外贸信用证用法大全(DOC)

出口信用证实务

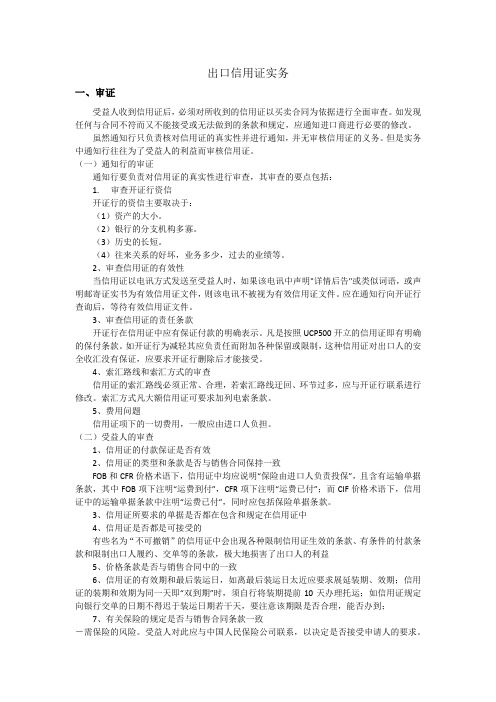

出口信用证实务一、审证受益人收到信用证后,必须对所收到的信用证以买卖合同为依据进行全面审查。

如发现任何与合同不符而又不能接受或无法做到的条款和规定,应通知进口商进行必要的修改。

虽然通知行只负责核对信用证的真实性并进行通知,并无审核信用证的义务。

但是实务中通知行往往为了受益人的利益而审核信用证。

(一)通知行的审证通知行要负责对信用证的真实性进行审查,其审查的要点包括:1.审查开证行资信开证行的资信主要取决于:(1)资产的大小。

(2)银行的分支机构多寡。

(3)历史的长短。

(4)往来关系的好坏,业务多少,过去的业绩等。

2、审查信用证的有效性当信用证以电讯方式发送至受益人时,如果该电讯中声明"详情后告"或类似词语,或声明邮寄证实书为有效信用证文件,则该电讯不被视为有效信用证文件。

应在通知行向开证行查询后,等待有效信用证文件。

3、审查信用证的责任条款开证行在信用证中应有保证付款的明确表示。

凡是按照UCP500开立的信用证即有明确的保付条款。

如开证行为减轻其应负责任而附加各种保留或限制,这种信用证对出口人的安全收汇没有保证,应要求开证行删除后才能接受。

4、索汇路线和索汇方式的审查信用证的索汇路线必须正常、合理,若索汇路线迂回、环节过多,应与开证行联系进行修改。

索汇方式凡大额信用证可要求加列电索条款。

5、费用问题信用证项下的一切费用,一般应由进口人负担。

(二)受益人的审查1、信用证的付款保证是否有效2、信用证的类型和条款是否与销售合同保持一致FOB和CFR价格术语下,信用证中均应说明“保险由进口人负责投保”,且含有运输单据条款,其中FOB项下注明“运费到付”,CFR项下注明“运费已付”;而CIF价格术语下,信用证中的运输单据条款中注明“运费已付”,同时应包括保险单据条款。

3、信用证所要求的单据是否都在包含和规定在信用证中4、信用证是否都是可接受的有些名为“不可撤销”的信用证中会出现各种限制信用证生效的条款、有条件的付款条款和限制出口人履约、交单等的条款,极大地损害了出口人的利益5、价格条款是否与销售合同中的一致6、信用证的有效期和最后装运日,如离最后装运日太近应要求展延装期、效期;信用证的装期和效期为同一天即“双到期”时,须自行将装期提前10天办理托运;如信用证规定向银行交单的日期不得迟于装运日期若干天,要注意该期限是否合理,能否办到;7、有关保险的规定是否与销售合同条款一致-需保险的风险。

