货币金融学chapter4英文习题

货币金融学第四章

4-4

时间轴(Time Line)

不能够直接将时间轴上显示的不同时间段的收益做对比

$100 $100 $100 $100

年限 现值

0 100

1 100/(1+年 率)

2 100/(1+年 利率)2

表1

• 1 如果息票债券的价格等于其面值,到期收益率就等于息 票利率。 • 2 息票债券的价格与到期收益率是负向相关的。 • 3 当债券价格低于其面值时,到期收益率要高于息票利率。

4-12

Copyright © 2010 Pearson Addison-Wesley. All rights reserved.

• 注:计算方法与固定支付贷款相同,就是要令债券今天的价值等于它的现值。 • P为债券的现价;C为每年的息票利息;F为债券的面值;n为距到期日的年数。

4-11

Copyright © 2010 Pearson Addison-Wesley. All rights reserved.

息票利率为10%、期限为10年的债 券的到期收益率(面值为1 000美元)

Copyright © 2010 Pearson Addison-Wesley. All rights reserved.

4-9

固定支付贷款

The same cash flow payment every period throughout the life of the loan LV = loan value FP = fixed yearly payment n = number of years until maturity FP FP FP FP LV = ...+ 2 3 1 + i (1 + i) (1 + i) (1 + i) n

