chapter7习题答案

米什金 货币金融学 英文版习题答案chapter 7英文习题

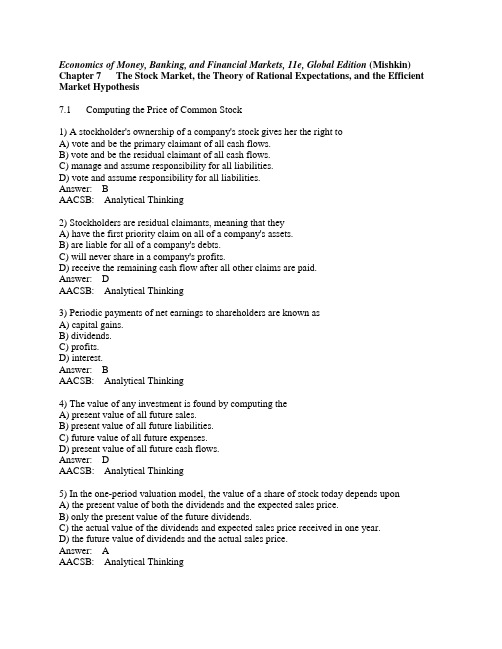

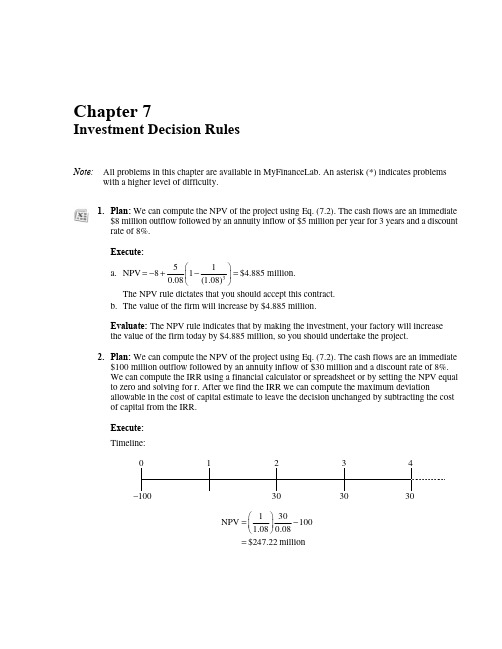

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 7 The Stock Market, the Theory of Rational Expectations, and the Efficient Market Hypothesis7.1 Computing the Price of Common Stock1) A stockholder's ownership of a company's stock gives her the right toA) vote and be the primary claimant of all cash flows.B) vote and be the residual claimant of all cash flows.C) manage and assume responsibility for all liabilities.D) vote and assume responsibility for all liabilities.Answer: BAACSB: Analytical Thinking2) Stockholders are residual claimants, meaning that theyA) have the first priority claim on all of a company's assets.B) are liable for all of a company's debts.C) will never share in a company's profits.D) receive the remaining cash flow after all other claims are paid.Answer: DAACSB: Analytical Thinking3) Periodic payments of net earnings to shareholders are known asA) capital gains.B) dividends.C) profits.D) interest.Answer: BAACSB: Analytical Thinking4) The value of any investment is found by computing theA) present value of all future sales.B) present value of all future liabilities.C) future value of all future expenses.D) present value of all future cash flows.Answer: DAACSB: Analytical Thinking5) In the one-period valuation model, the value of a share of stock today depends uponA) the present value of both the dividends and the expected sales price.B) only the present value of the future dividends.C) the actual value of the dividends and expected sales price received in one year.D) the future value of dividends and the actual sales price.Answer: AAACSB: Analytical Thinking6) In the one-period valuation model, the current stock price increases ifA) the expected sales price increases.B) the expected sales price falls.C) the required return increases.D) dividends are cut.Answer: AAACSB: Reflective Thinking7) In the one-period valuation model, an increase in the required return on investments in equityA) increases the expected sales price of a stock.B) increases the current price of a stock.C) reduces the expected sales price of a stock.D) reduces the current price of a stock.Answer: DAACSB: Reflective Thinking8) In a one-period valuation model, a decrease in the required return on investments in equity causes a(n) ________ in the ________ price of a stock.A) increase; currentB) increase; expected salesC) decrease; currentD) decrease; expected salesAnswer: AAACSB: Reflective Thinking9) Using the one-period valuation model, assuming a year-end dividend of $0.11, an expected sales price of $110, and a required rate of return of 10%, the current price of the stock would beA) $110.11.B) $121.12.C) $100.10.D) $100.11Answer: CAACSB: Analytical Thinking10) Using the one-period valuation model, assuming a year-end dividend of $1.00, an expected sales price of $100, and a required rate of return of 5%, the current price of the stock would beA) $110.00.B) $101.00.C) $100.00.D) $96.19.Answer: DAACSB: Analytical Thinking11) In the generalized dividend model, if the expected sales price is in the distant futureA) it does not affect the current stock price.B) it is more important than dividends in determining the current stock price.C) it is equally important with dividends in determining the current stock price.D) it is less important than dividends but still affects the current stock price.Answer: AAACSB: Analytical Thinking12) In the generalized dividend model, a future sales price far in the future does not affect the current stock price becauseA) the present value cannot be computed.B) the present value is almost zero.C) the sales price does not affect the current price.D) the stock may never be sold.Answer: BAACSB: Analytical Thinking13) In the generalized dividend model, the current stock price is the sum ofA) the actual value of the future dividend stream.B) the present value of the future dividend stream.C) the present value of the future dividend stream plus the actual future sales price.D) the present value of the future sales price.Answer: BAACSB: Analytical Thinking14) Using the Gordon growth model, a stock's current price will increase ifA) the dividend growth rate increases.B) the growth rate of dividends falls.C) the required rate of return on equity rises.D) the expected sales price rises.Answer: AAACSB: Reflective Thinking15) Using the Gordon growth model, a stock's current price decreases whenA) the dividend growth rate increases.B) the required return on equity decreases.C) the expected dividend payment increases.D) the growth rate of dividends decreases.Answer: DAACSB: Reflective Thinking16) In the Gordon growth model, a decrease in the required rate of return on equityA) increases the current stock price.B) increases the future stock price.C) reduces the future stock price.D) reduces the current stock price.Answer: AAACSB: Reflective Thinking17) Using the Gordon growth formula, if D1 is $2.00, k e is 12% or 0.12, and g is 10% or 0.10, then the current stock price isA) $20.B) $50.C) $100.D) $150.Answer: CAACSB: Analytical Thinking18) Using the Gordon growth formula, if D1 is $1.00, k e is 10% or 0.10, and g is 5% or 0.05, then the current stock price isA) $10.B) $20.C) $30.D) $40.Answer: BAACSB: Analytical Thinking19) Using the Gordon growth model, if D1 is $.50, k e is 7%, and g is 5%, then the present value of the stock isA) $2.50.B) $25.C) $50.D) $46.73.Answer: BAACSB: Analytical Thinking20) One of the assumptions of the Gordon Growth Model is that dividends will continue growing at ________ rate.A) an increasingB) a fastC) a constantD) an escalatingAnswer: CAACSB: Analytical Thinking21) In the Gordon Growth Model, the growth rate is assumed to be ________ the required return on equity.A) greater thanB) equal toC) less thanD) proportional toAnswer: CAACSB: Analytical Thinking22) You believe that a corporation's dividends will grow 5% on average into the foreseeable future. If the company's last dividend payment was $5 what should be the current price of the stock assuming a 12% required return?Answer: Use the Gordon Growth Model.$5(1 + .05)/(.12 - .05) = $75AACSB: Analytical Thinking23) What rights does ownership interest give stockholders?Answer: Stockholders have the right to vote on issues brought before the stockholders, be the residual claimant, that is, receive a portion of any net earnings of the corporation, and the right to sell the stock.AACSB: Reflective Thinking7.2 How the Market Sets Stock Prices1) In asset markets, an asset's price isA) set equal to the highest price a seller will accept.B) set equal to the highest price a buyer is willing to pay.C) set equal to the lowest price a seller is willing to accept.D) set by the buyer willing to pay the highest price.Answer: DAACSB: Reflective Thinking2) Information plays an important role in asset pricing because it allows the buyer to more accurately judgeA) liquidity.B) risk.C) capital.D) policy.Answer: BAACSB: Analytical Thinking3) New information that might lead to a decrease in a stock's price might beA) an expected decrease in the level of future dividends.B) a decrease in the required rate of return.C) an expected increase in the dividend growth rate.D) an expected increase in the future sales price.Answer: AAACSB: Reflective Thinking4) A change in perceived risk of a stock changesA) the expected dividend growth rate.B) the expected sales price.C) the required rate of return.D) the current dividend.Answer: CAACSB: Reflective Thinking5) A stock's price will fall if there isA) a decrease in perceived risk.B) an increase in the required rate of return.C) an increase in the future sales price.D) current dividends are high.Answer: BAACSB: Reflective Thinking6) A monetary expansion ________ stock prices due to a decrease in the ________ and an increase in the ________, everything else held constant.A) reduces; future sales price; expected rate of returnB) reduces; current dividend; expected rate of returnC) increases; required rate of return; future sales priceD) increases; required rate of return; dividend growth rateAnswer: DAACSB: Reflective Thinking7) The global financial crisis lead to a decline in stock prices becauseA) of a lowered expected dividend growth rate.B) of a lowered required return on investment in equity.C) higher expected future stock prices.D) higher current dividends.Answer: AAACSB: Reflective Thinking8) Increased uncertainty resulting from the global financial crisis ________ the required return on investment in equity.A) raisedB) loweredC) had no impact onD) decreasedAnswer: AAACSB: Reflective Thinking7.3 The Theory of Rational Expectations1) Economists have focused more attention on the formation of expectations in recent years. This increase in interest can probably best be explained by the recognition thatA) expectations influence the behavior of participants in the economy and thus have a major impact on economic activity.B) expectations influence only a few individuals, have little impact on the overall economy, but can have important effects on a few markets.C) expectations influence many individuals, have little impact on the overall economy, but can have distributional effects.D) models that ignore expectations have little predictive power, even in the short run. Answer: AAACSB: Reflective Thinking2) The view that expectations change relatively slowly over time in response to new information is known in economics asA) rational expectations.B) irrational expectations.C) slow-response expectations.D) adaptive expectations.Answer: DAACSB: Analytical Thinking3) If expectations of the future inflation rate are formed solely on the basis of a weighted average of past inflation rates, then economists would say that expectation formation isA) irrational.B) rational.C) adaptive.D) reasonable.Answer: CAACSB: Analytical Thinking4) If expectations are formed adaptively, then peopleA) use more information than just past data on a single variable to form their expectations of that variable.B) often change their expectations quickly when faced with new information.C) use only the information from past data on a single variable to form their expectations of that variable.D) never change their expectations once they have been made.Answer: CAACSB: Reflective Thinking5) If during the past decade the average rate of monetary growth has been 5% and the average inflation rate has been 5%, everything else held constant, when the Federal Reserve announces that the new rate of monetary growth will be 10%, the adaptive expectation forecast of the inflation rate isA) 5%.B) between 5 and 10%.C) 10%.D) more than 10%.Answer: AAACSB: Reflective Thinking6) The major criticism of the view that expectations are formed adaptively is thatA) this view ignores that people use more information than just past data to form their expectations.B) it is easier to model adaptive expectations than it is to model rational expectations.C) adaptive expectations models have no predictive power.D) people are irrational and therefore never learn from past mistakes.Answer: AAACSB: Reflective Thinking7) In rational expectations theory, the term "optimal forecast" is essentially synonymous withA) correct forecast.B) the correct guess.C) the actual outcome.D) the best guess.Answer: DAACSB: Analytical Thinking8) If a forecast is made using all available information, then economists say that the expectation formation isA) rational.B) irrational.C) adaptive.D) reasonable.Answer: AAACSB: Analytical Thinking9) If a forecast made using all available information is NOT perfectly accurate, then it isA) still a rational expectation.B) not a rational expectation.C) an adaptive expectation.D) a second-best expectation.Answer: AAACSB: Analytical Thinking10) If expectations are formed rationally, then individualsA) will have a forecast that is 100% accurate all of the time.B) change their forecast when faced with new information.C) use only the information from past data on a single variable to form their forecast.D) have forecast errors that are persistently low.Answer: BAACSB: Analytical Thinking11) If additional information is not used when forming an optimal forecast because it is not available at that time, then expectations areA) obviously formed irrationally.B) still considered to be formed rationally.C) formed adaptively.D) formed equivalently.Answer: BAACSB: Analytical Thinking12) An expectation may fail to be rational ifA) relevant information was not available at the time the forecast is made.B) relevant information is available but ignored at the time the forecast is made.C) information changes after the forecast is made.D) information was available to insiders only.Answer: BAACSB: Analytical Thinking13) According to rational expectations theory, forecast errors of expectationsA) are more likely to be negative than positive.B) are more likely to be positive than negative.C) tend to be persistently high or low.D) are unpredictable.Answer: DAACSB: Analytical Thinking。

