《金融学(第二版)》讲义大纲及课后习题答案详解 十二章

金融学第二版课后习题答案

金融学第二版课后习题答案【篇一:王重润公司金融学第二版课后答案】业有几种组织方式?各有什么特点?( 1)有两种,有限责任公司和股份有限责任公司( 2)有限责任公司特点:有限责任公司是指股东以其出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业法人;有限责任公司注册资本的最低限额为人民币3万元;其资本并不必分为等额股份,也不公开发行股票,股东持有的公司股票可以再公司内部股东之间自由转让,若向公司以外的人转让,须经过公司股东的同意;公司设立手续简便,而且公司无须向社会公开公司财务状况。

( 3)股份有限责任公司特点:1、有限责任2、永续存在3、股份有限责任公司的股东人数不得少于法律规定的数目,我国规定设立股份有限公司,应当有2人以上200人以下为发起人4、股份有限责任公司的全部资本划分为等额的股份,通过向社会公开发行的办法筹集资金,任何人在缴纳了股款之后,都可以成为公司股东,没有资格限制。

5、可转让性6、易于筹资2题:为什么我国《公司法》允许存在一人有限责任公司?一人有限责任公司与个人独资企业有何不同?答:1.就立法初衷而言,许可自然人投资设立一人有限责任公司的重要考虑是减少实质上的一人公司的设立,简化和明晰股权归属,减少纷争。

以往由于我国《公司法》禁止设立一人公司,使得投资人通过各种途径设立或形成的实质上的一人公司大量存在,挂名股东与真实股东之间的投资权益纠纷以及挂名股东与公司债权人之间的债务纠纷不断,令工商行政管理部门和司法机关无所适从。

在修订《公司法》的过程中,法律委员会、法制工作委员会会同国务院法制办、工商总局、国资委、人民银行和最高人民法院反复研究认为:从实际情况看,一个股东的出资额占公司资本的绝大多数而其他股东只占象征性的极少数,或者一个股东拉上自己的亲朋好友作挂名股东的有限责任公司,即实质上的一人公司,已是客观存在,也很难禁止。

根据我国的实际情况,并研究借鉴国外的通行做法,应当允许一个自然人投资设立有限责任公司。

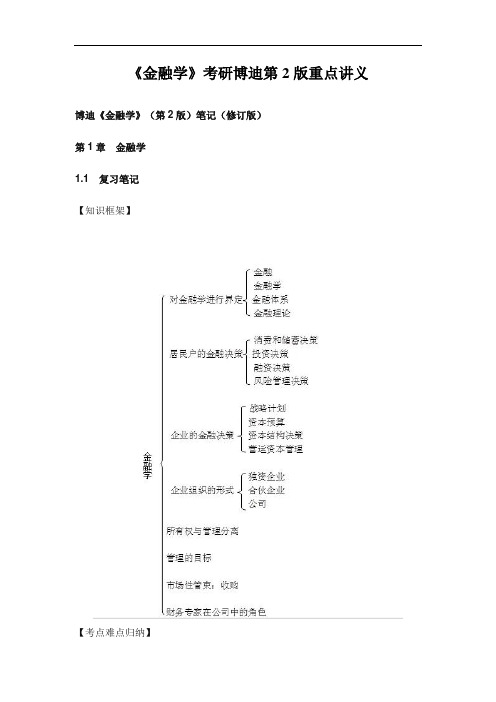

《金融学》考研博迪第2版重点讲义

《金融学》考研博迪第2版重点讲义博迪《金融学》(第2版)笔记(修订版)第1章金融学1.1复习笔记【知识框架】【考点难点归纳】考点一:对金融学进行界定1金融金融是货币流通、信用活动及与之相关的经济行为的总称。

简言之,就是货币资金的融通。

一般是指以银行、证券市场等为中心的货币流通和信用调节活动,包括货币的发行和流通、存款的吸收和提取、贷款的发放和收回、国内外汇兑往来、有价证券的发行和流通、保险、信托、抵押、典当以及各种金融衍生工具交易等。

按金融中介机构是否充当资金转移的媒介,金融可以分为直接金融(direct finance)和间接金融(indirect finance)。

2金融学金融学是一项针对人们怎样跨期配置稀缺资源的研究。

金融决策区别于其他资源配置决策的两项特征是:①金融决策的成本和收益是跨期分摊的;②无论是决策者还是其他人,通常都无法预先确知金融决策的成本和收益。

金融学是主要研究货币领域的理论及货币资源的配置与选择、货币与经济的关系及货币对经济的影响、现代银行体系的理论和经营活动的经济学科,是当代经济学的一个相对独立而又极为重要的分支。

金融学所涵盖的内容极为丰富,诸如货币原理、货币信用与利息原理、金融市场与银行体系、储蓄与投资、保险、信托、证券交易、货币理论、货币政策、汇率及国际金融等。

3金融体系金融体系是金融市场与金融机构的集合,这些集合被用于金融合同的订立以及资产和风险的交换。

金融体系是由连接资金盈余者和资金短缺者的一系列金融中介机构和金融市场共同构成的一个有机体,包括股票、债券和其他金融工具的市场、金融中介(如银行和保险公司)、金融服务公司(如金融咨询公司)以及监控管理所有这些单位的管理机构等。

研究金融体系如何发展演变是金融学科的重要方面。

4金融理论金融理论由一系列概念和数量化模型组成。

概念帮助人们思考如何在时间上配置资源;数量化模型用于估价替代方案、制定决策和执行决策。

各个层次的决策都采用同样的基本概念和数量化模型。

《金融学》 教案大纲及习题解答(姜法芹 )

