斯蒂芬D威廉森宏观经济学第三版第五章Stephen D. Williamson's Macroeconomics, Third Edition chapter5

威廉森《宏观经济学》(第3版)配套题库 章节题库第5章 封闭经济下的一时期宏观经济模型【圣才出品】

第5章封闭经济下的一时期宏观经济模型一、名词解释1.正外部性答:正外部性是指,那些能为社会和其他个人带来收益或能使社会和个人降低成本支出的外部性,它是对个人或社会有利的外部性。

正外部性时市场生产的数量小于社会合意的数量,政府可以通过对由正外部性的物品补贴来时外部性内在化。

2.生产可能性边界答:生产可能性边界也称为社会生产可能性边界或生产可能性曲线,指一个经济在可获得的生产要素与生产技术既定时所能生产的产量的各种组合。

由于整个社会的经济资源是有限的,当这些经济资源都被充分利用时,增加一定量的一种产品的生产,就必须放弃一定量的另一种产品的生产。

整个社会生产的选择过程形成了一系列的产品间的不同产量组合,所有这些不同产量的组合就构成了社会生产的可能性边界。

假设一个社会把其全部资源用于A 和B两种产品的生产,那么生产可能性边界可用图5-1表示。

图5-1生产可能性边界该图形表示,一个社会在资源一定、技术一定的情况下所可能生产的A产品和B产品的各种不同产量的组合。

位于曲线右边的点(如C点)是不能成立的,因为没有足够的资源,而曲线左边的点(如D点)可以成立,但没有利用或没有有效利用全部可供利用的资源。

而位于曲线上的点(如E点)则表示全部资源都得到了利用而又可以接受的组合。

这条曲线向下倾斜是因为当全部资源都被利用时,要获得更多一些的一种产品,就必须以牺牲其他的产品为代价。

一条生产可能性曲线说明:边界以外无法达到的组合意味着资源的有限性;边界线上各种组合的存在意味着选择的必要;边界向下倾斜意味着机会成本。

3.帕累托标准答:帕累托最优状态标准,简称为帕累托标准,是指如果至少有一人认为A优于B,而没有人认为A劣于B,则认为从社会的观点看亦有A优于B。

利用帕累托最优状态标准,可以对资源配置状态的任意变化做出“好”与“坏”的判断:如果既定的资源配置状态的改变使得至少有一个人的状况变好,而没有使任何人的状况变坏,则认为这种资源配置状态的变化是“好”的;否则认为是“坏”的。

斯蒂芬D威廉森宏观经济学第三版第六章Stephen D. Williamson's Macroeconomics, Third Edition chapter6

6-25

Figure 6.10 Adjustment to the Steady State in the Malthusian Model When z Increases

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

6-26

6-21

Figure 6.7 The Per-Worker Production Function

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

6-22

Figure 6.8 Determination of the Steady State in the Malthusian Model

6-4

Real Per Capita Income and the Investment Rate

Across countries, real per capita income and the investment rate are positively correlated.

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

• There is no tendency for rich countries to grow faster than poor countries, and vice-versa. • Rich countries are more alike in terms of rates of growth than are poor countries.

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

威廉森《宏观经济学》(第3版)配套题库【模拟试题】威廉森《宏观经济学》(第3版)模拟试题及详解(一)

威廉森《宏观经济学》(第3版)模拟试题及详解(一)一、名词解释(每小题5分,共计20分)1.IS LM-模型答:IS LM-模型是由英国经济学家希克斯和美国经济学家汉森在凯恩斯宏观经济理论基础上概括出的一个经济分析模式,即“希克斯—汉森模型”,也称“希克斯—汉森综合”或“希克斯—汉森图形”。

IS LM-模型是宏观经济分析的一个重要工具,是描述产品市场和货币市场之间相互联系的理论结构。

在产品市场上,国民收入取决于消费、投资、政府支出和净出口加起来的总支出或者说总需求水平,而总需求尤其是投资需求要受到利率影响,利率则由货币市场供求情况决定,就是说,货币市场要影响产品市场;另一方面,产品市场上所决定的国民收入又会影响货币需求,从而影响利率,这又是产品市场对货币市场的影响。

可见,产品市场和货币市场是相互联系、相互作用的,而收入和利率也只有在这种相互联系、相互作用中才能决定。

IS曲线是描述产品市场达到均衡,即I S=时,国民收入与利率之间存在着反向变动关=时,国民收入和利率之间存在着同系的曲线。

LM曲线是描述货币市场达到均衡,即L M向变动关系的曲线。

把IS曲线和LM曲线放在同一个图上,就可以得出说明两个市场同时均衡时,国民收入与利率决定的IS LM-模型。

2.国内生产总值(gross domestic product,GDP)答:国内生产总值指一个国家(地区)领土范围内,本国(地区)居民和外国居民在一定时期内所生产和提供的最终物品和劳务的市场价值。

GDP一般通过支出法和收入法两种方法进行核算。

用支出法计算的国内生产总值等于消费、投资、政府支出和净出口之和;用收入法计算的国内生产总值等于工资、利息、租金、利润、间接税和企业转移支付和折旧之和。

GDP是一国范围内生产的最终产品的市场价值,因此是一个地域概念,而与此相联系的国民生产总值(GNP)则是一个国民概念,乃指某国国民所拥有的全部生产要素所生产的最终产品的市场价值。

威廉森宏观经济学两期模型:消费储蓄决策与信贷市场

威廉森模型的基本假设与前提

假设经济中存在两个时期: 时期1和时期2。

信贷市场在时期2提供贷款, 消费者可以选择偿还或拖欠 前一时期的贷款。

消费者在时期1进行消费和储 蓄决策,以最大化其生命周 期效用。

利率在两个时期都是常数, 且市场出清。

威廉森模型在动态环境下的适用性有待进一 步研究,需要不断完善和调整模型参数。

威廉森模型的前沿研究与发展趋势

01

跨期消费决策

威廉森模型可进一步拓展至跨期 消费决策研究,以更全面地分析 消费者行为。

不确定性

02

03

信贷市场研究

考虑不确定性因素对消费、储蓄 和信贷市场的影响,提高模型的 预测精度。

深入探究信贷市场对消费和储蓄 决策的影响,以及信贷市场的运 行机制。

策制定提供依据。

政策评估

03

威廉森模型有助于评估现行政策的实施效果,为政策调整提供

参考。

威廉森模型的局限性与改进方向

数据依赖

假设限制

模型假设可能过于简化现实经济环境,导致预测结 果与实际经济状况存在偏差。

威廉森模型对数据的准确性和完整性要求较 高,实际应用中可能面临数据可得性和可靠 性的挑战。

动态调整

威廉森模型的主要结论

01

消费者在时期1的最优消费储蓄决策是使得生命周期效用最大化的决 策。

02

在信贷市场存在的情况下,消费者可能会选择在时期2偿还贷款,以 保持财务状况的稳健。

03

当利率下降时,消费者会增加借款和消费,导致总需求增加,进而影 响经济增长和就业。

04

政府可以通过货币政策和财政政策等宏观经济政策来影响总需求,从 而实现经济增长和就业的目标。

斯蒂芬D威廉森宏观经济学第三版第十一章Stephen D. Williamson's Macroeconomics, Third Edition chapter11

11-4

Figure 11.2 Effects of a Persistent Increase in Total Factor Productivity in the Real Business Cycle Model

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

11-9

Segmented Markets Model

• Business cycles can be caused in this model by unanticipated shocks to the money supply. • Model exhibits a liquidity effect – the interest rate falls in the short run when the money supply increases. • Monetary policy can only improve the functioning of the economy if the central bank has an informational advantage over the private sector. • Fit to the data is not as good as with the real business cycle model.

