管理会计(双语)课后答案answer-chapter 19

管理会计课后练习参考答案

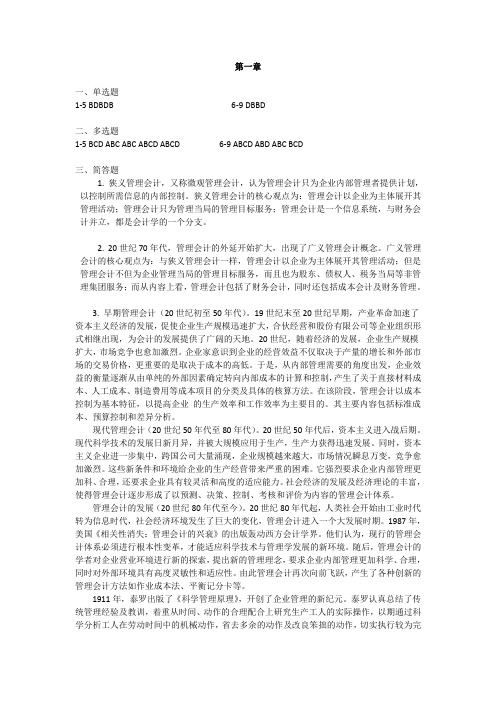

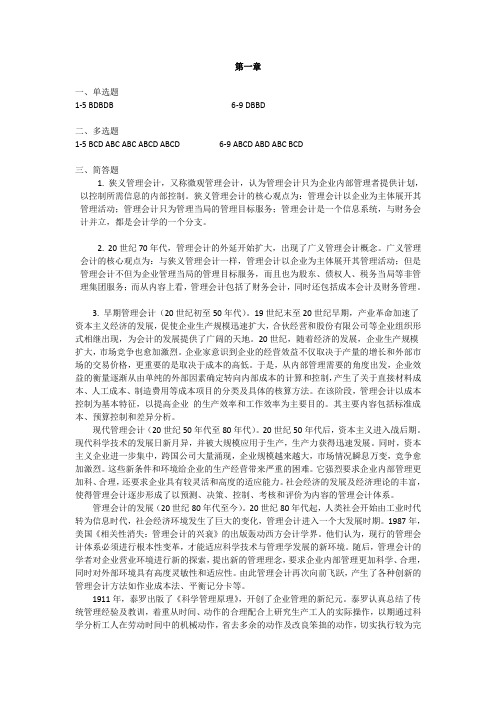

第一章一、单选题1-5 BDBDB 6-9 DBBD二、多选题1-5 BCD ABC ABC ABCD ABCD 6-9 ABCD ABD ABC BCD三、简答题1. 狭义管理会计,又称微观管理会计,认为管理会计只为企业内部管理者提供计划,以控制所需信息的内部控制。

狭义管理会计的核心观点为:管理会计以企业为主体展开其管理活动;管理会计只为管理当局的管理目标服务;管理会计是一个信息系统,与财务会计并立,都是会计学的一个分支。

2. 20世纪70年代,管理会计的外延开始扩大,出现了广义管理会计概念。

广义管理会计的核心观点为:与狭义管理会计一样,管理会计以企业为主体展开其管理活动;但是管理会计不但为企业管理当局的管理目标服务,而且也为股东、债权人、税务当局等非管理集团服务;而从内容上看,管理会计包括了财务会计,同时还包括成本会计及财务管理。

3. 早期管理会计(20世纪初至50年代)。

19世纪末至20世纪早期,产业革命加速了资本主义经济的发展,促使企业生产规模迅速扩大,合伙经营和股份有限公司等企业组织形式相继出现,为会计的发展提供了广阔的天地。

20世纪,随着经济的发展,企业生产规模扩大,市场竞争也愈加激烈。

企业家意识到企业的经营效益不仅取决于产量的增长和外部市场的交易价格,更重要的是取决于成本的高低。

于是,从内部管理需要的角度出发,企业效益的衡量逐渐从由单纯的外部因素确定转向内部成本的计算和控制,产生了关于直接材料成本、人工成本、制造费用等成本项目的分类及具体的核算方法。

