曼昆宏观经济学第七版英文课件第八章

曼昆《经济学原理》(宏观经济学分册)英文原版PPT课件

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

THE ECONOMY’S INCOME AND EXPENDITURE

• When judging whether the economy is doing well or poorly, it is natural to look at the total income that everyone in the economy is earning.

Y = C + I + G + NX

© 2007 Thomson South-Western

THE COMPONENTS OF GDP

• Consumption (C):

• The spending by households on goods and services, with the exception of purchases of new housing.

© 2007 Thomson South-Western

THE MEASUREMENT OF GROSS DOMESTIC PRODUCT

• The equality of income and expenditure can be illustrated with the circular-flow diagram.

曼昆宏观经济学第七版英文课件第八章

Consists of: k to replace depreciating capital

n k to provide capital for new workers g k to provide capital for the new “effective”

CHAPTER 8

Economic Growth II

5

Technological progress in the Solow model

We now write the production function as:

where L ×E = the number of effective workers. Increases in labor efficiency have the

If true, then the income gap between rich & poor

countries would shrink over time, causing living standards to “converge.”

In real world, many poor countries do NOT grow

CHAPTER 8Fra bibliotekEconomic Growth II

3

Examples of technological progress

From 1950 to 2000, U.S. farm sector productivity

中文曼昆宏观经济学第七版讲义

13

Assumptions about capital flows

a. domestic & foreign bonds are perfect substitutes (same risk, maturity, etc.)

b. perfect capital mobility: no restrictions on international trade in assets

I (r* )

S, I

CHAPTER 5 The Open Economy

15

If the economy were closed…

r

…the interest rate would adjust to equate investment

and saving: rc

S

I (r )

CHAPTER 5 The Open Economy

I (rc ) S

S, I

16

But in a small open economy…

r

the exogenous

world interest

rate determines

investment…

r*

…and the

difference

rc

between saving

and investment

determines net

5

The national income identity in an open economy

Y = C + I + G + NX

or, NX = Y – (C + I + G )

net exports

昆曼围观经济学原理英文课件第八章

A PB B D C E

S

PS

F

D

QT

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

P

A PB B D C E

S

PS

F

D

QT

QE

Q

7

The Effects of a Tax

P

C + E is called the deadweight loss (DWL) of the tax, the fall in total surplus that results from a market distortion, such as a tax.

Wojciech Gerson (1831-1901)

Economics

Principles of

In this chapter, look for the answers to these questions

• How does a tax affect consumer surplus,

producer surplus, and total surplus?

Review from Chapter 6

A tax drives a wedge between the price buyers pay and the price sellers receive. raises the price buyers pay and lowers the price sellers receive. reduces the quantity bought & sold. These effects are the same whether the tax is imposed on buyers or sellers, so we do not make this distinction in this chapter.

曼昆《经济学原理》(宏观经济学分册)英文原版PPT课件

THE COMPONENTS OF GDP • GDP includes all items produced in the economy and sold legally n markets. • What Is Not Counted in GDP?

– Every transaction has a buyer and a seller. – Every dollar of spending by some buyer is a dollar of income for some seller.

© 2007 Thomson South-Western

Y = C + I + G + NX

© 2007 Thomson South-Western

THE COMPONENTS OF GDP • Consumption (C):

• The spending by households on goods and services, with the exception of purchases of new housing. • Investment (I):

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

© 2007 Thomson South-Western

Table 2 Real and Nominal GDP

• “. . . Final . . .” – It records only the value of final goods, not intermediate goods (the value is counted only once).

中文曼昆宏观经济学第七版讲义

▪ Foreigners owned $21.1 trillion worth of

U.S. assets

▪ U.S. net indebtedness to rest of the world:

$2.7 trillion--higher than any other country, hence U.S. is the “world’s largest debtor nation”

Y = C + I + G + NX

or, NX = Y – (C + I + G )

net exports

output

domestic spending

CHAPTER 5 The Open Economy

6

Trade surpluses and deficits

NX = EX – IM = Y – (C + I + G )

are determined

▪ how policies affect trade balance &

exchange rate

Imports and exports (% of GDP), 2019

In an open economy, ▪ spending need not equal output ▪ saving need not equal investment

▪ trade surplus:

output > spending and exports > imports Size of the trade surplus = NX

▪ trade deficit:

曼昆经济学原理英文课件Chap08

Price sellers receive

Size of tax (T)

Supply

Quantity sold (Q)

0

Quantity Quantity

with tax without tax

Demand

Quantity

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc.

It does not matter whether a tax on a good is levied on buyers or sellers of the good…the price paid by buyers rises, and the price received by sellers falls.

Tax Distortions and Elasticities...

Price

(d) Elastic Demand Supply

Size of tax

0

When demand is relatively elastic, the deadweight loss of a tax is large.

How a Tax Affects Welfare...

Price

Tax reduces consumer surplus by (B+C) and producer surplus by (D+E)

Price

buyers

A

pay = PB

Tax revenue = (B+D) Supply

Price

Size of tax

Supply

第七版-曼昆宏观经济学课件

18

两部门国民收入流量循环图

生产要素市场

Y

工资,租金,利息,利润

家 庭 储蓄 金融机构 投资 企 业

S

I

购买各种产品和劳务

C 商品市场

总收入

2019/12/31

C+S =Y= C+I

总支出

19

三部门国民收入流量循环图

TR

G

政府

TA1 Y

TA2

家庭 S

金融机构 I

总

收 入

C

C+S+(TA-TR)= Y = C+I+G

5) GDP 是一国范围内生产的最终产品和 劳务的市场价值。

6) GDP一般仅指市场活动导致的价值。

2019/12/31

6

3.名义的GDP和实际的GDP

1) 名义的GDP(Nominal GDP)

以一定时期市场价格表示的国内生产

总值,称作该时期的名义的GDP。

2) 实际的GDP(Real GDP)

3. 国民收入(NI)National Income NI = NDP-间接税-企业转移支付+政府补贴

4.个人收入(PI)Personal Income PI=NI-公司未分配利润-公司所得税-社会保险

税+政府对个人的转移支付 5. 个人可支配收入(PDI)

Personal Disposable Income PDI = PI - 个人所得税

2019/12/31

12

部门法

一块面包的GDP的部门法核算

生产部门

市场价值(元) 附加价值(元)

农资公司(种子化肥)

0.10

0.10

农场(种小麦)

布兰查德宏观经济学第七版第7版英文版chapter (8)

