曼昆《经济学原理》(宏观)第五版测试题库 (23)

曼昆第五版复习经济学原理试题 (1)

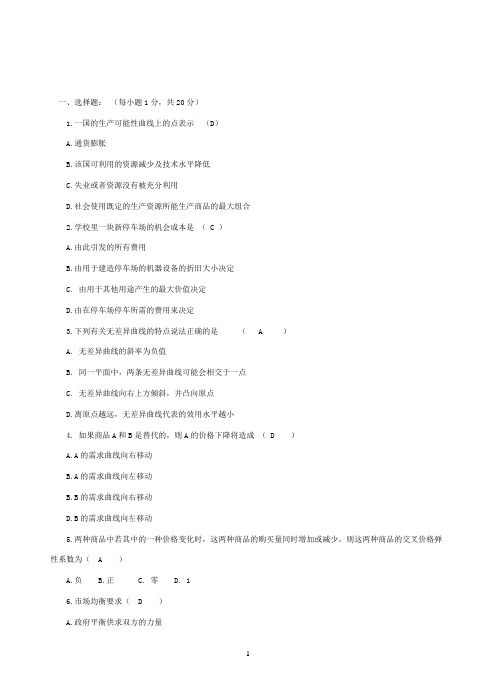

一、选择题:(每小题1分,共20分)1.一国的生产可能性曲线上的点表示(D)A.通货膨胀B.该国可利用的资源减少及技术水平降低C.失业或者资源没有被充分利用D.社会使用既定的生产资源所能生产商品的最大组合2.学校里一块新停车场的机会成本是( C )A.由此引发的所有费用B.由用于建造停车场的机器设备的折旧大小决定C. 由用于其他用途产生的最大价值决定D.由在停车场停车所需的费用来决定3.下列有关无差异曲线的特点说法正确的是( A )A. 无差异曲线的斜率为负值B. 同一平面中,两条无差异曲线可能会相交于一点C. 无差异曲线向右上方倾斜,并凸向原点D.离原点越远,无差异曲线代表的效用水平越小4. 如果商品A和B是替代的,则A的价格下降将造成( D )A.A的需求曲线向右移动B.A的需求曲线向左移动B.B的需求曲线向右移动D.B的需求曲线向左移动5.两种商品中若其中的一种价格变化时,这两种商品的购买量同时增加或减少,则这两种商品的交叉价格弹性系数为( A )A.负B.正C. 零D. 16.市场均衡要求( D )A.政府平衡供求双方的力量B.价格与数量相等C.价格保持不变D.在某一价格水平上,买者想要购买的数量恰好等于卖者想卖的数量7. 当总效用增加时,边际效用应该( C )A.为正值,并其值不断增加B. 为负值,并其值不断减少C.为正值,并其值不断减少D. 以上任何一种情况都有可能8.当生产函数Q=f ( L,K )的APL为递减时,则MPL( D )。

A.递减且为正B.递减且为负C.为零D.上述情况都可能9.在以下四种情况中,哪一种实现了生产要素的最适组合:( C )A. MPK / PK<MPL/ PLB. MPK / PK>MPL / PLC. MPK / PK=MPL/ PLD. MPK / PK ≥MPL/ PL10.边际成本低于平均成本时( B )。

A.平均成本上升B.平均成本下降C.成本下降D.平均可变成本上升11.长期边际成本曲线呈U型的原因是( A )。

曼昆《经济学原理(宏观经济学分册)》章节题库(一国收入的衡量)【圣才出品】

第23章一国收入的衡量一、名词解释1.国民收入答:国民收入即NI,是一国生产要素所有者在一定时期内,因从事生产和提供劳务,按生产要素所得的报酬,是劳动、资本和土地等生产要素所获得的全部收入,NI可由NDP 减去间接税和企业转移支付再加上政府补助金得到。

这里的国民收入,实际上是按要素费用计算的国民净收入。

在西方国家,有时简称为(狭义的)国民收入。

国民收入的核算公式为:NI=NDP-企业间接税-企业转移支付+政府补助金2.实际人均GDP答:实际人均GDP指标是指,实际GDP除以人口数量,是每个人的平均实际GDP。

实际人均GDP在某些情况下是一个比较有用的指标,例如,它可以用于比较不同国家的劳动生产率。

然而,它本身并不足以作为政策目标,因为它没有表明一个国家会如何使用这些产量来提高社会生活水平。

二、判断题1.GDP度量一个国家的社会福利水平。

()【答案】×【解析】GDP一般仅指市场活动导致的价值。

它不能度量一个国家的社会福利水平,GDP作为核算国民经济活动的核心指标也是有局限性的:①它不能反映社会成本。

②它不能反映经济增长方式付出的代价。

③它不能反映人们的生活质量。

④不能反映社会收入和财富分配的状况。

例如,即使两国人均GDP水平相同,但一国贫富差距比另一国大得多,显然,前一国的社会总福利要比后一国低的多。

基于GDP在度量社会福利水平上存在的诸多不足,经济学家们纷纷构建了一些新的指标来衡量社会福利水平,比如经济净福利指标、绿色GDP等。

2.购买100股苹果公司股票是宏观经济学中投资支出的一个例子。

()【答案】×【解析】宏观经济学中的投资是指一定时期内增加到资本存量中的资本流量,包括房屋建筑、机器制造,以及企业存货的增加等。

购买股票是个人与个人之间重新配置资产时发生的购买,不属于经济学中的投资。

3.如果有人在中国购买了澳大利亚生产的柑桔,那么这个支出就会计入中国GDP中的消费部分,也会计入中国GDP中的进口部分。

曼昆《经济学原理》宏观部分重点

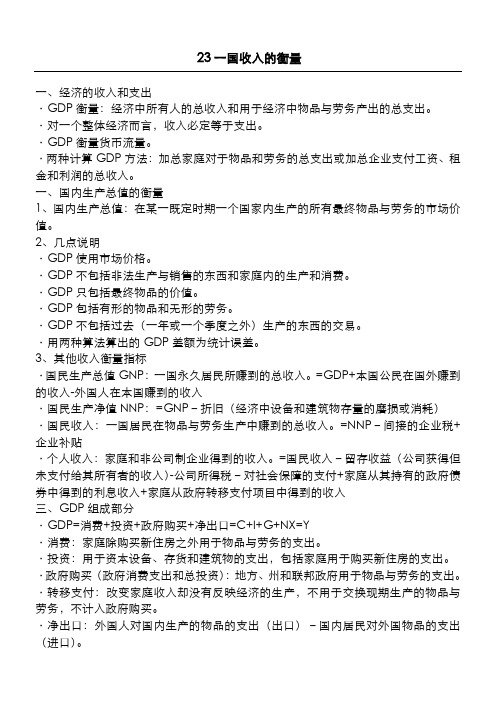

23一国收入的衡量一、经济的收入和支出·GDP衡量:经济中所有人的总收入和用于经济中物品与劳务产出的总支出。

·对一个整体经济而言,收入必定等于支出。

·GDP衡量货币流量。

·两种计算GDP方法:加总家庭对于物品和劳务的总支出或加总企业支付工资、租金和利润的总收入。

一、国内生产总值的衡量1、国内生产总值:在某一既定时期一个国家内生产的所有最终物品与劳务的市场价值。

2、几点说明·GDP使用市场价格。

·GDP不包括非法生产与销售的东西和家庭内的生产和消费。

·GDP只包括最终物品的价值。

·GDP包括有形的物品和无形的劳务。

·GDP不包括过去(一年或一个季度之外)生产的东西的交易。

·用两种算法算出的GDP差额为统计误差。

3、其他收入衡量指标·国民生产总值GNP:一国永久居民所赚到的总收入。

=GDP+本国公民在国外赚到的收入-外国人在本国赚到的收入·国民生产净值NNP:=GNP–折旧(经济中设备和建筑物存量的磨损或消耗)·国民收入:一国居民在物品与劳务生产中赚到的总收入。

=NNP–间接的企业税+企业补贴·个人收入:家庭和非公司制企业得到的收入。

=国民收入–留存收益(公司获得但未支付给其所有者的收入)-公司所得税–对社会保障的支付+家庭从其持有的政府债券中得到的利息收入+家庭从政府转移支付项目中得到的收入三、GDP组成部分·GDP=消费+投资+政府购买+净出口=C+I+G+NX=Y·消费:家庭除购买新住房之外用于物品与劳务的支出。

·投资:用于资本设备、存货和建筑物的支出,包括家庭用于购买新住房的支出。

·政府购买(政府消费支出和总投资):地方、州和联邦政府用于物品与劳务的支出。

·转移支付:改变家庭收入却没有反映经济的生产,不用于交换现期生产的物品与劳务,不计入政府购买。

曼昆经济学原理宏观习题

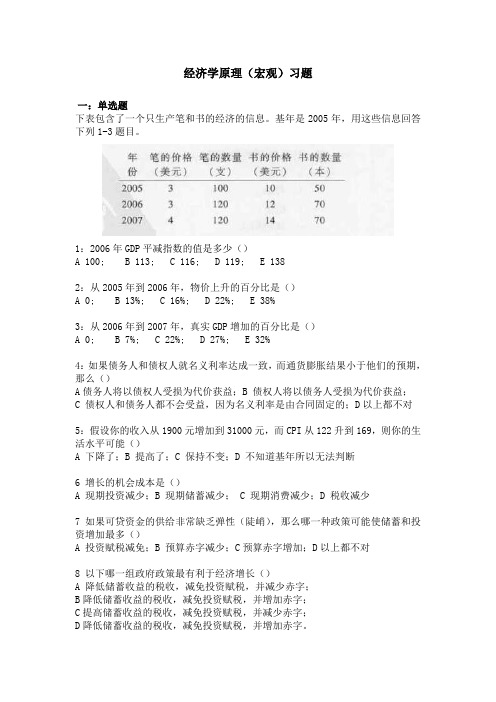

经济学原理(宏观)习题一:单选题下表包含了一个只生产笔和书的经济的信息。

基年是2005年,用这些信息回答下列1-3题目。

1:2006年GDP平减指数的值是多少()A 100;B 113;C 116;D 119;E 1382:从2005年到2006年,物价上升的百分比是()A 0;B 13%;C 16%;D 22%;E 38%3:从2006年到2007年,真实GDP增加的百分比是()A 0;B 7%;C 22%;D 27%;E 32%4:如果债务人和债权人就名义利率达成一致,而通货膨胀结果小于他们的预期,那么()A债务人将以债权人受损为代价获益;B 债权人将以债务人受损为代价获益;C 债权人和债务人都不会受益,因为名义利率是由合同固定的;D以上都不对5:假设你的收入从1900元增加到31000元,而CPI从122升到169,则你的生活水平可能()A 下降了;B 提高了;C 保持不变;D 不知道基年所以无法判断6 增长的机会成本是()A 现期投资减少;B 现期储蓄减少;C 现期消费减少;D 税收减少7 如果可贷资金的供给非常缺乏弹性(陡峭),那么哪一种政策可能使储蓄和投资增加最多()A 投资赋税减免;B 预算赤字减少;C预算赤字增加;D以上都不对8 以下哪一组政府政策最有利于经济增长()A 降低储蓄收益的税收,减免投资赋税,并减少赤字;B降低储蓄收益的税收,减免投资赋税,并增加赤字;C提高储蓄收益的税收,减免投资赋税,并减少赤字;D降低储蓄收益的税收,减免投资赋税,并增加赤字。

