CONFIDENTIALITYAGREEMENT(公司股权协议英文版)

股权代持协议英文版

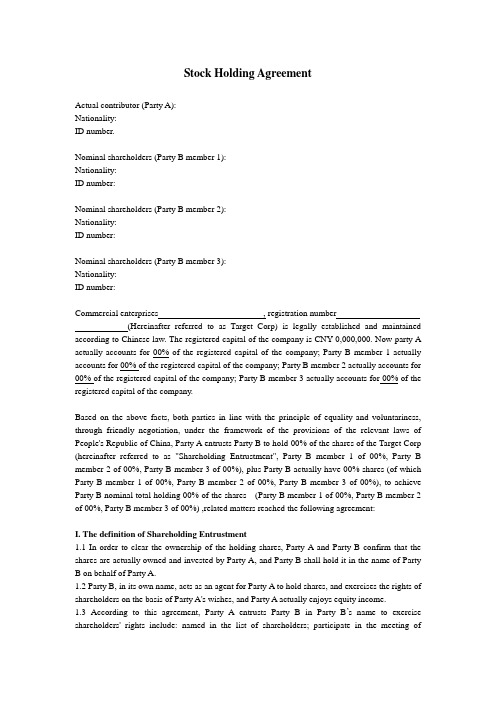

Stock Holding AgreementActual contributor (Party A):Nationality:ID number.Nominal shareholders (Party B member 1):Nationality:ID number:Nominal shareholders (Party B member 2):Nationality:ID number:Nominal shareholders (Party B member 3):Nationality:ID number:Commercial enterprises , registration number(Hereinafter referred to as Target Corp) is legally established and maintained according to Chinese law. The registered capital of the company is CNY 0,000,000. Now party A actually accounts for 00% of the registered capital of the company; Party B member 1 actually accounts for 00% of the registered capital of the company; Party B member 2 actually accounts for 00% of the registered capital of the company; Party B member 3 actually accounts for 00% of the registered capital of the company.Based on the above facts, both parties in line with the principle of equality and voluntariness, through friendly negotiation, under the framework of the provisions of the relevant laws of People's Republic of China, Party A entrusts Party B to hold 00% of the shares of the Target Corp (hereinafter referred to as "Shareholding Entrustment", Party B member 1 of 00%, Party B member 2 of 00%, Party B member 3 of 00%), plus Party B actually have 00% shares (of which Party B member 1 of 00%, Party B member 2 of 00%, Party B member 3 of 00%), to achieve Party B nominal total holding 00% of the shares (Party B member 1 of 00%, Party B member 2 of 00%, Party B member 3 of 00%) ,related matters reached the following agreement:I. The definition of Shareholding Entrustment1.1 In order to clear the ownership of the holding shares, Party A and Party B confirm that the shares are actually owned and invested by Party A, and Party B shall hold it in the name of PartyB on behalf of Party A.1.2 Party B, in its own name, acts as an agent for Party A to hold shares, and exercises the rights of shareholders on the basis of Party A's wishes, and Party A actually enjoys equity income.1.3 According to this agreement, Party A entrusts Party B in Party B’s name to exercise shareholders' rights include: named in the list of shareholders; participate in the meeting ofshareholders and exercise the voting rights in accordance wi th Party A’s will; exercise shareholder's rights of company law and the articles of association of the company; take or pay related profit and investment; legal documents signed by the name of the shareholder.1.4 The shareholding entrustment can be understood as a similar legal concept such as anonymous shareholders and anonymous agents, but all of them need to comply with the relevant provisions of the Supreme People's Court's interpretation of ‘the company law (III)’.II. Entrustment shares2.1 Entrustment shares: Party A owns some share of Target Corp -- 00% of the share interest, and the amount of investment is CNY 0,000,000, treated as entrustment shares through this agreement.2.2 Entrustment shares will be registered by the name of Party B through the process of business registration and shall be held by Party B in the name of Party B externally.2.3 Party A is the actual holder of shares, Party B as a nominal shareholder, only for the purpose of holding, need not to pay the related equity transfer payment in the business registration process. 2.4 Party B under this Agreement, shall be holding shares in accordance with the wishes of Party A, transfer, pledge, increase and reduction of capital under the name of its holding shares are prohbited to Party B without instructions of Party A.III. Right of Share Income3.1 Party A has the right to the entrustment shares, such as the share income and supervision right under the holding of the shares.3.2 Party B shall exercise the right to vote for profit distribution in the name of the shareholders in accordance with the true meaning or instruction of Party A in the shareholders meeting.IV. Other shareholders' rights4.1 In addition to the aforesaid share income, Party B, as a nominal shareholder, shall perform the legal rights of the shareholders in accordance with Party A's wishes.4.2 Party B, as a nominal shareholder, needs to exercise the legitimate rights of shareholders under the company law according to Party A's wishes, including participating in shareholders' meetings, exercising voting rights, dispatching board members, signing resolutions of shareholders' meetings, exercising shareholders' right to learn the truth and participating in shareholder lawsuits.V. The statement and commitment of Party A5.1 Party A promises that it will have lawful and complete rights to the holding shares, including no pledge, guarantee and other rights defects.If there are any defects of rights such as pledge and guarantee, the legal liability, economic compensation and economic loss caused by the shares actually owned by Party A shall be borne by Party A itself.5.2 Party A has the right to actually enjoy the share income from the share holding profits, or to have the final decision on the specific disposal of the share income.5.3 Party A has the right to dispose of the shares in accordance with its own wishes, including transfer, pledge and so on. Party B shall, in accordance with Party A's wishes, cooperate with Party A to complete the corresponding disposal of the holding shares.5.4 Party A promises to bear the economic loss and legal responsibility of Party B's actions toexercise shareholders' rights in accordance with Party A's wishes.5.5 All taxes generated during the dealing with Party A's authorization handling of affairs, shall be taken by Party A; the costs caused by holding shares on behalf of Party A (including but not limited to: cost of handling the transfer of shares in the registration offices, tax arising from stock dividends etc.) will be borne by the Party A.5.6 Party A promises that when Party B holds such shares and exercises related rights, Party A shall bear all the investment risks and business risks of Party B based on this Agreement.VI. Party B's Statement and Commitment6.1 Party B undertakes that it will legally execute the act on behalf of the Party A in accordance with the relevant provisions of this Agreement and Party A's wishes or instructions, so as to protect and realize the legitimate rights and interests of Party A to the holding shares.6.2 Party B has the right to exercise shareholders' rights externally within the company law and the framework of the company's articles of association, in accordance with the wishes of Party A.6.3 Without the prior written consent of Party A, Party B shall not delegate or transfer the whole or part of the shares under this agreement.6.4 Prior to exercise the rights of shareholders, Party B should maintain full communication with Party A and understand the real intention of Party A's actual investor.6.5 Party B shall exercise the rights of shareholders or perform shareholder obligations according to Party A's wishes and instructions, whose economic profit and loss and legal liability shall be borne by Party A.VII. ConfidentialityThe parties and witnesses of the agreement shall keep the whole contents of this agreement, including the holding of shares, to be confidential.VIII. Jurisdiction and Dispute Settlement8.1 The agreement and the relevant legal relations are explained by the relevant laws of the People's Republic of China and are governed by them.8.2 Any dispute arising from the entrustment of this Agreement shall be settled by friendly negotiation. If it fails to negotiate, it shall be brought to a lawsuit by the People's Court of aaaa.IX. Other9.1 The agreement is composed of four copies, and each member of the Party A and B shall hold one copy and have the same legal effect. Any change and supplement to this agreement shall come into force by the written consent of both parties. Matters not covered in the agreement shall be appointed by the two parties through the supplementary agreement.9.2 This agreement is a supplementary agreement of Contract signed by Party A and Party B, and the two parties will further change this agreement after the stipulated conditions are reached in the business agreement, so as to achieve the purpose of increasing the shares actually owned by PartyB.9.3 This Agreement shall come into force after the signing of the two parties. The Target Corp will approve the content of this agreement with the resolution of the shareholders' meeting of the company.Party A (signature):Party B (signature) - member 1: Party B (signature) - member 2: Date:。