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

11-10

Figure 11.5 Effects of an Unanticipated Increase in the Money Supply in the Segmented Markets Model

宏观经济学 斯蒂芬威廉森chap05

Macroeconomics, 3e (Williamson)Chapter 5 A Closed-Economy One-Period Macroeconomic Model1) A n economy that has no interaction with the rest of the world is calledA) a n isolated economy.B) a closed economy.C) a parochial economy.D) a rogue nation.Answer: BQuestion Status: P revious Edition2) A n economy that engages in international trade is calledA) a cooperative economy.B) a modern economy.C) a n engaged economy.D) a n open economy.Answer: DQuestion Status: P revious Edition3) G oods and services provided by the government are calledA) g overnment goods.B) p ublic goods.C) f ree goods.D) s ocial goods.Answer: BQuestion Status: P revious Edition4) I n an economic model, an exogenous variable isA) a stand-in for more complicated variables.B) d etermined by the model itself.C) d etermined outside the model.D) a variable that has no effect on the workings of the model.Answer: CQuestion Status: P revious Edition5) I n an economic model, an endogenous variable isA) a stand-in for more complicated variables.B) d etermined by the model itself.C) d etermined outside the model.D) a variable that has no effect on the workings of the model.Answer: BQuestion Status: P revious Edition6) I n a one-period model, government is likely to runA) a deficit but not a surplus.B) a surplus but not a deficit.C) e ither a surplus or a deficit.D) n either a surplus nor a deficit.Answer: DQuestion Status: P revious Edition7) I n a one-period economic model, the government budget constraint requires thatgovernment spendingA) = taxes + transfers.B) = taxes + borrowing.C) > 0.D) = taxes.Answer: DQuestion Status: P revious Edition8) W hich of the following relationships does not hold in the one-period model?A) G=TB) Y=C+GC) Y=zF(K,N)D) π=Y-wN-CAnswer: DQuestion Status: N ew9) F iscal policy refers to a government's choices over itsA) e xpenditures, taxes, transfers, and borrowing.B) e xpenditures, taxes, issuance of money, and borrowing.C) e xpenditures, foreign affairs, issuance of money, and borrowing.D) i ssuance of money, taxes, environmental regulations, and foreign affairs.Answer: AQuestion Status: P revious Edition10) M aking use of an economic model is a process ofA) s olving hundreds of simultaneous equations.B) r unning experiments to determine how changes in the endogenous variables willchange the exogenous variables.C) r unning experiments to determine how changes in the exogenous variables willchange the endogenous variables.D) r esolving inconsistencies in the actions of economic agents.Answer: CQuestion Status: P revious Edition11) A competitive equilibrium is a state of affairs in whichA) m arkets clear, and output is maximized.B) o utput is maximized, and all agents are equally well-off.C) a ll agents are equally well-off and agents are price-takers.D) a gents are price-takers, and markets clear.Answer: DQuestion Status: P revious Edition12) I n a general equilibrium modelA) a ll markets but one clear.B) t here are no fluctuations.C) a ll prices are exogenous.D) a ll prices are endogenous.Answer: DQuestion Status: N ew13) I n a competitive equilibrium all these relationships hold but one. Which one?A) N d= N sB) Y=G+CC) G=TD) w=zAnswer: DQuestion Status: N ew14) I n the one-period competitive model we have been studyingA) b oth consumption and total factor productivity are exogenous.B) c onsumption is exogenous and total factor productivity is endogenous.C) c onsumption is endogenous and total factor productivity is exogenous.D) b oth consumption and total factor productivity are endogenous.Answer: CQuestion Status: P revious Edition15) A relationship that shows the technological possibilities for an economy as a whole is calledaA) p roduction function.B) u tility possibilities frontier.C) p roduction possibilities frontier.D) b udget constraint.Answer: CQuestion Status: P revious Edition16) T he production possibilities frontier in the one-period model is aA) b ehavioral relationship between consumption and leisure.B) b ehavioral relationship between consumption and government spending.C) t echnological relationship between consumption and leisure.D) t echnological relationship between consumption and government spending.Answer: CQuestion Status: P revious Edition17) T he production possibilities frontier representsA) a ll combinations of consumption and leisure for fixed output.B) a ll equally affordable combinations of consumption and leisure for a given wage.C) a ll feasible combinations of consumption and leisure.D) a ll equally liked combinations of consumption and leisure.Answer: CQuestion Status: N ew18) W hich of the following is not a reason for solving the model with a PPF?A) I t merges the household and firm problems into one graph.B) I t is simpler to solve the social planner problem.C) I t highlights the fact that the marginal rate of substitution should equal the marginalrate of transformation.D) I t highlights the fact that firms make no profit in equilibrium.Answer: DQuestion Status: N ew19) T he PPF representsA) a ll possible outcomes for a given wage.B) t he set of feasible outcomes.C) g iven leisure, how much consumption a household wants.D) t he share of consumption in output.Answer: BQuestion Status: N ew20) T he rate at which one good can be converted technologically into another is calledA) t he marginal rate of transformation.B) t he marginal rate of substitution.C) t he marginal product of labor.D) t he rate of conversion.Answer: AQuestion Status: P revious Edition21) P oints on the production possibilities frontier have the property that theyA) a re inherently unattainable.B) s how the maximum amount of leisure that can be consumed for given amounts ofgoods consumed.C) s how the maximum amount of goods that can be consumed for given amounts ofgovernment spending.D) s how the maximum amount of leisure that can be consumed for given amounts ofhours worked.Answer: BQuestion Status: P revious Edition22) A competitive equilibrium has all of the following properties exceptA) M P N= slope of PPF.B) M RS l,C=MRT l,C.C) M RT l,C=MP N.D) M P N=w.Answer: AQuestion Status: P revious Edition23) A competitive equilibrium is Pareto optimal if there is no way to rearrange or to reallocategoods so thatA) a nyone can be made better off.B) n o one can be made worse off.C) s omeone can be made better off without making someone else worse off.D) s omeone can be made better off without making everyone else worse off.Answer: CQuestion Status: P revious Edition24) W hich of the following is not equal to the others in equilibrium?A) t he real wageB) t he marginal rate of substitution between leisure and consumptionC) t he marginal product of laborD) t he price of consumptionAnswer: DQuestion Status: N ew25) A Pareto optimum is a point thatA) a malevolent dictator would choose.B) a cooperative coalition of some altruistic consumers would choose.C) a cooperative coalition of some socially responsible firms would choose.D) a social planner would choose.Answer: DQuestion Status: P revious Edition26) A Pareto optimum requires all of the following exceptA) M P N=-slope of PPF.B) M RS l,C=MRT l,C.C) M RT l,C=MP N.D) M P N=w.Answer: DQuestion Status: P revious Edition27) M uch of the writings of Adam Smith are in close agreement withA) t he necessity of trade restrictions.B) t he first fundamental theorem of welfare economics.C) t he second theorem of welfare economics.D) b oth B and C above.Answer: BQuestion Status: P revious Edition28) T he first fundamental theorem of welfare economics states thatA) u nder certain conditions, a competitive equilibrium is Pareto optimal.B) a competitive equilibrium is always Pareto optimal.C) u nder certain conditions, a Pareto optimum is a competitive equilibrium.D) a Pareto optimum is always a competitive equilibrium.Answer: AQuestion Status: P revious Edition29) T he second fundamental theorem of welfare economics states thatA) u nder certain conditions, a competitive equilibrium is Pareto optimal.B) a competitive equilibrium is always Pareto optimal.C) u nder certain conditions, a Pareto optimum is a competitive equilibrium.D) a Pareto optimum is always a competitive equilibrium.Answer: CQuestion Status: P revious Edition30) T he concept of Pareto optimality is aA) u topian concept.B) u seful concept because it guarantees economic equality.C) u seful concept because it guarantees economic efficiency.D) u seful concept that carefully balances a society's desires for equality and efficiency.Answer: CQuestion Status: P revious Edition31) A competitive equilibrium may fail to be Pareto optimal due to all of the following exceptA) i nequality.B) e xternalities.C) d istorting taxes.D) n on-price-taking firms.Answer: AQuestion Status: P revious Edition32) A n externality is any activity for which an individual firm or consumer does not take intoaccount allA) o f the ramifications of its actions on others.B) a ssociated costs.C) a ssociated benefits.D) a ssociated costs and benefits.Answer: DQuestion Status: P revious Edition33) T he presence of a distorting tax on wage income can result inA) M P N<MRT l,C.B) M RT l,C<MRS l,C.C) M P N<w.D) M RS l,C<MP N.Answer: DQuestion Status: P revious Edition34) R elative to the social optimum, monopoly power directly leads toA) u nderproduction.B) o verproduction.C) t oo much leisure.D) t oo little leisure.Answer: AQuestion Status: P revious Edition35) A n increase in government spending shifts the PPFA) u pward, but does not change its slope.B) u pward, and also changes its slope.C) d ownward, but does not change its slope.D) d ownward, and also changes its slope.Answer: CQuestion Status: P revious Edition36) T he experience of the U.S. economy during World War II confirms the prediction that adramatic increase in government spending is likely toA) i ncrease both real GDP and consumption.B) i ncrease real GDP and decrease consumption.C) d ecrease real GDP and increase consumption.D) d ecrease both real GDP and consumption.Answer: BQuestion Status: P revious Edition37) A n increase in government spendingA) i ncreases consumption, increases hours worked, and increases the real wage.B) r educes consumption, increases hours worked, and increases the real wage.C) r educes consumption, increases hours worked, and reduces the real wage.D) r educes consumption, reduces hours worked, and reduces the real wage.Answer: CQuestion Status: P revious Edition38) A n increase in government spendingA) i ncreases consumption and output.B) i ncreases consumption, decreases output.C) d ecreases consumption, increases output.D) d ecreases consumption and output.Answer: CQuestion Status: N ew39) C hanges in government spending are not likely causes of business cycles becausegovernment spending induced business cycles would counterfactually predictA) c ountercyclical real wages.B) p rocyclical real wages.C) c ountercyclical employment.D) p rocyclical employment.Answer: AQuestion Status: P revious Edition40) C hanges in government spending are not likely causes of business cycles becausegovernment spending induced business cycles would counterfactually predictA) c ountercyclical consumption.B) p rocyclical consumption.C) c ountercyclical employment.D) p rocyclical employment.Answer: AQuestion Status: P revious Edition41) W hich feature of the business cycle does the one-period model replicate with shocks togovernment expenditures?A) p rocyclical employmentB) p rocyclical consumptionC) p rocyclical real wagesD) c ountercyclical pricesAnswer: AQuestion Status: N ew42) A n increase in total factor productivity shifts the PPFA) u pward, but does not change its slope.B) u pward, and also changes its slope.C) d ownward, but does not change its slope.D) d ownward, and also changes its slope.Answer: BQuestion Status: P revious Edition43) A n increase in total factor productivityA) i ncreases consumption, increases output, and increases the real wage.B) r educes consumption, increases output, and increases the real wage.C) r educes consumption, increases output and reduces the real wage.D) r educes consumption, reduces output, and reduces the real wage.Answer: AQuestion Status: P revious Edition44) W hich of the following is wrong with respect to an increase in total factor productivity?A) H ouseholds are better off.B) C onsumption is up.C) T he real wage is down.D) O utput is up.Answer: CQuestion Status: N ew45) I n response to an increase in total factor productivityA) b oth the substitution effect and the income effect suggest that hours worked shouldincrease.B) t he substitution effect suggests that hours worked should increase, while the incomeeffect suggests that hours worked should decrease.C) t he substitution effect suggests that hours worked should decrease, while the incomeeffect suggests that hours worked should increase.D) b oth the substitution effect and the income effect suggest that hours worked shoulddecrease.Answer: BQuestion Status: P revious Edition46) C hanges in total factor productivity are plausible causes of business cycles becauseproductivity-induced business cycles correctly predictA) r eal wages and total hours must be procyclical.B) r eal wages and consumption must be procyclical.C) t otal hours worked and consumption must be procyclical.D) c onsumption and government spending must be procyclical.Answer: BQuestion Status: P revious Edition47) C hanges in total factor productivity are plausible causes of business cycles becauseA) o f the welfare theorems.B) t he U.S. government is following supply-side economic policy.C) t he model matches many stylized facts.D) p rices are countercyclical.Answer: CQuestion Status: N ew48) R eal business cycle theory argues that the primary cause of business cycles is fluctuations inA) p references.B) g overnment spending.C) t he importance of externalities.D) t otal factor productivity.Answer: DQuestion Status: P revious Edition49) J ust prior to the four most recent U.S. recessions, there has been aA) s ignificant contraction of the money supply.B) l arge decrease in government spending.C) l arge increase in the relative price of food.D) s ignificant increase in the relative price of energy.Answer: DQuestion Status: P revious Edition50) I f the government replaces a lump sum tax with a proportional labor income tax, thenA) e mployment and output increase.B) e mployment increases and output decreases.C) e mployment decreases and output increases.D) e mployment and output decrease.Answer: DQuestion Status: N ew51) P roportional income taxation is distorting becauseA) p eople do all they can to avoid paying taxes.B) t he competitive equilibrium is not Pareto optimal.C) f irms do all they can to avoid paying taxes.D) t he government budget constraint does not hold.Answer: BQuestion Status: N ew52) W ith a linear production function in labor only, which of the following must be true?A) T he representative household works as much as possible.B) T he representative firm makes large profits.C) T he real wage equals total factor productivity.D) T he marginal product of labor exceeds the real wage.Answer: CQuestion Status: N ew53) H ow does an increase in the proportional labor income tax modify the budget constraint?A) a parallel move upB) a parallel move downC) a tilting upD) a tilting downAnswer: DQuestion Status: N ew54) A t the competitive equilibrium with a positive proportional labor income taxA) t he real wage after tax exceeds the marginal product of labor.B) t he real wage after tax equals the marginal product of labor.C) t he real wage after tax is lower than the marginal product of labor.D) W e cannot say.Answer: CQuestion Status: N ew55) A t the competitive equilibrium with a positive proportional labor income taxA) t he real wage before tax exceeds the marginal product of labor.B) t he real wage before tax equals the marginal product of labor.C) t he real wage before tax is lower than the marginal product of labor.D) W e cannot say.Answer: BQuestion Status: N ew56) T he tax base isA) t he average tax rate.B) t he tax rate for the base year.C) t he object being taxed.D) t he lowest tax rate.Answer: CQuestion Status: N ew57) W hen the tax rate increases, the tax revenueA) a lways increases.B) d oes not change.C) a lways decreases.D) m ay increase or decrease.Answer: DQuestion Status: N ew58) T he Laffer curve is a curve showingA) o utput as a function of the tax rate.B) t ax revenue as a function of the tax rate.C) g overnment expenses as a function of how liberal the government is.D) t he tax rate as a function of government expenses.Answer: BQuestion Status: N ew59) S upply-side economists argue thatA) o ne should get rid of all taxes.B) t ax rates should not be progressive.C) i ncreasing tax rates always hurts tax revenue.D) o ne can increase tax revenue by decreasing the tax rate.Answer: DQuestion Status: N ew60) I n a competitive equilibrium with a Laffer curve, there are two equilibria that differ in theirA) t ax revenue.B) t otal factor productivity.C) o utput.D) m arginal tax rate.Answer: CQuestion Status: N ew。