外贸单据之信用证大全

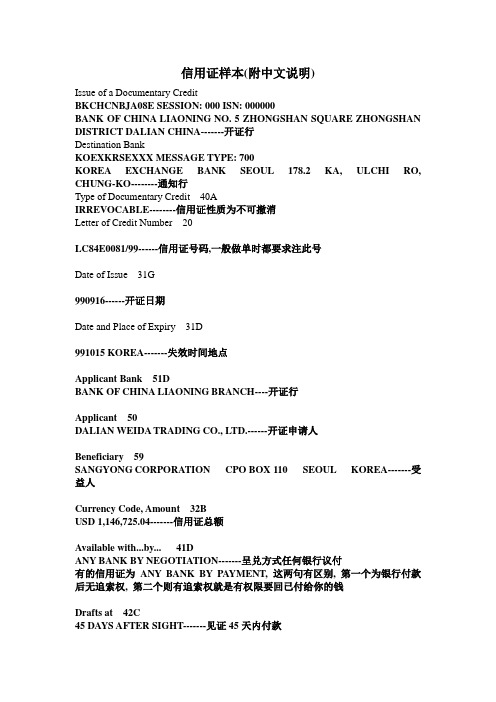

信用证样本(附中文说明)Issue of a Documentary CreditBKCHCNBJA08E SESSION: 000 ISN: 000000BANK OF CHINA LIAONING NO. 5 ZHONGSHAN SQUARE ZHONGSHAN DISTRICT DALIAN CHINA-------开证行Destination BankKOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANK SEOUL 178.2 KA, ULCHI RO, CHUNG-KO--------通知行Type of Documentary Credit 40AIRREVOCABLE--------信用证性质为不可撤消Letter of Credit Number 20LC84E0081/99------信用证号码,一般做单时都要求注此号Date of Issue 31G990916------开证日期Date and Place of Expiry 31D991015 KOREA-------失效时间地点Applicant Bank 51DBANK OF CHINA LIAONING BRANCH----开证行Applicant 50DALIAN WEIDA TRADING CO., LTD.------开证申请人Beneficiary 59SANGYONG CORPORATION CPO BOX 110 SEOUL KOREA-------受益人Currency Code, Amount 32BUSD 1,146,725.04-------信用证总额Available with...by... 41DANY BANK BY NEGOTIATION-------呈兑方式任何银行议付有的信用证为ANY BANK BY PAYMENT, 这两句有区别, 第一个为银行付款后无追索权, 第二个则有追索权就是有权限要回已付给你的钱Drafts at 42C45 DAYS AFTER SIGHT-------见证45天内付款Drawee 42DBANK OF CHINA LIAONING BRANCH-------付款行Partial Shipments 43PNOT ALLOWED---分装不允许Transhipment 43TNOT ALLOWED---转船不允许Shipping on Board/Dispatch/Packing in Charge at/ from44A RUSSIAN SEA----- 起运港Transportation to44B DALIAN PORT, P.R.CHINA -----目的港Latest Date of Shipment44C 990913--------最迟装运期Description of Goods or Services: 45A--------货物描述:FROZEN YELLOWFIN SOLE WHOLE ROUND (WITH WHITE BELLY) USD770/MT CFR DALIAN QUANTITY: 200MT ALASKA PLAICE (WITH YELLOW BELLY) USD600/MT CFR DALIAN QUANTITY: 300MTDocuments Required: 46A------------议付单据1. SIGNED COMMERCIAL INVOICE IN 5 COPIES.--------------签字的商业发票五份2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED "FREIGHT PREPAID" NOTIFYING LIAONING OCEAN FISHING CO., LTD. TEL (86)411-3680288-------------一整套清洁已装船提单, 抬头为TO ORDER 的空白背书,且注明运费已付,通知人为LIAONING OCEAN FISHING CO., LTD. TEL (86)411-36802883. PACKING LIST/WEIGHT MEMO IN 4 COPIES INDICATING QUANTITY/GROSS AND NET WEIGHTS OF EACH PACKAGE AND PACKING CONDITIONSAS CALLED FOR BY THE L/C.-------------装箱单/重量单四份, 显示每个包装产品的数量/毛净重和信用证要求的包装情况.4. CERTIFICATE OF QUALITY IN 3 COPIES ISSUED BY PUBLIC RECOGNIZED SURVEYOR.--------由PUBLIC RECOGNIZED SURVEYOR签发的质量证明三份..5. BENEFICIARY'S CERTIFIED COPY OF FAX DISPATCHED TO THE ACCOUNTEE WITH 3 DAYS AFTER SHIPMENT ADVISING NAME OF VESSEL, DATE, QUANTITY, WEIGHT, VALUE OF SHIPMENT, L/C NUMBER AND CONTRACT NUMBER.--------受益人证明的传真件, 在船开后三天内已将船名航次,日期,货物的数量, 重量价值,信用证号和合同号通知付款人.6. CERTIFICA TE OF ORIGIN IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION. ----------当局签发的原产地证明三份.7. CERTIFICATE OF HEALTH IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION. ----------当局签发的健康/检疫证明三份.ADDITIONAL INSTRUCTIONS: 47A-----------附加指示1. CHARTER PARTY B/L AND THIRD PARTY DOCUMENTS ARE ACCEPTABLE.----------租船提单和第三方单据可以接受2. SHIPMENT PRIOR TO L/C ISSUING DATE IS ACCEPTABLE.----------装船期在信用证有效期内可接受(理解:先于L/C签发日的船期是可接受的.,对否?)3. BOTH QUANTITY AND AMOUNT 10 PERCENT MORE OR LESS ARE ALLOWED. ---------允许数量和金额公差在10%左右Charges 71BALL BANKING CHARGES OUTSIDE THE OPENNING BANK ARE FOR BENEFICIARY'S ACCOUNT.Period for Presentation 48DOCUMENTSMUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF ISSUANCE OF THE TRANSPORT DOCUMENTS BUT WITHIN THE V ALIDITY OF THE CREDIT.Confirmation Instructions 49WITHOUTInstructions to the Paying/Accepting/Negotiating Bank: 781.ALL DOCUMENTS TO BE FORW ARDED IN ONE COVER, UNLESS OTHERWISE STATED ABOVE.2. DISCREPANT DOCUMENT FEE OF USD 50.00 OR EQUAL CURRENCY WILL BE DEDUCTED FROM DRAWING IF DOCUMENTS WITH DISCREPANCIES ARE ACCEPTED."Advising Through" Bank 57AKOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANK SOUTH KOREA 178.2 KA, ULCHI RO, CHUNG-KOSWIFT又称:“环球同业银行金融电讯协会”,是国际银行同业间的国际合作组织,成立于一九七三年,目前全球大多数国家大多数银行已使用SWIFT系统。

外贸业务中的信用证操作流程

外贸业务中的信用证操作流程随着全球化的发展,越来越多的企业开始开展国际贸易业务,而信用证作为一种常见的支付方式,在外贸业务中扮演着重要的角色。

那么,在外贸业务中如何进行信用证操作呢?第一步:确定交易方式在进行外贸业务前,首先需要根据双方的协商确定所采用的交易方式,如FOB、CIF、CFR等,然后根据交易方式确定开立信用证的类型。

对于FOB口岸交易,通常由买方提出信用证,而CFR和CIF方式下的交易,通常由卖方提出信用证。

第二步:申请信用证申请信用证是信用证操作中非常重要的一步。

对于卖方而言,如果需要买方开立信用证,那么就需要向买方提供有关信息,包括合同、发票、装箱单以及保险单等。

对于买方而言,就需要向银行提交开立信用证的申请。

这涉及到一些核心信息,如受益人、交单期限、货物描述等。

第三步:开立信用证开立信用证是银行的工作。

在买方向银行提交信用证申请后,银行将依据信用证申请上的信息来开立信用证,具体包括信用证金额、期限、交单信息等。

一旦信用证开立,银行就会通知卖方,卖方即可开始准备装运工作。

第四步:装运货物在货物准备装运时,卖方需要准备好所有的相关文件,包括发票、装箱单、提单、保险单等。

这些文件需要正式的签章和认证。

同时,如果信用证上规定了付款条件,卖方也需要遵守信用证的规定来完成全部的交单流程。

第五步:交单交单是外贸业务中非常重要的环节之一。

买方通过信用证要求的交单金额来完成信用证的付款操作。

卖方需要向银行提交交单资料,包括信用证规定的所有文件和资料。

银行将根据信用证要求检查交单资料的真实性和合法性,并进行资金划转。

如果资料不符合信用证规定,则银行有权不予承兑。

第六步:支付通过上述环节的操作,卖方即可获得自己的货款。

买方在自己的银行账户中支付货款,由银行进行结算,将货款划至卖方指定的账户中。

完成货款的支付,整个外贸交易终于完成。

以上就是外贸业务中的信用证操作流程。

在实际操作中,信用证的操作流程还会涉及到一些其它的细节问题,如信用证条款的复杂性、汇率波动的风险等,需要根据实际情况进行具体操作。

外贸单证信用证条款

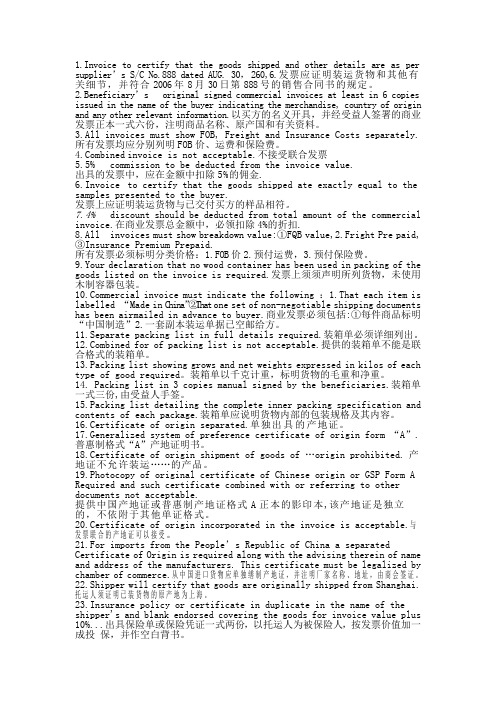

1.Invoice to certify that the goods shipped and other details are as per supplier’s S/C No.888 dated AUG. 30,260,6.发票应证明装运货物和其他有关细节,并符合2006年8月30日第888号的销售合同书的规定。

2.Beneficiary’s original signed commercial invoices at least in 6 copies issued in the name of the buyer indicating the merchandise, country of origin and any other relevant information.以买方的名义开具,并经受益人签署的商业发票正本一式六份,注明商品名称、原产国和有关资料。

3.All invoices must show FOB, Freight and Insurance Costs separately.所有发票均应分别列明FOB价、运费和保险费。

bined invoice is not acceptable.不接受联合发票5.5% commission to be deducted from the invoice value.出具的发票中,应在金额中扣除5%的佣金.6.Invoice to certify that the goods shipped ate exactly equal to the samples presented to the buyer.发票上应证明装运货物与已交付买方的样品相符。

7.4%discount should be deducted from total amount of the commercial invoice.在商业发票总金额中,必领扣除4%的折扣.8.All invoices must show breakdown value:①FQB value,2.Fright Pre paid,③Insurance Premium Prepaid.所有发票必须标明分类价格:1.FOB价2.预付运费,3.预付保险费。

