信用证中英文对照

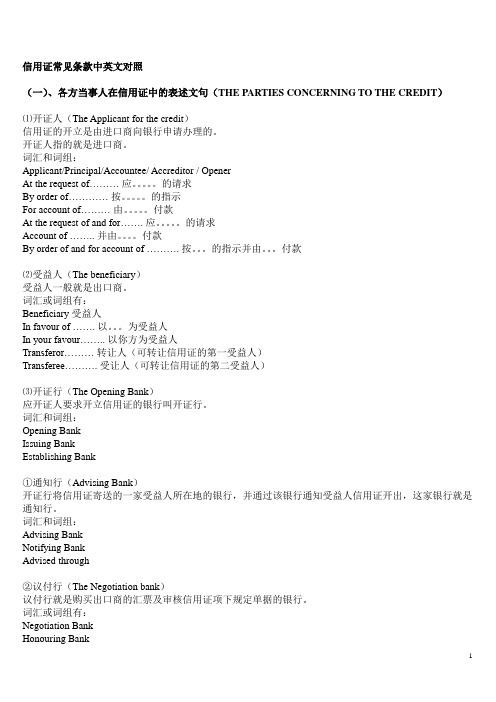

信用证中英文对照

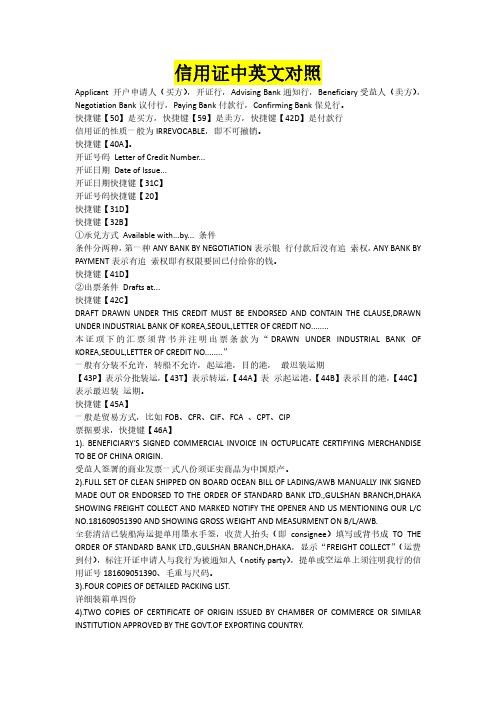

信用证中英文对照Applicant 开户申请人(买方),开证行,Advising Bank通知行,Beneficiary受益人(卖方),Negotiation Bank议付行,Paying Bank付款行,Confirming Bank保兑行。

快捷键【50】是买方,快捷键【59】是卖方,快捷键【42D】是付款行信用证的性质一般为IRREVOCABLE,即不可撤销。

快捷键【40A】。

开证号码Letter of Credit Number...开证日期Date of Issue...开证日期快捷键【31C】开证号码快捷键【20】快捷键【31D】快捷键【32B】①承兑方式Available with...by... 条件条件分两种,第一种ANY BANK BY NEGOTIATION表示银行付款后没有追索权,ANY BANK BY PAYMENT表示有追索权即有权限要回已付给你的钱。

快捷键【41D】②出票条件Drafts at...快捷键【42C】DRAFT DRAWN UNDER THIS CREDIT MUST BE ENDORSED AND CONTAIN THE CLAUSE,DRAWN UNDER INDUSTRIAL BANK OF KOREA,SEOUL,LETTER OF CREDIT NO........本证项下的汇票须背书并注明出票条款为“DRAWN UNDER INDUSTRIAL BANK OF KOREA,SEOUL,LETTER OF CREDIT NO........”一般有分装不允许,转船不允许,起运港,目的港,最迟装运期【43P】表示分批装运,【43T】表示转运,【44A】表示起运港,【44B】表示目的港,【44C】表示最迟装运期。

快捷键【45A】一般是贸易方式,比如FOB、CFR、CIF、FCA 、CPT、CIP票据要求,快捷键【46A】1). BENEFICIARY'S SIGNED COMMERCIAL INVOICE IN OCTUPLICATE CERTIFYING MERCHANDISE TO BE OF CHINA ORIGIN.受益人签署的商业发票一式八份须证实商品为中国原产。

信用证条款中英文对照带翻译.doc

信用证条款中英文对照带翻译,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A: Additional conditions 附加条件1.AGRICULTURAL BANK OF CHINA SINGAPORE BRANCH IS ASSIGNED TO DISCOUNT THE L/C 中国农业银行为指定的付款行2.AFTER NEGOTIATION BANK HAS SENT TESTED TELEX TO ISSUING BANK CERTIFYING DOCUMENTS IN COMPLIANCE WITH THE L/C TERMS AND INDICATION INVOICE VALUE,THEN NEGOTIATION BANK IS AUTHORIZED TO CLAIM REIMBURSEMENT BY TESTED TELEX/SWIFT FROM AGRICULTRUAL BANK OF CHINA SINGAPORE BRANCH AT SIGHT BASIS. SINGAPORE BRANCH WILL EFFECT PAYMENT WITHIN 5 WORKING DAYS.议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B: Charges 开证以外产生的费用ALL BANKING CHARGES OUTSIDE OFTHE ISSUING BANK (EXCEPT FOR THEDISCOUNT INTEREST AND DISCOUNTCHARGES) ARE FOR BENEFICIARYSACCOUNT 开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)常见信用证条款要求48: Period for presentation 单据提交期限DOCUMENTS MUST BE PRESENTED WITHINXX DAYS AFTER LATEST SHIPMENT DATEBUT WITHIN THE V ALIDITY OF THIS CREDIT在信用证有效期内,最迟装运期后XX天内,向银行提交单据49: Confirmation instructionWITHOUT 不保兑53A: Reimbursement Bank 偿付行ABOCSGSG78: Instructions to pay/account/negotiation bank 指示付款行? 议付行1.A DISCREPANCY(IES) FEE OF USDXX.00 WILL BE DEDUCTED FROM THE PROCEEDS IF THE DOCUMENTS ARE PRESENTED WITH A DISCREPANCY(IES). 如果单据提交有差异,差额将从信用额里扣除2.ALL DOCUMENTSSHOULD BE DESPATCHED TO US (ADDRESS:XXXXXXX)IN ONE LOT BY COURIER SERVICE.所有单据应一次性通过快件形式发给我们72: Sender to receiver information 说明THIS CREDIT IS ISSUED SUBJECT TO UCP500 (1993 REVISION)本信用证跟据跟单信用证通一惯例UCP500(1993 年版)开出one original and four photocopies of the commercial invoice showing standard export packing and also showing non-quota when a non-quota item is shipped.出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明one origianl and three photocopies of inspection certificate issued by hymin park of min woo international inc.出具一式三份由hymin park of min woo international inc.签发的商检证书a fax letter by angela stating that one full set of non-negotiable documents was received.Angela传真声明需出具一整套不可议付之单证one origianal and three photocopies of beneficiarys certificate certifying that a production sample was sent to theattention of ruth plant or Albert elkaim of buffalo jeans ,400 L sauve west, montreal , quebec一式三份的受益人产品样品之证明书寄至工厂或是此地址: Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 (好像是加拿大的一个地址)one original and three photocopies of packing list. 装箱单一式三份full set of original marine bills of lading clean on board or multimode transport documents clean on board plus 2 non-negotiable copies issued by air sea transport inc.. weihai, china made out or endorsed to order of bnp paribass(canada) marked freight collect, notify general customs brokers attn linda 514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由air sea transport inc签发的不可议付单据副本.提单需注明由bnp paribass(Canada)付费,通关联系人Linda,电话514-876-1704one original and three photocopies of certificate of export licence of textile products showing the year of quota which must correspond to the year of shipment except in the case of non-quota which an export licence is not required.出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外.one original and three photocopies of certificate of origin.一式三份的原产地证书one original and three photocopies of canada customs invoice.一式三份的加拿大海关发票a fax letter by albert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton stating a sample was received.p N0_ X H:V v Balbert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton这些人传真声明的可接受之样品letter from shipper on their letterhead indicating their name of company and address,bill of lading number,container number and that this shipment,including its container,does not contain any non-manufactured wooden material, tonnage, bracing material, pallets, crating or other non-manufactured wooden packing material.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款中英文对照DOCUMENTS REQUIRED 45A1、FULL SET CLEAN SHIPPED ON BOARD SHIPPING COS BILL OF LADING ISSUED TO THE ORDER OF OMDURMAN NATIONAL BANK, SAGGANA BRANCH MAKED FREIGHT PREPAIK AND NOTIFY APPLICANT.2、SIGNED COMMERCIAL INVOICE IN FIVE ORIGINAL AND THREE COPIES DULY CERTIFIED TRUE AND CORRECT.3、PACKING LIST IN ONE ORIGINAL AND FOUR COPIES.4、CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE CHINA CERTIFY THAT THE GOODS ARE OF CHINESE ORIGIN.1、全套清洁提单。

