【专业文档】国际金融答案.doc

2023年国际金融形成性考核册作业简答题打印版

国际金融形成性考核册作业4一、名词解释1.回购协议:是在买卖证券时发售者向购置者承诺在一定期限后,按预定旳价格如数购回证券旳协议。

2.远期利率协议:是交易双方同意在未来某一确定期间,对一笔规定了期限旳象征性存款按协定利率支付利息旳交易协议。

3.打包放款:即出口商持进口商银行开立旳信用性,从银行获得用于货品装运出口旳周转性贷款。

4.出口信贷:指发达国家为了支持和扩大本国资本货品旳出口,通过提供信贷担保予以利息补助旳措施,鼓励本国银行对本国出口商或进口方银行提供利率较低旳中长期贸易融资。

5.卖方信贷:指出口方银行为资助资本货品旳出口,对出口商提供旳中长期融资。

6.买方信贷:指出口方银行为资助资本货品旳出口,向进口商或进口方银行提供旳中长期融资。

7.福费廷:又称包买远期票据,指包买商从出口商那里无追索权地购置通过出口商承兑和进口方银行担保旳远期票据,向出口商提供中期贸易融资。

8.出口押汇:指出口商在货品运出后,持银行规定旳单证向银行申请以此单证为抵押旳贷款,是短期贸易融资中使用最多旳融资方式。

9.国际债券:是一国政府、金融机构、工商企业或国家组织为筹措和融通资金,在国外金融市场上发行旳,以外国货币为面值旳债券。

10.外国债券:是市场所在地旳非居民在一国债券市场上以该国货币为面值发行旳国际债券。

11欧洲债券:与老式旳外国债券不一样,是市场所在地非居民在面值货币国家以外旳若干个市场同步发行旳国际债券。

六、问答题1.怎样计算实际贷款期限和有效利率?P247 P250答:实际贷款期限指使有平均年限计算措施求出旳借款人支配所有贷款金额旳时间。

由于贷款也许是逐渐提取和逐渐偿还旳,实际贷款期会不大于名义贷款期。

在计算实际贷期时,可以把它划分为三个阶段:用款期,即从签约到提完贷款旳时期;还款期,即从开始还款到还清贷款旳时期;用款期和还款期之间旳时期,只是在这一阶段借款人实际支配着所有贷款。

求实际贷款期限,首先要计算用款期和还款期旳平均年限,然后根据用款期和还款期旳平均年限计算实际贷款期限。

国际金融习题与答案(6)精讲

第四章离岸金融市场一、本章要义练习说明:请结合学习情况在以下段落空白处填充适当的文字,使上下文合乎逻辑。

20世纪50年代以后,国际金融领域出现重大变化,将特定货币的存放业务转移到货币发行国境外进行,从而摆脱发行机构的管制和影响,此类市场称做(1)。

目前,全球主要国际金融中心都经营离岸市场业务。

通常,离岸业务与国内金融市场完全分开,不受所在国金融政策限制,可以自由筹措资金,进行外汇交易,实行(2),无需交纳(3)。

经营离岸金融业务的市场又称为(4)或境外货币市场。

20世纪60年代,欧洲货币市场的发展极为迅速,从内在原因来看,第二次世界大战后,资本主义国家经济加快复苏,各国间经济联系越来越密切,西方国家的生产、市场日趋国际化,促进了货币市场的国际化。

从外在原因来看,则集中表现为以下四个方面:(5)、(6)、(7)和(8)。

欧洲货币市场由(9)、(10)和(11)构成,其中(12)是办理短期信贷业务的市场,在该市场进行的资金拆放交易,一般以(13)为基础,酌量增加一定幅度的加息率。

欧洲货币市场的资金来源分别有(14)、(15)、(16)、石油美元存款以及银行发行中、短期欧洲票据和欧洲货币存款单,以此聚集大量欧洲银行贷款资金。

其资金的需求方分别是(17)、(18)和外汇投机者。

欧洲货币市场是一个国际性市场。

它的活动量很大,又不受任何国家的法律约束,所以具有很大的竞争性、投机性和破坏性。

该市场的发展会对国际金融的稳定产生影响,具体来说有以下三点:(19)、(20)和(21)。

总之,欧洲货币市场对国际经济金融局势的稳定是一个潜在的威胁,西方国家已在探讨对它加强管制的问题,但这种设想的提出和各种方案绝非短期所能实现。

(22)是指借款人(债券发行人)在其他国家发行的以非发行国货币标价的债券。

这种境外债券通常是由一些国家的银行和金融机构建立的(23)出售,并由有关国家向投资人提供担保,因此,这个市场作为本国资本市场和外国债券市场以外长期资金筹措的第三个来源,其特点是对借贷双方来说都具有国际性。

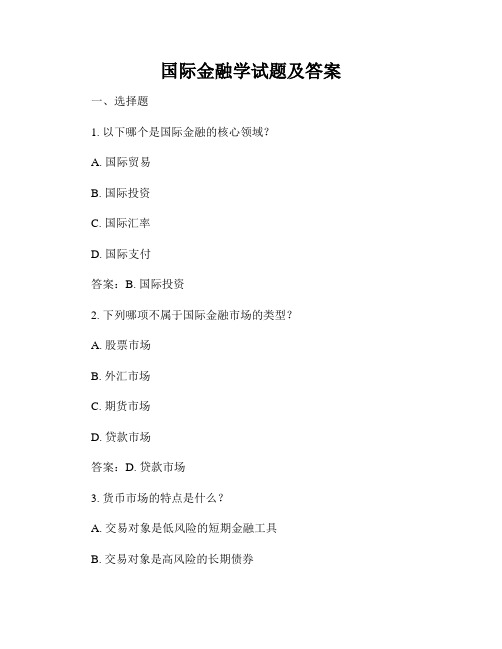

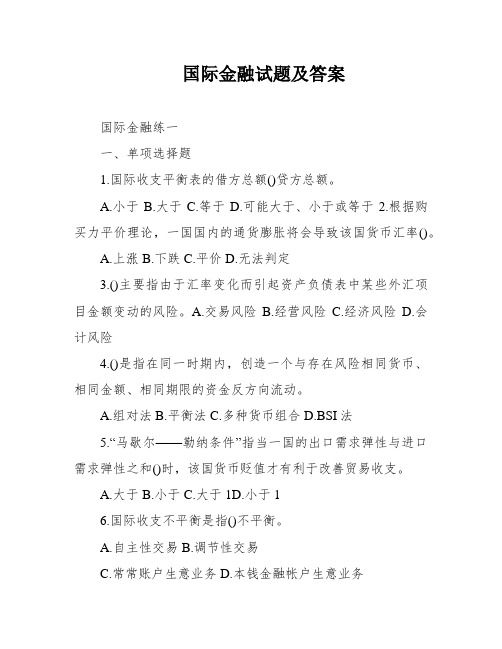

国际金融学试题及答案

国际金融学试题及答案一、选择题1. 以下哪个是国际金融的核心领域?A. 国际贸易B. 国际投资C. 国际汇率D. 国际支付答案:B. 国际投资2. 下列哪项不属于国际金融市场的类型?A. 股票市场B. 外汇市场C. 期货市场D. 贷款市场答案:D. 贷款市场3. 货币市场的特点是什么?A. 交易对象是低风险的短期金融工具B. 交易对象是高风险的长期债券C. 交易对象是外汇D. 交易对象是股票答案:A. 交易对象是低风险的短期金融工具4. 下列哪种情况属于贸易逆差?A. 进口多于出口B. 进口少于出口C. 进口等于出口D. 进口在一定范围内波动答案:A. 进口多于出口5. 以下哪个因素不会影响汇率的波动?A. 利率水平B. 政府干预C. 外汇储备D. 贸易差额答案:D. 贸易差额二、判断题判断下列说法是否正确。

1. 国际金融市场的发展与国际交流和合作密切相关。

答案:正确2. 国际金融市场的主要参与者是个人投资者。

答案:错误3. 汇率变动对国际经济和金融产生重要影响。

答案:正确4. 国际金融市场具有高度的流动性。

答案:正确5. 国际金融市场的主要功能之一是为企业提供融资渠道。

答案:正确三、问答题1. 请简要说明国际金融的定义和范畴。

国际金融是研究跨国金融活动的学科,它涉及到国际投资、国际贸易、国际汇率、国际支付等多个方面。

国际金融的范畴包括国际金融市场、国际金融机构、国际金融制度等内容。

2. 国际金融市场的种类有哪些?国际金融市场包括货币市场、债券市场、股票市场、外汇市场、期货市场等。

货币市场是短期资金融通的市场,债券市场提供长期融资的工具,股票市场是股权融资的市场,外汇市场是进行不同货币之间的交易,期货市场是进行标的物交割的市场。

3. 请简要说明汇率的意义及影响因素。

汇率是一国货币兑换另一国货币的比率。

汇率的变动对于国际经济和金融具有重要影响。

汇率的升值或贬值会直接影响国际贸易和国际投资,进而会对国家的经济发展产生影响。

国际金融(第4版)课后题答案

第1章外汇与汇率知识掌握二、单项选择题1.C2. D3.B4.B5.C三、多项选择题1.ABCD2. ABD3. BCDE4. ADE知识应用一、案例分析题1.2015年“8.11”汇改后人民币贬值速度较快,一时间引起阵阵恐慌,加之内地缺少有效投资工具,导致大量中产阶级欲将资金转移至境外以寻求保护。

