2015新年回顾,《F5业绩管理》重点知识辅导(4)

业绩管理F5中文版

中国海洋大学本科生课程大纲一、课程介绍1.课程描述:本课程大纲根据2016年ACCA本科人才培养方案进行修订。

本课程教学对象为全日制ACCA专业2年级本科生,课程于秋季学期开设。

2.设计思路:通过本课程的学习,使学生理解管理会计的主要功能,并且能够利用所学知识为企业生产经营实务提供建议和咨询,为将来的丄作打下坚实的基础。

对于本课程的具体要求包括以下儿个方面,第一,能够利用传统和现代的会计•方法进行成本处理,并能够清楚的把握两者的异同;第二,掌握一些与管理会讣相关的决策技巧,如量本利分析和限制因素分析;笫三,了解公司预算的系统和方法(包括定性和定量),并能够结合实际进行差异分析;最后,了解公司绩效管理系统,以及绩效评估和控制的方法和技巧。

二、课程目标绩效管理作为ACCA专业低年级学生的一门专业知识必修课程,其教学U的在于提高学生运用会计技巧进行企业管理的能力。

到课程结束时,学生应能:(1)掌握当前国际上比较流行的儿种成本的处理方法,并了解它们的本质和使用的前提条件。

(2)量本利分析的前提条件及如何进行产品组合的量本利分析,包括如何构建breakeven chart和p/v chart,以及如何利用breakeven和p/v分析进行决策;能够在单一或多种稀缺资源的情况下确定企业的限制因素,并能够选择合适的方法去解决它,包括图表法和联立方程法;学会计算shadow price和slack, 并了解它们对公司决策和绩效管理的意义;了解影响产品或服务定价的因素,学会讣算企业产品最佳价格及产量,并且掌握产品的定价方法和策略;能够进行相关成本(relevant cost)分析,并能够做出make-or-buy和其他一些短期决策; 能够从定性和定性的角度进行风险和不确定性分析,包括sensitivity analysis 和simulation modelSo (3)了解预算控制在绩效等级中的位置以及对公司行为方面的影响;了解不同的预算系统及其功能,同时掌握各种预算的方法;能够运用各种定量分析的方法去发现和解释预算中的缺陷及其优点。

《绩效管理(F5)》课程教学大纲

《绩效管理(F5)》课程教学大纲一、课程基本信息课程代码:16033103课程名称:绩效管理(F5)英文名称:Performance Management课程类别:专业课学时:48学分:3适用对象:国际会计(ACCA)创新实验区考核方式:考试先修课程:管理会计(F2)二、课程简介《绩效管理(F5)》是ACCA全球统考科目之一。

本课程主要介绍管理会计方法的应用,主要内容包括:专家成本、决策制定、编制预算、标准成本法和差异分析、业绩计量和控制等。

通过本课程的学习,学生应当能够掌握管理会计方法在企业中的应用,并能够分析不同方法对企业决策的影响。

本课程有助于学生进一步掌握管理会计知识方法体系,并理解管理会计在企业中的作用。

"Performance Management(F5)"is one of the ACCA global examination subjects. This course mainly introduces the application of management accounting methods, including specialist cost,decision making,budgeting,standard cost and variance analysis, performance measurement and control,etc..Through the study of this course,students should be able to master the application of management accounting methods in the enterprise,and can analyze the impact of different methods on enterprise decision-making. This course will help students to master the knowledge system of management accounting, and understand the role of management accounting in enterprises.三、课程性质与教学目的课程性质:专业必修课(国际会计(ACCA)创新实验区)教学目的:掌握管理会计知识和技能的应用,包括专家成本、决策制定、编制预算、标准成本法和差异分析、业绩计量和控制。

高顿名师讲解ACCA考试F5业绩管理知识点

名师讲解xx年ACCA考试F5业绩管理知识点Qualitative factors of Make –or-buy decision- Relevant to paper F5Make or buy decision is one of the most critical decision an organisation are often facing with in modern business environment. Hence, having a sound understanding of make or buy decision from F5 is crucial. Make-or-Buy decision (also called the outsourcing decision) is a judgment made by management whether to make a component internally or buy it from the market.Make-or-buy decisions usually arise when a firm that has developed a product or part—or significantly modified a product or part—is having trouble with current suppliers, or has diminishing capacity or changing demand.While making the decision, both qualitative and quantitative factors must be considered.2. Make-or-buy analysis is conducted at the operational levelAt the operational level the factors in favor of making a partin-house.· Cost considerations (less expensive to make the part)· Desire to integrate plant operations· Productive use of excess plant capacity to help absorb fixed overhead (using existing idle capacity)· Need to exert direct control over production and/or quality· Better quality control· Design secrecy is required to protect proprietary technology · Unreliable suppliers· No competent suppliers· Desire to maintain a stable workforce (in periods of declining sales)· Quantity too small to interest a supplier· Control of lead time, transportation, and warehousing costs · Greater assurance of continual supply· Provision of a second source· Political, social or environmental reasons (union pressure) · Emotion (e.g., pride)Factors that may influence firms to buy a part externally include:· Lack of expertise· Suppliers' research and specialized know-how exceeds that of the buyer· cost considerations (less expensive to buy the item)· Small-volume requirements· Limited production facilities or insufficient capacity· Desire to maintain a multiple-source policy· Indirect managerial control considerations· Procurement and inventory considerations· Brand preference· Item not essential to the firm's strategyThis article has discussed the qualitative factors at the both strategic and operational level while making the decision ofmake-or-buy. The quantitative factors will be discussed later.。

ACCA考试F5知识点:Performance management

ACCA考试F5知识点:Performance management本文由高顿ACCA整理发布,转载请注明出处业绩管理这门科目将在2014年12月份迎来考试的改革,下面和学员们一下来分享一下ACCA官方网站刊登出来的部分样题。

A company manufactures a product which requires four hours per unit of machine time. Machine time is a bottleneck resource as there are only ten machines which are available for 12 hours per day, five days per week. The product has a selling price of $130 per unit, direct material costs of $50 per unit, labour costs of $40 per unit and factory overhead costs of $20 per unit. These costs are based on weekly production and sales of 150 units.What is the throughput accounting ratio (to 2 decimal places)?A 1·33B 2·00C 0·75D 0·31这是选自其中一道题干比较长的考题,来为学员们作为参考。

学员们在考试的时候,如果碰到了类似题干较长的题目的时候,不用慌张。

首先要做的就是明确问题中想考到的知识点道题是什么,本题的问法比较明确,就是考怎样计算throughput accounting ratio,所以,学员们第一步就是先要反映出计算throughput accounting ratio的公式是什么,即Return per limiting factor/Limiting factor cost per hour。

acca f5科目包含哪些内容?如何学好acca f5科目?

acca f5科目包含哪些内容?如何学好acca f5科目?ACCA F5科目介绍:F5《业绩管理》是F2《管理会计》的后续课程,它也帮助考生建立了P5《高级业绩管理》的学习基础。

