金融机构管理课件2.09.第3章 习题

金融机构管理第九章中文版课后习题答案(1、2、3、6、11、12、13、16)

金融机构管理第九章课后习题部分答案(1、2、3、6、11、12、13、16)1. 有效期限衡量的是经济定义中资产和负债的平均期限。

有效期限的经济含义是资产价值对于利率变化的利率敏感性(或利率弹性)。

有效期限的严格定义是一种以现金流量的相对现值为权重的加权平均到期期限。

有效期限与到期期限的不同在于,有效期限不仅考虑了资产(或负债)的期限,还考虑了期间发生的现金流的再投资利率。

2.息票债券面值价值= $1,00利率= 0.10 每年付一次息到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.92593$92.59 $92.592 $1,100.00 0.85734$943.07 $1,886.15价格=$1,035.67分子= $1,978.74有效期限=1.9106= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.90909$90.91 $90.912 $1,100.00 0.82645$909.09 $1,818.18价格=$1,000.00分子= $1,909.09有效期限=1.9091= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.892$89.29 $89.292 $1,100.00 0.79719$876.91 $1,753.83价格=$966.20分子= $1,843.11有效期限=1.9076= 分子/价格b. 到期收益率上升时,有限期限减少。

c.零息债券面值价值= $1,00利率= 0.00到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.92593$0.00 $0.002 $1,000.00 0.85734$857.34 $1,714.68价格=$857.34分子= $1,714.68有效期限=2.000= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.90909$0.00 $0.002 $1,000.00 0.82645$826.45 $1,652.89价格=$826.45分子= $1,652.89有效期限=2.000= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.892$0.00 $0.002 $1,000.00 0.79719 $797.19 $1,594.39价格 = $797.19分子 =$1,594.39有效期限 =2.0000= 分子/价格d.到期收益率的变化不影响零息债券的有效期限。