信用证条款中英文对照.doc

信用证条款中英文对照一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under Unite d Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. c alling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

信用证中英文对照翻译

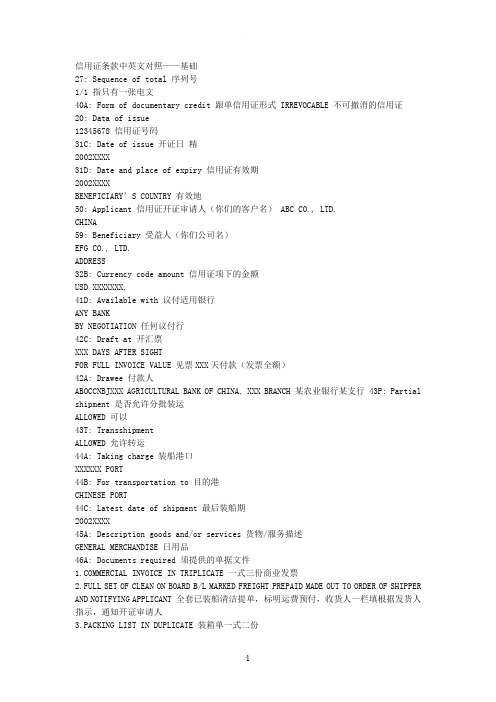

信用证条款中英文对照——基础27:Sequence of total 序列号1/1 指只有一张电文40A: Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20:Data of issue12345678 信用证号码31C:Date of issue 开证日精2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50:Applicant 信用证开证审请人(你们的客户名)ABC CO.,LTD。

CHINA59:Beneficiary 受益人(你们公司名)EFG CO.,LTD.ADDRESS32B:Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C:Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE V ALUE 见票XXX天付款(发票全额)42A: Drawee 付款人ABOCCNBJXXX AGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行43P: Partial shipment 是否允许分批装运ALLOWED 可以43T: TransshipmentALLOWED 允许转运44A:Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C: Latest date of shipment 最后装船期2002XXXX45A:Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A:Documents required 须提供的单据文件MERCIAL INVOICE IN TRIPLICATE 一式三份商业发票2.FULL SET OF CLEAN ON BOARD B/L MARKED FREIGHT PREPAID MADE OUT TO ORDER OF SHIPPER AND NOTIFYING APPLICANT 全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3。

信用证种类中英文对照

信用证种类中英文对照Letter of Credit (L/C) 信用证form of credit 信用证形式Terms of validity 信用证效期Expiry Date 效期Date of issue 开证日期L/C amount 信用证金额L/C number 信用证号码to open by airmail 信开to open by cable 电开to open by brief cable 简电开证to amend L/C 修改信用证fixed L/C or fixed amount L/C 有固定金额的信用证Sight L/C 即期信用证Usance L/C 远期信用证Buyers Usance L/C 买方远期信用证Travelers L/C 旅行信用证Revocable L/C 可撤消的信用证Irrevocable L/C 不可撤消的信用证Confirmed L/C 保兑的信用证Unconfirmed L/C 不保兑的信用证Confirmed Irrevocable L/C 保兑的不可撤消信用证Irrevocable Unconfirmed L/C 不可撤消不保兑的信用证Transferable L/C 可转让信用证Untransferable L/C 不可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to Back L/C 背对背信用证Countervailing credit (俗称)子证Overriding credit 母证Bankers Acceptance L/C 银行承兑信用证Trade Acceptance L/C 商业承兑信用证Red Clause L/C 红条款信用证Anticipatory L/C 预支信用证Credit payable by a trader 商业付款信用证Credit payable by a bank 银行付款信用证usance credit payment at sight 假远期信用证。