由于香港与内地特殊的政治经济关系而使其成为避险资金的首选,这属于正常现象。

但如果对此不加以约束,易造成资金外流的恶果。

2.人民币贬值对经济生活的影响可以从不同方面来解读:从进出口的角度看,人民币贬值有利于扩大出口,增强产品的国际竞争力;从资本流动的角度看,人民币的贬值会给投资者带来不安全感,对人民币的信心缺失,抛售人民币资产或将资产转移至境外,造成资本外流,而资本外流会进一步加大人民币贬值压力,从而形成恶性循环。

资本流动情况将直接影响国际储备情况,我国这两年外汇储备变动状况清楚地说明了这一点。

此外,人民币对外贬值对我国走出去战略也会产生一定影响,对于海外求学的人来说更不是利好。

知识掌握二、单项选择题1.B2.C 3.C 4.A5.B 6.B7.A8.B9.D 10.C 11.B12.A13.B 14. C 15. B 16.B 17.B知识应用一、案例分析题1.1950年以后,随着欧洲经济的苏和日本经济的崛起,美国贸易逆差不断扩大,黄金储备不断减少,导致美国无力维持美元官价兑换黄金,并最终停止以美元兑换黄金。

2.在布雷顿森森体系下实行的是以美元为中心的固定汇率制度。

以美元为中心的国际货币制度崩溃的根本原因,是这个制度本身存在着不可调和的矛盾。

一方面,美元作为国际支付手段与国际储备手段,要求美元币值稳定,才会在国际支付中被其他国家所普遍接受。

而美元币值稳定,不仅要求美国有足够的黄金储备,而且要求美国的国际收支必须保持顺差,从而使黄金不断流入美国而增加其黄金储备。

否则,人们在国际支付中就不愿接受美元。

另一方面,全世界要获得充足的外汇储备,又要求美国的国际收支保持逆差,否则全世界就会面临外汇储备短缺。

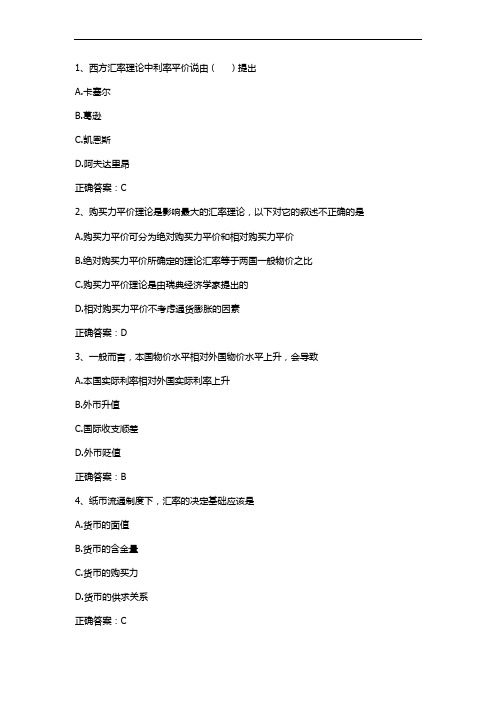

国际金融(汇率的决定与预测)习题与答案

1、西方汇率理论中利率平价说由()提出A.卡塞尔B.葛逊C.凯恩斯D.阿夫达里昂正确答案:C2、购买力平价理论是影响最大的汇率理论,以下对它的叙述不正确的是A.购买力平价可分为绝对购买力平价和相对购买力平价B.绝对购买力平价所确定的理论汇率等于两国一般物价之比C.购买力平价理论是由瑞典经济学家提出的D.相对购买力平价不考虑通货膨胀的因素正确答案:D3、一般而言,本国物价水平相对外国物价水平上升,会导致A.本国实际利率相对外国实际利率上升B.外币升值C.国际收支顺差D.外币贬值正确答案:B4、纸币流通制度下,汇率的决定基础应该是A.货币的面值B.货币的含金量C.货币的购买力D.货币的供求关系正确答案:C5、一般来说,各国都把本国货币对()的汇率作为基本汇率A.美元B.法国法郎C.德国马克D.英镑正确答案:A6、西方汇率理论中购买力平价说由()提出并加以系统阐述A.凯恩斯B.卡塞尔C.葛逊D.詹姆斯·托宾正确答案:B7、目前西方各国普遍实行()汇率制度A.自由浮动B.钉住浮动C.管理浮动D.联合浮动正确答案:C8、根据利率平价理论高利率的货币远期将A.升水B.贬值C.升值D.贴水正确答案:D9、在直接标价法下,本币币值变化与汇率数值()变化A.以上都不对B.同方向C.反方向D.不一定正确答案:B10、下列表述最为正确的是:A.如果PPP成立,那么只要各国用以计算物价水平的商品篮子相同,一价定律对于任何商品都成立B.如果一价定律不是对于所有商品都成立,那么只要各国以计算物价水平的商品篮子相同,PPP将不成立C.如果一价定律对于任何商品都成立,那么PPP将自动成立D.如果一价定律对于任何商品都成立,那么只要各国用以计算物价水平的商品篮子相同,PPP将自动成立正确答案:D11、()是外汇市场上的基础汇率A.信汇汇率B.现钞汇率C.票汇汇率D.电汇汇率正确答案:D12、外汇买卖双方在成交的当天或第二个营业日进行交割的汇率被称为A.即期汇率B.金融汇率C.贸易汇率D.浮动汇率正确答案:A13、根据购买力平价理论,高通货膨胀国家的货币将A.升值B.贬值C.贴水D.升水正确答案:B14、汇率由市场决定,外汇干预的目的是减少汇率波动以防止汇率过渡波动,而不是确定一个汇率水平。

《国际金融》大学生网课答案

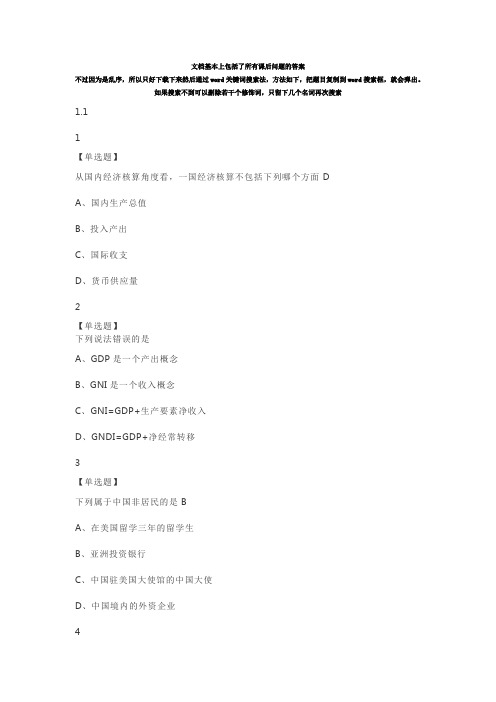

文档基本上包括了所有课后问题的答案不过因为是乱序,所以只好下载下来然后通过word关键词搜索法,方法如下,把题目复制到word搜索框,就会弹出。

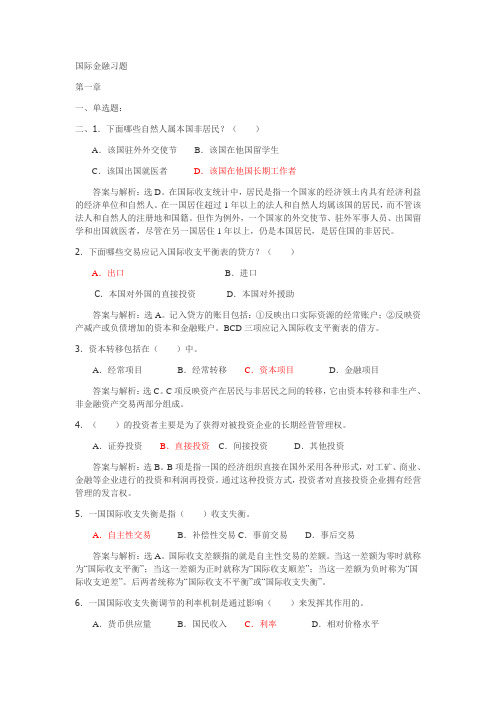

如果搜索不到可以删除若干个修饰词,只留下几个名词再次搜索1.11【单选题】从国内经济核算角度看,一国经济核算不包括下列哪个方面 DA、国内生产总值B、投入产出C、国际收支D、货币供应量2【单选题】下列说法错误的是A、GDP是一个产出概念B、GNI是一个收入概念C、GNI=GDP+生产要素净收入D、GNDI=GDP+净经常转移3【单选题】下列属于中国非居民的是BA、在美国留学三年的留学生B、亚洲投资银行C、中国驻美国大使馆的中国大使D、中国境内的外资企业4【判断题】在本国国内居住满一年以及一年以上的个人就是本国居民×5【判断题】住户的居民属性取决于其住所所在地,而不是工作所在地。

√1.2 封闭经济下的国民收入恒等式(上)1【单选题】下列活动不应计入GDP的是 CA、企业自己制造的生产用机器设备B、农民生产出供自己消费的粮食C、家庭主妇每天在家里带孩子D、某家庭请了一个保姆每天照看孩子2【单选题】固定资产与存货的差异为CA、空间上的“位置”是否固定B、时间上是否有耐久性C、是否可以在较长时间内反复或者连续用于生产D、体积的大小3【单选题】下列说法错误的是A、本期生产出来的产品是否销售出去与本期GDP规模无关B、以前年度生产出来的产品在本期销售也与本期GDP规模无关C、野生果实、原始森林的自然生长,公海中鱼类数量的自然增长计入GDPD、加总生产过程各个环节的增加值(value added)得到4【判断题】房产中介小王将手中的1套二手房以100万价格卖出,因此本年GDP增加80万元。

