AEO认证验证申请资料及认证标准-ENGLISH VERSION

AEO认证介绍解析

AEO认证介绍解析AEO认证(Authorized Economic Operator),也被称为授权经济运营商,是由世界海关组织(WCO)设立的国际认证制度,旨在通过识别和认可国际贸易中遵守安全合规标准的企业,为其提供便利和优先权,同时促进全球贸易的安全性和效率。

AEO认证的目标是建立一种互信机制,鼓励供应链各方共同合作,加强对全球贸易的安全管理。

通过获得AEO认证,企业可以享受到一系列的优惠政策和便利措施,如货物通关速度加快、减少检查和审批环节、减免关税等。

同时,AEO认证还可以提升企业的声誉和竞争力,为企业进一步扩大国际市场提供有力支持。

AEO认证的申请和评估过程相对复杂,包括了企业的组织结构、财务状况、安全管理体系等方面的评估。

申请企业需要提供相关资料和证明文件,并经过现场的审核和评估。

评估的标准包括企业的合规性、安全管理能力、供应链管理和信息技术支持等方面。

评估合格后,企业将获得由海关签发的AEO认证证书。

AEO认证分为三个级别,分别是AEO-C、AEO-S和AEO-F。

AEO-C级别是针对进出口企业的认证,主要评估企业在关务合规、安全管理和财务状况等方面的能力。

AEO-S级别是针对物流供应商的认证,主要评估企业在供应链管理和物流安全方面的能力。

AEO-F级别是针对海关代理商的认证,主要评估企业在代理海关业务方面的能力。

AEO认证的好处不仅体现在海关通关的便利和速度上,还有助于企业在全球贸易中建立信任关系和合作伙伴关系。

通过获得AEO认证,企业可以证明自己遵守国际贸易的标准和规范,提升声誉和信誉。

同时,AEO认证也可以帮助企业优化供应链管理,降低成本和风险,并加强对安全和可持续发展的关注。

在全球贸易中,安全和合规成为日益重要的因素。

AEO认证的推出,为企业提供了一个机遇,可以通过建立和改进自身的安全管理体系,与国际标准接轨,为客户提供更高质量和更安全的产品和服务。

同时,通过与其他AEO认证的企业建立合作伙伴关系,可以共同构建更加安全和高效的供应链。

英文版 aeo认证标准

英文版 aeo认证标准IntroductionThe Authorized Economic Operator (AEO) program is a global initiative aimed at enhancing international supply chain security and facilitation of trade. The AEO certification is granted to businesses that meet certain criteria and demonstrate compliance with global security standards. This article will provide an overview of the AEO certification process, the benefits it offers, and the criteria that businesses need to fulfill in order to obtain this prestigious recognition.Understanding AEO CertificationAEO certification is an internationally recognized accreditation that showcases a company's commitment to security and compliance within the global supply chain. This certification is essential for businesses engaged in international trade, as it not only improves security measures but also streamlines customs procedures, resulting in increased operational efficiency and cost savings.Benefits of AEO Certification1. Expedited Customs ClearanceOne of the key benefits of AEO certification is expedited customs clearance. AEO-certified businesses receive preferential treatment at customs checkpoints, resulting in reduced inspection times and faster clearance of goods. This advantage significantly reduces border delays and enhances supply chain efficiency.2. Enhanced Supply Chain SecurityAEO certification requires businesses to implement stringent security measures to protect their supply chain against unauthorized access or tampering. By meeting these standards, companies are better equipped to mitigate security risks and safeguard their goods throughout the entire logistics process.3. Improved Business ReputationObtaining AEO certification demonstrates a company's commitment to secure and compliant international trade practices. This enhanced reputation can attract new customers, partners, and investors who value businesses that prioritize security, reliability, and integrity.AEO Certification CriteriaTo obtain AEO certification, businesses must meet a set of criteria outlined by the World Customs Organization (WCO) or local customs authorities. While the specific requirements may vary, the following criteria are generally considered essential for AEO certification:1. Compliance with Customs RegulationsCompanies must have a proven track record of complying with customs regulations and procedures. This includes record-keeping, accurate declaration of goods, and timely payment of duties and taxes.2. Financial SolvencyBusinesses need to demonstrate financial solvency to ensure their ability to fulfill financial obligations related to international trade activities. Thismay involve submitting financial statements, bank guarantees, or other forms of financial documentation.3. Security MeasuresAEO-certified companies must establish and implement comprehensive security measures throughout their supply chain. This includes physical security of premises, personnel background checks, and robust cargo handling procedures.4. Record-Keeping and Internal ControlsMaintaining accurate records and implementing internal controls is crucial for AEO certification. Businesses must demonstrate their ability to track and monitor goods, provide appropriate documentation, and implement audit trails to ensure transparency and accountability.ConclusionThe AEO certification has become a valuable recognition for businesses engaged in international trade. By meeting the strict criteria outlined by customs authorities, companies can enjoy the benefits of expedited customs clearance, enhanced supply chain security, and an improved business reputation. Achieving AEO certification not only demonstrates a company's commitment to global security standards but also provides a competitive advantage in the global marketplace.。

aeo认证申请流程详解

aeo认证申请流程详解英文回答:AEO (Authorized Economic Operator) Certification Application Process.Step 1: Determine Eligibility and Gather Required Documents.Determine if your business meets the eligibility criteria set by your country's customs authority.Gather the necessary documents, such as business registration, financial statements, and supply chain documentation.Step 2: Submit Application.Submit your application to the customs authority.The application typically includes an assessment questionnaire and detailed documentation of your business practices.Step 3: Customs Audit.The customs authority will conduct an audit of your business to verify the information provided in your application.The audit may include a review of your premises, records, and processes.Step 4: Assessment and Decision.The customs authority will assess your application based on the information gathered during the audit.The decision on whether to grant AEO certification will be based on the level of compliance with customs regulations and supply chain security standards.Step 5: Maintenance.AEO certification is valid for a specified period of time, typically three to five years.To maintain your certification, you must continue to comply with customs regulations and undergo periodic audits.中文回答:AEO(授权经济经营者)认证申请流程。

申请海关AEO认证必须知道的5件事

2019年申请海关AEO认证必须知道的5件事——不知道这5件事肯定难过随着海关AEO认证新标准的发布及各项对认证企业联合激励措施的推出,越来越多的企业准备在2019年内申请海关AEO认证。

企业最常问的几个问题是:“从现在开始准备海关AEO认证需要多长时间?”“企业准备海关AEO认证要怎么做?”“......”其实,就笔者多年的关务工作经验和对AEO认证工作的理解来看,往往这些企业的问题都问错了,他们更应该关心的是——申请海关AEO认证的条件是什么!没错,各位报关同仁们既然谈到海关AEO认证就一定对海关总署237号令和其他相关法律法规都很熟悉了,其实从表面上来看,除了失信企业、被降级不满一年和认证未通过不满一年的情形以外,貌似没有设置任何准入门槛。