9如果GDO=1000元,消费=600元,税收=100元,政府购买=200元,储蓄和投资是多少()A 储蓄=200元;投资=200元;B 储蓄=300元;投资=300元;C储蓄=100元;投资=200元; D储蓄=200元;投资=100元;10 如果政府既增加投资赋税减免又减少储蓄收益的税收,那么()A 真实利率应该上升;B 真实利率应该下降;C 真实利率应该不变; D对真实利率的影响是不确定的10 现行利率上升( )A 减少了投资未来收益的现值,并减少了投资;B减少了投资未来收益的现值,并增加了投资;C增加了投资未来收益的现值,并减少了投资;D增加了投资未来收益的现值,并增加了投资;11 以下哪一项减少的投资组合风险最大( )A 在投资组合中,把股票数量从1增加到10;B在投资组合中,把股票数量从10增加到20;C在投资组合中,把股票数量从20增加到30;D 以上各项都提供了等量的风险;12 一位有注册会计师证书的会计师在相当长的时间里找不到工作,以至于他不再找工作,她被认为( )A 就业者;B 失业者;C 非劳动力;D 非成年人口13 工会如何扩大局内人与局外人工资的差别( )A 提高工会部门的工资,这会引起非工会部门的工人供给增加;B提高工会部门的工资,这会引起非工会部门的工人供给减少;C 减少非工会部门的工人需求;D增加非工会部门的工人需求;14 以下哪一种政策组合会一致地起到增加货币供给的作用?()A出售政府债券,降低法定准备金,降低贴现率;B出售政府债券,提高法定准备金,提高贴现率;C购买政府债券,提高法定准备金,降低贴现率;D购买政府债券,降低法定准备金,降低贴现率;15假设央行购买了你的1000元政府债券,如果你把这1000元全部存入银行,且法定准备金率是20%,那么央行的行为会引起货币供给总量多大的潜在变动()A 1000美元;B 4000美元;C 5000美元;D0美元16给出以下T型账户,如果法定准备金率是10%,这家银行可以谨慎地发放的贷款最多是多少()A0美元;B50美元;C150美元;D1000美元;17 假设名义利率是7%,而货币供给每年增长5%。

