实用会计英语(第四版) (4)

会计英语四

1212 deflator 物价折算指数

1213 degree of financial leverage 财务杠杆作用系数

1214 degree of operation leverage 营业杠杆作用系数

1215 degree of total leverage 全部杠杆作用系数

1167 decision making under uncertainty 在不确定情况下制定决策

1168 decision model 决策模型

1169 decision rule 决策规则

1170 decision software package 决策软件组合程序

1171 decision support system 决策支持信息系统

1245 deposit in transit 在途存款

1246 depository 保管机构,存储机构

1247 depository receipts 证券托存收据,证券存单

1248 depreciable asset 应计折旧资产

1249 depreciable cost 应计折旧成本

1126 days sales in inventory 存货销售天数

1127 dBase 数据库管理程序

1128 DCF 折现现金流量

1129 dead account 呆账

1130 dead capital 呆滞资本

1131 dead stock 呆滞存货,冷背存货

1132 deal 交易,买卖

1157 debt structure 债务结构

1158 debt to equity ratio 债务对产权比率

会计英语叶建芳第四版课后题

会计英语叶建芳第四版课后题摘要:一、引言1.会计英语的重要性2.叶建芳第四版教材的特点二、课后题概述1.题型分类2.难度分析3.解题技巧与策略三、重点题型详解1.选择题a.解题步骤b.常见错误分析c.答题技巧2.填空题a.解题方法b.易错点提示c.解题策略3.判断题a.判断标准b.解题技巧c.错误判断分析四、课后题练习与解答1.练习题一:会计基本概念2.练习题二:财务报表与分析3.练习题三:会计分录与账户4.练习题四:计量、估计与披露5.练习题五:财务决策与控制五、总结与展望1.课后题学习成果总结2.提高会计英语能力的建议3.叶建芳第四版教材在教学中的应用与评价正文:一、引言随着全球化进程的不断推进,会计英语在国际贸易、企业交流等领域发挥着越来越重要的作用。

我国著名会计学家叶建芳教授所著的《会计英语》教材,历经多次修订,已成为会计专业学生的必备书籍。

本篇文章将针对叶建芳第四版《会计英语》教材的课后题进行详细解析,以帮助读者提高会计英语水平。

二、课后题概述1.题型分类叶建芳第四版《会计英语》的课后题主要包括选择题、填空题、判断题等。

这些题型涵盖了会计英语的基本概念、财务报表、会计分录、计量、估计与披露、财务决策等方面,全面检测读者对会计英语知识的掌握程度。

2.难度分析总体来说,课后题的难度适中,既适合初学者巩固基础知识,又能锻炼有一定基础的读者提高解题能力。

其中,部分题目具有一定的挑战性,需要读者对相关知识点有较深入的理解。

3.解题技巧与策略为提高解题效率,读者需要掌握一定的解题技巧。

以下为针对不同题型的解题策略:(1)选择题:仔细阅读题干,分析选项差异,运用排除法缩小答案范围,最后根据知识点选择正确答案。

注意审题,避免粗心大意。

(2)填空题:根据题干信息,填入合适的知识点。

注意检查答案是否符合题意和语法规范。

(3)判断题:明确判断标准,分析题干中的关键信息,避免盲目判断。

对于存疑的题目,可以借助教材或其他资料进行查证。

会计英语-第四版-叶建芳04

Cash Management

Accurately account for cash. Prevent theft and fraud. Assure the availability of

adequate amounts of cash. Avoid unnecessarily large

having clearly established responsibilities maintaining adequate records insuring assets and bonding employees separating recordkeeping and custody over assets dividing responsibilities for related transactions using mechanical devices where practicable regularly performing independent reviews of the

internal control practices

10

Internal Control

Operational Controls Financial Reporting Controls

11

Cash defined

Liquidity refers to how readily an asset can be converted into other types of assets or can be used to buy services or satisfy obligations.

needs

enough

$ cash to pay its bills! 3

实用会计英语unit4简明教程PPT课件

3. 常见三大的存货成本 核算假设(方法) • 先进先出法:假设先放置 入库的存货先售出。 • 后进先出法:假设后放置 入库的存货先售出。 • 平均成本法:假设存货的 成本计价以本期存货的平 均成本为计价标准。

4-11

MODULE 2 手不释卷

实用会计英语 / Practical Accounting English

A. Look at the pictures and fill the blank with correct English words.

学 以 致 用

4-5

实用会计英语 / Practical Accounting English

MODULE 1

学 以 致 用

4-6

实用会计英语 / Practical Accounting English

4-12

MODULE 2 手不释卷

实用会计英语 / Practical Accounting English

B. Learn the new words and phrases in the passage and try to use them to make sentences. New Words

制造业企业通过使用机 器和雇佣工人将材料转换成 产成品,并通过销售产品获 取销售收入

4-8

MODULE 2 手不释卷

实用会计英语 / Practical Accounting English

2. Inventory of merchandise business V.S. manufacturing business The merchandise held by a merchandising business is recorded as current asset called merchandise inventory. Merchandise Inventory sold becomes cost of merchandise sold. In contrast to a merchandising company, a manufacturing company has three types of inventory: materials inventory, work in process inventory and finished goods inventory. The costs of work in process inventory include the direct materials, director labor and factory overhead.