科特勒市场营销习题与答案

Chapter 7 Customer-Driven Marketing Strategy: Creating Value for Target Customers 1) When a company identifies the parts of the market it can serve best and most profitably, it is practicing ________.A) concentrated marketingB) mass marketingC) market targetingD) segmentingE) differentiationAnswer: CDiff: 2 Page Ref: 191Skill: ConceptObjective: 7-12) What are the four steps, in order, to designing a customer-driven marketing strategy?A) market segmentation, differentiation, positioning, and targetingB) positioning, market segmentation, mass marketing, and targetingC) market segmentation, targeting, differentiation, and positioningD) market alignment, market segmentation, differentiation, and market positioningE) market recognition, market preference, market targeting, and market insistenceAnswer: CDiff: 2 Page Ref: 191Skill: ConceptObjective: 7-13) Which type of segmentation centers on the use of the word when, such as when consumers get the idea to buy, when they actually make their purchase, or when they use the purchased item?A) behavioralB) psychographicC) occasionD) impulseE) emergencyAnswer: CDiff: 2 Page Ref: 196Skill: ConceptObjective: 7-24) Markets can be segmented into groups of nonusers, ex-users, potential users, first-time users, and regular users of a product. This method of segmentation is called ________.A) user statusB) usage ratesC) benefitD) behaviorE) loyalty statusAnswer: ADiff: 1 Page Ref: 197Objective: 7-25) Consumers can show their allegiance to brands, stores, or companies. Marketers can use this information to segment consumers by ________.A) user statusB) loyalty statusC) store typeD) brand preferenceE) usage rateAnswer: BDiff: 1 Page Ref: 197Skill: ConceptObjective: 7-26) Consumer and business marketers use many of the same variables to segment markets. Business marketers use all of the following EXCEPT ________.A) operating characteristicsB) purchasing approachesC) situational factorsD) personal characteristicsE) brand personalitiesAnswer: EDiff: 3 Page Ref: 198Skill: ConceptObjective: 7-27) When the size, purchasing power, and profiles of a market segment can be determined, it possesses the requirement of being ________.A) measurableB) accessibleC) substantialD) actionableE) observableAnswer: ADiff: 2 Page Ref: 200Skill: ConceptObjective: 7-28) When a business market segment is large or profitable enough to serve, it is termed ________.A) measurableB) accessibleC) substantialD) actionableE) differentiableAnswer: CDiff: 2 Page Ref: 200Objective: 7-29) To evaluate the different market segments your company serves, you would look at all of these factors EXCEPT which one?A) segment sizeB) segment growthC) segment structural attractivenessD) company valuesE) company resourcesAnswer: DDiff: 3 Page Ref: 201Skill: ConceptObjective: 7-310) Which of the following is NOT one of the reasons a segment would be less attractive to a company?A) strong competitorsB) substitute productsC) concentrated marketD) power of buyersE) power of suppliersAnswer: CDiff: 2 Page Ref: 201Skill: ConceptObjective: 7-311) The 55-year-old baby boomers share common needs in music and performers. When a music company decides to serve this group, the group is called a(n) ________.A) market segmentB) target marketC) well-defined marketD) differentiated marketE) undifferentiated marketAnswer: BDiff: 1 Page Ref: 201Skill: ConceptObjective: 7-312) When New Port Shipping uses segmented marketing, it targets several segments and designs separate offers for each one. This approach is called ________ marketing.A) undifferentiatedB) differentiatedC) targetD) individualE) nicheAnswer: BDiff: 2 Page Ref: 202Skill: ConceptObjective: 7-313) Developing a strong position within several segments creates more total sales than ________ marketing across all segments.A) undifferentiatedB) differentiatedC) nicheD) targetE) individualAnswer: ADiff: 3 Page Ref: 202Skill: ConceptObjective: 7-314) Using concentrated marketing, the marketer goes after a ________ share of ________.A) small。