大纲首先介绍了更多的与业管理会计的内容,这些内容是F2(管理会计)已经涉及的,主要是关于成本费用的处理。

这里复习的目的是使得考生在学习F5 这门课程时对管理会计技能上有着更深的了解。

大纲然后涉及决策问题。

学员需要解决资源短缺、定价和自制或外部购买等问题,还需要了解这些和业绩评估有何关联。

风险和不确定性是真实生活中的一个因素,考生必须了解风险并且能够运用一些基础的方法来解决存在二决策内部的固有风险。

预算是很多会计师职业生涯中很重要的一部分。

大纲阐述了不同的预算方法以及它们存在的问题。

对会计师来说预算的行为方面的理解是很重要的。

大纲包括个人对预算做出反应的方式。

接下来是标准成本法和差异。

在F2 中涉及的所有差异计算是学习F5 的基础是必须掌握的。

除此之外,新增加了混合差异和收益差异不计划差异和经营差异两大类。

对二会计师来说要理解这些计算出来的数字并且明白在绩效背景下有着什么意义。

大纲还包括业绩评估和控制。

这是大纲主要的一个部分。

会计师需要理解一项业务应该如何管理和控制。

会计师应该对管理上的财务和非财务业绩评估的重要性做出正确的评价。

会计师也应该鉴别在评估事业部制公司的业绩中存在的困难和因为未能考虑外部环境对业绩的影响而导致的问题。

这些内容直接和P5(高级业绩管理)相关。

ACCAF5科目课程是F2(管理会计)的延续课程,是在F2 课程的基础上增加了一些商业决策和预算内容,同时F5 和P5(高级业绩管理)有着直接的联系,是P5(高级业绩管理)的基础内容,同时是P3(商业分析)提供基础知识。

考试形式:ACCAF5科目的考试题型由原来的3 小时5 道简答题改成3 小时20 个单选5 道长题。

3 道10 分的长题,两道15 分的长题,两道15 分的题主要考察预算和业绩管理。

2015ACCA F5业绩管理精选讲义(3)

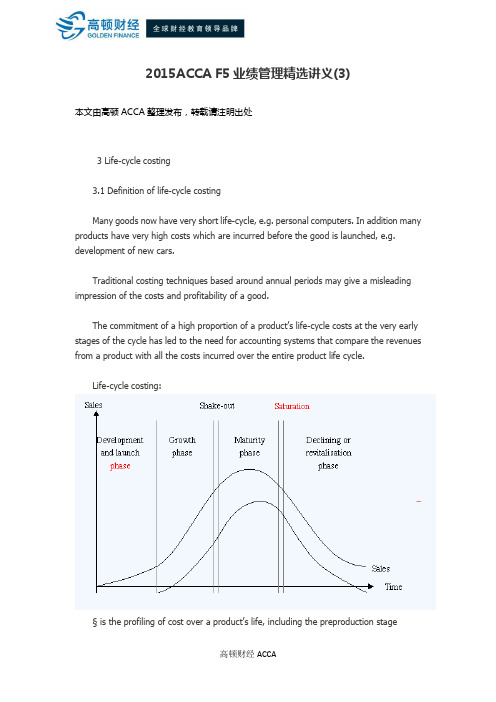

2015ACCA F5业绩管理精选讲义(3)本文由高顿ACCA整理发布,转载请注明出处3 Life-cycle costing3.1 Definition of life-cycle costingMany goods now have very short life-cycle, e.g. personal computers. In addition many products have very high costs which are incurred before the good is launched, e.g. development of new cars.Traditional costing techniques based around annual periods may give a misleading impression of the costs and profitability of a good.The commitment of a high proportion of a product’s life-cycle costs at the very early stages of the cycle has led to the need for accounting systems that compare the revenues from a product with all the costs incurred over the entire product life cycle.Life-cycle costing:§ is the profiling of cost over a product’s life, including the preproduction stage§ tracks and accumulates the actual costs and revenues attributable to each product from inception to abandonment§ enables a product’s true profitability to be determined at the end of its economic life.3.2 The costs involved at different stages in the product life-cycleMost products have a distinct product life-cycle:Specific costs may be associated with each stage.1 Development and launch stage- A high level of setup costs will already have been incurred by this stage (preproduction costs), including research and development (R&D), product design and building of production facilities.- Success depends upon awareness and trial of the product by consumers, so this stage is likely to be accompanied by extensive marketing and promotion costs.2 Growth stage- Marketing and promotion will continue through this stage.- In this stage sales volume increases dramatically, and unit costs fall as fixed costs are recovered over greater volumes.3 Maturity stage- Initially profits will continue to increase, as initial setup and fixed costs are recovered.- Marketing and distribution economies are achieved.- However, price competition and product differentiation will start to erode profitability as firms compete for the limited new customers remaining.4 Decline stage- Eventually, the product will move towards obsolescence as it is replaced by new and better alternatives.- The product will be abandoned when profits fall to an unacceptable level, or when further capital commitment is required.- Meanwhile, a replacement product will need to have been developed, incurring new levels of R&D and other product setup costs.- Alternatively additional development costs may be incurred to refine the model to extend the life-cycle (this is typical with cars where ‘product evolution’ is the norm rather than ‘product revolution’).3.3 The implications of life-cycle costingPricing§ Pricing decisions can be based on total life-cycle costs rather than simply the costs for the current period.Illustration 6 – Targeting costsA major bank and provider of credit cards wished to reduce the time taken to process credit card application forms and issue a credit card. The staff responsible for processing applications and issuing new cards were asked suggest how the period (of 14 days) could be reduced.The staff were unable to identify any significant time savings. The senior executive responsible for the area decided to pursue a version of target costing and instructed his staff that new cards were to be issued within 24 hours of an application being received and it was their responsibility to identify how this could be achieved.The imposition of this target forced a new approach to the problem and radical new ways of processing and approving applications were identified and implemented with the result that the 24-hour target was met.Decision making§ In deciding to produce or purchase a product or service, a timetable of life-cycle costs helps show what costs need to be allocated to a product so that an organization can recover its costs.§ If all costs cannot be recovered, it would not be wise to produce the product or service.§ Life-cycle costing allows an analysis of business function interrelationships, e.g. a decision towards lower R&D costs may lead to higher customer service costs in the future.Performance management – control§ Many companies find that 90% of the product’s life-cycle costs are determined by decisions made in the development and launch stages. Focusing on costs after the product has entered production results in only a small proportion of life-cycle costs being manageable.§ Target costs should be set throughout the life-cycle and revised/changed as needed.Performance management – reporting§ R&D, design, production setup, marketing and customer service costs are traditionally reported on an aggregated basis for all products and recorded as a period expense.§ Life-cycle costing traces these costs to individual products over their entire life cycles, to aid comparison with product revenues generated in later periods.更多ACCA资讯请关注高顿ACCA官网:。

2015ACCA F5业绩管理精选讲义(7)