《金融学》教案大纲及习题解答第一章:金融学导论1.1 金融学的定义与意义金融学的概念金融学的研究对象与内容金融学的重要性1.2 金融市场与金融体系金融市场的概念与类型金融体系的组织结构金融市场与金融体系的关系1.3 金融学的应用领域企业金融个人金融宏观金融第二章:金融市场与金融工具2.1 金融市场的概念与类型金融市场的定义金融市场的类型与特点金融市场的作用与功能2.2 金融工具与金融产品金融工具的定义与分类金融产品的特点与功能金融工具与金融产品的选择与运用2.3 金融市场的参与者金融市场的主体与客体金融市场的投资者与融资者金融市场的服务机构第三章:金融市场的基本原理3.1 供求关系与价格机制金融市场的供求关系价格机制的作用与影响市场均衡与市场失灵3.2 金融市场的基本原理与应用金融市场的效率与有效性金融市场的风险与收益金融市场的信息与信号传递3.3 金融市场的微观结构金融市场的交易机制金融市场的信息不对称问题金融市场的交易成本与效率第四章:金融机构与金融体系4.1 金融机构的概念与类型金融机构的定义与特点商业银行与其他金融机构的比较金融机构的职能与作用4.2 金融体系的组织结构金融体系的构成要素金融体系的层次结构金融体系的监管与调控机制4.3 金融体系的功能与目标金融体系的基本功能金融体系的宏观调控目标金融体系的微观审慎监管目标第五章:金融市场与宏观经济5.1 金融市场与经济增长金融市场对经济增长的影响金融市场的规模与经济增长的关系金融市场的结构与经济增长的关系5.2 金融市场与货币政策货币政策的概念与目标金融市场在货币政策传导中的作用货币政策对金融市场的影响5.3 金融市场与金融稳定性金融稳定性的概念与意义金融市场在金融稳定性维护中的作用金融市场风险管理与监管的策略与措施《金融学》教案大纲及习题解答第六章:商业银行与存款货币银行6.1 商业银行的组织结构与运营模式商业银行的定义与特点商业银行的组织结构与管理体系商业银行的运营模式与业务流程6.2 存款货币银行的存款创造与信贷扩张存款创造的概念与机制信贷扩张的过程与影响存款货币银行的风险管理与信贷政策6.3 商业银行的金融服务与产品商业银行的存款与贷款产品商业银行的支付结算服务商业银行的金融服务创新第七章:资本市场与证券交易7.1 资本市场的概念与类型资本市场的定义与特点股票市场与债券市场的比较资本市场的功能与作用7.2 证券交易与投资分析证券交易的基本流程投资分析的方法与工具投资者偏好与投资组合的选择7.3 资本市场的效率与有效性资本市场效率的定义与衡量资本市场的有效性假说资本市场效率与有效性的实证研究第八章:金融衍生品市场8.1 金融衍生品的概念与类型金融衍生品的定义与特点期货、期权和掉期的比较金融衍生品市场的功能与作用8.2 金融衍生品的定价与风险管理金融衍生品的定价原理金融衍生品的风险类型与风险管理策略金融衍生品市场的风险监管与调控8.3 金融衍生品市场的应用与影响金融衍生品在企业金融中的应用金融衍生品在个人理财中的应用金融衍生品市场对金融体系的影响第九章:国际金融与外汇市场9.1 国际金融市场的概念与类型国际金融市场的定义与特点国际资本市场与国际外汇市场的比较国际金融市场的作用与影响9.2 外汇市场的运行机制与交易策略外汇市场的组织结构与交易机制外汇市场的汇率决定与变动外汇市场的交易策略与风险管理9.3 国际金融市场的关系与影响国际金融市场之间的联系与互动国际金融市场对国内经济的影响国际金融市场风险的识别与应对第十章:金融监管与金融政策10.1 金融监管的概念与目标金融监管的定义与意义金融监管的目标与原则金融监管的机构与体系10.2 金融政策的概念与工具金融政策的定义与类型货币政策与财政政策的比较金融政策的工具与传导机制10.3 金融政策的效应与评估金融政策的宏观经济效应金融政策的微观经济效应金融政策的评估方法与指标《金融学》教案大纲及习题解答第十一章:金融创新与金融科技11.1 金融创新的定义与类型金融创新的含义与动力金融创新的产品与服务金融创新的风险与监管11.2 金融科技的发展与应用金融科技的概念与特点数字货币与区块链技术金融科技在金融服务中的应用11.3 金融创新与金融监管的关系金融监管对金融创新的影响金融创新对金融监管的挑战金融监管与金融创新的平衡策略第十二章:金融风险与管理12.1 金融风险的定义与类型金融风险的概念与特征市场风险、信用风险和流动性风险的比较金融风险的管理与控制12.2 金融风险评估与度量金融风险评估的方法与模型金融风险度量的指标与工具金融风险评估的实践应用12.3 金融风险管理的策略与工具金融风险管理的框架与程序金融风险规避、分散与转移金融风险管理的创新与挑战第十三章:企业金融与公司财务13.1 企业金融的概念与功能企业金融的定义与目标企业金融的资本结构与投资决策企业金融的融资与理财策略13.2 公司财务的理论与实践公司财务的基本原则与目标公司财务的财务报表分析与估值公司财务的资本预算与资本结构13.3 企业金融与公司财务的挑战与趋势企业金融与公司财务的国际化企业金融与公司财务的可持续发展企业金融与公司财务的创新与发展第十四章:个人金融与理财规划14.1 个人金融的概念与内容个人金融的定义与意义个人资产与个人负债的管理个人金融产品的选择与运用14.2 理财规划的理论与方法理财规划的基本原则与步骤理财规划的工具与技术理财规划的实际操作与案例分析14.3 个人金融与理财规划的挑战与趋势个人金融市场的变化与趋势理财规划在个人金融中的应用个人金融与理财规划的创新与发展第十五章:金融伦理与职业道德15.1 金融伦理的概念与重要性金融伦理的定义与特点金融伦理在金融行业中的重要性金融伦理的挑战与问题15.2 职业道德的标准与原则职业道德的内涵与要求职业道德的实践与遵守职业道德的监督与教育15.3 金融伦理与职业道德的发展趋势金融伦理与职业道德的改进与完善金融行业职业道德建设的措施与方法金融伦理与职业道德的未来发展重点和难点解析本文档详细地编写了《金融学》教案大纲及习题解答,涵盖了金融学的基本概念、原理和应用。

0《金融学》(第二版)第1-15章答案

第一章思考题A、B、C详解1.1 答案详解:A金银作为自然的产物,其只有在人类社会出现之后才作为货币,因此金银天然不是货币,B选项错误。

货币的本质是一般等价物,贝壳、铜在历史上都曾经做过货币,因此C选项错误。

金银只有在作为货币使用时才能作为一般等价物。

D选项也错误。

综合,A说法正确。

1.2 答案详解:A纸币是由国家发行的、强制使用的货币符号。

纸币的发行数量、面值等等都是由国家决定的,体现着一个国家的货币政策。

但是,货币的购买力不是由国家或者法律决定的,而是由货币发行数量和经济发展状况决定的。

如果生产力水平不变,社会生产出的总的商品数量不变,而流通中的货币数量为原来的两倍,那么商品的价格也会变成原来的两倍,此时每种面值的货币只代表原来一半的价值。

因此选A。

1.3 答案详解:ACDF在商品交换过程中,价值形式的发展经历的四个阶段有简单的价值形式、扩大的价值形式、相对价值形式、一般价值形式。

参见第一章第一节有关内容1.4 答案详解:银行券指由银行发行的以信用作为保证的可以兑现的银行票据,是以银行信用为担保所产生的一种信用工具银行券有其自身的发展历程。

开始时为安全的缘故,一些人将金银交由从事货币兑换业务的商铺保存,商铺则给客户开出相应收据,并承诺随时提取原有数量的金银;后来,由于交易和支付日益频繁,人们可以使用保管凭条进行直接收付,这就是银行券的雏形。

随着商业信用的不断扩大和发展,商业票据的运用范围日益广泛,但持票人只能到期才能兑现自己所持有的商业票据。

为了解决持票人临时需要资金的问题,银行进行金融创新,开展贴现业务,并且当银行的现款不足以支付持票人时,银行可以使用自己发行的银行券来支付。

1.5 答案详解:当货币在生活中日益重要时,一般说来,作为货币的商品有如下四个基本特征:一是价值比较高,这样可用较少的媒介完成较大量的商品交换;二是易于分割,一方面分割之后不会减少它的价值,另一方面分割成本较低,以便于同价值高低不等的商品交换;三是易于保存,即在保存过程中不会损失价值,费用很低;四是便于携带,以利于扩大化的商品交易。

金融学第二版课后复习思考题参考答案.docx

第一章货币与货币制度一、单项选择题1.B2. C3. B4. C5. A6.B7. C1、多项选择题1. ACDE2. CDE3. CD4. ABCD5. ABCDE6. ABCD三、简答题1.货币的职能有哪些?价值尺度;流通手段;支付手段;贮藏手段;世界货币2.人民币制度包括哪些内容?(1)人民币是我国的法定货币;(2)人民币是我国唯一的合法通货;(3)人民币的发行权集中于中央银行;(4)人民币以商品物资作为发行的首要保证,也以大量的政府政府债券、商业票据、商业银行票据等为发行的信用保证,还有黄金、外汇储备等也是人民币发行的现金保证;(5)人民币实行有管理的货币制度;(6)人民币称为可兑换货币。

3.货币制度的构成要素是什么?货币材料;货币单位;各种通货的铸造、发行和流通程序;准备制度4.不兑现的信用货币制度有哪些特点?(1)不兑现信用货币一般由屮央银行发行,并由国家赋予其无限法偿能力,这是不兑现信用货币制度最基本的特点;(2)信用货币不与任何金属保持等价关系,也不能兑换黄金;(3)货币通过信用程序投入流通领域;(4)信用货币制度是一种管理货币制度;5.钱、货币、通货、现金是一回事吗?银行卡是货币吗?墓不一样。

(1)钱的概念在不同场景下有很多不同的意思。

可以是个收入的概念、也可以是个财富的概念,也可以特指现金货币;(2)货币是在商品劳务交换与债券债务清偿时,被社会公众所普遍接受的东西。

(3)通货是流通中的货币,指流通与银行体系之外的货币。

范围小于货币。

(4)现金就是现钞,包括纸币、硬币。

现金是货币的一部分,流动性很强,对人们的日常消费影响很大。

(5)银行卡本身也称为“塑料货币”,包扌舌信用卡、支票卡,记账卡、自动出纳机卡等。

银行卡可以用于存取款和转账支付。

在发达西方国家,各种银行卡正在取代现钞和支票,称为经济生活中广泛的支付工具,因此现代社会银行卡也是货币6.社会经济生活中为什么离不开货币?为什么自古至今,人们又往往把金钱看做说万恶之源?(1)社会经济生活离不开货币,货币的产生和发展都有其客观必然性。

