金融英语1

unit 1 Financial system金融英语第一课ppt课件

We have repaid the principal and interest.

As to the penalty, we must consult our principal.

Key words, phrases and special terms

7. portfolio

investment portfolios a portfolio of shares foreign portfolio investment

Warm up

If I had so much money, I would deposit $ 40,000 in the bank for a fixed period. The fixed deposit can earn steady interest for me. Since it has a good liquidity, I can draw on my deposit in need of cash.

current year.

2. allocation

allocation of capital allocation of resources

资本配置 资源配置

The total cost of the project was found on allocation to be the materials ₤ 255, labor ₤ 570, machine-hire ₤ 175, total ₤ 1000.

$ 20,000 would be put in various bonds, which are less liquid but more profitable. The prices of stocks fluctuate every day. I may risk losing my investment if choosing a wrong stock. I would only put in $ 20,000 in stocks.

金融专业英语 Unit 1 Money

Learning Targets

After learning this unit, you will be able to: understand the general definition of money; explain the functions of money; explain the forms of money; describe the contents of monetary system.

0 9 International Financing

1 0 Financial Derivatives

1 1 International Financial Institution

12

International Banking Regulatory Framework

Unit 1 Money

1.1 Introduction 1.2 Functions of Money 1.3 Forms of Money 1.4 Monetary System

1.1.1 History of Money

简单或偶然的价值形式

扩大的价值形式

一般价值形式

货币形式

Simple or Accidental Expanded Form of

Form of Value

Value

General Form of Value

Currency Form

1.1.1.1 Simple or Accidental Form of Value

1.1 Introduction

1.1.1 History of Money

Human society has existed for millions of years, but the emergence of money is only a few thousand years. There are many theories about the origin of money in history, but none of them have formed a complete theoretical system. Until Marx, from the view of dialectical materialism (辩证唯物 主义) and historical materialism (历史唯物 主义), explained the essence of money— the labor theory of value (劳动价值论). Marx believed that money originated from commodity exchange, and its economic root was private ownership. It was formed spontaneously in the process of commodity exchange.

《金融专业英语》习题答案

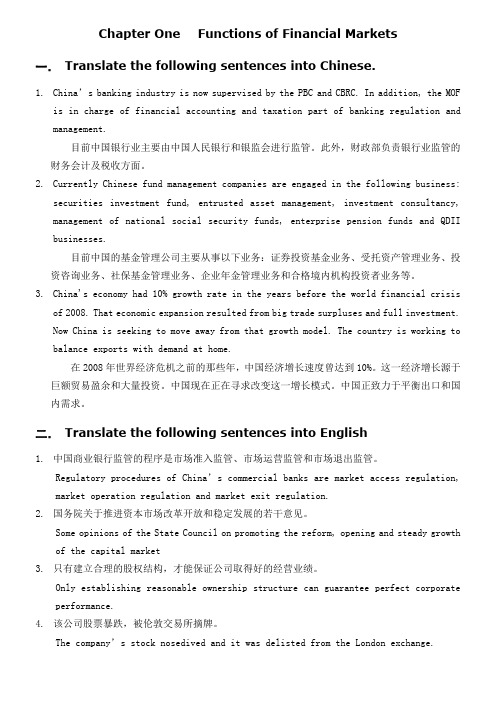

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

Financial English 金融英语教程chapter 1 money-张铁军教材版本

2. Compound Interest S=P(I+R)n I=S-P

Page 24

1.4.2 Nominal and Real Interest Rates

1. The definition of nominal interest. P7, 1.4.2, L1-2 2. The definition of real interest. P7, 1.4.2, L3-4

Page 2

Benefits

Financial English course will provide you with:

- Greater confidence when discussing financial documents and data

- Increased verbal fluency for face-to-face negotiations

Assignment

20%

Exam

50%

Total

100%

Page 4

Part 1 Money

1. Definition of Money 2. Types of Money 3. Functions of Money 5. Interest and Interest Rate 6. Money Supply 7. China’s Monetary System