信号与系统奥本海姆英文版课后答案chapter7

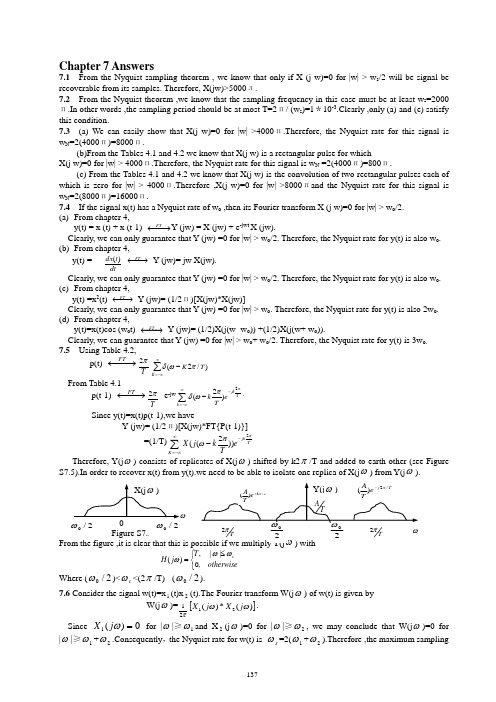

137Chapter 7 Answers7.1 From the Nyquist sampling theorem , we know that only if X (j w)=0 for |w| > w s /2 will be signal be recoverable from its samples. Therefore, X(jw)>5000л.7.2 From the Nyquist theorem ,we know that the sampling frequency in this case must be at least w s =2000п.In other words ,the sampling period should be at most T=2п/ (w s )=1*10-3.Clearly ,only (a) and (e) satisfy this condition.7.3 (a) We can easily show that X(j w)=0 for |w| >4000п.Therefore, the Nyquist rate for this signal is w N =2(4000п)=8000п.(b)From the Tables 4.1 and 4.2 we know that X(j w) is a rectangular pulse for which X(j w)=0 for |w| > 4000п.Therefore, the Nyquist rate for this signal is w N =2(4000п)=800п.(c) From the Tables 4.1 and 4.2 we know that X(j w) is the convolution of two rectangular pulses each of which is zero for |w| > 4000п.Therefore ,X(j w)=0 for |w| >8000пand the Nyquist rate for this signal is w N =2(8000п)=16000п.7.4 If the signal x(t) has a Nyquist rate of w o ,then its Fourier transform X (j w)=0 for |w| > w o /2. (a) From chapter 4,y(t) = x (t) + x (t-1) −→←FTY (jw) = X (jw) + e -jwt X (jw).Clearly, we can only guarantee that Y (jw) =0 for |w| > w o /2. Therefore, the Nyquist rate for y(t) is also w o . (b) From chapter 4,y(t) = dtt dx )( −→←FTY (jw)= jw X(jw).Clearly, we can only guarantee that Y (jw) =0 for |w| > w o /2. Therefore, the Nyquist rate for y(t) is also w o . (c) From chapter 4,y(t) =x 2(t) −→←FTY (jw)= (1/2п)[X(jw)*X(jw)]Clearly, we can only guarantee that Y (jw) =0 for |w| > w o . Therefore, the Nyquist rate for y(t) is also 2w o . (d) From chapter 4,y(t)=x(t)cos (w o t) −→←FTY (jw)= (1/2)X(j(w- w o )) +(1/2)X(j(w+ w o )).Clearly, we can guarantee that Y (jw) =0 for |w| > w o + w o /2. Therefore, the Nyquist rate for y(t) is 3w o. 7.5 Using Table 4.2,p(t) −→←FT Tπ2∑∞-∞=-K T K )/2(πωδFrom Table 4.1 p(t-1) −→←FT Tπ2 e -jw T jk k eTk ππωδ2)2(-∞-∞=∑-. Since y(t)=x(t)p(t-1),we haveY (jw)= (1/2п)[X(jw)*FT{P(t-1)}]=(1/T)T jk K e Tk j X ππω2))2((-∞-∞=∑-Therefore, Y(j ω) consists of replicates of X(j ω) shifted by k2π/T and added to earth other (see Figure⎩⎨⎧≤=otherwiseT j H c ,0||,)(ωωωWhere (2/0ω)<c ω<(2π/T) - (2/0ω).7.6 Consider the signal w(t)=x 1(t)x 2(t).The Fourier transform W(j ω) of w(t) is given by W(j ω)=π21[])(*)(21ωωj X j X .Since 0)(1=ωj X for |ω|≥1ωand X 2(j ω)=0 for |ω|≥2ω, we may conclude that W(j ω)=0 for |ω|≥1ω+2ω.Consequently ,the Nyquist rate for w(t) iss ω=2(1ω+2ω).Therefore ,the maximum sampling138period which would still allow w(t) to be recovered is T=2π/(s ω)=π/(1ω+2ω). 7.7 We note thatx 1(t) =h 1(t)*{∑∞-∞=-n nT t nT x )()(δ}Form Figure 7.7 in the book ,we know that the output of the zero-order hold may be written as x 0(t)=h 0(t)* {∑∞-∞=-n nT t nT x )()(δ}where h 0(t) is as shown in Figure S7.7 By taking the Fourier transform of the two above equations, we have X 1(j ω)=H 1( j ω)X p ( j ω)X 0(j ω)=H 0( j ω) X p ( j ω)We now need to determine a frequency response H d ( j ω) for a filter which produces x 1(t) at its output when x 0(t) is its input. Therefore, we needX 0(j ω) H d ( j ω)= X 1(j ω)The triangular function h 1(t) may be obtained by convolving two rectangular pulses as shown in Figure S7.7Therefore,h 1(t)={(1/T ) h 0(t+T/2)}*{( 1/T ) h 0(t+T/2)} Taking the Fourier transform of both sides of the above equation, H 1( j ω)=T1e T j ω H 0( j ω) H 0( j ω) ThereforeX 1(j ω)= H 1( j ω) X p ( j ω)=T 1e T j ω H 0( j ω) H 0( j ω) X p ( j ω) =T1e Tj ω H 0( j ω) X 0(j ω)ThereforeH d ( j ω)=T1eTj ω H 0( j ω)=e2/jwT TT ωω)2/sin(2 7.8 (a) Yes, aliasing does occur in this case .This may be easily shown by considering the sinusoidal term of x(t) for k=5. This term is a signal of the form y(t)=(1/2)5sin(5πt).If x(t) is sampled as T=0.2, then we will always be sampling y(t) at exactly its zero-crossings (This is similar to the idea presented in Figure 7.17 of your textbook). Therefore ,the signal y(t) appears to be identical to the signal (1/2)5sin(0πt) for frequency 5π is a liased into a sinusoid of frequency 0 in the sampled signal.(b) The lowpass filter performs band limited interpolation on the signal ∧x(t).But since aliasing has alreadyresulted in the loss of the sinusoid (1/2)5sin(5πt),the output will be of the formx γ(t)=k k )21(40∑= sin(k πt)The Fourier series representation of this signal is of the form139x γ(t)=∑-=44k k a e )/(t k j π-Where a k =-j(1/2)1+kj(1/2)1+-k7.9 The Fourier transform X(jWe know from the results on impulse-train sampling thatG(jw)=∑∞∞--ωωk j X T ((1s )),Where T=2π/s ω=1/75.therefore,G(jw) is as shown in Figure S7.9 .Clearly, G(jw)=(1/T)X(j ω)=75 X(j ω) for |ω|≤50π.7.10 (a) We know that x(t) is not a band-limited signal. Therefore, it cannot undergo impulse-train sampling without aliasing.(b) Form the given X(j ω) it is clear that the signal x(t) which is bandlimited. That is, X(j ω)=0 for |ω|>0ω.Therefore, it must be possible to perform impulse-train sampling on this signal without experiencing aliasing. The minimum sampling rate required would bes ω=20ω,This implies that thesampling period can at most be T=2π/s ω=π/0ω(c) When x(t) undergoes impulse train sampling with T=2π/0ω,we would obtain the signal g(t) with Fourier transformG(jw)= T1∑∞-∞=-k T k j X ))/2((πωFigure S7.10It is clear from the figure that no aliasing occurs, and that X(jw) can be recovered by using a filter with frequency response T 0≤ωω≤0 H(jw)= 0 otherwiseTherefore, the given statement is true. 7.11 We know from Section 7.4 thatX d (ωj e )= T1∑∞-∞=-k cT k j X ))/2((πω(a) Since X d (ωj e) is just formed by shifting and summing replicas of X(jw),we may argue that ifX d (ωj e ) is real , then X(jw) must also be real(b) X d (ωj e) consists of replicas of X(jw) which are scaled by 1/T,Therefore,if X d (ωj e) has amaximum of 1, then X(jw) must also be real.(c) The region πωπ≤≤||4/3in the discrete-time domain corresponds to the regionT T /||)4/(3πωπ≤≤ in the discrete-time domain. Therefore ,if X d (ωj e )=0 forπωπ≤≤||4/3,then X(jw)=0 for πωπ2000||1500≤≤,But since we already have X(jw)=0 for140πω2000||≥,we have X(jw)=0 for πω1500||≥(d) In this case, sinceπ in discrete-time frequency domain corresponds to 2000π in the continuous-time frequency domain, this condition translates to X(jw)=(j(ω-2000π))7.12 Form Section 7.4 ,we know that the discrete and continuous-time frequencies Ω and ω are related by Ω=ω.Therefore, in this case for Ω=43π,we find the corresponding value of ω toω=43πT1=3000π/4=7500π7.13 For this problem ,we use an approach similar to the one used in Example 7.2 .we assume thatx c (t)=tT t ππ)/sin(The overall output isy c (t)= x c (t-2T)= )2()]2)(/sin[(T t T t T --ππForm x c (t). We obtain the corresponding discrete-time signal x d [n] to be x d [n]= x c (nT)= T1][n δalso, we obtain from y c (t),the corresponding discrete-time signal y d [n] to be y d [n]= y c (nT) =)2()]2(sin[(--n T n ππWe note that the right-hand side of the above equation is always zero when n ≠2.When n=2 ,wemay evaluate the value of ratio using L ,Hospital ,s rule to be 1/T ,Thereforey d [n]= T1]2[-n δWe conclude that the impulse response of the filter is h d [n]= ]2[-n δ7.14 For this problem ,we use an approach similar to the one used in Example 7.2.We assume that x c (t)= tT t ππ)]/sin[(The overall output isy c (t)=)2(T t x dt d c -=)2/()]2/()/[()/(T t T t T COS T ---πππ-2))2/(()]2/)(/sin[(T t T t T --πππForm x c (t) , we obtain the corresponding discrete-time signal x d [n] to be x d [n]= x c (nT)= T1][n δAlso, we obtain from yc(t),the corresponding discrete-time signal y d [n] to beY d [n]=y c (nT)=)2/1()]2/1(cos[)/(--n T n T πππ- )2/1()]2/1(sin[--n T n ππThe first term in rig πht-hang side of the above equation is always zero because cos[π(n-1/2)]=0, therefore, y d [n]= )2/1()]2/1(sin[--n T n ππWe conclude that the impulse response of the filter is h d [n]= )2/1()]2/1(sin[--n T n ππ7.15. in this problem we are interested in the lowest rate which x[n] may be sampled without the possibility of aliasing, we use the approach used in Example 7.4 to solve this problem. To find the lowest rate at which x[n] may be sampled while avoiding the possibility of aliasing, we must find an N such that (22≥Nπ)73πN ≤7/37.16 Although the signal x 1[n]=2sin(πn/2)/( πn) satisfies the first tow conditions, it does not satisfy the thirdcondition . This is because the Flurries transform X 1(e j ω) of this signal is rectangular pulse which is zero for π/2<|ω|<π/2 We also note that the signal x[n]=4[sin(πn/2)/(πn)]2 satisfies the first tow conditions. Fromour numerous encounters with this signal, we know that its Fourier transform X(e j ω) is given by the periodic141convolution of X 1(e j ω) with itself. Therefore, X(e j ω) will be a triangular function in the range 0≤|ω|≤π. This obviously satisfies the third condition as well. T therefore, the desired signal is x[n]=4[sin(πn/2)/(πn)]2.7.17 In this problem .we wish to determine the effect of decimating the impulse response of the given filter by a factor of 2. As explained in Section 7.5.2 ,the process of decimation may be broken up into two steps. In the first step we perform impulse train sampling on h[n] to obtain H p [n]∑∞-∞=k h[2k]δ[n-2k]The decimated sequence is then obtained using h 1[n]=h[2n]=h p [2n]Using eq (7.37), we obtain the Fourier transform H p (e j ω) of h p [n] to beH 1(e j ω)=H p (e jω/2)In other words , H 1(e j ω) is H p (e j ω/2) expanded by a factor of 2. This is as shown in the figure above. Therefore, h 1[n]=h[2n] is the impulse response of an ideal lowpass filter with a passband gain of unity and a cutoff frequency of π/27.18 From Figure 7.37,it is clear interpolation by a factor of 2 results in the frequency response getting compressed by a factor of 2. Interpolation also results in a magnitude sealing by a factor of 2. Therefore, in this problem, the interpolated impulse response will correspond to an ideal lowpass filter with cutoff frequency π/ and a passband gain of 2.7.19 The Fourier transform of x[n] is given by1 |ω|≤ω1X(e j ω)= 0 otherwiseThis is as shown in Figure 7.19.