4.曼昆-经济学基础(第5版)复习资料

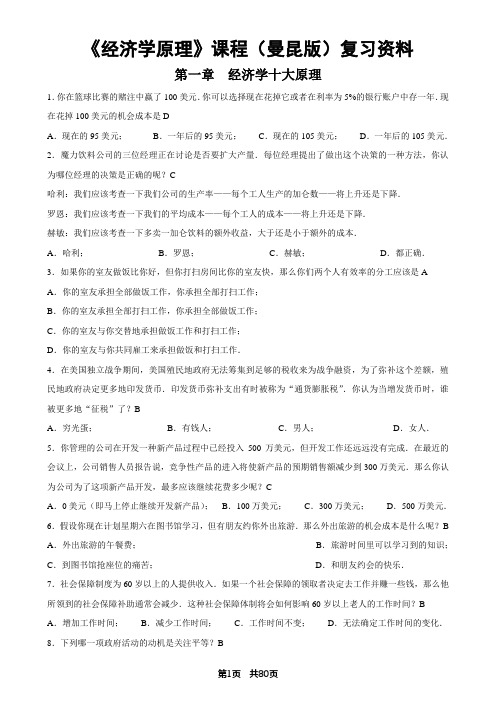

《经济学原理》课程(曼昆版)复习资料第一章经济学十大原理1.你在篮球比赛的赌注中赢了100美元.你可以选择现在花掉它或者在利率为5%的银行账户中存一年.现在花掉100美元的机会成本是DA.现在的95美元;B.一年后的95美元;C.现在的105美元;D.一年后的105美元.2.魔力饮料公司的三位经理正在讨论是否要扩大产量.每位经理提出了做出这个决策的一种方法,你认为哪位经理的决策是正确的呢?C哈利:我们应该考查一下我们公司的生产率——每个工人生产的加仑数——将上升还是下降.罗恩:我们应该考查一下我们的平均成本——每个工人的成本——将上升还是下降.赫敏:我们应该考查一下多卖一加仑饮料的额外收益,大于还是小于额外的成本.A.哈利;B.罗恩;C.赫敏;D.都正确.3.如果你的室友做饭比你好,但你打扫房间比你的室友快,那么你们两个人有效率的分工应该是A A.你的室友承担全部做饭工作,你承担全部打扫工作;B.你的室友承担全部打扫工作,你承担全部做饭工作;C.你的室友与你交替地承担做饭工作和打扫工作;D.你的室友与你共同雇工来承担做饭和打扫工作.4.在美国独立战争期间,美国殖民地政府无法筹集到足够的税收来为战争融资,为了弥补这个差额,殖民地政府决定更多地印发货币.印发货币弥补支出有时被称为“通货膨胀税”.你认为当增发货币时,谁被更多地“征税”了?BA.穷光蛋;B.有钱人;C.男人;D.女人.5.你管理的公司在开发一种新产品过程中已经投入500万美元,但开发工作还远远没有完成.在最近的会议上,公司销售人员报告说,竞争性产品的进入将使新产品的预期销售额减少到300万美元.那么你认为公司为了这项新产品开发,最多应该继续花费多少呢?CA.0美元(即马上停止继续开发新产品);B.100万美元;C.300万美元;D.500万美元.6.假设你现在计划星期六在图书馆学习,但有朋友约你外出旅游.那么外出旅游的机会成本是什么呢?B A.外出旅游的午餐费;B.旅游时间里可以学习到的知识;C.到图书馆抢座位的痛苦;D.和朋友约会的快乐.7.社会保障制度为60岁以上的人提供收入.如果一个社会保障的领取者决定去工作并赚一些钱,那么他所领到的社会保障补助通常会减少.这种社会保障体制将会如何影响60岁以上老人的工作时间?B A.增加工作时间;B.减少工作时间;C.工作时间不变;D.无法确定工作时间的变化.8.下列哪一项政府活动的动机是关注平等?BA.对有线电视频道的价格进行管制;B.向穷人提供可用来购买食物的消费券;C.在公共场所禁止吸烟;D.把美孚石油公司分拆为几个较小的公司.9.从总体上来说,我们的生活水平通常要高于我们父辈或祖辈那个时代,主要原因是DA.我们更年轻;B.我们更聪明;C.我们钞票更多;D.我们生产率更高.第二章象经济学家一样思考1.实证表述与规范表述之间的差别是什么?各举出一个例子.答:实证表述是描述世界是什么的观点,是描述性的.规范表述是企图描述世界应该如何运行的观点,是命令性的.两者的主要差别是我们如何判断它们的正确性.从原则上讲,可以通过检验证据而确认或否定实证描述.而规范表述的判断不仅涉及事实数据,还涉及价值观的问题.举例如下:实证表述:发放可交易的污染许可证可以有效地控制污染物的排放.规范表述:政府应该向企业发放可交易的污染许可证.2.下列论述中哪个问题属于宏观经济学范畴?CA.家庭把多少收入用于储蓄的决策;B.政府管制对汽车废气的影响;C.高国民储蓄对经济增长的影响;D.企业关于雇佣多少工人的决策.3.下列哪种表述是实证表述?AA.社会面临着通货膨胀与失业之间的短期权衡取舍;B.中国应该减少外汇储备数量;C.美联储应该降低货币增长率;D.社会应该要求福利领取者去找工作.4.设想一个生产军用品和消费品的社会,我们把这些物品称为“大炮”和“黄油”.假想一个侵略成性的邻国削减了军事力量,结果鹰党和鸽党都等量减少了自己原来希望生产的大炮数量.用黄油产量的增加幅度来衡量,哪一个党会得到更大的“和平红利”呢?AA.鹰党得到更大“和平红利”;B.鸽党得到更大“和平红利”;C.鹰党和鸽党获得相同“和平红利”;D.无法确定.5.一个经济由Larry、Moe和Curly这三个工人组成.每个工人每天工作10小时,并可以提供两种服务:割草和洗汽车.在一小时内,Larry可以割一块草地或洗一辆汽车;Moe可以割一块草地或洗两辆汽车,而Curly可以割两块草地或洗一辆汽车.请问下列哪一种资源配置明显地是无效率的呢?CA.三个工人把他们所有的时间都用于割草;B.三个工人把他们所有的时间都用于洗汽车;C.三个工人都分别把一半时间用于两种活动;D .Larry分别把一半时间用于两种活动,而Moe只洗汽车,Curly只割草.6.以下哪个表述是关于要素市场上物品与劳务流向和货币流向的?BA .Selena向店主支付1美元买了1夸脱牛奶;B.Stuart在快餐店工作,每小时赚4.5美元;C.Shanna花30美元理发; D .Sally从顶峰工业公司购买了一套价值1万美元的家具.7.人们需要在清洁的环境和工业产量之间进行权衡取舍.现在假设工程师开发出了一种几乎没有污染的新的发电方法,对于以清洁环境和工业产量为两种物品的生产可能性边界图中,生产可能性边界会发生什么变化呢?BA.生产可能性边界会向内移动;B.生产可能性边界会向外移动;C.生产可能性边界形状将变得内凹;D.生产可能性边界形状将变为直线.8.下列哪种表述是规范表述?CA.关税和进口配额通常降低了总体经济福利;B.租金上限降低了可得到的住房数量和质量;C.美国应该取消农业补贴;D.弹性汇率和浮动汇率提供了一种有效的国际货币协定.第三章相互依存性与贸易的好处1.为什么经济学家反对限制各国之间贸易的政策?答:因为每个国家都会在不同的劳务或物品生产上具有比较优势.各国在生产上进行分工,专门生产自己具有比较优势的产品,可以使世界经济的总产量增加,同时相互间进行贸易,每个国家的消费者都可以消费更多的物品和劳务,所有的国家都可以实现更大的繁荣.2.美国和日本工人每人每年可以生产4辆汽车.一个美国工人每年可以生产10吨粮食.而一个日本工人每年可以生产5吨粮食.为了简化起见,假设每个国家有1亿工人.哪个国家在生产汽车上具有绝对优势?在生产粮食上呢?答:美国在生产粮食中占有绝对优势.美国和日本生产汽车的绝对能力是相同的.哪个国家在生产汽车上具有比较优势?在生产粮食上呢?A答:美国在生产粮食上有比较优势,日本在生产汽车上有比较优势.A.美国生产粮食有比较优势,日本生产汽车有比较优势;B.美国生产汽车有比较优势,日本生产粮食有比较优势;C.美国生产粮食有比较优势,日本生产汽车有绝对优势;D.美国生产汽车有绝对优势,日本生产粮食有比较优势.3.Pat和Kris是室友.他们把大部分时间用于学习(理所当然),但也留出一些时间做他们喜爱的活动:做比萨饼和制作清凉饮料.Pat制作1加仑清凉饮料需要4小时,做1块比萨饼需要2小时.Kris制作1加仑清凉饮料需要6小时,做1块比萨饼需要4小时.A.每个室友做1块比萨饼的机会成本是什么?谁在做比萨饼上有绝对优势?谁在做比萨饼上有比较优势?答:Pat做1块比萨饼的机会成本是1/2加仑清凉饮料.Kris制作1块比萨饼的机会成本是2/3加仑清凉饮料.Pat在做比萨饼上既有绝对优势又有比较优势.B.如果Pat和Kris互相交换食物,谁将用比萨饼换取清凉饮料?可能的交换比例是多少?B答:Pat将用比萨饼换清凉饮料.A .Pat将用1块比萨饼交换Kris的1加仑清凉饮料;B.Pat将用1块比萨饼交换Kris的7/12加仑清凉饮料;C .Pat将用1加仑清凉饮料交换Kris的1/4块比萨饼;D .Pat将用1块比萨饼交换Kris的1/7加仑清凉饮料.C.比萨饼的价格可以用若干加仑清凉饮料来表示.能使两个室友状况都更好的比萨饼交易的最高价格是多少?最低价格是多少?解释原因.答:1块比萨饼的最高价格是2/3加仑清凉饮料,最低价格是1/2加仑清凉饮料.因为Pat在做比萨上有比较优势,并且机会成本是1/2加仑清凉饮料.如果两个室友之间实行贸易,他会选择生产比萨饼,并与Kris 交换清凉饮料.如果1块比萨交换不到1/2加仑清凉饮料,Pat就宁可少生产1块比萨饼,而自己去生产1/2加仑清凉饮料.Kris在生产清凉饮料上有比较优势,机会成本是3/2块比萨饼.在贸易中,他会选择生产清凉饮料并与pat交换比萨饼.对于克里斯而言,1加仑清凉饮料最少要换3/2块比萨饼,也就是说,1块比萨饼的最高价格是2/3加仑清凉饮料.如果1块比萨饼的价格高于2/3加仑清凉饮料,Kris的1加仑清凉饮料就换不到3/2块比萨饼.那他就宁可少生产1加仑饮料,自己去生产3/2块比萨饼.4.英格兰和苏格兰都生产烤饼和毛衣.假设一个英格兰工人每小时能生产50个烤饼或1件毛衣.假设一个苏格兰工人每小时能生产40个烤饼或2件毛衣.A.在每种物品的生产上,哪个国家有绝对优势?哪一国有比较优势?C答:英格兰工人在生产烤饼上有绝对优势,苏格兰工人在生产毛衣上有绝对优势.1个英格兰工人生产1个烤饼的机会成本是1/50件毛衣,生产1件毛衣的机会成本是50个烤饼.1个苏格兰工人生产1个烤饼的机会成本是1/20件毛衣,生产1件毛衣的机会成本是20个烤饼.可见,英格兰工人在生产烤饼上有比较优势,苏格兰人在生产毛衣上有比较优势.A.英格兰工人在生产毛衣上有绝对优势;B.苏格兰工人在生产烤饼上有绝对优势;C.英格兰工人在生产烤饼上有比较优势;D.苏格兰工人在生产烤饼上有比较优势.B.如果英格兰和苏格兰决定进行贸易,苏格兰将用哪种商品与英格兰交易?解释原因.答:苏格兰人将用毛衣与英格兰人交易.因为他们在生产毛衣上有比较优势.C.如果一个苏格兰工人每小时只能生产一件毛衣,苏格兰仍然能从贸易中得到好处吗?英格兰仍然能从贸易中得到好处吗?解释原因.答:如果1个苏格兰人每小时只能生产1件毛衣,那么他们生产1件毛衣的机会成本是40个烤饼,仍低于英格兰人生产1件毛衣的机会成本(50个烤饼).所以,苏格兰人在生产毛衣上仍有比较优势.而此时,1个苏格兰人生产1个烤饼的机会成本是l/40件毛衣,仍高于1个英格兰人生产1个烤饼的机会成本,即英格兰人在生产烤饼上仍有比较优势.那么在贸易中,苏格兰人和英格兰人仍都能受益.5.一个巴西的普通工人可以用20分钟生产1盎司大豆,用60分钟生产1盎司咖啡;而一个秘鲁的普通工人可以用50分钟生产1盎司大豆,用75分钟生产1盎司咖啡.A.在生产咖啡上有绝对优势?解释之.答:巴西的普通工人有绝对的优势,因为他生产1盎司咖啡用时(60分钟)比秘鲁的普通工人(75分钟)少.B.谁在生产咖啡上有比较优势?解释之.答:秘鲁的普通工人具有比较优势.因为秘鲁工人生产每盎司咖啡的机会成本(75/50=1.5盎司的大豆)低于在巴西工人平均每盎司咖啡的机会成本(60/20=3大豆盎司).C.如果两国进行专业分工并相互贸易,谁将进口咖啡?解释之.答:巴西将从秘鲁进口咖啡,因为秘鲁在咖啡生产上有比较优势.D.假设两国进行贸易,而且,进口咖啡的国家用2盎司大豆交换1盎司咖啡.解释为什么两国都将从这种贸易中获益.答:因为两国的机会成本都比原先下降了,生产时间节省了(巴西:60-40=20分钟;秘鲁:100-75=25分钟)6.假设加拿大有1000万工人,而且每个工人1年可生产2辆汽车或30蒲式耳小麦.那么,加拿大生产1蒲式耳小麦的机会成本是多少呢?CA.2辆汽车;B.1辆汽车;C.1/15辆汽车;D.无法确定.7.假设加拿大有1000万工人,而且每个工人1年可生产2辆汽车或30蒲式耳小麦.现在假设美国从加拿大购买1000万辆汽车,每辆汽车交换20蒲式耳小麦.如果加拿大消费1000万辆汽车,这种交易使加拿大可以消费多少小麦?BA.15000蒲式耳小麦;B.20000蒲式耳小麦;C.30000蒲式耳小麦;D.40000蒲式耳小麦.8.Maria每小时可以读20页经济学著作,也可以每小时读50页社会学著作.她每天学习5小时,那么Maria阅读100页社会学著作的机会成本是多少呢?BA.读20页经济学著作;B.读40页经济学著作;C.读50页经济学著作;D.读100页经济学著作.9.下表描述了Baseballia国两个城市的生产可能性如果这两个城市相互交易,那么两个城市之间贸易时白袜子的交易价格范围是多少?AA.最高价格是2双红袜子,最低价格是1双红袜子;B.最高价格是1双红袜子,最低价格是1/2双红袜子;C.最高价格是3双红袜子,最低价格是1双红袜子;D.最高价格是3双红袜子,最低价格是2/3双红袜子.10.下列表述哪个是正确?AA.“即使一国在所有物品上都有绝对优势,两国也能从贸易中得到好处.”B.“某些极有才能的人在做每一件事情时都有比较优势.”C.“如果某种贸易能给某人带来好处,那么,它就不会也给另一个人带来好处.D.“如果某种贸易对一个人是好事,那么它对另一个人也总是好事.”11.假定一个美国工人每年能生产100件衬衣或20台电脑,而一个中国工人每年能生产100件衬衣或10台电脑.A.画出这两个国家的生产可能性边界.假定没有贸易,每个国家的工人各用一半的时间生产两种物品,在你的图上标出这一点.答:两个国家的生产可能性边界如下图所示.如果没有贸易,一个美国工人把一半的时间用于生产每种物品,则能生产50件衬衣、10台电脑;同样,一个中国工人则能生产50件衬衣、5台电脑.生产可能性边界(图)B.如果这两个国家进行贸易,哪个国家将出口衬衣?举出一个具体的数字例子,并在你的图上标出.哪一个国家将从贸易中获益?解释原因.答:中国将出口衬衣.对美国而言,生产一台电脑的机会成本是5件衬衣,而生产一件衬衣的机会成本为1/5台电脑.对中国而言,生产一台电脑的机会成本是10件衬衣,而生产一件衬衣的机会成本为1/10台电脑.因此,美国在生产电脑上有比较优势,中国在生产衬衣上有比较优势,所以中国将出口衬衣.衬衣的价格在1/5到1/10台电脑之间.两个国家都会从贸易中获益.例如,衬衣的价格为1/8台电脑,换言之,中国出口8件衬衣换回1台电脑.中国专门生产衬衣(100件),并出口其中的8件,这样就有92件衬衣和换回的1台电脑.而没有贸易时,92件衬衣和1台电脑在中国是不可能得到的产出.美国专门生产电脑(20台)并向中国出口其中的1台换取8件衬衣.这样,美国最后就有19台电脑和8件衬衣,这是没有贸易时美国不可能得到的产出.由此可见,贸易使中国和美国所能消费的产品增加,两国都获益了.C.解释两国可以交易的电脑价格(用衬衣衡量)是多少.D答:一台电脑的价格将在5到10件衬衣之间.如果电脑价格低于5件衬衣,美国将不会出口,因为在美国一件衬衣的机会成本为1/5台电脑.如果电脑的价格高于10件衬衣,中国将不会进口,因为在中国一台电脑的机会成本是10件衬衣.A.1件衬衫交换1/2台电脑;B.1件衬衫交换1/12台电脑;C.1台电脑交换4件衬衫;D.1台电脑交换8件衬衫.D.假设中国的生产率赶上了美国,因此,一个中国工人每年可以生产100件衬衣或20台电脑.你预期这时的贸易形式会是什么样的.中国生产率的这种进步将如何影响两国居民的经济福利?答:此时,中美双方将同时生产两种商品,然后进行贸易,不过此时的贸易被称为水平贸易,即生产率大致相同的两个国家进行的贸易.而中国在提高生产率之前,两国进行的是垂直贸易.垂直贸易可以增进两国的福利,水平贸易同样能增进两国的福利.经常举的例子是,美国自己生产小汽车,但它还是进口日本的汽车.原因是两国生产的汽车在性能、耗油量及体积大小等方面有差异,通过进口国外的汽车可以满足美国人多样化的需求,因此会增进美国人的福利.总的来说,中国生产率的这种进步会提高两国居民的经济福利.12.下列表述正确还是错误?分别做出解释.AA.“即使一国在所有物品上都有绝对优势,两国也能从贸易中得到好处.”答:对.因为一国即使在生产所有的物品上都有绝对优势,它也不可能在所有物品上都有比较优势.相反,即使一国在所有物品的生产上都没有绝对优势,它也会在某些物品上具有比较优势.B.“某些极有才能的人在做每一件事情时都有比较优势.”答:错.一个人不可能同时在做两件事情上都拥有比较优势,因为如果用一件事情表示另一件事情的机会成本,那么这两件事情的机会成本互为倒数.C.“如果某种贸易能给某人带来好处,那么,它就不会也给另一个人带来好处.答:错.贸易所达到的是双赢或多赢局面.在贸易中,人们各自生产自己具有比较优势的产品,社会总产量增加,每个人的状况会变得更好.D.“如果某种贸易对一个人是好事,那么它对另一个人也总是好事.”答:错.双方的贸易价格必须位于两者之间的机会成本.E.“如果贸易能给某个国家带来好处,那么它也一定能给该国的每一个人带来好处.”答:错.贸易给某个国家带来好处的同时,可能损害该国内某些人的利益.如,假设一国在生产小麦上有比较优势,在生产汽车上有比较劣势,那么,出口小麦、进口汽车给这个国家带来好处,因为现在这个国家能够消费更多的商品.但是,贸易的出现,尤其是进口汽车,会损害国内汽车制造工人和厂商的利益.A.即使一国在所有物品上都有绝对优势,两国也能从贸易中得到好处;B.某些极有才能的人在做每一件事情时都有比较优势;C.如果某种贸易能给某人带来好处,那么,它就不会也给另一个人带来好处;D.如果贸易能给某个国家带来好处,那么它也一定能给该国的每一个人带来好处.13.下表描述了Baseballia国两个城市的生产可能性A.没有贸易,波士顿一双白袜子价格(用红袜子表示)是多少?芝加哥1双白袜子价格是多少?答:没有贸易时,波士顿1双白袜子价格是1双红袜子,芝加哥1双白袜子价格是2双红袜子.B.在每种颜色的袜子生产上,哪个城市有绝对优势?哪个城市有比较优势?答:波士顿在生产红、白袜子上都有绝对优势.波士顿在生产白袜子上有比较优势,芝加哥在生产红袜子上有比较优势.C.如果这两个城市相互交易,两个城市将分别出口哪种颜色的袜子?答:如果它们相互交易,波士顿将出口白袜子,而芝加哥出口红袜子.D.可以进行交易的价格范围是多少?答:白袜子的最高价格是2双红袜子,最低价格是1双红袜子.红袜子的最高价格是1双白袜子,最低价格是1/2双白袜子.第四章供给与需求的市场力量关键概念:1.竞争市场:指有许多买者和卖者,以致于每个人对市场价格的影响都微不足道的市场.具备四个条件:⑴市场上有大量的买者和卖者⑵市场上每个厂商提供的商品都是同质的;⑶所有资源具有完全的流动性;⑷信息是完全的或充分的.2.需求量:指买者愿意而且能够购买的一种物品数量.3.需求定理:在其他条件不变的情况下,某种商品的需求量与其价格之间成反向变动,即需求量随着商品价格上升而减少,随着商品价格下降而增加.4.正常商品:指在其他条件相同时,收入增加引起需求量增加的商品.5.低档商品:指在其他条件不变的情况下,收入增加引起需求减少的商品.6.替代品:指一种物品价格上升引起另一种物品需求量增加的两种物品,或者说是指在效用上可以相互代替,满足消费者同一种欲望的商品.7.互补品:指一种物品价格上升引起另一种物品需求量减少的两种物品,或者说是指在效用上互相补充配合,从而满足消费者同一种欲望的商品.8.供给量:指卖者愿意而且能够出售的数量,或者说是生产者在一定时期内在各种可能的价格下愿意而且能够提供出售的该种商品数量.9.供给定理:指有关价格与供给量之关系的定理,即在其他条件相同时,一种物品价格上升时,该物品供给量就增加;当价格下降时,该物品供给量就减少.10.均衡:指价格达到使供给量等于需求量水平的状况,即在某个给定的价格水平下,生产者愿意提供的商品量恰好等于消费者愿意而且能够购买的商品量.11.供求定理:指任何一种物品价格的调整都会使该物品的供给与需求达到均衡的定理,即在其他条件不变的情况下,需求变动分别引起均衡价格和均衡数量的同方向变动,供给变动分别引起均衡价格的反方向变动和均衡数量的同方向变动.1.什么因素决定买者对一种物品的需求量?答:物品的价格、买者的收入水平、相关物品的价格、买者的偏好和对物品的价格预期.2.什么因素决定了卖者对一种物品的供给量?答:价格、投入价格、技术、预期决定了卖者对一种物品的供给量.3.啤酒与比萨饼是互补品,因为人们常常边吃比萨饼,边喝啤酒.当啤酒价格上升时,比萨饼市场的供给、需求、供给量、需求量以及价格会发生什么变动?答:因为啤酒和比萨饼是互补品,所以当啤酒价格上升而其他条件不变时,啤酒的需求会下降,比萨饼的需求也下降.而比萨饼的供给并没有什么原因使它变动,这样,比萨饼的需求曲线会向左移动,而供给曲线不变.达到市场均衡时的供给量、需求量、均衡价格都会下降.4.考虑DVD、电视和电影院门票市场.A.对每一对物品,确定它们是互补品还是替代品·DVD和电视·DVD和电影票·电视和电影票答:DVD和电视机是互补品,因为不可能在没有电视的情况下看DVD.DVD和电影票是替代品,因为一部电影即可以在电影院看,也可以在家看.电视和电影票是替代品,原因与上面的类似.B.假设技术进步降低了制造电视机的成本.答:技术进步降低了制造电视机的成本,使电视机的供给曲线向右移动.电视机的需求曲线不变.结果是电视机的均衡价格下降,均衡数量上升.5.过去20年间,技术进步降低了电脑芯片的成本.你认为这会对电脑市场产生怎样的影响?对电脑软件呢?对打字机呢?答:技术突破降低芯片成本,使电脑投入价格降低,电脑供给曲线向右下方移动,电脑的需求曲线并未改变.于是电脑市场的均衡价格下降,均衡数量增加.电脑与电脑软件是互补品.电脑市场均衡数量上升,软件的需求也会上升,需求曲线向右上方移动,而供给曲线没有改变.于是,软件市场的均衡价格上升,均衡数量增加.由于打字机也可以用来打字,它和电脑是替代品.电脑芯片成本降低使电脑价格降低,销售量上升,人们对打字机的需求会下降.打字机的价格下降,销售量下降.6.番茄酱是热狗的互补品(以及调味品).如果热狗价格上升,番茄酱市场会发生什么变动?番茄市场呢?。

