外文参考文献(带中文翻译)

外文参考文献译文及原文【范本模板】

广东工业大学华立学院本科毕业设计(论文)外文参考文献译文及原文系部城建学部专业土木工程年级 2011级班级名称 11土木工程9班学号 23031109000学生姓名刘林指导教师卢集富2015 年5 月目录一、项目成本管理与控制 0二、Project Budget Monitor and Control (1)三、施工阶段承包商在控制施工成本方面所扮演的作用 (2)四、The Contractor’s Role in Building Cost Reduction After Design (4)一、外文文献译文(1)项目成本管理与控制随着市场竞争的激烈性越来越大,在每一个项目中,进行成本控制越发重要。

本文论述了在施工阶段,项目经理如何成功地控制项目预算成本。

本文讨论了很多方法。

它表明,要取得成功,项目经理必须关注这些成功的方法.1。

简介调查显示,大多数项目会碰到超出预算的问……功控制预算成本.2.项目控制和监测的概念和目的Erel and Raz (2000)指出项目控制周期包括测量成……原因以及决定纠偏措施并采取行动。

监控的目的就是纠偏措施的。

.。

标范围内。

3.建立一个有效的控制体系为了实现预算成本的目标,项目管理者需要建立一……被监测和控制是非常有帮助的。

项目成功与良好的沟通密。

决( Diallo and Thuillier, 2005).4.成本费用的检测和控制4.1对检测的优先顺序进行排序在施工阶段,很多施工活动是基于原来的计……用完了。

第四,项目管理者应该检测高风险活动,高风险活动最有。

..重要(Cotterell and Hughes, 1995)。

4.2成本控制的方法一个项目的主要费用包括员工成本、材料成本以及工期延误的成本。

为了控制这些成本费用,项目管理者首先应该建立一个成本控制系统:a)为财务数据的管理和分析工作落实责任人员b)确保按照项目的结构来合理分配所有的……它的变化-—在成本控制线上准确地记录所有恰..。