斯蒂芬D威廉森宏观经济学第三版第十五章Stephen-D

18

Equation 15.9

Pareto optimality requires that

19

Equation 15.10

wants. • The causes and effects of long-run inflation. • Financial intermediation and banking.

2

Alternative Forms of Money

• Commodity money • Circulating private bank notes • Commodity-backed paper currency • Fiat money • Transactions deposits at banks

26

Equation 15.12

• The marginal rate of substitution of early consumption for late consumption is

27

Equation 15.13

• First constraint that a deposit contract must satisfy is

9

Equation 15.1

Assume that the central bank causes the money supply to grow at a constant rate.

10

Equation 15.2

In equilibrium, money supply equals money demand.

威廉森宏观经济学有投资的实际跨期模型PPT课件

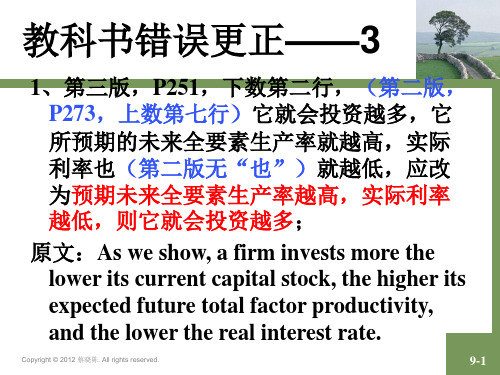

原文:As we show, a firm invests more the lower its current capital stock, the higher its expected future total factor productivity, and the lower the real interest rate.

9பைடு நூலகம்19

企业的劳动需求

Copyright © 2012 蔡晓陈. All rights reserved.

9-20

全要素生产率或资本存量变化时 的劳动需求需求移动

Copyright © 2012 蔡晓陈. All rights reserved.

9-21

Representative代表性企业投资决 策

9-11

实际利率提高对当期劳动供给 的影响(闲暇的跨期替代效应)

Copyright © 2012 蔡晓陈. All rights reserved.

9-12

一生财富增加对当期劳动供给 曲线的影响

Copyright © 2012 蔡晓陈. All rights reserved.

9-13

当前消费需求(参见第八章)

4、第三版,P300,式(10.15)应改为

A P Y P I P H ( X f) B f( 1 R ) B f

5、第三版,P300,式(10.16)应改为

A P Y P X f P H (X f)

Copyright © 2008 Pearson Addison-Wesley. All rights reserved.