金融机构管理练习题

Financial Institutions Management: A Risk Management Approach 5/e1 Why are Financial Intermediaries Special1 Financial intermediaries fulfill which of the following functions?A) BrokerageB) Asset transformationC) Savings providerD) All of the above.E) Only a and b above.2 The outlay in monetary expense to track the credit risk of borrowers is an exampleA) of liquidity cost.B) of monitoring cost.C) of price risk.D) of asset acquisition cost.E) agency cost.3 Actions that utilize the money supply in an effort to impact macroeconomic activity often are part ofA) fiscal policy.B) tax policy.C) monetary policy.D) credit allocation.E) redlining.4 The process of funding assets of one maturity with liabilities of another maturity is calledA) size intermediation.B) denomination intermediation.C) credit allocation.D) payment intermediation.E) maturity intermediation.5 The central bank directly controls the portion of money known asA) inside money.B) outside money.C) international money.D) M2.E) M3.6 Regulations supporting the lending to socially important sectors of the economy isA) safety and soundness regulation.B) monetary policy regulation.C) credit allocation regulation.D) entry regulation.E) consumer protection regulation.7 The most dramatic increase in the share of assets in FIs in the U.S. has been inA) investment companies.B) thrift institutions.C) commercial banks.D) mortgage companies.E) insurance companies.8 Protection against the risk of FI failure is a function ofA) safety and soundness regulation.B) monetary policy regulation.C) credit allocation regulation.D) entry regulation.E) consumer protection regulation.9 The risk that managers will take actions that are in their best interests, but knowingly not in the best interests of the firm, results inA) negative externalities.B) economies of scale.C) agency costs.D) price risks.E) market entry costs.10 Excluding potential financial service customers from the marketplace is know asA) credit allocation.B) redlining.C) agency costs.D) diversification.E) delegated monitoring.2 The Financial Services Industry: Depository Institutions1The largest group of depository institutions in size isA) insurance companies.B) securities firms.C) commercial banks.D) pension funds.E) finance companies.2 A bank that has assets under $1 billion is usually considered to be aA) regional bank.B) money center bank.C) super-regional bank.D) community bank.E) wholesale bank.3 The primary sources of funds for commercial banks areA) NOW accounts.B) transaction accounts.C) money market mutual funds.D) all of the above.E) only a and b of the above.4 An item that moves onto the asset side of the balance sheet when a contingent event occursisA) an off-balance-sheet liability.B) a derivative contract.C) an off-balance-sheet asset.D) a negotiable certificate of deposit.E) none of the above.5 Legislation that prohibited commercial banks from underwriting securities, except in very limited situations, is theA) 1982 Garn-St Germain Depository Institutions Act.B) 1933 Glass-Steagall Act.C) 1978 International Banking Act.D) 1987 Competitive Equality in Banking Act.E) 1927 McFadden Act.6 The main regulator(s) of savings associations is(are)A) FDIC-BIF fund.B) Office of Thrift Supervision.C) FDIC-SAIF fund.D) All of the above.E) b and c above.7 The process of deposit withdrawal, usually because of lower interest rates paid by FIs, for reinvestment elsewhere is calledA) disintermediationB) regulator forebearance.C) Regulation Q ceilings.D) off-balance-sheet financing.E) none of the above.8 The portion of the income statement that reflects money set aside for possible future credit losses isA) the reserve for loan losses.B) net interest income.C) non interest expense.D) the provision for loan losses.E) net interest margin.9 A commercial bank has earning assets of $1 billion which earn an average rate of 7 percent. The assets are funded by interest bearing liabilities of $800 million which cost 4 percent. Noninterest income is $18,000,000 and noninterest expense is $28,000,000. No money is set aside for future chargeoffs. What is the net interest income for the bank?A) $70,000,000B) $32,000,000C) $38,000,000D) $56,000,000E) $40,000,00010 A commercial bank has earning assets of $1 billion which earn an average rate of 7 percent. The assets are funded by interest bearing liabilities of $800 million which cost 4 percent.Noninterest income is $18,000,000 and noninterest expense is $28,000,000. No money is set aside for future chargeoffs. What is the earnings before tax?A) $22,000,000B) $28,000,000C) $46,000,000D) $30,000,000E) $60,000,000The Financial Services Industry: Insurance Companies(See related pages)第3章The Financial Services Industry: Insurance Companies1 The class or line of life insurance that is the most dominant isA) endowment life.B) ordinary life.C) variable life.D) term life.E) whole life.2 A life insurance policy that combines pure insurance with a savings element for some specified period of time isA) endowment life.B) ordinary life.C) variable life.D) term life.E) whole life.3 Life insurance companies concentrate their asset investmentsA) in money market investments.B) in real estate investments.C) in policy loans.D) at the longer end of the maturity spectrum.E) at the shorter end of the maturity spectrum.4 The legislation that confirms the primacy of state regulation of life insurance companies is theA) Garn-St Germain Depository Institutions Act of 1982.B) Glass-Steagall Act of 1933.C) McCarran-Ferguson Act of 1945.D) Competitive Equality in Banking Act of 1987.E) McFadden Act of 1927.5 Insurance guaranty fundsA) are administered by the insurance companies.B) maintain a permanent reserve to resolve failures.C) require homogeneous contributions by insurers across states.D) all of the above are correct.E) only two of the above are correct.6 When comparing life versus PC insurers, PC insurersA) have more certain payouts on their insurance contracts.B) maintain loss reserves because premiums generally exceed claims.C) hold long-term assets to match the maturity of long-term liabilities.D) generally realize premium payments coincidental with claims.E) realize more than one of the above items.7 The actuarial predictability of losses relative to the premiums earned for PC insurers is dependentA) on the fact that liability lines are more predictable than property lines.B) on the fact that high severity, low frequency lines are more predictable than low-severity, high-frequency lines.C) on the underlying inflation risk of the economy, especially for liability lines.D) on the underlying inflation risk of the economy, especially for property lines.E) on more than one of the above items.8 A performance measure that reflects the losses incurred to the premiums earned isA) the operating ratio.B) the combined ratio.C) the expense ratio.D) the dividend ratio.E) the loss ratio.9 A performance measure that reflects the overall average profitability of PC insurers isA) the operating ratio.B) the combined ratio.C) the expense ratio.D) the dividend ratio.E) the loss ratio.10 The tendency of profits in the PC industry to follow a cyclical pattern is described as theA) interest-rate cycle.B) underwriting cycle.C) catastrophe cycle.D) economic cycle.E) business cycle.The Financial Services Industry: Securities Firms and Investment Banks(See related pages)第4章The Financial Services Industry: Securities Firms and Investment Banks1 Securities firms that service both retail and corporate customers are calledA) discount brokers.B) broker-dealers.C) national full-line firms.D) corporate finance firms.E) regional securities firms.2 First-time equity securities issues of companies as public offerings are calledA) private placements.B) IPOs.C) best-efforts underwriting.D) firm commitment underwriting.E) market making.3 Creating a secondary market in an asset by a securities firm or investment bank isA) a principal transaction.B) an agency transaction.C) firm commitment underwriting.D) market making.E) best efforts underwriting.4 Buying an asset in one market at one price and selling it immediately in another market at another price is calledA) program trading.B) position trading.C) pure arbitrage trading.D) risk arbitrage trading.E) principal transaction trading.5 The primary asset of broker-dealers isA) receivables from other broker-dealers.B) reverse repurchase agreements.C) long positions in securities and commodities.D) repurchase agreements.E) securities and commodities sold short for future delivery.6 The primary source of funds of broker-dealers isA) receivables from other broker-dealers.B) reverse repurchase agreements.C) long positions in securities and commodities.D) repurchase agreements.E) securities and commodities sold short for future delivery.7 The primary regulator of the