在该阶段,管理会计以成本控制为基本特征,以提高企业的生产效率和工作效率为主要目的。

其主要内容包括标准成本、预算控制和差异分析。

现代管理会计(20世纪50年代至80年代)。

20世纪50年代后,资本主义进入战后期。

现代科学技术的发展日新月异,并被大规模应用于生产,生产力获得迅速发展。

同时,资本主义企业进一步集中,跨国公司大量涌现,企业规模越来越大,市场情况瞬息万变,竞争愈加激烈。

国际财务管理(英文版)第11版马杜拉答案Chapter19

国际财务管理(英文版)第11版马杜拉答案Chapter19Chapter 19International Cash Management Lecture OutlineCash Flow Analysis: Subsidiary PerspectiveSubsidiary ExpensesRevenueSubsidiarySubsidiary Dividend PaymentsSubsidiary Liquidity ManagementCentralized Cash ManagementTechniques to Optimize Cash FlowsAccelerating Cash InflowsMinimizing Currency Conversion CostsManaging Blocked FundsManaging Intersubsidiary Cash Transfers Complications in Optimizing Cash Flow CharacteristicsCompany-RelatedRestrictionsGovernmentCharacteristics of Banking SystemsInvesting Excess CashHow to Invest Excess CashCentralized Cash ManagementDetermining the Effective YieldImplications of Interest Rate ParityUse of the Forward Rate as a ForecastUse of Exchange Rate ForecastsDiversifying Cash Across CurrenciesHedgingDynamicChapter ThemeThis chapter emphasizes the decisions involved in the management of cash by an MNC. The additional opportunities and risks of cash management for an MNC versus a domestic firm should be stressed. There are actually three key components of the chapter. The first is distinguishing between subsidiary control over excess cash versus centralized control. An argument is made in favor of centralized control. The second component is optimizing cash flow. Several techniques are recommended to optimize cash flow. Finally, the decision of where to invest excess cash should be discussed with consideration of all factors that need to be incorporated for this decision.Topics to Stimulate Class Discussion1. Should international cash management be conducted at the subsidiary level or at the centralizedlevel? Elaborate.2. What is the use of netting to an MNC?3. How can a firm deal with blocked funds?4. Assume that as a treasurer of a U.S. corporation, you believe that the British pound’s forward rateis an accurate forecast of the pound’s future spot rate. What does this imply about your decision of whether to invest cash in the U.S. or in the U.K.?Critical debateShould a MNC’s subsidiaries operate their own cash management policies?Yes. Ultimately cash management means that everything is controlled from the Propositioncentre. Different countries and indeed different products have very different working capital requirements. Centralization could easily lead to poor working capital management and cash flow difficulties.No. Trade between subsidiaries accounts for about a large percentage of Opposingviewworld exports, there has to be coordination between subsidiaries, also customers can be MNC’s so coordination is also required in debt collection. Also, there are considerable exchangerate savings to be madeWith whom do you agree? Think carefully about the arguments for and against allowing subsidiaries to manage their own cash. What are the problems with each of the arguments? Is there a solution that avoids the main drawbacks?ANSWER: For is the argument that the business is more efficient when such matters are run centrally. There are many systems nowadays run centrally from road tax to supermatrket clubcards. However, against is the argument that motivation is lost by running the business from the centre. Is autonomy worth the loss of efficiency if it means a better motivated workforce. Does this answer depend on the type of business?Answers to End of Chapter Questions1. International Cash Management. Discuss the general functions involved in international cashmanagement. Explain how the MNC’s optimization of cash flow can distort the profits of each subsidiary.ANSWER: The general functions of international cash management are optimizing cash flows and investing excess cash. These functions combined will lead to efficient usage of funds.When subsidiaries adjust their cash transactions between each other to reduce taxes or financing costs, their individual performances are distorted. For example, a subsidiary that makes a late payment to another subsidiary (due to its shortage of funds) benefits in that it avoided a short-term loan by delaying payment. The recipient subsidiary was hampered due to not receiving funds earlier (since the present value of the late payment is lower).2. Netting. Explain the benefits of netting. How can a centralized cash management system bebeneficial to the MNC?ANSWER: Netting is a centralized compilation of inter-subsidiary cash flows. It is designed to reduce currency conversion costs and processing costs associated with payments between subsidiaries. By specifying a single net payment to be made instead of all individual payments owed between subsidiaries, transactions costs are reduced and cash flows may be forecasted more accurately.A centralized cash management system is beneficial in that it allows for netting, which can reducetransactions costs and improve cash budgeting. In addition, it can increase yields on short-term investments by pooling excess cash of various subsidiaries.3. Leading and Lagging. How can an MNC implement leading and lagging techniques to helpsubsidiaries in need of funds?ANSWER: A subsidiary in need of funds would receive cash inflows from another subsidiary sooner than is required. This early payment provides the necessary funds. If the subsidiary in need of funds is making payment, it may be allowed by the MNC parent or recipient subsidiary to delay on its payment.4. International Fisher Effect. If a U.S. firm believes that the international Fisher effect holds, whatare the implications regarding a strategy of continually attempting to generate high returns from investing in currencies with high interest rates?ANSWER: High interest rate currencies will typically depreciate to offset their interest rate advantage (on average) according to the IFE. Therefore, this strategy will on average provide similar returns as a domestic investment, and the strategy is not worthwhile.5. Investing Strategy. Trumpington ltd has £2 million in excess cash that it has invested in Mexicoat an annual interest rate of 60 percent. The UK interest rate is 9 percent. By how much would the Mexican peso have to depreciate to cause such a strategy to backfire?1 +9%-1 = -31.875%1 +60%ANSWER: If the peso depreciates by more than 31.875 percent, the effective yield on the Mexican deposit will be less than the domestic yield.6. Investing Strategy. Why would a UK firm consider investing short-term funds in euros evenwhen it does not have any future cash outflows in euros?ANSWER: The interest rate on the euro may be higher, or the euro may have a high probability of appreciating. Also the firm may invest in euros today to hedge a future payment in euros.7. Covered Interest Arbitrage. Granville SA has 2 million euro in cash available for 90 days. It isconsidering the use of covered interest arbitrage, since theeuro’s 90-day interest rate is higher than the euro interest rate. What will determine whether this strategy is feasible?ANSWER: If interest rate parity exists, then the forward rate of the euro contains a discount that sufficiently offsets the higher interest rate on euros. Consequently, the act of covered interest arbitrage would not be feasible.8. Effective Yield. Corlins plc has £1 million in cash available for 30 days. It can earn 1 percent on a30-day investment in the United Kingdom. Alternatively, if it converts the pounds to South African rand, it can earn 1 ? percent on a rand deposit. The spot rate of the rand is £0.09. The spot rate 30 days from now is expected to be £0.08. Should Corlins invest its cash in the United Kingdom or in South Africa? Explain your answer.ANSWER: If Corlins plc invests in a Mexican deposit, it will convert £1 million to 11,111,111R which will accumulate to 11,277,778R after one month (due to the 1 1/2% interest rate). If the spot rate of the rand is £0.08 after one month, the rand will be converted to £902,222, which is less than the amount of pounds the firm started with. Thus, the Corlins plc should invest its cash in the UK. An alternative approach is to note that the value of the rand is going to fall by (0.08 –0.09)/0.09 = -11.1% much greater than the difference in interest rates.9. Effective Yield. Rollins plc has £3 million in cash available for 180 days. It can earn 7 percent ona UK Treasury bill or 9 percent on a US Treasury bill. The US investment does require conversionof pounds to dollars. Assume that interest rate parity holds and that Rollins believes the 180-day forward rate is a reliablepredictor of the spot rate to be realized 180 days from now. Would the British investment provide an effective yield that is below, above, or equal to the yield on the U.S.investment? Explain your answer.ANSWER: If the forward rate is an accurate forecast of the future spot rate, then the return on a foreign investment without covering the currency exposure will be the same as if it was covered.The uncovered foreign investment, like the act of covered interest arbitrage, will generate a return similar to the domestic return (given that interest rate parity exists).10. Effective Yield. Repeat question 9, but this time assume that Rollins plc expects the 180-dayforward rate of the dollar to substantially overestimate the spot rate to be realized in 180 days.ANSWER: In this case, the future spot rate will be less than the forward rate. If it was equal to the forward rate, the foreign return would have been similar to the domestic return for Rollins Inc.(as explained in the answer to question 9). If the future spot rate is lower than the forward rate, the U.S. firm will receive less when converting the pounds back to dollars. Thus, the foreign return is expected to be less than the domestic return.11. Effective Yield. Repeat question 9, but this time assume that the Rollins plc expects the 180-dayforward rate of the pound to substantially underestimate the spot rate to be realized in 180 days.ANSWER: In this case, Rollins will receive more when converting the pounds back to dollars than the amount necessary to match the domestic return. Thus, the foreign returnis expected to be greater than the domestic return.12. Effective Yield. Assume that the one-year UK interest rate is 10 percent and the one-year USinterest rate is 13 percent. If a UK firm invests its funds in the US, by what percentage will the dollar have to depreciate to make its effective yield the same as the UK interest rate from the UK firm’s perspective?ANSWER:(1 + 10%) – 1 = about –2.65%(113%)+13. Investing in a Currency Portfolio. Why would a firm consider investing in a portfolio of foreigncurrencies instead of just a single foreign currency?ANSWER: A portfolio of currencies reduces the probability of the foreign investment backfiring due to depreciation in the currencies denominating the investment. If all funds are in an investment denominated in a single foreign currency, risk of that currency substantially depreciating is relatively high (compared to an entire portfolio of currencies substantially depreciating).14. Interest Rate Parity. Trellis ltd has determined that the interest rate on euros is 16 percent whilethe UK interest rate is 11 percent for one-year Treasury bills. The one-year forward rate of the euro has a discount of 7 percent. Does interest rate parity exist? Can Trellis achieve a higher effective yield by using covered interest arbitrage than by investing in UK Treasury bills? Explain.ANSWER: If interest rate parity (IRP) existed, the forward rate of the euro should have a discount reflecting the interest ratedifferential:(1 + 11%) – 1 = –4.31% (discount)=Forwarddiscount(1 + 16%)Since the euro’s actual discount exceeds that percentage, IRP does not exist. However, Dallas Company would achieve a lower effective yield if attempting covered interest arbitrage than if it invests in UK Treasury bills, because the euro’s forward discount more than offsets the interest rate differential.15. Diversified Investments. Hofstra ltd has no business outside the UK but has cash invested in sixEuropean countries, each of which uses the euro as its local currency. Are Hofstra’s short-term investments well diversified and subject to a low degree of exchange rate risk? Explain.ANSWER: The short-term investments are not well diversified, because the entire portfolio of investments is denominated in euros. If the euro weakens against the pound, the return on all short-term securities denominated in euros will decline from the perspective of the UK firm.16. Investing Strategy. Should McNeese ltd consider investing funds in Latin American countrieswhere it may expand facilities? The interest rates are high, and the proceeds from the investments could be used to help support the expansion. When would this strategy backfire?ANSWER: McNeese could benefit from investing at a high interest rate. However, this strategy could backfire if the currency weakens over time, because McNeese could have converted pounds later (at the time of expansion) at a more favourableexchange rate. The tradeoff is a higher interest rate if it invests funds now, versus a more favourable exchange rate if it invests funds later.17. Impact of a crisis. Palos SA (Spain) commonly invests some of its excess euros in foreigngovernment short-term securities in order to earn a higher short-term interest rate on its cash. Describe how the potential return and risk of this strategy may be affected by financial crisis.ANSWER: A financial crisis si likely to mean higher interest rates due to the greater risk. If the euros invested are excesss, then Palos might like to a certain extent to take the risk if it feels that the financial crisis is unwarranted. In this respect ti might use information from its local interests if there are any. Using specialist information in this way would lead to Palos earning excess returns as a reward for the information.Advanced Questions18. Investing in a Portfolio. Poppleton ltd plans to invest its excess cash in South African rand forone year. The one-year South African interest rate is 19 percent. The probability of the rand’s percentage change in value during the next year is shown below:Possible rate of change in the South African rand overthe life of theinvestmentProbability ofoccurrence-15% 20%-4 50%0 30%What is the expected value of the effective yield based onthis information? Given that the UKinterest rate for one year is 7 percent, what is the probability that a one-year investment in pesos will generate a lower effective yield than could be generated if Poppleton ltd simply invested domestically?ANSWER:Effective Yield if thisP ossible Rate of Rate of Change in theChange in Peso Probability Peso Does Occur –15% 20% (1.19) [1 + (–15%)] – 1 = 1.15% –4% 50% (1.19) [1 + (–4%)] – 1 = 14.24% 0% 30% (1.19) [1 + (0%)] – 1 = 19.00%E(r) = 20% (1.15%) + 50% (14.24%) + 30% (19.00%)= 0.23% + 7.12% + 5.70%= 13.05%There is a 20% probability that the rand’s effective yield will be less than the domestic yield.19. Effective Yield of Portfolio. Ithaca (Greece) considers placing 30 percent of its excess funds in a one-year Singapore dollar deposit and the remaining 70 percent of its funds in a one-year US dollar deposit. The Singapore one-year interest rate is 15 percent, while the US one-year interest rate is 10 percent. The possible percentage changes in the two currencies for the next year are forecasted as follows:currency Possible percentage change in the spot rate over the investmenthorizonProbability of that change in the spot rateoccurringSingapore dollar -2% 20%Singapore dollar 1 60Singapore dollar 3 20US dollar 1 50US dollar 4 40US dollar 6 10Given this information, determine the possible effective yields of the portfolio and the probability associated with each possible portfolio yield. Given a one-year euro interest rate of 8 percent, what is the probability that the portfolio’s effective yield will be lower than the yield achieved from investing in the United States? (assume that the movements on the two currencies are not correlated)ANSWER:Possible % Change Effective Yield Based on thein the Singapore Dollar% Change in the Singapore Dollar –2% (1.15) [1 + (–2%)] – 1 = 12.7%1% (1.15) [1 + (1%)] – 1 = 16.15%3% (1.15) [1 + (3%)] – 1 = 18.45%Possible % Change in Effective Yield Based on thethe US Dollar % Change in the US Dollar1% (1.13) [1 + (1%)] – 1 = 14.13%4% (1.13) [1 + (4%)] – 1 = 17.52%6% (1.13) [1 + (6%)] – 1 = 19.78%Possible JointEffective Yield Computation of Computation of EffectiveS$ C$ Joint Probability Yield of Portfolio12.7% 14.13% (20%)(50%) = 10% .3(12.7%) + .7(14.13%) =13.701%12.7 17.52 (20%)(40%) = 8% .3(12.7%) + .7(17.52%) = 16.074%12.7 19.78 (20%)(10%) = 2% .3(12.7%) + .7(19.78%) = 17.656%16.15 14.13 (60%)(50%) = 30% .3(16.15%) + .7(14.13%) =14.736%16.15 17.52 (60%)(40%) = 24% .3(16.15%) + .7(17.52%) =17.109%16.15 19.78 (60%)(10%) = 6% .3(16.15%) + .7(19.78%) =18.691%18.45 14.13 (20%)(50%) = 10% .3(18.45%) + .7(14.13%) =15.426%18.45 17.52 (20%)(40%) = 8% .3(18.45%) + .7(17.52%) =17.799%18.45 19.78 (20%)(10%) = 2% .3(18.45%) + .7(19.78%) =19.381%100%There is a 0% chance that the portfolio will generate a lower return than a euro investment (determined by the table above).。

