杭汽轮B:2011年第一季度报告全文(英文版) 2011-04-21

杭汽轮B:2010年半年度财务报告(英文版) 2010-08-28

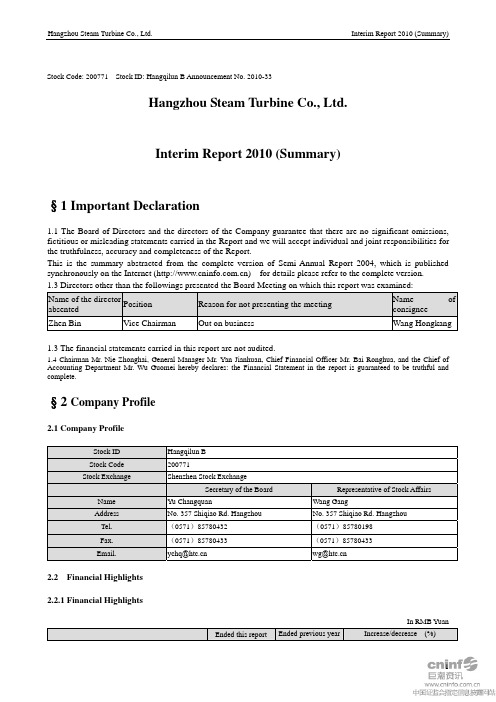

Hangzhou Steam Turbine Co., Ltd.Financial Report(Not Audited)(I) Financial StatementsBalance SheetPrepared by: Hangzhou Steam Turbine Co., Ltd. Ended June 30, 2010 in RMB YuanBalance at the end of term Balance at the beginning of year ItemsConsolidated Parent company Consolidated Parent company Current asset:Monetary capital 468,533,578.69149,989,673.29486,439,602.82 100,717,329.17 Settlement provisionOutgoing call loanTransactional financial assetsNotes receivable 569,736,165.06363,217,504.37585,510,190.21 434,620,525.22 Account receivable 1,589,408,947.691,322,963,582.451,329,433,302.65 1,115,063,042.90 Prepayment 318,739,151.06123,948,075.50219,791,399.56 78,676,643.13 Insurance receivableReinsurance receivableProvisions of Reinsurance contracts receivableInterest receivableDividend receivableOther account receivable 29,050,437.4324,249,125.6417,333,756.04 16,869,617.12 Repurchasing of financial assetsInventories 1,174,826,940.07869,692,814.011,009,100,047.12 774,155,875.55 Non-current asset due in 1 yearOther current asset 108,275.80Total of current asset 4,150,295,220.002,854,060,775.263,647,716,574.20 2,520,103,033.09 Non-current assetsLoans and payment on other’s behalf disbursedDisposable financial assetExpired investment in possessLong-term receivableLong-term share equity investment 402,586,451.62472,280,099.47402,586,451.62 472,280,099.47 Investment propertiesFixed assets 516,774,651.56336,300,049.36528,315,267.49 350,458,537.59 Construction in process 181,058,362.5739,587,413.97133,993,100.65 14,507,898.96 Engineering goods 411,981.80Fixed asset disposalProduction physical assetsGas & petrolIntangible assets 160,138,182.2346,724,159.17141,444,716.26 47,902,806.89 R&D expenseGoodwill 187,501.55Long-term amortizable expenses 9,716,028.937,438,801.138,092,318.74 7,438,801.13 Differed income tax asset 52,709,215.1939,114,576.9648,623,815.34 39,114,576.96 Other non-current assetTotal of non-current assets 1,323,582,375.45941,445,100.061,263,055,670.10 931,702,721.00 Total of assets 5,473,877,595.453,795,505,875.324,910,772,244.30 3,451,805,754.09 Current liabilitiesShort-term loans 195,000,000.00136,000,000.00Loan from Central BankDeposit received and hold for othersCall loan receivedTrade off financial liabilitiesNotes payable 70,004,809.9247,141,782.92103,656,815.22 155,170,592.22Account payable 536,270,437.77387,235,375.67320,766,161.48 202,453,257.90 Prepayment received 1,387,427,722.19961,417,044.871,233,884,154.03 872,137,702.04 Selling of repurchased financial assetsFees and commissions receivableEmployees’ wage payable 35,749,491.6923,286,688.3923,241,197.54 14,713,270.72 Tax payable 76,686,730.3966,942,907.1589,484,573.70 62,319,098.96 Interest payable 195,250.00Dividend payableOther account payable 88,031,611.0031,969,193.3924,231,372.13 14,582,847.36 Reinsurance fee payableInsurance contract provisionEntrusted trading of securitiesEntrusted selling of securitiesNon-current liability due in 1 yearOther current liabilityTotal of current liability 2,389,170,802.961,517,992,992.391,931,459,524.10 1,321,376,769.20 Non-current liabilitiesLong-term borrowings 260,463,800.00190,463,800.00247,463,800.00 190,463,800.00 Bond payableLong-term payable 330,000.00330,000.00Special payableContingent liabilitiesDiffered income tax liability 1,225,366.391,225,366.391,225,366.39 1,225,366.39 Other non-recurring liabilities 8,004,440.006,362,250.003,322,740.00 1,942,250.00 Total of non-current liabilities 270,023,606.39198,051,416.39252,341,906.39 193,631,416.39 Total of liability 2,659,194,409.351,716,044,408.782,183,801,430.49 1,515,008,185.59 Owners’ equity (or shareholders’ equity)Capital paid in (or share capital) 483,340,000.00483,340,000.00371,800,000.00 371,800,000.00 Capital reserves 138,953,250.09138,953,250.09138,953,250.09 138,953,250.09 Less: Shares in stockSpecial reservesSurplus reserves 327,932,742.87309,176,337.74327,932,742.87 309,176,337.74 Common risk provisionRetained profit 1,492,988,294.961,147,991,878.711,497,423,473.50 1,116,867,980.67 Different of foreign currency translationTotal of owner’s equity belong to the parent company 2,443,214,287.922,079,461,466.542,336,109,466.46 1,936,797,568.50 Minor shareholders’ equity 371,468,898.18390,861,347.35Total of owners’ equity 2,814,683,186.102,079,461,466.542,726,970,813.81 1,936,797,568.50 Total of liabilities and owners’ equity 5,473,877,595.453,795,505,875.324,910,772,244.30 3,451,805,754.09Income StatementPrepared by: Hangzhou Steam Turbine Co., Ltd. Jan - Jun 2010 in RMB YuanAmount of the Current Term Amount of the Previous Term ItemsConsolidated Parent company Consolidated Parent company I. Total revenue 1,840,515,550.971,315,034,718.531,646,527,768.37 1,073,162,456.36 Incl. Business income 1,840,515,550.971,315,034,718.531,646,527,768.37 1,073,162,456.36 Interest incomeInsurance fee earnedFee and commission receivedII. Total business cost 1,477,083,633.931,086,383,790.371,338,614,316.66 897,083,253.50 Incl. Business cost 1,180,414,236.98882,879,318.321,012,507,507.68 647,775,737.01 Interest expenseFee and commission paidInsurance discharge paymentNet claim amount paidNet insurance policy reserves providedInsurance policy dividend paidReinsurance expensesBusiness tax and surcharge 5,129,818.231,947,356.385,160,353.50 1,470,364.64 Sales expense 54,567,107.0535,616,211.6445,458,660.63 31,560,637.45 Administrative expense 177,912,362.66122,113,732.45249,922,132.65 201,008,922.60 Financial expenses 9,719,615.004,603,057.83-6,368,268.96 -8,223,147.20 Asset impairment loss 49,340,494.0139,224,113.7531,933,931.16 23,490,739.00 Plus: Gains from change of fair value (“-“ for loss)Investment gain (“-“ for loss) 1,100,735.7798,297,793.2729,898,083.98 74,878,300.00 Incl. Investment gains from affiliatesGains from currency exchange (“-“ for loss)III. Operational profit (“-“ for loss) 364,532,652.81326,948,721.43337,811,535.69 250,957,502.86 Plus: Non business income 2,207,680.04891,907.713,489,025.96 274,985.76 Less: Non-business expenses 5,058,255.042,382,712.612,868,349.38 1,673,162.45 Incl. Loss from disposal of non-current assetsIV. Gross profit (“-“ for loss) 361,682,077.81325,457,916.53338,432,212.27 249,559,326.17 Less: Income tax expenses 55,770,552.8534,074,018.4950,301,587.28 26,202,153.93 V. Net profit (“-“for net loss) 305,911,524.96291,383,898.04288,130,624.99 223,357,172.24 Net profit attributable to the owners of parent company255,824,821.46291,383,898.04238,780,981.80 223,357,172.24 Minor shareholders’ equity 50,086,703.5049,349,643.19VI. Earnings per share:(I) Basic earnings per share 0.52930.6422(II) Diluted earnings per share 0.52930.6422VII. Other misc. incomesVIII. Total of misc. incomes 305,911,524.96291,383,898.04288,130,624.99 223,357,172.24Total of misc. incomes attributable to the owners of the255,824,821.46291,383,898.04238,780,981.80 223,357,172.24 parent companyTotal misc gains attributable to the minor shareholders50,086,703.5049,349,643.19Cash Flow StatementPrepared by: Hangzhou Steam Turbine Co., Ltd. Jan - Jun 2010 in RMB YuanAmount of the Current Term Amount of the Previous TermItemsConsolidated Parent company Consolidated Parent companyI. Net cash flow from business operationCash received from sales of products and providing of1,762,387,472.251,107,857,783.611,406,430,485.49 938,720,443.94servicesNet increase of customer deposits and capital kept forbrother companyNet increase of loans from central bankNet increase of inter-bank loans from other financialbodiesCash received against original insurance contractNet cash received from reinsurance businessNet increase of client deposit and investmentNet increase of trade financial asset disposalCash received as interest, processing fee, andcommissionNet increase of inter-bank fund receivedNet increase of repurchasing businessTax returned 1,069,300.0015,999,725.87 14,407,182.93Other cash received from business operation 28,631,978.565,500,330.1420,064,437.32 2,191,871.00Sub-total of cash inflow from business activities 1,792,088,750.811,113,358,113.751,442,494,648.68 955,319,497.87 Cash paid for purchasing of merchandise and services1,074,285,012.58665,615,592.591,042,124,631.51 839,332,022.58Net increase of client trade and advanceNet increase of savings in central bank and brothercompanyCash paid for original contract claimCash paid for interest, processing fee and commissionCash paid for policy dividend152,196,676.51 Cash paid to staffs or paid for staffs 207,469,163.90164,121,586.78191,294,908.68Taxes paid 191,337,679.45115,386,353.49160,723,076.96 100,812,561.79Other cash paid for business activities 109,021,931.6135,380,449.4658,126,016.46 20,394,180.04Sub-total of cash outflow from business activities 1,582,113,787.54980,503,982.321,452,268,633.61 1,112,735,440.92Cash flow generated by business operation, net 209,974,963.27132,854,131.43-9,773,984.93 -157,415,943.05II. Cash flow generated by investingCash received from investment retrievingCash received as investment gains 1,100,735.7798,197,057.5030,114,561.65 92,090,800.00Net cash retrieved from disposal of fixed assets,92,900.0072,950.00146,400.00 146,400.00intangible assets, and other long-term assetsNet cash received from disposal of subsidiaries orother operational unitsOther investment-related cash received 90,868.96100,735.77Sub-total of cash inflow due to investment activities1,284,504.7398,370,743.2730,260,961.65 92,237,200.00Cash paid for construction of fixed assets, intangible123,511,525.9228,680,728.1524,019,009.01 7,944,707.66assets and other long-term assets1,937,647.85Cash paid as investment 700,000.001,937,647.85 Net increase of loan against pledgeNet cash received from subsidiaries and otheroperational unitsOther cash paid for investment activitiesSub-total of cash outflow due to investment124,211,525.9228,680,728.1525,956,656.86 9,882,355.51activitiesNet cash flow generated by investment -122,927,021.1969,690,015.124,304,304.79 82,354,844.49III. Cash flow generated by financingCash received as investmentIncl. Cash received as investment from minorshareholders140,463,800.00Cash received as loans 193,000,000.00287,463,800.00 Cash received from bond placingOther financing-related cash receivedSubtotal of cash inflow from financing activities 193,000,000.00287,463,800.00 140,463,800.00Cash to repay debts 71,000,000.00105,000,000.00Cash paid as dividend, profit, or interests 226,621,543.69152,939,465.11210,780,258.38 151,503,175.10Incl. Dividend and profit paid by subsidiaries to minorshareholdersOther cash paid for financing activities 3,000,000.00Subtotal of cash outflow due to financing activities297,621,543.69152,939,465.11318,780,258.38 151,503,175.10Net cash flow generated by financing -104,621,543.69-152,939,465.11-31,316,458.38 -11,039,375.10IV. Influence of exchange rate alternation on cash and cash-332,422.52-332,337.3213,042,975.99 13,042,967.12equivalentsV. Net increase of cash and cash equivalents -17,906,024.1349,272,344.12-23,743,162.53 -73,057,506.54Plus: Balance of cash and cash equivalents at the486,439,602.82100,717,329.17450,103,030.94 158,711,304.02beginning of termVI. Balance of cash and cash equivalents at the end of term468,533,578.69149,989,673.29426,359,868.41 85,653,797.48Consolidated Statement of Change in Owners’ EquityPrepared by: Hangzhou Steam Turbine Co., Ltd. The 1st Half of 2010 in RMB YuanAmount of the Current Term Amount of Last Year Owners’Equity Attributable to the Parent Company Owners’Equity Attributable to the Parent CompanyItems Capital paidin (or sharecapital) CapitalreservesLess:Sharesin stockSpecialreservesSurplusreservesCommon riskprovisionRetainedprofitOthersMinorshareholders’equityTotal ofowners’equityCapital paidin (or sharecapital)CapitalreservesLess:Sharesin stockSpecialreservesSurplusreservesCommon riskprovisionRetainedprofitOthersMinorshareholders’equityTotal ofowners’equityI. Balance at the end of last year 371,800,000.00138,953,250.09327,932,742.871,497,423,473.50390,861,347.352,726,970,813.81371,800,000.00138,953,250.09279,205,827.201,111,352,798.36306,483,927.772,207,795,803.42Plus: Change of accounting policy Correcting of previous errors OthersII. Balance at the beginning of current year 371,800,000.00138,953,250.09327,932,742.871,497,423,473.50390,861,347.352,726,970,813.81371,800,000.00138,953,250.09279,205,827.201,111,352,798.36306,483,927.772,207,795,803.42III. Changed in the current year (“-“ for decrease) 111,540,000.00-4,435,178.54-19,392,449.1787,712,372.2948,726,915.67386,070,675.1484,377,419.58519,175,010.39(I)Netprofit 255,824,821.4650,086,703.5305,911,524.96583,517,590.81121,356,241.00704,873,831.81(II) Other misc. incomeTotal of (I) and (II) 255,824,821.4650,086,703.5305,911,524.96583,517,590.81121,356,241.00704,873,831.81(III) Investment ordecreasing of capital by owners 6,585,711.866,585,711.861. Capital inputted by owners 18,067,564.8618,067,564.862. Amount of shares paid and accounted as owners’ equity3. Others -11,481,853.0-11,481,853.0(IV) Profit allotment 111,540,000.00260,260,000.0-69,479,152.67-218,199,152.6748,726,915.67-197,446,915.67-43,564,533.28-192,284,533.281. Providing of surplus reserves 48,726,915.67-48,726,915.672. Common riskprovision3. Allotment to the 111,540,000.260,260,000.0-69,479,152.6-218,199,152.-148,720,000.-43,564,533.2-192,284,533.6owners (orshareholders)000767008 28 4. Others(V) Internaltransferring ofowners’ equity1. Capitalizing ofcapital reserves (orto capital shares)2. Capitalizing ofsurplus reserves (orto capital shares)3. Making up lossesby surplus reserves4. Others(VI) Specialreserves1. Provided thisyear2. Used this termIV. Balance at the end of this term 483,340,000.00138,953,250.09327,932,742.871,492,988,294.96371,468,898.182,814,683,186.10371,800,000.00138,953,250.09327,932,742.871,497,423,473.50390,861,347.352,726,970,813.81Change in Owners’ Equity (Parent Co.)Prepared by: Hangzhou Steam Turbine Co., Ltd. The 1st Half of 2010 in RMB YuanAmount of the Current Term Amount of Last YearItems Capital paidin (or sharecapital) CapitalreservesLess:SharesinstockSpecialreservesSurplusreservesCommonriskprovisionRetainedprofitTotal ofowners’equityCapital paidin (or sharecapital)CapitalreservesLess:SharesinstockSpecialreservesSurplusreservesCommonriskprovisionRetainedprofitTotal ofowners’ equityI. Balance at the end of last year 371,800,000.00138,953,250.09309,176,337.741,116,867,980.671,936,797,568.50371,800,000.00138,953,250.09260,449,422.07827,045,739.681,598,248,411.84Plus: Change of accounting policy Correcting of previous errorsOthersII. Balance at the beginning of current year 371,800,000.00138,953,250.09309,176,337.741,116,867,980.671,936,797,568.50371,800,000.00138,953,250.09260,449,422.07827,045,739.681,598,248,411.84III. Changed in the current year (“-“ for decrease) 111,540,000.031,123,898.04142,663,898.0448,726,915.67289,822,240.99338,549,156.667(I)Netprofit 291,383,898.04291,383,898.04487,269,156.66487,269,156.66(II)Othermisc.incomeTotal of (I) and (II) 291,383,898.04291,383,898.04487,269,156.66487,269,156.66(III) Investment or decreasing of capital by owners1. Capital inputted by owners2. Amount of shares paid and accounted as owners’equity3. Others(IV) Profit allotment 111,540,000.0-260,260,000.00-148,720,000.0048,726,915.67-197,446,915.67-148,720,000.01. Providing of surplus reserves 48,726,915.67-48,726,915.672.Commonriskprovision3. Allotment to the owners (or shareholders) 111,540,000.0-260,260,000.00-148,720,000.00-148,720,000.00-148,720,000.04. Others(V) Internal transferringof owners’ equity1. Capitalizing of capital reserves (or to capitalshares)2. Capitalizing of surplus reserves (or to capitalshares)3. Making up losses bysurplus reserves4. Others(VI)Specialreserves 1.Providedthisyear 2. Used this termIV. Balance at the end of this term 483,340,000.00138,953,250.09309,176,337.741,147,991,878.712,079,461,466.54371,800,000.00138,953,250.09309,176,337.741,116,867,980.671,936,797,568.508(II) Notes to Financial Statements (the 1st half of 2010)In RMB I. Company ProfileHangzhou Steam Turbine Co., Ltd. (the Company) was incorporated as a joint stock limited company exclusively promoted by Hangzhou Steam Turbine & Power Group Company Limited (“HSTG”) approved by the Securities Regulatory Commission of the State Council with the Document SRC [1998] No. 8 by offering domestically listed foreign currency ordinary shares (B Shares), with registration date: April 23, 1998, legal entity business license No.: QGZZ Zi No. 002150, current registered capital RMB 220,000,000. The Company has issued 80,000,000 B Shares which have been listed for trading with Shenzhen Stock Exchange commencing from April 28, 1998. On December 2, 1998, the Company became a joint stock enterprise with foreign investment through approval by the State Ministry of Foreign Trade and Economic Cooperation with the document [1998]外经贸资二函字第745号. The number of Business License was changed to 330000400001023 on May 6, 2009.On June 8th 2006, as approved at the Shareholders’ Annual Meeting 2005, the Company capitalized the common reserves upon the total capital shares of 220 million shares at December 31, 2005, namely 3 new shares to each 10 shares. After that, the total of capital shares was changed to 286 million shares, and the registered capital was changed to RMB286 million thereof. Registration alternation procedures have been accomplished on December 31, 2006.On June 15th 2006, as approved at the Shareholders’ Annual Meeting 2006, the Company capitalized the common reserves upon the total capital shares of 286 million shares at December 31, 2006, namely 3 new shares to each 10 shares (tax included). After that, the total of capital shares was changed to 371.8 million shares, and the registered capital was changed to RMB371.8 million thereof. Registration alternation procedures have been accomplished in December, 2007.On June 2, 2010, as approved at the Shareholders’ Annual Meeting 2009, the Company capitalized the common reserves upon the total capital shares of 371.8 million shares at December 31, 2009, namely 3 new shares to each 10 shares (tax included). After that, the total of capital shares was changed to 483.34 million shares, and the registered capital was changed to RMB483.34 million thereof. Among the capital shares, 307.58 million shares are non-negotiable state-owned legal person shares, and 175.76 million are current B-shares. Registration alternation procedures are in process.The scope of key business of the Company: The design and manufacturing of steam turbine, gas turbine, other rotating and to-and-fro machinery and auxiliary equipment, and spare parts and components, sales of self-manufactured products and the provision of relevant after-sales service and import & export service.II. The main accounting policies and accounting estimations adopted(I) Basis of compiling the finance reportThe Company adopts perpetual operation as the basis of financial statements.(II) Statement of compliance to the Enterprise Accounting StandardThe finance report compiled by the Company is accordance with the enterprise accounting standard taken effect in February 2006, it reflects the Company’s finance state, achievements and cash flow fairly and entirely.(III) Accounting periodThe Company uses the calendar year for its fiscal year. A fiscal year is from January 1 to December 31.(IV) Standard currency for bookkeepingThe Company uses Renminbi (RMB) as the standard currency for book keeping.