2015ACCA F5业绩管理精选讲义(7)本文由高顿ACCA整理发布,转载请注明出处ENVIRONMENTAL MANAGEMENT ACCOUNTINGA member of the Paper F5 examining team provides students with an introduction to environmental management accountingThe new Paper F5 syllabus, which is effective from June 2011 onwards, introduces the area of environmental management accounting for the first time. It has, so far, been examined only in Paper P5 but, with its growing importance, it seemed appropriate to introduce it at an earlier level. The two requirements of the Paper F5 syllabus are as follows:discuss the issues businesses face in the management of environmental costsdescribe the different methods a business may use to account for its environmental costs.You should note that the Paper F5 syllabus examines 'environmental management accounting’ rather than ‘environmental accounting’. Environmental accounting is a broader term that encompasses the provision of environment-related information both externally and internally. It focuses on reports required for shareholders and other stakeholders, as well of the provision of management information. Environmental management accounting, on the other hand, is a subset of environmental accounting. It focuses on information required for decision making within the organisation, although much of the information it generates could also be used for external reporting.The aim of this article is to give a general introduction on the area of environmental management accounting, followed by a discussion of the first of the two requirements listed above.Many of you reading this article still won’t be entirely clear on what environmental management accounting actually is. You will not be alone! There is no single textbook definition for it, although there are many long-winded, jargon ridden ones available. Before we get into the unavoidable jargon, the easiest way to approach it in the first place is to step back and ask ourselves what management accounting itself is. Management accounts giveus an analysis of the performance of a business and are ideally prepared on a timely basis so that we get up-to-date management information. They break down each of our different business segments (in a larger business) in a high level of detail. This information is then used to assess how the business’ historic performance has been and, moving forward, how it can be improved in the future.Environmental management accounting is simply a specialised part of the management accounts that focuses on things such as the cost of energy and water and the disposal of waste and effluent. It is important to note at this point that the focus of environmental management accounting is not all on purely financial costs. It includes consideration of matters such as the costs vs benefits of buying fromsuppliers who are more environmentally aware, or the effect on the public image of the company from failure to comply with environmental regulations.Environmental management accounting uses some standard accountancy techniques to identify, analyse, manage and hopefully reduce environmental costs in a way that provides mutual benefit to the company and the environment, although sometimes it is only possible to provide benefit to one of these parties. For example, activity-based costing may be used to ascertain more accurately the costs of washing towels at a gym. The energy used to power the washing machine is an environmental cost; the cost driver is ‘washing’.Once the costs have been identified and information accumulated on how many customers are using the gym, it may actually be established that some customers are using more than one towel on a single visit to the gym. The gym could drive forward change by informing customers that they need to pay for a second towel if they need one. Given that this approach will be seen as ‘environmentally-friendly’, most customers would not argue with its introduction. Nor would most of them want to pay for the cost of a second towel. The costs to be saved by the company from this new policy would include both the energy savings from having to run fewer washing machines all the time and the staff costs of those people collecting the towels and operating the machines. Presumably, since the towels are being washed less frequently, they will need to be replaced by new ones less often as well.In addition to these savings to the company, however, are the all-important savings to the environment since less power and cotton (or whatever materials the towels are made from) is now being used, and the scarce resources of our planet are therefore being conserved. Lastly, the gym is also seen as an environmentally friendly organisation and this, in turn, may attract more customers and increase revenues. Just a little bit of managementaccounting (and common sense!) can achieve all these things. While I always like to minimise the use of jargon, in order to be fully versed on what environmental management accounting is really seen by the profession as encompassing today, it is necessary to consider a couple of the most widely accepted definitions of it.In 1998, the International Federation of Accountants (IFAC) originally defined environmental management accounting as:‘The management of environmental and economic performance through t he development and implementation of appropriate environment-related accounting systems and practices. While this may include reporting and auditing in some companies, environmental management accounting typically involves lifecycle costing, full costacco unting, benefits assessment, and strategic planning for environmental management.’Then, in 2001, The United Nations Division for Sustainable Development (UNDSD) emphasised their belief that environmental management accounting systems generate information for internal decision making rather than external decision making. This is in line with my statement at the beginning of this article that EMA is a subset of environmental accounting as a whole.The UNDSD make what became a widely accepted distinction between two types of information: physical information and monetary information. Hence, they broadly defined EMA to be the identification, collection, analysis and use of two types of information for internal decision making:physical information on the use, flows and destinies of energy, water and materials (including wastes)monetary information on environment-related cost, earnings and savings.This definition was then adopted by an international consensus group of over 30 nations and thus eventually adopted by IFAC in its 2005 international guidance document on ‘environmental management accounting’.To summarise then, for the purposes of clarifying the coverage of the Paper F5 syllabus, my belief is that EMA is internally not externally focused and the Paper F5 syllabus should, therefore, focus on information for internal decision making only. It should not be concerned with how environmental information is reported to stakeholders, although itcould include consideration of how such information could be reported internally. For example, Hansen and Mendoza (1999) stated that environmental costs are incurred because of poor quality controls. Therefore, they advocate the use of a periodical environmental cost report that is produced in the format of a cost of quality report, with each category of cost being expressed as a percentage of sales revenues or operating costs so that comparisons can be made between different periods and/or organisations. The categories of costs would be as follows:Environmental prevention costs: the costs of activities undertaken to prevent the production of waste.Environmental prevention costs: the costs of activities undertaken to prevent the production of waste.Environmental detection costs: costs incurred to ensure that the organisation complies with regulations and voluntary standards.Environmental internal failure costs: costs incurred from performing activities that have produced contaminants and waste that have not been discharged into the environment.Environmental external failure costs: costs incurred on activities performed after discharging waste into the environment.It is clear from the suggested format of this quality type report that Hansen and Mendoza’s definition of ‘environmental cost’ is relatively narrow.MANAGING ENVIRONMENTAL COSTSThere are three main reasons why the management of environmental costs is becoming increasingly important in organisations. First, society as a whole has become more environmentally aware, with people becoming increasingly aware aboutthe ‘carbon footprint’ and recycling taking place now in many countries. A ‘carbon footprint’ (as defined by the Carbon Trust) measures the total greenhouse gas emissions caused directly and indirectly by a person, organisation, event or product.Companies are finding that they can increase their appeal to customers by portraying themselves as environmentally responsible. Second, environmental costs are becoming huge for some companies, particularly those operating in highly industrialised sectors such as oil production. In some cases, these costs can amount to more than 20% of operating costs. Such significant costs need to be managed. Third, regulation is increasing worldwide at a rapid pace, with penalties for non-compliance also increasing accordingly. In the largest ever seizure related to an environmental conviction in the UK, a plant hire firm, John Craxford Plant Hire Ltd, had to not only pay £85,000 in costs and fines but also got £1.2m of its assets seized. This was because it had illegally buried waste and also breached its waste and pollution permits. And it’s not just the companies that need to worry. Officers of the company and even junior employees could find themselves facing criminal prosecution for knowingly breaching environmental regulations.But the management of environmental costs can be a difficult process. This is because first, just as EMA is difficult to define, so too are the actual costs involved. Second, having defined them, some of the costs are difficult to separate out and identify. Third, the costs can need to be controlled but this can only be done if they have been correctly identified in the first place. Each of these issues is dealt with in turn below.更多ACCA资讯请关注高顿ACCA官网:。

ACCA F5知识要点汇总(精简版)