(a) when ω1 ≤3π/5, the Fourier transform X 1(e j ω) of the output of the zero-insertion system is shown inFigure 7.19. The output w(e j ω) of the lowpass filter is as shown in Figure 7.19. The Fourier transform of theoutput of the decimation system Y(e j ω) is an expanded or stretched out version of W(e j ω). This is as shown in Figure 7.19.therefore, y[n]=51nn πω)3/5sin(1(b) When ω1>3π/5, the Fourier’s transform X 1(e j ω) of the output of the zero-insertion system is as shownin Figure 7.19 The output W(e j ω142The Fourier transform of the output of the decimation system Y(e j ω) bis an expanded or stretched outversion of W(e j ω) .This is as shown in Figure S7.19. Therefore,y[n]=][51n δ7.20 Suppose that X(e j ω) is as shown in Figure S7.20, then the Fourier transform X A (e j ω) of the output of theoutput of S A , the Fourier transform X 1(e j ω) of the output of the lowpass filter , and the Fourier transform X B (e j ω) of the output of S B are all shown in the figures below. Clearly this system accomplishes the filtering task .Figure S7.20(b) Suppose that X(e j ω) is as shown in Figure S7.20 ,then the Fourier transform X B (e j ω) of the output ofS B ,the Fourier transform X 1(e j ω)of the output of the first lowpass filter ,the Fourier transfore X A (e j ω) of theoutput of S A ,the Fourier transform X 2(e j ω) of the output of the first lowpass filter are all shown in the figure below .Clearly this system does not accomplish the filtering task. 7.21(a) The Nyquist rate for the given signal is 2×5000π=10000π. Therefore in order to be able to recover x(t)from x p (t) ,the sampling period must at most be T max =2π/10000π=2×10-4 sec .Since the sampling period used is T=10-4<T max ,x(t) can be recovered from x p (t).(b) The Nyquist rate for the given signal is 2×15000π=30000π. Therefore in order to be able to recover x(t)from x p (t) ,the sampling period must at most be T max =2π/30000π=0.66×10-4 sec .Since the sampling period used is T=10-4>T max , x(t) can not be recovered from x p (t).(c) Here,I m {X(j ω)} is not specified. Therefore, the Nyquist rate for the signal x(t) is indeterminate. Thisimplies that one cannot guarantee that x(t) would be recoverable from x p (t).(d) Since x(t) is real,we may conclude that X(j ω)=0 for |ω|>5000. Therefore the answer to this part isidentical to that of part (a)(e) Since x(t) is real, X(j ω)=0 for |ω|>15000π. Therefore the answer to this part is identical to that of part(b)(f) If X(j ω)=0 for |ω|>ω1,then X(j ω)*X(j ω)=0 for |ω|>2ω1,Therefore in this part X(j ω)=0 for |ω|>7500. The Nyquist rate for this signal is 2×7500π=15000π. Therefore in order to be able to recover x(t) from x p (t) ,the sampling period must at most be T max =2π/15000π=1.33×10-4 sec .Since the sampling period used is T=10-4<T max , x(t) can be recovered from x p (t). (g)If |X(j ω)|=0 for ω>5000π,then X(j ω)=0 for |ω|>5000π. Therefore the answer to this part is identical to that of part (a).7.22 Using the properties of the Fourier transform, we obtain Y(j ω)=X 1(j ω)X 2(j ω).Therefore, Y(j ω)=0 for |ω|>1000π.This implies that the Nyquist rate for y(t) is2×1000π=2000π.Therefore, the sampling period T can at most be 2π/(2000π)=10-3sec. Therefore we have to use T<10-3sec in order to be able to recover y(t) from y p (t). 7.23(a) We may express p(t) asP(t)=p 1(t)-p 1(t-△);Where p 1(t)=∑∞-∞=∆-k k t )2(δnow,143P 1(j ω)=∆π∑∞-∞=∆-k )/(πωδTherefore,P(j ω)= P 1(j ω)-e -j ω∆P 1(j )ωIs as shown in figure S7.23. Now,X p (j ω)=)](*)([21ωωπjP j XTherefore, X p (j ω) is as sketched below for △<π/(2ωM ),The corresponding Y(j ω) is also sketched in figure S7.23.(b) The system which can be used to recover x(t) from x p (t) is as shown in FigureS7.23. (c) The system which can be used to recover x(t) from x(t) is as shown in FigureS7.23.(d) We see from the figures sketched in part (a) that aliasing is avoided when ωM ≤π/△.therefore, △max =π/ωM.7.24 we may impress s(t) as s(t)=s(t)-1,where s(t) is as shown in Figure S7.24 we may easily show thats (j )ω= ∑∞-∞=-∆k T k kT k )/2()/2sin(4πωδπFrom this, we obtainS(j =-=)(2)()ωπδωωj S∑∞-∞=-∆k T k k T k )/2()/2sin(4πωδπ-2)(ωπδ Clearly, S(j ω) consists of impulses spaced every 2π/T.(a) If △=T/3, thenS(j =)ω∑∞-∞=-k T k kk )/2()3/2sin(4πωδπ-2)(ωπδNow, since w(t)=s(t)x(t),πω21)(=j W ∑∞-∞=--k X T k j X kk )(2))/2(()3/2sin(4ωππωπTherefore, W(j ω)consists of replicas of X(j ω) which are spaced 2π/T apart. Tn order to avoid aliasing,ωW should be less that π/T. Therefore, T max =2π/ωW. (b) If △=T/3, then(a)(b)()jw Figure S7.24x144S(j =)ω∑∞-∞=-k T k k k )/2()4/2sin(4πωδπ-2)(ωπδ we note that S(j ω)=0 for k=0,±2, ±4,…..This is as sketched in Figure S7.24.Therefore, the replicas of X(j ω)in W(j ω) are now spaced 4π/T apart. Tn order to avoid aliasing,ωW should be less that2π/T. Therefore, T max =2π/ωW. 7.25 Here, x T (kT) can be written asX T (kT)= ∑∞-∞=--k nT x n k n k )()()](sin[ππNote that when n ≠k,0)()](sin[=--n k n k ππAnd when n=k,1)()](sin[=--n k n k ππ Therefore,x τ(kT)=x(kT)7.26. We note thatp(j ω)=Tπ2δ(ω-k2π/T)Also, since x p (t)=x(t)p(t).X p (j ω)=12π{ x(j ω) * P(j ω)}=1Tx(j(ω-k2π/T))Figure S7.26Note that as T increase, Tπ2-ω2 approaches zero. Also, we note that there is aliasingWhen2ω1-ω2<Tπ2-ω2<ω2If 2ω1-ω2≥0(as given) then it is easy to see that aliasing does not occur when 0≤Tπ2-ω2≤2ω1-ω2For maximum T, we must choose the minimum allowable value for Tπ2-ω2 (which is zero).This implies that T max =2π/ω2. We plot x p (j ω) for this case in Figure S7.26. Therefore, A=T, ωb =2π/T, and ωa =ωb -ω11457.27.(a) Let x 1(j ω) denote the Fourier transform of the signal x 1(t) obtained by multiplyingx(t) with e -j ω0t Let x 2(j ω) be the Fourier transform of the signal x 2(t) obtained at the output of the lowpass filter. Then, x 1(j ω), x 2(j ω),and x p (j ω),are as shown in Figure S7.27(b) The Nyquist rate for the signal x 2(t) is 2×(ω2-ω1)/2=ω2-ω1.Therefore, thep 7.28. (a) The fundamental frequency of x(t) is 20π rad/sec.From Chapter 4 we know that the Fourier transform of x(t) is given byX(j ω)=2πk ∞=-∞∑a k δ(ω-20πk).This is as sketched below. The Fourier transform x c (j ω) of the signal x c (t) is also Sketched in Figure S7.28. Note thatP(j ω)=2510π⨯3(2/(510))k k δωπ∞-=-∞-⨯∑Andx p (j ω)=12π[ x c (j ω)* p(j ω)]Therefore, x p (j ω) is as shown in the Figure S7.28.Note that the impulses from adjacentReplicas of x c (j ω) add up at 200π.Now the Fourier transform x(e j Ω) of the sequence x[n] is given byx(e j Ω)= x p (j ω)|ω=ΩT. This is as shown in the Figure S7.28.Since the impulses in x(e j ω) are located at multiples of a 0.1π,the signal x[n] is146(b) The Fourier series coefficients of X[n] aT π2(12)k , k=0,±1,±2,….,±9 a k =4T π(12)10 , k=10 7.29. x p (j ω)=1T((2/))k x j k T ωπ∞=-∞-∑x(jwe ), Y(jwe ), Y p (j ω),and Y c (j ω) are as shown in Figure S7.29. 7.30. (a) Since x c (t)=δ(t),we have()c dy t dt+y c (t)= δ(t) Taking the Fourier transform we obtainj ωY(j ω)+ Y(j ω)=1 Therefore , Y c (j ω)=11j ω+, and y c (t) =e -t u(t). (b) Since y c (t) =e -tu(t) , y[n]= y c (nT)= e -nT u[n].Therefore, j ωH(e j ω)=()()j W e Y e ω=11/(1)T j e e ω---=1-e -T e -j ωTherefore,h[n]= δ[n]-e -T δ[n -1]7.31. In this problem for the sake of clarity we will use the variable Ωto denote discretefrequency. Taking the Fourier transform of both sides of the given difference equation we obtainH(j e Ω)=()()j j Y e X e ΩΩ=1112j e -Ω-Given that the sampling rate is greater than the Nyquist rate, we have147x(j eΩ)=1Tx c (j Ω/T), for -π≤Ω≤π Therefore,Y(j eΩ)=1(/)12c j x j T T e -ΩΩ-For -π≤Ω≤π.From this we getY(j ω)= Y(jw eT)= =1()12c j Tx j T e ωω--For -π/T ≤ω≤π/T. in this range, Y(j ω)= Y c (j ω).Therefore,H c (j ω)=()()c c Y j X j ωω=1/112j TT e ω--7.32. Let p[n]=[14]k n k δ∞=-∞--∑.Then from Chapter 5,p(jwe )= e -j ω24π(2/4)k k δωπ∞=-∞-∑=2π2/4(2/4)j k k k eπδωπ∞--=-∞∑Therefore, G(jw e )=()1()()2j j p e x e d πθωθπθπ--⎰=32/4(2/4)01()4j k j k k e x e πωπ--=∑jwjwFigure S7.32Clearly, in order to isolate just x(jwe ) we need to use an ideal lowpass filter with Cutoff frequency π/4 and passband gain of 4. Therefore, in the range |ω|<π, 4, |ω|<π/4H(e j ω)= 0, π/4≤|ω|≤π7.33. Let y[n]=x[n][3]k n k δ∞=-∞-∑.ThenY(e j ω)=3(2/3)1()3j k k x eωπ-=∑Note that sin(πn/3)/(πn/3) is the impulse response of an ideal lowpass filter with cutoff frequency π/3 and passband gain of 3.Therefore,we now require that y[n] when passed through this filter should yieldx[n].Therefore, the replicas of x(e j ω) contained in Y(e j ω) should not overlap with one another. This ispossible only if x(e j ω) =0 for π/3≤|ω|≤π.7.34. In order to make x(e j ω) occupy the entire region from -πto π,the signal x[n]148must be downsampled by a factor of 14/3.Since it is not possible to directly downsample by a noninteger factor, we first upsample the signal by a factor of 3. Therefore, after the upsampling we will need toreduce the sampling rate by 14/3× 3=14. Therefore, the overall system for performing the sampling rate conversion isy[n][]2nx ,n=0,±3,±6,… y[n]=p[14n] ω[n]= 0, otherwise Figure S7.34)(e xp)(ωj d e x 7.36. (a) Let us decnote the sampled signaled signal by x p (t). We have∑∞-∞=-=n pnT t nT x t x )()()(δSince the Nyquist rate for the signal x(t) is T /2π,we can reconstruct the signal from x p (t). From Section 7.2,we know that)(*)()(t h t x t x p = whereTt T t t h /)/sin()(ππ=Thereforedtt dh t x dtt dx p )(*)()(=Denoting dtt dh )( by g(t),we have∑∞-∞=-==n pnT t g nT x t g t x dtt dx )()()(*)()(Therefore,2)/sin()/cos()()(tT t T tT t dtt dh t g πππ-==(b) No.7.37. We may write p(t) asp(t)=p 1(t)+p 1(t-∆),where∑∞-∞=-=k W k t t p )/2()(1πδTherefore,)()1()(1ωωωj p e j p j ∆-+= where∑∞-∞=-=k kW w j p )()(1ωδω149Let us denote the product p(t)f(t) by g(t).Then,)()()()()()()(11t f t p t f t p t f t p t g ∆-+== This may be written as)()()(11∆-+=t bp t ap t g Therefore,)(()(1)ωωωj p be a j G j ∆-+= with )(1ωj p is specified in eq.(s7.37-1). Therefore [])()(kw be a w j G k w jk -+=∑∞-∞=∆-ωδωWe now have)()()()(1t f t p t x t y = Therefore,[])(*)(21)(1ωωπωj x j G j Y =This give us[]))((2)(1kW j x be a Wj Y wjk -+=∑∆-ωπωIn the range 0<ω<W, we may specify Y 1(j ω) as[]))(()()()(2)(1W j x be a j x b a w j Y w jk -+++=∆-ωωπωsince )()()(112ωωωj H j Y j Y =, in the range 0<ω<W we may specify Y 2(j ω) as []))(()()()(2)(2W j x be a j x b a jW j Y W j -+++=∆-ωωπωSince ),()()(3t p t x t y =in the range 0<ω<W we may specify Y 3(j ω) as []))(()1()(22)(3W j x e j x W j Y W j -++=∆-ωωπωGive that 0<W △<π,we require that )()()(32ωωωj kx j Y j Y =+ for 0<ω<W. That is[][])())(()1(2)()(2ωωπωπj kx W j x e W j x jb ja a Ww j =-++++∆-This implies that01=+++∆-∆-W j Wj jbe ja e Solving this we obtainA=1, b= -1, When W △=π/2. More generally, we also geta=sin(W △)+)tan())cos(1(∆∆+W W and )sin()cos(1∆∆+-=W W bexcept when 2/π=∆W Finally, we also get [])2/(12jb ja Wk ++=π。

