智利国家铜业公司介绍

中国铜矿资源供应安全及对策

矿产资源M ineral resources 中国铜矿资源供应安全及对策解舒喻,张嘉苒,孟嘉禾,赖弘宇摘要:铜矿是我国最重要的战略资源之一,随着“双碳”计划的有序推进,新型产业领域的蓬勃发展,铜的需求量迎来新的增量,我国铜矿的进口量持续上升,面临着对外依赖程度较高且进口地高度集中、缺乏战略储备、易受地缘政治、民族资本主义回潮影响等风险。

对加强铜矿产品供应链稳定性提出以下建议:①加强多边国际合作,寻求多样化投资主体;②加强对矿产资源安全的态势预测和策略安排;③加强综合利用,提高废铜回收效率。

关键词:铜矿资源;供需形势;政策建议铜是在自然界中应用的主要金属材料之一,由于其导热、导电、易焊接、延展、耐腐蚀和耐磨等性能俱佳,已被广泛地应用于机械制造、国防建设、基础设施工程、电力、交通运输以及新兴产业等领域。

据美国地质调查局公布的数据,2022年全球铜资源储量8.9亿吨,而中国铜矿储量为3494.79万吨,约占全球总储量的4%,位居全世界第六位,但我国人均铜矿占有量远远不及全球人均占有量,国内铜矿供给水平受限,可持续供给能力较弱。

据中国海关总署统计,2019年度,我国进口铜精矿2199万吨,铜对外依存度高达78%,铜精矿进口量占全球铜精矿产量的26.74%,是全球铜精矿需求第一大国。

2020年,全球矿产资源需求总体萎缩,中国逆势增长,铜消费量同比增长了17.1%,进口量增长了33%。

2021年,铜精矿(实物量)进量口2340.4万吨,同比增长7.6%。

2022年中国铜矿砂及其精矿进口量2527万吨,同比增长8.0%。

随着“双碳”计划的有序推进,新型产业领域的蓬勃发展,铜的应用领域不断扩大,需求将持续增长。

新能源汽车产销目前以每月100%的同比增速上涨,带动电池级铜箔和汽车铜线需求显著上升,以及新能源充电桩的普及也增加了对铜的需求。

目前我国铜产业链十分脆弱,原料供给端大量依靠进口,对外依存度高,因此分析铜矿资源保障所面临的风险,并寻找加强铜矿供应链稳定性的措施,对保障我国的铜矿资源战略安全具有重要意义。

智利:“铜王国”前景依然看好

者规约 ” 第 60号 法令 ,96年 ) ( 0 17 。此法 规 的 基本

原则 是 : 对智 利 的投 资者一律 平等相 待 ; 资者与智 投 利政府签订合 同 ; 保证 财 产 权 。该 法 规 也允 许 投资

者 : 投资准人 一年 以后 , 以将在智利 投资 的全部 从 可 所得 寄 回国内 ; 以通过 银行系 统兑换外 币 ; 收稳 可 税

矿。

产是智 利的一项 传统产业 。铜矿 是智利 的主要 经济 来源 , 智利 铜储 量 、 量 世界 第 1 铜 出 口量 也 是 世 产 , 界第 1 占全 国 出 口额 的 一 半 , 利 也 称 “ 矿 之 , 智 铜 国” 。智利 不仅 有 铜 , 且 在 锂 、 、 等 矿产 方 面 而 银 钼 也 闻名世 界 , 堪称 矿 业 的领 头 羊 。据 美 国地 调 局资 料 ,0 9年 , 20 智利铜产 量世 界第 1 钼 产量 世界 第 3 , 、

考 虑 到投资 额 和矿业 活 动存 在 的风 险 , 利 制 智

定 了特 定的法规来 吸引 外资 , 仅针对矿 业 , 不 而且 针

半。 新世 纪初 , 利铜产 量超 过 4 0万 t1 智 4 ,0年增 长

对需要特 殊对 待 的投 资 方 , 法 规称 为 “ 国 投 资 该 外

了 10 。这是 大 型 私 人公 司投 资 开 矿 的结 果 , 9% 智

国家铜 业公 司生产 了 10万 t 3 精铜 , 占全 国产 量 的

一

智利探 矿证 和采矿证 的 申请程 序 由高 等级 的法

律( 基本法 ) 规范 。为 了提 高程序 的公正 性 、 来 客观 性 , 采矿 特许权 的基本法就 授权 民事法庭 , 针对 由其

世界最大的铜矿是哪里

世界最大的铜矿是哪里铜矿可以使人发家致富,你知道哪里的铜矿是世界上最大的吗?让小编来告诉你。

智利埃斯康迪达铜矿当今世界上最大的铜矿是智利的埃斯康迪达(Escondida),2004年这座矿山的年产量超过120万吨,约占当年世界铜矿山产量的8%以上。

矿山距智利西海岸安托法加斯塔(Antofagasta)东南170公里,位于智利北部的阿塔卡马(Atacama)沙漠,海拔2987米。

1.埃斯康迪达(Escondida)铜矿埃斯康迪达铜矿位于智利的阿塔卡马(Atacama)沙漠。

这是必和必拓(BHP Billiton,NYSE:BHP,ASX:BHP,LSE:BLT)众多矿业项目中的一个。

必和必拓公司是一家矿业与石油的全球性公司,总部设在澳大利亚的墨尔本市。

在这个铜矿项目上,必和必拓拥有57.5%的股份,其余股份分别为力拓公司(Rio Tinto,NYSE:RIO,ASX:RIO,LSE:RIO)和杰科株式会社(JECO,TSE:7768)以及杰科第二株式会社(JECO 2)分享。