会计英语第四版叶建芳

Interpretation of the Income Statement

要点一

Revenue

Revenue reports the total amount of income generated by a company through its normal business operations This can include sales of products or services, interest income, and other sources of income

Accounting Definition and Function

Preparing financial statements

Recording business transactions

Functions of Accounting

01

03 02

Accounting Definition and Function

Owner's Equity

Owner's equity reports the residual interest in the assets of the company after conducting its liabilities It reflects the amount of capital contributed by the owners and the retained earnings over time

Cash Flow from Operating AThcistsievctiiotnieofsthe cash flow

statement shows how much cash is generated from a company's normal business operations It includes cash received from customers and cash paid to suppliers, employees, and for other operating expenses

会计英语第四版张其课后答案

会计英语第四版张其课后答案1、Sometimes Americans are said to be _____. [单选题] *A superficially friendB superficial friendC. superficial friendlyD. superficially friendly(正确答案)2、The famous writer, _____ writings for China Daily I appreciate a lot , is invited to give a speech in our university. [单选题] *A. thatB. whose(正确答案)C. whomD. who3、—When are you going to Hainan Island for a holiday? —______ the morning of 1st May.()[单选题] *A. InB. AtC. On(正确答案)D. For4、While they were in discussion, their manager came in by chance. [单选题] *A. 抓住时机B. 不时地C. 碰巧(正确答案)D. 及时5、I passed the test, I _____ it without your help. [单选题] *A.would not passB. wouldn't have passed(正确答案)C. didn't passD.had not passed6、Miss Smith is a friend of _____. [单选题] *A. Jack’s sister’s(正确答案)B. Jack’s sisterC. Jack sister’sD. Jack sister7、2.I think Game of Thrones is ________ TV series of the year. [单选题] *A.excitingB.more excitingC.most excitingD.the most exciting (正确答案)8、She found her wallet()she lost it. [单选题] *A. where(正确答案)B. whenC. in whichD.that9、52.I'm happy to ________ a birthday card from an old friend. [单选题] * A.buyB.makeC.loseD.receive(正确答案)10、Don’t ______. He is OK. [单选题] *A. worriedB. worry(正确答案)C. worried aboutD. worry about11、--_______ do you have to do after school?--Do my homework, of course. [单选题] *A. What(正确答案)B. WhenC. WhereD. How12、(), it would be much more sensible to do it later instead of finishing it now. [单选题] *A. FinallyB. MildlyC. Actually(正确答案)D. Successfully13、Though my best friend Jack doesn’t get()education, he is knowledgeable. [单选题] *A. ManyB. littleC. fewD. much(正确答案)14、He often comes to work early and he is _______ late for work. [单选题] *A. usuallyB. never(正确答案)C. oftenD. sometimes15、I want something to eat. Please give me a _______. [单选题] *A. bookB. watchC. shirtD. cake(正确答案)16、70.Would you like ________,sir? [单选题] *A.something else(正确答案)B.nothing elseC.else somethingD.else anything17、The()majority of the members were against the idea. [单选题] *A. substantialC. considerable(正确答案)D. overwhelming18、73.()about the man wearing sunglasses during night that he was determined to follow him.[单选题] *A. So curious the detective wasB.So curious was the detective(正确答案)C.How curious was the detectiveD.How curious the detective was19、What about _______ there by bike? [单选题] *A. goesB. wentC. goD. going(正确答案)20、It’s reported that there are more than 300?_______ smokers in China. [单选题] *A. million(正确答案)B. millionsC. million of21、74.In England people drive________. [单选题] *A.on the left(正确答案)B.in the leftC.on leftD.in left22、I don’t like playing chess. It is _______. [单选题] *A. interestingB. interestedC. boring(正确答案)D. bored23、Sometimes only()10 out of 500 or more candidates succeed in passing all the tests. [单选题] *A. as many asB. as few as(正确答案)C. as much asD. as little as24、61.How is online shopping changing our way? ? ? ? ? ? life? [单选题] *A.of(正确答案)B.inC.onD.for25、I have seldom seen my father()pleased with my progress as he is now. [单选题] *A. so(正确答案)B. veryC. tooD. rather26、The firm attributed the accident to()fog, and no casualties have been reported until now. [单选题] *A. minimumB. scarceC. dense(正确答案)D. seldom27、44.—Hi, Lucy. You ________ very beautiful in the new dress today.—Thank you very much. [单选题] *A.look(正确答案)B.watchC.look atD.see28、We have _______ a double room with a bath for you in the hotel. [单选题] *A. boughtB. reserved(正确答案)C. madeD. taken29、It’s so nice to hear from her again. ______, we last met more than thirty year ago [单选题] *A. What ‘s wordB. That’s to sayC. Go aheadD. Believe it or not(正确答案)30、He spoke too fast, and we cannot follow him. [单选题] *A. 追赶B. 听懂(正确答案)C. 抓住D. 模仿。