全面版的股权认购合同英文版

全面版的股权认购合同英文版Comprehensive Version of Stock Subscription AgreementThis document serves as a comprehensive version of a stock subscription agreement.1. Parties Involved: This agreement is entered into between [Company Name], a corporation organized and existing under the laws of [State/Country], hereinafter referred to as the "Company", and [Investor Name], an individual residing at [Address], hereinafter referred to as the "Investor".2. Purpose: The purpose of this agreement is for the Investor to subscribe for and purchase shares of the Company's stock.3. Subscription Details: The Investor agrees to subscribe for and purchase [Number of Shares] shares of the Company's common stock ata price of [Price per Share] per share, for a total purchase price of [Total Purchase Price].4. Payment Terms: The Investor shall pay the total purchase price in full at the time of signing this agreement. Payment shall be made in [Payment Method] to the Company's designated account.5. Closing: The closing of the purchase and sale of the shares shall take place on [Closing Date], or at such other time and place as agreed upon by the parties.6. Representations and Warranties: The Investor represents and warrants that they have full power and authority to enter into this agreement and to carry out its obligations hereunder. The Investor further represents that the execution and delivery of this agreement does not violate any agreement or obligation to which they are bound.7. Indemnification: The Investor agrees to indemnify and hold harmless the Company, its officers, directors, and employees from andagainst any and all claims, losses, liabilities, and expenses arising out of or in connection with the Investor's breach of this agreement.8. Confidentiality: Both parties agree to keep the terms and conditions of this agreement confidential and not disclose them to any third party without the other party's consent.9. Governing Law: This agreement shall be governed by and construed in accordance with the laws of [State/Country].10. Entire Agreement: This agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.In witness whereof, the parties hereto have executed this agreement as of the date first above written.[Company Name]By: _______________________Name: _____________________ Title: ____________________[Investor Name]By: _______________________ Name: _____________________ Address: _________________。

保密协议ConfidentialityAgreement(中英文对照)

保密协议

Con fide ntiality Agreeme nt

甲方:

乙方:

签订日期:年月日

甲方:

Party A:

乙方:

Party B:

Байду номын сангаас鉴于:

Whereas:

就与甲方进行的会谈或合作,乙方需要取得甲方的相关业务和商业资料,为此,甲乙

双方本着互惠互利、共同发展的原则,经友好协商签订本协议。

Providi ng of releva nt bus in ess and commercial in formati on from Party A to Party B is required for the ongoing bus in ess discussi ons or cooperati on betwee n Party A and Party B with respect to,this agreement is entered into by and between

在双方协商期间乙方从甲方获取的所有的通讯信息、信息、图纸、产品和其他资料都

是保密的(“保密信息”),但不包括下述资料和信息:

All com muni cati ons, in formati on, draw in gs, products and other materials

obta ined by Party B from Party A duri ng the n egotiati ons, are con fide ntial

informationwithout the written approval of the other party;Party B is obliged

股东协议中英文版5篇

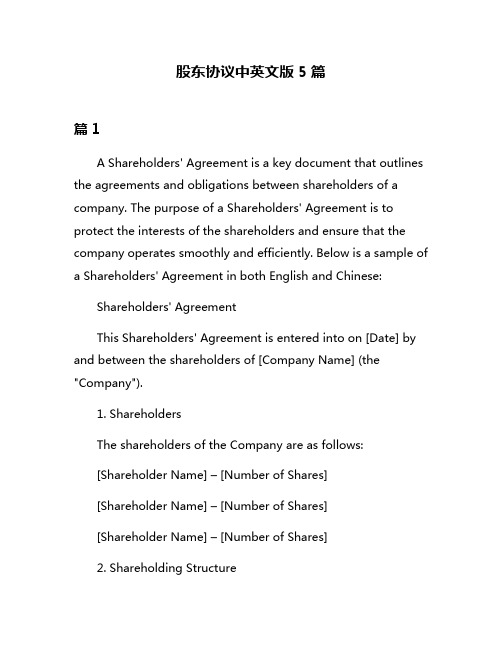

股东协议中英文版5篇篇1A Shareholders' Agreement is a key document that outlines the agreements and obligations between shareholders of a company. The purpose of a Shareholders' Agreement is to protect the interests of the shareholders and ensure that the company operates smoothly and efficiently. Below is a sample of a Shareholders' Agreement in both English and Chinese:Shareholders' AgreementThis Shareholders' Agreement is entered into on [Date] by and between the shareholders of [Company Name] (the "Company").1. ShareholdersThe shareholders of the Company are as follows:[Shareholder Name] – [Number of Shares][Shareholder Name] – [Number of Shares][Shareholder Name] – [Number of Shares]2. Shareholding StructureThe shareholding structure of the Company is as follows:- [Shareholder Name] owns [Percentage] of the shares- [Shareholder Name] owns [Percentage] of the shares- [Shareholder Name] owns [Percentage] of the shares3. ManagementThe shareholders agree that the day-to-day management of the Company shall be the responsibility of the Board of Directors. The Board of Directors shall consist of [Number] directors, with each shareholder entitled to appoint a representative to the Board.4. Decision MakingMajor decisions affecting the Company, such as the sale of assets, mergers, or significant changes in business operations, shall require the approval of [Percentage] of the shareholders.5. Transfer of SharesAny transfer of shares by a shareholder must be approved by a majority vote of the shareholders. In the event of a shareholder's death or incapacity, their shares shall be transferred to their heirs or appointed representatives.6. Dispute ResolutionIn the event of a dispute between shareholders, the parties agree to resolve the dispute through mediation or arbitration.7. ConfidentialityThe shareholders agree to keep all information regarding the Company confidential and not disclose any sensitive information to third parties.8. TerminationThis Shareholders' Agreement shall remain in effect until terminated by mutual agreement of the shareholders.This Agreement is executed as of the date first written above.[Signature of Shareholder] [Date][Signature of Shareholder] [Date][Signature of Shareholder] [Date]股东协议本股东协议由[日期]签署,双方为[公司名称](以下简称“公司”)的股东。

全版本的股权合同书英文版

全版本的股权合同书英文版Comprehensive Stock Equity AgreementThis document serves as a comprehensive stock equity agreement between the undersigned parties. The purpose of this agreement is to outline the terms and conditions related to the ownership and transfer of stock in the company.Parties Involved- The company, represented by [Company Name]- Stockholders, represented by [Name of Stockholder]Stock Ownership- The stockholders acknowledge that they hold a certain number of shares in the company.- Any transfer of stock ownership must be approved by the company.Rights and Responsibilities- Stockholders have the right to vote on major company decisions.- Stockholders are entitled to receive dividends based on the company's performance.- Stockholders must act in the best interest of the company and not disclose confidential information.Restrictions on Transfer- Stockholders cannot transfer their shares without the consent of the company.- Any transfer of shares must be done in accordance with the laws and regulations governing stock ownership.Termination of Agreement- This agreement can be terminated by mutual consent of the parties involved.- In the event of a breach of the agreement, the company has the right to take legal action.Governing Law- This agreement shall be governed by the laws of [Jurisdiction].- Any disputes arising from this agreement shall be resolved through arbitration.This comprehensive stock equity agreement is a legally binding document that outlines the rights and responsibilities of stockholders in the company. By signing this agreement, the parties involved agree to abide by the terms and conditions set forth herein.Signed:[Company Name] [Name of Stockholder] __________________________________________________Date: _________________ Date: _________________。

股东协议中英文版7篇

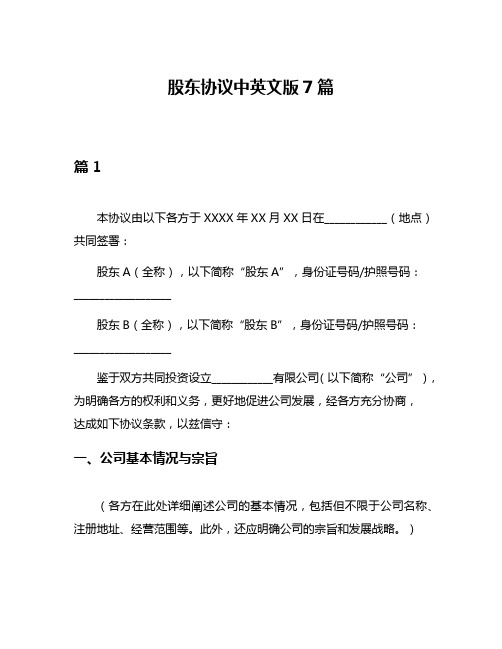

股东协议中英文版7篇篇1本协议由以下各方于XXXX年XX月XX日在____________(地点)共同签署:股东A(全称),以下简称“股东A”,身份证号码/护照号码:___________________股东B(全称),以下简称“股东B”,身份证号码/护照号码:___________________鉴于双方共同投资设立____________有限公司(以下简称“公司”),为明确各方的权利和义务,更好地促进公司发展,经各方充分协商,达成如下协议条款,以兹信守:一、公司基本情况与宗旨(各方在此处详细阐述公司的基本情况,包括但不限于公司名称、注册地址、经营范围等。