securities industry isA) New York stock Exchange.B) National Association of Securities Dealers.C) National Securities Markets Improvement Act of 1996.D) Securities and Exchange Commission.E) Office of the Comptroller of the Currency.8 The process of registering new issues with the SEC for sale up to two years in the future is calledA) a firm commitment offering.B) a best efforts offering.C) a shelf-offering.D) a global issue.E) either a or d above.9 Investment banking includesA) corporate finance activities such as restructuring existing corporations.B) corporate finance activities such as advising on mergers and acquisitions.C) raising debt and equity securities for corporations.D) all of the above.E) only two of the above.10 Creating trades for customers without offering investment advice is the job ofA) discount brokers.B) broker-dealers.C) national full-line firms.D) corporate finance firms.E) regional securities firms.The Financial Services Industry: Mutual Funds(See related pages)第5章The Financial Services Industry: Mutual Funds1 FIs that pool financial resources and invest in diversified portfolios of assets areA) mutual funds.B) open-ended mutual funds.C) bond funds.D) equity funds.E) all of the above.2 A mutual fund that stands ready to sell new shares to investors and to redeem outstanding shares on demand isA) a bond fund.B) an equity fund.C) an open-ended fund.D) a closed-end fund.E) a hedge fund.3 Mutual funds that invest in short-term securities are calledA) hedge funds.B) bond funds.C) equity funds.D) money market funds.E) hybrid funds.4 Adjusting the balance sheet asset values to reflect current market values is calledA) asset valuation.B) marking-to-market.C) determining NAVs.D) risk minimization.E) two of the above are correct.5 A mutual fund that charges a sales charge or fee isA) a hybrid fund.B) a no-load fund.C) a load fund.D) an open end fund.E) a REIT.6 The primary regulator of mutual funds isA) The Investment Advisors Act.B) The Glass-Steagall Act.C) The National Securities Markets Improvement Act.D) The Securities and Exchange Commission.E) The U.S.A. Patriot Act.7 A mutual fund has 100 share of ABC Company that currently trades at $12 per share and 200 shares of XYZ Company that trades at $8 per share. If the fund has 50 shares, what is the net asset value of the fund?A) $56.00B) $24.00C) $32.00D) $20.00E) $28.008 Marketing and distribution costs of no-load funds are calculated as a small percentage of assets and are calledA) back-end loads.B) net asset values.C) management fees.D) load fees.E) 12b-1 fees.9 A fund that specializes in the purchase of real estate company shares is calledA) a closed-end investment company.B) a load fund.C) a real estate investment trust.D) bond fund.E) fixed-asset fund.10 Household mutual fund owners have which of the following characteristics?A) Most are short-term owners.B) Most owners were born before 1946.C) Most mutual fund owners are retired.D) Few mutual fund holders own common stocks outright.E) None of the above.The Financial Services Industry: Finance Companies(See related pages)第6章The Financial Services Industry: Finance Companies1 The primary function of finance companies is to lend moneyA) through credit cards.B) to corporations.C) to government organizations.D) to individuals.E) b and d are correct.2 The first major finance company wasA) Household Finance.B) Sears Roebuck Acceptance Corporation.C) General Electric Capital Corporation.D) Ford Motor Credit.E) Bank of America.3 A finance company that makes loans to the customers of a particular retailer or manufacturer is called aA) business credit institution.B) personal credit institution.C) sales finance institution.D) factoring company.E) captive finance company.4 A finance company that makes loans to corporations, especially through leasing or factoring, is called aA) business credit institution.B) personal credit institution.C) sales finance institution.D) factoring company.E) captive finance company.5 A finance company that makes loans for the purchase of products manufactured by the parent is called aA) business credit institution.B) personal credit institution.C) sales finance institution.D) factoring company.E) captive finance company.6 A finance company that lends to high-risk customers is aA) loan shark companyB) personal credit institution.C) sales finance institution.D) subprime lender.E) captive finance company.7 Mortgages that are packaged and used as assets backing secondary market securities areA) residential mortgage loans.B) securitized mortgage assets.C) commercial mortgage loans.D) senior debt.E) subordinated debt.8 The primary assets held by finance companies areA) consumer loans.B) real estate loans.C) business loans.D) all of the above.E) a and c above.9 The primary funding source for finance companies isA) equity.B) long-term notes and bonds.C) commercial paper.D) bank loans.E) repurchase agreements.10 The primary regulator of finance companies isA) the Federal Reserve Bank.B) state banking commissions.C) state insurance commissions.D) the Office of Thrift Supervision.E) no one.Risks of Financial Intermediation(See related pages)第7章Risks of Financial Intermediation1 The risk that occurs when the maturities of an FI's assets and liabilities are mismatched isA) credit risk.B) operational risk.C) liquidity risk.D) interest rate risk.E) market risk.2 The risk that occurs when, in the trading of assets, prices change because of changes in interest rates or exchange rates isA) credit risk.B) operational risk.C) liquidity risk.D) interest rate risk.E) market risk.3 The possibility that promised cash flows on financial claims will not be paid in full isA) credit risk.B) operational risk.C) liquidity risk.D) interest rate risk.E) market risk.4 Risk diversification limits the possibilities of bad outcomes in the portfolio by reducingA) off-balance-sheet risk.B) firm-specific credit risk.C) systematic credit risk.D) operational risk.E) technology risk.5 The risk that asset investments do not produce the anticipated cost savings isA) off-balance-sheet risk.B) firm-specific credit risk.C) systematic credit risk.D) operational risk.E) technology risk.6 The risk of loss due to the failure of internal processes isA) off-balance-sheet risk.B) firm-specific credit risk.C) systematic credit risk.D) operational risk.E) technology risk.7 The ability to lower the average costs of production is possible withA) economies of scale.B) economies of scope.C) foreign exchange risk.D) sovereign risk.E) liquidity risk.8 The inability of an FI to meet the demands of liability holders or asset claimants isA) economies of scale.B) economies of scope.C) foreign exchange risk.D) sovereign risk.E) liquidity risk.9 The risk that a borrower may not be able to make payments on a contractual obligation because of interference by an outside governmental party isA) economies of scale.B) economies of scope.C) foreign exchange risk.D) sovereign risk.E) liquidity risk.10 The risk that asset and/or liability values and profitability can be affected by changes in the relationship between the currencies of two or more countries isA) economies of scale.B) economies of scope.C) foreign exchange risk.D) sovereign risk.E) liquidity risk.第8章Interest Rate Risk1 The interest rate risk model that concentrates on the impact of interest rate changes on an FI's net interest income isA) the duration model.B) the maturity model.C) the repricing model.D) the simulation model.E) the immunization model.2 The difference between the dollar amount of assets whose interest rates will change and the dollar amount of liabilities whose interest rates will change when market rates change in some given time window isA) rate sensitive assets.B) the repricing gap.C) rate-sensitive liabilities.D) the duration gap.E) the maturity gap.3 Perfect Bank has a repricing gap of -$400 million. Interest rates are expected to increase 1 percent. What will be the impact on the bank's net interest income?A) +$4,000,000B) -$2,000,000C) +$2,000,000D) -$4,000,000E) Can't tell because we don't know the amount of rate sensitive assets or rate sensitive liabilities.4 Imperfect Bank has rate-sensitive asset of $100 and rate-sensitive liabilities of $120. What is the repricing gap?A) -$20B) +$20C) +$100D) +$220E) +$1205 When rate changes on RSAs are different from rate changes on RSLs,the impact on net interest income is known as theA) CGAP effect.B) spread effect.C) volume effect.D) market value effect.E) overaggegation effect.6 Ignoring information regarding the distribution of assets and liabilities within buckets when defining buckets over a range of maturities isA) the problem of runoffs.B) the problem of ignoring cash flows from off-balance-sheet activities.C) the problem of overaggregation.D) the problem of market value effects.E) the problem of