会计英语第四版试题及答案

会计英语第四版试题及答案Section 1: Multiple Choice Questions1. Which of the following is a primary function of accounting?a) Data analysisb) Financial forecastingc) Budgetingd) Asset managementAnswer: a) Data analysis2. Which financial statement shows a company's revenues and expenses over a specific period of time?a) Balance sheetb) Income statementc) Statement of cash flowsd) Statement of retained earningsAnswer: b) Income statement3. The accrual basis of accounting recognizes revenues and expenses when:a) Cash is received or paidb) Goods are sold or purchasedc) Services are provided or receivedd) Assets are acquired or disposed ofAnswer: c) Services are provided or received4. The accounting equation can be expressed as:a) Assets = Liabilities + Owner's Equityb) Revenues - Expenses = Net Incomec) Cash Inflows - Cash Outflows = Net Cash Flowd) Assets + Liabilities = Owner's Equity + Revenues - ExpensesAnswer: a) Assets = Liabilities + Owner's Equity5. Which of the following statements is true about the International Financial Reporting Standards (IFRS)?a) They are principles-based accounting standardsb) They are used primarily in the United Statesc) They have been adopted by all countries globallyd) They focus only on financial reporting for public companiesAnswer: a) They are principles-based accounting standardsSection 2: Short Answer Questions1. Define the term "depreciation" in accounting.Depreciation is the systematic allocation of the cost of an asset over its useful life. It represents the decrease in value of an asset over time due to wear and tear, obsolescence, or other factors.2. What are the three main financial statements prepared by a company?The three main financial statements are the balance sheet, income statement, and statement of cash flows.3. Explain the difference between accounts payable and accounts receivable.Accounts payable refers to the money a company owes to its creditors or suppliers for goods or services received but not yet paid for. Accounts receivable, on the other hand, represents the money owed to a company by its customers for goods or services provided but not yet received payment for.4. What is the purpose of a trial balance in accounting?The purpose of a trial balance is to ensure the accuracy of the accounts and records by comparing the total debits and credits. It helps identify any errors or discrepancies that need to be rectified before preparing financial statements.5. Briefly explain the concept of "double-entry" bookkeeping.Double-entry bookkeeping is a system of recording financial transactions that requires each transaction to have at least two entries – a debit and a credit. This system ensures that the accounting equation (assets = liabilities+ owner's equity) remains in balance and helps maintain the accuracy of the financial records.Section 3: Essay Questions1. Discuss the role of ethics in accounting.Ethics plays a crucial role in accounting as it ensures the integrity, transparency, and fairness of financial reporting. Accountants are expectedto adhere to professional codes of conduct and ethical guidelines to maintain objectivity, confidentiality, and independence. Ethical behavior in accounting helps build trust among stakeholders, prevents fraudulent practices, and promotes accountability in financial management.2. What is the importance of internal controls in accounting?Internal controls are essential in accounting as they help safeguard assets, prevent and detect fraud, ensure accuracy in financial statements, and promote operational efficiency. They include procedures, policies, and mechanisms that mitigate risks, maintain the reliability of financial information, and protect a company's resources. Effective internal controls contribute to better financial management, compliance with regulations, and overall organizational success.3. Explain the concept of "going concern" in accounting.The concept of "going concern" in accounting assumes that a company will continue its operations and fulfill its obligations in the foreseeable future. It implies that the entity is financially stable, has sufficient resources to operate, and does not plan to liquidate or significantly curtail its activities. This assumption influences the valuation of assets, liabilities, and thepreparation of financial statements, giving stakeholders an understanding of the company's ability to continue as a viable entity.In conclusion, accounting is a fundamental aspect of business management that involves various principles, concepts, and practices. It serves as a tool for financial analysis, decision-making, and communication of financial information. Understanding accounting concepts and applying them accurately is crucial for professionals in the field to ensure reliable and transparent financial reporting.。

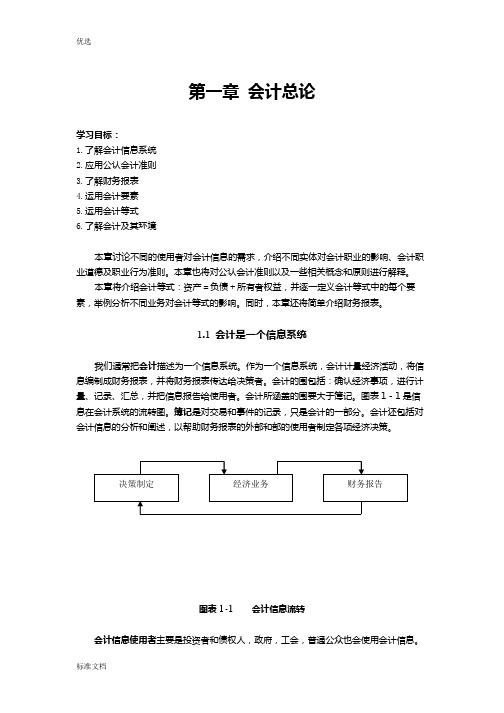

会计英语(第四版)

第一章会计总论学习目标:1.了解会计信息系统2.应用公认会计准则3.了解财务报表4.运用会计要素5.运用会计等式6.了解会计及其环境本章讨论不同的使用者对会计信息的需求,介绍不同实体对会计职业的影响、会计职业道德及职业行为准则。

本章也将对公认会计准则以及一些相关概念和原则进行解释。

本章将介绍会计等式:资产=负债+所有者权益,并逐一定义会计等式中的每个要素,举例分析不同业务对会计等式的影响。

同时,本章还将简单介绍财务报表。

1.1 会计是一个信息系统我们通常把会计描述为一个信息系统。

作为一个信息系统,会计计量经济活动,将信息编制成财务报表,并将财务报表传达给决策者。

会计的围包括:确认经济事项,进行计量、记录、汇总,并把信息报告给使用者。

会计所涵盖的围要大于簿记。

图表1-1是信息在会计系统的流转图。

簿记是对交易和事件的记录,只是会计的一部分。

会计还包括对会计信息的分析和阐述,以帮助财务报表的外部和部的使用者制定各项经济决策。

图表1-1 会计信息流转会计信息使用者主要是投资者和债权人,政府,工会,普通公众也会使用会计信息。

1.2 组织形式企业有三种组织形式:个人独资企业是指由一个自然人投资拥有的企业组织。

个人独资企业是一个会计实体,但并不是法律实体个人独资企业的所有者对企业的债务承担无限责任,这也是个人独资企业的一个主要缺点。

合伙企业与个人独资企业的区别只在于它有两个或两个以上的所有者。

合伙企业的所有者被称为合伙人。

现实商业活动中有许多不同类型的合伙企业。

公司是依据当地法律注册成立的单独实体;公司的所有者被称为股东。

股东不对公司的债务负责。

有限责任是公司这种组织形式的一个显著优点。

公司的所有权被分为股份。

股份可以在所有者之间转让。

1.3 编报财务报表的框架由于各个国家的法律和经济环境不同,各国有不同的会计模式。

在一个国家可行的会计实务在另一个国家并不一定可行。

由于各国的会计模式不同,所以我们需要制定一个互相协调的会计标准:用全球通用的会计语言来传达相关的且可靠的会计信息。

《会计英语》Accounting04

16

Reconciling the Bank Balance(银行账户余 额的调节)

What's the bank statement?