出口信用证抵押外汇贷款 (5)

出口信用证抵押外汇贷款随着国际贸易的不断发展,出口信用证已经成为企业对外贸易的一种常用的结算方式。

而在出口信用证的结算过程中,抵押外汇贷款已经成为了一种常见且有效的融资方式。

本文将详细介绍出口信用证抵押外汇贷款的操作流程、注意事项以及优势。

一、抵押外汇贷款的定义抵押外汇贷款,是指企业通过将出口信用证作为担保品,向银行借款,同时将银行的贷款金额以及利息担保给银行。

该方式是国际贸易中的一种融资方式,也是外贸信用证的一种用途。

二、操作流程抵押外汇贷款的操作流程如下:1.签订合同:企业和买方进行贸易合同签订,确定交货日期和货款条件。

2.发出信用证:买方按合同约定向银行发出信用证,保证合同金额能够准确到位。

信用证中约定结算方式、期限以及相关条款。

3.出口者提交单据:出口者按信用证要求发货,并向银行提交相应单据,包括提单、商业发票、装箱单等证明出口者发货及货物到达买方的文件。

4.银行审核文件:银行收到单据后,将审核货物的完整性、单据的真实性和信用证的实现性。

5.支付货款:如果单据符合信用证要求,银行将支付货款给出口者。

此时,银行会收回出口者的信用证和相应质押(如果有的话)。

6.抵押外汇贷款:在信用证结算完成后,银行将根据企业风险以及贷款金额等因素,向出口者提供一定额度的贷款。

该贷款需要按贷款利率及期限还款,同时,出口者需要将信用证作为担保。

三、注意事项1.信用证要求必须严格遵守,确保单据符合信用证的规范。

2.出口者必须将单据通知银行,确保银行能够及时审核并结算货运单据。

3.如果信用证标明了质押物,则出口者需要将质押物抵押作担保。

4.出口者签订借款合同时,需要明确贷款利率、期限和还款方式。

四、优势1.融资成本低:由于抵押外汇贷款的贷款额度和利率等因素均与出口信用证的金额和期限有关,因此企业可以在贷款成本上得到较大优惠。

2.降低信用风险:抵押外汇贷款生效后,企业将不再面临买方不支付货款的风险。

因为银行会根据信用证的实现情况来为企业提供贷款,从而保证了交易的安全性。

外贸出口信用证操作流程

外贸出口信用证操作流程Exporting goods through a letter of credit (LC) is a common payment method in international trade. 外贸出口货物通过信用证(LC)是国际贸易中常见的支付方式。

The process of dealing with an LC can be complex and requires careful attention to detail. 处理信用证的流程可能非常复杂,需要仔细关注细节。

The first step in the process is for the seller and the buyer to agree on the terms of the LC. 流程的第一步是卖方和买方就信用证的条款达成一致。

This involves specifying the documents that the seller must present to the bank in order to receive payment. 这涉及要求卖方出具哪些文件给银行以便获得支付。

Once the terms are agreed upon, the buyer applies for the LC from their bank and the bank then issues the LC to the seller's bank. 一旦卖方和买方就条款达成一致,买方向银行申请开立信用证,银行随后将信用证发给卖方的银行。

After receiving the LC, the seller then proceeds to manufacture and ship the goods according to the terms specified in the LC. 在收到信用证后,卖方根据信用证中指定的条款继续制造和发货货物。

(完整word版)外贸英文书信复习资料

(完整word版)外贸英文书信复习资料外贸英文书信复习资料专业名词解释:建立贸易关系establishment of business relations询盘enquiry 实盘firm offer虚盘non-firm offer 还盘-offer催证urging the establishment of L/C 信用证展期限extension of L/C装运和包装shipment and packing 保险insurance目录,价格表catalogue 得到的,可得到的available汇款remittance 设立,建立,确立establishment确定,确认comfirmation 修改,修正amendment(期限等的)延长,延期extension 小册子brochure pamphlet 提供furnish 附上attach 或enclose报价quotation 纺织品textile出口export 进口import高级代表senior representative 向某人提供….. to provide sb to (for) sb 交付,交货delivery 不要可撤销的irrevocable已确认的confirmed 其它条款和条件Other terms and conditions 信用情况credit standing 有效期……valid for a period of 60 days可行的价格workable / acceptable/ reasonable / favourable price买卖,经营deal in 以…..为条件,视….而定subject to营业额,总量,产量turnover 佣金commisson代理agent 后期,下旬the latter part of July装箱单packing list 综合险All-Risks保险金额value to be insured 投保cover合资企业joint venture 以….为条件(为准)subject to代为….问候,转达extend my greetings to sb 库存无货out of stock与某人建立业务关系to enter into business relation with sb与…..进行交易to deal with ……建议某人去做某事to recommend sb to do sth如果某人能够….,我们将会十分感激we shall would appreciate it if sb .will….告知某人某事,告知某人可以得到….. to let sb. Have/know sth 告知某人某事to inform/sb.of sth ./that以我方最后的确认为准/为有效subject to our comfirmation向某人订购货物to place an order with sb. for sth给某人百分之几的佣金折扣to give/offer sb a commission /discount of….%on sth向某人保证……to assure sb of sth /that提及in regard to / referring to请某人参阅,请某人询问to refer sb to sth /to doing sth通过银行开出的以….为受益人,金额为…..的信用证To open /establish an L/C in sb`s favor for an amount with/throung a bank在…..地方转船to be transshipped at分批装运to make a partial shipment报盘make/ send /give /fax/offer for例如,以下as follows= as what follows ,无论什么情况都要用follows值得的good value for money=worthy of the money充分利用take advtantage of = make use of sth properly中译英1.盼望早日收到你方来信We are looking forword to your early reply2.如你方报最低价,我们将非常感激We will appreciate if you offer us the lowest quotation3.随函附上我方价目单供你方参考We enclose the catalogues for your reference4.现向你们自我介绍,我们是一家中国国营公司专门经营轻工产品。

教你10小时快速入门外贸操作(10)信用证

教你10小时快速入门外贸操作(10)信用证本节我们来彻底弄清楚外贸行业中最独特、有趣而神秘的东西---信用证。

基本上每个做外贸的人早晚都将会接触到它,至少是听说过。

初次见到信用证的时候,看上去是一叠密密麻麻充满术语的令人望而生畏的文件。

那么,它到底是什么?首先得从外贸的难题—商业信用谈起。

为什么要信用证?我们不难想象和体会,国际贸易的确是一个颇具风险的行当。

大宗的货物和款项在国际间传递交易,各国商人语言不同,法律各异,相隔万里,交易时甚至没有见过面,交易耗时也长。

生意场本来就是个尔虞我诈的战场,更何况面对的是遥远陌生的客户。

如果像菜市场买个西瓜那样一手交钱一手交货自然方便,可是国际贸易不行,即便在科技发达的现在,货物从深圳港口海运到欧洲,也需要在海上跋涉20多天甚至1个多月,同样地,一笔款项从国外银行转至国内银行,辗转几天到半个月一点也不奇怪。