Page 5

Chapter 1 Money

Professional Terms

1.monetary area货币区 货币区是货币一体化的较高层次,它是指成员国之间的货

币建立紧密联系的地理区域。 货币区的初级阶段是固定汇率制度,包括货币局制度和美

金融英语lecture1money

MoneyIf you can actually count your money, then you are not really a rich man.——American oil billionaire J. Paul Getty What is moneyEconomists define money as anything that is generally accepted in payment for goods or services or in the repayment of debts.Types of moneyA. Commodity moneyB. Convertible paper moneyC. Fiat money(or fiat currency):Usually paper money, is a type of currency whose only value is that a government made a fiat that the money is a legal method of exchange.Unlike commodity money or representative money it is not based in another commodity such as gold or silver and is not covered by a special reserve.D. Private debt moneyE. Electronic moneyPrivate debt moneyA loan that the borrower promises to repay in currency ondemand. . IOU the checkable deposit at commercial banks and other financial institutions.Commercial notes(商业票据):Short-term, unsecured, discounted, and negotiable notes sold by one company to another in order to satisfy immediate cash needs.Include: promissory note (期票,拮据) draft (汇票) check and so on.Electronic money: Electronic Check, Internet Payment System, Credit Card ServiceWhat does money doA. Medium of ExchangeIn almost all market transactions in our economy, money in the form of currency or checks is a medium of exchange; it is used to pay for goods and services. The use of money as a medium of exchange promotes economic efficiency by eliminating much of the time spent in exchanging goods and services. Terms: Transaction cost, Time value of moneyB. Unit of AccountThe second role of money is to provide a unit of account; that is, it is used to measure value in the economy. We measure the value of goods and services in terms of money, just as we measure weight in terms of pounds or distance in terms of miles.Note: Fiat money has not only no particular value in use; it doesn't even really have a value in exchange except that which is decreed that it would have.Terms: Good money, Bad moneyC. Store of ValueMoney also functions as a store of value: it is a repository of purchasing power over time. It is an asset. It 's something that we can use to store value away to be retrieved at a later point in time. So we can not consume today, we can hold money instead - and transfer that consumption power to some point in the future.Term: Hard currencyMeasuring Monetary Aggregates1. Measure as “money” only those assets that are most liquid, hence that function best as a medium of exchange.2. Include all financial assets in the measure of money, but weight them in proportion to their liquidity.1. M1 = Most Narrow Measure (Most Liquid)M1 = currency + traveler’s checks + demand deposits + other checkable deposits2. M2 = M1 + Less Liquid AssetsM2 = M1 + small denomination time deposits + savings deposits+ money market deposit accounts + money market mutual fund shares3. M3 = M2 + Less Liquid AssetsMoney supplyThe revenue raised through the printing of money. When the government prints money to finance expenditure, it increases the money supply. The increase in the money supply, in turn, causes inflation. Printing money to raise revenue is like imposing an inflation tax.To expand the money supply:The Federal Reserve buys Treasury Bonds and pays for them with new money.To reduce the money supply:The Federal Reserve sells Treasury Bonds and receives the existing dollars and then destroys them.InflationInflation is an increase in the average level of prices, and a price is the rate at which money is exchanged for a good or service.Here is a great illustration of the power of inflation:In 1970, the New York Times cost 15 cents, the median price of a single-family home was $23,400, and the average wage inmanufacturing was $ per hour. In 2008, the Times cost $, the price of a home was $183,300, and the average wage was $ per hour.Hyperinflation is defined as inflation that exceeds 50 percent per month, which is just over 1 percent a day. Questions1. Money is not unique as a store of value; any asset, be it money, stocks, bonds, land, houses, art, or jewelry, can be used to store wealth. Many such assets have advantages over money as a store of value: They often pay the owner a higher interest rate than money, experience price appreciation, and deliver services such as providing a roof over one's head. If these assets are a more desirable store of value than money, why do people hold money at allThe answer to this question relates to the important economic concept of liquidity.2. Rank the following assets from most liquid to least liquid:a.Checking account depositsb. Housesc. Currencyd. Washing machinese. Savings depositsf. Common stock3. Why have some economists described money during ah yperinflation as a “hot potato” that is quickly passed from one person to another4. Was money a better store of value in the United States in the 1950s than it was in the 1970s Why or why not In which period would you have been more willing to hold money5. In Brazil, a country that was undergoing a rapid inflation before 1994, many transactions were conducted in dollars rather than in Reals, the domestic currency. Why Quiz1. Fiat money is:A. credit card chargesB. CoinsC. not convertible into precious metals.D. checks Answer: C2. Which of these is not a function of money in an economyA. Store of valueB. Medium of exchangeC. Source of incomeD. Unit of account Answer:C3. Which of the following is not part of M1A. checking accountsB. traveler's checksC. savings accountsD. currencyAnswer:C4. If Mary deposits $100 of her currency in her checking account, then:A. M1 will increase by $100.B. M2 will fall by $100.C. M1 and M2 will not change.D. M2 will increase by $100.Answer:C5. If Mary moves $100 from her savings account to her checking account, then:A. M1 will not change.B. M2 will not change.C. M1 will fall by $100.D. M2 will fall by $100. Answer:B6. Which of the following is not part of M2A. Small time depositsB. CurrencyC. Institutional money market mutual fundsD. Saving accountsAnswer:C7. Inefficiencies that are created when using checks as money include:A. Checks can transfer funds slowly.B. There are too many bad checks written.C. Checkbooks can be stolen.D. Checks can be written for any amount.Answer:A8. The liquidity of an asset is:A. the ability of an asset to earn interest income.B. the amount of an asset sold at discount or premium.C. the relative ease with which an asset can be converted into a medium of exchange.D. the relative ease with which an asset can be converted into a common stock.Answer:C9. For a commodity to function effectively as money, it mustA. Be widely accepted.B. Be backed by gold or silver.C. Be indestructible.D. Be printed by the government.Answer:A10. Money supply data is generated by:A. The Department of CommerceB. The Federal Deposit Insurance Corporation (FDIC)C. The Federal Reserve System (the Fed)D. The Treasury DepartmentAnswer:C11. Which of the following correctly shows the evolution of the payments systemA. Commodity money, fiat money, checks, electronic money.B. Commodity money, fiat money, electronic money, checks.C. Commodity money, checks, fiat money, electronic money.D. Fiat money, commodity money, checks, electronic money. Answer:A12.Which of the following is true regarding money's store of value functionA. money does not allow a person to hold purchasing power from the time income is earned until it is spent.B. money is the only store of value available.C. money is the most liquid store of value available.D. money is superior to all other stores of value during periods of inflation.Answer:C13. Which of the following is not a disadvantage of electronic moneyA. People are concerned about the privacy and security of e-money transactions.B. E-money transactions cost more than paper check transactions.C. The cost of setting up a system for processing e-money payments is high.D. E-money does not allow people to take advantage of float. Answer:B14. Wealth isA. Generally accepted for the repayment of debtsB. A flow of earnings per unit of timeC. A stock conceptD. The total collection of pieces of property that serve to store valueAnswer:D15. The Fed's measurements of monetary aggregatesA. Are more reliable in the short run than the long run.B. Are revised once a year.C. Does not depend on the definition of money.D. Are more reliable in the long run than the short run. Answer:D。