×5【判断题】房产中介小王将手中的1套二手房以100万价格卖出,所获提成为1万,该笔收入应计入GDP。

√1.3 封闭经济下的国民经济恒等式(下)1【单选题】下列说法错误的是A、生产税包括产品税、销售税、营业税B、生产补贴包括对企业的价格补贴和出口退税以及消费目的的补贴C、营业盈余体现了资本所得D、营业盈余是企业从事生产经营活动所获得的利润2【单选题】在封闭经济环境下,下列等式错误的是CA、Sg=T-TR-INT-GB、PDI=GDP+TR-TC、S=GDP-C-G-ID、Sp=GDP+TR+INT-T-C3【单选题】下列说法错误的是A、政府部门的可支配收入等于政府的税收收入T减去转移支付TRB、政府的转移支付(Transfer Payment),包括各种形式的失业救济金、养老金等C、国民储蓄包括私人部门的储蓄加上政府部门的储蓄D、国民储蓄就是本国国民收入中未被用于消费的部分。

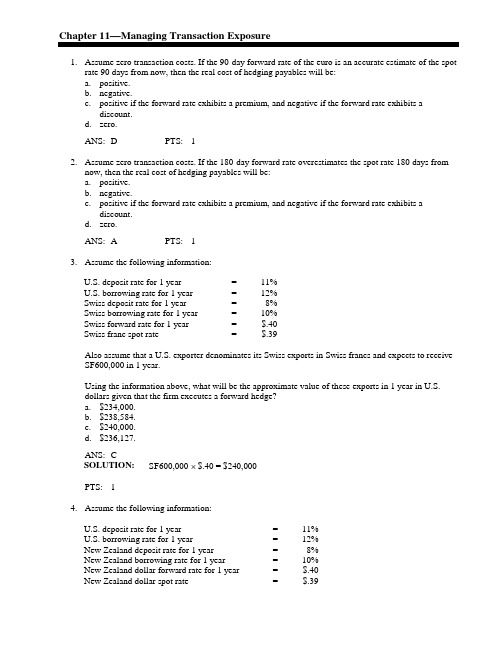

国际金融 International Finance Test Bank_11

Chapter 11—Managing Transaction Exposure1. Assume zero transaction costs. If the 90-day forward rate of the euro is an accurate estimate of the spotrate 90 days from now, then the real cost of hedging payables will be:a. positive.b. negative.c. positive if the forward rate exhibits a premium, and negative if the forward rate exhibits adiscount.d. zero.ANS: D PTS: 12. Assume zero transaction costs. If the 180-day forward rate overestimates the spot rate 180 days fromnow, then the real cost of hedging payables will be:a. positive.b. negative.c. positive if the forward rate exhibits a premium, and negative if the forward rate exhibits adiscount.d. zero.ANS: A PTS: 13. Assume the following information:U.S. deposit rate for 1 year = 11%U.S. borrowing rate for 1 year = 12%Swiss deposit rate for 1 year = 8%Swiss borrowing rate for 1 year = 10%Swiss forward rate for 1 year = $.40Swiss franc spot rate = $.39Also assume that a U.S. exporter denominates its Swiss exports in Swiss francs and expects to receive SF600,000 in 1 year.Using the information above, what will be the approximate value of these exports in 1 year in U.S.dollars given that the firm executes a forward hedge?a. $234,000.b. $238,584.c. $240,000.d. $236,127.ANS: CSOLUTION: SF600,000 $.40 = $240,000PTS: 14. Assume the following information:U.S. deposit rate for 1 year = 11%U.S. borrowing rate for 1 year = 12%New Zealand deposit rate for 1 year = 8%New Zealand borrowing rate for 1 year = 10%New Zealand dollar forward rate for 1 year = $.40New Zealand dollar spot rate = $.39Also assume that a U.S. exporter denominates its New Zealand exports in NZ$ and expects to receive NZ$600,000 in 1 year. You are a consultant for this firm.Using the information above, what will be the approximate value of these exports in 1 year in U.S.dollars given that the firm executes a money market hedge?a. $238,584.b. $240,000.c. $234,000.d. $236,127.ANS: DSOLUTION:1. Borrow NZ$545,455 (NZ$600,000/1.1) = NZ$545,455.2. Convert NZ$545,455 to $212,727 (at $.39 per NZ$).3. Invest $212,727 to accumulate $236,127 ($212,727 1.11) = $236,127.PTS: 15. An example of cross-hedging is:a. find two currencies that are highly positively correlated; match the payables of the onecurrency to the receivables of the other currency.b. use the forward market to sell forward whatever currencies you will receive.c. use the forward market to buy forward whatever currencies you will receive.d. B and CANS: A PTS: 16. Which of the following reflects a hedge of net receivables in British pounds by a U.S. firm?a. purchase a currency put option in British pounds.b. sell pounds forward.c. borrow U.S. dollars, convert them to pounds, and invest them in a British pound deposit.d. A and BANS: D PTS: 17. Which of the following reflects a hedge of net payables on British pounds by a U.S. firm?a. purchase a currency put option in British pounds.b. sell pounds forward.c. sell a currency call option in British pounds.d. borrow U.S. dollars, convert them to pounds, and invest them in a British pound deposit.e. A and BANS: D PTS: 18. If Lazer Co. desired to lock in the maximum it would have to pay for its net payables in euros butwanted to be able to capitalize if the euro depreciates substantially against the dollar by the time payment is to be made, the most appropriate hedge would be:a. a money market hedge.b. purchasing euro put options.c. a forward purchase of euros.d. purchasing euro call options.e. selling euro call options.ANS: D PTS: 19. If Salerno Inc. desired to lock in a minimum rate at which it could sell its net receivables in Japaneseyen but wanted to be able to capitalize if the yen appreciates substantially against the dollar by the time payment arrives, the most appropriate hedge would be:a. a money market hedge.b. a forward sale of yen.c. purchasing yen call options.d. purchasing yen put options.e. selling yen put options.ANS: D PTS: 110. The real cost of hedging payables with a forward contract equals:a. the nominal cost of hedging minus the nominal cost of not hedging.b. the nominal cost of not hedging minus the nominal cost of hedging.c. the nominal cost of hedging divided by the nominal cost of not hedging.d. the nominal cost of not hedging divided by the nominal cost of hedging.ANS: A PTS: 111. From the perspective of Detroit Co., which has payables in Mexican pesos and receivables in Canadiandollars, hedging the payables would be most desirable if the expected real cost of hedging payables is ____, and hedging the receivables would be most desirable if the expected real cost of hedgingreceivables is ____.a. negative; positiveb. zero; positivec. zero; zerod. positive; negativee. negative; negativeANS: E PTS: 112. Use the following information to calculate the dollar cost of using a money market hedge to hedge200,000 pounds of payables due in 180 days. Assume the firm has no excess cash. Assume the spot rate of the pound is $2.02, the 180-day forward rate is $2.00. The British interest rate is 5%, and the U.S. interest rate is 4% over the 180-day period.a. $391,210.b. $396,190.c. $388,210.d. $384,761.e. none of the aboveANS: ESOLUTION:1. Need to invest £190,476 (£200,000/1.05) = £190,476.2. Need to exchange $384,762 to obtain the £190,476 (£190,476 ⨯ $2.02) = $384,762.3. At the end of 180 days, need $400,152 to repay loan ($384,762 ⨯ 1.04) = $400,152.PTS: 113. Assume that Cooper Co. will not use its cash balances in a money market hedge. When decidingbetween a forward hedge and a money market hedge, it ____ determine which hedge is preferable before implementing the hedge. It ____ determine whether either hedge will outperform an unhedged strategy before implementing the hedge.a. can; canb. can; cannotc. cannot; cand. cannot; cannotANS: B PTS: 114. Foghat Co. has 1,000,000 euros as receivables due in 30 days, and is certain that the euro willdepreciate substantially over time. Assuming that the firm is correct, the ideal strategy is to:a. sell euros forward.b. purchase euro currency put options.c. purchase euro currency call options.d. purchase euros forward.e. remain unhedged.ANS: A PTS: 115. Spears Co. will receive SF1,000,000 in 30 days. Use the following information to determine the totaldollar amount received (after accounting for the option premium) if the firm purchases and exercises a put option:Exercise price = $.61Premium = $.02Spot rate = $.60Expected spot rate in 30 days = $.5630-day forward rate = $.62a. $630,000.b. $610,000.c. $600,000.d. $590,000.e. $580,000.ANS: DSOLUTION: ($.61 - $.02) ⨯ SF1,000,000 = $590,000PTS: 116. A ____ involves an exchange of currencies between two parties, with a promise to re-exchangecurrencies at a specified exchange rate and future date.a. long-term forward contractb. currency option contractc. parallel loand. money market hedgeANS: C PTS: 117. If interest rate parity exists and transactions costs are zero, the hedging of payables in euros with aforward hedge will ____.a. have the same result as a call option hedge on payablesb. have the same result as a put option hedge on payablesc. have the same result as a money market hedge on payablesd. require more dollars than a money market hedgee. A and DANS: C PTS: 118. Assume that Parker Company will receive SF200,000 in 360 days. Assume the following interestrates:U.S. Switzerland360-day borrowing rate 7% 5%360-day deposit rate 6% 4%Assume the forward rate of the Swiss franc is $.50 and the spot rate of the Swiss franc is $.48. IfParker Company uses a money market hedge, it will receive ____ in 360 days.a. $101,904b. $101,923c. $98,769d. $96,914e. $92,307ANS: DSOLUTION:1. Borrow SF190,476 (SF200,000/1.05) = SF190,476.2. Convert SF190,476 to $91,428 (SF190,476 ⨯ $.48) = $91,428.3. Invest $91,428 at 6% to accumulate $96,914 ($91,428 ⨯ 1.06) = $96,914.PTS: 119. The forward rate of the Swiss franc is $.50. The spot rate of the Swiss franc is $.48. The followinginterest rates exist:U.S. Switzerland360-day borrowing rate 7% 5%360-day deposit rate 6% 4%You need to purchase SF200,000 in 360 days. If you use a money market hedge, the amount of dollars you need in 360 days is:a. $101,904.b. $101,923.c. $98,770.d. $96,914.e. $92,307.ANS: CSOLUTION:1. Need to invest SF192,308 (SF200,000/1.04) = SF192,308.2. Need to borrow $92,308 to exchange for SF192,308 (SF192,308 ⨯ $.48) = $92,308.3. At the end of 360 days, need $98,769 to repay the loan ($92,308 ⨯ 1.07) = $98,770.PTS: 120. Your company will receive C$600,000 in 90 days. The 90-day forward rate in the Canadian dollar is$.80. If you use a forward hedge, you will:a. receive $750,000 today.b. receive $750,000 in 90 days.c. pay $750,000 in 90 days.d. receive $480,000 today.e. receive $480,000 in 90 days.ANS: ESOLUTION: C$600,000 ⨯ $0.80 = $480,000PTS: 121. A call option exists on British pounds with an exercise price of $1.60, a 90-day expiration date, and apremium of $.03 per unit. A put option exists on British pounds with an exercise price of $1.60, a 90-day expiration date, and a premium of $.02 per unit. You plan to purchase options to cover your future receivables of 700,000 pounds in 90 days. You will exercise the option in 90 days (if at all).You expect the spot rate of the pound to be $1.57 in 90 days. Determine the amount of dollars to be received, after deducting payment for the option premium.a. $1,169,000.b. $1,099,000.c. $1,106,000.d. $1,143,100.e. $1,134,000.ANS: CSOLUTION: ($1.60 - $.02) ⨯ £700,000 = $1,106,000PTS: 122. Assume that Smith Corporation will need to purchase 200,000 British pounds in 90 days. A call optionexists on British pounds with an exercise price of $1.68, a 90-day expiration date, and a premium of $.04. A put option exists on British pounds, with an exercise price of $1.69, a 90-day expiration date, and a premium of $.03. Smith Corporation plans to purchase options to cover its future payables. It will exercise the option in 90 days (if at all). It expects the spot rate of the pound to be $1.76 in 90 days. Determine the amount of dollars it will pay for the payables, including the amount paid for the option premium.a. $360,000.b. $338,000.c. $332,000.d. $336,000.e. $344,000.ANS: ESOLUTION: ($1.68 + $.04) ⨯ £200,000 = $344,000PTS: 123. Assume that Kramer Co. will receive SF800,000 in 90 days. Today's spot rate of the Swiss franc is$.62, and the 90-day forward rate is $.635. Kramer has developed the following probabilitydistribution for the spot rate in 90 days:$.64 40%$.65 30%The probability that the forward hedge will result in more dollars received than not hedging is:a. 10%.b. 20%.c. 30%.d. 50%.e. 70%.ANS: CSOLUTION: The forward hedge will result in more dollars if the spot rate is less than theforward rate, which is true in the first two cases.PTS: 124. Assume that Jones Co. will need to purchase 100,000 Singapore dollars (S$) in 180 days. Today's spotrate of the S$ is $.50, and the 180-day forward rate is $.53. A call option on S$ exists, with an exercise price of $.52, a premium of $.02, and a 180-day expiration date. A put option on S$ exists, with an exercise price of $.51, a premium of $.02, and a 180-day expiration date. Jones has developed the following probability distribution for the spot rate in 180 days:Possible Spot Ratein 90 Days Probability$.48 10%$.53 60%$.55 30%The probability that the forward hedge will result in a higher payment than the options hedge is ____ (include the amount paid for the premium when estimating the U.S. dollars required for the options hedge).a. 0%b. 10%c. 30%d. 40%e. 70%ANS: BSOLUTION: There is a 10% probability that the call option will not be exercised. In thatcase, Jones will pay $.48 ⨯ S$100,000 = $48,000, which is less than theamount paid with the forward hedge ($.53 ⨯ S$100,000 = $53,000).PTS: 125. Assume that Patton Co. will receive 100,000 New Zealand dollars (NZ$) in 180 days. Today's spotrate of the NZ$ is $.50, and the 180-day forward rate is $.51. A call option on NZ$ exists, with an exercise price of $.52, a premium of $.02, and a 180-day expiration date. A put option on NZ$ exists with an exercise price of $.51, a premium of $.02, and a 180-day expiration date. Patton Co. hasdeveloped the following probability distribution for the spot rate in 180 days:$.55 30%The probability that the forward hedge will result in more U.S. dollars received than the options hedge is ____ (deduct the amount paid for the premium when estimating the U.S. dollars received on the options hedge).a. 10%b. 30%c. 40%d. 70%e. none of the aboveANS: DSOLUTION: The put option will be exercised in the first two cases, resulting in an amountreceived per unit of $.51 - $.02 = $.49. Thus, the forward hedge will result inmore U.S. dollars received ($.51 per unit).PTS: 126. The ____ hedge is not a technique to eliminate transaction exposure discussed in your