(V) Accounting treatment of the entities under common control and different control as well1. Treatment of entities under common controlAssets and liabilities acquired in merger of entities are measured at book values at the date of merger. The difference between the net book value of asset and the offered price (or total of face value of shares issued) will be adjusted into capital reserves; when the capital reserves is not enough to reduce, it will be adjusted into retainedprofit.2. Treatment of entities under different controlThe difference of takeover cost over the fair value of recognizable net asset of the acquired entity is recognized as goodwill at the day of takeover; in case the takeover cost is lower than the fair value of recognizable net asset of the acquired entity, the measuring process over the recognizable asset, liabilities,contingent liabilities, and takeover cost, shall be repeated, if comes out the same result, the difference shall be recorded into current income account.(VI) Method for preparing the consolidated financial statementsThe parent company puts all of its subsidiaries under its control into the consolidated financial statements. The consolidated financial statements are prepared according to the 揈nterprise Accounting Standard No. 33 – Consolidated Financial Statements”, basing on the accounts of the parent company and the subisidiaries, and after adjusting the long-term investment equity in the subsidiary on equity basis.(VII) Recognition of cash and cash equivalentsCash equivalent refers to the investment held by the Company with short term, strong liquidity and lower risk of value fluctuation that is easy to be converted into cash of known amount.(VIII) Foreign currency trade and translation of foreign currencies1. Translation of foreign currencyForeign currency trades are translated into RMB at the rate of the day when the trades are made. Those balances of foreign currencies and monetary items in foreign currencies are accounted at the exchange rate of the balance sheet date. Exchange differences, other than special loans satisfying the conditions of capitalization, are accounted into current income account. Non-monetary items in foreign currencies and on historical cost are translated at the rate of the trade day. Non-monetary items in foreign currencies and on fair value are translated at the rate of the day when the fair value is recognized, where the differences are accounted as gain/loss from change of fair value.2. Translation of foreign currency financial statementsAsset and liability items in the balance sheet are translated at the rate of the balance sheet day; Owners’ equity, other than “retained profit”, are translated at the rate when occurred; income and expense items in the income statement are translated at the rate of the trade date. Differences raised from aforesaid translations are presented individually under the owners’ equity in the balance sheet. Items in the cash flow statement are translated at the rate when the particular item was occurred. Influence of the changing of exchange rate are presented in the cash flow statement individually.(IX) Financial instruments1. Type of finance asset and finance debtFinance assets are divided initially into four types of financial asset appointed to be measured at fair value with their changes are accounted into current gain/loss accounts(including transactional finance asset and financial asset appointed to be measured at fair value with their changes are accounted into current gain/loss accounts), transactional financial assets, debt and account receivable, finance asset saleable.Finance debts are divided initially into two types of financial debt appointed to be measured at fair value with their changes are accounted into current gain/loss accounts(including transactional finance debt and financial debt appointed to be measured at fair value with their changes are accounted into current gain/loss accounts), other finance debt.2. Basis of recognition and accounting of finance asset and finance debtWhen the Company is one part of the finance instrument contract, one finance asset or debt is recognized. When on recognizing initially finance asset or debt, it is measured by fair value, for the finance asset or debt which appointed to be measured at fair value with their changes are accounted into current gain/loss accounts, the related transaction expenses are directly accounted into current gain and loss; for other finance asset and debt, the related transaction expenses accounted into the initial recognition account.The Company future measures finance asset by fair value without deducting future possible transaction fee but with exception: (1) Due investment, debt and account receivable are measured by actual interest rate according to the amortized costs. (2) Equity instrument investment which have no quote in active market and which fair value can’tbe measured reliably, and its derived finance assets which are connected with the equity instrument and which are summarized through the equity instrument, are measured by cost.The Company conduct successive measure of finance debt according to amortized cost by actual interest rate with exception as following: (1) finance debt which appointed to be measured at fair value with their changes are accounted into current gain/loss accounts, is measured at fir value without deducting possible future transactional fee at settlement; (2) Equity instrument investment which have no quote in active market and which fair value can’t be measured reliably, and its derived finance assets which are connected with the equity instrument and which are closed off through the equity instrument, are measured by cost. (3) finance debt sponship contracts which are not appointed to be measured at fair value with their changes are accounted into current gain/loss accounts, or debt agreements at rate lower than market rate and which are not appointed to be measured at fair value with their changes are accounted into current gain/loss accounts, are measured at the higher value between the optimal estimated value payable according to current obligations and the surplus value from which the initial recognition value deduct the accumulated amortized amount according to the actual interest rate.Gain or loss from fluctuation of financial assets or liabilities are handled at the following ways, except for relating to hedge instrument. (1) Gain or loss from fluctuation of fair value of financial assets or liabilities and accounted into current gain/loss account, are accounted into gain/loss of fluctuation of fair value. Interests or cash dividend received in the period of holding these assets are recognized as investment gains. When they are disposed, the difference between the amount actually received and initially booked value is recognized as investment gains, and adjust the gain/loss from fair value fluctuation. (2) Fluctuation of fair value of sellable financial assets accounted into capital reserves; interests gained at actual interest rate are accounting into investment gains; the cash dividend received from sellable instrument investment, are accounted into investment gains when distributed; At disposal of these investment, the difference between actual amount received and book value are recognized as investment gains after deducting of accumulated change of fair value which are originally accounted into capital reserves.As soon as the contract rights of acquiring the cash flow of particular financial asset have been terminated or almost all of the risks and rewards attached to the financial asset have been transferred, recognition of the financial asset is terminated; as soon as the current liabilities attached to the financial liability have been completely or partially relieved, recognition of the financial liability or part of is terminated.3. Basis of recognition and accounting of financial asset transferringThe Company stop recognizing the finance asset which risks and remuneration of ownership are transferred to the receiver; and continue to recognize the transferred finance asset which risks and remuneration of ownership are kept, and recognize the value as one finance debt. For the finance assets which risks and remuneration of ownership are not transferred or kept, the Company recognize them as following: (1) stop recognizing the finance asset which are given up the control; (2) continue to recognize the finance asset and related finance debt according to the extend which involved into the transferred finance asset for the finance asset which are not given up control.The Company measured the surplus between the following two values for the transferred finance assets which fulfill the stop recognition requirements into current gain or loss: (1) Account value of the transferred finance asset; (2) Consideration plus the accumulated fair value changes which were accounted directed into ownership rights. For the transferred finance assets which partly fulfill the stop recognition requirements the Company amortized the stopped recognition part and the not-stopped recognition part of the account value of the whole transferred finance asset, and account the surplus between the following two values into current gain or loss: (1) Account value of the stopped recognition part; (2) consideration plus the corresponding stopped recognition part of the accumulated fair value changes which were accounted directed into ownership rights.4. Basis of recognition and accounting of fair value for the main finance asset and finance debtFor the finance asset or debt which active market exists, the Company recognize the fair value according to the quote on the active market; for the finance asset or debt which active market not exists, the Company recognized the fair value using estimation technology (including reference of the latest market prices from freewill transactions by persons familiar with conditions, reference of the current fair value of other similar finance instrument in characteristics, discounted cash flow models and Option Pricing Model); for the initially acquired or initial finance asset or finance debt, the Company recognize the fair value basis on the market trading price.5. Impairment test and impairment reserves planThe Company conduct impairment test to the finance asset other than which appointed to be measured at fair value。

