第3章存货rechal1

案例八:戴尔存货管理

戴尔公司从1984年创立,到今天不过31年, 在段暂的30多年时间里,已经发展成为世界上 最大的电脑直销商,并成为最受尊敬的企业,但 现在也受到许多冲击和挑战.

四、 问题提出

1、“零库存”是不是意味着没有库存?戴尔 公司的“零库存”运行模式的精髓在哪里? 2、在企业里推行“零库存”运行模式需要什 么条件?是不是所有的企业都适合“零库存” 的管理模式? 3、戴尔在全世界都是直销 , 为何在中国不但 直销,而且实行分销?

案例八

戴尔的存货管理

一、戴尔公司发展史

戴尔公司(Dell Computer)(NASDAQ: DELL)(港交所:4332), 是一家总部位于美国 德克萨斯州的世界五百强企业。戴尔以生产、 设计、销售家用以及办公室电脑而闻名,不过 它同时也涉足高端电脑市场,生产与销售服务 器、数据储存设备、网络设备及打印机等电脑 周边产品。 2012年公司营业额达到了574亿美元, 在全球共有约75,100名雇员。

更重要的是,分销还与中国人的购买习惯有关。 中国的消费者购买商品喜欢去卖场货比三家,因为卖 场里可以多一些选择机会,购买前还能看到真品。对 于电脑这类的大件商品,非要试用几下,才能买得踏 实。像美国人那样还没看到真品模样,就打个电话购 买了产品,一般的中国消费者还难以接受。这归根结 底还是因为中国的人均收入暂时还处于较低的水平: 美国人买一台电脑稀疏平常,算不得什么大件。

需要注意的是,当我们为戴尔“物料的低库存与 成品的零库存”给予喝彩和掌声的同时,应该看到: 戴尔没有仓库,但是供应商在它周围有仓库。事实上, 戴尔的工厂外边有很多配套厂家。戴尔在网上或电话 里接到定单,收了钱之后会告诉你要多长时间货可以 到。在这段时间里它就有时间去对订单进行整合,对 既有的原材料进行分拣,需要什么原材料就下订单给 供应商,下单之后,货到了生产线上才进行产权交易, 之前的库存都是供应商的。

亚当理论

亚当理论亚当理论亚当理论作者:威尔斯·韦登 (Welles J. Wilder) ,同时他又是 相对强弱指数(RSI)、抛物线(PAR)、摇摆指数(SI)、转向分析(DM)、动力指标(MOM)、变异率(VOL)等等指标的发明者。

