国际会计第四章练习

国际会计题答案

国际会计题答案《国际会计》第一章国际会计的形式与发展一、单项选择题1、国际会计成为一门新的会计学科,大致在(A)A 20世纪70年代B 20世纪60年代C20世纪90年代D20世纪50年代2、跨国公司兴起导致的独特的会计问题是()A 国际物价变动影响的调整B 国际财务报表的合并C 外币报表的折算D 国际税务会计3、“四大”会计师事务所的业务扩展与委托人的联系使用的是(A)A 同一名称和同一语言B 不同名称和同一语言C 不同名称和不同语言D 同一名称和不同语言4、第一次国际会计师大会举行的时间、地点是(A )A 1904年圣路易斯B 1952年伦敦C 1962年纽约D 1972年悉尼5、1977年于慕尼黑举行的第十一次国际会计师大会上创建的国际会计师联合会(IFAC)的前身是(A )A 会计职业界国际协调委员会(ICCAP)B 国际会计准则委员会(IASC)C 国际审计事务委员会(IAPC)D 国际会计师大会技术委员会二、多项选择题1、国际会计的三大课题是(ABC )A 国际物价变动影响的调整B 国际财务报表的合并C 外币报表的折算D 国际税务会计2、现有的国际性会计事务所(会计公司)中所谓的“四大”包括(A B C D )A普华永道B毕马威国际C德勤D永安国际E安达信国际3、国内性质的会计师事务所为从事国际业务而进行的临时协作一般要通过哪些途径联系?()A 国际性的职业届会议B 双方直接联系C 各国的执业会计师协会下设的国际联络委员会D 各国政府4、我国注册会计师考试的报考者的条件包括(AB )A 具有大专或大专以上学历B 具有会计、审计、统计、经济中级或中级以上的专业技术职称C 有两年的会计师事务所工作经验D 必须是中国公民5、自1994年,我国已允许(ABCD)参加我国注册会计师统一考试。

A 我国大陆公民B 香港居民C 澳门居民3D 台湾居民E 外国籍公民(该国法律允许中国公民参加该国注册会计师考试)6、20世纪70年代国际会计的研究中,悲观主义者的“国别会计”观的主要观点包括(ABC )A 各国会计的差异是各国不同的经济、政治、社会、法律、文化等环境影响所形成,不可能协调一致。

第四章国际会计

4.1.4 日本会计准则与国际会计准则的趋同 进程

日本会计准则的制定转向了主要依靠民间力量的机制

目前存在于日本公认会计实务和国际会计准则中的7处 主要不同之处:

(1)金融工具(终止确认,要求取得法律认可);(2 )企业合并(极少使用权益集合法,合并商誉必须摊销); (3)资产减值(不用);(4)养老金(对损失和利得进行 摊销);(5)研发费用(费用化);(6)合并报表(独立 列示少数股东权益);(7)投资用房产(历史成本计量) 。

• 行政管理层次指大藏省下设的企业会计 审议会 。

(二)会计规范

• 法律中的会计规范

–日本的商法 –日本的证券交易法 –日本的企业所得税法

• 政府会计规范

–(1)日本企业会计原则

–(2)合并报表原则及其注释。 –(3)外币交易会计处理标准及其注释。 –(4)成本计算标准。

4.1.1 会计实务基本上服从法律要求

(4)应在一致的基础上编制财务报表, 对会计原则 变动的重大影响应予以披露;