9-26

第三节 政府

• 政府 ☆假设

1、当期购买G单位的消费品,未来购买G’单位的消费品; 2、当期的总税收是T,未来的总税收是T’; 3、政府当期发行B单位的政府债券;

威廉森《宏观经济学》(第3版)配套题库【名校考研真题+课后习题+章节题库+模拟测试】第一篇 导论

第1篇导论和衡量问题第1章导论一、复习题1.宏观经济学的主要确切特征是什么?答:(1)宏观经济学的研究对象是众多经济主体的行为。

它关注的是消费者和企业的总体行为、政府的行为、单个国家的经济活动总水平、各国间的经济影响,以及财政政策和货币政策的效应。

(2)宏观经济学侧重于总量研究,强调的问题主要是长期增长和经济周期。

其研究的具体内容包括:①持续经济增长的动力;②经济增长是否有极限;③政府应该如何改变经济增长率,促进经济增长;④经济周期的原因;⑤经济增长在大萧条和第二次世界大战期间发生的剧烈波动是否会重现;⑥政府是否应该采取行动以熨平经济周期2.宏观经济学与微观经济学有何异同?答:(1)宏观经济学与微观经济学的联系20世纪70年代以来,微观经济学家与宏观经济学家都在使用非常相似的研究工具。

宏观经济学家用来描述消费者与企业的行为、目标与约束,以及它们之间如何相互影响的经济模型,是根据微观经济学原理建立起来的,而且在分析这些模型和拟合数据时通常都用微观经济学家所用的方法。