这样一来,国际贸易买卖双方自然会颇有疑忌。

作为卖方,首先担心买方订了合同,到时候却不要货。

须知国际贸易一般交易量都挺大,卖方备货费时费力,万一届时买方毁约,大批货物积压在手里可就头疼了。

更何况很多时候货物是按照买方要求而定制的,想转售他人都很麻烦。

其次,担心把货物交付买方后,买方拖延付款甚至赖账。

毕竟海运费用不菲,比如一个20尺标准集装箱的货物从深圳运到欧洲港口,单程的海运杂费就远远超过1万元人民币。

即便能保住货物不被骗走,往返运费也吃不消。

因为有这些担心,卖方自然希望买方能在签订合同以后就支付一部分定金预付款,或者在交货运输之前把货款结清。

作为买方,则担心卖方不能按时、按质、按量地交货。

同时,也不愿意提前就把货款交给卖方,一来占用资金影响生意周转;二来万一卖方出现纰漏,买方隔着万水千山地也很难费力追讨。

因此与卖方相反,买方自然希望能先交货,查验无误了再付款。

当然了,理论上是有国际贸易惯例,有仲裁,有法律,可生意人都知道,不到万不得已,打官司实在是劳民伤财,胜负难卜。

外贸企业的信用证结算方式

外贸企业的信用证结算方式信用证是指由开证行根据开证申请人(进口商)的要求和指示向受益人(出口商)开立一定金额的、并在一定期限内凭规定的单据承诺付款的凭证。

(一)信用证结算方式的当事人1.开证申请人它是指向银行申请开立信用证的单位,也就是进口商。

2.开证行它是指接受开证申请人的申请,开立并签发信用证的银行。

开证行通常在开证申请人的所在地。

3.通知行它是指收到开证行的信用证,核实其真实性,并通知受益人的银行。

通知行通常在受益人的所在地。

4.受益人它是指信用证的权利拥有者,也就是出口商。

5.议付行它是指应受益人的请求,买人或贴现信用证项下票据及单据的银行。

6.付款行它是指由开证行指定的在单据相符时付款给受益人的银行。

(二)信用证的基本内容世界各国的信用证的格式和内容虽然有所不同,但其基本上具有下列各项内容。

1.开证行名称、地址和开证日期。

2.信用证的性质及号码。

3.开证申请人名称。

4.受益人名称、通知行名称和地址。

5.信用证的最高金额和采用的货币。

6.开证的依据。

7.信用证的有效期限和到期地点有效期限是指银行承担信用证付款的期限。

出口商交单的时间如果超过了规定的有效期限,银行可因信用证逾期而解除其付款责任。

到期地点是指在哪个国家及地区到期。

8.汇票和单据条款受益人(出口商)应凭汇票取款,信用证应列明汇票的付款人、汇票是即期还是远期,以及汇票应附的单据、单据的份数以及单据所列商品的名称、品质、数量、单价、金额、包装等。

9.商品装运条款它包括装运港、目的港、装运期限、运输方式、能否分批装运和转运等。

10.保证责任条款它是开证行确定履行付款责任的依据。

(三)信用证结算方式的基本程序采取信用证结算方式,进口商和出口商应在贸易合同中规定使用信用证方式支付。

信用证结算方式的基本程序有如下九个部分。

1.进口商申请开立信用证进口商向其所在地的银行填写开证申请书,根据贸易合同填写各项规定和要求,并按信用证金额的一定比例交付押金或提供其他保证,请开证行开证。

外贸信用证(LC)用语大全(下)

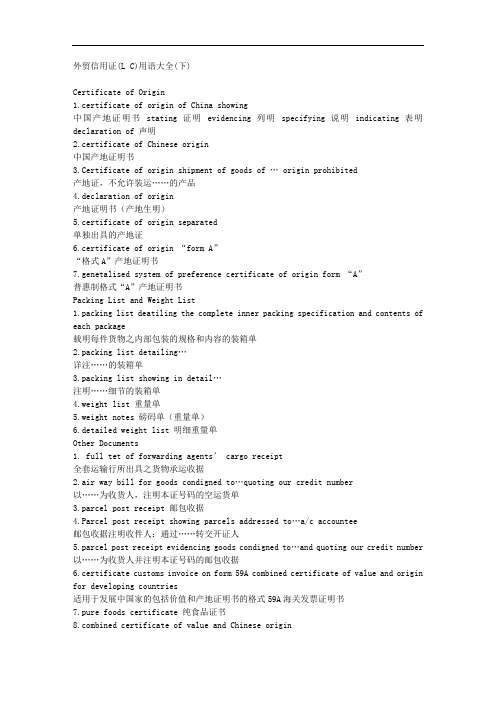

外贸信用证(L C)用语大全(下)Certificate of Origin1.certificate of origin of China showing中国产地证明书 stating 证明 evidencing 列明 specifying 说明 indicating 表明declaration of 声明2.certificate of Chinese origin中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited产地证,不允许装运……的产品4.declaration of origin产地证明书(产地生明)5.certificate of origin separated单独出具的产地证6.certificate of origin “form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form “A”普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full tet of forwarding agents' cargo receipt全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment分运与转运(1)partial shipments are (not) permitted(不)允许分运(2)partial shipments (are) allowed (prohibited)准许(不准)分运(3)without transhipment不允许转运(4)transhipment at Hongkong allowed允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until…在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August,1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August,1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s)drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit)凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon(本证)无需你行保兑(4)documents must be sent by consecutive airmails单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with偿付办法,由你行开出英镑即期汇票向……银行支取。

国际结算信用证范文

国际贸易中,信用证是一种最常用的结算方式,尤其是在跨国贸易中,信用证的应用率更是高达90%以上。

信用证是倍受买卖双方欢迎的支付方式,因为它非常安全、快速和可靠。

然而,很多人对信用证这个概念还很陌生,下面我们来详细介绍一下信用证的定义、结算流程及其优点。

一、信用证的定义信用证(Letter of Credit, L/C)是商业银行根据买卖双方的申请和要求,通过信用证的形式,用银行的信用保证买卖双方交易的安全性和支付的可靠性的一种结算方式。