text.a. indexb. futuresc. forwardd. money markete. currency optionANS: A PTS: 127. Money Corp. frequently uses a forward hedge to hedge its Malaysian ringgit (MYR) receivables. Forthe next month, Money has identified its net exposure to the ringgit as being MYR1,500,000. The 30-day forward rate is $.23. Furthermore, Money's financial center has indicated that the possiblevalues of the Malaysian ringgit at the end of next month are $.20 and $.25, with probabilities of .30 and .70, respectively. Based on this information, the revenue from hedging minus the revenue from not hedging receivables is____.a. $0.b. -$7,500.c. $7,500.d. none of the aboveANS: CSOLUTION: RCH(1) = (MYR1,500,000 ⨯ $0.20) - (MYR1,500,000 ⨯ $0.23)= -$45,000RCH(2) = (MYR1,500,000 ⨯ $0.25) - (MYR1,500,000 ⨯ $0.23)= $30,000E[RCH] = (.30)(-45,000) + (.7)(30,000) = 7,5000PTS: 128. Hanson Corp. frequently uses a forward hedge to hedge its British pound (£) payables. For the nextquarter, Hanson has identified its net exposure to the pound as being £1,000,000. The 90-day forward rate is $1.50. Furthermore, Hanson's financial center has indicated that the possible values of theBritish pound at the end of next quarter are $1.57 and $1.59, with probabilities of .50 and .50,respectively. Based on this information, what is the expected real cost of hedging payables?a. $80,000.b. -$80,000.c. $1,570,000.d. $1,580,000.ANS: BSOLUTION: RCH(1) = (£1,000,000 ⨯ $1.50) - (£1,000,000 ⨯ $1.57) = -$70,000RCH(2) = (£1,000,000 ⨯ $1.50) - (£1,000,000 ⨯ $1.59) = -$90,000E[RCH] = (.50)(-70,000) + (.50)(-$90,000) = -$80,000PTS: 1Exhibit 11-1U.S. Jordan360-day borrowing rate 6% 5%360-day deposit rate 5% 4%29. Refer to Exhibit 11-1. Perkins Corp. will receive 250,000 Jordanian dinar (JOD) in 360 days. Thecurrent spot rate of the dinar is $1.48, while the 360-day forward rate is $1.50. How much will Perkins receive in 360 days from implementing a money market hedge (assume any receipts before the date of the receivable are invested)?a. $377,115.b. $373,558.c. $363,019.d. $370,000.ANS: DSOLUTION:1. Borrow JOD238,095.24 (JOD250,000/1.05) = JOD238,095.24.2. Convert JOD238,095.24 to $352,380.95 (JOD238,095.24 ⨯ $1.48) = $352,380.95.3. Invest $352,380.95 at 5% to accumulate $370,000 ($352,280.95 ⨯ 1.05) = $370,000.PTS: 130. Refer to Exhibit 11-1. Pablo Corp. will need 150,000 Jordanian dinar (JOD) in 360 days. The currentspot rate of the dinar is $1.48, while the 360-day forward rate is $1.46. What is Pablo's cost fromimplementing a money market hedge (assume Pablo does not have any excess cash)?a. $224,135.b. $226,269.c. $224,114.d. $223,212.ANS: BSOLUTION:1. Need to invest JOD144,230.76 (JOD150,000/1.04) = JOD144,230.76.2. Need to convert $213,461.52 to obtain the JOD144,230.76 dinar (JOD144,230.76 ⨯ $1.48)= $213,461.52.3. At the end of 360 days, need $226,269.22 ($213,461.52 ⨯ 1.06) = $226,269.21.PTS: 131. Lorre Company needs 200,000 Canadian dollars (C$) in 90 days and is trying to determine whether ornot to hedge this position. Lorre has developed the following probability distribution for the Canadian dollar:Possible Value ofCanadian Dollar in 90 Days Probability$0.54 15%0.57 25%0.58 35%0.59 25%The 90-day forward rate of the Canadian dollar is $.575, and the expected spot rate of the Canadian dollar in 90 days is $.55. If Lorre implements a forward hedge, what is the probability that hedging will be more costly to the firm than not hedging?a. 40%.b. 60%.c. 15%.d. 85%.ANS: ASOLUTION: Since Lorre locks into the $.575 with a forward contract, the first two caseswould have been cheaper had Lorre not hedged (15% + 25% = 40%).PTS: 132. Quasik Corporation will be receiving 300,000 Canadian dollars (C$) in 90 days. Currently, a 90-daycall option with an exercise price of $.75 and a premium of $.01 is available. Also, a 90-day put option with an exercise price of $.73 and a premium of $.01 is available. Quasik plans to purchase options to hedge its receivable position. Assuming that the spot rate in 90 days is $.71, what is the net amount received from the currency option hedge?a. $219,000.b. $222,000.c. $216,000.d. $213,000.ANS: CSOLUTION: ($.73 - $.01) ⨯ 300,000 = $216,000.PTS: 133. FAB Corporation will need 200,000 Canadian dollars (C$) in 90 days to cover a payable position.Currently, a 90-day call option with an exercise price of $.75 and a premium of $.01 is available. Also,a 90-day put option with an exercise price of $.73 and a premium of $.01 is available. FAB plans topurchase options to hedge its payable position. Assuming that the spot rate in 90 days is $.71, what is the net amount paid, assuming FAB wishes to minimize its cost?a. $144,000.b. $148,000.c. $152,000.d. $150,000.ANS: ASOLUTION: ($.71 + $.01) 200,000 = $144,000. Note: the call option is not exercisedsince the spot rate is less than the exercise price.PTS: 134. You are the treasurer of Arizona Corporation and must decide how to hedge (if at all) futurereceivables of 350,000 Australian dollars (A$) 180 days from now. Put options are available for a premium of $.02 per unit and an exercise price of $.50 per Australian dollar. The forecasted spot rate of the Australian dollar in 180 days is:Future Spot Rate Probability$.46 20%$.48 30%$.52 50%The 90-day forward rate of the Australian dollar is $.50.What is the probability that the put option will be exercised (assuming Arizona purchased it)?a. 0%.b. 80%.c. 50%.d. none of the aboveANS: CSOLUTION: Arizona will exercise when the exercise price is greater than the future spot(20% + 30% = 50%).PTS: 135. If interest rate parity exists, and transaction costs do not exist, the money market hedge will yield thesame result as the ____ hedge.a. put optionb. forwardc. call optiond. none of the aboveANS: B PTS: 136. Which of the following is the least effective way of hedging exposure in the long run?a. long-term forward contract.b. currency swap.c. parallel loan.d. money market hedge.ANS: D PTS: 137. When a perfect hedge is not available to eliminate transaction exposure, the firm may considermethods to at least reduce exposure, such as ____.a. leadingb. laggingc. cross-hedgingd. currency diversificatione. all of the aboveANS: E PTS: 138. Sometimes the overall performance of an MNC may already be insulated by offsetting effects betweensubsidiaries and it may not be necessary to hedge the position of each individual subsidiary.a. Trueb. FalseANS: T PTS: 139. To hedge a ____ in a foreign currency, a firm may ____ a currency futures contract for that currency.a. receivable; purchaseb. payable; sellc. payable; purchased. none of the aboveANS: C PTS: 140. A forward contract hedge is very similar to a futures contract hedge, except that ____ contracts arecommonly used for ____ transactions.a. forward; smallb. futures; largec. forward; larged. none of the aboveANS: C PTS: 141. Celine Co. will need €500,000 in 90 days to pay for German imports. Today's 90-day forward rate ofthe euro is $1.07. There is a 40 percent chance that the spot rate of the euro in 90 days will be $1.02, and a 60 percent chance that the spot rate of the euro in 90 days will be $1.09. Based on thisinformation, the expected value of the real cost of hedging payables is $____.a. -35,000b. 25,000c. -1,000d. 1,000ANS: DSOLUTION: E[RCH p] = -$35,000 ⨯ 0.40 + $25,000 ⨯ 0.60 = $1,000PTS: 142. In a forward hedge, if the forward rate is an accurate predictor of the future spot rate, the real cost ofhedging payables will be:a. highly positive.b. highly negative.c. zero.d. none of the aboveANS: C PTS: 143. If an MNC is hedging various currencies, it should measure the real cost of hedging in each currencyas a dollar amount for comparison purposes.a. Trueb. FalseANS: F PTS: 144. Samson Inc. needs €1,000,000 in 30 days. Samson can earn 5 percent annualized on a German security.The current spot rate for the euro is $1.00. Samson can borrow funds in the U.S. at an annualizedinterest rate of 6 percent. If Samson uses a money market hedge, how much should it borrow in the U.S.?a. $952,381.b. $995,851.c. $943,396.d. $995,025.ANS: BSOLUTION: 1,000,000/[1 + (5% ⨯ 30/360) = $995,851PTS: 145. Blake Inc. needs €1,000,000 in 30 days. It can earn 5 percent annualized on a Ge rman security. Thecurrent spot rate for the euro is $1.00. Blake can borrow funds in the U.S. at an annualized interest rate of 6 percent. If Blake uses a money market hedge to hedge the payable, what is the cost ofimplementing the hedge?a. $1,000,000.b. $1,055,602.c. $1,000,830.d. $1,045,644.ANS: CSOLUTION:1. Borrow $995,851 from a U.S. bank (€1,000,000 ⨯ $1.00 ⨯ [1 + (.05 ⨯ 30/360)]2. Convert $995,851 to €995,851, given the exchange rate of $1.00 per euro.3. Use the euros to purchase a German security that offers 0.42% interest over 30 days.4. Repay the U.S. loan in 30 days, plus interest; the amount owed is $1,000,830 (computed as$995,851 ⨯ [1 + (.06 ⨯ 30/360)]).PTS: 146. Since the results of both a money market hedge and a forward hedge are known beforehand, an MNCcan implement the one that is more feasible.a. Trueb. FalseANS: T PTS: 147. If interest rate parity exists, the forward hedge will always outperform the money market hedge.a. Trueb. FalseANS: F PTS: 148. To hedge a contingent exposure, in which an MNC's exposure is contingent on a specific eventoccurring, the appropriate hedge would be a(n) ____ hedge.a. money marketb. futuresc. forwardd. optionsANS: D PTS: 149. A ____ is not normally used for hedging long-term transaction exposure.a. long-term forward contactb. futures contractc. currency swapd. parallel loanANS: B PTS: 150. The ____ does not represent an obligation.a. long-term forward contractb. currency swapc. parallel loand. currency optionANS: D PTS: 151. Hedging the position of individual subsidiaries is generally necessary, even if the overall performanceof the MNC is already insulated by the offsetting positions between subsidiaries.a. Trueb. FalseANS: F PTS: 152. If an MNC is extremely risk-averse, it may decide to hedge even though its hedging analysis indicatesthat remaining unhedged will probably be less costly than hedging.a. Trueb. FalseANS: T PTS: 153. A money market hedge involves taking a money market position to cover a future payables orreceivables position.a. Trueb. FalseANS: T PTS: 154. To hedge a payable position with a currency option hedge, an MNC would write a call option.a. Trueb. FalseANS: F PTS: 155. MNCs generally do not need to hedge because shareholders can hedge their own risk.a. Trueb. FalseANS: F PTS: 156. Currency futures are very similar to forward contracts, except that they are standardized and are moreappropriate for firms that prefer to hedge in smaller amounts.a. Trueb. FalseANS: T PTS: 157. To hedge payables with futures, an MNC would sell futures; to hedge receivables with futures, anMNC would buy futures.a. Trueb. FalseANS: F PTS: 158. When the real cost of hedging is positive, this implies that hedging was more favorable than nothedging.a. Trueb. FalseANS: F PTS: 159. A futures hedge involves taking a money market position to cover a future payables or receivablesposition.a. Trueb. FalseANS: F PTS: 160. If interest rate parity (IRP) exists, then the money market hedge will yield the same result as theoptions hedge.a. Trueb. FalseANS: F PTS: 161. The price at which a currency put option allows the holder to sell a currency is called the settlementprice.a. Trueb. FalseANS: F PTS: 162. A put option essentially represents two swaps of currencies, one swap at the inception of the loancontract and another swap at a specified date in the future.a. Trueb. FalseANS: F PTS: 163. The hedging of a foreign currency for which no forward contract is available with a highly correlatedcurrency for which a forward contract is available is referred to as cross-hedging.a. Trueb. FalseANS: T PTS: 164. The exact cost of hedging with call options (as measured in the text) is not known with certainty at thetime that the options are purchased.a. Trueb. FalseANS: T PTS: 165. The tradeoff when considering alternative call options to hedge a currency position is that an MNC canobtain a call option with a higher exercise price, but would have to pay a higher premium.a. Trueb. FalseANS: F PTS: 166. When comparing the forward hedge to the options hedge, the MNC can easily determine which hedgeis more desirable, because the cost of each hedge can be determined with certainty.a. Trueb. FalseANS: F PTS: 167. When comparing the forward hedge to the money market hedge, the MNC can easily determine whichhedge is more desirable, because the cost of each hedge can be determined with certainty.a. Trueb. FalseANS: T PTS: 168. Assume zero transaction costs. If the 90-day forward rate of the euro underestimates the spot rate 90days from now, then the real cost of hedging payables will be:a. positive.b. negative.c. positive if the forward rate exhibits a premium, and negative if the forward rate exhibits adiscount.d. zero.ANS: B PTS: 169. Johnson Co. has 1,000,000 euros as payables due in 30 days, and is certain that euro is going toappreciate substantially over time. Assuming the firm is correct, the ideal strategy is to:a. sell euros forwardb. purchase euro currency put options.c. purchase euro currency call options.d. purchase euros forward.e. remain unhedged.ANS: D PTS: 1。