(5)应在财务报表及其附加的注释中披露上期的比 较财务信息。

荷兰还是世界上惟一明确规定对《年度报表法》的实 施进行法定检查的国家。

荷兰《年度报表法》和《所得税法》的会计要求并不 完全一致。区别于德国, 类似于美国。

4.2.2 由官方和民间结合的三方准则委员 会”制定会计准则

• 日本会计中, 不得将资本交易带来的净资产增 加额纳入分配。这条原则实质上是企业资本保 全原则。

• 日本会计模式具有宏观利益和企业利益双重导 向。

(一)会计管理体制

• 日本的会计管理体制可以分为法制管理 和行政管理两个层次。

• 法制管理层次又可以分为三个部分, 即 商法、证券交易法和公司所得税法。

国际会计第七版课后答案(第四章)作者:弗雷德里克

Chapter 4Comparative Accounting: The Americas and AsiaDiscussion Questions1. Public and private sector bodies are involved in regulating and enforcing financial reporting in the UnitedStates. The Financial Accounting Standards Board is a private sector body that determines U.S.generally accepted accounting principles. The Securities and Exchange Commission has the authority to determine U.S. GAAP for publicly held companies, but defers to the FASB. The FASB and SEChave a close working relationship that ensures that FASB standards are acceptable to the SEC. The SEC enforces financial reporting rules for publicly held companies. It actively reviews the filings thatcompanies make. Auditors are the enforcers for non-publicly held companies.Accounting standards in Mexico are issued by the Council for Research and Development of Financial Information Standards (CINIF), an independent public-private sector body patterned after the U.S.FASB. Its authority for issuing Mexican accounting standards is recognized by the National Bankingand Securities Commission, the government agency that regulates the Mexican Stock Exchange. The Commission is responsible for enforcing financial reporting standards for listed companies. However, it is unclear how proactive the Commission is in investigating filings that it receives. Enforcement offinancial reporting for non-listed companies effectively rests with auditors.Japanese accounting standards are set by a private sector body, the Accounting Standards Board of Japan. The establishment of the ASBJ is a recent development in Japan. Before, accounting standard setting was a government activity. Enforcement of financial reporting effectively rests with auditors. The stock exchange is regulated by the Financial Services Agency, a government body. However, it isunclear how proactive the FSA is in monitoring financial reporting by Japanese companies.Accounting standard setting is a government activity in China. The China Accounting StandardsCommittee is the authoritative body within the Ministry of Finance responsible for developingaccounting standards. The China Securities Regulatory Committee is the government agency thatregulates China 'tws o stock exchanges. The CSRC is also responsible for enforcing financial reporting for listed companies. Many question the effectiveness of the Chinese enforcement mechanism.The Institute of Chartered Accountants in India, a private sector professional body, developsaccounting standards in India. The Securities and Exchange Board of India, an agency of the Ministry of Finance, regulates India '22s stock exchanges and is responsible for enforcing financial reportingrules. However, it is unclear how proactive the board is in monitoring financial reporting by Indiancompanies.Overall, the five countries vary in terms of private versus public sector responsibility for regulating and enforcing financial reporting. Enforcement is questionable in several countries.The United States has the strongest mechanism for regulating and enforcing financial reporting of the five countries.2. The United States and India are common law countries that have fair presentation oriented financialreporting. Mexico also has fair presentation oriented financial reporting because of U.S.influence. In addition, Mexico has inflation-adjusted accounting, in contrast to the other four countries.Japan is a code law country and its accounting has traditionally been characterized as conservativeand tax-driven, just like other code law countries (such as France and Germany discussed in Chapter3.) However, it is moving to fair presentation because of its commitment to converge Japaneseaccounting standards with IFRS. China is likewise moving toward fair presentation oriented accountingby adopting IFRS as Chinese GAAP. Despite adopting fair presentation principles, one can questionwhether the Chinese achieve it in application. There is an acute shortage of trained accountants inChina and the profession remains undeveloped. The accounting profession is strong in the other fourdevelopin countries, including the of India and Mexico.3. The auditor oversight bodies discussed in this chapter are:a. Un ited States - Public Company Acco un ti ng Oversight Boardb. Japan - Certified PublicAccountant and Auditing Oversight BoardThe recent establishment of independent auditor oversight bodies in the United States and Japan is inresponse to recent worldwide accounting scandals. Both represent tightening control over auditors.4. Tax legislation pays a limited role in all five countries, with the exception of Japan. In the United States,financial and tax accounting are separate except for LIFO. Tax legislation has little influence onfinancial reporting practices in Mexico. For example, there are numerous differences between financialand tax accounting, such as the calculation of cost of sales, depreciation, and goodwill amortization.Tax legislation has traditionally been one side of the “triangularlegal system” in Japan, exerting aninfluence on Japanese accounting standards. However, the influence of taxation is declining with thealignment of Japanese accounting standards to IFRS. Several years ago, tax legislation had someinfluence in China, but this has waned as China develops a more complete set of financial reportingstandards. India, like other common law countries, separates financial and tax accounting.4.This question has been of interest in academia for quite some time. Is accounting expertise a necessaryprecondition for economic development, or can an economy advance without it? It would seem that aneconomy cannot advance very far without accounting expertise. But the relationship probably worksboth ways, just like demand creates supply and vice-versa.The example of China demonstrates the importance of developing accounting (standards, knowledge,etc.). Accounting is a part of the market reform packages in China, so the need has been recognizedfrom the start. Mexico and India have been market-oriented longer than China, and their accounting ismore developed. But again, it is apparent in these two countries that accounting supports economicdevelopment.6. U.K. standards (Chapter 3) and IFRS (Chapter 8) are said to reflect principles-based standards, whileU.S. standards (this chapter) are said to be rules-based. Generally speaking, principles- basedstandards set forth broad objectives and fundamentals and require professional judgment for theirimplementation. They are more flexible than rules-based standards and are likely to result in moredivergence in practice. Rules-based standards are more specific in their requirements and have moredetailed implementation guidance than principles-based standards. They are likely to result in morecomparability than principles-based standards, but are said tofoster a “checkthe box ”mentality. The chapter says that U.S. GAAP is “probablymorevoluminous than in the rest of the world combined and substantially more detailed than in any other country. ” Thus, one can argue that U.S. GAAP is r-ublae s ed.7. The U.K. and U.S. both follow fair presentation accounting, reflecting economic substance ratherthan legal form. Both the U.K. “ trueand fair ”and the U.S. “ presentsfairly r ”eflect fair presentation. However, the U.K. has a true and fair override -accounting standards can be overridden if necessary to achieve a true and fair view. In the U.S., presents fairly means that generally accepted accounting principles have been followed. 8. The most important reconciling item (i.e., the most significant difference between Mexican and U.S.accounting) relates to the use of general price level accounting in Mexico. Strict historical cost is used in the U.S. Two other differences noted in the chapter are (a) Mexico applies the equity method at 10 percent, whereas the U.S. applies it at 20 percent and (b) in Mexico development costs are capitalized and amortized after technological feasibility has been established; in the U.S., they are expensed. 9. The bursting of the Japanese bubble economy in the 1990s prompted a review of Japanesefinancial reporting standards. It became clear that many accounting practices hid how badly many Japanese companies were actually doing. The accounting was d “esbii g nbeadntgom ”ake thefinancial condition of Japanese companies more transparent and bring Japanese accounting more in line with international norms.Practice changes include the following:Requiring listed companies to report a statement of cash flows.Subsidiary companies are consolidated based on control rather than ownership.Affiliated companies are accounted for using the equity method based on influence ratherthan ownership. Investments in securities are valued at market rather than cost. Deferred taxes are fully provided. Pension and other retirement obligations are accrued in full.10. Full and complete disclosure of reliable, evenhanded information is necessary to develop a fair andefficient stock market. The “Anglo-Saxon ” model of accounting (discussed in Chapter 2),emphasizing a fair presentation of financial condition and results, and emphasizing stewardship, also fosters the development of a fair and efficient stock market. Countries with this accounting orientation (such as the U.S. and U.K.) have active, fair and efficient stock markets. There is also a legal structure and an effective enforcement of laws and accounting disclosures to make it all work.China is developing accounting standards with the stock market orientation discussed above. So China is on the right track here -the standards themselves will support the development of a stock market. In addition, investors must have confidence that the standards are being followed, i.e., that the information disseminated by companies is reliable. Thus, good auditing by well- trained accounting professionals is important. China may have difficulty developing ana. b. c. d. e. f.accounting profession, which would in turn be a hindrance to stock market development. China must also overcome the culture of secrecy developed under communism.11. The chapter mentions a number of examples where Chinese accounting standards are consistentwith world class practices. A selective list of the more important ones are the following:a. Comparative, consolidated financial statements including a balance sheet, incomestatement, cash flow statement, and notes. b. Accrual basis for recognizing revenues and expenses, matching, and consistency. c. Purchase method for business combinations with annual impairments test. d. Equity method for nonconsolidated affiliates.e. Use of historical cost.f. Finance leases capitalized. 12. The British influence on accounting in India is clear. India has a common law legal system and fair presentation accounting that accompanies it. Like Britain, financial statements must give a true and fair view and there is a strong self-regulated accounting profession. Professional accountants (auditors) are called chartered accountants in both countries. The financial reporting and accounting measurements described in this chapter for India are very similar to those described in Chapter 3 for the United Kingdom. Exercises 1. United States Financial Accounting Standards Board.Securities and Exchange Commission.a. b. Mexicoa. b. The Council for Research and Development of Financial Information Standards.There is no definitive enforcement agency. However, the National Banking and Securitiescommission regulates the Mexican Stock Exchange.Japana. b. The Accounting Standards Board of Japan.The Financial Services Agency for listed companies under the securities law and the Ministry of Justice, when company law is involved.Chinaa. b. The Chinese Accounting Standards Committee under the Ministry of Finance.The Chinese Institute of Certified Public Accountants, under the jurisdiction of the Ministry of Finance, regulates auditing. Indiaa. b. Institute of Chartered Accountants of India. Institute of Chartered Accountants of India.2.At the time of writing, the following organizations were linked to IFAC 's website:United StatesInstitute of Management AccountantsAmerican Institute of Certified Public AccountantsNational Association of State Boards of AccountancyMexicoInstituto Mexicano de Contadores P blicos uJapanJapanese Institute of Certified Public AccountantsChinaChinese Institute of Certified Public Accountants3.The question asked for five expressions, terms, or short phrases unfamiliar or unusual in the student's home country. Taking the United States as the home coyu,nhterre are twelve:a. Triangular legal system -A description of accounting regulation in Japan consisting of theinteracting Company Law, Securities and Exchange Law, and Corporate Income TaxLaw.b. Socialist market economy -Used in China to describe its planned economy with marketadaptations.c. Land and in dustrial prop erty rights - Still owned by the Chin ese gover nment, p rivatecompanies acquire the right to use these industrial assets.d. Pesos of current purchasing power -A term to describe general price level accounting inMexico.e. Tax complianee audit report - Mexican auditors must attest that no irregularities wereobserved regarding compliance with tax laws.f. Statement of changes in financial position - the financial statement in Mexico thatcorresponds to the statement of cash flow. However, the statement of changes in financialposition is prepared in constant pesos (adjusted for inflation), while the cash flowstatement uses historical cost.g. Seni ority p remiums - compen sati on p aid in Mexico at the term in ati on of employmentbased on how long the employee has worked.h. Keiretsu —n terlock ing gia nt con glomerates inJapan.i. Guanxi -Relationship culture in China that is based on mutuality and mutual duties.j. B-shares -Shares issued to foreig n in vestors by Chin ese listedcompanies.k. True and fair view -The requirement in India that financial statements present a true and fair view came from Britain.I. Amalgamaten -The term used in India for a merger.4. The most important financial