信用证常用英语

信用证常用英语

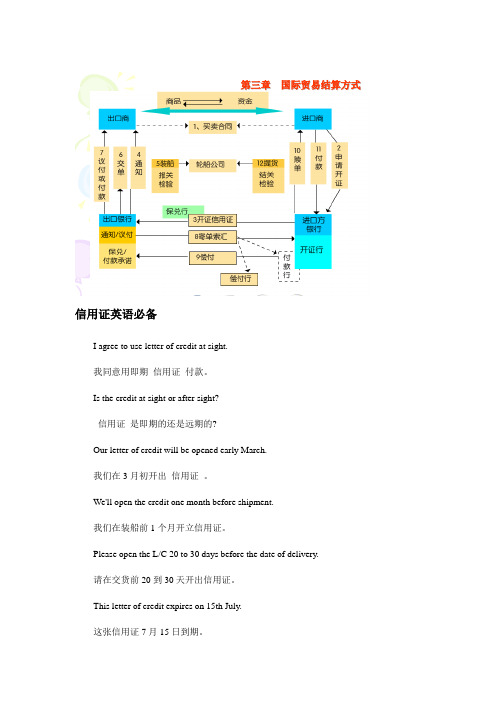

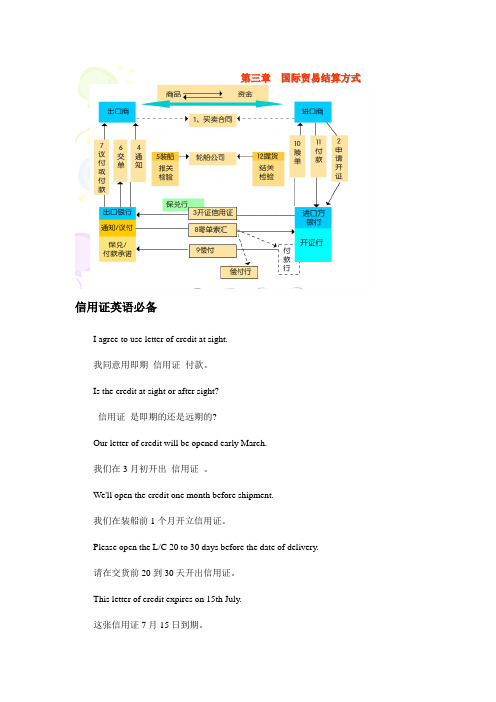

第三章国际贸易结算方式信用证英语必备I agree to use letter of credit at sight.我同意用即期信用证付款。

Is the credit at sight or after sight?信用证是即期的还是远期的?Our letter of credit will be opened early March.我们在3月初开出信用证。

We'll open the credit one month before shipment.我们在装船前1个月开立信用证。

Please open the L/C 20 to 30 days before the date of delivery.请在交货前20到30天开出信用证。

This letter of credit expires on 15th July.这张信用证7月15日到期。

The validity of the L/C will be extended to 30th August.信用证的有效期将延至8月30日。

Will you persuade your customer to arrange for a one-month extension of L/C No.TD204?你们能不能劝说客户将TD204号信用证延期一个月?To do so, you could save bank charges for opening an L/C.这样做,你们可以省去开证费用。

It's expensive to open an L/C because we need to put a deposit in the bank.开证得交押金,因此花费较大。

We pay too much for such a letter of credit arrangement.这种信用证付款方式让我们花费太大了。

There will be bank charges in connection with the credit.开立信用证还要缴纳银行手续费。

外贸英语口语信用证专业英语词汇

外贸英语口语:信用证专业英语词汇开证申请人:Opener信用证上的进口人||买方:Accredited buyer||Accredited holder||Accredited importer 开证行:Opening bank||Issuing bank受益人:beneficiary受领信用的人:accreditee受领信用证的人:addressee受雇人:user通知银行||联系银行:Notifying bank||Advising bank||Transmitting bank购买银行||议付行:Negotiating bank||Purchaser||Negotiating party善意持票人:Bona fide holder受票人::Drawee接受银行||承兑银行:Accepting bank保兑银行:Confirming bank无担保信用证||不跟单信用证:clean letter of credit押汇信用证||跟单信用证:documentary letter of credit确认信用证||保兑信用证:confirmed letter of credit不确认信用证||不保兑信用证:unconfirmed letter of credit不可撤消信用证:irrevocable letter of credit可撤消信用证:revocable letter of credit保兑不可撤消信用证:irrevocable and confirmed credit不保兑、不可撤消信用证:irrevocable and unconfirmed credit不保兑、可撤消信用证:revocable and unconfirmed credit循环信用证:circular letter of credit||revolving credit特定信用证:restricted letter of credit旅行信用证:traveller's letter of credit商业信用证:commercial letter of credit无条件信用证:"general credit委托购买信用证:L/A letter of credit特定授权信用证:S/A letter of credit有条件转让信用证:ESCROW letter of credit背对背信用证:back-to-back letter of credit交互计算信用证:swing clause letter of credit开出计算信用证:open account letter of credit可转让信用证:assignable L/C有权追索信用证:with recourse L/C无权追索信用证:without recourse L/C银行信用证:banker's credit||bank credit前借信用证:packing credit原始信用证:original credit开立信用证:"to open a credit在银行裁决信用证:to arrange a credit with a bank以电报开出信用证:to cable a credit开出信用证:to issue a credit修改信用证:to amend a credit将信用证有效期延长:to extend a credit增加信用证金额:to increase a credit请求开立信用证:to take out a credit收回信用证||撤回信用证:to revoke a credit信用证例文我们很高兴得知贵公司早于5月5日向旧金山美国银行开出信用证。