简而言之,信用证是银行为了保证交易的安全性和支付的可靠性,向卖方开出的文件信用。

二、信用证结算流程第一步:发货人与买方签订合同,并申请开立信用证在发货人和买方达成交易协议后,发货人需要向买方提供一份合同,以及相关的发票、装运单据等资料。

接着,买方需要向自己的银行申请开立信用证,并填写信用证开立申请书。

信用证开立申请书包括了支付金额、货物规格、运输方式、交货日期、付款期限和信用证的有效期等详细信息。

第二步:买方银行开立信用证买方银行根据买方的信用证开立申请书,开立一份符合要求的信用证。

第三步:发货人向银行出具装运单据发货人凭借合同,向银行出具一份符合要求的装运单据。

第四步:买方银行付款发货人凭借银行出具的装运单据,向买方银行索取相应的付款。

买方银行在核实装运单据和信用证的一致性后,按照信用证的要求,向发货人付款。

第五步:买方向银行索取货物买方凭借信用证,向银行索取货物。

三、信用证的优点1、实现交易的安全性和可靠性银行按照信用证的要求,向发货人付款,可以保证交易的安全性和可靠性。

2、提高交易的效率信用证作为结算方式,可以帮助买卖双方快速达成交易,并促进交易的顺利进行。

3、避免双方信誉风险通过信用证的形式,买方不需要担心发货人无法履行义务,发货人也不需要担心买方无法及时付款,从而避免了双方信誉风险。

4、增强国际贸易合作关系通过开立信用证,买卖双方可以建立起信任和合作关系,从而为未来的贸易合作打下坚实的基础。

外贸英语信用证

Dear Sirs,Thank you for your letter of the 20th of this month.We have been importers of candles for many years.At present,we are interested in expanding our business and would appreciate your catalogues and quotations.If your prices are competitives, I believe important business can materialize..We are looking forward to your early reply.Yours truly Dear Sirs,Thank you for your letter of 10th March.We are gratified to receive your request for candles. As we have not previously done business together,perhaps you will kindly agree to supply either the usual trade references,or the name of a bank to which we may refer.As soon as these enquiries are satisfactorily settled,we shall be happy to send you the items you mention in your letter.We sincerely hope this will be beginning of long and pleasant business cooperation.We shall do our best to take it so.Your faithfully, Dear Sirs,Through the courtesy of Israel bank,your name has been supplied to us.We are export trders dealing in candles products,and we are now planning to open account with Irael zhongse trade company in your locality.We shall be much obliged if you will kindly give us any confidential information about the reputation and financial status of Irael zhongse trade company.We are looking forward to your early reply.Your faithfully, Dear Sirs,This is in reply to your enquiry dated March 27th about the credit status of Irael zhongse trade company. They command considerable funds and an unlimited credit, and the executives are through business men.Any statement on the part of this bank or any of its officers as to the standing of any person ,firm or corporation, is given as a mere matter of opinion for which no responsibility,in any way,is to attach to this bank or any of its officers.Your faithfully,询盘Dear Sir,Through the courtesy of Israel bank,we learn that you are one of the leading exporters of scentrd candle.We avail ourselves of this opportunity to approach you in the hope of establishing Business relations with you.We are pleased to advise that some of our prospective customers are interested in the scentrd candle and have requested us to qpproach you of quotations.Please let us know the unit price and on what terms of payment you are able to supply 1,000 PC scentrd candles.If your price is attractive and time of delivery acceptable,we have confidence in securing the order for you.Please quote 1,000 PC scentrd candles CIF ISRAEL stating your terms of payment and time of shipment.We are looking forward to your early reply.Yours faithfully,回复询盘Dear Sir,We are in receipt of your inquiry of April 3 and pleased to enclose our illustrated catalogue and price list giving the details you asked for.Also be separate post we are sending you some samples. Our regular purchase in quantities is no less than 100 PCs.Payment is to be made by irrevocable L/C .Because of the high quality and unique design, our scenrtd candle are quite popular.After studying the prices and terms of trade, you will understand why we are working to capacity to meet the demand.But if you place your order no later than this month,we wouid ensure shipment.Sincerely yours,报盘Dear Sir,We thank you for your email enquiry for scented candle CIF HAIFA date April,3.In reply, we offer firm subject to your reply reaching us on or before April,8 for 1000 PC of scented candle at $6.7 net per PC CIF HAIFA.Shipment can be made within two months after receipt of your order.We have quoted our most favorable price and are unable to entertain any counter offer. Please note there likely been alarge demand for the above commodities and such growing demand will likely result in increased prices. However you can secure these prices if you send us an immediate reply.Sincerely,还盘Dear Sir,Thank you for your letter of April 8 about the offer for your scented candles.Although we appteciate the quality of your products,we regret to say their price is too high for us to accept. Since we placed the last order,price for raw materials has been decreased considerably.Acceoting your present price will mean loss to us.We would like to place repeat orders with you if you could reduce your price at least by3%.Otherwise,we have to shift to the other suppliers for our similar request.We hope you take our suggestion into serious consideration and give us your reply as soon as possible.Yours truly,卖方拒绝降价的还盘Dear Sir,Thanks for your letter of April 8.We regret to find that we didn’t agree on the price.Much as we would like to cooperate with you in expanding sales, we are regretful that we can not accept your counter-offer,as the price we quote is rather realistic.Through our study of your market situation,we are confident our offer is competitive.As a matter of fact, we have received a lot of orders from many countries at the price.If you could accept our price after careful consideration,please do let us know.On account of a limited supply available at present,we would ask you to act quickly.We are looking forward to your early reply.Yours faithfully,卖方同意还盘,提出要求Dear Sir,We acknowledge with thanks receipt of your enquiry of April 10,and are pleased to hear that you are interested in our scented candles.In the letter,you asked us for a special price discount of 3% of price list. While appreciating your order,we feel we must point our that our listed prices have already been cut to the minimum possible,and our goods are unobtainable elsewhere at our rate.We are sure the doog quality of our products and reasonable price will equip you with great competitive edge in your market.We should,however,be pleasd to allow you the requested 3% if you care to raise your order to 2,000 PCs and we await your confirmation before putting the matter in hand.With our best regards.Yours faithfully,购货合同和购货确认书Dear Sir,On viewing the samples and pricelist you sent us on April 11,we have the pleasure in placing with you the following trial order, which we expect your immediate and best attention.Item Quantity CIF HAIFAscented candles 1000 US$6.7per1 Packing: 1PC/BOX,20PCS/CARTON .Shipment:All of the goods will be shipped on or before Sep.20,2015 to L/C reaching the SELLER by the end of August,2015. Partial shipments and transhipment are not allowed. Payment:prime bankers irrevocable sight letter of credit in sellers favor for 100% of invoice value.Please note that the scented candles should be of the same quality as that used in the sample.We place this order on the clear understanding that you can guarantee shipment at WEHAI to HAIFA by Sep.20,2015,and we reserve the right to cancel it and refuse delivery after this date.All customs duties, taxes and other charges incurred on the merchandise and/or containers and/or documents including the certificate of origin shall be the responsibility of Seller and for the Seller’s account.We expect to find a good market for these goods and hope to place further and larger order with you in the near future. Enclosed are our Purchase Contracts in duplicate for signature.Please sign and return one copy for our file.Upon receipt of your confirmation,an L/C will be issued.Faithfully yours,销售确认书及相关函电往来Dear Sirs,We are very pleased to receive your order 1000 scented candles.We accept the order and are enclosing you our Sales Confirmation NO.YG in duplicate of which please countersign and return one copy to us for our file.Please note that a confirmed and irrevocable Letter of Credit in our favor covering theabove mentioned goods should be established immediately.The stipulations in the relevant Letter of credit should strictly conform to the terms stated in the herewith enclosed Sales Confirmation so as to avoid possible subsequent amendments.As soon as we get your L/C, we shall arrange the delivery immediately.We believe that the goods will turn out to be your entire satisfaction and we may have further ordersfrom you.Yours faithfully,收到样品Dear Sirs,Thank you very much for your quotation of 15 April and the sample scented candles.We find both quality and prices satisfactory. Enclosed here is our order sheet and we are pleased to place an order for following:Item Quantity CIF HAIFAscented candles 1000 US$6.7per1As we are in bad demand of the goods, your earliest shipment of this order shall be appreciated.We are arranging the establishment of relative L/C through The industrial and commercial bank of China,and shall let you know by cable as soon as it is opened.Yours faithfully, 凭卖方样品买卖Dear Sirs,We thank you very much for the samples and pricelist you sent us no April 15,we are pleased to place the following trial order,which we expect your prompt attention.Please note that scented candles should be as per the sample dispatched by you on April 15.Particular care should be taken about the quality and the packing of the goods to be delivered in the first order.It is the usual practice here that 3 candles are packed to a carton and 10cartons to a strong seaworthy wooden case.There will be a flow of orders if this initial order proves to be satisfactory.We are enclosing our Confirmation of Purchase in duplicate.Please sign one copy and return it to our records.As soon as we receive your confirmation,a letter of credit will be opened through The industrial and commercial bank of China.We are looking forward to your early reply.Yours faithfully,投诉货品与卖方样品不符Dear Sirs,After carefully examining the candles supplied to our order of April 15,we must express our surprise and disappointment at their quality.They certainly do not match the samples we sent you.The materials are quite unsuited to needs of our customers and we have no choice but to ask you to take them back and replace them by the materials of quality ordered.If this is not possible,then I am afraid we shall ask you to cancel our order.We have no wish to embarrass you.If you can send us substitute by August 18,We will appreciate your cooperation and plan to order more with you.We are looking forward to receiving your order.Yours faithfully,付款方式磋商Dear Salvatore,We’ve studied the specifications and price-list of your candles and now to place an order with you.Enclosed is our Order NO.YG.As we are in urgent need of this good,we shall be glad if you ship the order as soon as you possibly can.In the past,we have dealt with you on sight L/C basis.Now, we would like to propose a different way of payment,i.e.,when the goods purchased by us are ready for shipment and the freight space booked,you let us know and we will remit you the full amount by T/T. The reason are we can thus more confidently assure our buyers of the time of delivery and save a lot of expenses in opening a letter of credit.And for such a larger amount, an L/C is costly .Besides, it ties up my money.All this adds to my cost.As feel this would not make much different to you but would facilitate our sales,we hope you will grant our request.We look forward to your confirmation of our order and your affirmative reply to our new arrangements of payment.Yours sincerely,Elena GilbertDear Mrs. Gilbert,We are in receipt of your leeter of May 14.Having studied your suggestion for payment by T/T,it is quite difficult for us to accept that.We have never granted T/T terms to any new clients. As our uasual practice goes, we require payment by confirmed and irrevocable letter of credit.This is to say ,at present, we can’t accept T/T terms in all transactions with our customers abroad. In view of our friendly relations,we ,however, expceptionally agree to accept L/C payable by draft at 60 days’sight. We hope this accommodation will result in more orders from your customers.We are awaiting your letter of credit, upon receipt of which we shall arrange shipment without delay.Yours sincerely,信用证相关函件1. 买方向买方所在地开证行申请开立信用证Dear Sirs,Please open a credit of USD 6700 with your correspondents in Israel in favor of the WINNER TRADE COMPANY,to be available to the Company until July 30 against a shipment of scented candle by “Volendam” leaving WEIHAI for HAIFA on July20.When the consignment is shipped the Company is to draw on your correspondents at sigtht. The documents to accompany the draft are bill of lading,commercial and consular invoices and insurance policy.Kindly ask your correspondents to see that the insurance policy gives full cover before they accept the draft.Yours faithfully2. 买方通知卖方信用证已开出Dear Sirs,Re:Order NO.YGWe write to inform you that we have now opended an irrevocable letter of credit in your favor for $6700 covering 1000 scented candles under our Order NO.YG with The industrial and commercial bank of China .The credit is valid until Augest 23 and will be confirmed to you by The BANK OF ISRAEL .It is understood that the doogs will be shipped by Volendam ,sailing from WEIHAI on July 20.The letter of credit authorizes you to draw at sigh on The Bank in Israel for the amount of your invoice after shipment is made.Before accepting the draft, the bank will require you produce the following documents;Bill of Lading in triplicate,Commerical and Consular Invoices,Packing List.and Insurance policy.We will expect your consignment about the end of August.Please notify us when the goods are shipped.Yours faithfully3. 卖方催开信用证Dear sirs,We wish to refer to your order No.YG for 1000 scented candles. As the goods were contracted for shipment in July 20,the relative letter of credit should reach us not later than July 21.The date of delivery is approaching; however, we have not yet received the required L/C up to now. Please look into the matter and do your utmost to expedite the L/C or the shipment will be affected and the manufacturers will complain of the holding up of their products. In order to avoid subsequent amendment, please see to it that the L/C stipulations are in exact accordance with the contract terms.As the matter is urgent, we would be most grateful for an early reply.Yours faithfully4. 卖方要求修改及延展信用证Dear Sirs,We hereby acknowledge with thanks receipt of captioned L/C for the amount of USD6700 covering your Order NO.YG for scented candles.It appers that the amount of your L/C is insufficient,as the correct total CIF value of your order comes to USD6800 instead of USD 6700 with a difference of USD100. Furthermore, when we booked your order,we made it clear that delivery should be made within one month after receipt of your L/C. Now you are allowing us only half a month.As you may be well aware ,it is impossible for us to get the shipment ready in such a short period of time.In view of the above,you are requested to increase the amount of your L/C by USD100,making a total of USD6800,and also to extend the time of shipment to 31st June and validity of L/C to July 15. Your prompt attention to this matter will be appreciated.Yours faithfully包装买房向卖方提出包装及标志方面的详细要求Dear Sirs,We acknowledge receipt of your letter dated the 3rd this month enclosing the above sales contract in duplicate but wish to state that after going through the contract we find that the packing clause in it is not clear enough. The relative clause reads as follows:Packing: Seaworthy export packing, suitable for distance ocean transportation.In order to eliminate possible future troubles, we would like to make clear beforehand our packing requirements as follows:The candles under the captioned contract should be packed in international standard candle boxes, 20 boxes on a carton. On the outer packing please mark our initials YG in a diamond under which the port of destination and our order number should be stenciled. In addition, warning marks like KEEP DRY,USE NO HOOK, etc, should be indicated.We have made a footnote on the contract to that effect and are returning herein one copy of the contract after duly countersigning it. W e hope you will find it in order and pay special attention to the packing.We look forward to receiving your shipping advice and thank you in advance.Yours faithfully。

