会计英文常用词汇更是必不可少的。

本文将为您介绍一些常见的会计英文词汇,以帮助您更好地进行会计工作。

1. 会计基础•Accounting: 会计•Bookkeeping: 簿记•Assets: 资产•Liabilities: 负债•Equity: 权益•Income: 收入•Expenses: 费用•Ledger: 分类账•Balance sheet: 资产负债表•Income statement: 损益表•Cash flow statement: 现金流量表•Trial balance: 试算表•Double-entry accounting: 复式记账2. 账户类型•Cash: 现金•Accounts receivable: 应收账款•Accounts payable: 应付账款•Inventory: 存货•Fixed assets: 固定资产•Intangible assets: 无形资产•Equity or Owner’s equity: 所有者权益•Retned earnings: 留存收益•Revenue: 收益•Expense: 费用•Cost of goods sold: 销售成本3. 交易和记录•Journal entry: 日志记录•Debit: 借方•Credit: 贷方•General ledger: 总分类账•Accounts receivable ledger: 应收账款分类账•Accounts payable ledger: 应付账款分类账•Cash disbursements journal: 现金支付日记账•Cash receipts journal: 现金收款日记账•Sales journal: 销售日记账•Purchase journal: 采购日记账•General journal: 总记账簿•Posting: 记账•Trial balance: 试算表4. 税务相关•Tax: 税收•Income tax: 所得税•Sales tax: 销售税•Value-added tax (VAT): 增值税•Tax return: 纳税申报表•Tax deduction: 税务减免•Tax evasion: 逃税•Tax audit: 税务审计•Taxable income: 应纳税所得额5. 财务报告•Financial statement: 财务报表•Balance sheet: 资产负债表•Income statement: 损益表•Cash flow statement: 现金流量表•Statement of retned earnings: 公积金变动表•Financial ratios: 财务比率•Profit margin: 利润率•Return on investment (ROI): 投资回报率•Earnings per share (EPS): 每股收益•Interest coverage ratio: 利息偿付倍数结论以上是一些最常用的会计英文词汇,掌握这些词汇将有助于您更好地理解和运用英语进行会计工作。

常用会计英语词汇完整

常用会计英语词汇完整Introduction会计是一门涉及到财务数据处理和分析的重要学科,它在全球范围内都有广泛的应用。

掌握会计英语词汇是进行国际财务交流和专业沟通的必备技能。

本文将介绍一些常用的会计英语词汇,帮助读者更好地理解和运用这些术语。

1. Financial Statements(财务报表)Income Statement(损益表) - 一种用于报告某一特定时期的公司收入、费用和净利润的财务报表。

Balance Sheet(资产负债表) - 描述企业在特定日期的资产、负债和所有者权益的快照。

Cash Flow Statement(现金流量表) - 报告企业经营活动、投资活动和筹资活动的现金流量情况。

Statement of Shareholders’ Equity(股东权益变动表) - 展示了股东权益在特定时期内的变动情况,包括净利润、股东投入和股东取出的金额。