信用证英语之关键英语词汇

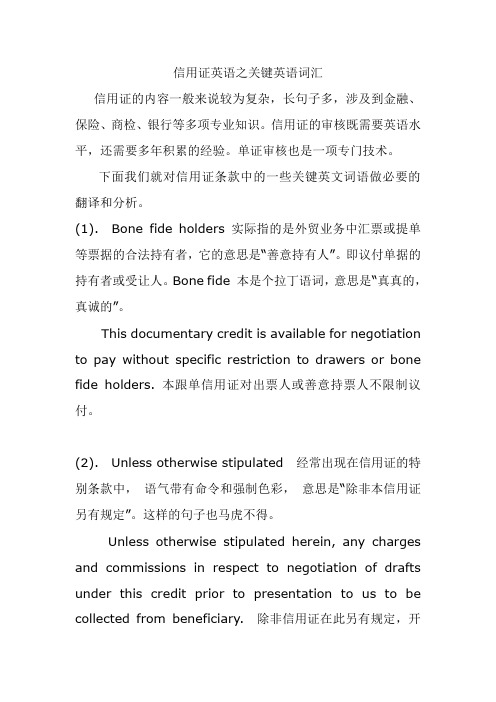

信用证英语之关键英语词汇信用证的内容一般来说较为复杂,长句子多,涉及到金融、保险、商检、银行等多项专业知识。

信用证的审核既需要英语水平,还需要多年积累的经验。

单证审核也是一项专门技术。

下面我们就对信用证条款中的一些关键英文词语做必要的翻译和分析。

(1). Bone fide holders 实际指的是外贸业务中汇票或提单等票据的合法持有者,它的意思是“善意持有人”。

即议付单据的持有者或受让人。

Bone fide 本是个拉丁语词,意思是“真真的,真诚的”。

This documentary credit is available for negotiation to pay without specific restriction to drawers or bone fide holders. 本跟单信用证对出票人或善意持票人不限制议付。

(2). Unless otherwise stipulated 经常出现在信用证的特别条款中,语气带有命令和强制色彩,意思是“除非本信用证另有规定”。

这样的句子也马虎不得。

Unless otherwise stipulated herein, any charges and commissions in respect to negotiation of drafts under this credit prior to presentation to us to be collected from beneficiary. 除非信用证在此另有规定,开证行见到银行提示前的任何议付费用和其他费用都向受益人收取。