17

Bank Statements(银行对账单)

Shows the beginning bank balance, deposits made, checks paid, other debits and credits in the month, and the ending bank balance.

14

Example of Petty Cash Payments

• Jose also spent $20 for delivery charges and $60 for coffee and other miscellaneous expenses. • What is the journal entry to record the Reimbursing of the frrency (纸币)

Cash is defined as any deposit banks will accept.

Checks

Money orders (汇票)

A cash equivalent is an investment that is readily convertible to a known amount of cash and is sufficiently close to its maturity date so that its market value is relatively insensitive to interest rate changes. 现金等价物是指企业持有至到期,容易兑换成确定金额的现 金,并且市场价值不随利率的变化有较大波动的一项投资。

会计英语 第四版 叶建芳04

protect assets against theft or misuse

promote operational efficiencies encourage adherence to prescribed managerial policies

YE SUN AccountingEnglish 9

Cash not needed for business purposes should be distributed to the company’s stockholders.

YE SUN AccountingEnglish

8

Internal control

Internal control procedures are designed to:

YE SUN AccountingEnglish 21

The Bank Reconciliation

1

2

What are two records of a business’s cash? Cash account in the business’s own general ledger. The bank statement which tells the actual amount of cash the business has in the bank.

YE SUN lish

10

Internal Control

Operational Controls Financial Reporting Controls

YE SUN AccountingEnglish

11

Cash defined

Liquidity refers to how readily an asset can be converted into other types of assets or can be used to buy services or satisfy obligations. Cash is a current asset that includes currency, coin, money orders received from customers, amounts held in the form of demand deposits, savings accounts, and certificates of deposit.

会计英语 第四版

The accounting

process

Economic activities

Accounting is an information system.

Accounting thinks decision makers with economic activities and with the

results of their decisions.

Users of accounting information

Primary users – investors and creditors

External users & Internal users

External users are users outside of the entity examples: banks, government, creditors, unions

Types of accountants

There are three basic types of accountants:

Private accountants work for a single employer.

Public accountants are available to the public.

(revenue and gains) less expenses (including losses).

The statement of changes in equity reconciles changes in equity (increases are caused by owner investments and net income, while decreases result from owner withdrawals and net losses for sole proprietorship ).

会计英语第四版参考答案

会计英语第四版参考答案会计英语第四版参考答案会计英语是会计专业学生必修的一门课程,它旨在帮助学生掌握会计领域的专业术语和表达方式。

《会计英语第四版》是一本广泛使用的教材,其中包含了大量的习题和案例,供学生练习和巩固知识。

本文将为大家提供《会计英语第四版》的参考答案,希望对学习者有所帮助。

第一章:会计概述1. 会计的定义是什么?会计是一门研究经济活动并提供相关信息的学科,它通过记录、分类、汇总和报告财务信息,帮助用户做出经济决策。

2. 什么是会计要素?会计要素是构成会计信息的基本要素,包括资产、负债、所有者权益、收入和费用。

3. 会计的目标是什么?会计的目标是提供有关企业财务状况、经营成果和现金流量的信息,帮助用户做出正确的经济决策。

第二章:会计准则和规范1. 什么是会计准则?会计准则是规范会计信息记录和报告的原则和规则,它确保财务报表的准确性、可比性和可理解性。

2. 什么是国际财务报告准则(IFRS)?国际财务报告准则是由国际会计准则委员会制定的全球通用的会计准则,旨在提高财务报告的质量和可比性。

3. 什么是美国通用会计准则(US GAAP)?美国通用会计准则是美国财务会计准则委员会制定的会计准则,适用于在美国注册的公司。

第三章:资产负债表1. 什么是资产负债表?资产负债表是一份反映企业财务状况的报表,它列出了企业的资产、负债和所有者权益。

2. 资产负债表的基本公式是什么?资产负债表的基本公式是:资产=负债+所有者权益。

3. 什么是流动资产和非流动资产?流动资产是指在一年内可以变现或消耗的资产,如现金、应收账款等;非流动资产是指长期持有的资产,如固定资产和投资。

第四章:利润表1. 什么是利润表?利润表是一份反映企业经营成果的报表,它列出了企业的收入、费用和利润。

2. 利润表的基本公式是什么?利润表的基本公式是:利润=收入-费用。

3. 什么是毛利润和净利润?毛利润是指企业在销售产品或提供服务后剩余的金额,净利润是指扣除所有费用后的利润。

_会计英语(B)试题及答案《实用会计英语》(第四版)李海红[5页]

![_会计英语(B)试题及答案《实用会计英语》(第四版)李海红[5页]](https://img.taocdn.com/s3/m/fa39fce890c69ec3d4bb7574.png)