管理会计第14版(charles 查尔斯)英文影印版课后答案

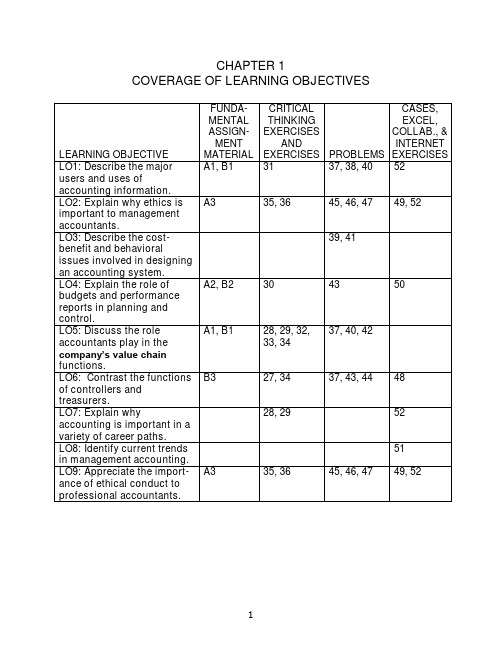

COVERAGE OF LEARNING OBJECTIVESManagerial Accounting and the Business Organization1-A1 (10-15 min.)Because the accountant's duties are often not sharply defined, some of these answers could be challenged:1. Attention directing and problem solving. Budgeting involves makingdecisions about planned activities -- hence, aiding problem solving.Budgets also direct attention to areas of opportunity or concern --hence, directing attention. Reporting against the budget also has ascorekeeping dimension.2. Problem solving. Helps a manager assess the impact of a decision.3. Scorekeeping. Reports on the results of an operation. Could also beattention direction if scrap is an area that might require management decisions.4. Attention directing. Focuses attention on areas that need attention.5. Attention directing. Helps managers learn about the informationcontained in a performance report.6. Scorekeeping. The statement merely reports what has happened.7. Problem solving. The cost comparison is apparently useful becausethe manager wishes to decide between two alternatives. Thus, it aids problem solving.8. Attention directing. Variances point out areas where results differfrom expectations. Interpreting them directs attention to possiblecauses of the differences.9. Problem solving. Aids a decision about where the parts should bemade.10. Scorekeeping. Determining a depreciation schedule is simply anexercise in preparing financial statements to report the results ofactivities.1. Budgeted Actual DeviationsAmounts Amounts or Variances Room rental $ 140 $ 140 $ 0Food 800 1,008 208UEntertainment 600 600 0Decorations 220 190 30FTotal $1,760 $1,938 $178U2. Because of the management by exception rule, room rental andentertainment require no explanation. The actual expenditure forfood exceeded the budget by $208. Of this $208, $150 is explained by attendance of 15 persons more than budgeted (at a budget of $10 per person) and $58 is explained by expenditures above $10 per person.Actual expenditures for decorations were $30 less than the budget. If all desired decorations were purchased, the decorations committee should be commended for their savings.1-A3 (10 min.)All of the situations raise possibilities for violation of the integrity standard. In addition, the manager in each situation must address an additional ethical standard:1. The General Mills manager must respect the confidentiality standard.He or she should not disclose any information about the new cereal.2. Roberto must address his level of competence for the assignment. Ifhis supervisor knows his level of expertise and wants an analysisfrom a “layperson” point of view, he should do it. However, if thesupervisor expects an expert analysis, Roberto must admit his lackof competence.3. The objectivity standard should cause Helen to decline to omit theinformation from her budget. It is relevant information, and itsomission may mislead readers of the budget.Because the accountant’s duties are often not sharply defined, some of these answers could be challenged:1. Scorekeeping. Records events.2. Scorekeeping. Simply recording of what has happened.3. Problem solving. Helps a manager decide between alternatives.4. Attention directing. Directs attention to the use of overtime labor.5. Problem solving. Provides information to managers for decidingbetween alternatives.6. Attention directing. Directs attention to why nursing costs increased.7. Attention directing. Directs attention to areas where actual resultsdiffered from the budget.8. Problem solving. Helps the vice-president to decide which course ofaction is best.9. Scorekeeping. Records costs in the department to which theybelong.10. Scorekeeping. Records actual overtime costs.11. Attention directing. Directs attention to stores with either high or lowratios of advertising expenses to sales.12. Attention directing. Directs attention to causes of returns of the drug.13. Attention directing or problem solving, depending on the use of theschedule. If it is to identify areas of high fuel usage it is attentiondirecting. If it is to plan for purchases of fuel, it is problem solving. 14. Problem solving. Provides information for deciding between twoalternative courses of action.15. Scorekeeping. Records items needed for financial statements.1 & 2. Budget Actual VarianceSales $75,000 $74,860 $ 140UCosts:Fireworks $35,000 $39,500 $4,500ULabor 15,000 13,000 2,000FOther 8,000 8,020 20UProfit $17,000 $14,340 $2,660U3. The cost of fireworks was $4,500 ÷ $35,000 = 13% over budget. Didfireworks suppliers raise their prices? Did competition cause retailprices to be lower than expected? There should be someexplanation for the extra cost of fireworks. Also, the labor cost was$2,000 ÷ $15,000 =13% below budget. It would be useful to discover why this cost was saved. Both sales and other costs were very close to budget.1-B3 (10 - 15 min.)1. Treasurer. Analysts affect the company's ability to raise capital,which is the responsibility of the treasurer.2. Controller. Advising managers aids operating decisions.3. Controller. Advice on cost analysis aids managers' operatingdecisions.4. Controller. Divisional financial statements report on operations.Financial statements are generally produced by the controller'sdepartment.5. Treasurer. Financing the business is the responsibility of thetreasurer.6. Controller. Tax returns are part of the accounting process overseenby the controller.7. Treasurer. Insurance, as with other risk management activities, isusually the responsibility of the treasurer.8. Treasurer. Allowing credit is a financial decision.1-1 Decision makers within and outside an organization use accounting information for three broad purposes:1. Internal reporting to managers for planning and controllingoperations.2. Internal reporting to managers for special decision-making and long-range planning.3. External reporting to stockholders, government, and other interestedparties.1-2 The emphasis of financial accounting has traditionally been on the historical data presented in the external reports. Management accounting emphasizes planning and control purposes.1-3 The branch of accounting described in the quotation is management accounting.1-4 Scorekeeping is the recording of data for a later evaluation of performance. Attention directing is the reporting and interpretation of information for the purpose of focusing on inefficiencies of operation or opportunities for improvement. Problem solving presents a concise analysis of alternative courses of action.1-5 GAAP applies to publicly issued annual financial reports. Internal accounting reports are not restricted by GAAP.1-6 Yes, but it covers more than that. The Foreign Corrupt Practices Act applies to all publicly-held companies and covers the quality of internal accounting control as well as bribes and other matters.1-7 Users cannot easily observe the quality of accounting information. Thus, they rely on the integrity of accountants to be sure the information is accurate. Information that is unreliable is worthless, so if accountants do not have a reputation for integrity, the information they produce will not have value.1-8 Three examples of service organizations are banks, insurance companies, and public accounting firms. Such organizations tend to be labor intensive, have outputs that are difficult to define and measure, and have both inputs and outputs that are difficult or impossible to store.1-9 Two considerations are cost-benefit balance and behavioral effects. Cost-benefit balance refers to how well an accounting system helps achieve management's goals in relation to the cost of the system. The behavioral consideration specifies that an accounting system should be judged by how it will affect the behavior (that is, decisions) of managers.1-10 Yes. The act of recording events has become as much a part of operating activities as the act of selling or buying. For example, cash receipts and disbursements must be traced, and receivables and payables must be recorded, or else gross confusion would ensue.1-11 A budget is a prediction and guide; a performance report is a tabulation of actual results compared with the budget; and a variance reconciles the differences between budget and actual.1-12 No. Management by exception means that management spends more effort on those areas that seem to be out of control and less on areas that are functioning as planned. This method is an efficient way for managers to decide where to put their time and effort.1-13 No. There is no perfect system of automatic control, nor does accounting control anything. Accounting is a tool used by managers in their control of operations.1-14 Information that is relevant for decisions about a product depends on the product's life-cycle stage. Therefore, to prepare and interpret information, accountants should be aware of the current stage of a product's life cycle.1-15 The six functions are: (1) research and development – generation and experimentation with new ideas; (2) product and service process design – detailed design and engineering of products; (3) production – use of resources to produce a product or service; (4) marketing - informing customers of the value and features of products or services; (5) distribution – delivering products or services to customers; and (6) customer service –support provided to customers.1-16 No. Not all of the functions are of equal importance to the success of a company. Measurement and reporting should focus on those functions that enable a company to gain and maintain a competitive edge.1-17 Line managers are directly responsible for the production and sale of goods or services. Staff managers have an advisory function – they support line managers.1-18 Management accountants are the information specialists, even in non-hierarchical companies. However, in such companies they are more directly involved with managers and are often parts of cross-functional teams.1- 19 A treasurer is concerned mainly with the company's financial matters, the controller with operating matters. In large organizations, there are sufficient activities associated with both financial and operating matters to justify two separate positions. In a small organization the same person might be both treasurer and controller.1-20 The four parts of the CMA examination are: (1) economics, finance, and management, (2) financial accounting and reporting, (3) management reporting, analysis, and behavioral issues, and (4) decision analysis and information systems.1-21 This is not true. About one-third of CEOs come from finance or accounting backgrounds. Accounting is excellent preparation for top management positions because accountants are often exposed to many parts of the company early in their careers.1-22 Changes in technology are affecting how accountants operate. They must be able to account for e-commerce transactions efficiently and safely, they often must integrate their accounting systems into ERP systems, and an increasing number are beginning to use XBRL to communicate information electronically.1-23 The essence of the just-in-time philosophy is the elimination of waste, accomplished by reducing the time products spend in the production process and trying to eliminate the time spent in processes that do not add value to the product.1-24 Moving tools and products that are in process from one location to another in a plant is an activity that does not add value to the product. So changing the plant layout to eliminate wasted movement and time improves production efficiency.1-25 The four major responsibilities are: (1) competence - develop knowledge; know and obey laws, regulations, and technical standards; and perform appropriate analyses, (2) confidentiality - refrain from disclosing or using confidential information, (3) integrity - avoid conflicts of interest, refuse gifts that might influence actions, recognize limitations, and avoid activities that might discredit the profession, and (4) objectivity - communicate information fairly, objectively, and completely, within confidentiality constraints.1-26 Standards do not always provide the needed guidance. Sometimes an action borders on being unethical, but it is not clearly an ethical violation. Other times two ethical standards conflict. In situations such as these, accountants must make ethical judgments.1-27 (5-10 min.)Typical activities associated with the treasurer function include:❑Provision of capital❑Investor relations❑Short-term financing❑Banking and custody❑Credits and collections❑Investments❑Risk managementTypical activities associated with the controller function include:❑Planning for control❑Reporting and interpreting❑Evaluating and consulting❑Tax administration❑Government reporting❑Protection of assets❑Economic appraisal1-28 (5-10 min.)Activities 2, 4, 5, and 6 are primarily associated with marketing decisions. The management accountant would assist in these decisions as follows: Boeing Company’s pricing decision requires cost data relevant to the new method of distributing spare parts. will need to know the costs of the advertising program as well as the additional costs of other value chain functions resulting from increased sales. TexMex Foods will need to know the incremental revenues and incremental costs associated with the special order. Target Stores needs to know the impact on both revenues and costs of closing one of its stores.Activities 1, 7, and 8 are primarily associated with production decisions. The management accountant would assist in these decisions as follows. Porsche Motor Company needs an