深赛格B:2010年第一季度报告全文(英文版) 2010-04-29

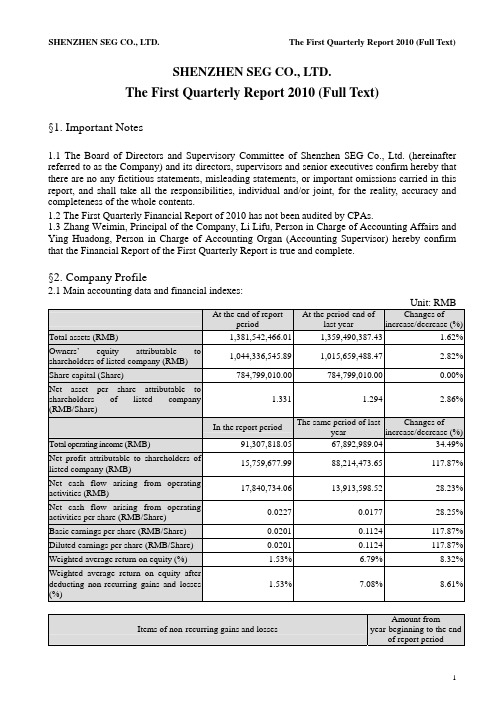

SHENZHEN SEG CO., LTD.The First Quarterly Report 2010 (Full Text)§1. Important Notes1.1 The Board of Directors and Supervisory Committee of Shenzhen SEG Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives confirm hereby that there are no any fictitious statements, misleading statements, or important omissions carried in this report, and shall take all the responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents.1.2 The First Quarterly Financial Report of 2010 has not been audited by CPAs.1.3 Zhang Weimin, Principal of the Company, Li Lifu, Person in Charge of Accounting Affairs and Ying Huadong, Person in Charge of Accounting Organ (Accounting Supervisor) hereby confirm that the Financial Report of the First Quarterly Report is true and complete.§2. Company Profile2.1 Main accounting data and financial indexes:Unit: RMBAt the end of reportperiod At the period-end oflast yearChanges ofincrease/decrease (%)Total assets (RMB) 1,381,542,466.011,359,490,387.43 1.62% Owners’ equity attributable toshareholders of listed company (RMB)1,044,336,545.891,015,659,488.47 2.82% Share capital (Share) 784,799,010.00784,799,010.00 0.00% Net asset per share attributable toshareholders of listed company(RMB/Share)1.331 1.2942.86%In the report period The same period of lastyearChanges ofincrease/decrease (%)Total operating income (RMB) 91,307,818.0567,892,989.04 34.49% Net profit attributable to shareholders oflisted company (RMB)15,759,677.99-88,214,473.65 -117.87% Net cash flow arising from operatingactivities (RMB)17,840,734.0613,913,598.52 28.23% Net cash flow arising from operatingactivities per share (RMB/Share)0.02270.0177 28.25% Basic earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Diluted earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Weighted average return on equity (%) 1.53%-6.79% 8.32% Weighted average return on equity afterdeducting non-recurring gains and losses(%)1.53%-7.08% 8.61%Items of non-recurring gains and lossesAmount from year-beginning to the end of report periodOther non-operating income and expenditure except for the aforementioned items 97,850.12 Influenced amount of income tax -21,527.03Influenced amount of minority shareholders’ equity -31,864.37Total 44,458.72 Explanations of items of significant non-recurring gains and losses1. Other non-operating income and expenditure except for the aforementioned items:mainly the damages for breach of contract received by the Company;2. Influenced amount of income tax: the influenced amount of deductible income tax increased due to the profit increase because of the aforementioned item;;3. Influenced amount of minority shareholders’ equity: this item increased due to the increase of the aforementioned No.1 item of controlling subsidiary of the Company.2.2 Total number of shareholders at the end of the report period and shares held by the top ten shareholders without restricted conditionsUnit: Share Total number of shareholdersat the end of report period59,152Particulars about the shares held by the top ten tradable shareholders without restricted conditionsFull name of shareholder Amount of tradable shares withoutrestricted conditions held at the endof report periodType of sharesSHENZHEN SEG GROUP CO., LTD. 237,359,666 RMB ordinary shares GUANGZHOU FODAK ENTERPRISEGROUP CO., LTD.18,880,334 RMB ordinary shares Yang Zhihui 12,582,734 RMB ordinary shares Taifook Securities CompanyLimited-Account Client5,758,103 Domestically listed foreign shares Gong Qianhua 5,560,967 Domestically listed foreign shares Zeng Ying 4,280,048 Domestically listed foreign shares Zhu Wei 4,066,739 RMB ordinary shares Tang Lizhu 3,796,200 RMB ordinary shares SHANGHAI QILE ECONOMIC ANDTRADE CO., LTD.2,754,330 RMB ordinary shares Cao Xianhua 2,702,000RMB ordinary shares§3. Significant Events3.1 Particulars about material changes in items of main accounting statement and financial index, and explanations of reasons√Applicable □InapplicableI. Balance sheet itemItem Mar. 31, 2010 Dec. 31, 2009 Balance Proportion ofchanges % Inventory 1,919,437.27 5,886,392.39 -3,966,955.12 -67.39% Construction in progress 9,776,526.68 26,192,075.55 -16,415,548.87 -62.67% Staff salaries payable 1,172,559.95 4,261,476.99 -3,088,917.04 -72.48% 1. Inventory: decreased by RMB 3.97 million with a fall of 67.39% over the end of last year, which was mainly because the inventories of the Company decreased in the report period.2. Construction in progress: decreased by RMB 16.42 million with a fall of 62.67% over the end of last year. Its reason was that the construction in progress of the subsidiary Changsha SEG Development Co., Ltd. (hereinafter referred to as Changsha SEG) was completed and thentransferred into fixed assets in the report period.3. Staff salaries payable: decreased by RMB 3.09 million with a fall of 72.48% over the end of last year. Its reason was that the Company paid the staff for salaries in the report period.II. Income statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Operating income 91,307,818.0567,892,989.0423,414,829.01 34.49% Operating cost 56,496,489.2231,746,485.6924,750,003.53 77.96% Operating tax and extras 3,724,614.303,012,887.52711,726.78 23.62% Sales expense 1,370,260.25906,378.64463,881.61 51.18% Losses from devaluation ofassets--1,500,000.001,500,000.00 -100.00% Investment gains -3,029,152.47-115,823,698.14112,794,545.67 -97.38% Operating profit 23,529,850.53-85,166,016.78108,695,867.31 -127.63% Non-operating income 139,079.301,620,912.10-1,481,832.80 -91.42% Non-operating expenditure 41,229.18100,985.93-59,756.75 -59.17% Total profits 23,627,700.65-83,646,090.61107,273,791.26 -128.25% Income tax expense 5,951,587.042,313,487.223,638,099.82 157.26% Net profit 17,676,113.61-85,959,577.83103,635,691.44 -120.56% Net profit attributable toowners of parent company15,759,677.99-88,214,473.65103,974,151.64 -117.87% Basic earnings per share 0.0201-0.11240.1325 -117.87% Diluted earnings per share 0.0201-0.11240.1325 -117.87% Other consolidated income 12,964,835.24-574,782.6813,539,617.92 -2355.61% Total consolidated income 30,640,948.85-86,534,360.52117,175,309.37 -135.41% Total consolidated incomeattributable to owners ofparent company28,677,057.42-88,896,727.63117,573,785.05 -132.26% 1. Operating income: increased by RMB 23.41 million with an increase of 34.49% over the same period of last year. The main reasons were i. In the report period, Changsha SEG and Changsha Hotel of Shenzhen Mellow Orange Business Hotel Management Co., Ltd. (hereinafter referred to as Mellow Orange Hotel) started operation which increased the operating income of the Company; ii. Income from Buy-it Store increased compared with the same period of last year.2. Operating cost: increased by RMB 24.75 million with an increase of 77.96% over the same period of last year. The main reason was the increase of operating income caused the increase of operating cost accordingly.3. Operating tax and extras: increased by RMB 710,000 with an increase of 23.62% over the same period of last year. The main reason was the increase of operating income caused the increase ofoperating tax and extras accordingly.4. Sales expense: increased by RMB 460,000 with an increase of 51.18% over the same period of last year. The main reason was the increase of operating income caused the increase of sales expense accordingly.5. Losses from devaluation of assets: no losses from devaluation of assets occurred in the report period, whereas that was RMB -1.5 million in the same period of last year. The main reasons was part of account receivable which had been withdrawn losses of bad debts in the same period of last year was taken back through lawsuit.6. Investment gains: increased by RMB 112.79 million over the same period of last year. The main reason was the losses of Shenzhen SEG Samsung Co., Ltd. (hereinafter referred to as SEG Samsung) in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year.7. Operating profit: increased largely over the same period of last year. The main reasons were the losses of SEG Samsung in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year causing a large decrease in investment losses.8. Non-operating income: decreased by RMB 1.48 million with a decrease of 91.42% over the same period of last year. The main reasons were the Company switched back the account payable which it did not need to pay in the same period of last year, but no such switch-back occurred in the report period.9. Total profits: increased largely over the same period of last year. The main reason was the same as that of Item 7.10. Income tax expense: increased by RMB 3.64 million with an increase of 157.26% over the same period of last year. The main reason was the profit payable of this report year went up and income tax rate of this report year in Shenzhen also grew.11. Net profit: increased largely over the same period of last year. The main reason was the same as that of Item 7.12. Net profit attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Item 7.13. Basic earnings per share: increased largely over the same period of last year. The main reasons were the same with Item 7.14. Diluted earnings per share: increased largely over the same period of last year. The main reason was the same as that of Item 7.15. Other consolidated income: increased by RMB 13.54 million largely over the same period of last year. The main reason was in the report period, SEG Samsung in which the Company holds 22.45% of its equity received the financial support funds amounting to RMB 56 million from its shareholder Samsung Corning Investment Co., Ltd., thus RMB 12.57 million was added into other consolidated income of the Company.16. Total consolidated income: increased largely over the same period of last year. The main reasons were the same as that of Items 7 and 15.17. Total consolidated income attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Items 7 and 15.III. Cash flow statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Other cash receivedrelating to operating activities64,583,939.9735,621,486.0928,962,453.88 81.31% Cash paid to/for staff andworkers11,883,672.359,605,770.002,277,902.35 23.71%Other cash paid relating to53,590,151.5031,135,749.7322,454,401.77 72.12% operating activitiesCash received from0.002,198,720.24-2,198,720.24 -100.00% recovering investmentNet cash received from15,444.00141,500.00-126,056.00 -89.09% disposal of fixed, intangible andother long-term assetsNet cash received from disposal0.0034,229,363.41-34,229,363.41 -100.00% of subsidiaries and other unitsCash paid for purchasing fixed,4,591,584.05701,547.003,890,037.05 554.49% intangible and other long-termassetsCash paid for investment 0.0053,030,000.00-53,030,000.00 -100.00% 1. Other cash received relating to operating activities: increased by RMB 28.96 million with an increase of 81.31% over the same period of last year. The main reasons were i. items of newly-opened Changsha SEG and Mellow Orange Hotel in the report period and newly-increased Buy-it Store in last May increased; ii. The general cashing business was developed in the electronic market, so the goods payment received on behalf of merchants increased.2. Cash paid to/for staff and workers: increased by RMB 2.28 million with an increase of 23.71% over the same period of last year. The main reasons were in the report period, Changsha SEG and Mellow Orange Hotel started operations, and the staff in Buy-it Store added increasing the salaries payable to the staff of the three companies.3. Other cash paid relating to operating activities: increased by RMB 22.45 million with an increase of 72.12% over the same period of last year. The main reasons were i. items of Changsha SEG and Mellow Orange Hotel newly-opened in the report period and Buy-it Store newly-increased last year increased; ii. The general cashing business was developed in the electronic market, the goods payment returning to merchants increased.4. Cash received from recovering investment: decreased by RMB 2.2million over the same period of last year. The main reason was in the same period of last year, the Company reduced the shares of Shenzhen Zero-Seven Co., Ltd. held by the Company amounting to 530,000, but no such sales occurred in the report period.5. Net cash received from disposal of fixed, intangible and other long-term assets: decreased by RMB 130,000 with a decrease of 89.09% over the same period of last year. The main reasons was the amount of fixed assets disposal in the same period of last year was bigger.6. Net cash received from disposal of subsidiaries and other units: decreased by RMB 34.23 million over the same period of last year. The main reasons was in the same period of last year, the Company received the equity account on selling former subsidiaries Shenzhen SEG Communications Co., Ltd, but no such sales of subsidiary occurred in the report period.7. Cash paid for purchasing fixed, intangible and other long-term assets: increased by RMB 3.89 million with an increase of 554.49% over the same period of last year. The main reasons were: the newly-opened Changsha SEG and Mellow Orange Hotel purchased fixed assets in the report period, thus the item increased.8. Cash paid for investment: decreased by RMB 55.03 million over the same period of last year. The main reason was in the same period of last year, the Company purchased 46 percent of the equity of Changsha SEG, but no such expenditure of