货币金融学chapter 4英文习题

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 4 The Meaning of Interest Rates4.1 Measuring Interest Rates1) The concept of ________ is based on the common-sense notion that a dollar paid to you in the future is less valuable to you than a dollar today.A) present valueB) future valueC) interestD) deflationAnswer: AAACSB: Application of Knowledge2) The present value of an expected future payment ________ as the interest rate increases.A) fallsB) risesC) is constantD) is unaffectedAnswer: AAACSB: Reflective Thinking3) An increase in the time to the promised future payment ________ the present value of the payment.A) decreasesB) increasesC) has no effect onD) is irrelevant toAnswer: AAACSB: Reflective Thinking4) With an interest rate of 6 percent, the present value of $100 next year is approximatelyA) $106.B) $100.C) $94.D) $92.Answer: CAACSB: Analytical Thinking5) What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent?A) $453.51B) $500.00C) $476.25D) $550.00Answer: AAACSB: Analytical Thinking6) If a security pays $55 in one year and $133 in three years, its present value is $150 if the interest rate isA) 5 percent.B) 10 percent.C) 12.5 percent.D) 15 percent.Answer: BAACSB: Analytical Thinking7) To claim that a lottery winner who is to receive $1 million per year for twenty years has won $20 million ignores the process ofA) face value.B) par value.C) deflation.D) discounting the future.Answer: DAACSB: Analytical Thinking8) A credit market instrument that provides the borrower with an amount of funds that must be repaid at the maturity date along with an interest payment is known as aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: AAACSB: Application of Knowledge9) A credit market instrument that requires the borrower to make the same payment every period until the maturity date is known as aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: BAACSB: Application of Knowledge10) Which of the following are TRUE of fixed payment loans?A) The borrower repays both the principal and interest at the maturity date.B) Installment loans and mortgages are frequently of the fixed payment type.C) The borrower pays interest periodically and the principal at the maturity date.D) Commercial loans to businesses are often of this type.Answer: BAACSB: Reflective Thinking11) A fully amortized loan is another name forA) a simple loan.B) a fixed-payment loan.C) a commercial loan.D) an unsecured loan.Answer: BAACSB: Application of Knowledge12) A credit market instrument that pays the owner a fixed coupon payment every year until the maturity date and then repays the face value is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: CAACSB: Application of Knowledge13) A ________ pays the owner a fixed coupon payment every year until the maturity date, when the ________ value is repaid.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceAnswer: CAACSB: Analytical Thinking14) The ________ is the final amount that will be paid to the holder of a coupon bond.A) discount valueB) coupon valueC) face valueD) present valueAnswer: CAACSB: Application of Knowledge15) When talking about a coupon bond, face value and ________ mean the same thing.A) par valueB) coupon valueC) amortized valueD) discount valueAnswer: AAACSB: Application of Knowledge16) The dollar amount of the yearly coupon payment expressed as a percentage of the face value of the bond is called the bond'sA) coupon rate.B) maturity rate.C) face value rate.D) payment rate.Answer: AAACSB: Application of Knowledge17) The ________ is calculated by multiplying the coupon rate times the par value of the bond.A) present valueB) face valueC) coupon paymentD) maturity paymentAnswer: CAACSB: Analytical Thinking18) If a $1000 face value coupon bond has a coupon rate of 3.75 percent, then the coupon payment every year isA) $37.50.B) $3.75.C) $375.00.D) $13.75Answer: AAACSB: Analytical Thinking19) If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year isA) $650.B) $1,300.C) $130.D) $13.Answer: AAACSB: Analytical Thinking20) An $8,000 coupon bond with a $400 coupon payment every year has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.Answer: AAACSB: Analytical Thinking21) A $1000 face value coupon bond with a $60 coupon payment every year has a coupon rate ofA) .6 percent.B) 5 percent.C) 6 percent.D) 10 percent.Answer: CAACSB: Analytical Thinking22) All of the following are examples of coupon bonds EXCEPTA) corporate bonds.B) U.S. Treasury bills.C) U.S. Treasury notes.D) U.S. Treasury bonds.Answer: BAACSB: Analytical Thinking23) A bond that is bought at a price below its face value and the face value is repaid at a maturity date is called aA) simple loan.B) fixed-payment loan.C) coupon bond.D) discount bond.Answer: DAACSB: Application of Knowledge24) A ________ is bought at a price below its face value, and the ________ value is repaid at the maturity date.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceAnswer: DAACSB: Analytical Thinking25) A discount bondA) pays the bondholder a fixed amount every period and the face value at maturity.B) pays the bondholder the face value at maturity.C) pays all interest and the face value at maturity.D) pays the face value at maturity plus any capital gain.Answer: BAACSB: Reflective Thinking26) Examples of discount bonds includeA) U.S. Treasury bills.B) corporate bonds.C) U.S. Treasury notes.D) municipal bonds.Answer: AAACSB: Analytical Thinking27) Which of the following are TRUE for discount bonds?A) A discount bond is bought at par.B) The purchaser receives the face value of the bond at the maturity date.C) U.S. Treasury bonds and notes are examples of discount bonds.D) The purchaser receives the par value at maturity plus any capital gains.Answer: BAACSB: Reflective Thinking28) The interest rate that equates the present value of payments received from a debt instrument with its value today is theA) simple interest rate.B) current yield.C) yield to maturity.D) real interest rate.Answer: CAACSB: Application of Knowledge29) Economists consider the ________ to be the most accurate measure of interest rates.A) simple interest rate.B) current yield.C) yield to maturity.D) real interest rate.Answer: CAACSB: Reflective Thinking30) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer: CAACSB: Application of Knowledge31) If the amount payable in two years is $2420 for a simple loan at 10 percent interest, the loan amount isA) $1000.B) $1210.C) $2000.D) $2200.Answer: CAACSB: Analytical Thinking32) For a 3-year simple loan of $10,000 at 10 percent, the amount to be repaid isA) $10,030.B) $10,300.C) $13,000.D) $13,310.Answer: DAACSB: Analytical Thinking33) If $22,050 is the amount payable in two years for a $20,000 simple loan made today, the interest rate isA) 5 percent.B) 10 percent.C) 22 percent.D) 25 percent.Answer: AAACSB: Analytical Thinking34) If a security pays $110 next year and $121 the year after that, what is its yield to maturity if it sells for $200?A) 9 percentB) 10 percentC) 11 percentD) 12 percentAnswer: BAACSB: Analytical Thinking35) The present value of a fixed-payment loan is calculated as the ________ of the present value of all cash flow payments.A) sumB) differenceC) multipleD) logAnswer: AAACSB: Analytical Thinking36) Which of the following are TRUE for a coupon bond?A) When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate.B) The price of a coupon bond and the yield to maturity are positively related.C) The yield to maturity is greater than the coupon rate when the bond price is above the par value.D) The yield is less than the coupon rate when the bond price is below the par value. Answer: AAACSB: Reflective Thinking37) The ________ of a coupon bond and the yield to maturity are inversely related.A) priceB) par valueC) maturity dateD) termAnswer: AAACSB: Reflective Thinking38) The price of a coupon bond and the yield to maturity are ________ related; that is, as the yield to maturity ________, the price of the bond ________.A) positively; rises; risesB) negatively; falls; fallsC) positively; rises; fallsD) negatively; rises; fallsAnswer: DAACSB: Reflective Thinking39) The yield to maturity is ________ than the ________ rate when the bond price is ________ its face value.A) greater; coupon; aboveB) greater; coupon; belowC) greater; perpetuity; aboveD) less; perpetuity; belowAnswer: BAACSB: Reflective Thinking40) The ________ is below the coupon rate when the bond price is ________ its par value.A) yield to maturity; aboveB) yield to maturity; belowC) discount rate; aboveD) discount rate; belowAnswer: AAACSB: Reflective Thinking41) A $10,000 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.Answer: AAACSB: Analytical Thinking42) Which of the following $1,000 face-value securities has the highest yield to maturity?A) a 5 percent coupon bond selling for $1,000B) a 10 percent coupon bond selling for $1,000C) a 12 percent coupon bond selling for $1,000D) a 12 percent coupon bond selling for $1,100Answer: CAACSB: Analytical Thinking43) Which of the following $5,000 face-value securities has the highest yield to maturity?A) a 6 percent coupon bond selling for $5,000B) a 6 percent coupon bond selling for $5,500C) a 10 percent coupon bond selling for $5,000D) a 12 percent coupon bond selling for $4,500Answer: DAACSB: Analytical Thinking44) Which of the following $1,000 face-value securities has the highest yield to maturity?A) a 5 percent coupon bond with a price of $600B) a 5 percent coupon bond with a price of $800C) a 5 percent coupon bond with a price of $1,000D) a 5 percent coupon bond with a price of $1,200Answer: AAACSB: Analytical Thinking45) Which of the following $1,000 face-value securities has the lowest yield to maturity?A) a 5 percent coupon bond selling for $1,000B) a 10 percent coupon bond selling for $1,000C) a 15 percent coupon bond selling for $1,000D) a 15 percent coupon bond selling for $900Answer: AAACSB: Analytical Thinking46) Which of the following bonds would you prefer to be buying?A) a $10,000 face-value security with a 10 percent coupon selling for $9,000B) a $10,000 face-value security with a 7 percent coupon selling for $10,000C) a $10,000 face-value security with a 9 percent coupon selling for $10,000D) a $10,000 face-value security with a 10 percent coupon selling for $10,000 Answer: AAACSB: Analytical Thinking47) A coupon bond that has no maturity date and no repayment of principal is called aA) consol.B) cabinet.C) Treasury bill.D) Treasury note.Answer: AAACSB: Application of Knowledge48) The price of a consol equals the coupon paymentA) times the interest rate.B) plus the interest rate.C) minus the interest rate.D) divided by the interest rate.Answer: DAACSB: Analytical Thinking49) The interest rate on a consol equals theA) price times the coupon payment.B) price divided by the coupon payment.C) coupon payment plus the price.D) coupon payment divided by the price.Answer: DAACSB: Analytical Thinking50) A consol paying $20 annually when the interest rate is 5 percent has a price ofA) $100.B) $200.C) $400.D) $800.Answer: CAACSB: Analytical Thinking51) If a perpetuity has a price of $500 and an annual interest payment of $25, the interest rate isA) 2.5 percent.B) 5 percent.C) 7.5 percent.D) 10 percent.Answer: BAACSB: Analytical Thinking52) The yield to maturity for a perpetuity is a useful approximation for the yield to maturity on long-term coupon bonds. It is called the ________ when approximating the yield for a coupon bond.A) current yieldB) discount yieldC) future yieldD) star yieldAnswer: AAACSB: Reflective Thinking53) The yield to maturity for a one-year discount bond equals the increase in price over the year, divided by theA) initial price.B) face value.C) interest rate.D) coupon rate.Answer: AAACSB: Analytical Thinking54) If a $10,000 face-value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 5 percent.B) 10 percent.C) 50 percent.D) 100 percent.Answer: DAACSB: Analytical Thinking55) If a $5,000 face-value discount bond maturing in one year is selling for $5,000, then its yield to maturity isA) 0 percent.B) 5 percent.C) 10 percent.D) 20 percent.Answer: AAACSB: Analytical Thinking56) A discount bond selling for $15,000 with a face value of $20,000 in one year has a yield to maturity ofA) 3 percent.B) 20 percent.C) 25 percent.D) 33.3 percent.Answer: DAACSB: Analytical