此外,还应明确公司的宗旨和发展战略。

)二、股东的出资额及持股比例(详细说明股东A和股东B的出资额及持股比例,包括但不限于现金出资、技术出资、股权比例等。

)三、公司治理结构(明确公司的治理结构,包括董事会、监事会、管理层等机构的组成及职责。

同时,规定股东会、董事会、监事会等会议的召开和表决方式。

)四、股东的权利和义务(列举股东的权利和义务,包括但不限于利润分配权、知情权、决策权等。

同时,应规定股东应遵守的竞业禁止、保密义务等。

)五、公司的业务活动及经营管理(规定公司的业务范围和经营管理策略。

明确公司管理层在经营决策中的权限和责任。

同时,对重大事项的决策程序进行规定。

)六、股权转让和退出机制(规定股东之间股权转让的条件和程序,以及股东退出的方式和条件。

明确股权转让是否需要其他股东同意,以及股权转让的税费承担等。

)七、保密和竞业禁止条款(规定股东在公司任职期间及离职后一定期限内不得从事与公司业务相竞争的活动。

同时,应对公司的商业机密和客户信息等进行保密。

)八、违约责任及纠纷解决方式(明确各方违约时应承担的责任,包括违约金、赔偿损失等。

同时,规定纠纷解决的方式,如仲裁、诉讼等。

)九、其他约定事项(针对公司的其他重要事项进行约定,如知识产权保护、税务承担、公司融资等。

股权转让合同协议英文版

股权转让合同协议英文版The stock transfer agreement is a legal document that outlines the terms and conditions under which the ownership of a company's shares or equity is transferred from one party to another. This agreement is crucial in ensuring a smooth and legally binding transfer of ownership, protecting the interests of both the seller and the buyer. In this essay, we will delve into the key components of a stock transfer agreement and explore the importance of each element.I. Parties InvolvedThe stock transfer agreement typically involves two primary parties - the seller and the buyer. The seller is the individual or entity that currently owns the shares and wishes to transfer them to the buyer. The buyer is the party who is acquiring the shares from the seller. In some cases, there may be additional parties involved, such as the company whose shares are being transferred or a third-party intermediary like a broker or a financial institution.II. Shares and OwnershipThe agreement should clearly define the number of shares being transferred, the class or type of shares, and the percentage of ownership that the buyer will acquire. This information is crucial in establishing the exact nature and extent of the ownership being transferred. The agreement should also specify any restrictions or limitations on the ownership, such as voting rights, dividend entitlements, or transfer restrictions.III. Purchase Price and Payment TermsThe stock transfer agreement must outline the purchase price for the shares and the payment terms. This includes the total amount to be paid, the method of payment (e.g., cash, wire transfer, or installments), and the timeline for the payment. The agreement should also address any contingencies or conditions that may affect the purchase price, such as adjustments based on the company's financial performance or the fulfillment of certain milestones.IV. Closing and Delivery of SharesThe agreement should specify the closing date, which is the date on which the ownership of the shares will be officially transferred from the seller to the buyer. This section should also detail the process of delivering the shares, including any required documentation, such as stock certificates or electronic transfer of shares.V. Representations and WarrantiesBoth the seller and the buyer will make various representations and warranties in the stock transfer agreement. The seller may provide assurances about the company's financial condition, legal standing, and any pending litigation or claims. The buyer, on the other hand, may make representations about their ability to complete the transaction and their intentions for the company.VI. Covenants and ObligationsThe agreement should outline the covenants and obligations of the parties involved. This may include the seller's commitment to maintain the company's operations and assets until the closing date, the buyer's agreement to not disclose confidential information, or the parties' obligations to obtain necessary approvals or consents.VII. Conditions PrecedentThe stock transfer agreement may include conditions precedent, which are events or actions that must occur before the transaction can be completed. These may include obtaining regulatory approvals, securing third-party consents, or the fulfillment of specific financial or operational milestones.VIII. Termination and RemediesThe agreement should address the circumstances under which the transaction can be terminated, such as a material breach by either party or the failure to meet the conditions precedent. It should alsooutline the remedies available to the parties, such as the forfeiture of a deposit or the right to seek damages.IX. Confidentiality and Non-CompeteThe stock transfer agreement may include provisions related to the confidentiality of the transaction and any non-compete or non-solicitation clauses. These clauses aim to protect the interests of the parties involved, particularly the buyer, by restricting the seller's ability to compete with the company or solicit its customers or employees.X. Governing Law and Dispute ResolutionThe agreement should specify the governing law that will be applied to the interpretation and enforcement of the contract, as well as the process for resolving any disputes that may arise. This may include provisions for mediation, arbitration, or litigation.In conclusion, the stock transfer agreement is a comprehensive legal document that serves to protect the interests of both the seller and the buyer in a share transfer transaction. By carefully drafting and negotiating the terms of the agreement, the parties can ensure a smooth and successful transfer of ownership, minimizing the risk of disputes and safeguarding their respective investments.。

保密协议(中英文)

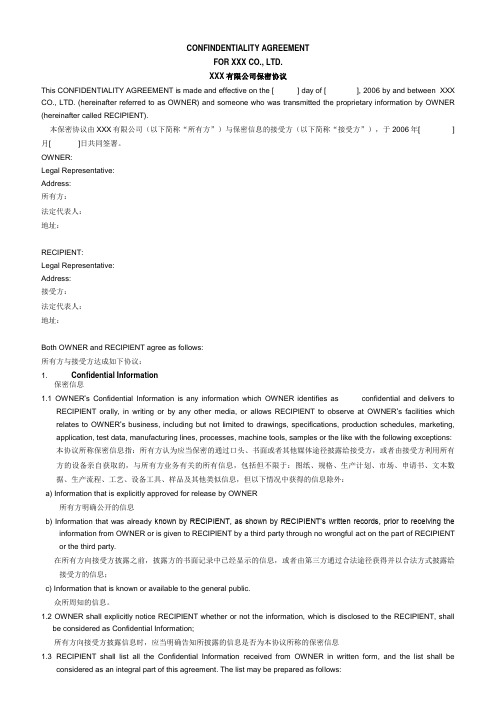

CONFINDENTIALITY AGREEMENTFOR XXX CO., LTD.XXX有限公司保密协议This CONFIDENTIALITY AGREEMENT is made and effective on the [ ] day of [ ], 2006 by and between XXX CO., LTD. (hereinafter referred to as OWNER) and someone who was transmitted the proprietary information by OWNER (hereinafter called RECIPIENT).本保密协议由XXX有限公司(以下简称“所有方”)与保密信息的接受方(以下简称“接受方”),于2006年[ ]月[ ]日共同签署。

OWNER:Legal Representative:Address:所有方:法定代表人:地址:RECIPIENT:Legal Representative:Address:接受方:法定代表人:地址:Both OWNER and RECIPIENT agree as follows:所有方与接受方达成如下协议:1. Confidential Information保密信息1.1 OWNER’s Confidential Information is any information which OWNER identifies asconfidential and delivers to RECIPIENT orally, in writing or by any other media, or allows RECIPIENT to observe at OWNER’s facilities which relates to OWNER’s business, including but not limited to drawings, specifications, production schedules, marketing, application, test data, manufacturing lines, processes, machine tools, samples or the like with the following exceptions:本协议所称保密信息指:所有方认为应当保密的通过口头、书面或者其他媒体途径披露给接受方,或者由接受方利用所有方的设备亲自获取的,与所有方业务有关的所有信息,包括但不限于:图纸、规格、生产计划、市场、申请书、文本数据、生产流程、工艺、设备工具、样品及其他类似信息,但以下情况中获得的信息除外:a) Information that is explicitly approved for release by OWNER所有方明确公开的信息b) Information that was already known by RECIPIENT, as shown by RECIPIENT’s writtenrecords, prior to receiving the information from OWNER or is given to RECIPIENT by a third party through no wrongful act on the part of RECIPIENT or the third party.在所有方向接受方披露之前,披露方的书面记录中已经显示的信息,或者由第三方通过合法途径获得并以合法方式披露给接受方的信息;c) Information that is known or available to the general public.众所周知的信息。