据必和必拓的网站,埃斯康迪达铜矿是世界上最大的铜生产商。

这个铜矿于1990年开始生产铜精矿和阴极铜。

2012年2月,必和必拓宣布,埃斯康迪达铜矿的资源量增加了17%。

必和必拓贱金属部总裁彼得·比文说,更多的开发项目已经同时开工,将在2015年时,帮助埃斯康迪达铜矿将铜产量增加到130万吨/年。

2.丘基卡马塔(Chuquicamata)铜矿丘基卡马塔铜矿也位于智利,属于国有的智利铜业公司(Codelco)拥有和经营。

智利国有铜业公司声称,这是世界上最大的露天矿,从1910年以来一直在运行。

丘基卡马塔铜矿的产品包括精炼铜、阴极铜和铜精矿。

从2010年以来,它的精炼铜年产量为528377吨。

同时,它每年还向市场提供约10,760吨钼金属。

有一点必须指出,这个铜矿曾经被认为将在2013年停止生产并关闭。

然而,智利铜业公司最近获得了在丘基卡马塔铜矿进行扩建的批准,表明这个矿将继续运转。

自由港集团(Freeport-McMoRan):全球铜行业最具实力的企业

自由港集团(Freeport-McMoRan):全球铜行业最具实力的企业王之泉五矿经济研究院摘要:2017年第一季度,自由港录得利润(税前)4.38亿美元,而2016年同期为-40.27亿美元。

这一巨大转变的背后,是全球第二大铜生产商、第一大钼生产商,进行了持续的运营与管理变革。

2012年激进地油气业务扩张及随后大宗商品价格持续回落,致2014-2016年自由港经营异常惨淡,累计亏损超过180亿美元,资金链几近中断,市值缩水更是超过90%。

此后,油气业务战略剥离、核心资产权益出售及大刀阔斧的举措,方才避免了巨人倒下。

随着业务经营进一步聚焦以及行业形势逐步好转,凭借优质的矿资产储备和积淀百年的矿山运营管理能力,自由港将会逐步恢复昔日的光彩。

一、屹立百年的跨国巨头,位居全球矿业第二阵营自由港*麦克莫兰(Freeport-McMoRan Inc.,FCX)是目前全球第二大铜生产商、第一大钼生产商,并曾经是全球最重要的金、钴生产商之一。

该公司的历史,最早可追溯至1912年在德克萨斯州成立Freeport Sulphur(FSC)。

成立之初,FSC主要从事硫化矿的开发业务。

三十年代后,该公司逐步走上多元化经营道路,先后进入锰、镍矿石开发以及镍钴精炼等领域,并于1956年进军石油领域。

1967年,FSC设立Freeport Indonesia,专门负责开发印尼境内的矿产资源开发。

为展示其多元化矿产资源开发商的身份,FSC于1971年更名为Freeport Minerals(FMC),并于1981年与McMoRan Oil & Gas合并组建Freeport-McMoRan。

新公司业务涉及石油&天然气生产、硫和磷矿石开发以及金银、铜、铀矿开发。

随着业务重要性的持续凸显,1995年Freeport-McMoRan Copper & Gold被从其控股母公司Freeport-McMoRan中分拆独立出来。

铜矿全球供应链管理与合作

PART 2

铜矿全球供应链概述

铜矿全球供应链的定义和构成

定义:铜矿全球供应链是指从铜矿开采、加工、 运输、销售到最终消费者的全过程。

构成:包括铜矿开采、铜矿加工、铜矿运输、铜 矿销售等环节。

铜矿开采:包括露天开采和地下开采两种方式。

铜矿加工:包括粗加工和精加工两个阶段。粗 加工主要是将铜矿石加工成铜精矿,精加工主 要是将铜精矿加工成铜产品。

PART 6

结论

对铜矿全球供应链管理与合作的总结

铜矿全球供应链管理的重要性:确保铜矿资源的稳定供应,提高铜矿企业的竞争力。

合作模式:建立战略合作伙伴关系,实现资源共享、风险共担、利益共赢。

挑战与机遇:全球政治经济环境的变化、技术进步、环保要求等对铜矿全球供应链管理与 合作带来挑战和机遇。

发展趋势:加强全球供应链管理与合作,提高铜矿企业的国际竞争力,实现可持续发展。

铜矿全球供应链合作的必要性

资源分布不均:全球铜矿资源分布不均,需要全球合作才能满足需求 降低成本:全球供应链合作可以降低采购、运输、仓储等成本 提高效率:全球供应链合作可以提高生产效率,缩短生产周期 风险分散:全球供应链合作可以分散市场风险,降低企业经营风险