曼昆_宏观经济学_第五版答案(可直接复制)

P 。因此

作为一个竞争性的、追求利润最大化的企业对工人的雇用应使劳动的边际产量等于实际工资。 这同样也适用于资本的使用,应使资本的边际产量等于实际利率。

3. 在收入分配中规模收益不变的假设有什么作用?

复习题

1. 描述货币的职能。

第四章 货币与通货膨胀

【答案】货币有三种职能:价值储藏、计价单位以及交换媒介。作为一种价值储藏,货币是一 种把现在的购买力变成未来的购买力的方法;作为一种计价单位,货币提供了可以表示价格和

记录债务的单位;作为一种交换媒介,货币是我们用以购买商品与服务的东西。

通货膨胀率的变动。假设实际利率与通货膨胀无关;正如第三章中讨论的那样,是使储蓄和投 资达到均衡时的实际利率。因此通货膨胀率与名义汇率之间就有一对一的关系:如果通货膨胀 率上升

1%,那么名义利率也增长 1%。这种一对一的关系称为费雪效应。如果通货膨胀从 6% 上升到 8%,那么实际利率不变,名义汇率增长 2%。

模收益不变的条件下,经济利润为零。

4. 什么因素决定消费和投资?

【答案】消费正相关于可支配收入——完税后的收入。可支配收入越高,消费越高。投资负相 关于实际利率。投资的目的是获得利润,收益必须大于成本。由于实际利率即资本的使用成本,

实际利率越高资本使用成本就越高,因此投资需求下降。

【答案】当政府增加税收时,可支配收入下降,因此消费也下降。下降的消费数量等于增加的 税收乘以边际消费倾向(MPC)。边际消费倾向越高,增税对于消费的抑制作用越明显。由于产

量由生产要素和生产技术决定,政府购买没有改变,下降的消费数量必须由增加投资来补偿。 因为投资的增加,实际利率必然下降。因此,税收的增加导致了消费的下降,投资的增加,实 际利率的下降。

曼昆《经济学原理》(宏观)第五版测试题库(23)