国际金融考试题及答案

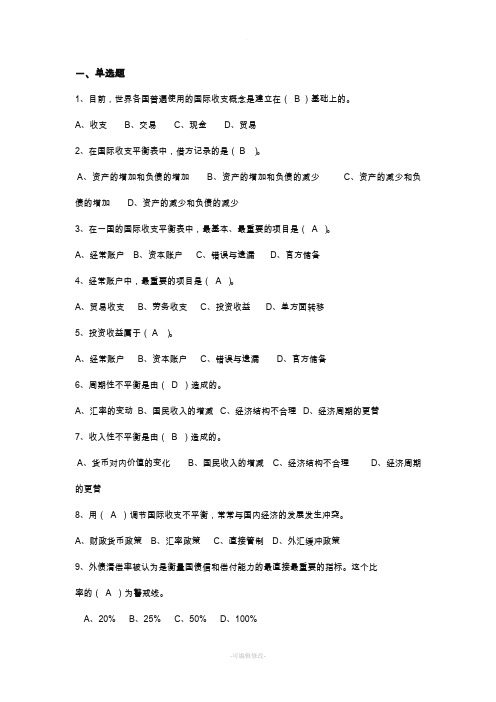

一、单选题1、目前,世界各国普遍使用的国际收支概念是建立在(B)基础上的。

A、收支B、交易C、现金D、贸易2、在国际收支平衡表中,借方记录的是(B)。

A、资产的增加和负债的增加B、资产的增加和负债的减少C、资产的减少和负债的增加D、资产的减少和负债的减少3、在一国的国际收支平衡表中,最基本、最重要的项目是(A)。

A、经常账户B、资本账户C、错误与遗漏D、官方储备4、经常账户中,最重要的项目是(A)。

A、贸易收支B、劳务收支C、投资收益D、单方面转移5、投资收益属于(A)。

A、经常账户B、资本账户C、错误与遗漏D、官方储备6、周期性不平衡是由(D)造成的。

A、汇率的变动B、国民收入的增减C、经济结构不合理D、经济周期的更替7、收入性不平衡是由(B)造成的。

A、货币对内价值的变化B、国民收入的增减C、经济结构不合理D、经济周期的更替8、用(A)调节国际收支不平衡,常常与国内经济的发展发生冲突。

A、财政货币政策B、汇率政策C、直接管制D、外汇缓冲政策9、外债清偿率被认为是衡量国债信和偿付能力的最直接最重要的指标。

这个比率的(A)为警戒线。

A、20%B、25%C、50%D、100%10、以下国际收支调节政策中(D)能起到迅速改善国际收支的作用。

A、财政政策B、货币政策C、汇率政策D、直接管制11、对于暂时性的国际收支不平衡,我们应用(B)使其恢复平衡。

A、汇率政策B、外汇缓冲政策C、货币政策D、财政政策12、我国的国际收支中,所占比重最大的是(A)A、贸易收支B、非贸易收支C、资本项目收支D、无偿转让13、目前,世界各国的国际储备中,最重要的组成部分是(B)。

A、黄金储备B、外汇储备C、特别提款权D、在国际货币基金组织(IMF)的储备头寸14、在金币本位制度下,汇率决定的基础是(A)A、铸币平价B、黄金输送点C、法定平价D、外汇平准基金15、仅限于会员国政府之间和IMF与会员国之间使用的储备资产是(C)。