a.in respect to 这个短语与“尊重、关心”毫无关联。

它的意思是“关于”“就…… 方面”(with reg ard to)。

b.掌握prior to 之意,意为“在…… 之前”即previous to or before 之意。

c.搞清presentation 的意义,词根present 的意思非常之多,在本条款中的意思是“提示,银行提示”。

有关信用证词汇中英对照

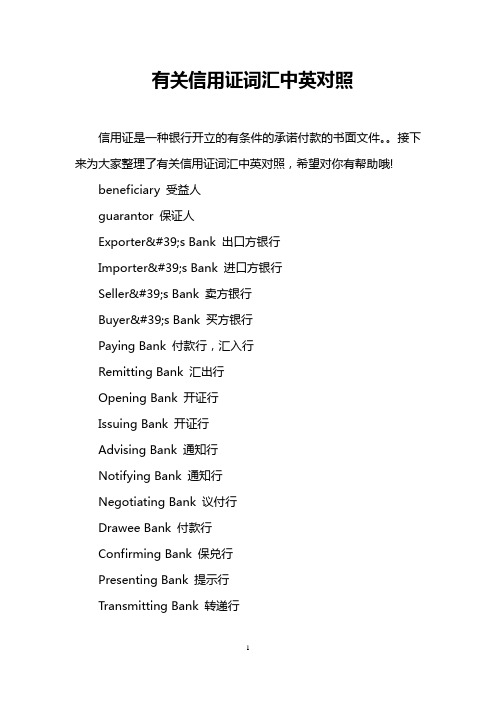

有关信用证词汇中英对照信用证是一种银行开立的有条件的承诺付款的书面文件。

接下来为大家整理了有关信用证词汇中英对照,希望对你有帮助哦!beneficiary 受益人guarantor 保证人Exporter's Bank 出口方银行Importer's Bank 进口方银行Seller's Bank 卖方银行Buyer's Bank 买方银行Paying Bank 付款行,汇入行Remitting Bank 汇出行Opening Bank 开证行Issuing Bank 开证行Advising Bank 通知行Notifying Bank 通知行Negotiating Bank 议付行Drawee Bank 付款行Confirming Bank 保兑行Presenting Bank 提示行Transmitting Bank 转递行Accepting Bank 承兑行Additional Words and Phrasespay bearer 付给某人bearer 来人payer 付款人consignee 受托人consignor 委托人drawer 出票人principal 委托人drawee 付款人consingnee 受托人truster 信托人acceptor 承兑人trustee 被信托人endorser 背书人discount 贴现endorsee 被背书人endorse 背书holder 持票人endorsement 背书bailee 受托人,代保管人payment against documents 凭单付款Untransferable L/C 不可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to Back L/C 背对背信用证Countervailing credit (俗称)子证Overriding credit 母证Banker's Acceptance L/C 银行承兑信用证Trade Acceptance L/C 商业承兑信用证Red Clause L/C 红条款信用证Anticipatory L/C 预支信用证Credit payable by a trader 商业付款信用证Credit payable by a bank 银行付款信用证usance credit payment at sight 假远期信用证Uniform Customs and Practice for Documentary Credits 跟单信用证统一惯例I.C.C. Publication No.400 第400号出版物Credit with T/T Reimbursement Clause 带有电报索汇条款的信用证method of reimbursement 索汇方法without recourse 不受追索Opening Bank' Name & Signature 开证行名称及签字payment against documents through collection 凭单托收付款payment by acceptance 承兑付款payment by bill 凭汇票付款Letter of Guarantee (L/G) 保证书Bank Guarantee 银行保函Contract Guarantee 合约保函Payment Guarantee 付款保证书Repayment Guarantee 还款保证书Import Guarantee 进口保证书Tender/Bid Guarantee 投标保证书Performance Guarantee 履约保证书Retention Money Guarantee 保留金保证书Documents of title to the goods 物权凭证Authority to Purchase (A/P) 委托购买证Letter of Indication 印鉴核对卡Letter of Hypothecation 质押书General Letter of Hypothecation 总质押书。

信用证常用英语词汇整理

信用证常用英语词汇整理信用证常用英语词汇整理Untransferable L/C 不可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to Back L/C 背对背信用证Countervailing credit (俗称)子证Overriding credit 母证Banker's Acceptance L/C 银行承兑信用证Trade Acceptance L/C 商业承兑信用证Red Clause L/C 红条款信用证Anticipatory L/C 预支信用证Credit payable by a trader 商业付款信用证Credit payable by a bank 银行付款信用证usance credit payment at sight 假远期信用证Uniform Customs and Practice for Documentary Credits 跟单信用证统一惯例I.C.C. Publication No.400 第400号出版物Credit with T/T Reimbursement Clause 带有电报索汇条款的信用证method of reimbursement 索汇方法without recourse 不受追索Opening Bank' Name & Signature 开证行名称及签字beneficiary 受益人guarantor 保证人Exporter's Bank 出口方银行Importer's Bank 进口方银行Seller's Bank 卖方银行Buyer's Bank 买方银行Paying Bank 付款行,汇入行Remitting Bank 汇出行Opening Bank 开证行Issuing Bank 开证行Advising Bank 通知行Notifying Bank 通知行Negotiating Bank 议付行Drawee Bank 付款行Confirming Bank 保兑行Presenting Bank 提示行Transmitting Bank 转递行Accepting Bank 承兑行Additional Words and Phrasespay bearer 付给某人bearer 来人payer 付款人consignee 受托人consignor 委托人drawer 出票人principal 委托人drawee 付款人consingnee 受托人truster 信托人acceptor 承兑人trustee 被信托人endorser 背书人discount 贴现endorsee 被背书人endorse 背书holder 持票人endorsement 背书bailee 受托人,代保管人payment against documents 凭单付款payment against documents through collection 凭单托收付款payment by acceptance 承兑付款payment by bill 凭汇票付款Letter of Guarantee (L/G) 保证书Bank Guarantee 银行保函Contract Guarantee 合约保函Payment Guarantee 付款保证书Repayment Guarantee 还款保证书Import Guarantee 进口保证书Tender/Bid Guarantee 投标保证书Performance Guarantee 履约保证书Retention Money Guarantee 保留金保证书Documents of title to the goods 物权凭证Authority to Purchase (A/P) 委托购买证Letter of Indication 印鉴核对卡Letter of Hypothecation 质押书General Letter of Hypothecation 总质押书。