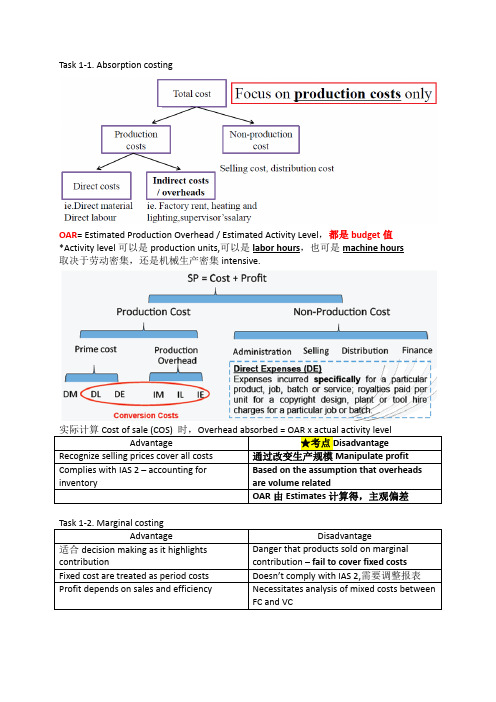

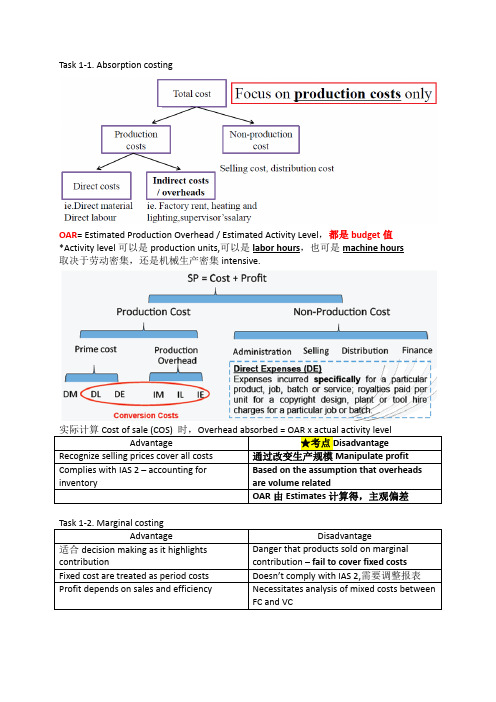

Task 1‐1. Absorption costingOAR= Estimated Production Overhead / Estimated Activity Level,都是budget值*Activity level可以是production units,可以是labor hours,也可是machine hours取决于劳动密集,还是机械生产密集intensive.实际计算Cost of sale (COS) 时,Overhead absorbed = OAR x actual activity levelAdvantage ★考点Disadvantage Recognize selling prices cover all costs 通过改变生产规模Manipulate profitComplies with IAS 2 – accounting for inventory Based on the assumption that overheads are volume relatedOAR由Estimates计算得,主观偏差Task 1‐2. Marginal costingAdvantage Disadvantage适合decision making as it highlights contribution Danger that products sold on marginal contribution – fail to cover fixed costsFixed cost are treated as period costs Doesn’t comply with IAS 2,需要调整报表 Profit depends on sales and efficiency Necessitates analysis of mixed costs betweenFC and VC☆技巧 AC = MC + (Closing Inventory – Opening Inventory) x OAR*The absorption costing requires subjective judgments.预算估计主观判断太多*There is often more than one way to allocate the overheads.制造成本分摊可操纵Task 2. Activity‐based costing★考点Traditional absorption costing适用于★考点Activity‐based costing适用于 One or a few simple and similar products Production has become more complex Overhead costs 占很小比例proportion Assess product profitability realistically资源consumption not driven by volumeLarger organizations & the service sector成本驱动drive:不同单位,不同OAR◆解题步骤:Cost Pool → Cost Drive → OAR → Absorbed → Full Cost★考点Advantage ★考点DisadvantageMore accurate cost/unit.适用绩效appraisal.Time consuming & expensiveControl OC by managing cost drivers Limited benefit当成本和volume related Profitability analysis to customers或生产线 Multiple cost drivers情况复杂,导致不精确Better understanding of what drives OC Arbitrary apportionment 任意分配★考点‐计算题(10.Dec.Q4) Problems when implementing ABC:‐ 耗时‐ 需要上层支持,因为缺乏信息‐ Project team运作,成员来自各个部门‐ IT部门支持‐ 了解成本结构‐ Cost‐benefit analysis★成本效益分析Target 3. Target costingCost plus pricing 传统成本法 Target costingFocus on internal Focus on external Steps of target costing 如何减少Cost gap✓ Product specifications ✓ Selling price ✓ Target profit: margin/ ROI ✓ Target cost ✓ Close the cost gap1) 购买便宜的材料(bulk buying 采购折扣或新供应商)2) 降低人工成本3) 提高生产能力,生产效率4) 以自动化替代人工automation 5) 减少无用环节 eliminate non value added activities6) 尽量减少部件数量,或尽可能使用多的标准件注:不能在质量上妥协compromise ,不得影响质量★考点Implications of target costing‐ Cost control: 目标成本体系中,价格是首要考量consideration ! 开发development过程中就要考虑成本,而不是后来产生时再考虑。

F5基本操作培训

F5基本操作培训一、F5基本操作培训的内容1.F5产品概述:介绍F5产品的种类、用途及优势,了解F5在网络应用中的重要地位。

2.F5产品安装和配置:介绍F5产品的安装和配置步骤,包括硬件安装、初始设置、网络配置等,使学员能够快速将设备部署并接入网络。

3.负载均衡配置:详细介绍F5产品的负载均衡功能和配置方法,包括虚拟服务器的创建、节点的添加和删除、负载均衡策略的设置等,使学员能够灵活配置负载均衡规则以实现高可用和性能优化。