宏观经济分析建立在微观经济学原理基础之上。

(2)宏观经济学与微观经济学的区别①研究方法不同微观经济学家侧重个量分析,宏观经济学侧重于总量研究。

②研究内容不同微观经济学研究单个家庭和企业的行为。

因为经济作为一个整体是由许多家庭与企业组成的,在总体水平上的相互影响是单个家庭和企业决策的结果。

宏观经济学有别于微观经济学,因为它涉及的是所有经济主体的选择对经济的总影响,而不是单个消费者或企业的选择对经济的影响,它强调的问题主要是长期增长和经济周期。

3.2005年的普通美国人比1900年的普通美国人富多少?答:2005年的普通的美国人比1900年的普通美国人平均来说富8倍。

人均实际GDP是衡量一国居民平均收入水平的指标。

1900年,一个美国人的平均收入是4232美元(以2000年美元计),2005年增加到37773美元(以2000年美元计)。

因此,以实际价值计算,美国人在105年间财富平均增长8倍。

宏观经济学-课后思考题答案_史蒂芬威廉森002

Chapter 2MeasurementTeaching GoalsStudents must understand the importance of measuring aggregate economic activity. Macroeconomics hopes to produce theories that provide useful insights and policy conclusions. To be credible, such theories must produce hypotheses that evidence could possibly refute. Macroeconomic measurement provides such evidence. Without macroeconomic measurements, macroeconomics could not be a social science, and would rather consist of philosophizing and pontificating. Market transactions provide the most simple and direct measurements. Macroeconomists’ most basic measurement is Gross Domestic Product (GDP), the value of final, domestically market output produced during a given period of time.In the United States, the Commerce Department’s National Income and Product Accounts provide official estimates of GDP. These accounts employ their own set of accounting rules to ensure internal consistency and to provide several separate estimates of GDP. These separate estimates are provided by the product accounts, the expenditure accounts, and the income accounts. The various accounting conventions may, at first glance, be rather dry and complicated. However, students can only easily digest the material in later chapters if they have a good grounding in the fundamentals.GDP changes through time because different amounts of goods and services are produced, and such goods and services are sold at different prices. Standards of living are determined by the amounts of goods and services produced, not by the prices they command in the market. While GDP is relatively easy to measure, the decomposition of changes in real GDP into quantity and price components is much more difficult. This kind of problem is less pressing for microeconomists. It is easy to separately measure the number of apples sold and the price of each apple. Because macroeconomics deals with aggregate output, the differentiation of price and quantity is much less easily apparent. It is important to emphasize that while there may be more or less reasonable approaches to this problem, there is no unambiguous best approach. Since many important policy discussions involve debates about output and price measurements, it is very important to understand exactly how such measurements are produced.Classroom Discussion TopicsAs the author demonstrates in presenting this chapter’s material, much of this material is best learned by example. Rather than simply working through the examples from the text or making up your own, the material may resonate better if the students come up with their own examples. They can start by picking a single good, and by the choice of their numbers they provide their own implied decomposition of output into wage and profit income. Later on, encourage them to suggest intermediate input production, inventory adjustments, international transactions, a government sector, and so on. Such an exercise may help assure them that the identities presented in the text are more than simply abstract constructions.If many of your students are familiar with accounting principles, it may also be useful to present the National Income and Product Account with the “T” accounts. Highlighting how every income is an expense elsewhere. Make one account for each of the firms, one for the household and one for the government. Add another account for the rest of the world when discussing the example with international trade. This procedure can highlight how some entities can be inferred from others because accounting10 Williamson • Macroeconomics, Third Editionidentities must hold. It makes it also easier to determine consumption for some student Social Security benefits are indexed to the Consumer Price Index. Explain with an example exactly how these adjustments are made. Ask the students if they think that this procedure is “fair.” Another topic for concern is the stagnation in the growth of measured real wages. Real wages are measured by dividing (for example) average hourly wages paid in manufacturing by the consumer price index. Ask students if measured changes in real wages confirm or conflict with their general beliefs about whether the typical worker is better or worse off than 10 or 20 years ago. How does possible mis-measurement of prices reconcile any apparent differences between casual impressions and statistical evidence?The text discusses why unemployment may or may not be a good measure of labor market tightness. Another interpretation of the unemployment rate is as a(n inverse) measure of economic welfare. Ask the students if they agree with this interpretation. Does the unemployment rate help factor in considerations like equal distribution of income? How can the unemployment rate factor in considerations like higher income per employed worker? Discuss possible pros and cons of using unemployment rather than per capita real GDP as a measure of well-being. Can unemployment be too low? Why or why not?OutlineI. Measuring GDP: The National Income and Product AccountsA. What Is GDP and How Do We Measure It?1. GDP: Value of Domestically Produced Output2. Commerce Department’s National Income and Product Accounts3. Business, Consumer, and Government AccountingB. The Product Approach1. Value Added2. Intermediate Good InputsC. The Expenditure Approach1. Consumption2. Investment3. Government Spending4. Net ExportsD. The Income Approach1. Wage Income2. After-Tax Profits3. Interest Income4. Taxes5. The Income-Expenditure IdentityE. Gross National Product (GNP)1. Treatment of Foreign Income2. GNP = GDP + Net Foreign IncomeF. What Does GDP Leave Out?1. GDP and Welfarea. Income Distributionb. Non-Market Production2. Measuring Market Productiona. The Underground Economyb. Valuing Government ProductionChapter 2 Measurement 11G. Expenditure Components1. Consumptiona. Durable Goodsb. Non-Durable Goodsc. Services2. Investmenta. Fixed Investment: Nonresidential and Residentialb. Inventory Investment3. Net Exportsa. Exportsb. Imports4. Government Expendituresa. Federal Defenseb. Federal Non-Defensec. State and Locald. Treatment of Transfer PaymentsII. Nominal and Real GDP and Price IndicesA. Real GDP1. Output Valued at Base Year Prices2 Chain Weighted Real GDPB. Measures of the Price Level1. Implicit GDP Price Deflator2. Consumer Price Index (CPI)C. Problems Measuring Real GDP and Prices1. Substitution Biases2. Accounting for Quality Changes3. Treatment of Newly Introduced GoodsIII. Savings, Wealth, and CapitalA. Stocks and FlowsB. Private Disposable Income and Private Sector Saving1.d Y Y NFP TR INT T =+++− 2.p d S Y C =− C. Government Surpluses, Deficits, and Government Saving1.g S T TR INT G =−−− 2. g D S =− D. National Saving: p g S S S Y NFP C G =+=+−−E. Saving, Investment, and the Current Account1. NFP NX I S ++=2. CA I S NFP NX CA +=⇒+=F. The Stock of Capital1. Wealth ΔS ⇒2. K I Δ⇒3. Claims on Foreigners CA ⇒12 Williamson • Macroeconomics, Third EditionIV. Labor Market MeasurementA. BLS Categories1. Employed2. Unemployed3. Not in the Labor ForceB. The Unemployment RateNumber unemployed=Unemployment RateLabor forceC. The Participation RateLabor force=Participation RateTotal working age populationD. Unemployment and Labor Force Tightness1. Discouraged Workers2. Job Search IntensityTextbook Question SolutionsQuestions for Review1. Product, income, and expenditure approaches.2. For each producer, value added is equal to the value of total production minus the cost ofintermediate inputs.3. This identity emphasizes the point that all sales of output provide income somewhere in the economy.The identity also provides two separate ways of measuring total output in the economy.4. GNP is equal to GDP (domestic production) plus net factor payments from abroad. Net factorpayments represent income for domestic residents that are earned from production that takes place in foreign countries.5. GDP provides a reasonable approximation of economic welfare. However, GDP ignores the value ofnonmarket economic activity. GDP also measures only total income without reference to how that income is distributed.6. Measured GDP does not include production in the underground economy, which is difficult toestimate. GDP also measures the value of government spending at its cost of production, which may be greater or less than its true value.7. The largest component is consumption, which represents about 2/3 of GDP.8. Investment is equal to private, domestic expenditure on goods and services (Y − G − NX) minusconsumption. Investment includes residential investment, nonresidential investment, and inventory investment.9. National defense spending represents about 5% of GDP.Chapter 2 Measurement 13 10. GDP values production at market prices. Real GDP compares different years’ production at a specificset of prices. These prices are those that prevailed in the base year. Real GDP is therefore a weighted average of individual production levels. The weights are determined according to prevailing relative prices in the base year. Because relative prices change over time, comparisons of real GDP across time can differ according to the chosen base year.11. Chain weighting directly compares production levels only in adjacent years. The price weights aredetermined by averaging the prices of the individual goods and services over the two adjacent years.12. Real GDP is difficult to measure due to changes over time in relative prices, difficulties in estimatingthe extent of quality changes, and how one estimates the value of newly introduced goods.13. Private saving measures additions to private sector wealth. Government saving measures reductionsin government debt (increases in government wealth). National saving measures additions to national wealth. National saving is equal to private saving plus government saving.14. National wealth is accumulated as increases in the domestic stock of capital (domestic investment)and increases in claims against foreigners (the current account surplus).15. Measured unemployment excludes discouraged workers. Measured unemployment only accounts forthe number of individuals unemployed, without reference to how intensively they search for newjobs.Problems1. Product accounting adds up value added by all producers. The wheat producer has no intermediateinputs and produces 30 million bushels at $3/bu. for $90 million. The bread producer produces100 million loaves at $3.50/loaf for $350 million. The bread producer uses $75 million worth ofwheat as an input. Therefore, the bread producer’s value added is $275 million. Total GDP istherefore $90 million + $275 million = $365 million.Expenditure accounting adds up the value of expenditures on final output. Consumers buy100 million loaves at $3.50/loaf for $350 million. The wheat producer adds 5 million bushels ofwheat to inventory. Therefore, investment spending is equal to 5 million bushels of wheat valued at $3/bu., which costs $15 million. Total GDP is therefore $350 million + $15 million = $365 million.2. Coal producer, steel producer, and consumers.(a) (i) Product approach: Coal producer produces 15 million tons of coal at $5/ton, which adds$75 million to GDP. The steel producer produces 10 million tons of steel at $20/ton, whichis worth $200 million. The steel producer pays $125 million for 25 million tons of coal at$5/ton. The steel producer’s value added is therefore $75 million. GDP is equal to$75 million + $75 million = $150 million.(ii) Expenditure approach: Consumers buy 8 million tons of steel at $20/ton, so consumption is $160 million. There is no investment and no government spending. Exports are 2 milliontons of steel at $20/ton, which is worth $40 million. Imports are 10 million tons of coal at$5/ton, which is worth $50 million. Net exports are therefore equal to $40 million −$50 million =−$10 million. GDP is therefore equal to $160 million + (−$10 million) =$150 million.14 Williamson • Macroeconomics, Third Edition(iii) Income approach: The coal producer pays $50 million in wages and the steel producer pays $40 million in wages, so total wages in the economy equal $90 million. The coal producerreceives $75 million in revenue for selling 15 million tons at $15/ton. The coal producerpays $50 million in wages, so the coal producer’s profits are $25 million. The steel producerreceives $200 million in revenue for selling 10 million tons of steel at $20/ton. The steelproducer pays $40 million in wages and pays $125 million for the 25 million tons ofcoal that it needs to produce steel. The steel producer’s profits are therefore equal to$200 million − $40 million − $125 million = $35 million. Total profit income in theeconomy is therefore $25 million + $35 million = $60 million. GDP therefore is equal towage income ($90 million) plus profit income ($60 million). GDP is therefore $150 million.