analysis of the costs associated with purchasing the part compared to the costs of making the part. Dell will need to know the costs of the training program and the savings associated with increased efficiencies in the setup and changeover activities. General Motors needs to know the costs and salvage values of the replacement equipment, the proceeds of the sale of the old equipment, and the operating savings associated with the use of the new equipment.1-30 (5 min.)1. Management 4. Management 7. Financial2. Management 5. Management3. Financial 6. Financial1. Performance ReportBudget Actual Variance Explanation Revenues $220,000 $228,000 $8,000 F Additional salesfrom newproducts* Advertising cost 15,000 16,500 (1,500) U New advertisingCampaignNet $6,500 F* From the New Products Report, seven new products were added. This exceeded the plan to add six.2.Factors that may not have been considered include:a.The costs of new products may have exceeded their price.b.Customer satisfaction with new products may not have been partof the new products report.petitors’ reactions to the Starbucks store’s actions may nothave been anticipated.d.External uncontrollable factors such as increases in operatingcosts, adverse weather, changes in the overall economy, newcompetitors entering the market, or key employee turnover mayhave decreased efficiency.1-32 (5 min.)1. Line, support 3. Staff, marketing 5. Staff, support2. Staff, support 4. Line, marketing 6. Line, productionMicrosoft is a company that most students will know and have some understanding of what functions its managers perform. Nevertheless, this may not be an easy exercise for those who have little knowledge of how companies operate.Research & development – Because software companies must continually come out with new products and upgrades to their current products this is a critical function for Microsoft. More than one-fourth of Microsoft’s operating expenses are devoted to R&D.Design of products, services, or processes – For Microsoft the design and R&D process probably overlap considerably. Product design is critical; process design is probably not. One essential part of design is beta testing – that is, field testing of new software. This quality-control step is essential to prevent customer dissatisfaction with new products.Production – Microsoft produces disks and CD-ROMs and the manuals and packaging to go with them. However, they are increasingly delivering software over the Internet, which takes an initial process design and then few resources. It is not likely a major focus for Microsoft.Marketing – Microsoft spends more on sales and marketing than on any other operating expense. Increasing competition in software sales makes marketing essential to the company’s future. This function includes advertising and direct marketing activities, but it also includes activities of the company’s sales force. Distribution – This function is becoming simpler for Microsoft as it delivers more and more software over the Internet. Although the company must stay abreast of competitors in delivery methods, this is not likely to create a major competitive advantage or disadvantage for Microsoft.Customer service – Customer service is important, but Microsoft tries to minimize its costs in this area by product design – making things work right without needing deep computer expertise. Still, poor customer service can severely impact a company, so Microsoft must attend to it.Support functions – Most of the time these are not a major focus. There is one exception recently for Microsoft. Legal support has been front and center. The very future of the company was based on court judgments for which good legal support was essential.The management accountant's major purpose is to provide information that helps line managers in making decisions regarding the planning and controlling of operations. The accountant supplies information for scorekeeping, attention directing, and problem solving. In turn, managers use this and other information for routine and non-routine decisions and for evaluating subordinates and the performance of sub-parts of the organization. Management accountants must walk a delicate line between (1) making sure that managers are properly using the pertinent information and (2) making sure that the managers, not the accountants, are doing the actual managing.1-35(5 min.)Other costs of a poor ethical environment include legal costs and costs due to high employee turnover. Other benefits of a good ethical environment include low employee turnover, low loss from internal theft, and improved customer satisfaction resulting from better quality and service (that result from a more productive work environment).1-36(5 min.)There are numerous examples.“You understand how important it is to record this sale before year end, don’t you?”“Doing it this way is common for all companies in our business, so don’t worry!”“Trust me, the inventory is at the warehouse.”This problem can form the basis of an introductory discussion of the entire field of management accounting.1. The focus of management accounting is on helping internal users tomake better decisions, whereas the focus of financial accounting ison helping external users to make better decisions. Managementaccounting helps in making a host of decisions, including pricing,product choices, investments in equipment, making or buying goods and services, and manager rewards.2. Generally accepted accounting standards or principles affect bothinternal and external accounting. However, change in internalaccounting is not inhibited by generally accepted principles. Forexample, if an organization wants to account for assets on the basisof replacement costs for internal purposes, no outside agency canprohibit such accounting. Of course, this means that organizationsmay have to keep more than one set of records. There is nothingimmoral or unethical about having multiple sets of books, but theyareexpensive. Accounting data are commodities, just like butter or eggs.Innovations in internal accounting systems must meet the samecost-benefit tests that other commodities endure. That is, theirperceived increases in benefits must exceed their perceivedincreases in costs. Ultimately, benefits are measured by whetherbetter decisions are forthcoming in the form of increased net profitsor cost savings.3. Budgets, the formal expressions of management plans, are a majorfeature of management accounting, whereas they are not asprominent in financial accounting. Budgets are major devices forcompelling and disciplining management planning.4. An important use of management accounting information is theevaluation of performance, which often takes the form of comparisonof actual results against budgets, providing incentives and feedback to improve future decisions.5.Accounting systems have an enormous influence on the behavior ofindividuals affected by them. Management accounting is moreconcerned with the likely behavioral effects of various accountingalternatives that may be adopted than is financial accounting.1-38(10 min.)The main point of this question is that cost information is crucial for decisions regarding which products and services should be emphasized or de-emphasized. The incentives to measure costs precisely are far greater when flat fees are being received instead of reimbursements of costs.Note, too, that nonprofit organizations and profit-seeking organizations have similar desires regarding management accounting. Accountability is now in fashion for many purposes, including justification of prices, cost control, and response to criticisms by investors (whether they be donors, taxpayers, or others).When somebody's money is at stake, accounting systems get much love and attention. In a survey of 550 hospitals, hospital financial executives said that improved cost accounting systems "are crucial to responding to changes in hospital payment mechanisms and that better cost information is essential for more profitable and efficient operations." Hospitals will increasingly identify costs by product (type of case), not just by departments.1-39 (10 min.)Paperwork and systems often seem to become ends in themselves. However, the rationale that should underlie systems design is the cost-benefit philosophy or approach that is implied in the quotation. The aim is to get the managers and their subordinates collectively to make better decisions under one system versus another system -- for a given level of costs.Marks & Spencer should look at each of the management accounting reports it produces with an eye toward how it helps managers make better decisions. Does it provide needed scorekeeping? Does it direct attention to aspects of operations that might need altering? Does it provide information for specific management decisions? These types of questions will help identify the benefit of the information in the report.Then the company must consider the cost – not just the cost of collecting the data and preparing the reports, but the cost of educating managers to use the information and the cost of the time to read, digest, and act on the information. Too much information may be costly because it makes it time-consuming (and thus costly) to sift through the reams of information to find the few items that are important. And one cost may be the loss of important information because the total volume of information makes it too difficult to ferret out the important items.1-40(10 min.) Financial information is important in all companies. But how managers get and use financial information can differ depending on the culture and philosophies of the company.Top executives of a company often represent a functional area that is critical to the comparative economic advantage of the company. If technology is crucial, engineers generally hold important executive positions. If marketing differentiates the company from others, marketing executive s usually dominate. But regardless of the source of a company’s competitive advantage, its success will eventually be measured in economic terms. They must attend to financial aspects to thrive and often even to survive.Management accountants must work with the dominant managers in any organization. The modern trend toward use of cross-functional teams places management accountants at the center of the action regardless of what type of managers and executives dominate. Most companies realize that there is a financial dimension to almost every major decision, so they want the financial experts, management accountants, involved in the decisions. But to be accepted as an important part of these teams, the management accountants must know how to help managers in various functional areas. In General Mills, if accountants can’t talk the language of marketing, they will not have great influence. In ArvinMeritor, if they do not understand the information needs of engineers they will not provide value.1-41(10-15 min.)1. Boeing's competitive environment and manufacturing processeschanged greatly during the 1990s. An accounting system that served them well in their old environment would not necessarily be optimal in the 2000s. Boeing's management probably thought that changes in the accounting system were necessary to produce the kind of information necessary to remain competitive.2. A cost-benefit criterion was probably used. Boeing's management maynot have quantified the costs and the benefits, but they certainlyassessed whether the new system would help decisions enough towarrant the cost of the system.Many of the benefits of a better accounting system are hard to measure.They affect many strategic decisions of an organization. Withoutaccurate product costs, management will find it difficult to assess the consequences of their decisions. An accurate accounting system will help to price airplanes and other products competitively.3. More accurate product costs will usually result in better managementdecisions. But if the cost of the accounting system that produces the more accurate costs is too high, it may be best to forego the increased accuracy. The benefit of better decisions must exceed the added cost of the system for a change to be desirable.1-42(10 min.)1. There are many possible activities for each function of Nike's valuechain. Some possibilities are:Research and development -- Determining changes in customers'tastes and preferences for shoes and sportswear to come up withnew products (maybe the next "Air Jordans").Product and service process design -- Design a shoe to meet theincreasing demands of competitive athletes.Production -- Determine where to produce products and negotiatecontracts with the companies producing them.Marketing -- Signing prominent athletes to endorse Nike's products.Distribution -- Select the best locations for warehouses fordistribution to retail outlets.Customer service -- Formulate return policies for products thatcustomers perceive to be defective.2. Accounting information that aids managers' decisions includes:Research and development -- Trends in sales for various products, to determine which are becoming more and less popular.Product and service process design -- Production costs of variousshoe designs.Production -- Measure total costs, including both purchase cost and transportation costs, for production in various parts of the world.Marketing -- The added profits generated by the added sales due toproduct endorsements.Distribution -- Storage and shipping costs for different alternativewarehouse locations.Customer service -- The net cost of returned merchandise, to becompared with the benefits of better customer relations.。