mismatching cash flows.7 The approach to accounting that recognizes the true value of assets and liabilities over time isA) book value accounting.B) maturity value accounting.C) marking-to-market value accounting.D) market value accounting.E) origination value accounting.8 The difference between the weighted-average maturity of an FI's assets and liabilities is theA) rate sensitive assets.B) the repricing gap.C) rate-sensitive liabilities.D) the duration gap.E) the maturity gap.9 A measure of the life of an asset or liability that considers the present value of the cash flows isA) maturity value.B) duration.C) immunization.D) reinvestment risk.E) repricing risk.10 The process of constructing an FI's balance sheet so that any change in interest rates will affect the market value of assets and liabilities by equal dollar amounts is calledA) duration pricing.B) reinvestment risk pricing.C) immunization.D) maturity value pricing.E) regulatory pricing.Multiple Choice Quiz(See related pages)第9章Interest Rate Risk II1 A model of interest rate risk exposure that considers the degree of leverage on the balance sheet as well as the timing of the cash flows for liabilities and assets isA) the maturity gap.B) the repricing gap.C) the duration gap.D) the funding gap.E) the equity gap.2 A measure of the weighted-average time to maturity on an asset using the relative present values of the cash flows as weights isA) average maturity.B) duration.C) Monte Carlo simulation.D) the funding gap.E) none of the above.3 An FI has invested in a five-year zero coupon bond that is selling to yield 6 percent. What is the duration of this bond?A) Less than 5 years.B) More than 5 years.C) Exactly 5 years.D) Less than 5 years if using semiannual compounding.E) More than 5 years if using semiannual compounding.4 JKL FI has invested $400 in an asset with a duration of 2 years and $600 in an asset with duration of 4 years. What is the duration of the total assets?A) 3.0 years.B) 0.8 years.C) 2.4 years.D) 3.2 years.E) 6.0 years.5 Duration increases with the maturity of a fixed-income asset,A) but at a decreasing rate.B) but at a constant rate.C) but at an increasing rate.D) and can become infinite.E) but will never equal the maturity of the asset.6 The higher is the coupon or promised interest payment on a fixed-income asset,A) the higher is duration.B) the impact on duration cannot be determined.C) the lower is duration.D) the duration will eventually become negative.E) the rate has no effect on duration.7 A fixed-rate bond has a duration of 4.2 years. The bond is trading at a current yield to maturity of 8 percent. What is the modified duration of this bond?A) 4.20 years.B) 3.89 years.C) 4.54 years.D) 3.60 years.E) 4.90 years.8 Investing in an asset to achieve a specific future cash flow regardless of what happens to interest rates in the interim is calledA) immunization.B) fixed-rate asset selection.C) variable-rate asset selection.D) simulating the future cash flow.E) achieving negative duration.9 XYZ FI has a duration of 4.0 years for $1,000 million of assets, and a duration of 2.0 years for $900 million of liabilities. What is the leverage adjusted duration gap for this FI?A) 2.0 years.B) 3.0 years.C) 5.8 years.D) 2.2 years.E) 1.8 years.10 The effect of interest rate changes on the market value of an FI's equity is determined byA) the size of the interest rate shock.B) the size of the FI.C) the leverage adjusted duration gap.D) All of the above.E) Only two of the above.第10章Market Risk1 The securities portfolio of an FI that contains assets and liabilities that are relatively illiquid and are held for longer time periods isA) the trading portfolio.B) the investment portfolio.C) the loan book.D) the negotiable CD book.E) none of the above.2 The risk related to the uncertainty of an FI's earnings on its trading portfolio caused by changes in market conditions isA) liquidity risk.B) interest rate risk.C) credit risk.D) market risk.E) operational risk.3 The establishment of economically logical position minimums and maximums per security trader is which of the following reasons for market risk measurement?A) Management information.B) Performance evaluation.C) Regulation.D) Resource allocation.E) Setting limits.4 Considering the return-risk ratio of traders for the purpose of incentive compensation is which of the following reasons for market risk measurement?A) Management information.B) Performance evaluation.C) Regulation.D) Resource allocation.E) Setting limits.5 Market risk, as measured by daily earnings at risk, includes which of the following components?A) Potential adverse move in yield.B) Price sensitivity of the position.C) Dollar market value of the position.D) All of the above.E) Only two of the above.6 Price volatility includes which of the following components?A) Potential adverse move in yield.B) Price sensitivity of the position.C) Dollar market value of the position.D) All of the above.E) Only two of the above.7 A firm has $21,500 daily earnings at risk for 7 days. What is its 7-day market value at risk?A) $56,884B) $150,500C) $1,026D) $388E) $3,0718 The risk that reflects the comovement of a stock with a market portfolio and the volatility of the market portfolio isA) unsystematic risk.B) beta.C) systematic risk.D) standard deviation.E) covariance.9 A criticism of which of the following is the need to assume a normal or symmetric distribution for all asset returns?A) Back simulation.B) Risk Metrics.C) Monte Carlo simulation.D) CreditMetrics.E) Random analysis.10 In the BIS Standardized Framework, the product of the modified durations and the interest rate shocks reflectsA) vertical offsets.B) horizontal offsets.C) specific risk charges.D) general market risk charges.E) junk bond risk.第11章Credit Risk: Individual Loan Risk1 In the last two decades of the 1990s, credit quality of FIs has been affected byA) junk bonds.B) agricultural loans.C) loans to less developed countries.D) real estate loans.E) all of the above.2 A loan which is made and taken down immediately is aA) syndicated loan.B) loan commitment.C) spot loan.D) secured loan.E) commercial paper.3 Debt that is senior to other debt that has only a general claim on assets is aA) syndicated loan.B) loan commitment.C) spot loan.D) secured loan.E) commercial paper.4 Loans that have their contractual rates periodically adjusted to some underlying index areA) syndicated loans.B) secured loans.C) adjustable rate mortgages.D) commercial paper.E) revolving loans.5 Ceilings that reflect the maximum rate that FIs can charge on consumer and mortgage debt are imposed byA) federal legislation.B) state legislation.C) the OCC.D) the Federal Reserve BankE) the NCUA.6 A portion of a loan which a borrower may not use but which must be kept on deposit at the lending institution is aA) compensating balance.B) revolving credit line.C) loan commitment.D) minimum reserve requirement.E) loan origination fee.7 The risk that the borrower is unwilling or unable to fulfill the terms promised under the loan contract isA) market risk.B) default risk.C) interest rate risk.D) liquidity risk.E) price risk.8 The process of restricting the quantity of loans to an individual borrower isA) leverage lending.B) covenants.C) using implicit contracts.D) credit rationing.E) redlining.9 Which of the following borrower-specific factors involves the ratio of debt to equity?A) Reputation.B) Covenants.C) Leverage.D) Volatility of earnings.E) Collateral.10 Historic default risk experience often is referred to asA) credit scoring models.B) mortality rates.C) RAROC.D) implicit contracts.E) option models.Credit Risk: Loan Portfolio and Concentration Risk(See related pages)第12章Credit Risk: Loan Portfolio and Concentration Risk1 A method of measuring loan concentration by tracking credit ratings of firms in particular classes for unusual declines is known asA) concentration analysis.B) migration analysis.C) diversification analysis.D) minimum risk analysis.E) loan migration matrix.2 The vehicle used to reflect the historic experience of a pool of loans in terms of their credit-rating migration over time is aA) concentration analysis.B) migration analysis.C) diversification analysis.D) minimum risk analysis.E) loan migration matrix.3 The variables that are used in setting concentration limits includeA) the borrower's strategic plans.B) the economic projection by its economists.C) the operating units business plans.D) all of the above.E) a and b above.4 The combination of assets that reduces the variance of portfolio returns to the lowest feasible level is theA) efficient frontier.B) least cost portfolio.C) minimum risk portfolio.D) maximum return portfolio.E) dominant asset portfolio.5 The return on a loan in the KMV Portfolio Manager Model as measured by the all-in-spread includes measures ofA) annual fees.。