Thinking57) The yield to maturity for a discount bond is ________ related to the current bond price.A) negativelyB) positivelyC) notD) directlyAnswer: AAACSB: Reflective Thinking58) A discount bond is also called a ________ because the owner does not receive periodic payments.A) zero-coupon bondB) municipal bondC) corporate bondD) consolAnswer: AAACSB: Application of Knowledge59) Another name for a consol is a ________ because it is a bond with no maturity date. The owner receives fixed coupon payments forever.A) perpetuityB) discount bondC) municipalityD) high-yield bondAnswer: AAACSB: Application of Knowledge60) If the interest rate is 5%, what is the present value of a security that pays you $1, 050 next year and $1,102.50 two years from now? If this security sold for $2200, is the yield to maturity greater or less than 5%? Why?Answer: PV = $1,050/(1. +.05) + $1,102.50/(1 + 0.5)2PV = $2,000If this security sold for $2200, the yield to maturity is less than 5%. The lower the interest rate the higher the present value.AACSB: Analytical Thinking4.2 The Distinction Between Interest Rates and Returns1) The ________ is defined as the payments to the owner plus the change in a security's value expressed as a fraction of the security's purchase price.A) yield to maturityB) current yieldC) rate of returnD) yield rateAnswer: CAACSB: Application of Knowledge2) Which of the following are TRUE concerning the distinction between interest rates and returns?A) The rate of return on a bond will not necessarily equal the interest rate on that bond.B) The return can be expressed as the difference between the current yield and the rate of capital gains.C) The rate of return will be greater than the interest rate when the price of the bond falls during the holding period.D) The return can be expressed as the sum of the discount yield and the rate of capital gains. Answer: AAACSB: Reflective Thinking3) The sum of the current yield and the rate of capital gain is called theA) rate of return.B) discount yield.C) perpetuity yield.D) par value.Answer: AAACSB: Analytical Thinking4) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,200 next year?A) 5 percentB) 10 percentC) -5 percentD) 25 percentAnswer: DAACSB: Analytical Thinking5) What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $900 next year?A) 5 percentB) 10 percentC) -5 percentD) -10 percentAnswer: CAACSB: Analytical Thinking6) The return on a 5 percent coupon bond that initially sells for $1,000 and sells for $950 next year isA) -10 percent.B) -5 percent.C) 0 percent.D) 5 percent.Answer: CAACSB: Analytical Thinking7) Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding?A) 5 percentB) 10 percentC) 15 percentD) 20 percentAnswer: CAACSB: Analytical Thinking8) I purchase a 10 percent coupon bond. Based on my purchase price, I calculate a yield to maturity of 8 percent. If I hold this bond to maturity, then my return on this asset isA) 10 percent.B) 8 percent.C) 12 percent.D) there is not enough information to determine the return.Answer: BAACSB: Analytical Thinking9) If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, which bond would you prefer to have been holding?A) a bond with one year to maturityB) a bond with five years to maturityC) a bond with ten years to maturityD) a bond with twenty years to maturityAnswer: AAACSB: Analytical Thinking10) An equal decrease in all bond interest ratesA) increases the price of a five-year bond more than the price of a ten-year bond.B) increases the price of a ten-year bond more than the price of a five-year bond.C) decreases the price of a five-year bond more than the price of a ten-year bond.D) decreases the price of a ten-year bond more than the price of a five-year bond.Answer: BAACSB: Analytical Thinking11) An equal increase in all bond interest ratesA) increases the return to all bond maturities by an equal amount.B) decreases the return to all bond maturities by an equal amount.C) has no effect on the returns to bonds.D) decreases long-term bond returns more than short-term bond returns.Answer: DAACSB: Analytical Thinking12) Which of the following are generally TRUE of bonds?A) A bond's return equals the yield to maturity when the time to maturity is the same as the holding period.B) A rise in interest rates is associated with a fall in bond prices, resulting in capital gains on bonds whose terms to maturity are longer than the holding periods.C) The longer a bond's maturity, the smaller is the size of the price change associated with an interest rate change.D) Prices and returns for short-term bonds are more volatile than those for longer-term bonds. Answer: AAACSB: Reflective Thinking13) Which of the following are generally TRUE of all bonds?A) The longer a bond's maturity, the greater is the rate of return that occurs as a result of the increase in the interest rate.B) Even though a bond has a substantial initial interest rate, its return can turn out to be negative if interest rates rise.C) Prices and returns for short-term bonds are more volatile than those for longer term bonds.D) A fall in interest rates results in capital losses for bonds whose terms to maturity are longer than the holding period.Answer: BAACSB: Reflective Thinking14) The riskiness of an asset's returns due to changes in interest rates isA) exchange-rate risk.B) price risk.C) asset risk.D) interest-rate risk.Answer: DAACSB: Application of Knowledge15) Interest-rate risk is the riskiness of an asset's returns due toA) interest-rate changes.B) changes in the coupon rate.C) default of the borrower.D) changes in the asset's maturity.Answer: AAACSB: Application of Knowledge16) Prices and returns for ________ bonds are more volatile than those for ________ bonds, everything else held constant.A) long-term; long-termB) long-term; short-termC) short-term; long-termD) short-term; short-termAnswer: BAACSB: Reflective Thinking7) There is ________ for any bond whose time to maturity matches the holding period.A) no interest-rate riskB) a large interest-rate riskC) rate-of-return riskD) yield-to-maturity riskAnswer: AAACSB: Analytical Thinking18) All bonds that will not be held to maturity have interest rate risk which occurs because of the change in the price of the bond as a result ofA) interest-rate changes.B) changes in the coupon rate.C) default of the borrower.D) changes in the asset's maturity date.Answer: AAACSB: Application of Knowledge19) Your favorite uncle advises you to purchase long-term bonds because their interest rate is 10%. Should you follow his advice?Answer: It depends on where you think interest rates are headed in the future. If you think interest rates will be going up, you should not follow your uncle's advice because you would then have to discount your bond if you needed to sell it before the maturity date. Long-term bonds have a greater interest-rate risk.AACSB: Reflective Thinking4.3 The Distinction Between Real and Nominal Interest Rates1) The ________ interest rate is adjusted for expected changes in the price level.A) ex ante realB) ex post realC) ex post nominalD) ex ante nominalAnswer: AAACSB: Application of Knowledge2) The ________ interest rate more accurately reflects the true cost of borrowing.A) nominalB) realC) discountD) marketAnswer: BAACSB: Analytical Thinking3) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a less accurate measure of the incentives to borrow and lend than is the nominal interest rate.C) is a less accurate indicator of the tightness of credit market conditions than is the nominal interest rate.D) defines the discount rate.Answer: AAACSB: Analytical Thinking4) When the ________ interest rate is low, there are greater incentives to ________ and fewer incentives to ________.A) nominal; lend; borrowB) real; lend; borrowC) real; borrow; lendD) market; lend; borrowAnswer: CAACSB: Reflective Thinking5) The interest rate that describes how well a lender has done in real terms after the fact is called theA) ex post real interest rate.B) ex ante real interest rate.C) ex post nominal interest rate.D) ex ante nominal interest rate.Answer: AAACSB: Analytical Thinking6) The ________ states that the nominal interest rate equals the real interest rate plus the expected rate of inflation.A) Fisher equationB) Keynesian equationC) Monetarist equationD) Marshall equationAnswer: AAACSB: Application of Knowledge7) If the nominal rate of interest is 2 percent, and the expected inflation rate is -10 percent, the real rate of interest isA) 2 percent.B) 8 percent.C) 10 percent.D) 12 percent.Answer: DAACSB: Analytical Thinking8) In which of the following situations would you prefer to be the lender?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent.Answer: BAACSB: Analytical Thinking9) In which of the following situations would you prefer to be the borrower?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent.Answer: DAACSB: Analytical Thinking10) If you expect the inflation rate to be 15 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) 7 percent.B) 22 percent.C) -15 percent.D) -8 percent.Answer: DAACSB: Analytical Thinking11) If you expect the inflation rate to be 12 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) -5 percent.B) -2 percent.C) 2 percent.D) 12 percent.Answer: AAACSB: Analytical Thinking12) If you expect the inflation rate to be 4 percent next year and a one year bond has a yield to maturity of 7 percent, then the real interest rate on this bond isA) -3 percent.B) -2 percent.C) 3 percent.D) 7 percent.Answer: CAACSB: Analytical Thinking13) In the United States during the late 1970s, the nominal interest rates were quite high, but the real interest rates were negative. From the Fisher equation, we can conclude that expected inflation in the United States during this period wasA) irrelevant.B) low.C) negative.D) high.Answer: DAACSB: Reflective Thinking14) The interest rate on Treasury Inflation Indexed Securities can be roughly interpreted asA) the real interest rate.B) the nominal interest rate.C) the rate of inflation.D) the rate of deflation.Answer: AAACSB: Analytical Thinking15) Assuming the same coupon rate and maturity length, the difference between the yield on a Treasury Inflation Indexed Security and the yield on a nonindexed Treasury security provides insight intoA) the nominal interest rate.B) the real interest rate.C) the nominal exchange rate.D) the expected inflation rate.Answer: DAACSB: Analytical Thinking16) Assuming the same coupon rate and maturity length, when the interest rate on a Treasury Inflation Indexed Security is 3 percent, and the yield on a nonindexed Treasury bond is 8 percent, the expected rate of inflation isA) 3 percent.B) 5 percent.C) 8 percent.D) 11 percent.Answer: BAACSB: Analytical Thinking17) Would it make sense to buy a house when mortgage rates are 14% and expected inflation is 15%? Explain your answer.Answer: Even though the nominal rate for the mortgage appears high, the real cost of borrowing the funds is -1%. Yes, under this circumstance it would be reasonable to make this purchase.AACSB: Reflective Thinking4.4 Web Appendix: Measuring Interest-Rate Risk: Duration1) Duration isA) an asset's term to maturity.B) the time until the next interest payment for a coupon bond.C) the average lifetime of a debt security's stream of payments.D) the time between interest payments for a coupon bond.Answer: CAACSB: Application of Knowledge2) Comparing a discount bond and a coupon bond with the same maturityA) the coupon bond has the greater effective maturity.B) the discount bond has the greater effective maturity.C) the effective maturity cannot be calculated for a coupon bond.D) the effective maturity cannot be calculated for a discount bond.Answer: BAACSB: Reflective Thinking3) The duration of a coupon bond increasesA) the longer is the bond's term to maturity.B) when interest rates increase.C) the higher the coupon rate on the bond.D) the higher the bond price.Answer: AAACSB: Reflective Thinking4) All else equal, when interest rates ________, the duration of a coupon bond ________.A) rise; fallsB) rise; increasesC) falls; fallsD) falls; does not changeAnswer: AAACSB: Reflective Thinking5) All else equal, the ________ the coupon rate on a bond, the ________ the bond's duration.A) higher; longerB) higher; shorterC) lower; shorterD) greater; longerAnswer: BAACSB: Reflective Thinking。