《商务英语函电》 Chapter 7

II. Fill in the blanks with the proper forms of the following words or

expressions.

1. captioned

2. With regaห้องสมุดไป่ตู้d to, so far

3. enabling

4. see that, avoid

5. the fact that

6. stress v./n. 着重强调;重点

1) stress + that clause

2) stress + n.

The sellers stressed the importance of establishing L/C in strict accordance with the stipulations of the contract.

6. relevant

7. in exact accordance with

8. drawing near

9. call, attention

III. Identify and correct the mistakes in the following sentences.

1. A. have

2. C. be opened

谨启

(B) 通知开证 敬启者:

我方第5781号订单订购的500匹柞丝绸,约在30日前 开出不可撤消的信用证,到期日为五三月十五日,特函提 请注意。

由于销售季节很快临近,我方客户急需此货,请尽快 交货,以便在季节开始时赶上旺销。

我们愿强调如延迟交货,无疑地会给我们造成不小的 困难。

对你方合作,预致谢意。

3. A. With regard to

当代医学英语答案chapter7复旦

当代医学英语答案chapter7复旦1、His remarks _____me that I had made the right decision. [单选题] *A.ensuredB.insuredC.assured(正确答案)D.assumed2、—Where ______ you ______ for your last winter holiday?—Paris. We had a great time. ()[单选题] *A. did; go(正确答案)B. do; goC. are; goingD. can; go3、Though my best friend Jack doesn’t get()education, he is knowledgeable. [单选题] *A. ManyB. littleC. fewD. much(正确答案)4、Mr. White likes to live in a _______ place. [单选题] *A. quiteB. quiet(正确答案)C. quickD. quietly5、—______ my surprise, Zhu Hui won the first prize in the speech contest. —But I think he could, because he kept practicing speaking.()[单选题] *A. To(正确答案)B. AboutC. ForD. In6、Could you tell me _____ to fly from Chicago to New York? [单选题] *A.it costs how muchB. how much does it costC. how much costs itD.how much it costs(正确答案)7、The manager demanded that all employees _____ on time. [单选题] *A. be(正确答案)B. areC. to beD. would be8、He always did well at school _____ having to do part-time jobs every now and then. [单选题] *A despite ofB. in spite of(正确答案)C. regardless ofD in case of9、In crowded places like airports and railway stations, you___ take care of your luggage. [单选题] *A. canB. mayC. must(正确答案)D. will10、66.—How much meat do you want?—________.[单选题] *A.Sorry, there isn't anyB.I can't give you anyC.Half a kilo, please(正确答案)D.Twelve yuan a kilo11、He held his()when the results were read out. [单选题] *A. breath(正确答案)B. voiceC. soundD. thought12、Becky is having a great time ______ her aunt in Shanghai. ()[单选题] *A. to visitB. visitedC. visitsD. visiting(正确答案)13、Don't tell me the answer, I'll work out the problem _____. [单选题] *A .by meB. myself(正确答案)C. meD. mine14、No writer will be considered()of the name until he writes a work. [单选题] *A. worthlessB. worthy(正确答案)C. worthwhileD. worth15、Everyone here is _______ to me. [单选题] *A. happyB. wellC. kind(正确答案)D. glad16、I gave John a present but he gave me nothing_____. [单选题] *A.in advanceB.in vainC.in return(正确答案)D.in turn17、( ) What other books have you read___ this English novel? [单选题] *A. besides(正确答案)B. exceptC.inD. about18、_____ the project, we'll have to work two more weeks. [单选题] *A. CompletingB. CompleteC. Having completedD.To complete(正确答案)19、_______ your parents at home last week? [单选题] *A. IsB. WasC. AreD. Were(正确答案)20、He _______ maths. [单选题] *A. does well in(正确答案)B. good atC. is well inD. does well at21、Julia’s on holiday in Shanghai _______. [单选题] *A. in a momentB. after a momentC. at the moment(正确答案)D. at any moment22、( ) You had your birthday party the other day,_________ [单选题] *A. hadn't you?B. had you?C. did you?D. didn't you?(正确答案)23、6.Hi, boys and girls. How are you ________ your posters for the coming English Festival at school? [单选题] *A.getting onB.getting offC.getting with (正确答案)D.getting24、--Why are you late for school today?--I’m sorry. I didn’t catch the early bus and I had to _______ the next one. [单选题] *A. wait for(正确答案)B. ask forC. care forD. stand for25、This year our school is _____ than it was last year. [单选题] *A. much more beautiful(正确答案)B. much beautifulC. the most beautifulD. beautiful26、—Whose book is it? Is it yours?—No, ask John. Maybe it’s ______.()[单选题] *A. hersB. his(正确答案)C. he’sD. her27、The Titanic is a nice film. I _______ it twice. [单选题] *A. sawB. seeC. have seen(正确答案)D. have saw28、There are about eight ______ students in my school.()[单选题] *A. hundred(正确答案)B. hundredsC. hundred ofD. hundreds of29、Look at those black clouds! Take ______ umbrella or ______ raincoat with you. ()[单选题] *A. a; anB. an; a(正确答案)C. an; anD. a; a30、She serves as a secretary in a university. [单选题] *A. 为…服务B. 担任…职务(正确答案)C. 竞争…服务D. 申请…职务。

第七章一维波动方程的解题方法与习题答案

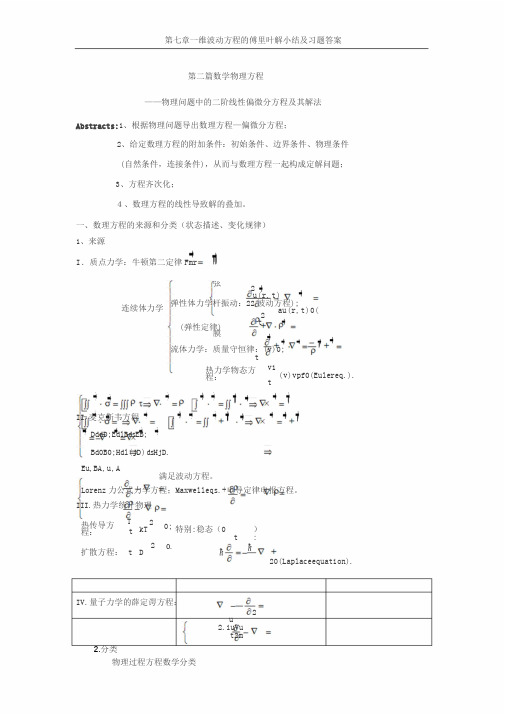

第七章一维波动方程的傅里叶解小结及习题答案第二篇数学物理方程——物理问题中的二阶线性偏微分方程及其解法Abstracts:1、根据物理问题导出数理方程—偏微分方程;2、给定数理方程的附加条件:初始条件、边界条件、物理条件(自然条件,连接条件),从而与数理方程一起构成定解问题;3、方程齐次化;4、数理方程的线性导致解的叠加。

一、数理方程的来源和分类(状态描述、变化规律)1、来源I.质点力学:牛顿第二定律Fmr连续体力学弦2u(r,t)弹性体力学杆振动:22波动方程);au(r,t)0(2t(弹性定律)膜流体力学:质量守恒律:(v)0;t热力学物态方程:v1(v)vpf0(Eulereq.).tII.麦克斯韦方程DddD;EdlBdsEB;Bd0B0;Hdl(jD)dsHjD.Eu,BA,u,A满足波动方程。

Lorenz力公式力学方程;Maxwelleqs.+电导定律电报方程。

III.热力学统计物理热传导方程:扩散方程:Ttt2kT2D0;0.特别:稳态(0t):20(Laplaceequation).IV.量子力学的薛定谔方程:2u2.iuVut2m2.分类物理过程方程数学分类振动与波波动方程2u 12u22at双曲线输运方程能量:热传导质量:扩散ut20ku抛物线1稳态方程Laplaceequation 2u0椭圆型二、数理方程的导出推导泛定方程的原则性步骤:(1)定变量:找出表征物理过程的物理量作为未知数(特征量),并确定影响未知函数的自变量。

(2)立假设:抓主要因素,舍弃次要因素,将问题“理想化”---“无理取闹”(物理趣乐)。

(3)取局部:从对象中找出微小的局部(微元),相对于此局部一切高阶无穷小均可忽略---线性化。

(4)找作用:根据已知物理规律或定律,找出局部和邻近部分的作用关系。

(5)列方程:根据物理规律在局部上的表现,联系局部作用列出微分方程。

Chapter7一维波动方程的傅里叶解第一节一维波动方程-弦振动方程的建立1.弦横振动方程的建立(一根张紧的柔软弦的微小振动问题)(1)定变量:取弦的平衡位置为x轴。