铜矿全球供应链合作的成功案例

必和必拓与智利国家铜业公司的合作:共同开发智利铜矿资源,提高生产效率,降低成本 嘉能可与莫桑比克政府合作:投资建设铜矿项目,带动当地经济发展,提高人民生活水平 力拓集团与蒙古国政府合作:开发蒙古国铜矿资源,促进两国经济合作,实现互利共赢 英美资源集团与秘鲁政府合作:投资建设铜矿项目,提高秘鲁铜矿产量,带动当地经济发展

铜矿运输:包括陆路运输、水路运输和航空运输 等方式。

铜矿销售:包括批发和零售两种方式。批发主 要是将铜产品销售给铜产品加工企业,零售主 要是将铜产品销售给最终消费者。

世界上主要铜矿供应商

1.BHP必和必拓必和必拓公司(BHP Billiton Ltd. - Broken Hill Proprieta ry Billiton Ltd.):以经营石油和矿产为主的著名跨国公司。

BHP于1885年在墨尔本成立。

Billiton于1860年成立。

2001年6月,两公司合并。

2003-2004财年,总收入340.87亿澳元,总市值1363.5亿澳元,雇佣员工3.5万人,成为全球第二大矿业集团公司。

在澳大利亚、伦敦和纽约的股票交易所上市。

目前,公司是全球第三大铁矿供应商。

该公司与中国已有百余年的业务关系,包括矿产品和钢材进出口,矿物和海陆石油勘探等。

BHP公司的矿山位于澳大利亚西部皮尔巴拉地区,分别是纽曼、扬迪和戈德沃斯。

这三个矿区的总探明储量约为29亿吨,目前铁矿石的年产量为1亿吨。

在亚里南部,还有未开发的C采区,保有储量45亿吨。

石油必和必拓是著名的石油天然气勘探和生产商,其主要生产基地位于澳大利亚、英国、墨西哥湾(美国)、阿尔及利亚和巴基斯坦。

必和必拓公司高质量、高利润的资产具有强大的增长潜力,并能提供丰厚的资本回报。

石油和天然气业务为必和必拓提供了产品多样性,并使其在这一具有强大发展动力的行业占有一席之地。

铝必和必拓活跃在原铝产业链中的每一个环节:铝矾土开采、氧化铝精炼和金属铝冶炼。

必和必拓公司是世界上氧化铝和金属铝的主要供应商,主要资产位于澳大利亚、巴西、莫桑比克、南非和苏里南。

基本金属必和必拓是世界前三大铜生产商和世界前五大银、沿、锌生产商之一。

必和必拓公司向欧洲、亚洲和南美洲治炼厂提供高质量的金属精矿,并向黄铜和铜线生产商提供高质量的阴极铜板。

拥有大规模、低成本的优良资产,极具发展潜力。

碳钢材料必和必拓向全球钢铁制造业提供主要原材料(铁矿、炼焦煤和锰矿)和服务。

必和必拓公司是世界第一大炼焦煤和锰矿海运供应商,世界第三大铁矿供应商。

集团拥有众多开采年限长的"优势资源",为全球市场尤其是发展迅速的亚太市场提供低成本、高质量的产品。

2023年高纯阴极铜行业市场环境分析

2023年高纯阴极铜行业市场环境分析一、行业概况高纯阴极铜是电子行业核心原材料,主要用于半导体制造和电子设备生产,如芯片、集成电路、光伏电池板、LCD面板和半导体器件等。