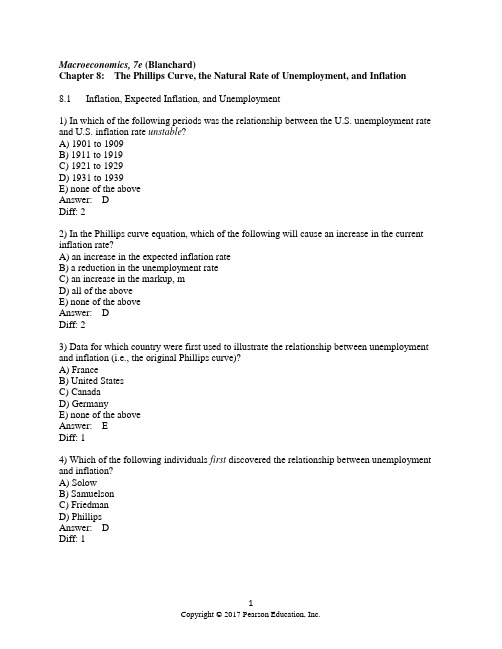

Macroeconomics, 7e (Blanchard)Chapter 8: The Phillips Curve, the Natural Rate of Unemployment, and Inflation8.1 Inflation, Expected Inflation, and Unemployment1) In which of the following periods was the relationship between the U.S. unemployment rate and U.S. inflation rate unstable?A) 1901 to 1909B) 1911 to 1919C) 1921 to 1929D) 1931 to 1939E) none of the aboveAnswer: DDiff: 22) In the Phillips curve equation, which of the following will cause an increase in the current inflation rate?A) an increase in the expected inflation rateB) a reduction in the unemployment rateC) an increase in the markup, mD) all of the aboveE) none of the aboveAnswer: DDiff: 23) Data for which country were first used to illustrate the relationship between unemployment and inflation (i.e., the original Phillips curve)?A) FranceB) United StatesC) CanadaD) GermanyE) none of the aboveAnswer: EDiff: 14) Which of the following individuals first discovered the relationship between unemployment and inflation?A) SolowB) SamuelsonC) FriedmanD) PhillipsAnswer: DDiff: 15) Which of the following individuals first discovered the relationship between unemployment and inflation for the United States?A) Solow and FriedmanB) Samuelson and SolowC) Friedman and PhillipsD) Friedman and PhelpsAnswer: BDiff: 16) Explain what is meant by the "wage-price" spiral.Answer: The wage-price spiral refers to the effects of low unemployment on inflation. Specifically, when the unemployment rate falls, the nominal wage will rise. As W rises, firms' costs increase causing them to increase prices. As prices rise, workers will later ask for increases in the nominal wage. This increase in W again causes firms' costs and prices to rise and the process repeats itself.Diff: 17) Based on the 'early incarnation' of the Phillips curve, explain what effect an increase in the unemployment rate will have on the inflation rate.Answer: An increase in u will cause a reduction in W. As W falls, firms' costs fall. As firms' costs fall, they will reduce the price level. This reduction in the price level represents, in this case, deflation.Diff: 28.2 The Philips Curve and Its Mutations1) Since approximately 1970, the most stable Phillips-type relationship for the United States has been between which of the following?A) the rate of inflation and the change in the unemployment rateB) the unemployment rate and the change in the rate of inflationC) the change in the unemployment rate and the change in the rate of inflationD) the inverse of the unemployment rate and the rate of inflationE) the unemployment rate and the rate of inflationAnswer: BDiff: 22) Which of the following assumptions best characterized the assumption about how individuals formed expectations of inflation by the early 1970s?A) Expected inflation for the current year was smaller than the previous year's inflation rate.B) Expected inflation for the current year was approximately equal to the previous year's inflation rate.C) Expected inflation for the current year was less than the previous year's inflation rate.D) Expected inflation for the current year equal to the average inflation rate over the past five years.E) Expected inflation for the current year equal to the average inflation rate over the past ten years.Answer: BDiff: 23) When inflation has not been very persistent, as was the case in the United States before the mid-1960s, we can expect thatA) the expected price level for a given year will equal the previous year's actual price level.B) the current inflation rate will not depend heavily on past years' inflation rates.C) lower unemployment rates will be associated with higher inflation rates.D) all of the aboveE) none of the aboveAnswer: DDiff: 24) When inflation has been persistent, as was the case in the United States during the 1970s, low unemployment rates will likely be associated withA) low natural rates of unemployment.B) high natural rates of unemployment.C) low but stable rates of inflation.D) high but stable rates of inflation.E) increases in the inflation rate.Answer: EDiff: 25) For this question, assume that individuals form expectations of inflation according to the following equation πe t= θπt-1. From 1970 on, the value of θ for this equationA) increased over time and approached 1.B) decreased over time and approached zero.C) remained constant at zero.D) remained constant at negative one.E) none of the aboveAnswer: ADiff: 26) For this question, assume that the Phillips curve equation is represented by the following equation:πt - πt-1 = (m + z) - αu t. A reduction in the unemployment rate will causeA) a reduction in the markup over labor costs (i.e., a reduction in m).B) an increase in the markup over labor costs.C) an increase in the inflation rate over time.D) a decrease in the inflation rate over time.E) none of the aboveAnswer: DDiff: 27) For this question, assume that the expected rate of inflation is a function of past year's inflation. Also assume that the unemployment rate has greater than the natural rate of unemployment for a number of years. Given this information, we know thatA) the rate of inflation will approximately be equal to zero.B) the rate of inflation should neither increase nor decrease.C) the rate of inflation should steadily increase over time.D) the rate of inflation should steadily decrease.E) the inflation rate will be approximately equal to the natural rate of unemployment. Answer: DDiff: 28) The original Phillips curve implied or assumed thatA) the markup over labor costs was zero.B) the expected rate of inflation would be zero.C) the actual and expected rates of inflation would always be equal.D) all of the aboveE) none of the aboveAnswer: BDiff: 29) For this question, assume that the Phillips curve equation is represented by the following equation:πt - πt-1 = (m + z) - αu t. Given this information, the natural rate of unemployment will be equal toA) m + z.B) (m + z - α).C) α(m + z).D) 0.E) none of the aboveAnswer: EDiff: 210) For this question, assume that the Phi llips curve equation is represented by the following: πt - πt-1 = (m + z) - αu t. Which of the following will cause a reduction in the natural rate of unemployment?A) an increase in mB) an increase in zC) an increase in αD) an increase in actual inflationE) an increase in expected inflationAnswer: CDiff: 211) For this question, assume that the Phillips curve equation is represented by the following: πt - πt-1 = (m + z) - αu t. Which of the following will not cause an increase in the natural rate of unemployment?A) a reduction in mB) a reduction in zC) an increase in αD) an increase in the expected rate of inflationE) all of the aboveAnswer: DDiff: 212) Use the following Phillips curve equation to answer this question: πt - πt-1 = (m + z) - αu t. Which of the following will cause an increase in the natural rate of unemployment?A) a reduction in mB) an increase in zC) an increase in αD) a reduction in expected inflationE) none of the aboveAnswer: BDiff: 213) In which of the following decades did the Phillips curve break down for the U.S.?A) 1940sB) 1950sC) 1960sD) none of the aboveAnswer: DDiff: 114) Assume that expected inflation is based on the following: πe t= θπt-1. An increase in θ will causeA) an increase in the natural rate of unemployment.B) a reduction in the natural rate of unemployment.C) no change in the natural rate of unemployment.D) inflation in period t to be more responsive to changes in unemployment in period t. Answer: CDiff: 215) Assume that expected inflation is based on the following: πe t= θπt-1. If θ = 0, we know thatA) a reduction in the unemployment rate will have no effect on inflation.B) low rates of unemployment will cause steadily increasing rates of inflation.C) high rates of unemployment will cause steadily declining rates of inflation.D) the Phillips curve illustrates the relationship between the level of inflation rate and the level of the unemployment rate.Answer: DDiff: 216) Assume that expected inflation is based on the following: πe t= θπt-1. If θ = 1, we know thatA) a reduction in the unemployment rate will have no effect on inflation.B) low rates of unemployment will cause steadily increasing rates of inflation.C) the actual unemployment rate will not deviate from the natural rate of unemployment.D) the Phillips curve illustrates the relationship between the level of inflation rate and the level of the unemployment rate.Answer: BDiff: 217) Suppose policy makers underestimate the natural rate of unemployment. In a situation like this, policy makers might implement a policy thatA) attempts to maintain output below the natural level of output.B) results in deflation.C) both A and BD) results in steadily rising inflation.Answer: DDiff: 218) During which decade did the original Phillips curve break down? Also, briefly explain why the original Phillips curve broke during this period.Answer: The original Phillips curve broke down in the United States in the 1970s. First, the United States was affected by oil shocks that would cause an increase in both inflation and the unemployment rate. Second, individuals changed the way they formed expectations of prices. Rather than assume that this year's price level would be equal to last year's price level (i.e., zero expected inflation), individuals started to assume that previous inflation would persist.Diff: 219) Explain how the original Phillips curve differs from the expectations-augmented Phillips curve (or the modified, or accelerationist Phillips curve).Answer: The original Phillips curve did not take into account the effects of changes in expected inflation on inflation. The expectations-augmented Phillips curve did allow for changes in expected inflation to affect actual inflation.Diff: 28.3 The Philips Curve and the Natural Rate of Unemployment1) Which of the following will not cause an increase in the natural rate of unemployment?A) an increase in mB) an increase in zC) an increase in the expected inflation rateD) a reduction in mE) none of the aboveAnswer: CDiff: 22) Since 1970, the evidence for the U.S. suggests that the average rate of unemployment required to keep inflation constant has beenA) between 1% and 2%.B) between 2% and 3%.C) between 3% and 4%.D) between 9% and 10%.E) none of the aboveAnswer: EDiff: 23) The evidence for the U.S. suggests that the natural rate of unemployment hasA) increased by more than 5% since the 1960s.B) increased by 1 to 2% since the 1960s.C) decreased from 2000-2007, lower than it had been in the 1980s.D) decreased by more than 5% since the 1960s.E) fluctuated over time since the 1960s.Answer: CDiff: 14) When a worker's nominal wage is indexed, the nominal wage is usually automatically adjusted based on movements in which of the following variables?A) productivityB) the price of the firm's productC) the average wage in the countryD) the average wage in the industryE) none of the aboveAnswer: EDiff: 15) If a country experiences persistently low inflation, which of the following tends NOT to occur?A) wage indexation will become less importantB) nominal wages will be set for shorter periods of timeC) the markup over labor costs will decreaseD) all of the aboveAnswer: ADiff: 26) Which of the following will tend to occur as a result of a reduction in the proportion of a country's workers who have indexed wages?A) the unemployment rate will