《金融专业英语》习题答案

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

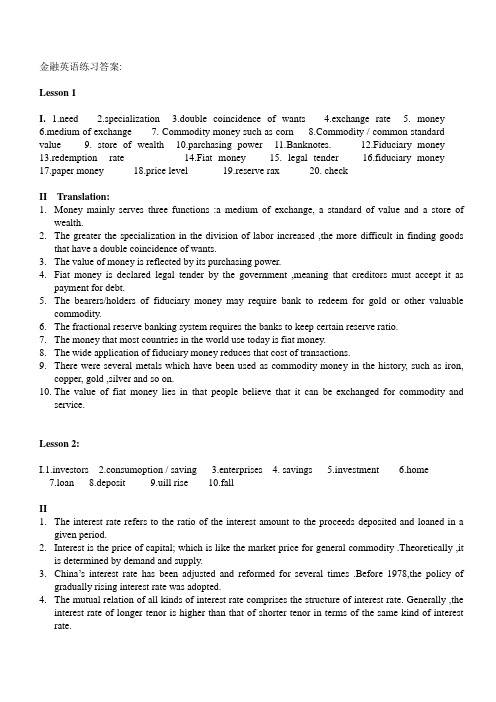

金融英语练习答案

金融英语练习答案:Lesson 1I. 1.need 2.specialization 3.double coincidence of wants 4.exchange rate 5. money6.medium of exchange7. Commodity money such as cornmodity / common standard value9. store of wealth 10.parchasing power 11.Banknotes. 12.Fiduciary money 13.redemption rate 14.Fiat money 15. legal tender 16.fiduciary money 17.paper money 18.price level 19.reserve rax 20. checkII Translation:1.Money mainly serves three functions :a medium of exchange, a standard of value and a store ofwealth.2.The greater the specialization in the division of labor increased ,the more difficult in finding goodsthat have a double coincidence of wants.3.The value of money is reflected by its purchasing power.4.Fiat money is declared legal tender by the government ,meaning that creditors must accept it aspayment for debt.5.The bearers/holders of fiduciary money may require bank to redeem for gold or other valuablecommodity.6.The fractional reserve banking system requires the banks to keep certain reserve ratio.7.The money that most countries in the world use today is fiat money.8.The wide application of fiduciary money reduces that cost of transactions.9.There were several metals which have been used as commodity money in the history, such as iron,copper, gold ,silver and so on.10.The value of fiat money lies in that people believe that it can be exchanged for commodity andservice.Lesson 2:I.1.investors 2.consumoption / saving 3.enterprises 4. savings 5.investment 6.home7.loan 8.deposit 9.uill rise 10.fallII1.The interest rate refers to the ratio of the interest amount to the proceeds deposited and loaned in agiven period.2.Interest is the price of capital; which is like the market price for general commodity .Theoretically ,itis determined by demand and supply.3.China’s interest rate has been adjusted and reformed for several times .Before 1978,the policy ofgradually rising interest rate was adopted.4.The mutual relation of all kinds of interest rate comprises the structure of interest rate. Generally ,theinterest rate of longer tenor is higher than that of shorter tenor in terms of the same kind of interest rate.5.Among various interest rate, the interest rate for deposit is lower that for loan; the interest rate offeredby commercial bank is higher than discount rate offered by the central bank.6.At present ,China’s interest rate system consists of the interest rate of bank, non-bank financialinstitution, portfolio and market.7.The discount rate offered by central bank refers to the discount rate for the instrument held by thecommercial banks. it reflects the redemption rate for the amounts of rediscount instrument.8.Due to free competition ,the demand and supply of currency borrowing and lending tend to bebalanced out through market mechanism .in this case ,the market interest rate is called equilibrium rate.9.The bond interest rate is interest rate paid by the government, banks and corporation for theaccommodation in the form of issuing, securities in domestic or foreign financial markets.10.The interest rate for corporate bond is basically determined by the bond issuing corporation itself, butthe government exercises control by setting the ceiling.Lesson 3:I.1.Firrancial intermediary 2.demard deposit /checking account 3.savings and loan associations, mutual savings bank and credit union. 4.Federal reserve system ernment securities/require that member banks hold reserves equal to some fraction of their deposits. 6.Feder Reserve Board 7.Federal Open market committee 8.reserve requirements 9.the ceiling 10. interest rate level 11.portfolios 12.outstanding loans 13.were deregulated 14.deposit insurance 15.merge with other banks 16. automatic teller machines 17.By pooling funds of many share holders 18.branches 19.The banking holding company 20.financialII1.Federal Reserve System was established in 1914,with its aim to stabilize the banking system. thepower of the Federal Reserve System was enhanced and centralized after the failures of many American banks in the Great Depression. The Arts passed in1980s authorized the Federal Reserve System with the power to regulate all the saving institutions. The main powers of Federal Reserve System were:(1)guide the transactions of open market so to control supply of money by buying and selling government securities,(2)determine the reserve requirements for saving institution (3)setting rediscount rate.2.The banking regulations in Great Depression made bank a trade that closely controlled andpredictable. But the high interest rate in 1970s disturbed the peaceful days of saving institutions. But many banks still couldn’t survive in the transive period of keen competition.Lesson 4:1.as a result of /helped to /by the time2.concerned about/at the outset3.offerd to take/in dollars/departure fromTransaction account is checking account which can write checks on deposits balance. They have three forms, the first one is “Demand Deposit”which banks don’t pay explicit interest; the second one is “ other checkable deposits”, which includes NOW(Negotiable Order of Withdrawal)accounts; the third one is Money Market Deposit accounts. Although banks can’t pay explicit interest on demand deposit, they can pay implicit interest in the form of proving free services. Different from NOW accounts, commercial banks don’t need to maintain reserves, so banks pay higher interest on the NOW accounts. At present, transaction account is the second largest debt form of the commercial banks.Lesson 5I1.as well as 2.in total assets 3.intermediate 4. title 5.an agent 6.Financial instruments 7.pay 8.as par 9.documentary letters of credit 10.prof-of –shipment documents . 11. HedgingII. Translation:Lesson 6I.1.bank 2.discount 3.buyers/sellers 4.short-term 5.borrowing/lending 6.deposits7.brokers 8.loans 9.linked 10.marketII Translation:1.The activities of money market mainly aim at keeping the liquidity of assets so that they can bechanged into cash on demand.2.On one hand, the money market meets the demand for short-term money of borrowers, one the otherhand, it finds a way out for lenders who have temporary excessive money.3.The Financial instruments of money market mainly are short-term treasury bill, commercial bill, bankacceptance, certificate of deposits, the tenors of these instruments range from one day shortest to one year longest.4.The participants of buying and selling short-term assets in the money market are individuals, businessfirms, various financial institutions, and governments. They act either as the provider of funds or as the demander of funds.5.As the intermediary of money market, various financial institutions have different functions inaffecting the demand for and supply of funds in the capital market, because their stress of importance on business if different.6.The commercial banks provide the money market mainly with short-term loans mainly with themoney obtained from deposits and other sources.7.In many countries, commercial banks are in the position of key importance in the money market,while the central bank controls commercial banks by various means so as to control money market. 8.Just as a country can’t be without a government, the money market can’t be without a central bank,whose activities in money market will affect the volume of money and interest rate at any time.9.The inter-bank market refers to the market where financial institutions solve the problem of excessiveor short of money by financing one another.10.With the development of the reform of financial system in our country, the inter-bank markets startedto develop rapidly.Lesson 7I.1.firms 2.inter rate /exchange 3. regional exchange 4.negotiable 5.exchange6.bond7.funds8.outstanding9.brokers 10.dealers.II. Translation:1.According to the situation of various countries, the issuance of government bonds adopts the methodof raising money from public, which can be divided into direct and indirect ones.2.The government bonds outstanding are not all held by individuals, but by the government units,financial institutions and the public commonly.3.The government should keep a stable increase for the issuance of securities, if the market price for thegovernment bonds often fluctuate, the investors will be reluctant to hold the government bonds.4.Corporate bonds are the certificates that the business owes to the public, it is the issuing corporationthat makes a promise to pay certain amount of money plus interest at a fixed date in future.5.The better the credit standing of a company, the longer maturity of the bond is ,but the solvency ofcorporate bonds cannot be compared with that of government, so the longest tenor of corporate bond will not be very long.pared with stock investment, the holders of corporate bonds can only have the interest income asthe fixed reward for the investment, but they can’t share the profit of the corporation like share holders.pared with stocks, corporation bonds have lower risks, but the safety can’t be compared to that ofgovernments bonds, that’s why the return ration is always higher than government bonds.8.With the rapid development of capitalist industry, shareholding corporation system becomesirresistible trend.9.The price of stocks are of substantial fluctuation, which makes investment of stocks very speculative.10.The market price of stocks is subject to the status of operation, allocation of profits, as well as to theeconomical, political social factors that make the price of stocks more volatile.Lesson 8I. 1.foreign 2.activities/lend 3.standing 4.role 5.independent 6.consortium banks7.money 8.bond 9.subsidiary 10.EurocurrencyII. Translation:1.In most countries, commercial banks all establish international department or foreign department inorder to deal in foreign exchange or to raise money for foreign trade.2.Due to the development of international banking business and the establishment of the bank’soverseas network organization, commercial banks of western countries become real multinational banks.3.The international network of the multinational bank includes branch, subsidiary, correspondent,resident representative and so on.4.The activities of the multinational bank through exclusive international network are retail deposit,money market activities, foreign trade financing, corporation loans, foreign trade business, investment business, trust business and so on .5.Because most of the clients of the multinational bank are large corporations and banks, they mainlydeal in retail deposits with few retail loans.6.The multinational banks put surplus money into money market when the demand is low, but raisemoney when demand