难道这就意味着所有企业都可以申请AEO认证吗?当然不是!大家都知道,向海关提交认证申请,都是通过互联网+海关提交申请信息,然后到海关现场去交付资料就可以了。

既然通过网上提交申请,并且很快可以被海关入库,那么不存在不受理申请的问题。

但是,真正的问题在于:如果你对海关AEO认证的政策不够了解,即便用了很多时间去做准备工作,但可能从一开始就注定了根本无法通过认证,那你怎么去跟领导交待呢?!所以说,不存在申请门槛不代表海关AEO认证没有门槛,并不是每一家企业都适合申请认证的。

成功通过海关AEO认证的5大先决条件如果把申请海关AEO认证这个环节作为游戏关底的话,你要先通过五个隐藏关卡。

条件1:员工人数是的,你没看错!并不是海关歧视中小企业,而是的确存在人数的要求(这里大中型生产企业请忽略)。

笔者碰到很多次这样的认证咨询:“我旗下有一家贸易公司和一家报关行,能否申请AEO认证。

” 类似这样的设置并不鲜见,多出现在大型集团化企业和私营企业中。

这里重点以私营企业为例,他们往往是专注于某一领域的进出口贸易,随着业务量逐渐增加,为了降低成本和便于管理,就将原有报关部门独立出去成立一家报关行或者新设一家报关行来解决本公司的业务,捎带还可以承接少量外来业务。

海关AEO企业认证标准

人员安全 26.人员安全 的检查或者调查。一经录用,要根据员工表现,以及对处于重要敏感工作

控制措施

岗位的员工进行定期审查和重新调查。

(3)员工离职程序:有书面制度和程序,对离职或者停职员工及时收回

工作证件、设备,并禁止其进入企业生产经营场所及使用企业信息系统。

(4)安全培训:要对员工进行供应链安全意识的日常性培训,员工要了

5.进出口活动

进出口业务管理流程设置合理、完备,涉及的货物流、单证流、信息流能 够得到有效控制,经抽查,未发现有不符合海关监管规定的情形。

6.内审制度

(三) 内部审计 7.责任追究

控制

(1)设立专门的内部审计机构或者岗位,或者聘请外部专职人员独立对 进出口业务等实施内部审计。 ((21))每建年立至对少进内出审口1业次务,发建现立问内题审或书者面违或法者行电子为档的案责。任追究制度或者措施 。 (2)建立对企业人员和报关人员私揽货物报关、假借海关名义牟利、向 海关人员行贿等行为的责任追究制度或者措施。

达标

0 企业有检查、阻止未载明的货物和未经许可的人员进入场所、货物装卸和 储存区域的书面制度和程序;进出口货物进出的区域设有隔离设施,以防 止未经许可的人员进入。 (1)大门和传达室:车辆、人员进出的大门配备人员驻守。 (2)建筑结构:建筑物的建造方式能够防止非法闯入。定期对建筑物进 行检查和修缮,确保其完好无损。 (3)照明:企业生产经营场所配备充足的照明,包括以下区域:出入 口,货物装卸和储存区,围墙周边及停车场/停车区域。 (4)报警系统及视频监控摄像机:装配报警系统和视频监控摄像机,监 测以下区域:出入口,货物装卸和储存区,围墙周边及停车场/停车区域, 防止未经许可进入货物存储以及装卸区。 (5)存储区域:在货物装卸和储存区域,以及用于存放进出口货物的区 域,设有隔离设施,以阻止任何未经许可的人员进入。 (6)锁闭装置及钥匙保管:所有内外窗户,大门和围栏都设有足够数量 的锁闭装置。管理层或者保安人员要保管所有锁和钥匙。 企业实行门禁管理,有实施员工和访客进出、保护公司资产的书面制度和 (1)员工:具有员工身份识别系统,对员工进行身份识别和进入控制。 对员工、访客的身份标识(比如钥匙、钥匙卡等)的发放和回收进行统一 (2)访客:对进入企业的访客要检查带有照片的身份证件并进行登记, 访(客3)要未佩经戴许临可时进身入份、标身识份并不且明有的内人部员人:员陪有同识。别、质询和确认未经许可进 入、身份不明的人员的程序;发现可疑人员进入的,企业员工要及时报告 。

aeo认证标准解读

aeo认证标准解读英文回答:The AEO (Authorized Economic Operator) certification standard is a set of requirements that companies must meet in order to be recognized as a reliable and secure partner in the international supply chain.The AEO certification is a voluntary program that is offered by the World Customs Organization (WCO). The program is designed to help companies improve their security measures and to facilitate trade by reducing the time and cost of customs clearance.To become AEO certified, companies must meet a number of requirements, including:Having a comprehensive security program in place.Having a good track record of compliance with customsregulations.Being able to demonstrate financial solvency.Being able to provide detailed information about their business operations.The AEO certification process can be complex and time-consuming. However, the benefits of certification can be significant. AEO certified companies can:Benefit from reduced customs clearance times.Get priority treatment from customs authorities.Be eligible for other benefits, such as reduced insurance premiums.The AEO certification is a valuable tool for companies that are looking to improve their security and tofacilitate trade. The certification process can be challenging, but the benefits can be significant.中文回答:经认证的经济运营商 (AEO) 认证标准是一组要求,公司必须满足这些要求才能被承认为国际供应链中可靠且安全的合作伙伴。

海关aeo认证标准硬件改造要求

海关aeo认证标准硬件改造要求

海关AEO认证(Authorized Economic Operator)是指在国际贸易中被认可为合规、安全可靠的经营者。

为了获得AEO认证,企业需要符合一系列标准和要求,其中包括硬件改造要求。

在进行硬件改造时,企业需要注意以下几点:

1. 安全性要求,硬件改造必须符合海关安全要求,以确保货物在运输过程中不会被非法侵入或被盗。

这可能涉及到安装安全摄像头、门禁系统、防盗报警器等设备。

2. 数据保护,硬件改造需要保证货物信息的安全性和保密性,以防止信息泄露和篡改。

企业需要考虑使用加密技术、安全存储设备等措施来保护数据。

3. 自动化和智能化,硬件改造还需要考虑自动化和智能化技术的应用,以提高货物运输的效率和准确性。

例如,使用智能识别技术、自动化装卸设备等,可以提高货物处理的速度和准确性。

4. 跟踪和监控,硬件改造还需要考虑货物跟踪和监控技术的应

用,以实现对货物运输过程的实时监控和跟踪。

这可以帮助企业及

时发现货物异常情况,并采取相应的措施。

总之,海关AEO认证标准下的硬件改造要求是为了确保企业在

国际贸易中的合规性、安全性和可靠性。

企业需要根据AEO认证标准,对硬件进行改造,以满足海关的安全要求和提高货物运输效率,从而获得AEO认证资格。

完整版海关AEO高级认证升级项目核心标准

word 整理版8.改进机制(四)信息系统控制9.信息系统10.数据管理7-_2_建立对企业人员和报关人员私揽货物报关、假借海关名义牟利、向海关人员行贿等行为的责任追究制度或者措施。