Chap002金融机构管理课后题答案

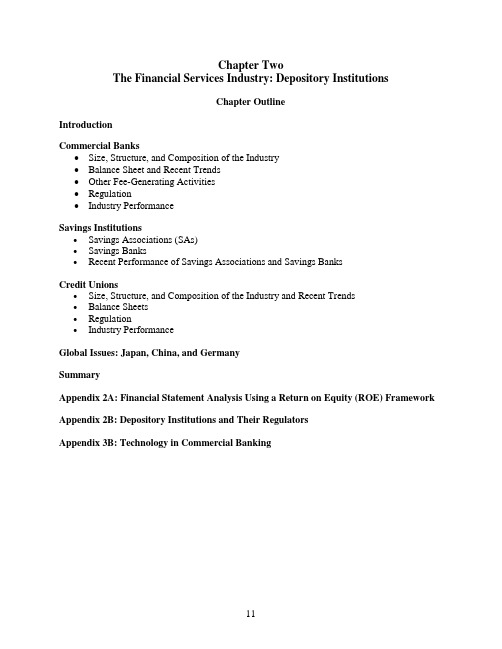

Chapter TwoThe Financial Services Industry: Depository InstitutionsChapter OutlineIntroductionCommercial Banks∙Size, Structure, and Composition of the Industry∙Balance Sheet and Recent Trends∙Other Fee-Generating Activities∙Regulation∙Industry PerformanceSavings Institutions∙Savings Associations (SAs)∙Savings Banks∙Recent Performance of Savings Associations and Savings BanksCredit Unions∙Size, Structure, and Composition of the Industry and Recent Trends∙Balance Sheets∙Regulation∙Industry PerformanceGlobal Issues: Japan, China, and GermanySummaryAppendix 2A: Financial Statement Analysis Using a Return on Equity (ROE) Framework Appendix 2B: Depository Institutions and Their RegulatorsAppendix 3B: Technology in Commercial BankingSolutions for End-of-Chapter Questions and Problems: Chapter Two1.What are the differences between community banks, regional banks, and money-centerbanks? Contrast the business activities, location, and markets of each of these bank groups. Community banks typically have assets under $1 billion and serve consumer and small business customers in local markets. In 2003, 94.5 percent of the banks in the United States were classified as community banks. However, these banks held only 14.6 percent of the assets of the banking industry. In comparison with regional and money-center banks, community banks typically hold a larger percentage of assets in consumer and real estate loans and a smaller percentage of assets in commercial and industrial loans. These banks also rely more heavily on local deposits and less heavily on borrowed and international funds.Regional banks range in size from several billion dollars to several hundred billion dollars in assets. The banks normally are headquartered in larger regional cities and often have offices and branches in locations throughout large portions of the United States. Although these banks provide lending products to large corporate customers, many of the regional banks have developed sophisticated electronic and branching services to consumer and residential customers. Regional banks utilize retail deposit bases for funding, but also develop relationships with large corporate customers and international money centers.Money center banks rely heavily on nondeposit or borrowed sources of funds. Some of these banks have no retail branch systems, and most regional banks are major participants in foreign currency markets. These banks compete with the larger regional banks for large commercial loans and with international banks for international commercial loans. Most money center banks have headquarters in New York City.e the data in Table 2-4 for the banks in the two asset size groups (a) $100 million-$1billion and (b) over $10 billion to answer the following questions.a. Why have the ratios for ROA and ROE tended to increase for both groups over the1990-2003 period? Identify and discuss the primary variables that affect ROA andROE as they relate to these two size groups.The primary reason for the improvements in ROA and ROE in the late 1990s may berelated to the continued strength of the macroeconomy that allowed banks to operate with a reduced regard for bad debts, or loan charge-off problems. In addition, the continued low interest rate environment has provided relatively low-cost sources of funds, and a shifttoward growth in fee income has provided additional sources of revenue in many product lines. Finally, a growing secondary market for loans has allowed banks to control the size of the balance sheet by securitizing many assets. You will note some variance inperformance in the last three years as the effects of a softer economy were felt in thefinancial industry.b. Why is ROA for the smaller banks generally larger than ROA for the large banks?Small banks historically have benefited from a larger spread between the cost rate of funds and the earning rate on assets, each of which is caused by the less severe competition in the localized markets. In addition, small banks have been able to control credit risk moreefficiently and to operate with less overhead expense than large banks.c. Why is the ratio for ROE consistently larger for the large bank group?ROE is defined as net income divided by total equity, or ROA times the ratio of assets to equity. Because large banks typically operate with less equity per dollar of assets, netincome per dollar of equity is larger.d. Using the information on ROE decomposition in Appendix 2A, calculate the ratio ofequity-to-total-assets for each of the two bank groups for the period 1990-2003. Whyhas there been such dramatic change in the values over this time period, and why isthere a difference in the size of the ratio for the two groups?ROE = ROA x (Total Assets/Equity)Therefore, (Equity/Total Assets) = ROA/ROE$100 million - $1 Billion Over $10 BillionYear ROE ROA TA/Equity Equity/TA ROE ROA TA/Equity Equity/TA1990 9.95% 0.78% 12.76 7.84% 6.68% 0.38% 17.58 5.69%1995 13.48% 1.25% 10.78 9.27% 15.60% 1.10% 14.18 7.05%1996 13.63% 1.29% 10.57 9.46% 14.93% 1.10% 13.57 7.37%1997 14.50% 1.39% 10.43 9.59% 15.32% 1.18% 12.98 7.70%1998 13.57% 1.31% 10.36 9.65% 13.82% 1.08% 12.80 7.81%1999 14.24% 1.34% 10.63 9.41% 15.97% 1.28% 12.48 8.02%2000 13.56% 1.28% 10.59 9.44% 14.42% 1.16% 12.43 8.04%2001 12.24% 1.20% 10.20 9.80% 13.43% 1.13% 11.88 8.41%2002 12.85% 1.26% 10.20 9.81% 15.06% 1.32% 11.41 8.76%2003 12.80% 1.27% 10.08 9.92% 16.32% 1.42% 11.49 8.70% The growth in the equity to total assets ratio has occurred primarily because of theincreased profitability of the entire banking industry and the encouragement of theregulators to increase the amount of equity financing in the banks. Increased fee income, reduced loan loss reserves, and a low, stable interest rate environment have produced the increased profitability which in turn has allowed banks to increase equity through retained earnings.Smaller banks tend to have a higher equity ratio because they have more limited assetgrowth opportunities, generally have less diverse sources of funds, and historically have had greater profitability than larger banks.3.What factors have caused the decrease in loan volume relative to other assets on thebalance sheets of commercial banks? How has each of these factors been related to the change and development of the financial services industry during the 1990s and early2000s? What strategic changes have banks implemented to deal with changes in thefinancial services environment?Corporations have utilized the commercial paper markets with increased frequency rather than borrow from banks. In addition, many banks have sold loan packages directly into the capital markets (securitization) as a method to reduce balance sheet risks and to improve liquidity. Finally, the decrease in loan volume during the early 1990s and early 2000s was due in part to the recession in the economy.As deregulation of the financial services industry continued during the 1990s, the position of banks as the primary financial services provider continued to erode. Banks of all sizes have increased the use of off-balance sheet activities in an effort to generate additional fee income. Letters of credit, futures, options, swaps and other derivative products are not reflected on the balance sheet, but do provide fee income for the banks.4.What are the major uses of funds for commercial banks in the United States? What are theprimary risks to the bank caused by each use of funds? Which of the risks is most critical to the continuing operation of the bank?Loans and investment securities continue to be the primary assets of the banking industry. Commercial loans are relatively more important for the larger banks, while consumer, small business loans, and residential mortgages are more important for small banks. Each of these types of loans creates credit, and to varying extents, liquidity risks for the banks. The security portfolio normally is a source of liquidity and interest rate risk, especially with the increased use of various types of mortgage backed securities and structured notes. In certain environments, each of these risks can create operational and performance problems for a bank.5.What are the major sources of funds for commercial banks in the United States? How isthe landscape for these funds changing and why?The primary sources of funds are deposits and borrowed funds. Small banks rely more heavily on transaction, savings, and retail time deposits, while large banks tend to utilize