原书最初发表于:1987年6月一九八三年秋,一位名叫威廉史洛门的人打电话给我,这位仁兄我素来不认识。

史洛门告诉我,他发现了市场的原理,愿意以高价出售。

他说,如果我到芝加哥,他会展现给我看。

我曾经接到无数这类的电话,以往这种情形都是无的放矢,因此我问了史洛门几个相关的问题。

史洛门似乎真的发现了预测市场未来走势的方法 ....... 也就是,下一个高点和低点可能发生的时间。

很明显,这套方法并不是根据市场上知名方法如江恩理论 . 艾略特波浪理论或是其他理论衍生而来的。

我问史洛门,我如何知道他要卖给我的东西具有价值。

他说,如果我去芝加哥,他会展示给我看,之后我再决定要不要买。

我十足受到诱惑,因此决定冒个险,买张机票到芝加哥一趟。

到了芝加哥,史洛门将他的发现展示给我,这套方法的名称叫做三角洲理论( DELTA )。

史洛门发现的是所有市场存在的完美次序。

了解这个次序,便能准确预测市场未来长期走势。

而且,方法非常简单 ........ 不必用到数学 ...... 更有甚者,以前根本就没有人发现。

我付给史洛门一大笔钱,而他要求付现,之后我便搭晚上班机飞回到格林斯巴诺。

我花了六个月时间证明,三角洲理论在回朔几年前的资料时,是否应用恰当。

我也应用到其它多种市场。

研究完成后,我发现三角洲理论在应用到以前和现在的资料时,都十分准确,不管采取的资料时段的长短,对理论的准确性毫无影响。

一九八五年,我创办三角洲国际学社。

这个学社的成员可以分享三角洲理论预测的市场未来反转点资料。

这项资料在公元二千年之前可以随时取得。

前面所记述的事情,是我下文所要叙述故事的背景资料。

其实,没有上述背景资料,下面所要陈述的一切可能会被认为纯属无稽之谈 ...... 或者说,你会认为我是个不折不扣的白痴。

公司理财精要版原书第12版习题库答案Ross12e_Chapter03_TB

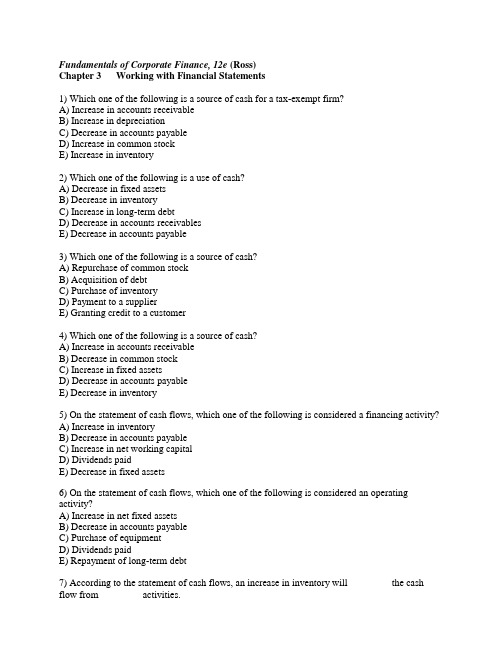

Fundamentals of Corporate Finance, 12e (Ross)Chapter 3 Working with Financial Statements1) Which one of the following is a source of cash for a tax-exempt firm?A) Increase in accounts receivableB) Increase in depreciationC) Decrease in accounts payableD) Increase in common stockE) Increase in inventory2) Which one of the following is a use of cash?A) Decrease in fixed assetsB) Decrease in inventoryC) Increase in long-term debtD) Decrease in accounts receivablesE) Decrease in accounts payable3) Which one of the following is a source of cash?A) Repurchase of common stockB) Acquisition of debtC) Purchase of inventoryD) Payment to a supplierE) Granting credit to a customer4) Which one of the following is a source of cash?A) Increase in accounts receivableB) Decrease in common stockC) Increase in fixed assetsD) Decrease in accounts payableE) Decrease in inventory5) On the statement of cash flows, which one of the following is considered a financing activity?A) Increase in inventoryB) Decrease in accounts payableC) Increase in net working capitalD) Dividends paidE) Decrease in fixed assets6) On the statement of cash flows, which one of the following is considered an operating activity?A) Increase in net fixed assetsB) Decrease in accounts payableC) Purchase of equipmentD) Dividends paidE) Repayment of long-term debt7) According to the statement of cash flows, an increase in inventory will ________ the cash flow from ________ activities.A) increase; operatingB) decrease; financingC) decrease; operatingD) increase; financingE) increase; investment8) According to the statement of cash flows, an increase in interest expense will ________ the cash flow from ________ activities.A) decrease; operatingB) decrease; financingC) increase; operatingD) increase; financingE) Increase; investment9) Activities of a firm that require the spending of cash are known as:A) sources of cash.B) uses of cash.C) cash collections.D) cash receipts.E) cash on hand.10) The sources and uses of cash over a stated period of time are reflected on the:A) income statement.B) balance sheet.C) tax reconciliation statement.D) statement of cash flows.E) statement of operating position.11) A common-size income statement is an accounting statement that expresses all of a firm's expenses as a percentage of:A) total assets.B) total equity.C) net income.D) taxable income.E) sales.12) Which one of the following standardizes items on the income statement and balance sheet relative to their values as of a chosen point in time?A) Statement of standardizationB) Statement of cash flowsC) Common-base year statementD) Common-size statementE) Base reconciliation statement13) On a common-size balance sheet all accounts for the current year are expressed as a percentage of:A) sales for the period.B) the base year sales.C) total equity for the base year.D) total assets for the current year.E) total assets for the base year.14) On a common-base year financial statement, accounts receivables for the current year will be expressed relative to which one of the following?A) Current year salesB) Current year total assetsC) Base-year salesD) Base-year total assetsE) Base-year accounts receivables15) Which one of the following ratios is a measure of a firm's liquidity?A) Cash coverage ratioB) Profit marginC) Debt-equity ratioD) Quick ratioE) NWC turnover16) An increase in current liabilities will have which one of the following effects, all else held constant? Assume all ratios have positive values.A) Increase in the cash ratioB) Increase in the net working capital to total assets ratioC) Decrease in the quick ratioD) Decrease in the cash coverage ratioE) Increase in the current ratio17) An increase in which one of the following will increase a firm's quick ratio without affecting its cash ratio?A) Accounts payableB) CashC) InventoryD) Accounts receivableE) Fixed assets18) A supplier, who requires payment within 10 days, should be most concerned with which one of the following ratios when granting credit?A) CurrentB) CashC) Debt-equityD) QuickE) Total debt19) A firm has an interval measure of 48. This means that the firm has sufficient liquid assets to do which one of the following?A) Pay all of its debts that are due within the next 48 hoursB) Pay all of its debts that are due within the next 48 daysC) Cover its operating costs for the next 48 hoursD) Cover its operating costs for the next 48 daysE) Meet the demands of its customers for the next 48 hours20) Ratios that measure a firm's liquidity are known as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) book value21) Which one of the following statements is correct?A) If the total debt ratio is greater than .50, then the debt-equity ratio must be less than 1.0.B) Long-term creditors would prefer the times interest earned ratio be 1.4 rather than 1.5.C) The debt-equity ratio can be computed as 1 plus the equity multiplier.D) An equity multiplier of 1.2 means a firm has $1.20 in sales for every $1 in equity.E) An increase in the depreciation expense will not affect the cash coverage ratio.22) If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be which one of the following?A) 0B) .5C) 1.0D) 1.5E) 2.023) The cash coverage ratio directly measures the ability of a company to meet its obligation to pay:A) an invoice to a supplier.B) wages to an employee.C) interest to a lender.D) principal to a lender.E) a dividend to a shareholder.24) All-State Moving had sales of $899,000 in 2017 and $967,000 in 2018. The firm's current accounts remained constant. Given this information, which one of the following statements must be true?A) The total asset turnover rate increased.B) The days' sales in receivables increased.C) The net working capital turnover rate increased.D) The fixed asset turnover decreased.E) The receivables turnover rate decreased.25) The Corner Hardware has succeeded in increasing the amount of goods it sells while holding the amount of inventory on hand at a constant level. Assume that both the cost per unit and the selling price per unit also remained constant. This accomplishment will be reflected in the firm's financial ratios in which one of the following ways?A) Decrease in the inventory turnover rateB) Decrease in the net working capital turnover rateC) Increase in the fixed asset turnover rateD) Decrease in the day's sales in inventoryE) Decrease in the total asset turnover rate26) RJ's has a fixed asset turnover rate of 1.26 and a total asset turnover rate of .97. Sam's has a fixed asset turnover rate of 1.31 and a total asset turnover rate of .94. Both companies have similar operations. Based on this information, RJ's must be doing which one of the following?A) Utilizing its fixed assets more efficiently than Sam'sB) Utilizing its total assets more efficiently than Sam'sC) Generating $1 in sales for every $1.26 in net fixed assetsD) Generating $1.26 in net income for every $1 in net fixed assetsE) Maintaining the same level of current assets as Sam's27) Ratios that measure how efficiently a firm manages its assets and operations to generate net income are referred to as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) turnover28) If a company produces a return on assets of 14 percent and also a return on equity of 14 percent, then the firm:A) may have short-term, but not long-term debt.B) is using its assets as efficiently as possible.C) has no net working capital.D) has a debt-equity ratio of 1.0.E) has an equity multiplier of 1.0.29) Which one of the following will decrease if a firm can decrease its operating costs, all else constant?A) Return on equityB) Return on assetsC) Profit marginD) Total asset turnoverE) Price-earnings ratio30) Al's has a price-earnings ratio of 18.5. Ben's also has a price-earnings ratio of 18.5. Which one of the following statements must be true if Al's has a higher PEG ratio than Ben's?A) Al's has more net income than Ben's.B) Ben's is increasing its earnings at a faster rate than Al's.C) Al's has a higher market value per share than does Ben's.D) Ben's has a lower market-to-book ratio than Al's.E) Al's has a higher earnings growth rate than Ben's.31) Tobin's Q relates the market value of a firm's assets to which one of the following?A) Initial cost of creating the firmB) Current book value of the firmC) Average asset value of similar firmsD) Average market value of similar firmsE) Today's cost to duplicate those assets32) The price-sales ratio is especially useful when analyzing firms that have:A) volatile market prices.B) negative earnings.C) positive PEG ratios.D) a high Tobin's Q.E) increasing sales.33) Mortgage lenders probably have the most interest in the ________ ratios.A) return on assets and profit marginB) long-term debt and times interest earnedC) price-earnings and debt-equityD) market-to-book and times interest earnedE) return on equity and price-earnings34) Relationships determined from a company's financial information and used for comparison purposes are known as:A) financial ratios.B) identities.C) dimensional analysis.D) scenario analysis.E) solvency analysis.35) DL Farms currently has $600 in debt for every $1,000 in equity. Assume the company uses some of its cash to decrease its debt while maintaining its current equity and net income. Which one of the following will decrease as a result of this action?A) Equity multiplierB) Total asset turnoverC) Profit marginD) Return on assetsE) Return on equity36) Which one of these identifies the relationship between the return on assets and the return on equity?A) Profit marginB) Profitability determinantC) Balance sheet multiplierD) DuPont identityE) Debt-equity ratio37) Which one of the following accurately describes the three parts of the DuPont identity?A) Equity multiplier, profit margin, and total asset turnoverB) Debt-equity ratio, capital intensity ratio, and profit marginC) Operating efficiency, equity multiplier, and profitability ratioD) Return on assets, profit margin, and equity multiplierE) Financial leverage, operating efficiency, and profitability ratio38) An increase in which of the following must increase the return on equity, all else constant?A) Total assets and salesB) Net income and total equityC) Total asset turnover and debt-equity ratioD) Equity multiplier and total equityE) Debt-equity ratio and total debt39) Which one of the following is a correct formula for computing the return on equity?A) Profit margin × ROAB) ROA × Equity multiplierC) Profit margin × Total asset turnover × Debt-equity ratioD) Net income/Total assetsE) Debt-equity ratio × ROA40) The DuPont identity can be used to help managers answer which of the following questions related to a company's operations?I. How many sales dollars are being generated per each dollar of assets?II. How many dollars of assets have been acquired per each dollar in shareholders' equity? III. How much net profit is being generating per dollar of sales?IV. Does the company have the ability to meet its debt obligations in a timely manner?A) I and III onlyB) II and IV onlyC) I, II, and III onlyD) II, III and IV onlyE) I, II, III, and IV41) The U.S. government coding system that classifies a company by the nature of its business operations is known as the:A) Centralized Business Index.B) Peer Grouping codes.C) Standard Industrial Classification codes.D) Governmental ID codes.E) Government Engineered Coding System.42) Which one of the following statements is correct?A) Book values should always be given precedence over market values.B) Financial statements are rarely used as the basis for performance evaluations.C) Historical information is useful when projecting a company's future performance.D) Potential lenders place little value on financial statement information.E) Reviewing financial information over time has very limited value.43) The most acceptable method of evaluating the financial statements is to compare the company's current financial:A) ratios to the company's historical ratios.B) statements to the financial statements of similar companies operating in other countries.C) ratios to the average ratios of all companies located within the same geographic area.D) statements to those of larger companies in unrelated industries.E) statements to the projections that were created based on Tobin's Q.44) All of the following issues represent problems encountered when comparing the financial statements of two separate entities except the issue of the companies:A) being conglomerates with unrelated lines of business.B) having geographically varying operations.C) using differing accounting methods.D) differing seasonal peaks.E) having the same fiscal year.45) Which one of these is the least important factor to consider when comparing the financial