equity acquisition occurred in the report period.3.2 Analysis and explanation of significant events and their influence and solutions□Applicable √Inapplicable3.3 Implementations of commitments by the Company, shareholders and actual controller√Applicable □InapplicableItem of CommitmentsPromiseeContent of commitmentsImplementationCommitments on Share Merger ReformInapplicable ----Commitments on share restricted tradeInapplicable ----Commitments made in Acquisition Report or Reports on Change in EquityInapplicable ----Commitments made in MaterialAssets ReorganizationInapplicable----Commitments made in issuanceShenzhen SEG Group Co., Ltd. Article 5 of the Equity Transfer Agreement which the Company had signed with SEG Group at the time of the Company’s listing stipulated: SEG Group permits the Company, as well as its subsidiaries of theCompany and affiliated companies to use the 8 registered trademarks that SEG Group has presently registered at the StateTrademark Office; italso permits theCompany to take the aforesaid trademarks and symbols that are similar to these marks as the symbol of the Company, as well as to use the aforesaid symbols or symbols that are similar to these symbols during the operation process; the Company doesn’t have to pay SEG Group any fee for the use of the aforesaidtrademarks or symbols.In the report period, this commitmentwas still executed according to thecommitment.Other commitments (includingadditional commitments)Shenzhen SEG Group Co., Ltd. According to the problem of “Yourcompany’s existing same industry competition in theelectronic market business with SEGIn the report period, controllingshareholder abided by the above commitment.Group” pointed outby Shenzhen Securities Regulatory Bureau in 2007 at the spot investigation of the Company, the Company received written Commitment Letter from SEG Group on Sep.14, 2007 and the content was as follows: our Group has similar business in Shenzhen electronic market with Shenzhen SEG Co., Ltd. (Shenzhen SEG), and the business was resulted by history and it has objective market developmentbackground. The Group made commitment: For the future, we do not operate on the market which is similar to Shenzhen SEG singly in the same city. The aforesaid matters have been disclosed in Securities Times ,China Securities Journal and Hong Kong Wen Wei Po and Juchao Website dated Sep. 18, 2007. In the report period, the holding company observed the above commitment.3.4 Estimation of accumulative net profit from the beginning of the year to the end of next report period to be a loss probably or the warning of its material change compared with the same period of last year and explanation of its reason √Applicable □InapplicableFore-notice of performances Carry-back of lossesYear-beginning to the end of next report period The same period oflast yearChange of increase/decrease (%)Estimated amount ofaccumulative net profit(RMB’0000)Approximately 1,600.00to2,700.00-14,608.35 -- -- Basic earnings per share(RMB/Share)Approximately 0.0204 to -0.1861 -- --0.0344Explanations onfore-notice ofperformances(1) SEG Samsung in which the Company holds its equity is predicted to suffer aloss accumulatively from RMB 30 million to RMB 50 million from year-beginning toend of next report period;(2) The performance prediction has not been pre-audited by CPAs.3.5 Other significant events which need explanations3.5.1 Particulars about securities investment □Applicable √Inapplicable3.5.2 Registration form of receiving research, communication and interview in the report periodDate Place Way ObjectsDiscussed main contents andsupplied materials Jan. 6, 2010 Office of the Company Telephone communication Investors Basic information of theCompany Feb. 12, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Mar. 26, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Apr. 7, 2010Office of the CompanyEnquire in written formSecurities DailyGot to know relevant public information of the Company3.5.3 Explanations of other significant events √Applicable □InapplicableThe net profit attributable to owners of parent company disclosed in the 1st quarterly report 2009 was RMB 2.85 million, but that of the same period of last year disclosed in the report was RMB -88.21 million, with the change amount of RMB -91.06 million. The reason for such change was the net profit attributable to owners of parent company of SEG Samsung in which the Company holds 22.45% of its equity disclosed in the 1st quarterly report 2009 was RMB-122 million, whereas that of the same period of last year disclosed in 1st quarterly report 2010 was RMB -504 million. The Company calculated the investment gains from SEG Samsung based on equity method, which caused the investment losses of the same period of last year disclosed in this report of the Company increased by RMB 91.06 million over that disclosed in the 1st quarterly report of 2009.3.6 Particulars about derivatives investment □Applicable √Inapplicable3.6.1 Particulars about derivatives investment held at the end of report period □Applicable √Inapplicable§4. Appendix4.1 Balance sheetPrepared by Shenzhen SEG Co., Ltd. March 31, 2010 Unit: RMBBalance at period-end Balance at year-beginning Items Consolidation Parent Company Consolidation Parent Company Current assets:Monetary funds 498,955,096.86372,852,381.52485,135,270.94 375,350,393.53 SettlementprovisionslentCapitalTransactionassetfinancereceivableNotesAccounts receivable 17,234,225.88400,000.0018,130,631.40 1,134,357.47 Accounts paid in advance 20,037,842.341,081,095.0018,404,268.08 8,035,295.00 receivableInsurancereceivablesReinsuranceContract reserve ofreinsurance receivableInterest receivable 2,460,821.922,460,821.922,460,821.92 2,460,821.92Dividend receivableOther receivables 12,042,162.4945,095,461.3911,971,998.74 45,306,466.00 Purchase restituted financeassetInventories 1,919,437.275,886,392.39 Non-current asset duewithin one yearassetsOthercurrentTotal current assets 552,649,586.76421,889,759.83541,989,383.47 432,287,333.92 Non-current assets:Granted loans and advancesFinance asset available for4,229,970.093,548,500.003,843,571.87 3,304,100.00 salesHeld-to-maturityinvestmentLong-term accountreceivableLong-term equity129,274,947.39310,372,446.43119,732,099.86 300,829,598.90 investmentInvestment property 438,740,452.42345,143,558.87442,502,999.44 347,797,315.91 Fixed assets 210,589,972.7523,031,843.38189,516,718.30 23,314,450.93 Construction in progress 9,776,526.6826,192,075.55materialEngineeringDisposal of fixed assetassetbiologicalProductiveOil and gas assetIntangible assets 4,681,177.38610,581.394,756,432.31 651,865.38 Expense on Research andDevelopmentGoodwill 10,328,927.8210,328,927.82Long-term expenses to be 13,684,505.73961,414.0213,041,779.82 1,165,451.06apportionedDeferred income tax asset 7,586,398.995,994,015.937,586,398.99 5,994,015.93 assetnon-currentOtherTotal non-current asset 828,892,879.25689,662,360.02817,501,003.96 683,056,798.11 Total assets 1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 Current liabilities:Short-termloansLoan from central bankAbsorbing deposit andinter-bank depositborrowedCapitalTransaction financialliabilitiespayableNotesAccounts payable 7,716,840.382,149,017.128,225,509.02 2,178,169.12Accounts received in90,214,246.1242,701,579.41105,563,890.39 65,801,272.52 advanceSelling financial asset ofrepurchaseCommission charge andcommission payableWage payable 1,172,559.9524,450.874,261,476.99 2,065,724.98 Taxes payable 26,095,556.9526,470,386.0424,421,758.66 24,773,634.49 payableInterestDividend payable 921,420.73153,403.29921,420.73 153,403.29 Other accounts payable 95,328,850.9637,415,008.7786,454,289.91 41,932,495.62 payablesReinsuranceInsurance contract reserveagencySecurity trading ofSecurity sales of agencyNon-current liabilities duewithin 1 yearliabilitiescurrentOtherTotal current liabilities 221,449,475.09108,913,845.50229,848,345.70 136,904,700.02 Non-current liabilities:loansLong-termpayableBondspayableLong-termaccountSpecial accounts payableliabilitiesProjectedDeferred income tax liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 non-currentliabilitiesOtherTotal non-current liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 Total liabilities 244,419,509.72109,460,971.21253,008,379.99 137,451,825.73 Owner’s equity (or shareholders’equity):Paid-in capital (or sharecapital)784,799,010.00784,799,010.00784,799,010.00 784,799,010.00 Capital public reserve 409,833,425.36407,164,608.41396,922,482.95 394,348,208.41 Less: Treasury stocksReasonable reserveSurplus public reserve 102,912,835.67102,912,835.67102,912,835.67 102,912,835.67 Provision of general riskRetained profit -252,672,245.53-292,785,305.44-268,431,923.52 -304,167,747.78 Balance difference offoreign currency translation-536,479.61-542,916.63Total owner’s equity attributableto parent company1,044,336,545.891,002,091,148.641,015,659,488.47 977,892,306.30 Minority shareholders’ interests 92,786,410.4090,822,518.97Total owner’s equity 1,137,122,956.291,002,091,148.641,106,482,007.44 977,892,306.30 Total liabilities and owner’sequity1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 4.2 Profit statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Total operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 Including: Operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 InterestincomeInsurancegainedCommission charge andcommission incomeII. Total operating cost 64,748,815.0510,069,765.9037,235,307.68 6,271,611.87 Including: Operating cost 56,496,489.228,821,226.1931,746,485.69 6,224,508.93 InterestexpenseCommission charge andcommission expenseCash surrender valueNet amount of expense ofcompensationNet amount of withdrawalof insurance contract reserveBonus expense of guaranteeslipReinsuranceexpenseOperating tax and extras 3,724,614.301,652,232.843,012,887.52 1,426,154.86 Sales expenses 1,370,260.25906,378.64Administration expenses 6,914,893.783,749,113.976,753,654.36 3,527,096.41 Financial expenses -3,757,442.50-4,152,807.10-3,684,098.53 -3,406,148.33Losses of devaluation of asset -1,500,000.00-1,500,000.00Add: Changing income offair value (Loss is listed with“-”)Investment income (Loss is-3,029,152.47-3,029,152.47-115,823,698.14 -115,823,699.14 listed with “-”)Including: Investmentincome on affiliated companyand joint ventureExchange income (Loss islisted with “-”)III. Operating profit (Loss is23,529,850.5315,446,866.52-85,166,016.78 -93,782,529.51 listed with “-”)Add: Non-operating income 139,079.30300.001,620,912.10 1,486,477.57Less: Non-operating41,229.18100,985.93expenseIncluding: Disposal loss ofnon-current assetIV. Total Profit (Loss is listed23,627,700.6515,447,166.52-83,646,090.61 -92,296,051.94 with “-”)Less: Income tax 5,951,587.044,064,724.182,313,487.22 450,000.00V. Net profit (Net loss is listed17,676,113.6111,382,442.34-85,959,577.83 -92,746,051.94 with “-”)Net profit attributable to15,759,677.9911,382,442.34-88,214,473.65 -92,746,051.94 owner’s equity of parentcompanyMinority shareholders’ gains1,916,435.622,254,895.82and lossesVI. Earnings per sharei. Basic earnings per share 0.02010.0145-0.1124 -0.1182 ii. Diluted earnings per share 0.02010.0145-0.1124 -0.1182 VII. Other consolidated income 12,964,835.2412,816,400.00-574,782.68 -682,253.97 VIII. Total consolidated income 30,640,948.8524,198,842.34-86,534,360.51 -93,428,305.91 Total consolidated income28,677,057.4224,198,842.34-88,896,727.62 -93,428,305.91 attributable to owners of parentcompanyTotal consolidated income1,963,891.432,362,367.11attributable to minorityshareholders4.3 Cash flow statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Cash flows arising fromoperating activities:Cash received from selling76,838,162.928,489,484.2877,509,335.13 16,793,838.47 commodities and providinglabor servicesNet increase of customerdeposit and inter-bank depositNet increase of loan fromcentral bankNet increase of capitalborrowed from other financialinstitutionCash received fromoriginal insurance contract feeNet cash received fromreinsurance businessNet increase of insuredsavings and investmentNet increase of disposal oftransaction financial assetCash received from interest,commission charge andcommissionNet increase of capitalborrowedNet increase of returnedbusiness capitalWrite-back of tax receivedOther cash receivedrelating to operating activities64,583,939.9735,796,951.0335,621,486.09 34,108,393.77 Subtotal of cash inflowarising from operating activities141,422,102.8944,286,435.31113,130,821.22 50,902,232.24 Cash paid for purchasingcommodities and receivinglabor service34,506,524.285,428,566.4833,515,780.98 4,689,090.60Net increase of customerloans and advancesNet increase of deposits incentral bank and inter-bankCash paid for originalinsurance contractcompensationCash paid for interest,commission charge andcommissionCash paid for bonus ofguarantee slipCash paid to/for staff andworkers11,883,672.355,234,585.349,605,770.00 4,602,269.51 Taxes paid 23,601,020.7018,545,462.2824,959,921.99 18,464,019.40 Other cash paid relating tooperating activities53,590,151.5017,876,799.3431,135,749.73 14,893,005.25Subtotal of cash outflowarising from operating activities123,581,368.8347,085,413.4499,217,222.70 42,648,384.76Net cash flows arisingfrom operating activities17,840,734.06-2,798,978.1313,913,598.52 8,253,847.48II. Cash flows arising frominvesting activities:Cash received from recovering investment 2,198,720.242,198,720.24Cash received frominvestment income5,270,590.49 Net cash received from 15,444.00141,500.00。