be relatively low.B) the unemployment rate will be relatively high.C) the inflation rate will be relatively low.D) a given change in the unemployment rate will cause a relatively smaller change in the inflation rate.E) none of the aboveAnswer: DDiff: 27) Which of the following does not represent a "labor market rigidity" to which critics refer when discussing unemployment in Europe?A) generous unemployment insuranceB) restrictive monetary and fiscal policiesC) a high degree of employment protectionD) relatively high minimum wagesE) none of the aboveAnswer: BDiff: 18) Suppose policy makers overestimate the natural rate of unemployment. In situations like these, policy makers will likely implement policies that result inA) less unemployment than necessary.B) an unemployment rate that is "too low."C) a lower inflation rate than necessary.D) a steadily increasing inflation rate.E) overly expansionary monetary and fiscal policy.Answer: CDiff: 29) Which of the following is one possible explanation for the change in the natural rate of unemployment in the United States during the 1970s?A) contractionary fiscal policyB) an increase in the proportion of labor contracts that were indexedC) contractionary monetary policyD) all of the aboveE) none of the aboveAnswer: EDiff: 210) Which of the following will most likely cause a change in the natural rate of unemployment?A) changes in monetary policyB) changes in fiscal policyC) changes in expected inflationD) all of the aboveE) none of the aboveAnswer: CDiff: 211) An increase in the price of oil will likely cause which of the following?A) increase the markup in the Phillips curve equationB) increase the sum "m + z" in the Phillips curve equationC) increase the natural rate of unemploymentD) all of the aboveE) none of the aboveAnswer: DDiff: 212) As the proportion of labor contracts that index wages to prices declines, we would expect thatA) a reduction in the unemployment rate will now have a smaller effect on inflation.B) the natural rate of unemployment will increase.C) the natural rate of unemployment will decrease.D) nominal wages will become more sensitive to changes in unemployment.Answer: ADiff: 213) Suppose the Phillips curve is represented by the following equation: πt - πt-1 = 20 - 2u t. Given this information, we know that the natural rate of unemployment in this economy isA) 10%.B) 20%.C) 6.5%.D) 5%.E) none of the aboveAnswer: ADiff: 214) Suppose the Phillips curve is represented by the following equation: πt - πt-1 = 20 - 2u t. Given this information, which of the following is most likely to occur if the actual unemployment in any period is equal to 6%?A) the rate of inflation will tend to increaseB) the rate of inflation will be constantC) the rate of inflation will tend to decreaseD) none of the aboveAnswer: ADiff: 215) Based on your understanding of the Phillips curve, explain what happens to actual inflation (relative to expected inflation) when the actual unemployment rate is either above or below the natural rate of unemployment.Answer: When the actual unemployment rate is equal to the natural rate of unemployment, we know that actual inflation and expected inflation must be equal. In such a case, all else fixed, inflation will not change. If the actual unemployment rate were to fall below the natural rate, inflation would increase. So, the natural rate of unemployment rate may also be referred to the non-accelerating-inflation rate of unemployment. If the opposite occurs, inflation will fall below expected.Diff: 216) Briefly comment on the predictions of economists Milton Friedman and Edmund Phelps about the ability to exploit a trade-off between inflation and unemployment.Answer: Both Friedman and Phelps (separately) argued that there might be a temporarytrade-off between inflation and unemployment. However, both argued that this trade-off could not be exploited permanently. Eventually, expectations of inflation would adjust.Diff: 217) A number of factors are believed to have caused changes in the natural rate of unemployment in the United States during the 1990s. Briefly comment on each of these factors.Answer: There are a number of candidates here: decrease in monopoly power, decreasing role of unions, aging U.S. population, increased prison population, increased number of workers on disability, and unexpectedly high rate of productivity growth.Diff: 218) Based on your understanding of the Phillips curve, is it possible for the unemployment rate to increase while inflation increases? Explain.Answer: This can occur when negative supply shocks occur. That is, we would observe this when factors cause the natural rate of unemployment to rise (e.g. during the 1970s). This would cause an increase in u and an increase in inflation.Diff: 28.4 A Summary and Many Warnings1) The data suggest that in the European Union countries, the natural rate of unemploymentA) is now higher than in the U.S.B) is no longer a relevant concept.C) has steadily declined over the past two decades.D) will soon exceed the percentage of the labor force that is working.E) has become less "natural," since it is now almost entirely determined by the policies of a few large corporations.Answer: ADiff: 12) During the Great Depression, the actual unemployment rate in the U.S. ________, and the natural rate apparently ________.A) increased; decreasedB) increased; remain unchangedC) increased; increased as wellD) decreased; increasedE) decreased; remained unchangedAnswer: CDiff: 23) Which of the following explains why the original Phillips curve relation disappeared or, as some economists have remarked, "broke down" in the 1970s?A) Individuals assumed the expected price level for the current year would be equal to the actual price level from the previous year.B) Individuals assumed that expected inflation would be zeroC) Individuals changed the way they formed expectations of inflation.D) Monetary policy became contractionary.E) More labor contracts became indexed to changes in inflation.Answer: CDiff: 24) Which of the following situations generally exists when deflation occurs?A) Inflation and unemployment are both increasing.B) Inflation and unemployment are both decreasing.C) The price level is decreasing.D) The rate of inflation is falling from, for example, 10% to 3%.E) The natural rate of unemployment is zero.Answer: CDiff: 15) As of 2009, what was the last year that U.S. experienced deflation?A) 1933B) 1955C) 1973D) 1991E) 2001Answer: BDiff: 16) During the 1980s and early 1990s, it was believed that the natural rate of unemployment in the U.S. was equal toA) 4%.B) 4.5%.C) 5%.D) 6.5%.E) 7%.Answer: DDiff: 17) Which of the following does not explain the relatively low price inflation compared to the higher wage inflation in the U.S. during the 1990s?A) the appreciation of the dollarB) a reduction in benefits paid to workersC) an increase in the natural rate of unemploymentD) a reduction in the price of oilAnswer: CDiff: 28) In the Phillips curve equation, which of the following will cause a reduction in the current inflation rate?A) a reduction in the expected inflation rateB) an increase in the unemployment rateC) a reduction in the markup, mD) all of the aboveE) none of the aboveAnswer: DDiff: 29) Suppose policy makers underestimate the natural rate of unemployment. In situations like these, policy makers will likely implement policies that result inA) more unemployment than necessary.B) an unemployment rate that is "too high."C) a higher inflation rate than necessary.D) a steadily decreasing inflation rate.E) overly contractionary monetary and fiscal policy.Answer: CDiff: 210) Explain how a reduction in the proportion of contracts that are indexed affects the relationship between changes in the unemployment rate and inflation.Answer: As the proportion of labor contracts that are indexed falls, the effects of changes in unemployment on inflation would fall. A reduction in u will cause an increase in inflation. When inflation rises in a period, some contracts (those that are indexed) will call for an immediate increase in wages further increasing inflation within that period. As indexation becomes less prevalent, that secondary effect (caused by the indexed contracts) on inflation will be reduced. Diff: 211) Explain how the unexpectedly high rate of productivity growth at the end of the 1990s affected inflation and unemployment during this period.Answer: The unexpectedly high rate of growth of productivity would cause firms' costs to drop. This would cause (if unexpected) a reduction in unemployment. So, we would observe a simultaneous drop in u and drop in inflation.Diff: 212) Explain how changes in the proportion of contracts that are indexed affect how a given change in monetary policy will affect economic activity.Answer: An increase in nominal money growth will increase the real money supply causing an increase in economic activity. As the proportion of labor contracts that are indexed increases, the effects of changes in unemployment on inflation would increase. A reduction in u will cause an increase in inflation. When inflation rises in a period, some contracts (those that are indexed)will call for an immediate increase in wages further increasing inflation within that period. As indexation becomes more prevalent, that secondary effect on inflation will be magnified. This magnification of the inflation effect will cause the real money supply to increase by a smaller amount and, therefore, reduce the output effects of a given monetary expansion.Diff: 213) Based on the 'early incarnation' of the Phillips curve, explain what effect a decrease in the unemployment rate will have on the inflation rate.Answer: An decrease in u will cause a rise in W. As W rises, firms' costs increase. As firms' costs increase, they will raise the price level. This increase in the price level represents, in this case, inflation.Diff: 214) Why has the U.S. natural rate of unemployment fallen since the early 1990s?Answer: Researchers have offer a number of explanations: Increased globalization and stronger competition between US and foreign firms may have led to a decrease in monopoly power and a decrease in the markup; The nature of the labor market has changed; the aging of the US population; an increase in the prison population and the increase in the number of workers on disability.Diff: 215) Explain the natural unemployment rate and its relationship to inflation rate.Answer: The natural unemployment rate is the unemployment rate at which the inflation rate remains constant. When the actual unemployment rate exceeds the natural rate of unemployment, the inflation rate typically decreases; when the actual unemployment rate is less than the natural unemployment, the inflation rate typically increases.Diff: 216) What is the difference between deflation and disinflation?Answer: Deflation refers to a decrease in the price level, or equivalently, negative inflation. Disinflation is a decrease in the inflation rate.Diff: 117) How will the crisis affect the natural rate of unemployment?Answer: There is an increasing worry that the increase in the actual unemployment rate may eventually translate into an increase in the natural unemployment rate. Workers who have been unemployed for a long time may lose their skills, or their morale, and become unemployable, leading to a higher natural rate.Diff: 2。