(b) There are no net factor payments from abroad in this example. Therefore, the current accountsurplus is equal to net exports, which is equal to (−$10 million).(c) As originally formulated, GNP is equal to GDP, which is equal to $150 million. Alternatively, ifforeigners receive $25 million in coal industry profits as income, then net factor payments from abroad are (−$25 million), so GNP is equal to $125 million.3. Wheat and Bread(a) Product approach: Firm A produces 50,000 bushels of wheat, with no intermediate goods inputs. At$3/bu., the value of Firm A’s production is equal to $150,000. Firm B produces 50,000 loaves ofbread at $2/loaf, which is valued at $100,000. Firm B pays $60,000 to firm A for 20,000 bushels of wheat, which is an intermediate input. Firm B’s value added is therefore $40,000. GDP is therefore equal to $190,000.(b) Expenditure approach: Consumers buy 50,000 loaves of domestically produced bread at $2/loafand 15,000 loaves of imported bread at $1/loaf. Consumption spending is therefore equal to$100,000 + $15,000 = $115,000. Firm A adds 5,000 bushels of wheat to inventory. Wheat isworth $3/bu., so investment is equal to $15,000. Firm A exports 25,000 bushels of wheat for$3/bu. Exports are $75,000. Consumers import 15,000 loaves of bread at $1/loaf. Imports are$15,000. Net exports are equal to $75,000 − $15,000 = $60,000. There is no governmentspending. GDP is equal to consumption ($115,000) plus investment ($15,000) plus net exports($60,000). GDP is therefore equal to $190,000.(c) Income approach: Firm A pays $50,000 in wages. Firm B pays $20,000 in wages. Total wagesare therefore $70,000. Firm A produces $150,000 worth of wheat and pays $50,000 in wages.Firm A’s profits are $100,000. Firm B produces $100,000 worth of bread. Firm B pays $20,000in wages and pays $60,000 to Firm A for wheat. Firm B’s profits are $100,000 − $20,000 −$60,000 = $20,000. Total profit income in the economy equals $100,000 + $20, 000 = $120,000.Total wage income ($70,000) plus profit income ($120,000) equals $190,000. GDP is therefore$190,000.Chapter 2 Measurement 15 4. Price and quantity data are given as the following.Year 1Good Quanti tyPri ceComputers 20$1,000 Bread 10,000$1.00Year 2Good Quanti tyPri ceComputers 25$1,500Bread 12,000$1.10(a) Year 1 nominal GDP =×+×=20$1,00010,000$1.00$30,000.Year 2 nominal GDP =×+×=25$1,50012,000$1.10$50,700.With year 1 as the base year, we need to value both years’ production at year 1 prices. In the base year, year 1, real GDP equals nominal GDP equals $30,000. In year 2, we need to value year 2’s output at year 1 prices. Year 2 real GDP =×+×=25$1,00012,000$1.00$37,000. The percentage change in real GDP equals ($37,000 − $30,000)/$30,000 = 23.33%.We next calculate chain-weighted real GDP. At year 1 prices, the ratio of year 2 real GDP to year1 real GDP equals g1= ($37,000/$30,000) = 1.2333. We must next compute real GDP using year2 prices. Year 2 GDP valued at year 2 prices equals year 2 nominal GDP = $50,700. Year 1 GDPvalued at year 2 prices equals (20 × $1,500 + 10,000 × $1.10) = $41,000. The ratio of year 2 GDP at year 2 prices to year 1 GDP at year 2 prices equals g2=chain-weighted ratio of real GDP in the two years therefore is equal to 1.23496cg==. The percentage change chain-weighted real GDP from year 1 to year 2 is therefore approximately23.5%.If we (arbitrarily) designate year 1 as the base year, then year 1 chain-weighted GDP equals nominal GDP equals $30,000. Year 2 chain-weighted real GDP is equal to (1.23496 × $30,000) = $37,048.75.(b) To calculate the implicit GDP deflator, we divide nominal GDP by real GDP, and then multiplyby 100 to express as an index number. With year 1 as the base year, base year nominal GDP equals base year real GDP, so the base year implicit GDP deflator is 100. For the year 2, the implicit GDP deflator is ($50,700/$37,000) × 100 = 137.0. The percentage change in the deflator is equal to 37.0%.With chain weighting, and the base year set at year 1, the year 1 GDP deflator equals($30,000/$30,000) × 100 = 100. The chain-weighted deflator for year 2 is now equal to($50,700/$37,048.75) × 100 = 136.85. The percentage change in the chain-weighted deflator equals 36.85%.16 Williamson • Macroeconomics, Third Edition(c) We next consider the possibility that year 2 computers are twice as productive as year1 computers. As one possibility, let us define a “computer” as a year 1 computer. In this case,the 25 computers produced in year 2 are the equivalent of 50 year 1 computers. Each year 1computer now sells for $750 in year 2. We now revise the original data as:Year 1Good Quanti tyPri ceYear 1 Computers 20 $1,000Bread 10,000$1.00Year 2Good Quanti tyPri ceYear 1 Computers 50 $750Bread 12,000$1.10First, note that the change in the definition of a “computer” does not affect the calculations of nominal GDP. We next compute real GDP with year 1 as the base year. Year 2 real GDP in year 1 prices is now ×+×=50$1,00012,000$1.00$62,000. The percentage change in real GDP is equal to ($62,000 − $30,000)/$30,000 = 106.7%.We next revise the calculation of chain-weighted real GDP. From above, g1 equals($62,000/$30,000) = 206.67. The value of year 1 GDP at year 2 prices equals $26,000. Therefore,g 2 equals ($50,700/$26,000) = 1.95. 200.75. The percentage change chain-weighted real GDPfrom year 1 to year 2 is therefore 100.75%.If we (arbitrarily) designate year 1 as the base year, then year 1 chain-weighted GDP equalsnominal GDP equals $30,000. Year 2 chain-weighted real GDP is equal to (2.0075 × $30,000) = $60,225. The chain-weighted deflator for year 1 is automatically 100. The chain-weighteddeflator for year 2 equals ($50,700/$60,225) × 100 = 84.18. The percentage rate of change of the chain-weighted deflator equals −15.8%.When there is no quality change, the difference between using year 1 as the base year and using chain weighting is relatively small. Factoring in the increased performance of year 2 computers, the production of computers rises dramatically while its relative price falls. Compared withearlier practices, chain weighting provides a smaller estimate of the increase in production and a smaller estimate of the reduction in prices. This difference is due to the fact that the relative price of the good that increases most in quantity (computers) is much higher in year 1. Therefore, the use of historical prices puts more weight on the increase in quality-adjusted computer output. 5. Price and quantity data are given as the following:Year 1GoodQuantity(million lbs.)Price(per lb.)Broccoli 1,500 $0.50 Cauliflower 300$0.80Year 2GoodQuantity(million lbs.)Price(per lb.)Broccoli 2,400 $0.60 Cauliflower 350$0.85Chapter 2 Measurement 17(a) Year 1 nominal GDP = Year 1 real GDP =×+×=1,500million$0.50300million$0.80 $990million.Year 2 nominal GDP=×+×=2,400million$0.60350million$0.85$1,730.5million Year 2 real GDP=×+×=2,400million$0.50350million$0.80$1,450million.Year 1 GDP deflator equals 100.Year 2 GDP deflator equals ($1,730.5/$1,450) × 100 = 119.3.The percentage change in the deflator equals 19.3%.(b) Year 1 production (market basket) at year 1 prices equals year 1 nominal GDP = $990 million.The value of the market basket at year 2 prices is equal to ×+×1,500million$0.60300million $0.85= $1,050 million.Year 1 CPI equals 100.Year 2 CPI equals ($1,050/$990) × 100 = 106.1.The percentage change in the CPI equals 6.1%.The relative price of broccoli has gone up. The relative quantity of broccoli has also gone up. The CPI attaches a smaller weight to the price of broccoli, and so the CPI shows less inflation.6. Corn producer, consumers, and government.(a) (i) Product approach: There are no intermediate goods inputs. The corn producer grows30 million bushels of corn. Each bushel of corn is worth $5. Therefore, GDP equals$150 million.(ii) Expenditure approach: Consumers buy 20 million bushels of corn, so consumption equals $100 million. The corn producer adds 5 million bushels to inventory, so investment equals$25 million. The government buys 5 million bushels of corn, so government spendingequals $25 million. GDP equals $150 million.(iii) Income approach: Wage income is $60 million, paid by the corn producer. The corn producer’s revenue equals $150 million, including the value of its addition to inventory. Additions toinventory are treated as purchasing one owns output. The corn producer’s costs includewages of $60 million and taxes of $20 million. Therefore, profit income equals $150 million −$60 million − $20 million = $70 million. Government income equals taxes paid by the cornproducer, which equals $20 million. Therefore, GDP by income equals $60 million +$70 million + $20 million = $150 million.(b) Private disposable income equals GDP ($150 million) plus net factor payments (0) plusgovernment transfers ($5 million is Social Security benefits) plus interest on the government debt ($10 million) minus total taxes ($30 million), which equals $135 million. Private saving equalsprivate disposable income ($135 million) minus consumption ($100 million), which equals$35 million. Government saving equals government tax income ($30 million) minus transferpayments ($5 million) minus interest on the government debt ($10 million) minus governmentspending ($5 million), which equals $10 million. National saving equals private saving($35 million) plus government saving ($10 million), which equals $45 million. The government budget surplus equals government savings ($10 million). Since the budget surplus is positive, the government budget is in surplus. The government deficit is therefore equal to (−$10 million).18 Williamson • Macroeconomics, Third Edition7. Price controls.Nominal GDP is calculated by measuring output at market prices. In the event of effective pricecontrols, measured prices equal the controlled prices. However, controlled prices reflect an inaccurate measure of scarcity values. Nominal GDP is therefore distorted. In addition to distortions in nominal GDP measures, price controls also inject an inaccuracy in attempts to decompose changes in nominal GDP into movements in real GDP and movements in prices. With price controls, there is typically little or no change in white market prices over time. Alternatively, black market or scarcity value prices typically increase, perhaps dramatically. Measures of prices (in terms of scarcity values) understate inflation. Whenever inflation measures are too low, changes in real GDP overstate the extent of increases in actual production.8. Underground economy.Transactions in underground economy are performed with cash exclusively, to exploit the anonymous nature of currency. Thus, once we have established the amount of currency held abroad, we know the portion of $2,474 that is held domestically. Remove from it what is used for recorded transactions, say by using some estimate of the proportion of transactions using cash and applying this to observed GDP. Finally apply a concept of velocity of money to the remaining amount of cash to obtain the size of the underground economy.9. S p– 1 = CA + D(a) By definition:p d S Y C Y NFP TR INT T C =−=+++−− Next, recall that .Y C I G NX =+++ Substitute into the equation above and subtract I to obtain:()()p S I C I G NX NFP INT T C INX NFP G INT TR T CA D −=+++++−−−=++++−=+(b) Private saving, which is not used to finance domestic investment, is either lent to the domesticgovernment to finance its deficit (D ), or is lent to foreigners (CA ).10. Computing capital with the perpetual inventory method.(a) First, use the formula recursively for each year:K 0 = 80K 1 = 0.9 × 80 + 10 = 82K 2 = 0.9 × 82 + 10 = 83.8K 3 = 0.9 × 83.8 + 10 = 85.42K 4 = 0.9 × 85.42 + 10 = 86.88K 5 = 0.9 × 86.88 + 10 = 88.19K 6 = 0.9 × 88.19 + 10 = 89.37K 7 = 0.9 × 89.37 + 10 = 90.43K 8 = 0.9 × 90.43 + 10 = 91.39K 9 = 0.9 × 91.39 + 10 = 92.25K 10 = 0.9 × 92.25 + 10 = 93.03(b) This time, capital stays constant at 100, as the yearly investment corresponds exactly to theamount of capital that is depreciated every year. In (a), we started with a lower level of capital, thus less depreciated than what was invested, as capital kept rising (until it would reach 100).Chapter 2 Measurement 19 11. Assume the following:10540308010520D INT T G C NFP CA S =======−= (a)201080110d p Y S C S D C =+=++=++= (b)103054015D G TR INT T TR D G INT T =++−=−−+=−−+= (c)208030130S GNP C G GNP S C G =−−=++=++= (d)13010120GDP GNP NFP =−=−= (e)Government Surplus 10g S D ==−=− (f)51015CA NX NFP NX CA NFP =+=−=−−=− (g)12080301525GDP C I G NXI GDP C G NX =+++=−−−=−−+=。