信用证中英文对照

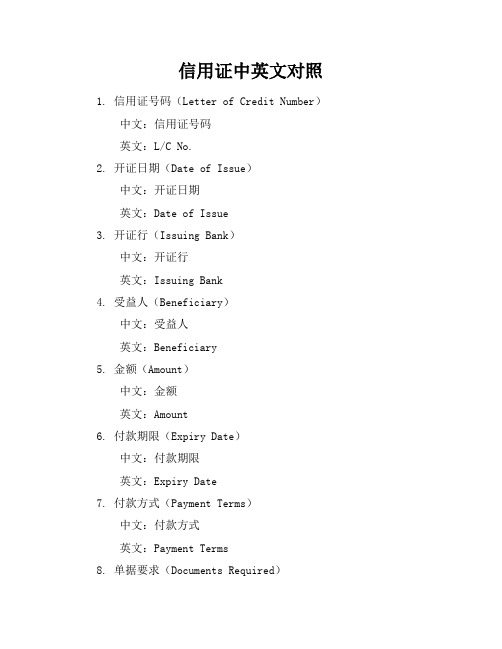

信用证中英文对照1. 信用证号码(Letter of Credit Number)中文:信用证号码英文:L/C No.2. 开证日期(Date of Issue)中文:开证日期英文:Date of Issue3. 开证行(Issuing Bank)中文:开证行英文:Issuing Bank4. 受益人(Beneficiary)中文:受益人英文:Beneficiary5. 金额(Amount)中文:金额英文:Amount6. 付款期限(Expiry Date)中文:付款期限英文:Expiry Date7. 付款方式(Payment Terms)中文:付款方式英文:Payment Terms8. 单据要求(Documents Required)英文:Documents Required9. 信用证类型(Type of Credit)中文:信用证类型英文:Type of Credit10. 货物描述(Description of Goods)中文:货物描述英文:Description of Goods11. 运输方式(Means of Transport)中文:运输方式英文:Means of Transport12. 起运地/装运港(Place of Dispatch/Shipment)中文:起运地/装运港英文:Place of Dispatch/Shipment13. 目的地/卸货港(Place of Destination/Discharge)中文:目的地/卸货港英文:Place of Destination/Discharge14. 最迟装运日期(Latest Date of Shipment)中文:最迟装运日期英文:Latest Date of Shipment15. 通知行(Advising Bank)中文:通知行英文:Advising Bank16. 交单期限(Presentation Period)英文:Presentation Period17. 特殊条款(Special Conditions)中文:特殊条款英文:Special Conditions18. 其他条款(Additional Conditions)中文:其他条款英文:Additional Conditions19. 开证申请人(Applicant)中文:开证申请人英文:Applicant20. 开证行地址(Issuing Bank's Address)中文:开证行地址英文:Issuing Bank's Address。

信用证英语词汇

信用证常用词语的理解一. against 在L/C 中的高频率出现及正确理解。

我们常见的against 是介词, 通常意为“反对”( indicating opposite ion) , 例如:Public opinion was against the Bill. 舆论反对此法案。

The resolution was adopted by a vote of 30 in favor to 4 against it. 议以30 票同意、4 票反对获得通过。

另外还有“用. . . 交换, 用. . . 兑付”之意。

如:“the rates against U. S. dollars”中的against 就是指美元兑换率。

但在信用证中常出现的against 这个词及词义却另有所指, 一般词典无其释义及相关用法。

注意以下两个出现在信用证句中的against 之意, 其意思是凭. . . ”“以. . . ”(“take as the basis ” or meaning of “by”)。

而不是“以. . . 为背景”“反对”“对照”“兑换”或其他什么意思。

1. This credit valid until September 17, 2001 in Switzerland for payment available against the presentation of following documents . . . 本信用证在2001年9月17日在瑞土到期前, 凭提交以下单据付款. . . . . .2. Documents bearing discrepancies must no t be negotiated against guarantee and reserve. 含有不符点的单据凭保函或在保留下不能议付。

3. The payment is available at sight against the following documents. 凭下列单据即期付款。

信用证常用英语句子

1. In the case of sight credits, payment can be made promptly upon presentationof draft and impeccable shipping documents.在即期信用证情况下,提示汇票和正确无误的单据后便立即付款。

2. L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

3. Is the credit at sight or after sight?我同意用即期信用证付款。

4. L/C at sight is what we request for all our customers.开即期信用证是我方对我们所有客户的要求。

5. We'll agree to change the terms of payment from L/C at sight to D/P at sight.我们同意将即期信用证付款方式改为即期付款交单。

6. Payment: 100% by irrevocable and confirmed letter of credit drawn at sight.100%的不可撤消、保兑的即期信用证。

7. We insist on payment by irrevocable sight credit.我们坚持凭不可撤消的即期信用证付款。

8. I agree to use letter of credit at sight.我同意用即期信用证付款。

9. As this is the first deal between us, I hope we can trade on customary terms, i.E., Letter of credit payable against sight draft.由于这是我们之间进行的第一笔交易,我很希望能够遵照惯例,也就是说,用即期信用证付款。

信用证常用术语(中英文版)

信用证常用术语信用证常用术语We insist on a letter of credit.我们坚持用信用证方式付款。

As I've said, we require payment by L/C.我已经说过了,我们要求以信用证付款。

We still intend to use letter of credit as the term of payment.我们仍然想用信用证付款方式。

We always require L/C for our exports.我们出口一向要求以信用证付款。

L/C at sight is normal for our exports to France.我们向法国出口一般使用即期信用证付款。

We pay by L/C for our imports.进口我们也采用信用证汇款。

Our terms of payment is confirmed and irrevocable letter of credit.我们的付款条件是保兑的不可撤消的信用证。

You must be aware that an irrevocable L/C gives the exporter the additional protection of banker's guarantee.你必须意识到不可撤消信用证为出口商提供了银行担保。

Is the wording of "confirmed" necessary for the letter of credit?信用证上还用写明“保兑”字样吗?For payment we require 100% value, irrevocable L/C in our favour with partial shipment allowed clause available by draft at sight.我们要求用不可撤消的、允许分批装运、金额为全部货款、并以我方为抬头人的信用证,凭即期汇票支付。