信用证条款中英文对照带翻译

信用证条款中英文对照带翻译信用证条款基本都是大同小异,那么英文的信用证条款如何写呢,接下来店铺为大家整理了信用证条款中英文对照。

希望对你有帮助哦! 信用证条款中规格1/1 指只有一张电文40A: Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20: Data of issue12345678 信用证号码31C: Date of issue 开证日2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50: Applicant 信用证开证审请人(你们的客户名)ABC CO., LTD.CHINA59: Beneficiary 受益人(你们公司名)EFG CO., LTD.ADDRESS32B: Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C: Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE VALUE 见票XXX天付款(发票全额)42A: Drawee 付款人ABOCCNBJXXXAGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行43P: Partial shipment 是否允许分批装运ALLOWED 可以43T: TransshipmentALLOWED 允许转运44A: Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C: Latest date of shipment 最后装船期2002XXXX45A: Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A: Documents required 须提供的单据文件MERCIAL INVOICE IN TRIPLICATE 一式三份商业发票2.FULL SET OF CLEAN ON BOARD B/L MARKED FREIGHT PREPAID MADE OUT TO ORDER OF SHIPPER AND NOTIFYING APPLICANT 全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A: Additional conditions 附加条件1.AGRICULTURAL BANK OF CHINA SINGAPORE BRANCH IS ASSIGNED TO DISCOUNT THE L/C 中国农业银行为指定的付款行2.AFTER NEGOTIATION BANK HAS SENT TESTED TELEX TO ISSUING BANK CERTIFYING DOCUMENTS IN COMPLIANCE WITH THE L/C TERMS AND INDICATION INVOICE VALUE,THEN NEGOTIATION BANK IS AUTHORIZED TO CLAIM REIMBURSEMENT BY TESTED TELEX/SWIFT FROMAGRICULTRUAL BANK OF CHINA SINGAPORE BRANCH AT SIGHT BASIS. SINGAPORE BRANCH WILL EFFECT PAYMENT WITHIN 5 WORKING DAYS.议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B: Charges 开证以外产生的费用ALL BANKING CHARGES OUTSIDE OFTHE ISSUING BANK (EXCEPT FOR THEDISCOUNT INTEREST AND DISCOUNTCHARGES) ARE FOR BENEFICIARY’SACCOUNT 开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)常见信用证条款要求48: Period for presentation 单据提交期限DOCUMENTS MUST BE PRESENTED WITHINXX DAYS AFTER LATEST SHIPMENT DATEBUT WITHIN THE VALIDITY OF THIS CREDIT在信用证有效期内,最迟装运期后XX天内,向银行提交单据49: Confirmation instructionWITHOUT 不保兑53A: Reimbursement Bank 偿付行ABOCSGSG78: Instructions to pay/account/negotiation bank 指示付款行 ? 议付行1.A DISCREPANCY(IES) FEE OF USDXX.00 WILL BE DEDUCTED FROM THE PROCEEDS IF THE DOCUMENTS ARE PRESENTED WITH A DISCREPANCY(IES). 如果单据提交有差异,差额将从信用额里扣除2.ALL DOCUMENTS SHOULD BE DESPATCHED TO US (ADDRESS:XXXXXXX)IN ONE LOT BY COURIER SERVICE.所有单据应一次性通过快件形式发给我们72: Sender to receiver information 说明THIS CREDIT IS ISSUED SUBJECT TO UCP500 (1993 REVISION) 本信用证跟据跟单信用证通一惯例UCP500(1993 年版)开出one original and four photocopies of the commercial invoice showing standard export packing and also showing non-quota when a non-quota item is shipped.出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明one origianl and three photocopies of inspection certificate issued by hymin park of min woo international inc.出具一式三份由hymin park of min woo international inc.签发的商检证书a fax letter by angela stating that one full set of non-negotiable documents was received.Angela传真声明需出具一整套不可议付之单证one origianal and three photocopies of beneficiary's certificate certifying that a production sample was sent to the attention of ruth plant or Albert elkaim of buffalo jeans ,400 L sauve west, montreal , quebec一式三份的受益人产品样品之证明书寄至工厂或是此地址: Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 (好像是加拿大的一个地址)one original and three photocopies of packing list. 装箱单一式三份full set of original marine bills of lading clean on board or multimode transport documents clean on board plus 2 non-negotiable copies issued by air sea transport inc.. weihai, china made out or endorsed to order of bnp paribass(canada) markedfreight collect, notify general customs brokers attn linda 514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由air sea transport inc签发的不可议付单据副本.提单需注明由bnp paribass(Canada)付费,通关联系人 Linda,电话514-876-1704 one original and three photocopies of certificate of export licence of textile products showing the year of quota which must correspond to the year of shipment except in the case of non-quota which an export licence is not required.出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外.one original and three photocopies of certificate of origin.一式三份的原产地证书one original and three photocopies of canada customs invoice.一式三份的加拿大海关发票a fax letter by albert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton stating a sample was received.'p N0_ X H:V v Balbert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton这些人传真声明的可接受之样品letter from shipper on their letterhead indicating their name of company and address,bill of lading number,container number and that this shipment,including its container,does not contain any non-manufactured wooden material, tonnage, bracing material, pallets, crating or other non-manufactured wooden packing material.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款中英文对照DOCUMENTS REQUIRED 45A1、FULL SET CLEAN SHIPPED ON BOARD SHIPPING CO’S BILL OF LADING ISSUED TO THE ORDER OF OMDURMAN NATIONAL BANK, SAGGANA BRANCH MAKED FREIGHT PREPAIK AND NOTIFY APPLICANT.2、 SIGNED COMMERCIAL INVOICE IN FIVE ORIGINAL AND THREE COPIES DULY CERTIFIED TRUE AND CORRECT.3、 PACKING LIST IN ONE ORIGINAL AND FOUR COPIES.4、CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE CHINA CERTIFY THAT THE GOODS ARE OF CHINESE ORIGIN.1、全套清洁提单。

信用证中英文对照翻译

信用证条款中英文对照——基础27: Sequence of total 序列号1/1 指只有一张电文40A:Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20:Data of issue12345678 信用证号码31C:Date of issue 开证日精2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50:Applicant 信用证开证审请人(你们的客户名)ABC CO., LTD.CHINA59:Beneficiary 受益人(你们公司名)EFG CO。

,LTD.ADDRESS32B:Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C: Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE V ALUE 见票XXX天付款(发票全额)42A:Drawee 付款人ABOCCNBJXXX AGRICULTURAL BANK OF CHINA,XXX BRANCH 某农业银行某支行43P:Partial shipment 是否允许分批装运ALLOWED 可以43T:TransshipmentALLOWED 允许转运44A: Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C: Latest date of shipment 最后装船期2002XXXX45A: Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A: Documents required 须提供的单据文件MERCIAL INVOICE IN TRIPLICATE 一式三份商业发票2.FULL SET OF CLEAN ON BOARD B/L MARKED FREIGHT PREPAID MADE OUT TO ORDER OF SHIPPER AND NOTIFYING APPLICANT 全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A:Additional conditions 附加条件1。

常见信用证条款中英文对照(绝对实用)

信用证条款中英文对照一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts a re to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated(issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order andendorsed in blank notify buyers M/S … Co. ca lling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