宏观经济学课件(英文版)

The breakdown of GDP into its various components, such as consumption, investment, government spending, and net exports.

VS

A measure of the percentage of the labor force that is jobless and actively seeking employment.

04

Fiscal Policy and Government Speing is a significant component of the economy, representing a significant share of GDP.

Government spending can also act as a stabilizer during economic downturns, stimulating growth and absorbing economic shocks.

05

Monetary Policy and Central Bank Operations

The main monetary policy tools used by central banks are open market operations, reserve requirements, and interest rate policy.

02

Examples include stimulus packages during the Great Recession, infrastructure spending programs, and social welfare policies.

曼昆-微观经济学-第八章PPT课件

可编辑

税收规

模

29

税收收入与税收规模

P

税收小时,增

PB

税使税收收入

PB

增加

PS

PS

2T T

可编辑

Q2 Q1

S D Q

30

税收收入与税收规模

P

PB

PB

税收大时,增 税使税收收入 减少

3T 2T

PS PS

Q3 Q2

可编辑

S D Q

31

税收收入与税收规模

拉弗曲线:揭示 了税收规模与税 收收入之间的关 系

支出。为达到这个目的,政府既可以对普通食品 征税也可以对高档餐馆的用餐征税

▪ 应该对哪个征税?

应用:赋税的代价

22

政府应该多大?

▪ 一个更大的政府能提供更多的服务,但这需要更高

的税收,而税收会带来无谓损失

▪ 税收带来的无谓损失越大,对小政府的呼声就越大

▪ 对劳动收入征收尤其重要:它是政府收入的最大来

本章我们将探索这些问题答案:

▪ 税收怎样影响消费者剩余,生产者剩余和总剩余? ▪ 什么是税收的无谓损失? ▪ 决定无谓损失大小的因素有哪些? ▪ 税收规模如何影响税收收入?

应用:赋税的代价

1

复习第六章

▪ 税收

▪ 在买者支付的价格和卖者得到的价格之间打入一

个契子

▪ 提高了买者为该物品支付的价格,降低了卖者从

源

▪ 对一个典型的工作者而言,边际税率(对最后一美

元收入的征税)高达40%.

▪ 这种税收的无谓损失有多大?它取决于弹性……

可编辑

23

政府应该多大?

▪ 如果劳动的供给是缺乏弹性的,那无谓损失比较

小

曼昆的宏观经济学课件(英文版)

1990

1995

2000

2021/4/30

Why learn macroeconomics?

1. The macroeconomy affects society’s well-being. ▪ example: Unemployment and social problems

2021/4/30

Unemployment and social problems

• Why are there recessions? Can the government do anything to combat recessions? Should it??

2021/4/30

Important issues in macroeconomics

• What is the government budget deficit? How does it affect the economy?

▪ example 1:

Unemployment and earnings growth

▪ example 2:

Interest rates and mortgage payments

2021/4/30

%

Unemployment and earnings growth

5 4 3 2 1 0 -1 -2 -3 -4 -5 1965 1970 1975 1980 1985 1990 1995 2000

2021/4/30

Important issues in macroeconomics

• Why does the cost of living keep rising?

• Why are millions of people unemployed, even when the economy is booming?

第七版曼昆宏观经济学课件

作用和效果。

03

国际合作与协调

探讨国际社会在应对国际金融危机中的合作与协调,以及未来应对类似

危机的建议。

38

06

总结回顾与未来展望

2024/1/25

39

关键知识点总结回顾

国民收入核算

GDP、GNP等核算体系,以及 相关的经济增长、经济周期等 概念。

AD-AS模型

描述总需求与总供给之间的均 衡模型,分析价格水平和产出 之间的关系。

宏观经济学对于理解经济体系的运行规律、预测经济发展 趋势、制定经济政策具有重要意义。它有助于我们认识各 种宏观经济现象背后的原因和机制,为政府制定有效的经 济政策提供理论支持和实践指导。同时,宏观经济学也有 助于我们理解微观经济行为与宏观经济表现之间的联系, 为个体经济单位提供更加全面和准确的经济分析和决策依 据。