《货币金融学》英文版米什金第十一版最新题库及解析

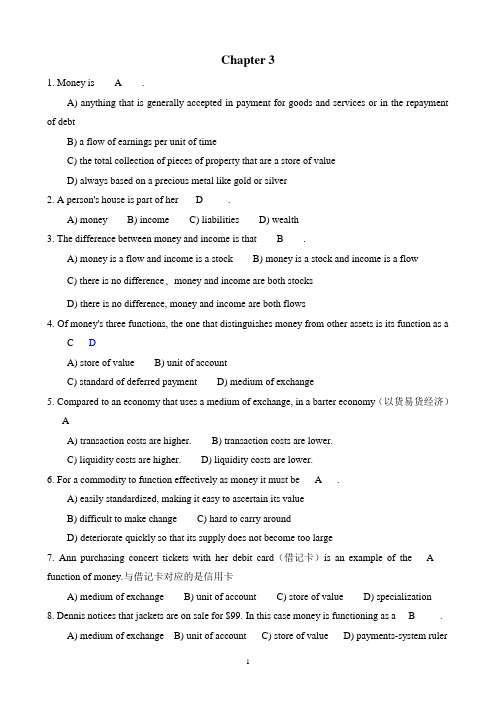

Chapter 31. Money is____A____.A) anything that is generally accepted in payment for goods and services or in the repayment of debtB) a flow of earnings per unit of timeC) the total collection of pieces of property that are a store of valueD) always based on a precious metal like gold or silver2. A person's house is part of her ___D_____.A) money B) income C) liabilities D) wealth3. The difference between money and income is that____B____.A) money is a flow and income is a stock B) money is a stock and income is a flowC) there is no difference, money and income are both stocksD) there is no difference, money and income are both flows4. Of money's three functions, the one that distinguishes money from other assets is its function as aC DA) store of value B) unit of accountC) standard of deferred payment D) medium of exchange5. Compared to an economy that uses a medium of exchange, in a barter economy(以货易货经济)___A___A) transaction costs are higher. B) transaction costs are lower.C) liquidity costs are higher. D) liquidity costs are lower.6. For a commodity to function effectively as money it must be___A___.A) easily standardized, making it easy to ascertain its valueB) difficult to make change C) hard to carry aroundD) deteriorate quickly so that its supply does not become too large7. Ann purchasing concert tickets with her debit card(借记卡)is an example of the __A___ function of money.与借记卡对应的是信用卡A) medium of exchange B) unit of account C) store of value D) specialization8.Dennis notices that jackets are on sale for $99. In this case money is functioning as a __B_____.A) medium of exchange B) unit of account C) store of value D) payments-system ruler9.As a store of value, money ____D___.A) does not earn interest B) cannot be a durable asset C) must be currencyD) is a way of saving for future purchases10. ___C__B_ is the relative ease and speed that an asset can be converted into a medium of exchange.资产转化为货币的速度和容易程度称之为什么A) Efficiency B) Liquidity C) Deflation D) Specialization11. Of the following assets, the least liquid is___D____.A) stocks B) traveler's checks C) checking deposits D) a house12. A fall in the level of prices___C____.物价与货币价值呈反比关系A) does not affect the value of money B) has an uncertain effect on the value of moneyC) increases the value of money D) reduces the value of money13. Paper currency that has been declared legal tender but is not convertible into coins or precious metals is called ____B____ money. (fiat money法定货币、名义货币)A) commodity B) fiat C) electronic D) funnypared to checks, paper currency and coins have the major drawbacks that they___A____.A) are easily stolen B) are hard to counterfeit C) are not the most liquid assetsD) must be backed by gold15. Which of the following is not a form of e-money? A BA) a debit card B) a credit card 不是货币,借银行的,属于负债方C) a stored-value card D) a smart card ——储值卡16. An electronic payments system has not completely replaced the paper payments system because of all of the following reasons except___A____.DA) expensive equipment is necessary to set up the systemB) security concerns C) privacy concerns D) transportation costs.17. ____B____ is the narrowest monetary aggregate that the Fed reports.美联储A) M0 B) M1 C) M2 D) M318. Which of the following is not included in the M1 but is included in the M2? DA) Currency B) Traveler's checks C) Demand depositsD) Small-denomination time deposits19. Of the following, the largest is___D____.A) money market deposit accounts B) demand deposits C) M1 D) M220. If an individual moves money from currency to a demand deposit account, CA) M1 decreases and M2 stays the same B) M1 stays the same and M2 increasesC) M1 stays the same and M2 stays the same D) M1 increases and M2 stays the sameChapter 41.The present value of an expected future payment ___B_____ as the interest rate increases.当利率增加时,现值的未来付款会AA) falls B) rises C) is constant D) is unaffected2. With an interest rate of 6 percent, the present value of $100 next year is approximately__A___. 利率为6%时,现值为100元,明年时大约有C PV=CF/利率=100/1+0.06 现值一般小于未来值A) $106 B) $100 C) $94 D) $923. A credit market instrument that requires the borrower to make the same payment every period until the maturity date is known as a___B__.信用市场工具要求借贷者每段时间支付相同的钱直到到期是A) simple loan B) fixed-payment loan C) coupon bond D) discount bond4. A ___C_____ pays the owner a fixed coupon payment every year until the maturity date, when the ________ value is repaid.向持有者支付每年固定付款贷款,直到到期,当价值被支付A) coupon bond; discount B) discount bond; discountC) coupon bond; face D) discount bond; face5. When talking about a coupon bond, face value and ___B_____ mean the same thing.当谈到零息债券,面值和是相同的意义A 面值:face value/par valueA) par value B) coupon value C) amortized value D) discount value.6. All of the following are examples of coupon bonds (付息债权)except__D___.以下例子中除了,都是付息债券的例子 BA) Corporate bonds 长期B) U.S. Treasury bills 短期债C) U.S. Treasury notes 中期(两年以上)D) U.S. Treasury bonds长期(十年以上)7. If the amount payable in two years is $2420 for a simple loan at 10 percent interest, the loan amount is___C__.如果一个简单贷款两年的应付款为以10%的利率支付2420,则贷款金额为A) $1000 B) $1210 C) $2000 D) $22008.The yield to maturity is __A____ than the ______ rate when the bond price is _____ its face value. B到期收益率比的利率时,此时,市场价值它的面值面值由公司决定为1000,市场发售时为900,低于面值,而价格与到期收益率呈反比A) greater; coupon; above B) greater; coupon; belowC) greater; perpetuity; above D) less; perpetuity(永续债,不受市场影响,); below9.Which of the following $5,000 face-value securities has the highest yield to maturity? B以下5000元面值的证券到期收益率最高的是 DA) A 6 percent coupon bond selling for $5,000B) A 6 percent coupon bond selling for $5,500C) A 10 percent coupon bond selling for $5,000D) A 12 percent coupon bond selling for $4,50010. The interest rate on a consol equals the __D___.债务的利率与相同A) price times the coupon payment B) price divided by the coupon paymentC) coupon payment plus the price D) coupon payment divided by the price11. The sum of the current yield and the rate of capital gain(资本利得=收益/本金)is called the _A____.当前的总收益和资本收益率被称为A) rate of return B) discount yield C) perpetuity yield D) par value.12. The return on a 5 percent coupon bond that initially sells for $1,000 and sells for $950 next year is __A___. C 资本利得=-5% 利息=5% 回报率=两者相加=05%的零息债券最初售价为1000元,下一年售价为950的回报率为A) -10 percent B) -5 percent C) 0 percent D) 5 percent13. Interest-rate risk is the riskiness of an asset's returns due to__B___.利率风险是资产由于的风险 AA) interest-rate changes (利率改变)B) changes in the coupon rate()C) default of the borrower( credit risk信用风险) D) changes in the asset's maturity14. An equal decrease in all bond interest rates___A__.所有债权利率下降同样多会BA) increases the price of a five-year bond more than the price of a ten-year bondB) increases the price of a ten-year bond more than the price of a five-year bondC) decreases the price of a five-year bond more than the price of a ten-year bondD) decreases the price of a ten-year bond more than the price of a five-year bond15. The ____B____ interest rate more accurately reflects the true cost of borrowing.的利率会更准确的反映到对借贷的实际支付A) nominal B) real C) discount D) market16. When the ____C____ interest rate is low, there are greater incentives to ________ and fewer incentives to ________.当的利率降低,的让利会增大,的让利会降低A) nominal; lend; borrow B) real; lend; borrowC) real; borrow; lend D) market; lend; borrow17.The ___A_____ states that the nominal interest rate equals the real interest rate plus the expected rate of inflation.表明名义利率等于实际利率加上通货膨胀的预期利率A) Fisher equation B) Keynesian equation C) Monetarist equation D) Marshall equation18. If you expect the inflation rate to be 4 percent next year and a one year bond has a yield to maturity of 7 percent, then the real interest rate on this bond is ___C_____.如果你希望明年的通货膨胀率为4%,一年期债券的到期收益率达到7%,则这种债券的实际利率为A) -3 percent B) -2 percent C) 3 percent D) 7 percent19. The yield to maturity for a discount bond is ____A____ related to the current bond price.贴现债券的到期收益率与债券的现值的关系为A) negatively B) positively C) not D) directly20. The yield to maturity for a one-year discount bond equals the increase in price over the year, divided by the___A_____.一年期的贴现债券的到期收益率等于一年来价格的上涨除以A)initial price B) face value C) interest rate D) coupon rateChapter 101.Which of the following statements are true? D以下哪个描述是对的CA) A bank's assets are its sources of funds. B) A bank's liabilities are its uses of funds.C) A bank's balance sheet shows that total assets equal total liabilities plus equity capital.D) A bank's balance sheet indicates whether or not the bank is profitable.2. Which of the following are reported as liabilities on a bank's balance sheet? B下列哪个选项是作为银行资产负债表的负债A) Reserves B) Checkable deposits C) Loans D) Deposits with other banks3. Because checking accounts are ___D_____ liquid for the depositor than passbook savings, they earn ________ interest rates.因为活期存款对于存款人具有比存折储蓄的流动性,因而他们可以获得利息A) less; higher B) less; lower C) more; higher D) more; lower4. Bank loans from the Federal Reserve are called ____C____ and represent a ________ of funds. 来自美联储的银行贷款被称为B且代表了一种基金A) discount loans; use B) discount loans; source C) fed funds; use D) fed funds; source5. Bank capital is equal to ___A_____ minus ________.银行资本相当于减去。

货币金融学Chapter 4

Understanding Interest Rates

Main Concepts

• Present Discounted Value (PDV) • What is an interest rate?

Yield to maturity A measure of an Intertemporal Price

900 11.75 Consider a bond with the following characteristics: 800 13.81 10% Coupon-Rate, Face Value = $1000, Bond Maturing in 10 Years Three Interesting Facts Emerge from the table above: • When bond is at par, yield equals coupon rate • Price and yield are negatively related • Yield greater than coupon rate when bond price is below par value

Note: These lecture notes are incomplete without having attended lectures.

Yield on a Discount Basis

F −P 360 idb = × F ( number of days to maturity )

Consider the following bill, P = $900, F = $1000 which has 1 year to maturity.

– Lottery Win: $1 Million today vs.. $1000pm for next 10 years? – $500 five years from now vs. $800 ten years from now?