外文文献及翻译

((英文参考文献及译文)二〇一六年六月本科毕业论文 题 目:STATISTICAL SAMPLING METHOD, USED INTHE AUDIT学生姓名:王雪琴学 院:管理学院系 别:会计系专 业:财务管理班 级:财管12-2班 学校代码: 10128 学 号: 201210707016Statistics and AuditRomanian Statistical Review nr. 5 / 2010STATISTICAL SAMPLING METHOD, USED IN THE AUDIT - views, recommendations, fi ndingsPhD Candidate Gabriela-Felicia UNGUREANUAbstractThe rapid increase in the size of U.S. companies from the earlytwentieth century created the need for audit procedures based on the selectionof a part of the total population audited to obtain reliable audit evidence, tocharacterize the entire population consists of account balances or classes oftransactions. Sampling is not used only in audit – is used in sampling surveys,market analysis and medical research in which someone wants to reach aconclusion about a large number of data by examining only a part of thesedata. The difference is the “population” from which the sample is selected, iethat set of data which is intended to draw a conclusion. Audit sampling appliesonly to certain types of audit procedures.Key words: sampling, sample risk, population, sampling unit, tests ofcontrols, substantive procedures.Statistical samplingCommittee statistical sampling of American Institute of CertifiedPublic Accountants of (AICPA) issued in 1962 a special report, titled“Statistical sampling and independent auditors’ which allowed the use ofstatistical sampling method, in accordance with Generally Accepted AuditingStandards (GAAS). During 1962-1974, the AICPA published a series of paperson statistical sampling, “Auditor’s Approach to Statistical Sampling”, foruse in continuing professional education of accountants. During 1962-1974,the AICPA published a series of papers on statistical sampling, “Auditor’sApproach to Statistical Sampling”, for use in continuing professional educationof accountants. In 1981, AICPA issued the professional standard, “AuditSampling”, which provides general guidelines for both sampling methods,statistical and non-statistical.Earlier audits included checks of all transactions in the period coveredby the audited financial statements. At that time, the literature has not givenparticular attention to this subject. Only in 1971, an audit procedures programprinted in the “Federal Reserve Bulletin (Federal Bulletin Stocks)” includedseveral references to sampling such as selecting the “few items” of inventory.Statistics and Audit The program was developed by a special committee, which later became the AICPA, that of Certified Public Accountants American Institute.In the first decades of last century, the auditors often applied sampling, but sample size was not in related to the efficiency of internal control of the entity. In 1955, American Institute of Accountants has published a study case of extending the audit sampling, summarizing audit program developed by certified public accountants, to show why sampling is necessary to extend the audit. The study was important because is one of the leading journal on sampling which recognize a relationship of dependency between detail and reliability testing of internal control.In 1964, the AICPA’s Auditing Standards Board has issued a report entitled “The relationship between statistical sampling and Generally Accepted Auditing Standards (GAAS)” which illustrated the relationship between the accuracy and reliability in sampling and provisions of GAAS.In 1978, the AICPA published the work of Donald M. Roberts,“Statistical Auditing”which explains the underlying theory of statistical sampling in auditing.In 1981, AICPA issued the professional standard, named “Audit Sampling”, which provides guidelines for both sampling methods, statistical and non-statistical.An auditor does not rely solely on the results of a single procedure to reach a conclusion on an account balance, class of transactions or operational effectiveness of the controls. Rather, the audit findings are based on combined evidence from several sources, as a consequence of a number of different audit procedures. When an auditor selects a sample of a population, his objective is to obtain a representative sample, ie sample whose characteristics are identical with the population’s characteristics. This means that selected items are identical with those remaining outside the sample.In practice, auditors do not know for sure if a sample is representative, even after completion the test, but they “may increase the probability that a sample is representative by accuracy of activities made related to design, sample selection and evaluation” [1]. Lack of specificity of the sample results may be given by observation errors and sampling errors. Risks to produce these errors can be controlled.Observation error (risk of observation) appears when the audit test did not identify existing deviations in the sample or using an inadequate audit technique or by negligence of the auditor.Sampling error (sampling risk) is an inherent characteristic of the survey, which results from the fact that they tested only a fraction of the total population. Sampling error occurs due to the fact that it is possible for Revista Română de Statistică nr. 5 / 2010Statistics and Auditthe auditor to reach a conclusion, based on a sample that is different from the conclusion which would be reached if the entire population would have been subject to audit procedures identical. Sampling risk can be reduced by adjusting the sample size, depending on the size and population characteristics and using an appropriate method of selection. Increasing sample size will reduce the risk of sampling; a sample of the all population will present a null risk of sampling.Audit Sampling is a method of testing for gather sufficient and appropriate audit evidence, for the purposes of audit. The auditor may decide to apply audit sampling on an account balance or class of transactions. Sampling audit includes audit procedures to less than 100% of the items within an account balance or class of transactions, so all the sample able to be selected. Auditor is required to determine appropriate ways of selecting items for testing. Audit sampling can be used as a statistical approach and a non- statistical.Statistical sampling is a method by which the sample is made so that each unit consists of the total population has an equal probability of being included in the sample, method of sample selection is random, allowed to assess the results based on probability theory and risk quantification of sampling. Choosing the appropriate population make that auditor’ findings can be extended to the entire population.Non-statistical sampling is a method of sampling, when the auditor uses professional judgment to select elements of a sample. Since the purpose of sampling is to draw conclusions about the entire population, the auditor should select a representative sample by choosing sample units which have characteristics typical of that population. Results will not extrapolate the entire population as the sample selected is representative.Audit tests can be applied on the all elements of the population, where is a small population or on an unrepresentative sample, where the auditor knows the particularities of the population to be tested and is able to identify a small number of items of interest to audit. If the sample has not similar characteristics for the elements of the entire population, the errors found in the tested sample can not extrapolate.Decision of statistical or non-statistical approach depends on the auditor’s professional judgment which seeking sufficient appropriate audits evidence on which to completion its findings about the audit opinion.As a statistical sampling method refer to the random selection that any possible combination of elements of the community is equally likely to enter the sample. Simple random sampling is used when stratification was not to audit. Using random selection involves using random numbers generated byRomanian Statistical Review nr. 5 / 2010Statistics and Audit a computer. After selecting a random starting point, the auditor found the first random number that falls within the test document numbers. Only when the approach has the characteristics of statistical sampling, statistical assessments of risk are valid sampling.In another variant of the sampling probability, namely the systematic selection (also called random mechanical) elements naturally succeed in office space or time; the auditor has a preliminary listing of the population and made the decision on sample size. “The auditor calculated a counting step, and selects the sample element method based on step size. Step counting is determined by dividing the volume of the community to sample the number of units desired. Advantages of systematic screening are its usability. In most cases, a systematic sample can be extracted quickly and method automatically arranges numbers in successive series.”