会计英语资产负债表及利润表

最新会计英语资产负债表及利润表

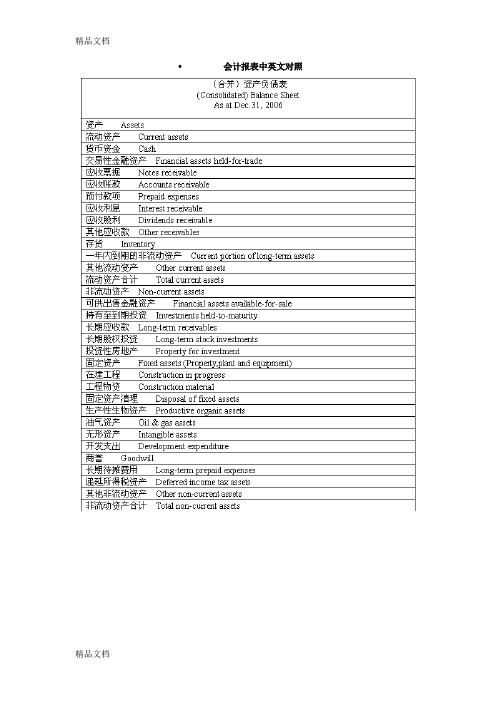

会计报表中英文对照Accounting1. Financial reporting(财务报告) includes not only financial statements but also other means of communicating information that relates, directly or indirectly, to the information provided by a business enterprise’s accounting system----that is, information about an enterprise’s resources, obligations, earnings, etc.2. Objectives of financial reporting: 财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions.(2) Provide information that enables assessing future cash flows.(3) Provide information that enables users to learn about economic resources, claims against those resources, and changes in them.3. Basic accounting assumptions 基本会计假设(1) Economic entity assumption 会计主体假设This assumption simply says that the business and the owner of the business are two separate legal and economic entities. Each entity should account and report its own financial activities.(2) Going concern assumption 持续经营假设This assumption states that the enterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be amortized over time.This assumption enables an accountant to use accrual accounting which records accrual and deferral entries as of each balance sheet date.(3) Time period assumption 会计分期假设This assumption assumes that the economic life of a business can be divided into artificial time periods.The most typical time segment = Calendar YearNext most typical time segment = Fiscal Year(4) Monetary unit assumption 货币计量假设This assumption states that only transaction data that can be expressed in terms of money be included in the accounting records, and the unit of measure remains relatively constant over time in terms of purchasing power.In essence, this assumption disregards the effects of inflation or deflation in the economy in which the entity operates.This assumption provides support for the "Historical Cost" principle.4. Accrual-basis accounting 权责发生制会计5. Qualitative characteristics 会计信息质量特征(1) Reliability 可靠性For accounting information to be reliable, it must be dependable and trustworthy. Accounting information is reliable to the extend that it is:Verifiable: means that information has been objectively determined, arrived at, or created. More than one person could consider the facts of a situation and reach a similar conclusion.Representationally faithful: that something is what it is represented to be. For example, if a machine is listed as a fixed asset on the balance sheet, then the companycan prove that the machine exists, is owned by the company, is in working condition, and is currently being used to support the revenue generating activities of the company.Neutral: means that information is presented in accordance with generally accepted accounting principles and practices, and without bias.(2) Relevance 相关性Relevant information is capable of making a difference in the decisions of users by helping them to evaluate the potential effects of past, present, or future transactions or other events on future cash flows (predictive value) or to confirm or correct their previous evaluations (confirmatory value).(3) Understandability 可理解性Understandability is the quality of information that enables users who have a reasonable knowledge of business and economic activities and financial reporting, and who study the information with reasonable diligence, to comprehend its meaning.(4) Comparability 可比性Comparability: suggests that accounting information that has been measured and reported in a similar manner by different enterprises should be capable of being compared because each of the enterprises is applying the same generally accepted accounting principles and practices.Consistency: suggests that an entity has used the same accounting principle or practice from one period to another, therefore, if the dollar amount reported for a category is different from one period to the next, then chances are that the difference is due to a change like an increase or decrease in sales volume rather than being due to a change in the method of calculating the dollar amount. (5) Substance over form 实质重于形式Substance over form emphasizes the economic substance of an event even though its legal form may provide a different result.It requires that business enterprise should perform accounting recognition, measurement and reporting in accordance with the economic substance rather than the legal form of an event or transaction.(6) Materiality 重要性Information is material if its omission or misstatement could influence the resource allocation decisions that users make on the basis of an entity’s financial report. Materiality depends on the nature and amount of the item judged in the particular circumstances of its omission or misstatement. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise.(7) Conservatism 谨慎性Conservatism dictates that when in doubt, choose the method that will be least likely to overstate assets and income, and understate liabilities and expenses.(8) Timeliness 及时性Timeliness means having information available to decision makers before it loses its capacity to influence decisions. If information becomes available only afterthe time that a decision must be made, it has no capacity to influence that decision and thus lacks relevance.6. Basic accounting elements 基本会计要素(1) Asset 资产An asset is a resource that is owned or controlled by an enterprise as a result of past transactions or events and is expected to generate economic benefits to the enterprise.(2) Liability 负债A liability is a present obligation arising from past transactions or events which are expected to give rise to an outflow of economic benefits from the enterprise.A present obligation is a duty committed by the enterprise under current circumstances. Obligations that will result from the occurrence of future transactions or events are not present obligations and shall not be recognized as liabilities.(3) owners’ equity 所有者权益Owners’ equity is the residual interest in the assets of an enterprise after deducting all its liabilities.Owners’ equity of a company is also known as shareholders’ equity.(4) Revenue 收入Revenue is the gross inflow of economic benefits derived from the course of ordinary activities that result in increases in equity, other than those relating to contributions from owners.(5) Expense 费用Expenses are the gross outflow of economic benefits resulted from the course of ordinary activities that result in decreases in owners’ equity, other than those relating to appropriations of profits to owners.(6) Profit 利润Profit is the operating result of an enterprise over a specific accounting period. Profit includes the net amount of revenue after deducting expenses, gains and losses directly recognized in profit of the current period, etc.7. Five measurement attributes 会计计量属性(1) Historical cost 历史成本Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition. Liabilities are recorded at the amount of proceeds or assets received in exchange for the present obligation, or the amount payable under contract for assuming the present obligation, or at the amount of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.(2) Current replacement cost 现时重置成本Assets are carried at the amount of cash or cash equivalents that would have to be paid if a same or similar asset was acquired currently. Liabilities are carried at the amount of cash or cash equivalents that would be currently required to settle the obligation.(3) Net realizable value 可实现净值Assets are carried at the amount of cash or cash equivalents that could be obtained by selling the asset in the ordinary course of business, less the estimated costs of completion, the estimated selling costs and related tax payments.(4) Present value 现值Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate from its continuing use and ultimate disposal. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities within the expected settlement period.(5) Fair value 公允价值Assets and liabilities are carried at the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.8. Financial statements 财务报表(1) Balance sheet 资产负债表A balance sheet is an accounting statement that reflects the financial position of an enterprise at a specific date.(2) Income statement 损益表An income statement is an accounting statement that reflects the operating results of an enterprise for a certain accounting period.(3) Statement of cash flows 现金流量表A cash flow statement is an accounting statement that reflects the inflows and outflows of cash and cash equivalents of an enterprise for a certain accounting period.(4) Statement of changes in owners’equity 所有者权益变动表A statement of changes in owners’ equity reports the changes in owners’ equity for a specific period of time.(5) Notes to financial statements 财务报表附注Notes to the accounting statements are further explanations of items presented in the accounting statements, and explanations of items not presented in the accounting statements, etc.9. Accounting entry 会计分录Debit: CashCredit: Common Stock10. Basic accounting equation 基本会计等式Assets = Liabilities + owners’ equity11. List of present and potential users of financial information 财务信息的使用者investors, creditors, employees, suppliers, customers, and governmental agencies.Definitions of Four Categories of Financial AssetsA financial asset or liability held for trading is one that was acquired or incurred principally for the purpose of generating a profit from short-term fluctuations in price or dealers margin. A financial asset should be classified as held for trading if, regardless of why it was acquired, it is part of a portfolio for which there is evidence of a recent actual pattern of short-term profit-taking. Derivative financial assets and derivative financial liabilities are always deemed held for trading unless they are designated and effective hedging instruments.Held-to-maturity investments are financial assets with fixed or determinable payments and fixed maturity that an enterprise has the positive intent and ability to hold to maturity other than loans and receivables originated by the enterprise.四类金融资产的定义为交易而持有的金融资产或金融负债,指主要为了从价格或交易商保证金的短期波动中获利而购置的金融资产或承担的金融负债。