2. Accounting Methods(会计方法)Accrual Accounting(权责发生制) - 根据经济实际发生的权责将收入和支出划分到特定期间,无论与货币流动是否有关。

Cash Accounting(现金基准制) - 根据现金实际收入和支出的时间来记录收入和支出,忽略收入和支出的实际发生时间。

Double-Entry Bookkeeping(复式记账法) - 一种会计方法,每个交易都会同时在借方和贷方产生相等的金额。

Cost Accounting(成本会计) - 一种会计方法,用于计算和控制产品和服务的成本。

Forensic Accounting(法务会计) - 结合会计和调查技术,用于揭示和防止经济犯罪。

3. Financial Ratios(财务比率)Profit Margin(利润率) - 净利润与收入的比例,反映每销售单位产品或提供服务的利润水平。

Return on Investment (ROI)(投资回报率) - 投资获得的利润与投资成本的比例。

会计的30个专业术语

会计的30个专业术语会计是一个涉及复杂的领域,其中有许多专业术语需要了解和运用。

以下是30个常见的会计专业术语及其解释。

1. 资产(Assets):指企业拥有并能够支配的经济利益。

资产包括现金、应收账款、存货、固定资产等。

2. 负债(Liabilities):指企业所欠的债务或应付的款项。

负债包括应付账款、借款、未付工资等。

3. 所有者权益(Owner's Equity):指企业所有者对企业资产的权益。

所有者权益等于资产减去负债。

4. 利润(Profit):指企业在一定时期内收入超过支出的金额。

利润是企业经营活动的核心指标之一。

5. 成本(Cost):指企业购买或生产商品或服务所发生的费用。

成本包括直接成本、间接成本、固定成本和变动成本等。

6. 收入(Revenue):指企业销售商品或提供服务所获得的现金或应收账款。

收入是企业经营活动的主要来源之一。

7. 费用(Expense):指企业在生产或销售商品或提供服务过程中发生的费用。

费用包括人工费用、运输费用、管理费用等。

8. 折旧(Depreciation):指企业固定资产因使用年限和技术进步而产生的价值减少。

折旧是企业在会计上确认的费用。

9. 摊销(Amortization):指企业无形资产(如专利权、版权等)价值的减少。

摊销是企业在会计上确认的费用。

10. 应收账款(Accounts Receivable):指企业向其他单位或个人销售商品或提供服务而尚未收到的款项。

11. 应付账款(Accounts Payable):指企业购买商品或接受服务而尚未支付的款项。

12. 现金流量表(Cash Flow Statement):指企业在一定时期内现金流入和流出的情况。

现金流量表反映了企业的现金状况和经营活动的现金流量。

13. 资产负债表(Balance Sheet):指企业在一定时期结束时的资产、负债和所有者权益的情况。

资产负债表反映了企业的财务状况。

外贸术语

外贸专业术语(上)装运 shipment. loading装上货轮 to ship, to load, to take on a ship装运费 shipping charges, shipping commission装运单||载货单 shipping invoice装运单据 shipping documents大副收据 mates receipt装船单 shipping order提货单 delivery order, dandy note装船通知 shipping advice包裹收据 parcel receipt准装货单 shipping permit租船契约 charter party租船人 charterer程租船||航次租赁 voyage charter期租船 time charter允许装卸时间 lay days, laying days工作日 working days连续天数 running days, consecutive days滞期费 demurrage滞期日数 demurrage days速遣费 dispatch money空舱费 dead freight退关 short shipment, goods short shipped, goods shut out, shut-outs赔偿保证书(信托收据) letter of indemnity, trust receipt 装载 loading卸货 unloading, discharging, landing装运重量 shipping weight, in-take-weight卸货重量 landing weight压舱 ballasting压舱货 in ballast舱单 manifest船泊登记证书 ships certificate of registry航海日记 ships log船员名册 muster-roll(船员, 乘客)健康证明 bill of health光票 clean bill不清洁提单 foul bill有疑问提单 suspected bill包装用语用木箱包装 to be cased. to be encased用袋装 to be bagged用纸箱包装 to be boxed用席包 to be matted用捆包to be baled包装费另计 casing extra包装费不另计算 cased free装箱免费 boxed free代费免除 bagged free席包免费 matted free捆包免费 baled free出口用包装 packed for export箱外附铁箍 cases to be iron-hooped施以铁箍 iron-hooping施以铁条 iron-banding用绳捆 roping鞭打||用藤捆包 caning情况良好 in good condition. In good order. in good state 情况特别好in excellent condition情况差劲 in bad condition呈腐败状况 in rotten condition已有发霉现象 in musty condition已受潮 in wet condition呈干燥状况 in dry condition已有破损 in damaged condition呈受热状况 in heated condition情况不很完整, 有瑕疵 in defective condition搬运注意事项小心搬运 Handle with care. With care此端向上 This side up. This end up请勿用钩 Use no hooks. Do not use dog hooks. No hooks不可滚转 Don’t turn over不可掉落 Don’t drop. Not to be dropped保持干燥 Keep dry不可横置 Keep flat. Stow level保持直立 Stand on end. To be kept upright易腐物品 Perishable goods保持冷冻(不可近热) Stow in a cool place。