信用证应用词汇

信用证应用词汇(精简版)LCA NO信用证授权书号码IRC NO.进口许可证号码TIN NO税务登记号码VAT NO增值税号码HS CODE海关编码号customhouse 海关DC跟单信用证Bill of exchange=Draft汇票endorse背书Issuing bank 开证银行ETD预计交货时间ETA预计到达时间SWIFT:环球银行金融电信协会BL:bill of lading提单COO/CO:Certificate of origin产地证FTA自由贸易协定SEQ=Seq uence of total合计次序,也叫电文页次Date of Issue和Date Of Expiry开证日期和有效期限Currency code 货币transhipment转船转运drafts at出票条件shipment advice装运通知Quoting报价marine海运的At sight 即期Drawee汇票付款人,受票人drawer出票人Identifier code识别代码Port of discharge卸货港=destination port目的港Merchandise 商品consignment装运的货物,托运的货物reimbursement退还,偿还presentation 提交enfaced写、印或盖在面上As per按照Quality质量,品质quantity量,数量net weight and gross weight净重和毛重T are weight皮重,(集装箱)自重Containerised shippment 货柜船container seals集装箱封条Vessel 容器Trade terms贸易术语Manually signed 手签premium额外费用;;保险费;附加费octuplicate 一式八份triplicate一式三份in duplicate一式两份clean shipped清洁运输Agent代理人DULY及时,按时dispatched派遣Comfirmation instructions 确认指示counters柜台on the reverse of在....的背面strictly complying严格遵守INCOTERMS 2010 2010年国际贸易术语解释通则SEAWORTHY(尤指船舶)适航的Be forwarded to寄往...deducted扣除,减去discrepant差异存在差异(LES)is subject to 受支配,从属于CLAUSE索赔ALTERATIONS改动SIGNED AND STAMPED 签字盖章proceeds (买卖等的)收入,收益assigned to 以...为准。

信用证贸易专用英文词汇

9.reimbursing bank 偿付行

10.the confirming bank 保兑行

Amount of the L/C 信用证金额

1.amount RMB¥… 金额:人民币

2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……

----Draft(Bill of Exchange)

1.the kinds of drafts 汇票种类

(1)available by drafts at sight 凭即期汇票付款

(2)draft(s) to be drawn at 30 days sight 开立30天的期票

(3)sight drafs 即期汇票

(4)time drafts 远期汇票

2.drawn clauses 出票条款(注:即出具汇票的法律依据)

(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款

(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”

(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期

综合辅导:信用证英语大全

综合辅导:信用证英语大全Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.we----Other Documents1. full tet of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运 (4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运 (6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until…在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

信用证常用英语

第三章国际贸易结算方式信用证英语必备I agree to use letter of credit at sight.我同意用即期信用证付款。

Is the credit at sight or after sight?信用证是即期的还是远期的?Our letter of credit will be opened early March.我们在3月初开出信用证。

We'll open the credit one month before shipment.我们在装船前1个月开立信用证。

Please open the L/C 20 to 30 days before the date of delivery.请在交货前20到30天开出信用证。

This letter of credit expires on 15th July.这张信用证7月15日到期。

The validity of the L/C will be extended to 30th August.信用证的有效期将延至8月30日。

Will you persuade your customer to arrange for a one-month extension of L/C No.TD204?你们能不能劝说客户将TD204号信用证延期一个月?To do so, you could save bank charges for opening an L/C.这样做,你们可以省去开证费用。

It's expensive to open an L/C because we need to put a deposit in the bank.开证得交押金,因此花费较大。

We pay too much for such a letter of credit arrangement.这种信用证付款方式让我们花费太大了。

There will be bank charges in connection with the credit.开立信用证还要缴纳银行手续费。

常见信用证明条款英汉对照

常见信用证明条款英汉对照在国际贸易中,信用证是一种常见的付款方式。

以下是一些常见的信用证条款的英汉对照:1. Amount: 金额2. Beneficiary: 受益人3. Applicant: 申请人4. Issuing bank: 开证行5. Advising bank: 通知行6. Expiry date: 到期日期7. Shipment date: 装运日期8. Port of loading: 装运港9. Port of discharge: 卸货港10. Documents required: 所需单据11. Shipping marks: 装运唛头12. Insurance coverage: 保险覆盖范围13. Partial shipment: 分批装运14. Transshipment: 转运15. L/C negotiation: 信用证议付16. L/C confirmation: 信用证保兑17. Bill of lading: 提单18. Commercial invoice: 商业发票19. Packing list: 装箱单20. Insurance policy: 保险单21. Inspection certificate: 检验证书22. Certificate of origin: 原产地证书23. Clean on board B/L: 清洁提单24. FOB (Free On Board): 离岸价25. CIF (Cost, Insurance, and Freight): 成本、保险加运费价26. CFR (Cost and Freight): 成本加运费价27. D/P (Documents against Payment): 付款交单28. D/A (Documents against Acceptance): 承兑交单29. Sight payment: 即期付款30. Usance payment: 远期付款请注意,在特定的贸易合同和信用证中,可能会有自定义的条款和定义。