通货膨胀可能导致经济周 期波动加剧,增加经济不 确定性。

社会不稳定

通货膨胀可能导致社会财 富重新分配,加剧社会矛 盾和不稳定因素。

21

货币政策目标与工具选择

价格稳定

保持物价水平基本稳定,避免通货膨胀和通货紧缩对经济造成不良影响。

充分就业

通过促进经济增长和减少结构性失业等措施,实现充分就业的目标。

2024/1/25

2024/1/25

恒等式的意义

提供了核算国民收入的一种方法,即通 过加总各个部门的增加值来计算GDP。

9

价格指数与通货膨胀率计算

价格指数

是反映不同时期一般价格水平的变化方向和变化程度的相对数。常见的价格指数有消费物价指数(CPI)、批发 物价指数(WPI)和GDP折算指数等。

通货膨胀率计算

通货膨胀率是指物价平均水平的上升幅度(以通货膨胀为准)。计算公式为:通货膨胀率=(现期物价水平—基 期物价水平)/基期物价水平。其中,基期就是选定某年的物价水平作为一个参照,这样就可以把其他各期的物 价水平通过与基期水平作一对比,从而衡量现今市场每平均每单位货币的购买力。

曼昆《宏观经济学》(第6、7版)习题精编详解(第8章 经济增长Ⅱ:技术、经验和政策)

第8章 经济增长Ⅱ:技术、经验和政策跨考网独家整理最全经济学考研真题,经济学考研课后习题解析资料库,您可以在这里查阅历年经济学考研真题,经济学考研课后习题,经济学考研参考书等内容,更有跨考考研历年辅导的经济学学哥学姐的经济学考研经验,从前辈中获得的经验对初学者来说是宝贵的财富,这或许能帮你少走弯路,躲开一些陷阱。

以下内容为跨考网独家整理,如您还需更多考研资料,可选择经济学一对一在线咨询进行咨询。

一、判断题1.如果MPK n g δ-=+,则该式所对应的资本存量是资本存量黄金律。

( ) 【答案】T【解析】资本的黄金律水平是使消费最大化的稳定状态的k 值。

考虑人口增长和技术进步,人均消费可写为:()()c f k n g k ***=-++δ,根据人均消费最大化的一阶条件可得:MPK n g δ-=+。

2.根据索洛增长模型,一国GDP 的增长率主要取决于该国的技术进步率。

( ) 【答案】F【解析】根据索洛增长模型,一国GDP 的增长率取决于劳动、资本投入以与技术进步。

3.在考虑人口增长和技术进步的索洛模型中,稳态意味着()()sf k n g k δ=++。

( ) 【答案】T【解析】稳态意味着持平投资等于储蓄,考虑人口增长和技术进步,()()sf k n g k δ=++。

4.根据内生经济增长模型,投资可以导致一国的长期增长。

( ) 【答案】T【解析】投资使得一国的资本存量增加,而资本存量的增加会促进经济增长。

内生经济增长模型中,资本边际收益是非递减的,因此投资可以导致一国的长期增长。

5.内生增长模型可以写作Y AK =,其中,A 为常数。

( ) 【答案】T 【解析】不存在资本边际递减是该公式的主要特征,因此符合内生增长理论的假设条件,可以作为内生增长模型的一种特例。

6.内生增长模型与索洛增长模型的主要区别在于前者假定一个总资本的边际报酬不递减。

( )【答案】T【解析】内生增长理论将资本这一要素广义化,不但用来指物质资本,同时还包括人力资本,它通过生产者“知识溢出”和人力资本的“外部利益”的作用,使得投资收益递增,从而避免了资本积累收益递减的倾向,从而使得资本边际报酬不递减。

曼昆宏观经济学ppt课件

02

国民收入核算与衡量

国内生产总值(GDP)概念及核算方法

GDP核算方法

包括生产法、收入法和支出法 三种。

收入法

GDP=劳动者报酬+生产税净 额+固定资产折旧+营业盈余 。

GDP定义

指一个国家或地区所有常住单 位在一定时期内生产活动的最 终成果。

生产法

GDP=各部门的总产出-各部门 的中间消耗。

经济增长放缓

失业导致消费减少、投资不足,进而影响经济增 长。

通货膨胀定义、类型及影响探讨

通货膨胀定义 通货膨胀是指物价总水平持续上涨的现象,即货币购买力不断下降的过程。

通货膨胀定义、类型及影响探讨

需求拉上型通货膨胀

总需求超过总供给,导致物价上涨。

成本推进型通货膨胀

成本上升推动物价上涨,如原材料、工资等成本增加。

通货膨胀定义、类型及影响探讨

• 输入型通货膨胀:由于进口商品价格上升而引起的国内物价 上涨。

通货膨胀定义、类型及影响探讨

01

02

03

实际收入减少

物价上涨导致货币购买力 下降,实际收入减少。

社会财富再分配

通货膨胀有利于债务人而 不利于债权人,导致社会 财富再分配。

经济秩序紊乱

通货膨胀可能导致价格信 号失真,经济秩序紊乱。

财政政策工具

02

政府支出、税收和公债等。

效果比较

03

通过经济增长率、失业率、财政收入和支出等指标来比较不同

财政政策的效果。

06

国际经济关系与汇率制度选择

国际收支平衡表编制原理和方法介绍

1 2 3

国际收支平衡表定义

记录一个国家在一定时期内(通常为一年)与外 国进行经济往来的全部收入和支出的统计报表。

中文曼昆宏观经济学第七版讲义-62页精选文档

6

Trade surpluses and deficits

NX = EX – IM = Y – (C + I + G )

trade surplus:

output > spending and exports > imports Size of the trade surplus = NX

trade deficit:

spending > output and imports > exports Size of the trade deficit = –NX

CHAPTER 5 The Open Economy

7

International capital flows

Net capital outflow

=S –I

IM = imports = C f + I f + G f

= spending on foreign goods

NX = net exports (a.k.a. the “trade balance”) = EX – IM

CHAPTER 5 The Open Economy

4

GDP = expenditure on domestically produced g & s

9

Saving, investment, and the trade balance

(percent of GDP) 1960-2019

investment

saving

trade balance (right scale)

U.S.: “The world’s largest debtor nation”

曼昆经济学原理第七章(第七版) PPT

7.1 消费者剩余

• 7.1.2用需求曲线衡量消费者剩余

• 各位看官原谅,由于内容假设你的朋友正在考虑两家手机服务提供商.A提供商每月 收取固定服务费120美元,无论打多少次电话都是如此.B提 供商不收取固定的服务费,而是每打1分钟电话费1美元.你 的朋友对每个月打电话时间的需求由方程Qd=150-50P给 出,其中P是每分钟电话的价格. a,对每个提供商,你朋友多打1分钟电话的费用是多少? b,根据你对a的回答,你朋友用每个提供商的服务会打多少 分钟电话? c,他每个月给每个提供商付费多少? d,他从每个提供商得到的消费剩余是多少? e,你会推荐选择哪个提供商?为什么?

曼昆经济学原理第七章(第七版)

大纲

• 引言 • 7.1 消费者剩余 • 7.2 生产者剩余 • 6.3 市场效率

引言

• 1、本书第一章引言中,经济学的定义是:研究社会如何管 理自己的稀缺资源。

• 2、换句话说,社会要对稀缺资源进行管理的目的是为了最 大限度地实现效率和平等这样两个目标。

• 3、如何考察一个市场或政府颁布的一项政策,是否最大限 度地实现了资源配置的效率和平等这样两个目标,需要用 科学的方法进行分析。

• C、(白话版)surplus若翻译为“盈余”可能理解起来更方 便些。消费者剩余说到底就是消费者觉得自己占了多少便宜, 因为愿意支付多少钱是每个人内心对商品价值的评价,若内 心估价较高,而实际价格较低,那购买此商品的“盈余”就 大了,占了大便宜,内心感觉很美好,这就是享受到市场经 济的“福利”了。所以商品要卖给对它评价最高者,因为这 样可以使福利最大化。