situations of utility companies that generate electric power and have the same SIC code?A) Type of ownershipB) Government regulations affecting the firmC) Fiscal year endD) Methods of power generationE) Number of part-time employees46) At the beginning of the year, Brick Makers had cash of $183, accounts receivable of $392, accounts payable of $463, and inventory of $714. At year end, cash was $167, accounts payables was $447, inventory was $682, and accounts receivable was $409. What is the amount of the net source or use of cash by working capital accounts for the year?A) Net use of $16 cashB) Net use of $17 cashC) Net source of $17 cashD) Net source of $15 cashE) Net use of $15 cash47) During the year, Al's Tools decreased its accounts receivable by $160, increased its inventory by $115, and decreased its accounts payable by $70. How did these three accounts affect the sources of uses of cash by the firm?A) Net source of cash of $120B) Net source of cash of $205C) Net source of cash of $45D) Net use of cash of $115E) Net use of cash of $2548) Lani's generated net income of $911, depreciation expense was $47, and dividends paid were $25. Accounts payables increased by $15, accounts receivables increased by $28, inventory decreased by $14, and net fixed assets decreased by $8. There was no interest expense. What was the net cash flow from operating activity?A) $776B) $865C) $959D) $922E) $98549) For the past year, Jenn's Floral Arrangements had taxable income of $198,600, beginning common stock of $68,000, beginning retained earnings of $318,750, ending common stock of $71,500, ending retained earnings of $316,940, interest expense of $11,300, and a tax rate of 21 percent. What is the amount of dividends paid during the year?A) $157,280B) $159,935C) $163,200D) $153,555E) $158,70450) The Floor Store had interest expense of $38,400, depreciation of $28,100, and taxes of $19,600 for the year. At the start of the year, the firm had total assets of $879,400 and current assets of $289,600. By year's end total assets had increased to $911,900 while current assets decreased to $279,300. What is the amount of the cash flow from investment activity for the year?A) −$51,150B) $21,850C) $29,300D) −$70,900E) −$89,40051) Williamsburg Market is an all-equity firm that has net income of $96,200, depreciation expense of $6,300, and an increase in net working capital of $2,800. What is the amount of the net cash from operating activity?A) $91,300B) $99,700C) $93,400D) $105,300E) $113,70052) The accounts payable of a company changed from $136,100 to $104,300 over the course of a year. This change represents a:A) use of $31,800 of cash as investment activity.B) source of $31,800 of cash as an operating activity.C) source of $31,800 of cash as a financing activity.D) source of $31,800 of cash as an investment activity.E) use of $31,800 of cash as an operating activity.53) Oil Creek Auto has sales of $3,340, net income of $274, net fixed assets of $2,600, and current assets of $920. The firm has $430 in inventory. What is the common-size statement value of inventory?A) 12.22 percentB) 44.16 percentC) 16.54 percentD) 13.36 percentE) 46.74 percent54) Pittsburgh Motors has sales of $4,300, net income of $320, total assets of $4,800, and total equity of $2,950. Interest expense is $65. What is the common-size statement value of the interest expense?A) .89 percentB) 1.51 percentC) 1.69 percentD) 2.03 percentE) 1.35 percent55) Last year, which is used as the base year, a firm had cash of $52, accounts receivable of $223, inventory of $509, and net fixed assets of $1,107. This year, the firm has cash of $61,accounts receivable of $204, inventory of $527, and net fixed assets of $1,216. What is this year's common-base-year value of inventory?A) .67B) .91C) .88D) 1.04E) 1.1856) Duke's Garage has cash of $68, accounts receivable of $142, accounts payable of $235, and inventory of $318. What is the value of the quick ratio?A) 2.25B) .53C) .71D) .89E) 1.3557) Uptown Men's Wear has accounts payable of $2,214, inventory of $7,950, cash of $1,263, fixed assets of $8,400, accounts receivable of $3,907, and long-term debt of $4,200. What is the value of the net working capital to total assets ratio?A) .31B) .42C) .47D) .51E) .5658) DJ's has total assets of $310,100 and net fixed assets of $168,500. The average daily operating costs are $2,980. What is the value of the interval measure?A) 31.47 daysB) 47.52 daysC) 56.22 daysD) 68.05 daysE) 104.62 days59) Corner Books has a debt-equity ratio of .57. What is the total debt ratio?A) .36B) .30C) .44D) 2.27E) 2.7560) SS Stores has total debt of $4,910 and a debt-equity ratio of 0.52. What is the value of the total assets?A) $16,128.05B) $7,253.40C) $9,571.95D) $11,034.00E) $14,352.3161) JK Motors has sales of $96,400, costs of $53,800, interest paid of $2,800, and depreciation of $7,100. The tax rate is 21 percent. What is the value of the cash coverage ratio?A) 15.21B) 12.14C) 17.27D) 23.41E) 12.6862) Terry's Pets paid $2,380 in interest and $2,200 in dividends last year. The times interest earned ratio is 2.6 and the depreciation expense is $680. What is the value of the cash coverage ratio?A) 1.42B) 2.72C) 2.94D) 2.89E) 2.4663) The Up-Towner has sales of $913,400, costs of goods sold of $579,300, inventory of $123,900, and accounts receivable of $78,900. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit?A) 74.19 daysB) 84.69 daysC) 78.07 daysD) 96.46 daysE) 71.01 days64) Flo's Flowers has accounts receivable of $4,511, inventory of $1,810, sales of $138,609, and cost of goods sold of $64,003. How many days does it take the firm to sell its inventory and collect the payment on the sale assuming that all sales are on credit?A) 11.88 daysB) 22.20 daysC) 16.23 daysD) 14.50 daysE) 18.67 days65) The Harrisburg Store has net working capital of $2,715, net fixed assets of $22,407, sales of $31,350, and current liabilities of $3,908. How many dollars' worth of sales are generated from every $1 in total assets?A) $1.08B) $1.14C) $1.19D) $84E) $9366) TJ's has annual sales of $813,200, total debt of $171,000, total equity of $396,000, and a profit margin of 5.78 percent. What is the return on assets?A) 8.29 percentB) 6.48 percentC) 9.94 percentD) 7.78 percentE) 8.02 percent67) Frank's Used Cars has sales of $807,200, total assets of $768,100, and a profit margin of 6.68 percent. The firm has a total debt ratio of 54 percent. What is the return on equity?A) 13.09 percentB) 12.04 percentC) 11.03 percentD) 8.56 percentE) 15.26 percent68) Bernice's has $823,000 in sales. The profit margin is 4.2 percent and the firm has 7,500 shares of stock outstanding. The market price per share is $16.50. What is the price-earnings ratio?A) 3.58B) 3.98C) 4.32D) 3.51E) 4.2769) Hungry Lunch has net income of $73,402, a price-earnings ratio of 13.7, and earnings per share of $.43. How many shares of stock are outstanding?A) 13,520B) 12,460C) 165,745D) 171,308E) 170,70270) A firm has 160,000 shares of stock outstanding, sales of $1.94 million, net income of $126,400, a price-earnings ratio of 21.3, and a book value per share of $7.92. What is the market-to-book ratio?A) 2.12B) 1.84C) 1.39D) 2.45E) 2.6971) Taylor's Men's Wear has a debt-equity ratio of 48 percent, sales of $829,000, net income of $47,300, and total debt of $206,300. What is the return on equity?A) 19.29 percentB) 11.01 percentC) 15.74 percentD) 18.57 percentE) 14.16 percent72) Nielsen's has inventory of $29,406, accounts receivable of $46,215, net working capital of $4,507, and accounts payable of $48,919. What is the quick ratio?A) 1.55B) .49C) 1.32D) .94E) .9273) The Strong Box has sales of $859,700, cost of goods sold of $648,200, net income of $93,100, and accounts receivable of $102,300. How many days of sales are in receivables?A) 57.60 daysB) 40.32 daysC) 54.53 daysD) 29.41 daysE) 43.43 days74) Corner Books has sales of $687,400, cost of goods sold of $454,200, and a profit margin of 5.5 percent. The balance sheet shows common stock of $324,000 with a par value of $5 a share, and retained earnings of $689,500. What is the price-sales ratio if the market price is $43.20 per share?A) 4.28B) 12.74C) 6.12D) 4.07E) 14.5175) Gem Jewelers has current assets of $687,600, total assets of $1,711,000, net working capital of $223,700, and long-term debt of $450,000. What is the debt-equity ratio?A) .87B) .94C) 1.21D) 1.15E) 1.0676) Russell's has annual sales of $649,200, cost of goods sold of $389,400, interest of $23,650, depreciation of $121,000, and a tax rate of 21 percent. What is the cash coverage ratio for the year?A) 8.43B) 10.99C) 11.64D) 5.87E) 18.2277) Lawn Care, Inc., has sales of $367,400, costs of $183,600, depreciation of $48,600, interest of $39,200, and a tax rate of 25 percent. The firm has total assets of $422,100, long-term debt of $102,000, net fixed assets of $264,500, and net working capital of $22,300. What is the return on equity?A) 24.26 percentB) 15.38 percentC) 38.96 percentD) 29.96 percentE) 17.06 percent78) Frank's Welding has net fixed assets of $36,200, total assets of $51,300, long-term debt of $22,000, and total debt of $29,700. What is the net working capital to total assets ratio?A) 12.18 percentB) 16.82 percentC) 14.42 percentD) 17.79 percentE) 9.90 percent79) The Green Fiddle has current liabilities of $28,000, sales of $156,900, and cost of goods sold of $62,400. The current ratio is 1.22 and the quick ratio is .71. How many days on average does it take to sell the inventory?A) 128.13 daysB) 74.42 daysC) 199.81 daysD) 147.46 daysE) 83.53 days80) Green Yard Care has net income of $62,300, a tax rate of 21 percent, and a profit margin of 6.7 percent. Total assets are $1,100,500 and current assets are $328,200. How many dollars of sales are being generated from every dollar of net fixed assets?A) $2.83B) $1.37C) $.84D) $1.20E) $1.2381) Jensen's Shipping has total assets of $694,800 at year's end. The beginning owners' equity was $362,400. During the year, the company had sales of $711,000, a profit margin of 5.2 percent, a tax rate of 21 percent, and paid $12,500 in dividends. What is the equity multiplier at year-end?A) 1.67B) 1.72C) 1.93D) 1.80E) 1.8682) Western Gear has net income of $12,400, a tax rate of 21 percent, and interest expense of $1,600. What is the times interest earned ratio for the year?A) 9.63B) 7.75C) 10.81D) 14.97E) 10.9783) Big Tree Lumber has earnings per share of $1.36. The firm's earnings have been increasing at an average rate of 2.9 percent annually and are expected to continue doing so. The firm has 21,500 shares of stock outstanding at a price per share of $23.40. What is the firm's PEG ratio?A) 2.27B) 11.21C) 4.85D) 3.94E) 5.9384) Townsend Enterprises has a PEG ratio of 5.3, net income of $49,200, a price-earnings ratio of 17.6, and a profit margin of 7.1 percent. What is the earnings growth rate?A) 2.48 percentB) 1.06 percentC) 3.32 percentD) 5.20 percentE) 10.60 percent85) A firm has total assets with a current book value of $71,600, a current market value of $82,300, and a current replacement cost of $90,400. What is the value of Tobin's Q?A) .85B) .87C) .90D) .94E) .9186) Dixie Supply has total assets with a current book value of $368,900 and a current replacement cost of $486,200. The market value of these assets is $464,800. What is the value of Tobin's Q?A) .79B) .76C) .96D) 1.26E) 1.0587) Dandelion Fields has a Tobin's Q of .96. The replacement cost of the firm's assets is $225,000 and the market value of the firm's debt is $101,000. The firm has 20,000 shares of stock outstanding and a book value per share of $2.09. What is the market-to-book ratio?A) 2.75 timesB) 3.18 timesC) 3.54 timesD) 4.01 timesE) 4.20 times88) The Tech Store has annual sales of $416,000, a price-earnings ratio of 18, and a profit margin of 3.7 percent. There are 12,000 shares of stock outstanding. What is the price-sales ratio?A) .97B) .67C) 1.08D) 1.15E) .8689) Lassiter Industries has annual sales of $328,000 with 8,000 shares of stock outstanding. The firm has a profit margin of 4.5 percent and a price-sales ratio of 1.20. What is the firm's price-earnings ratio?A) 21.9B) 17.4C) 18.6D) 26.7E) 24.390) Drive-Up has sales of $31.4 million, total assets of $27.6 million, and total debt of $14.9 million. The profit margin is 3.7 percent. What is the return on equity?A) 6.85 percentB) 9.15 percentC) 11.08 percentD) 13.31 percentE) 14.21 percent91) Corner Supply has a current accounts receivable balance of $246,000. Credit sales for the year just ended were $2,430,000. How many days on average did it take for credit customers to pay off their accounts during this past year?A) 44.29 daysB) 55.01 daysC) 55.50 daysD) 36.95 daysE) 41.00 days92) BL Industries has ending inventory of $302,800, annual sales of $2.33 million, and annual cost of goods sold of $1.41 million. On average, how long did a unit of inventory sit on the shelf before it was sold?A) 47.43 daysB) 22.18 daysC) 78.38 daysD) 61.78 daysE) 83.13 days93) Billings Inc. has net income of $161,000, a profit margin of 7.6 percent, and an accounts receivable balance of $127,100. Assume that 66 percent of sales are on credit. What is the days' sales in receivables?A) 21.90 daysB) 27.56 daysC) 33.18 daysD) 35.04 daysE) 36.19 days94) Stone Walls has a long-term debt ratio of .6 and a current ratio of 1.2. Current liabilities are $800, sales are $7,800, the profit margin is 6.5 percent, and return on equity is 15.5 percent. What is the amount of the firm's net fixed assets?A) $8,880.15B) $8,017.43C) $7,666.67D) $5,848.15E) $8,977.43。