随着科技的不断发展和新兴产业的兴起,高纯阴极铜的需求量逐年不断增加。

二、市场需求1.电子行业需求目前,中国电子信息产业已经成为国民经济发展的一个重要支柱产业,成为全球最大的电子生产和消费市场。

因此,高纯阴极铜的需求量也不断增加,预计未来几年内市场需求将维持稳步增长。

2.新能源行业需求近年来,氢能源、光伏能源、新能源汽车等新兴产业在国内不断发展壮大。

高纯阴极铜在新能源领域的使用越来越广泛,预计未来几年内新能源领域对高纯阴极铜的需求量会不断增加。

三、行业现状1.市场格局目前,全球高纯阴极铜生产市场主要由几家大型公司垄断。

其中,智利国家铜业公司(Codelco)是全球最大的高纯铜阴极生产商之一,占据了全球高纯阴极铜总产量的15%左右。

此外,美国自由港铜业公司和智利安达卢西特铜业公司等也是高纯铜阴极生产市场的主要参与者。

2.生产技术水平高纯阴极铜生产涉及到高端的冶炼、加工和精炼技术,需要先进的生产设备,并具备严格的环保和安全标准。

目前,国内高纯阴极铜生产企业技术水平有所提高,但与国际先进水平还存在差距。

3.供应情况国内高纯阴极铜供应以进口为主,目前供应压力较大。

在国内高耗能、高污染、低效益的生产环境下,高纯阴极铜生产成本较高,同时进口高纯阴极铜也受到国际市场价格波动的影响。

四、发展趋势1.市场规模将进一步扩大高纯阴极铜是电子行业原材料的重要组成部分,随着电子行业和新能源行业的发展,高纯阴极铜的需求在未来几年内将稳步增长。

2.产业集中度将不断提高随着行业规模的扩大和成本的不断提高,企业之间的竞争也将越来越激烈。

产业集中度将不断提高,行业规模化经营和资本市场化进程将不可避免。

3.技术水平将得到提高高纯阴极铜生产技术关键在于提高炼铜产业链上下游的自主化和提高单产量和降低生产成本。

铜冶炼中的化学矿物应用技术

减少环境污染:化学矿物应用技术可以减少铜冶炼过程中的环境污染,降低对环境的影响。

缺点

成本较高:化学矿物应用技术需要大量的设备和原材料,成本较高。

环境污染:化学矿物应用技术可能会产生有害气体、废水等污染物,对环境造成污染。

技术难度大:化学矿物应用技术需要较高的技术水平和经验,操作难度较大。

安全隐患:化学矿物应用技术可能会存在安全隐患,如爆炸、火灾等。

添加标题

紫金矿业:中国第二大铜冶炼企业,采用先进的火法冶炼技术,年产量超过50万吨

添加标题

智利国家铜业公司:全球最大的铜冶炼企业,采用先进的湿法冶炼技术,年产量超过200万吨

添加标题

必和必拓:全球第二大铜冶炼企业,采用先进的火法冶炼技术,年产量超过100万吨

添加标题

力拓:全球第三大铜冶炼企业,采用先进的湿法冶炼技术,年产量超过50万吨

氧化矿:用于提取铜,降低生产成本

磷矿:用于去除铜中的杂质,提高铜的质量

硼矿:用于改善铜的加工性能,提高铜的强度和韧性

04

化学矿物应用技术的优缺点

优点

提高产品质量:化学矿物应用技术可以提高铜冶炼产品的质量,提高产品的市场竞争力。

提高冶炼效率:化学矿物应用技术可以提高铜冶炼的效率,缩短冶炼时间。

降低能耗:化学矿物应用技术可以降低铜冶炼的能耗,减少能源消耗。

改善铜产品质量:化学矿物应用技术可以改善铜产品的质量,提高铜产品的纯度和性能。

成功与失败案例的对比分析

06

化学矿物应用技术的发展趋势和展望

环保要求对化学矿物应用技术的影响

环保要求促进了化学矿物应用技术的绿色化和智能化,提高了生产效率和资源利用率

环保要求推动了化学矿物应用技术的创新和发展,促进了新技术、新工艺、新材料的研发和应用

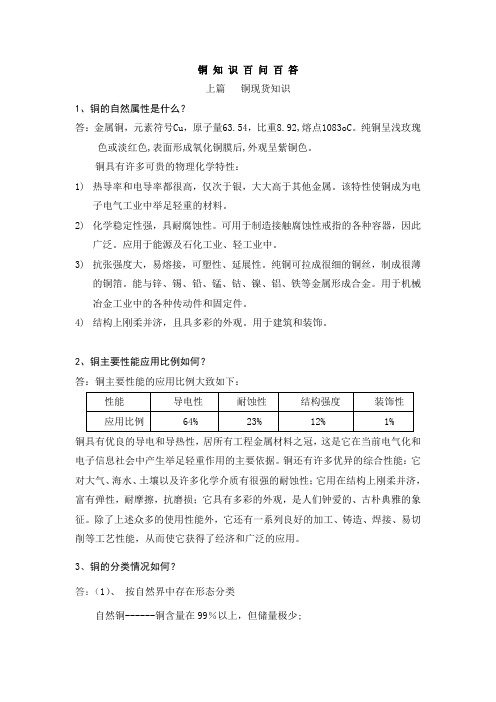

铜知识百问百答2

铜知识百问百答上篇铜现货知识1、铜的自然属性是什么?答:金属铜,元素符号Cu,原子量63.54,比重8.92,熔点1083oC。

纯铜呈浅玫瑰色或淡红色,表面形成氧化铜膜后,外观呈紫铜色。

铜具有许多可贵的物理化学特性:1)热导率和电导率都很高,仅次于银,大大高于其他金属。

该特性使铜成为电子电气工业中举足轻重的材料。

2)化学稳定性强,具耐腐蚀性。

可用于制造接触腐蚀性戒指的各种容器,因此广泛。

应用于能源及石化工业、轻工业中。

3)抗张强度大,易熔接,可塑性、延展性。

纯铜可拉成很细的铜丝,制成很薄的铜箔。

能与锌、锡、铅、锰、钴、镍、铝、铁等金属形成合金。

用于机械冶金工业中的各种传动件和固定件。

4)结构上刚柔并济,且具多彩的外观。

用于建筑和装饰。

2、铜主要性能应用比例如何?答:铜主要性能的应用比例大致如下:铜具有优良的导电和导热性,居所有工程金属材料之冠,这是它在当前电气化和电子信息社会中产生举足轻重作用的主要依据。