宏观经济学-课后思考题答案_史蒂芬威廉森004

Chapter 4Consumer and Firm Behavior: The Work-Leisure Decision and Profit MaximizationTeaching GoalsThe microeconomic approach to macroeconomics stresses the notion that economy-wide events are the result of decisions made by individuals. People work so that they may afford to buy market goods. On the other hand, people generally prefer to work less rather than working more. Although discussions in the popular press often refer to the idea that spending is what drives the economy, an economy cannot produce unless people are willing to work. Therefore, the most basic macroeconomic decision is the decision to choose whether, and how much, to work. Production and willingness to work are intrinsically interconnected.Students often believe that how much a person works is largely determined by the necessities of their circumstances. Students will report that they have to work to survive and pay tuition. Some might point out that some students need not work much or at all because their parents provide more support. However, circumstances need not dictate exactly how much they may choose to work. They may work less if they go to a less costly school. They may sometimes decide to switch to part-time student status and full-time work status if they find a high-paying job. A key message of this chapter is that choice is important and that choice is influenced by changes in circumstances.This chapter demands the mastery of a large body of structure and yet provides little in the way of immediate insights. Students may need frequent assurances that the mastery of this material eventually pays big dividends in providing hope of understanding the phenomenon of business cycles. This is particularly important as this chapter lays critical foundations for the rest of the book: the use of microfoundations in macroeconomics. Students need to be able to justify macroeconomic relationships with microeconomic arguments, like in this chapter. This requires to some extend some boring drills that they will come to appreciate only later. If for many textbooks the strategy is to teach one chapter a week, spend more time on this one, especially if students have not yet mastered intermediate microeconomics. Two key points of this chapter are the concepts of income and substitution effects. Often, students are perplexed at the amount of time spent on this material because nothing in practice is purely an income effect or a substitution effect. However, the two most basic insights of microeconomic analysis are that when we become more well-off we generally want more of everything and that we respond to price incentives at the margin.Classroom Discussion TopicsAsk the students about their work choices and the choices of their parents, friends, and relatives. Does everyone work? Does everyone work the same amount of hours? Then ask the students for examples of the kinds of factors that lead people to work more or less. Try to elicit very specific examples. Thenask the students to categorize these factors that lead to more or less work. Some of these factors are actually the by-products of more complex decision making. For example, if they say that they work more or less because they go to school, point out that going to school is a choice. They may also point to28 Williamson • Macroeconomics, Third Editioncircumstances like whether a married couple has children, and if so, their number and their ages. Point out that these events are also the results of other choices. Then ask the students to try to categorize the remaining factors as being primarily an income effect or a substitution effect. Compare also labor choices across countries, as the Macroeconomics in Action feature, new to the third edition, does.Ask the students to provide examples of factors other than more labor or capital that can allow some countries to be a lot more productive than others. What factors other than growth in capital and labor allow a given economy to produce more (or less) over time? Explain that these are the kinds of factors that we summarize by the concept of total factor productivity. Insist also on the concept of physical capital and what it measures and what it is not.OutlineI. The Representative ConsumerA. Preferences1. Goods: The Consumption Good and Leisure2. The Utility Functiona. More Preferred to Lessb. Preference for Diversityc. Normal Goods3. Indifference Curvesa Downward Slopingb. Convex to the Origin4. Marginal Rate of SubstitutionB. Budget Constraint1. Price-taking Behavior2. The Time Constraint3. Real Disposable Income4. A Graphical RepresentationC. Optimization1. Rational Behavior2. The Optimal Consumption Bundle3. Marginal Rate of Substitution = Relative Price4. A Graphical RepresentationD. Comparative Statics Experiments1. Changes in Dividends and Taxes: Pure Income Effect2. Changes in the Real Wage: Income and Substitution EffectsII. The Representative FirmA. The Production Function1. Constant Returns to Scale2. Monotonicity3. Declining MPN4. Declining MPK5. Changes in Capital and MPN6. Total Factor ProductivityChapter 4 Consumer and Firm Behavior: The Work-Leisure Decision and Profit Maximization 29B. Profit Maximization1. Profits = Total Revenue − Total Variable Costs2. Marginal Product of Labor = Real Wage3. Labor DemandTextbook Question SolutionsQuestions for Review1. Consumers consume an aggregate consumption good and leisure.2. Consumers’ preferences are summarized in a utility function.3. The first property is that more is always preferred to less. This property assures us that a consumptionbundle with more of one good and no less of the other good than any second bundle will always be preferred to the second bundle.The second property is that a consumer likes diversity in his or her consumption bundle. Thisproperty assures us that a linear combination of two consumption bundles will always be preferred to the two original bundles.The third property is that both consumption and leisure are normal goods. This property assures us that an increase in a consumer’s income will always induce the individual to consume more of both consumption and leisure.4. The first property of indifference curves is that they are downward sloping. This property is a directconsequence of the property that more is always preferred to less. The second property ofindifference curves is that they are bowed toward the origin. This property is a direct consequence of consumers’ preference for diversity.5. Consumers maximize the amount of utility they can derive from their given amount of availableresources.6. The optimal bundle has the property that it represents a point of tangency of the budget line with anindifference curve. An equivalent property is that the marginal rate of substitution of leisure forconsumption and leisure is equal to the real wage.7. In response to an increase in dividend income, the consumer will consume more goods and moreleisure.8. In response to an increase in the real value of a lump-sum tax, the consumer will consume less goodsand less leisure.9. An increase in the real wage makes the consumer more well off. As a result of this pure incomeeffect, the consumer wants more leisure. Alternatively, the increase in the real wage induces asubstitution effect in which the consumer is willing to consume less leisure in exchange for working more hours (consuming less leisure). The net effect of these two competing forces is theoretically ambiguous.10. The representative firm seeks to maximize profits.30 Williamson • Macroeconomics, Third Edition11. As the amount of labor is increased, holding the amount of capital constant, each worker gets asmaller share of the fixed amount of capital, and there is a reduction in each worker’s marginalproductivity.12. An increase in total factor productivity shifts the production function upward.13. The representative firm’s profit is equal to its production (revenue measured in units of goods) minusits variable labor costs (the real wage times the amount of labor input). A unit increase in labor input adds the marginal product of labor to revenue and adds the real wage to labor costs. The amount of labor demand is that amount of labor input that equates marginal revenue with marginal labor costs.This quantity of labor, labor demand, can simply be read off the marginal product of labor schedule.Problems1. Consider the two hypothetical indifference curves in the figure below. Point A is on both indifferencecurves, I1 and I2. By construction, the consumer is indifferent between A and B, as both points are onI 2. In like fashion, the consumer is indifferent between A and C, as both points are on I1. But atpoint C, the consumer has more consumption and more leisure than at point B. As long as the consumer prefers more to less, he or she must strictly prefer C to A. We therefore contradict the hypothesis that two indifference curves can cross.Chapter 4 Consumer and Firm Behavior: The Work-Leisure Decision and Profit Maximization 312. u al bC =+(a) To specify an indifference curve, we hold utility constant at u . Next rearrange in the form:u a C l b b=− Indifference curves are therefore linear with slope, −a /b , which represents the marginal rate ofsubstitution. There are two main cases, according to whether /a b w > or /.a b w < The top panelof the left figure below shows the case of /.a b w < In this case the indifference curves are flatterthan the budget line and the consumer picks point A, at which 0l = and .C wh T π=+− Theright figure shows the case of /.a b w > In this case the indifference curves are steeper than thebudget line, and the consumer picks point B, at which l h = and .C T π=− In the coincidentalcase in which /,a b w = the highest attainable indifference curve coincides with the indifference curve, and the consumer is indifferent among all possible amounts of leisure and hours worked.(b) The utility function in this problem does not obey the property that the consumer prefersdiversity, and is therefore not a likely possibility.