is on rise.7.The tenor of foreign trade financing is usually short with high return, mostly denominated in thecurrency other that of the country where the bank locates.8.Corporation loans refer to the loans given to private business, state-owned business, especially to themultinational corporation.9.Foreign exchange business includes buying and selling foreign exchange and hedging conducting inforeign exchange market for the clients.10.Investment business refers to the underwriting of international securities and the distribution activities,as well as advisory service for customers and governments in the issue of securities.Lesson 9I.1.short-term 2.medium-term /long-term 3.restrictions 4.deposits 5.absence6.Euro currencies7.borrowers abroad8.entities9.deposits 10. convertibleII. Translation:1.Eurodollar refers to the deposits denominated in US dollar in various banks outside USA andEuropean branches of American banks, as well as the loans obtained by these banks.2.Off-shore money market is concentrated by Eurocurrency market , which is habitually called theEurodollar market, because the currency traded in this market is mainly Eurodollar.3.Eurobanks deal in Eurocurrency business which is strictly separated from domestic banking.4.London in the largest Eurodollar market, engaging in both deposit and loan, with huge volume oftransactions.5.Eurobank’s business usually not subject to local banking rules, such as deposit rate and maturity,therefore, banks can compete freely to attract customers.6.The interest rate for Eurodollar deposit is higher than for US domestic deposit since there is noreserve requirement for Eurodollar deposit nor premium insurance.7.The emergence of Eurodollar is due to the deficit of American balance of payments The accumulationof huge deficit and the outflow of large amount of US dollar resulted in substantial increase of Eurodollar deposits.8.The brokers or dealers of American stock Exchange often borrow Eurodollars from Eurodollarmarket.9.The Eurodollar market is a short-term wholesale market of inter bank, it functions in Europe asproviding banks with liquidity like the federal fund market in USA.10.Banks put the money in the Eurodollar market when the liquidity is excessive and borrow moneywhen the liquidity is in squeeze.Lesson 10I. Part(1)1.the creation of money 2.cooperative /voluntarily 3.external/economic reforms4.the par value system5.on demand6.stable/predictable/disadvantages7.float8.quota subscriptions 9.needy/favorable 10.buying power/importsPart(2)1.subsidize 2. internal 3.bargain 4.peg 5.payments 6.assistance/sufficient7.stabilizing/strengthening 8.repay/repayment period 9.effectively11.lower/export/governmentII. Translation:1.The fund shows great concern over the internal economic policies of its member countries.2.The Fund is a cooperative institution, overseeing/supervising and monitoring the foreign exchangepolicies its member countries.3.The exchange of currency is the center of financial connection/relation among various countries, aswell as a dispensable tool of world trade.4.Due to constant fluctuation of exchange rate for major/leading currency, the dealers of foreignexchange may gain profit or suffer loss.5.The convertibility of currencies facilitates tourism, trade and investment in a worldwide scale.6.By analyzing the wealth and economic status of each member the fund determines the quotasubscription for each member. The richer the country is, the higher quota it Subscribes.7.Since the abandonment of the par value system, the membership of the Fund has agreed to allow eachmember to choose its own method of determine an exchange value for its money.8.Man large industrial nations allow their currencies to float, other countries peg the value of theircurrency to that of a major currency of a group of currencies so that, for example, as the U.S. dollar rises in value their own currencies rise too.9.The source of finance of the Fund mainly comes from the quota subscription of its member countriesat the same time, the Fund also borrows money from member governments or their monetary authorities.10.The Fund lends money according to regulation to the member countries with a payments problem,due to their expenditure in foreign exchange exceeding income.Lesson 11I. Part(1)1.catalyst 2.equity 3. creditworthy 4.reschedule/made 5.carry6.fourfold7.share8.foreign exchange9.attained 10.indexPart(2)1.productivity 2.affiliates 3.self-sustaining 4.call up 5.quota/economic strength6.a third/raised7.politicalitary/political9.enjoined 10.indexII Translation:1.The IBRD has more than 140 member countries, which all subscribe quotas to the bank.2.The IBRD gives loans only to creditworthy borrowing countries for the project that has a high realrates of economic return.3.The IDA gives loans only to poorest countries with a annual GNP per capita lower than $795.Actually, 80% of IDA’s loans are given to the countries with annual per capita GNP lower than $410.4.The IDA gives loans only to the government of the borrowing countries, with maturity of 50 years(repayable over 50 years) with grace period of 10 years, no interest.5.In the past decade, the volume of the IBRD’s loans have increased by fourfold.6.The IBRD has helped to develop agriculture, improve education, increase the output of energy,expand industry, create better urban facilities, promote family planning, extend telecommunications network, modernize transportation systems, improve water supply and sewerage facilities, and establish medical care.7.It’s hard to say that the IBRD’s decisions on loans are not influenced by the political character of theborrowing countries.8.Some of the earliest borrowing countries of the IBRD have graduated from the reliance on the IBRD’sloans, in return they become the provider of the IBRD’s finance source.9.The IBRD and IFC jointly provide funds for many projects.10.The more quota the member country subscribes, the more votes it gains.Lesson 12I . Part(1) 1.foster 2.raise 3.subregional/regional 4.multilateral 5.cost-effective6.evaluation7.weighted8.proportional9.paid in 10.developrnental Part(2) 1.equity 2.private 3.subscriptions 4.installment 5.subscribed6.coordinate7.procurement8.absorb9.pooling 10.bidsII. Translation:1.The purpose of the ADB is to provide fund and technical assistance to its developing membercountries in the Asia-Pacific region and to promote investment and foster economic growth.2.The shortage of capital, lack of skilled labor, poor technology, limited markets and the vagaries ofnature have impeded the economic development of the developing countries.3.The Bank’s Charter provides that the capital owned by the Asia-Pacific member countries should notbe less than 60% of total equity.4.Multilateral institution plays an important role in the economic development.5.The projects for bank financing are identified after strictly evaluated.6.The ADB keeps close working relationship with the United Nations as well as all kinds of specialinstitution.7.Some member countries in Asia-Pacific region voluntarily increase their subscriptions.8.The main subscribers of the ADB have no veto. In practice, decisions are reached by process ofdiscussion rather than by voting.9.The capital structure of the ADB is crucial/vital key to its loan/financing capacity.10.The ADB is authorized to make and guarantee loans to its member countries.Lesson 13I 1. surplus 2.surplus 3.deficit 4.capital 5.demand 6.supply 7.supply/demand8.outstanding 9.demand 10.supplyII. Translation:1.Just as a country’s domestic economy should have a financial record, a country’s authority should alsohave a statistical summery for all the external economic and financial transaction of its residents.2.The content of the balance of payments concept differs in different historical stage.3.In narrow sense, the balance of payments is defined as the receipts and payments arising frominternational trade or receipt and payments in foreign exchange.4.The balance of payments is a kind of statistic statement in the given period, which reflects thetransactions of goods, services and incomers of an economy.5.The statement of balance of payments is a kind of material that statistical financial transactions in thegiven period according to the form stipulated by IMF.6.The items entering into credit includes goods and services provided from abroad and so on.7.The items entering into debit includes goods and services obtained from abroad and so on.8.Receipts and payment arising from international trade is the most important item in current account,which comprise export and import of various commodities. Generally, the export and import of commodities account for the biggest proportion in the international transactions.9.Capital account reflects the changed of a country’s foreign assets and liabilities. The financial assethere doesn’t include monetary gold and Special Drawing Rights.10.In order to alter the deficits of our country’s balance of payments, the government adopts a series ofpolicies and measures, for examples, reduce domestic basis construction, adjust the structure of exporting and importing commodity, improve the environment for foreign investment, lower the exchange rate of our currency to the main currencies in the world, and so on.Lesson 14I .1.strike 2.The exchange rate 3.bank deposits 4.coordinates5.Arbitraggeurs6.discrepancies7.depreciation8.appreciation9.foreign exchange market 10.speculatorsII. Translation:1.It’s vitally important for those who are engaged in international finance to be aware of the tender offoreign exchange market.2.As long as the foreign exchange floats, there always exist the risks of change of foreign exchange rateand interest rate.3.The arbitrageurs make profits by taking advantage rate across markets to buy low and sell high.4.The buyers and sellers come to an agreement of transaction according to the exchange rate of twocurrencies.5. A greater demand for foreign goods and services means a greater demand for foreign exchange.6.The view that the price of us dollar will fall might note be wrong.7.If more people want to exchange pound into US dollar, the change of exchange rate is favorable to USdollar, and unfavorable to pound when the demand exceeds the supply.8.If the supply of certain goods is excessive, the demand for the goods will go down/decline.9.To devaluate a country’s currency can encourage export.10.There are tow ways to express foreign exchange rate.Lesson 15I. Part (1) 1. fluctuate 2.predictable 3.Capital flows 4.manufactured 5.speed6. refinements7.open/bonds/exchange8.devaluation9.nominal10.halvePart(2) 1.devalues 2.priced 3.demand 4.expectations 5.profit 6.fund7.closed 8.reduces 9.real 10.verticalII. Translation:。