铜还有许多优异的综合性能:它对大气、海水、土壤以及许多化学介质有很强的耐蚀性;它用在结构上刚柔并济,富有弹性,耐摩擦,抗磨损;它具有多彩的外观,是人们钟爱的、古朴典雅的象征。

除了上述众多的使用性能外,它还有一系列良好的加工、铸造、焊接、易切削等工艺性能,从而使它获得了经济和广泛的应用。

3、铜的分类情况如何?答:(1)、按自然界中存在形态分类自然铜------铜含量在99%以上,但储量极少;氧化铜矿-----为数也不多硫化铜矿-----含铜量极低,一般在2--3%左右。

世界上80%以上的铜是从硫化铜矿精炼出来的。

(2)、按生产过程分类铜精矿----冶炼之前选出的含铜量较高的矿石。

粗铜------铜精矿冶炼后的产品,含铜量在95-98%。

纯铜------火炼或电解之后含量达99%以上的铜。

火炼可得99-99.9%的纯铜,电解可以使铜的纯度达到99.95-99.99%。

(3)、按主要合金成份分类黄铜-----铜锌合金青铜-----铜锡合金等(除了锌镍外,加入其他元素的合金均称青铜)白铜-----铜钴镍合金4、世界铜市场在各个建设部门中应用的分配情况如何?答:①房屋建设占48%。

智利的著名公司

智利的著名公司智利国家铜公司(Corporacion Nacional del Cobre de Chile, 简称CODELCO),成立于1976年4月1 日,是世界最大的铜生产企业,经营铜矿的开发、开采、提炼、加工及销售等。

资产总额80.83亿美元,2005年销售额104.91亿美元。

董事长系智利矿业部长卡雷恩·波尼亚奇科·波利亚克(Karen Poniachik Pollak),执行总裁何塞·巴勃罗·阿雷利亚诺(José Pablo Arellano)智利化工、矿业公司(Sociedad Quimica y Minera de Chile S.A.,简称SQM),成立于1968年,经营化肥、化工产品、碘、锂的生产及销售。

资产总额13.63亿美元,2005年销售额10.43亿美元。

董事长胡利奥·庞塞·勒鲁(Julio Ponce Lerou),首席执行官帕特里西奥·孔特塞·冈萨雷斯(Patricio Contesse Gonzalez)智利钼金属公司(Molibdenos y Metales S.A.,简称Molymet),成立于1975年,是世界上钼的主要生产企业,占有全球1/3的市场份额,从事钼及相关产品的生产及销售。

资产总额2452亿比索,2005年销售额20.9亿美元。

总裁卡洛斯·乌尔塔多·鲁伊斯-塔格莱(Carlos Hurtado Ruiz-Tagle)南美船运公司(Compania Sudamericana de Vapores S.A.,简称CSAV),成立于1872年,拉美最大的船运公司,经营船运及相关配套服务。

资产总额6270亿比索,2005年销售额38.95亿美元。

董事长里卡多·克拉罗(Ricardo Claro),总经理胡安·安东尼奥·阿尔瓦雷斯(Juan Antonio Alvarez)。

世界第一大地下铜矿——特恩尼特(El Teniente)铜矿

世界第一大地下铜矿——特恩尼特(El Teniente)铜矿

佚名

【期刊名称】《新疆有色金属》

【年(卷),期】2012(35)6

【摘要】特恩尼特(EI Teniente)铜矿位于智利首都圣地亚哥以南约90km的兰卡瓜市(Rancagua),属智利第六行政大区。

它是智利国营铜业公司(Codelco)的第二大铜矿,在地下开采的铜矿中,其规模位居世界第一。

【总页数】1页(P98-98)

【关键词】铜矿;世界;大地;圣地亚哥;铜业公司;地下开采;智利

【正文语种】中文

【中图分类】TD862.1

【相关文献】

1.智利埃尔特尼恩特铜矿2005年铜产量将跌至43万t [J],

2.阿尔泰铜矿带南缘希勒克特哈腊苏斑岩铜矿的发现及其意义 [J], 龙文国;杨文平;丁式江;张招崇;李惠民;周刚;林义华;闫升好;何立新;陈柏林

3.智利埃尔特尼恩特铜矿Sub—6采区的自动化 [J], 查德.,J;周叔良

4.埃尔特尼恩特铜矿的岩爆问题 [J], 萨蒂.,KR;沈德贵

5.智利Codelco将提高El Teniente铜矿产量至逾50万t/年 [J],

因版权原因,仅展示原文概要,查看原文内容请购买。

走进智利-世界上铜的王国

走进智利——世界上铜的王国国土资源部信息中心张苺我国许多矿产资源不足已经成为制约我国经济持续发展的瓶颈,积极开展国际合作,利用国外矿产资源,开辟长期稳定的供给源,是保障我国经济持续发展行之有效方法之一。