accounting practice or principle at variance with international norms isprobably the following:Uni ted States -LIFO. Drive n by tax law con siderati ons, no other country uses LIFO to the exte nt found in the U.S. LIFO reduces reported earnings. Because older, lower costs of inventory are shown on the balance sheet, the debt to asset ratio will be higher. Companies using LIFO must report so-called LIFO reserves that enable an analyst to convert LIFO amounts to FIFO amounts.Mexico Tnflation adjustments. Most countries in the world value assets and related expenses at historical cost; few countries incorporate inflation adjustments. With inflation adjustments, earnings will be lower and the debt to asset ratio will probably be lower as well. It is unlikely that an analyst will be able to adjust Mexican accounts to historical cost. Of course, such an adjustment is unwise, given high inflation.Japan - Pooli ng of in terests method for bus in ess comb in ati ons where no p arty obta ins con trol over the other. The international norm is to treat all business combinations as a purchase.Compared to purchase accounting, pooling results in higher income and lower asset values.Therefore, the debt to asset ratio will be higher. An analyst will be unable to adjust for thisaccounting method.China -Show ing the right to use land and in dustrial property owned by the gover nment as an intangible asset. China is unusual in the extent to which the government owns land and industrial property. As long as these intangibles are fairly valued, there will be no effect on reported earnings or the debt to asset ratio. However, the analyst must realize that the intangible asset shown on a Chinese company' sbalance sheet is a tangible asset on the balance sheets of companies from other countries.In dia -Pooli ng of in terests method for amalgamati ons (mergers). As no ted above for Japan, the international norm is to treat all business combinations as a purchase. Compared to purchase accounting, pooling results in higher income and lower asset values. Therefore, the debt to asset ratio will be higher. An analyst will be unable to adjust for this accounting method.5. At the time of writing, the following numbers are reported by the World Federation of StockExchanges:The significant number of listed companies in India may be surprising. It may also be surprising that the number of listed Japanese companies matches the numbers for the United States. Ano ther poten tial sur prise is the fact that the Mexica n Stock Excha nge has more foreig n listed firms than domestic listed firms. Students will probably speculate that most of the foreig n listed firms in Mexico are from other Lat in America n coun tries, a stateme nt that is in fact true.The lack of foreig n listed firms in China and In dia has two p ossible explan ati ons -either the gover nment does not allow foreig n firms to list on domestic excha nges, or companies do not see these stock markets as an attractive place to raise cap ital. The latter explan ati on is why there are so few foreig n listed firms in Japan.5.A comparison of the countries in Exhibit 4-5 reveals few differences among the United States,Mexico, and China. Thus, all three coun tries can claim that their GAAP are comp arably orie nted toward equity in vestors. However, of the three coun tries, the Un ited States can p robably claim to have GAAP most orie nted toward equity in vestors. The cha pter no tes that the U.S. has the most voluminous and detailed accounting requirements in the world and that they are rigorously en forced. Thus, the nod goes to the Un ited States.India and Japan both allow pooling of interests accounting, an accounting treatment now at varia nee with in ter nati onal no rms. The treatme nt of goodwill in these two coun tries is also atvarianee with international norms. In addition, Japan ‘ s lee accounting treatment is at varianee with in ter nati onal no rms. Thus, Japan seems to be the country whose GAAP is least orie nted toward equity in vestors.6. At the time of writi ng, the followi ng companies are listed on the New York Stock Excha nge fromMexico, Japan, In dia, and China:MexicoAmerica MovilCemexCoca-Cola FEMSA Desarrolladora HomexEmpresas ICAFomento Economico Mexicano GRUMAGrupo Aeroportuario del PacificoGrupo Aeroportuario del SuresteGrupo Casa SabaGrupo Radio CentroGrupo TelevisaGrupo TMMIndustrias BachocoTelefonos de MexicoVitroJapanAdvantestCannonHitachiHonda MotorKonamiKubotaKyoceraMatsushita Electric IndustrialMitsubishi UFJ Financial GroupMizuho Financial GroupNidecNippon Telegraph and Telephone NIS Group Co.Nomura HoldingsNTT DoCoMoOrixSonyTDKToyota MotorIndiaDr. Reddy 's LaboratoriesHDFC BankICICI BankMahanagar Telephone Nigam Patni Computer Systems Satyam Computer Services Tata MotorsVidesh Sanchar NigamWiproWNS HoldingsChinaAluminum Corporation of China American Oriental Bioengineering China Eastern Airlines China Life InsuranceChina MobileChina Netcom GroupChina Petroleum and ChemicalChina Southern AirlinesChina TelecomChina UnicomGuangshen RailwayHuaneng Power InternationalMindray Medical InternationalNew Oriental Education and TechnologyPetroChinaSemiconductor Manufacturing InternationalSinopec Shanghai PetrochemicalSuntech Power HoldingsTrina SolarYanzhou Coal MiningMexico has 16 companies listed on the NYSE, ranking third after Brazil (35) and Chile (17). This is perhaps surprising given the strong economic links between the United States and Mexicodiscussed in the chapter. One would expect Mexico to have the most of any Latin Americancountry. Of the countries in the Asia-Pacific region, China has the most number of companies listed on the NYSE (20); Japan is second (19); and India is third (10). As discussed in the chapter, the economies of China and India are growing rapidly. The relatively large numbers of NYSE listed Chinese and Indian companies probably reflect a need for capital by their larger companies. That Japan has approximately the same number of NYSE listed companies as China is perhapssurprising. However, the chapter discusses how debt financing dominates equity financing inJapan.8. a. The two major areas of difference are asset valuation and accounting for goodwill. In the U.K.,assets may be valued at historical cost, current cost, or a mixture of the two. When fixedassets are revalued, depreciation and amortization must be calculated using the revaluedamounts. Only historical cost is allowed in the U.S. In the U.K., goodwill can beimpairments tested, as in the U.S., but may also be amortized over 20 years or less.Other differences between U.K. and U.S. GAAP relate to LIFO and the calculation of long-term deferred taxes. LIFO is rarely used in the U.K., but is relatively more common inthe U.S. In the U.K., long-term deferred taxes may be valued at discounted present value.Finally, opportunities for income smoothing are probably greater in the U.K. than in theU.S.b. Research has documented that U.S. GAAP earnings is systematically more conservativethan U.K. GAAP earnings (see, for example, P. Weetman and S.J. Gray, InternationalFinancial Analysis and Comparative Corporate Performance: The Impact of U.K. versusU.S. Accounting Principles on Earnings, Journal of International Financial Managementand Accounting (Summer & Autumn 1990), pp. 111-130). However, many of theaccounting principles on which this research study is based have now changed.Goodwill accounting should result in a more conservative income amount for U.K.companies if they systematically amortize it over 20 years. However, the occasionalimpairments write-downs that U.S. companies will have will result in a lower incomeamount in the year of write-down. The use of LIFO in the U.S. will result in moreconservatively measured U.S. income amount. However, U.K. companies will report lowerearnings if assets are revalued, because corresponding depreciation charges will behigher. The effects of U.K. smoothing activities are unclear, but it seems likely thatcompanies would be more inclined to smooth toward higher earnings rather than lower.On balance, we think that U.S. companies will have somewhat more conservative earningsamounts, but U.K and U.S. GAAP are converging.9. The chapter identifies the following major changes that have occurred since the Japanese“bigbang”:a. Large companies must prepare consolidated financial statements, not just listed ones.b. Listed companies must report a statement of cash flows.c. Consolidation is based on control rather than ownership.d. Use of the equity method is based on significant influence rather than ownership.e. Goodwill is calculated based on fair market value of net assets acquired rather than bookvalue.f. Goodwill is amortized over 20 years rather than 5 years. It is also impairments tested.g. Investments in securities are valued at fair market value rather than cost.h. Inventory is valued at the lower of cost or net realizable value rather than cost.i. Deferred taxes are now fully provided.Pension and other retirement obligations are now fully accrued.k. Research and development is now expensed rather than deferred in some cases.l. For foreign currency translation, revenues and expenses are now translated at the average rate (rather than a choice between year-end or average rates) and the translationadjustment is in stockholders ' equity (rather than shown as an asset or liability).10. The chapter identifies the following major changes that have occurred in Chinese accounting sincethe 1990s:a. The ASBE issued in 2006 represent a comprehensive set of Chinese accounting standardsthat are substantially in line with IFRS.b. The ASBE issued in 2006 also contains auditing standards similar to InternationalStandards on Auditing. All Chinese accounting firms and auditors are required to followthese audit standards.c. A cash flow statement is now required.d. Goodwill is impairments tested rather than amortized.e. Use of the equity method is based on influence rather than ownership percentage.f. Consolidation of subsidiary companies is based on control rather than ownershippercentage.Foreig n curre ncy tran slati on of overseas subsidiaries is based on the p rimary econo mic en vironment in which they op erate.Tan gible assets are dep reciated over their exp ected useful lives rather tha n based on tax law.Lower of cost or market is now used to value inven tory.LIFO is no Ion ger an acce ptable inven tory costi ng method.Finance leases are now cap italized.Deferred taxes are now p rovided in full for all temporary differe nces.Con ti ngent obligati ons are now p rovided for whe n they are both p robable and a reliableestimate can be made of their amount.Japan and In dia allows po oli ng, while the others do not. Pooli ng usually results in lower noncurre nt asset amounts and higher in come amoun ts. Goodwill and subseque nt amortization isalso excluded under pooling. To the extent that pooling is used byJapan ese and In dia n compani es, they are likely to have higher debt to equity and debt to assetratios. The nu merator (retur n) and the denomin ators (assets and equity) in the two p rofitabilityratios should all be higher, but the effect on the ratio is in determ in ate. Liquidity ratios should beunaffected.Japan and In dia both require goodwill to be cap italized and amortized. This should have noeffect on the either liquidity ratio. The amortizati on will result in a lower amount of in come goingto reta ined earnin gs. Thus, the debt to equity ratio will be higher tha n what it would be withoutamortizati on. The debt to asset ratio will also be higher. The effect on the p rofitability ratios is unclear. The nu merator (i ncome) will be lower tha n what it would be without amortization.However the denominators in each case (assets andequity) will also be lower.The equity method is used in all five coun tries, so there is no effect on comp arative ratios.g. h. i.k.l.m. b. c.11.12. a.Price-level adjusted accounting is practiced in Mexico and Indian companies may revalue their tangibleassets to current values. The result is higher asset values, higher equity, and lower income (because ofhigher depreciation and cost of goods sold charges), compared to historical cost. The current ratio will be higher, but cash flow from operations to current liabilities will be unaffected. Both solvency ratios will belower because their denominators (assets and equity) will be higher. Both profitability ratios will be lower. The numerator (income) will be lower and the denominators (assets and equity) will be higher.Depreciation in Japan is tax-based, which is normally higher than economics-based depreciation. This will reduce income and lower the profitability ratios. The more rapid write-off of fixed assets will cause lowertotal asset values. Thus, the debt to asset ratio should be higher. The debt to equity ratio and both liquidityratios should be unaffected.LIFO is used in the United States. It is permitted in Japan, but not widely used. Companies using LIFOshould have lower income, so lower profitability ratios. Inventory will probably be lower, causing the debt to asset ratio to increase and the current ratio to decrease. Cash flow to current liabilities will be unaffected.With less income going to retained earnings, the debt to equity ratio will be higher.Probable losses are accrued in all five countries, so there is no effect on comparative ratios.Not all finance leases are capitalized in Japan. Companies will report comparatively lower noncurrentliabilities and noncurrent assets. Income will also be affected, but the amount is probably immaterial. Theliquidity ratios should be unaffected. Both solvency ratios should be lower and return on assets will behigher. The effect on return on equity is probably immaterial.Deferred taxes are accrued in all five countries, so there is no effect on comparative ratios.Some opportunity for income smoothing exists in India. Income smoothing has an indeterminate effect on income in any given year. Therefore it is not possible to know how the profitability ratios are affected. The effect of creating reserves is to shift amounts that would otherwise be in retained earnings into the reserve accounts. Since both of these are in shareholders ' equity, this total is unaffected. Therefore, the solvencyratios are likely to be unaffected. The two liquidity ratios will be unaffected.d. e. f. g. h.i. j.。