信用证专用英文词汇

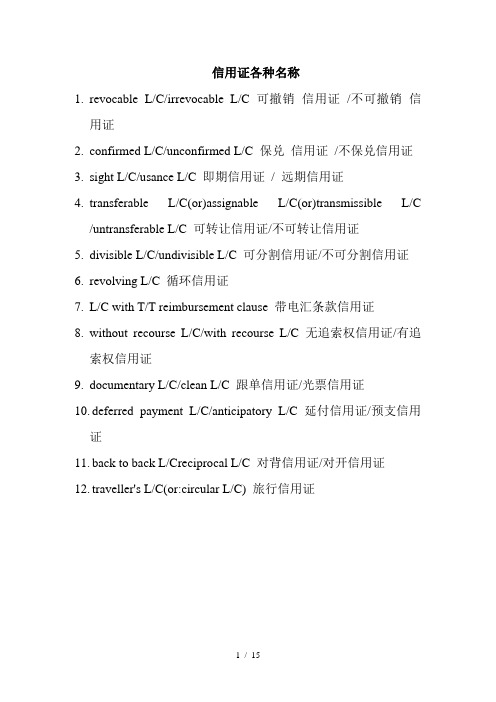

信用证专用英文词汇 一、Kinds of L/C 信用证类别 二、Names of Parties Concerned 有关当事人 三、Amount of the L/C 信用证金额 四、The Stipulations for the shipping Documents 跟单文句 五、Draft(Bill of Exchange)汇票 六、Invoice 发票 七、Bill of Loading 提单 八、Insurance Policy (or Certificate)保险单(或凭证) 九、Certificate of Origin 产地证 十、Packing List and Weight List 装箱单与重量单 十一、Inspection Certificate 检验证书 十二、Other Documents 其他单据 十三、The Stipulation for Shipping Terms 装运条款 十四、Date & Address of Expiry 有效日期与地点 十五、The Guarantee of the Opening Bank 开证行付款保证 十六、Special Conditions 特别条款 十七、In Reimbursement 索偿文句 ----Kinds of L/C 1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证 2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证 3.sight L/C/usance L/C 即期信用证/远期信用证 4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证 5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证 6.revolving L/C 循环信用证 7.L/C with T/T reimbursement clause 带电汇条款信用证 8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证 9.documentary L/C/clean L/C 跟单信用证/光票信用证 10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证 11.back to back L/Creciprocal L/C 对背信用证/对开信用证 12.traveller's L/C(or:circular L/C)旅行信用证 ----Names of Parties Concerned 1.opener 开证人 (1)applicant 开证人(申请开证人) (2)principal 开证人(委托开证人) (3)accountee 开证人 (4)accreditor 开证人(委托开证人) (5)opener 开证人 (6)for account of Messrs 付(某人)帐 (7)at the request of Messrs 应(某人)请求 (8)on behalf of Messrs 代表某人 (9)by order of Messrs 奉(某人)之命 (10)by order of and for account of Messrs 奉(某人)之命并付其帐户 (11)at the request of and for account of Messrs 应(某人)得要求并付其帐户 (12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示 2.beneficiary 受益人 (1)beneficiary 受益人 (2)in favour of 以(某人)为受益人 (3)in one's favour 以……为受益人 (4)favouring yourselves 以你本人为受益人 3.drawee 付款人(或称受票人,指汇票) (1)to drawn on (or :upon)以(某人)为付款人 (2)to value on 以(某人)为付款人 (3)to issued on 以(某人)为付款人 4.drawer 出票人 5.advising bank 通知行 (1)advising bank 通知行 (2)the notifying bank 通知行 (3)advised through…bank 通过……银行通知 (4)advised by airmail/cable through…bank 通过……银行航空信/电通知 6.opening bank 开证行 (1)opening bank 开证行 (2)issuing bank 开证行 (3)establishing bank 开证行 7.negotiation bank 议付行 (1)negotiating bank 议付行 (2)negotiation bank 议付行 8.paying bank 付款行 9.reimbursing bank 偿付行 10.the confirming bank 保兑行 Amount of the L/C 信用证金额 1.amount RMB¥…金额:人民币 2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币…… 3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑…… 4.to the extent of HKD… 总金额为港币…… 5.for the amount of USD… 金额为美元…… 6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度 跟单文句 ----- The Stipulations for the shipping Documents 1.available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款 2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据 3.accompanied against to documents hereinafter 随附下列单据 4.accompanied by following documents 随附下列单据 5.documents required 单据要求 6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份 7.drafts are to be accompanied by… 汇票要随附(指单据)…… ----Draft(Bill of Exchange) 1.the kinds of drafts 汇票种类 (1)available by drafts at sight 凭即期汇票付款 (2)draft(s) to be drawn at 30 days sight 开立30天的期票 (3)sight drafs 即期汇票 (4)time drafts 远期汇票 2.drawn clauses 出票条款(注:即出具汇票的法律依据) (1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款 (2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立” (3)draft(s) drawn under this credit to be marked:“Drawn under…BankL/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立” (4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具” (5)draft(s) so drawn must be in scribed with the number and date ofthis L/C 开具的汇票须注上本证的号码和日期 关税customs duty 净价 net price 印花税stamp duty 含佣价price including commission 港口税port dues 回佣return commission . 