• A、 由Qd=150-50P,这个方程可以得出以下结论:P哪怕 是无限接近于0,Q也只能无限接近于150,由于打电话的 分钟只能按个位数计算,所以选择A提供商的话最多打149 分钟电话。(可能会有人说,超过或等于150分钟后的每 分钟就是0元啊,还是请回看一下方程式,P不可能为负数, 否则提供商要赔死了,所以方程式已经限定了最多150分 钟的,这时P=0,实际上这时已经是极限值了;综上所述: 选择A提供商,最多打149分钟电话,再多打1分钟的费用 是0美元。选择B提供商,根据方程得出,P=1时,共打100 分钟电话,再多打1分钟的费用仍是1美元。

曼昆经济学原理英文版文案加习题答案8章

144WHAT’S NEW IN THE S EVENTH EDITION: A new In the News box on ―The Tax Debate ‖ has been added.LEARNING OBJECTIVES: By the end of this chapter, students should understand:how taxes reduce consumer and producer surplus.the meaning and causes of the deadweight loss from a tax.why some taxes have larger deadweight losses than others.how tax revenue and deadweight loss vary with the size of a tax.CONTEXT AND PURPOSE:Chapter 8 is the second chapter in a three-chapter sequence dealing with welfare economics. In theprevious section on supply and demand, Chapter 6 introduced taxes and demonstrated how a tax affects the price and quantity sold in a market. Chapter 6 also described the factors that determine how the burden of the tax is divided between the buyers and sellers in a market. Chapter 7 developed welfare economics —the study of how the allocation of resources affects economic well-being. Chapter 8 combines the lessons learned in Chapters 6 and 7 and addresses the effects of taxation on welfare. Chapter 9 will address the effects of trade restrictions on welfare. The purpose of Chapter 8 is to apply the lessons learned about welfare economics in Chapter 7 to the issue of taxation that was addressed in Chapter 6. Students will learn that the cost of a tax to buyers and sellers in a market exceeds the revenue collected by the government. Students will also learn about the factors that determine the degree by which the cost of a tax exceeds the revenue collected by the government.8 APPLICATION: THE COSTS OF TAXATIONChapter 8 /Application: The Costs of Taxation ❖145KEY POINTS:∙ A tax on a good reduces the welfare of buyers and sellers of the good, and the reduction in consumer and producer surplus usually exceeds the revenue raised by the government. The fall in total surplus—the sum of consumer surplus, producer surplus, and tax revenue—is called thedeadweight loss of the tax.∙Taxes have deadweight losses because they cause buyers to consume less and sellers to produce less, and these changes in behavior shrink the size of the market below the level that maximizes total surplus. Because the elasticities of supply and demand measure how much market participantsrespond to market conditions, larger elasticities imply larger deadweight losses.∙As a tax grows larger, it distorts incentives more, and its deadweight loss grows larger. Because a tax reduces the size of a market, however, tax revenue does not continually increase. It first rises with the size of a tax, but if the tax gets large enough, tax revenue starts to fall.CHAPTER OUTLINE:I. The Deadweight Loss of TaxationA. Remember that it does not matter who a tax is levied on; buyers and sellers will likely share inthe burden of the tax.B. If there is a tax on a product, the price that a buyer pays will be greater than the price the sellerreceives. Thus, there is a tax wedge between the two prices and the quantity sold will be smaller if there was no tax.146 ❖ Chapter 8 /Application: The Costs of TaxationC. How a Tax Affects Market Participants1. We can measure the effects of a tax on consumers by examining the change in consumersurplus. Similarly, we can measure the effects of the tax on producers by looking at the change in producer surplus.2. However, there is a third party that is affected by the tax —the government, which gets total tax revenue of T × Q. If the tax revenue is used to provide goods and services to the public,then the benefit from the tax revenue must not be ignored.3. Welfare without a Taxa. Consumer surplus is equal to: A + B + C.b. Producer surplus is equal to: D + E + F.c. Total surplus is equal to: A + B + C + D + E + F.4. Welfare with a Taxa. Consumer surplus is equal to: A.Chapter 8 /Application: The Costs of Taxation ❖147b. Producer surplus is equal to: F.c. Tax revenue is equal to: B + D.d. Total surplus is equal to: A + B + D + F.5. Changes in Welfarea. Consumer surplus changes by: –(B + C).b. Producer surplus changes by: –(D + E).c. Tax revenue changes by: +(B + D).d. Total surplus changes by: –(C + E).6. Definition of deadweight loss: the fall in total surplus that results from a marketdistortion, such as a tax.D. Deadweight Losses and the Gains from Trade1. Taxes cause deadweight losses because they prevent buyers and sellers from benefiting fromtrade.2. This occurs because the quantity of output declines; trades that would be beneficial to boththe buyer and seller will not take place because of the tax.3. The deadweight loss is equal to areas C and E (the drop in total surplus).4. Note that output levels between the equilibrium quantity without the tax and the quantitywith the tax will not be produced, yet the value of these units to consumers (represented by the demand curve) is larger than the cost of these units to producers (represented by thesupply curve).148 ❖ Chapter 8 /Application: The Costs of TaxationII. The Determinants of the Deadweight LossA. The price elasticities of supply and demand will determine the size of the deadweight loss that occurs from a tax.1. Given a stable demand curve, the deadweight loss is larger when supply is relatively elastic.2. Given a stable supply curve, the deadweight loss is larger when demand is relatively elastic. B. Case Study: The Deadweight Loss Debate1. Social Security tax and federal income tax are taxes on labor earnings. A labor tax places a tax wedge between the wage the firm pays and the wage that workers receive.2. There is considerable debate among economists concerning the size of the deadweight lossfrom this wage tax.3. The size of the deadweight loss depends on the elasticity of labor supply and demand, andthere is disagreement about the magnitude of the elasticity of supply.Chapter 8 /Application: The Costs of Taxation ❖149a. Economists who argue that labor taxes do not greatly distort market outcomes believethat labor supply is fairly inelastic.b. Economists who argue that labor taxes lead to large deadweight losses believe that laborsupply is more elastic.III. Deadweight Loss and Tax Revenue as Taxes VaryA. As taxes increase, the deadweight loss from the tax increases.B. In fact, as taxes increase, the deadweight loss rises more quickly than the size of the tax.1. The deadweight loss is the area of a triangle and the area of a triangle depends on thesquare of its size.150 ❖ Chapter 8 /Application: The Costs of Taxation2. If we double the size of a tax, the base and height of the triangle both double so the area ofthe triangle (the deadweight loss) rises by a factor of four.C. As the tax increases, the level of tax revenue will eventually fall.D. Case Study: The Laffer Curve and Supply-Side Economics1. The relationship between the size of a tax and the level of tax revenues is called a Laffercurve.2. Supply-side economists in the 1980s used the Laffer curve to support their belief that a drop in tax rates could lead to an increase in tax revenue for the government.3. Economists continue to debate Laffer’s argument.a. Many believe that the 1980s refuted Laffer’s theory.b. Others believe that the events of the 1980s tell a more favorable supply-side story.c. Some economists believe that, while an overall cut in taxes normally decreases revenue,some taxpayers may find themselves on the wrong side of the Laffer curve. E. In the News: The Tax Debate1. Recently, policymakers have debated the effects of increasing the tax rate, particularly onhigher-income taxpayers.2. These two opinion pieces from The Wall Street Journal present both sides of the issue. ALTERNATIVE CLASSROOM EXAMPLE: Draw a graph showing the demand and supply of paper clips. (Draw each curve as a 45-degree line so that buyers and sellers will share any tax equally.) Mark the equilibrium price as $0.50 (per box) and the equilibrium quantity as 1,000 boxes. Show students the areas of producer and consumer surplus.Impose a $0.20 tax on each box. Assume that sellers are required to ―pay‖ the tax to the government. Show students that:▪ the price buyers pay will rise to $0.60.▪ the price sellers receive will fall to $0.40.▪ the quantity of paper clips purchased will fall (assume to 800 units).▪ tax revenue would be equal to $160 ($0.20 800).Have students calculate the area of deadweight loss. (You may have to remind students how to calculate the area of a triangle.)Show students that as the tax increases (to $0.40, $0.60, and $0.80), tax revenue rises and then falls, and the deadweight loss increases.Chapter 8 /Application: The Costs of Taxation ❖151152 ❖ Chapter 8 /Application: The Costs of TaxationSOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. Figure 1 shows the supply and demand curves for cookies, with equilibrium quantity Q 1 andequilibrium price P 1. When the government imposes a tax on cookies, the price to buyers rises to P B , the price received by sellers declines to P S , and the equilibrium quantity falls to Q 2. The deadweight loss is the triangular area below the demand curve and above the supply curve between quantities Q 1 and Q 2. The deadweight loss shows the fall in total surplus that results from the tax.Figure 12. The deadweight loss of a tax is greater the greater is the elasticity of demand. Therefore, a tax on beer would have a larger deadweight loss than a tax on milk because the demand forbeer is more elastic than the demand for milk.Chapter 8 /Application: The Costs of Taxation ❖1533. If the government doubles the tax on gasoline, the revenue from the gasoline tax could riseor fall depending on whether the size of the tax is on the upward or downward slopingportion of the Laffer curve. However, if the government doubles the tax on gasoline, you canbe sure that the deadweight loss of the tax rises because deadweight loss always rises as thetax rate rises.Questions for Review1. When the sale of a good is taxed, both consumer surplus and producer surplus decline. Thedecline in consumer surplus and producer surplus exceeds the amount of governmentrevenue that is raised, so society's total surplus declines. The tax distorts the incentives ofboth buyers and sellers, so resources are allocated inefficiently.2. Figure 2 illustrates the deadweight loss and