曼昆《经济学原理》(宏观)第五版测试题库(23)Chapter 23Measuring a Nation's IncomeTRUE/FALSE1. In years of economic contraction, firms throughout the economy increase their production of goods and services, employment rises, and jobs are easy to find.ANS: F DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Economic expansion MSC: Definitional2. Macroeconomic statistics include GDP, the inflation rate, the unemployment rate, retail sales, and the trade deficit.ANS: T DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Definitional3. Macroeconomic statistics tell us about a particular household, firm, or market.ANS: F DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Definitional4. Macroeconomics is the study of the economy as a whole.ANS: T DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Definitional5. The goal of macroeconomics is to explain the economic changes that affect many households, firms, and markets simultaneously.ANS: T DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Definitional6. Microeconomics and macroeconomics are closely linked.ANS: T DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Microeconomics | Macroeconomics MSC: Definitional7. The basic tools of supply and demand are as central to macroeconomic analysis as they are to microeconomic analysis.TOP: Demand | Supply MSC: Definitional8. GDP is the most closely watched economic statistic because it is thought to be the best single measure of asociety’s economic well-being.ANS: T DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional9. GDP can measure either the total income of everyone in the economy or the total expenditure on theeconomy’s output of goods and services, but GDP cannot measure both at the same time.ANS: F DIF: 2 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive10. For an economy as a whole, income must exceed expenditure.ANS: F DIF: 1 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economics11. An economy’s income is the same as its expenditure because every transaction has a buyer and a seller. ANS: T DIF: 1 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Income | Expenditure MSC: Definitional12. GDP is the market value of all final goods and services produced by a country’s citizens in a given period oftime.ANS: F DIF: 1 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional13. GDP adds together many different kinds of products into a single measure of the value of economic activity byusing market prices.ANS: T DIF: 1 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional14. U.S. GDP includes the market value of rental housing, but not the market value of owner-occupied housing. ANS: F DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive15. U.S. GDP excludes the production of most illegal goods.ANS: T DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economics16. U.S. GDP includes estimates of the value of items that are produced and consumed at home, such as housework and car maintenance.ANS: F DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Applicative17. GDP includes only the value of final goods because the value of intermediate goods is already included in the prices of the final goods.ANS: T DIF: 1 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP | Intermediate goods MSC: Definitional18. Additions to inventory subtract from GDP, and when the goods in inventory are later used or sold, the reductions in inventory add to GDP.ANS: F DIF: 1 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP | Inventory MSC: Definitional19. While GDP includes tangible goods such as books and bug spray, it excludes intangible services such as the services provided by teachers and exterminators.ANS: F DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Applicative20. At a rummage sale, you buy two old books and an old rocking chair; your spending on these items is not included in current GDP.ANS: T DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Applicative21. When an American doctor opens a practice in Bermuda, his production there is part of U.S. GDP.ANS: F DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economics1560 Chapter 23 /Measuring a Nation's Income22. If the U.S. government reports that GDP in the third quarter was $12 trillion at an annual rate, then the amount of income and expenditure during quarter three was $3 trillion.ANS: T DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Applicativedifferent stories about overall economic conditions.ANS: F DIF: 2 REF: 23-2NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP | Income MSC: Interpretive24. Expenditures by households on education are included in the consumption component of GDP.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Consumption MSC: Interpretive25. Most goods whose purchases are included in the investment component of GDP are used to produce other goods.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Investment MSC: Interpretive26. New home construction is included in the consumption component of GDP.ANS: F DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Investment MSC: Interpretive27. Changes in inventory are included in the investment component of GDP.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Investment MSC: Interpretive28. The investment component of GDP refers to financial investment in stocks and bonds.ANS: F DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Investment MSC: Interpretive29. The government purchases component of GDP includes salaries paid to soldiers but not Social Security benefits paid to the elderly.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Government purchases MSC: Interpretive30. If the value of an economy’s imports exceeds the value of that economy’s exports, then net exports is a negative number.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economics31. If someone in the United States buys a surfboard produced in Australia, then that purchase is included in both the consumption component of U.S. GDP and the net exports component of U.S. GDP.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Consumption | Net exports MSC: Applicative32. If consumption is $4000, exports are $300, government purchases are $1000, imports are $400, and investment is $800, then GDP is $5700.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economics33. If exports are $500, GDP is $8000, government purchases are $1200, imports are $700, and investment is $800, then consumption is $6200.ANS: T DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Consumption MSC: Applicative34. If consumption is $1800, GDP is $4300, government purchases are $1000, imports are $700, and investment i s $1200, then exports are $300.ANS: F DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Exports MSC: Applicative35. U.S. GDP was almost $14 billion in 2007.ANS: F DIF: 1 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional36. In 2007, government purchases was the largest component of U.S. GDP.ANS: F DIF: 2 REF: 23-3NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive37. If total spending rises from one year to the next, then the economy must be producing a larger output of goods and services.ANS: F DIF: 2 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive38. An increase in nominal U.S. GDP necessarily implies that the United States is producing a larger output of goods and services.TOP: Nominal GDP MSC: Interpretive39. Nominal GDP uses constant base-year prices to place a value on the economy’s production of goods a nd services, while real GDP uses current prices to place a value on the economy’s production of goods and services.ANS: F DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Nominal GDP | Real GDP MSC: Definitional40. Real GDP evaluates current production using prices that are fixed at past levels and therefore shows how the economy’s overall production of goods and services changes over time.ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP MSC: Definitional41. The term real GDP refers to a country’s actual GDP as opposed to its estimated GDP.ANS: F DIF: 2 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP MSC: Interpretive42. Changes in real GDP reflect only changes in the amounts being produced.ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP MSC: Definitional43. Real GDP is a better gauge of economic well-being than is nominal GDP.ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economics1562 Chapter 23 /Measuring a Nation's Income44. Changes in the GDP deflator reflect only changes in the prices of goods and services.ANS: T DIF: 2 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP deflator MSC: Interpretive45. If nominal GDP is $10,000 and real GDP is $8,000, then the GDP deflator is 125.ANS: T DIF: 2 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP deflator MSC: Applicative46. If nominal GDP is $12,000 and the GDP deflator is 80, then real GDP is $15,000.TOP: Real GDP MSC: Applicative47. Economists use the term inflation to describe a situation in whic h the economy’s overall production level isrising.ANS: F DIF: 1 REF: 23-4NAT: Analytic LOC: Unemployment and inflation TOP: InflationMSC: Definitional48. If the GDP deflator in 2006 was 160 and the GDP deflator in 2007 was 180, then the inflation rate in 2007 was12.5%.ANS: T DIF: 2 REF: 23-4NAT: Analytic LOC: Unemployment and inflation TOP: Inflation rateMSC: Applicative49. If the GDP deflator in 2004 was 150 and the GDP deflator in 2005 was 120, then the inflation rate in 2005 was25%.ANS: F DIF: 2 REF: 23-4NAT: Analytic LOC: Unemployment and inflation TOP: Inflation rateMSC: Applicative50. The GDP deflator can be used to take inflation out of nominal GDP.ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP deflator MSC: Definitional51. In 2004, the level of U.S. real GDP was close to four times its 1965 l evel.ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP MSC: Definitional52. The output of goods and services produced in the United States has grown on average 3.2 percent per year. ANS: T DIF: 1 REF: 23-4NAT: Analytic LOC: Productivity and growthTOP: GrowthMSC: Definitional53. Periods during which real GDP rises are called recessions.ANS: F DIF: 1 REF: 23-4NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Recessions MSC: Definitional54. Recessions are associated with lower incomes, rising unemployment, and falling profits.TOP: Recessions MSC: Definitional55. If real GDP is higher in one country than in another, then we can be sure that the standard of living is higher inthe country with the higher real GDP.ANS: F DIF: 2 REF: 23-5NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP | Standard of living MSC: Interpretive56. Real GDP per person tells us the income and expenditure of the average person in the economy.ANS: T DIF: 1 REF: 23-5NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Real GDP per person MSC: Definitional57. GDP does not directly measure those things that make life worthwhile, but it does measure our ability toobtain many of the inputs into a worthwhile life.ANS: T DIF: 1 REF: 23-5NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional58. GDP does not make adjustments for leisure time, environmental quality, or volunteer work.ANS: T DIF: 2 REF: 23-5NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive59. Other things equal, in countries with higher levels of real GDP per person, life expectancy and literacy ratesare higher than in countries with lower levels of real GDP per person.ANS: T DIF: 2 REF: 23-5NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: InterpretiveSHORT ANSWER1. GDP is defined as the market value of all final goods and services produced within a country in a given periodof time. In spite of this definition, some production is left out of GDP. Explain why some final goods and services are not included.ANS:GDP excludes some products because they are so difficult to measure. These products include services performed by individuals for themselves and their families, and most goods that are produced and consumed at home and, therefore, never enter the marketplace. In addition, illegal products are not included in GDP even if they can be measured because, by society's definition, they are bads, not goods.DIF: 2 REF: 23-2 NAT: AnalyticLOC: The study of economics and definitions of economics TOP: GDPMSC: Interpretiveincluded directly as part of GDP, but the value of intermediate goods produced and not sold is includeddirectly as part of GDP.ANS:Intermediate goods produced and sold during the year are not included separately as part of GDP because the value of those goods is included in the value of the final goods produced from them. If the intermediate good is produced but not sold during the year, its value is included as inventory investment for the year in which it was produced. If inventory investment was not included as part of GDP, true production would be underestimated for the year the intermediate good went into inventory, and overestimated for the year the intermediate good is used or sold.DIF: 2 REF: 23-2 NAT: AnalyticLOC: The study of economics and definitions of economics TOP: GDP | Intermediate goods MSC: Interpretive1564 Chapter 23 /Measuring a Nation's Income3. Since it is counted as investment, why doesn't the purchase of earthmoving equipment from China by a U.S.corporation increase U.S. GDP?ANS:The purchase of foreign equipment is counted as investment, but GDP measures only the value of production within the geographic borders of the United States. In order to avoid including the value of the imported equipment, imports are subtracted from GDP. Hence, the value of the equipment in investment is canceled by subtracting its value as an import.DIF: 2 REF: 23-3 NAT: AnalyticLOC: The study of economics and definitions of economics TOP: GDP | Investment | Imports MSC: Applicative4. Identify the immediate effect of each of the following events on U.S. GDP and its components.a. James receives a Social Security check.b. John buys an Italian sports car.c. Henry buys domestically produced tools for his construction company.ANS:a. Since this is a transfer payment, there is no change to GDP or to any of its components.b. Consumption and imports will rise and cancel each other out so that there is no change in U.S. G DP.c. This increases the investment component of GDP and so increases GDP.DIF: 2 REF: 23-3 NAT: AnalyticLOC: The study of economics and definitions of economicsTOP: GDP | Transfer payments | Net exports | Investment MSC: Applicative5. Between 1929 and 1933, NNP measured in current prices fell from $96 billion to $48 billion. Over the sameperiod, the relevant price index fell from 100 to 75.a. What was the percentage decline in nominal NNP from 1929 to1933?b. What was the percentage decline in real NNP from 1929 to 1933? Show your work.ANS:a. NNP measured in current prices is nominal NNP. Nominal NNP fell from $96 billion to $48 billion, adecline of 50 percent.($96 b/100) 100 = $96 b. Real NNP in 1933 was ($48 b/75) 100 = $64 b. Real NNP fell from$96 billion to $64 billion, a decline of 33 percent.DIF: 2 REF: 23-4 NAT: AnalyticLOC: The study of economics and definitions of economics TOP: Nominal NNP | Real NNP MSC: Applicative6. You find that your paycheck for the year is higher this year than last. Does that mean that your real incomehas increased? Explain carefully.ANS:Real income is nominal income adjusted for general increase in prices. I f my paycheck is higher this year than last, my nominal income has increased. Whether my real income has increased or not depends on what has happened since last year to the level of prices of things I buy with my income. If the percentage increase in prices is less than the percentage increase in my nominal income, then my real income h as increased. Otherwise, my real income has not increased.DIF: 2 REF: 23-4 NAT: AnalyticLOC: The study of economics and definitions of economicsTOP: Nominal income | Real income MSC: Interpretive7. U.S. real GDP is substantially higher today than it was 60 years ago. What does this tell us, and what does itnot tell us, about the well-being of U.S. residents?ANS:Since this is in real terms, it tells us that the U.S. is able to make a lot more stuff than in the past. Some of the increase in real GDP is probably due to an increase in population, so we could say more if we knew what had happened to real GDP per person. Supposing that there was also an increase in real GDP per person, we can say that the standard of living has risen. Material things are an important part of well-being. Having sufficient amounts of things such as food, shelter, and clothing are fundamental to well-being. Other things such as security, a safe environment, access to safe water, access to medical care, justice, and freedom also matter. However, many of these things are more easily obtained by being able to produce more using fewer resources. Countries with higher real GDP per person tend to have longer life spans, less discrimination towards women, less child labor, and a higher rate of literacy.DIF: 2 REF: 23-5 NAT: AnalyticLOC: The study of economics and definitions of economicsTOP: Real GDP | Economic welfare MSC: InterpretiveSec00 - Measuring a Nation's IncomeMULTIPLE CHOICE1. Statistics that are of particular interest to macroeconomistsa. are largely ignored by the media.b. are widely reported by the media.c. include the equilibrium prices of individual goods and services.d. tell us about a particular household, firm, or market.ANS: B DIF: 2 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Interpretiveb. the interaction between households and firms.c. economy-wide phenomena.d. regulations on firms and unions.ANS: C DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Definitional3. Which of the following newspaper headlines is more closely related to what microeconomists study than to what macroeconomists study?a. Unemployment rate rises from 5 percent to 5.5 percent.b. Real GDP grows by 3.1 percent in the third quarter.c. Retail sales at stores show large gains.d. The price of oranges rises after an early frost.ANS: D DIF: 2 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Microeconomics | Macroeconomics MSC: Interpretive4. Which of the following questions is more likely to be studied by a microeconomist than a macroeconomist?a. Why do prices in general rise by more in some countries than in others?b. Why do wages differ across industries?c. Why do production and income increase in some periods and not in others?d. How rapidly is GDP currently increasing?ANS: B DIF: 2 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Microeconomics | Macroeconomics MSC: Interpretive1566 Chapter 23 /Measuring a Nation's Income5. Which of the following topics are more likely to be studied by a macroeconomist than by a microeconomist?a. the effect of taxes on the prices of airline tickets, the profitability of automobile-manufacturingfirms, and employment trends in the food-service industryb. the price of beef, wage differences between genders, and antitrust lawsc. how consumers maximize utility, and how prices are established in markets for agriculturalproductsd. the percentage of the labor force that is out of work, and differences in average income fromcountry to countryANS: D DIF: 2 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Microeconomics | Macroeconomics MSC: Interpretive6. We would expect a macroeconomist, as opposed to a microeconomist, to be particularly interested ina. explaining how economic changes affect prices of particular goods.b. devising policies to deal with market failures such as externalities and market power.c. devising policies to promote low inflation.d. identifying those markets that are competitive and those that are not competitive.ANS: C DIF: 2 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Microeconomics | Macroeconomics MSC: Interpretive7. Which of the following is not a question that macroeconomists address?a. Why is average income high in some countries while it is low in others?b. Why does the price of oil rise when war erupts in the Middle East?c. Why do production and employment expand in some years and contract in others?d. Why do prices rise rapidly in some periods of time while they are more stable in other periods? ANS: B DIF: 2 REF: 23-0 NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Macroeconomics MSC: Interpretive8. The basic tools of supply and demand area. useful only in the analysis of economic behavior in individual markets.b. useful in analyzing the overall economy, but not in analyzing individual markets.c. central to microeconomic analysis, but seldom used in macroeconomic analysis.d. central to macroeconomic analysis as well as to microeconomic analysis.ANS: D DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Demand | Supply MSC: Definitional9. Which of the following statistic is usually regarded as the best single measure of a society’s economic well-being?a. the unemployment rateb. the inflation ratec. gross domestic productd. the trade deficitANS: C DIF: 1 REF: 23-0NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: DefinitionalSec01 - Measuring a Nation's Income - The Economy's Income and Expenditure MULTIPLE CHOICE1. Which of the following statements about GDP is correct?a. GDP measures two things at once: the total income of everyone in the economy and the unemployment rate of the economy’s labor force.b. Money continuously flows from households to government and then back to households, and GDP measures this flow of money.c. GDP is to a nation’s economy as household income is to a household.d. All of the above are correct.ANS: C DIF: 2 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Interpretive2. Gross domestic product measures two things at once:a. the total spending of everyone in the economy and the total saving of everyone in the economy.b. the total income of everyone in the economy and the total expenditure on the economy's output of goods and services.c. the value of the economy's output of goods and services for domestic citizens and the value of the economy's output of goods and services for the rest of the world.d. the total income of households in the economy and the total profit of firms in the economy. ANS: B DIF: 1 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: GDP MSC: Definitional3. For an economy as a whole,a. wages must equal profit.b. consumption must equal saving.c. income must equal expenditure.d. the number of buyers must equal the number of sellers.ANS: C DIF: 2 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Income | Expenditure MSC: Interpretive4. For an economy as a whole, income must equal expenditure becausea. the number of firms is equal to the number of households in an economy.b. international law requires that income equal expenditure.c. every dollar of spending by some buyer is a dollar of income for some seller.d. every dollar of saving by some consumer is a dollar of spending by some other consumer. ANS: C DIF: 2 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economicsTOP: Income | Expenditure MSC: Interpretive5. If an economy’s GDP rises, then it must be the case that the economy’sa. income rises and saving falls.b. income and saving both rise.c. income rises and expenditure falls.d. income and expenditure both rise.ANS: D DIF: 2 REF: 23-1NAT: Analytic LOC: The study of economics and definitions of economics TOP: Income | Expenditure MSC: Interpretive。