《金融学》课程教学大纲

《金融学》课程大纲课程代码:00406004课程学分:3课程总学时:48适用专业:经济学(转本)专业一、课程概述(一)课程性质《金融学》是一门研究金融领域各要素及其基本关系与运行规律的专业基础理论课程,是经济学、金融学专业的基础性理论课,也是经济类、管理类等多个专业的主干课程。

通过本课程的教学,使学生对金融的基本知识、基本概念、基本理论有较全面的理解和较深刻的认识,对货币、信用、金融机构、金融市场、国际金融、金融宏观调控与监管等方面的基本内容有较系统的掌握,提高学生在社会科学方面的综合素养,为进一步学习其他专业课程打下必要的基础,进而培养学生作为一个经济、金融从业者以及管理者应当具备的正确观察、分析和解决当前经济、金融领域面临的实际问题的能力。

(二)设计理念鉴于本课程是理论性较强的专业课程,所以本课程的总体设计思路是打破传统的单纯以讲授知识为主要目标的教学模式,注重理论讲授与案例分析相结合、注重理论知识与现实实践相结合、注重理论与政策相结合,综合运营案例教学法、课程实验法、研讨性教学法、研究性教学法等多种课程教学方式。

课程评价要侧重综合能力的评价,采取理论考核、论文考核部分和实践考核相结合方式,构建科学、合理、适用的考核机制。

(三)开发思路按照南京晓庄学院关于“高素质、应用型”本科人才培养目标,设计以培养学生概括和归纳能力、写作能力、自学能力、实践能力和科研能力为目标的教学内容,重视理论与实践相结合,形成以考核学生综合能力为主的课程评价方法,切实提高学生的综合素质和职业竞争能力。

二、课程目标(一)知识目标1.使学生对货币金融方面的基本知识、基本概念、基本理论有较全面的理解和较深刻的认识,对货币、信用、利率、金融机构、金融市场、国际金融、金融宏观调控、金融监管等基本范畴、内在关系及其运动规律有较系统的掌握。