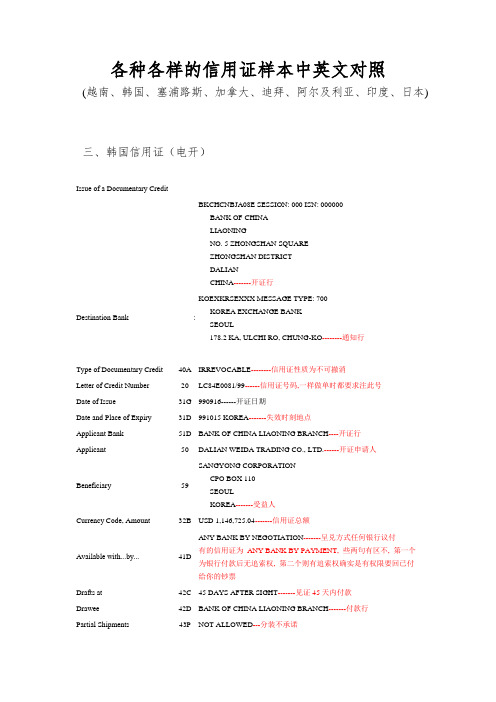

各种各样的信用证样本中英文对照

各种各样的信用证样本中英文对照(越南、韩国、塞浦路斯、加拿大、迪拜、阿尔及利亚、印度、日本)三、韩国信用证(电开)Issue of a Documentary CreditBKCHCNBJA08E SESSION: 000 ISN: 000000BANK OF CHINALIAONINGNO. 5 ZHONGSHAN SQUAREZHONGSHAN DISTRICTDALIANCHINA-------开证行Destination Bank : KOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO--------通知行Type of Documentary Credit 40A IRREVOCABLE--------信用证性质为不可撤消Letter of Credit Number 20 LC84E0081/99------信用证号码,一样做单时都要求注此号Date of Issue 31G 990916------开证日期Date and Place of Expiry 31D 991015 KOREA-------失效时刻地点Applicant Bank 51D BANK OF CHINA LIAONING BRANCH----开证行Applicant 50 DALIAN WEIDA TRADING CO., LTD.------开证申请人Beneficiary 59 SANGYONG CORPORATION CPO BOX 110SEOULKOREA-------受益人Currency Code, Amount 32B USD 1,146,725.04-------信用证总额Available with...by... 41D ANY BANK BY NEGOTIATION-------呈兑方式任何银行议付有的信用证为ANY BANK BY PAYMENT, 些两句有区不, 第一个为银行付款后无追索权, 第二个则有追索权确实是有权限要回已付给你的钞票Drafts at 42C 45 DAYS AFTER SIGHT-------见证45天内付款Drawee 42D BANK OF CHINA LIAONING BRANCH-------付款行Partial Shipments 43P NOT ALLOWED---分装不承诺Transhipment 43T NOT ALLOWED---转船不承诺Shipping on Board/Dispatch/Packing in Charge at/ from44A RUSSIAN SEA----- 起运港Transportation to 44B DALIAN PORT, P.R.CHINA -----目的港Latest Date of Shipment 44C 990913--------最迟装运期Description of Goods or Services: 45A--------物资描述FROZEN YELLOWFIN SOLE WHOLE ROUND (WITH WHITE BELLY) USD770/MT CFR DALIAN QUANTITY: 200MTALASKA PLAICE (WITH YELLOW BELLY) USD600/MT CFR DALIAN QUANTITY: 300MTDocuments Required: 46A------------议付单据----------当局签发的原产地证明三份.7. CERTIFICATE OF HEALTH IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的健康/检疫证明三份.ADDITIONAL INSTRUCTIONS: 47A-----------附加指示1. CHARTER PARTY B/L AND THIRD PARTY DOCUMENTS ARE ACCEPTABLE.----------租船提单和第三方单据能够同意2. SHIPMENT PRIOR TO L/C ISSUING DATE IS ACCEPTABLE.----------装船期早于信用证的签发日期是能够同意的3. BOTH QUANTITY AND AMOUNT 10 PERCENT MORE OR LESS ARE ALLOWED.---------承诺数量和金额公差在10%左右Charges 71B ALL BANKING CHARGES OUTSIDE THE OPENNING BANK ARE FOR BENEFICIARY'S ACCOUNT.Period for Presentation 48 DOCUMENTSMUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF ISSUANCE OF THE TRANSPORT DOCUMENTS BUT WITHIN THE VALIDITY OF THE CREDIT.Confimation Instructions 49 WITHOUTInstructions to the Paying/Accepting/Negotiating Bank: 781. ALL DOCUMENTS TO BE FORWARDED IN ONE COVER, UNLESS OTHERWISE STATED ABOVE.2. DISCREPANT DOCUMENT FEE OF USD 50.00 OR EQUAL CURRENCY WILL BE DEDUCTED FROM DRAWING IF DOCUMENTS WITH DISCREPANCIES ARE ACCEPTED."Advising Through" Bank 57A KOEXKRSEXXX MESSAGE TYPE: 700 KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO(B)单据上的任何修改或更正必须有出具小人签,否则不予同意。

信用证中英文对照翻译

信用证条款中英文对照—-基础27: Sequence of total 序列号1/1 指只有一张电文40A:Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20:Data of issue12345678 信用证号码31C:Date of issue 开证日精2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50:Applicant 信用证开证审请人(你们的客户名) ABC CO。

,LTD。

CHINA59:Beneficiary 受益人(你们公司名)EFG CO., LTD。

ADDRESS32B:Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C:Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE V ALUE 见票XXX天付款(发票全额)42A:Drawee 付款人ABOCCNBJXXX AGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行43P:Partial shipment 是否允许分批装运ALLOWED 可以43T:TransshipmentALLOWED 允许转运44A: Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C:Latest date of shipment 最后装船期2002XXXX45A:Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A: Documents required 须提供的单据文件1。