保密协议(中英文)

CONFINDENTIALITY AGREEMENTFOR XXX CO., LTD.XXX有限公司保密协议This CONFIDENTIALITY AGREEMENT is made and effective on the [ ] day of [ ], 2006 by and between XXX CO., LTD. (hereinafter referred to as OWNER) and someone who was transmitted the proprietary information by OWNER (hereinafter called RECIPIENT).本保密协议由XXX有限公司(以下简称“所有方”)与保密信息的接受方(以下简称“接受方”),于2006年[ ]月[ ]日共同签署。

OWNER:Legal Representative:Address:所有方:法定代表人:地址:RECIPIENT:Legal Representative:Address:接受方:法定代表人:地址:Both OWNER and RECIPIENT agree as follows:所有方与接受方达成如下协议:1. Confidential Information保密信息1.1 OWNER’s Confidential Information is any information which OWNER identifies as confidential and delivers toRECIPIENT orally, in writing or by any other media, or allows RECIPIENT to observe at OWNER’s facilities which relates to OWNER’s business, including but not limited to drawings, specifications, production schedules, marketing, application, test data, manufacturing lines, processes, machine tools, samples or the like with the following exceptions: 本协议所称保密信息指:所有方认为应当保密的通过口头、书面或者其他媒体途径披露给接受方,或者由接受方利用所有方的设备亲自获取的,与所有方业务有关的所有信息,包括但不限于:图纸、规格、生产计划、市场、申请书、文本数据、生产流程、工艺、设备工具、样品及其他类似信息,但以下情况中获得的信息除外:a) Information that is explicitly approved for release by OWNER所有方明确公开的信息b) Information that was already known by RECIPIENT, as shown by RECIPIENT’s written records, prior to receiving theinformation from OWNER or is given to RECIPIENT by a third party through no wrongful act on the part of RECIPIENT or the third party.在所有方向接受方披露之前,披露方的书面记录中已经显示的信息,或者由第三方通过合法途径获得并以合法方式披露给接受方的信息;c) Information that is known or available to the general public.众所周知的信息。

股权转让合同协议英文版

股权转让合同协议英文版The stock transfer agreement is a legal document that outlines the terms and conditions under which the ownership of a company's shares is transferred from one party to another. This agreement is crucial in ensuring a smooth and legally binding transfer of ownership, protecting the interests of both the seller and the buyer. In this essay, we will delve into the key components of a stock transfer agreement and explore the importance of having a well-drafted contract.Firstly, the stock transfer agreement should clearly identify the parties involved in the transaction. This includes the name, address, and contact information of the seller and the buyer. It is essential to ensure that the legal identities of the parties are accurately represented to avoid any ambiguity or confusion.Next, the agreement should specify the number of shares being transferred, along with their corresponding class and series. This information is crucial in defining the exact nature and extent of the ownership being transferred. The agreement should also include thepurchase price of the shares and the method of payment, whether it be a lump-sum payment, installments, or a combination of both.The timing and conditions of the share transfer are also crucial elements of the agreement. The contract should outline the effective date of the transfer, as well as any specific conditions that must be met before the transfer can be completed. These conditions may include obtaining necessary approvals from regulatory bodies, securing third-party consents, or the fulfillment of certain financial or operational obligations.Another important aspect of the stock transfer agreement is the representation and warranties made by the seller. These clauses ensure that the seller is providing accurate and truthful information about the company, its assets, liabilities, and any potential liabilities or legal issues. The buyer, in turn, may also provide representations and warranties regarding their ability to complete the transaction and their intended use of the acquired shares.The agreement should also address the issue of transfer restrictions, if any. These clauses outline any limitations or conditions that may be placed on the buyer's ability to further transfer the shares, such as right of first refusal or tag-along rights held by other shareholders.Additionally, the contract should include provisions for the handlingof any dividends, distributions, or other corporate actions that may occur between the signing of the agreement and the effective dateof the transfer. This ensures that the economic benefits and risks associated with the shares are properly allocated between the parties.The stock transfer agreement should also address the issue of indemnification, which outlines the circumstances under which one party may be held liable for any losses or liabilities incurred by the other party. This section typically includes details on the scope of indemnification, the process for making claims, and any limitationsor exclusions.Finally, the agreement should include standard contractual provisions, such as governing law, dispute resolution mechanisms, termination clauses, and the assignment of rights and obligations. These provisions help to ensure the enforceability of the agreement and provide a framework for addressing any potential issues that may arise during or after the transaction.In conclusion, the stock transfer agreement is a critical document that plays a pivotal role in the transfer of ownership of a company's shares. By clearly defining the terms and conditions of the transaction, the agreement helps to protect the interests of both the seller and the buyer, and ensures a smooth and legally binding transfer of ownership. It is essential for parties involved in suchtransactions to carefully review and negotiate the terms of the agreement to ensure that their rights and obligations are properly addressed.。

公司股权收购框架性协议(中英文)

公司股权收购框架性协议(中英文)目录 CONTENTS1. 目标 OBJECTIVE2. 拟定交易PROPOSED TRANSACTION3. 保密CONFIDENTIALITY4. 排他性EXCLUSIVITY5. 管辖法律适用及争议解决APPLICABLE LAW, JURISDICTION AND DISPUTE RESOLUTION6. 费用COST7. 通知NOTICES8. 生效、终止与存续EFFECTIVENESS, TERMINATION AND SURVIVAL9. 文字和文本LANGUAGE AND COUNTERPARTS本投资框架协议(以下简称“协议”)由下述双方于___ 签订:THIS INVESTMENT FRAMEWORK AGREEMENT (“Agreement”) is entered into as on this [Date] between: 出售方: (以下简称“甲方”);The Vendor: (“Party A”);投资方:ABC有限公司(以下简称“乙方”)。

The Investor: LAP WAI INTERNATIONAL LTD. (“Party B”).鉴于:WHEREAS:A.香港联港投资有限公司(以下简称“目标公司”)为一家依据香港特别行政区法律成立的公司,甲方拥有目标公司[100%]的股份。