4.安全防护配置:介绍F5产品的安全防护功能和配置方法,包括SSL加密、应用层防火墙、DDoS防护等,使学员了解如何保护应用安全和防范网络攻击。

5.全球负载均衡配置:介绍F5产品的全球负载均衡功能和配置方法,包括全网站负载均衡和分布式负载均衡等,使学员了解如何在多地域多数据中心实现全局负载均衡。

6.网络流量管理配置:介绍F5产品的网络流量管理功能和配置方法,包括流量控制、流量监控和流量优化等,使学员了解如何合理分配网络资源和优化网络性能。

二、F5基本操作培训的必备知识1.网络基础知识:学员需要具备一定的计算机网络基础知识,包括IP地址、子网划分、路由协议等,以便更好地理解F5产品的配置过程。

2.TCP/IP协议:学员需要了解TCP/IP协议栈的基本工作原理和核心协议,如IP协议、TCP协议和HTTP协议等,以便更好地理解F5产品的应用和功能。

3.负载均衡原理:学员需要了解负载均衡的基本工作原理,包括请求分发、会话保持、节点健康检查等,以便更好地理解F5负载均衡的配置和优化。

4.网络安全知识:学员需要了解网络安全的基本概念和常见的攻击方式,包括DDoS攻击、SQL注入、跨站脚本攻击等,以便更好地理解F5安全防护的配置和应用。

5.数据中心架构:学员需要了解数据中心的基本架构和组成部分,包括服务器、交换机、防火墙等,以便更好地理解F5产品在数据中心中的应用和配置。

三、总结F5基本操作培训是一种面向F5产品使用者的专门培训课程,通过对F5产品的安装、配置、功能和应用进行详细讲解,使学员能够快速掌握F5产品的基本使用方法。

2015年12月ACCA考试F5业绩管理真题SB部分_真题(含答案与解析)-交互

2015年12月ACCA考试F5业绩管理真题(SectionB部分)(总分60, 做题时间195分钟)Section BThe Chemical Free Clean Co (C Co) provides a range ofenvironmentally-friendly cleaning services to business customers, often providing a specific service to meet a client's needs. Its customers range from large offices and factories to specialist care wards at hospitals, where specialist cleaning equipment must be used and regulations adhered to. C Co offers both regular cleaning contracts and contracts for one-off jobs. For example, its latest client was a chain of restaurants which employed them to provide an extensive clean of all their business premises after an outbreak of food poisoning.The cleaning market is **petitive, although there are only a small number of companies providing a chemical free service. C Co has always used cost-plus pricing to determine the prices which it charges to its customers but recently, the cost of the cleaning products C Co uses has increased. This has meant that C Co has had to increase its prices, resulting in the loss of several regular customers to competing service providers.The finance director at C Co has heard about target costing and is considering whether it could be useful at C Co.Required:SSS_TEXT_QUSTI(a) Briefly describe the main steps involved in deriving a target cost.该题您未回答:х该问题分值: 3答案:Target costing stepsDeriving a target costStep 1: A product or service is developed which is perceived to be needed by customers and therefore will attract adequate sales volumes.Step 2: A target price is then set based on the customers' perceived value of the product. This will therefore be a market based price. Step 3: The required target operating profit per unit is then calculated. This may be based on either return on sales or return oninvestment.Step 4: The target cost is derived by subtracting the target profit from the target price.Step 5: If there is a cost gap, attempts will be made to close the gap. Techniques such as value engineering may be performed, which looks at every aspect of the value chain business functions with an objective of reducing costs while satisfying customer needs.Step 6: Negotiation with customers may take place before deciding whether to go ahead with the project.SSS_TEXT_QUSTI(b) Explain any difficulties which may be encountered and any benefits which may arise when implementing target costing at C Co.该题您未回答:х该问题分值: 7答案:Application at C CoDifficulties in implementation– C Co is a **pany and in **panies, it is often more difficult to find a precise definition for some of the services. In order for target costing to be useful, it is necessary to define the service being provided. C Co actually provides a range of services toclients including specialist care wards at hospitals. This meansthat the definition of the services being provided will vary. Different target costs will need to be derived for the different services provided.– C Co has two types of clients: regular clients and one-off clients. Since the service for regular clients is being repeated, it should be relatively easy to set a target cost for these jobs. However, for the one-off jobs, there may not be **parative data available and therefore setting the target cost will be difficult. – Similarly, some of the work available is very specialist. For example, cleaning restaurants and kitchens after an outbreak of food poisoning will require specialist techniques and adherence to a set of regulations with which C Co may not be familiar. It may be difficult to establish the market price for a service like this, thus making it difficult to derive a target cost.Benefits to C Co– Target costing is useful in competitive markets where a companyis not dominant in the market and therefore has to accept a marketprice for their products. C Co is operating in a competitive market and whilst the service offered by C Co is more specialist, it is clear from the recent drop in sales that price increases do lead to loss of customers. C Co cannot therefore ignore the market price for cleaning services and simply pass on cost increases as it has done. Target costing would therefore help C Co to focus on the marketprice of similar services provided by competitors, where this information is available.– If after calculating a target cost C Co finds that a cost gap exists, it will then be forced to examine its internal processes and costs more closely. It should establish why the prices of the products it uses have increased in the first place. If it cannot achieve any reduction in these prices, it should consider whether it can source cheaper non-chemical products from alternative suppliers. So, target costing will benefit C Co by helping it to focus on cost reduction and consequently customer retention.Note: More points could be made and would earn marks.Bus Co is a large bus operator, operating long-distance bus services across the country. There are two other national operators in the country. Bus Co's mission is to ‘be the market leader in long-distance transport providing a greener, cleaner service for passengers nationwide’. Last month, an independent survey of 40,000 passengers was carried out, the results of which are shown in the table below:Table: Bus passenger satisfaction % by national operator* denotes that the percentage has not yet been calculated.The ‘overall satisfaction’ percentages, which have not yet been inserted into the table, are calculated using a weighted average which reflects the importance customers place on each of the other three criteria above. The weightings used are as follows:The managing director (MD) of Bus Co has said: ‘Independent research has shown that our customers are the most satisfied of any national bus operator. We are now leading the way on what matters most to customers –value for money and punctuality.’Required:SSS_TEXT_QUSTI(a) Calculate the ‘overall satisfaction’ percentage for each operator.该题您未回答:х该问题分值: 2答案:CalculationsBus: (0·4 × 0·67) + (0·32 × 0·8) + (0·28 × 0·82) = 75·36%. Prime: (0·4 × 0·58) + (0·32 × 0·76) + (0·28 × 0·83) = 70·76%.Express: (0·4 × 0·67) + (0·32 × 0·76) + (0·28 × 0·89) = 76·04%.SSS_TEXT_QUSTI(b) Taking into account all the data in the table and your calculations from part (a), discuss whether the managing director's statement is true.该题您未回答:х该问题分值: 4答案:Accuracy of statementThe MD's statement says that Bus Co's customers are the mostsatisfied of any national bus operator. However, this is not quite the case since, when the ‘overall satisfaction’ levels are calculated, Express's level is 76·04% compared to Bus Co's 75·36%. So, the first part of the MD's statement is untrue.The MD then goes on to say that Bus Co is leading the way on what matters most to customers – value for money and punctuality. Given the weightings attached to these two criteria, it appears true to say that these are the factors which matter most to customers. Similarly, it is true to say that Bus Co is leading as regards punctuality, being 4 percentage points ahead of Prime and Express on this criterion. However, given that Express also has the same level of satisfaction as regards offering value for money, Bus Co is only leading ahead of Prime on this criterion, not ahead of Express. Therefore, whilst it can say that it is the leader on punctuality, it can only say that it is the joint leader on value for money.SSS_TEXT_QUSTI(c)When measuring performance using a ‘value for money’ approach, the criteria of economy, efficiency and effectiveness can be used. Required:Briefly define ‘efficiency’ and ‘effectiveness’ and suggest one performance measure for EACH, which would help Bus Co assess the efficiency and effectiveness of the service it provides.该题您未回答:х该问题分值: 4答案:VFM‘Efficiency’ focuses on the relationship between inputs and outputs, considering whether the maximum output is being achieved for the resources used.Performance measure:Occupancy rate of buses.Utilisation rate for buses.(utilisation rate = hours on theroad/total hours available)Utilisation rate for drivers.(Many others could be given too but only one was asked for.)‘Effectiveness’ focuses on the relationship between anorganisation's objectives and outputs, considering whether the objectives are being met.Possible performance measures:Percentage of customers satisfied with cleanliness of buses. Percentage of carbon emissions relative to target set.(Many others could be given too but only one was asked for.)The Organic Bread Company (OBC) makes a range of breads for sale direct to the public. The production process begins with workers weighing out ingredients on electronic scales and then placing themin a machine for mixing. A worker then manually removes the mix from the machine and shapes it into loaves by hand, after which the bread is then placed into the oven for baking.All baked loaves are then inspected by OBC's quality inspector before they are packaged up and made ready for sale. Any loaves which fail the inspection are donated to a local food bank.The standard cost card for OBC's ‘Mixed Bloomer’, one of its most popular loaves, is as follows:Budgeted production of Mixed Bloomers was 1,000 units for the quarter, although actual production was only 950 units. The total actual quantities used and their actual costs were:Required:SSS_TEXT_QUSTI(a) Calculate the total material mix variance and the total material yield variance for OBC for the last quarter.