管理会计课后练习参考答案

四、案例分析

案例一

(1)该观点是错误的。管理会计的职能与财务会计不同,它不在于对数据的核算和监督,而是着重于管理方面。具体可表述为:为决策提供客观可靠的信息;制度计划,编制预算;成本确定和成本计算;指导经营,实施控制等。小贾混淆了财务会计和管理会计的职能,核算和监督是财务会计的主要职能。

(2)该观点是错误的。根据企业会计准则的规定,企业必须按规定的特定的会计期间来编制财务报表。财务报表的编制时间可分为年、半年、季度和月份,以反映企业在特定时间的财务状况及特定期间的经营成果和现金流量。管理会计面向未来进行进行预测、决策,报告的编制不受固定期间的限制,它可以根据企业的具体情况和需要来编制各种报表。它既可以按年、季度、月份来编制,也可以按周、天来编制。

5.管理会计与财务会计的联系:(1)工作对象相同。财务会计和管理会计的工作对象都是企业的经营资金运动。(2)基本资料来源相同。管理会计根据企业内部经营管理的要求,主要利用财务会计提供的信息进行分析研究,并对它们进行加工、延伸,编制成内部报表,从而为企业管理当局提供管理会计信息。管理会计不需要另行组织一套原始数据。(3)主要指标相互渗透。财务会计提供的历史性资金、成本、利润等有关指标,是管理会计进行长、短期决策分析的重要依据。而管理会计中确定的预算、标准等数据又是财务会计进行日常核算的目标。两者的指标体系及内容基本一和管理。(4)最终目标一致。提高企业经营管理水平和经济效益都是管理会计和财务会计的最终目标。管理会计为企业内部管理当局提供与决策相关的信息,为企业提供经营管理水平及经济效益服务。

管理会计课后练习参考答案

第一章一、单选题1-5 BDBDB 6-9 DBBD二、多选题1-5 BCD ABC ABC ABCD ABCD 6-9 ABCD ABD ABC BCD;三、简答题1. 狭义管理会计,又称微观管理会计,认为管理会计只为企业内部管理者提供计划,以控制所需信息的内部控制。

狭义管理会计的核心观点为:管理会计以企业为主体展开其管理活动;管理会计只为管理当局的管理目标服务;管理会计是一个信息系统,与财务会计并立,都是会计学的一个分支。

2. 20世纪70年代,管理会计的外延开始扩大,出现了广义管理会计概念。

广义管理会计的核心观点为:与狭义管理会计一样,管理会计以企业为主体展开其管理活动;但是管理会计不但为企业管理当局的管理目标服务,而且也为股东、债权人、税务当局等非管理集团服务;而从内容上看,管理会计包括了财务会计,同时还包括成本会计及财务管理。

3. 早期管理会计(20世纪初至50年代)。

19世纪末至20世纪早期,产业革命加速了资本主义经济的发展,促使企业生产规模迅速扩大,合伙经营和股份有限公司等企业组织形式相继出现,为会计的发展提供了广阔的天地。

20世纪,随着经济的发展,企业生产规模扩大,市场竞争也愈加激烈。

企业家意识到企业的经营效益不仅取决于产量的增长和外部市场的交易价格,更重要的是取决于成本的高低。

于是,从内部管理需要的角度出发,企业效益的衡量逐渐从由单纯的外部因素确定转向内部成本的计算和控制,产生了关于直接材料成本、人工成本、制造费用等成本项目的分类及具体的核算方法。