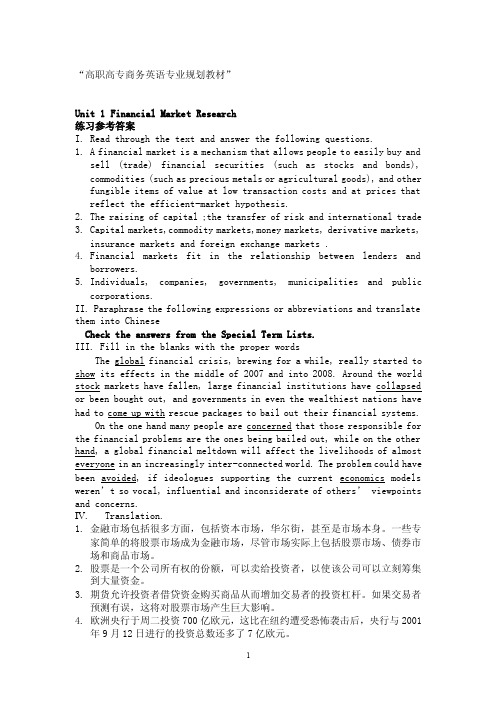

《金融英语》习题答案unit1-10

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

金融英语翻译

金融用英语怎么说finance和banking都是金融的英语。

1、finance。

读音:英[ˈfaɪnæns];美[fəˈnæns, faɪ-, ˈfaɪˌnæns]。

词性:n.和vt.。

做名词时意为金融,作动词时意为为…供给资金,从事金融活动;赊货给…;掌握财政。

变形:过去式:financed;过去分词:financed;现在分词:financing;第三人称单数:finances。

例句:The finance minister will continue to mastermind Poland's eco nomic reform.翻译:财政部长将继续策划波兰的经济改革。

2、banking。

读音:英[ˈbæŋkɪŋ];美[ˈbæŋkɪŋ]。

词性:n.和v.。

做名词时意为金融,做动词时意为堆积(bank的现在分词);筑(堤);将(钱)存入银行;(转弯时)倾斜飞行。

例句:His government began to unravel because of a banking scand al.翻译:他的政府由于一起金融丑闻而开始瓦解。

扩展资料金融的常见英文词组:financial ratios、financial stringency、financial ref orm。

1、financial ratios。

释义:财务比率。

中文解释:财务比率是财务报表上两个数据之间的比率,这些比率涉及企业管理的各个方面。

例句:Ratio analysis is the process of determining and evaluating fin ancial ratios.翻译:比率分析是指对财务比率进行决定和评价的过程。

2、financial stringency。

发音:[faɪˈnænʃ(ə)l ˈstrindʒənsi]。

释义:金融呆滞。

《金融英语》试卷(I卷)