会计英语期末考试题I. Words and terms (20%)1. bankruptcy _________2. financial performance________3. debit ______________4. compound entry__________5. accrual accounting__________6. gross proceeds____________7. marketable securities __________ 8.operating expenses___________9. cash flow______________ 10. store credit_____________11.预付费用________ 12.累计折旧______13.试算平衡________ 14.资产负债表________15.业主提款账户_______ 16.坏账准备账户________17.贴现利息________ 18.会计循环_______19.股息________ 20.日记账___II Fill in the blanks with proper words.(20%)1. Accounting profession is sorted into ____________________, government accounting, management accounting and __________________.2._________________,____________________________,_________________________are the three basic forms of business activities.3.____________________________ is considered as the heart of modern accounting.4. Basically, the T account has three parts: _______________, the debit and ______________.5.Each source document should include at least three parts: the date, the_________________ and ______________________________________.6. After the transactions have been entered in the journal, they must be transferred to the _______________________________ and this process is called ____________.7. The first step of the closing entries is the ________________ accounts are closed by transferring their balances to the ___________________________ account.8. At the beginning of accounting period, the investment cost of marketable securities includes _____________________, taxes, and ________________________ .9. The accounts that can’t be collected are called _____________________________ or ___________________.10. A 60-day, 6%, $4000 note was issued on October 3rd. The note will be due on ________________ and the maturity value of the note is _________________.III. Write T ( true) before the statements which are true and (F) which are false.(5%)1. ( ) The profits and losses in a partnership must be allocated equally by the partners.2. ( ) The total of the debits equals the total of the credits means there is not any error in the process of recording and calculating.3. ( ) The balance of the temporary accounts such as revenue, expense and withdrawals should be zero in preparation for the start of the next accounting period.4. ( ) The collection of the credit sales will increase the balance of Accounts Receivable.5. ( ) The company can discount the promissory note to the bank or other financial units when it needs cash.IV. Match the classifications in Column A with the expression in Column B and write the correct letters on the lines.(15%)Column A Column BCurrent asset a. cash in the safe________________ b. five-year bondsc. lathesd. drillse. accounting system softwareLong –term asset f. cash in bank_______________ g. pencilsh. stationaryi. brand namej. import quotasIntangible asset k. notes receivable______________ l. desksm. motion picture filmn. customer and supplier relationshipo. countersV. Translate the following sentences (15%)1.Bookkeeping is the day-to-day record-keeping involved in the process of accounting.2. The journal records transactions day by day and shows an explanation of each transaction.3. If the prepaid expenses are not adjusted at the end of accounting period, the assets will be exaggerated and the expenses will be understated.4. Income statement is used to track revenues and expenses so that you can determine the operating performance of the business over a period of time.5.While profit is the amount of money you expect to make over a given period of time, cash iswhat you must have to keep your business running.VI. Calculation ( 10% )1.At the beginning of the year , Kevin Young company ‘s assets were 220,000, and its ownersequity was $ 123,000 . During the year, assets increased $60,000, and the liabilities decreased $ 10,000. What was the owner’s equity at the end of the year?2. A sale is made on August 1 for $ 400 ,terms 2/10, n/30, on which a sales return of $ 100 isgranted on August 6 .What is the dollar amount received for payment in full on August 9 ?VII. Make entries (15%)Tom Vega, after receiving his degree in computer science, began his own business called A Star System Company. He completed the following transactions soon after starting the business. Make entries to record these transactions using the following account titles: Cash, Accounts Receivable, Prepaid Rent, Computer Supplies, Minicomputer, System Library, Accounts Payable, Service Revenue, Expense, Tom Vega, Capital and Tom Vega, Withdrawals.1.Tom began his business with a $10,000 cash investment, and a system library, which cost$920.2.Paid two months’ rent for an office. Rent is $360 per month.3.Purchased a minicomputer for $4,500 in cash.4.Purchased computer supplies on credit, $620.5.Collected revenue from a client, $730.6.Billed a client $450 upon completion of a short project.7.Paid expenses of $230.8.Received $450 from the client billed previously.9.Withdrew $210 in cash for personal expense.10.Paid $620 of amount owed in transaction 4.会计英语答案I. Words and terms1. 破产2. 财务业绩3.借方4.复合分录5. 权责发生制会计6.毛利润7.有价证券8.营业费用9.现金流10.赊账11.Prepaid Expense 12. Accumulated Depreciation 13. trial balance 14. balance sheet 15. Withdrawals Account 16. Allowance for Uncollectible Accounts 17. discount 18. accounting cycle 19. dividend 20. journal评分标准:共计20分,每题1分。