在该阶段,管理会计以成本控制为基本特征,以提高企业的生产效率和工作效率为主要目的。

其主要内容包括标准成本、预算控制和差异分析。

现代管理会计(20世纪50年代至80年代)。

20世纪50年代后,资本主义进入战后期。

现代科学技术的发展日新月异,并被大规模应用于生产,生产力获得迅速发展。

同时,资本主义企业进一步集中,跨国公司大量涌现,企业规模越来越大,市场情况瞬息万变,竞争愈加激烈。

管理会计双语

管理会计双语Managerial Accounting Review Question⼀、True/False QuestionsFor each of the following, circle the T or the F to indicate whether the statement is true or false.1Managerial accounting refers to the preparation and use of accounting information designed to meet the needs of decision makers inside the business organization.2Product costs are selling expenses that appear on the income statement.3Management accounting reports provide a means of monitoring , evaluating and rewarding performance.4Product costs are offset against revenue in the period in which the related products are sold, rather than the period in which the costs are incurred.5Manufacturing overhead is considered an indirect cost, since overhead costs generally cannot be traced conveniently and directly to specific units of product.6Overhead application rates allow overhead to be assigned at the beginning of a period to help set prices.7Pepsi Cola would most likely use a job order costing system.8Activity-based costing tracks cost to the activities that consume resources.9Activity based costing uses multiple activity bases to assign overhead costs to units of production.10The two steps required in Activity Based Costing are 1) Identify separate activity cost pools and 2) allocate each cost pool to the product using an appropriate cost driver11The new manufacturing environment is characterized by its shift toward labor intensive production and declining manufacturing overhead costs.12A cost driver is an activity base that is highly correlated with manufacturing overhead costs.13In ABC, only one cost driver should be used in applying overhead.14As companies become more automated overhead costs decrease and direct labor costs increase.15An equivalent unit measures the percentage of a completed units cost that is present in a partially finished unit.16Costs do not flow through a process cost system in the same sequence as actual products move through the assembly process.17Non-value added activities are those that do not add to a product's desirability.18Target costing centers on new product and service development as opposed to managing the value chain for existing products.19In the target costing process, target price is computed by adding the desired profit margin to the target product cost.20Target cost equals target price plus profit margin.21Variable costs which increase in total amount in direct proportion to an increase in output represent a constant amount per unit of output.22Any business which operates at less than capacity will have larger fixed costs than variable costs.23With variable costs, the cost per unit varies with changes in volume.24The contribution margin is the difference between total revenue and fixed costs.25The volume of output which causes fixed costs to be equal in amount to variable costs is called the break-even point.26Any business which operates at less than capacity will have larger fixed costs than variable costs.27Margin of safety is the dollar amount by which actual sales volume exceeds the break-even sales volume.28Life cycle costing considers all potential resources used by the product over its entire life.29Economies of scale can be achieved by using facilities more intensively.30The break-even point is the level of activity at which operating income is equal to cost of goods sold.31Contribution margin ratio is equal to contribution margin per unit divided by unit sales price.32Opportunity cost is the benefit that could have been obtained by pursuing an alternate course of action.33All incremental revenue or incremental costs are relevant.34Sunk costs are relevant to decisions about replacing plant assets.35In determining whether to scrap or to rebuild defective units of product, the cost already incurred in producing the defective units is not relevant.36In making a decision, management will look thoroughly at both relevant and irrelevant data.373.Responsibility margin is useful in evaluating the consequences of short-run marketing strategies, while contribution margin is more useful in evaluating long-term profitability.38The transfer price is the dollar amount used in recording sales to primary customers.39Under variable costing, fixed manufacturing costs are treated as period costs, rather than product costs.40The transfer price is the dollar amount used in recording sales to primary customers.41Variable costing treats all fixed manufacturing costs as expenses of the current period.42In full costing when production rises above the amount of sales, some of the fixed costs will remain in inventory.43Return on Investment (ROI) tells us how much earnings can be expected for the average invested dollar.44Capital turnover can be improved by reducing invested capital while keeping sales constant.45The value chain consists of only those activities that increase the selling price of a product as it is distributed to a customer.46Residual income is calculated by subtracting the minimum acceptable return on the average invested capital from the operating income.⼆、Multiple Choice QuestionsChoose the best answer for each of the following questions and insert the identifying letter in the space provided.1.Costs that are traceable to a particular unit and are inventoriable are calledA) Period costs B) Product costs C) Overhead costs D) Job costs2. .Determine the amount of manufacturing overhead given the following information:a. Depreciation on a factory building $2,400b. Telephone expense in factory office750c. Telephone expense in sales showroom850d. Factory foreman’s salary5000e. Maintenance for factory` 800f. Maintenance for sales showroom 680A) $4,010 B) $9,800 C) $8,950 D) $10,54024.Goods that are still in the production process would be in which account?A) Materials inventory B) Work-in-process inventory C)Finished goods inventory D)Cost of goods sold29.The principal difference between managerial accounting and financial accounting is that managerial accounting information is:A) Prepared by managers.B) Intended primarily for use by decision makers inside the business organization.C) Prepared in accordance with a set of accounting principles developed by the Institute of CertifiedManagerial Accountants.D) Oriented toward measuring solvency rather than profitability.30.Management accounting systems are designed to assist organizations in the performance of all of the following functions except:A) The assignment of decision-making authority over company assets.B) Planning and decision-making.C) Monitoring, evaluating and rewarding performance.D) The preparation of income tax returns.35.In comparison with a financial statement prepared in conformity with generally accepted accounting principles, a managerial accounting report is less likely to:A) Focus upon the entire organization as the accounting entity. B) Focus upon future accounting periods.C) Make use of estimated amounts. D) Be tailored to the specific needs of an individual decision maker.4.If the salaries of the sales staff of a manufacturing company are improperly recorded as a product cost, what will be the likely effect on net income of the period in which the error occurs?A) Net income will be overstated. B) Net income will be understated.C) Net income will be unaffected. D) Net income will be understated only if inventory levels rise.5.Manufacturing overhead is best described as:A) All manufacturing costs other than direct materials and direct labor.B) All period costs associated with manufacturing operations.C) Indirect materials and indirect labor.D) All operating expenses other than selling expenses and general and administrative expenses.43.Underapplied overhead at the end of a month:A) Results when actual overhead costs are less than amounts applied to work in process.B) Indicates a poorly designed cost accounting system.C) Is represented by a debit balance remaining in the Manufacturing Overhead account.D) Is represented by a credit balance remaining in the Manufacturing Overhead account.58.The account Work-in-Process InventoryA) Consists of completed goods that have not yet been soldB) Consists of goods being manufactured that are incompleteC) Consists of materials to be used in the production processD) Consists of the cost of new materials used, labor but not overhead.66.Red Star Company uses a job order cost system. Overhead is applied to jobs on the basis of direct labor hours.During the current period, Job No. 288 was charged $400 in direct materials, $450 in direct labor, and $180 in manufacturing overhead. If direct labor costs an average of $15 per hour, the company's overhead application rate is:A) $9 per direct labor hour. B) $6 per direct labor hour.C) $17 per direct labor hour. D) $20 per direct labor hour.24.The best cost system to use for a company producing a continuous stream of similar items would be aA) Job order system B) Process costing system C) Production costing systemD) No cost system is required when jobs are similar64.Ken Gorman’s Company uses a job order cost system and has established a predetermined overhead application rate for the current year of 150% of direct labor cost, based on budgeted overhead of $900,000 and budgeted direct labor cost of $600,000. Job no. 1 was charged with direct materials of $30,000 and with overhead of $24,000.The total cost of job no. 1:A) Is $54,000. B) I s $70,000. C)Is $90,000. D) Cannot be determined without additional information.27.Equivalent units of production areA) A measure representing the percentage of a unit's cost that has been completed.B) May be computed separately for each input added during productionC) May be assigned to beginning work-in-process or ending work-in-processD) All of the above27.Equivalent units of production areA) A measure representing the percentage of a unit's cost that has been completed.B) May be computed separately for each input added during productionC) May be assigned to beginning work-in-process or ending work-in-processD) All of the above21.Process costing would be suitable forA) Automobile repair B) Production of television sets C) Boat building D) K itchen remodeling Use the following to answer questions 75-76:Riverview Company's budget for the coming year includes $6,000,000 for manufacturing overhead, 100,000 hours of direct labor, and 500,000 hours of machine time.75. Refer to the above data. If Riverview applies overhead using a predetermined rate based on machine-hours,what amount of overhead will be assigned to a unit of output which requires 0.5 machine hours and 0.25 labor hours to complete?A) $6.00. B) $15.00. C) $21.00. D) S ome other amount.76. Refer to the above data. If Riverview applies overhead using a predetermined rate based on labor-hours, whatamount of overhead will be assigned to a unit of output which requires 0.5 machine hours and 0.25 labor hours to complete?A) $6.00. B) $15.00. C) $21.00. D) S ome other amount.21.Process costing would be suitable forA) Automobile repair B) Production of television sets C)Boat building D)Kitchen remodeling21.Which one of the following is not one of the basic procedures related to ABC?A) Identify the activity. B) Create an associated activity cost pool.C) Transact identified cost centers. D) Calculate the cost per unit of activity.23.Examples of value-adding activities include all of the following except:A) Product design. B) Assembly activities.C) Machinery set-up activities. D) Establishing efficient distribution channels.26.Just-in-time manufacturing systems are also known as:A) Supply push systems. B)Supply pull systems. C)Demand push systems. D) Demand pull systems.28.Target costing is directed toward:A) Reducing the activity costs associated with existing products.B) Identifying the amount by which the costs of existing products must be reduce to achieve a target profitmargin.C) The creation and design of products that will provide adequate profits.D) The improvement of existing production processes by eliminating non-value adding activities.30.During which element of manufacturing cycle time is value added to products?A) Storage and waiting time. B) Processing time.C) Movement time. D) Inspection time.33.Four categories of costs associated with product quality are:A) External failure, internal failure, prevention, and carrying.B) External failure, internal failure, prevention, and