常熟理工学院2012〜2013学年第二学期20XX 级后续课《金融英语》考查试卷(I 卷)试题总分:Part I Listening Comprehension©' 25=50')Section A Short ConversationsListe n carefully and choose the best an swer to the questi on after each conv ersatio n.1. Which of the following is NOT among the four major commercial banks of China?A. Ba nk of China.B. China Co nstruction Ba nk.C. I ndustrial and Commercial Ba nk of Chi na.D. The People's Bank of Chi na.2. Which of the following is NOT mentioned in the dialog?A. China Mercha nts Ban k.B. I ndustrial Ba nk Co., Ltd.C. China Citic Bank.D. Chi na Min she ng Banking Corp. Ltd. 3. What is the man accord ing to the dialog?A. A bank man ager.B. A clerk of a foreig n bank.C. A uni versity stude nt.D. A teacher from a college.4. Which of the followi ng has the right to decide the preside nt of BOC?A. The shareholders.B. The shareholders' meet ing.C. The Board of Directors.D. The Preside nt Office.5. A. The man lost his checkbooks.B. The man lost his passport.C. The man lost his password.D. The man lost his passbook. 6. A. Hous ing loa n.B. Foreig n curre ncy loa n.C. Dollar loa n.D. Credit loa n. 7. A. Jan uary 24. B. February 31. C. Jan uary 25. D. February 26.8. A. Payme nt by dema nd drafts. B. Payme nt by collectio n.C. Payme nt by letters of credit.D. Payme nt by remitta nee. 9. A. To avoid problems aris ing from in flatio n.B. To preve nt possible fraud.C. To avoid problems aris ing from fluctuati ons of excha nge rate.D. To preve nt overdraw ing. 10. A. In spect ion certificate. B. Certificate of origi n. C. In sura nee policy. D. Bill of ladi ng.Section B Long ConversationListe n to the conv ersati on carefully and choose the best an swer to each of the questio ns below.11. Which of the following statements was mentioned in the magazine The Banker?A. BOC ranked the 9th amo ng the world's top 1,000 banks in 2007.B. BOC is one of the four big commercial banks of China.C. The developme nt of BOC is un believable.D. The top man ageme nt of BOC is young and effective. 12. What are the main sect ions un der the top man ageme nt of BOC?A. Corporate banking sect ion and retail banking sect ion.B. Security sect ion and supervisory sect ion.C. Operati onal sect ion and supervisory sect ion.D. Audit ing sect ion and in spect ion secti on. 13. Which do you think is NOT the duty of the supervisory section?A. Audit ing the ban k's acco un ts.B. Han dli ng gen eral affairs.C. Being resp on sible for the security of the ban k..D. Oversee ing the banking operati on. 14. What is the bus in ess scope of the operati onal secti on?A. Banking bus in ess.B. Gen eral bus in ess.C. Support ing bus in ess.D. All items men ti oned above.15. Which of the followi ng is NOT men ti oned among the bus in esses offered by BOC?A. Retail banking.B. Docume ntary letter of credit.C. On li ne banking or e-ba nking.D. Finan cial advisory service. Section C PassagesDirecti ons: In this sect ion, you will hear three short passages. At the end of each passage, you will hear some questi ons. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D. The n mark the corresp onding letter on the ANSWER SHEET with a si ngle line through the cen ter.Passage One16. A. 1992 B. 1993 C. 1994 D. 199517. A. The People's Bank of China. B. China Foreig n Excha nge Tradi ng Cen ter.C. I nter-ba nk Foreig n Excha nge Market.D. The State Admi nistratio n of Foreig n Excha nge.18. A. 1%0.3% C. 0.5% Passage Two19. A. High risk. B. A type of credit product. 20. A. Collateral loan. B. Educati on loa n.21. A.1952 B.1958 D. 0.4% C. High in terest. D . A ki nd of revolvi ng loa n C. Mortgage loa n. D . Commercial loa n. C.1962 D . 1968C. Public con fide nce in the in surers rema ined low.D. A rise in Tokyo stock helped improve the bala nce sheets of life in surers.Part II. Reading Comprehension (30 ')Section A (1 '*10=10 ')Directions: Each of the following sentences is provided with four choices. Choose the one that best completes the sentence.26. Although the compa ny showed a profit, the bala nce sheet looks in creas in gly .A. brightB. dimC. shallowD. fragile 27. _ money refers to curre ncy issued on the basis of ban k's credit in stead of gold reserve. A. Fair B. Fiduciary C. FixedD. Deposit 28. In creased flows of world capital inten sify finan cial competiti on among n ati ons. This trend places pressures on n ati onal gover nment to their domestic markets and liberalize intern ati onal capital moveme nts.A. removeB. settleC. deregulateD. con trol 29. Many finan cial tran sacti ons are _ sheet items such as in terest rate swaps and are not clearly ide ntified through the usual report ingcha nn els.A. zeroB. capitalC. off-bala nceD. major30. The ban kers _ the steel compa ny's new shares, which means the share issue will be sold to the ban kers in stead of the public directly. A. un derwrite B. un dercharge C. un dertakeD. un derestimate 31. With no in terest rate _ on deposits or restrict ions on maturities, banks can offer any deposit product customers dema nd. A. cutB. ceili ngsC. dema ndD. con tract 32. From ban k's perspective, liabilities have become more in terest elastic, so that small rate cha nges can produce large fluctuati ons in bala nces.A. outsta ndingB. outreach ingC. rema iningD. dema nding33. Checks are attractive because they are readily accepted and provide formal _______________ of payment. A. credit B. verificati onC. clarityD. collectio n 34. Normally, ____ capital loans are secured by accounts receivable or by pledges of inventory and carry a floating interest rate on theamounts actually borrowed aga inst the approved credit line.A. curre ntB. stockC. work ingD. Ion g-term35. Dealers in gover nment and private securities n eed short-term financing to purchase new securities and carry their exist ing portfolios ofsecurities un til those securities are sold to customers or reach ________ .A. bus in essB. marketsC. maturityD. objectiveSection B (2*10=20 * Directi ons: Read the passages and choose the right an swer for each questio n.Passage 1Text ?36. How many types of banks or banking in stitutio ns are men ti oned in the lecture?A. 5.B. 4.C. 52.D. 183.37. Which of the follow ing is NOT a join t-equity commercial bank? A. China Min she ng Ba nki ng Corp. Ltd. B. Bank of East Asia.C. China Citic Bank.D. Bank of Commun icati ons.38. How many bran ches and sub-bra nches have foreig n banks set up in China accord ing to the speaker?A. 264.B. 177.C. 183.D. 235. 39. Which of the follow ing was once ran ked amon gst the top three stron gest banks in Chin a's mainland?A. Chi na In dustrial Ba nk.B. Ba nk of East Asia.C. China Mercha nts Ba nk.D. Sha nghai Pudo ng Developme nt Ban k.40. Which of the following is a wholly foreign-owned bank?A. Chi na Min she ng Ba nki ng Corp., Ltd.B. Chi na Citic Bank.C. Hong Kong & Shan ghai Banking Corporati on Limited.D. China Export & Import Bank.Passage 2Liabilities are "outsider claims ” , whiche economic obligations, debts payable to outsiders. These outside parties are called creditors.Financial statement users such as creditors are interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more curre nt it is. Liabilities that must be paid on the earliest future date create the greatest stra in on cash. Therefore, the bala nce sheet lists liabilities in the order in which they are due. Knowing how many of a bus in ess's liabilities are curre nt and how many are Ion g-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications: current liabilities and Iong-term liabilities.Current liabilities are debts that are due to be paid with in one year or with the en tity's operati ng cycle. Notes payable due with in one year, salary 22. A. It is a ki nd of short-term loa n.C. It is supposed to pay back at one time.Passage Three23. A. A rise in Tokyo stock.B. It is also called bridge loa n. D. Its maturity exceeds five years.C. Negative spread.24. A. Rise. B. Fall. 25. A. The value of outsta nding policies went dow n. B. Japa n's life in sura nee firms. D. Japa nese life in surers' difficult situati on.C. Rema in un cha nged.D. Not sure. B. Life in surers' n egative spreads ten ded to grow small.payable, unearned reve nue, and in terest payable owed on no tes payable are curre nt liabilities.Long-term liabilities are those liabilities other than current ones.41. The liabilities are classified as current or Iong-term liabilities according to _ .A. the liquidity of the liabilityB. the future date when the liability must be paidC. the operati ng cycleD. one year42. Liabilities are __ .A. money borrowed from banksB. money received from creditorsC. "outsider claims ” which are economic obligations, debts payable to outsidersD. notes receivable43. Which of the followi ng is current liability?A. cashB. inventoryC. salary payableD. money from the bank44. Which of the following is Iong-term liability?A. debt payable due with 10 yearsB. inven toryC. unearned revenueD. note payable due withi n 6 mon ths45. For a note payable to be paid in in stallme nts with in 5 years, which of the follow ing stateme nts is correct?A. The first installment due within one year is a current liability.B. The first installment due within one year is a Iong-term liability.C. All the in stallme nts due are Ion g-term liabilities.D. All the in stallme nts due are curre nt liabilities.Part ill. Translation (2‘ *=10')Part IV. Writing (10 ')Directions: You are asked to write a report on Bank of China with 120 words to make the brief introduction of BOC s orga ni zati ons and developme nt.。