本文就我国未来相当一段时间内仍将短缺的铜矿资源,介绍世界上铜的王国——智利,或许那里就有机遇。

智利共和国位于南美洲西海岸中南部,是世界上形状最狭长的国家。

其西临太平洋,北部以拉康迪亚线为界与秘鲁接壤,东部以安第斯山脉最高峰走向划界与阿根廷相邻,东北与玻利维亚交界。

面积75.7万km2,人口1580万,首都圣地亚哥,官方语言为西班牙语,货币为比索(PESO)。

全国有铁路14771km,公路8万多km,机场390个,10多个港口。

智利是自由市场经济体制国家,是第一个与中国建交的南美洲国家,也是第一个与中国完成入世谈判的南美洲国家,目前是中国在南美洲的第二大摩易伙伴。

据《Mining Journal,2007》报道,智利2006年的GDP为1458亿美元。

矿业生产(主要矿产资源是铜和伴生在铜矿中的钼、金、银等)和矿产品出口在经济中占有重要地位。

2006年出口矿产品总价值559亿美元,约占本年度GDP的38.3%。

其中出口的铜矿产品价值323亿美元,约占本年度GDP的22.2%。

2006矿业协会的17个成员(16个私营公司和智利国家铜业公司)纳税80.1亿美元,其中包括缴纳权利金(royalty tax)9.6亿美元。

一、矿业管理机构、法规和税收管理机构智利政府通过四个管理机构对全国的矿业实施管理和监督。

他们是智利国家地质矿产局(SERNAGEOMIN)、智利铜业委员会(COCHILCO)、外商投资委员会(CIE)和国家环境委员会(CONAMA)。

法规智利的《宪制矿业特许权基本法》、《矿业法典》、《矿业安全条例》是国家管理各类矿产资源和矿业活动的现行法规,《外国人投资法》中有关外国人对智利矿产资源调查和矿业活动投资的条款,补充了外资企业的管理法规。

全球最大铜出口国智利或将面临铜资源枯竭

全球最大铜出口国智利或将面临铜资源枯竭

佚名

【期刊名称】《中国粉体工业》

【年(卷),期】2016(000)004

【摘要】来自全球最大铜供应国智利的一份官方报告传来了令人不安的消息:最近勘探出来的铜资源越来越少了。

智利负责指导铜生产和对铜业市场进行评估的智利铜业委员会(Cochilco)在最新发布的研究报告中表示,他们汇集了过去十五年的全球铜勘探数据,以观察哪些地方发现了重大铜矿资源,以及行业勘探开支最近有没有成效。

根据多年的行业勘探数据,智利铜业委员会作出了上述结论。

勘探数据显示,过去几年,

【总页数】1页(P35-35)

【正文语种】中文

【中图分类】TD982

【相关文献】

1.南半球最大的鲜果出口国智利 [J],

2.巴西:将成为全球最大的铜出口国 [J], 龙斌

3.智利国有铜:加大与世界最大铜消费国的合作 [J], 周烨彬

4.五矿与智利铜公司合资开发铜资源 [J],

5.中国首次成智利最大肉类出口国 [J],

因版权原因,仅展示原文概要,查看原文内容请购买。

智利铜企业的脱砷处理工艺与经验

目前,智利是世界上最大的铜生产国,由于其铜资源中含有不少难以脱除的砷,故而其铜企业在处理这种有害杂质过程中采用了很多先进的工艺流程。

因此,智利铜企业的脱砷处理工艺与经验,很值得我们重视与借鉴。

智利铜矿中砷的分布情况Distribution of arsenic in Chile copper ores智利的铜精矿和金—铜精矿中通常都含有不同的砷矿物,如:毒砂(FeAsS)、硫砷铜矿(Cu3AsS4)、雄黄(As2S3)、雌黄(As4S4)和砷黝铜矿(Cu,Fe)12As4S13。

智利部分典型铜冶炼厂所用铜精矿的化学成份,见表1。

从表中可见,在智利铜企业所用的铜精矿中,砷含量高的为12.1%,低的则为0.14% 0.18%,几乎没有不含砷的铜精矿。

因此,智利铜冶炼企业在处理铜原料过程中均要涉及脱砷问题。

如果处理不好,砷不仅有可能被带到铜的最终产品中,影响其产品的质量,而且还会危害企业周边的生态环境。

故而,智利的铜冶炼企业在冶炼过程中都很重视脱砷处理。

智利铜企业不同生产阶段的脱砷处理工艺Process of removing arsenic indifferent production stage inChile copper enterprises当铜冶炼厂输入的铜精矿砷含量一定时,铜阳极中砷含量是工艺过程的函数。