九阳股份:2011年第一季度报告全文 2011-04-19

九阳股份有限公司2011年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司负责人王旭宁先生、主管会计工作负责人杨宁宁女士及会计机构负责人(会计主管人员)温海涛女士声明:保证季度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标单位:元非经常性损益项目√适用□不适用单位:元2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用3.2 重大事项进展情况及其影响和解决方案的分析说明3.2.1 非标意见情况□适用√不适用3.2.2 公司存在向控股股东或其关联方提供资金、违反规定程序对外提供担保的情况□适用√不适用3.2.3 日常经营重大合同的签署和履行情况□适用√不适用3.2.4 其他□适用√不适用3.3 公司、股东及实际控制人承诺事项履行情况上市公司及其董事、监事和高级管理人员、公司持股5%以上股东及其实际控制人等有关方在报告期内或持续到报告期内的以下承诺事项√适用□不适用3.4 对2011年1-6月经营业绩的预计3.5 其他需说明的重大事项3.5.1 证券投资情况□适用√不适用§4 附录4.1 资产负债表编制单位:九阳股份有限公司2011年03月31日单位:元4.2 利润表编制单位:九阳股份有限公司2011年1-3月单位:元本期发生同一控制下企业合并的,被合并方在合并前实现的净利润为:0.00元。

4.3 现金流量表编制单位:九阳股份有限公司2011年1-3月单位:元4.4 审计报告审计意见:未经审计§5 其他报送数据5.1 大股东及其附属企业非经营性资金占用及清偿情况表□适用√不适用5.2 违规对外担保情况□适用√不适用九阳股份有限公司法定代表人:王旭宁2011年4月19日。

2011年总目次(中英文)

航 空 发 动 机

Ae o n i e r e gn

V0_7 o 6 l N . 3

De . e 201 1

21 0 总 目 1年

圆 e n cog s h1 i t n。 ge Y

健( — ) 1 1 航空发动机滑油泵 气塞 的预防措施 … …… ……………………………………………………………………… 李国权 , 黄

… … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … …

பைடு நூலகம்

睿 , 军 (一 6 陆 1 l)

WU We - , U igqn , I u, U Jn 1 1 ) n  ̄iG O Yn — ig L iL u (- 6 R

Aeo n ieolp mp ar c rv niemeh d … … … … … … … … … … … … … … … … …… …… … L o q a ,HUAN Ja ( —1 re gn i u io k pe e t to s l v IGu — u n G in 1 )

航空推进系统性能寻优 控制 的系统模 型 ………………………………………………………………… 尹大伟 , 樊照远 , 瑛 (- ) 廖 19

Ss m m dl o it npo us nss m e omac- ek gcnrl … … … … Y ND - e , A h oy a, I O Yn (- ) yt oes f va o rpl o t pr r ne se i ot e a i i ye f n o I a w i F NZ a-u n LA ig 19

石油济柴:2011年第一季度报告全文 2011-04-22

济南柴油机股份有限公司2011年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司负责人姜小兴、主管会计工作负责人刘明怀及会计机构负责人(会计主管人员)吴艳君声明:保证季度报告中财务报告的真实、完整。