2.通过课堂教学和课外学习,使学生了解国内外金融问题的现状,掌握观察和分析金融问题的正确方法,培养解决金融实际问题的能力。

《金融学(第二版)》讲义大纲及课后习题答案详解十三章

《⾦融学(第⼆版)》讲义⼤纲及课后习题答案详解⼗三章CHAPTER 13THE CAPITAL ASSET PRICING MODELObjectivesExplain the theory behind the CAPM.Explain how to use the CAPM to establish benchmarks for measuring the performance of investment portfolios. Explain how to infer from the CAPM the correct risk-adjusted discount rate to use in discounted-cash-flow valuation models. Explain the APT and its relationship to the CAPM.Outline13.1 The Capital Asset Pricing Model in Brief13.2 Determinants of the Risk Premium on the Market Portfolio13.3 Beta and Risk Premiums on Individual Securities13.4 Using the CAPM in Portfolio Selection13.5 Valuation and Regulating Rates of Return13.6 Extensions, Modifications, and Alternatives to the CAPMSummaryThe CAPM has three main implications:In equilibrium, ev eryone’s relative holding of risky assets are the same as in the market portfolio.The size of the risk-premium of the market portfolio is determined by the risk-aversion of investors.The risk premium on any asset is equal to its beta times the risk premium on the market portfolio.Whether or not the CAPM is strictly true, it provides a rationale for a very simple passive portfolio strategy: Diversify your holdings of risky assets in the proportions of the market portfolio, andMix this portfolio with the risk-free asset to achieve a desired risk-reward combination.The CAPM is used in portfolio management primarily in two ways:To establish a logical and convenient starting point in asset allocation and security selectionTo establish a benchmark for evaluating portfolio management ability on a risk-adjusted basis.In corporate finance the CAPM is used to determine the appropriate risk-adjusted discount rate in valuation models of the firm and in capital budgeting decisions. The CAPM is also used to establish a “fair” rate of return on invested capital for regulated firms and in cost-plus pricing.Today few financial scholars consider the CAPM in its simplest form to be an accurate model for explaining or predicting risk premiums on risky assets. However, modified versions of the model are still a central feature of the theory and practice of finance.The APT gives a rationale for the expected return-beta relationship that relies on the condition that there be no arbitrage profit opportunities; the CAPM requires that investors be portfolio optimizers. The APT and CAPM are not incompatible; rather, they complement each other.Solutions to Problems at End of ChapterComposition of the Market Portfolio1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a risklessgovernment security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively, $24 billion, $36 billion, $24 billion and $16 billion.a. Determine the relative proportions of each asset in the market portfolio.b. If one trader with a $100,000 portfolio holds $40,000 in the riskless security, $15,000 in X, $12,000 in Y, and$33,000 in Z, determine the holdings of the three risky assets of a second trader who invests $20, 000 of a $200, 000 portfolio in the riskless security.SOLUTION:The total value of all assets in the economy is 100 billion dollars. a. The proportions of each asset relative to the value of all assets are, respectively, .24 (X), .36 (Y),b. .24 (Z) and .16 (riskless bond.) The proportions of each risky asset to the total value of all risky assets are, respectively, (2/7) (X), (3/7) (Y) and (2/7) (Z).c. . Ignore the question as it appears in the First Edition of the textbook. Instead, the question should be: If aninvestor has $100,000 with $30,000 invested in the riskless asset, how much is invested in securities X, Y, and Z? The answer to this question is $20,000 in X and Z, and $30,000 in Y.Implications of CAPM2. The riskless rate of interest is .06 per year, and the expected rate of return on the market portfolio is .15 per year.a. According to the CAPM , what is the efficient way for an investor to achieve an expected rate of returnof .10 per year?b. If the standard deviation of the rate of return on the market portfolio is .20, what is the standarddeviation on the above portfolio?c. Draw the CML and locate the foregoing portfolio on the same graph.d. Draw the SML and locate the foregoing portfolio on the same graph.e. Estimate the value of a stock with an expected dividend per share of $5 this coming year, an expecteddividend growth rate of 4% per year forever, and a beta of .8. If its market price is less than the value you have estimated, i.e., if it is under-priced, what is true of its mean rate of return?SOLUTION: a.So one would hold a portfolio that is 4/9 invested in the market portfolio and 5/9 in the riskless asset. b.c. The formula for the CML is9415.)1(06.10.)()1()(=+-=?+-?=x xx x r E x r r E M f 08889.)20(.94==?=M x σσσσσ45.06.)()(+=-+=MfM f r r E r r Ed. The formula for the SML ise. Use constant growth rate DDM and find r using the SML relationIf the market price of the stock is less than this, then its expected return is higher than the 13.2% required rate.()ββ09.06.)()(+=-+=f M f r r E r r E 35.54$04.132.504.510=-=-=-=r g r D P 132.8.09.06.09.06.=?+=+=βr3. If the CAPM is valid, which of the following situations is possible? Explain. Consider each situation independently. a.PortfolioExpected ReturnBeta A 0.20 1.4B 0.25 1.2b.PortfolioExpected ReturnStandard DeviationA 0.300.35B 0.400.25c.Portfolio Expected ReturnStandard DeviationRisk-free 0.100Market 0.180.24A 0.160.12d.Portfolio Expected ReturnStandard DeviationRisk-free 0.100Market 0.180.24A0.200.22SOLUTION:a. Impossible. Since the risk premium on the market portfolio is positive, a security with a higher beta must have ahigher expected return.b. Possible. Since portfolios A & B are not necessarily efficient, A can have a higher standard deviation and alower expected return than B.c. Impossible. Portfolio A lies above the CML, implying that the CML is not efficient. If the standard deviation ofA is .12, then according to the CML its expected return cannot be greater than .14.d. Impossible. Portfolio A has a lower standard deviation and a higher mean return than the market portfolio,implying that the market portfolio is not efficient.4. If the Treasury bill rate is currently 4% and the expected return to the market portfolio over the same period is 12%, determine the risk premium on the market. If the standard deviation of the return on the market is .20, what is the equation of the Capital Market Line?SOLUTION: The risk premium on the market portfolio is .08. The slope of the CML is .08/.2 = .4. Thus, the equation of the CML is:Determinants of the Market Risk Premium5. Consider an economy in which the expected return on the market portfolio over a particular period is .25, the standard deviation of the return to the market portfolio over this same period is .25, and the averagedegree of risk aversion among traders is 3. If the government wishes to issue risk-free zero-coupon bonds with a term to maturity of one period and a face value per bond of $100,000, how much can the government expect to receive per bond? []σσσ4.04.)()(+=++=MfMf r rE r r ESOLUTION:According to the CAPM, E(r M) - r f = Aσ2, so that r f = E(r M) - Aσ2.Substituting into this formula we find: r f = .25 – 3 x .252 = .0625Therefore the revenue raised by the government per bond issued is $100,000 = $94,117.651.06256. . Norma Swanson has invested 40% of her wealth in MGM stock and 60% in Industrial Light and Magic stock. Norma believes the returns to these stocks have a correlation of .06 and that their respective means and standard deviations are: MGM ILMExpected Return (%) 10 15Standard Deviation (%) 15 25a.Determine the expected value and standard deviation of the return on Norma’s portfolio.b.Would a risk-averse investor such as Norma prefer a portfolio composed entirely of only MGM stock? Ofonly ILM stock? Why or why not?SOLUTION:a.The expected return is .13, and the standard deviation is .1649.b. A risk averse investor will not want to hold a portfolio composed entirely of MGM or of ILM stock, becauseone can, in general, achieve the same expected return with a lower standard deviation by combining a portfolio of MGM and ILM with the risk-free asset.7. Consider a portfolio exhibiting an expected return of 20% in an economy in which the riskless interest rate is 8%, the expected return to the market portfolio is thirteen percent, and the standard deviation of the return to the market portfolio is .25. Assuming this portfolio is efficient, determine:a.its beta.b.the standard deviation of its return.c.its correlation with the market return.SOLUTION:/doc/ad5801fd700abb68a982fb59.html e the security market line to infer that the beta of this portfolio is 2.4:.20 = .08 + β(.13 - .08)β = (.20 - .08)/(.13 - .08) = .12/.05 = 2.4/doc/ad5801fd700abb68a982fb59.html e the capital market line to infer that the standard deviation of the yield to this portfolio is .6:.20 = .08+ (.13 - .08) σ = .08+ .2 σ.25σ = .12/.2 = .6c.By definition the following relationships hold:β = cov/σ2Mρ = covσiσMwhere ρ denotes the correlation coefficient. We know that β = 2.4, σM = .25, and σi = .6.So from the definition of β, we get that the cov is 2.4 x .252 = .15. Substituting this into the definition of ρ: ρ = cov = .15 __ = 1σiσM .6 x .25Application of CAPM to Corporate Finance8. . The Suzuki Motor Company is contemplating issuing stock to finance investment in producing a new sports-utility vehicle, the Seppuku. Financial analysts within Suzuki forecast that this investment will have precisely the same risk as the market portfolio, where the annual return to the market portfolio is expected to be 15% and the current risk-free interest rate is 5%. The analysts further believe that the expected return to the Seppuku project will be 20% annually. Derive the maximal beta value that would induce Suzuki to issue the stock.SOLUTION:The project would be on the borderline if its required return were 20% per year. Since the risk-free rate is 5% and the risk premium on the market portfolio is 10%, the required return would be 20% if the beta were 1.5.9. . Roobel and Associates, a firm of financial analysts specializing in Russian financial markets, forecasts that the stock of the Yablonsky Toy Company will be worth 1,000 roubles per share one year from today. If the riskless interest rate on Russian government securities is 10% and the expected return to the market portfolio is 18% determine how much you would pay for a share of Yablonsky stock today if:a.the beta of Yablonsky is 3.b.the beta of Yablonsky is 0.5.SOLUTION:Use the security market line in each case to determine a required rate of return, then infer the current price from the forecasted price of 1,000 roubles and the required rate of return you have determined.a.If beta is 3, the required return is .10+ 3x.08 = .34. You would pay 1,000/1.34 = 746.27 roubles;b.If beta is .5, the required return is .10+ .5x.08 = .14. You would pay 1,000/1.14 = 877.19 roubles.Application of CAPM to Portfolio Management10. Suppose that the stock of the new cologne manufacturer, Eau de Rodman, Inc., has been forecast to havea return with standard deviation .30 and a correlation with the market portfolio of .9. If the standard deviation of the yield on the market is .20, determine the relative holdings of the market portfolio and Eau de Rodman stock to form a portfolio with a beta of 1.8.SOLUTION: By definition:β = cov/σ2Mρ = covσrσMTherefore, β = ρσr/σM. The beta of Rodman stock is therefore .9x.3/.2 = 1.35.The beta of a portfolio is a weighted average of the betas of the component securities. Let A be a fraction of the portfolio invested in Rodman stock to produce a beta of 1.8. Then we have:1.35A + (1-A) = 1.8.35A = .8A = 2.286So the portfolio would have to have 228.6% invested in Rodman stock and a short position in the market portfolio equal to 128.6%.11. The current price of a share of stock in the Vo Giap Clothing Company of Vietnam is 50 dong and its expected yield over the year is 14%. The market risk premium in Vietnam is 8% and the riskless interest rate 6%. What would happen to the stock’s current price if its expected future payout remains co nstant while the covariance of its rate of return with the market portfolio falls by 50%?SOLUTION:Deduce that the expected future price of a share of Vo Giap is 57 dong, so that a reduction in this stock’s beta of 50% implies, by the security market relation, that the required yield on Vo Giap is now 10%, so that its current share price rises by 3.64% toa new value of 51.82 dong.12. Suppose that you believe that the price of a share of IBM stock a year from today will be equal to the sumof the price of a share of General Motors stock plus the price of a share of Exxon, and further you believethat the price of a share of IBM stock in one year will be $100 whereas the price of a share of General Motors today is $30. If the annualized yield on 91-day T-bills (the riskless rate you use) is 5%, the expected yield on the market is 15%, the variance of the market portfolio is 1, and the beta of IBM is 2, what price would you be willing to pay for one share of Exxon stock today?SOLUTION:Expected return = .05 + 2(.15 - .05) = 25%; (100 - x)/x = .25 → x = $80Deduce that the current price of a share of IBM stock is $80, so that the upper bound on the price of a share of Exxon is ($80 -$30 = $50).13. Ascertain whether the following quotation is true or false, and state why:“When arbitrage is absent from financial markets, and investors are each concerned with only the risk and return to their portfolios, then each investor can eliminate all the riskiness of his investments through diversification, and as a consequence the expected yield on each available asset will depend only on the covariance of its yield with the covariance of the yield on the diversified portfolio of risky assets each investor holds.”SOLUTION:False. You cannot eliminate all risk through diversification, only the unsystematic risk.Application of CAPM to Measuring Portfolio Performance14. During the most recent 5-year period, the Pizzaro mutual fund earned an average annualized rate of return of 12% and had an annualized standard deviation of 30%. The average risk-free rate was 5% per year. The average rate of return in the market index over that same period was 10% per year and the standard deviation was 20%. How well did Pizzaro perform on a risk-adjusted basis?SOLUTION:Compute the ratio of average excess return to standard deviation for Pizzaro and compare it to that of the market portfolio: Pizzaro risk-adjusted performance ratio = (.12-.05)/.30 = .233Market portfolio risk-adjusted performance ratio = (.1-.05)/.2 = .250So, on a risk-adjusted basis, Pizzaro did worse than the market index.Challenge ProblemCAPM with only 2 Risky Assets15. There are only two risky assets in the economy: stocks and real estate and their relative supplies are 50% stocks and 50% real estate. Thus, the market portfolio will be half stocks and half real estate. The standard deviations are .20 for stocks, .20 for real estate, and the correlation between them is 0. The coefficient of relative risk aversion of the average market participant (A) is 3. r f is .08 per year.a.According to the CAPM what must be the equilibrium risk premium on the market portfolio, on stocks,and on real estate?b.Draw the Capital Market Line. What is its slope? Where is the point representing stocks located relativeto the CML?c.Draw the SML. What is its formula? Where is the point representing stocks located relative to the SML? SOLUTION: a.The market portfolio consists of half stocks and half real estate. It has a standard deviation of .1414, computedas follows:σ2M = w2σ2s + (1-w)2σ2r+ 2 w(1-w) cov s,rσ2M = 2 x (1/2)2 .22 = .02σM = .1414The equilibrium risk premium on the market portfolio is E(r M)-r f = Aσ2M = 3x.02 = .06.The market portfolio’s expected rate of return is also a weighted average of the expected rates of return on stocks and real estate, where the weights are each 1/2. Stocks and real estate must have the same risk premiumbecause they have the same standard deviation and correlation with the market. Therefore the risk premium on stocks and real estate must be .06, the same as the market portfolio’s risk premium.b.The slope of the CML is .06/.1414 = .424. The point representing stocks is M, it is to the right of the CML.equaling to 1.The formula is: E(r) = r f + (E(r M) –r f).。