会计英语知识点汇总

会计英语知识点汇总会计英语是指与会计相关的英语词汇、表达方式以及专业术语。

随着国际间经济交流的日益频繁和全球化进程的加快,掌握会计英语成为了很多专业人士的必备技能。

本文将梳理一些常见的会计英语知识点,以帮助读者更好地理解和运用这些术语。

一、财务报表1. Balance Sheet(资产负债表):用于反映企业在特定日期的资产、负债和所有者权益的情况。

2. Income Statement(利润表):反映企业在一定期间内的收入、费用和净利润。

3. Cash Flow Statement(现金流量表):按照企业的经营、投资和筹资活动分类,反映现金的流入和流出。

4. Statement of Retained Earnings(留存收益表):展示企业在一定期间内的净利润留存情况。

二、会计核算1. Accounting Equation(会计等式):Assets(资产)= Liabilities(负债)+ Owner's Equity(所有者权益),反映了企业财务状况的基本平衡关系。

2. Depreciation(折旧费用):用于反映资产价值随时间的减少。

3. Accrual Accounting(权责发生制):将收入和费用与实际发生的时间匹配,而非支付和收入的时间。

4. Double-entry Bookkeeping(复式记账法):每笔交易必须同时记录借方和贷方的金额。

5. Financial Ratios(财务比率):用于分析企业财务状况和经营绩效的指标,包括盈利能力、杠杆比率、偿债能力等。

三、财务分析1. Liquidity(流动性):反映企业偿付短期债务的能力。

2. Solvency(偿债能力):反映企业偿付长期债务的能力。

3. Profitability(盈利能力):反映企业获取利润的能力。

4. Efficiency(效率):反映企业运营资源利用的程度。

5. DuPont Analysis(杜邦分析):将利润率、资产周转率和资本结构相互关联,分析企业绩效因素。

会计英语

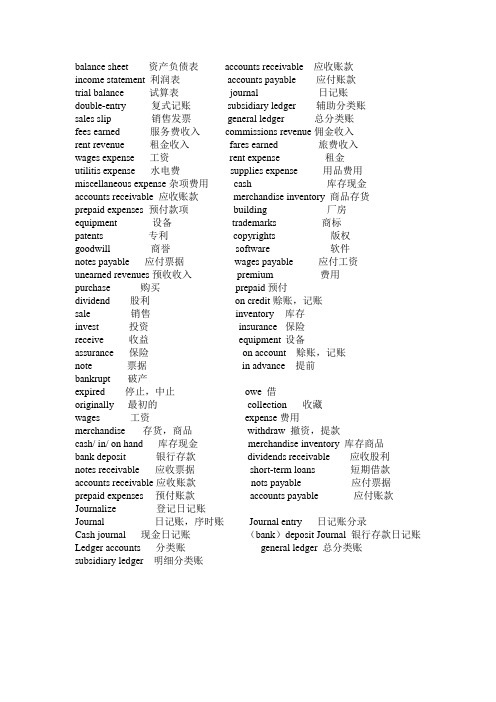

balance sheet 资产负债表accounts receivable 应收账款income statement 利润表accounts payable 应付账款trial balance 试算表journal 日记账double-entry 复式记账subsidiary ledger 辅助分类账sales slip 销售发票general ledger 总分类账fees earned 服务费收入commissions revenue佣金收入rent revenue 租金收入fares earned 旅费收入wages expense 工资rent expense 租金utilitis expense 水电费supplies expense 用品费用miscellaneous expense杂项费用cash 库存现金accounts receivable 应收账款merchandise inventory 商品存货prepaid expenses 预付款项building 厂房equipment 设备trademarks 商标patents 专利copyrights 版权goodwill 商誉software 软件notes payable 应付票据wages payable 应付工资unearned revenues预收收入premium 费用purchase 购买prepaid 预付dividend 股利on credit赊账,记账sale 销售inventory 库存invest 投资insurance 保险receive 收益equipment 设备assurance 保险on account 赊账,记账note 票据in advance 提前bankrupt 破产expired 停止,中止owe 借originally 最初的collection 收藏wages 工资expense费用merchandise 存货,商品withdraw 撤资,提款cash/ in/ on hand 库存现金merchandise inventory 库存商品bank deposit 银行存款dividends receivable 应收股利notes receivable 应收票据short-term loans 短期借款accounts receivable应收账款nots payable 应付票据prepaid expenses 预付账款accounts payable 应付账款Journalize 登记日记账Journal 日记账,序时账Journal entry 日记账分录Cash journal 现金日记账(bank)deposit Journal 银行存款日记账Ledger accounts 分类账general ledger 总分类账subsidiary ledger 明细分类账salaries/1)purchases of inventory in cash for $3 000Dr. inventory 3000Cr. cash 30002)sales on account of $10 000Dr. accounts receivable 10 000Cr. sales revenue 10 0003) paid $50 000 in salaries & wagesDr. wages & salaries expense 50 000Cr. bank deposit 50 0004)cash sale of US$1 180Dr. cash 1 180Cr. sales revenue 1 1805)pre-paid insurance for $12 000Dr. prepaid insurance 12 000Cr. bank deposit 12 0006) Issued a one-month-term note $20 000 for the payment of accounts payable.Dr. Accounts payable 20 000Cr. notes payable 20 0007) purchased a piece of land as long-term investment for cash $10 000.Dr. Land 10 000Cr. Cash 10 0008) purchased office equipment for cash $5 000.Dr. office equipment 5000Cr. Cash 50009) purchased on account a lot of merchandise amounting $60 000.Dr. inventory 60 000Cr. Accounts payable 60 00010) made a sale of merchandise on account for $81 000Dr. accounts receivable 81 000Cr. Sales revenue 81 00011) paid cash in advance for two months’ rent $800.Dr. prepaid rent 800Cr. Cash 80012) collection from customers $70 000: $60 000 cash, $10 000 note–a one-month term note bearing 10.8% interest.Dr. cash 60 000notes receivable 10 000Cr. Accounts receivable 70 00013) paid $40 000 cash for accounts payable–liability item.Dr. accounts payable 40 000Cr. Cash 40 00014) paid other expenses $5 200 in cash.Dr. other expenses 5 200Cr. Cash 5 20015) paid cash for employees’ salaries $16 000 for the first four weeks of the month.Dr. salary expenses 16 000Cr. Cash 16 00016) payment of cash dividend $2 000.Dr. dividend 2 000Cr. Cash 2 00017) paid a $1 200 premium(费用)for one year’s assurance in advance.Dr. Prepaid Insurance 1 200Cr. Cash 1 20018) At the end of this month, $100 of prepaid insurance had expired(期满) or been used up. Dr. Insurance Expense 100Cr. Prepaid Insurance 10019) The owner Andy invest $20 000 cash into businessDr. bank deposit 20 000Cr. Capital 20 00020) Purchased a dental equipment(牙科设备) for $16,000 cash in bank(银行存款)Dr. Fixed asset (dental equipment) 16 000Cr. Cash in bank 16 00021) Purchase an air conditioner(空调)on credit for $16,000Dr. Fixed asset (air conditioner) 16 000Cr. Account payable 16 00022) Received Accounting service revenue $1500Dr. bank deposit 1 500Cr. service revenue 1 50023) Sold goods on credit for $1000 that originally cost $600Dr. Account payable 1000Cr. Sales revenues 1000Dr. Cost of good sold(主营业务成本) 600Cr. Inventory 60024) Paid money owed to the transportation company $100Dr. Account payable 100Cr. cash 10025) Received $150 from customer.Dr. cash 150Cr. Account receivable 15026) Owner withdrew $100 for personal useDr. Drawings(资本退出)100Cr. Cash 10027) Customer- Janson owing $100 has gone bankrupt (破产)Dr. Bad debts (坏账)100Cr. Account receivable 100。