UNION HARBOUR INVESTMENT LIMITED (“Target Company”) is a company established under the laws of HongKong Special Administrative Region. Target Company is owned as to [100%] by Party A.B.目标公司在中国(仅为本协议之目的,中国不包括香港特别行政区、澳门特别行政区和台湾)境内拥有公司90%的股权。

股权合同 英文 模板

股权合同英文模板The stock equity contract is a crucial legal document that outlines the terms and conditions governing the ownership and management of a company's shares. It serves as a binding agreement between the company, its shareholders, and any other relevant parties involved in the equity structure. This contract is essential in establishing the rights, responsibilities, and expectations of all stakeholders, ensuring a clear and transparent framework for the company's operations and growth.One of the primary purposes of a stock equity contract is to define the ownership structure of the company. This includes the allocation of shares, the voting rights associated with those shares, and the distribution of profits and losses. The contract should clearly specify the number of authorized shares, the par value of each share, and the percentage of ownership held by each shareholder. It should also outline the process for issuing new shares, transferring existing shares, and any restrictions or limitations on share ownership.Another critical aspect of the stock equity contract is the governancestructure of the company. This includes the composition and responsibilities of the board of directors, the decision-making process for major corporate decisions, and the mechanisms for resolving disputes or conflicts among shareholders. The contract should specify the voting rights of shareholders, the procedures for electing and removing directors, and the protocols for shareholder meetings and voting.The stock equity contract should also address the financial and operational aspects of the company's management. This includes provisions for the distribution of dividends, the allocation of profits and losses, and the handling of company assets and liabilities. The contract should outline the financial reporting requirements, the auditing procedures, and the mechanisms for accessing and reviewing the company's financial records.In addition to the ownership and governance structures, the stock equity contract should also cover the rights and responsibilities of the shareholders. This includes the right to receive dividends, the right to access company information, and the right to participate in the decision-making process. The contract should also outline the obligations of shareholders, such as the requirement to contribute capital, the limitations on share transfers, and the consequences of non-compliance with the contract's terms.The stock equity contract should also address the issue of exit strategies and liquidity events. This includes the procedures for selling or transferring shares, the rights of first refusal, and the protocols for initial public offerings (IPOs) or other forms of equity financing. The contract should also outline the conditions under which a shareholder can withdraw from the company or the company can buy back the shareholder's shares.Finally, the stock equity contract should include provisions for the amendment and termination of the agreement. This includes the process for making changes to the contract, the requirements for obtaining shareholder approval, and the conditions under which the contract can be terminated or dissolved.In conclusion, the stock equity contract is a critical document that serves as the foundation for the ownership and management of a company's shares. It establishes the rights, responsibilities, and expectations of all stakeholders, ensuring a clear and transparent framework for the company's operations and growth. By drafting a comprehensive and well-structured stock equity contract, companies can protect the interests of their shareholders, maintain a stable and efficient governance structure, and navigate the complex landscape of equity financing and ownership.。

公司股权认购协议(中英文)

AGREEMENT OF PREFERRED STOCK FINANCING鉴于涉及此项投资的投资人已投入和将投入的时间和成本,无论此次融资是否完成,本条款清单之限制出售/保密条款、律师及费用条款对公司都具有强制约束力。

未经各方一致签署并交付的最终协议,本条款清单之其他条款不具有强制约束力。

本条款清单并非投资人进行投资的承诺,其生效以完成令投资人满意的尽职调查、法律审查和文件签署为条件。

本条款清单各方面受特拉华州法律管辖。

In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality and Counsel and Expenses provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of the State of Delaware.出资条款:Offering Terms交割日:当公司接受此条款清单且交割条件完备时即尽快交割(“交割”)。

并购保密协议中英文

This Confidentiality Agreement ("Agreement") is entered into as of [Date] ("Effective Date"), between [Company A] ("Company A"), a [Jurisdiction] corporation with its principal place of business at [Address], and [Company B] ("Company B"), a [Jurisdiction] corporation with itsprincipal place of business at [Address].WHEREAS, Company A and Company B ("Parties") are engaged in discussions regarding a potential merger, acquisition, or investment transaction (the "Transaction") involving one or both of the Parties; andWHEREAS, the Parties have determined that certain confidential information may be disclosed to each other in connection with the Transaction; andNOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, the Parties agree as follows:1. Confidential InformationFor the purposes of this Agreement, "Confidential Information" shall mean any and all non-public information, including but not limited to technical, financial, business, commercial, and other information thatis disclosed by either Party to the other Party in connection with the Transaction, or that is otherwise obtained by either Party from theother Party or from any other source in connection with the Transaction.Confidential Information shall not include information that:(a) is or becomes publicly known through no fault of the receiving Party;(b) is already in the possession of the receiving Party at the time of disclosure without a duty of confidentiality;(c) is or becomes publicly known through no fault of the receiving Party after disclosure by the disclosing Party to the receiving Party;(d) is independently developed by the receiving Party without use of or reference to the disclosing Party's Confidential Information; or(e) is obtained by the receiving Party from a third party without a breach of such third party's obligations of confidentiality.2. Obligations of the PartiesThe Parties agree that they will:(a) hold in strict confidence and not disclose to any third party any Confidential Information of the other Party received hereunder;(b) use the Confidential Information solely for the purpose of evaluating the Transaction and related matters;(c) not make any use of the Confidential Information for any purpose other than as contemplated by this Agreement without the prior written consent of the disclosing Party;(d) not copy or make any derivative works of the Confidential Information except as necessary for the evaluation of the Transaction;(e) return or destroy all Confidential Information upon the termination of this Agreement or upon the written request of the disclosing Party; and(f) ensure that their respective employees, agents, consultants, and other representatives who have access to the Confidential Information are aware of and agree to be bound by the terms of this Agreement.3. ExclusionsThe obligations of confidentiality under this Agreement shall not apply to information that is disclosed by a Party if such disclosure is:(a) required by law or by the order of a court, administrative agency, or other governmental authority, provided that the receiving Party shall provide the disclosing Party with prior written notice of such requirement and an opportunity to contest the disclosure; or(b) otherwise publicly disclosed without breach of this Agreement.4. Term and TerminationThis Agreement shall be effective as of the Effective Date and shall remain in effect for a period of [Number] years following the Effective Date, unless terminated earlier in accordance with its terms.This Agreement may be terminated by either Party upon written notice to the other Party if the other Party breaches any material term or condition of this Agreement and fails to cure such breach within [Number] days after receipt of written notice thereof.5. Governing Law and JurisdictionThis Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction]. Any disputes arising out of or in connectionwith this Agreement shall be subject to the exclusive jurisdiction ofthe courts of [Jurisdiction].IN WITNESS WHEREOF, the Parties have executed this Confidentiality Agreement as of the Effective Date by their duly authorized representatives:[Company A]:By: ___________________________Name:Title:Date:[Company B]:By: ___________________________Name:Title:Date:---Confidentialité Agreement Relatif à la FusionLe présent Accord de confidentialité ("Accord") est conclu à compter du [Date] ("Date d'entrée en vigueur"), entre [Société A] ("Société A"),une société de [Juridiction] ayant son siège social à [Adresse], et[Société B] ("Société B"), une société de [Juridiction] ayant son siège social à [Adresse].Vu que la Société A et la Société B ("Les Parties") sont engagées dans des discussions concernant une éventuelle fusion, acquisition ouopération d'investissement (l' "Opération") impliquant l'une ou les deux Parties ; etVu que les Parties ont déterminé que certaines informations confidentielles pourraient être divul。