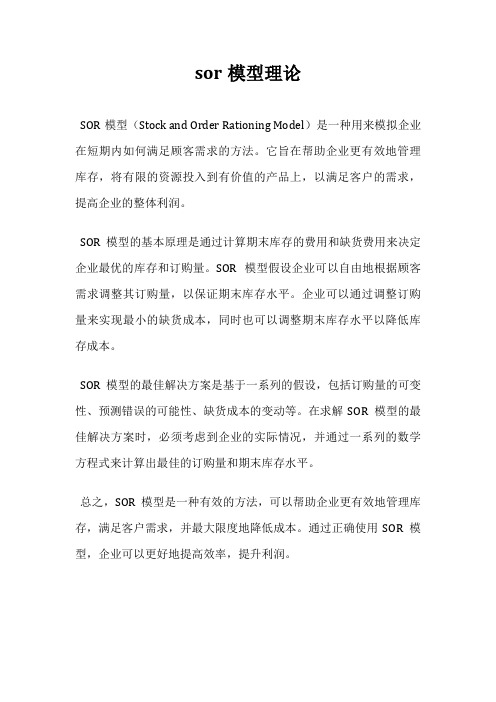

sor模型理论

sor模型理论

SOR模型(Stock and Order Rationing Model)是一种用来模拟企业在短期内如何满足顾客需求的方法。

它旨在帮助企业更有效地管理库存,将有限的资源投入到有价值的产品上,以满足客户的需求,提高企业的整体利润。

SOR模型的基本原理是通过计算期末库存的费用和缺货费用来决定企业最优的库存和订购量。

SOR模型假设企业可以自由地根据顾客需求调整其订购量,以保证期末库存水平。

企业可以通过调整订购量来实现最小的缺货成本,同时也可以调整期末库存水平以降低库存成本。

SOR模型的最佳解决方案是基于一系列的假设,包括订购量的可变性、预测错误的可能性、缺货成本的变动等。

在求解SOR模型的最佳解决方案时,必须考虑到企业的实际情况,并通过一系列的数学方程式来计算出最佳的订购量和期末库存水平。

总之,SOR模型是一种有效的方法,可以帮助企业更有效地管理库存,满足客户需求,并最大限度地降低成本。

通过正确使用SOR模型,企业可以更好地提高效率,提升利润。

5库存管理

不同的国家。在美国销售的产品是通过海运运到芝加哥的仓库。近年

来,美国詹姆公司已经感觉到竞争剧烈,并感受到来自于其顾客要求

提高服务水平和降低成本的巨大压力。正如其库存经理所说:“目前

的服务水平处于历史最低水平,只有大约70%的定单能够准时交货,

另一方面,库存却不断地堆积起来,大多是没有需求的产品。”

他指出服务水平低的几个原因:

2.22

2

2.22

3

2.22

累计品种 (%)

2.22

单价 (元/件)

480

销售量 (件)

3280

4.44

470

1680

6.70

200

1060

销售额 (元)

1833600

销售额百 分比

40.5

销售额累计 分类 百分比(%)