(c) This utility function does have the property that more is preferred to less. However, the marginalrate of substitution is constant, and therefore this utility function does not satisfy the property ofdiminishing marginal rate of substitution.32 Williamson • Macroeconomics, Third Edition3. When the government imposes a proportional tax on wage income, the consumer’s budget constraintis now given by:(1)(),C w t h l T π=−−+−where t is the tax rate on wage income. In the figure below, the budget constraint for t = 0, is FGH.When t > 0, the budget constraint is EGH. The slope of the original budget line is –w , while the slope of the new budget line is –(1 – t )w . Initially the consumer picks the point A on the original budget line. After the tax has been imposed, the consumer picks point B. The substitution effect of theimposition of the tax is to move the consumer from point A to point D on the original indifference curve. The point D is at the tangent point of indifference curve, I 1, with a line segment that is parallel to EG. The pure substitution effect induces the consumer to reduce consumption and increase leisure (work less).The tax also makes the consumer worse off, in that he or she can no longer be on indifference curve,I 1, but must move to the less preferred indifference curve, I 2. This pure income effect moves the consumer to point B, which has less consumption and less leisure than point D, because bothconsumption and leisure are normal goods. The net effect of the tax is to reduce consumption, but the direction of the net effect on leisure is ambiguous. The figure shows the case in which the substitution effect on leisure dominates the income effect. In this case, leisure increases and hours worked fall. Although consumption must fall, hours worked may rise, fall, or remain the same.4. The increase in dividend income shifts the budget line upward. The reduction in the wage rate flattensthe budget line. One possibility is depicted in the figures below. The original budget constraint HGL shifts to HFE. There are two income effects in this case. The increase in dividend income is a positive income effect. The reduction in the wage rate is a negative income effect. The drawing in the topfigure shows the case where these two income effects exactly cancel out. In this case we are left with a pure substitution effect that moves the consumer from point A to point B. Therefore, consumption falls and leisure increases. As leisure increases, hours of work must fall. The middle figure shows a case in which the increase in dividend income, the distance GF, is larger and so the income effect is positive. The consumer winds up on a higher indifference curve, leisure unambiguously increases,Chapter 4 Consumer and Firm Behavior: The Work-Leisure Decision and Profit Maximization 33 and consumption may either increase or decrease. The bottom figure shows a case in which the increase in dividend income, the distance GF, is smaller and so the income effect is negative. The consumer winds up on a lower indifference curve, consumption unambiguously decreases, and leisure may either increase or decrease.34 Williamson • Macroeconomics, Third Edition5. This problem introduces a higher, overtime wage for hours worked above a threshold, q . Thisproblem also abstracts from any dividend income and taxes.(a) The budget constraint is now EJG in the figure below. The budget constraint is steeper for levels ofleisure less than h – q , because of the higher overtime wage. The figure depicts possible choices for two different consumers. Consumer #1 picks point A on her indifference curve, I 1. Consumer #2 picks point B on his indifference curve, I 2. Consumer #1 chooses to work overtime; consumer #2 does not.(b) The geometry of the figure above makes it clear that it would be very difficult to have anindifference curve tangent to EJG close to point J. In order for this to happen, an indifferencecurve would need to be close to right angled as in the case of pure complement. It is unlikely that consumers wish to consume goods and leisure in fixed proportions, and so points like A and Bare more typical. For any other allowable shape for the indifference curve, it is impossible forpoint J to be chosen.(c) An increase in the overtime wage steepens segment EJ of the budget constraint, but has no effecton the segment JG. For an individual like consumer #2, the increase in the overtime wage has no effect up until the point at which the increase is large enough to shift the individual to a point like point A. Consumer #2 receives no income effect because the income effect arises out of a higher wage rate on inframarginal units of work. An individual like consumer #1 has the traditionalincome and substitution effects of a wage increase. Consumer #1 increases her consumption, but may either increase or reduce hours of work according to whether the income effect outweighsthe substitution effect.Chapter 4 Consumer and Firm Behavior: The Work-Leisure Decision and Profit Maximization 356. Lump-sum Tax vs. Proportional Tax. Suppose that we start with a proportional tax. Under theproportional tax the consumer’s budget line is EFH in the figure below. The consumer choosesconsumption, *,C and leisure, *,l at point A on indifference curve I 1. A shift to a lump-sum tax steepens the budget line. The absolute value of the slope of the budget line is (1),t w − and t has fallen to zero. The imposition of the lump-sum tax shifts the budget line downward in a parallel fashion. By construction, the lump-sum tax must raise the same amount of revenue as the proportional tax. The consumer must therefore be able to continue to consume *C of the consumption good and *l ofleisure after the change in tax collection. Therefore, the new budget line must also pass through pointA. The new budget line is labeled LGH in the figure below. With the lump-sum tax, the consumer can do better by choosing point B, on the higher indifference curve, I 2. Therefore, the consumer is clearly better off. We are also assured that consumption will be greater at point B than at point A, and that leisure will be smaller at point B than at point A.7. Leisure represents all time used for nonmarket activities. If the government is now providing forsome of those, like providing free child care, households will take advantage of such a program,thereby allowing more time for other activities, including market work. Concretely, this translates in a change of preferences for households. For the same amount of consumption, they are now willing to work more, or in other words, they are willing to forego some additional leisure. On the figure below, the new indifference curve is labeled I 2. It can cross indifference curve I 1 because preferences, as we measure them here, have changed. The equilibrium basket of goods for the household now shifts from A to B. This leads to reduced leisure (from l *1 to l *2), and thus increased hours worked, and increased consumption (from C *1 to C *2) thanks to higher labor income at the fixed wage.36 Williamson • Macroeconomics, Third Edition8. The firm chooses its labor input, N d , so as to maximize profits. When there is no tax, profits for thefirm are given by(,).d d zF K N wN π=−That is, profits are the difference between revenue and costs. In the top figure on the following page,the revenue function is (,)d zF K N and the cost function is the straight line, wN d . The firm maximizes profits by choosing the quantity of labor where the slope of the revenue function equals the slope of the cost function:.N MP w =The firm’s demand for labor curve is the marginal product of labor schedule in the bottom figure on the following page.With a tax that is proportional to the firm’s output, the firm’s profits are given by:(,)(,)(1)(,),d d d d zF K N wN tzF K N t zF K N π=−−=−where the term (1)(,)d t zF K N − is the after-tax revenue function, and as before, wN d is the costfunction. In the top figure below, the tax acts to shift down the revenue function for the firm and reduces the slope of the revenue function. As before, the firm will maximize profits by choosing the quantity of labor input where the slope of the revenue function is equal to the slope of the cost function, but the slope of the revenue function is (1),N t MP − so the firm chooses the quantity of labor where(1).N t MP w −=In the bottom figure below, the labor demand curve is now (1),N t MP − and the labor demand curve has shifted down. The tax acts to reduce the after-tax marginal product of labor, and the firm will hire less labor at any given real wage.9. The firm chooses its labor input N dso as to maximize profits. When there is no subsidy, profits forthe firm are given by (,).d d zF K N wN π=−That is, profits are the difference between revenue and costs. In the top figure on the following page the revenue function is (,)d zF K N and the cost function is the straight line, wN d . The firm maximizes profits by choosing the quantity of labor where the slope of the revenue function equals the slope of the cost function:.N MP w =The firm’s demand for labor curve is the marginal product of labor schedule in the bottom figure below.With an employment subsidy, the firm’s profits are given by:(,)()d d zF K N w s N π=−−where the term (,)d zF K N is the unchanged revenue function, and (w – s )N d is the cost function. The subsidy acts to reduce the cost of each unit of labor by the amount of the subsidy, s . In the top figure below, the subsidy acts to shift down the cost function for the firm by reducing its slope. As before, the firm will maximize profits by choosing the quantity of labor input where the slope of the revenue function is equal to the slope of the cost function, (t – s ), so the firm chooses the quantity of labor where.N MP w s =−In the bottom figure below, the labor demand curve is now ,N MP s + and the labor demand curve has shifted up. The subsidy acts to reduce the marginal cost of labor, and the firm will hire more labor at any given real wage.10. Minimum Employment Requirement. Below *,N no output is produced. Thereafter, the production function has its usual properties. Such a production function is reproduced in the first two figures below. At high wages, the firm’s cost curve is entirely above the revenue curve, so the firm hires no labor, to prevent incurring losses. Only if the wage rate is less than ˆw will the firms choose to hire anyone. At ˆ,N just as it would in the absence of the constraint. Below ˆ,w w w=the firm chooses*,the labor demand curve is unaffected. The labor demand curve is reproduced in the bottom figure.11. The level of output produced by one worker who works h – l hours is given by(,).s Y zF K h l =−This equation is plotted in the figure below. The slope of this production possibilities frontier is simply .N MP −12. As the firm has to internalize the pollution, it realizes that labor is less effective than it previouslythought. It now needs to hire N (1 + x ) workers where N were previously sufficient. This is qualitatively equivalent to a reduction of z , total factor productivity. The figure below highlights the resulting outcome: the firm now hires fewer people for a given wage and thus its labor demand is reduced.13. 0.30.7Y zK n =(a) 0.7.Y n = See the top figure below. The marginal product of labor is positive and diminishing. (b) 0.72.Y n = See the figures below.(c) 0.30.70.72 1.23.Y n n =≈ See the figures below.(d) See the bottom figure below.−−−−==⇒===⇒===⇒=×≈0.30.30.30.30.31,10.72,1 1.41,220.70.86N N N z K MP n z K MP n z K MP n n。

宏观经济学-课后思考题答案_史蒂芬威廉森005