large, negotiable time deposits and nondeposit liabilities such as federal funds and repurchase agreements. The supply of nontransaction deposits is shrinking, because of the increased use by small savers of higher-yielding money market mutual funds,6. What are the three major segments of deposit funding? How are these segments changingover time? Why? What strategic impact do these changes have on the profitable operation of a bank?Transaction accounts include deposits that do not pay interest and NOW accounts that pay interest. Retail savings accounts include passbook savings accounts and small, nonnegotiable time deposits. Large time deposits include negotiable certificates of deposits that can be resold in the secondary market. The importance of transaction and retail accounts is shrinking due to the direct investment in money market assets by individual investors. The changes in the deposit markets coincide with the efforts to constrain the growth on the asset side of the balance sheet.7. How does the liability maturity structure of a bank’s balance sheet compare with thematurity structure of the asset portfolio? What risks are created or intensified by thesedifferences?Deposit and nondeposit liabilities tend to have shorter maturities than assets such as loans. The maturity mismatch creates varying degrees of interest rate risk and liquidity risk.8. The following balance sheet accounts have been taken from the annual report for a U.S.bank. Arrange the accounts in balance sheet order and determine the value of total assets.Based on the balance sheet structure, would you classify this bank as a community bank, regional bank, or a money center bank?Assets Liabilities and EquityCash $ 2,660 Demand deposits $ 5,939Fed funds sold $ 110 NOW accounts $12,816Investment securities $ 5,334 Savings deposits $ 3,292Net loans $29,981 Certificates of deposit $ 9,853Intangible assets $ 758 Other time deposits $ 2,333Other assets $ 1,633 Short-term Borrowing $ 2,080Premises $ 1,078 Other liabilities $ 778Total assets $41,554 Long-term debt $ 1,191Equity $ 3,272Total liab. and equity $41,554This bank has funded the assets primarily with transaction and savings deposits. The certificates of deposit could be either retail or corporate (negotiable). The bank has very little ( 5 percent) borrowed funds. On the asset side, about 72 percent of total assets is in the loan portfolio, but there is no information about the type of loans. The bank actually is a small regional bank with $41.5 billion in assets, but the asset structure could easily be a community bank with $41.5 million in assets.9.What types of activities normally are classified as off-balance-sheet (OBS) activities?Off-balance-sheet activities include the issuance of guarantees that may be called into play at a future time, and the commitment to lend at a future time if the borrower desires.a. How does an OBS activity move onto the balance sheet as an asset or liability?The activity becomes an asset or a liability upon the occurrence of a contingent event,which may not be in the control of the bank. In most cases the other party involved with the original agreement will call upon the bank to honor its original commitment.b.What are the benefits of OBS activities to a bank?The initial benefit is the fee that the bank charges when making the commitment. If the bank is required to honor the commitment, the normal interest rate structure will apply to the commitment as it moves onto the balance sheet. Since the initial commitment does notappear on the balance sheet, the bank avoids the need to fund the asset with either deposits or equity. Thus the bank avoids possible additional reserve requirement balances anddeposit insurance premiums while improving the earnings stream of the bank.c.What are the risks of OBS activities to a bank?The primary risk to OBS activities on the asset side of the bank involves the credit risk of the borrower. In many cases the borrower will not utilize the commitment of the bank until the borrower faces a financial problem that may alter the credit worthiness of the borrower.Moving the OBS activity to the balance sheet may have an additional impact on the interest rate and foreign exchange risk of the bank.e the data in Table 2-6 to answer the following questions.a.What was the average annual growth rate in OBS total commitments over the periodfrom 1992-2003?$78,035.6 = $10,200.3(1+g)11 g = 20.32 percentb.Which categories of contingencies have had the highest annual growth rates?Category of Contingency or Commitment Growth RateCommitments to lend 14.04%Future and forward contracts 15.13%Notional amount of credit derivatives 52.57%Standby contracts and other option contracts 56.39%Commitments to buy FX, spot, and forward 3.39%Standby LCs and foreign office guarantees 7.19%Commercial LCs -1.35%Participations in acceptances -6.11%Securities borrowed 20.74%Notional value of all outstanding swaps 31.76%Standby contracts and other option contracts have grown at the fastest rate of 56.39 percent, and they have an outstanding balance of $214,605.3 billion. The rate of growth in thecredit derivatives area has been the second strongest at 52.57 percent, the dollar volumeremains fairly low at $1,001.2 billion at year-end 2003. Interest rate swaps grew at anannual rate of 31.76 percent with a change in dollar value of $41,960.7 billion. Clearly the strongest growth involves derivative areas.c.What factors are credited for the significant growth in derivative securities activities bybanks?The primary use of derivative products has been in the areas of interest rate, credit, andforeign exchange risk management. As banks and other financial institutions have pursuedthe use of these instruments, the international financial markets have responded byextending the variations of the products available to the institutions.11. For each of the following banking organizations, identify which regulatory agencies (OCC,FRB, FDIC, or state banking commission) may have some regulatory supervisionresponsibility.(a) State-chartered, nonmember, nonholding-company bank.(b)State-chartered, nonmember holding-company bank(c) State-chartered member bank(d)Nationally chartered nonholding-company bank.(e)Nationally chartered holding-company bankBank Type OCC FRB FDIC SBCom.(a) Yes Yes(b) Yes Yes Yes(c) Yes Yes Yes(d) Yes Yes Yes(e) Yes Yes Yes12. What factors normally are given credit for the revitalization of the banking industry duringthe decade of the 1990s? How is Internet banking expected to provide benefits in thefuture?The most prominent reason was the lengthy economic expansion in both the U.S. and many global economies during the entire decade of the 1990s. This expansion was assisted in the U.S. by low and falling interest rates during the entire period.The extent of the impact of Internet banking remains unknown. However, the existence of this technology is allowing banks to open markets and develop products that did not exist prior to the Internet. Initial efforts have focused on retail customers more than corporate customers. The trend should continue with the advent of faster, more customer friendly products and services, and the continued technology education of customers.13. What factors are given credit for the strong performance of commercial banks in the early2000s?The lowest interest rates in many decades helped bank performance on both sides of the balance sheet. On the asset side, many consumers continued to refinance homes and purchase new homes, an activity that caused fee income from mortgage lending to increase and remain strong. Meanwhile, the rates banks paid on deposits shrunk to all-time lows. In addition, the development and more comfortable use of new financial instruments such as credit derivatives and mortgage backed securities helped banks ease credit risk off the balance sheets. Finally, information technology has helped banks manage their risk more efficiently.14. What are the main features of the Riegle-Neal Interstate Banking and Branching EfficiencyAct of 1994? What major impact on commercial banking activity is expected from this legislation?The main feature of the Riegle-Neal Act of 1994 was the removal of barriers to inter-state banking. In September 1995 bank holding companies were allowed to acquire banks in other states. In 1997, banks were allowed to convert out-of-state subsidiaries into branches of a single interstate bank. As a result, consolidations and acquisitions have allowed for the emergence of very large banks with