完整word版托马斯国际金融课后习题答案解析word文档良心出品

完美WORD 格式 专业整理知识分享Suggested an swers to questio ns and p roblems(in the textbook)Chap ter 2Disagree, at least as a general statement. One meaning of a current account surplus is that the country is exporting more goods and services than it isbe con sidered good the extra imp orts allow the country to con sume and in vest domestically more tha n thevalue of its curre nt production. Another meaning of a current account surplus is that the country is en gaging in foreig n finan cial inv estme nt it is buildi ng up its claimson foreig ners, and this adds to n ati onal wea 1th. This sounds good, but as no ted above it comes at thecost of forego ing curre nt domestic pu rchases of goods and services ・ A curre nt acco unt deficit is thecountry running dow n its claims on foreigners or increasing its indebtedness toforeigners ・ Thissounds bad, but it comeswith the ben efit of higher levels of curre nt domestic expen diture.Differe nt coun tries at differe nt times may weigh the bala nee of these costs and ben efitsdiffere ntly, so that we cannot simply say that a curre nt acco unt surplus is better tha n a curre nt account deficit.4. Disagree ・ If the country has a surplus (a p ositive value) for its official settleme nts bala nee, the n the valuefor its official reserves bala nee must be a negative value of the sameamount (so that the two add to zero)・A negative value for this asset item means that funds are flow ing out in order for the country to acquire moreof these kinds of assets ・ Thus, the country is in creas ing its hold ings of official reserve assets ・Item e is a tran sacti on in which foreig n official hold ings of U.S. assets in crease ・ This is a po sitive(credit) item for official reserve assets and a negative (debit) item for private capital flows as the U ・S ・bank acquires pound bank depo sits ・ The debit item con tributes to a U.S. deficit in the official settleme ntsbala nee (while the credit item is recorded "below the lin e, " p ermitti ng the official settleme nts bala neeto be in deficit)・ All other transactions involve debit and credit items both of which are includedin the official settleme nts bala nee, so that they do not directly con tribute to a deficit (or surpi us)in the official settleme nts bala nee ・8. a. Mercha ndise trade bala nee: $330 - 198 二 $132Goods and services bala nee: $330 - 198 + 196 - 204 = $1242.importing.Onemightgood the count ry isCurre nt account bala nee: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settleme nts bala nee: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b・ Change in official reserve assets (net) = - official settlements balanee =-$23.The country is in creas ing its net hold ings of official reserve assets.10. 8. In ternatio nal in vestme nt p ositio n (billio ns) : $30 + 20 + 15 一40 一25 二so.The country is n either an intern ati onal creditor nor a debtor・ Its hold ing of intern ati onal assets equals its liabilities to foreig ners.b. A curre nt acco unt surplus p ermits the country to add to its net claims on foreig ners・ For this reas onthe coun try,s intern atio nal inv estme nt po siti on will becomea p ositive value・ The flow in crease in net foreig n assets results in the stock of net foreig n assets beco ming po sitive.Chap ter 32. Exports of merchandise and services result in supply of foreign currency in the foreig n exchange market・ Domestic sellers ofte n want to be p aid using domestic curre ncy, while the foreig n buyers want to pay in their curre ncy・In the p rocess of paying for these exp orts, foreig n curre ncy is excha nged for domestic curre ncy, creat ing supply of foreig n curre ncy・Intern ati onalcap ital in flows result in a supply of foreig n curre ncy in the foreig n excha nge market・ I n maki ng inv estme nts in domestic finan cial assets, foreig ninvestors often start with foreign currency and must exchange it for domestic curre ncy before they can buy the domestic assets・The excha nge creates a supply of foreig n curre ncy. Sales of foreig n finan cial assets that the country's residents had previously acquired, and borrowing from foreignersby this coun try's reside nts are other forms of cap ital in flow that can create supply of foreig n curre ncy・4. The U. S. firm obta ins a quotatio n from its bank on the spot excha nge rate for buying yen with dollars・ If therate is acce ptable, the firm in struets its bank that it wants to use dollars from its dollar check ing acco unt to buy 1 millio n yen at this spot excha nge rate・ It also in struets its bank to send the yen to the bank acco unt of the Japan ese firm. To carry out thisinstruction, the U.S. bank instructs its correspondent bank in Japan to take1 milli on yen from its acco unt at the corres pondent bank and tran sfer the yen to the bank acco unt of theJapan ese firm. (The U.S. bank could also use yen at its own branch if it has a branch in Japan.)5 The trader would seek out the best quoted spot rate for buying euros with dollars, either throughdirect con tact with traders at other banks or by using the services of a foreign exchange broker・ The trader would use the best :rate to buy euro spot. Sometime in the n ext hour or so (or, typ ically at least by the end of the day), the trader will en ter the in terba nk market aga in, to obtain the best quoted spot rate for selling euros for dollars・The traderwill use the best spot rate to sell her p reviously acquired euros・ If the spot value of the euro has rise n duri ng this short time, the trader makes a p rofit・The cross rate betwee n the yen and the krone is too high (the yen value of the krone is too high) relative to the dollar-foreig n curre ncy excha nge rates・ Thus, in a p :rofitable tria ngular3 a arbitrage, you want to sell kroner at the high cross rate・ The arbitrage will be: Use dollars to buy kroner at$0. 20/kr one, use these kroner to buy yen at 25 yen/krone, and use the yen to buy dollars at $0. 01/ye n.For each dollar that you sell in itially, you can obta in 5 kroner, these 5 kroner can obta in 125 yen, and the 125 yen can obta in $1.25. The arbitrage p :rofit for each dollar is therefore 25 cen ts.Selli ng kroner to buy yen p uts dow nward p ressure on the cross rate (the yen price of krone)・The value of the cross :rate must fall to 20 (=0.20/0.01) yen/krone to elimi nate the opportunity for tria ngular arbitrage, assu ming that the dollar excha nge rates are un cha nged・b.The in crease in supply of Swiss francs puts dow nward p ressure on the excha nge~rate value ($/SFr) of the franc・The mon etary authorities must intervene to defend the fixed exchange :rate bybuying SFr and sellingb. The in crease in supply of francs puts dow nward p ressure on the excha nge-rate value ($/SFr) of10. 8・the franc・The mon etary authorities must intervene to defend the fixed exchange rate by buying SFr and sellingdollars・c.The in crease in supply of francs puts dow nward p ressure on the excha nge^rate value($/SFr) of the franc・ The mon etary authorities must intervene to defend the fixed exchange rate by buying SFr and sellingdollars・dollars.完美WORD 格式 专业整理知识分享d. The decrease in dema nd for francs puts dow nward p ressure on the excha nge-rate value ($/SFr) ofthe franc ・ The mon etary authorities must intervene to defend the fixed exchange rate by buyingSFr and sellingChap ter 4on bonds issued by the U ・ S ・ government that mature in one year, the interestrate (or yield) on bonds issued by the British government that maturein one year, the curre nt spot excha nge rate betwee n the dollar and pound, and the year forwardexchange rate between the dollar and pound. Do these :rates result in a covered4. a The U. S. firm has an asset p ositi on in yen 一 it has a long p ositi on in yen.To hedge its exp osure to excha nge rate risk, the firm should en ter into a forward excha nge con tract nowin which the firm commits to sell yen and receive dollars at the curre nt forward rate. The con tract amountsare to 1 millio n yen and receive $9,000, both in 60 sell days ・b. The stude nt has an asset po siti on in yen 一 a long p ositi on in yen. Tohedge the exp osure to excha nge rate risk, the stude nt should en ter into a forward excha nge con tractnow in which the stude nt commits to sell yen and receive dollars at the current forward rate ・ The con tract amounts are to 10 millio n yen and receive $90,000, both in 60 sell days.c. The U. S. firm has an liability position in yen 一 a short position in y en-To hedge its exp osure to excha nge rate risk, the firm should en ter into a forward exchange con tract now in which the firm commits to sell dollars receive yen at the curre nt an jforward rate ・ The con tract amounts are to sell $900,000 and receive 100 millio n yen, both in 60 days ・6. Relative to your exp ected spot value of the euro in 90 days ($1.22/euro), the current forward rate of the euro($1・ 18/euro) is low the forward value of the euro is relatively low ・ Using the principle of "buy low, sell high," you can sp eculate by en teri ng into a forward con tract now to buy euros at $1.18/euro. If you are be ableto immediately of $0. 04 for each euro this way, then massive(in creas ing the dema nddollars.2.You will need data on four market rates: The current interest rate (or yield)curre nt curre ntinter est differential that is very close correct inyour then in 90 days you will pocketing a profit that you bought完美WORD 格式 专业整理知识分享for euros forward) will t end to drive up the forward value of the euro, to ward a curre nt forward rate of $1.22/euro. The Swiss franc is at a forward prem ium. Its curre nt forward value($0・505/SFr) is greater than its current sp ot value (SO ・500/SFr)・ The covered in terest differe ntial "i n favor of Switzerla nd" is ((1 + 0.005) (0.505) / 0. 500) 一 (1+0. 01)二 0. 005・(Note that the interest rate used must match the time p eriod of the in vestme nt.) There is a covered interest differential of 0. 5% for 30 days (6 percent at an annual rate)・ The U ・S. investor can make a higher return, covered against exchange rate risk, by inv esti ng in SFr-de nomin ated bon ds, so p resumably the inv estor should makethis covered investment ・ Although the interest :rate on SFr-denominated bondsis lower tha n the in terest rate on dollar-de nomin ated bon ds, the forward p remium on the franc is larger tha n this differe nee, so that the covered inv estme nt is a good idea ・The lack of demandfor dollar-denominated bonds (or the supply of thesebonds as in vestors sell them in order to shift into SFr-de nomin ated bon ds) puts dow nward p ressure on the p rices of U ・ S ・ bon ds up ward p ressure on U ・ S ・ in terest rates ・ The extra dema nd for the franc in the spot excha nge market (as in vestors buy SFr in order to buy SFr~de nomin ated bon ds) puts up ward p ressure on the spot excha nge rate ・ The extra dema nd for SFr~de nomin ated bonds puts up ward p ressure on the p rices of Swiss bondsdow nward p ressureon Swiss in terest rates ・ The extra supply of francs in the forward market (as U ・ S ・ i nv estors cover their SFr in vestme nts back into dollars) p uts downwardpressure on the forward exchange rate. If the only :rate that changes is the forward exchange rate, this rate must fall to about $0. 5025/SFr ・ With this forward rate and the other in itial rates, the covered in terest differe ntial is close to zero.In test ing covered in terest p arity, all of the in terest rates and excha nge :rates that are n eeded to calculatethe covered in terest differe ntial are rates that can observed in the bond and foreign exchange markets ・ Determining whether the covered in terest differe ntial is about zero (covered in terest parity) is then straightforward (although somemore subtle issues regarding tim ing of tran sact ions may also n eed to be addressed)・ I n order to test uncovered interest parity, we need to know not only three rates two interest rates and the current spot exchange rate that can be observed in the market, but also one ratethe exp ected future spot exchange rate that is notobserved in any market ・ The tester the n n eeds a way to find out about inv estors , exp ectati ons ・ One way is to ask them, using a survey, but they may not say exactly what theyreally think ・ Ano ther way is to exam ine the actual un covered in terest differe ntial after we know whatthe future spot excha nge rate actually turns out to be, and see whether the statistical characteristics ofthe actual uncovered differential are consistentwith an expected uncovered differential of about zero (uncovered interest parity).8. a. 10.Cha pter 52. a. The euro is expected to appreciate at an annual rate of approximately ((1.005 一1・000)/1.000) (360/180)100 = 1%. The exp ected un covered in terestdifferential is approximately 3%+ 1%- 4%= 0, so uncovered interest parityholds (app roximately)・If the in terest rate on 180-day dollar-de nomin ated bonds decli nes tonow p ositive, 3% + 1% - 3% 二 1%, favori ng un covered inv estme nt in euro^de nomin ated bon The in creased dema ndfor euros in the spot excha nge market tends to app reciate the euro ・ If the euroin terest rate and the exp ected future spot excha nge rate rema in un cha nged, the n the curre nt spot :ratemust cha nge immediately to be $1.005/euro, to reestablish un covered interest parity ・ Whenthe current spotrate jumps to this value, the euro^ s excha nge rate value is not exp ected to cha nge in value subseque ntlyduri ng the next 180 days ・The dollar has depreciated immediately , and the uncovered differe ntial then again is zero (3% + 0% 一 3% 二0).4. a. For uncovered interest parity to hold, investors must expect that the rateof change in the spot exchange-rate value of the yen equals the interest rate differential, which is zero. Investorsmust expect that the future spot valueis the same as the curre nt spot value, $0.01/ye n.b ・ If inv estors exp ect that the excha nge rate will be $0. 