装运港port of shipment 折扣discount, allowance 卸货港port of discharge 批发价 wholesale price 目的港port of destination 零售价 retail price 进口许口证import licence 现货价格spot price 出口许口证export licence 期货价格forward price 现行价格(时价)current price prevailing price 国际市场价格 world (International)Market price 离岸价(船上交货价)FOB-free on board 成本加运费价(离岸加运费价) C&F-cost and freight 到岸价(成本加运费、保险费价)CIF-cost,insurance and freight 3、交货条件 交货delivery 轮船steamship(缩写S.S) 装运、装船shipment 租船charter (the chartered ship) 交货时间 time of delivery 定程租船voyage charter 装运期限time of shipment 定期租船time charter 托运人(一般指出口商)shipper, consignor 收货人consignee 班轮regular shipping liner 驳船lighter 舱位shipping space 油轮tanker 报关clearance of goods 陆运收据cargo receipt 提货to take delivery of goods 空运提单airway bill 正本提单original B\\\\L 选择港(任意港)optional port 选港费optional charges 选港费由买方负担 optional charges to be borne by the Buyers 或 optional charges for Buyers' account 一月份装船 shipment during January 或 January shipment 一月底装船 shipment not later than Jan.31st.或shipment on or before Jan.31st. 一/二月份装船 shipment during Jan./Feb.或 Jan./Feb. shipment 在……(时间)分两批装船 shipment during……in two lots 在……(时间)平均分两批装船 shipment during……in two equal lots 分三个月装运 in three monthly shipments 分三个月,每月平均装运 in three equal monthly shipments 立即装运 immediate shipments 即期装运 prompt shipments 收到信用证后30天内装运 shipments within 30 days after receipt of L/C 允许分批装船 partial shipment not allowed partial shipment not permitted partial shipment not unacceptable 4、交易磋商、合同签订 订单 indent 订货;订购 book; booking 电复 cable reply 实盘 firm offer 递盘 bid; bidding 递实盘 bid firm 还盘 counter offer 发盘(发价) offer 发实盘 offer firm 询盘(询价) inquiry;enquiry 5、交易磋商、合同签订 订单 indent 订货;订购 book; booking 电复 cable reply 实盘 firm offer 递盘 bid; bidding 递实盘 bid firm 还盘 counter offer 发盘(发价) offer 发实盘 offer firm 询盘(询价) inquiry;enquiry 6、交易磋商、合同签订 指示性价格 price indication 速复 reply immediately 参考价 reference price 习惯做法 usual practice 交易磋商 business negotiation 不受约束 without engagement 业务洽谈 business discussion 限**复 subject to reply ** 限* *复到 subject to reply reaching here ** 有效期限 time of validity 有效至**: valid till ** 购货合同 purchase contract 销售合同 sales contract 购货确认书 purchase confirmation 销售确认书 sales confirmation 一般交易条件 general terms and conditions 以未售出为准 subject to prior sale 需经卖方确认 subject to seller's confirmation 需经我方最后确认 subject to our final confirmation 7、贸易方式 INT (拍卖auction) 寄售consignment 招标invitation of tender 投标submission of tender 一般代理人agent 总代理人general agent 代理协议agency agreement 累计佣金accumulative commission 补偿贸易compensation trade (或抵偿贸易)compensating/compensatory trade (又叫:往返贸易) counter trade 来料加工processing on giving materials 来料装配assembling on provided parts 独家经营/专营权exclusive right 独家经营/包销/代理协议exclusivity agreement 独家代理 sole agency; sole agent; exclusive agency; exclusive agent 8、品质条件 品质 quality 原样 original sample 规格 specifications 复样 duplicate sample 说明 description 对等样品 countersample 标准 standard type 参考样品 reference sample 商品目录 catalogue 封样 sealed sample 宣传小册 pamphlet 公差 tolerance 货号 article No. 花色(搭配) assortment 样品 sample 5% 增减 5% plus or minus 代表性样品 representative sample 大路货(良好平均品质)fair average quality 9、商检仲裁 索赔 claim 争议disputes 罚金条款 penalty 仲裁arbitration 不可抗力 force Majeure 仲裁庭arbitral tribunal 产地证明书certificate of origin 品质检验证书 inspection certificate of quanlity 重量检验证书 inspection certificate of weight (quantity) **商品检验局 **commodity inspection bureau (*.C.I.B) 品质、重量检验证书 inspection certificate 10、数量条件 个数 number 净重 net weight 容积 capacity 毛作净 gross for net 体积 volume 皮重 tare 毛重 gross weight 溢短装条款 more or less clause 11、外汇 外汇 foreign exchange 法定贬值 devaluation 外币 foreign currency 法定升值 revaluation 汇率 rate of exchange 浮动汇率floating rate 国际收支 balance of payments 硬通货 hard currency 直接标价 direct quotation 软通货 soft currency 间接标价 indirect quotation 金平价 gold standard 买入汇率 buying rate 通货膨胀 inflation 卖出汇率 selling rate 固定汇率 fixed rate 金本位制度 gold standard 黄金输送点 gold points 铸币平价 mint par 纸币制度 paper money system 国际货币基金 international monetary fund 黄金饣愦⒈?gold and foreign exchange reserve 汇率波动的官定上下限 official upper and lower limits of fluctuation国际招标与投标英语词汇 标的物 Subject matter 招标通告 call for bid 招标通知 tender notice 招标文件 bid documents 招标条件 general conditions of tender 招标截止日期 date of the closing of tender 招标方 tenderer 投标 submission of tenders 投标方,投标商tenderer, bidder 投标邀请书 Invitation to Bid 投标押金,押标金 Bid Bond 投标文件 tender documents 做标,编标 work out tender documents 投标书 Form of Tender 投标评估 evaluation of bids 愿意/不愿意参加投标 be wi11ing/unwilling to participate in the bid 我们拟参加……的投标。