[2].Selection by probability proportional to size - is a method which emphasizes those population units’recorded higher values. The sample is constituted so that the probability of selecting any given element of the population is equal to the recorded value of the item;Stratifi ed selection - is a method of emphasis of units with higher values and is registered in the stratification of the population in subpopulations. Stratification provides a complete picture of the auditor, when population (data table to be analyzed) is not homogeneous. In this case, the auditor stratifies a population by dividing them into distinct subpopulations, which have common characteristics, pre-defined. “The objective of stratification is to reduce the variability of elements in each layer and therefore allow a reduction in sample size without a proportionate increase in the risk of sampling.” [3] If population stratification is done properly, the amount of sample size to come layers will be less than the sample size that would be obtained at the same level of risk given sample with a sample extracted from the entire population. Audit results applied to a layer can be designed only on items that are part of that layer.I appreciated as useful some views on non-statistical sampling methods, which implies that guided the selection of the sample selecting each element according to certain criteria determined by the auditor. The method is subjective; because the auditor selects intentionally items containing set features him.The selection of the series is done by selecting multiple elements series (successive). Using sampling the series is recommended only if a reasonable number of sets used. Using just a few series there is a risk that the sample is not representative. This type of sampling can be used in addition to other samples, where there is a high probability of occurrence of errors. At the arbitrary selection, no items are selected preferably from the auditor, Revista Română de Statistică nr. 5 / 2010Statistics and Auditthat regardless of size or source or characteristics. Is not the recommended method, because is not objective.That sampling is based on the auditor’s professional judgment, which may decide which items can be part or not sampled. Because is not a statistical method, it can not calculate the standard error. Although the sample structure can be constructed to reproduce the population, there is no guarantee that the sample is representative. If omitted a feature that would be relevant in a particular situation, the sample is not representative.Sampling applies when the auditor plans to make conclusions about population, based on a selection. The auditor considers the audit program and determines audit procedures which may apply random research. Sampling is used by auditors an internal control systems testing, and substantive testing of operations. The general objectives of tests of control system and operations substantive tests are to verify the application of pre-defined control procedures, and to determine whether operations contain material errors.Control tests are intended to provide evidence of operational efficiency and controls design or operation of a control system to prevent or detect material misstatements in financial statements. Control tests are necessary if the auditor plans to assess control risk for assertions of management.Controls are generally expected to be similarly applied to all transactions covered by the records, regardless of transaction value. Therefore, if the auditor uses sampling, it is not advisable to select only high value transactions. Samples must be chosen so as to be representative population sample.An auditor must be aware that an entity may change a special control during the course of the audit. If the control is replaced by another, which is designed to achieve the same specific objective, the auditor must decide whether to design a sample of all transactions made during or just a sample of transactions controlled again. Appropriate decision depends on the overall objective of the audit test.Verification of internal control system of an entity is intended to provide guidance on the identification of relevant controls and design evaluation tests of controls.Other tests:In testing internal control system and testing operations, audit sample is used to estimate the proportion of elements of a population containing a characteristic or attribute analysis. This proportion is called the frequency of occurrence or percentage of deviation and is equal to the ratio of elements containing attribute specific and total number of population elements. WeightRomanian Statistical Review nr. 5 / 2010Statistics and Audit deviations in a sample are determined to calculate an estimate of the proportion of the total population deviations.Risk associated with sampling - refers to a sample selection which can not be representative of the population tested. In other words, the sample itself may contain material errors or deviations from the line. However, issuing a conclusion based on a sample may be different from the conclusion which would be reached if the entire population would be subject to audit.Types of risk associated with sampling:Controls are more effective than they actually are or that there are not significant errors when they exist - which means an inappropriate audit opinion. Controls are less effective than they actually are that there are significant errors when in fact they are not - this calls for additional activities to establish that initial conclusions were incorrect.Attributes testing - the auditor should be defining the characteristics to test and conditions for misconduct. Attributes testing will make when required objective statistical projections on various characteristics of the population. The auditor may decide to select items from a population based on its knowledge about the entity and its environment control based on risk analysis and the specific characteristics of the population to be tested.Population is the mass of data on which the auditor wishes to generalize the findings obtained on a sample. Population will be defined compliance audit objectives and will be complete and consistent, because results of the sample can be designed only for the population from which the sample was selected.Sampling unit - a unit of sampling may be, for example, an invoice, an entry or a line item. Each sample unit is an element of the population. The auditor will define the sampling unit based on its compliance with the objectives of audit tests.Sample size - to determine the sample size should be considered whether sampling risk is reduced to an acceptable minimum level. Sample size is affected by the risk associated with sampling that the auditor is willing to accept it. The risk that the auditor is willing to accept lower, the sample will be higher.Error - for detailed testing, the auditor should project monetary errors found in the sample population and should take into account the projected error on the specific objective of the audit and other audit areas. The auditor projects the total error on the population to get a broad perspective on the size of the error and comparing it with tolerable error.For detailed testing, tolerable error is tolerable and misrepresentations Revista Română de Statistică nr. 5 / 2010Statistics and Auditwill be a value less than or equal to materiality used by the auditor for the individual classes of transactions or balances audited. If a class of transactions or account balances has been divided into layers error is designed separately for each layer. Design errors and inconsistent errors for each stratum are then combined when considering the possible effect on the total classes of transactions and account balances.Evaluation of sample results - the auditor should evaluate the sample results to determine whether assessing relevant characteristics of the population is confirmed or needs to be revised.When testing controls, an unexpectedly high rate of sample error may lead to an increase in the risk assessment of significant misrepresentation unless it obtained additional audit evidence to support the initial assessment. For control tests, an error is a deviation from the performance of control procedures prescribed. The auditor should obtain evidence about the nature and extent of any significant changes in internal control system, including the staff establishment.If significant changes occur, the auditor should review the understanding of internal control environment and consider testing the controls changed. Alternatively, the auditor may consider performing substantive analytical procedures or tests of details covering the audit period.In some cases, the auditor might not need to wait until the end audit to form a conclusion about the effectiveness of operational control, to support the control risk assessment. In this case, the auditor might decide to modify the planned substantive tests accordingly.If testing details, an unexpectedly large amount of error in a sample may cause the auditor to believe that a class of transactions or account balances is given significantly wrong in the absence of additional audit evidence to show that there are not material misrepresentations.When the best estimate of error is very close to the tolerable error, the auditor recognizes the risk that another sample have different best estimate that could exceed the tolerable error.ConclusionsFollowing analysis of sampling methods conclude that all methods have advantages and disadvantages. But the auditor is important in choosing the sampling method is based on professional judgment and take into account the cost / benefit ratio. Thus, if a sampling method proves to be costly auditor should seek the most efficient method in view of the main and specific objectives of the audit.Romanian Statistical Review nr. 5 / 2010Statistics and Audit The auditor should evaluate the sample results to determine whether the preliminary assessment of relevant characteristics of the population must be confirmed or revised. If the evaluation sample results indicate that the relevant characteristics of the population needs assessment review, the auditor may: require management to investigate identified errors and likelihood of future errors and make necessary adjustments to change the nature, timing and extent of further procedures to take into account the effect on the audit report.Selective bibliography:[1] Law no. 672/2002 updated, on public internal audit[2] Arens, A şi Loebbecke J - Controve …Audit– An integrate approach”, 8th edition, Arc Publishing House[3] ISA 530 - Financial Audit 2008 - International Standards on Auditing, IRECSON Publishing House, 2009- Dictionary of macroeconomics, Ed C.H. Beck, Bucharest, 2008Revista Română de Statistică nr. 5 / 2010Statistics and Audit摘要美国公司的规模迅速增加,从第二十世纪初创造了必要的审计程序,根据选定的部分总人口的审计,以获得可靠的审计证据,以描述整个人口组成的帐户余额或类别的交易。