《金融学(第二版)》(高等教育出版社)名词解释及课后习题答案

第一章货币概述货币量层次划分:货币量层次划分,即是把流通中的货币量,主要按照其流动性的大小进行相含排列,分成若干层次并用符号代表的一种方法。

价值尺度:货币在表现商品的价值并衡量商品价值量的大小时,发挥价值尺度的职能。

这是货币最基本、最重要的职能。

价格标准:指包含一定重量的贵金属的货币单位。

在历史上,价格标准和货币单位曾经是一致的,随着商品经济的发展,货币单位名称和货币本身重量单位名称分离了。

货币制度:货币制度简称“币制”,是一个国家以法律形式确定的该国货币流通的结构、体系与组织形式。

它主要包括货币金属,货币单位,货币的铸造、发行和流通程序,准备制度等。

金本位制:金本位制又称金单本位制,它是以黄金作为本位货币的一种货币制度。

其形式有三种金币本位制、金块本位制和金汇兑本位制。

无限法偿:即在货币收付中无论每次支付的金额多大,用本位币支付时,受款人不得拒绝接受,也即本位币具有无限的法定支付能力,即无限法偿。

有限法偿:有限法偿是指,货币在每一次支付行为中使用的数量受到限制,超过限额的部分,受款人可以拒绝接受。

格雷欣法则:即所谓“劣币驱逐良币”的规律。

就是在两种实际价值不同而面额价值相同的通货同时流通的情况下,实际价值较高的通货(所谓良币)必然会被人们熔化、输出而退出流通领域;而实际价值较低的通货(所谓劣币)反而会充斥市场。

6.什么是货币量层次划分,我国划分的标准和内容如何?(1)所谓货币量层次划分,即是把流通中的货币量,主要按照其流动性的大小进行相含排列,分成若干层次并用符号代表的一种方法。

(2)货币量层次划分的目的是把握流通中各类货币的特定性质、运动规律以及它们在整个货币体系中的地位,进而探索货币流通和商品流通在结构上的依存关系和适应程度,以便中央银行拟订有效的货币政策。

(3)我国货币量层次指标的划分标准主要为货币的流动性。

所谓流动性是指一种资产具有可以及时变为现实的购买力的性质。

流动性程度不同,所形成的购买力也不一样,因而对社会商品流通的影响程度也就不同。

《金融学》 教案大纲及习题解答(姜法芹 )

《金融学》教案大纲及习题解答第一章:金融学导论1.1 金融学的定义和研究对象1.2 金融市场的基本概念和分类1.3 金融市场的参与者:投资者、金融机构、监管机构1.4 金融学的主要学科领域和应用范围习题解答:1.1 金融学是研究金融市场、金融机构以及金融政策的学科。

它的研究对象包括金融市场的运作机制、金融产品的定价和交易、金融机构的经营管理和监管政策等方面。

1.2 金融市场是指资金供应者和资金需求者通过金融工具进行交易的场所。

金融市场可以分为货币市场、资本市场、金融衍生品市场和外汇市场等。

1.3 金融市场的参与者包括投资者、金融机构和监管机构。

投资者包括个人投资者和机构投资者,金融机构包括银行、证券公司、保险公司等,监管机构负责对金融市场进行监管和调控。

1.4 金融学的主要学科领域包括金融市场、金融机构、金融衍生品、金融政策和金融监管等。

金融学广泛应用于金融行业、企业管理和政府监管等领域。

第二章:金融市场的基本原理2.1 金融市场的供求关系和价格机制2.2 金融市场的效率和稳定性2.3 金融市场的风险和收益2.4 金融市场的信息不对称和信息不对称问题习题解答:2.1 金融市场的供求关系是指资金供应者和资金需求者之间的相互作用。

价格机制是指金融市场的价格由市场供求关系决定,反映了资金的稀缺程度。

2.2 金融市场的效率是指市场能够迅速、准确地反映信息的能力。

金融市场的稳定性是指市场能够保持稳定的运行,不发生大规模的波动。

2.3 金融市场的风险是指投资者在投资过程中可能遭受的损失。

收益是指投资者从投资中获得的回报。

投资者在选择金融产品时需要权衡风险和收益。

2.4 信息不对称是指市场参与者之间信息的不平衡。

信息不对称问题可能导致市场失灵和资源配置效率低下,需要通过监管和制度建设来解决。

第三章:金融市场的主要金融产品3.1 货币市场的金融产品:短期债券、商业票据等3.2 资本市场的主要金融产品:股票、债券、基金等3.3 金融衍生品市场的主要产品:期货、期权、掉期等3.4 其他金融产品:外汇、黄金、大宗商品等习题解答:3.1 货币市场的金融产品是指在货币市场上交易的金融工具。

博迪《金融学》第2版课后习题及详解

博迪《金融学》第2版课后习题及详解博迪的《金融学》第2版是一本广泛使用的金融学教材,其中的课后习题对于学生理解和掌握金融学概念和理论具有重要意义。

本文将选取一些具有代表性的课后习题,并提供详细的解答和分析。

答:金融学是一项针对人们怎样跨期配置稀缺资源的研究。

它涉及货币、投资、证券、银行、保险、基金等领域,主要研究如何在不确定的环境下对资源进行跨时期分配,以实现最大化的收益或满足特定的目标。

金融体系(financial system)答:金融体系是金融市场以及其他金融机构的集合,这些集合被用于金融合同的订立以及资产和风险的交换。

它是由连接资金盈余者和资金短缺者的一系列金融中介机构和金融市场共同构成的一个有机体,包括股票、债券和其他金融工具的市场、金融中介(如银行和保险公司)、金融服务公司(如金融咨询公司)以及监控管理所有这些单位的管理机构等。

研究金融体系如何发展演变是金融学科的重要方面。

假设某个投资者在2022年购买了一张面值为1000元,年利率为5%的债券,并在2023年以1100元的价格卖出。

请问该投资者的年化收益率是多少?(1100 - 1000) / 1000 × 100% = 10%其中,分子部分为投资者获得的收益,分母部分为投资者的初始投资金额。