branches across the country.15. What happened in 1979 to cause the failure of many savings associations during the early1980s? What was the effect of this change on the operating statements of savingsassociations?The Federal Reserve changed its reserve management policy to combat the effects of inflation, a change which caused the interest rates on short-term deposits to increase dramatically more than the rates on long-term mortgages. As a result, the marginal cost of funds exceeded the average yield on assets that caused a negative interest spread for the savings associations. Further, because savings associations were constrained by Regulation Q on the amount of interest which could be paid on deposits, they suffered disintermediation, or deposit withdrawals, which led to severe liquidity pressures on the balance sheets.16. How did the two pieces of regulatory legislation, the DIDMCA in 1980 and the DIA in1982, change the operating profitability of savings associations in the early 1980s? What impact did these pieces of legislation ultimately have on the risk posture of the savingsassociation industry? How did the FSLIC react to this change in operating performance and risk?The two pieces of legislation allowed savings associations to offer new deposit accounts, such as NOW accounts and money market deposit accounts, in an effort to reduce the net withdrawal flow of deposits from the institutions. In effect this action was an attempt to reduce the liquidity problem. In addition, the savings associations were allowed to offer adjustable-rate mortgages and a limited amount of commercial and consumer loans in an attempt to improve the profitability performance of the industry. Although many savings associations were safer, more diversified, and more profitable, the FSLIC did not foreclose many of the savings associations which were insolvent. Nor did the FSLIC change its policy of assessing higher insurance premiums on companies that remained in high risk categories. Thus many savings associations failed, which caused the FSLIC to eventually become insolvent.17. How do the asset and liability structures of a savings association compare with the assetand liability structures of a commercial bank? How do these structural differences affect the risks and operating performance of a savings association? What is the QTL test?The savings association industry relies on mortgage loans and mortgage-backed securities as the primary assets, while the commercial banking industry has a variety of loan products, including mortgage products. The large amount of longer-term fixed rate assets continues to cause interestrate risk, while the lack of asset diversity exposes the savings association to credit risk. Savings associations hold considerably less cash and U.S. Treasury securities than do commercial banks. On the liability side, small time and saving deposits remain as the predominant source of funds for savings associations, with some reliance on FHLB borrowing. The inability to nurture relationships with the capital markets also creates potential liquidity risk for the savings association industry.The acronym QTL stands for Qualified Thrift Lender. The QTL test refers to a minimum amount of mortgage-related assets that a savings association must hold. The amount currently is 65 percent of total assets.18. How do savings banks differ from savings and loan associations? Differentiate in terms ofrisk, operating performance, balance sheet structure, and regulatory responsibility.The asset structure of savings banks is similar to the asset structure of savings associations with the exception that savings banks are allowed to diversify by holding a larger proportion of corporate stocks and bonds. Savings banks rely more heavily on deposits and thus have a lower level of borrowed funds. The banks are regulated at both the state and federal level, with deposits insured by t he FDIC’s BIF.19. How did the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of1989 and the Federal Deposit Insurance Corporation Improvement Act of 1991 reversesome of the key features of earlier legislation?FIRREA rescinded some of the expanded thrift lending powers of the DIDMCA of 1980 and the Garn-St Germain Act of 1982 by instituting the qualified thrift lender (QTL) test that requires that all thrifts must hold portfolios that are comprised primarily of mortgages or mortgage products such as mortgage-backed securities. The act also required thrifts to divest their portfolios of junk bonds by 1994, and it replaced the FSLIC with a new thrift deposit insurance fund, the Savings Association Insurance Fund, which was managed by the FDIC.The FDICA of 1991 amended the DIDMCA of 1980 by introducing risk-based deposit insurance premiums in 1993 to reduce excess risk-taking. FDICA also provided for the implementation of a policy of prompt corrective actions (PCA) that allows regulators to close banks more quickly in cases where insolvency is imminent. Thus the ill-advised policy of regulatory forbearance should be curbed. Finally, the act amended the International Banking Act of 1978 by expanding the regulatory oversight powers over foreign banks.20. What is the “common bond” membership qualification under which credit unions havebeen formed and operated? How does this qualification affect the operational objective ofa credit union?The common bond policy allows any one who meets a specific membership requirement to become a member of the credit union. The requirement normally is tied to a place of employment. Because the common bond policy has been loosely interpreted, implementation has allowed credit union membership and assets to grow at a rate that exceeds similar growth inthe commercial banking industry. Since credit unions are mutual organizations where the members are owners, employees essentially use saving deposits to make loans to other employees who need funds.21. What are the operating advantages of credit unions that have caused concern bycommercial bankers? What has been the response of the Credit Union NationalAssociation to the bank criticisms?Credit unions are tax-exempt organizations that often are provided office space by employers at no cost. As a result, because non-interest operating costs are very low, credit unions can lend money at lower rates and pay higher rates on savings deposits than can commercial banks. CUNA has responded that the cost to tax payers from the tax-exempt status is replaced by the additional social good created by the benefits to the members.22. How does the asset structure of credit unions compare with the asset structure ofcommercial banks and savings and loan associations? Refer to Tables 2-5, 2-9, and 2-12 to formulate your answer.The relative proportions of credit union assets are more similar to commercial banks than savings associations, with 20 percent in investment securities and 63 percent in loans. However, nonmortgage loans of credit unions are predominantly consumer loans. On the liability side of the balance sheet, credit unions differ from banks in that they have less reliance on large time deposits, and they differ from savings associations in that they have virtually no borrowings from any source. The primary sources of funds for credit unions are transaction and small time and savings accounts.23. Compare and contrast the performance of the U.S. depository institution industry withthose of Japan, China, and Germany.The entire Japanese financial system was under increasing pressure from the early 1990s as the economy suffered from real estate and other commercial industry pressures. The Japanese government has used several financial aid packages in attempts to avert a collapse of the Japanese financial system. Most attempts have not been successful.The deterioration in the banking industry in China in the early 2000s was caused by nonperforming loans and credits. The remedies include the opportunity for more foreign bank ownership in the Chinese banking environment primarily via larger ownership positions, less restrictive capital requirements for branches, and increased geographic presence.German banks also had difficulties in the early 2000s, but the problems were not universal. The large banks suffered from credit problems, but the small banks enjoyed high credit ratings and low cast of funds because of government guarantees on their borrowing. Thus while small banks benefited from growth in small business lending, the large banks became reliant on fee and trading income.。