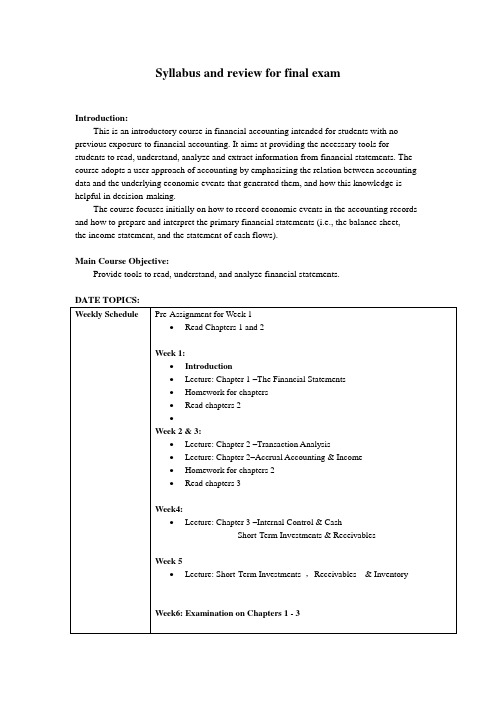

会计英语(第4版)教学大纲和期末复习题目

Syllabus and review for final examIntroduction:This is an introductory course in financial accounting intended for students with no previous exposure to financial accounting. It aims at providing the necessary tools for students to read, understand, analyze and extract information from financial statements. The course adopts a user approach of accounting by emphasizing the relation between accounting data and the underlying economic events that generated them, and how this knowledge is helpful in decision-making.The course focuses initially on how to record economic events in the accounting records and how to prepare and interpret the primary financial statements (i.e., the balance sheet,the income statement, and the statement of cash flows).Main Course Objective:Provide tools to read, understand, and analyze financial statements.Question 1 costing method for inventory Stylish Jeans Company markets blue jeans and uses a perpetual inventory system to account for its merchandise. The beginning balance of the inventory and transactions during the year were as follows:January 1: Balance: 350 units at €52 eachMarch 12: Purchased 175 units at €61 each.May 21: Sold 260 units for a selling price of €112 each.July 8: Purchased 300 units at €73.October 31: Sold 320 units for a selling price of €112 each.Required1. Calculate cost of goods available for sale and units available for sale for the year.2. Calculate units remaining in ending inventory.3. Calculate the currency value of cost of goods sold and ending inventory usinga) FIFOb) Weighted averageRound to two decimal places.1.Beg. 350 units @ €52= €18,200Mar. 12 175 units @ 61 = 10,675July 8 300 units @ 73 = 21,900UnitsAvailable 825 units €50,775Cost of goods available for sale2. Units in ending inventory:Units available 825Less: Units sold 580Ending Inventory 2453.(b) Weighted-average perpetualQuestion 2 accounting for bad debtsBeleVu Supplies showed the following selected adjusted balances at itsDecember 31, 2011 year end:During the year 2012, the following selected transactions occurred:1. Sales totalled €2,960,000, of which 25% were cash sales (cost of sales€1,804,000).2. Sales returns were €114,000, half regarding credit sales. The returnedmerchandise was scrapped.3. An account for €24,000 was recovered.4. Several accounts were written off; €39,000.5. Collections from credit customers totalled €1,880,000 (excluding the recovery in(3) above).Requireda. Prepare the December 31, 2012 adjusting entry to estimate bad debts, assuming that uncollectible accounts are estimated to be 1% of net credit sales.b. Show how accounts receivable will appear on the December 31, 2012 statement offinancial position.c. What will bad debts expense be on the statement of comprehensive income for theyear ended December 31, 2012?d. Prepare the December 31, 2012 adjusting entry to estimate bad debts, assumingthat uncollectible accounts are estimated to be 3% of outstanding receivables.e. Show how accounts receivable will appear on the December 31, 2012 statement offinancial position.f. What will bad debt expense be on the statement of comprehensive income for theyear ended December 31, 2012?a. Dec. 31 Bad Debt Expense 21,630 Allowance for Doubtful Accounts 21,630 2,220,000 – 57,000 = 2,163,000 2,163,000 × 1% = 21,630b. Current assets: Accounts receivable € 742,000 Less: Allowance for doubtful accounts (23,310) € 718,690 ORCurrent assets: Accounts receivable (net of €23,310 estimated uncollectible accounts) € 718,690c.d. Dec.31 Bad Debt Expense ................................................... 20,580 Allowance for Doubtful Accounts .................... 20,580 742,000 × 3% = 22,260 – 1,680 = 20,580Calculations:× 3%€22,260e.Current assets:Accounts receivable €742,000Less: Allowance for doubtful accounts (22,260) €719,740 ORCurrent assets:Accounts receivable (net of €22,260estimated uncollectible accounts) €719,740f. €20,580Question 3 accounting for trading investmentExtel Company’s fair value through profit or loss investments as of December 31, 2011 are as follows:Cost MarketKlondike ordinary shares €11,250 €14,875Kaffner ordinary shares 56,070 55,950IDEA ordinary shares 12,400 10,800Western ordinary shares 35,400 30,220RequiredPart 1Prepare the journal entries to record the adjustments to fair value for the fair value through profit or loss investments as per the requirements of IAS 39.Part 2Illustrate how the fair value through profit or loss investments will be reported on the statement of financial position on December 31, 2011.Illustrate what effect your adjustments would have on the Statement of Comprehensive Income for the year ended December 31, 2011.Part 1Cost Market Difference Klondike ordinary shares €11,250€14,875€3,625Kaffner ordinary shares 56,070 55,950 (120)IDEA ordinary shares 12,400 10,800 (1,600) Western ordinary shares 35,400 30,220 (5,180)2011Dec. 31 FVPL investments — Klondike shares 3,625Unrealized gain on FVPL investments 3,625€14,875 –€11,250 = €3,62531 Unrealized loss on FVPL investments (120)FVPL investments — Kaffner shares (120)€55,950 –€56,070 = (€120)31 Unrealized loss on FVPL investments ...................................... 1,600FVPL investments — IDEA shares .................................... 1,600 €10,800 –€12,400 = (€1,600)31 Unrealized loss on FVPL investments ...................................... 5,180FVPL investments — Western shares ................................ 5,180 €30,220 –€35,400 = (€5,180)Part 2Statement of Financial Position:Current assets:Fair value through profit or loss investments .................................... €111,845 Total fair or market values = €14,875 + €55,950 + €10,800 + €30,220Statement of Comprehensive Income:Other Income and Expenses:Unrealized loss on fair value through profit or loss investments....... €3,275Net unrealized loss = €3,625 –€120 –€1,600 –€5,180 = (€3,275)Question 4 accounting for fixed assetsShield Corporation purchased a used machine for €282,000 on January 7, 2007. It was repaired the next day at a cost of €12,500 and installed on a new platform that cost €2,000. The company predicted that the machine would be used for six years and would then have a €16,200 residual value. Depreciation was to be charged on a straight-line basis. A full year’s depreciation was charged on December 31, 2007. On June 25, 2012 it was retired.Required1. Prepare journal entries to record the purchase of the machine, the cost of repairingit, and the installation. Assume that cash was paid.2. Prepare entries to record depreciation on the machine on December 31 of its firstyear and on September 30 in the year of its disposal. (Round calculations to the nearest whole dollar.)3. Prepare entries to record the retirement of the machine under each of thefollowing unrelated assumptions:a) It was sold for €42,000;b) It was sold for €32,000; andc) It was stolen and the insurance company paid €37,500 in ful l settlement of theloss claim.4. Explain the purpose of recording depreciation. If depreciation is not recorded, whatis the effect on the statement of comprehensive income and statement of financial position?Part 12007Jan. 7 Machine ........................................................ 282,000Cash .................................................... 282,000 To record purchase of machine.8 Machine ........................................................ 12,500Cash .................................................... 12,500 To record capital repairs on machine.8 Machine ........................................................ 2,000Cash .................................................... 2,000 To record installation of machine.Part 2Dec. 31 Depreciation Expense, Machine .................. 46,717Accumulated Depreciation, Machine ........................................................46,717To record depreciation;(296,500 – 16,200)/6 = 46,717. 2012June. 25 Depreciation Expense, Machine .................. 23,359Accumulated Depreciation, Machine ........................................................23,359To record partial year’s depreciation; 46,717 × 6/12 = 23,359.Part 3(a)25 Accumulated Depreciation, Machine 1 ......... 256,944 Cash .............................................................. 42,000Gain on Disposal 2............................... 2,444 Machine .............................................. 296,500Sold machine for €42,000.Part 3(b)25 Accumulated Depreciation, Machine ........... 