电大专科金融《英语I(1)》试题及答案1.doc

中央广播电视大学2010-2011学年度第二学期“开放专科”期末考试英语工(1) 试题注意事项一、将你的学号、姓名及分校(工作站)名称填写在答题纸的规定栏内。

考试结束后,把试卷和答题纸放在桌上。

试卷和答题纸均不得带出考场。

监考人收完考卷和答题纸后才可离开考场。

一、仔细读懂题目的说明,并按题目要求答题。

答案一定要写在答题纸的指定位置上,写在试卷上的答案无效。

三、用蓝、黑圆珠笔或钢笔答题,使用铅笔答题无效。

第一部分交际用语(共计10分,每小题2分)1-5题:阅读下面的小对话,判断答语是否恰当,恰当的选A(Right).不恰当的选B( Wrong).并将答案写在答题纸上。

1.- What do you do?-1 work in insurance.A.Right B.Wrong2. - How about going to an estate agent?- Yes, that's a good idea.A.Right B.Wrong3. - Excuse me, where is the nearest bank, please?-It's not sure.A.Right B.Wrong4.- Are you free on Friday?- No, I'm sorry.A.Right B.Wrong5.-What do you think of the invitations?- That's a good idea.A.Right B.Wrong第二部分词汇与结构(共计40分,每小题2分)6-25题:阅读下面的句子,从A.B.C三个选项中选出一个能填入空白处的最佳选项,并在答题纸上写出所选项的字母符号。

6. He works in____office in London.A.a B.anC.the7. London is——capital of Britain, and it is——great city, too.A.a,the B.the,/C.the,a8. I have a sandwich --------lunch.A. forB. inC. to9. This is my new watch. It was a present___ my wife.A. withB. fromC. to10. I'm hungry. Could you get a sandwich for --------, please?A. IB. myselfC. me11. Who is that man over there? Do you know -------name?A. heB. hisC. him12. She likes swimming, but he --------.A. is notB. don'tC. doesn't13. I think there will ----------50 people at tomorrow's party.A. beB. beingC. are14. He--------in Beijing, but his parents---------in Hangzhou.NA. live, livesB. lives, liveC. live, live15. It --------- heavily here at this moment.A. rainB. rainsC. is raining16. My husband doesn't -------- shopping, but I like it very much.A. likeB. likesC. likes to17. Who are those ----------? Do you know their names?A. manB. womanC. men18. I don't need ------- coffee, thanks.A. someB. anyC. /19. Would you like to---- a reservation for dinner in the restaurant this evening?A. makeB. giveC. hold20. -1 have got a pain in my chest.-You --------- to see the doctor.' A. have B. needC. should21. Which is -------, the Yangtze River or the Yellow River?A. a bit longB. longerC. more long22. She is-----------at training than me.A. goodB. betterC. best23. -----------do I get to the bus station?A. WhatB. WhereC. How24. ---------rice do you want to buy?A. How muchB. How manyC. How often25. - I haven't got a car.- Neither ---------- IA. haveB. doC* am第三部分句型变换(共计15分,每小题3分)26-30小题:根据括号里的提示或利用括号里的词语改写下列句子,并将答案写在答题纸上。

与金融的英语单词

与金融的英语单词与金融有关的英语单词金融是现代比较大的一个经济体,经常会左右世界的经济发展趋势。

下面,我们来看一些金融相关的英语单词吧。

1).economy n.经济If you want to be acquainted with the development of economy in China, you can read some books about economics 如果你想对中国的.经济发展有所了解,你可以读一些经济学方面的书籍。

2).macroeconomics n.宏观经济学l cant tell the difference between macroeconomics and microeconomics.我说不出宏观经济学和微观经济学之间的区别。

3).depression n.萧条期,经济衰退As far as l know, many people lost their jobs during the great depression据我所知,许多人在大萧条时期丢了工作。

4).stagnant adj.停滞的,萧条的He complained that his business was stagnant at present他抱怨说目前生意不景气。

5).revitalize v.使恢复生机Anyway we should take measures to revitalize industry不管怎样我们都应该采取措施振兴工业。

6).prosper v.繁荣,兴旺After he got married, his family began to prosper结婚后,他的家开始兴旺发达起来。

7).finance n.资金,金融An expert in finance will tell you how to manage your money 财务专家会告诉你如何理财8).capital n.资金,资本In order fo collect enough capital to build a factory. he turned to his uncle for help为了筹集到足够的资金建工厂,他向他叔叔求助。

金融用英语怎么说

金融用英语怎么说金融指货币的发行、流通和回笼,贷款的发放和收回,存款的存入和提取,汇兑的往来等经济活动。

那么你知道金融用英语怎么说吗?下面来学习一下吧。

金融英语说法1:finance金融英语说法2:banking金融的相关短语:金融机构financial institution ; banking institution ; The Financial Institutions ; monetary institution金融市场 Financial market ; money market ; monetary market ; ING Financial Markets金融危机 financial crisis ; monetary crisis ; Economic crisis ; financial turmoil金融资产 Financial asset ; Monetary assets ; Capital markets ; FVTPL金融工具financial instruments ; Derivative Financial Instruments ; monetary instrument ; financial tool金融区 Financial District ; Canary Wharf金融学 Finance ; MSc Finance ; MSc in Finance ; fianc金融期货financial futures ; FITF ; haha financial futures ; Financial Ftres金融信用 credit ; Consumer Credit ; Lending industry ; Bank credit金融的英语例句:1. His government began to unravel because of a banking scandal.他的政府由于一起金融丑闻而开始瓦解。