会计科目中英文对照cpa版

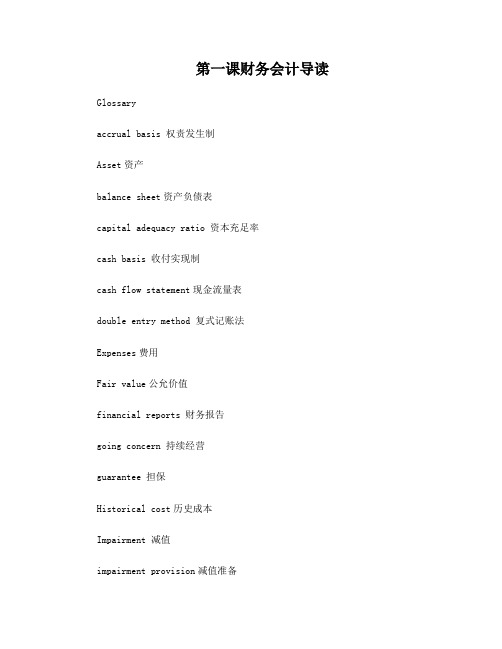

第一课财务会计导读Glossaryaccrual basis 权责发生制Asset资产balance sheet资产负债表capital adequacy ratio 资本充足率cash basis 收付实现制cash flow statement现金流量表double entry method 复式记账法Expenses费用Fair value公允价值financial reports 财务报告going concern 持续经营guarantee 担保Historical cost历史成本Impairment 减值impairment provision减值准备income statement利润表Liabilities负债Maturity 到期Net realizable value可变现净值Owners’ Equity 所有者权益post-amortization costs摊余成本Present value现值Profit利润Replacement cost重置成本stewardship 受托责任transferor转出方transferee转入方1.资产类科目Assets现金:Cash and cash equivalents 银行存款:Bank deposit应收账款:Account receivable应收票据:Notes receivable应收股利:Dividend receivable应收利息:Interest receivable其他应收款:Other receivables原材料:Raw materials在途物资:Materials in transport库存商品:inventory存货跌价准备:provision for the decline in value of inventories 坏账准备:Allowance for doubtful acounts待摊费用:Prepaid expense交易性金融资产:Trading financial assets持有至到期投资:held-to-maturity investment可供出售金融资产:Available-for-sale financial assets短期投资:Short-term investment长期股权投资:Long-term equity investment固定资产:Fixed assets累计折旧:Accumulated depreciation在建工程:Construction-in-process固定资产减值准备:provision for the decline in value of fixed assets 无形资产:Intangible assets累计摊销:Accumulated amortization商誉:Goodwill递延所得税资产:deferred tax assets (DTA)2.负债类Liability短期借款:Short-term loans/ borrowing长期借款:Long-term loans/ borrowing预收账款:advance from customers/ Deposit received应付票据:Notes payable应付账款:Account payable应付工资薪酬:wages payable应付股利:Dividends payable应付利息:Interest payable应交税费:Tax payable其他应付款:Other payables递延所得税负债:Deferred tax liabilities3.所有者权益类 OWNERS' EQUITY实收资本:Paid-in capital资本公积:Additional paid-in capital 盈余公积:Surplus reserves未分配利润:Retained earnings4.成本类科目Cost生产成本:Manufacturing Cost制造费用:Manufacturing overhead劳务成本:labor costs研发支出:R & D expenditure5.损益类Profit and loss主营业务收入:Main operating revenue 其他业务收入:Other operating revenue 营业外收入:Non-operating income投资收益:Investment income产品销售收入:sales revenue主营业务成本:Main operating costs;cost of goods sold / cost of sales 其他业务支出:Other operating costs营业外支出:Non-operating expenditure销售费用:Selling expense(advertisement)管理费用:General and administration expense (G&A expense)财务费用:Finance expense公允价值变动损益:Gain/loss of the change of fair value所得税:Income tax第二课流动资产GlossaryAllowance Method备抵法Bad debts坏账Cash 现金Cash Discounts现金折扣Cash Equivalents 现金等价物consigned goods代销存货Current Asset流动资产Direct Write-Off直接转销法finished products完工产品FIFO, First-in-first-out先进先出法general and administrative expenses管理费用goods in transit在途存货Gross Method总价法Inventory 存货LIFO: Last-in-first-out后进先出法Maturity 到期Merchandise 商品Net Method净价法NRV(Net Realizable Value) 可变现净值Notes Receivable应收票据Periodic system定期盘存Perpetual system永续盘存physical count 盘点purchase costs采购成本Specific Identification个别认定法the provision for the loss on decline in value of inventories存货跌价准备Trade Discounts商业折扣Receivables 应收款work in progress 在产品第3课非流动资产GlossaryAccumulated amortization累计摊销Amortization 摊销capitalize资本化Construction-in-process在建工程Costs Subsequent to Acquisition后续支出Discard 报废Depreciation折旧Disposal 处置double declining balance method双倍余额递减法expense费用化fiscal year 会计年度fixed assets固定资产Goodwill 商誉Impairment 减值Intangible Asset无形资产Noncurrent Asset非流动资产recoverable amount 可收回金额research and development(R&D) 研发salvage value 残值sum of the years digits年数总和法the straight-line method直线法unit of production method工作量法useful life 使用寿命第四课负债GlossaryContingency 或有事项Contingent 或有的contingent asset或有资产contingent Liability或有负债Coupon息票Current liability 流动负债Discount折价effective yield有效利率face value面值interest利息Liability负债loss contract亏损合同Market rate市场利率nominal rate名义利率Off-Balance-Sheet Financing表外融资Operating Leases经营租赁Capital leases融资租赁par面值pending litigation 未决诉讼Premium溢价principal本金virtually certain基本确定第五课投资Glossaryavailable for sale可供出售Consolidate 合并Control 控制Debt securities债务证券Derivative 衍生品Equity securities权益性证券Financial Asset 金融资产Held-to-maturity持有至到期Investee 被投资人Issuer 发行方Repurchase 回购post-amortization cost 摊余成本Security 有价证券Significant influence 重大影响Trading financial assets交易性金融资产Financial assets at fair value through profit or loss以公允价值计量且其变动计入当期损益的金融资产, including:Trading financial assets交易性金融资产andthe financial assets which are measured at their fair values and of which the variation is included in the current profits and losses指定为以公允价值计量且其变动计入当期损益的金融资产;the investments which will be held to their maturity;持有至到期投资loans and the account receivables; and贷款和应收款项Financial assets available for sale.可供出售金融资产继续阅读。

会计核算英语

会计核算英语

会计核算是指对企业财务事项进行系统、全面、准确的记录、分类、加工、分析、报告和监督的过程。

会计核算是企业财务管理的基础,对企业的发展和决策具有重要的作用。

以下是一些常用的会计核算英语词汇:

1. Balance sheet 资产负债表

2. Income statement 损益表

3. Cash flow statement 现金流量表

4. General ledger 总账

5. Journal voucher 记账凭证

6. Accounts payable 应付账款

7. Accounts receivable 应收账款

8. Depreciation 折旧

9. Amortization 摊销

10. Accruals 暂计款项

11. Bad debts 坏账

12. Inventory 存货

13. Cost of goods sold 销售成本

14. Gross profit 毛利润

15. Net profit 净利润

16. Return on investment 投资回报率

17. Financial ratios 财务比率

18. Audit审计

以上词汇是会计核算中常用的英语词汇,掌握这些词汇对于提高英语水平和工作效率都有很大的帮助。

会计英语术语中英文对照

会计英语术语中英文对照会计是一门重要的商业领域,涉及到许多专业术语。

对于许多学习会计的人来说,掌握这些术语之间的英文对照是至关重要的。

本文将为您提供一些常见的会计英语术语及其中英文对照。

1. 会计基础术语•Assets(资产)•Liabilities(负债)•Equity(股权)•Revenue(收入)•Expenses(费用)•Net Income(净收入)•Gross Income(毛收入)•Profit(利润)•Loss(亏损)•Balance Sheet(资产负债表)•Income Statement(利润表)•Cash Flow Statement(现金流量表)•Statement of Retned Earnings(留存收益表)2. 资产类•Current Assets(流动资产)•Fixed Assets(固定资产)•Intangible Assets(无形资产)•Cash(现金)•Accounts Receivable(应收账款)•Inventory(库存)•Prepd Expenses(预付费用)•Property, Plant, and Equipment(房地产、厂房和设备)3. 负债类•Current Liabilities(流动负债)•Long-term Liabilities(长期负债)•Accounts Payable(应付账款)•Notes Payable(应付票据)•Accrued Expenses(应计费用)•Deferred Revenues(预收收入)•Bonds Payable(应付债券)4. 股权类•Common Stock(普通股)•Preferred Stock(优先股)•Retned Earnings(留存收益)•Dividends(股息)•Treasury Stock(库存股)5. 收入类•Sales(销售额)•Revenue(收入)•Sales Revenue(销售收入)•Service Revenue(服务收入)•Interest Revenue(利息收入)•Dividend Revenue(股息收入)6. 费用类•Cost of Goods Sold(销售成本)•Operating Expenses(营业费用)•Selling Expenses(销售费用)•General and Administrative Expenses(管理费用)•Depreciation Expenses(折旧费)•Amortization Expenses(摊销费)•Interest Expenses(利息费用)•Income Tax Expenses(所得税费用)7. 现金流量类•Operating Activities(经营活动)•Investing Activities(投资活动)•Financing Activities(融资活动)•Cash Inflows(现金流入)•Cash Outflows(现金流出)•Net Cash Flow(净现金流量)8. 财务报表•Balance Sheet(资产负债表)•Income Statement(利润表)•Cash Flow Statement(现金流量表)•Statement of Retned Earnings(留存收益表)总结以上是一些常见的会计英语术语及其中英文对照。