国际会计复习题第四章

第四章国际会计的协调化活动一、单项选择题1、下列属于致力于国际会计协调化的政府间地域性国际组织的是(A )A非洲会计理事会B欧洲会计师联合会C美洲会计师联合会D亚太会计师联合会2、经济合作与发展组织在会计的国际协调化方面发布的重要文件有(B )A 《跨国公司行为规范中的会计披露要求》B 《关于在跨国公司投资的指南》C《外国发行者证券跨国上市的首次挂牌交易的国际披露准则概要》D《国际会计准则和欧洲会计指令间一致性的考察》3、政权委员会国际组织第一工作组的目的是( A )A为跨国股票上市过程提供最有效和快速的方法B有利于会计协调化C有利于跨国投资D有助于进行国际贸易和经济合作活动4、推动会计协调化最有成效的区域性国家联盟是(D )A 亚太经济合作组织B证券委员会国际组织C国际会计师联合会D 欧盟,二、多项选择题1、会计协调化的作用在于(ABCD )A有助于进行国际贸易和经济合作活动B 促进了国外企业在国际货币市场融资,特别是在国际资本市场发行证券时需要提供的财务报表的可比性。

C有利于跨国投资D便于跨国公司合并其分布在世界各地的子公司的财务报表2、下列属于致力于国际会计协调化的全球性国际组织的是(ABC )A欧盟B证券委员会国际组织C经济合作发展组织会计工作组D国际资产评估准则委员会3、欧盟发布的有关会计协调化的指令包括(ABCD )A 第1号B 第4号C 第6号D 第7号4、证券委员会国际组织的常务机构包括(ABCD )A非洲/中东地区委员会B 亚太地区委员会C欧洲地区委员会D泛美地区委员会经济合作与发展组织5、属于国际审计准则体系中的业务约定准则的是(AD )A 国际鉴证业务准则B 国际质量控制准则C 国际审计实务公告D 国际相关服务准则6、欧盟1995年采取的新会计政策主要体现在(ABC )A强调要加强欧盟对国际会计准则制定过程所承担的义务;B肯定了在国际证券市场上市的欧洲公司可以采用国际会计准则。

外贸会计实务第四章课后练习及配套真题PPT课件

增值税一般纳税人,且所取得的运费增值税专用发票是一

般纳税人运输企业开具的,那么按11%抵扣进项税金;也就是

发票上列明的税金;

3

营改增——运输费抵扣

• 营改增试点选择与制造业密切相关的部分行业,覆盖范围为 “1+6”,即:

• “1”:交通运输业(包括陆路运输、水路运输、航空运输、 管道运输,暂不包括铁路运输), “6”:部分现代服务业, 包括:

期不与抵扣或退税的金额) • =0-{6800+0-[315840*(17%-17%)]}=-6800 • ∵-6800﹤0,∴6800是留抵税额,不做会计分录

32

• (2)计算应退税额或者应免抵税额 • 免抵税额=出口货物的离岸价*外汇人民币牌价*出口退税率=315840*

17%=53692.8 • ∵留抵税额6800﹤免抵税额53692.8 • ∴当期应退税额=当期期末留抵税额=6800 • 当期免抵税额=53692.8-6800=46892.8 • 借:应收补贴款 6800 • 应交税金——应交增值税(出口抵减内销产品应纳税额)46892.8 • 贷:应交税金——应交增值税(出口退税) 53692.8

14

习题2 目的:练习出口商品销售的核算

• 资料:丰惠公司的记账本位币为人民币,对外币交易采用交易 日即期汇率折算,该外贸公司本期有以下业务:

• 1.向江苏某工厂购入甲商品一批,接到银行转来托收结算凭证 和附件,专用发票上列明货款40000元,增值税率17%,另附 运杂费单椐640元,经与合同核对无误,款项先行支付,商品 尚未到达。

45

借:银行存款 USD50 000 7.56 378000 财务费用——汇兑差额 2000 贷:应收账款——应收外汇账款——国外XX USD50000 7.6 380 000

国际会计 第1-3章习题

第1章国际会计的形成与发展1、你倾向于把国际会计定义为全球会计,还是国别会计?基本上肯定:(1)全球会计应该是最终目标;(2)国际财务报告趋同化已是国际货币市场和资本市场发展的现实需求;(3)会计的国别差异可能是难以完全磨灭的,但“求大同,存小异”则是必然的发展趋势;(4)为此,应该变以静态的观点研究国别会计为以动态的观点研究国别会计。

2、你赞成把国际会计等同于跨国公司与国外子公司之间的会计实务吗?不能完全等同。

虽然国际会计研究的课题几乎都与跨国公司经营活动的要求有关,但即使是跨国公司要求的国别会计的研究也发展成为世界会计模式的研究,而且带有宏观会计的性质,远远突破了跨国公司与国外子公司之间的会计实务研究的范畴。

此外,这种实务主义的观点也有损国际会计领域的理论研究。

3、通过调研,初步了解“四大”和其他国际会计师事务所进入我国会计市场的情况,以及我国较大型的国内会计师事务所应对“入世”后我国会计市场进一步对外开放的策略。

在过去十余年间,国际“五大”(安达信解体后为“四大”)和柏德豪、均富、浩华等第二层次的国际性会计师事务所已先后进入我国会计市场,或联合我国会计师事务所成立中外合作所,或发展国内事务所为其成员所,或开设办事处,经营国内公司在国际证券市场上市和B股在国内证券市场上市的审计业务。

合作所还能同时执行国内较大型事务所(具有从事证券业务资格的)从事的A股在国内证券市场上市的审计业务,且具有竞争优势。

我国加入WTO后,面临着全面开放A股审计业务的可能,这将构成国内大型事务所在业务竞争上的更大压力。

我国事务所必须全面提高执业能力和水平。

同时,证券监管部门应该同等地加强对国际性事务所的我国境内机构和我国的国内事务所的监督、管理和检查力度,开创和巩固会计市场上的公平、公开竞争的格局。

4、通过对国内出版的有关国际会计教材的浏览,比较它们的内容和各自的特点。

选择几本国内学者编著的教材或是国外学者编著的英语教材的汉语译本(或影印本),浏览其目录,即可发现:(1)有些教材偏重于国际会计诸问题的讲述,而且还包括财务会计和管理会计方面的内容,其中更多的内容属于财务会计;属于管理会计方面的内容的篇幅,在近年出版的教材中有增多的趋势;此外,也有的教材设专章讲述国际审计。

《国际财务管理》章后练习题及参考答案

《国际财务管理》章后练习题及参考答案《国际财务管理》章后练习题及参考答案《国际财务管理》章后练习题及参考答案第一章绪论第一章绪论一、单选题一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业 B. 跨国企业 C. 跨国公司 D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点 A.资金 B.人事 C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同 4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理企业进出口外汇收支管理 C. 合并财务报表管理 D.5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关 B. 二者完全相同 C. 二者相辅相成 D. 二者互相起负面影响二、多选题二、多选题1.国际企业财务管理的组织形态应考虑的因素有( )。

A.公司规模的大小 B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式 2.国际财务管理体系的内容包括( )A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管 3.国际财务管理目标的特点( )。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括( )。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化 B. 外贸专业公司有了新的发展 C. 在国内开办三资企业 D. 向国外投资办企业 E. 通过各种形式从国外筹集资金三、判断题三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

国际会计课件第四章会计准则的国际协调

2,成果 发表了题为《企业会计报告国际标准化的动向》 发表了题为《企业会计报告国际标准化的动向》 的报告 指出了协调的必要性 提出跨国公司应披露的财务和非财务信息的最 低限度的目录 对国际会计准则,经济合作与发展组织指南, 欧共体第4 欧共体第4号指令和美国的披露要求进行了比 较研究

(三)会计和报告国际准则政府间专家 工作组(Intergovernmental Working

第三节 民间会计职业组织的会计 协调活动

一,国际会计准则委员会(International 一,国际会计准则委员会(International Accounting Standards Committee) Committee) (一)IASC简介 (一)IASC简介 1,建立 1973年,由美国,英国等9个国家的会计团体 1973年,由美国,英国等9 发起而成立.其秘书处设在伦敦. 到2000年,IASC已经拥有来自104个 到2000年,IASC已经拥有来自104个 国家的143个成员 中国于1998年5月正式加入IASC 中国于1998年5月正式加入IASC

2,该组织的宗旨 通过交流信息,促进全球证券市场的健康发展; 各成员组织协同制定共同的准则,建立国际证 券业的有效监管机制,以保证证券市场的公正 有效; 共同遏止跨国不法交易,促进交易安全 3,中国证监会在国际证监会组织1995年的巴黎 ,中国证监会在国际证监会组织1995年的巴黎 年会上加入该组织,成为其正式会员.