对砷分布有明显影响的变量是冰铜品位和烟气温度。

其它变量,比如物相构成、熔池温度、氧分压、其它杂质含量等的影响则较小。

1 焙烧为了获得适合于冶炼深加工所智利铜企业的脱砷处理工艺与经验Process and experience of removing arsenic in Chilecopper enterprise李卫民 德 洪(编译)/Li Weimin De Hong工 厂Cu Fe S As Sb Aug/t Agg/t Bippm丘基卡马塔铜矿28-3328.630.50.3-1.00.1-0.3--30-60埃尔印第欧矿(已闭坑)23-2518-2032-368.0-8.50.8-0.915-20250-300-金属矿物矿床公司35.617.233.0 4.10.27---恩纳吉特矿物41.658.032.212.1----文塔纳斯冶炼厂24-2720-2825-300.14-0.180.01--10卡利托恩尼斯冶炼厂31-3321-2529-320.23-0.350.012-0.02--N.D.表1 智利铜精矿的化学成份(%)注:1、从智利国营铜业公司的MM矿山获得;2、加入特尼恩特反应器的精矿混合物成分;3、该矿数据为1999年1月 2000年4月的平均值。

浅谈中国矿企海外并购

浅谈中国矿企海外并购付霞【摘要】@@ 中国企业到海外投资主要有两种方式,即新建和并购,虽然新建方式的经济风险相对较小,但由于并购具有可以实现企业快速发展的优势,近年来,通过跨国并购以达到海外投资目的的中国企业越来越多,从而为中国企业海外投资闯出了一条新路.2009年上半年,中国已宣布的海外并购交易额已高达147亿美元.【期刊名称】《中国金属通报》【年(卷),期】2009(000)032【总页数】2页(P34-35)【作者】付霞【作者单位】山西华泽铝电有限公司【正文语种】中文并购是企业海外发展的有效方式之一,利于企业迅速做强做大。

矿产这样开采投资周期长、投资涉及环节较多和限制条件较多的资源类行业,更适宜于选择并购方式。

当前全球经济受到金融危机的负面影响,中国矿企应在国家“走出去”战略背景下,及时布局,把跨国并购当成企业国际化的快速通道。

中国企业到海外投资主要有两种方式,即新建和并购,虽然新建方式的经济风险相对较小,但由于并购具有可以实现企业快速发展的优势,近年来,通过跨国并购以达到海外投资目的的中国企业越来越多,从而为中国企业海外投资闯出了一条新路。

2009年上半年,中国已宣布的海外并购交易额已高达147亿美元。

企业并购是市场经济发展的必然要求,是企业资本运营和组织调整的重要方式。

近几年,全球矿业领域的并购呈现出愈演愈烈态势。

目前,各大矿业公司凭借雄厚的实力参与国际并购,通过并购获得新的发展空间。

全球前10大矿业公司占全球矿业公司总市值的50%以上,单体市值多在百亿美元以上。

2007年,全球矿业领域并购交易总额达1060亿美元;而2008年,尽管次贷危机不断扩大,前7个月全球矿业并购金额已高达2242亿美元。

通过研究世界一流矿业集团的发展历程,可以清晰地看到通过并购实现做大做强这一成长路径贯穿其发展历史。

2000年后,淡水河谷公司通过频繁的兼并收购,迅速做大做强,尤其是2006年11月,以177亿美元的价格收购了加拿大国际镍业公司75.66%的股份,是淡水河谷公司建立64年来的最大规模的并购案,也是迄今为止世界矿业领域金额最大的收购案。

上海期货交易所关于智利国营铜业公司(CODELCO)生产的CCC SX-EW牌高纯阴极铜注册的通知

上海期货交易所关于智利国营铜业公司(CODELCO)生产的CCC SX-EW牌高纯阴极铜注册的通知

文章属性

•【制定机关】上海期货交易所

•【公布日期】2009.05.06

•【字号】上期交有色字[2009]163号

•【施行日期】2009.05.06

•【效力等级】地方规范性文件

•【时效性】现行有效

•【主题分类】期货

正文

上海期货交易所关于智利国营铜业公司(CODELCO)生产的CCC SX-EW牌高纯阴极铜注册的通知

(上期交有色字[2009]163号)

各会员单位、各指定交割仓库(铜):

经我所审核,智利国营铜业公司(CODELCO)生产的CCC SX-EW牌高纯阴极铜已获准注册。

注册企业:智利国营铜业公司(CODELCO)

冶炼厂:Norte Division(智利)

(Avenida Tocopilla Sin Numero. Chuquicamata. II Region, Chile)产品名称:高纯阴极铜

注册商标:CCC SX-EW

产品标识:(略)

外形尺寸:1100*920*7毫米

块重:约65公斤

捆重:约2300公斤

每交割单位(25吨):11捆组成

包装材料:钢带,“︱︱︱”字形打捆,捆扎坚固。

特此通知。

二○○九年五月六日。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chuqui RT

Antofagasta

El Abra MMH

Calama

Gaby C H

Santiago

CODELCO Resources: Largest world’s world s proven and probable copper reserves, 10%

Andina

El Teniente

Source: Codelco

g Resources Co. Wanxiang

Copyrights © 2010 by CODELCO-CHILE. All Rights Reserved.