8-1建立改进制度或者措施。

8-2对海关要求的规范改进事项,应由负责关务的高级管理人员直接负责具,体规范改进实施。

9-1具备真实、准确、完整、有效记录企业生产经营、进出口或者代理报关活动的信息系统,特别是财务控制、关务、物流控制等功能模块有效运行。

10-1生产经营数据以及与进出口活动有关的数据及时、准确、完整录入系统。

系统数据自进出口货物办结海关手续之日起保存3年以上。

与相关人员进行面谈,了解企业是否有效执行上述制度或者措施。

查阅企业以往对进出口业务发现的问题或者违法行为进行责任追究的书面记录,审核是否与书面文件相符。

要求企业提供公司责任追究制度或者措施的书面文件,查阅是否有对企业人员和报关人员私揽货物报关、假借海关名义牟利、向海关人员行贿等行为进行责任追究的内容。

与相关人员进行面谈,了解企业是否有效执行上述制度或者措施。

查阅企业以往对企业人员和报关人员私揽货物报关、假借海关名义牟利、向海关人员行贿等行为进行责任追究的书面记录,审核是否与书面文件相符。

要求企业提供公司改进制度或者措施的书面文件,查阅是否有规定由负责海关事务的高级管理人员直接负责海关要求改进事项的具体改进实施等内容。

与负责海关事务的高级管理人员进行面谈,了解企业以往是否有海关要求规范改进的情事,并查阅规范改进的书面记录,审核是否与书面文件相符。

了解企业是否有信息系统,系统是否记录了企业生产经营、进出口或者代理报关活动。

系统是否有财务控制和关务物流控制模块。

审核信息系统中上述功能模块是否有效运行。

要求企业演示如何通过系统进行生产经营数据以及与进出口活动有关数据的录入等操作。

范文范例学习指导21.税款缴纳的,海关不再开展实地认证「由企业自行撤回申请或者制发《不予适用认证企业决定书》;企业已经成为高级认证企业,通过系统判别发现,申报(传输)差错率不达标的,允许企业规范改进,海关下发《规范改进通知书》。

aeo认证申请书

aeo认证申请书

尊敬的AEOS认证部门:

我/我们谨向贵部门提交AEOS认证申请书,希望能够获得AEOS认证。

以下是申请书的详细内容和相关资料:

1. 申请单位或个人信息:

- 单位/个人名称:

- 联系地址:

- 联系电话:

- 电子邮箱:

2. AEOS认证类别:

- 请列出所需认证的具体类别或标准。

3. 申请材料准备:

在此提供所需的申请材料清单,并附上所有材料的副本(电子版或纸质版)。

4. 申请理由:

对于为什么选择AEOS认证以及认证对申请单位或个人的重要性,请简要说明。

5. 组织结构和管理体系:

- 请提供有关申请单位或个人的组织结构和管理体系的详细描述。

6. 申请人承诺:

- 请附上申请人签名并承诺提供真实准确的信息和材料。

请注意:以上内容仅为示例,请根据实际情况进行修改和补充。

感谢贵部门的时间和考虑,我们期待能够获得AEOS认证,

以证明我们对环境保护和可持续发展的承诺和努力。

此致,

申请人签名

日期。

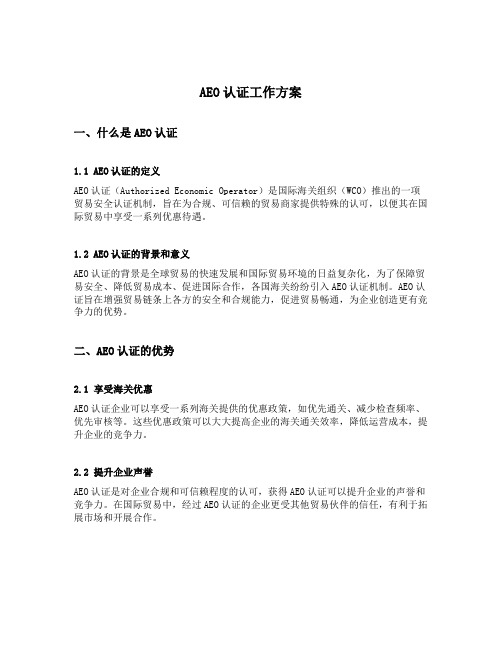

aeo认证工作方案

AEO认证工作方案一、什么是AEO认证1.1 AEO认证的定义AEO认证(Authorized Economic Operator)是国际海关组织(WCO)推出的一项贸易安全认证机制,旨在为合规、可信赖的贸易商家提供特殊的认可,以便其在国际贸易中享受一系列优惠待遇。

1.2 AEO认证的背景和意义AEO认证的背景是全球贸易的快速发展和国际贸易环境的日益复杂化,为了保障贸易安全、降低贸易成本、促进国际合作,各国海关纷纷引入AEO认证机制。

AEO认证旨在增强贸易链条上各方的安全和合规能力,促进贸易畅通,为企业创造更有竞争力的优势。

二、AEO认证的优势2.1 享受海关优惠AEO认证企业可以享受一系列海关提供的优惠政策,如优先通关、减少检查频率、优先审核等。

这些优惠政策可以大大提高企业的海关通关效率,降低运营成本,提升企业的竞争力。

2.2 提升企业声誉AEO认证是对企业合规和可信赖程度的认可,获得AEO认证可以提升企业的声誉和竞争力。

在国际贸易中,经过AEO认证的企业更受其他贸易伙伴的信任,有利于拓展市场和开展合作。

2.3 降低贸易风险通过AEO认证,企业需要通过一系列安全管理措施和合规制度的审核,这有助于企业识别和管理潜在的贸易风险。

AEO认证可以帮助企业建立起健全的风险管理体系,提高防范安全威胁的能力。

三、AEO认证的申请流程3.1 准备资料企业准备好与AEO认证相关的各项资料,包括企业注册证明、财务报表、经营许可证明、安全管理制度等。

这些资料将用于审核企业是否符合AEO认证的要求。

3.2 提交申请企业将准备好的资料提交给相关的海关机构,填写申请表格,并按要求缴纳申请费用。

申请表格中需要提供详细的企业信息,包括业务范围、运营情况、关键人员等。

3.3 审核和评估海关机构将对企业提交的资料进行审核和评估,包括对企业的合规能力、安全管理制度等进行检查。

审核和评估过程中,可能需要海关机构与企业进行沟通和现场检查。

aeo认证申请书

aeo认证申请书

尊敬的相关部门/机构:

我代表(公司名称/个人名称)申请进行AEO认证,现将相关信息及申请材料提交如下:

1. 申请主体信息:

- 公司名称/个人名称:

- 统一社会信用代码/个人身份证号码:

- 注册地址/个人住址:

- 联系人及联系方式:

2. 申请理由:

(在此说明申请AEO认证的原因、目的以及预期效果)

3. 经营范围/个人职业:

(请列出公司经营范围或个人从事的职业)

4. 经营历史:

(请简要介绍公司/个人的经营/工作历史)

5. 申请认证类型:

(请在此说明希望申请的AEO认证类型,比如AEO信用认证、AEO安全认证等)

6. 资质证明:

(请提供相关资质证明文件,比如企业营业执照、个人身份证

复印件等)

7. 经营状况/个人履历:

(请提供过去一段时间内的经营状况说明、公司介绍或个人履历等)

8. 进出口情况:

(请提供近期的进出口情况说明、货物运输、报关记录等)

9. 安全管理体系/风险管理措施:

(请说明公司/个人的安全管理体系建设及风险管理措施)

10. 推荐人/引荐单位:

(如果有推荐人或引荐单位,请提供其名称、联系方式及相关身份证明)

11. 其他材料:

(请根据AEO认证要求提供相关的其他申请材料)

附:法定代表人(企业申请)或申请人(个人申请)签字盖章

以上信息真实有效,如有不实,愿意承担相应的法律责任。

感谢您的关注和审核,我们诚挚期待获得AEO认证,与您共同促进进出口贸易的便利化与安全保障。

谢谢!

申请人签名:日期:。

aeo高级认证标准

aeo高级认证标准

AEONET认证机构的高级认证标准(AEON Advanced Certification Standards)是一套用于评估组织管理和运营的标准。

以下是AEONET高级认证标准的一些要点:

1. 组织资质:要求组织具备合法注册和运营的资质,并拥有相关领域的专业知识和经验。

2. 组织经营管理:要求组织有健全的管理制度和规范,包括责任分工、流程管理、决策机制、风险管理等。

3. 人力资源管理:要求组织有完善的人力资源管理制度,包括招聘、培训、绩效评估、员工福利等。

4. 财务管理:要求组织有有效的财务管理制度,包括预算编制、财务报表的编制和审计等。

5. 组织业务运营:要求组织具备专业的业务能力和技术实力,能够有效地提供产品或服务。

6. 客户关系管理:要求组织有良好的客户关系管理制度,包括客户投诉处理、客户满意度调查等。

7. 环境保护和社会责任:要求组织积极承担环境保护和社会责任,推动可持续发展。

以上是AEONET高级认证标准的一些要点,具体的认证标准可能会有所调整和更新,具体的认证要求可以咨询AEONET认证机构。

进出口企业海关认证档案管理:AEO认证文件方案

进出口企业海关认证档案管理:AEO认证文件方案1. 背景进出口企业在进行国际贸易时,需要经过海关的认证程序。

AEO(Authorized Economic Operator)认证是一种国际通用的认证制度,旨在为合规的进出口企业提供便利和优惠。

为了有效管理AEO认证文件,进出口企业需要建立一套完善的档案管理方案。

2. 目标本文档旨在提出一种简单且没有法律复杂性的AEO认证文件管理方案,帮助进出口企业有效管理相关档案,以满足AEO认证的要求,并提高企业的贸易便利化程度。

3. 管理方案3.1 档案分类将AEO认证文件分为以下几个类别进行分类管理:- 企业基本信息:包括企业注册信息、法人代表信息等。

- 财务文件:包括财务报表、税务证明等。

- 进出口合同:包括合同、采购订单等。

- 物流文件:包括运输合同、装箱单等。

- 安全文件:包括安全管理制度、安全检查报告等。

- 人员资质:包括员工背景调查、培训记录等。

3.2 档案存储建议将AEO认证文件以电子形式存储,并采用合适的文件命名规则和文件夹结构进行管理。

确保档案易于查找和访问,并设置合适的权限控制,保证档案的安全性和私密性。

3.3 档案更新与备份定期更新AEO认证文件,确保文件的有效性和完整性。

同时,建议定期进行档案备份,以防止文件丢失或损坏。

3.4 保密措施在档案管理过程中,要严格遵守相关的保密法律法规,确保AEO认证文件的机密性。

限制档案的访问权限,只允许授权人员查看和处理相关档案。

4. 相关注意事项- 档案管理应遵循国家和地区的法律法规要求,确保合规性。

- 档案管理人员应接受相关培训,熟悉档案管理流程和要求。

- 定期进行档案管理的自查和复审,确保档案的准确性和完整性。

以上是一份进出口企业海关认证档案管理的AEO认证文件方案,旨在帮助企业建立简单且没有法律复杂性的档案管理系统,以满足AEO认证的要求。

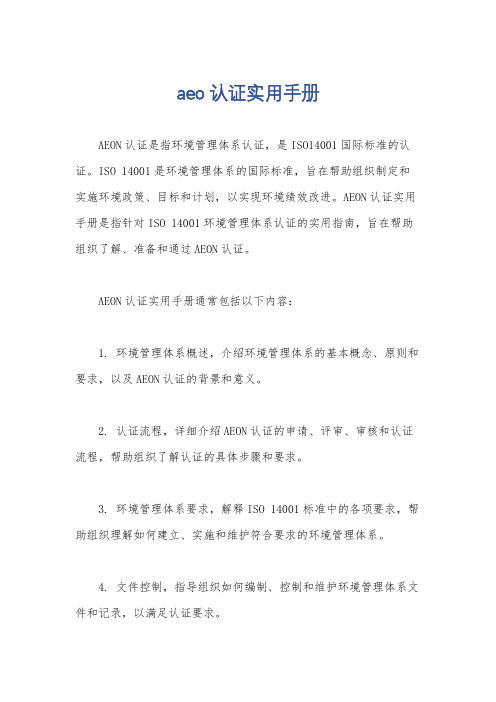

aeo认证实用手册

aeo认证实用手册

AEON认证是指环境管理体系认证,是ISO14001国际标准的认证。

ISO 14001是环境管理体系的国际标准,旨在帮助组织制定和实施环境政策、目标和计划,以实现环境绩效改进。

AEON认证实用手册是指针对ISO 14001环境管理体系认证的实用指南,旨在帮助组织了解、准备和通过AEON认证。

AEON认证实用手册通常包括以下内容:

1. 环境管理体系概述,介绍环境管理体系的基本概念、原则和要求,以及AEON认证的背景和意义。

2. 认证流程,详细介绍AEON认证的申请、评审、审核和认证流程,帮助组织了解认证的具体步骤和要求。

3. 环境管理体系要求,解释ISO 14001标准中的各项要求,帮助组织理解如何建立、实施和维护符合要求的环境管理体系。

4. 文件控制,指导组织如何编制、控制和维护环境管理体系文件和记录,以满足认证要求。

5. 内部审核和管理评审,介绍如何进行内部审核和管理评审,

以确保环境管理体系的持续有效性和改进。

6. 风险管理和持续改进,指导组织如何识别、评估和应对环境

方面的风险,并持续改进环境绩效。

7. 术语解释和案例分析,对环境管理体系认证中常用的术语进

行解释,并通过案例分析帮助组织更好地理解认证要求和实践经验。

总的来说,AEON认证实用手册是一本针对ISO 14001环境管理

体系认证的实用指南,通过系统、全面地介绍认证要求、流程和实

践经验,帮助组织顺利通过认证并持续改进环境绩效。

希望这些信

息能够帮助到你。

AEO高级认证实用标准

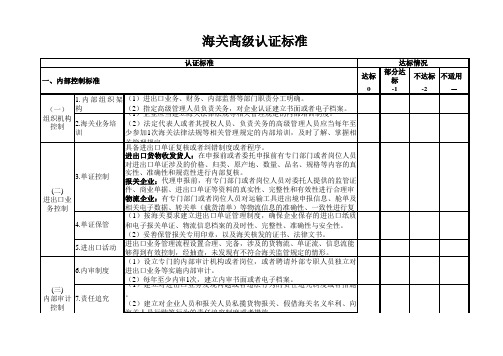

海关认证企业标准(高级认证)说明一、关于认证标准的分类本认证标准分为内部控制、财务状况、守法规范、贸易安全与附加标准,共5大类18条32项。

其中前4类为基础标准,第5类为附加标准。

二、关于认证标准的赋分规则(一)基础标准赋分规则。

赋分选项分为两种,一就是“达标”、“不达标”,对应分值为“0”、“-2”;二就是“达标”、“部分达标”、“不达标”,对应分值为“0”、“-1”、“-2”。

达标:企业实际情况符合该项标准。

该项标准中有分项标准(用(1)、(2)、(3)等表示)的,也应符合每个分项标准。

部分达标:企业实际情况基本符合该项标准。

该项标准中有分项标准(用(1)、(2)、(3)等表示)的,也应基本符合每个分项标准。

不达标:企业实际情况不符合该项标准。

相关标准项不适用于该经营类别企业的,海关不再对该项标准进行认证。

(二)附加标准赋分规则。

设定“符合”与“不适用”选项,对应分值为“2”与“0”。

附加标准分值最高为“2”,不重复记分。

三、关于认证标准的通过条件企业同时符合下列两个条件并经海关认定的,通过认证:(一)所有赋分项目均没有不达标(-2分)情形;(二)认证标准总分在95分(含本数)以上。

认证标准总分=100+(所有赋分项目得分总与)。

四、关于认证标准的自我评估企业向海关提出适用认证企业管理申请前,应当按照本认证标准进行自我评估,并将自我评估报告随认证申请一并提交海关。

五、关于规范改进情形的适用除本认证标准第12、13、14、15、17、22、23项外,其她项不达标或者部分达标的,允许企业规范改进。

规范改进期限由海关确定,最长不超过90日。

根据规范改进情况,海关认定就是否通过认证。

海关认证企业标准(高级认证)。

最新海关AEO认证审核要求

最新海关AEO认证审核要求1.要求出示公司组织架构图。

2.要求企业出示各部门职责分工的书面文件和制度。

3.要求同企业进出口部、财务部和内部审计部门的主管进行面谈,询问其所负责业务的设置和执行情况。

4.要求企业出示管理层职责分工的书面文件和制度,并与负责关务的高级管理人员进行面谈,了解公司关务开展情况。

5.要求企业提供认证工作的书面或者电子档案。

6.要求企业出示内部培训的书面文件和制度以及最近12个月的海关业务培训记录。

7.要求企业出示进出口货物流、单证流、信息流管理和控制的书面管理制度。

8.要求企业提供三年来的报关单证样本,根据抽取的报关单证样本,结合企业贸易方式类别,依据操作规范的提示要求进行实质性测试。

9.要求企业的法定代表人或其授权人员,辅助关务的高级管理人员到场,并进行询问,了解其掌握海关法律法规特别是企业信用管理制度的情况。

就相关制度,可以准备几个问题询问上述人员。

10.根据海关系统抓取的三年来的进出口报关单号(至少10份或以上),要求企业提供和这些相关的单证,含报关单、发票、舱单、提单、业务往来单据等,并对这些单证复核或纠错情况进行样本穿行测试。

11.抽查10份以上的进出口单证(不足10份的,全部查看),审核是否按海关要求保存。

12.要求抽取的报关单样本原则上应当为三年以内的,复核报关单证保管的期限要求。

报关单样本的抽取方式可以根据实际情况确定,包括随机抽取、根据商品种类抽取、根据贸易方式抽取、根据进出口时间抽取等。

13.要求企业提供报关专用章,并抽查海关核发的证书、法律文书三份以上,审核是否妥善保管。

14.要求企业出示信息管理系统使用手册,并请技术人员到场使用最高权限进行三个模块(财务控制、关务控制、物流控制)的现场演示,审核其是否有效运行。

认证时,上述模块不要求全部集成在一个系统中,但是各个模块之间必须能够实现进出口数据的关联和查询。

15.对于纯代理报关的报关企业可以没有物流控制模块,但有仓储业务的报关企业必须具备物流控制模块。

海关AEO认证需要符合哪些条件?

海关AEO认证需要符合哪些条件?功能说明系统管理:有效防护系统的数据安全,有效监管每个操作人员的系统操作使用权限,符合AEO认证要求密码定时修改基础资料:及时规范保存企业通关的申报大数据,有效对接企业ERP系统的基础数据的对应管控,实现企业一对多的不同通关申报信息的有效管理。

符关务合贸易合规授权管理:管理者有效监管每个操作人员的系统操作使用权限。

订单管理:企业进出口业务处理的数据协同与规范管理。

支持关务规划贸易合规协同ERP数据工厂管理:与企业ERP系统的对接,将企业的生产过程数据形成合规范的关务批次跟踪的海关物流单证。

关务风险预警:金二手册/账册管理支持下载报关单手册与企业ERP系统的对接,料号级双编码进行智慧备案管理,结合生产工单,高效形成成品的备案单耗,并实现智慧备案,有效实现关务风险的提前防范。