appraisal.C) External failure, internal failure, training, and appraisal.D) Warranty, product liability, prevention, and training.41.During cycle time, value is added only duringA) Processing time. B) Storage and waiting time. C) Movement time. D) Inspection time.26.A semivariable cost:A) Increases and decreases directly and proportionately with changes in volume.B) Changes in response to a change in volume, but not proportionately.C) Increases if volume increases, but remains constant if volume decreases.D) Changes inversely in response to a change in volume.27.Which of the following is an example of a fixed cost for an airline?A) Depreciation on the corporate headquarters. B) Fuel costs.C) Income taxes expense. D) Passengers' meals.28.In order to calculate break-even sales units, fixed costs are divided by:A) Contribution margin per unit. B) Contribution margin percentage.C) Target operating income. D) Sales volume.29.A company's relevant range of production is:A) The production range from zero to 100% of plant capacity.B) The production range over which CVP assumptions are valid.C) The production range beyond the break-even point.D) The production range that covers fixed but not variable costs.30.The break-even point in a cost-volume-profit graph is always found:A) At 50% of full capacity.B) At the sales volume resulting in the lowest average unit cost.C) At the volume at which total revenue equals total variable costs.D) At the volume at which total revenue equals total fixed costs plus total variable costs.32.The contribution ratio is computed as:A) Sales minus variable costs, divided by sales. B) F ixed costs plus variable costs, divided by sales.C) Sales minus fixed costs, divided by sales. D) S ales divided by variable costs.33.In comparison to selling a product with a low contribution margin ratio, selling a product with a high contribution margin ratio always:A) Requires less dollar sales volume to cover a given level of fixed costs.B) Results in a greater margin of safety.C) Results in higher operating income. D) Results in a higher contribution margin per unit sold.36.How will a company's contribution margin be affected by an investment in equipment that increases fixed costs in order to achieve a reduction in direct labor cost?A) Contribution margin will increase. B) Contribution margin will fall.C) Contribution margin will either increase or decrease depending on the relative magnitudes of the changesin fixed and variable costs. D) Contribution margin will remain the same.43.If a product sells for $10, variable costs are $6 and fixed costs are $400,000 what would total sales have to be in order to break-even?A) $160,000 B) $166,667 C) $1,000,000 D) $266,66746.If unit sales prices are $10 and variable costs are $6 per unit how many units would have to be sold to break even if fixed costs equal $12,000?A) $1,200 B) $2,000 C) $3,000 D) $2,80062.A company with an operating income of $65,000 and a contribution margin ratio of 55% has a margin of safety of:A) $35,750. B) $118,182.C) $153,932. D) It is not possible to determine the margin of safety from the information provided.63.The following information is available:Sales ............................................................................................. $100,000Break-even sales ........................................................................ $40,000Contribution margin ratio ............................................................ 25%What is the operating income?A) $0. B) $75,000. C) $87,500. D) $12,500.65. A company with monthly fixed costs of $140,000 expects to earn monthly operating income of $10,000 byselling 5,000 units per month. What is the company's expected unit contribution margin?A) $30. B) $28.C) $2. D) The information given is insufficient to determine unit contribution margin.Use the following to answer questions 82-86:Empire Company produces a single product. The selling price is $50 per unit, and variable costs amount to $20 per unit. Empire's fixed costs per month total $80,000.82. Refer to the above information. What is the contribution margin ratio of Empire's product?A) 25%. B) 75%. C) 60%. D) 40%.83. Refer to the above information. What is the monthly sales volume in dollars necessary to break even? (Rounded)A) $320,000. B) $106,667. C) $200,000. D) $133,333.84. Refer to the above information. How many units must be sold each month to earn a monthly operatingincome of $25,000?A) 833. B) 2,300. C) 3,500. D) S ome other amount.85.Refer to the above information. What will be the monthly margin of safety (in dollars) if 3,000 units are sold each month?A) $16,667. B) $100,000. C) $12,000. D) $150,000.86. Refer to the above information. What will be Empire's monthly operating income if 3,500 units are sold eachmonth?A) $15,000. B) $25,000. C) $75,000. D) $105,000.24.A cost that has already been incurred and cannot be changed is called aA) Opportunity cost B) Out of Pocket cost C) Joint cost D) Sunk CostUse the following to answer questions 46-48:Tech Products, Inc. is interested in producing and selling an improved widget. Market research indicates that customers would be willing to pay $95 for such a widget and that 50,000 units could be sold each year at this price. The current cost to produce the widget is estimated to be $60.46. Refer to the information above. If Tech Products requires a 25% return on sales to undertake production, whatis the target cost for the new widget?A) $60. B) $71.25. C) $75. D) Some other amount.47. Refer to the information above. Tech has learned that a competitor plans to introduce a similar widget at a priceof $85. If Tech requires a 25% return on sales, what is the target cost for the new widget?A) $75. B) $63.75. C) $21.75. D) $25.48.Refer to the information above. At a price of $85, Tech's market research indicates that it can sell 40,000 units per year. Assuming Tech can reach its new target cost, how will Tech's profit at the $85 price compare to what it would have earned in the absence of the competitor's product?A) Profit will be $12,500 greater. B) P rofit will be $12,500 smaller.C) Profit will be unaffected if Tech can reach the revised target cost. D) None of the above.33.In comparison to selling a product with a low contribution margin ratio, selling a product with a high contribution margin ratio always:A) Requires less dollar sales volume to cover a given level of fixed costs.B) Results in a greater margin of safety.C) Results in higher operating income.D) Results in a higher contribution margin per unit sold.26.Incremental revenuesA) Always increase revenue when one course of action is selected over anotherB) Always decrease revenue when one course of action is selected over anotherC) May increase or decrease when one course of action is selected over anotherD) Cause revenues to remain steady27.By choosing to go into business for himself, Joe Green foregoes the possibility of getting a highly paid job with alarge company. This is called a (n)A) Sunk cost B) Out-of-pocket cost C) Opportunity cost D) Joint Cost29.Which of the following types of cost are always relevant to a decision?A) Sunk costs. B) Average costs. C) Incremental costs. D) Fixed costs.40.Which cost is not relevant in making financial decisions?A) Sunk costs. B) Opportunity costs. C) Incremental costs. D) All three are relevant.Use the following to answer questions 50-52:John Stag Corporation manufactures and sells 1,000 tractors each month. The primary component in each tractor is the motor. John Stag has the monthly capacity to produce 1,300 motors. The variable costs associated with manufacturing each motor are shown below:Direct materials ............................................................................ $22Direct labor (14)Variable manufacturing overhead (27)Fixed manufacturing overhead per month (for up to 1,300 units of production) averages $26,000. Mary Doe, Inc., has offered to purchase 200 motors from John Stag per month to be used in its own outboard motors.50. Refer to the information above. If Mary Doe's order is rejected, what will be John Stag's average unit cost of manufacturing each motor?A) $83. B) $63. C) $89. D) Some other amount.51. Refer to the information above. What is the incremental cost of producing each additional motor?A) $26. B) $63. C) $89. D) Some other amount.52.Refer to the information above. Assuming John Stag wants to earn a pretax profit of $10,000 on this special order, what price must it charge Mary Doe?A) $62. B) $75 C) $94. D) Some other amount.55.Korler Company currently produces all of the components for its one product an electric eraser. The unit cost of manufacturing the motor for this eraser is:Direct materials ............................................................................ $3.40Direct labor .................................................................................. 3.20Variable overhead ........................................................................ 1.40Fixed overhead ............................................................................ 1.10The company is considering the possibility of buying this motor from a subcontractor and has been quoted a price of $7.60 per unit. The relevant cost of manufacturing the motor to be considered in reaching the decision is:A) $9.10. B) $8.00. C) $6.60. D) $4.80.63.Tony Co. manufactures four products. Direct materials and direct labor are available in sufficient quantities, but machine capacity is limited to 3,000 hours. Cost and revenue data for the four products are given below:Of the four products which is the most profitable for Tony Co.?A) Product A. B) Product B. C) Product C. D) Product D.29.A responsibility accounting system measures the performance of each of the following centers except:A) Profit center B) Investment center C) Control center D) Cost center29.A responsibility accounting system measures the performance of each of the following centers except:A) Profit center B) Investment center C) Control center D) Cost center38.The primary difference between profit centers and cost centers is that:A) Profit centers generate revenue. B) Cost centers incur costs.C) Profit centers are evaluated using return on investment criteria.D) Profit centers provide services to other centers in the organization.46.Cost centers are evaluated primarily on the basis of their ability to control costs and:A) Their return on assets. B) Residual income.C) The quantity and quality of the services they provide. D) Their contribution margin ratio.50.Under a variable costing system:A) All fixed manufacturing costs are treated as period costs.B) All fixed manufacturing costs are not treated as period costs.C) All variable manufacturing costs are treated as period costs.D) All variable costs, manufacturing and selling, are treated as product costs.50.Under a variable costing system:A) All fixed manufacturing costs are treated as period costs.B) All fixed manufacturing costs are not treated as period costs.C) All variable manufacturing costs are treated as period costs.D) All variable costs, manufacturing and selling, are treated as product costs.57.Responsibility margin is equal to:A) Revenue, less contribution margin and traceable fixed costs.B) Revenue, less variable costs.C) Revenue, less variable costs and traceable fixed costs.D) Revenue, less variable fixed costs, traceable fixed costs, and common costs.73.The human resources department of a large company would beconsidered:A) A cost center. B) A profit center. C) An investment center. D) A revenue center.17. Accounting systems can generate motivation byA) Creating and setting goals B) Measuring progress towards those goalsC) Allocating rewards towards goal achievement D) All of the above17.Accounting systems can generate motivation byA) Creating and setting goals B) Measuring progress towards those goalsC) Allocating rewards towards goal achievement D) All of the above25.The value chain usually starts with the _________ and ends with the ____________.A) Supplier, customer. B)Retailer, wholesaler.C) Customer, retailer. D) Retailer, customer./doc/1061907c168884868762d67b.html cy Stores has sales of $3,280,000, cost of sales of $1,360,000, and operating expenses of $608,000. What is Lacy's return on sales?A) 58.5%. B) 41.5%. C) 60%. D) 40%.41.Calculate the residual income assuming the following information:Operating earnings. $300,000Minimum acceptable return. 15%Invested capital. 1,500,000A) $225,000. B) $100,000. C) $75,000. D) $45,000.。