40.5

789600 17.4 57.9

A

212000 4.7

62.6

4

2.22

库存管理的目标:保障供应;成本低

5

库存的利弊分析

作用

预防不确定的、随机的需求变动。 调节供求差异,保证生产经营活动的正常进行。 为了以经济批量订货。 可以满足季节性需求、促销活动、节假日等的需 求变化。

库存带来的弊端

占用大量资金。 发生库存成本。 带来其他一些管理上的问题。

6

库存的分类

按其在生产过程和配送过程中所处的状态分类:原 材料库存、在制品库存、维修库存和产成品库存

的用户。

生产

如果我按大批量生产,就可能降低单位成本和 有效地经营。

采购

如果整批大量购进,就能降低单位成本。

财务

我从哪里筹集资金来支付存货的货款?库存水 平应更低些。

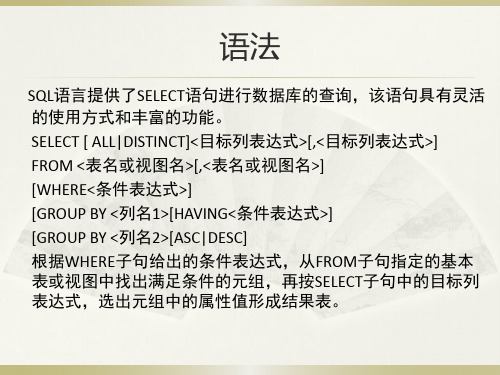

数据库实验三

SELECT mat_name, amount, unit FROM stock WHERE unit BETWEEN 50 AND 100 等价

SELECT mat_name, amount, unit FROM stock WHERE unit>=50 AND unit<=100

%代表任意长度(长度可以为0)的字符串

_代表任意单个字符

【例4.20】查询存放在供电局1#仓库的物资的详细情况 SELECT * FROM stock WHERE warehouse LIKE ‘供电局1#仓库’ 等价于 SELECT * FROM stock WHERE warehouse=‘供电局1#仓库’

一、单表查询

单表查询是指仅涉及一张表的查询。 1、选择表中的若干列 选择表中的全部列或部分列,这就是关系代数的投影运算。 1)查询指定的列:在很多情况下,用户只对表中一部分属性列

感兴趣,这时可以通过在SELECT子句的<目标列表达式>中指定 要查询的属性列。 【例4.8】查询所有配电物资的物资编号、物资名称、规格 SELECT mat_num, mat_name, speci FROM stock;

请按照课本第62页的语法,演练【例4.22】、【例 4.23】、【例4.24】

(5) 涉及空值的查询

空值(NULL)在数据库中有特殊含义,它表示不确定的值。 判断取值为空的语句格式为:列名 IS NULL 判断取值不为空的语句格式为:列名 IS NOT NULL 【例4.25】 查询无库存单价的物资编号及其名称 SELECT mat_num, mat_name FROM stock WHERE unit IS NULL 注意: 这里的“IS”不能用等号(=)代替。

mrp练习题讲解

mrp练习题讲解在进行MRP(物料需求计划)的实践中,练习题是非常重要的一部分。

通过解答练习题,我们可以加深对MRP概念、原理和应用的理解,培养我们的分析和解决问题的能力。

本文将对几个MRP练习题进行详细的讲解。

练习题一:某公司制造一种产品,产品的整个生产过程主要包括三个阶段:A、B、C。

每个阶段的生产周期如下:A阶段:2天B阶段:3天C阶段:1天同时,每个阶段都有一定的工艺加工时间要求:A阶段:1天B阶段:2天C阶段:1天现在,假设某公司面临市场需求,每天有20个单位的产品需求量。

请回答以下问题:1. 如果初始库存为200个单位的产品,计算第6天需要生产多少个单位的产品?2. 如果初始库存为50个单位的产品,计算第8天需要生产多少个单位的产品?3. 如果初始库存为0个单位的产品,计算第5天需要生产多少个单位的产品?解答:1. 首先,我们需要计算每个阶段的净需求量。

A阶段的净需求量 = (第6天需求量 - 第2天的产品库存)= 20 * 6 - 200 = 20个单位的产品B阶段的净需求量 = (第6天需求量 - 第3天的产品库存)= 20 * 6 - (20 * 3 - 20 * 2)= 20个单位的产品C阶段的净需求量 = (第6天需求量 - 第4天的产品库存)= 20 * 6 - (20 * 2 - 20 * 1)= 20个单位的产品2. 类似地,我们可以计算出第8天每个阶段的净需求量:A阶段的净需求量 = (第8天需求量 - 第2天的产品库存)= 20 * 8 - 200 = 120个单位的产品B阶段的净需求量 = (第8天需求量 - 第3天的产品库存)= 20 * 8 - (20 * 3 - 20 * 2)= 140个单位的产品C阶段的净需求量 = (第8天需求量 - 第4天的产品库存)= 20 * 8 - (20 * 2 - 20 * 1)= 160个单位的产品3. 在初始库存为0的情况下,同样计算每个阶段的净需求量:A阶段的净需求量 = (第5天需求量 - 第2天的产品库存)= 20 * 5 - 0 = 100个单位的产品B阶段的净需求量 = (第5天需求量 - 第3天的产品库存)= 20 * 5 - (20 * 3 - 20 * 2)= 120个单位的产品C阶段的净需求量 = (第5天需求量 - 第4天的产品库存)= 20 * 5 - (20 * 2 - 20 * 1)= 140个单位的产品通过以上计算,我们可以得出在不同的初始库存下,不同天数所需要生产的产品数量。