支持贸易风险预警智慧备案:备案管理与企业ERP系统的对接,结合生产工单,高效形成成品的备案单耗,并实现智慧备案,有效实现关务风险的提前防范。

自动制单:支持报关单证制作通关管理规范化的通关业务处理、过程化节点管理、智慧逻辑审单、真正满足最严格的AEO的管理。

内部协同:深加工管理企业ERP的转厂收料单及发货单的自动合并形成海关收发货单的数据协同数据链管理,深加工结转的海关管理的一健申报与数据化管控。

内销征税管理企业ERP的内销的相关数据自动合并形成海关内销征税申请表实现与企业ERP的数据协同数据链管理,内销征税相关对接海关的一健申报与内销征税数据化管控。

外发加工管理企业ERP的外发加工数据自动合并形成海关外发加工的相关数据协同数据链管理,外发加工相关对接海关的一健申报与内销征税数据化管控。

支持单一窗口数据对接公路舱单管理舱单的相关信息化管理,系统化实现舱单数据的自动生成及对接海关的一健申报。

自动统计报表:报表中心一健自动生成加工贸易和一般贸易业务相关业务的37张相关业务报表,及时生成海关稽查相关报表和海关风险管控报表。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Version 2.0, edited in January,2015For Customs Use Only Legislations on Certified Enterprises/AEOJanuary 2015Department of Audit-Based Control and RiskManagementGeneral Administration of Customs of the People’s Republic of ChinaTABLE OF CONTENTSⅠ. DECREE NO. 225 OF GACC: (3)II. BULLETIN NO. 75 OF GACC 2014 (11)A NNEX 1:A PPLICATION FOR THE STA TUS OF C ERTIFIED ENTERPRISES (12)A NNEX 2: DECISION NOT TO GRANT THE STATUS OF C ERTIFIED ENTERPRISES (13)A NNEX 3: DECISION TO TERMINATE CERTIFICATION (14)A NNEX:4 NOTICE OF RECTIFICA TION (15)A NNEX 5: AEO CERTIFICA TE (16)A NNEX 6: DECISION OF DETERMINATION OF CREDIT STA TUS (17)A NNEX 7: RECEIPT OF THE APPLICATION FOR THE STA TUS OF C ERTIFIED ENTERPRISES (18)III. BULLETIN NO. 81 OF GACC, 2014 (19)IV. BULLETIN NO. 82 OF GACC, 2014 (21)A NNEX 1:C RITERIA OF C ERTIFIED E NTERPRISES OF C USTOMS A DMINISTRATION (A DVANCED C ERTIFIED E NTERPRISE).22 A NNEX 2:C RITERIA OF C ERTIFIED E NTERPRISES OF C USTOMS A DMINISTRATION (G ENERAL C ERTIFIED E NTERPRISE) (37)V. FIGURES (51)F IGURE 1:D OCUMENTS FOR A PPLICATION (51)F IGURE 2:C ERTIFICATION P ROCEDURE (52)F IGURE 3:C ERTIFICATION T ERMINATION (53)F IGURE 4:D ECISION P ROCESS (54)Ⅰ.Decree NO. 225 of GACC:Decree No. 225 of the General Administration of Customs of thePeople’s Republic of ChinaPublished on October 14, 2014Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management(IMECM) , which were deliberated and adopted by the executive meeting of the General Administration of Customs on September 4, 2014, are hereby promulgated and shall come into effect on December 1, 2014.MinisterOctober 8, 2014Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit ManagementChapter I General ProvisionsArticle 1 For the purpose of pushing forward the development of social credit systems, establishing import and export credit management systems, and ensuring trade security and facilitation, these Measures are hereby formulated in accordance with the Customs Law of the People’s Republic of China and the provisions of other relevant laws and administrative regulations.Article 2 These Measures shall apply to the collection and public disclosure of credit information of enterprises registered with Customs administrations as well as the determination and management of enterprise credit status.Article 3 Customs administrations will determine the status of an enterprise as a certified enterprise, a general-credit enterprise or a discredited enterprise depending on the enterprise’s credit standing and will take appropriate administrative measures against said enterprise pursuant to the principle of facilitating enterprises that act in good faith and in compliance with laws and penalizing enterprises that lose credit and go against laws.Article 4 A certified enterprise is an Authorized Economic Operator(AEO) recognized by Customs administrations of China, which carry out mutual recognition of AEOs with the Customs administrations of other countries or regions in accordance with laws, and grant corresponding clearance facilitation to mutually recognized AEOs.Article 5 Customs administrations will, in light of the needs of the development of social credit systems and the international cooperation, establish a mechanism to cooperate with other related authorities of the State and the Customs administrations of other countries or regions to promote mutual exchange of information, mutual recognition of supervision, and mutual assistance in law enforcement.Chapter II Collection and Public Announcement of Enterprise Credit Information Article 6 The Customs administration shall collect the following information that is able to reflect the import and export credit status of an enterprise in order to establish a management system of enterprise credit information:1. Registration information of the enterprise filed with the Customs administration;2. Import and export business information of the enterprise;3. AEO mutual recognition information;4. Information of the enterprise filed with other administrative authorities; and5. Other information relating to the import and export of the enterprise.Article 7 On the condition that state secret, trade secret and personal privacy are protected, the Customs administration shall publicly disclose the following credit information of an enterprise:1. Registration information of the enterprise filed with the Customs administration;2. The result of Customs determination on the credit status of the enterprise ;3. Information regarding administrative sanctions against the enterprise; and4. Other information of the enterprise that should be announced.The term of public announcement of information regarding administrative sanctions against the enterprise is five (5) years.The Customs administration shall publish the method of searching for the credit information of enterprises.Article 8 Where a citizen, legal person or other organizations deem the enterprise credit information publicized by the Customs administration inaccurate, he may raise objection to the Customs administration and provide relevant materials or evidence. The Customs administration shall review the information within twenty (20) days of receipt of the objection application, and shall accept the objection if the reason(s) for the objection raised by the citizen, legal person or other organizations is tenable.Chapter III Criteria and Procedures of Determination of an Enterprise’s Credit Status Article 9 A certified enterprise shall be in compliance with the Criteria of Certified Enterprises of the Customs Administration.The Criteria of Certified Enterprises of the Customs Administration are classified into criteria of general certified enterprises and criteria of advanced certified enterprises, which are formulated and published by the General Administration of Customs.Article 10An enterprise falling in any of the following circumstances shall be identified by the Customs administration as a discredited enterprise:1. Committing the crime of smuggling or conducting an act of smuggling;2. For an enterprise other than Customs brokerage services, the number of violations of Customs regulatory provisions within one year exceeding 0.1% of the total number of the declaration forms, entry-exit filing lists, and other relevant documentations of the previous year and subject to administrative sanctions amounted to more than RMB100,000 for more than twice or of more than RMB1 million accumulatively.For a Customs brokerage service, the number of violations of customs regulatory provisions within one year exceeding 0.05% of the total number of the declaration forms and entry-exit filing lists of the previous year and subject to administrative sanctions amounted to more than RMB100,000 accumulatively.3. In arrears with payable taxes and penalties and/or confiscated illegal gains due;4. Declaration error rate of the previous quarter one time above the average declaration error rate across the country of the same period;5. Upon site investigation, registration information proved to be false and inability to contact the enterprise;6. Suspended from Customs brokerage business by the Customs administration in accordancewith laws;7. Suspected of smuggling or violating customs regulatory provisions and refusing to cooperate with the Customs administration in the investigation;8. Fraudulently using the name of the Customs administration or other enterprises to seek illicit proceeds;9. faking or forging credit information; or10. Other circumstances determined by the Customs administration as a discredited enterprise.Article 11An enterprise falling in any of the following circumstances will be identified by the Customs administration as a general-credit enterprise:1. An enterprise registered for the first time;2. A certified enterprise that is no longer in compliance with the requirements of Article 9 hereof and does not fall in any of the circumstances set out in Article 10 hereof; or3. An enterprise that has been identified as discredited for one full year and no longer falls in any of the circumstances set out in Article 10 hereof.Article 12Where an enterprise applies with the Customs administration for the status of a certified enterprise, the Customs administration shall authorize the enterprise pursuant to the Criteria of Certified Enterprises of the Customs Administration.The Customs administration or the applicant enterprise may engage social intermediaries with statutory qualifications to authorize the enterprise, the result of which can