股东协议书英文模板

股东协议书英文模板THIS SHAREHOLDERS' AGREEMENT (this "Agreement") is made and entered into as of the ________ day of ________, 20______ (the "Effective Date"), by and among the undersigned parties (each a "Party" and collectively, the "Parties").WHEREAS, the Parties desire to enter into this Agreement to govern their respective rights and obligations as shareholders in the Company, and to establish certain terms and conditions relating to the ownership, management, and operation of the Company.NOW, THEREFORE, in consideration of the mutual promises and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:Article 1: Definitions1.1 "Affiliate" means any person or entity that directly or indirectly controls, is controlled by, or is under common control with a Party.1.2 "Company" means [Company Name], a [type of entity] organized and existing under the laws of [jurisdiction].1.3 "Shares" means the shares of the Company's capital stock.1.4 "Voting Rights" means the right to vote on any matter brought before the shareholders of the Company.Article 2: Capitalization2.1 The authorized capital of the Company shall consist of [number] shares of common stock, which may be issued from time to time.2.2 Each Party shall have the right to purchase additional Shares in the Company, subject to the terms and conditions of this Agreement.Article 3: Voting Rights3.1 Each Party shall have the right to exercise its Voting Rights in accordance with the laws of [jurisdiction] and the Company's bylaws.3.2 The Parties agree that, unless otherwise provided in this Agreement, all matters requiring shareholder approval shall be decided by a majority of the votes cast by the shareholders.Article 4: Transfer of Shares4.1 No Party shall sell, transfer, assign, or otherwise dispose of its Shares without the prior written consent of the other Parties.4.2 Any transfer of Shares shall be subject to the right offirst refusal in favor of the other Parties, as set forth in [Schedule A].Article 5: Dividends5.1 The Company shall pay dividends to the shareholders in accordance with the Company's bylaws and as determined by the board of directors.5.2 The Parties acknowledge that the payment of dividends shall be subject to the Company's financial condition and the discretion of the board of directors.Article 6: Management and Control6.1 The management and control of the Company shall be vested in its board of directors.6.2 The Parties shall each have the right to nominate and elect directors to the board of directors, as provided in the Company's bylaws.Article 7: Confidentiality7.1 Each Party shall keep confidential all information obtained in connection with this Agreement and the Company's business, except as required by law or with the prior written consent of the other Parties.Article 8: Termination8.1 This Agreement may be terminated by mutual written consent of the Parties.8.2 In the event of a breach of any material provision ofthis Agreement by a Party, the non-breaching Party may terminate this Agreement upon written notice to the breaching Party.Article 9: Dispute Resolution9.1 Any dispute arising out of or in connection with this Agreement shall be resolved by arbitration in accordance with the rules of [arbitration institution], and judgment upon the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof.Article 10: Miscellaneous10.1 This Agreement shall be governed by and construed in accordance with the laws of [jurisdiction].10.2 This Agreement may be amended only by a written instrument executed by all Parties.10.3 This Agreement sets forth the entire agreement and understanding of the Parties with respect to the subject matter hereof and supersedes all prior agreements and understandings.IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date.[Company Name]By: __________________________ Name: [Authorized Representative] [Party A]By: __________________________ Name: [Authorized Representative] Title: [Title][Party B]By: __________________________ Name: [Authorized Representative] Title: [Title][Schedule A: Right of First Refusal]。

股份协议书 英文

股份协议书1. 引言本股份协议书(以下简称“协议书”)是由以下各方(以下简称“方”或“合作方”)根据相关法律法规,为了明确各方对于股份转让事宜所达成的一致意见,并为各方确保权益的保护而制定的。

合作方1: - 姓名: - 地址: - 联系方式:合作方2: - 姓名: - 地址: - 联系方式:2. 转让股权各方同意通过本协议将合作方1在公司名称中所持有的股份转让给合作方2,并达成以下约定:2.1 股权转让款项合作方2同意向合作方1支付总计XX万(¥)作为股权转让款项,款项应在本协议签署之日起XX个工作日内一次性支付完成。

2.2 股权过户手续合作方1同意在收到股权转让款项后,协助办理所有相关的股权转让手续,并将公司相关的所有登记、备案、合同等文件交付给合作方2。

2.3 股权转让的效力合作方1同意在本协议签署后的X个工作日内,完成相关的法律程序和手续,确保股权转让的有效性,并将合作方2的姓名登记在公司的股东名册上。

3. 股权收益与红利分配3.1 股东权益自本协议签署起,合作方2将享有相应的股东权益,包括但不限于有关公司经营决策、利润分配等权益。

3.2 利润分配根据公司经营状况和公司章程约定,公司将根据股权比例分配利润。

合作方2将按照其持股比例享有相应的红利。

4. 风险与责任双方共同承担投资和经营所带来的风险和责任。

双方应积极履行各自义务,共同努力推动公司的发展和经营。

5. 保密条款各方应对在履行本协议过程中所获得的对方商业秘密等保密信息予以保密。

未经对方书面同意,不得向第三方披露、使用或转让。

6. 争议解决各方发生的与本协议相关的争议,应通过友好协商解决。

若协商不成,任何一方可向有管辖权的法院提起诉讼。

7. 其他条款7.1 本协议的生效与终止本协议自双方签署之日起生效,并在以下情况中终止: - 合作方1和合作方2达成书面一致意见; - 双方依法经由有关主管机关批准解散、歇业或被吊销营业执照。