常用会计英语词汇汇总

常用会计英语词汇汇总- Assets: 资产- Liabilities: 负债- Equity: 资本- Revenue: 收入- Expenses: 费用- Depreciation: 折旧- Amortization: 摊销- Net profit: 净利润- Gross profit: 毛利润- Balance sheet: 资产负债表- Cash flow statement: 现金流量表- General ledger: 总分类账- Trial balance: 试算平衡表- Cash flow: 现金流- Cost of goods sold: 销售成本- Gross margin: 毛利率- Tax payable: 应交税费- Accounts payable: 应付账款- Accounts receivable: 应收账款- Accruals: 预提项目- Accrued expenses: 应计费用- Audit: 审计- Audit trail: 审计追踪- Financial statements: 财务报表- Bookkeeping: 簿记- Journal entries: 分录- Cash basis accounting: 现金会计- Accrual basis accounting: 权责发生制会计- Accounts payable turnover: 应付账款周转率- Accounts receivable turnover: 应收账款周转率- Return on assets: 资产收益率- Return on investment: 投资回报率- Cost accounting: 成本会计- Managerial accounting: 管理会计- Financial analysis: 财务分析- Budgeting: 预算编制- Forensic accounting: 司法会计。

会计类英语单词

会计类英语单词一、导言英语作为国际通用语言,在现代社会中扮演着重要的角色。

学习会计类英语单词对于从事会计相关工作的人员来说尤为重要。

本文将介绍一些常用的会计类英语单词及其释义,帮助读者更好地理解和掌握这些专业术语。

二、常用会计类英语单词1. Accountant:会计师2. Accrual:应计3. Asset:资产4. Audit:审计5. Balance sheet:资产负债表6. Budget:预算7. Depreciation:折旧8. Equity:股本9. Expense:费用10. Financial statement:财务报表11. Income statement:利润表12. Interest:利息13. Ledger:总账14. Liabilities:负债15. Profit:利润16. Revenue:收入17. Tax:税收18. Trial balance:试算平衡表19. Wage:工资20. Working capital:营运资本三、对会计类英语单词的进一步解读1. Accountant(会计师)Accountant指的是负责处理和记录财务和税务事务的专业人员。

他们负责准确地记录和分析财务数据,并根据法律法规进行合规处理。

2. Accrual(应计)Accrual是指在会计报表中记录收入和费用时,以实际发生的时间为准。

这意味着即使在现金流发生之前或之后,也要将相关项目计入账目。

3. Asset(资产)Asset是指企业所拥有的有形或无形的东西,具有经济价值。

资产可以包括现金、股票、土地、建筑物等。

4. Audit(审计)Audit是指对企业的财务记录进行全面检查和评估的过程。

审计的目的是确认财务数据的真实性和准确性,以及检查企业是否遵守财务相关法规和准则。

5. Balance sheet(资产负债表)Balance sheet是一份会计报表,用于呈现企业在特定时间点上的资产、负债和所有者权益的情况。

会计英语的名词解释

会计英语的名词解释在全球化的经济环境中,会计英语作为一种专业词汇系统成为了国际上财务人员必备的技能之一。

掌握会计英语不仅可以提高专业素养,还有助于加强与国际同行的交流。

本文将对一些常见的会计英语名词进行解释,帮助读者更好地理解与运用这些术语。

1. Assets(资产)资产是指任何有经济价值的资源,可以是现金、股票、债券、房产等,用来支持企业运营。

资产一般被分为长期资产和流动资产,前者指那些用于长期经营的资产,如土地、建筑等,后者指较流动的资产,如存货、应收账款等。

2. Liabilities(负债)负债是指企业所欠的债务或义务,包括应付账款、贷款、未付工资等。

负债按照偿还期限可以分为长期负债和流动负债,前者指一年以上需要偿还的债务,后者指一年内需要偿还的债务。

3. Equity(所有者权益)所有者权益是指企业拥有者对其资产净值的权利。

它包括股东权益和留存收益。

股东权益可以通过发行股票来获得,而留存收益是企业利润未分配的部分。

4. Revenue(收入)收入是企业在正常经营活动中产生的经济利益,如销售商品、提供服务等所获得的钱款。

收入可以分为主营业务收入和其他业务收入。

5. Expenses(费用)费用是企业为了开展正常经营活动而发生的支出,如工资、租金、采购成本等。

费用可以分为直接费用和间接费用,前者指与产品生产直接相关的费用,后者指与产品生产间接相关的费用。

6. Depreciation(折旧)折旧是指某种固定资产按照一定的标准逐年减少其价值的过程。

折旧费用会计上被逐年分摊在企业的成本中,以反映固定资产的使用寿命与价值的变化。

7. Amortization(摊销)摊销是指对某类资产进行逐年分配的过程,以反映其价值随时间的减少。

摊销一般适用于有限生命周期的资产,如专利权、版权等。

8. Audit(审计)审计是一项独立的、客观的评估,用于确定企业的财务报表是否符合会计准则和法律法规的规定。

审计旨在验证企业的财务信息的真实性与准确性。

会计词汇英语

会计词汇英语以下是一些常见的会计词汇的英语:1. Accounting 会计2. Accountant 会计师3. Accounting Principles 会计准则4. Balance Sheet 资产负债表5. Income Statement 利润表6. Statement of Cash Flows 现金流量表7. Asset 资产8. Liability 负债9. Owner's Equity 所有者权益10. Revenue 收入11. Expense 费用12. Profit 利润13. Depreciation 折旧14. Amortization 摊销15. Accruals 应计制16. Cash Basis of Accounting 收付实现制17. Adjustment of Accounts 账务调整18. Audit 审计19. Auditor 审计师20. Audit Report 审计报告21. Internal Audit 内部审计22. External Audit 外审23. Consolidated Financial Statements 合并财务报表24. Stockholder 股东25. Dividend 股息26. Capital Stock 股本27. Additional Paid-in Capital 实收资本公积28. Retained Earnings 留存收益29. Cost of Goods Sold 产品销售成本30. Inventory 存货31. Fixed Asset 固定资产32. Current Asset 流动资产33. Current Liability 流动负债34. Long-term Liability 长期负债35. Sales 销售额36. Cost of Sales 销售成本37. Expenses 开销,费用38. Net Profit/Loss 净利润/亏损39. Accounts Payable 应付款项40. Accounts Receivable 应收款项41. Notes Payable 应付款项/应付票据42. Notes Receivable 应收款项/应收票据43. Accrued Expenses 应计费用/预提费用44. Accrued Revenue 应计收入/预提收入45. Deposits in Advance 预付款项46. Prepaid Expenses/Prepaid Rent 预付费用/预付租金。

会计报表科目英语

annuities 年金

applied cost 已分配成本

applied expense 已分配費用

applied manufacturing expense 己分配製造費用

apportioned charge 攤派費用

appreciation 漲價

administration expense 管理費用

advances 預付

advertising expense 廣告費

agency 代理

agent 代理人

agreement 契約

allotments 分配數

allowance 津貼

amalgamation 合併

amortization 攤銷

一年内到期的长期存款

long-term deposit in one year

其它流动资产 other current assets

流动资产合计 total current assets

长期投资: long-term investment

一年以上的投资款项

investment over 1year

deferred liabilities 遞延負債

dense 送貨費

delivery order 出貨單

demand draft 即期匯票

demand note 即期票據

demurrage charge 延期費

deposit 存款

deposit slip 存款單

charges 費用

charge for remittances 匯水手續費

charter 營業執照

会计英语 财务报表

other cash paid relating to operating activities

支付的其他与经营活动有关的现金

Sub-total of cash outflows

现金流出小计

Net cash flows from operating activities

经营活动产生的现金流量净值

减:营业成本

Less:operating costs

营业税金及附加

Operating tax

销售费用

Sales expense

管理费用

Administrative expense

财务费用

Financial expense

资产减值准备

Loss of impairment of assets

加:公允价值变动收益

一年内到期的非流动负债

current liailities falling due within one year

其他流动负债

other current liabilities

流动负债合计

Total of current liabilities

非流动负债:

Non-current Liabilities

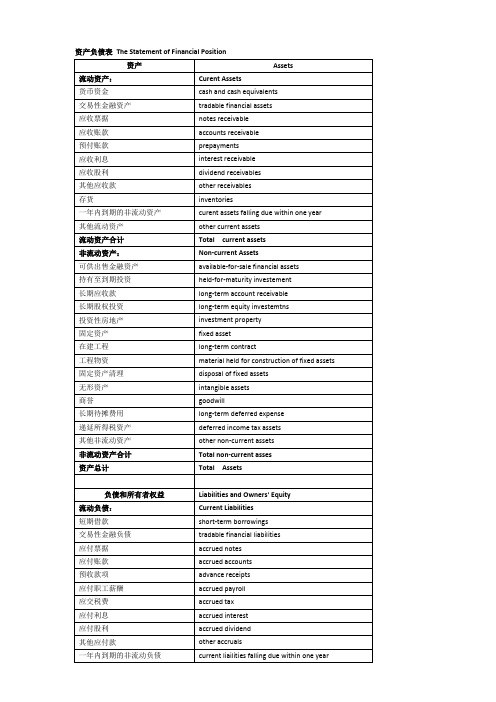

资产负债表The Statement of Financial Position

资产

Assets

流动资产:

Curent Assets

货币资金

cash and cash equivalents

交易性金融资产

tradable financial assets

应收票据

notes receivable

应收账款

非流动资产合计

Total non-current asses

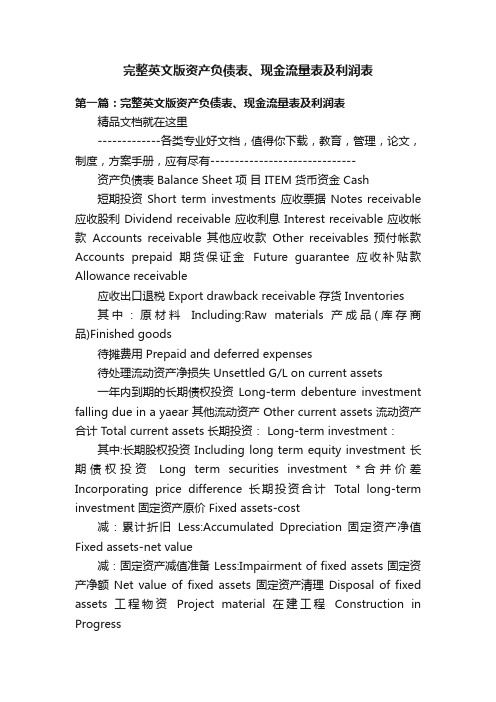

完整英文版资产负债表、现金流量表及利润表

完整英文版资产负债表、现金流量表及利润表第一篇:完整英文版资产负债表、现金流量表及利润表精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------资产负债表 Balance Sheet 项目 ITEM 货币资金 Cash短期投资 Short term investments 应收票据 Notes receivable 应收股利 Dividend receivable 应收利息 Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable应收出口退税 Export drawback receivable 存货 Inventories其中:原材料Including:Raw materials 产成品(库存商品)Finished goods待摊费用 Prepaid and deferred expenses待处理流动资产净损失 Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产 Other current assets 流动资产合计 Total current assets 长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment 长期债权投资Long term securities investment *合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价 Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value减:固定资产减值准备 Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress待处理固定资产净损失 Unsettled G/L on fixed assets 固定资产合计 Total tangible assets 无形资产 Intangible assets其中:土地使用权 Including and use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets --------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计T otal intangible assets and other assets 递延税款借项 Deferred assets debits 资产总计 Total Assets 资产负债表(续表)Balance Sheet 项目 ITEM短期借款 Short-term loans 应付票款 Notes payable 应付帐款Accounts payab1e 预收帐款 Advances from customers 应付工资Accrued payro1l 应付福利费 Welfare payable 应付利润(股利)Profits payab1e 应交税金 Taxes payable其他应交款Other payable to government 其他应付款Other creditors 预提费用Provision for expenses 预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities 流动负债合计Total current liabilities 长期借款Long-term loans payable 应付债券Bonds payable长期应付款long-term accounts payable 专项应付款Special accounts payable 其他长期负债 Other long-term liabilities 其中:特准储备资金Including:Special reserve fund 长期负债合计 Total long term liabilities 递延税款贷项 Deferred taxation credit 负债合计 Total liabilities * 少数股东权益 Minority interests 实收资本(股本)Subscribed Capital 国家资本National capital 集体资本Collective capital 法人资本Legal person“s capital其中:国有法人资本Including:State-owned legal person”s capital 集体法人资本Collective legal person“s capital 个人资本Personal capital--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------外商资本Foreign businessmen”s capital 资本公积Capital surplus 盈余公积 surplus reserve其中:法定盈余公积 Including:statutory surplus reserve 公益金public welfare fund补充流动资本 Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss 未分配利润 Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements 所有者权益合计 Total shareholder"s equity 负债及所有者权益总计 Total Liabilities & Equity利润表 INCOME STATEMENT 项目 ITEMS产品销售收入Sales of products 其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances 产品销售净额 Net sales of products 减:产品销售税金 Less:Sales tax 产品销售成本Cost of sales其中:出口产品销售成本 Including:Cost of export sales 产品销售毛利Gross profit on sales 减:销售费用Less:Selling expenses 管理费用 General and administrative expenses 财务费用 Financial expenses其中:利息支出(减利息收入)Including:Interest expenses(minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润 Profit on sales 加:其他业务利润Add:profit from other operations 营业利润 Operating profit加:投资收益Add:Income on investment 加:营业外收入Add:Non-operating income 减:营业外支出Less:Non-operating expenses加:以前年度损益调整 Add:adjustment of loss and gain for previous years 利润总额Total profit减:所得税Less:Income tax 净利润Net profit--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------现金流量表Cash Flows Statement Prepared by: Period: Unit: Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities 2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets 28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities 3.Cash Flows fromFinancing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities 4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories 2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets 66)and other long-term assets(or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments(or deduct:gains)70)Defered tax credit(or deduct:debit)71)Decrease in inventories(or deduct:increase)72)Decrease in operating receivables(or deduct:increase)73)Increase in operating payables(or deduct:decrease)74)Net payment on value added tax(or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01)所收到的现金从销售货物或提供劳务02)收到的租金增值税销售额收到退款的价值03)增值税缴纳04)退回的其他税收和征费以外的增值税07)其他现金收到有关经营活动08)分,总现金流入量09)用现金支付的商品和服务)用现金支付经营租赁)用现金支付,并代表员工)增值税购货支付)所得税的缴纳)支付的税款以外的增值税和所得税)其他现金支付有关的经营活动)分,总的现金流出)净经营活动的现金流量2.cash流向与投资活动:)所收到的现金收回投资)所收到的现金从分配股利,利润)所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产)资产和其他长期资产)其他收到的现金与投资活动)小计的现金流入量用现金支付购建固定资产,无形资产)和其他长期资产)用现金支付,以获取股权投资)用现金支付收购债权投资33)其他现金支付的有关投资活动34)分,总的现金流出35)的净现金流量,投资活动产生3.cash流量筹资活动:36)的收益,从发行股票37)的收益,由发行债券38)的收益,由借款--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------41)其他收益有关的融资活动42),小计的现金流入量43)的现金偿还债务所支付的44)现金支付的费用,对任何融资活动45)支付现金,分配股利或利润46)以现金支付的利息费用47)以现金支付,融资租赁48)以现金支付,减少注册资本51)其他现金收支有关的融资活动52)分,总的现金流出53)的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56)偿还债务的转让固定资产57)偿还债务的转移投资58)投资在形成固定资产59)偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62)净利润63)补充规定的坏帐或不良债务注销64)固定资产折旧65)无形资产摊销损失处置固定资产,无形资产66)和其他长期资产(或减:收益)67)损失固定资产报废68)财务费用69)引起的损失由投资管理(或减:收益)70)defered税收抵免(或减:借记卡)71)减少存货(或减:增加)72)减少经营性应收(或减:增加)73)增加的经营应付账款(或减:减少)74)净支付的增值税(或减:收益净额75)净经营活动的现金流量增加现金和现金等价物76)的现金,在此期限结束--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------ 77)减:现金期开始78)加:现金等价物在此期限结束79)减:现金等价物期开始80),净增加现金和现金等价物--------------------------精品文档-------第二篇:完整英文版资产负债表、利润表及现金流量表资产负债表 Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货Inventories其中:原材料 Including:Raw materials产成品(库存商品)Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear其他流动资产Other current assets流动资产合计Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets 其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets 递延税款借项 Deferred assets debits资产总计Total Assets资产负债表(续表)Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费 Welfare payable应付利润(股利)Profits payab1e应交税金Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计 Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本)Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person“s capital其中:国有法人资本Including:State-owned legal person”s capital集体法人资本Collective legal person“s capital个人资本Personal capital外商资本Foreign businessmen”s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity 负债及所有者权益总计Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额 Net sales of products减:产品销售税金 Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本 Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用 General and administrative expenses财务费用 Financial expenses其中:利息支出(减利息收入)Including:Interest expenses(minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains) 产品销售利润 Profit on sales加:其他业务利润 Add:profit from other operations营业利润 Operating profit加:投资收益 Add:Income on investment加:营业外收入 Add:Non-operating income减:营业外支出 Less:Non-operating expenses加:以前损益调整Add:adjustment of loss and gain for previous years利润总额T otal profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by: Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets(or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments(or deduct:gains)70)Defered tax credit(or deduct:debit)71)Decrease in inventories(or deduct:increase)72)Decrease in operating receivables(or deduct:increase)73)Increase in operating payables(or deduct:decrease)74)Net payment on value added tax(or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents第三篇:资产负债表、利润表现金流量表三者关系三者之间的钩稽关系有:(1)损益表及利润分配表中的未分配利润=资产负债表中的未分配利润(2)资产负债表中现金及其等价物期末余额与期初余额之差=现金流量表中现金及其等价物净增加(3)利润表中的净销货额-资产负债表中的应收账款(票据)增加额+预收账款增加额=现金流量表中的销售商品、提供劳务收到的现金(4)资产负债表中除现金及其等价物之外的其他各项流动资产和流动负债的增加(减少)额=现金流量表中各相关项目的减少(增加)额。