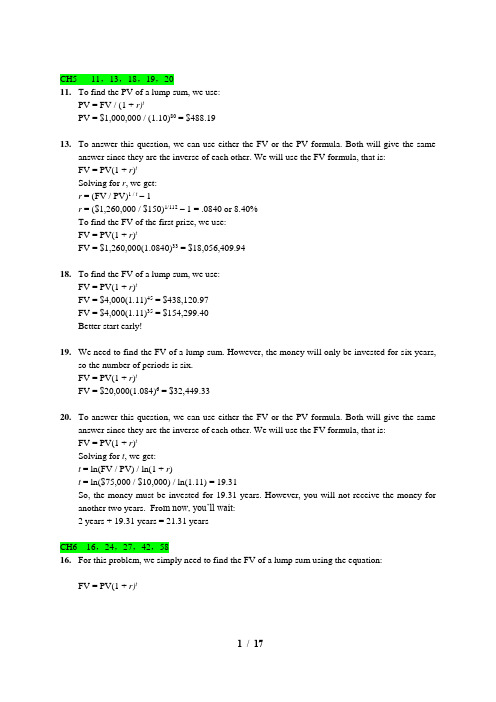

罗斯《公司理财》第9版精要版英文原书课后部分章节答案

CH5 11,13,18,19,2011.To find the PV of a lump sum, we use:PV = FV / (1 + r)tPV = $1,000,000 / (1.10)80 = $488.1913.To answer this question, we can use either the FV or the PV formula. Both will give the sameanswer since they are the inverse of each other. We will use the FV formula, that is:FV = PV(1 + r)tSolving for r, we get:r = (FV / PV)1 / t– 1r = ($1,260,000 / $150)1/112– 1 = .0840 or 8.40%To find the FV of the first prize, we use:FV = PV(1 + r)tFV = $1,260,000(1.0840)33 = $18,056,409.9418.To find the FV of a lump sum, we use:FV = PV(1 + r)tFV = $4,000(1.11)45 = $438,120.97FV = $4,000(1.11)35 = $154,299.40Better start early!19. We need to find the FV of a lump sum. However, the money will only be invested for six years,so the number of periods is six.FV = PV(1 + r)tFV = $20,000(1.084)6 = $32,449.3320.To answer this question, we can use either the FV or the PV formula. Both will give the sameanswer since they are the inverse of each other. We will use the FV formula, that is:FV = PV(1 + r)tSolving for t, we get:t = ln(FV / PV) / ln(1 + r)t = ln($75,000 / $10,000) / ln(1.11) = 19.31So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. Fro m now, you’ll wait:2 years + 19.31 years = 21.31 yearsCH6 16,24,27,42,5816.For this problem, we simply need to find the FV of a lump sum using the equation:FV = PV(1 + r)tIt is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get:FV = $2,100[1 + (.084/2)]34 = $8,505.9324.This problem requires us to find the FVA. The equation to find the FVA is:FVA = C{[(1 + r)t– 1] / r}FVA = $300[{[1 + (.10/12) ]360 – 1} / (.10/12)] = $678,146.3827.The cash flows are annual and the compounding period is quarterly, so we need to calculate theEAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get:EAR = [1 + (APR / m)]m– 1EAR = [1 + (.11/4)]4– 1 = .1146 or 11.46%And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.11462 + $1,360 / 1.11464 = $2,320.3642.The amount of principal paid on the loan is the PV of the monthly payments you make. So, thepresent value of the $1,150 monthly payments is:PVA = $1,150[(1 – {1 / [1 + (.0635/12)]}360) / (.0635/12)] = $184,817.42The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is:$240,000 – 184,817.42 = $55,182.58This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be:Balloon payment = $55,182.58[1 + (.0635/12)]360 = $368,936.5458.To answer this question, we should find the PV of both options, and compare them. Since we arepurchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is thesame as the interest rate of the loan. The PV of leasing is:PV = $99 + $450{1 – [1 / (1 + .07/12)12(3)]} / (.07/12) = $14,672.91The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is:PV = $23,000 / [1 + (.07/12)]12(3) = $18,654.82The PV of the decision to purchase is:$32,000 – 18,654.82 = $13,345.18In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be:$32,000 – PV of resale price = $14,672.91PV of resale price = $17,327.09The resale price that would make the PV of the lease versus buy decision is the FV of this value, so:Breakeven resale price = $17,327.09[1 + (.07/12)]12(3) = $21,363.01CH7 3,18,21,22,313.The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice thisproblem assumes an annual coupon. The price of the bond will be:P = $75({1 – [1/(1 + .0875)]10 } / .0875) + $1,000[1 / (1 + .0875)10] = $918.89We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PVA equation, it is common to abbreviate the equations as:PVIF R,t = 1 / (1 + r)twhich stands for Present Value Interest FactorPVIFA R,t= ({1 – [1/(1 + r)]t } / r )which stands for Present Value Interest Factor of an AnnuityThese abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key.18.The bond price equation for this bond is:P0 = $1,068 = $46(PVIFA R%,18) + $1,000(PVIF R%,18)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.06%This is the semiannual interest rate, so the YTM is:YTM = 2 4.06% = 8.12%The current yield is:Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61%The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter:Effective annual yield = (1 + 0.0406)2– 1 = .0829 or 8.29%20. Accrued interest is the coupon payment for the period times the fraction of the period that haspassed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $74/2 × 2/6 = $12.33And we calculate the clean price as:Clean price = Dirty price – Accrued interest = $968 – 12.33 = $955.6721. Accrued interest is the coupon payment for the period times the fraction of the period that haspassed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $68/2 × 4/6 = $22.67And we calculate the dirty price as:Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.6722.To find the number of years to maturity for the bond, we need to find the price of the bond. Sincewe already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P0P0 = $80/.0755 = $1,059.60Now that we have the price of the bond, the bond price equation is:P = $1,059.60 = $80[(1 – (1/1.072)t ) / .072 ] + $1,000/1.072tWe can solve this equation for t as follows:$1,059.60(1.072)t = $1,111.11(1.072)t– 1,111.11 + 1,000111.11 = 51.51(1.072)t2.1570 = 1.072tt = log 2.1570 / log 1.072 = 11.06 11 yearsThe bond has 11 years to maturity.31.The price of any bond (or financial instrument) is the PV of the future cash flows. Even thoughBond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is:P M= $1,100(PVIFA3.5%,16)(PVIF3.5%,12) + $1,400(PVIFA3.5%,12)(PVIF3.5%,28) + $20,000(PVIF3.5%,40)P M= $19,018.78Notice that for the coupon payments of $1,400, we found the PVA for the coupon payments, and then discounted the lump sum back to today.Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or:P N= $20,000(PVIF3.5%,40) = $5,051.45CH8 4,18,20,22,24ing the constant growth model, we find the price of the stock today is:P0 = D1 / (R– g) = $3.04 / (.11 – .038) = $42.2218.The price of a share of preferred stock is the dividend payment divided by the required return.We know the dividend payment in Year 20, so we can find the price of the stock in Year 19, one year before the first dividend payment. Doing so, we get:P19 = $20.00 / .064P19 = $312.50The price of the stock today is the PV of the stock price in the future, so the price today will be: P0 = $312.50 / (1.064)19P0 = $96.1520.We can use the two-stage dividend growth model for this problem, which is:P0 = [D0(1 + g1)/(R –g1)]{1 – [(1 + g1)/(1 + R)]T}+ [(1 + g1)/(1 + R)]T[D0(1 + g2)/(R –g2)]P0= [$1.25(1.28)/(.13 – .28)][1 – (1.28/1.13)8] + [(1.28)/(1.13)]8[$1.25(1.06)/(.13 – .06)]P0= $69.5522.We are asked to find the dividend yield and capital gains yield for each of the stocks. All of thestocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield.W: P0 = D0(1 + g) / (R–g) = $4.50(1.10)/(.19 – .10) = $55.00Dividend yield = D1/P0 = $4.50(1.10)/$55.00 = .09 or 9%Capital gains yield = .19 – .09 = .10 or 10%X: P0 = D0(1 + g) / (R–g) = $4.50/(.19 – 0) = $23.68Dividend yield = D1/P0 = $4.50/$23.68 = .19 or 19%Capital gains yield = .19 – .19 = 0%Y: P0 = D0(1 + g) / (R–g) = $4.50(1 – .05)/(.19 + .05) = $17.81Dividend yield = D1/P0 = $4.50(0.95)/$17.81 = .24 or 24%Capital gains yield = .19 – .24 = –.05 or –5%Z: P2 = D2(1 + g) / (R–g) = D0(1 + g1)2(1 + g2)/(R–g2) = $4.50(1.20)2(1.12)/(.19 – .12) = $103.68P0 = $4.50 (1.20) / (1.19) + $4.50 (1.20)2/ (1.19)2 + $103.68 / (1.19)2 = $82.33Dividend yield = D1/P0 = $4.50(1.20)/$82.33 = .066 or 6.6%Capital gains yield = .19 – .066 = .124 or 12.4%In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time.24.Here we have a stock with supernormal growth, but the dividend growth changes every year forthe first four years. We can find the price of the stock in Year 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Year 3 will be the dividend in Year 4, divided by the required return minus the constant dividend growth rate. So, the price in Year 3 will be:P3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Year 3, so:P0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.112 + $2.45(1.20)(1.15)(1.10)/1.113 + $65.08/1.113 P0 = $55.70CH9 3,4,6,9,153.Project A has cash flows of $19,000 in Year 1, so the cash flows are short by $21,000 ofrecapturing the initial investment, so the payback for Project A is:Payback = 1 + ($21,000 / $25,000) = 1.84 yearsProject B has cash flows of:Cash flows = $14,000 + 17,000 + 24,000 = $55,000during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is:B: Payback = 3 + ($5,000 / $270,000) = 3.019 yearsUsing the payback criterion and a cutoff of 3 years, accept project A and reject project B.4.When we use discounted payback, we need to find the value of all cash flows today. The valuetoday of the project cash flows for the first four years is:Value today of Year 1 cash flow = $4,200/1.14 = $3,684.21Value today of Year 2 cash flow = $5,300/1.142 = $4,078.18Value today of Year 3 cash flow = $6,100/1.143 = $4,117.33Value today of Year 4 cash flow = $7,400/1.144 = $4,381.39To find the discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is:Discounted payback = 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 yearsFor an initial cost of $10,000, the discounted payback is:Discounted payback = 2 + ($10,000 – 3,684.21 – 4,078.18)/$4,117.33 = 2.54 yearsNotice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Year 1 and Year 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Year 3 to get the fractional portion of the discounted payback.If the initial cost is $13,000, the discounted payback is:Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years6.Our definition of AAR is the average net income divided by the average book value. The averagenet income for this project is:Average net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325And the average book value is:Average book value = ($15,000,000 + 0) / 2 = $7,500,000So, the AAR for this project is:AAR = Average net income / Average book value = $1,836,325 / $7,500,000 = .2448 or 24.48%9.The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cashinflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA8%, 9) = $40,036.31At an 8 percent required return, the NPV is positive, so we would accept the project.The equation for the NPV of the project at a 20 percent required return is:NPV = –$138,000 + $28,500(PVIFA20%, 9) = –$23,117.45At a 20 percent required return, the NPV is negative, so we would reject the project.We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is:0 = –$138,000 + $28,500(PVIFA IRR, 9)IRR = 14.59%15.The profitability index is defined as the PV of the cash inflows divided by the PV of the cashoutflows. The equation for the profitability index at a required return of 10 percent is:PI = [$7,300/1.1 + $6,900/1.12 + $5,700/1.13] / $14,000 = 1.187The equation for the profitability index at a required return of 15 percent is:PI = [$7,300/1.15 + $6,900/1.152 + $5,700/1.153] / $14,000 = 1.094The equation for the profitability index at a required return of 22 percent is:PI = [$7,300/1.22 + $6,900/1.222 + $5,700/1.223] / $14,000 = 0.983We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI is less than one.CH10 9,13,14,17,18ing the tax shield approach to calculating OCF (Remember the approach is irrelevant; the finalanswer will be the same no matter which of the four methods you use.), we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = ($2,650,000 – 840,000)(1 – 0.35) + 0.35($3,900,000/3)OCF = $1,631,50013.First we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation = $560,000/5Annual depreciation = $112,000Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so:Aftertax salvage value = MV + (BV – MV)t cVery often the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes:Aftertax salvage value = MV + (0 – MV)t cAftertax salvage value = MV(1 – t c)We will use this equation to find the aftertax salvage value since we know the book value is zero.So, the aftertax salvage value is:Aftertax salvage value = $85,000(1 – 0.34)Aftertax salvage value = $56,100Using the tax shield approach, we find the OCF for the project is:OCF = $165,000(1 – 0.34) + 0.34($112,000)OCF = $146,980Now we can find the project NPV. Notice we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value.NPV = –$560,000 – 29,000 + $146,980(PVIFA10%,5) + [($56,100 + 29,000) / 1.105]NPV = $21,010.2414.First we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation charge = $720,000/5Annual depreciation charge = $144,000The aftertax salvage value of the equipment is:Aftertax salvage value = $75,000(1 – 0.35)Aftertax salvage value = $48,750Using the tax shield approach, the OCF is:OCF = $260,000(1 – 0.35) + 0.35($144,000)OCF = $219,400Now we can find the project IRR. There is an unusual feature that is a part of this project.Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We also must include the aftertax salvage value at the end of the project. The IRR of the project is:NPV = 0 = –$720,000 + 110,000 + $219,400(PVIFA IRR%,5) + [($48,750 – 110,000) / (1+IRR)5]IRR = 21.65%17.We will need the aftertax salvage value of the equipment to compute the EAC. Even though theequipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is:Both cases: aftertax salvage value = $40,000(1 – 0.35) = $26,000To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is:OCF = –$67,000(1 – 0.35) + 0.35($290,000/3) = –9,716.67NPV = –$290,000 – $9,716.67(PVIFA10%,3) + ($26,000/1.103) = –$294,629.73EAC = –$294,629.73 / (PVIFA10%,3) = –$118,474.97And the OCF and NPV for Techron II is:OCF = –$35,000(1 – 0.35) + 0.35($510,000/5) = $12,950NPV = –$510,000 + $12,950(PVIFA10%,5) + ($26,000/1.105) = –$444,765.36EAC = –$444,765.36 / (PVIFA10%,5) = –$117,327.98The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost.18.To find the bid price, we need to calculate all other cash flows for the project, and then solve forthe bid price. The aftertax salvage value of the equipment is:Aftertax salvage value = $70,000(1 – 0.35) = $45,500Now we can solve for the necessary OCF that will give the project a zero NPV. The equation for the NPV of the project is:NPV = 0 = –$940,000 – 75,000 + OCF(PVIFA12%,5) + [($75,000 + 45,500) / 1.125]Solving for the OCF, we find the OCF that makes the project NPV equal to zero is:OCF = $946,625.06 / PVIFA12%,5 = $262,603.01The easiest way to calculate the bid price is the tax shield approach, so:OCF = $262,603.01 = [(P – v)Q – FC ](1 – t c) + t c D$262,603.01 = [(P – $9.25)(185,000) – $305,000 ](1 – 0.35) + 0.35($940,000/5)P = $12.54CH14 6、9、20、23、246. The pretax cost of debt is the YTM of the company’s bonds, so:P0 = $1,070 = $35(PVIFA R%,30) + $1,000(PVIF R%,30)R = 3.137%YTM = 2 × 3.137% = 6.27%And the aftertax cost of debt is:R D = .0627(1 – .35) = .0408 or 4.08%9. ing the equation to calculate the WACC, we find:WACC = .60(.14) + .05(.06) + .35(.08)(1 – .35) = .1052 or 10.52%b.Since interest is tax deductible and dividends are not, we must look at the after-tax cost ofdebt, which is:.08(1 – .35) = .0520 or 5.20%Hence, on an after-tax basis, debt is cheaper than the preferred stock.ing the debt-equity ratio to calculate the WACC, we find:WACC = (.90/1.90)(.048) + (1/1.90)(.13) = .0912 or 9.12%Since the project is riskier than the company, we need to adjust the project discount rate for the additional risk. Using the subjective risk factor given, we find:Project discount rate = 9.12% + 2.00% = 11.12%We would accept the project if the NPV is positive. The NPV is the PV of the cash outflows plus the PV of the cash inflows. Since we have the costs, we just need to find the PV of inflows. The cash inflows are a growing perpetuity. If you remember, the equation for the PV of a growing perpetuity is the same as the dividend growth equation, so:PV of future CF = $2,700,000/(.1112 – .04) = $37,943,787The project should only be undertaken if its cost is less than $37,943,787 since costs less than this amount will result in a positive NPV.23. ing the dividend discount model, the cost of equity is:R E = [(0.80)(1.05)/$61] + .05R E = .0638 or 6.38%ing the CAPM, the cost of equity is:R E = .055 + 1.50(.1200 – .0550)R E = .1525 or 15.25%c.When using the dividend growth model or the CAPM, you must remember that both areestimates for the cost of equity. Additionally, and perhaps more importantly, each methodof estimating the cost of equity depends upon different assumptions.Challenge24.We can use the debt-equity ratio to calculate the weights of equity and debt. The debt of thecompany has a weight for long-term debt and a weight for accounts payable. We can use the weight given for accounts payable to calculate the weight of accounts payable and the weight of long-term debt. The weight of each will be:Accounts payable weight = .20/1.20 = .17Long-term debt weight = 1/1.20 = .83Since the accounts payable has the same cost as the overall WACC, we can write the equation for the WACC as:WACC = (1/1.7)(.14) + (0.7/1.7)[(.20/1.2)WACC + (1/1.2)(.08)(1 – .35)]Solving for WACC, we find:WACC = .0824 + .4118[(.20/1.2)WACC + .0433]WACC = .0824 + (.0686)WACC + .0178(.9314)WACC = .1002WACC = .1076 or 10.76%We will use basically the same equation to calculate the weighted average flotation cost, except we will use the flotation cost for each form of financing. Doing so, we get:Flotation costs = (1/1.7)(.08) + (0.7/1.7)[(.20/1.2)(0) + (1/1.2)(.04)] = .0608 or 6.08%The total amount we need to raise to fund the new equipment will be:Amount raised cost = $45,000,000/(1 – .0608)Amount raised = $47,912,317Since the cash flows go to perpetuity, we can calculate the present value using the equation for the PV of a perpetuity. The NPV is:NPV = –$47,912,317 + ($6,200,000/.1076)NPV = $9,719,777CH16 1,4,12,14,171. a. A table outlining the income statement for the three possible states of the economy isshown below. The EPS is the net income divided by the 5,000 shares outstanding. The lastrow shows the percentage change in EPS the company will experience in a recession or anexpansion economy.Recession Normal ExpansionEBIT $14,000 $28,000 $36,400Interest 0 0 0NI $14,000 $28,000 $36,400EPS $ 2.80 $ 5.60 $ 7.28%∆EPS –50 –––+30b.If the company undergoes the proposed recapitalization, it will repurchase:Share price = Equity / Shares outstandingShare price = $250,000/5,000Share price = $50Shares repurchased = Debt issued / Share priceShares repurchased =$90,000/$50Shares repurchased = 1,800The interest payment each year under all three scenarios will be:Interest payment = $90,000(.07) = $6,300The last row shows the percentage change in EPS the company will experience in arecession or an expansion economy under the proposed recapitalization.Recession Normal ExpansionEBIT $14,000 $28,000 $36,400Interest 6,300 6,300 6,300NI $7,700 $21,700 $30,100EPS $2.41 $ 6.78 $9.41%∆EPS –64.52 –––+38.714. a.Under Plan I, the unlevered company, net income is the same as EBIT with no corporate tax.The EPS under this capitalization will be:EPS = $350,000/160,000 sharesEPS = $2.19Under Plan II, the levered company, EBIT will be reduced by the interest payment. The interest payment is the amount of debt times the interest rate, so:NI = $500,000 – .08($2,800,000)NI = $126,000And the EPS will be:EPS = $126,000/80,000 sharesEPS = $1.58Plan I has the higher EPS when EBIT is $350,000.b.Under Plan I, the net income is $500,000 and the EPS is:EPS = $500,000/160,000 sharesEPS = $3.13Under Plan II, the net income is:NI = $500,000 – .08($2,800,000)NI = $276,000And the EPS is:EPS = $276,000/80,000 sharesEPS = $3.45Plan II has the higher EPS when EBIT is $500,000.c.To find the breakeven EBIT for two different capital structures, we simply set the equationsfor EPS equal to each other and solve for EBIT. The breakeven EBIT is:EBIT/160,000 = [EBIT – .08($2,800,000)]/80,000EBIT = $448,00012. a.With the information provided, we can use the equation for calculating WACC to find thecost of equity. The equation for WACC is:WACC = (E/V)R E + (D/V)R D(1 – t C)The company has a debt-equity ratio of 1.5, which implies the weight of debt is 1.5/2.5, and the weight of equity is 1/2.5, soWACC = .10 = (1/2.5)R E + (1.5/2.5)(.07)(1 – .35)R E = .1818 or 18.18%b.To find the unlevered cost of equity we need to use M&M Proposition II with taxes, so:R E = R U + (R U– R D)(D/E)(1 – t C).1818 = R U + (R U– .07)(1.5)(1 – .35)R U = .1266 or 12.66%c.To find the cost of equity under different capital structures, we can again use M&MProposition II with taxes. With a debt-equity ratio of 2, the cost of equity is:R E = R U + (R U– R D)(D/E)(1 – t C)R E = .1266 + (.1266 – .07)(2)(1 – .35)R E = .2001 or 20.01%With a debt-equity ratio of 1.0, the cost of equity is:R E = .1266 + (.1266 – .07)(1)(1 – .35)R E = .1634 or 16.34%And with a debt-equity ratio of 0, the cost of equity is:R E = .1266 + (.1266 – .07)(0)(1 – .35)R E = R U = .1266 or 12.66%14. a.The value of the unlevered firm is:V U = EBIT(1 – t C)/R UV U = $92,000(1 – .35)/.15V U = $398,666.67b.The value of the levered firm is:V U = V U + t C DV U = $398,666.67 + .35($60,000)V U = $419,666.6717.With no debt, we are finding the value of an unlevered firm, so:V U = EBIT(1 – t C)/R UV U = $14,000(1 – .35)/.16V U = $56,875With debt, we simply need to use the equation for the value of a levered firm. With 50 percent debt, one-half of the firm value is debt, so the value of the levered firm is:V L = V U + t C(D/V)V UV L = $56,875 + .35(.50)($56,875)V L = $66,828.13And with 100 percent debt, the value of the firm is:V L = V U + t C(D/V)V UV L = $56,875 + .35(1.0)($56,875)V L = $76,781.25c.The net cash flows is the present value of the average daily collections times the daily interest rate, minus the transaction cost per day, so:Net cash flow per day = $1,276,275(.0002) – $0.50(385)Net cash flow per day = $62.76The net cash flow per check is the net cash flow per day divided by the number of checksreceived per day, or:Net cash flow per check = $62.76/385Net cash flow per check = $0.16Alternatively, we could find the net cash flow per check as the number of days the system reduces collection time times the average check amount times the daily interest rate, minusthe transaction cost per check. Doing so, we confirm our previous answer as:Net cash flow per check = 3($1,105)(.0002) – $0.50Net cash flow per check = $0.16 per checkThis makes the total costs:Total costs = $18,900,000 + 56,320,000 = $75,220,000The flotation costs as a percentage of the amount raised is the total cost divided by the amount raised, so:Flotation cost percentage = $75,220,000/$180,780,000 = .4161 or 41.61%8.The number of rights needed per new share is:Number of rights needed = 120,000 old shares/25,000 new shares = 4.8 rights per new share.Using P RO as the rights-on price, and P S as the subscription price, we can express the price per share of the stock ex-rights as:P X = [NP RO + P S]/(N + 1)a.P X = [4.8($94) + $94]/(4.80 + 1) = $94.00; No change.b. P X = [4.8($94) + $90]/(4.80 + 1) = $93.31; Price drops by $0.69 per share.。