国际信用证基础知识和操作流程外贸销售培训

国际信用证基础知识和操作流程外贸销售培训国际信用证是国际贸易中常用的支付方式之一,它是由买方银行(开证行)在买卖双方达成一致意见后,按照买方要求向卖方开立的一种信用证。

信用证的开立以及后续操作流程需要遵循一定的规则和程序,下面将介绍一些基础知识和操作流程。

一、基础知识:1.信用证类型:根据支付方式的不同,信用证分为可撤销信用证和不可撤销信用证两种类型。

2.参与主体:信用证的参与主体包括开证行、通知行、受益人、买方和卖方等。

3.核心原则:信用证的核心原则是合规性、自主性、不可撤销性和独立性等。

4.信用证的要素:信用证中包含诸如金额、有效期、付款行、单据要求等要素,双方需在合同中明确确认。

二、操作流程:1.双方达成合意:买卖双方在商品、数量、价格、条件等方面达成一致意见,并签订购销合同。

2.开证申请:买方将合同及开证要求提交给开证行,并支付相应的手续费和保证金。

3.开证行开证:开证行收到买方的申请后,核对相关文件,如合同、信用证申请书等,遵循信用证的开证流程开立信用证。

4.信用证通知:开证行将开立好的信用证发送给通知行,通知行将信用证转交给卖方。

5.卖方准备货物:卖方收到信用证后,开始准备货物,并按照信用证要求进行装运。

6.卖方提供单据:卖方按照信用证要求提供相应的单据给开证行,如发票、装箱单、提单等。

7.开证行复核单据:开证行收到卖方提供的单据后,进行单据的复核,确认是否符合信用证的要求。

8.付款申请和结算:开证行在收到符合要求的单据后,根据信用证的付款方式向卖方付款,双方完成结算。

需要注意的是,在整个操作流程中,双方需严格遵守信用证的规定和要求,如开证行和卖方必须严格按照信用证的要求提供单据,开证行必须在规定时间内付款等。

另外,对于不符合信用证要求的单据,开证行有权拒绝付款。

总结起来,国际信用证的基础知识和操作流程对外贸销售来说非常重要,掌握了这些知识可以帮助企业更好地进行国际贸易,并避免因为支付方式的问题导致的信任和经济风险。

外贸合同中信用证常见的合同条款

外贸合同中信用证常见的合同条款在外贸合同中,信用证常见的合同条款包括以下内容:信用证的有效期:这是买卖双方商定的期限,在这个期限内买方必须完成货物的付款和货物的收货。