货币银行学题库Chapter4 (1)

Chapter 4 Understanding Interest Rates1. Simple Present Value2. Yield to Maturity(1) Simple Loan(2) Fixed-Payment Loann PV = today's (present) valueCF = future cash flow (payment) = the interest rateCF PV = (1 + )i i 1PV = amount borrowed = $100CF = cash flow in one year = $110 = number of years = 1$110$100 = (1 + )(1 + ) $100 = $110$110(1 + ) = $100 = 0.10 = 10%For simple loans, the simple interest rate equ n i i i i als the yield to maturity23Using the same strategy used for the fixed-payment loan:P = price of coupon bond C = yearly coupon payment F = face value of the bond = years to maturity date C C C C F P = . . . +1+(1+)(1+)(1+)(1n n i i i i +++++)ni(3) C oupon Bond(4) D iscount Loan1. I = ( F -P) / P2. I = ( F -P) / P * 360/(number of day to maturity)(5) A bond with no maturity date that does not repay principalbut pays fixed coupon payments foreverI = C / P(6) Three interesting facts emerge:1. When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate2. The price of a coupon bond and the yield to maturity are negatively related3. The yield to maturity is greater than the coupon rate when the bond price is below its face value23Using the same strategy used for the fixed-payment loan:P = price of coupon bond C = yearly coupon payment F = face value of the bond = years to maturity date C C C C F P = . . . +1+(1+)(1+)(1+)(1n n i i i i +++++)ni3. Rate of ReturnSeveral key findings•The return equals the yield to maturity only if the holding period equals the time to maturity• A rise in interest rates is associated with a fall in bond prices, resulting in a capital loss if time to maturity is longer than the holding period•The m ore distant a bond’s maturity, the greater the size of the percentage price change associated with an interest-rate change•The more distant a bond’s maturity, the lower the rate of return the occurs as a result of an increase in the interest rate•Even if a bond has a substantial initial interest rate, its return can be negative if interest rates rise4. Interest Risk• Prices and returns for long-term bonds are more volatilethan those for shorter-term bonds• There is no interest-rate risk for any bond whose time tomaturity matches the holding period5. Fisher Equation (Real Interest Rate and Nominal Interestrate)= nominal interest rate= real interest rate= expected inflation rateWhen the real interest rate is low,there are greater incentives to borrow and fewer incentives to lend.The real inter er r e i i i i ππ=+est rate is a better indicator of the incentives toborrow and lend.。

国际金融英文版试题chapter4(1)

INTERNATIONAL FINANCEAssignment Problems (4) Name: Student#:I. Choose the correct answer for the following questions (only correct answer) (3.5 credits for each question, total credits 3.5 x 20 = 70)1. The exchange rate system refers to __________.A. a country’s internal economic policies such as employment, inflation and interest rate levelsB. a country’s monetary policiesC. a country’s fiscal policesD. a country’s choice as to which exchange rate regime such as fixed or floating or between to follow2. The international monetary system is broadly defined as ___________.A. the set of conventions, rules, procedures and institutions that govern the conduct of financial relations between nationsB. the set of rules to manage every country’s central banksC. the set of rules to solve trade disputes between countriesD. the set of rules to develop world economy3. Under the gold standard, the exchange rate was fixed because __________.A. each currency unit could be converted to a weight of goldB. the gold could be exported and imported with no restrictionsC. gold coins could be freely mintedD. all of the above4. When the gold standard prevailed, the United States fixed the price of gold at $20.646 per ounce and the Britain fixed the price at 4.252 per ounce. Now suppose the fees for transporting one ounce of gold were approximately $0.03 per sterling of gold. Then the exchange rate of dollar versus sterling would fluctuate between _________.A. $4.8856/₤ and $4.8256/₤B. $4.9042/₤ and $4.8070/₤C. $4.9770/₤ and $4.7463/₤D. We don’t know, because it depends on the supply and demand forces in the foreign exchange market5. Under the gold standard, the par value of the exchange rate was determined by __________ .A. gold parity of the relative currenciesB. interest rate of the relative currenciesC. demand and supply forces in the foreign exchange marketD. inflation rate of the relative currencies6. Which of the following is true regarding the collapse of the gold standard system?A. The World War I had many European countries suspend convertibility of their currencies into gold.B. The political costs of maintaining the overvalued pound were so great in the United Kingdom.C. Nations facing 1929 – 1933 worldwide recession decided to pursue objectives such as higher employment rates and real growth rates, rather than to maintain the exchange value of their currencies.D. All of the above are the reasons that the gold standard finally collapsed.7. The U.S. dollar was designated as the international currency in international settlements under the Bretton Woods system. The dollar was accepted by the rest of the world because __________.A. it could be used to purchase U.S. goods and servicesB. it could be converted to gold at a price of $35/ounceC. the U.S. was the only super power at that timeD. the IMF forced the rest of the world to use dollar to settle international debts8. The principal function of the International Monetary Fund (IMF) was originally to __________.A. act as a sup ranational regulatory agency for all countries’ central banksB. lend to member nations experiencing a shortage of foreign exchange reservesC. finance postwar reconstruction, particularly in Europe and JapanD. reduce trade barriers and settle disputes among countries relating to currency negotiations9. Before 1971 the exchange rates were pretty stable because of the Bretton Woods Agreement. So if the par value of the Japanese Yen and U.S. dollar was set by ¥100/$, the upper limit and lower limit that this exchange rate was allowed to fluctuate freely would be __________ .A. ¥ 101/$ and ¥ 99/$B. ¥ 102.25/$ and ¥ 97.75/$C. ¥ 105/$ and ¥ 95/$D. ¥ 110/$ and ¥ 90/$10. The increase in value of a currency pegged to gold or another currency is known as __________,A. appreciationB. depreciationC. revaluationD. devaluation11. A country that regulates the rate at which its currency is exchanged for all othercurrencies is considered to have a __________ exchange rate system.A. fixed or managedB. floating or flexibleC. currency boardD. dollarization12. Which of the following is true for those who are in favor of floating exchange rate system?A. Floating exchange rates ensure balance-of-payments equilibriumB. Floating exchange rates ensure monetary autonomyC. Floating exchange rates promote economic stabilityD. All of the above are true.13. Since the advent of floating exchange rates in 1973 it has become evident that authorities have not always let their currency float freely but rather they have frequently intervened to influence the exchange rate. This floating exchange rate system is also called __________.A. clean floatB. managed floatC. dirty floatD. Both B and C are correct14. One of the benefits of the creation of euro is that it __________.A. promotes trades and investments in those euro-zone countriesB. makes those euro-zone countries avoid the exchange rate risksC. helps those euro-zone countries restrain inflationD. All of the above are benefits for euro-zone countries.15. Which of the following correctly identifies exchange rate systems from less fixed to more fixed?A. independent floating, currency board, crawling pegsB. independent floating, crawling pegs, dollarizationC. independent floating, currency board, managed floatingD. dollarization, currency board, crawling pegs16. A currency board’s foreign exchange reserves are equal to __________ or slightly more of its notes and coins in circulation, as set by law.A. 100%B. 90%C. 75%D. 50%17. Which of the following features are NOT shared by independent floating exchange rate system?A. The exchange rates are determined by the market forces.B. The exchange rates may change minute by minute.C. The central bank has to maintain large quantities of foreign exchange reserves.D. The central bank can pursue desired monetary policy.18. The IMF constitution was amended to allow member nations to determine their own exchange rate arrangements by the __________.A. Louvre AccordB. Jamaica AccordC. Smithsonian AgreementD. Plaza Agreement19. The United States adopted a modified gold standard in 1934 when the dollar was devalued to $35 per ounce of gold from the 20.67 per ounce price in effect prior to World War I. The dollar’s devaluation rate can be calculated as __________.A. (20.67 – 35) /35B. (20.67 – 35) / 20.67C. (35 – 20.67) / 35D. (35 – 20.67) / 20.6720. Which of the following is NOT true regarding the 1976 Jamaica Accord?A. It formally legitimized the floating exchange system.B. It aimed at increasing the importance of SDRs in international reserves.C. It emphasized the importance of gold in international reservesD. All of the above are true.II. QuestionsQuestions 1 through 4 are based on the following information. (2.5 credits for each question, total credits 2.5 x 4 = 10 credits)Assume one Argentina peso is composed of $0.50 and €0.50. Also assume the spot dollar/euro exchange rate is $1.10/€.1. The peso/dollar exchange rate should be __________.2. The peso/euro exchange rate should be __________.3. The weight assigned to the U.S. dollar in one Argentina peso is __________.4. The weight assigned to the euro in one Argentina peso is __________.Questions 5 through 7 are based on the following information. (10 credits total) Under the gold standard the gold par value was $20.67 per ounce in the United States. The gold par value was ₤4.2474 per ounce in Britain.5. The par exchange rate (dollars per pound) implied by the gold parities is __________. (2 credits)6. How would you arbitrage if the exchange rate quoted in the foreign exchange market were $4.00 per pound instead? (4 credits)7. What pressure is placed on the exchange rate by this arbitrage? (4 credits)8. A European-based manufacturer ships a machine tool to a buyer in Jordan. The purchase price is €375,000. Jordan imposes a 12% import duty on all products purchased from the European Union. The Jordanian importer then re-exports the product to a Saudi Arabian importer, but only after imposing its own resale fee of 22%. Given the following spot exchange rates on May 25, 2004, what is the total cost to the Saudi Arabian importer in Saudi Arabian riyal, and what is the U.S. dollar equivalent of that price? (10 credits)Answers to Assignment Problems (4)Part I.1. D2. A3. D4. A5. A6. D7. B8. B9. A 10. C11. A 12.D 13. D 14. D 15. B 16. A 17.C 18. B 19.A 20. CPart II.1. Since 50% ($1) + 50% (1€) = Mex$ 1S$/€ = 1.10 , S€/$ = 1/1.10 = 0.9091So, 50% ($1.10) + 50% ($1) = $1.05/Mex$ 12. 50% (€0.9091) +50% (€1) = €0.9545/Mex$ 13. 0.5/1.05 = 0.47624. 0.5/0.9545 = 0.52385. $4.8665/₤6. buy pound in foreign exchange market, change pound for gold in England, transport gold to U.S., convert gold to dollar. (alternative answer)7. towards to the par r ate: $4.8665/₤, because the supply of dollar and the demand for pound rise. That pushes up the value of the pound.8. 375,000 x 0.87 = 326,250 x (1 + 12%) = JD365,400365,400 x (1 + 22%) = JD445.788445,788/0.7080 = $629,644.07 (U.S. dollar equivalent)。