MMOG中文标准

AIAG Cara Besh Morris Brown Connie Harde Michael Howard Aidan Hughes Chuck Koehn Donna LeFaive Kevin Lockwood Eric Minehart

DaimlerChrysler Corporation AIAG American Axle & Manufacturing, Inc. Ford Motor Company Gates Corporation DaimlerChrysler Corporation JCI Corporation Universal Bearings Corporation Ford Motor Company

第 2 章 - 组织的工作 组织的过程 组织的程序 资源规划 工作环境和人力资源

第3 章 - 产能和生产的规划 产品实现 产能规划 生产计划 系统整合

第4 章 - 与顾客的接口 沟通 包装与标识 交运 运输 顾客满意和反馈

第5 章 - 生产和产品的控制 物料识别 库存 工程更改的控制 可追溯性

第6 章 - 与供应商的接口 供应商的选择 物料计划和后勤协议 沟通 包装和标识 运输 物料接收 供应商评审

从评价看结果:任何下列情況则是 C-级:1) 有任何 F3 问题的不符合,2) F2 问题的不符合多于 13 个或更多,3) 获得的分数低于75%。

M-7

第1 版,第2 次发布:2004 年 12月

全球 MMOG/LE

5 评价过程

确定评审的类型 是内部的自我评审?还是由外部的顾客或第三方机构所执行的验证评审?

物流后勤管理业务模式交运包装策划实施顾客包装箱管理包装箱顾客要求订单发行的管理生产预测策划过程mpsbom参数与顾客的接口交运排程支持过程对资源和设施的管理策略和改善组织的工作产能和生产的规划交运包装生产策划实施顾客供应商包装箱管理包装箱顾客要求订单发行的管理生产预测策划过程mpsmrpcrp生产排程库存数据生产计划库存管理零件接收对供应商的要求信息流bom参数与顾客的接口物料流供应商排程供应商计划与供应商的关系交运排程支持过程对资源和设施的管理信息控制生产和产品控制策略和改善组织的工作产能和生产的规划m712月全球mmogle第一章和第二章介绍了组织内物流策划和后勤的整体结构

《数据仓库建模》课件

分析型数据仓库(Analytical Data Warehouse, ADW):用于数据分析、 报表生成和数据挖掘等高级应用场景。

第三章

数据仓库建模理论

C ATA L O G U E

维度建模理论

总结词

维度建模理论是一种以业务需求为导向的数据仓库建模方法,通过构建事实表和维度表来满足业务分析需求。

01

CATALOGUE

02

05

索引技术

索引概述

01

索引是提高数据仓库查询性能的重要手段,通过建立索引

可以快速定位到所需数据,避免全表扫描。

索引类型

02

常见的索引类型包括B树索引、位图索引、空间索引等,根据

数据仓库中数据的特性和查询需求选择合适的索引类型。

索引维护

03

定期对索引进行维护,如重建索引、更新统计信息等,以

包括数据库连接技术、数据抽取技术、数据转 换技术、数据加载技术和元数据管理等。这些 技术是ETL过程的基础,确保了ETL过程的稳定 性和高效性。

提供了图形化界面和自动化功能,使得ETL过程 更加高效和易于管理。常见的ETL工具有 Apache NiFi、Talend、Pentaho等。

ETL工具

数据仓库的性能优化

对数据进行必要的转换和处理,以满足业务需求和数据仓库模 型的要求。

ETL过程

数据存储

将转换后的数据加载到数据仓库中, 确保数据的存储安全和可靠。

数据加载策略

根据数据量、数据变化频率等因素选 择实时加载或批量加载。

数据审计

记录数据的加载过程和结果,以便进 行数据审计和追溯。

ETL技术

ETL工具和技术

第一章 数 据 仓 库 建 模

目录

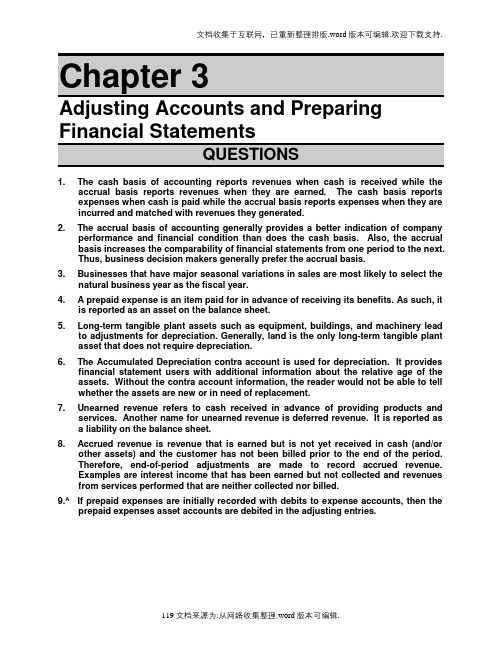

怀尔德会计学原理答案Chapter-03