该题您未回答:х该问题分值: 7答案:Variance calculationsMix variancePer question, total g of materials per standard batch = 610 g. Therefore standard quantity to produce 950 units = 950 × 610 g = 579·5 kgPer question, actual total kg of materials used to produce 950 units = 570·5 kgAlternative yield calculation570·5 kg should yield (÷ 0·61 kg) = 935·25 loaves570·5 kg did yield = 950 loavesDifference = 14·75 FValued a t standard material cost = 14·75F × $1·34 = $19·77FSSS_TEXT_QUSTI(b) Using the information in the question, suggest THREE possible reasons why an ADVERSE MATERIAL YIELD variance could arise at OBC.该题您未回答:х该问题分值: 3答案:Material yield varianceThree reasons why an adverse material yield variance may arise:– The mix may not be **pletely out of the machine, leaving some mix behind.– Since the loaves are made by hand, they may be made slightly too large, meaning that fewer loaves can be baked.– Errors or changes in the mix may cause some loaves to be sub-standard and therefore rejected by the quality inspector.– The loaves might be baked at the wrong temperature and therefore be rejected by the quality inspector.Note: Many more reasons could be given.Cardio Co manufactures three types of fitness equipment: treadmills (T), cross trainers (C) and rowing machines (R). The budgeted sales prices and volumes for the next year are as follows:The standard cost card for each product is shown below.Labour costs are 60% fixed and 40% variable. General fixed overheads excluding any fixed labour costs are expected to be $55,000 for the next year.Required:SSS_TEXT_QUSTI(a) Calculate the weighted average contribution to sales ratio for Cardio Co.该题您未回答:х该问题分值: 4答案:Weighted average C/S ratioWeighted average contribution to sales ratio (WA C/S ratio) = total contribution/total sales revenue.WA C/S ratio = ($408,240 + $433,600 + $330,220)/($672,000 + $720,000 + $532,000)= $1,172,060/$1,924,000 = 60·92%.SSS_TEXT_QUSTI(b) Calculate the margin of safety in $ revenue for Cardio Co.该题您未回答:х该问题分值: 3答案:Margin of safetyMargin of safety = budgeted sales – breakeven salesBudgeted sales revenue = $1,924,000Fixed labour costs = {(420 × $220) + (400 × $240) + (380 × $190)} × 0·6 = $156,360k.Therefore total fixed costs = $156,360 + $55,000 = $211,360. Breakeven sales revenue = fixed costs/weighted average C/S ratio= $211,360/60·92% = $346,947Therefore margin of safety = $1,924,000 – $346,947 = $1,577,053.SSS_TEXT_QUSTI(c) Using the graph paper provided and assuming that the products are sold in a CONSTANT MIX, draw a multi-product breakeven chart for Cardio Co. Label fully both axes, any lines drawn on the graph and the breakeven point.该题您未回答:х该问题分值: 6答案:Multi-product breakeven chartWorkingsTotal revenue = $1,924,000.Total variable costs = $1,924,000 – $1,172,060 = $751,940. Therefore total costs = $211,360 + $751,940 = $963,300.SSS_TEXT_QUSTI(d) Explain what would happen to the breakeven point if the products were sold in order of the most profitable products first.Note: You are NOT required to demonstrate this on the graph drawn in part (c).该题您未回答:х该问题分值: 2答案:BEP if products sold in order of profitabilityIf the more profitable products are sold first, this means that**pany will cover its fixed costs more quickly. Consequently, the breakeven point will be reached earlier, i.e. fewer sales will need to be made in order to break even. So, the breakeven point will be lower.Cardale Industrial Metal Co (CIM Co) is a large supplier ofindustrial metals. **pany is split into two divisions: Division F and Division N. Each division operates separately as an investment centre, with each one having full control over its non-current assets. In addition, both divisions are responsible for their own current assets, controlling their own levels of inventory and cash and having full responsibility for the credit terms granted to customers and the collection of receivables balances. Similarly, each division has full responsibility for its current liabilities and deals directly with its own suppliers.Each divisional manager is paid a salary of $120,000 per annum plus an annual performance-related bonus, based on the return on investment (ROI) achieved by their division for the year. Each divisional manager is expected to achieve a minimum ROI for their division of 10% per annum. If a manager only meets the 10% target, they are not awarded a bonus. However, for each whole percentage point above 10% which the division achieves for the year, a bonus equivalent to 2% of annual salary is paid, subject to a maximum bonus equivalent to 30% of annual salary.The following figures relate to the year ended 31 August 2015:/During the year ending 31 August 2015, Division N invested $6·8m in new equipment including a technologically advanced cutting machine, which is expected to increase productivity by 8% per annum. Division F has made no investment during the year, although **puter system is badly in need of updating. Division F's manager has said that he hasalready had to delay payments to suppliers (i.e. accounts payables) because of limited cash and **puter system ‘will just have to wait’, although the cash balance at Division F is still better than that of Division N.Required:SSS_TEXT_QUSTI(a) For each division, for the year ended 31 August 2015, calculate the appropriate closing return on investment (ROI) on which the payment of management bonuses will be based. Briefly justify the figures used in your calculations.Note: There are 3 marks available for calculations and 2 marks available for discussion.该题您未回答:х该问题分值: 5答案:Division FControllable profit = $2,645k.Total assets less trade payables = $9,760k + $2,480k – $2,960k = $9,280k.ROI = 28·5%.Division NControllable profit = $1,970k.Total assets less trade payables = $14,980k + $3,260k – $1,400k = $16,840k.ROI = 11·7%.In both calculations controllable profit has been used to reflect profit, rather than net profit. This is because the managers do not have any control over the Head Office costs and responsibility accounting deems that managers should only be held responsible for costs which they control. The same principle is being applied in the choice of assets figures being used. The current assets and current liabilities figures have been taken into account in the calculation because of the fact that the managers have full control over both of these.SSS_TEXT_QUSTI(b) Based on your calculations in part (a), calculate each manager's bonus for the year ended 31 August 2015.该题您未回答:х该问题分值: 3答案:BonusBonus to be paid for each percentage point = $120,000 × 2% = $2,400. Maximum bonus = $120,000 × 0·3 = $36,000.Division F:ROI = 28·5% = 18 whole percentage points above minimum ROI of 10%.18 × $2,400 = $43,200.Therefore manager will be paid the maximum bonus of $36,000.Division N: ROI = 11·7% = 1 whole percentage point above minimum. Therefore bonus = $2,400.SSS_TEXT_QUSTI(c) Discuss whether ROI is providing a fair basis for calculating the managers' bonuses and the problems arising from its use at CIM Co for the year ended 31 August 2015.该题您未回答:х该问题分值: 7答案:Discussion– The manager of Division N will be paid a far smaller bonus than the manager of Division F. This is because of the large asset base on which the ROI figure has been calculated. Total assets ofDivision N are almost double the total assets of Division F. This is largely attributable to the fact that Division N invested $6·8m in new equipment during the year. If this investment had not been made, net assets would have been only $10·04m and the ROI for Division N would have been 19·62%. This would have led to the payment of a $21,600 bonus (9 × $2,400) rather than the $2,400 bonus. Consequently, Division N's manager is being penalised for making decisions which are in the best interests of his division. It is very surprising that he did decide to invest, given that he knewthat he would receive a lower bonus as a result. He has actedtotally in the best interests of **pany. Division F's manager, onthe other hand, has benefitted from the fact that he has made no investment even though it is badly needed. This is an example ofsub-optimal decision making.– Division F's trade payables figure is much higher than DivisionN's. This also plays a part in reducing the net assets figure on which the ROI has been based. Division F's trade payables are over double those of Division N. In part, one would expect this because sales are over 50% higher (no purchases figure is given). However,it is clear that it is also because of low cash levels at Division F. The fact that the manager of Division F is then being rewardedfor this, even though relationships with suppliers may be adversely affected, is again an example of sub-optimal decision making.– If the co ntrollable profit margin is calculated, it is 18·24%for Division F and 22·64% for Division N. Therefore, if capital employed is ignored, it can be seen that Division N is performing better. ROI is simply making the division's performance look worse because of its investment in assets. Division N's manager is likely to feel extremely demotivated by **paratively small bonus and, in the future, he may choose to postpone investment in order to increase his bonus. Managers not investing in new equipment and technology will mean that **pany will not keep up with industry changes and affect its overall **petitiveness.– To summarise, the use of ROI is leading to sub-optimal decision making and a lack of goal congruence, as what is good for the managers is not good for **pany and vice versa. Luckily, the manager at Division N still appears to be acting for the benefit of **pany but the other manager is not. The fact that one manager is receiving a much bigger bonus than the other is totally unfair here and may lead to conflict in the long run. This is not good for **pany, particularly if **es a time when the divisions need to work together.1。