米什金《货币金融学-英文第12版》PPT课件-第四章-利率和利率的计算(包括利率分类及现值终值计算)

FinanceChapter2 Financial MarketsInterest Rates and Calculation of Interest RatesThe Behavior of Interest RatesThe Risk and Term Structure of Interest RatesThe Stock MarketTheory of Rational Expectations, and the Efficient Market HypothesisLecture 4Interest Rates and Calculation of Interest Rates •Interest Rate and Classification of Interest Rate •Simple and Compound Interest Rate •Present Value•Yield to Maturity and Its Calculation•The Distinction Between Interest Rates And ReturnsLearning ObjectivesCalculate the present value of future cash flows and the yield to maturity on the four types of credit market instruments.Recognize the distinctions among yield to maturity, current yield, rate of return, and rate of capital gain.Interpret the distinction between real and nominal interest rates.Part 1Interest Rate and Classification of Interest Rate1.1 Interest RateInterest rate (P3) is the cost of borrowing or the price paid for the rental of funds.利率是借款的成本或为借入资金支付的价格。

米什金《货币金融学-英文第12版》PPT课件-货币政策工具

FinanceChapter4 Central Banking and the Conduct of Monetary PolicyCentral BanksThe Money Supply ProcessTools of Monetary PolicyLecture 10Tools of Monetary Policy•Goals of Monetary Policy and Conventional Monetary Policy Tools•The Market for Reserves and the Federal Funds Rate •How Tools of Monetary Policy Affect the Federal Funds Rate •Advantages and Disadvantages of Conventional Monetary Policy ToolsLearning ObjectivesSummarize how conventional monetary policy tools are implemented and the relative advantages and limitations of each toolIllustrate the market for reserves, and demonstrate how changes in monetary policy can affect the equilibrium federal funds rate.Part 1Goals of Monetary Policy and Conventional Monetary Policy Tools1.1 Goals of Monetary Policy•Price stability (*)•High Employment•Economic Growth•Stability of Financial Markets •Interest-Rate Stability•Stability in Foreign Exchange Markets1.2 Monetary Policy ToolsMonetary policy tools are the instruments used by the central bank to regulate the money supply and interest rates in order to achieve the goal of monetary policy.Conventional monetary policy tools :•Open market operations•Discount lending•Reserve requirementsNonconventional Monetary Policy Tools:Quantitative Easing, Credit Easing, Liquidity Provision, Large-Scale Asset Purchases, Forward Guidance and the Commitment to Future Policy ActionsPart 2The Market for Reserves and the Federal Funds Rate2.1 Goals of the Fed's Monetary PolicyThe goals of the Fed's monetary policy:According to the Federal Reserve Act, the goal of U.S. monetary policy is to control inflation and promote full employment.Intermediate goals of the Fed's monetary policy:The Fed uses the federal funds rate as the main monetary policy monitoring indicator and manipulation target.2.2 The Market for Reserves and the Federal Funds Rate•Demand CurveRR dd= Required reserves + Excess reservesThe trend of demand curve:As the federal funds rate ii ffff decreases, other things being equal, the opportunity cost of holding excess reserves decreases and the demand for excess reserves increases——the demand curve is downward sloping——but the process is not over.2.2 The Market for Reserves and the Federal Funds Rate•Demand CurveThe trend of demand curve:Since 2008, the Fed has paid interest on reserves at a level that is typically set at a fixed amount below the federal funds rate target.Suppose the interest rate paid on reserves is ii oooo, when federal funds rate ii ffff begins to fall below ii oooo, banks do not lend in the overnight market at a lower interest rate. Instead, they just keep on adding to their holdings of excess reserves indefinitely——the demand curve becomes flat (infinitely elastic)2.2 The Market for Reserves and the Federal Funds Rate2.2 The Market for Reserves and the Federal Funds Rate•Supply CurveRR ss= Nonborrowed reserves (NBR)+ borrowed reserves (BR) NBR: Amount of reserves that are supplied by the Fed’s open market operations. BR: Amount of reserves borrowed from the Fed, the interest rate charged by the Fed on these loans is the discount rate,ii dd, which is set at a fixed amount above the federal funds target rate.2.2 The Market for Reserves and the Federal Funds Rate•Supply CurveThe trend of supply curve:Borrowing federal funds from other banks is a substitute for borrowing (taking out discount loans) from the Fed.When ii ffff< ii dd,banks will not borrow from the Fed because borrowing in the federal funds market is cheaper, so BR=0, R s= NBR. And so the supply curve will be vertical. When ii ffff> ii dd, banks will want to keep borrowing more and more at ii dd and then lending out the proceeds in the federal funds market at the higher rate, ii ffff. The supply curve becomes flat (infinitely elastic) at ii dd.2.2 The Market for Reserves and the Federal Funds Rate2.2 The Market for Reserves and the Federal Funds Rate•Market EquilibriumMarket equilibrium occurs when the quantity of reserves demanded equals the quantity supplied, RR dd=RR ssEquilibrium therefore occurs at the intersection of the demand curve RR dd and the supply curve RR ss, with an equilibrium federal funds rate of ii ffff∗When ii ffff>ii ffff∗, more reserves are supplied than are demanded (excess supply). When ii ffff<ii ffff∗, more reserves are demanded than are supplied (excess demand).2.2 The Market for Reserves and the Federal Funds Rateii dd>ii ffff>ii ooooPart 3How Tools of Monetary Policy Affect the Federal Funds RateOpen market purchase leads to greater quantity of reserves supplied, which increases nonborrowed reserves.Open market sale leads to less quantity of reserves supplied, which decreases nonborrowed reservesThe effect of an open market operation depends on whether the supply curve initially intersects the demand curve in its downward-sloped section or in its flat section.If the intersection initially occurs on the downward-sloped section of the demand curve, an open market purchase causes the federal funds rate to fall, whereas an open market sale causes the federal funds rate to rise. (typical situation)If the supply curve initially intersects the demand curve on its flat section, open market operations have no effect on the federal funds rate, because the interest rate paid on reserves, ii oooo, sets a floor for the federal funds rateThe effect of a discount rate change depends on whether the demand curve intersects the supply curve in its vertical section or its flat section.If the intersection occurs on the vertical section of the supply curve, there is no discount lending and borrowed reserves (BR=0). When the discount rate (ii dd) is lowered by the Fed, no change occurs in the equilibrium federal fundsrate. (typical situation)If the demand curve intersects the supply curve on its flat section, there is some discount lending (BR>0). When the discount rate (ii dd) is lowered by the Fed, the equilibrium federal funds rate falls, and BR increases.When the required reserve ratio increases, required reserves increase and hence the quantity of reserves demanded increases for any given interest rate.When the Fed raises reserve requirements, the federal funds rate rises.When the Fed decreases reserve requirements, the federal funds rate fallsMonetary PolicyTools How to Affect Money Supply and ii ffffOpen Market Operations•Affect Money Supply: Open Market Purchase → MB↑→M↑•Affect ii ffff : a) Open Market Purchase → ii ffff ↓ (Usually)b) Open Market Purchase → ii ffff remains unchangedDiscount Lending •Affect Money Supply: a) Discount rate change → M is unchanged (Usually)b) Discount rate ↓ → M↑•Affect ii ffff : a) Discount rate change →ii ffff remains unchanged (Usually)b) Discount rate ↓ → ii ffff ↓Reserve Requirements•Affect Money Supply: rr ↑→M↓•Affect ii ffff : rr ↑→ii ffff ↑3.4 Summary3. How Monetary Policy Tools Affect ii ffffPart 4Advantages and Disadvantages of Conventional Monetary Policy ToolsMonetaryPolicy ToolsAdvantages DisadvantagesOpen Market Operations •The initiative lies with the centralbank•Flexible and precise•Can be executed quicklyMust be based on well-developed financialmarkets, i.e. there must be a sufficient variety andnumber of securitiesDiscount Lending •Central bank can act as the lenderof last resort•Central banks can realize theirpolicy intentions by increasing ordecreasing the discount rate•Central banks can only affect discount rate,but cannot command banks to borrow•When ii dd remains unchanged, changes in ii ffffmay change discount loans and money supply.•Central bank's changes in the discount ratemay be misinterpreted by the market.MonetaryPolicy ToolsAdvantages DisadvantagesReserve Requirements •The initiative lies with the central bank•Can have a rapid, powerful and widespreadimpact on the money supply•Acts on all banks or depository financialinstitutions, and is objective and fair to allfinancial institutions.•Can reflect the policy intention of the centralbank.•The effect on the money supplyis too violent and lack ofelasticity;•The expected effect of thepolicy is largely limited by theamount of excess reserves in thebanking system.SummaryT H A N K S。