付款条件:信用证规定的付款条件是必须满足的,通常包括货物数量、质量、价格、装运期限等。

装运期限:信用证规定的装运期限是必须严格遵守的,通常规定了装运开始和结束的时间范围,以确保货物能在规定时间内送达买方。

提单要求:信用证规定了提单的要求,通常包括提单必须标明信用证号码、货物数量、品种、装运日期等信息,并由指定的船公司或航空公司签发。

货物的品质规格条款:这一条款规定了商品所具有的内在质量与外观形态法。

通常在合同中规定有“约数”,但需注意“溢短装条款”,明确规定溢短装幅度,并规定溢短装的作价方法。

货物的数量条款:主要内容是交货数量、计量单位与计量方法。

在数量方面,合同通常规定有“约数”,但对“约数”的解释容易发生争议,故应在合同中增订“溢短装条款”,明确规定溢短装幅度,如“东北大米500公吨,溢短装3%”,同时规定溢短装的作价方法。

货物的包装条款:包装是指为了有效地保护商品的数量完整和质量要求,把货物装进适当的容器法。

应明确包装的材料、造型和规格,不应使用“适合海运包装”、“标准出口包装”等含义不清的词句。

货物的价格条款:价格条款的主要内容有:每一计量单位的价格金额、计价货币、指定交货地点、贸易术语与商品的作价方法等。

为防止商品价格受汇率波动的影响,在合同中还可以增订黄金或外汇保值条款。

货物的装运条款: 装运条款的主要内容是:装运时间、运输方式、装运地与目的地、装运方式以装运通知法。

根据不同的贸易术语, 装运的要求是不一样的, 所以应该依照贸易术语来确定装运条款。

如果合同中定有选择港, 则应定明增加的运费、附加费用应由谁承担。

货物的保险条款:保险是指进出口商按照一定险别向保险公司投保并交纳保险费,以便货物在运输过程中受到损失时,从保险公司得到经济上的补偿。

信用证在外贸中的使用流程

信用证在外贸中的使用流程介绍信用证是国际贸易中常用的付款方式之一,它是由购买方(申请人)的银行(开证行)或者代理开证行,以购买方为收款人,向卖方(受益人)的银行发出的,对卖方进行货款支付承诺的一种书面文件。

信用证在国际贸易中具有保障双方权益、减少交易风险的作用,同时也被双方银行作为交易过程中的支付工具。

本文将介绍信用证在外贸中的使用流程,包括开证、修改、付款、提货等过程,并提供相关操作步骤和注意事项。

开证流程1.购买方与卖方达成贸易合同,约定付款方式为信用证。

2.购买方与开证行签订信用证开证申请书,并提供相关资料,包括:–合同副本–国际信用证申请书–发票副本–货运单据3.开证行审核申请材料,并按合同约定开立信用证。

信用证必须明确规定货款的金额、货物的数量、质量要求、装运和付款的期限等内容。

4.开证行发出信用证通知书给卖方的银行,要求其通知卖方。

信用证修改流程1.如果双方需要对信用证内容进行修改,购买方需要向开证行提出修改申请,并提供修改后的信用证条款。

2.开证行审核修改申请,如果同意修改,则发出修改通知书给卖方的银行。

3.卖方的银行通知卖方对信用证的修改进行确认。

4.卖方确认修改后,可以按照信用证的修改内容进行后续的提货和付款。

付款流程1.卖方按照信用证的要求提供货物,并将相关单据提交给其银行(通常为卖方的银行)。

2.卖方的银行审核单据的真实性和符合信用证要求,然后将单据交给开证行。

3.开证行根据信用证规定的时间和条件,审核单据的真实性和符合信用证要求。

4.如果开证行确认单据符合要求,则向卖方的银行支付货款。

5.卖方的银行收到货款后,通知卖方进行提货。

提货流程1.卖方在获得付款后,提前通知买方提货的时间和地点。

2.买方按照约定的时间和地点进行提货,并出示相关单据。

3.卖方核对相关单据的真实性和完整性。

4.如果单据符合要求,则卖方确认提货,并向买方签发提货单。

5.如果单据不符要求,则双方沟通解决。

外贸业务中的信用证操作

外贸业务中的信用证操作在外贸业务中,信用证是重要的支付方式之一。

一般来说,信用证是由进口国的银行(开证行)向出口国的银行(通知行)发出的一种支付保证函,用于保障进口商支付货款并确保出口商按照贸易合同要求按时交货。

在信用证操作中,有以下几个关键步骤:一、买卖双方达成贸易合同作为信用证操作的第一步,买卖双方需要达成一份贸易合同。

合同内容应该包括商品的品种、数量、价格、交货方式、装运口岸、付款方式等细节。

在确定付款方式时,出口商可以选择信用证作为支付方式。

二、买方开立信用证如果买方选择使用信用证作为支付方式,那么他需要向自己所在的银行提交申请,开立一份信用证。

信用证应该包括以下内容:1. 买方和卖方的名称和地址。

2. 开证银行和通知行的名称和地址。

3. 信用证金额和币种。

4. 发货日期和最迟交货日期。

5. 卖方需要满足的文件要求,例如发票、装箱单、清关单等。

6. 其他特殊要求,例如保险、装运方式等。

开证银行会根据信用证的要求决定是否批准开证,如果批准,银行会要求买方提供质押或者其他形式的担保。

此时,银行会向通知行发出信用证,通知行需要通知出口商信用证的详细内容和金额。

三、出口商提交货物并按照信用证要求提供相关文件出口商收到通知行的信用证后,就可以准备货物并按照信用证的要求提交相关文件。

出口商需要在规定的时间内提交发票、装箱单、清关单、保险单等文件,以证明已按照贸易合同要求交付货物。

四、通知行审核文件通知行收到出口商的文件后,会针对文件进行审核,确认是否符合信用证的要求。

如果文件不完整或者不符合要求,通知行会立即通知出口商进行修正。

五、通知买方支付经过通知行的审核确认后,信用证的款项将会被释放并支付给卖方。

通常情况下,该过程需要一定时间,具体时间取决于货物的承运时间和检验时间等因素。

六、结算结算是指支付款项、退税以及其他结算操作。

在结算过程中,出口商需要注意管理好各种收据和发票,并妥善处理可能出现的退税问题。

外贸信用证常见条款的英文表述二

with credit terms and conditions. Telex charges are for account of beneficiary.

议付行证明本信用证条款已履行,可按电汇索偿条款向中国银行纽约分行索回货款。

2、佣金/折扣条款(Commission and discount)

信用证中常常有佣金和折扣条款,其表现形式各不一样,有的称为明佣,有的称之为暗佣,在信用证中的表示经常是这样的:

Signed commercial invoice must show 5% commission.

信用证中常见的分批/转运条款有:

Partial shipments are allowed and transshipment is allowed.

分批装运和转运是被允许的。

Transshipment and Partial shipment prohibited.

不允许分装运和转运。

Partial shipment is allowed and transshipment is authorized at Hongkong only.

分批装运允许,转运仅允许在香港。

Shipment from Shanghai to Singapore without partial shipment/transshipment.

从上海装运到新加坡,不允许分批/转运。

Transshipment is allowed provided“Through Bill of Lading” are presented.