0095/ye n, the nthey expect the yen to depreciate from its initial spot value during the next 90 days ・ Give n the other rates,i nv estors tend to shift their inv estme nts toward dollar-de nomin ated inv estme nts. The extra supply ofyen (and dema ndb.3%,spot excha nge rate is likely to in crease the euro will appreciate, the dollar depreciate. At the initial current spot exchange rate, the initial expected future spot exchange rate, and the initial euro interestected un covered in terest differe ntial shifts in favor of investing rate, thein is ds.app reciate) immediately in the curre nt spot market. 6. The law of one p rice will hold better for gold ・ Gold can be traded easilyso that any price differences would lead to arbitrage that would tend to push gold p rices (stated in a com moncurre ncy by converting p rices using market excha nge rates) back close to equality. Big Macs cannot be arbitraged・ If p rice differe nces exist, there is no arbitrage p ressure, so the p rice differences can persist ・ Theprices of Big Macs(stated in a commoncurrency)vary widely around the world ・8. According to PPP, the exchange rate value of the DM(relative to the dollar) has rise n since the early1970s because Germa ny has exp erie need less inflation than has the United States -------- the productprice level has risen less in Germa ny since the early 1970s tha n it has rise n in the Un ited States.According to the monetary approach, the Germanprice level has not risen as muchbecause the Germa nmoneys upply has in creased less tha n the has in creased in the Un ited States, relative to the growth rates of real domestic production case more in flati on growth in Brita in.in the two countries. The British pound is in Britain than in the United States, and10. a. Because the growth rate °fthe domestic moneysupply (M s ) is two percentage points higher tha n it was previously, the mon etary app roach in dicates that the excha nge rate value (e) of the foreig n curre ncy willbe higher tha n it otherwise would be that is, the excha nge rate value of the coun try ,scurre ncy will be lower ・ Sp ecifically, the foreig n curre ncy will app reciate by two percentage points moreper year, or depreciate by two percentage less ・ That is, the domestic currencypoints will depreciate by two percentage more per year, or app reciate by two p erce ntage pointspoints less.b. The faster growth of the coun try's money supply eve ntually leads to afaster rate of inflation of the domestic price level (P)・ Specifically, theinflation rate will be two percentage points higher than it otherwise be. Accord ing towould relative PPP, a faster rate of in crease in the domestic level (P) leads to a higher rate of price app reciation of the foreig n curre ncy ・12. a. For the Un ited States in 1975, 20,000 = kFor P ugelovia in 1975, 10, 000 = k 100 200, or k = 0. 5.b. For the Un ited States, the qua ntity theory of money with a con sta nt kfor dollars) in the spot exchange market resuIts in a decre ase value of (thedollathe yen dollar appreciate) sometime during the next 90 days tends to cause the (the dollar to moneys■ 100 800, or k = 0. 25.means that the quantity equa tion with k 二0. 25 should hold in 2002: 65, 000二0. 25 2601, 000. It does. Because the quantity equation holds for both years with the samek, the change in the price level from 1975 to 2002 is consistent with the quantity theory of moneywith a constant k・ Similarly, for Pugelovia, the quantity equation with k 二0. 5 should hold for 2002, and it does (58, 500 =0. 5 390 300).14・ a. The tighte ning typ ically leads to an immediate in crease in the coun try'sin terest rates・ In additi on, the tighte ning p robably also results ininvestors" expecting that the exchange-rate value of the country,s currencyis likely to be higher in the future・ The higher expected exchange-rate value for the currency is based on the expectation that the country,s price level will be lower in the future, and PPP in dicates that the curre ncy will the n be stro nger・ For both of these reas ons, intern ati onal inv estors will shift toward inv est ing in this coun try's bon ds. The in crease in dema nd for the coun try"s curre ncy in the spot excha nge market causes the curre ntexcha nge-rate value of the curre ncy to in crease・The curre ncy maya pp reciate a lot because thecurrent exchange rate must "overshoot" its expected future spot value・Un covered in terest p arityis reestablished with a higher in terest rate and a subseque nt exp ected dep reciati on of the curre ncy.b・If everyth ing else is rather steady, the excha nge rate (the domesticcurrency price of foreign currency) is likely to decrease quickly by a large amount・ After this jump, the excha nge rate maythe n in crease gradually toward its long-run value the value con siste nt with PPP in the long run.Chap ter 62. Weoften use the term pegged exchange rate to refer to a fixed exchange rate, because fixed ratesgen erally are not fixed forever・ An adjustable peg isan exchange rate policy in which the "fixed" exchange rate value of a currency can be cha nged from time to time, but usually it is cha nged rather seldom(for in sta nee, not mote tha n once every several years)・ A crawli ng peg isan exchange rate policy in which the "fixed" exchange rate value of a currency is cha nged ofte n(for in sta nee, weekly or mon thly), sometimes accordi ng to in dicators such as the differe nee inin flati on :rates.4. Disagree・ If a country is expected to impose exchange controls, which usuallymake it more difficult to move funds out of the country in the future,investors are likely to try to shift funds out of the country now before the con trols are imp osed. The in crease in supply of domestic curre ncy into the foreig n excha nge market (or in crease in dema nd for foreig n curre ncy) p utsdownward pressure on the exchange rate value of the country's currency the curre ncy tends to dep reciate.6. a. The market is atte mpting to dep reciate the pn ut (app reciate the dollar) toward a value of 3. 5 pnuts per dollar,which is outside of the top of the allowable band (3・06 pnuts per dollar). In order to defend the pegged exchange rate, the Pu gelovia n mon etary authorities could use official in terve ntio nto buy pnuts (in exchange for dollars)・ Buying pnuts prevents the pnut ' svalue from declining (selling dollars prevents the dollar , s value fromrisin g)・ The in terve nti on satisfies the excess p rivate dema nd for dollarsat the curre nt p egged excha nge rate・b. In order to defend the pegged exchange rate, the Pugelovian governmentcould impose excha nge con trols in which some p rivate in dividuals who want to sell pnuts and buy dollars are told that they cannot legally do this (or cannot do this without gover nment p ermissi on, and not all requests are approved by the government)・ By artificially restricting the supply of pnuts (and the dema nd for dollars), the Pu gelovia n gover nment can force the remai ning p rivate supply and dema nd to ''clear'7within the allowable band.The exchange controls attempt to stifle the excess private demandfor dollars at the curre nt p egged excha nge rate・c・In order to defend the pegged exchange rate, the Pugelovian governmentcould in crease domestic in terest rates (p erha ps by a lot)・ The higher domestic interest rates shift the incentives for international capital flows toward inv estme nts in Pu gelovia n bon ds. The in creased flow of intern ati onal finan cial cap ital into Pu gelovia in creases the dema nd for pnuts on the foreig n excha nge market・(Also, the decreased flow of intern ati onal financial capital out of Pugelovia reduces the supply of pnuts on the foreignexcha nge market・)By in creas ing the dema nd for pnuts (and decreas ing the suppl y), the Pu gelovia n gover nment can in duce the p rivate market to clear within the allowable band・ The in creased domestic in terestrates attem pt to shift the private supply and demandcurves so that there is no excess private dema nd for dollars at the curre nt p egged excha nge rate value・8. a. The gold sta ndard was a fixed rate system. The gover nment of each countryp artici pati ng in the system agreed to buy or sell gold in excha nge for itsown currency at a fixed price of gold (in terms of its own currency)・Because eachcurrency was fixed to gold, the exchange rates between currencies also ten ded to be fixed, because in dividuals could arbitrage betwee n gold and curre ncies if the curre ncy excha nge rates deviated from those imp lied by the fixed gold p rices・Britai n was central to the system, because the British economy was the leader in in dustrializatio n and world trade, and because Brita in was con sidered finan cially secure and p rude nt. Brita in was b. able and willi ng to run p ayme nts deficits that p ermitted many other coun tries to run p ayme nts surpi uses. The other coun tries used their surpi uses to build up their holdi ngs of gold reserves (and of intern ati onal reserves in the form of sterling-denominated assets). These other countries were satisfied with therate of growth of their holdings of liquid reserve assets, and most countries were able to avoid the crisis of running low on intern ati onal reserves.Duri ng the height of the gold stan dard, from about 1870 to 1914, theeconomic shocks to the system were mild・ A major shock World War I caused many coun tries to sus pend the gold sta ndard・C・Sp ecula ti on was gen erally stabiliz ing, both for the excha nge rates bet ween the currencies of countries that were adhering to the gold standard, and for the excha nge rates of coun tries that temp orarily allowed their curre ncies to float・d.10. a. The Brett on Woods system was an adjustable p egged excha nge rate system.Coun tries comm it ted to set and defe nd fixed excha nge rat es, financing temporary p ayme nts imbala nces out of their official reserve holdi ngs・ If a "fun dame ntal disequilibrium "in a coun try's intern ati onal p ayme ntsdeveloped, the country could change the value of its fixed exchange rate to a new value・b. The Un ited States was cen tral to the system・ As the Brett on Woodssystemevolved, it became esse ntially a gold-excha nge sta ndard・ The mon etaryauthorities of other countries committed to peg the exchange rate values of their curre ncies to theU. S. dollar・ The U. S・ mon etary authority committedto buy and sell gold in exchange for dollars with other countries' monetaryauthorities at a fixed dollar p rice of gold・c・To a large extent speculation was stabilizing, both for the fixed ratesfollowed by most countries, and for the exchange rate value of the Canadian dollar, which floated duri ng 1950-62・ However, the p egged excha nge rateobligations denominated in foreign currency, because it cannot print foreignmon ey.The debt crisis in 1982 was precip itated by (a) in creased cost of servici ng4.debt, because of a rise in in terest :rates in the Un ited States and other devel oped coun tries astighter mon etary p olicies were used to fight in flati on, (b) decreased export earnings in the debtor coun tries, because of decreased dema nd and lower commodity p rices as the tighter mon etary p olicies resulted in a world recessi on, and (c) an inv estor shift to curtaili ng new lending and trying to get old loa ns rep aid quickly, once it became clear that (a) and (b) would lead to some defaults・With free in ternatio nal le nding Japan lends 1, 800 (二6, 000 - 4, 200) to America, at point T・If Japan and America专业整理知识分享完美WORD格式each impose a 2 p erce nt tax on intern atio nal le nding, the total tax is 4 p erce nt. The gap WZ restores equilibrium, and the amount lent in ternatio nally decli nes to 600 (= 6, 000 -65, 400)・ The in terest rate in Japan (and the one received net of taxes by Japan s international lenders) is3 percent and the interest(and the one paid including taxes by AmeFca,s international 7 p erce nt. (The differe nee is the 4 p erce nt of taxes・)Japan collects intern ati on al-le nding tax reve nues equal to area r, but this is . .rate in America effectively p aid by Japan ese len ders who see their earnings on the 600 ofborrowers) is foreign lending that continues decline by this amount. The net effect on Japan ,s government is a loss of area n because the taxes p reve nt some p reviously p :rofitablelending from occurring・ America ' s government collects tax revenues equal to area k, but this is effectively p aid by America n borrowers who must pay a higher interest rate on their foreign borrowing・ The net effect on America is a loss of area j because of the decli ne in intern atio nal borrow ing・8. a. The in crease in the in terest :rate rotates the li ne show ing the debt service due, which is also the ben efitfrom not repaying, up ward to (1 + i ')D from(1 + i)D・ The threshold amount of debt beyond which the country , s government should defaultCapital = Wealth。