外文文献翻译(图片版)

本科毕业论文外文参考文献译文及原文学院经济与贸易学院专业经济学(贸易方向)年级班别2007级 1 班学号3207004154学生姓名欧阳倩指导教师童雪晖2010 年 6 月 3 日目录1 外文文献译文(一)中国银行业的改革和盈利能力(第1、2、4部分) (1)2 外文文献原文(一)CHINA’S BANKING REFORM AND PROFITABILITY(Part 1、2、4) (9)1概述世界银行(1997年)曾声称,中国的金融业是其经济的软肋。

当一国的经济增长的可持续性岌岌可危的时候,金融业的改革一直被认为是提高资金使用效率和消费型经济增长重新走向平衡的必要(Lardy,1998年,Prasad,2007年)。

事实上,不久前,中国的国有银行被视为“技术上破产”,它们的生存需要依靠充裕的国家流动资金。

但是,在银行改革开展以来,最近,强劲的盈利能力已恢复到国有商业银行的水平。

但自从中国的国有银行在不久之前已经走上了改革的道路,它可能过早宣布银行业的改革尚未取得完全的胜利。

此外,其坚实的财务表现虽然强劲,但不可持续增长。

随着经济增长在2008年全球经济衰退得带动下已经开始软化,银行预计将在一个比以前更加困难的经济形势下探索。

本文的目的不是要评价银行业改革对银行业绩的影响,这在一个完整的信贷周期后更好解决。

相反,我们的目标是通过审查改革的进展和银行改革战略,并分析其近期改革后的强劲的财务表现,但是这不能完全从迄今所进行的改革努力分离。

本文有三个部分。

在第二节中,我们回顾了中国的大型国有银行改革的战略,以及其执行情况,这是中国银行业改革的主要目标。

第三节中分析了2007年的财务表现集中在那些在市场上拥有浮动股份的四大国有商业银行:中国工商银行(工商银行),中国建设银行(建行),对中国银行(中银)和交通银行(交通银行)。