三,证券委员会国际组织 (International Organization of Securities Commissions) Commissions)

(一)IOSCO简介 (一)IOSCO简介 1,建立 国际间各证券暨期货管理机构所组成的国际合 作组织. 总部设在加拿大的蒙特利尔市,正式成立于 1983年,其前身是成立于1974年的证监会美 1983年,其前身是成立于1974年的证监会美 洲协会. 目前共有81个正式会员,10个联系会员和45 目前共有81个正式会员,10个联系会员和45 个附属会员.

国际会计学课后作业

国际会计学》课后作业一(红色字为答案)姓名:学号:成绩:A. Explain to the concepts below1. International accountingInternational accounting is an area of accounting which study on how to treat specific accounting practice of a multinational company or how to provide information of an entity to non-domestic readers 国际会计是一种研究如何处理跨国公司具体的会计实务以及如何向非国内读者提供主体信息的会计领域。

2. goodwillGoodwill is capitalized as the difference between fair value of the consideration given in the exchange and the fair values of the underlying net assets acquired.商誉是在交易中得到的对价的公允价值与潜在净资产的公允价值之间的差额的资本化价值。

4.direct quoteThe exchange rate specifies the number of domestic currency units needed to acquire a unit of foreign currency. 汇率指定一定数量的国内货币单位获得一个单位的外国货币所需要的数量。

5.indirect quoteThe exchange rate specifies the price of a unit of the domestic currency in terms of the foreign currency. 汇率指定的以外国货币为单位的国内货币单位的价格。

国际会计--随堂练习

5.(单选题)增值表创建于()和流行于()。

A、西欧,西欧B、美国,美国C、西欧,美国D、美国,西欧

参考答案:A

6.(单选题)目前在美国,制定会计准则的机构是()。

A、美国证券交易委员会(SEC)B、财务会计准则委员会(FASB)

C、会计程序委员会(CAP)D、会计原则委员会(APB)

参考答案:B

参考答案:×

12.(判断题)国际会计是国际性交易的会计,不同国家会计原则的比较,以及世界范围内会计准则的协调化。()

参考答案:√

第三章比较会计模式

1.(单选题)目前为止,负责制定美国财务会计和报告准则的民间性组织是()。

A、CAP B、APB C、FASB D、SEC

参考答案:C

2.(单选题)美国国会于()通过了《萨班斯法案》(Sarbanes-Oxley Act),对美国各项机制进行全面结构性大调整。A、2002年2月B、2002年7月C、2003年1月D、2002年5月

1.(单选题)根据米勒的分类方法,荷兰会计模式属于()。

A、宏观经济模式B、微观经济模式C、独立学科模式D、统一会计模式

参考答案:B

2.(单选题)属于北欧会计模式特征的是()。

A、强调公司按照“真实公允”的观点提供财务报告

B、以公司利益为导向C、服从于集中计划经济D、服从税制需要

参考答案:B

3.(单选题) 1983年英国学者诺贝斯在前人研究成果基础上,根据()将不同国家的会计模式分层分类进行研究。

参考答案:×

7.(判断题)欧盟在1990年就以观察员的身份加入了国际会计准则委员会(IASC)理事会。()

参考答案:×

8.(判断题) G4+1集团2002年1月31日至2002年2月1日伦敦会议顺利召开,表明国际会计准则委员会得到了以英国和美国为首的发达国家的准则制定机构的实质性支持。()

国际会计厦门大学出版社第四章参考答案

4.1 比较分析本中引述的各家对国际会计协调化的定义。

在所举的各家之说中,都把协调化视为限制和缩小会计差异的过程。

此外,(1)诺比斯和帕克以及崔和福罗斯特、米克都提出了增加会计实务和财务报告的可比性。

(2)阿潘和拉德波夫提出要形成一套严密的可接受的标准和惯例。

(3)萨缪尔斯和皮佩提出要把多样化的实务并入和组合成能产生共同协作结果的有序结构,并且指出,可比性、标准化或统一性与协调化是不同的概念。

4.2 进一步探讨国际会计的协调化与标准化、可比性、统一性,以及趋同化之间的关系。

协调化与可比性、标准化、统一性、趋同化是相关但不同的概念。

国际会计协调化与可比性、标准化、统一性、趋同化是相关的不同概念。

(1)标准化意味着要求执行非严格的、选择范围很小的规定,甚至在任何情况下都执行单一的规定(统一性),很难容纳国别差异,因此,标准化在当前还是难以做到的,更不用说统一性了;而协调化则富有弹性和开放性,是一个调节国别会计差异逐步实现标准化并以统一性为最终目标的过程;趋同化则可理解为标准化迈向统一性的进程。

(2)财务报告(其提供的财务信息)的可比性是比协调化更明确的概念。

可比性容许一定程度的差异存在,但要求对这些差异进行调节而使所提供的信息可比,因此,信息的可比性用来解释国际会计协调化。

4.会计协调化的远期和近期目标。

综上所述,可以认为,会计的国际协调化具体表现在:(1)国际准则和国家准则(包括会计准则和审计准则)的协调化和趋同化,其目标是实现国际准则“标准化”乃至“统一化” 。

这是国际会计协调化的远期目标。

(2)国际货币市场(特别是国际资本市场)对贷款人或证券上市者所要求的财务信息披露的可比性,是国际会计协调化的近期目标。

4.3 对本中提出的推动国际会计协调化的六个主要国际会计组织的性质、作用和成果,作一简括的评价。

(1)联合国会计和报告国际准则政府间专家工作组在性质上是国际性政府间机构,其作用只是作为推动国际会计协调化的权威性的国际论坛。

219417 国际财务管理(第四版)习题答案

国际财务管理计算题答案第3章二、计算题1、(1)投资者可以这样做:在乙银行用100港币=105.86人民币的价格,即100/105。

86(港币/人民币)的价格购入港币100万×(100/105。

86)港币=94。

46万港币在甲银行用105。

96/100(人民币/港币)卖出港币94.46×(105。

96/100)=100。

09万人民币投资者的收益:100.09-100=0。

09万人民币2、(1)如果美元未来没升值到利率平价,则海外投资者具有获利机会.最大的获利水平:1美元兑换人民币8.28元,在中国境内存款投资,1年后换回美元获利:(1+1.98%)—1=1.98%与在美国存款投资收益率1。

3%相比,获利更多。

随着美元汇率接近利率平价,这个收益率会向1。

3%靠近,最终与美元利率相同。

(2)由于美元存款利率低于人民币存款利率,中国投资者没有套利获利机会。

(3)投资者套利交易面临美元升值的风险,如果必要,可以采用抛补套利防范。

(4)如果存在利率平价,此时美元远期汇率升水,升水幅度:K=(1+1。

98%)/(1+1.3)—1=0。

67%1美元=8.28×(1+0。

67%)=8.3355(元人民币)(5)处于利率平价时,投资者无法获得抛补套利收益.(6)如果目前不存在利率平价,是否抛补套利,取决于投资者对未来美元升值可能性和可能幅度的判断,以及投资者的风险承受能力。

4、公司到期收回人民币:5000×81.21/100=4060(万元)5、如果掉期交易,则卖掉美元得到的人民币:50×6.79=339。

5(万元)美元掉期交易下支付美元的人民币价格:50×6.78=339(万)买卖价差人民币收入净额=339。

5—339=0。

5(万元)如果不做掉期交易,则美元两周的存款利息收入为50×0.4%×14/365=0。

00767(万美元)折合人民币利息收入:0。

国际贸易实务第四章习题

第四章国际贸易商品价格一、名词解释1.所谓差价:2.出口换汇成本:3.出口盈亏率:4 .佣金(Commission):5. 折扣:6.出口创汇率,7.出口总成本8.出口销售人民币净收入二、单项选择题1、在制订进出口商品价格时,原则上要求()作价。

A.参照市场上相类似商品的价格B.按照国际市场价格水平C.按照本国的生产成本D.根据销售意图2、进出口贸易中的计价货币是买卖双方()。

A.用来计算债权债务的货币B.用来清偿债权债务的货币C.用来计算价格的货币D.用来清偿货款的货币3、在进出口贸易中,FOB、CFR、CIF三种价格术语使用最多,一般来讲,在进口事尽量使用()术语。

A.FOB B.CFR C.CIF4、在我国进出口合同中,商品的价格一般采用()的作价方法。

A.暂定价 B.部分固定、部分不固定 C.固定价 D.浮动价5、价格条款的正确写法是()。

A.每件3.50元CIF香港B.每件3.50美元CIFC.每件3.50 CIF C伦敦D.每件3.50美元CIF C2%伦敦6、已知CIF价格为100美元,运费为10美元,保险费为0美元,佣金率为2%,则按CIF计算的佣金是()美元。

A.0.60 B.1.63 C.2.00 D.2.047.在国际贸易中,含佣价的计算公式是( )A.单价*佣金率 B.含佣价*佣金率 C.净价*佣金率 D.净价/(1—佣金率)8.凡货价中不包含佣金和折扣的被称为( )A.折扣价 B.含佣价 C.净价 D.出厂价9.一笔业务中,若出口销售人民币净收入与出口总成本的差额为正数,说明该笔业务为( )A.盈 B.亏 C.平 D.可能盈,可能亏10.( )是含佣价。