信用证中英文对照翻译

信用证条款中英文对照——基础27: Sequence of total 序列号1/1 指只有一张电文40A: Form of documentary credit 跟单信用证形式 IRREVOCABLE 不可撤消的信用证20: Data of issue12345678 信用证号码31C: Date of issue 开证日精2002XXXX31D: Date and place of expiry 信用证有效期2002XXXXBENEFICIARY’S COUNTRY 有效地50: Applicant 信用证开证审请人(你们的客户名) ABC CO., LTD.CHINA59: Beneficiary 受益人(你们公司名)EFG CO., LTD.ADDRESS32B: Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANKBY NEGOTIATION 任何议付行42C: Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE VALUE 见票XXX天付款(发票全额)42A: Drawee 付款人ABOCCNBJXXX AGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行 43P: Partial shipment 是否允许分批装运ALLOWED 可以43T: TransshipmentALLOWED 允许转运44A: Taking charge 装船港口XXXXXX PORT44B: For transportation to 目的港CHINESE PORT44C: Latest date of shipment 最后装船期2002XXXX45A: Description goods and/or services 货物/服务描述GENERAL MERCHANDISE 日用品46A: Documents required 须提供的单据文件MERCIAL INVOICE IN TRIPLICATE 一式三份商业发票2.FULL SET OF CLEAN ON BOARD B/L MARKED FREIGHT PREPAID MADE OUT TO ORDER OF SHIPPER AND NOTIFYING APPLICANT 全套已装船清洁提单,标明运费预付,收货人一栏填根据发货人指示,通知开证审请人3.PACKING LIST IN DUPLICATE 装箱单一式二份47A: Additional conditions 附加条件1.AGRICULTURAL BANK OF CHINA SINGAPORE BRANCH IS ASSIGNED TO DISCOUNT THE L/C 中国农业银行为指定的付款行2.AFTER NEGOTIATION BANK HAS SENT TESTED TELEX TO ISSUING BANK CERTIFYING DOCUMENTS IN COMPLIANCE WITH THE L/C TERMS AND INDICATION INVOICE VALUE,THEN NEGOTIATION BANK IS AUTHORIZED TO CLAIM REIMBURSEMENT BY TESTED TELEX/SWIFT FROM AGRICULTRUAL BANK OF CHINA SINGAPORE BRANCH AT SIGHT BASIS. SINGAPORE BRANCH WILL EFFECT PAYMENT WITHIN 5 WORKING DAYS. 议付行发电传给开证行确认单证相符,并指示发票金额,然后以SWIFT 电码或电传的形式授权中国农业银行新加波支行付款给收益人,新加波支行将在五个工作日内履行付款义务71B: Charges 开证以外产生的费用ALL BANKING CHARGES OUTSIDE OFTHE ISSUING BANK (EXCEPT FOR THE DISCOUNT INTEREST AND DISCOUNTCHARGES) ARE FOR BENEFICIARY’SACCOUNT 开证行以外产生的费用由信用证收益人负担(票据贴现利息与折扣除外)48: Period for presentation 单据提交期限DOCUMENTS MUST BE PRESENTED WITHINXX DAYS AFTER LATEST SHIPMENT DATEBUT WITHIN THE VALIDITY OF THISCREDIT 在信用证有效期内,最迟装运期后XX天内,向银行提交单据49: Confirmation instructionWITHOUT 不保兑53A: Reimbursement Bank 偿付行ABOCSGSG 78: Instructions to pay/account/negotiation bank 指示付款行?议付行1.A DISCREPANCY(IES) FEE OF USDXX.00 WILL BE DEDUCTED FROM THE PROCEEDS IF THE DOCUMENTS ARE PRESENTED WITH A DISCREPANCY(IES). 如果单据提交有差异,差额将从信用额里扣除2.ALL DOCUMENTS SHOULD BE DESPATCHED TO US (ADDRESS:XXXXXXX)IN ONE LOT BY COURIER SERVICE.所有单据应一次性通过快件形式发给我们72: Sender to receiver information 说明THIS CREDIT IS ISSUED SUBJECT TOUCP500 (1993 REVISION) 本信用证跟据跟单信用证通一惯例UCP500(1993 年版)开出one original and four photocopies of the commercial invoice showing standard export packing and also showing non-quota when a non-quota item is shipped. 出具一式四份标准出口包装的商业发票,若为无配额商品,则需另出无配额证明 one origianl and three photocopies of inspection certificate issued by hymin park of min woo international inc.出具一式三份由hymin park of min woo international inc.签发的商检证书 a fax letter by angela stating that one full set of non-negotiable documents was received. Angela传真声明需出具一整套不可议付之单证 one origianal and three photocopies of beneficiary's certificatecertifying that a production sample was sent to the attention of ruth plant or Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 一式三份的受益人产品样品之证明书寄至工厂或是此地址: Albert elkaim of buffalo jeans ,400sauve west, montreal , quebec h3l 1z8 (好像是加拿大的一个地址) one original and three photocopies of packing list.装箱单一式三份full set of original marine bills of lading clean on board or multimode transport documents clean on board plus 2 non-negotiable copies issued by air sea transport inc.. weihai, china made out or endorsed to order of bnp paribass(canada) marked freight collect, notify general customs brokers attn linda 514-876-1704全套清洁已装船的海运提单或是清洁已装船之多式联运提单需加两份由air sea transport inc签发的不可议付单据副本.提单需注明由bnp paribass(Canada)付费,通关联系人 Linda,电话514-876-1704one original and three photocopies of certificate of export licence of textile products showing the year of quota which must correspond to the year of shipment except in the case of non-quota which an export licenceis not required. 出具一式三份的纺织品出品许可证明书,年度配额须与年度出货一致,其中无需配额要求除外.one original and three photocopies of certificate of origin. 一式三份的原产地证书one original and three photocopies of canada customs invoice. 一式三份的加拿大海关发票a fax letter by albert elkaim,michel bitton, ruth plant,kathy alix,nancy whalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton stating a sample was received.albert elkaim,michel bitton, ruth plant,kathy alix,nancywhalen,marjolaine martel,mimi bernola,anna sciortino,jennyfer hassan or charles bitton这些人传真声明的可接受之样品letter from shipper on their letterhead indicating their name of company and address,bill of lading number,container number and that thisshipment,including its container,does not contain any non-manufactured wooden material, tonnage, bracing material, pallets, crating or other non-manufactured wooden packing material.托单需注明托运人公司,地址,提单号,货柜号,及装载量,包括非木质包装之排水量,托盘,板条箱或其它非木质包装材料信用证条款如下:DOCUMENTS REQUIRED45A1、 FULL SET CLEAN SHIPPED ON BOARD SHIPPING CO’S BILL OF LADING ISSUED TO THE ORDER OF OMDURMAN NATIONAL BANK, SAGGANA BRANCH MAKED FREIGHT PREPAIK AND NOTIFY APPLICANT.2、 SIGNED COMMERCIAL INVOICE IN FIVE ORIGINAL AND THREE COPIES DULY CERTIFIED TRUE AND CORRECT.3、 PACKING LIST IN ONE ORIGINAL AND FOUR COPIES.4、 CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE CHINA CERTIFY THAT THE GOODS ARE OF CHINESE ORIGIN.1、全套清洁提单。