serve as the reference and basis to determine the credit status of the enterprise if it is accepted by the Customs administration.Article 13The Customs administration shall draw certification conclusions within ninety (90) days of receipt of the written certification application of the enterprise. The term of customs certification can be extended for thirty (30) days under special circumstances.Article 14In the case of any of the following circumstances, the Customs administration shall terminate certification of an enterprise:1. Detected or investigated by the Customs administration due to being suspected of smuggling or violating customs regulatory provisions;2. Withdrawing the application on its own initiative; or3. Other circumstances under which the certification shall be terminated.Article 15The Customs administration will adjust the result of determination of enterprises’ credit status dynamically.The Customs administration shall re-authorize the advanced certified enterprises every three (3) years and re-authorize the general certified enterprises on an irregular basis. Where it fails in the re-certification, a certified enterprise shall be granted the status of a general-credit enterprise, and cannot apply for certified enterprise status again within one year. Where it fails in the re-certification but meets the criteria of general certified enterprises, an advanced certified enterprise shall be granted the status of a general certified enterprise.Where an enterprise has been identified as a discredited enterprise for one full year and no longer falls in any of the circumstances set out in Article 10 hereof, the Customs administration shall adjust its status and manage it as a general-credit enterprise.A discredited enterprise that has been adjusted to be a general-credit enterprise for one (1) full year may apply with the Customs administration for certified enterprise status.Chapter IV Management Principles and MeasuresArticle 16The following management principles and measures shall apply to general certified enterprises:1. Relatively low inspection rate of import and export goods;2. Simplified examination of documentations of import and export goods;3. Priority in processing import and export clearance formalities; and4. Other management principles and measures prescribed by the General Administration of Customs.Article 17In addition to the management principles and measures applicable to general certified enterprises, the following management measures shall also apply to advanced certified enterprises:1. Advanced certified enterprises can go through inspection and release formalities before the commodity classification, customs valuation and origin of the import and export goods are determined or other customs formalities are fulfilled;2. Coordinators for such enterprises are offered by the Customs administration;3. Enterprises engaged in processing trade are not subject to the customs duty deposit system; and4. Clearance facilitation measures are offered by the Customs administrations of foreign countries or regions covered by mutual recognition of AEOs.Article 18The following management principles and measures shall apply to discredited enterprises:1. Relatively high inspection rate of import and export goods;2. Focus of document examination for import and export goods;3. Highlighted supervision over processing trade and other links; and4. Other management principles and measures prescribed by the General Administration of Customs.Article 19The management measures applicable to advanced certified enterprises shall be superior to those applicable to general certified enterprises.Where there is a conflict in the applicable management measures due to the different results of determination of the enterprise’s credit status, the Customs administration shall apply the management measures pursuant to inferior principles.Where a certified enterprise is suspected of engaging in smuggling and is thus looked into or investigated, the Customs administration will suspend the applicability of corresponding management measures and treat the same as a general-credit enterprise.Article 20Where the name or customs registration code of an enterprise is changed, the determination result of the credit status of the enterprise by the Customs administration and the corresponding management measures shall continue to apply.Where an enterprise is under any of the following circumstances, adjustments shall be made pursuant to the following principles:1. In the case of split-off of an enterprise, where the survived enterprise succeeds the major rights and obligations of the predecessor enterprise, the result of credit status of the predecessor enterprise determined by the Customs administration and the corresponding management measures shall apply to the survived enterprise, and other divided enterprises shall be deemed as enterprises registered for the first time;2. In the case of split-up of an enterprise, the divided enterprises shall be deemed as enterprises registered for the first time;3. In the case of merger, the result of credit status of the survived enterprise determined by the Customs administration and the corresponding management measures shall apply to the mergedenterprise; and4. In the case of consolidation, the consolidated enterprise shall be deemed as an enterprise registered for the first time.Chapter V Supplementary ProvisionsArticle 21The crime of smuggling based on which the credit status of an enterprise is determined shall be subject to the effective date of the criminal sentence paper.The acts of smuggling and violations of customs regulatory provisions based on which the credit status of an enterprise is determined shall be subject to the date on which the administrative sanction decision is rendered by the Customs administration.Article 22The meanings of the following terms in these Measures:“Amount of administrative sanctions” refers to the sum of penalties imposed by Customs administration and the amount of illegal gains and/or the value of the goods and articles confiscated by the Customs administration due to violations of customs regulatory provisions. “In arrears with taxes payable” refers to the failure to pay, over three months upon the due date, the sum of payable tariffs and other taxes levied by the Customs administration on other agencies’ behalf for import and export goods and articles during importation and exportation, including the taxes payable in addition to the penalties imposed by the Customs administration upon determination of a violation of the customs regulatory provisions.“In arrears with penalties and/or confiscated illegal gains due” refers to the failure to pay the penalties imposed by and illegal gains confiscated by and the amount equivalent to the value of the smuggled goods and articles pursued by the Customs administration, over three months upon the expiry date set out in the administrative sanction decision of the Customs administration. “One year” refers to twelve (12) consecutive months.“Year” refers to a calendar year.“Above” and “below” shall include the given figure.“Authorized Economic Operator” (“AEO”) is an enterprise involved in the international movement of goods in whatever function, conforming to the conditions set out herein and the Criteria of Certified Enterprises of the Customs Administration, and certified by the Customs administration.Article 23The General Administration of Customs shall be responsible for the interpretationto these Measures.Article 24These Measures shall come into effect on December 1, 2014. The Measures of the General Administration of Customs of the People’s Republic of China on Classified Management of Enterprises promulgated as Decree No. 197 of the General Administration of Customs on November 15, 2010 shall be repealed simultaneously.II. Bulletin No. 75 of GACC 2014Bulletin of the General Administration of Customs of the People’sRepublic of ChinaNo.75, 2014The legal documents which are involved in the implementation of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management (Decree No. 225 of GACC) are hereby promulgated, effective as of December 1st, 2014, and Bulletin No. 78 of General Administration of Customs shall be cancelled simultaneously.Annexes:1. Annex 1: Application for the Status of Certified Enterprises2. Annex 2: Decision Not to Grant the Status of Certified Enterprises3. Annex 3: Decision to Terminate Enterprise Certification4. Annex 4: Notice of Rectification5. Annex 5: AEO Certificate of Customs Administration of the PRC6. Annex 6: Decision of Determination of Credit Status7. Annex 7: Receipt of the Application for the Status of Certified EnterprisesApplication for the Status of Certified Enterprises Company NameCustoms Registration No.Status to Be Applied □Advanced □GeneralBusiness Type □Customs Brokerage Service □OthersContact Person TelephoneCustoms:In accordance with the provision of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management, having conducted theself-assessment