chap7中级宏观经济学答案 华中科技大学

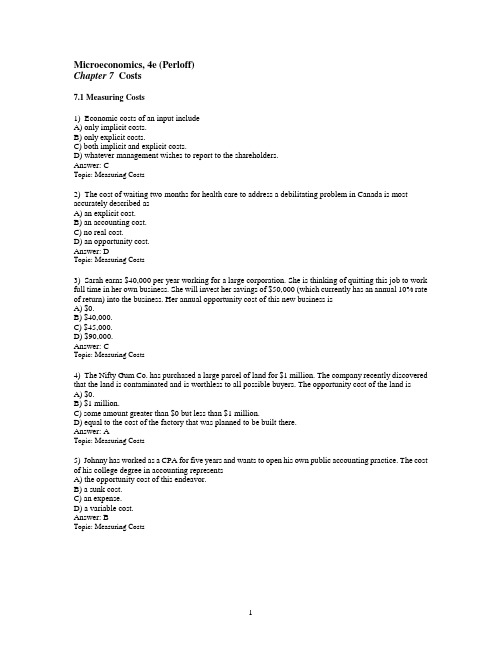

Microeconomics, 4e (Perloff)Chapter 7 Costs7.1 Measuring Costs1) Economic costs of an input includeA) only implicit costs.B) only explicit costs.C) both implicit and explicit costs.D) whatever management wishes to report to the shareholders.Answer: CTopic: Measuring Costs2) The cost of waiting two months for health care to address a debilitating problem in Canada is most accurately described asA) an explicit cost.B) an accounting cost.C) no real cost.D) an opportunity cost.Answer: DTopic: Measuring Costs3) Sarah earns $40,000 per year working for a large corporation. She is thinking of quitting this job to work full time in her own business. She will invest her savings of $50,000 (which currently has an annual 10% rate of return) into the business. Her annual opportunity cost of this new business isA) $0.B) $40,000.C) $45,000.D) $90,000.Answer: CTopic: Measuring Costs4) The Nifty Gum Co. has purchased a large parcel of land for $1 million. The company recently discovered that the land is contaminated and is worthless to all possible buyers. The opportunity cost of the land isA) $0.B) $1 million.C) some amount greater than $0 but less than $1 million.D) equal to the cost of the factory that was planned to be built there.Answer: ATopic: Measuring Costs5) Johnny has worked as a CPA for five years and wants to open his own public accounting practice. The cost of his college degree in accounting representsA) the opportunity cost of this endeavor.B) a sunk cost.C) an expense.D) a variable cost.Answer: BTopic: Measuring Costs6) Economists proclaim that competitive firms make zero economic profit in the long run. This shows howA) detached economists are from the real world.B) unrealistic economic theory is.C) firms cover all their cost, both monetary and non-monetary.D) firms cover only monetary cost when economic profits are zero.Answer: CTopic: Measuring Costs7) If a firm buys a building so as to have office space for its workers, the monthly opportunity cost of the building is best measured asA) the monthly mortgage payment the firm must pay.B) the price the firm paid divided by twelve.C) zero.D) the rent the firm could earn if it rented the building to another firm.Answer: DTopic: Measuring CostsFor the following, please answer "True" or "False" and explain why.8) When buying a piece of equipment, it is always best for the firm to pay cash instead of borrowing the funds since this renders the equipment less costly.Answer: False. It depends. The opportunity cost of the capital when paying cash is the interest the firm receives on its cash reserves. This is an implicit cost. The opportunity cost of the capital when the funds are borrowed is the interest the firm must pay to the lender. This is an explicit cost. If the rate the firm receives on its cash reserves exceeds the rate at which it borrows, the firm is better off borrowing the funds to buy the equipment.Topic: Measuring Costs9) Four years after graduating from college you must decide if you want to go on as an accountant (your college major) or if you want to make a career change and become a singer. The cost of your education will matter for your decision.Answer: False. At this point the cost of your education represents a sunk cost and therefore should not figure into your decision. You incur it no matter what decision you make.Topic: Measuring Costs10) An accountant may amortize the expense of a durable good by dividing the total amount spent on the good by the number of years the good is expected to last. An economist may amortize the expense of a durable and never fully account for the total expense.Answer: True. The accountant uses a set of predetermined rules to amortize the total expense of the good. The economist amortizes based on the opportunity cost of the good, which may never sum to the total expense of the good.Topic: Measuring Costs11) Your company makes copper pipes. Over the years, you have collected a large inventory of raw copper. The production process involves melting the copper and shaping it into pipes. You also have a large stockpile of pennies. Suppose the price of copper rises so much that the copper in the penny becomes worth more than one cent. Should you melt down your pennies?Answer: This problem appeared as a puzzle in the Journal of Economic Perspectives (Winter, 1988). It is true (in this problem) that the pennies when melted currently have a value greater than one cent. Yet, the price of copper can fluctuate. If the price of copper stays high, it does not matter if you melt pennies or not. However, if the price of copper falls so that the value of the copper in the penny falls below one cent, your unmelted pennies are still worth one cent. Your melted pennies would be worth less than one cent. Thus, as long as you have some other source of copper, you are better off melting that copper and not the pennies.Topic: Measuring Costs12) You have two career options. You can work for someone else for $50,000 a year, or, you can run your own business, with an annual revenue of $100,000, and explicit costs of $40,000 annually. Explain which career option a profit-maximizer would select and why.Answer: In the absence of other implicit costs a profit-maximizer will run their own business. The business owner will receive $100,000 - $40,000 = $60,000. The opportunity cost is only $50,000.Topic: Measuring Costs7.2 Short-Run Costs1) A firm's marginal cost can always be thought of as the change in total cost ifA) the firm produces one more unit of output.B) the firm buys one more unit of capital.C) the firm's average cost increases by $1.D) the firm moves to the next highest isoquant.Answer: ATopic: Short-run Costs2) Fixed costs areA) a production expense that does not vary with output.B) a production expense that changes with the quantity of output produced.C) equal to total cost divided by the units of output produced.D) the amount by which a firm's cost changes if the firm produces one more unit of output.Answer: ATopic: Short-run Costs3) Variable costs areA) a production expense that does not vary with output.B) a production expense that changes with the quantity of output produced.C) equal to total cost divided by the units of output produced.D) the amount by which a firm's cost changes if the firm produces one more unit of output.Answer: BTopic: Short-run Costs4) Which of the following statements is NOT true?A) AC = AFC + AVCB) C = F + VCC) AVC = wage/MP LD) AFC = AC - AVCAnswer: CTopic: Short-run Costs5) Joey's Lawncutting Service rents office space from Joey's dad for $300 per month. Joey's dad is thinking of increasing the rent to $400 per month. As a result Joey's marginal cost of cutting grass willA) increase by $100 divided by the amount of grass cut.B) increase by $100.C) decrease by $100.D) not change.Answer: DTopic: Short-run Costs6) Suppose a firm can only vary the quantity of labor hired in the short run. An increase in the cost of capital willA) increase the firm's marginal cost.B) decrease the firm's marginal cost.C) have no effect on the firm's marginal cost.D) More information is needed to answer the question.Answer: CTopic: Short-run Costs7) Suppose the total cost of producing T-shirts can be represented as TC = 50 + 2q. The marginal cost of the 5th T-shirt isA) 2.B) 10.C) 12.D) 60.Answer: ATopic: Short-run Costs8) Suppose the total cost of producing T-shirts can be represented as TC = 50 + 2q. The average cost of the 5th T-shirt isA) 2.B) 12.C) 52.D) 60.Answer: BTopic: Short-run Costs9) Suppose the total cost of producing T-shirts can be represented as TC = 50 + 2q. Which of the following statements is TRUE at all levels of production?A) MC = AVCB) MC = ACC) MC > AFCD) All of the above.Answer: ATopic: Short-run Costs10) Suppose the short-run production function is q = 10 * L. If the wage rate is $10 per unit of labor, then AVC equalsA) q.B) q/10.C) 10/q.D) 1.Answer: DTopic: Short-run Costs11) Suppose the short-run production function is q = 10 * L. If the wage rate is $10 per unit of labor, then MC equalsA) q.B) q/10.C) 10/q.D) 1.Answer: DTopic: Short-run Costs12) If average cost is decreasingA) Marginal cost equals average cost.B) Marginal cost exceeds average cost.C) Marginal cost is less average cost.D) Not enough informationAnswer: CTopic: Short-run Costs13) If average cost is positiveA) Marginal cost equals average cost.B) Marginal cost exceeds average cost.C) Marginal cost is less average cost.D) Not enough informationAnswer: DTopic: Short-run Costs14) Suppose the short-run production function is q = L0.5. If the marginal cost of producing the tenth unit is $5, what is the wage per unit of labor?A) $1B) $0.5C) $0.25D) It cannot be determined without more information.Answer: CTopic: Short-run Costs15) Suppose the short-run production function is q = 10 * L. If the wage rate is $10 per unit of labor, then AFC equalsA) 0.B) 1.C) 10/q.D) It cannot be determined from the information provided.Answer: DTopic: Short-run Costs16) When a firm produces one unit, the variable cost is $3. When the firm produces two units, the variable cost is $6. What is the marginal cost associated with two units of production?A) $2B) $0.5C) $6D) $3Answer: DTopic: Short-run Costs17) In the short run, the point at which diminishing marginal returns to labor begin is the point at which the marginal cost curveA) peaks.B) bottoms out.C) is upward sloping.D) is downward sloping.Answer: BTopic: Short-run Costs18) If the marginal cost of producing a good is increasing as a firm produces more of the good, then which of the following must be TRUE?A) AFC is rising.B) AVC is rising.C) MC > AVC.D) MPL is falling.Answer: DTopic: Short-run Costs19) If the average cost of producing a good is increasing as a firm produces more of the good, then which of the following must be TRUE?A) AFC is falling.B) AVC is rising.C) MC > AVC.D) All of the above.Answer: DTopic: Short-run Costs20) If a particular production process is subject to diminishing marginal returns to labor at every level of output, then at every level of outputA) AC is upward sloping.B) MC exceeds AVC.C) AFC is constant.D) All of the above.Answer: BTopic: Short-run Costs21) Marginal Cost is equal toA) the increase in total cost from increasing the amount of labor by one unit.B) the increase in average cost from increasing the amount of labor by one unit.C) Both A and B.D) Neither A nor B.Answer: CTopic: Short-run Costs22) Suppose each worker must use only one shovel to dig a trench, and shovels are useless by themselves. In the short run, an increase in the price of shovels will result inA) fewer shovels being purchased.B) more workers being hired.C) a decrease in the firm's output.D) no change in the firm's output.Answer: DTopic: Short-run Costs23) Which of the following will cause the marginal cost curve of making cigarettes to shift?A) A $5 million penalty charged to each cigarette maker.B) A $1 per pack tax on cigarettes.C) A $1 million advertising campaign by the American Cancer Society.D) All of the above.Answer: BTopic: Short-run Costs24) Which of the following will cause the average cost curve of making cigarettes to shift?A) A $5 million penalty charged to each cigarette maker.B) A $1 per pack tax on cigarettes.C) A $1 an hour wage increase paid to all cigarette production workers.D) All of the above.Answer: DTopic: Short-run Costs25) Which of the following will cause the average fixed cost curve of making cigarettes to shift?A) A $5 million penalty charged to each cigarette maker.B) A $1 per pack tax on cigarettes.C) A $3 per hour wage increase.D) An increase in the demand for cigarettes.Answer: ATopic: Short-run Costs26) A specific tax of $1 per unit of output will affect a firm'sA) average total cost, average variable cost, average fixed cost, and marginal cost.B) average total cost, average variable cost, and average fixed cost.C) average total cost, average variable cost, and marginal cost.D) marginal cost only.Answer: CTopic: Short-run CostsFor the following, please answer "True" or "False" and explain why.27) The "Law of Diminishing Marginal Returns" could also be termed the "Law of Increasing Marginal Costs."Answer: True. Since MC = w/MP L in the short run, the fact that MPL eventually declines means that MC must eventually increase.Topic: Short-run Costs28) The marginal cost curve intersects the average fixed cost curve at its minimum.Answer: False. Marginal cost intersects average variable cost (and average cost) at its minimum.Topic: Short-run Costs29) A consumer purchases a book by driving across town to a bookstore, standing in line for five minutes to pay the cashier, and then pays $5. The same book is purchased by another consumer who spends 2 minutes placing the order over the internet for $10. The book necessarily cost the first consumer less.Answer: False. The opportunity cost of driving across town and standing in line may have raised the total cost of the book to the first consumer to more than $10.Topic: Short-run Costs30) A firm's production function for pretzels is shown in the above figure. If the firm's fixed cost equals $100 per time period and the wage rate equals $1 per unit of