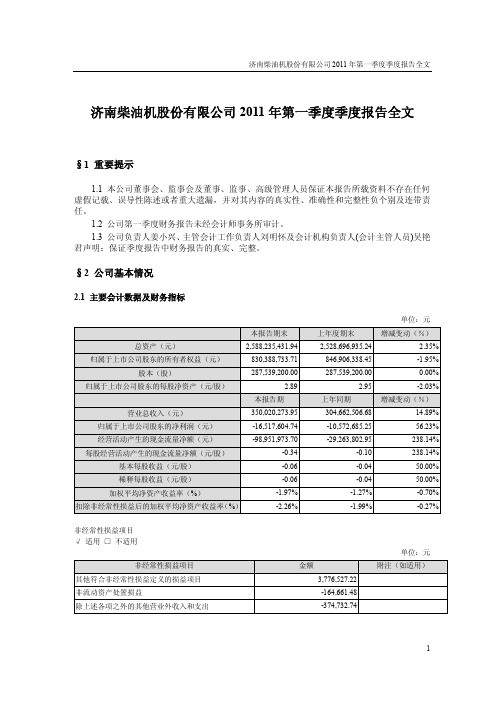

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)2,588,235,431.94 2,528,696,935.24 2.35% 归属于上市公司股东的所有者权益(元)830,388,733.71 846,906,338.45 -1.95% 股本(股)287,539,200.00 287,539,200.00 0.00% 归属于上市公司股东的每股净资产(元/股) 2.89 2.95 -2.03%本报告期上年同期增减变动(%)营业总收入(元)350,020,273.95 304,662,506.68 14.89% 归属于上市公司股东的净利润(元)-16,517,604.74 -10,572,685.25 56.23% 经营活动产生的现金流量净额(元)-98,951,973.70 -29,263,802.95 238.14% 每股经营活动产生的现金流量净额(元/股)-0.34 -0.10 238.14% 基本每股收益(元/股)-0.06 -0.04 50.00%稀释每股收益(元/股)-0.06 -0.04 50.00% 加权平均净资产收益率(%)-1.97% -1.27% -0.70% 扣除非经常性损益后的加权平均净资产收益率(%)-2.26% -1.99% -0.27%非经常性损益项目√适用□不适用单位:元非经常性损益项目金额附注(如适用)其他符合非经常性损益定义的损益项目3,776,527.22非流动资产处置损益-164,661.48除上述各项之外的其他营业外收入和支出-374,732.74合计3,237,133.00 -2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股报告期末股东总数(户)21,623前十名无限售条件流通股股东持股情况股东名称(全称)期末持有无限售条件流通股的数量种类中国石油集团济柴动力总厂172,523,520 人民币普通股中国工商银行-诺安平衡证券投资基金3,387,843 人民币普通股霍萌846,154 人民币普通股包头平安物业管理有限公司731,304 人民币普通股厦门国际信托有限公司-塔晶华南虎一号集合资金信托650,000 人民币普通股郭林致600,500 人民币普通股葛荣生597,720 人民币普通股黄泽阳524,631 人民币普通股中融国际信托有限公司-融金25号资金信托合同507,101 人民币普通股中国工商银行-海富通中小盘股票型证券投资基金499,909 人民币普通股§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用项目年末余额年初余额变动额变动率原因说明货币资金76,104,361.81 126,814,280.75 -50,709,918.94 -39.99% 生产经营支付资金所致在建工程111,529,210.31 85,251,212.92 26,277,997.39 30.82% 设备购建、工程实施增加所致投资性房地产36,427,667.21 9,226,063.52 27,201,603.69 295.00% 公司将综合办公楼租赁给母公司所致应交税费-6,390,178.97 8,009,991.99 -14,400,170.96 -179.78% 期末增值税进项税金额较多所致财务费用9,635,664.62 6,108,087.46 3,527,577.16 57.75% 本期增加有息负债总额所致销售费用18,539,598.51 10,779,287.54 7,760,310.97 71.99% 公司增加市场开拓费用所致投资收益-6,783,517.75 12,091,460.58 -18,874,978.33 -156.10% 两参股公司经营业绩下滑所致营业外收入3,776,527.22 7,269,887.77 -3,493,360.55 -48.05% 上年收到政府补助,本年未收到所得税费用169,562.83 868,701.85 -699,139.02 -80.48% 本年子公司应税利润较少所致净利润-16,517,604.74 -10,572,685.25 -5,944,919.49 56.23% 投资收益下滑、经营利润亏损所致每股收益-0.06 -0.04 -0.02 50.00% 投资收益下滑、经营利润亏损所致销售商品、提供劳务收到的现金414,537,264.50 286,913,607.05 127,623,657.45 44.48% 销售回款增加所致购买商品、接受劳务支付的现金438,863,137.20 250,511,824.90 188,351,312.30 75.19% 采购生产资料付现增加所致支付的各项税费15,972,791.57 25,092,411.38 -9,119,619.81 -36.34% 本期应缴税费较少所致购建固定资产、无形资产和其他长期资产支付的现金41,961,082.74 29,954,130.20 12,006,952.54 40.08% 设备购建、工程实施付现较多所致取得借款收到的现金200,000,000.00 100,000,000.00 100,000,000.00 100.00% 本期增加中油财务公司借款所致分配股利、利润或偿付利息支付的现金9,796,862.50 6,206,062.50 3,590,800.00 57.86% 本期增加有息负债,增加利息支付所致3.2 重大事项进展情况及其影响和解决方案的分析说明3.2.1 非标意见情况□适用√不适用3.2.2 公司存在向控股股东或其关联方提供资金、违反规定程序对外提供担保的情况□适用√不适用3.2.3 日常经营重大合同的签署和履行情况□适用√不适用3.2.4 其他□适用√不适用3.3 公司、股东及实际控制人承诺事项履行情况上市公司及其董事、监事和高级管理人员、公司持股5%以上股东及其实际控制人等有关方在报告期内或持续到报告期内的以下承诺事项□适用√不适用3.4 预测年初至下一报告期期末的累计净利润可能为亏损或者与上年同期相比发生大幅度变动的警示及原因说明□适用√不适用3.5 其他需说明的重大事项3.5.1 证券投资情况□适用√不适用3.5.2 报告期接待调研、沟通、采访等活动情况表接待时间接待地点接待方式接待对象谈论的主要内容及提供的资料2011年03月21日公司215会议室实地调研民生人寿保险股份有限公司詹粤萍中银国际罗丹了解生产运营情况3.6 衍生品投资情况□适用√不适用3.6.1 报告期末衍生品投资的持仓情况□适用√不适用§4 附录4.1 资产负债表编制单位:济南柴油机股份有限公司2011年03月31日单位:元期末余额年初余额项目合并母公司合并母公司流动资产:货币资金76,104,361.81 71,651,743.67 126,814,280.75 117,727,162.19 结算备付金拆出资金交易性金融资产应收票据30,276,600.00 18,946,600.00 42,043,898.89 37,443,898.89 应收账款656,703,712.48 580,654,186.02 632,710,260.09 549,506,929.15 预付款项61,040,772.35 57,900,651.49 64,435,774.82 61,554,824.63 应收保费应收分保账款应收分保合同准备金应收利息应收股利112,513,653.18 112,513,653.18 112,513,653.18 112,513,653.18 其他应收款21,154,700.16 18,188,946.32 18,686,874.41 16,401,882.00 买入返售金融资产存货471,185,061.33 454,055,559.20 399,456,427.04 374,421,183.42 一年内到期的非流动资产其他流动资产流动资产合计1,428,978,861.31 1,313,911,339.88 1,396,661,169.18 1,269,569,533.46 非流动资产:发放委托贷款及垫款可供出售金融资产持有至到期投资长期应收款长期股权投资265,444,203.55 323,946,703.55 272,227,721.30 330,730,221.30 投资性房地产36,427,667.21 36,427,667.21 9,226,063.52 9,226,063.52固定资产571,892,417.28 570,625,568.09 591,722,553.85 590,387,627.94 在建工程111,529,210.31 111,529,210.31 85,251,212.92 85,251,212.92 工程物资固定资产清理生产性生物资产油气资产无形资产59,346,835.92 57,996,835.92 59,946,550.44 58,529,050.44 开发支出111,019,845.41 111,019,845.41 110,065,273.08 110,065,273.08 商誉长期待摊费用递延所得税资产3,596,390.95 3,596,390.95 3,596,390.95 3,596,390.95 其他非流动资产非流动资产合计1,159,256,570.63 1,215,142,221.44 1,132,035,766.06 1,187,785,840.15 资产总计2,588,235,431.94 2,529,053,561.32 2,528,696,935.24 2,457,355,373.61 流动负债:短期借款700,000,000.00 700,000,000.00 600,000,000.00 600,000,000.00 向中央银行借款吸收存款及同业存放拆入资金交易性金融负债应付票据298,548,661.56 298,548,661.56 293,218,033.20 293,218,033.20 应付账款353,092,683.40 322,290,359.60 350,908,396.28 321,718,672.53 预收款项51,258,806.92 27,654,551.87 64,046,197.40 32,685,900.59 卖出回购金融资产款应付手续费及佣金应付职工薪酬3,180,521.28 2,830,360.04 2,805,009.28 2,495,508.03 应交税费-6,390,178.97 -4,352,822.47 8,009,991.99 8,413,515.84 应付利息应付股利其他应付款149,599,756.60 149,578,377.35 150,614,434.43 150,548,946.52 应付分保账款保险合同准备金代理买卖证券款代理承销证券款一年内到期的非流动负债其他流动负债流动负债合计1,549,290,250.79 1,496,549,487.95 1,469,602,062.58 1,409,080,576.71 非流动负债:长期借款应付债券长期应付款21,285,167.03 21,285,167.03 21,285,167.03 21,285,167.03 专项应付款预计负债递延所得税负债其他非流动负债187,271,280.41 187,271,280.41 190,903,367.18 190,903,367.18 非流动负债合计208,556,447.44 208,556,447.44 212,188,534.21 212,188,534.21 负债合计1,757,846,698.23 1,705,105,935.39 1,681,790,596.79 1,621,269,110.92 所有者权益(或股东权益):实收资本(或股本)287,539,200.00 287,539,200.00 287,539,200.00 287,539,200.00 资本公积47,976,721.01 47,770,909.39 47,976,721.01 47,770,909.39 减:库存股专项储备盈余公积87,548,942.88 87,230,859.49 87,548,942.88 87,230,859.49 一般风险准备未分配利润407,323,869.82 401,406,657.05 423,841,474.56 413,545,293.81 外币报表折算差额归属于母公司所有者权益合计830,388,733.71 823,947,625.93 846,906,338.45 836,086,262.69 少数股东权益所有者权益合计830,388,733.71 823,947,625.93 846,906,338.45 836,086,262.69 负债和所有者权益总计2,588,235,431.94 2,529,053,561.32 2,528,696,935.24 2,457,355,373.614.2 利润表编制单位:济南柴油机股份有限公司2011年1-3月单位:元本期金额上期金额项目合并母公司合并母公司一、营业总收入350,020,273.95 319,698,817.26 304,662,506.68 270,604,637.32 其中:营业收入350,020,273.95 319,698,817.26 304,662,506.68 270,604,637.32 利息收入已赚保费手续费及佣金收入二、营业总成本362,821,931.11 328,291,069.27 333,239,710.92 297,099,734.13 其中:营业成本316,277,282.79 284,875,825.52 295,183,493.16 264,418,586.64 利息支出手续费及佣金支出退保金赔付支出净额提取保险合同准备金净额保单红利支出分保费用营业税金及附加660,219.08 505,637.73 526,520.60 499,894.40销售费用18,539,598.51 16,807,047.33 10,779,287.54 6,960,004.35 管理费用17,709,166.11 16,448,808.33 20,642,322.16 19,106,820.61财务费用9,635,664.62 9,653,750.36 6,108,087.46 6,114,428.13 资产减值损失加:公允价值变动收益(损失以“-”号填列)投资收益(损失以“-”号-6,783,517.75 -6,783,517.75 12,091,460.58 12,091,460.58 填列)其中:对联营企业和合-6,783,517.75 -6,783,517.75 12,091,460.58 12,091,460.58 营企业的投资收益汇兑收益(损失以“-”号填列)三、营业利润(亏损以“-”号填-19,585,174.91 -15,375,769.76 -16,485,743.66 -14,403,636.23 列)加:营业外收入3,776,527.22 3,776,527.22 7,269,887.77 7,269,887.77减:营业外支出539,394.22 539,394.22 488,127.51 487,979.01 其中:非流动资产处置损失四、利润总额(亏损总额以“-”-16,348,041.91 -12,138,636.76 -9,703,983.40 -7,621,727.47 号填列)减:所得税费用169,562.83 868,701.85 730,692.74五、净利润(净亏损以“-”号填-16,517,604.74 -12,138,636.76 -10,572,685.25 -8,352,420.21 列)归属于母公司所有者的净-16,517,604.74 -12,138,636.76 -10,572,685.25 -8,352,420.21 利润少数股东损益六、每股收益:(一)基本每股收益-0.06 -0.04(二)稀释每股收益-0.06 -0.04七、其他综合收益八、综合收益总额-16,517,604.74 -12,138,636.76 -10,572,685.25 -8,352,420.21归属于母公司所有者的综-16,517,604.74 -12,138,636.76 -10,572,685.25 -8,352,420.21 合收益总额归属于少数股东的综合收益总额本期发生同一控制下企业合并的,被合并方在合并前实现的净利润为:0.00元。