against the Criteria of Certified Enterprises of Customs Administration, and now deeming that we meet the criteria of □General Certified Enterprise □Advanced Certified Enterprise, we hereby apply with you for the status of a certified enterprise.We know well and agree to comply with the Interim Measures and other relevant Customs regulations. We guarantee that the application files submitted are true, complete and valid, keep relevant documents and materials for audit and are prepared to accept Customs audit for certification.Encl.: Self-Assessment Report prepared according to Criteria of Certified Enterprise of Customs administrationApplicant Company (Stamp)Date: M/D/YXX Customs of the People’s Republic of China Decision Not to Grant the Status of Certified EnterprisesNo.:Company Name:Customs Registration No.:We have received your application for the status of □General Certified Enterprise □Advanced Certified Enterprise on _________M _________D________Y. Upon auditing, we find that you do not meet the Criteria of Certified Enterprises of Customs Administration due to the following circumstance:(Factual Description)Pursuant to the provisions of Clause 1, Article 9 of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management, we thus decide not to grant you the status of □General Certified Enterprise □Advanced Certified Enterprise.If you do not agree with the decision, you may apply for administrative review within 60 days of receipt of this Decision, or appeal to __________ People’s Court within three months of receipt of this Decision in accordance with the provisions of Article 9 and Article 20 of the Administrative Review Law of the People’s Republic of China or the provisions of Article 39 of the Administrative Procedure Law of the People’s Republic of China. During the period of the administrative review or proceedings, this Decision shall remain effective in execution.StampM/D/YAnnex 3:XX Customs of the People’s Republic of ChinaDecision to Terminate CertificationNo.:Company Name:Customs Registration No.:During the process of certification, we find that you have the following circumstance:(Factual Description for Terminating the Certification)Pursuant to the provisions of Article 14 of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management, we have decided to terminate the certification of your company.If you do not agree with the decision, you may apply for administrative review within 60 days of receipt of this Decision, or appeal to __________ People’s Court within three months of receipt of this Decision in accordance with the provisions of Article 9 and Article 20 of the Administrative Review Law of the People’s Republic of China or the provisions of Article 39 of the Administrative Procedure Law of the People’s Republic of China. During the period of the administrative review or proceedings, this Decision shall remain effective in execution.StampM/DYXX Customs of the People’s Republic of ChinaNotice of RectificationNo.:Company Name:Customs Registration No.:Pursuant to the provisions of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management and Criteria of Certified Enterprise of Customs Administration, we find that you have the circumstance to be rectified. You are thus required to make the following rectification:(What to be rectified and time limit)StampM/DY证 书 编 号:CERTIFICATE NO.(AEO标识)认证企业证书AEO CERTIFICATE 认证企业名称:AEO NAME:认证企业编号:AEO CODE:认证企业等级:AEO TYPE:认证日期:DATE OF CERTIFICATION:发证机关:(盖章)ISSUING AUTHORITY:发证日期:DATE OF ISSUE:XX Customs of the People’s Republic of ChinaDecision of Determination of Credit StatusNo.:Company Name:Customs Registration No.:You were granted as the status of □Advanced Certified Enterprise □General Certified Enterprise □General-Credit Enterprise □ Discredited enterprise. But we find that you fall into the following circumstance:(Factual Description)Pursuant to the provisions of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management, we now thus decide to determine your credit status as □General Certified Enterprise □General Credit Enterprise □ Discredited enterprise.If you do not agree with the decision, you may apply for administrative review within 60 days of receipt of this Decision, or appeal to __________ People’s Court within three months of receipt of this Decision in accordance with the provisions of Article 9 and Article 20 of the Administrative Review Law of the People’s Republic of China or the provisions of Article 39 of the Administrative Procedure Law of the People’s Republic of China. During the period of the administrative review or proceedings, this Decision shall remain effective in execution.StampM/DYXX Customs of the People’s Republic of ChinaReceipt of the Application for the Status of CertifiedEnterprisesNo.:Company No.:Customs Registration No.:We have received your application for the status of □General Certified Enterprise □ Advanced Certified Enterprise on _________M _________D _________Y. Upon examination, we find that the documents you presented are complete and conform to the mandatory format. Pursuant to the provisions of Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management, we hereby accept your application.StampM/D/YIII. Bulletin No. 81 of GACC, 2014Bulletin of the General Administration of Customs of the People’sRepublic of ChinaNo. 81, 2014/11/26Interim Measures of the General Administration of Customs of the People’s Republic of China for Enterprise Credit Management (Decree No. 225 of GACC, hereinafter referred to as Measures for Credit) promulgated to the public on Oct. 8th, 2014 shall come into effect on December 1st, 2014. Hence the following decisions are announced hereby:1. As of December 1st, 2014, the enterprises of Class AA, Class A and Class B determined pursuant to Measures of the General Administration of Customs of the People’s Republic of China on Classified Management of Enterprises (Decree No. 197 of GACC) shall turn into respectively advanced certified enterprise, general certified enterprise and general-credit enterprise. The credit status of the enterprises of Class C and D will be re-determined by Customs administrations according to Measures for Credit.Where the credit status of the enterprises of Class C and D are re-determined as discredited enterprises, the term of the credit status of such enterprises is still subject to the original term of the credit status of Class C and D.The certified enterprises may apply to Customs administrations, with the decision paper of Class AA or A, for replacing the original certificate with AEO Certificate.2. In light of the Enterprise Credit Information (see the annex), Customs administrations will publicly disclose the credit information of those enterprises registered with Customs administration through the Platform of Enterprises’ Import and Export Credit Information of China Customs ().3. Those citizens or legal or other entities that raise objection to the credit information disclosed by Customs administrations should provide written statement or evidences.Where the objection is raised by citizens, the documents submitted shall be signed and the original identity card of those citizens shall also be verified by Customs administrations; where the objection is raised by legal or other entities, the documents shall be stamped with the seal of those entities.4. Where the credit status of a certified enterprise is adjusted, the original AEO Certificate should be returned to the Customs administration. Where it is not returned, the original certificate shall be invalidated by the Customs administration through public announcement.Under the circumstance of losing the AEO Certificate, the certified enterprise may apply for a new certificate to the Customs administration which issued the original certificate, and the lost certificate shall be nullified by the Customs administration through public announcement.5. During the process of determining the credit status, where the enterprise may make necessary rectification to meet the criteria according to relevant provisions, Customs shall allow such rectification. The time limit of rectification shall be decided by the Customs administration, and shall not exceed a maximum of 90 days. The period of time for rectification by the enterprise shall not be calculated into the time of certification.6. “Within one year” indicated in Measures for Credit and Criteria of Certified Enterprises of the Customs Administration shall be counted as follows according to the adjustment of the credit status of an enterprise:Where the credit status is upgraded to a certified enterprise, it refers to the past consecutive 12 months from the date when the Customs administration accepts the application; where the credit status is downgraded, it refers to the past consecutive 12 months from the date when the last decision of Customs administrative sanction is rendered.This bulletin shall come into effect as of December 1st, 2014.Annex: Enterprise Credit InformationGeneral Administration of CustomsNov. 18, 2014。