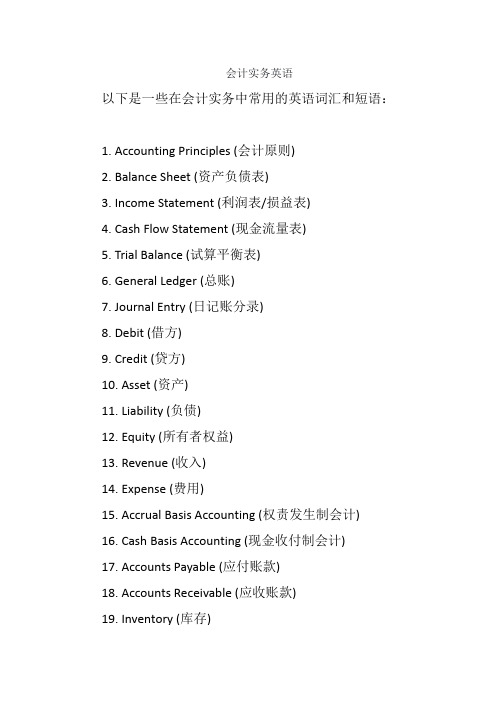

会计实务英语

会计实务英语以下是一些在会计实务中常用的英语词汇和短语:1. Accounting Principles (会计原则)2. Balance Sheet (资产负债表)3. Income Statement (利润表/损益表)4. Cash Flow Statement (现金流量表)5. Trial Balance (试算平衡表)6. General Ledger (总账)7. Journal Entry (日记账分录)8. Debit (借方)9. Credit (贷方)10. Asset (资产)11. Liability (负债)12. Equity (所有者权益)13. Revenue (收入)14. Expense (费用)15. Accrual Basis Accounting (权责发生制会计)16. Cash Basis Accounting (现金收付制会计)17. Accounts Payable (应付账款)18. Accounts Receivable (应收账款)19. Inventory (库存)20. Depreciation (折旧)21. Amortization (摊销)22. Budget (预算)23. Cost of Goods Sold (销售成本)24. Financial Statement Analysis (财务报表分析)25. Audit (审计)26. Internal Control (内部控制)27. GAAP (Generally Accepted Accounting Principles,公认会计原则)28. IFRS (International Financial Reporting Standards,国际财务报告准则)29. Taxation (税收)30. Bookkeeping (记账)在实际的会计实务中,这些词汇和相关的表达会频繁出现,理解和掌握它们对于进行英文环境下的会计工作非常重要。