管理会计课后习题答案(全)

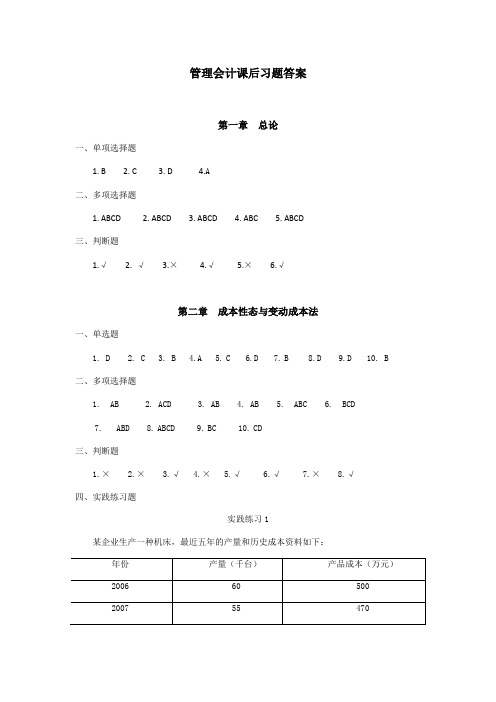

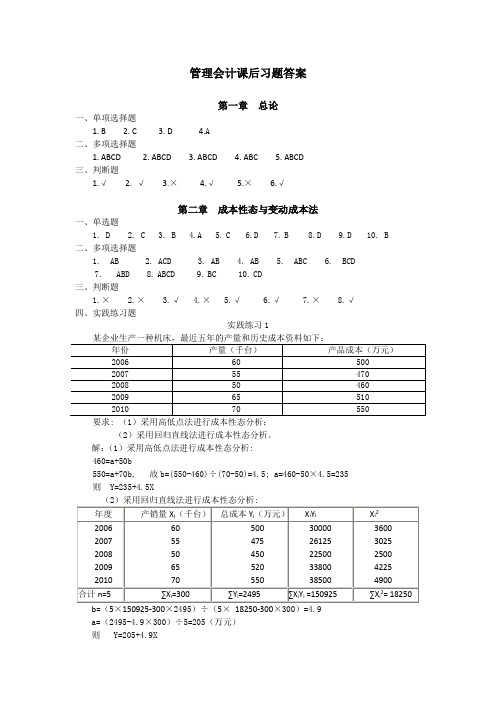

管理会计课后习题答案第一章总论一、单项选择题1. B2. C3. D4.A二、多项选择题1. ABCD2. ABCD3. ABCD4. ABC5. ABCD三、判断题1.√2. √3.×4.√5.×6.√第二章成本性态与变动成本法一、单选题1. D2. C3. B4.A5.C6.D7.B8.D9.D 10. B二、多项选择题1. AB2. ACD3. AB4. AB5. ABC6. BCD7. ABD 8.ABCD 9.BC 10.CD三、判断题1.×2.×3.√4.×5.√6.√7.×8.√四、实践练习题实践练习1某企业生产一种机床,最近五年的产量和历史成本资料如下:要求: (1)采用高低点法进行成本性态分析;(2)采用回归直线法进行成本性态分析。

解:(1)采用高低点法进行成本性态分析:460=a+50b550=a+70b, 故b=(550-460)÷(70-50)=4.5; a=460-50×4.5=235则 Y=235+4.5X(2)采用回归直线法进行成本性态分析:b=(5×150925-300×2495)÷(5×18250-300×300)=4.9a=(2495-4.9×300)÷5=205(万元)则 Y=205+4.9X实践练习2已知:某企业本期有关成本资料如下:单位直接材料成本为10元,单位直接人工成本为5元,单位变动性制造费用为7元,固定性制造费用总额为4,000元,单位变动性销售管理费用为4元,固定性销售管理费用为1,000元。

期初存货量为零,本期产量为1,000件,销量为600件,单位售价为40元。

要求:分别按变动成本法和完全成本法的有关公式计算下列指标:(1)单位产品成本;(2)期间成本;(3)销货成本;(4)营业利润。

解:变动成本法:(1)单位产品成本=10+5+7=22元(2)期间费用=4000 +(4×600+1000)=7400元(3)销货成本=22×600=13200元(4)边际贡献=40×600-(22×600+4×600)=8400元营业利润==8400-(4000+1000)=3400元完全成本法:(1)单位产品成本=22+4000/1000=26元(2)期间费用=4×600+1000=3400元(3)销货成本=26×600=15600元(4)营业利润=(40×600-15600)- 3400=5000元实践练习3已知:某厂只生产一种产品,第一、二年的产量分别为30 000件和24 000件,销售量分别为20 000件和30 000件;存货计价采用先进先出法。

管理会计期末考试试题及答案双语

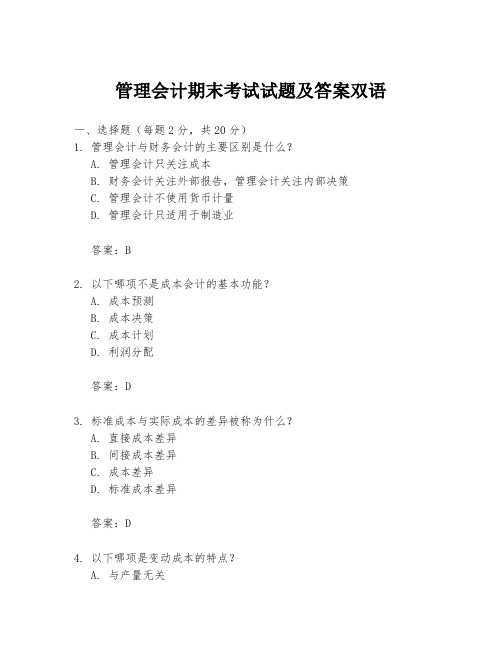

管理会计期末考试试题及答案双语一、选择题(每题2分,共20分)1. 管理会计与财务会计的主要区别是什么?A. 管理会计只关注成本B. 财务会计关注外部报告,管理会计关注内部决策C. 管理会计不使用货币计量D. 管理会计只适用于制造业答案:B2. 以下哪项不是成本会计的基本功能?A. 成本预测B. 成本决策C. 成本计划D. 利润分配答案:D3. 标准成本与实际成本的差异被称为什么?A. 直接成本差异B. 间接成本差异C. 成本差异D. 标准成本差异答案:D4. 以下哪项是变动成本的特点?A. 与产量无关B. 随产量的增加而减少C. 随产量的增加而增加D. 固定不变答案:C5. 预算管理的首要步骤是什么?A. 预算审批B. 预算编制C. 预算执行D. 预算分析答案:B...二、简答题(每题10分,共30分)1. 简述管理会计在企业决策中的作用。

答案:管理会计在企业决策中的作用主要体现在以下几个方面:首先,它通过成本分析帮助企业确定产品定价;其次,它参与企业的预算编制,为企业的经营活动提供财务规划;再次,管理会计通过成本控制帮助企业降低成本,提高效率;最后,它通过各种决策分析工具,如边际分析、本量利分析等,为企业的长期战略决策提供支持。

2. 解释什么是直接成本和间接成本,并举例说明。

答案:直接成本是指那些可以明确归属于特定产品或服务的成本,如原材料成本和直接人工成本。

例如,制造一台电脑的直接成本可能包括电脑零件和组装工人的工资。

间接成本则是指不能直接归属于特定产品或服务的成本,通常需要通过某种方法分配到各个产品上,如工厂租金、管理人员工资等。

3. 描述预算编制的一般流程。

答案:预算编制的一般流程包括以下几个步骤:首先,确定预算目标和预算范围;其次,收集和分析历史数据,预测未来趋势;然后,根据预测结果和企业目标,制定预算草案;接着,进行预算的内部沟通和协调,确保各部门的预算需求得到满足;最后,经过审批后,正式发布预算,并进行监控和调整。

管理会计课后习题答案(全)

管理会计课后习题答案第一章总论一、单项选择题1. B2. C3. D4.A二、多项选择题1. ABCD2. ABCD3. ABCD4. ABC5. ABCD三、判断题1.√2. √3.×4.√5.×6.√第二章成本性态与变动成本法一、单选题1. D2. C3. B4.A5.C6.D7.B8.D9.D 10. B二、多项选择题1. AB2. ACD3. AB4. AB5. ABC6. BCD7. ABD 8.ABCD 9.BC 10.CD三、判断题1.×2.×3.√4.×5.√6.√7.×8.√四、实践练习题实践练习1要求: (1)采用高低点法进行成本性态分析;(2)采用回归直线法进行成本性态分析。

解:(1)采用高低点法进行成本性态分析:460=a+50b550=a+70b, 故b=(550-460)÷(70-50)=4.5; a=460-50×4.5=235则 Y=235+4.5X(2)采用回归直线法进行成本性态分析:b=(5×150925-300×2495)÷(5×18250-300×300)=4.9a=(2495-4.9×300)÷5=205(万元)则 Y=205+4.9X实践练习2已知:某企业本期有关成本资料如下:单位直接材料成本为10元,单位直接人工成本为5元,单位变动性制造费用为7元,固定性制造费用总额为4,000元,单位变动性销售管理费用为4元,固定性销售管理费用为1,000元。

期初存货量为零,本期产量为1,000件,销量为600件,单位售价为40元。

要求:分别按变动成本法和完全成本法的有关公式计算下列指标:(1)单位产品成本;(2)期间成本;(3)销货成本;(4)营业利润。

解:变动成本法:(1)单位产品成本=10+5+7=22元(2)期间费用=4000 +(4×600+1000)=7400元(3)销货成本=22×600=13200元(4)边际贡献=40×600-(22×600+4×600)=8400元营业利润==8400-(4000+1000)=3400元完全成本法:(1)单位产品成本=22+4000/1000=26元(2)期间费用=4×600+1000=3400元(3)销货成本=26×600=15600元(4)营业利润=(40×600-15600)- 3400=5000元实践练习3已知:某厂只生产一种产品,第一、二年的产量分别为30 000件和24 000件,销售量分别为20 000件和30 000件;存货计价采用先进先出法。

管理会计英文版答案