tax revenue from a tax on the sale of a good.Without a tax, the equilibrium quantity would be Q1, the equilibrium price would be P1,consumer surplus would be A + B + C, and producer surplus would be D + E + F. Theimposition of a tax places a wedge between the price buyers pay, P B, and the price sellersreceive, P S, where P B = P S + tax. The quantity sold declines to Q2. Now consumer surplus isA, producer surplus is F, and government revenue is B + D. The deadweight loss of the tax isC+E, because that area is lost due to the decline in quantity from Q1 to Q2.Figure 23. The greater the elasticities of demand and supply, the greater the deadweight loss of a tax.Because elasticity measures the responsiveness of buyers and sellers to a change in price,higher elasticity means the tax induces a greater reduction in quantity, and therefore, agreater distortion to the market.4. Experts disagree about whether labor taxes have small or large deadweight losses becausethey have different views about the elasticity of labor supply. Some believe that labor supplyis inelastic, so a tax on labor has a small deadweight loss. But others think that workers canadjust their hours worked in various ways, so labor supply is elastic, and thus a tax on laborhas a large deadweight loss.5. The deadweight loss of a tax rises more than proportionally as the tax rises. Tax revenue,however, may increase initially as a tax rises, but as the tax rises further, revenue eventuallydeclines.Quick Check Multiple Choice1. a2. b3. c4. a5. b6. aProblems and Applications1. a. Figure 3 illustrates the market for pizza. The equilibrium price is P1, the equilibriumquantity is Q1, consumer surplus is area A + B + C, and producer surplus is area D + E +F. There is no deadweight loss, as all the potential gains from trade are realized; totalsurplus is the entire area between the demand and supply curves: A + B + C + D + E +F.Figure 3b. With a $1 tax on each pizza sold, the price paid by buyers, P B, is now higher than theprice received by sellers, P S, where P B = P S + $1. The quantity declines to Q2, consumersurplus is area A, producer surplus is area F, government revenue is area B + D, anddeadweight loss is area C + E. Consumer surplus declines by B + C, producer surplusdeclines by D + E, government revenue increases by B + D, and deadweight lossincreases by C + E.c. If the tax were removed and consumers and producers voluntarily transferred B + D tothe government to make up for the lost tax revenue, then everyone would be better offthan without the tax. The equilibrium quantity would be Q1, as in the case without thetax, and the equilibrium price would be P1. Consumer surplus would be A + C, becauseconsumers get surplus of A + B + C, then voluntarily transfer B to the government.Producer surplus would be E + F, because producers get surplus of D + E + F, thenvoluntarily transfer D to the government. Both consumers and producers are better offthan the case when the tax was imposed. If consumers and producers gave a little bitmore than B + D to the government, then all three parties, including the government,would be better off. This illustrates the inefficiency of taxation.2. a. The statement, "A tax that has no deadweight loss cannot raise any revenue for thegovernment," is incorrect. An example is the case of a tax when either supply or demand is perfectly inelastic. The tax has neither an effect on quantity nor any deadweight loss,but it does raise revenue.b. The statement, "A tax that raises no revenue for the government cannot have anydeadweight loss," is incorrect. An example is the case of a 100% tax imposed on sellers.With a 100% tax on their sales of the good, sellers will not supply any of the good, sothe tax will raise no revenue. Yet the tax has a large deadweight loss, because it reduces the quantity sold to zero.3. a. With very elastic supply and very inelastic demand, the burden of the tax on rubberbands will be borne largely by buyers. As Figure 4 shows, consumer surplus declinesconsiderably, by area A + B, but producer surplus decreases only by area C+D..Figure 4 Figure 5b.With very inelastic supply and very elastic demand, the burden of the tax on rubberbands will be borne largely by sellers. As Figure 5 shows, consumer surplus does notdecline much, just by area A + B, while producer surplus falls substantially, by area C +D. Compared to part (a), producers bear much more of the burden of the tax, andconsumers bear much less.4. a. The deadweight loss from a tax on heating oil is likely to be greater in the fifth year afterit is imposed rather than the first year. In the first year, the demand for heating oil isrelatively inelastic, as people who own oil heaters are not likely to get rid of them rightaway. But over time they may switch to other energy sources and people buying newheaters for their homes will more likely choose gas or electric, so the tax will have agreater impact on quantity. Thus, the deadweight loss of the tax will get larger over time.b. The tax revenue is likely to be higher in the first year after it is imposed than in the fifthyear. In the first year, demand is more inelastic, so the quantity does not decline asmuch and tax revenue is relatively high. As time passes and more people substitute away from oil, the quantity sold declines, as does tax revenue.5. Because the demand for food is inelastic, a tax on food is a good way to raise revenuebecause it leads to a small deadweight loss; thus taxing food is less inefficient than taxing other things. But it is not a good way to raise revenue from an equity point of view, because poorer people spend a higher proportion of their income on food. The tax would affect them more than it would affect wealthier people.6. a. This tax has such a high rate that it is not likely to raise much revenue. Because of thehigh tax rate, the equilibrium quantity in the market is likely to be at or near zero.b. Senator Moynihan's goal was probably to ban the use of hollow-tipped bullets. In thiscase, the tax could be as effective as an outright ban.7. a. Figure 6 illustrates the market for socks and the effects of the tax. Without a tax, theequilibrium quantity would be Q1, the equilibrium price would be P1, total spending byconsumers equals total revenue for producers, which is P1 x Q1, which equals area B + C + D + E + F, and government revenue is zero. The imposition of a tax places a wedgebetween the price buyers pay, P B, and the price sellers receive, P S, where P B = P S + tax.The quantity sold declines to Q2. Now total spending by consumers is P B x Q2, whichequals area A + B + C + D, total revenue for producers is P S x Q2, which is area C + D,and government tax revenue is Q2 x tax, which is area A + B.b. Unless supply is perfectly elastic or demand is perfectly inelastic, the price received byproducers falls because of the tax. Total receipts for producers fall, because producerslose revenue equal to area B + E + F.Figure 6c. The price paid by consumers rises, unless demand is perfectly elastic or supply isperfectly inelastic. Whether total spending by consumers rises or falls depends on theprice elasticity of demand. If demand is elastic, the percentage decline in quantityexceeds the percentage increase in price, so total spending declines. If demand isinelastic, the percentage decline in quantity is less than the percentage increase in price, so total spending rises. Whether total consumer spending falls or rises, consumer surplus declines because of the increase in price and reduction in quantity.8. Figure 7 illustrates the effects of the $2 subsidy on a good. Without the subsidy, theequilibrium price is P1 and the equilibrium quantity is Q1. With the subsidy, buyers pay price P B, producers receive price P S (where P S = P B + $2), and the quantity sold is Q2. Thefollowing table illustrates the effect of the subsidy on consumer surplus, producer surplus, government revenue, and total surplus. Because total surplus declines by area D + H, the subsidy leads to a deadweight loss in that amount.Figure 79. a. Figure 8 shows the effect of a $10 tax on hotel rooms. The tax revenue is represented byareas A + B, which are equal to ($10)(900) = $9,000. The deadweight loss from the tax is represented by areas C + D, which are equal to (0.5)($10)(100) = $500.Figure 8 Figure 9b. Figure 9 shows the effect of a $20 tax on hotel rooms. The tax revenue is represented byareas A + B, which are equal to ($20)(800) = $16,000. The deadweight loss from the tax is represented by areas C + D, which are equal to (0.5)($20)(200) = $2,000.When the tax is doubled, the tax revenue rises by less than double, while the deadweight loss rises by more than double. The higher tax creates a greater distortion to the market.10. a. Setting quantity supplied equal to quantity demanded gives 2P = 300 –P. Adding P toboth sides of the equation gives 3P = 300. Dividing both sides by 3 gives P = 100.Substituting P = 100 back into either equation for quantity demanded or supplied gives Q = 200.b. Now P is the price received by sellers and P +T is the price paid by buyers. Equatingquantity demanded to quantity supplied gives 2P = 300 − (P+T). Adding P to both sides of the equation gives 3P = 300 –T. Dividing both sides by 3 gives P = 100 –T/3. This is the price received by sellers. The buyers pay a price equal to the price received by sellers plus the tax (P +T = 100 + 2T/3). The quantity sold is now Q = 2P = 200 – 2T/3.c. Because tax revenue is equal to T x Q and Q = 200 – 2T/3, tax revenue equals 200T−2T2/3. Figure 10 (on the next page) shows a graph of this relationship. Tax revenue iszero at T = 0 and at T = 300.Figure 10 Figure 11 d. As Figure 11 shows, the area of the triangle (laid on its side) that represents the deadweight loss is 1/2 × base × height, where the base is the change in the price, which is the size of the tax (T ) and the height is the amount of the decline in quantity (2T /3). So the deadweight loss equals 1/2 × T × 2T /3 = T 2/3. This rises exponentially from 0 (when T = 0) to 30,000 when T = 300, as shown in Figure 12.Figure 12e. A tax of $200 per unit is a bad policy, because tax revenue is declining at that tax level.The government could reduce the tax to $150 per unit, get more tax revenue ($15,000 when the tax is $150 versus $13,333 when the tax is $200), and reduce the deadweight loss (7,500 when the tax is $150 compared to 13,333 when the tax is $200).。