256,944 Cash .............................................................. 32,000 Loss on Disposal 3 ......................................... 7,556Machine .............................................. 296,500Sold machine for €32,000.Part 3(c)25 Accumulated Depreciation, Machine256,944 Cash37,500 Loss on Disposal4 2,056Machine296,500 Received insurance settlement.Dep. for 2007, 2008, 2009, 2010, and 2011.Dep. for 2012.1 Accumulated depreciation = (46,717 × 5 years) + 23,359 = 256,9442Gain (Loss) = Cash Proceeds – Book Value= 42,000 – (296,500 – 256,944) = 2,4443 Gain (Loss) = Cash Proceeds – Book Value= 32,000 – (296,500 – 256,944) = (7,556)4 Gain (Loss) = Cash Proceeds – Book Value= 3,7500 – (296,500 – 256,944) = (2,056)Part 4Depreciation is the process of allocating the cost of property, plant, and equipment in a rational and systematic manner over the assets’ useful life. It is required by the expense recognition principle. If depreciation is not recorded, net income will be overstated on the statement of comprehensive income. On the statement of financial position, assets and equity will be overstated.Question 5 accounting for bonds payableApplet Inc. issued bonds on January 1, 2011, that pay interest semi-annually on June30 and December 31. The par value of the bonds is €80,000, the annual contract rateis 8%, and the bonds mature in 10 years.RequiredFor each of these three situations, (a) determine the issue price of the bonds, and (b) show the journal entry that would record the issuance, assuming the market interestrate at the date of issuance was1. 6%2. 8%3. 10%Part 1a.Par value 0.5537 €80,000€44,296Interest (annuity) 14.8775 3,200 47,608Total €91,904Premium € 11,904* The table values are based on a discount rate of 3% (half the annual market rate)and 20 periods/payments.b.2011Jan. 1 Cash......................................................................... 91,904Premium on Bonds Payable .............................. 11,904Bonds Payable ................................................... 80,000 Sold bonds on original issue date.Part 2a.Par value 0.4564 €80,000 €36,512 Interest (annuity) 13.5903 3,200 43,488 Total €80,000* The table values are based on a discount rate of 4% (half the annual market rate)and 20 periods/payments.b.2011Jan. 1 Cash......................................................................... 80,000Bonds Payable ................................................... 80,000 Sold bonds on original issue date.Part 3a.Par value 0.3769 €80,000€30,152Interest (annuity) 12.4622 3,200 39,879Total €70,031Discount €9,969* The table values are based on a discount rate of 5% (half the annual market rate)and 20 periods/payments.b.2011Jan. 1 Cash ......................................................................... 70,031Discount on Bonds Payable .................................. 9,969Bonds Payable ................................................... 80,000 Sold bonds on original issue date.Entry for period 6 interestDR interest expense 3585CR cash 3200CR discount 385Question 6 accounting for shareholders equityMajestic Inc. was authorized to issue 250,000 €1.00 noncumulative preference shares and an unlimited number of ordinary shares. During Majestic’s first month of operations, May 2011, the following selected transactions occurred:May 1 10,000 preference shares were issued at €15.00 for cash.May 5 9,000 of the ordinary shares were issued for a total of €9,000 cash.May 6 14,000 ordinary shares were issued in exchange for land valued at €30,000.The shares were actively trading on this date at €2.00 per share.May 26 The corpora tion’s promoters were given 14,000 ordinary shares for their services in organizing the corporation. The directors valued the services at€70,000.May 31 The Board of Directors declared and paid a total dividend of €12,000.May 31 The €120,000 credit balan ce in the Income Summary account was closed. May 31 The cash dividends declared were closed to retained earnings.Required1.Prepare the journal entries to record the above transactions.2.Prepare the shareholders’ equity section of the company’s statemen t offinancial position as of May 31, 2011.Part 2Majestic Inc.Partial Statement of Financial PositionMay 31, 2011Shareholders’ EquityContributed capital:Preferred shares, €1.00, non-cumulativeAuthorized: 250,000Issued and outstanding: 10,000 € 150,000 Ordinary sharesAuthorized: unlimitedIssued and outstanding: 37,000 107,000 Total contributed capital ............................ €257,000 Retained earnings ............................................... 108,000 Total shareholders’ equity .......................................... €365,000Question 7 the statement of cash flowHolliday Corp.’s statement of financial position and statement ofcomprehensive income are as follows:HOLLIDAY CORP.Comparative Statement of Financial Position InformationDecember 31Assets 2012 2011Cash ............................................................................ €150,850 €214,550 Accounts receivable ..................................................... 182,000 138,950 Merchandise inventory ................................................. 766,500 707,000 Prepaid expenses ........................................................ 15,050 17,500 Equipment .................................................................. 446,600 308,000 Accumulated depreciation ........................................ (96,950) (123,200) Total assets ................................................................. €1,464,050 €1,262,800Liabilities and Shareholder s’ EquityAccounts payable ......................................................... €246,750 €326,550 Short-term notes payable ............................................. 28,000 17,500 Long-term notes payable ............................................. 262,500 150,500 Ordinary shares ........................................................... 563,500 437,500 Retained earnings ........................................................ 363,300 330,750 Total liabilities and shareholders’ equity ...................... €1,464,050 €1,262,800HOLLIDAY CORP.Statement of Comprehensive Incomefor year ended December 31, 2012Sales ............................................................................ €1,389,500 Cost of goods sold ....................................................... 700,000 Gross profit .................................................................. €689,500 Operating expenses:Depreciation expense ............................................. €52,500Other expenses ...................................................... 382,200Total operating expenses ....................................... 434,700 Income from operations ............................................... €254,800 Loss on sale of equipment ........................................... 14,350 Income taxes ............................................................... 33,950Net income ................................................................... €206,500 Other information regarding Holliday Corp.:a. All sales are credit sales.b. All credits to accounts receivable in the period are receipts from customers.c. Purchases of merchandise are on credit.d. All debits to accounts payable in the period result from payments formerchandise.e. The other operating expenses are cash expenses.f. The only decrease in income taxes payable is for payment of taxes.g. The other expenses are paid in advance and are initially debited to Prepaidexpenses.Additional information regarding Holliday Corp.’s activities during 2012:h. Loss on sale of equipment is €14,350.i. Equipment costing €131,250,with accumulated depreciation of €78,750, issold for cash.j. Equipment costing €269,850is purchased by paying cash of €70,000 and signing a long-term note payable for the balance.k. Borrowed €10,500 by signing a short-term note payable.l. Paid €87,850 to reduce a long-term note payable.m. Issued 7,000 ordinary shares for cash at €18 per share.n. Declared and paid cash dividends of €173,950.HOLLIDAY CORP.Statement of Cash FlowsNote A:The company purchased equipment for €269,850 by signing a €199,850 long-term note payable and paying €70,000 in cash.Note 2 retained earnings330,750+ profit 206,500 - 173,950(n) = 363,300Name______________ Student Number___________________HOLLIDAY CORP.Statement of Cash Flows。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