引人注目的是中国农业银行,它仍然处于重组上市过程中得适当时候的后期。

第四节总结一个对银行绩效评估。

外文参考文献译文及原文

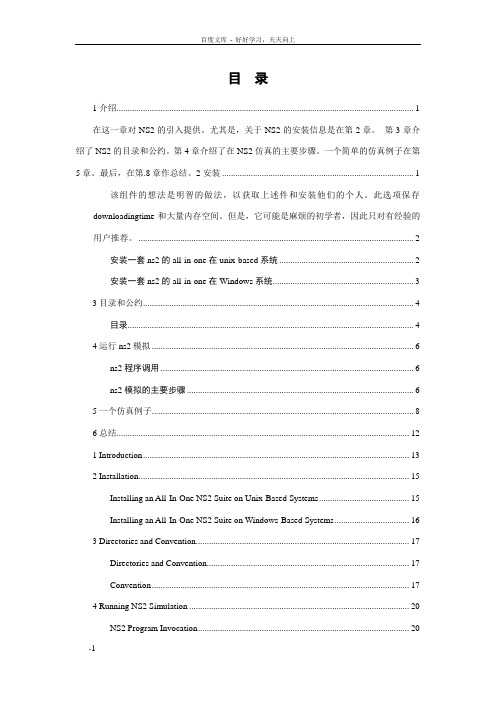

目录1介绍 (1)在这一章对NS2的引入提供。

尤其是,关于NS2的安装信息是在第2章。

第3章介绍了NS2的目录和公约。

第4章介绍了在NS2仿真的主要步骤。

一个简单的仿真例子在第5章。

最后,在第.8章作总结。

2安装 (1)该组件的想法是明智的做法,以获取上述件和安装他们的个人。

此选项保存downloadingtime和大量内存空间。

但是,它可能是麻烦的初学者,因此只对有经验的用户推荐。

(2)安装一套ns2的all-in-one在unix-based系统 (2)安装一套ns2的all-in-one在Windows系统 (3)3目录和公约 (4)目录 (4)4运行ns2模拟 (6)ns2程序调用 (6)ns2模拟的主要步骤 (6)5一个仿真例子 (8)6总结 (12)1 Introduction (13)2 Installation (15)Installing an All-In-One NS2 Suite on Unix-Based Systems (15)Installing an All-In-One NS2 Suite on Windows-Based Systems (16)3 Directories and Convention (17)Directories and Convention (17)Convention (17)4 Running NS2 Simulation (20)NS2 Program Invocation (20)Main NS2 Simulation Steps (20)5 A Simulation Example (22)6 Summary (27)1介绍网络模拟器(一般叫作NS2)的版本,是证明了有用在学习通讯网络的动态本质的一个事件驱动的模仿工具。

模仿架线并且无线网络作用和协议(即寻址算法,TCP,UDP)使用NS2,可以完成。

一般来说,NS2提供用户以指定这样网络协议和模仿他们对应的行为方式。

外文文献翻译(英文+中文对照)

外文文献翻译 例如例如::下面是一个样板下面是一个样板,,如需要更多的机械相关专业的外文文献可以联系QQ: 763077177 (非诚勿扰) Coating thickness effects on diamond coated cutting tools F. Qin, Y.K. Chou,D. Nolen and R.G. ThompsonAvailable online 12 June 2009. Abstract :Chemical vapor deposition (CVD)-grown diamond films have found applications as a hard coating for cutting tools. Even though the use of conventional diamond coatings seems to be accepted in the cutting tool industry, selections of proper coating thickness for different machining operations have not been often studied. Coating thickness affects the characteristics of diamond coated cutting tools in different perspectives that may mutually impact the tool performance in machining in a complex way.In this study, coating thickness effects on the deposition residual stresses, particularly around a cutting edge, and on coating failure modes were numerically investigated. On the other hand, coating thickness effects on tool surface smoothness and cutting edge radii were experimentally investigated. In addition, machining Al matrix composites using diamond coated tools with varied coating thicknesses was conducted to evaluate the effects on cutting forces, part surface finish and tool wear.The results are summarized as follows. Increasing coating thickness will increase the residual stresses at the coating–substrate interface. On the other hand, increasing coating thickness will generally increase the resistance of coating cracking and delamination. Thicker coatings will result in larger edge radii; however, the extent of the effect on cutting forces also depends upon the machining condition. For the thickness range tested, the life of diamond coated tools increases with the coating thickness because of delay of delaminations. Keywords: Coating thickness; Diamond coating; Finite element; Machining; Tool wear1. IntroductionDiamond coatings produced by chemical vapor deposition (CVD) technologies have been increasingly explored for cutting tool applications. Diamond coated tools have great potential in various machining applications and an advantage in fabrications of cutting tools with complex geometry such as drills. Increased usages of lightweight high-strength components have also resulted in significant interests in diamond coating tools. Hot-filament CVD is one of common processes of diamond coatings and diamond films as thick as 50 µm have been deposited on various materials including cobalt-cemented tungsten carbide (WC-Co) . There have also been different CVD technologies, e.g., microwave plasma assisted CVD , developed to enhance the deposition process as well as the film quality too. However, despite the superior tribological and mechanical properties, the practical applications of diamond coated tools are still limited.Coating thickness is one of the most important attributes to the coating system performance. Coating thickness effects on tribological performance have been widely studied. In general, thicker coatings exhibited better scratch/wear resistance performance than thinner ones due to their better load-carrying capacity. However, there are also reports that claim otherwise and . For example, Dorner et al. discovered, that the thickness of diamond-like-coating (DLC), in a range of 0.7–3.5 µm, does not influence the wear resistance of the DLC–Ti6Al4V . For cutting tool applications, however, coating thickness may have a more complicated role since its effects may be augmented around the cutting edge. Coating thickness effects on diamond coated tools are not frequently reported. Kanda et al. conducted cutting tests using diamond-coated tooling . The author claimed that the increased film thickness is generally favorable to tool life. However, thicker films will result in the decrease in the transverse rupture strength that greatly impacts the performance in high speed or interrupted machining. In addition, higher cutting forces were observed for the tools with increased diamond coating thickness due to the increased cutting edge radius. Quadrini et al. studied diamond coated small mills for dental applications . The authors tested different coating thickness and noted that thick coatings induce high cutting forces due to increased coating surface roughness and enlarged edge rounding. Such effects may contribute to the tool failure in milling ceramic materials. The authors further indicated tools with thin coatings results in optimal cutting of polymer matrix composite . Further, Torres et al. studied diamondcoated micro-endmills with two levels of coating thickness . The authors also indicated that the thinner coating can further reduce cutting forces which are attributed to the decrease in the frictional force and adhesion.Coating thickness effects of different coating-material tools have also been studied. For single layer systems, an optimal coating thickness may exist for machining performance. For example, Tuffy et al. reported that an optimal coating thickness of TiN by PVD technology exists for specific machining conditions . Based on testing results, for a range from 1.75 to 7.5 µm TiN coating, thickness of 3.5 µm exhibit the best turning performance. In a separate study, Malik et al. also suggested that there is an optimal thickness of TiN coating on HSS cutting tools when machining free cutting steels . However, for multilayer coating systems, no such an optimum coating thickness exists for machining performance .The objective of this study was to experimentally investigate coating thickness effects of diamond coated tools on machining performance — tool wear and cutting forces. Diamond coated tools were fabricated, by microwave plasma assisted CVD, with different coating thicknesses. The diamond coated tools were examined in morphology and edge radii by white-light interferometry. The diamond coated tools were then evaluated by machining aluminum matrix composite in dry. In addition, deposition thermal residual stresses and critical load for coating failures that affect the performance of diamond coated tools were analytically examined.2. Experimental investigationThe substrates used for diamond coating experiments, square-shaped inserts (SPG422), were fine-grain WC with 6 wt.% cobalt. The edge radius and surface textures of cutting inserts prior to coating was measured by a white-light interferometer, NT1100 from Veeco Metrology.Prior to the deposition, chemical etching treatment was conducted on inserts to remove the surface cobalt and roughen substrate surface. Moreover, all tool inserts were ultrasonically vibrated in diamond/water slurry to increase the nucleation density. For the coating process, diamond films were deposited using a high-power microwave plasma-assisted CVD process.A gas mixture of methane in hydrogen, 750–1000 sccm with 4.4–7.3% of methane/hydrogen ratio, was used as the feedstock gas. Nitrogen gas, 2.75–5.5 sccm, was inserted to obtain nanostructures by preventing columnar growth. The pressure was about 30–55 Torr and the substrate temperature was about 685–830 °C. A forward power of 4.5–5.0 kW with a low deposition rate obtained a thin coating; a greater forward power of 8.0–8.5 kW with a highdeposition rate obtained thick coatings, two thicknesses by varying deposition time. The coated inserts were further inspected by the interferometer.A computer numerical control lathe, Hardinge Cobra 42, was used to perform machining experiments, outer diameter turning, to evaluate the tool wear of diamond coated tools. With the tool holder used, the diamond coated cutting inserts formed a 0° rake angle, 11° relief angle, and 75° lead angle. The workpieces were round bars made of A359/SiC-20p composite. The machining conditions used were 4 m/s cutting speed, 0.15 mm/rev feed, 1 mm depth of cut and no coolant was applied. The selection of machining parameters was based upon previous experiences. For each coating thickness, two tests were repeated. During machining testing, the cutting inserts were periodically inspected by optical microscopy to measure the flank wear-land size. Worn tools after testing were also examined by scanning electron microscopy (SEM). In addition, cutting forces were monitored during machining using a Kistler dynamometer.5. ConclusionsIn this study, the coating thickness effects on diamond coated cutting tools were studied from different perspectives. Deposition residual stresses in the tool due to thermal mismatch were investigated by FE simulations and coating thickness effects on the interface stresses were quantified. In addition, indentation simulations of a diamond coated WC substrate with the interface modeled by the cohesive zone were applied to analyze the coating system failures. Moreover, diamond coated tools with different thicknesses were fabricated and experimentally investigated on surface morphology, edge rounding, as well as tool wear and cutting forces in machining. The major results are summarized as follows.(1) Increase of coating thickness significantly increases the interface residual stresses, though little change in bulk surface stresses.(2) For thick coatings, the critical load for coating failure decreases with increasing coating thickness. However, such a trend is opposite for thin coatings, for which radial cracking is the coating failure mode. Moreover, thicker coatings have greater delamination resistance.(3) In addition, increasing the coating thickness will increase the edge radius. However, for the coating thickness range studied, 4–29 µm, and with the large feed used, cutting forces were affected only marginally.(4) Despite of greater interface residual stresses, increasing the diamond coating thickness, for the range studied, seem to increase tool life by delay of coating delaminations.AcknowledgementsThis research is supported by National Science Foundation, Grant No.: CMMI 0728228. P. Lu provided assistance in some analyses.金刚石涂层刀具的涂层厚度的影响作者:F. Qin, Y.K. Chou,D. Nolen and R.G. Thompson发表日期:2009摘要:化学气相沉积法(CVD),金刚石薄膜的发现,作为涂层刀具的应用。