曼昆经济学原理试题及答案

一、名词解释(每小题5分,共50分)1。

机会成本2.科斯定理3.搭便车4。

囚徒困境5。

菲利普斯曲线6。

供应学派7.凯恩斯革命8。

看不见的手9。

比较优势10。

外部性二、简述题(第11、12、13题各12分,14题14分,共50分)1.简述银行存款的创造过程。

2.简述失业的根源及其类型.3。

简述节俭的是非。

4.根据有关经济学原理,简析我国森林减少、珍稀动物来绝的原因及解决的措施。

三、论述题(每小题25分,共计50分)1.论述人民币升值对中国经济的影响。

2。

论述政府公共投资对国民经济的作用。

一、名词解释(每小题5分,共50分)1。

机会成本:指人们利用一定资源获得某种收入时所放弃的在其他可能的用途中所能够获取的最大收入。

生产一单位的某种商品的机会成本是指生产者所放弃的使用相同的生产要素在其他生产用途中所能得到的最高收入。

机会成本的存在需要三个前提条件。

第一,资源是稀缺的;第二,资源具有多种生产用途;第三,资源的投向不受限制。

从机会成本的角度来考察生产过程时,厂商需要将生产要素投向收益最大的项目,而避免带来生产的浪费,达到资源配置的最优。

机会成本的概念是以资源的稀缺性为前提提出的.从经济资源的稀缺性这一前提出发,当一个社会或一个企业用一定的经济资源生产一定数量的一种或者几种产品时,这些经济资源就不能同时被使用在其他的生产用途方面。

这就是说,这个社会或这个企业所能获得的一定数量的产品收入,是以放弃用同样的经济资源来生产其他产品时所能获得的收入作为代价的。

这也是机会成本产生的缘由.因此,社会生产某种产品的真正成本就是它不能生产另一些产品的代价。

所以,机会成本的含义是:任何生产资源或生产要素一般都有多种不同的使用途径或机会,也就是说可以用于多种产品的生产。

但是当一定量的某种资源用于生产甲种产品时,就不能同时用于生产乙种产品。

因此生产甲种产品的真正成本就是不生产乙种产品的代价,或者是等于该种资源投放于乙种产品生产上可能获得的最大报酬.一种资源决定用于甲种产品,就牺牲了生产其他产品的机会;从事生产甲种产品的收入,是由于不从事或放弃其他产品生产的机会而产生的。

曼昆经济学原理(宏观分册)第23章课后习题答案(英文版)

Quick Quizzes:1. Gross domestic product measures two things at once: (1) the total income of everyone in theeconomy and (2) the total expenditure on the economy’s output of final goods and services.It can measure both of these things at once because all expenditure in the economy ends up assomeone’s income.2. The production of a pound of caviar contributes more to GDP than the production of a pound ofhamburger because the contribution to GDP is measured by market value and the price of apound of caviar is much higher than the price of a pound of hamburger.3. The four components of expenditure are: (1) consumption; (2) investment; (3) governmentpurchases; and (4) net exports. The largest component is consumption, which accounts formore than 70 percent of total expenditure.4. Real GDP is the production of goods and services valued at constant prices. Nominal GDP isthe production of goods and services valued at current prices. Real GDP is a better measure ofeconomic well-being because changes in real GDP reflect changes in the amount of outputbeing produced. Thus, a rise in real GDP means people have produced more goods andservices, but a rise in nominal GDP could occur either because of increased production orbecause of higher prices.5. Although GDP is not a perfect measure of well-being, policymakers should care about itbecause a larger GDP means that a nation can afford better healthcare, better educationalsystems, and more of the material necessities of life.Questions for Review:1. An economy's income must equal its expenditure, because every transaction has a buyer and aseller. Thus, expenditure by buyers must equal income by sellers.2. The production of a luxury car contributes more to GDP than the production of an economy carbecause the luxury car has a higher market value.3. The contribution to GDP is $3, the market value of the bread, which is the final good that issold.4. The sale of used records does not affect GDP at all because it involves no current production.5. The four components of GDP are consumption, such as the purchase of a DVD; investment,such as the purchase of a computer by a business; government purchases, such as an order formilitary aircraft; and net exports, such as the sale of American wheat to Russia. (Many otherexamples are possible.)6. Economists use real GDP rather than nominal GDP to gauge economic well-being because realGDP is not affected by changes in prices, so it reflects only changes in the amounts beingproduced. You cannot determine if a rise in nominal GDP has been caused by increasedproduction or higher prices.7.405The percentage change in nominal GDP is (600 – 200)/200 x 100% = 200%. The percentagechange in real GDP is (400 – 200)/200 x 100% = 100%. The percentage change in the deflator is (150 – 100)/100 x 100% = 50%.8. It is desirable for a country to have a large GDP because people could enjoy more goods andservices. But GDP is not the only important measure of well-being. For example, laws thatrestrict pollution cause GDP to be lower. If laws against pollution were eliminated, GDP wouldbe higher but the pollution might make us worse off. Or, for example, an earthquake wouldraise GDP, as expenditures on cleanup, repair, and rebuilding increase. But an earthquake is anundesirable event that lowers our welfare.Problems and Applications1. a. Consumption increases because a refrigerator is a good purchased by a household.b. Investment increases because a house is an investment good.c. Consumption increases because a car is a good purchased by a household, but investmentdecreases because the car in Ford’s inventory had been counted as an investment gooduntil it was sold.d. Consumption increases because pizza is a good purchased by a household.e. Government purchases increase because the government spent money to provide a goodto the public.f. Consumption increases because the bottle is a good purchased by a household, but netexports decrease because the bottle was imported.g. Investment increases because new structures and equipment were built.2. With transfer payments, nothing is produced, so there is no contribution to GDP.3. If GDP included goods that are resold, it would be counting output of that particular year, plussales of goods produced in a previous year. It would double-count goods that were sold morethan once and would count goods in GDP for several years if they were produced in one yearand resold in another.4. a. Calculating nominal GDP:2010: ($1 per qt. of milk ⨯ 100 qts. milk) + ($2 per qt. of honey ⨯ 50 qts. honey) = $2002011: ($1 per qt. of milk ⨯ 200 qts. milk) + ($2 per qt. of honey ⨯ 100 qts. honey) = $4002012: ($2 per qt. of milk ⨯ 200 qts. milk) + ($4 per qt. of honey ⨯ 100 qts. honey) = $800Calculating real GDP (base year 2010):2010: ($1 per qt. of milk ⨯ 100 qts. milk) + ($2 per qt. of honey ⨯ 50 qts. honey) = $2002011: ($1 per qt. of milk ⨯ 200 qts. milk) + ($2 per qt. of honey ⨯ 100 qts. honey) = $4002012: ($1 per qt. of milk ⨯ 200 qts. milk) + ($2 per qt. of honey ⨯ 100 qts. honey) = $400 Calculating the GDP deflator:2010: ($200/$200) ⨯ 100 = 1002011: ($400/$400) ⨯ 100 = 1002012: ($800/$400) ⨯ 100 = 200b. Calculating the percentage change in nominal GDP:Percentage change in nominal GDP in 2011 = [($400 – $200)/$200] ⨯ 100% = 100%.Percentage change in nominal GDP in 2012 = [($800 – $400)/$400] ⨯ 100% = 100%.Calculating the percentage change in real GDP:Percentage change in real GDP in 2011 = [($400 – $200)/$200] ⨯ 100% = 100%.Percentage change in real GDP in 2012 = [($400 – $400)/$400] ⨯ 100% = 0%.Calculating the percentage change in GDP deflator:Percentage change in the GDP deflator in 2011 = [(100 – 100)/100] ⨯ 100% = 0%.Percentage change in the GDP deflator in 2012 = [(200 – 100)/100] ⨯ 100% = 100%.Prices did not change from 2010 to 2011. Thus, the percentage change in the GDP deflator is zero. Likewise, output levels did not change from 2011 to 2012. This means that thepercentage change in real GDP is zero.c. Economic well-being rose more in 2010 than in 2011, since real GDP rose in 2011 but not in2012. In 2011, real GDP rose but prices did not. In 2012, real GDP did not rise but prices did.5. a. C alculating Nominal GDP:Year 1: (3 bars ⨯ $4) = $12Year 2: (4 bars ⨯ $5) = $20Year 3: (5 bars ⨯ $6) = $30b. C alculating Real GDP:Year 1: (3 bars ⨯ $4) = $12Year 2: (4 bars ⨯ $4) = $16Year 3: (5 bars ⨯ $4) = $20c. Calculating the GDP delator:Year 1: $12/$12 ⨯ 100 = 100Year 2: $20/$16 ⨯ 100 = 125Year 3: $30/$20 ⨯ 100 = 150d. T he growth rate from Year 2 to Year 3 = (16 – 12)/12 ⨯ 100% = 4/12 ⨯ 100% = 33.3%e. The inflation rate from Year 2 to Year 3 = (150 – 125)/125 ⨯ 100% = 25/125 ⨯ 100% =20%.f. To calculate the growth rate of real GDP, we could simply calculate the percentage changein the quantity of bars. To calculate the inflation rate, we could measure the percentage change in the price of bars.6.a. The growth rate of nominal GDP = 100% ⨯ [($14,256/$9,353)0.10– 1] = 4.3%b. The growth rate of the deflator = 100% ⨯ [(109.886.8)0.10– 1] = 2.4%c. Real GDP in 1999 (in 2005 dollars) is $9,353/(86.8/100) = $10,775.35.d. Real GDP in 2009 (in 2005 dollars) is $14,256/(109.8/100) = $12,983.61.e. The growth rate of real GDP = 100% ⨯ [($12,983.61/$10,775.35)0.10– 1] = 1.9%f. The growth rate of nominal GDP is higher than the growth rate of real GDP because ofinflation.7. Many answers are possible.8. a. GDP is the market value of the final good sold, $180.b. Value added for the farmer: $100.Value added for the miller: $150 – $100 = $50.Value added for the baker: $180 – $150 = $30.c. Together, the value added for the three producers is $100 + $50 + $30 = $180. This is thevalue of GDP.9. In countries like India, people produce and consume a fair amount of food at home that is notincluded in GDP. So GDP per person in India and the United States will differ by more than their comparative economic well-being.10. a. The increased labor-force participation of women has increased GDP in the United States,because it means more people are working and production has increased.b. If our measure of well-being included time spent working in the home and taking leisure, itwould not rise as much as GDP, because the rise in women's labor-force participation has reduced time spent working in the home and taking leisure.c. Other aspects of well-being that are associated with the rise in women's increasedlabor-force participation include increased self-esteem and prestige for women in theworkforce, especially at managerial levels, but decreased quality time spent with children, whose parents have less time to spend with them. Such aspects would be quite difficult to measure.11. a. GDP equals the dollar amount Barry collects, which is $400.b. NNP = GDP – depreciation = $400 – $50 = $350.c. National income = NNP = $350.d. Personal income = national income – retained earnings – indirect business taxes = $350 –$100 – $30 = $220.e. Disposable personal income = personal income – personal income tax = $220 – $70 =$150.。