6

Highlights Industry Overview Operating Performance Financial Review

Ventanas Smelter & Refinery Division

Salvador Division Copper Andina Division Copper El Teniente Division Copper pp

Shanghai - China Representative p Office

Leadership in Copper Production

Codelco : 11% Others:6 3% FCX:9% BHP Billiton:7 % Xstrata:6 % Rio Tinto:4%

Australia:4 % Russia:4% Poland:5% China:5% Indonesia: 6% United Mexico:7 % States:6% Peru:12% Other Countries: 20% Others Chile:20%

Asia (ex. China) 21% Europe 23%

1Q 2011 Sales Breakdown by Region

Oceania 1% South America 9% N th A North America i 12% China 35%

1Q 2011 Copper pp Sales Breakdown ( (mft) )

Others: 54%

China Molybden um:9% China JDC:7% Grupo Mexico: 6%

Chuquicamata q Radomiro Tomic MMH Salvador Andina El Teniente Minera Gaby S.A. CODELCO

*: Proven and Probable Reserves and Identified Mineral Resources in Minning Plan of BDP Source: Codelco

20.000 18.000 16.000 14 000 14.000 12.000 10.000 8.000 6.000 4.000 2.000 0 1950

Other Developing Countries

Developing Countries: 39%

2010*

China: 38%

24

Kg of Copper / Person

2

Competitive Strengths

CODELCO: The World’s Leading Mining Company with High Quality Assets

CODELCO´s CODELCO is one of Leadership: the world’s lowest cost #1 Copper Producer producers of copper: #2 Moly Producer US¢ 98.2 cash cost** Strong 1Q Financial Performance**: EBITDA : US$2 US$2,750 750 mn EBIDA Margin: 64% Interest Coverage: 30x Ratings: g Moody’s A1 Stable S&P A Stable Fitch A+ Stable DBRS A Stable

6 5 4

20.000

30.000

40.000

Developed Countries

China Brazil India

0 2.000 4.000 6.000 8.000 10.000 12.000

3 2

1960

1970

1980

1990

2000

2010

1 0

Source: WBMS, FMI, World Bank *Figures 2010: Forecast. ** Period 1980 – 2010

CODELCO UPDATE

July 2011

Highlights Industry Overview Operating Performance and Capex Program Financial Review

Copyrights © 2010 by CODELCO-CHILE. All Rights Reserved.

2008-2009 Subprime Crisis

1972-1978 Worldwide deceleration due to Petroleum crisis

50 1908

1997-2003 Excessive stock levels, increase in Chilean Production, Asian Crisis

1917

1926

1935

1944

1953

1962

1971

1980

1989

1998

2007

Source: WBMS, WBMS IMF and Codelco. Codelco *: USA: 1980 – 2004. 2004 2010: Forecast. Forecast

Copyrights © 2010 by CODELCO-CHILE. All Rights Reserved.

Copyrights © 2010 by CODELCO-CHILE. All Rights Reserved.

7

Copper Real Price

500 450 400 350 300 250 200 150 100

1930 Great Depression 2004-2008 Price “Boom” principally provoked by China irruption 1914 ‐ 1916 WW1 1966 Bankruptcy of many companies due to Chilean nationalizations & Japanese economic miracle

Ministro Hales Division Copper

New York - US Codelco Group Inc.

London - UK Chile Copper Ltd.

Düsseldorf - Germany Codelco Kupferhandel GMHB

El Abra Copper Gabriela Mistral Operation Copper

Concentrate 11% Refined Copper 89% - Cathodes 79% - Fire refined 6% - Blister 4%

1Q 2011 Top p Clients

Nexans Copper France Southwire Company Codelco Kupferhandel Copper Partners Cobre Cerrillos S.A. Maike Metals Int. Int Ltd LS Cable Company Ltd Ningbo Sunhu Chem. Products France USA Germany China Chile China South Korea China China

US$ millions Copper Molybdenum Other Products (wire rod, sulfuric acid, id etc..) t ) Total 3 874 3,874 177 254 4,305 Share 90 0% 90.0% 4.1% 5.9% 100%

Leadership in Copper Reserves

Codelco: 10%

Second Largest Molybdenum Producer

FCX: 15% Codelco: 9%

Long Life Copper Resources

TOTAL MINERAL RESOURCES* (mn of tonnes) Mineral Ore Grade (%) Copper 3,277 , 0.57 18.7 2,584 0.47 12.3 902 0.91 8.2 341 0.53 1.8 5,888 0.78 45.8 4 176 4,176 0 84 0.84 35 1 35.1 553 0.39 2.2 17,721 0.70 124.1

I L E

Largest company in Chile: Contributes 16% of Chilean government budget *

Байду номын сангаас

* Average contribution to Chilean Government Budget from 2006 to 2010 ** As of 1Q 2011

9

Consensus about Solid Market Fundamentals