Financial Ratios

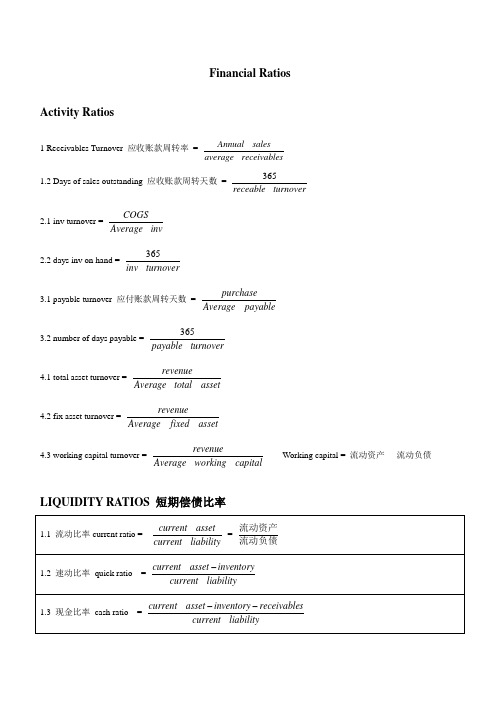

Financial RatiosActivity Ratios1 Receivables Turnover 应收账款周转率 =sreceivable average salesAnnual __1.2 Days of sales outstanding 应收账款周转天数 =turnoverreceable _3652.1 inv turnover =invAverage COGS_2.2 days inv on hand =turnoverinv _3653.1 payable turnover 应付账款周转天数 =payableAverage purchase_3.2 number of days payable =turnoverpayable _3654.1 total asset turnover =assettotal Average revenue__4.2 fix asset turnover =assetfixed Average revenue__4.3 working capital turnover = capitalworking Average revenue__ Working capital = 流动资产 - 流动负债LIQUIDITY RATIOS 短期偿债比率1.1 流动比率current ratio =liabilitycurrent assetcurrent __ = 流动负债流动资产1.2 速动比率 quick ratio =liabilitycurrent inventoryasset current __-1.3 现金比率 cash ratio =liabilitycurrent sreceivable inventory asset current __--1.4 速动资产够用天数 defensive interval =endituresdaily average sreceivable urities marketable cash exp __sec _++1.5 cash conversion cycle = days sales outstanding + days inv. on hand - days payableCurrent asset = current liabilities + cash + marketable securities + receivables + inventoriesSOLVENCY RATIOS1.1 D to E (D :短期债,一年内到期的长期债,剩余长期债)1.2 D to A (严格来说A 要从asset 中扣除 deferred tax liabilities and average payables) 1.3 debt to capital =ED D+ 1.4 Financial leverage = A:E 1.5 Interest coverage = EBIT: interest 1.6 fixed charge coverage = pmtlease erest pmtlease EBIT _int _+-PROFITABILITY RATIOS1.1 Net profit margin = profit / sales or net income/revenue 1.2 Gross profit margin = gross profit / revenue 1.3 operating profit margin = EBIT / revenue2.1 Gross profit = net sales - COGS 2.2 Operating profit = EBIT2.3 Net income = net income before dividends2.4 Total capital = long-term capital + short-term capital + common and preferred equity = Total Asset3.1 return on common E =Equityaverage divpreferred income net ___-It only measures the accounting profits available to , and the capital invested by, common stockholders,instead of common and preferred stockholders. 3.2 ROE = net income / Equity3.3 return on assets =assetstotal average t I income net __)1(*_--To add interest adjusted for tax back to net income puts the returns to both equity and debt holders. 3.4 ROA=net income / AThe DuPont analysis method: to decompose ROEROE =salesincomenet_assetssalesequityassetsNet profit margin Asset turnover Equity multiplier/ leverage ratioROE=EBTincomenet_EBITEBTrevenueEBITassetsrevenueequityassetsTax burdenInterestburdenEBIT marginAssetturnoverEquity multiplier/leverage ratio(sales - COGS = gross profitgross profit - operating expenses(SG&A)= EBIT(operating profit)EBIT -I-T=net incomenet income - preferred dividend = income available for common stockholders )。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。