labor per time period, calculate the firm's MC, AVC, and AC schedules. Do these cost functions follow the general rules concerning the relationships between MC, AVC and AC?Answer:❑✌☞ ✌✞✌ MC > AVC, AVC is rising.MC < AC, AC is falling.Topic: Short-run Costs31) Explain why the marginal cost curve intersects a U-shaped average cost curve at its minimum point. Answer: At low quantities, the average cost curve declines as the quantity increases. The marginal cost is below the average cost. The marginal cost represents the cost of an additional unit of production. Thus, as the marginal cost curve declines, this pulls the average cost down from its previous level. Then, the marginal cost curve will begin to rise. However, the marginal cost is still below the average cost, which will continue to lower the average cost. When the two costs are equal the marginal cost will leave the average cost unchanged. Then, the marginal cost will be above the average cost so it will start to pull up the average cost. Thus, the marginal cost curve will intersect the average cost curve at its minimum point.Topic: Short-run Costs7.3 Long-Run Costs1) In the long run, fixed costs areA) sunk.B) avoidable.C) larger than in the short run.D) not included in production decisions.Answer: BTopic: Long-run Costs2) The slope of the isocost line tells the firm how muchA) capital must be reduced to keep total cost constant when hiring one more unit of labor.B) capital must be increased to keep total cost constant when hiring one more unit of labor.C) more expensive a unit of capital costs relative a unit of labor.D) the isocost curve will shift outward if the firm wishes to produce more.Answer: ATopic: Long-run Costs3) Which of the following does NOT represent a possible shape of the long-run average cost curve?A) downward-slopingB) upward-slopingC) U-shapedD) verticalAnswer: DTopic: Long-run Costs4) The slope of the isoquant tells the firm how muchA) output increases when labor increases by one unit.B) output increases when capital and labor are doubled.C) capital must decrease to keep output constant when labor increases by one unit.D) a unit of capital costs relative to the cost of labor.Answer: CTopic: Long-run Costs5) If an isocost line crosses the isoquant twice, a cost minimizing firm willA) use a different isocost line to select the bundle of inputs.B) use the input bundle associated with the intersection on the higher point of the isoquant.C) use the input bundle associated with the intersection on the lower point of the isoquant.D) Both B and C.Answer: ATopic: Long-run Costs6) When the isocost line is tangent to the isoquant, thenA) MRTS = w/r.B) the firm is producing that level of output at minimum cost.C) the last dollar spent on capital yields as much extra output as the last dollar spent on labor.D) All of the above.Answer: DTopic: Long-run Costs7) A firm can minimize cost byA) picking the bundle of inputs where the lowest isocost line touches the isoquant.B) picking the bundle of inputs where the isoquant is tangent to the isocost line.C) picking the bundle of inputs where the last dollar spent on one input gives as much extra output as the last dollar spent on any other input.D) All of the above.Answer: DTopic: Long-run Costs8) When the isocost line is tangent to the isoquant, thenA) MPL = MPK.B) the firm is producing that level of output at minimum cost.C) the firm has achieved the right economies of scale.D) All of the above.Answer: BTopic: Long-run Costs9) If the wage in increases the isocost line willA) stay the same.B) shift outward in parallel fashion.C) rotate inward around the point where only capital is employed in production.D) shift inward in parallel fashion.Answer: CTopic: Long-run Costs10) If the isoquants are straight lines or L-shaped, then a cost-minimizing firm willA) not be able to minimize costs.B) find the lowest isocost line touching the relevant isoquant.C) find the highest isocost line touching the relevant isoquant.D) choose not to produce any output.Answer: BTopic: Long-run Costs11) If the marginal rate of technical substitution for a cost minimizing firm is 10, and the wage rate for labor is $5, what is the rental rate for capital in dollars?A) .5B) 1C) 2D) 10Answer: ATopic: Long-run Costs12) Suppose MPL = 0.5 * (q/L) and MPK = 0.5 * (q/K). In the long run, the firm will hire equal amounts of capital and laborA) all of the time.B) only when w = r.C) only when w = 0.5 * r.D) at no point in time.Answer: BTopic: Long-run Costs13) Suppose that each worker must use only one shovel to dig a trench, and shovels are useless by themselves. In the long run, an increase in the price of shovels will result inA) fewer shovels being purchased to produce the same number of trenches.B) more workers being hired to produce the same number of trenches.C) the firm wishing to produce more trenches.D) no change in the firm's input mix.Answer: DTopic: Long-run Costs14) Suppose that each worker must use only one shovel to dig a trench, and shovels are useless by themselves. In the long run, the firm will experienceA) increasing returns to scale.B) constant returns to scale.C) decreasing returns to scale.D) The returns to scale cannot be determined from the information provided.Answer: BTopic: Long-run Costs15) Suppose that each worker must use only one shovel to dig a trench, and shovels are useless by themselves. In the long run, the firm's cost function isA) TC = (w/r) * q.B) TC = (w + r)/q.C) TC = (w + r).D) TC = (w + r) * q.Answer: DTopic: Long-run Costs16) At the XYZ Co., a unit of capital costs 3 times as much as a unit of labor. If the isoquants are convex, and the firm does not change its input mix in the long run, we can conclude thatA) MPK = 3 * MP L.B) the firm will not hire any capital.C) the firm will hire 3 times as much labor as capital.D) the firm will hire 3 times as much capital as labor.Answer: ATopic: Long-run Costs17) The production of cigarettes is highly automated; however, a worker is required to monitor each machine. Machines and workers do not interact with one another. Given this information, there are most likelyA) economies of scale.B) economies of scope.C) constant returns to scale.D) increasing returns to scale.Answer: CTopic: Long-run Costs18) Suppose that capital and labor must be kept in a fixed proportion to produce a particular good. For example, digging a trench requires one worker who has one shovel. What does this imply about returns to scale?A) There are constant returns to scale.B) There are increasing returns to scale.C) There are decreasing returns to scale.D) Nothing.Answer: ATopic: Long-run Costs19) A change in relative factor prices will always result inA) a change in the slope of the isoquants.B) a tangency between the new isocost line and a new isoquant.C) a rotation of the isocost lines.D) All of the above.Answer: CTopic: Long-run Costs20) Assuming that w and r are both positive, if the long-run expansion path is horizontal, thenA) MP K = 0.B) MRTS is a function of capital only.C) w = r.D) All of the above.Answer: BTopic: Long-run Costs21) The above figure shows the long-run expansion path. The long-run average cost curve will beA) horizontal.B) downward sloping.C) upward sloping.D) vertical.Answer: BTopic: Long-run Costs22) The long run average cost curve may initially slope downward due toA) decreasing average fixed costs.B) increasing marginal returns.C) economies of scale.D) All of the above.Answer: CTopic: Long-run Costs23) If a production function is represented as q = LαKβ, the long-run average cost curve will be horizontal as long asA) a + b = 0.B) a + b = 1.C) q > 0.D) L = K.Answer: BTopic: Long-run Costs24) If there are diseconomies of scale within a given range of output, which of following is(are) TRUE?A) The short-run average cost curve must be upward sloping within that range of output.B) The long-run average cost curve must be upward sloping within that range of output.C) Long-run average cost must equal short-run average cost.D) All of the above.Answer: BTopic: Long-run Costs25) The total cost of producing one unit is $50. The total cost of producing two units is $75. At a production level of two units, the cost function exhibitsA) economies of scale.B) rising average costs.C) increasing marginal costs.D) constant returns to scale.Answer: ATopic: Long-run CostsFor the following, please answer "True" or "False" and explain why.26) If increasing returns to scale are present, the long-run average cost increases as more output is produced. Answer: False. Increasing returns to scale imply that with a doubling of inputs, output more than doubles. Since average cost is the ratio of total cost divided by output, this increase in inputs will cause the numerator to be just double the old value while the new denominator is more than double the old value. As a result, long-run average cost falls as more output is produced.Topic: Long-run Costs27) Economies of scale and Increasing Returns to Scale are the same thing looked at from either the production or cost perspective.Answer: False. Increasing returns to scale imply economies of scale but the reverse is not true. A firm can experience economies of scale for other reasons (without increasing returns to scale)Topic: Long-run Costs28) Explain the difference between fixed costs in the short run and fixed costs in the long run.Answer: In the short run fixed costs are sunk; in the long run, fixed costs are avoidable.Topic: Long-run Costs29) What are the functions for MC and AC if TC = 100q + 100q2? Are the returns to scale increasing, decreasing, or constant?Answer: MC = 100 + 200qAC = 100 + 100qSince AC increases with an increase in output, there are decreasing returns to scale.Topic: Long-run Costs30) Explain how a firm can have constant returns to scale in production and economies of scale in cost. Answer: A firm can have constant returns to scale in production at every output level. If the firm doubled all inputs the output would double. However, the firm may have a decreasing average cost. As more inputs areused and output increases, the average cost declines, which is known as economies of scale.Topic: Long-run Costs31) Explain why the long-run total cost curve, not the short-run total cost curve, shows the lowest cost of producing any level of output. Is there an exception?Answer: In the long run, all costs are variable so the firm can select the least-cost mix of all inputs to produce any given quantity. The exception would be at minimum long-run cost where min. LR and min. SR costs are equal.Topic: Long-run Costs32) A local non-profit group prints a weekly newsletter. Professional typists earn $10 per hour and can type 2 pages per hour. Unpaid volunteers can type only 1 page per hour. Measuring hours of professional typist services on the vertical axis and hours of unpaid volunteer typist services on the horizontal axis, draw the relevant isoquant and isocost curves if the newsletter is 10 pages long. What input mix is chosen by the non-profit group if they wish to minimize the cost of the newsletter? If the group will reimburse volunteers for expenses (lunch, driving), how much must the reimbursement be for your answer to change? Answer:See the above figure. The isoquant is a straight line with a slope of 1/2. The group can use either 5 pros, 10 volunteers, or some combination of the two. The isocost curves are horizontal since volunteers are free. As a result, the lowest isocost curve is achieved by hiring all volunteers. If the group reimbursed volunteers for expenses (lunch, driving, etc.) then the group will still hire all volunteers as long as they do not cost more than $5 per hour.Topic: Long-run Costs33) A firm pays $5 for each unit of capital. Labor costs $5 per hour for the first 10 hours and $10 per hour for every hour thereafter. Draw the isocost curves for total costs of $50 and $100.Answer:See the above figure.Topic: Long-run Costs34) To dig a trench, each worker needs a shovel. Workers can use only one shovel at a time. Workers without shovels do nothing, and shovels cannot operate on their own. Graphically determine the number of shovels and workers used by a firm to dig 2 trenches when:(a) w = 10 and r = 10(b) w = 10 and r = 5Answer:See the above figure. Because the production process requires fixed proportions of K and L, the firm cannot change input mix when the relative factor costs change.Topic: Long-run Costs35) Suppose the production function is q = 12 L0.25K0.75. Determine the long-run capital-to-labor ratio (K/L) if the cost a unit of capital (r) is three times the cost of a unit of labor (w).Answer: The firm minimizes costs by setting MRTS = w/r. MRTS = MP L/MP K = K/3L = 1/3 = w/r. This firm will set K/L equal to one.Topic: Long-run Costs36) "If the wage rate paid to one form of labor is twice the cost of another form of labor, the first type of labor must be twice as productive." Comment.Answer: This is true. Firms minimize cost by setting the ratio of marginal productivity per unit cost equally across all inputs. If one form of labor is twice as expensive as another, the firm will want the MP of the first type of labor to be twice that of the second.Topic: Long-run Costs。