中级经济师考试《金融专业》章节练习:第三章含答案

中级经济师考试《金融专业》章节练习:第三章含答案中级经济师考试《金融专业》章节练习第三章金融机构与金融制度一、单项选择题1. 最典型的间接金融机构是( )。

A.证券公司B.商业银行C.投资银行D.保险公司2. 金融机构之所以被称为金融企业,是因为它所经营的对象不是普通商品,而是( )。

A.存款B.货币资金C.资本D.有价证券3. 与其他金融机构相比,商业银行最明显的特征是( )。

A.吸收活期存款,创造信用货币B.以盈利为目的C.经营对象是货币资金D.制定国家金融政策4. 在所有金融机构中,历史最悠久、资本最雄厚、体系最庞大、业务范围最广、掌握金融资源最多的金融机构是( )。

A.投资银行B.储蓄银行C.商业银行D.开发银行5. 目前唯一没有资本金的中央银行是( )。

A.美国联邦储备银行B.英格兰银行C.韩国中央银行D.德国中央银行6. 采取“牵头式”监管体制的典型国家是( )。

A.瑞典B.美国C.巴西D.澳大利亚7. 政策性金融机构的经营原则不包括( )。

A.流动性原则B.政策性原则C.安全性原则D.保本微利原则8. 在法律、法规规定的范围内,小额贷款公司从银行业金融机构获得融入资金的余额,不得超过其资本净额的( )。

A.8%B.20%C.30%D.50%9. 目前我国上海和深圳证券交易所实行( )交割方式完成清算交易。

A.T+2B.T+0C.T+1D.T+310. 适用于融资租赁交易的租赁物是( )。

A.固定资产B.流动资产C.商品D.产品11. 我国国有重点金融机构监事会的核心工作是( )。

A.财务监督B.人事监督C.合规监督D.经营监督12. 对我国期货结算机构进行监管的金融监管机构是( )。

A.中国人民银行B.中国证监会C.中国保监会D.中国银监会13. 中国人民银行作为政府的银行,其重要的职能是( )。

A.对政府贷款B.再贷款C.经理国库D.再贴现二、多项选择题1. 金融机构的主要职能有( )。

Chap009金融机构管理课后题答案