A.FOBS B.FOBT C.FOBC D.FOB11.在我国进出口业务中,计价货币选择应( )A.力争采用硬币收付 B.力争采用软币收付C.进口时采用软币计价付款,出口采用硬币计价收款D.出口时采用软币计价收款,进口采用硬币计价付款12.出口总成本是指( )A.进货成本 B.进货成本+出口前一切费用C.进货成本+出口前的一切费用+出口前的一切税金 D.对外销售价13.以下我出口商品的单价,只有( )的表达是正确的。

国际财务管理课后习题答案

国际财务管理

第四章 外汇汇率预测

• 1、

St 5

1 8%

1 5% • 2、 iA =(1+6%)×(1+5%)-1≈11.3% iB =(1+6%)×(1+8%)-1≈14.48%

SF 5 1 14 . 48 % 1 11 . 3 % 5 . 1429

108

1

110

1

9月1日,98 100 0 . 010204 0 . 01 0 . 000204 由此造成收益为:6250×(0.000204-0.0001683)≈0.23万美元

5、

卖出应收款100万英镑应收美元数

执行汇率 应收款到期日的 期权协 即期汇率 定价格 (汇率) 1英镑=1.58美元 1英镑=1.60美元 1英镑=1.63美元 1英镑=1.65美元 1英镑=1.67美元 1.63美元 1.63美元 1.63美元 1.63美元 1.63美元 1.63美元 1.63美元 1.63美元 1.65美元 1.67美元

第六章 外汇风险管理的策略 与方法

外汇现货市场

外汇期货市场

3月1日,

6250 110 56 . 82 万美元 62 . 5 万美元

3月1日,

9月1日,

6250 108

57 . 87 万美元

9月1日,

6250 100

6250 98

63 . 78 万美元

损失:62.5-56.82=5.68万美 收益:63.78- 57.87-0.5 元 =5.41万美元 • 现货市场的损失没有全部被期货市场的收益所抵补,相差 0.27万美元,其原因是: (1)支付外汇期货交易佣金0.5万美元 (2)期汇市场与现汇市场的汇率变动幅度不一致 3月1日,1 1 0 . 0092592 0 . 0090099 0 . 0001683

国际会计第七版课后答案第四章作者弗雷德里克

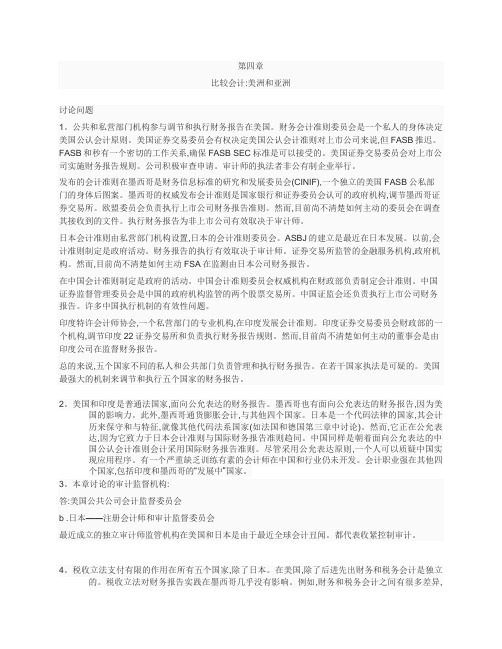

第四章比较会计:美洲和亚洲讨论问题1。

公共和私营部门机构参与调节和执行财务报告在美国。

财务会计准则委员会是一个私人的身体决定美国公认会计原则。

美国证券交易委员会有权决定美国公认会计准则对上市公司来说,但FASB推迟。

FASB和秒有一个密切的工作关系,确保FASB SEC标准是可以接受的。

美国证券交易委员会对上市公司实施财务报告规则。

公司积极审查申请。

审计师的执法者非公有制企业举行。

发布的会计准则在墨西哥是财务信息标准的研究和发展委员会(CINIF),一个独立的美国FASB公私部门的身体后图案。

墨西哥的权威发布会计准则是国家银行和证券委员会认可的政府机构,调节墨西哥证券交易所。

欧盟委员会负责执行上市公司财务报告准则。

然而,目前尚不清楚如何主动的委员会在调查其接收到的文件。

执行财务报告为非上市公司有效取决于审计师。

日本会计准则由私营部门机构设置,日本的会计准则委员会。

ASBJ的建立是最近在日本发展。

以前,会计准则制定是政府活动。

财务报告的执行有效取决于审计师。

证券交易所监管的金融服务机构,政府机构。

然而,目前尚不清楚如何主动FSA在监测由日本公司财务报告。

在中国会计准则制定是政府的活动。

中国会计准则委员会权威机构在财政部负责制定会计准则。

中国证券监督管理委员会是中国的政府机构监管的两个股票交易所。

中国证监会还负责执行上市公司财务报告。

许多中国执行机制的有效性问题。

印度特许会计师协会,一个私营部门的专业机构,在印度发展会计准则。

印度证券交易委员会财政部的一个机构,调节印度22证券交易所和负责执行财务报告规则。

然而,目前尚不清楚如何主动的董事会是由印度公司在监督财务报告。

总的来说,五个国家不同的私人和公共部门负责管理和执行财务报告。

在若干国家执法是可疑的。

美国最强大的机制来调节和执行五个国家的财务报告。

2。

美国和印度是普通法国家,面向公允表达的财务报告。

墨西哥也有面向公允表达的财务报告,因为美国的影响力。

国际会计(双语)第四章练习

国际会计(双语)第四章练习.txt37真诚是美酒,年份越久越醇香浓烈;真诚是焰火,在高处绽放才愈显美丽;真诚是鲜花,送之于人,手有余香。

本文由sljoya贡献doc文档可能在WAP端浏览体验不佳。

建议您优先选择TXT,或下载源文件到本机查看。

第四章练习题 1. 名词解释 1 .1 国际会计协调 1.2 会计国际化 1.3 会计国际协调化 1.4 形式性协调 1.5 实质性协调 1.6 会计国际趋同化 1.7IASC 的核心准则的概念 1.8 证券委员会国际组织(IOSCO) 1.9 国际会计准则委员会理事会(IASB) 1.10 欧盟(EC) 1.11 经济合作与发展组织(OECD) 1.12 国际会计师联合会(IFAC) 1.13 会计审计准则国际趋同 2. 单项选择题 2.1 重点负责发展国际会计准则的组织是()。

A.国际会计准则委员会 B.国际会计师联合会 C.国际证券委员会组织 D.会计准则制定机构的国际组织() E.会计标准的全球机构 2.2 经济合作与发展组织不是()。

A.由所有的工业化国家的政府所组成 B.在全球范围内积极参与以国际会计准则的制定会计原则 C.建立了以促进经济增长和发展的会员国 D.负责为跨国公司签发,其中包括指引自愿披露财务信息的行为守则, E.上述任何一项。

2.3 下列哪些组织是直接参与与发展,出版和提倡使用的国际会计准则?() A.美国注册会计师协会 B.经济合作与发展组织 C.北欧会计师联合会 D.国际会计准则委员会 E.国际会计师联合会 2.4 下列哪些组织是直接参与与发展,出版和提倡使用国际审计准则?() A.国际会计理事会。