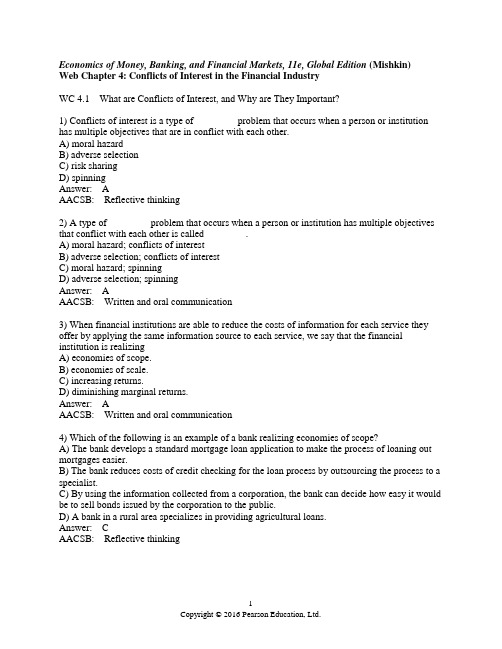

货币金融学11ge_TestBank web chapter 4

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin)Web Chapter 4: Conflicts of Interest in the Financial IndustryWC 4.1 What are Conflicts of Interest, and Why are They Important?1) Conflicts of interest is a type of ________ problem that occurs when a person or institution has multiple objectives that are in conflict with each other.A) moral hazardB) adverse selectionC) risk sharingD) spinningAnswer: AAACSB: Reflective thinking2) A type of ________ problem that occurs when a person or institution has multiple objectives that conflict with each other is called ________.A) moral hazard; conflicts of interestB) adverse selection; conflicts of interestC) moral hazard; spinningD) adverse selection; spinningAnswer: AAACSB: Written and oral communication3) When financial institutions are able to reduce the costs of information for each service they offer by applying the same information source to each service, we say that the financial institution is realizingA) economies of scope.B) economies of scale.C) increasing returns.D) diminishing marginal returns.Answer: AAACSB: Written and oral communication4) Which of the following is an example of a bank realizing economies of scope?A) The bank develops a standard mortgage loan application to make the process of loaning out mortgages easier.B) The bank reduces costs of credit checking for the loan process by outsourcing the process to a specialist.C) By using the information collected from a corporation, the bank can decide how easy it would be to sell bonds issued by the corporation to the public.D) A bank in a rural area specializes in providing agricultural loans.Answer: CAACSB: Reflective thinking5) One problem with conflicts of interest is that they can reduce the ________ in financial markets, thereby increasing ________.A) quantity of information; financial institutions' profitsB) quantity of information; asymmetric informationC) quality of information; asymmetric informationD) quality of information; financial institutions' profitsAnswer: CAACSB: Reflective thinking6) Describe what is meant by economies of scope and explain how financial institutions' realizing economies of scope has led to an increase in conflicts of interest.Answer: Economies of scope is when firms can reduce costs by offering different products or services. For a financial institution, this usually takes the form of taking one information source and using it to provide a different array of services. This may lead to conflicts of interest because these services may have conflicting goals in which employees of different departments may conceal information or disseminate misleading information to financial markets.AACSB: Written and oral communicationWC 4.2 Ethics and Conflicts of Interest1) Not surprisingly, when financial institutions have consolidated more services under one roof, the amount of conflicts of interest has ________, which has led to ________ in unethical behavior.A) increased; an increaseB) increased; a decreaseC) decreased; an increaseD) decreased; a decreaseAnswer: AAACSB: Reflective thinkingWC 4.3 Types of Conflicts of Interest1) In investment banking, a conflict usually is present between the issuers of securities, who________, and investors, who ________.A) benefit from unbiased auditing; desire unbiased consultingB) desire unbiased research; benefit from optimistic researchC) benefit from optimistic research; desire unbiased researchD) desire unbiased consulting; benefit from unbiased auditingAnswer: CAACSB: Reflective thinking2) The incentive for analysts in investment banks to distort research increases whenA) revenues from brokerage commissions increase.B) the potential revenues from underwriting greatly exceed brokerage commissions.C) the potential brokerage commissions greatly exceed revenues from underwriting.D) revenues from underwriting decrease.Answer: BAACSB: Reflective thinking3) When investment banks allocate shares of a popular but underpriced IPO to executives of other firms in order to attract their business, it is calledA) spinning.B) a bribe.C) reputational activities.D) a kickback.Answer: AAACSB: Written and oral communication4) The problem with spinning is that it may ________ the cost of capital to a firm and thus________ the efficiency of the capital market.A) increase; increaseB) increase; decreaseC) decrease; increaseD) decrease; decreaseAnswer: BAACSB: Reflective thinking5) Which of the following is not a conflict of interest in accounting firms?A) The firm provides consulting as well as rating creditworthiness.B) Auditors may be pressured to skew their opinions so the client will stay with the firm.C) Auditors may be reluctant to criticize advice put into place by nonaudit personnel of the firm.D) Auditors release an overly favorable audit in order to solicit business.Answer: AAACSB: Analytical thinking6) Advice on taxes, accounting or management information systems, and business strategies are commonly referred to as ________ services.A) accounting auditB) management advisoryC) sellerD) managing underwriterAnswer: BAACSB: Written and oral communication7) Conflicts of interest arising from management advisory services brought down ________ in 2002.A) EnronB) WorldCommC) Arthur AndersenD) Global CrossingAnswer: CAACSB: Written and oral communication8) Conflicts of interest may arise within the credit rating agencies becauseA) the investors pay the credit agencies for ratings.B) the issuers of debt securities pay the credit agencies for ratings.C) the credit rating agencies provide auditing services to issuers of debt securities.D) the credit rating agencies are involved in offering credit counseling to investors.Answer: BAACSB: Reflective thinking9) When the Glass-Steagall Act was repealed in 1999, potential conflicts of interest arose withA) the development of universal banking.B) the introduction of more credit-rating agencies.C) accounting firms developing more comprehensive services.D) investment analysis in investment banking.Answer: AAACSB: Reflective thinking10) Explain the type of conflicts of interest that can arise from the development of universal banking.Answer: There are five main conflicts of interest:1. The underwriting department would benefit from aggressive sales of a security to the customers of a bank where the customers would benefit from unbiased advice.2. A bank manager may try to hard-sell an issuing firm's securities to the disadvantage of the bank customer or limit losses of an underperforming IPO to the bank's trust accounts.3. A bank may push a bond issue of a firm with a high default risk to pay off a loan the bank has with the firm.4. May grant favorable loan conditions to a firm in return for fees to perform underwriting activities.4. May try to hard-sell the bank's insurance to its customers.AACSB: Written and oral communicationWC 4.4 Can the Market Limit Exploitation of Conflicts of Interest?1) Evidence suggests that credit-rating agencies ________ exploited conflicts of interest because ________.A) have not; it would cause their ratings to lose credibility and thus have a lower value in the marketplaceB) have not; they would have an increase in profits in the long-runC) have; it would cause their ratings to lose credibility and thus have a lower value in the marketplaceD) have; they would have an increase in profits in the long-runAnswer: AAACSB: Reflective thinking2) Evidence suggests that the market ________ take into account the credibility of analyst's recommendations of IPOs that were underwritten at the analyst's investment bank because the performance of these recommendations was about 50% ________ compared to recommendations made by other analysts at different investment banks.A) does; betterB) does; worseC) does not; betterD) does not; worseAnswer: BAACSB: Reflective thinking3) Reputational rents refer toA) the profit earned by a firm when it captures economies of scope.B) the costs associated with building credibility of a firm.C) the profit earned solely based on the credibility of a firm.D) the costs associated with the firm's achievement of economies of scale.Answer: CAACSB: Reflective thinking4) Explain how the market can reduce the incentive for credit-rating firms to take advantage of conflicts of interest.Answer: If a credit-rating firm gives a higher than deserved rating to debt issuers, then the ratings from the firm will lose credibility. If that happens, then the ratings will have a lower value in the marketplace.AACSB: Written and oral communicationWC 4.5 What Has Been Done to Remedy Conflicts of Interest?1) Which of the following is not a part of the Sarbanes-Oxley Act of 2002?A) the establishment of a Public Company Accounting Oversight Board (PCAOB) to supervise accounting firms and thus insure that audits are independent and controlled for qualityB) increased penalties for white-collar crime and obstruction of official investigationsC) requires a CEO and CFO to certify that periodic financial statements and disclosure of the firm are accurateD) requires investment banks to make public their analysts' recommendationsAnswer: DAACSB: Analytical thinking2) Which policy measure increased the SEC budget to supervise securities markets?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking3) Which policy measure makes it unlawful for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking4) Which policy measure increases the punishment for white-collar crime and obstruction of official investigations?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking5) Which of the following is a part of the Global Legal Settlement of 2002?A) The establishment of a Public Company Accounting Oversight Board (PCAOB) to supervise accounting firms and thus insure that audits are independent and controlled for quality.B) Increased penalties for white-collar crime and obstruction of official investigations.C) Requires a CEO and CFO to certify that periodic financial statements and disclosure of the firm are accurate.D) Requires investment banks to make public their analysts' recommendations.Answer: DAACSB: Reflective thinking6) Which policy measure requires investment banks to sever the links between research and securities underwriting?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: BAACSB: Reflective thinking7) Which policy measure bans spinning?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: BAACSB: Reflective thinking8) Which policy measure requires investment banks to make public their analysts' recommendations?A) Sarbanes-Oxley Act of 2002B) Global Legal Settlement of 2002C) Gramm-Leach-Bliley Act of 1999D) Riegle-Neal Act of 1994Answer: BAACSB: Reflective thinking9) The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 included which of the following provisions to deal with conflicts of interest in the credit-rating Industry?1. Created an Office of Credit Ratings at the SEC with its own staff and the authority to fine credit-rating agencies and to deregister an agency if it produces bad ratings.2. Forced credit-rating agencies to provide reports to the SEC when their employees go to work for a company that has been rated by them in the last twelve months.3. Prohibited compliance officers from being involved in producing or selling credit ratings.4. Required the SEC to prevent issuers of asset-backed securities from choosing thecredit-rating agencies that will give them the highest rating and supported earlier initiatives by the SEC.4. Authorized investors to bring lawsuits against credit-rating agencies for a reckless failure to get the facts when providing a credit rating.A) 1, 2, 3, and 4.B) 2, 3, 4, and 4.C) none.D) 1, 2, 3, 4, and 4.Answer: DAACSB: Ethical understanding and reasoning10) Which of the following policy measures forced credit-rating agencies to provide reports to the SEC when their employees go to work for a company that has been rated by them in the last twelve months?A) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010B) Sarbanes-Oxley Act of 2002C) Global Legal Settlement of 2002D) Gramm-Leach-Bliley Act of 1999E) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking11) Which of the following policy measures created an Office of Credit Ratings at the SEC with its own staff and the authority to fine credit-rating agencies and to deregister an agency if it produces bad ratings?A) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010B) Sarbanes-Oxley Act of 2002C) Global Legal Settlement of 2002D) Gramm-Leach-Bliley Act of 1999E) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking12) Which of the following policy measures prohibited compliance officers from being involved in producing or selling credit ratings?A) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010B) Sarbanes-Oxley Act of 2002C) Global Legal Settlement of 2002D) Gramm-Leach-Bliley Act of 1999E) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking13) Which of the following policy measures required the SEC to prevent issuers of asset-backed securities from choosing the credit-rating agencies that will give them the highest rating and supported earlier initiatives by the SEC?A) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010B) Sarbanes-Oxley Act of 2002C) Global Legal Settlement of 2002D) Gramm-Leach-Bliley Act of 1999E) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinking14) Which of the following policy measures authorized investors to bring lawsuits against credit-rating agencies for a reckless failure to get the facts when providing a credit rating?A) the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010B) Sarbanes-Oxley Act of 2002C) Global Legal Settlement of 2002D) Gramm-Leach-Bliley Act of 1999E) Riegle-Neal Act of 1994Answer: AAACSB: Reflective thinkingWC 4.6 A Framework for Evaluating Policies to Remedy Conflicts of Interest1) If a conflict of interest existsA) it will always have serious adverse consequences.B) it may not have a serious adverse consequences if the incentive to take advantage of the conflict is low.C) the government needs to step in to pass legislation to remove the conflict.D) there will not be serious adverse consequences, even if the incentive to take advantage of the conflict is low.Answer: BAACSB: Reflective thinking2) If the incentive to take advantage of a conflict of interest is highA) removing the economies of scope that created the conflict may induce higher costs because of the decrease in the flow of reliable information.B) then the government must step in to remove the conflict.C) the costs of non-action in removing the conflict will always be higher than the cost of removing the conflict.D) firms will always step in and work to remove the conflict.Answer: AAACSB: Reflective thinking3) If there isn't sufficient information available, then which of the following approaches to reduce conflicts of interest will have the lowest probability of working?A) leave it to the marketB) supervisory oversightC) separation of functionsD) socialization of information productionAnswer: AAACSB: Reflective thinking4) When the SEC requires companies to publicly release financial statements, which of the following remedies of conflicts of interest does this fall under?A) leave it to the marketB) regulate for transparencyC) supervisory oversightD) separation of functionsAnswer: BAACSB: Analytical thinking5) If firms have an incentive to hide information from mandatory disclosure because the information is proprietary, then which of the following remedies is the least intrusive way to overcome this incentive?A) leave it to the marketB) separation of functionsC) supervisory oversightD) socialization of information productionAnswer: CAACSB: Analytical thinking6) Under the Sarbanes-Oxley Act of 2002, the clause that makes it unlawful for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit is an example of which remedy of conflicts of interest?A) regulate for transparencyB) supervisory oversightC) separation of functionsD) socialization of information productionAnswer: CAACSB: Analytical thinking7) Of the remedies for conflicts of interest, which one is the most intrusive?A) regulate for transparencyB) separation of functionsC) supervisory oversightD) socialization of information productionAnswer: DAACSB: Analytical thinking8) Under the Global Legal Settlement of 2002, the provision that requires, for a period of five years, brokerage firms to contract with independent research firms to provide information to their customers is an example ofA) regulate for transparency.B) supervisory oversight.C) separation of functions.D) socialization of information production.Answer: DAACSB: Analytical thinking9) Under the Global Legal Settlement of 2002, the provision that requires investment banking firms to make their analysts' recommendations public is an example ofA) regulate for transparency.B) supervisory oversight.C) separation of functions.D) socialization of information production.Answer: AAACSB: Analytical thinking10) Under the Sarbanes-Oxley Act of 2002, the provision that established the PCAOB to supervise accounting firms is an example ofA) regulate for transparency.B) supervisory oversight.C) separation of functions.D) socialization of information production.Answer: BAACSB: Analytical thinking11) Under the Sarbanes-Oxley Act of 2002, the provision that gives more funding to the SEC is an example ofA) regulate for transparency.B) supervisory oversight.C) separation of functions.D) socialization of information production.Answer: BAACSB: Analytical thinking12) Under the Global Legal Settlement of 2002, the provision that requires investment banking firms to sever the link between underwriting and research is an example ofA) regulate for transparency.B) supervisory oversight.C) separation of functions.D) socialization of information production.Answer: CAACSB: Analytical thinking13) The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 did not prohibit companies issuing securities from paying the credit-rating agencies to rate them. This is an example of which remedy of conflicts of interest?A) regulate for transparencyB) supervisory oversightC) leave it to the marketD) socialization of information productionAnswer: CAACSB: Analytical thinking14) The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 authorized investors to bring lawsuits against credit-rating agencies for a reckless failure to get the facts when providing a credit rating. This is an example of which remedy of conflicts of interest?A) regulate for transparencyB) supervisory oversightC) leave it to the marketD) socialization of information productionAnswer: CAACSB: Analytical thinking15) The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 created an Office of Credit Ratings at the SEC with its own staff and the authority to fine credit-rating agencies and to deregister an agency if it produces bad ratings. This is an example of which remedy of conflicts of interest?A) regulate for transparencyB) supervisory oversightC) leave it to the marketD) socialization of information productionAnswer: BAACSB: Analytical thinking。