答:现代金融学的三个主要理论包括资本资产定价模型(CAPM)、有效市场假说(EMH)和现代投资组合理论(MPT)。

资本资产定价模型(CAPM)是一种用来决定资产合理预期收益的模型,它认为资产的预期收益与该资产的系统性风险有关。

在投资决策中,投资者可以通过比较不同资产的预期收益与其系统性风险来确定最优投资组合。

有效市场假说(EMH)认为市场是有效的,即市场上的价格反映了所有可用信息。

根据这个理论,投资者无法通过分析信息来获取超额收益。

然而,在实践中,许多研究表明市场并非完全有效,投资者可以通过分析和利用信息来获得超额收益。

现代投资组合理论(MPT)是由Harry Markowitz于20世纪50年代提出的,它认为投资者应该通过多元化投资来降低风险。

《金融学(第二版)》讲义大纲及课后习题答案详解十二章

《⾦融学(第⼆版)》讲义⼤纲及课后习题答案详解⼗⼆章CHAPTER 12CHOOSING AN INVESTMENT PORTFOLIOObjectivesTo understand the process of personal investing in theory and in practice.To build a quantitative model of the tradeoff between risk and reward.Outline12.1 The Process of Personal Portfolio Selection12.2 The Trade-off between Expected Return and Risk12.3 Efficient Diversification with Many Risky AssetsSummaryThere is no single portfolio selection strategy that is best for all people.Stage in the life cycle is an imp ortant determinant of the optimal composition of a person’s optimal portfolio of assets and liabilities.Time horizons are important in portfolio selection. We distinguish among three time horizons: the planning horizon, the decision horizon, and the trading horizon.In making portfolio selection decisions, people can in general achieve a higher expected rate of return only by exposing themselves to greater risk.One can sometimes reduce risk without lowering expected return by diversifying more completely either withina given asset class or across asset classes.The power of diversification to reduce the riskiness of an investor’s portfolio depends on the correlations among the assets that make up the portfolio. In practice, the vast majority of assets are positively correlated with each other because they are all affected by common economic factors. Consequently, one’s ability to reduce risk through diversification among risky assets without lowering expected return is limited.Although in principle people have thousands of assets to choose from, in practice they make their choices from a menu of a few final products offered by financial intermediaries such as bank accounts, stock and bond mutual funds, and real estate. In designing and producing the menu of assets to offer to their customers theseintermediaries make use of the latest advances in financial technology.Solutions to Problems at End of Chapter1. Suppose that your 58-year-old father works for the Ruffy Stuffed Toy Company and has contributed regularly to his company-matched savings plan for the past 15 years. Ruffy contributes $0.50 for every $1.00 your father puts into the savings plan, up to the first 6% of his salary. Participants in the savings plan can allocate their contributions among four different investment choices: a fixed-income bond fund, a “blend” option that invests in large companies, small companies, and the fixed-income bond fund, a growth-income mutual fund whose investments do not include other toy companies, and a fund whose sole investment is stock in the Ruffy Stuffed Toy Company. Over Thanksgiving vacation, Dad realizes that you have been majoring in finance and decides to reap some early returns on that tuition money he’s been investing in your education. He shows you the most recent quarterly statement for his savings plan, and you see that 98% of its current value is in the fourth investment option, that of the Ruffy Company stock..a.Assume that your Dad is a typical risk-averse person who is considering retirement in five years. Whenyou ask him why he has made the allocation in this way, he responds that the company stock has continually performed quite well, except for a few declines that were caused by problems in a division that the company has long since sold off. Inaddition, he says, many of his friends at work have done the same. What advice would you give your dad about adjustments to his plan allocations? Why?b.If you consider the fact that your dad works for Ruffy in addition to his 98% allocation to the Ruffy stockfund, does this make his situation more risky, less risky, or does it make no difference? Why? SOLUTION:a.Dad has exposed himself to risk by concentrating almost all of his plan money in the Ruffy Stock fund. This is analogous to taking 100% of the money a family has put aside for investment and investing it in a single stock.First, Dad needs to be shown that just because the company stock has continually performed quite well is no guarantee that it will do so indefinitely. The company may have sold off the divisions which produced price declines in the past, but future problems are unpredictable, and so is the movement of the stock price. “Past performance is no guarantee of future results” is the lesson.Second, Dad needs to hear about diversification. He needs to be counseled that he can reduce his risk by allocating his money among several of the options available to him. Indeed, he can reduce his risk considerably merely by moving all of his money into the “blend” fund because it is diversifi ed by design: it has a fixed-income component, a large companies component, and a small companies component. Diversification isachieved not only via the three differing objectives of these components, but also via the numerous stocks that comprise each of the three components.Finally, Dad’s age and his retirement plans need to be considered. People nearing retirement age typically begin to shift the value of their portfolios into safer investments. “Safer” normally connotes less variability, so that the risk of a large decline in the value of a portfolio is reduced. This decline could come at any time, and it would be very unfortunate if it were to happen the day before Dad retires. In this example, the safest option would be the fixed-income bond fund because of its diversified composition and interest-bearing design, but there is still risk exposure to inflation and the level of interest rates. Note that the tax-deferred nature of the savings plan encourages allocation to something that produces interest or dividends. As it stands now, Dad is very exposed to a large decline in the value of his savings plan because it is dependent on the value of one stock.Individual equities over time have proven to produce the most variable of returns, so Dad should definitely move some, probably at least half, of his money out of the Ruffy stock fund. In fact, a good recommendation given his retirement horizon of five years would be to re-align the portfolio so that it has 50% in the fixed- income fund and the remaining 50% split between the Ruffy stock fund (since Dad insists) and the “blend” fund.Or, maybe 40% fixed-income, 25% Ruffy, 15% growth-income fund, and 20% “blend” fund. This latterallocation has the advantage of introducing another income-producing component that can be shielded by the tax-deferred status of the plan.b.The fact that Dad is employed by the Ruffy Company makes his situation more risky. Let’s say that the companyhits a period of slowed business activities. If the stock price declines, so will th e value of Dad’s savings plan. If the company encounters enough trouble, it may consider layoffs. Dad’s job may be in jeopardy. At the same time that his savings plan may be declining in value, Dad may also need to look for a job or go onunemployment. Thus, Dad is exposed on two fronts to the same risk. He has invested both his human capital and his wealth almost exclusively in one company.2. Refer to Table 12.1.a.Perform the calculations to verify that the expected returns of each of the portfolios (F, G, H, J, S) in thetable (column 4) are correct.b.Do the same for the standard deviations in column 5 of the table.c.Assume that you have $1million to invest. Allocate the money as indicated in the table for each of the fiveportfolios and calculate the expected dollar return of each of the portfolios.d.Which of the portfolios would someone who is extremely risk tolerant be most likely to select? SOLUTION:d.An extremely risk tolerant person would select portfolio S, which has the largest standard deviation but also thelargest expected return.3. A mutual fund company offers a safe money market fund whose current rate is4.50% (.045). The same company also offers an equity fund with an aggressive growth objective which historically has exhibited an expected return of 20% (.20) and a standard deviation of .25.a.Derive the equation for the risk-reward trade-off line.b.How much extra expected return would be available to an investor for each unit of extra risk that shebears?c.What allocation should be placed in the money market fund if an investor desires an expected return of15% (.15)?SOLUTION:a.E[r] = .045 + .62b.0.62c.32.3% [.15 = w*(.045) + (1-w)*(.020) ]4. If the risk-reward trade-off line for a riskless asset and a risky asset results in a negative slope, what does that imply about the risky asset vis-a-vis the riskless asset?SOLUTION:A trade-off line wit h a negative slope indicates that the investor is “rewarded” with less expected return for taking on additional risk via allocation to the risky asset.5. Suppose that you have the opportunity to buy stock in AT&T and Microsoft.a.stocks is 0? .5? 