会计英语 资产负债表,损益表等对应英语

一、资产类Assets流动资产Current assets货币资金Cash and cash equivalents现金Cash银行存款Cash in bank其他货币资金Other cash and cash equivalents外埠存款Other city Cash in bank银行本票Cashiers cheque银行汇票Bank draft信用卡Credit card信用证保证金L/C Guarantee deposits存出投资款Refundable deposits短期投资Short-term investments股票Short-term investments - stock债券Short-term investments - corporate bonds基金Short-term investments - corporate funds其他Short-term investments - other短期投资跌价准备Short-term investments falling price reserves应收款Account receivable应收票据Note receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable其他应收款Other notes receivable坏账准备Bad debt reserves预付账款Advance money应收补贴款Cover deficit by state subsidies of receivable库存资产Inventories物资采购Supplies purchasing原材料Raw materials包装物Wrappage低值易耗品Low-value consumption goods材料成本差异Materials cost variance自制半成品Semi-Finished goods库存商品Finished goods商品进销差价Differences between purchasing and selling price委托加工物资Work in process - outsourced委托代销商品Trust to and sell the goods on a commission basis受托代销商品Commissioned and sell the goods on a commission basis 存货跌价准备Inventory falling price reserves分期收款发出商品Collect money and send out the goods by stages待摊费用Deferred and prepaid expenses长期投资Long-term investment长期股权投资Long-term investment on stocks股票投资Investment on stocks其他股权投资Other investment on stocks长期债权投资Long-term investment on bonds债券投资Investment on bonds其他债权投资Other investment on bonds长期投资减值准备Long-term investments depreciation reserves股权投资减值准备Stock rights investment depreciation reserves债权投资减值准备Bcreditors rights investment depreciation reserves委托贷款Entrust loans本金Principal利息Interest减值准备Depreciation reserves固定资产Fixed assets房屋Building建筑物Structure机器设备Machinery equipment运输设备Transportation facilities工具器具Instruments and implement累计折旧Accumulated depreciation固定资产减值准备Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciation reserves工程物资Project goods and material专用材料Special-purpose material专用设备Special-purpose equipment预付大型设备款Prepayments for equipment为生产准备的工具及器具Preparative instruments and implement for fabricate 在建工程Construction-in-process安装工程Erection works在安装设备Erecting equipment-in-process技术改造工程Technical innovation project大修理工程General overhaul project在建工程减值准备Construction-in-process depreciation reserves固定资产清理Liquidation of fixed assets无形资产Intangible assets专利权Patents非专利技术Non-Patents商标权Trademarks, Trade names著作权Copyrights土地使用权Tenure商誉Goodwill无形资产减值准备Intangible Assets depreciation reserves专利权减值准备Patent rights depreciation reserves商标权减值准备trademark rights depreciation reserves未确认融资费用Unacknowledged financial charges待处理财产损溢Wait deal assets loss or income长期待摊费用Long-term deferred and prepaid expenses待处理财产损溢Wait deal assets loss or income待处理流动资产损溢Wait deal intangible assets loss or income待处理固定资产损溢Wait deal fixed assets loss or income二、负债类Liability短期负债Current liability短期借款Short-term borrowing应付票据Notes payable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance应付账款Account payable预收账款Deposit received代销商品款Proxy sale goods revenue应付工资Accrued wages应付福利费Accrued welfarism应付股利Dividends payable应交税金Tax payable应交增值税value added tax payable进项税额Withholdings on VAT已交税金Paying tax转出未交增值税Unpaid VAT changeover减免税款Tax deduction销项税额Substituted money on VAT出口退税Tax reimbursement for export进项税额转出Changeover withnoldings on VAT出口抵减内销产品应纳税额Export deduct domestic sales goods tax转出多交增值税Overpaid VAT changeover未交增值税Unpaid VAT应交营业税Business tax payable应交消费税Consumption tax payable应交资源税Resources tax payable应交所得税Income tax payable应交土地增值税Increment tax on land value payable应交城市维护建设税Tax for maintaining and building cities payable应交房产税Housing property tax payable应交土地使用税Tenure tax payable应交车船使用税Vehicle and vessel usage license plate tax(VVULPT) payable 应交个人所得税Personal income tax payable其他应交款Other fund in conformity with paying其他应付款Other payables预提费用Drawing expense in advance其他负债Other liabilities待转资产价值Pending changerover assets value预计负债Anticipation liabilities长期负债Long-term Liabilities长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year一年后到期的长期借款Long-term loans due over one year应付债券Bonds payable债券面值Face value, Par value债券溢价Premium on bonds债券折价Discount on bonds应计利息Accrued interest长期应付款Long-term account payable应付融资租赁款Accrued financial lease outlay一年内到期的长期应付Long-term account payable due within one year 一年后到期的长期应付Long-term account payable over one year专项应付款Special payable一年内到期的专项应付Long-term special payable due within one year 一年后到期的专项应付Long-term special payable over one year递延税款Deferral taxes三、所有者权益类OWNERS EQUITY资本Capital实收资本(或股本) Paid-up capital(or stock)实收资本Paicl-up capital实收股本Paid-up stock已归还投资Investment Returned公积资本公积Capital reserve资本(或股本)溢价Cpital(or Stock) premium接受捐赠非现金资产准备Receive non-cash donate reserve股权投资准备Stock right investment reserves拨款转入Allocate sums changeover in外币资本折算差额Foreign currency capital其他资本公积Other capital reserve盈余公积Surplus reserves法定盈余公积Legal surplus任意盈余公积Free surplus reserves法定公益金Legal public welfare fund储备基金Reserve fund企业发展基金Enterprise expension fund利润归还投资Profits capitalizad on return of investment利润Profits本年利润Current year profits利润分配Profit distribution其他转入Other chengeover in提取法定盈余公积Withdrawal legal surplus提取法定公益金Withdrawal legal public welfare funds提取储备基金Withdrawal reserve fund提取企业发展基金Withdrawal reserve for business expansion提取职工奖励及福利基金Withdrawal staff and workers bonus and welfare fund利润归还投资Profits capitalizad on return of investment应付优先股股利Preferred Stock dividends payable提取任意盈余公积Withdrawal other common accumulation fund应付普通股股利Common Stock dividends payable转作资本(或股本)的普通股股利Common Stock dividends change to assets(or stock) 未分配利润Undistributed profit四、成本类Cost生产成本Cost of manufacture基本生产成本Base cost of manufacture辅助生产成本Auxiliary cost of manufacture制造费用Manufacturing overhead材料费Materials管理人员工资Executive Salaries奖金Wages退职金Retirement allowance补贴Bonus外保劳务费Outsourcing fee福利费Employee benefits/welfare会议费Coferemce加班餐费Special duties市内交通费Business traveling通讯费Correspondence电话费Correspondence水电取暖费Water and Steam税费Taxes and dues租赁费Rent管理费Maintenance车辆维护费Vehicles maintenance油料费Vehicles maintenance培训费Education and training接待费Entertainment图书、印刷费Books and printing运费Transpotation保险费Insurance premium支付手续费Commission杂费Sundry charges折旧费Depreciation expense机物料消耗Article of consumption劳动保护费Labor protection fees季节性停工损失Loss on seasonality cessation劳务成本Service costs五、损益类Profit and loss收入Income业务收入OPERATING INCOME主营业务收入Prime operating revenue产品销售收入Sales revenue服务收入Service revenue其他业务收入Other operating revenue材料销售Sales materials代购代售包装物出租Wrappage lease出让资产使用权收入Remise right of assets revenue返还所得税Reimbursement of income tax其他收入Other revenue投资收益Investment income短期投资收益Current investment income长期投资收益Long-term investment income计提的委托贷款减值准备Withdrawal of entrust loans reserves 补贴收入Subsidize revenue国家扶持补贴收入Subsidize revenue from country其他补贴收入Other subsidize revenue营业外收入NON-OPERATING INCOME非货币性交易收益Non-cash deal income现金溢余Cash overage处置固定资产净收益Net income on disposal of fixed assets出售无形资产收益Income on sales of intangible assets固定资产盘盈Fixed assets inventory profit罚款净收入Net amercement income支出Outlay业务支出Revenue charges主营业务成本Operating costs产品销售成本Cost of goods sold服务成本Cost of service主营业务税金及附加Tax and associate charge营业税Sales tax消费税Consumption tax城市维护建设税Tax for maintaining and building cities资源税Resources tax土地增值税Increment tax on land value其他业务支出Other business expense销售其他材料成本Other cost of material sale其他劳务成本Other cost of service其他业务税金及附加费Other tax and associate charge费用Expenses营业费用Operating expenses代销手续费Consignment commission charge运杂费Transpotation保险费Insurance premium展览费Exhibition fees广告费Advertising fees管理费用Adminisstrative expenses职工工资Staff Salaries修理费Repair charge低值易耗摊销Article of consumption办公费Office allowance差旅费Travelling expense工会经费Labour union expenditure研究与开发费Research and development expense福利费Employee benefits/welfare职工教育经费Personnel education待业保险费Unemployment insurance劳动保险费Labour insurance医疗保险费Medical insurance会议费Coferemce聘请中介机构费Intermediary organs咨询费Consult fees诉讼费Legal cost业务招待费Business entertainment技术转让费Technology transfer fees矿产资源补偿费Mineral resources compensation fees排污费Pollution discharge fees房产税Housing property tax车船使用税Vehicle and vessel usage license plate tax(VVULPT) 土地使用税Tenure tax印花税Stamp tax财务费用Finance charge利息支出Interest exchange汇兑损失Foreign exchange loss各项手续费Charge for trouble各项专门借款费用Special-borrowing cost营业外支出Nonbusiness expenditure捐赠支出Donation outlay减值准备金Depreciation reserves非常损失Extraordinary loss处理固定资产净损失Net loss on disposal of fixed assets出售无形资产损失Loss on sales of intangible assets固定资产盘亏Fixed assets inventory loss债务重组损失Loss on arrangement罚款支出Amercement outlay所得税Income tax以前年度损益调整Prior year income adjustment现金Cash in hand银行存款Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票Other monetary assets - bank draft其他货币资金-信用卡Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment 短期投资-股票投资Investments - Short term - stocks短期投资-债券投资Investments - Short term - bonds短期投资-基金投资Investments - Short term - funds短期投资-其他投资Investments - Short term - others短期投资跌价准备Provision for short-term investment长期股权投资-股票投资Long term equity investment - stocks长期股权投资-其他股权投资Long term equity investment - others长期债券投资-债券投资Long term securities investemnt - bonds长期债券投资-其他债权投资Long term securities investment - others 长期投资减值准备Provision for long-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interest receivable应收帐款Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款Prepayment应收补贴款Allowance receivable其他应收款Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产Other current assets物资采购Purchase原材料Raw materials包装物Packing materials低值易耗品Low value consumbles材料成本差异Material cost difference自制半成品Self-manufactured goods库存商品Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资Consigned processiong material委托代销商品Consignment-out受托代销商品Consignment-in分期收款发出商品Goods on instalment sales存货跌价准备Provision for obsolete stocks待摊费用Prepaid expenses待处理流动资产损益Unsettled G/L on current assets待处理固定资产损益Unsettled G/L on fixed assets委托贷款-本金Consignment loan - principle委托贷款-利息Consignment loan - interest委托贷款-减值准备Consignment loan - provision固定资产-房屋建筑物Fixed assets - Buildings固定资产-机器设备Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures 固定资产-运输设备Fixed assets - Automobiles累计折旧Accumulated depreciation固定资产减值准备Impairment of fixed assets工程物资-专用材料Project material - specific materials工程物资-专用设备Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具Project material - tools and facilities for production在建工程Construction in progress在建工程减值准备Impairment of construction in progress固定资产清理Disposal of fixed assets无形资产-专利权Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权Intangible assets - trademark rights无形资产-土地使用权Intangible assets - land use rights无形资产-商誉Intangible assets - goodwill无形资产减值准备Impairment of intangible assets长期待摊费用Deferred assets未确认融资费用Unrecognized finance fees其他长期资产Other long term assets递延税款借项Deferred assets debits应付票据Notes payable应付帐款Trade creditors预收帐款Adanvances from customers代销商品款Consignment-in payables其他应交款Other payable to government其他应付款Other creditors应付股利Proposed dividends待转资产价值Donated assets预计负债Accrued liabilities应付短期债券Short-term debentures payable其他流动负债Other current liabilities预提费用Accrued expenses应付工资Payroll payable应付福利费Welfare payable短期借款-抵押借款Bank loans - Short term - pledged短期借款-信用借款Bank loans - Short term - credit短期借款-担保借款Bank loans - Short term - guaranteed一年内到期长期借款Long term loans due within one year一年内到期长期应付款Long term payable due within one year长期借款Bank loans - Long term应付债券-债券面值Bond payable - Par value应付债券-债券溢价Bond payable - Excess应付债券-债券折价Bond payable - Discount应付债券-应计利息Bond payable - Accrued interest长期应付款Long term payable专项应付款Specific payable其他长期负债Other long term liabilities应交税金-所得税Tax payable - income tax应交税金-增值税Tax payable - VAT应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings, beginning of the year资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - return investment by investment主营业务收入Sales主营业务成本Cost of sales主营业务税金及附加Sales tax营业费用Operating expenses管理费用General and administrative expenses财务费用Financial expenses投资收益Investment income其他业务收入Other operating income营业外收入Non-operating income补贴收入Subsidy income其他业务支出Other operating expenses营业外支出Non-operating expenses所得税Income tax11。