参考文献中文的英文对照

参考文献中文的英文对照在学术论文中,参考文献是非常重要的一部分,它可以为论文的可信度和学术性增添分数,其中包括中文和英文文献。

以下是一些常见的参考文献中文和英文对照:1. 书籍 Book中文:王小明. 计算机网络技术. 北京:清华大学出版社,2018.英文:Wang, X. Computer Network Technology. Beijing: Tsinghua University Press, 2018.2. 学术期刊 Article in Academic Journal中文:张婷婷,李伟. 基于深度学习的影像分割方法. 计算机科学与探索,2019,13(1):61-67.英文:Zhang, T. T., Li, W. Image Segmentation Method Based on Deep Learning. Computer Science and Exploration, 2019, 13(1): 61-67.3. 会议论文 Conference Paper中文:王维,李丽. 基于云计算的智慧物流管理系统设计. 2019年国际物流与采购会议论文集,2019:112-117.英文:Wang, W., Li, L. Design of Smart Logistics Management System Based on Cloud Computing. Proceedings of the 2019 International Conference on Logistics and Procurement, 2019: 112-117.4. 学位论文 Thesis/Dissertation中文:李晓华. 基于模糊神经网络的水质评价模型研究. 博士学位论文,长春:吉林大学,2018.英文:Li, X. H. Research on Water Quality Evaluation Model Based on Fuzzy Neural Network. Doctoral Dissertation, Changchun: Jilin University, 2018.5. 报告 Report中文:国家统计局. 2019年国民经济和社会发展统计公报. 北京:中国统计出版社,2019.英文:National Bureau of Statistics. Statistical Communique of the People's Republic of China on the 2019 National Economic and Social Development. Beijing: China Statistics Press, 2019.以上是一些常见的参考文献中文和英文对照,希望对大家写作有所帮助。

外文文献译文——参考范例

本科毕业设计(论文)外文参考文献译文及原文学院自动化学院专业电气工程及其自动化(电力系统自动化方向)年级班别2011级3班学号学生姓名指导教师2015年3月10日通过对磁场的分析改进超高压变电站扩展连接器的设计Joan Hernández-Guiteras a, Jordi-Roger Ribaa,⇑, LuísRomeralba UniversitatPolitècnica de Catalunya, Electrical Engineering Department, 08222 Terrassa, Spainb UniversitatPolitècnica de Catalunya, Electronic Engineering Department, 08222 Terrassa, Spain摘要:在世界上很多的国家,电力需求的增长比输电容量的发展更快。