曼昆《经济学原理》第五版宏观经济学习题答案

第20章货币制度1、为什么银行不持有百分百的准备金?银行持有的准备金量和银行体系所创造的货币量有什么关系?参考答案:银行不持有百分百的准备金是因为把存款用于放贷并收取利息比持有全部存款更有利可图。

银行持有的准备金量和银行体系通过货币乘数所创造的货币量是相关的。

银行的准备金率越低,货币乘数越大,所以银行存款的每一元钱可以创造更多的货币2、考察以下情况如何影响经济的货币制度。

a、假设雅普岛的居民发现了一种制造石轮的简单方法。

这种发现如何影响石轮作为货币的有用性呢?并解释之。

b、假设美国某个人发现了一种仿造100美元钞票的简单办法。

这种发现将如何影响美国的货币制度呢?并解释之。

参考答案:a、如果有一种制造石轮的简单方法,雅普岛上的居民就会制造多余的石轮,只要每个石轮的货币价值大于制造它的成本。

结果,人们会自己制造货币,于是就有太多的货币被制造出来。

最有可能的是,人们会停止接受石轮作为货币,而转向其他资产作为交换的媒介b. 如果美国有人发现了伪造百元面值美钞的简单方法,他们就会大量地生产这种假钞,而降低百元美钞的价值,结果可能是转为使用另一种通货。

3、伯列戈瑞德州银行(BSB)有亿美元存款,并保持10%的准备率。

a)列出BSB的T账户。

b)现在假设BSB的大储户从其账户中提取了1000万美元现金。

如果BSB决定通过减少其未清偿贷款量来恢复其准备率,说明它的新T账户。

c)解释BSB的行动对其他银行有什么影响?d)为什么BSB要采取(b)中所描述的行为是困难的?讨论BSB恢复其原来准备金率的另一种方法。

参考答案:a. BSB的T账户如下::b. 当BSB的大储户提取了1000万美金现金,而BSB通过减少其未清偿贷款量来恢复其准备率,它的T账户如下:c. 因为BSB收回了它的部分贷款并持有为准备金,其它银行持有的准备金会减少,于是可能也会减少其未清偿贷款额。

d. BSB也许会发现很难立即减少未清偿贷款,因为它不能强迫债务人立即还款,作为替代,它会停止发放新的贷款。

宏观经济学习题答案(曼昆第五版)

第二十三章国收入的衡量复习题3 .农民以2 美元的价格把小麦卖给面包师。

面包师用小麦制成面包,以3 美元的价格出售。

这些交易对 GDP 的贡献是多少呢? 答:对GDP 的贡献是3 美元。

GDP 只包括最终物品的价值,因为中间物品的价值已经包括在最终物品的价格中了.6 .为什么经济学家在判断经济福利时用真实GDP ,而不用名义GDP? 答:经济学家计算GDP 的目的就是要衡量整个经济运行状况如何。

由于实际GDP 衡量经济中物品与劳务的生产,所以,它反映了经济满足人们需要与欲望的能力。

这样,真实GDP 是比名义GDP 衡量经济福利更好的指标.7 .在2010 年,某个经济生产100 个面包,每个以2 美元的价格售出。

在2011 年,这个经济生产200 个面包,每个以3 美元的价格售出。

计算每年的名义GDP 、真实GDP 和GDP 平减指数。

( 用2010 年做基年。

) 从一年到下一年这三个统计数字的百分比分别提高了多少?答:2010 年的名义GDP 等于200 美元,真实GDP 也等于200 美元, GDP 平减指数是100. 2011 年的名义GDP 等于600 美元,真实GDP 等于400 美元,GDP 平减指数是150.从2010 年到2011 年,名义GDP 提高了200%,真实GDP 提高了100%,GDP 平减指数提高了50%.问题与应用5 .以下是牛奶和蜂蜜之间的一些数据:年份名义GDP 1 P1Q1 2 P2Q2 3 P3Q3 年份真实GDP 1 P1Q1 2 P1Q2 3 P1Q3 年份GDP 平减指数 1 100 2 (P2/P1)100 3 (P3/P1)100 年份牛奶的价格(美元)牛奶量(品脱)蜂蜜的价格(美元)蜂蜜量(品脱) 2008 1 100 2 50 2009 1 200 2 100 2010 2 200 4 100 137 A .把2008 年作为基年,计算每年的名义GDP 、真实GDP 和GDP 平减指数.答:把2008 年作为基年时,2008 年的名义GDP 是200 美元,2008 年的真实GDP 是200 美元,GDP 平减指数是100.2006 年的名义GDP 是400 美元,2006 年的实际GDP 是400 美元, GDP 平减指数是100. 2007 年的名义GDP 是800 美元,2007 年的实际GDP 是400 美元, GDP 平减指数是200.B .计算2009年和2010 年从上一年以来名义GDP 、真实GDP 和GDP 平减指数变动的百分比.答:从2008 年到2009 年,名义GDP 增加了100%,真实GDP 增加了100%,GDP 平减指数未变.从2009 年到2010 年,名义GDP 增加了100%,真实GDP 未变,因而GDP 平减指数增加了100.C .在2009 年或2010 年,经济福利增加了吗?解释之.答:在2009 年,经济福利增加了,因为真实GDP 增加了100%。

曼昆经济学原理第五版标准答案宏观

曼昆经济学原理第五版答案宏观【篇一:经济学原理曼昆(宏观部分答案)】>第二十三章一国收入的衡量复习题 1.解释为什么一个经济的收入必定等于其支出? 答:对一个整体经济而言,收入必定等于支出。

因为每一次交易都有两方:买者和卖者。

一个买者的1 美元支出是另一个卖者的1 美元收入。

因此,交易对经济的收入和支出作出了相同的贡献。

由于gdp 既衡量总收入 135又衡量总支出,因而无论作为总收入来衡量还是作为总支出来衡量,gdp都相等.2 .生产一辆经济型轿车或生产一辆豪华型轿车,哪一个对gdp的贡献更大?为什么? 答:生产一辆豪华型轿车对gdp的贡献大。

因为gdp是在某一既定时期一个国家内生产的所有最终物品与劳务的市场价值。

由于市场价格衡量人们愿意为各种不同物品支付的量,所以市场价格反映了这些物品的市场价值。

由于一辆豪华型轿车的市场价格高于一辆经济型轿车的市场价格,所以一辆豪华型轿车的市场价值高于一辆经济型轿车的市场价值,因而生产一辆豪华型轿车对gdp 的贡献更大.3 .农民以2美元的价格把小麦卖给面包师。

面包师用小麦制成面包,以3美元的价格出售。

这些交易对gdp的贡献是多少呢?答:对gdp 的贡献是3美元。

gdp 只包括最终物品的价值,因为中间物品的价值已经包括在最终物品的价格中了.4 .许多年以前,peggy 为了收集唱片而花了500 美元。

今天她在旧货销售中把她收集的物品卖了100 美元.这种销售如何影响现期gdp? 答:现期gdp只包括现期生产的物品与劳务,不包括涉及过去生产的东西的交易。

因而这种销售不影响现期gdp.5 .列出gdp的四个组成部分。

各举一个例子.答:gdp等于消费(c)+投资(i)+政府购买(g)+净出口(nx) 消费是家庭用于物品与劳务的支出,如汤姆一家人在麦当劳吃午餐.投资是资本设备、存货、新住房和建筑物的购买,如通用汽车公司建立一个汽车厂.政府购买包括地方政府、州政府和联邦政府用于物品与劳务的支出,如海军购买了一艘潜艇.净出口等于外国人购买国内生产的物品(出口)减国内购买的外国物品(进口)。