1? -1? What do you notice about the change in the allocations between AT&T andMicrosoft as their correlation moves from -1 to 0? to .5? to +1? Why might this be?b.What is the variance of each of the minimum-variance portfolios in part a?c.What is the optimal combination of these two securities in a portfolio for each value of the correlation,assuming the existence of a money market fund that currently pays 4.5% (.045)? Do you notice any relation between these weights and the weights for the minimum variance portfolios?d.What is the variance of each of the optimal portfolios?e.What is the expected return of each of the optimal portfolios?f.Derive the risk-reward trade-off line for the optimal portfolio when the correlation is .5. How much extraexpected return can you anticipate if you take on an extra unit of risk?SOLUTION:a.Minimum risk portfolios if correlation is:-1: 62.5% AT&T, 37.5% Microsoft0: 73.5% AT&T, 26.5% Microsoft.5: 92.1% AT&T, 7.9% Microsoft1: 250% AT&T, short sell 150% MicrosoftAs the correlation moves from -1 to +1, the allocation to AT&T increases. When two stocks have negativec orrelation, standard deviation can be reduced dramatically by mixing them in a portfolio. It is to the investors’benefit to weight more heavily the stock with the higher expected return since this will produce a high portfolio expected return while the standard deviation of the portfolio is decreased. This is why the highest allocation to Microsoft is observed for a correlation of -1, and the allocation to Microsoft decreases as the correlationbecomes positive and moves to +1. With correlation of +1, the returns of the two stocks will move closely together, so you want to weight most heavily the stock with the lower individual standard deviation.b. Variances of each of the minimum variance portfolios:62.5% AT&T, 37.5% Microsoft Var = 073.5% AT&T, 26.5% Microsoft Var = .016592.1% AT&T, 7.9% Microsoft Var = .0222250% AT&T, short 150% Microsoft Var = 0c. Optimal portfolios if correlation is:-1: 62.5% AT&T, 37.5% Microsoft0: 48.1% AT&T, 51.9% Microsoft.5: 11.4% AT&T, 88.6% Microsoft1: 250% AT&T, short 150% Microsoftd. Variances of the optimal portfolios:62.5% AT&T, 37.5% Microsoft Var = 048.1% AT&T, 51.9% Microsoft Var = .022011.4% AT&T, 88.6% Microsoft Var = .0531250% AT&T, short 150% Microsoft Var = 0e. Expected returns of the optimal portfolios:62.5% AT&T, 37.5% Microsoft E[r] = 14.13%48.1% AT&T, 51.9% Microsoft E[r] = 15.71%11.4% AT&T, 88.6% Microsoft E[r] = 19.75%250% AT&T, short 150% Microsoft E[r] = -6.5%f.Risk-reward trade-off line for optimal portfolio with correlation = .5:E[r] = .045 + .66/doc/31dbf23b580216fc700afd59.html ing the optimal portfolio of AT&T and Microsoft stock when the correlation of their price movements is 0.5, along with the results in part f of question 12-5, determine:a.the expected return and standard deviation of a portfolio which invests 100% in a money market fundreturning a current rate of 4.5%. Where is this point on the risk-reward trade-off line?b.the expected return and standard deviation of a portfolio which invests 90% in the money market fundand 10% in the portfolio of AT&T and Microsoft stock.c.the expected return and standard deviation of a portfolio which invests 25% in the money market fundand 75% in the portfolio of AT&T and Microsoft stock.d.the expected return and standard deviation of a portfolio which invests 0% in the money market fundand 100% in the portfolio of AT&T and Microsoft stock. What point is this?SOLUTION:a.E[r] = 4.5%, standard deviation = 0. This point is the intercept of the y (expected return) axis by the risk-rewardtrade-off line.b.E[r] = 6.03%, standard deviation = .0231c.E[r] = 15.9%, standard deviation = .173d.E[r] = 19.75%, standard deviation = .2306. This point is the tangency between the risk-reward line from 12-5part f and the risky asset risk-reward curve (frontier) for AT&T and Microsoft.7. Again using the optimal portfolio of AT&T and Microsoft stock when the correlation of their price movements is 0.5, take $ 10,000 and determine the allocations among the riskless asset, AT&T stock, and Microsoft stock for:a. a portfolio which invests 75% in a money market fund and 25% in the portfolio of AT&T and Microsoftstock. What is this portfolio’s expected return?b. a portfolio which invests 25% in a money market fund and 75% in the portfolio of AT&T and Microsoftstock. What is this portfolio’s expect ed return?c. a portfolio which invests nothing in a money market fund and 100% in the portfolio of AT&T andMicrosoft stock. What is this portfolio’s expected return?SOLUTION:a.$7,500 in the money-market fund, $285 in AT&T (11.4% of $2500), $2215 in Microsoft. E[r] = 8.31%, $831.b.$2,500 in the money-market fund, $855 in AT&T (11.4% of $7500), $6645 in Microsoft. E[r] = 15.94%, $1,594.c.$1140 in AT&T, $8860 in Microsoft. E[r] = 19.75%, $1,975.8. What strategy is implied by moving further out to the right on a risk-reward trade-off line beyond the tangency point between the line and the risky asset risk-reward curve? What type of an investor would be most likely to embark on this strategy? Why?SOLUTION:This strategy calls for borrowing additional funds and investing them in the optimal portfolio of AT&T and Microsoft stock. A risk-tolerant, aggressive investor would embark on this strategy. This person would be assuming the risk of the stock portfolio with no risk-free component; the money at risk is not onl y from this person’s own wealth but also represents a sum that isowed to some creditor (such as a margin account extended by the investor’s broker).9. Determine the correlation between price movements of stock A and B using the forecasts of their rate of return and the assessments of the possible states of the world in the following table. The standard deviations for stock A and stock B are0.065 and 0.1392, respectively. Before doing the calculation, form an expectation of whether that correlation will be closer to1 or -1 by merely inspecting the numbers.SOLUTION:Expectation: correlation will be closer to +1.E[r A] = .05*(-.02) + .15*(-.01) + .60*(.15) + .20*(.15) = .1175, or, 11.75%E[r B] = .05*(-.20) + .15*(-.10) + .60*(.15) + .20*(.30) = .1250, or, 12.50%Covariance = .05*(-.02-.1175)*(-.20-.125) + .15*(-.01-.1175)*(-.10-.125) +.60*(.15-.1175)*(.15-.125) + .20*(.15-.1175)*(.30-.125) =.008163Correlation = .008163/(.065)*(.1392) = .90210.Analyze the “expert’s” answers to the following questions:a.Question:I have approx. 1/3 of my investments in stocks, and the rest in a money market. What do you suggestas a somewhat “safer” place to invest another 1/3? I like to keep 1/3 accessible for emergencies.Expert’s answer:Well, you could try 1 or 2 year Treasury bonds. You’d get a little bit more yie ld with no risk.b.Question:Where would you invest if you were to start today?Expert’s answer:That depends on your age and short-term goals. If you are very young – say under 40 –and don’tneed the money you’re investing for a home or college tuition or such, you would put it in a stockfund. Even if the market tanks, you have time to recoup. And, so far, nothing has beaten stocks overa period of 10 years or more. But if you are going to need money fairly soon, for a home or for yourretirement, you need to play it safer.SOLUTION:a.You are not getting a little bit more yield with no risk. The real value of the bond payoff is subject to inflationrisk. In addition, if you ever need to sell the Treasury bonds before expiration, you are subject to the fluctuation of selling price caused by interest risk.b.The expert is right in pointing out that your investment decision depends on your age and short-term goals. In addition, the investment decision also depends on other characteristics of the investor, such as the special character of the labor income (whether it is highly correlated with the stock market or not), and risk tolerance.Also, the fact that over any period of 10 years or more the stock beats everything else cannot be used to predict the future.。