2024版曼昆宏观经济学ppt课件完整版

曼昆宏观经济学ppt课件完整版•宏观经济学概述•国民收入核算与经济增长•失业、通货膨胀与货币政策•总需求-总供给模型与财政政策•国际金融与汇率制度•劳动市场、资本市场与长期经济增长•政府角色、社会保障与环境问题目录宏观经济学概述01宏观经济学定义与研究对象定义宏观经济学是研究整个经济体系的总体经济行为、经济表现及其内在规律的一门学科。

研究对象主要包括国民收入、就业、通货膨胀、经济增长等宏观经济现象。

宏观经济学与微观经济学关系联系微观经济学和宏观经济学都是研究经济现象的学科,两者相互补充,共同构成了经济学的完整体系。

区别微观经济学研究个体经济单位(如家庭、企业)的经济行为,而宏观经济学研究整个经济体系的总体经济行为。

03研究方法曼昆宏观经济学采用实证分析和规范分析相结合的方法,既注重理论推导,又强调经验验证。

01理论框架曼昆宏观经济学以新古典综合学派为基础,吸收了货币主义、理性预期学派等理论,形成了一个完整的理论体系。

02主要内容包括国民收入决定理论、就业理论、通货膨胀理论、经济增长理论等。

曼昆宏观经济学理论体系国民收入核算与经济增长02支出法通过核算一定时期内整个社会购买最终产品的总支出计算GDP ,适用于市场经济比较发达的国家。

收入法通过核算整个社会在一定时期内获得的收入总量来计算GDP ,适用于收入分配比较均衡的国家。

生产法通过核算一定时期内各生产单位所生产的全部最终产品的价值总量来计算GDP ,适用于统计基础比较完善的国家。

国内生产总值(GDP )核算方法经济增长率计算及分析经济增长的源泉主要包括劳动投入的增加、资本投入的增加以及技术进步等。

经济增长的波动经济增长不是平稳的,而是呈现出周期性的波动,包括繁荣、衰退、萧条和复苏四个阶段。

比较优势与国际贸易对经济增长影响比较优势理论不同国家在生产不同产品时具有不同的比较优势,通过国际贸易可以实现互利共赢。

国际贸易对经济增长的影响国际贸易可以促进资源在全球范围内的优化配置,提高生产效率,推动技术创新和产业升级,从而促进经济增长。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

SEVEchapter, you will learn:

how to incorporate technological progress in

the Solow model

CHAPTER 8

Economic Growth II

5

Technological progress in the Solow model

We now write the production function as:

where L ×E = the number of effective workers. Increases in labor efficiency have the

( + n + g)k = break-even investment: the amount of investment necessary to keep k constant.

Consists of: k to replace depreciating capital

n k to provide capital for new workers g k to provide capital for the new “effective”

about policies to promote growth about growth empirics: confronting the

theory with facts

two simple models in which the rate of

technological progress is endogenous

Economic Growth II

4

CHAPTER 8

Technological progress in the Solow model A new variable: E = labor efficiency Assume:

Technological progress is labor-augmenting: it increases labor efficiency at the exogenous rate g:

CHAPTER 8

Economic Growth II

3

Examples of technological progress

From 1950 to 2000, U.S. farm sector productivity

nearly tripled. The real price of computer power has fallen an average of 30% per year over the past three decades. Percentage of U.S. households with ≥ 1 computers: 8% in 1984, 62% in 2003 1981: 213 computers connected to the Internet 2000: 60 million computers connected to the Internet 2001: iPod capacity = 5gb, 1000 songs. Not capable of playing episodes of True Blood. 2009: iPod capacity = 120gb, 30,000 songs. Can play episodes of True Blood.

workers created by technological progress

CHAPTER 8

Economic Growth II

8

Technological progress in the Solow model

MACROECONOMICS

N. Gregory Mankiw

PowerPoint® Slides by Ron Cronovich

CHAPTER

8

Economic Growth II: Technology, Empirics, and Policy

Modified for EC 204 by Bob Murphy

Introduction

In the Solow model of Chapter 7, the production technology is held constant. income per capita is constant in the steady state. Neither point is true in the real world: 1908-2008: U.S. real GDP per person grew by a factor of 7.8, or 2.05% per year. examples of technological progress abound (see next slide).

Production function per effective worker:

y = f(k)

Saving and investment per effective worker:

s y = s f(k )

CHAPTER 8

Economic Growth II

7

Technological progress in the Solow model

same effect on output as increases in the labor force.

CHAPTER 8

Economic Growth II

6

Technological progress in the Solow model

Notation:

y = Y/LE = output per effective worker k = K/LE = capital per effective worker