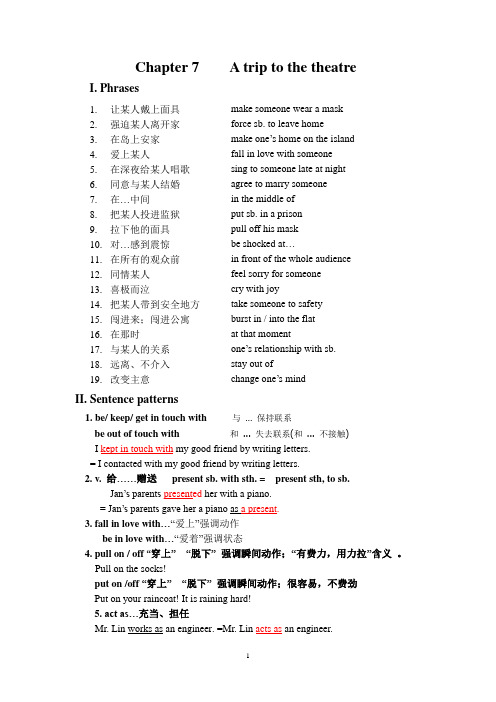

Chapter 7 A trip to the theatre答案(1)1

Chapter 7 A trip to the theatreI. Phrases 1. 让某人戴上面具 2. 强迫某人离开家 3. 在岛上安家 4. 爱上某人 5. 在深夜给某人唱歌 6. 同意与某人结婚 7. 在…中间 8. 把某人投进监狱 9. 拉下他的面具 10. 对…感到震惊 11. 在所有的观众前 12. 同情某人 13. 喜极而泣 14. 把某人带到安全地方 15. 闯进来;闯进公寓 16. 在那时 17. 与某人的关系 18. 远离、不介入 19. 改变主意 II. Sentence patterns1. be/ keep/ get in touch with 与 … 保持联系be out of touch with 和 ... 失去联系(和 ... 不接触)I kept in touch with my good friend by writing letters.= I contacted with my good friend by writing letters.2. v. 给……赠送 present sb. with sth. = present sth, to sb.Jan’s parents presented her with a piano.= Jan’s parents gave her a piano as a present.3. fall in love with …“爱上”强调动作be in love with …“爱着”强调状态4. pull on / off “穿上” “脱下” 强调瞬间动作;“有费力,用力拉”含义 。

Pull on the socks!put on /off “穿上” “脱下” 强调瞬间动作;很容易,不费劲Put on your raincoat! It is raining hard!5. act as…充当、担任 Mr. Lin works as an engineer. =Mr. Lin acts as an engineer.make someone wear a maskforce sb. to leave homemake one ’s home on the islandfall in love with someonesing to someone late at nightagree to marry someonein the middle ofput sb. in a prisonpull off his maskbe shocked at …in front of the whole audiencefeel sorry for someonecry with joytake someone to safetyburst in / into the flatat that momentone ’s relationship with sb.stay out ofchange one ’s mind6. so… that …. “如此…以致…”也可以跟“too…to…”转换。

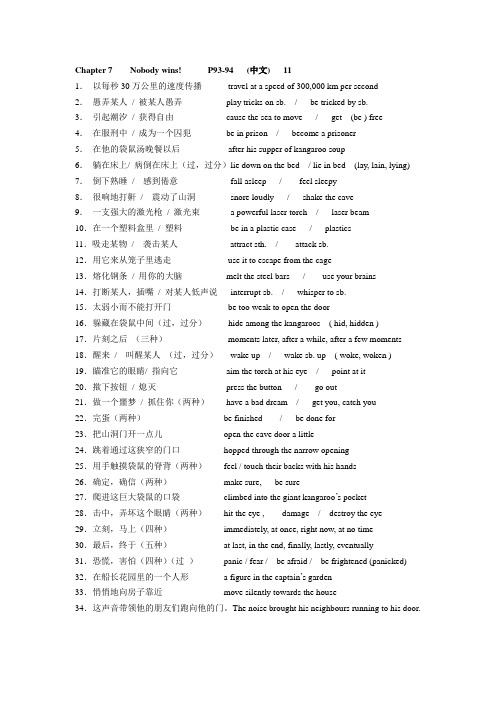

Chapter 7 Nobody wins 11

Chapter 7 Nobody wins! P93-94 (中文) 111.以每秒30万公里的速度传播travel at a speed of 300,000 km per second2.愚弄某人/ 被某人愚弄play tricks on sb. / be tricked by sb.3.引起潮汐/ 获得自由cause the sea to move / get (be ) free4.在服刑中/ 成为一个囚犯be in prison / become a prisoner5.在他的袋鼠汤晚餐以后after his supper of kangaroo soup6.躺在床上/ 病倒在床上(过,过分)lie down on the bed / lie in bed (lay, lain, lying) 7.倒下熟睡/ 感到倦意fall asleep / feel sleepy8.很响地打鼾/ 震动了山洞snore loudly / shake the cave9.一支强大的激光枪/ 激光束 a powerful laser torch / laser beam10.在一个塑料盒里/ 塑料be in a plastic case / plastics11.吸走某物/ 袭击某人attract sth. / attack sb.12.用它来从笼子里逃走use it to escape from the cage13.熔化钢条/ 用你的大脑melt the steel bars / use your brains14.打断某人,插嘴/ 对某人低声说interrupt sb. / whisper to sb.15.太弱小而不能打开门be too weak to open the door16.躲藏在袋鼠中间(过,过分)hide among the kangaroos ( hid, hidden )17.片刻之后(三种)moments later, after a while, after a few moments 18.醒来/ 叫醒某人(过,过分)wake up / wake sb. up ( woke, woken ) 19.瞄准它的眼睛/ 指向它aim the torch at his eye / point at it20.揿下按钮/ 熄灭press the button / go out21.做一个噩梦/ 抓住你(两种)have a bad dream / get you, catch you22.完蛋(两种)be finished / be done for23.把山洞门开一点儿open the cave door a little24.跳着通过这狭窄的门口hopped through the narrow opening25.用手触摸袋鼠的脊背(两种)feel / touch their backs with his hands26.确定,确信(两种)make sure, be sure27.爬进这巨大袋鼠的口袋climbed into the giant kangaroo’s pocket28.击中,弄坏这个眼睛(两种)hit the eye , damage / destroy the eye29.立刻,马上(四种)immediately, at once, right now, at no time30.最后,终于(五种)at last, in the end, finally, lastly, eventually31.恐慌,害怕(四种)(过)panic / fear / be afraid / be frightened (panicked) 32.在船长花园里的一个人形 a figure in the captain’s garden33.悄悄地向房子靠近move silently towards the house34.这声音带领他的朋友们跑向他的门。

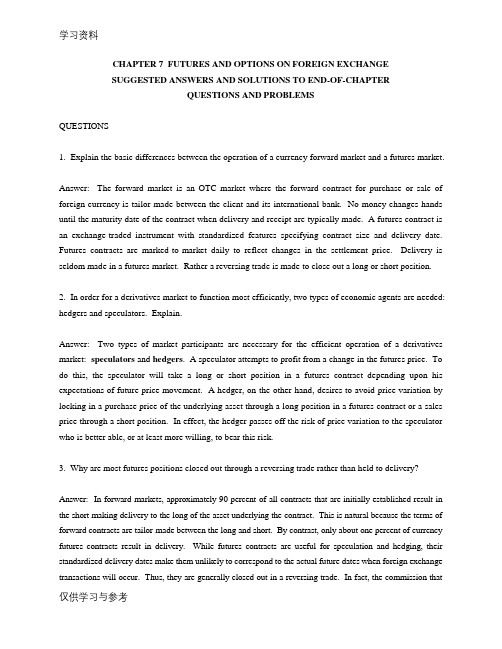

CCNA_EWAN_Chapter_7_答案

参加考试- EWAN Chapter 7 - CCNA Exploration: 接入WAN (版本 4.0)1主管要求技术人员在尝试排除NAT 连接故障之前总是要清除所有动态转换。

主管为什么提出这一要求?主管希望清除所有的机密信息,以免被该技术人员看见。

因为转换条目可能在缓存中存储很长时间,主管希望避免技术人员根据过时数据进行决策。

转换表可能装满,只有清理出空间后才能进行新的转换。

清除转换会重新读取启动配置,这可以纠正已发生的转换错误。

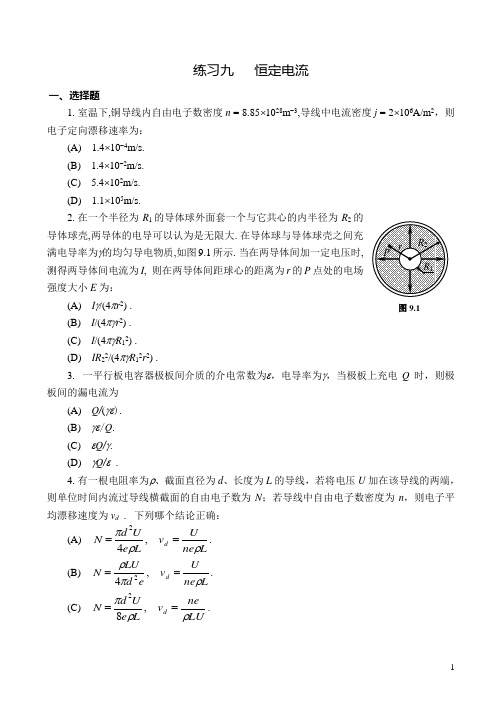

2请参见图示。

技术人员使用SDM 为一台Cisco 路由器输入了NAT 配置。

哪种说法正确描述了配置结果?内部用户会看到192.168.1.3 使用端口8080 发来了一个web 流量。

地址172.16.1.1 会被转换为以192.168.1.3 开头的地址池中的一个地址。

外部用户会看到192.168.1.3 使用端口80 发来了一个请求。

外部用户必须将流量发往端口8080 才能到达地址172.16.1.1。

3请参见图示。

R1 为网络10.1.1.0/24 执行NAT,R2 为网络192.168.1.2/24 执行NAT。

主机A 与网络服务器通信时,主机A 在其IP 报头中加的地址是什么?10.1.1.1172.30.20.2192.168.1.2255.255.255.2554网络管理员应该使用哪种NAT 来确保外部网络一直可访问内部网络中的web 服务器?NAT 过载静态NAT静态NATPAT5请参见图示。

流出R1 的流量转换失败。

最可能出错的是配置的哪个部分?ip nat pool语句access-list语句ip nat inside配置在错误的接口上接口s0/0/2 应该拥有一个私有IP 地址6网络管理员希望将两个IPv6 岛连接起来。

最简单的方式是通过仅使用IPv4 设备的公共网络来连接。

哪种简单的解决方案可解决此问题?将公共网络中的设备替换为支持IPv6 的设备。

国际金融Chapter 7

ANSWER:

A

4. If the interest rate is higher in the U.S. than in the United Kingdom, and if the forward rate of the British pound (in U.S. dollars) is the same as the pound’s spot rate, then: A) U.S. investors could possibly benefit from covered interest arbitrage. B) British investors could possibly benefit from covered interest arbitrage. C) neither U.S. nor British investors could benefit from covered interest arbitrage. D) U.S. and British investors could possibly benefit from covered interest arbitrage.

A) B)

C)

D)

As locational arbitrage occurs: the bid rate for pounds at Bank A will increase; the ask rate for pounds at Bank B will increase. the bid rate for pounds at Bank A will increase; the ask rate for pounds at Bank B will decrease. the bid rate for pounds at Bank A will decrease; the ask rate for pounds at Bank B will decrease. the bid rate for pounds at Bank A will decrease; the ask rate for pounds at Bank B will increase.

国际财务管理课后习题答案chapter 7doc资料