曼昆经济学原理第五版答案英文ch23

WHAT’S NEW:The In the News box on “Mr. Index Goes to Hollywood” has been updated and is now a Case Study with a Web site reference where students can obtain continually updated information. There is also a new In the News box on “A CPI for Senior Citizens.”LEARNING OBJECTIVES:By the end of this chapter, students should understand:how the consumer price index (CPI) is constructed.why the CPI is an imperfect measure of the cost of living.how to compare the CPI and the GDP deflator as measures of the overall price level.how to use a price index to compare dollar figures from different times.the distinction between real and nominal interest rates.KEY POINTS:1. The consumer price index shows the cost of a basket of goods and services relative to thecost of the same basket in the base year. The index is used to measure the overall level of prices in the economy. The percentage change in the price level measures the inflation rate.2. The consumer price index is an imperfect measure of the cost of living for three reasons.First, it does not take into account consumers’ ability to substitute toward goods that become relatively cheaper over time. Second, it does not take into account increases in thepurchasing power of a dollar due to the introduction of new goods. Third, it is distorted by unmeasured changes in the quality of goods and services. Because of these measurement problems, the CPI overstates annual inflation by about 1 percentage point.3. Although the GDP deflator also measures the overall level of prices in the economy, it differsfrom the consumer price index because it includes goods and services produced rather than goods and services consumed. As a result, imported goods affect the consumer price index but not the GDP deflator. In addition, while the consumer price index uses a fixed basket ofMEASURING THE COST OFLIVINGgoods, the GDP deflator automatically changes the group of goods and services over time as the composition of GDP changes.4. Dollar figures from different points in time do not represent a valid comparison of purchasingpower. To compare a dollar figure from the past to a dollar figure today, the older figure should be inflated using a price index.5. Various laws and private contracts use price indexes to correct for the effects of inflation.The tax laws, however, are only partially indexed for inflation.6. A correction for inflation is especially important when looking at data on interest rates. Thenominal interest rate is the interest rate usually reported; it is the rate at which the number of dollars in a savings account increases over time. By contrast, the real interest rate takes into account changes in the value of the dollar over time. The real interest rate equals the nominal interest rate minus the rate of inflation.CHAPTER OUTLINE:I. The Consumer Price IndexA.Definition of Consumer Price Index (CPI): a measure of the overall cost of the goods and services bought by a typical consumer .B.How the Consumer Price Index is Calculated1.Fix the basket.a.The Bureau of Labor Statistics uses surveys to determine a representative bundle of goods and services purchased by a typical consumer.b.Example: 4 hot dogs and 2 hamburgers.2.Find the prices. a.Prices for each of the goods and services in the basket must be determined for each time period.b. Example:3.Compute the basket’s cost.Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.a.By keeping the basket the same, only prices are being allowed change. This allows us to isolate the effects of price changes over time. b.Example:Cost in 2001 = ($1 × 4) + ($2 × 2) = $8. Cost in 2002 = ($2 × 4) + ($3 × 2) = $14. Cost in 2003 = ($3 × 4) + ($4 × 2) = $20.4. Choose a base year and compute the index.a. The base year is the benchmark against which other years arecompared.b.The formula for calculating the price index is:c.Example (using 2001 as the base year):CPI for 2001 = ($8)/($8) × 100 = 100. CPI for 2002 = ($14)/($8) × 100 = 175. CPI for 2003 = ($20)/($8) × 100 = 250.a.Definition of Inflation Rate: the percentage change in the price index from the preceding period .b.The formula used to calculate the inflation rate is:c.Example:Inflation Rate for 2002 = (175 – 100)/100 × 100% = 75%. Inflation Rate for 2003 = (250 – 175)/175 × 100% = 43%.C.Another Important Price Index: The Producer Price Index 1.Definition of Producer Price Index: a measure of the cost of a basket of goods and services bought by firms .2.Because firms pass on higher costs to consumers in the form of higher prices on products, the producer price index is believed to be helpful in predicting changes in the CPI.D.FYI: What Is in the CPI’s Basket?1. Figure 23-1 shows the make-up of the market basket used to compute the CPI.2. The largest category is housing, which makes up 40% of a typicalE. In the News: Shopping for the CPI1. There are approximately 300 employees of the Bureau of Labor Statisticswho gather information on prices.2. This is an article that appeared in The Wall Street Journal about theseindividuals.F. Problems in Measuring the Cost of Living1. Substitution Biasa. When the price of one good changes, consumers often respondby substituting another good in its place.b. The CPI does not allow for this substitution; it is calculated usinga fixed basket of goods and services.c. This implies that the CPI overstates the increase in the cost ofliving over time.2. Introduction of New Goodsa. When a new good is introduced, consumers have a wider varietyof goods and services to choose from.b. This makes every dollar more valuable, which means that thereis an increase in the purchasing power of the dollar.c. Because the market basket is not revised often enough, thesenew goods are left out of the bundle of goods and servicesincluded in the basket.3. Unmeasured Quality Changea. If the quality of a good falls from one year to the next, the valueof a dollar falls; if quality rises, the value of the dollar rises.b. Attempts are made to correct prices for changes in quality, but itis often difficult to do so because quality is hard to measure.4. The size of these problems is also difficult to measure.5. The issue is important because many government transfer programs(such as Social Security) are tied to increases in the CPI.Harcourt, Inc. items and derived items copyright 2001 by Harcourt, Inc.6.Most studies indicate that the CPI overstates the rate of inflation by approximately 1 percentage point per year.G. In the News: A CPI for Senior Citizens1. Senior citizens generally do not spend their budgets in the same proportions as younger individuals.2.In fact, senior citizens spend a great deal on medical care, which has risen in price by a much larger than amount than the prices of most other consumer products.3.This is an article from The New York Times discussing the debate over creating a separate price index for this group.H.The GDP Deflator Versus the Consumer Price Index 1. The GDP deflator reflects the prices of all goods produced domestically, while the CPI reflects the prices of all goods bought by consumers.2.The CPI compares the prices of a fixed basket of goods over time, while the GDP deflator compares the prices of the goods currently produced to the prices of the goods produced in the base year. This means that the group of goods and services used to compute the GDP deflator changes automatically over time as output changes.3. Figure 23-2 shows the inflation rates calculated using the CPI and the GDP deflator.II. Correcting Economic Variables for the Effects of Inflation A.Dollar Figures from Different Times1.To change dollar values from one year to the next, we can use this formula:2. Example: Babe Ruth’s 1931 salary in 1999 dollars:Salary in 1999 dollars = Salary in 1931 dollars × price level in 1999price level in 1931Salary in 1999 dollars = $80,000 × (166/15.2). Salary in 1999 dollars = $873,684.3. Case Study: Mr. Index Goes to HollywoodHarcourt, Inc. items and derived items copyright 2001 by Harcourt, Inc.a.Reports of box office success are often made in terms of the dollar values of ticket sales.b.These ticket sales are then compared with ticket sales of movies in the past.c.However, no correction for changes in the value of a dollar are made.d.Table 23-2 shows a table of the top 20 films with the estimated box office gross in 1998 dollars. The winner: Gone with the Wind .B. Indexation1. Definition of Indexation: the automatic correction of a dollaramount for the effects of inflation by law or contract .2.As mentioned above, many government transfer programs use indexation for the benefits. The government also indexes the tax brackets used for federal income tax.3.There are uses of indexation in the private sector as well. Many labor contracts include Cost-of-Living-Allowances (COLAs).C.Real and Nominal Interest Rates 1. Definition of Nominal Interest Rate: the interest rate as usuallyreported without a correction for the effects of inflation .2. Definition of Real Interest Rate: the interest rate corrected for the effects of inflation .ALTERNATIVE CLASSROOM EXAMPLE:Your father graduated from school and took his first job in 1972, which paid a salary of $7,000. What is this salary worth in 1999 dollars?CPI in 1972 = 41.8 CPI in 1999 = 166Value in 1999 dollars = 1972 salary × (CPI in 1999/CPI in 1972)Value in 1999 dollars = $7,000 × (166/41.8) = $7,000 × 3.97 = $27,7903. Figure 23-3 shows real and nominal interest rates from 1965 to thepresent. Note that in the late 1970s, the real interest rate was negativebecause the inflation rate exceeded the nominal interest rate. ADJUNCT TEACHING TIPS AND WARM-UP ACTIVITIES:1.Have students ask their parents (or grandparents) how much they paid for their first car andin what year they bought it. (If there are older students in the class, ask them to remember how much they paid for their first car.) Students can then determine how much they would have to pay in current dollars using the consumer price index.2.Ask for a volunteer to search the internet to find out average medical care prices for the pasttwenty to fifty years. Make a graph and compare the rising medical prices with rising prices in general using the CPI for the same period.SOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. The consumer price index tries to measure the overall cost of the goods and servicesbought by a typical consumer. It is constructed by surveying consumers to fix a basketof goods and services that the typical consumer buys, finding the prices of the goods and services over time, computing the cost of the basket at different times, choosing a baseyear, computing the index, then computing the inflation rate.2. Since Henry Ford paid his workers $5 a day in 1914 and the consumer price index was10 in 1914 and 166 in 1999, then the Ford paycheck was worth $5 ⨯ 166/10 = $83 a dayin 1999 dollars.Questions for Review1. A 10 percent increase in the price of chicken has a greater effect on the consumer priceindex than a 10 percent increase in the price of caviar because chicken is a bigger part of the average consumer's market basket.2. The three problems in the consumer price index as a measure of the cost of living are:(1) substitution bias, which arises because people substitute toward goods that havebecome relatively less expensive; (2) the introduction of new goods, which are notreflected quickly in the CPI; and (3) unmeasured quality change.3. If the price of a Navy submarine rises, there is no effect on the consumer price index,since Navy submarines aren't consumer goods. But the GDP price index is affected,since Navy submarines are included in GDP.4. Since the overall price level doubled, but the price of the candy bar rose sixfold, the realprice (the price adjusted for inflation) of the candy bar tripled.5. The nominal interest rate is the rate of interest paid on a loan in dollar terms. The realinterest rate is the rate of interest corrected for inflation. The real interest rate is thenominal interest rate minus the rate of inflation.Problems and Applications1. a. The price of tennis balls increases 0%; the price of tennis racquets increases50% [=($60-$40)/$40 x 100%]; the price of Gatorade increases 100% [= ($2 -$1)/$1 x 100%].To find the percentage change in the overall price level, follow these steps:1. Determine the fixed basket of goods: 100 balls, 10 racquets, 200Gatorades2. Find the price of each good in each year:3. Compute the cost of the basket of goods in each year:2001: (100 x $2) + (10 x $40) + (200 x $1) = $8002002: (100 x $2) + (10 x $60) + (200 x $2) = $1,2004. Choose one year as a base year (2001) and compute the CPI in eachyear:2001: $800/$800 x 100 = 1002002: $1,200/$800 x 100 = 1505. Use the CPI to compute the inflation rate from the previous year:2002: (150 - 100)/100 x 100% = 50%b. Tennis racquets are less expensive relative to Gatorade, since their price rose50% while the price of Gatorade rose 100%. The well-being of some peoplechanges relative to the well-being of others. Those who purchase a lot ofGatorade become worse off relative to those who purchase a lot of tennisracquets or tennis balls.2. To find the percentage change in the overall price level, follow these steps:a. Determine the fixed basket of goods: 100 heads of cauliflower, 50 bunches ofbroccoli, 500 carrotsb. Find the price of each good in each year:Harcourt, Inc. items and derived items copyright 2001 by Harcourt, Inc.c. Compute the cost of the basket of goods in each year:2001: (100 x $2) + (50 x $1.50) + (500 x $.10) = $3252002: (100 x $3) + (50 x $1.50) + (500 x $.20) = $475d. Choose one year as a base year (2001) and compute the CPI in each year:2001: $325/$325 x 100 = 1002002: $475/$325 x 100 = 146e. Use the CPI to compute the inflation rate from the previous year:2002: (146-100)/100 x 100% = 46%3. Since the CPI rose 637%, that means [CPI(1997)-CPI(1947)]/CPI(1947) x 100% = 637%,so CPI(1997)/CPI(1947) -1 = 6.37, so CPI(1997)/CPI(1947) = 7.37. So if an item costsunder 7.37 times as much in 1997 than it did in 1947, then it's relatively less expensive.The easiest way to see this is to take the 1947 price, multiply it by 7.37, and compare itto the 1997 price.University of Iowa tuition: $130 x 7.37 = $958 < $2,470, so the 1997 cost is highergallon of gasoline: $0.23 x 7.37 = $1.70 > $1.22, so the 1997 cost is lowerphone call: $2.50 x 7.37 = $18.42 > $0.45, so the 1997 cost is lowerday in hospital: $35 x 7.37 = $258 < $2,300, so the 1997 cost is higherhamburger: $0.15 x 7.37 = $1.11 > $0.59, so the 1997 cost is lower4. a. Since the increase in cost was considered a quality improvement, there was noincrease registered in the CPI.b. The argument in favor of this is that consumers are getting a better good thanbefore, so the price increase equals the improvement in quality. The problem isthat the increased cost might exceed the value of the improvement in air quality,so consumers are worse off. In this case, it would be better for the CPI to atleast partially reflect the higher cost.5. a. introduction of new goods; b. unmeasured quality change; c. substitution bias; d.unmeasured quality change; e. substitution bias6. a. ($0.75 - $0.15)/$0.15 x 100% = 400%.b. ($13.84 - $3.35)/$3.35 x 100% = 313%.c. In 1970: $.15/($3.35/60) = 2.7 minutes. In 1999: $.75/($13.84/60) = 3.3minutes.d. Workers' purchasing power fell in terms of newspapers.7. a. If the elderly consume the same market basket as other people, Social Securitywould provide the elderly with an improvement in their standard of living eachyear because the CPI overstates inflation and Social Security payments are tiedto the CPI.Chapter 23 — MEASURING THE COST OF LIVING 11 Harcourt, Inc. items and derived items copyright 2001 by Harcourt, Inc.b. Since the elderly consume more health care than younger people, and sincehealth care costs have risen faster than overall inflation, it's possible that the elderly are worse off. To investigate this, you'd need to put together a marketbasket for the elderly, which would have a higher weight on health care. You'd then compare the rise in the cost of the "elderly" basket with that of the generalbasket for CPI.8.Many answers are possible. A common answer may be that as students, they spend a greater proportion of their income on tuition and books than the typical household. Since the prices of tuition and books have risen faster than average prices, students face a higher inflation rate than the typical household.9. When bracket creep occurred, inflation increased people's nominal incomes, pushingthem into higher tax brackets, so they had to pay a higher proportion of their incomes in taxes, even though they weren't getting higher real incomes. As a result, real tax revenue rose.10. In deciding how much income to save for retirement, workers should consider the real interest rate, since they care about their purchasing power in the future, not the number of dollars they’ll have.11. a. When inflation is higher than was expected, the real interest rate is lower thanexpected. For example, suppose the market equilibrium has an expected real interest rate of 3% and people expect inflation to be 4%, so the nominal interestrate is 7%. If inflation turns out to be 5%, the real interest rate is 7% minus5% equals 2%, which is less than the 3% that was expected.b. Since the real interest rate is lower than was expected, the lender loses and the borrower gains. The borrower is repaying the loan with dollars that are worthless than was expected.c. Homeowners in the 1970s who had fixed-rate mortgages from the 1960sbenefited from the unexpected inflation, while the banks who made the mortgage loans lost a lot of money.。

曼昆《经济学原理》(宏观)第五版测试题库(30)