ACCA F5知识要点汇总(精简版)

Task 1‐1. Absorption costingOAR= Estimated Production Overhead / Estimated Activity Level,都是budget值*Activity level可以是production units,可以是labor hours,也可是machine hours取决于劳动密集,还是机械生产密集intensive.实际计算Cost of sale (COS) 时,Overhead absorbed = OAR x actual activity levelAdvantage ★考点Disadvantage Recognize selling prices cover all costs 通过改变生产规模Manipulate profitComplies with IAS 2 – accounting for inventory Based on the assumption that overheads are volume relatedOAR由Estimates计算得,主观偏差Task 1‐2. Marginal costingAdvantage Disadvantage适合decision making as it highlights contribution Danger that products sold on marginal contribution – fail to cover fixed costsFixed cost are treated as period costs Doesn’t comply with IAS 2,需要调整报表 Profit depends on sales and efficiency Necessitates analysis of mixed costs betweenFC and VC☆技巧 AC = MC + (Closing Inventory – Opening Inventory) x OAR*The absorption costing requires subjective judgments.预算估计主观判断太多*There is often more than one way to allocate the overheads.制造成本分摊可操纵Task 2. Activity‐based costing★考点Traditional absorption costing适用于★考点Activity‐based costing适用于 One or a few simple and similar products Production has become more complex Overhead costs 占很小比例proportion Assess product profitability realistically资源consumption not driven by volumeLarger organizations & the service sector成本驱动drive:不同单位,不同OAR◆解题步骤:Cost Pool → Cost Drive → OAR → Absorbed → Full Cost★考点Advantage ★考点DisadvantageMore accurate cost/unit.适用绩效appraisal.Time consuming & expensiveControl OC by managing cost drivers Limited benefit当成本和volume related Profitability analysis to customers或生产线 Multiple cost drivers情况复杂,导致不精确Better understanding of what drives OC Arbitrary apportionment 任意分配★考点‐计算题(10.Dec.Q4) Problems when implementing ABC:‐ 耗时‐ 需要上层支持,因为缺乏信息‐ Project team运作,成员来自各个部门‐ IT部门支持‐ 了解成本结构‐ Cost‐benefit analysis★成本效益分析Target 3. Target costingCost plus pricing 传统成本法 Target costingFocus on internal Focus on external Steps of target costing 如何减少Cost gap✓ Product specifications ✓ Selling price ✓ Target profit: margin/ ROI ✓ Target cost ✓ Close the cost gap1) 购买便宜的材料(bulk buying 采购折扣或新供应商)2) 降低人工成本3) 提高生产能力,生产效率4) 以自动化替代人工automation 5) 减少无用环节 eliminate non value added activities6) 尽量减少部件数量,或尽可能使用多的标准件注:不能在质量上妥协compromise ,不得影响质量★考点Implications of target costing‐ Cost control: 目标成本体系中,价格是首要考量consideration ! 开发development过程中就要考虑成本,而不是后来产生时再考虑。

一起来认识F5之课程介绍

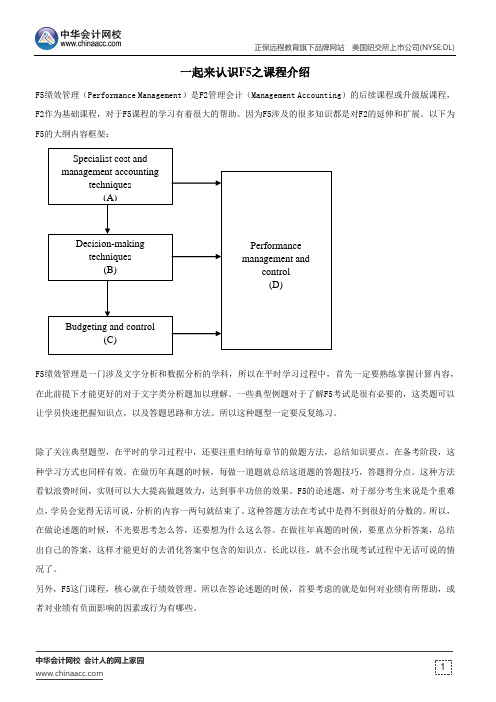

正保远程教育旗下品牌网站美国纽交所上市公司(NYSE:DL)中华会计网校会计人的网上家园一起来认识F5之课程介绍F5绩效管理(Performance Management)是F2管理会计(Management Accounting)的后续课程或升级版课程,F2作为基础课程,对于F5课程的学习有着很大的帮助。

因为F5涉及的很多知识都是对F2的延伸和扩展。

以下为F5的大纲内容框架:F5绩效管理是一门涉及文字分析和数据分析的学科,所以在平时学习过程中,首先一定要熟练掌握计算内容,在此前提下才能更好的对于文字类分析题加以理解。

一些典型例题对于了解F5考试是很有必要的,这类题可以让学员快速把握知识点,以及答题思路和方法。

所以这种题型一定要反复练习。

除了关注典型题型,在平时的学习过程中,还要注重归纳每章节的做题方法,总结知识要点。

在备考阶段,这种学习方式也同样有效。

在做历年真题的时候,每做一道题就总结这道题的答题技巧,答题得分点。

这种方法看似浪费时间,实则可以大大提高做题效力,达到事半功倍的效果。

F5的论述题,对于部分考生来说是个重难点,学员会觉得无话可说,分析的内容一两句就结束了。

这种答题方法在考试中是得不到很好的分数的。

所以,在做论述题的时候,不光要思考怎么答,还要想为什么这么答。

在做往年真题的时候,要重点分析答案,总结出自己的答案,这样才能更好的去消化答案中包含的知识点。

长此以往,就不会出现考试过程中无话可说的情况了。

另外,F5这门课程,核心就在于绩效管理。

所以在答论述题的时候,首要考虑的就是如何对业绩有所帮助,或者对业绩有负面影响的因素或行为有哪些。

ACCAF5知识要点汇总

ACCAF5知识要点汇总知识点一:成本与收益关系成本与收益关系是管理会计中的基本原理,也是制定和评估管理决策的重要依据。

在做出决策时,必须考虑成本和收益之间的关系,以确保决策是符合企业利益的。

知识点二:计算成本计算成本是管理会计的核心内容之一、成本的计算包括直接成本和间接成本两部分。

直接成本是可以直接与产品或服务相关联的成本,如原材料成本、直接人工成本等。

间接成本是无法直接与产品或服务相关联的成本,如间接人工成本、间接材料成本等。

知识点三:成本行为成本行为是指成本与产量或活动水平之间的关系。

成本行为可以分为固定成本、可变成本和半固定成本三种类型。

固定成本是不随产量或活动水平变化的成本,可变成本是随产量或活动水平变化的成本,半固定成本是产量或活动水平变化时部分固定、部分可变的成本。

知识点四:成本控制成本控制是指通过对成本的管理和控制,实现成本目标和利润目标的过程。

成本控制包括成本预算、成本分析和成本控制措施等。

成本预算是将预计成本与实际成本进行比较,以评估成本的控制效果。

成本分析是通过对成本的详细分析,找出成本的主要影响因素,以确定成本控制的重点。

成本控制措施是指通过采取各种措施,降低成本或提高效率,以实现成本控制的目标。

知识点五:决策分析决策分析是管理会计的核心内容之一,也是管理决策的重要工具和方法。

决策分析包括差异分析、边际成本分析和投资决策等。

差异分析是通过对实际成本与预算成本进行比较,找出成本差异的原因,以评估决策的效果。

边际成本分析是通过对变动成本与边际收益进行比较,确定最佳决策方案。

投资决策是基于投资项目的成本、收益和风险,确定是否进行投资。

知识点六:绩效评估绩效评估是指对企业绩效进行评价和分析,以衡量企业的经营状况和管理水平。

绩效评估包括财务绩效评价和非财务绩效评价两方面。

财务绩效评价是通过财务指标,如利润、资产回报率等,评估企业的经济效益和财务运营状况。

非财务绩效评价是通过其他非财务指标,如客户满意度、员工满意度等,综合评价企业的全面绩效和可持续发展能力。

2015年ACCA《F5业绩管理》辅导讲义(1)