各种各样的信用证样本中英文对照

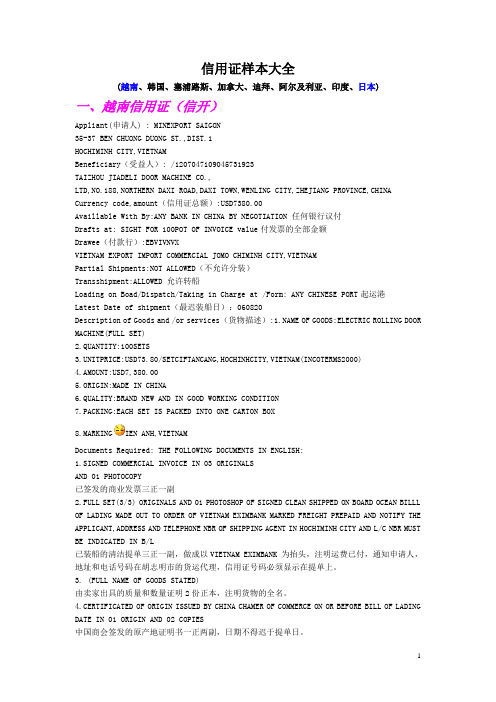

各种各样的信⽤证样本中英⽂对照信⽤证样本⼤全(越南、韩国、塞浦路斯、加拿⼤、迪拜、阿尔及利亚、印度、⽇本)⼀、越南信⽤证(信开)Appliant(申请⼈) : MINEXPORT SAIGON35-37 BEN CHUONG DUONG ST.,DIST.1HOCHIMINH CITY,VIETNAMBeneficiary(受益⼈): /1207047109045731923TAIZHOU JIADELI DOOR MACHINE CO.,LTD,NO.188,NORTHERN DAXI ROAD,DAXI TOWN,WENLING CITY,ZHEJIANG PROVINCE,CHINACurrency code,amount(信⽤证总额):USD7380.00Availlable With By:ANY BANK IN CHINA BY NEGOTIATION 任何银⾏议付Drafts at: SIGHT FOR 100POT OF INVOICE value付发票的全部⾦额Drawee(付款⾏):EBVIVNVXVIETNAM EXPORT IMPORT COMMERCIAL JOMO CHIMINH C ITY,VIETNAMPartial Shipments:NOT ALLOWED(不允许分装)Transshipment:ALLOWED 允许转船Loading on Boad/Dispatch/Taking in Charge at /Form: ANY CHINESE PORT起运港Latest Date of shipment(最迟装船⽇):060820Description of Goods and /or services(货物描述):/doc/3f4279c189eb172ded63b76a.html OF GOODS:ELECTRIC ROLLING DOOR MACHINE(FULL SET)2.QUANTITY:100SETS3.UNITPRICE:US D73.80/SETCIFTANCANG,HOCHINHCITY,VIETNAM(INCOTERMS2000)4.AMOUNT:USD7,380.005.ORIGIN:MADE IN CHINA6.QUALITY:BRAND NEW AND IN GOOD WORKING CONDITION7.PACKING:EACH SET IS PACKED INTO ONE CARTO N BOX8.MARKING IEN ANH,VIETNAMDocuments Required: THE FOLLOWING DOCUMENTS IN ENGLIS H:1.SIGNED COMMERCIAL INVOICE IN 03 ORIGINALSAND 01 PHOTOCOPY已签发的商业发票三正⼀副2.FULL SET(3/3) ORIGINALS AND 01 PHOTOSHOP OF SIGNED CLEAN SHIPPED ON BOARD OCEAN BILLL OF LADING MADE OUT TO ORDER OF VIETNAM EXIMBANK MARKED FREIGHT PREPAID AND NOTIFY THE APPLICANT,ADDRESS AND TELEPHONE NBR OF S HIPPING AGENT IN HOCHIMINH CITY AND L/C NBR MUST BEINDICATED IN B/L已装船的清洁提单三正⼀副,做成以VIETNAM EXIMBANK 为抬头,注明运费已付,通知申请⼈,地址和电话号码在胡志明市的货运代理,信⽤证号码必须显⽰在提单上。

信用证中英文对照

一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Mala yan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. callin g for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

信用证条款中英文对照

信用证条款中英文对照信用证条款中英文对照一、Kinds of L/C 信用证类型1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延期付款信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证二、L/C Parties Concerned 有关当事人1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行三、Amount of the L/C 信用证金额1.amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度四、The Stipulations for the shipping Documents 跟单条款1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……五、Draft(Bill of Exchange) 汇票1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 原期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立” (3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”六、Invoice 发票1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be sho wed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发七、Bill of Loading 提单1.full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本八、Insurance Policy (or Certificate) 保险单(或凭证)1.Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险2.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People's Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

常见信用证明条款英汉对照

常见信用证明条款英汉对照在国际贸易中,信用证是一种常见的付款方式。

以下是一些常见的信用证条款的英汉对照:1. Amount: 金额2. Beneficiary: 受益人3. Applicant: 申请人4. Issuing bank: 开证行5. Advising bank: 通知行6. Expiry date: 到期日期7. Shipment date: 装运日期8. Port of loading: 装运港9. Port of discharge: 卸货港10. Documents required: 所需单据11. Shipping marks: 装运唛头12. Insurance coverage: 保险覆盖范围13. Partial shipment: 分批装运14. Transshipment: 转运15. L/C negotiation: 信用证议付16. L/C confirmation: 信用证保兑17. Bill of lading: 提单18. Commercial invoice: 商业发票19. Packing list: 装箱单20. Insurance policy: 保险单21. Inspection certificate: 检验证书22. Certificate of origin: 原产地证书23. Clean on board B/L: 清洁提单24. FOB (Free On Board): 离岸价25. CIF (Cost, Insurance, and Freight): 成本、保险加运费价26. CFR (Cost and Freight): 成本加运费价27. D/P (Documents against Payment): 付款交单28. D/A (Documents against Acceptance): 承兑交单29. Sight payment: 即期付款30. Usance payment: 远期付款请注意,在特定的贸易合同和信用证中,可能会有自定义的条款和定义。