英文版金融第四章

What is the expected return on an Exxon-Mobil bond if the return is 12% two-thirds of the time and 8% one-third of the time? Solution The expected return is 10.68%. Re = p1R1 + p2R2 where p1 = probability of occurrence of return 1 = 2/3 = .67 R1 = return in state 1 = 12% = 0.12 p2 = probability of occurrence return 2 = 1/3 = .33 R2 = return in state 2 = 8% = 0.08 Thus Re = (.67)(0.12) + (.33)(0.08) = 0.1068 = 10.68%

Derivation of Demand Curve How do we know the demand (Bd) at point A is 100 and at point B is 200? Well, we are just making-up those numbers. But we are applying basic economics – more people will want (demand) the bonds if the expected return is higher.

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

Derivation of Demand Curve

货币金融学(全英)chapter 4习题PPT教学课件

million per year for twenty years has won $20 million ignores the concept of • A) face value. • B) par value. • C) deflation. • D) discounting the future. • Answer: D

• pared to the situation in which interest rate is 15% and expected inflation rate is 14%, companies are more willing to borrow funds in the situation in which price is stable and interest rate is 2%.

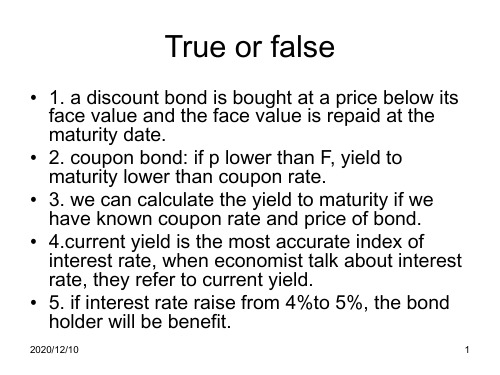

True or false

• 1. a discount bond is bought at a price below its face value and the face value is repaid at the maturity date.

• 2. coupon bond: if p lower than F, yield to maturity lower than coupon rate.

• 5. if interest rate raise from 4%to 5%, the bond holder will be benefit.

英文版国际金融练习题Chapter-4