国际金融名词解释课后答案

2013.1国际金融名词解释1.Official settlements balance or Overall Balance 官方结算差额(综合账户差额或总差额)The overall balance(B) equals the sum of the current account balance(CA) plus the private capital account balance(FA).B=CA+FA.综合账户差额或总差额,也称官方结算差额,等于经常账户差额(CA)加上私人资本账户余额(FA)。

It should indicate whether the overall pattern of the country's balance of payments has achieved a sustainable equilibrium.It indicates the extent of official intervention in the foreign exchange markets.The official settlements balance also equals the negative of the official reserves balance (OR). B+OR=0.总差额旨在表明国家的国际收支总体状况是否已达到了可持续的均衡,反应了官方干预外汇市场的程度。

由于综合差额必然导致官方储备的反方向变动,所以可用来衡量国际收支对一国储备造成的压力。

2.Dirty Float or Managed Float 肮脏浮动(有管理的浮动)Governments often do not allow a clean float,but rather take actions like official intervention to manage or dirty the float.This policy approach--an exchange rate that is generally floating(or flexible)but with the government willing to intervene to attempt to influence the market rate--is called a dirty float(or a managed float). 各国政府一般不允许汇率完全自由浮动,而是采取官方干预对汇率的浮动进行管理。

托马斯国际金融课后习题答案解析