信用证样本大全及中英文对照

信用证样本大全(越南、韩国、塞浦路斯、加拿大、迪拜、阿尔及利亚、印度、日本)一、越南信用证(信开)Appliant(申请人) : MINEXPORT SAIGON35-37 BEN CHUONG DUONG ST.,DIST.1HOCHIMINH CITY,VIETNAMBeneficiary(受益人): /1207047109045731923TAIZHOU JIADELI DOOR MACHINE CO.,LTD,NO.188,NORTHERN DAXI ROAD,DAXI TOWN,WENLING CITY,ZHEJIANG PROVINCE,CHINA Currency code,amount(信用证总额):USD7380.00Availlable With By:ANY BANK IN CHINA BY NEGOTIATION 任何银行议付Drafts at: SIGHT FOR 100POT OF INVOICE value付发票的全部金额Drawee(付款行):EBVIVNVXVIETNAM EXPORT IMPORT COMMERCIAL JOMO CHIMINH CITY,VIETNAMPartial Shipments:NOT ALLOWED(不允许分装)Transshipment:ALLOWED 允许转船Loading on Boad/Dispatch/Taking in Charge at /Form: ANY CHINESE PORT起运港Latest Date of shipment(最迟装船日):060820Description of Goods and /or services(货物描述): OF GOODS:ELECTRIC ROLLING DOOR MACHINE(FULL SET)2.QUANTITY:100SETS3.UNITPRICE:USD73.80/SETCIFTANCANG,HOCHINHCITY,VIETNAM(INCOTERMS2000)4.AMOUNT:USD7,380.005.ORIGIN:MADE IN CHINA6.QUALITY:BRAND NEW AND IN GOOD WORKING CONDITION7.PACKING:EACH SET IS PACKED INTO ONE CARTON BOX8.MARKING IEN ANH,VIETNAMDocuments Required: THE FOLLOWING DOCUMENTS IN ENGLISH:1.SIGNED COMMERCIAL INVOICE IN 03 ORIGINALSAND 01 PHOTOCOPY已签发的商业发票三正一副2.FULL SET(3/3) ORIGINALS AND 01 PHOTOSHOP OF SIGNED CLEAN SHIPPED ON BOARD OCEAN BILLL OF LADING MADE OUT TO ORDER OF VIETNAM EXIMBANK MARKED FREIGHT PREPAID AND NOTIFY THE APPLICANT,ADDRESS AND TELEPHONE NBR OF SHIPPING AGENT IN HOCHIMINH CITY AND L/C NBR MUST BE INDICATED IN B/L已装船的清洁提单三正一副,做成以VIETNAM EXIMBANK 为抬头,注明运费已付,通知申请人,地址和电话号码在胡志明市的货运代理,信用证号码必须显示在提单上。

信用证中英文

信用证常见条款中英文对照(一)、各方当事人在信用证中的表述文句(THE PARTIES CONCERNING TO THE CREDIT)⑴开证人(The Applicant for the credit)信用证的开立是由进口商向银行申请办理的。

开证人指的就是进口商。

词汇和词组:Applicant/Principal/Accountee/ Accreditor / OpenerAt the request of………应。

的请求By order of…………按。

的指示For account of………由。

付款At the request of and for…….应。

的请求Account of ……..并由。

付款By order of and for account of ……….按。

的指示并由。

付款⑵受益人(The beneficiary)受益人一般就是出口商。

词汇或词组有:Beneficiary 受益人In favour of …….以。

为受益人In your favour……..以你方为受益人Transferor………转让人(可转让信用证的第一受益人)Transferee……….受让人(可转让信用证的第二受益人)⑶开证行(The Opening Bank)应开证人要求开立信用证的银行叫开证行。

词汇和词组:Opening BankIssuing BankEstablishing Bank①通知行(Advising Bank)开证行将信用证寄送的一家受益人所在地的银行,并通过该银行通知受益人信用证开出,这家银行就是通知行。

词汇和词组:Advising BankNotifying BankAdvised through②议付行(The Negotiation bank)议付行就是购买出口商的汇票及审核信用证项下规定单据的银行。

词汇或词组有:Negotiation BankHonouring Bank③付款行(Paying Bank)付款行就是经开证行授权按信用证规定的条件向受益人付款的银行.Paying BankDrawee Bank④保兑行(confirming Bank)保兑行就是对开证行开立的信用证进行保兑的银行,通常以通知行作为保兑行,或者是第三家银行。

信用证中英文对照

信用证中英文对照一、基本术语对照1. 信用证(Letter of Credit,简称LC)2. 申请人(Applicant)3. 受益人(Beneficiary)4. 开证行(Issuing Bank)5. 通知行(Advising Bank)6. 议付行(Negotiating Bank)7. 付款行(Paying Bank)8. 保兑行(Confirming Bank)二、信用证类型对照1. 可撤销信用证(Revocable Letter of Credit)2. 不可撤销信用证(Irrevocable Letter of Credit)3. 即期信用证(Sight Letter of Credit)4. 远期信用证(Usance Letter of Credit)5. 可转让信用证(Transferable Letter of Credit)6. 循环信用证(Revolving Letter of Credit)7. 背对背信用证(BacktoBack Letter of Credit)8. 预支信用证(Anticipatory Letter of Credit)三、信用证关键条款对照1. 信用证金额(Credit Amount)英文:The total amount for which the Letter of Credit is issued.2. 信用证有效期(Validity of the Credit)英文:The date until which the Letter of Credit remains valid for presentation of documents.3. 交单期限(Period for Presentation)英文:The time frame within which the shipping documents must be presented to the bank.4. 货物描述(Description of Goods)英文:A detailed description of the merchandise covered the Letter of Credit.5. 装运条款(Shipment Terms)英文:The conditions under which the goods are to be shipped, including the latest date of shipment.6. 付款条件(Payment Terms)英文:The conditions under which the payment will be made, whether at sight or on a deferred basis.四、信用证相关单据对照1. 发票(Invoice)英文:A document issued the seller to the buyer, indicating the goods sold and their agreed prices.2. 提单(Bill of Lading,简称B/L)英文:A receipt issued the carrier to the shipper, acknowledging receipt of goods for transportation.3. 保险单(Insurance Policy)4. 检验证书(Inspection Certificate)5. 装箱单(Packing List)英文:A detailed list of the contents of each package, prepared the shipper.五、信用证操作注意事项对照1. 信用证条款审核(Review of Credit Terms)英文:Carefully examine the terms and conditions ofthe Letter of Credit to ensure they match the sales contract.2. 单据准备与提交(Preparation and Submission of Documents)英文:Prepare all required documents accurately and submit them to the bank within the specified time frame.3. 银行费用承担(Bank Charges)英文:Clarify which party is responsible for the bank charges associated with the Letter of Credit.4. 风险防范(Risk Prevention)英文:Be aware of potential risks such as discrepancies in documents, bank defaults, and changes intrade policies.六、信用证修改与撤销对照1. 信用证修改(Amendment to the Letter of Credit)英文:A formal request to change certain terms or conditions of the Letter of Credit after it has been issued.2. 信用证撤销(Cancellation of the Letter of Credit)英文:The act of terminating the Letter of Credit before its expiry date, if it is a revocable credit.七、信用证常见问题及解决方案对照1. 文件不符(Discrepancy in Documents)英文:When the documents presented do not conform to the terms and conditions of the Letter of Credit.解决方案:Rectify the discrepancies and resubmit the corrected documents within the allowed time frame.2. 信用证延期(Extension of the Letter of Credit)英文:Requesting an extension of the validity period of the Letter of Credit.解决方案:Coordinate with the applicant to request the issuing bank to extend the credit's validity.3. 信用证付款延迟(Delay in Payment)英文:When the payment under the Letter of Credit is not made on time the issuing bank.解决方案:Communicate with the issuing bank to expedite the payment process or seek assistance from the confirming bank, if applicable.八、信用证在国际贸易中的作用对照1. 降低交易风险(Reducing Transaction Risks)英文:The Letter of Credit provides a secure payment method, reducing the risk of nonpayment for the seller.2. 促进贸易便利化(Facilitating Trade)英文:By offering a guarantee of payment, the Letter of Credit facilitates smoother trade transactions between parties in different countries.3. 融资工具(Financing Instrument)英文:The Letter of Credit can be used the beneficiary to obtain financing from the bank before the actual payment is received.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