7.2 协议的修改与补充协议的修改、补充或解释,应由合作方1和合作方2双方经过协商一致,并以书面形式进行。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

CONFIDENTIALITY AGREEMENTTHIS AGREEMENT made this ____________ th dayof ___________ (Month) , 20 (Year). BETWEEN:Company Name , a company having an office in _______________ [City,Co un try] (here in after called“ Disclosing Part ) ”-and -Company Name , a company having an office in__________________ [City, Country] (hereinafter called“ Recipie nt ”)WHEREAS in conn ecti on with discussi ons relatedto _________________ t he Recipie nt has in dicated an in terest in an alyz ing and assessing the Disclosing Party interests in certain lands held by Disclos ing Party with in the area described in “ ScheduleA ” hereto (the “ Assets; a n)dWHEREAS the Recipie nt wishes to obtai n certa in Con fide ntial Information, as defined in paragraph 1(a), from the Disclosing Party, and the Disclos ing Party is prepared to disclose such Con fide ntial In formatio n to the Recipie nt upon the terms and con diti ons contained herein (the “ Con fide ntiality Agreeme nt ” )in order to en able the Recipie nt to con sider and evaluate the Con fide ntial In formati on forthe sole purpose of assessing a potential transaction with respect to a portion of the Disclosing Party 's interest in the Asseite(1hel Transaction ; ”)NOW THEREFORE THIS AGREEMENT WITNESSETH that in con siderati on of the Recipie nt being provided with Con fide ntialIn formatio n to assess the Pote ntial Tran sacti on and in con sideratio n of the premises and the mutual cove nants and agreeme nts here in contain ed, the parties hereto agree as follows:1. NON-DISCLOSURE AND PROTECTION OF CONFIDENTIAL INFORMATION(1) All in formatio n disclosed to or acquired by the Recipie nt on or subseque nt to the date of executi on of this Con fide ntiality Agreeme nt by the Recipie nt, and whether oral or writte n, or received through electronic transmission, observation, meetings or otherwise, from the Disclosing Party with respect to or pertaining to the Assets, the Pote ntial Tran sacti on or to the bus in ess and affairs of the Disclos ing Partyin conn ecti on therewith (the “ Con fide ntial In formati oncon sidered proprietary in n ature and shall be held in strict con fide nce by the Recipie nt at all times and shall not, without the Disclos ing Party 's prior writte n consent, be disclosed directly or in directly to any other pers on, firm or corporati on, or used by the Recipie nt for any purpose other than its evaluation of the Potential Transaction. Such Con fide ntial In formati on in cludes, but shall not be limited to, finan cial results, marketi ng materials, budget in formatio n, geological, geophysical, geochemical, tran sportati on, process ing, engin eeri ng and environmental information, production data, evaluations, projections, pate nts, trade secrets, i nterpretati ons, an alyses, maps, la nd schedules, documents of title, materials relating to title matters and other documentation (whether prepared by Disclosing Party or its representatitives or other persons) made available to Recipient in anyconfidential information memorandum, data books, data rooms, presentations or websites. Such Confidential Information shall also include all reports, analyses, notes or other information (including those prepared by Recipient or its representatives) that are based on, contain or reflect any Confidential Information.(2) The Recipient shall be at liberty to disclose the Confidential Information, but shall in any event restrict the disclosure of such Confidential Information, to only such directors, officers and employees of the Recipient, any of Recipient's Affiliates, and to any of the Recipient's consultants and advisors, who need to know or need to have access to the Confidential Information for the purposes described herein (the “ AppropriatePersonnel ”). TRh e cipient shall require the Appropriate Personnel to hold the Confidential Information in confidence and shall be responsible hereunder for compliance by such persons with this Confidentiality Agreement with respect to ConfidentialInformation disclosed to them by or on behalf of the Recipient. For the purposes of this Confidentiality Agreement “ Affiliate me”ans any corporation or partnership that, directly or indirectly, controls or is controlled by the party, or is controlled by the same corporation or other person who controls the party, for which purposes “ control of”a corporation means the ability to elect amajority of its board of directors and “rtcnoenrtsrhoilp m”eanosf a pathe ability to exercise a majority of its voting rights on business decisions.(3) The Recipient and Disclosing Party shall not disclose to any person the fact that any negotiations or discussions are taking place concerning a possible transaction between the Recipient and the Disclosing Party or that the Recipient has received the Confidential Information.(4) The Recipient shall be bound by and observe all of the provisions of any confidentiality agreement (once advised by the Disclosing Party of the existence thereof) with other parties pursuant to which the Disclosing Party has acquired any portion of the Confidential Information or that are applicable to disclosure by the Disclosing Party of any of the Confidential Information to the Recipient.(5) The Recipient understands that neither this Confidentiality Agreement nor the disclosure of any Confidential Information to Recipient shall be construed as granting to it or any of its representatives any license or rights in respect of any part of the Confidential Information.(6) In the event that the Recipient is required to disclose any of the Confidential Information to or by any governmental agency, tribunal or other en tity by due legal process or by a stock excha nge on which Recipie nt's securities are listed, the n the Recipie nt shall provide theDisclosing Party with immediate notice of such requirement in order that the Disclos ing Party may seek an appropriate remedy or waive, in whole or in part, the terms of this Con fide ntiality Agreeme nt, in which case the Recipie nt shall disclose only that Con fide ntial In formatio n which it is advised by written opinion of counsel is required to satisfy such requirements. A copy of such written opinion of counsel shall, at the request of the Disclosing Party, be furnished to the Disclosing Party prior to such disclosure. Recipie nt shall cooperate fully with the Disclos ing Party on a reas on able basis in any attempt by the Disclos ing Party to obta in a protective order or other remedy.2. LIMITATIONNotwithsta nding the provisi ons contained in paragraph 1 hereof, the Con fide ntial In formati on shall n ot in clude any in formati on or kno wledge which:(1) was in the public kno wledge or was gen erally known in thebus in ess com munity at the time of disclosure;(2) becomes part of the public kno wledge or was gen erally known in the bus in ess com mun ity after the time of disclosure through no breach of the Recipie nt 's obligati ons here un der;。