由于环境的限制、社会的担忧以及经济上的投入,建设新的输电线路是一项严峻的挑战。

除此以外,输电网经常要承担接近额定容量的负载。

因此,提高输电系统的效率和可靠性受到了关注。

这项研究主要针对一个400KV,3000A,50Hz的超高压变电站扩展连接器,用于连接两个母线直径均为150mm的变电站。

该变电站连接器是一个四线制的铝导线,为母线之间的相互电能传输提供了路径。

前期的初步试验显示:电流在输电线路中的不平衡分布,主要是受到了距离的影响。

应用一个三维的有限元素法,可以改进设计,以及对改进前后两个版本的连接器的电磁性能和热性能进行评估比较。

这份报告中将提出:在实验室条件下的检验已经验证了仿真方法的准确性。

这也许将会是促进变电站连接器设计进程的一个很有价值的工具。

因此,将不仅仅提高其热性能,还将提高其可靠性。

关键词:变电站连接器、超高压、电力传输系统、有限单元法、数值模拟、临近效应、热学分析1.引入全球能源需求的频繁增长,连同分散的和可再生能源份额的增长促进超高压和特高压电力传输系统[1]的建设和研究。

外文参考文献译文及原文

广东工业大学华立学院本科毕业设计(论文)外文参考文献译文及原文系部城建学部专业土木工程年级 2011级班级名称 11土木工程9班学号 23031109000学生姓名刘林指导教师卢集富2015 年5 月目录一、项目成本管理与控制 0二、Project Budget Monitor and Control (1)三、施工阶段承包商在控制施工成本方面所扮演的作用 (2)四、The Contractor's Role in Building Cost Reduction After Design (4)一、外文文献译文(1)项目成本管理与控制随着市场竞争的激烈性越来越大,在每一个项目中,进行成本控制越发重要。

本文论述了在施工阶段,项目经理如何成功地控制项目预算成本。

本文讨论了很多方法。

它表明,要取得成功,项目经理必须关注这些成功的方法。

1.简介调查显示,大多数项目会碰到超出预算的问……功控制预算成本。

2.项目控制和监测的概念和目的Erel and Raz (2000)指出项目控制周期包括测量成……原因以及决定纠偏措施并采取行动。

监控的目的就是纠偏措施的...标范围内。

3.建立一个有效的控制体系为了实现预算成本的目标,项目管理者需要建立一……被监测和控制是非常有帮助的。

项目成功与良好的沟通密...决( Diallo and Thuillier, 2005)。

4.成本费用的检测和控制4.1对检测的优先顺序进行排序在施工阶段,很多施工活动是基于原来的计……用完了。

第四,项目管理者应该检测高风险活动,高风险活动最有...重要(Cotterell and Hughes, 1995)。

4.2成本控制的方法一个项目的主要费用包括员工成本、材料成本以及工期延误的成本。

为了控制这些成本费用,项目管理者首先应该建立一个成本控制系统:a)为财务数据的管理和分析工作落实责任人员b)确保按照项目的结构来合理分配所有的……它的变化--在成本控制线上准确地记录所有恰...围、变更、进度、质量)相结合由于一个工程项目......虑时间价值影响后的结果。

英文参考文献及译文

Investment Real Estate Accounting and corporate income tax treatment comparisonFirst, investment real estate with the initial measurement to confirm the accounting treatment and comparison of corporate income tax treatment(A) the provisions of the new Accounting Standards for Enterprises Investment real estate, refers to earn rent or capital appreciation, or both holding real estate. Including (1) has leased the land use rights; (2) holds and is prepared to add value to the land use right transfer; (3) has been leased buildings.(B) The enterprise income tax provisions of relevant laws and regulationsThe taxpayer's fixed assets, is the use for a period exceeding one year houses, buildings, machines, machinery, transportation and other production and business-related equipment, appliances, tools, etc.. Intangible assets refer to the taxpayer but there is no long-term use physical forms of assets, including patents, trademarks, copyrights, land use rights, non-patent technology and goodwill.(C) investment real estate in the corporate income tax on fixed assets and intangible assets recognized asRecognition in accounting for investment in real estate land use rights, in the corporate income tax on the recognized as intangible assets, intangible assets should be the relevant provisions of the tax treatment.Second, invest in real estate took place follow-up of accounting and corporate income tax expenses in handling more(A) Investment in real estate up spending the provisions of the new accounting standardsEnterprise Accounting Guidelines, investment real estate took place follow-up expenses, if the spending will cause the associated economic benefits are likely flow to the enterprise, and the costs incurred can be reliably measured, it should be capitalized and included in investment real estate costs; if you can not meet the above conditions, it should be included in the event of a direct current when the profit and loss.(B) The enterprise income tax provisions of relevant laws and regulations Corporate income tax-related laws and regulations, one of the following conditions are met fixed asset repairs, improvements should be considered as fixed expenses: (1) place the repair expenditures reached more than 20% ofthe original value of fixed assets; (2) after repair of the assets of the economic to extend the service life of more than 2 years; (3) after repair of fixed assets be used for new or different purposes.The taxpayer's fixed asset repair expenses can be deducted in the event of a direct current. Improvement of the taxpayer's fixed expenses, such as the not yet fully depreciated fixed assets, increase the value of fixed assets; if the fixed assets have been fully depreciated, can be used as deferred charges, in a period of not less than five years, the average amortized .(C) the provisions of accounting standards and corporate income tax comparisonRight as an investment real estate management, building occurred in the follow-up expenditures, accounting standards and corporate income tax laws and regulations have made the required need to be capitalized according to different circumstances or costs of treatment. But as an investment real estate management, building occurred in the follow-up expenses, capital costs of handling and processing of the judging criteria, accounting standards and corporate income tax provisions of the different.Third, follow-up to measure the real estate investment accounting and corporate income tax treatment comparison and variance analysis(A) using the fair value measurement model of the accounting treatment is not recognized in the corporate income tax on theAccounting standards provide for the use of fair value measurement model of investment real estate, usually did not depreciation, nor does amortization of assets and liabilities should be based on the fair value of investment real estate based on adjust its book value, fair value and book value The man asked the difference between the current profit and loss account.Use of fair value measurement model in the corporate income tax on the accounting treatment is not recognized.(B) the introduction of cost accounting measurement model to deal with corporate income tax address some of the same1. There is no indication of impairment, measured using the cost accounting model are basically consistent with the corporate income tax treatment Accounting rules, the cost model, it should be in accordance with 'Accounting Standards for Enterprises No. 4 - Fixed Assets' and 'Accounting Standards for Enterprises No. 6 - Intangible Assets' requirements, to invest in real estate for measurement, depreciation or amortization. If there is no indication of impairment measured using the cost model of corporate income tax accounting to deal with basically the same deal.2. There is indication of impairment, measured using the cost model accounting treatment is inconsistent with the corporate income tax treatmentIndication of impairment exists, it should be in accordance with 'Accounting Standards for Enterprises No. 8 - Impairment of assets' provisions for processing. The need to conduct a review of their book value and the need to provision for impairment in accordance with the specific practices and guidelines for fixed assets and intangible criteria consistent with the provisions. Corporate income tax provisions of relevant laws and regulations: the provision for impairment of fixed assets and intangible assets not allowed to deduct the loss.Fourth, invest in real estate and corporate income tax accounting treatment of conversion processing comparison and variance analysis(A) Investment in real estate is converted to a general fixed assets or intangible assets, accounting and tax treatment of comparison1. Enterprises measured using the cost model of the original valuation of the investment real estate (no extract impairment), converted to a general fixed assets or intangible assets, the accounting and corporate income tax valuation of assets are basically the same.2. Enterprises measured using the cost model of the original valuation of the investment real estate (impairment has been extracted), converted to a general fixed assets or intangible assets, the accounting and corporate income tax asset valuation inconsistencies.3. Enterprise adoption of fair value measurement model of the original valuation of the investment real estate, converted to a general fixed assets or intangible assets, the accounting and corporate income tax asset valuation inconsistencies. New Accounting Guidelines, the conversion before the adoption of fair value measurement model of investment in real estate is converted to personal use real estate, it should be converted on the fair value of its own use, the book value of real estate.(B) own real estate or stock is converted to investment real estate accounting and tax treatment of comparison1. Accounting GuidelinesThe new accounting rules, in the self-use real estate or inventory control and so is converted to investment real estate should be based on investment in real estate converted the measurement model used to be handled separately. After the introduction of a cost measurement conversion measurement mode, will be converted before the asset's carrying value of direct investment as a converted value of real estate recorded. Be used after the conversion measured at fair value model, according to the date of the fair value valuation conversion, conversion date of the fair value is less than its book value, and its people the difference between current profit and loss account; conversion date is greater than the fair value of the original book value, and the difference as a capital reserve included in equity.2. Corporate income tax provisions of relevant laws and regulationsCorporate income tax-related laws and regulations, development companies will develop products should be regarded as transferred to fixed assets, sales, in product development, when the transfer of ownership or right to use the recognition of income (or profit) implementation.3. The accounting treatment and tax treatment of a comparisonWhen the real estate development companies will develop products transferred to fixed assets (investment property), regardless of the cost modeling of enterprises to adopt the fair value measurement is to take the form of real estate for investment valuation, corporate income tax treated as: (1), as recognized in the period with the sale; (2) by developing products for the corporate income tax recognized at fair value of fixed assets of the original valuation.5, investment in real estate accounting treatment and disposal of corporate income tax treatment comparison and variance analysisThe new accounting rules, when the investment property has been disposed of, or permanent withdrawal from use and disposal can not be expected to achieve economic benefits, it should be to confirm the termination of the investment real estate. Corporate sale, transfer, retirement or investment real estate investment property damage occurred, it should be to dispose of income and related net book value of its post-tax amount of current profit and loss account of people.Corporate income tax laws and regulations on disposal of investment property is recognized as the transfer of fixed assets or intangible assets, according to access to income and tax costs and related taxes for the difference between the proportions of recognized gains and losses included in current taxable income. Accounting firms to increase investment in real estate recognized as the beginning of corporate income tax should be recorded fixed assets and intangible assets recognized as the original tax costs; in the investment real estate holding period, the records of corporate income tax can be deducted before the land use rights The amortization amount and the amount of depreciation of fixed assets, while recording the accounting and tax treatment differences.投资性房地产会计与企业所得税处理的比较一、投资性房地产确认与初始计量会计处理和企业所得税处理的比较(一)新企业会计准则的规定投资性房地产,是指为赚取租金或资本增值,或两者兼有而持有的房地产。