新世纪:2011年第一季度报告全文 2011-04-21

杭州新世纪信息技术股份有限公司2011年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司负责人徐智勇、主管会计工作负责人俞竣华及会计机构负责人(会计主管人员)蒋旭谊声明:保证季度报告中财务报告的真实、完整。

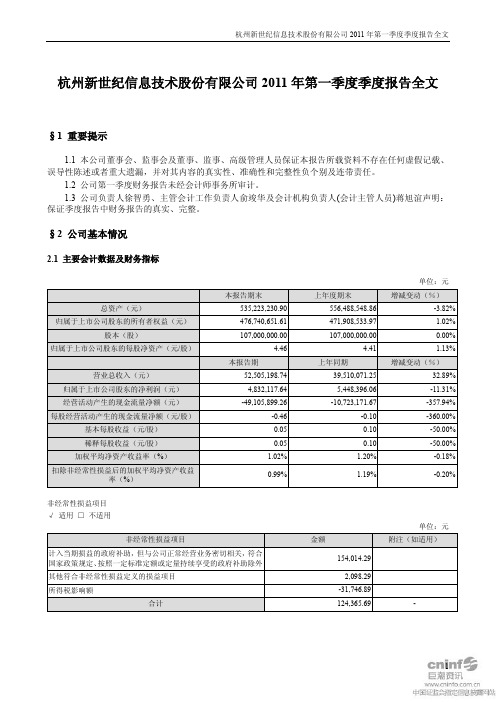

§2 公司基本情况2.1 主要会计数据及财务指标单位:元非经常性损益项目√适用□不适用单位:元2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用3.2 重大事项进展情况及其影响和解决方案的分析说明3.2.1 非标意见情况□适用√不适用3.2.2 公司存在向控股股东或其关联方提供资金、违反规定程序对外提供担保的情况□适用√不适用3.2.3 日常经营重大合同的签署和履行情况√适用□不适用3.2.4 其他□适用√不适用3.3 公司、股东及实际控制人承诺事项履行情况上市公司及其董事、监事和高级管理人员、公司持股5%以上股东及其实际控制人等有关方在报告期内或持续到报告期内的以下承诺事项√适用□不适用3.4 对2011年1-6月经营业绩的预计3.5 其他需说明的重大事项3.5.1 证券投资情况□适用√不适用§4 附录4.1 资产负债表编制单位:杭州新世纪信息技术股份有限公司2011年03月31日单位:元4.2 利润表编制单位:杭州新世纪信息技术股份有限公司2011年1-3月单位:元本期发生同一控制下企业合并的,被合并方在合并前实现的净利润为:5,905,266.48元。

4.3 现金流量表编制单位:杭州新世纪信息技术股份有限公司2011年1-3月单位:元4.4 审计报告审计意见:未经审计§5 其他报送数据5.1 大股东及其附属企业非经营性资金占用及清偿情况表□适用√不适用5.2 违规对外担保情况□适用√不适用杭州新世纪信息技术股份有限公司董事长:徐智勇二O一一年四月十九日。

杭汽轮B:关于回购股份实施进展公告(英文版)

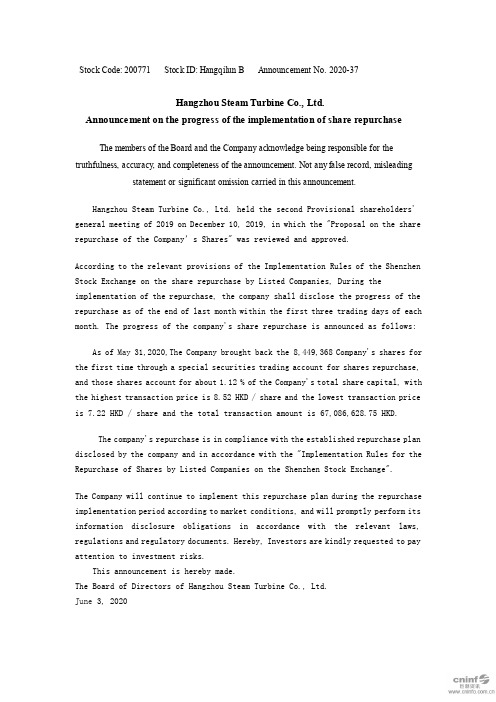

Stock Code: 200771 Stock ID: Hangqilun B Announcement No. 2020-37Hangzhou Steam Turbine Co., Ltd.Announcement on the progress of the implementation of share repurchaseThe members of the Board and the Company acknowledge being responsible for the truthfulness, accuracy, and completeness of the announcement. Not any false record, misleading statement or significant omission carried in this announcement.Hangzhou Steam Turbine Co., Ltd. held the second Provisional shareholders' general meeting of 2019 on December 10, 2019, in which the "Proposal on the share repurchase of the Company’s Shares" was reviewed and approved.According to the relevant provisions of the Implementation Rules of the Shenzhen Stock Exchange on the share repurchase by Listed Companies, During the implementation of the repurchase, the company shall disclose the progress of the repurchase as of the end of last month within the first three trading days of each month. The progress of the company's share repurchase is announced as follows:As of May 31,2020,The Company brought back the 8,449,368 Company's shares for the first time through a special securities trading account for shares repurchase, and those shares account for about 1.12 % of the Company's total share capital, with the highest transaction price is 8.52 HKD / share and the lowest transaction price is 7.22 HKD / share and the total transaction amount is 67,086,628.75 HKD.The company's repurchase is in compliance with the established repurchase plan disclosed by the company and in accordance with the "Implementation Rules for the Repurchase of Shares by Listed Companies on the Shenzhen Stock Exchange".The Company will continue to implement this repurchase plan during the repurchase implementation period according to market conditions, and will promptly perform its information disclosure obligations in accordance with the relevant laws, regulations and regulatory documents. Hereby, Investors are kindly requested to pay attention to investment risks.This announcement is hereby made.The Board of Directors of Hangzhou Steam Turbine Co., Ltd.June 3, 2020。

江 铃B:2011年第一季度报告全文(英文版) 2011-04-26