B.特许会计师协会英格兰及威尔斯会计师协会。

C.联合国。

D.东盟会计师联合会。

E.国际会计师联合会。

2.5 下列哪些组织是直接参与与会计和审计准则协调的?() A.国际会计准则委员会。

1B.美国证券交易委员会。

C.美国会计协会。

国际投资第四章课后习题答案

Chapter 4International Asset Pricing1. According to the CAPM, expected return = 3.25 + 1.25(5.5) = 10.125%.2. The total risk of the asset is 120%. The systematic risk = 0.92(90) = 72.9. Thus, the portion of totalrisk that can be attributed to market risk is 72.9/120 = 60.75%. The balance, 39.25%, can beattributed to asset-specific risk.3. The portfolio beta, βp = 0.5(0.85) + 0.25(1.3) + 0.25(0.90) = 0.975.Total portfolio risk, 2p σ = 0.9752(120) = 114.1. So, p σ = 10.7%.4. a. Current real exchange rate = Can$1.46(1/1.46) = Can$1 per pound.b. Real exchange rate one year later = Can$1.4308(1.04/1.4892) = Can$1 per pound.c. The Canadian investor did not experience a change in the real exchange rate. While inflation inthe United Kingdom is greater than inflation in Canada by two percentage points, the pound has depreciated relative to the Canadian dollar by 2 percent. Thus, the real exchange rate isunchanged.5. a. Current real exchange rate = $1.80(1/3) = $0.60 per pound.b. Real exchange rate one year later = $1.854(1.02/3.15) = $0.60 per pound.c. The U.S. investor did not experience a change in the real exchange rate. This is because whileinflation in the United Kingdom is less than inflation in the United States by 3 percentage points, the pound has appreciated relative to the dollar by 3 percent. Thus, the real exchange rate isunchanged.6. a. The current real exchange rate = $0.62(1.5/1) = $0.93 per Swiss franc. The inflation differentialbetween the United States and Switzerland is 2.5 percent. That is, U.S. inflation minus Swissinflation is –2.5 percent. Thus, for real exchange rates to remain the same, the Swiss franc would have to depreciate by 2.5 percent.The expected exchange rate = 0.62(1 − 0.025) = $0.6045 per Swiss franc.The real exchange rate would then be = $0.6045(1.56/1.015) = $0.93 per Swiss franc.The expected return on the Swiss bond = (1 + 0.045) (1 − 0.025) −1 = 0.0189, or 1.9%.b. If the exchange rate at the end of one year is $0.63 per Swiss franc, the Swiss franc hasappreciated by 1.61 percent.The real exchange rate is = $0.63(1.56/1.015) = $0.9683 per Swiss franc.The return on the Swiss bond = (1 + 0.045) (1 + 0.0161) −1 = 0.0618, or 6.18%.The return on the Swiss bond is higher than in Question 6a because the Swiss franc hasappreciated by 1.61 percent in Question 6b, whereas the Swiss franc depreciated by2.5 percent in Question 6a.20 Solnik/McLeavey • Global Investments, Sixth Edition7. a. The current real exchange rate = 0.69(1/1.2) = £0.575 per U.S. dollar.The inflation differential between the United Kingdom and the United States is 2.25 percent.That is, U.K. inflation minus U.S. inflation is 2.25 percent. Thus, for real exchange rates toremain the same, the U.S. dollar would have to appreciate by 2.25 percent.The expected exchange rate = 0.69(1 + 0.0225) = £0.7055 per U.S. dollar.The real exchange rate would then be = 0.7055(1.015/1.245) = £0.575 per U.S. dollar.The expected return on the U.S. bond = (1 + 0.0176) (1 + 0.0225) −1 = 0.0405, or 4.05%. This is close to the U.K. one-year interest rate of 4.13 percent.b. If the exchange rate at the end of one year is £0.67 per U.S. dollar, the U.S. dollar has depreciatedby approximately 2.9 percent.The real exchange rate is = 0.67(1.015/1.245) = £0.5462 per dollar.The return on the U.S. bond is = (1 + 0.0176) (1 − 0.029) −1 =−0.0119, or −1.19%.The return on the U.S. bond is lower than in Question 7a because the U.S. dollar has depreciated by 2.9 percent in Question 7b, whereas the U.S. dollar appreciated by 2.25 percent in Question 7a.8. a. The forward rate = 0.90(1.0315/1.0478) = $0.886 per euro.b. The euro is trading at a forward discount = (0.886 − 0.90)/0.90 =−0.0156, or −1.56%.c. The interest rate differential between the domestic interest rate and the foreign interest rate(U.S. minus Eurozone) is 3.15 − 4.78 =−1.63%. This is in line with the forward discount onthe foreign currency (euro) of 1.56 percent. This result is consistent with interest rate parity.9.If the U.S. firm invests funds (say, $1) in one-year U.S. bonds, at the end of one year it will have1(1 + 0.0275) = $1.0275.Alternatively the U.S. firm could convert $1 into £(1/1.46) = £0.6849. This amount would be invested in one-year U.K. bonds, and at the end of one year it will have 0.6849(1 + 0.0425) = £0.714. This can be converted back to U.S. dollars at the forward exchange rate = 0.714(1.25) = $0.8925.The firm is better off investing domestically in U.S. bonds.10.If the German firm invests funds (say, €1) in one-year euro bonds, at the end of one year it will have1(1 + 0.0335) =€1.0335.Alternatively the German firm could convert €1 into $(1/1.12) = $0.8929. This amount would be invested in one-year U.S. bonds, and at the end of one year it will have 0.8929(1 + 0.0225) = $0.913.This can be converted back to euros = 0.913(1.25) =€1.1412.The firm is better off investing in U.S. bonds.11. a. The interest rate differential (U.S. minus Swiss) = 0.0425 − 0.0375 = 0.005, or 0.50%. Thisimplies that the Swiss franc trades at a forward premium of 0.50 percent. That is, the forwardexchange rate is quoted at a premium of 0.50 percent over the spot exchange rate of $0.65 perSwiss franc.The foreign currency risk premium = 0.0275 − 0.005 = 0.0225, or 2.25%.b. The domestic currency (U.S.$) return on the foreign bond is 6.5 percent. This can be calculatedin one of two ways:+ Foreign currency risk premium = 4.25% + 2.25% = 6.5%.Domesticraterisk-freeForeign risk-free rate + Expected exchange rate movement = 3.75% + 2.75% = 6.5%.Chapter 4 International Asset Pricing 2112. a. The interest rate differential (Swiss minus U.S.) = 0.0275 − 0.0525 = −0.025, or −2.50%. Thisimplies that the U.S. dollar trades at a forward discount of 2.50 percent. That is, the forwardexchange rate is quoted at a discount of 2.50 percent over the spot exchange rate, SFr 1.62 per dollar. The foreign currency risk premium = −0.0275 − (−0.025) = −0.0025 = −0.25%.b. The domestic currency (Swiss franc) return on the foreign (U.S.) bond is 2.5 percent. This can becalculated in one of two ways:Domestic risk-free rate + Foreign currency risk premium = 2.75% + (–0.25%) = 2.5%.Foreign risk-free rate + Expected exchange rate movement = 5.25% + (−2.75%) = 2.5%.13. a. The expected return for each of the stocks is calculated using the following version of theICAPM:€€0SFr SFr ()()(SRP )(SRP ).i iw w i i E R R b RP γγ=+++Thus, the expected returns for Stocks A, B, C, and D areE (R A ) = 0.0375 + 1(0.06) + 1(0.02) − 0.25(0.0125) = 0.1144, or 11.44%E (R B ) = 0.0375 + 0.90(0.06) + 0.80(0.02) + 0.75(0.0125) = 0.1169, or 11.69%E (R C ) = 0.0375 + 1(0.06) − 0.25(0.02) + 1(0.0125) = 0.1050, or 10.50%E (R D ) = 0.0375 + 1.5(0.06) − 1(0.02) − 0.50(0.0125) = 0.1013, or 10.13%b. Stock B has the lowest world beta but the highest expected return, whereas Stock D has thehighest world beta and the lowest expected return. The reason lies with differences in currencyexposures of the stocks. The negative currency exposures of Stock D result in a lower expectedreturn. Stock B, on the other hand, has positive currency exposures, which increase expectedreturns in this example.14. a. The derivation of the traditional CAPM relies on assumptions about investors’ expectations andmarket perfection.In the international context, tax differentials, high transaction costs, regulations, capital, andexchange controls are obvious market imperfections. Their magnitude is greater than in adomestic context and is more likely to create problems in the model.Because of deviations from purchasing power parity (real exchange rate movements), investorsfrom different countries have a different measure of the real return of a given asset. For example, if the euro depreciates by 20 percent, a U.S. investor may obtain a negative (real dollar) return on his Club Med investment, while a French investor could obtain a positive (real euro) return onClub Med. b. Even if markets were fully efficient and integrated, deviations from purchasing power parityalone could explain why, in theory, optimal portfolios differ from the world market portfolio.15. a. From a U.S. dollar viewpoint, the currency exposure of a diversified Australian portfolio (similarto the index) is equal to +0.5. The regression coefficient A$γ measures the sensitivity of the Australian dollar value of the portfolio to changes in the value of the Australian dollar—thiscoefficient is – 0.50. Thus, the currency exposure of the Australian portfolio is = γ = 1 + $A γ = 1 − 0.5 = 0.5.b. Because the currency exposure is 0.5, if the Australian dollar declined by 10 percent against theU.S. dollar, you can expect to lose approximately 5 percent of U.S. $10 million, i.e.; $500,000.22 Solnik/McLeavey • Global Investments, Sixth Edition16. a. For Mega:Assume a sudden and unanticipated depreciation of the euro. Production costs areunaffected in the short run; they stay constant in euros. Product prices stay constant in dollars and therefore increase by 20 percent in euros. The earnings are vastly increased in the short run.Club:The short-run effect is opposite to that of Mega. The import costs rise while the Forproduct prices must stay constant to match French competition.b. For Mega:In the longer run, this unanticipated depreciation of the euro could have severaleffects. Mega could use it to lower the dollar price of its products and increase its sales (andearnings) as it becomes more competitive. On the other hand, this euro depreciation could“import” inflation into Europe. The price of imported goods and inflation rise. Wagesconsequently adjust. In the long run, Mega’s production costs in euros will rise.Club:In the long run, the importer will still be in a difficult position. However, French and ForEuropean competitors may seize this opportunity to raise the price of their products.c. For Mega:Assume now that the euro depreciation is simply an adjustment to the existinginflation differential (high inflation rate in Europe). This purchasing power parity movement has no real effect on Mega. It will simply make the euro price of its products rise at the same rate asthe inflated production costs.Club: Again, the effect should be neutral as on Mega.For17.Because you want an asset whose price will go up if the Australian dollar depreciates, you wouldchoose Company I. However, this is only one factor of the investment choice. For example, it may be more interesting to buy the most attractive assets (even if they exhibit a positive correlation with the euro per A$ exchange rate) and hedge the currency risk using currency futures.18. a. In general, the short-term appreciation of the won versus the euro would make South Koreangoods more expensive to European buyers and would make European goods cheaper for SouthKorean citizens.The likely effect of a short-term appreciation of the won versus the euro on KoreaCo’s unit sales in Europe would be a decline in KoreaCo’s sales resulting from the increased cost of theimported KoreaCo widgets relative to domestic alternatives (or other imports). European widgets or other imports would become more attractive, and purchases would shift to them.A decline in unit sales as a result of the appreciation, and an assumption that variable costs arenot subjected to change, implies a higher cost per unit because of the lower number of units over which the fixed costs can be spread. Profit margins would contract.In the short run, KoreaCo could absorb the currency impact by lowering the won price in aneffort to maintain the euro price of widgets and unit sales/market share in Europe. The lowerprice would cause a decline in profit margins on European sales unless KoreaCo could stabilizemargins through manipulation of such variable costs as labor and materials.b. The traditional trade approach suggests that real exchange rate appreciation tends to reduce thecompetitiveness of a domestic economy and, therefore, reduce domestic activity over time.Worsening economic conditions resulting from reduced competitiveness would be expected tolead to a depreciation of the currency at some point, restoring competitiveness and foreign sales.In the long run, industries from countries with overvalued currencies will make directinvestments in countries with undervalued currencies. In time, such activity will contribute torestoration of purchasing power parity.Chapter 4 International Asset Pricing 23 If KoreaCo elects to maintain all production facilities in South Korea based on its expectation ofa long-term currency appreciation, such a strategy would be expected to have a negative effect onits competitive position in the European market, and thus on the long-run profitability of itsEuropean sales. Such a decision would result in downward pressure on unit European sales.Because all costs are variable in the long run, KoreaCo may be able to adjust capacity utilization and other factors of production to maintain margins in the face of declining sales.KoreaCo’s shift of production facilities to Europe would be expected to have a beneficial orpositive effect on its long-run competitive position in Europe. The proposed strategy would lower average total costs on KoreaCo’s European sales as it establishes production facilities in thecheaper currency. KoreaCo’s lower cost structure and improved competitiveness would beexpected to have a positive effect on the profitability of KoreaCo’s European sales.19. The dollar value of the foreign bonds would rise because the foreign currency appreciates relative tothe dollar. Furthermore, many countries practice a “leaning against the wind” exchange rate policy.Foreign bond yields are likely to drop to stabilize the exchange rate against the dollar. The localcurrency price of foreign bonds tends to go up when the dollar depreciates relative to the localcurrency. Hence, the dollar value of the foreign bonds would rise both because the foreign currency appreciates relative to the dollar and because the foreign bond prices rise.20. The following are some arguments in favor of international bond diversification:A rise in European inflationary anticipations is bad for European bond prices (increasing nominalyields), but should not affect foreign bond prices. Because foreign economies are lagging theEuropean economy, inflationary pressures are not yet felt abroad.Increased European inflation would lead to a depreciation of the euro, which would be good for the euro return of assets denominated in foreign currencies.An inflation-induced depreciation of the euro (appreciation of the foreign currency) is good forinvesting in foreign bond markets, if foreign governments lower their interest rates to avoid toostrong an appreciation of their domestic currency (“leaning against the wind”).。