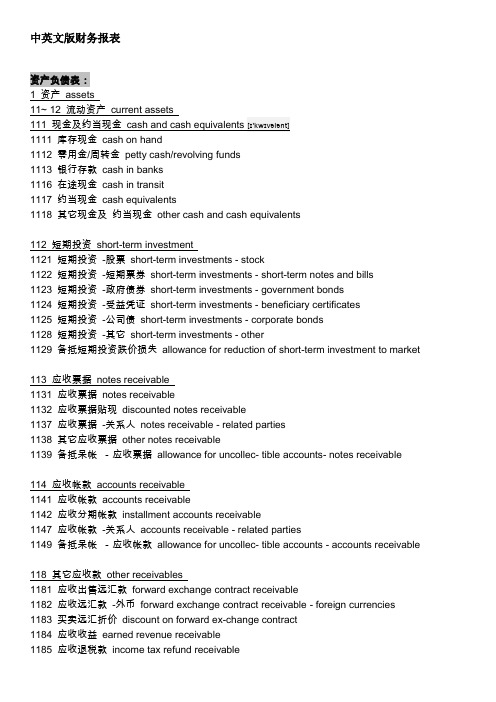

中英文版财务报表-资产负债表及利润表

中英文版财务报表资产负债表:1 资产assets11~ 12 流动资产current assets111 现金及约当现金cash and cash equivalents [ɪ'kwɪvələnt]1111 库存现金cash on hand1112 零用金/周转金petty cash/revolving funds1113 银行存款cash in banks1116 在途现金cash in transit1117 约当现金cash equivalents1118 其它现金及约当现金other cash and cash equivalents112 短期投资short-term investment1121 短期投资-股票short-term investments - stock1122 短期投资-短期票券short-term investments - short-term notes and bills1123 短期投资-政府债券short-term investments - government bonds1124 短期投资-受益凭证short-term investments - beneficiary certificates1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资-其它short-term investments - other1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market113 应收票据notes receivable1131 应收票据notes receivable1132 应收票据贴现discounted notes receivable1137 应收票据-关系人notes receivable - related parties1138 其它应收票据other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable1182 应收远汇款-外币forward exchange contract receivable - foreign currencies 1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1187 其它应收款- 关系人other receivables - related parties1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise ['mɝtʃəndaɪs] inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1255 预付所得税prepaid income tax1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1293 业主(股东)往来owners(stockholders) current account1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments1429 累积折旧-土地改良物accumulated depreciation - land improvements143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment 1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments1619 累积折耗-天然资源accumulated depletion - natural resources17 无形资产intangible assets171 商标权trademarks172 专利权patents173 特许权franchise174 著作权copyright175 计算机软件computer software176 商誉goodwill177 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation1859 累积折旧-出租资产accumulated depreciation - assets leased to others186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2121 应付商业本票commercial paper payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties216 应付所得税income taxes payable2161 应付所得税income tax payable217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2193 应付董监事酬劳compensation payable to directors and supervisors2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion2271 一年或一营业周期内到期公司债corporate bonds payable - current portion2272 一年或一营业周期内到期长期借款long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2291 递延所得税负债deferred income tax liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties 2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax2341 估计应付土地增值税estimated accrued land value incremental tax pay-able235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2814 递延所得税负债deferred income tax liabilities2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债-其它miscellaneous liabilities损益表:项目ITEMS产品销售收入Sales其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discounts and allowances产品销售净额Net sales减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit减:销售费用Less:Selling expense管理费用General and administrative expense财务费用Financial expense其中:利息支出(减利息收入) Including:Interest expense ( less interest income ) 汇兑损失(减汇兑收益) Exchange loss ( less exchange gain )产品销售利润Income from main operation加:其他业务利润Add:Income from other operations营业利润Operating income加:投资收益Add:Investment income营业外收入Non-operating income减:营业外支出Less:Non-operating expense加:以前年度损益调整Add:Adjustment to prior year\'s income and expense利润总额Income before tax减:所得税Less:Income tax净利润NET INCOME流动资产:Current asset货币资金Cash(currency fund)Bank短期投资Short-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interests receivable应收账款Accounts receivable其他应收款Other receivable预付账款Advances to suppliers应收补贴款Subsidies receivable存货Inventories待摊费用Prepaid expenses一年内到期的长期债券投资Long-term investments maturing within one year 其他流动资产Other current assets流动资产合计Total current assets长期投资:LONG TERM INVESTMENTS长期股权投资Long-term equity investment长期债权投资Long-term debt investment长期投资合计Total long term investment固定资产:FIXED ASSETS:固定资产原值Fixed assets-cost减:累计折旧Less:Accumulated depreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less: Impairment of fixed assets固定资产净额Fixed assets-book value工程物资Materials for projects在建工程Construction in progress固定资产清理Disposal of fixed assets固定资产合计Total Fixed Assets无形资产及其它资产INTANGIBLE ASSETS AND OTHER ASSETS:无形资产Intangible assets长期待摊费用Long-term deferred expenses其他长期资产Other long-term assets无形资产及其他资产合计Total intangible assets and other assets递延税项Deferred tax递延税款借项Deferred tax debit资产总计TOTAL ASSETS短期借款Short-term loans应付票据Notes payable应付账款Accounts payable预收账款Advances from customers应付工资Accrued payroll应付福利费Accrued Employee’s welfare expenses应付股利Dividends payable未交税金Taxes payable其他应交款Other taxes and expenses payable其他应付款Other payables预提费用Accrued expenses预提负债Provisions一年内到期的长期负债Long-term liabilities due within one year其他流动负债Other current liabilities长期借款Long-term loans应付债券Bonds payable长期应付款Long-term accounts payable专项应付款Specific accounts payable其他长期负债Other long-term liabilities长期负债合计Total long-term liabilities递延税项:Deferred tax递延税款贷项Deferred tax credit实收资本(或股本)Paid-in capital减:已归还投资Less:Investments returned实收资本(或股本)净额Paid-in capital-net资本公积Capital surplus盈余公积Surplus from profits其中:法定公益金Including:statutory public welfare fund未分配利润Undistributed profit所有者权益(或股东权益)合计Total owner`s equity负债及所有者权益(或股东权益)合计TOTAL LIABILITIES AND OWNER`S EQUITY项目ITEMS一、营业收入Income from main减:营业成本Less:Cost of main operation营业税金及附加Tax and additional expense二、经营利润Income from main operation加:其他业务利润Add:Income from other operation 减:营业费用Less:Operating expense管理费用General and administrative expense财务费用Financial expense三、营业利润Operating Income加:投资收益Add:Investment income补贴收入Income from subsidies营业外收入Non-operating income减:营业外支出Less:Non-operating expense四、利润总额Income before tax减:所得税Less:Income tax五、净利润NET INCOME。

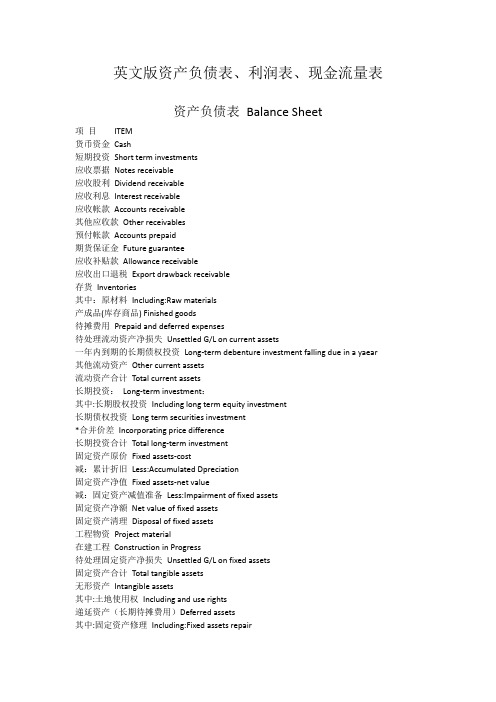

英文版资产负债表、利润表、现金流量表

英文版资产负债表、利润表、现金流量表资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve 学会计公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 )小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 )净增加现金和现金等价物Net profit。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。