《金融英语听说》Unit1

Unit 1Short DialogsMultiple ChoicesDialog 1W: Hi, Mike. Why do you look puzzled?M: I’ve learnt that there are four big commercial banks in your country.Would you please tell me what they are?W: Yes, it is a pleasure. They are Bank of China, China Construction Bank,Industrial and Commercial Bank of China and Agricultural Bank ofChina.M: So, does CCB refer to China Construction Bank?W: I don’t see any reason why not. You can simply call them respectivelyBOC, CCB, ICBC and ABC.Question: Which of the following is NOT among the four major commercial banks of China? (D) 译文女:你好!麦克。

为什么一脸困惑呀?男:我知道你们国家有四大商业银行,请你告诉我是哪几家,好吗?女:行,乐意效劳。

这四大商业银行是中国银行、中国建设银行、中国工商银行和中国农业银行。

男:所以CCB 是指中国建设银行吗?女:一点不错。

你可以简单地分别称它们BOC, CCB, ICBC 和ABC。

Dialog 2M: It is reported that some joint-stock banks have been established in severalmajor cities.W: Exactly. They are allowed to offer various banking services to individualsand businesses just as the four big commercial banks do.M: You said it. Can you tell me some joint-stock banks?W: It is no sweat. China Minsheng Banking Corp. Ltd., China Citic Bank,Industrial Bank Co., Ltd., and Guangdong Development Bank are all joint stockbanks.M: What about Shenzhen Development Bank?W: Of course it is one of them.Question: Which of the following is NOT mentioned in their conversation? (A)译文男:有报道说在一些大城市已经建立了数家股份制银行。

金融英语教程 第一章

Be tempered with 使调和,使缓和

Risk has clearly not disappeared financial market. Global imbalances, sustained high oil prices and soaring levels of household indebtedness - each alone, or in combination- could impair future global growth. However, they are unlikely to materialize any time soon.

before class 课前预习 Preparation for the class

preview

Reading the text Finding out the new words Checking out the meanings of new words Trying to understand the main idea of the text Examining the Chinese concept of the professional financial term

Ordinary time study performance

2 If you don’t have 24 points (40%×60 points) for this part , you will not allowed to take the final exam.

What should you write on the cover of the exercise book as required:

金融专业英语词汇大全1金融英语

金融专业英语词汇大全1金融英语1. banker's bank 中央银行2. banker's guarantee 银行担保3. bank's buying rate 银行买入价4. bank's selling rate 银行卖出价5. banks with business dealing with the center中央银行的往来银行6. Barclay card 巴克莱银行信用卡7. base rate 基本汇价8. basis order 基差订单9. basis risk 基差风险10. bear market 熊市11. bear operation 卖空行为12. bear raiders 大量抛空者13. beneficial owner 受益所有人14. beneficiary of insurance 保险金受益人15. best-efforts offering 尽力推销(代销)发行16. bid and ask prices 买入和卖出价17. bid and ask spread 买卖差价18. bid price = buying price 买价19. bid-ask spread 递盘虚盘差价20. big board 大行情牌21. big slump 大衰退(暴跌)22. bill-paying services 代付帐款23. black market 黑市24. black market financing 黑市筹资25. black money 黑钱26. blanket mortgage 总括抵押27. block positioner 大宗头寸商28. blowout 畅销29. blue-chip stocks 蓝筹股30. board of arbitration 仲裁委员会31. board of governors 理事会32. bond fund 债券基金33. borrowing from affiliates 向联营公司借款34. borrowing power of securities 证券贷款能力35. borrowing risks 借款风险36. bought deal 包销37. bread and butter business 基本业务38. breadth index 宽度指数39. break-even 不亏不盈,收支相抵40. breakout 突破41. bridging finance 过渡性融资42. broker 经纪人,掮客43. brokerage 经纪人佣金44. brokerage 经纪业;付给经纪人的佣金45. brokerage firm 经纪商(号)46. broker's loan 经纪人贷款47. broking house 经纪人事务所48. building agreement 具有约束力的协定49. building tax (tax on construction)建筑税50. bullish 行情看涨51. business insurance 企业保险52. business risk 营业风险53. business savings 企业储蓄54. business tax 营业税55. business term loan 企业长期贷款56. bust-up risks 破产风险57. buyer's risks 买方风险58. call (option) 买方期权,看涨期权59. call and put options 买入期权和卖出期权60. call for funds 控股、集资61. call loan transaction 短期拆放往来62. call market 活期存款市场63. call money 拆放款64. call options on an equity 权益(证券)的买入期权65. call-options 认购期权66. cancellation 取消67. cancellation money 解约金68. cap 带利率上限的期权69. capital assets 资本资产70. capital lease 资本租赁71. capital market 信贷市场、资本市场72. capital resources 资本来源73. capital surplus 资本盈余74. capital transfer 资本转移75. capital turnover rate 资本周转率76. card issuing institution 发卡单位77. carefully selected applicant 经仔细选定的申请人78. cargo insurance 货物保险79. cash 现金,现款v.兑现,付现款80. cash a cheque 支票兑现81. cash account 现金帐户82. cash advance 差旅预支款83. cash against bill of lading 凭提单付现84. cash against documents(C.A.D.)凭单付现,凭单据付现金=document against cash85. cash and carry 付现自运;现金交易和运输自理;现购自运商店86. cash and carry wholesale 付现自运批发87. cash assets 现金资产88. cash audit 现金审核89. cash audit 现金审核,现金审计90. cash balance 现金余额,现款结存91. cash basis 现金制92. cash basis 现金制,现金基础93. cash basis accounting 现金收付会计制94. cash before delivery(C.B.D.)空货前付款,付款后交货,付现款交货95. cash bonus 现金红利96. cash book 现金簿;现金帐;现金出纳帐97. cash boy 送款员98. cash budget 现金预算END。

《金融专业英语》课件-Chapter 1 Finance Foundations

Fundamentals of finance(金融的原理)

Fundamentals of finance play a very important role in the present market-driven world. Starting from the process of production to distribution, the entrepreneur, as well as the company needs finance.

dividends and return on capital. 公司金融研究企业的投资、融资、收益分配

Corporate finance

Public finance

✓ finances of the government of the country or the state.

✓ government expenditure, effects of taxation, deficit financing and public borrowing.

✓ The medium-term financial needs generally last for a period of 1 year to 5 years.

✓ The long-term financial need is generally to make an investment in the fixed assets such as plants, machines and buildings.

✓ savings, earnings, spending, and investing. ✓ life insurance, home insurance, mortgages,

金融英语初级-1