(完整word版)国际财务管理课后习题答案chapter4

CHAPTER 4 CORPORATE GOVERNANCE AROUND THE WORLDSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQuestions1.The majority of major corporations are franchised as public corporations. Discuss the key strengthand weakness of the ‘public corporation’. When do you think the public corporation as an organizational form is unsuitable?Answer: The key strength of the public corporation lies in that it allows for efficient risk sharing among investors. As a result, the public corporation may raise a large sum of capital at a relatively low cost. The main weakness of the public corporation stems from the conflicts of interest between managers and shareholders.2.The public corporation is owned by multitude of shareholders but managed by professional managers.Managers can take self-interested actions at the expense of shareholders. Discuss the conditions under which the so-called agency problem arises.Answer: The agency problem arises when managers have control rights but insignificant cash flow rights. This wedge between control and cash flow rights motivates managers to engage in self-dealings at the expense of shareholders.3.Following corporate scandals and failures in the U.S. and abroad, there is a growingdemand for corporate governance reform. What should be the key objectives ofcorporate governance reform? What kind of obstacles can there be thwarting reformefforts?Answer: The key objectives of corporate governance reform should be to strengthen shareholder rights and protect shareholders from expropriation by corporate insiders, whether managers or large shareholders. Controlling shareholders or managers do not wish to lose their control rights and thus resist reform efforts.4.Studies show that the legal protection of shareholder rights varies a great deal acrosscountries. Discuss the possible reasons why the English common law traditionprovides the strongest and the French civil law tradition the weakest protection ofinvestors.Answer: In civil law countries, the state historically has played an active role in regulating economic activities and has been less protective of property rights. In England, control of the court passed from the crown to the parliament and property owners in seventeenth century. English common law thus became more protective of property owners, and this protection was extended to investors over time.5.Explain ‘the wedge’ between the control and cash flow rights and discuss its implications forcorporate governance.Answer: When there is a separation of ownership and control, managers have control rights with insignificant cash flow rights, whereas shareholders have cash flow rights but no control rights. This wedge gives rise to the conflicts of interest between managers and shareholders. The wedge is the source of the agency problem.6.Discuss different ways that dominant investors use to establish and maintain the control of thecompany with relatively small investments.Answer: Dominant investors may use: (i) shares with superior voting rights, (ii) pyramidal ownership structure, and (iii) inter-firm cross-holdings.7.The Cadbury Code of the Best Practice adopted in the United Kingdom led to a successful reform ofcorporate governance in the country. Explain the key requirements of the Code and discuss how it may have contributed to the success of reform.Answer: The Code requires that chairman of the board and CEO be held by two different individuals, and that there should be at least three outside board members. The recommended board structure helped to strengthen the monitoring function of the board and reduce the agency problem.8.Many companies grant stocks or stock options to the managers. Discuss the benefitsand possible costs of using this kind of incentive compensation scheme.Answer: Stock options can be useful for aligning the interest of managers with that of shareholders and reduce the wedge between managerial control rights and cash flow rights. But at the same time, stock options may induce managers to distort investment decisions and manipulate financial statements so that they can maximize their benefits in the short run.9.It has been shown that foreign companies listed in the U.S. stock exchanges are valued more thanthose from the same countries that are not listed in the U.S. Explain the reasons why U.S.-listed foreign firms are valued more than those which are not. Also explain why not every foreign firm wants to list stocks in the United States.Answer: Foreign companies domiciled in countries with weak investor protection can bond themselves credibly to better investor protection by listing their stocks in U.S. exchanges that are known to provide a strong investor protection. Managers of some companies may not wish to list shares in U.S. exchanges, subjecting themselves to stringent disclosure and monitoring, for fear of losing their control rights and private benefits.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际会计第四章练习

• 三、True or False

• C. Non- monetary assets

D. All of the above

国际会计第四章练习

• 3. Which country expenses all R&D outlays when they are incurred? • (C ). • A. U.K. • B. Germany • C. U.S. • D. China

国际会计第四章练习

• 6. During a high-inflationary period, if Current Cost-Adjusted Model is

used in translation, an entity would Gain from holding

(C )

• A. Monetary Assets

B. Equipment borrowed from other entities

• C. Long-term debt borrow from banks D. Non- monetary Liabilities

国际会计第四章练习

• 二、Multiple Choice • 1. The reasons that recognized goodwill should be systematically amortized

• B. Intangible assets that have finite useful lives are to be amortized over their useful lives in SFAS 142

• C. All R&D outlays should be expensed when they are incurred in the US

• A. Purchased goodwill meets the criteria for asset recognition while internally generated goodwill doesn’t

• B. Goodwill is the excess of the value of an ongoing business over the value of the individual identifiable net assets of the business

• D. Research costs should be expensed immediately in IAS38

国际会计第四章练习

• 5. Which of the following description about the goodwill in American isn’t correct? (D )

earnings.

国际会计第四章练习

• 2. In segment financial reporting, which of the following classifications are not classified by business segment (comparing to geographical segment)? (ABE )

• C. Positive goodwill is the total price paid for an acquired business is higher than the fair value of its net identifiable assets

• D. Recognized goodwill with finite useful lives should be amortized

国际会计第四章练习

• 4. Which of the following treatments for intangible assets isn’t correct? (A)

• A. Many companies recognize internally generated brands as assets in American•Biblioteka 一、Single Choice

• 1. In highly inflationary economies, firms would experience a monetary loss because of holding

• (B).

• A. Monetary liabilities

B. Monetary assets

• A. The nature of the products or services • B. The nature of the production processes • C. Relationship between operations in different geographic areas • D. Special risks associated with operations in a particular area • E. The methods used to distribute the products or provide the

are • (AB ) • A. goodwill has a finite life and erodes over time. • B. the purchased goodwill is of necessity replaced by internally generated

goodwill. • C. goodwill has an infinite life and even enhanced over time • D. systematically amortized is inherently arbitrary. • E. systematically amortized would result in a double hit against future