2015年ACCA《F5业绩管理》辅导讲义(1)本文由高顿ACCA整理发布,转载请注明出处Chapter 1Advanced costing methodChapter learning objectivesUpon completion of this chapter you will be able to:§ explain what is meant by the term cost driver§ identify appropriate cost drivers under activity-based costing (ABC)§ calculate costs per driver and per unit using (ABC)§ compare ABC and traditional methods of overhead absorption based on production units, labour hours or machine hours.§ explain the implications of switching to ABC on pricing, performance management and decision making.§ explain what is meant by the term ‘target cost’ in both manufacturing and service industries.§ derive a target cost in both manufacturing and service industries.§ explain the difficulties of using target costing in service industries§ explain the implications of using target costing on pricing, cost control and performance management.§ describe the target cost gap.§ suggest how a target cost gap might be closed.§ explain what is meant by the term ‘life-cycle costing’ in a manufacturing industry§ identify the costs involved at different stages of the life-cycle.§ explain the implications of life-cycle costing on pricing, performance management and decision making.§ describe the process of back-flush accounting and contrast with traditional process accounting.§ explain, for a manufacturing business, the implications of back-flush accounting on performance management§ evaluate the decision to switch to back-flush accounting from traditional process control for a manufacturing business.§ explain throughput accounting and the throughput accounting ratio (TPAR), and calculate and interpret, a TPAR.§ suggest how a TPAR could be improved.§ apply throughput accounting to a given multi-production decision making problem.1 Activity based costing1.1 Introduction – absorption costIn F2 we saw how to determine a cost per unit for a product. Key issues of relevance here are the following:Firms have the choice of two basic costing methods – marginal costing and absorption costing.Under absorption costing it is necessary to absorb overheads into units of production using a suitable basis.The main basis of absorption used in F2 questions is direct labour hours. This involves calculating an overhead absorption rate (OAR) for each production department as follows:OAR =To enable this, all overheads must first be allocated/apportioned/reapportioned into production departments, again using a suitable basis (e.g. rent on the basis of floor area).Overhead expenses incurred/budgetedStep 1: Overheads allocated or apportioned to cost centres using suitable bases Cost centres (usually departments)Step 2: Service centre costs reapportioned to production centresStep 3: Overheads absorbed into units of production using an OAR (usually on the basis of direct labour hours) outputExpandable textThe assumption underlying the traditional method of costing is that overhead expenditure is connected to the volume of production activity.§ This assumption was probably valid many years ago, when production system were based on labour-intensive or machine-intensive mass production of fairly standard items. Overhead costs were also fairly small relative to direct materials and direct labour costs; therefore any inaccuracy in the charging of overheads to products costs was not significant.§ The assumption is not valid in a complex manufacturing environment, where production is based on smaller customised batches of products, indirect costs are high in relation to direct costs, and a high proportion of overhead activities – such as production scheduling, order handling and quality control – are not related to production volume.§ For similar reasons, traditional absorption costing is not well-suited to the costing of many services.更多ACCA资讯请关注高顿ACCA官网:。

ACCA F5知识点框架

学习F5之前,得先知道F5是干嘛的,简而言之,F5就是通过动用能够动用资源、控制能控制因素,对公司的内部因素进行分析、调控,从而对公司未来的运行进行预测、规划,同时力求规避风险,为公司谋划一个可行性、正确性的前景。

同时,在公司发生运营活动时,对其效绩进行监控,并对其中出现的差异进行有针对性的分析,并进行相对应的调整,最大化公司的利润。

F5知识点框架总结:

n Advanced Costing Methods(高级成本计算方法)

n Cost volume profit analysis(成本,产量,利润分析)

n Planning with limited factors(规划有限制因素)

n Pricing(定价)

n Relevant Costing(相关成本)

n Risk and uncertainty(风险和不确定性)

n Budgeting(预算)

n Quantitative analysis(定量分析)

✦Advance variances(预算差额)

✦Performance measurement and control(绩效评估与控制)

✦Divisional performance measurement and transferpricing(部门绩效评估和转移定价)

✦Performance measurement in not-for-profit organizations(非营利组织的绩效评估)

✦Performance management information systems(绩效管理信息系统)

第 1 页。

F5 Performance management(业绩管理)备考指南一

F5 Performance management(业绩管理)备考指南一本文由高顿ACCA整理发布,转载请注明出处

成本的分类(在完全成本法下的分类)

首先,帮同学们理清或者疏通的是,在F5的学习中,会碰到的几乎所有的成本。

建议学员们在自己的心理形成一个成本架构,这样也更有助于做最后的业绩评估和控制,因为知道到哪一类的成本该从哪里能够找到。

总成本(Total cost),总成本可以理解为在日常经营生产活动中财务部门经常提到的所有的成本,在总成本中,可以分为两大类,第一大类是直接成本,第二大类是间接成本。

直接成本(Direct cost),在网校的基础班中,同学们已经听过老师重复了很多遍的料工费了,或者是以Material cost, labour cost and expenses的形式出现也是一样的,其实不管在题目中怎样变化,直接成本在现阶段就只能分为这三大类成本。

另一个大类就是间接成本(Indirect cost/Overhead)。

在间接成本中,管理会计又分成了两大主线,一条是与生产息息相关的(Production overhead),另外一条线就是除与生产相关的间接成本(Non-production overhead)。

但是,学员们也一定要注意,在Production overhead中会存在过度或者补足吸收的问题,类似这些比较系的知识点,网校会通过以后的复习短篇和学员们慢慢分享。

最后,高顿网校预祝您顺利通过考试!

更多ACCA资讯请关注高顿ACCA官网:。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2015新年回顾,《F5业绩管理》重点知识辅导(4)

本文由高顿ACCA整理发布,转载请注明出处

Back-flush accounting

1 The basic concepts of back-flush accounting

§ In traditional accounting systems inventory is a key item. Traditional manufacturing firms hold high levels of inventory for raw materials, work-in-progress (WIP)and finished goods.

§ Much of the work of the management (or cost)accountant would be to place a value on this inventory, e.g. using process cost accounting.

§ Back-flush accounting is an alternative approach to cost and management accounting that can be applied where:

- the speed of throughput (or ‘velocity’ of throughput)is high, and

- inventories of raw materials, WIP and unsold finished goods are very low.来自

§ Instead of building up product costs sequentially from start to finish of production, back-flush accounting calculates product costs retrospectively, at the end of each accounting period.

Illustration 7 – Targeting costs

A key performance target for many banks is to reduce staff costs as a percentage of total bank costs.

The launch of first telephone banking and then internet banking for personal customers (both services enabling bank customers to access their bank accounts, transfer funds and pay bills on a 24-hour basis)has enabled the banks to vary the level of bank staff involvement in the provision of these services and to provide a relatively cost-effective service.

2 The accounting aspects of back-flush accounting

§ Back-flush accounting offers an abbreviated and simplified approach to costing by getting rid of ‘unnecessary’ costing records.

§ In the examination you will not be required to perform the double entry for

back-flush accounting.

A traditional system

§ A traditional costing system will include the following Τ accounts:

A back-flush accounting system

§ The cost of raw materials is allocated to a ‘raw materials and in progress’(RIP)account.

§ Conversion costs (labour and production overheads)are allocated straight to the cost of goods sold account.

§ At the end of the accounting period an inventory stock-take is carried out to determine closing balances for raw materials, WIP and finished goods. This is quick as there are few inventories. Inventory values are based on budget/standard costs.

§ The closing inventory values for raw materials and WIP are then ‘back-flushed’ from the cost of goods sold account into the RIP account.

§ Similarly the closing inventory value for finished goods is ‘back-flushed’ into th e finished goods account.

§ Thus with back-flush accounting there will be a significant reduction in accounting costs albeit at the cost of reduced detail. (e.g. a split of conversion costs between production labour and overhead is not available)。

§ However, as noted above, if the production cycle is short and there is only a small amount of WIP at any time, it is questionable whether there is much value in building up

detailed cost records as items progress through production. This is key to back-flush accounting.

§ In process production systems back-flush accounting often combines all processes into one.

Test your understanding 8

Target costing is best understood as finding:

(a)What a new product or service actually costs.

(b)The cost of a new product or service of target competitors.

(c)What a new product or service should cost.

更多ACCA资讯请关注高顿ACCA官网:。