外贸英语进出口实用英语信用证

外贸英语《进出口实用英语:信用证》1. 通知对方以开立信用证As you have confirmed theorder, we have arranged with the Bank of China to open an L/C in your favor for the amount of US $150,000 in accordance with the trade terms stipulated.2. 通知对方已寄出信用证According to your request for opening L/C, we are pleased to inform you that we have airmailed today through the Bank of China an irrevocable L/C for $200,000 in favor of the New York Trading Co., Inc. on the following terms and conditions.3. 通知对方已开立并寄出信用证We hasten to inform you that we have today been advised by the Bank of China of the establishment of an L/C in your favor to the amount of $100,000 available on or before April 30, 2001.We believe it will be in your hands within this week.4. 通知对方外国银行开立信用证By order and for your account we have made fax instructions to our Los Angeles branch to establish an L/C in favor of the Pacific Trading Co., Inc., Los Angeles to the amount of US$50,000.5. 通知对方已收到信用证Thank you very much for your L/C covering your order No.100.The goods you have ordered are being prepared for shipment.As soon as the shipment has been executed, you will be advised by fax and our letter will follow with the shipping documents.6. 通知信用证的开立与有效期限We have instructed the Bank of China to open an irrevocable letter of credit for US$35,000. This will be advised by the bankers' correspondents, Beijing City Commercial Bank. They will accept your draft on them at 30 days after sight for the amount of your invoices.The credit id valid until September 30.7. 通知对方已开立信用证,并支付汇票We have asked the Bank of China here to open a credit for US$50,000 in your favor and this will remain in force until March 31, 2001.The bank will honor your draft at sight for the amount of your invoice drawn under the L/C.8. 督促对方开立信用证In order to execute your order No.205, please urgently open an irrevocable L/C for the amount of US$100,000 in our favor, available until April 30.As the shipping time is near, we ask you to instruct your bankers to open it so that we can receive it within this week.9. 督促对方确认订单并开立信用证We are pleased to confirm your fax order today and inform you that your order No. 100 is now ready for shipment per M/S Pacific leaving Jilong around June 10. Therefore we are anxious to receive your advice of L/C against this order.要求提早开立信用证10.We need a period of three months for production in order to execute this order and request your immediately arrangement for opening an L/C two months before the time of shipment.备注说明,非正文,实际使用可删除如下部分。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

外贸信用证用语大全一、信用证种类——Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller’s L/C(or:circular L/C) 旅行信用证二、信用证有关各方名称——Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one’s favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C ——信用证金额1.amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dollars…累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP…总金额不得超过英镑……4.to the extent of HKD…总金额为港币……5.for the amount of USD…金额为美元……6.for an amount not exceeding total of JPY…金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents ——单据要求1. available against surrender of the following documents bearing our credit number and the full name and addressof the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by…汇票要随附(指单据)……五、Draft(Bill of Exchange)——汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s)to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause“Drafts drawn Under Bank of…credit No.…dated…”本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978”汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s)drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…”即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s)so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s)bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank”汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice ——发票1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary’s original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of)the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将…寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.…date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据8.combined invoice is not acceptable 不接受联合发票七、Bill of Loading——提单1. full set shipping(company’s)clean on board bill(s)of lading marked “Freight Prepaid“to order of shipperendorsed to …Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked “Freight Prepaid“notify: importer(openers,accountee)洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean “on board”bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S …Co. calling for shipment from China to Hamburg marked “Freight prepaid”/ “Freight Payable at Destination”全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of…提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment”B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Certificate of Origin——产地证1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of …origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form “A”普惠制格式“A”产地证明书九、Packing List and Weight List ——装箱单与重量单1.packing list deatiling the complete inner packing specification and contents of each package 载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单十、Other Documents ——其他条款1. full tet of forwarding agents'cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书8.combined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书十一、The Stipulation for Shipping Terms ——装运条款1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to …not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not)permitted (不)允许分运(2)partial shipments (are) allowed (prohibited)准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运十二、Date & Address of Expiry——效期效地1. valid in…for negotiation until…在……议付至……止2.draft(s)must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s)must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port)until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s)drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s)drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring)date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents'cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付十三、The Guarantee of the Opening Bank ——开征行付款保证1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will beduly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s)drawn under and in compliance with the terms of the credit that such draft(s)shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit)凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付十四、Special Conditions 特别条款1.for special instructions please see overleaf 特别事项请看背面2.at the time of negotiations you will be paid the draft amount less 5% due to… 议付时汇票金额应少付5%付给……(注:这种条款是开证行对议付行的指示)3.which amount the negotiation bank must authorise us to pay 该项金额须由议付行授权我行付给(注:指佣金的金额)4.if the terms and conditions of this credit are not acceptable to you please contact the openers for necessaryamendments 如你方不接受本证条款,请与开证人联系以作必要修改5.negotiations unrestricted/restricted to advising bank 不限制议付行/限于通知行6.(the price)including packing charges (价格)包括包装费用7.all documents must be separated 各种单据须分开(即联合单证不接受)8.beneficiary's drafts are to be made out for 95% of invoice value, being 5% commission payable to creditopener 受益人的汇票按发票金额95%开具,5%佣金付给开证人9.drafts to be drawn for full CIF value less 5% commission, invoice to show full CIF value 汇票按CIF总金额减少5%开具发票须表明CIF的全部金额10.5% commission to be remitted to credit openers by way of bank drafts in sterling poungds drawn on…thiscommission not to be showed on the invoice 5%佣金用英镑开成以……为付款人的银行汇票付给开证人,该佣金勿在发票上表明11.freight and charges to be showed on bill of lading etc. 提单等(单据)须标明运费及附加费12.cable copy of shipping advice despatched to the accountee immediately after shipment 装船后,即将装船通知电报副本寄交开证人13.one copy of commercial invoice and packing list should be sent to the credit openers 15 days before shipment商业发票和装箱单各一份须在装船前15天寄给开证人14.the beneficiary is to cable Mr.…stating L/C No., quantity shipped name & ETD of vessel within 5 days aftershipment, a copy of this cable must accompany the documents for negotiation 受益人应在装船后5天内将信用证号码、装船数量、船名和预计开航日期电告……先生,该电报的副本须随同单据一起议付15.all documents except bills of exchange and B/Lading to be made out in name of A.B.C.Co. Ltd. and whichname is to be shown in B/Lading as joint notifying party with the applicant 除汇票和提单外,所有单据均须作成以A.B.C.有限公司为抬头,并以该公司和申请人作为提单的通知人16.signed carbon copy of cable required 要求(提供)经签署的电报复本17.both shipment and validity dates of this credit shall be automatically extended for 15 days at the date of expiry本证的装船有效期均于到期日自延展15天18.amount of credit and quantity of merchandise…% more or less acceptable 证内金额与货物数量允许增减……%19.credit amount and shipment quantity…% more or less allowed 证内金额与装运数量允许增减……%20.shipment samples to be sent direct by airmail to buyer before shipment 装运前须将装船货样直接航寄买方21.cable accountee name of steamer/carriage number, quantity of goods and shipment date(or E.T.A.) 将船名/车号、货物数量及装船期(或预抵期)电告开证人22.all banking charges outside Hongkong are for account of accountee 香港以外的全部银行费用由开证人负担23.drawee Bank's charges and acceptance commission are for buyer's account 付款行的费用和承兑费用由买方负担24.port congestion surcharge, if any, is payable by openers inexcess of this documentary credit amount againstevidence 如果有港口拥挤费,超过本证金额部分凭证明由开证人支付25.amount of this credit may be exceeded by cost of insurance 本证金额可以超过保险费部分26.this letter of credit is transferable in China only, in the event of a transfer, a letter from the first beneficiarymust accompany the documents for negotiation 本信用证仅在中国可转让,如实行转让,由第一受益人发出的书面(证明)须连同单据一起议付27.letter of guarantee and discrepancies are not acceptable 书面担保和错误单据均不接受28.admixture 5% max. including organic matter such as weed and inorganic 杂质最高5%,包括有机物(如杂草)和无机物29.include this symbol “丹” in the shipping marks on each side of the carton(that is four markings in onecarton) 包含有“丹”字记号的装船唛头刷在纸箱的每一面(即每个纸箱要刷四个唛头)十五、In Reimbursement ——索偿文句1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding)airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。