信用证样本(中英文对照)信用证样本:以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTDLETTERS OF CREDIT DEPARTMENTNTCOSIA COMMERCIAL OPERATIONS CENTERINTERNATIONAL DIVISION************TEL:******FAX:******TELEX:2451 & 4933 KYPRIA CYSWIFT:BCYPCY2NDATE:23 MARCH 2005APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDITSWIFT MT700 SENT TO:MT700转送至STANDARD CHARTERD BANKUNIT 1-8 52/F SHUN NIND SQUAREO1 WANG COMMERCIAL CENTRE,SHEN NANROAD EAST,SHENZHEN 518008 - CHINA渣打银行深圳分行深南东路5002号信兴广场地王商业大厦52楼1-8单元电话:82461688:27: SEQUENCE OF TOTAL序列号1/1 指只有一张电文:40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式IRREVOCABLE 不可撤消的信用证:20OCUMENTARY CREDIT NUMBER信用证号码00143-01-0053557:31C: DATE OF ISSUE开证日如果这项没有填,则开证日期为电文的发送日期。

:31DATE AND PLACE OF EXPIRY信用证有效期050622 IN CHINA 050622在中国到期:50: APPLICANT 信用证开证审请人******* NICOSIA 较对应同发票上是一致的:59: BENEFICIARY 受益人CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂:32B: CURRENCY CODE,AMOUNT 信用证项下的金额USD***7841,89:41D:AVAILABLE WITH....BY.... 议付适用银行STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行:42CRAFTS AT 开汇票SIGHT 即期:42A:DRAWEE 付款人BCYPCY2NO10BANK OF CYPRUS LTD 塞浦路斯的银行名:43 PARTIAL SHIPMENTS 是否允许分批装运NOT ALLOWED 不可以:43T:TRANSHIPMENT转运ALLOWED允许:44AOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM...装船港口SHENZHEN PORT深圳:44B:FOR TRANSPORTATION TO 目的港LIMASSOL PORT发票中无提及:44C: LATEST DATE OF SHIPMENT最后装船期050601:045A:DESCRIPTION OF GOODS AND/OR SERVICES 货物/服务描述SANITARY WARE 陶瓷洁具F O B SHENZHEN PORT,INCOTERMS 2000 fob深圳港,INCOMTERMS 2000:046A:DOCUMENTS REQUIRED 须提供的单据文件*FULL SET (AT LEAST THREE) ORIGINAL CLEAN SHIPPED ON BOARD BILLSOF LADING ISSUED TO THE ORDER OF BANK OF CYPRUS PUBLIC COMPANYLTD,CYPRUS,NOTIFY PARTIES APPLICANT AND OURSELVES,SHOWING全套清洁已装船提单原件(至少三份),作成以“塞浦路斯股份有限公司”为抬头,通知开证人和我们自己,注明*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIRAGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYINGTHAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETYMANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001BY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO.HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:A)原产地为中国B)同号码为HL050307 开立日为07/03/05的商业发票内容一致:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND THE NAME OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(如果有要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSEL IS NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI, CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta, Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICANTS.保险由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANGUAGE.所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARANTEE STRICTLY 保结押汇或是银行保函PROHIBITED. 禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTS PRESENTED UNDER THIS CREDIT,WHETHER ACCEPTED OR NOT,PLUS OUR CHARGES FOR EACH MESSAGE CONCERNING REJECTION AND/OR ACCEPTANCE MUST BE BORNE BY BENEFICIARIES THEMSELVES AND DEDUCTED FROM THE AMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US AND REJECTED,WE MAY RELEASE THE DOCUMENTS AND EFFECT SETTLEMENT UPON APPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANY COMMUNICATION WITH THE PRESENTER THAT WE ARE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS TO THE CONTRARY ARE RECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利。

是说你如果提交了有不符点的单据并且被银行拒付的话,如果客人接受这些不符点,银行在没有收到你们的指示之前有权把单据REALSE给客人*TRANSPORT DOCUMENTS BEARING A DATE PRIOR TO THE L/C DATE ARE NOT ACCEPTABLE.早于开证前的运输文件不接受*DIFFERENCE OF USD3363.81(T.E.30 PERCENT OF INVOICE VALUE)BETWEEN L/C AMOUNT AND INVOICES AMOUNT REPRESENTS AMOUNT PAID BY APPLICANTS DIRECT TO BENEFICIARIES OUTSIDE THE L/C TERMS WITHOUTANY RESPONSIBILITY ON OURSELVES AND TO BE SHOWN ON INVOICES ASSUCH. L/C跟发票上USD3363.81的差额(30%发票额)由申请人直接用L/C以外的方式直接给予受益人:71B: CHARGESBANK CHARGES OUTSIDE CYPRUSINCLUDING THOSE OF THE REIMBURSINGBANK ARE FOR BEN. A/C. 在塞浦路斯以外银行产生的费用包括支付行的费用由信用证收益人负担,:48: PERIOD FOR PRESENTATION 单据提交期限DOCUMENTS MUST BE PRESENTED WITHIN21 DAYS AFTER B/LADING DATE,BUTWITHIN THE VALIDITY OF THE CREDIT.在信用证有效期内,最迟装运期后21天内,向银行提交单据:49:CONFIRMATION INSTRUCTIONS保兑指示WITHOUT 不保兑:53A: REIMBURSING BANK偿付行BCYPGB2LBANK OF CYPRUS UKINTERNATIONAL DEPARTMENT,87/93 CHASE SIDE,SOUTHGATE N14 5BULONDON - UNITED KINGDOM.:78: INSTRUCTIONS TO THE PAY/ACCEP/NEG BANK 议付行NEGO OF DOCS THRU BANK OF CHINA LIMITED CHINA IS ALLOWED.PLEASE可通过中国银行议付,请DEDUCT RROM YOUR PAYMENT TO BENEFICIARIES THE AMOUNT OF USD15,00 (是15还是1500,请指明)于受益人的帐户中扣去USD15,00REPRESENTING RECORDING FEES. NEGOTIATION BANK TO OBTAIN作为记录费。