信用证英语词汇汇总

信用证各种名称1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/ 远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两份;in triplicate 一式三份;in quadruplicate 一式四份;in quintuplicate 一式五份;in sextuplicate 一式六份;in septuplicate 一式七份;in octuplicate 一式八份;in nonuplicate 一式九份;in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据8aaabined invoice is not acceptable 不接受联合发票Bill of Loading --- 提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“L iner terms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本原产地证明-----Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地声明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" “格式A”产地证明书10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书----The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运------Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4.draft(s) must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第三章国际贸易结算方式信用证英语必备I agree to use letter of credit at sight.我同意用即期信用证付款。

Is the credit at sight or after sight?信用证是即期的还是远期的?Our letter of credit will be opened early March.我们在3月初开出信用证。

We'll open the credit one month before shipment.我们在装船前1个月开立信用证。

Please open the L/C 20 to 30 days before the date of delivery.请在交货前20到30天开出信用证。

This letter of credit expires on 15th July.这张信用证7月15日到期。

The validity of the L/C will be extended to 30th August.信用证的有效期将延至8月30日。

Will you persuade your customer to arrange for a one-month extension of L/C No.TD204?你们能不能劝说客户将TD204号信用证延期一个月?To do so, you could save bank charges for opening an L/C.这样做,你们可以省去开证费用。

It's expensive to open an L/C because we need to put a deposit in the bank.开证得交押金,因此花费较大。

We pay too much for such a letter of credit arrangement.这种信用证付款方式让我们花费太大了。

There will be bank charges in connection with the credit.开立信用证还要缴纳银行手续费。

A letter of credit would increase the cost of my import.信用证会增加我们进口货物的成本。

The seller will request to amend the letter of credit.卖方要修改信用证。

Please amend L/C No.205 as follows.请按下述意见修改第205号信用证。

Your refusal to amend the L/C is equivalent to cancellation of the order.你们拒绝修改信用证就等于取消订单。

Letter of Credit (L/C) 信用证form of credit 信用证形式Terms of validity 信用证效期Expiry Date 效期Date of issue 开证日期L/C amount 信用证金额L/C number 信用证号码to open by airmail 信开to open by cable 电开to open by brief cable 简电开证to amend L/C 修改信用证fixed L/C or fixed amount L/C 有固定金额的信用证Sight L/C 即期信用证Usance L/C 远期信用证Buyer''s Usance L/C 买方远期信用证Traveler''s L/C 旅行信用证Revocable L/C 可撤消的信用证Irrevocable L/C 不可撤消的信用证Confirmed L/C 保兑的信用证Unconfirmed L/C 不保兑的信用证Confirmed Irrevocable L/C 保兑的不可撤消信用证Irrevocable Unconfirmed L/C 不可撤消不保兑的信用证Transferable L/C 可转让信用证Untransferable L/C 不可转让信用证Revolving L/C 循环信用证Reciprocal L/C 对开信用证Back to Back L/C 背对背信用证Countervailing credit (俗称)子证Overriding credit 母证Banker''s Acceptance L/C 银行承兑信用证Trade Acceptance L/C 商业承兑信用证Red Clause L/C 红条款信用证Anticipatory L/C 预支信用证Credit payable by a trader 商业付款信用证Credit payable by a bank 银行付款信用证usance credit payment at sight 假远期信用证Uniform Customs and Practice for Documentary Credits 跟单信用证统一惯例I.C.C. Publication No.400 第400号出版物Credit with T/T Reimbursement Clause 带有电报索汇条款的信用证method of reimbursement 索汇方法without recourse 不受追索Opening Bank'' Name & Signature 开证行名称及签字beneficiary 受益人guarantor 保证人Exporter''s Bank 出口方银行Importer''s Bank 进口方银行Seller''s Bank 卖方银行Buyer''s Bank 买方银行Paying Bank 付款行,汇入行Remitting Bank 汇出行Opening Bank 开证行Issuing Bank 开证行Advising Bank 通知行Notifying Bank 通知行Negotiating Bank 议付行Drawee Bank 付款行Confirming Bank 保兑行Presenting Bank 提示行Transmitting Bank 转递行Accepting Bank 承兑行Additional Words and Phrases pay bearer 付给某人bearer 来人payer 付款人consignee 受托人consignor 委托人drawer 出票人principal 委托人drawee 付款人consingnee 受托人truster 信托人acceptor 承兑人trustee 被信托人endorser 背书人discount 贴现endorsee 被背书人endorse 背书holder 持票人endorsement 背书bailee 受托人,代保管人payment against documents 凭单付款payment against documents through collection 凭单托收付款payment by acceptance 承兑付款payment by bill 凭汇票付款Letter of Guarantee (L/G) 保证书Bank Guarantee 银行保函Contract Guarantee 合约保函Payment Guarantee 付款保证书Repayment Guarantee 还款保证书Import Guarantee 进口保证书Tender/Bid Guarantee 投标保证书Performance Guarantee 履约保证书Retention Money Guarantee 保留金保证书Documents of title to the goods 物权凭证Authority to Purchase (A/P) 委托购买证Letter of Indication 印鉴核对卡Letter of Hypothecation 质押书General Letter of Hypothecation 总质押书信用证英语- 信用证种类1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票) (1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dollars…累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP…总金额不得超过英镑……4.to the extent of HKD…总金额为港币……5.for the amount of USD…金额为美元……6.for an amount not exceeding total of JPY…金额的总数不得超过……日元的限度----- The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by…汇票要随附(指单据)……----Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…”本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978”汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…”即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank”汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”信用证付款英语例句【 国际商贸人才门户-世贸人才网2009-07-29】【字体:放大缩小】一、支付条件(Terms of payment)1. Our usual way of payment is by confirmed and irrevocable letter of credit available by draft at sight for the full amount of the contracted goods to be established in our favour through a bank acceptable to the sellers.我们的一般付款方式是保兑的、不可撤销的、以我公司为受益人的、足额信用证,见票即付。