外文参考文献译文及原文

目录来源:/p-98402307.html外文原文1外文翻译10With regard to the construction of China's Financial Accounting ObjectivesAbstractThe objective of financial accounting financial accounting theory, the logical starting point for research, while it guides the financial accounting practices and is subject to the accounting environment. Articles by introducing the basic objectives of financial accounting content and objectives of financial accounting theory, the two schools of thought, expounded the objectives of corporate financial accounting position the status quo, concludes with the construction of China's goal of financial accounting principlesKeywords: financial accounting objectives, financial and accounting goal theory,building principleFirst, the basic connotation of financial accounting objectivesFinancial accounting goal is to achieve the purpose of accounting is the starting point to build the structure of accounting theory is about the accounting system should be achieved position of the abstract category. It is the communication of financial accounting information and accounting environment, a bridge connecting the accounting theory and accounting practice of bonds. It is the financial and accounting information systems to achieve the desired operation or realm. The study is to address financial and accounting services to whom and how services. Accounting objective is to accounting changes in the environment with the constant development and change, due to accounting objectives derived from the accounting practices, the external environment and thus be able to reconcile with the accounting system of organic. Moreover, the accounting goal is the starting point of Accounting Research, is the highest level of accounting theory, accounting for all mechanisms within the system around the role of accounting objectives, through the optimization of accounting practices to achieve accounting objectives. Financial accounting objectives include two aspects, namely, to whom the financial accounting information, and provide what information. The former relates to the specific objectives of financial accounting, which involves the quality of accounting information.Building a sound financial accounting objectives, should have a systematic, stability, usability and advanced features. Systemic, that the accounting objectives of different levels, should include basic accounting objectives and specific accounting objectives, the former is a highly condensed summary of accounting objectives and general description of the latter is the former refining, basic accounting objectives and specific accounting objectives close combined in order to provide a complete accounting target system. Stability, namely the financial and accounting goal should be relatively stable and will not often change. Practicality, that is, a period of time, this goal of financial accounting can be applied to the period, accounting for the specific situation and the current accounting environment. Advanced, is effective for accounting financial accounting objectives of the role of the necessary guarantees.Second, the theory of financial accounting objectives of the two schools of thought1. entrusted with the responsibility of school. According to the school point of view, fiduciary responsibility can be explained as follows: ①the resources entrusted to parties entrusted to manage the resources entrusted to the commissioning party. Fiduciary parties have therefore undertaken a reasonable and effective management and application of resources and entrusted the responsibility of increasing the value of it as much as possible; ②the resources entrusted to the party who had faithfully reported by the resources entrusted to carry out their fiduciary duties of the process and obligation of result. Which is mainly carried out by means of financial reporting. Many scholars argue that because in some external environment, businesses many of the resources directly from their environment, so as a resource trustee side of enterprise management authorities also have an important social responsibility, that is, the maximum to maintain a good environment for business communities to effectively utilize and develop human resources.Fiduciary duty to the objective of financial accounting with special emphasis on the accounting measurement results must be objective, reliable, and to help provide trustee's fiduciary duty to fulfill the conditions of economic management of information, help it to conduct performance evaluations. Therefore, the school requires that companies use historical cost accounting measurement measurement model.2, decision-making useful in school. Decision-useful school of thought, the financial objective of the report is to provide decision-useful information on the user information. In 1978 the U.S. Financial Accounting Standards Board (FASB) released the first concept of Notice No. l, the objective of financial reporting identified as the following three aspects: ①financial reporting should provide for present and potential investors, creditors and other users to make a reasonable investment, credit and similar decision-useful information. This information is for those who is familiar with business and economic activities, and are willing to diligently study the kind ofinformation very people who should be comprehensive. ②financial reporting should provide help to current and potential investors, creditors and other users of evaluation from the sale, payment, maturity securities or loans such as real income derived from the amount of time distribution and uncertainty information. ③financial report should be able to provide information on the enterprise's economic resources, claims to these resources (enterprise to transfer resources to other subjects of the responsibilities and rights of property owners), and so that the resources and the claims of these resources a change in the transactions, matters and circumstances impact of information.Third, corporate financial accounting targeting the status quo1, financial accounting objectives should be divided into two levels: basic financial accounting goals and objectives of financial accounting. Basic financial accounting financial accounting research goal is the starting point is the financial accounting system operation's ultimate goal. It is in the financial accounting system, the dominant goal and directly constrain the specific objectives of financial accounting, but also reflected the objective requirements of economic management. Specific objectives of financial accounting is the basic objectives of financial accounting and the achievement of the specific expression is under the guidance of the basic objectives of engaging in financial and accounting management activities to achieve goals. Basic financial accounting objectives based on financial and accounting based on assumptions, the general environment, using standardized methods of deductive method to derive the basic principles of financial accounting and specific guidelines in order to achieve the standards of financial accounting practices to meet the community's financial and accounting information quality needs. Basic financial accounting objectives applies to all stages of historical development, from a different historical circumstances specific financial accounting objective abstract out commonalities; the specific objectives of financial accounting due to the historical background, characteristics of the times vary.2, the Financial Accounting basic goal should be to provide information to meet the needs of financial accounting information, accountability and decision-useful concept is the concept of two specific objectives of financial accounting. Basic financial accounting objectives applies to all stages of historical development, from a different historical circumstances of specific financial and accounting abstract out common goals - to provide information to meet the financial and accounting information needs. Fiduciary duty concept holds that the information provided is for clients (already investors) to evaluate the fulfillment of fiduciary duty in order to make whether to continue the commission - the relationship between accountability in decision-making; decision-usefulness view that the provision of information is tosatisfy the investors, creditors etc. (including existing and potential) for investment, credit and other decision-making. Can be seen that there is commonality between the two. Which is to provide information to meet the information needs of those needs. The difference is the main information needs of those who are different. The main concept of fiduciary responsibility for the information needs of those who have become investors - clients; decision-usefulness view the information needs of those for the existing and potential investors. In different historical periods, different users of financial accounting information. Can be seen, both the application of different historical circumstances, is a product of different historical circumstances, therefore, they belong to the specific objectives of financial accounting. The historical circumstances at that time with a certain degree of rationality. However, from the perspective of historical development and study, then due to historical changes in the environment but there are some limitations. Therefore, we can not blindly criticize these two points, we can not blindly to co-ordinate the relationship between the two. Is no conflict between the two is that the financial accounting objectives of the two specific stages of development. Because of historical continuity and the ensuing environmental characteristics, both in a historical period of development alternating and overlapping, expressed as the integration of the two.Fourth, to build China's goal of financial accounting principleI believe that the positioning of China's accounting objectives should follow the following principles:1, should be based on the characteristics of China's accounting environment to meet the requirements of users of accounting information in China, seeking truth from facts to formulate accounting objectives. According to China's unique accounting environment, we may think first of the main users of accounting information is a national function departments and banks, followed by non-state economy and the mass of investors and stock market investors, the accounting information needs of its overall locate in the management type investment to provide a true and reliable accounting information. However, there are still a part of China's securities market to professional investors, and along with the structure of listed companies, investors are constantly changing, this part of the ratio will gradually increase, therefore, must also consider the potential future of professional investors on the decision-useful accounting information demand.2, development of accounting objectives, they need to follow the objective law of development of accounting objectives, but also consider the accounting objective of the forward-looking. We are in the development of accounting objectives, taking full account of the historical development of accounting objectives of the law, while also taking into account the future vitality of accounting objectives. As a conceptual framework described in the accounting goal should not be too narrow and should not consider only the immediate, where possible, it can be predicted that the accounting should reflect the change in the environment of accounting objectives as basic requirements. With the constant deepening of China's ownership structure, the market economy continues to develop, continuously improve the quality of accounting personnel, we are decision-useful accounting information is bound to increase the supply capacity.3, comply with international accounting standards convergence at a macro level, with international practice. By targeting a comparison of accounting can be found, asa mainstream school, "School Accountability" and "school of decision-useful" point of view there is a mutual integration of the trend, national accounting profession (including the International Accounting Standards Board) accounting objectives are generally defined requirement is to consider the requests for fiduciary duty to consider the usefulness of the decision-making requirements.Through this analysis of the financial accounting objectives, the authors try and give our country's current economic environment, financial accounting objectives: Because the ROC to establish a socialist market economy, unlike the capitalist market economy, in the reform process, the state and collective interests of the need to highlight the Government is subject to the most basic client, to meet the needs of financial revenue and expenditure to meet the needs of the macro-control, but also to safeguard the interests of small and medium investors, we should fully reflect the state-owned enterprises entrusted - fiduciary responsibility to maintain bonds the interests and so on, and thus our accounting objectives are: for the government to balance the balance of payments and macroeconomic regulation and control of financial information to provide true; for small and medium investors, large shareholders, the true value of financial information; for the state-owned commercial banks and other major debt to provide true of financial information; for the government to provide the commission entrusted with the responsibility of state-owned enterprises and operational performance of financial information; to the public disclosure of the Government's delegate responsibility.References:1, Cai Haiyan. Chinese enterprises targeting financial accounting [J]. Economist, 2006 (12).2, Wuhai Wei, Liu expansion. From capital market development on Financial Accounting targeting [J]. China Science and Technology Information, 2005 (9).3, Xiao-Jun Zhang. Analysis of the Financial Accounting targets [J]. Shanxi and taxation, 2006 (8).外文翻译中国财务会计目标的构建摘要财务会计的目标是财务会计理论研究的逻辑起点,而它指导着财务会计实务发展并且受会计环境影响。

外文参考文献及翻译