高等教育出版社

7

4.3 Accounts Receivable

高等教育出版社

8Leabharlann 4.3 Accounts Receivable

高等教育出版社

9

4.3 Accounts Receivable

Definition:

▲ Credit sales on open account increase Account Receivable. Accounts Receivable arise when a business sells goods and services on credit. Sales and profits can be increased by granting customers the privilege of making payment a month after the date of sale

(5) goods returned from customers (or amounts claimed)-sales returns and allowances

(6) adjustments to other item

高等教育出版社

10

4.3 Accounts Receivable

Example: Assume the following transactions occurred in the month of July for Swanson’ Motor Repairs: July 1 sold motor parts on credit to Wilson $3,000.July 3 Wilson returned unused parts to the value of $45.At end of the month Swanson collected the amount of credit sales. The related journal entry as follows:

July 1 Dr. Account Receivable 3,000

Cr. Sales Revenue

3,000

Sale on account

July 3 Dr. Sales Returns and Allowances 45

Cr. Account Receivable

45

Sales return for unused parts

Related Process of Cash Transaction:

(1) Cash recording

(2) Cash depositing

(3) Reconciliation

(4) Refunds and voids

(5) Safeguarding cash

高等教育出版社

5

4.2 The Bank Account: a Control Device

Unit 4 Cash and Receivables

1

葛军 吴晓华

高等教育出版社

2 Outline of Unit 4

4.1 Cash 4.2 The Bank Account: a Control Device 4.3 Accounts Receivable 4.4 Notes Receivable 4.5 Accounting for Bad Debts

Related process of Bank Account:

(1) goods sold on credit

(2) services performed on credit

(3) other revenues e.g. commissions

(4) the collection of Accounts Receivable

高等教育出版社

3 List of Cash and Receivables

高等教育出版社

4

4.1 Cash

Definition:

▲ The term ‘cash’ includes currency, coins, checks, money orders and credit card receipts. Individual accountability for all cash, including cash receipts, change funds and petty cash funds, should be maintained at all times. An accounting record for cash should be established immediately upon receipt. Access to cash should be restricted at all times to the person accountable for the funds

Related process of Bank Account:

(1) Bank Statement

(2) Bank Reconciliation

(3) Recording Entries from the Reconciliation

高等教育出版社

6

4.2 The Bank Account: a Control Device

Definition:

▲ Keeping cash in a bank account is part of internal control because banks have established practices for safe guarding cash. Banks also provide depositors with detailed records of cash transactions. To take full advantage of these control features, the business should deposit all cash receipts in the bank account and make all cash payments through it.