《金融学(第二版)》讲义大纲及课后习题答案详解 第13章

CHAPTER 13THE CAPITAL ASSET PRICING MODELObjectives•Explain the theory behind the CAPM.•Explain how to use the CAPM to establish benchmarks for measuring the performance of investment portfolios. •Explain how to infer from the CAPM the correct risk-adjusted discount rate to use in discounted-cash-flow valuation models.•Explain the APT and its relationship to the CAPM.Outline13.1 The Capital Asset Pricing Model in Brief13.2 Determinants of the Risk Premium on the Market Portfolio13.3 Beta and Risk Premiums on Individual Securities13.4 Using the CAPM in Portfolio Selection13.5 Valuation and Regulating Rates of Return13.6 Extensions, Modifications, and Alternatives to the CAPMSummary•The CAPM has three main implications:•In equilibrium, ev eryone’s relative holding of risky assets are the same as in the market portfolio.•The size of the risk-premium of the market portfolio is determined by the risk-aversion of investors.•The risk premium on any asset is equal to its beta times the risk premium on the market portfolio. •Whether or not the CAPM is strictly true, it provides a rationale for a very simple passive portfolio strategy: •Diversify your holdings of risky assets in the proportions of the market portfolio, and•Mix this portfolio with the risk-free asset to achieve a desired risk-reward combination.•The CAPM is used in portfolio management primarily in two ways:•To establish a logical and convenient starting point in asset allocation and security selection•To establish a benchmark for evaluating portfolio management ability on a risk-adjusted basis.•In corporate finance the CAPM is used to determine the appropriate risk-adjusted discount rate in valuation models of the firm and in capital budgeting decisions. The CAPM is also used to establish a “fair” rate of return on invested capital for regulated firms and in cost-plus pricing.•Today few financial scholars consider the CAPM in its simplest form to be an accurate model for explaining or predicting risk premiums on risky assets. However, modified versions of the model are still a central feature of the theory and practice of finance.•The APT gives a rationale for the expected return-beta relationship that relies on the condition that there be no arbitrage profit opportunities; the CAPM requires that investors be portfolio optimizers. The APT and CAPM are not incompatible; rather, they complement each other.Solutions to Problems at End of ChapterComposition of the Market Portfolio1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a risklessgovernment security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively, $24 billion, $36 billion, $24 billion and $16 billion.a. Determine the relative proportions of each asset in the market portfolio.b. If one trader with a $100,000 portfolio holds $40,000 in the riskless security, $15,000 in X, $12,000 in Y, and$33,000 in Z, determine the holdings of the three risky assets of a second trader who invests $20, 000 of a $200, 000 portfolio in the riskless security.SOLUTION:The total value of all assets in the economy is 100 billion dollars. a. The proportions of each asset relative to the value of all assets are, respectively, .24 (X), .36 (Y),b. .24 (Z) and .16 (riskless bond.) The proportions of each risky asset to the total value of all risky assets are,respectively, (2/7) (X), (3/7) (Y) and (2/7) (Z). c. . Ignore the question as it appears in the First Edition of the textbook. Instead, the question should be: If aninvestor has $100,000 with $30,000 invested in the riskless asset, how much is invested in securities X, Y, and Z? The answer to this question is $20,000 in X and Z, and $30,000 in Y.Implications of CAPM2. The riskless rate of interest is .06 per year, and the expected rate of return on the market portfolio is .15 per year.a. According to the CAPM , what is the efficient way for an investor to achieve an expected rate of returnof .10 per year?b. If the standard deviation of the rate of return on the market portfolio is .20, what is the standarddeviation on the above portfolio?c. Draw the CML and locate the foregoing portfolio on the same graph.d. Draw the SML and locate the foregoing portfolio on the same graph.e. Estimate the value of a stock with an expected dividend per share of $5 this coming year, an expecteddividend growth rate of 4% per year forever, and a beta of .8. If its market price is less than the value you have estimated, i.e., if it is under-priced, what is true of its mean rate of return?SOLUTION: a.So one would hold a portfolio that is 4/9 invested in the market portfolio and 5/9 in the riskless asset. b.c. The formula for the CML is9415.)1(06.10.)()1()(=+-=⨯+-⨯=x xx x r E x r r E M f 08889.)20(.94==⨯=M x σσσσσ45.06.)()(+=-+=MfM f r r E r r Ed. The formula for the SML ise. Use constant growth rate DDM and find r using the SML relationIf the market price of the stock is less than this, then its expected return is higher than the 13.2% required rate.()ββ09.06.)()(+=-+=f M f r r E r r E 35.54$04.132.504.510=-=-=-=r g r D P 132.8.09.06.09.06.=⨯+=+=βr3. If the CAPM is valid, which of the following situations is possible? Explain. Consider each situation independently.a.PortfolioExpected ReturnBeta A 0.20 1.4B 0.25 1.2b.PortfolioExpected ReturnStandard DeviationA 0.300.35B 0.400.25c.Portfolio Expected ReturnStandard DeviationRisk-free 0.100Market 0.180.24A 0.160.12d.Portfolio Expected ReturnStandard DeviationRisk-free 0.100Market 0.180.24A0.200.22SOLUTION:a. Impossible. Since the risk premium on the market portfolio is positive, a security with a higher beta must have ahigher expected return.b. Possible. Since portfolios A & B are not necessarily efficient, A can have a higher standard deviation and alower expected return than B.c. Impossible. Portfolio A lies above the CML, implying that the CML is not efficient. If the standard deviation ofA is .12, then according to the CML its expected return cannot be greater than .14.d. Impossible. Portfolio A has a lower standard deviation and a higher mean return than the market portfolio,implying that the market portfolio is not efficient.4. If the Treasury bill rate is currently 4% and the expected return to the market portfolio over the same period is 12%, determine the risk premium on the market. If the standard deviation of the return on the market is .20, what is the equation of the Capital Market Line?SOLUTION: The risk premium on the market portfolio is .08. The slope of the CML is .08/.2 = .4. Thus, the equation of theCML is:Determinants of the Market Risk Premium5. Consider an economy in which the expected return on the market portfolio over a particular period is .25, the standard deviation of the return to the market portfolio over this same period is .25, and the averagedegree of risk aversion among traders is 3. If the government wishes to issue risk-free zero-coupon bonds with a term to maturity of one period and a face value per bond of $100,000, how much can the government expect to receive per bond?[]σσσ4.04.)()(+=++=MfMf r rE r r ESOLUTION:According to the CAPM, E(r M) - r f = Aσ2, so that r f = E(r M) - Aσ2.Substituting into this formula we find: r f = .25 – 3 x .252 = .0625Therefore the revenue raised by the government per bond issued is $100,000 = $94,117.651.06256. . Norma Swanson has invested 40% of her wealth in MGM stock and 60% in Industrial Light and Magic stock. Norma believes the returns to these stocks have a correlation of .06 and that their respective means and standard deviations are:MGM ILMExpected Return (%) 10 15Standard Deviation (%) 15 25a.Determine the expected value and standard deviation of the return on Norma’s portfolio.b.Would a risk-averse investor such as Norma prefer a portfolio composed entirely of only MGM stock? Ofonly ILM stock? Why or why not?SOLUTION:a.The expected return is .13, and the standard deviation is .1649.b. A risk averse investor will not want to hold a portfolio composed entirely of MGM or of ILM stock, becauseone can, in general, achieve the same expected return with a lower standard deviation by combining a portfolio of MGM and ILM with the risk-free asset.7. Consider a portfolio exhibiting an expected return of 20% in an economy in which the riskless interest rate is 8%, the expected return to the market portfolio is thirteen percent, and the standard deviation of the return to the market portfolio is .25. Assuming this portfolio is efficient, determine:a.its beta.b.the standard deviation of its return.c.its correlation with the market return.SOLUTION:e the security market line to infer that the beta of this portfolio is 2.4:.20 = .08 + β(.13 - .08)β = (.20 - .08)/(.13 - .08) = .12/.05 = 2.4e the capital market line to infer that the standard deviation of the yield to this portfolio is .6:.20 = .08+ (.13 - .08) σ = .08+ .2 σ.25σ = .12/.2 = .6c.By definition the following relationships hold:β = cov/σ2Mρ = covσiσMwhere ρ denotes the correlation coefficient. We know that β = 2.4, σM = .25, and σi = .6.So from the definition of β, we get that the cov is 2.4 x .252 = .15. Substituting this into the definition of ρ: ρ = cov = .15 __ = 1σiσM .6 x .25Application of CAPM to Corporate Finance8. . The Suzuki Motor Company is contemplating issuing stock to finance investment in producing a new sports-utility vehicle, the Seppuku. Financial analysts within Suzuki forecast that this investment will have precisely the same risk as the market portfolio, where the annual return to the market portfolio is expected to be 15% and the current risk-free interest rate is 5%. The analysts further believe that the expected return to the Seppuku project will be 20% annually. Derive the maximal beta value that would induce Suzuki to issue the stock.SOLUTION:The project would be on the borderline if its required return were 20% per year. Since the risk-free rate is 5% and the risk premium on the market portfolio is 10%, the required return would be 20% if the beta were 1.5.9. . Roobel and Associates, a firm of financial analysts specializing in Russian financial markets, forecasts that the stock of the Yablonsky Toy Company will be worth 1,000 roubles per share one year from today. If the riskless interest rate on Russian government securities is 10% and the expected return to the market portfolio is 18% determine how much you would pay for a share of Yablonsky stock today if:a.the beta of Yablonsky is 3.b.the beta of Yablonsky is 0.5.SOLUTION:Use the security market line in each case to determine a required rate of return, then infer the current price from the forecasted price of 1,000 roubles and the required rate of return you have determined.a.If beta is 3, the required return is .10+ 3x.08 = .34. You would pay 1,000/1.34 = 746.27 roubles;b.If beta is .5, the required return is .10+ .5x.08 = .14. You would pay 1,000/1.14 = 877.19 roubles.Application of CAPM to Portfolio Management10. Suppose that the stock of the new cologne manufacturer, Eau de Rodman, Inc., has been forecast to havea return with standard deviation .30 and a correlation with the market portfolio of .9. If the standard deviation of the yield on the market is .20, determine the relative holdings of the market portfolio and Eau de Rodman stock to form a portfolio with a beta of 1.8.SOLUTION: By definition:β = cov/σ2Mρ = covσrσMTherefore, β = ρσr/σM. The beta of Rodman stock is therefore .9x.3/.2 = 1.35.The beta of a portfolio is a weighted average of the betas of the component securities. Let A be a fraction of the portfolio invested in Rodman stock to produce a beta of 1.8. Then we have:1.35A + (1-A) = 1.8.35A = .8A = 2.286So the portfolio would have to have 228.6% invested in Rodman stock and a short position in the market portfolio equal to 128.6%.11. The current price of a share of stock in the Vo Giap Clothing Company of Vietnam is 50 dong and its expected yield over the year is 14%. The market risk premium in Vietnam is 8% and the riskless interest rate 6%. What would happen to the stock’s current price if its expected future payout remains co nstant while the covariance of its rate of return with the market portfolio falls by 50%?SOLUTION:Deduce that the expected future price of a share of Vo Giap is 57 dong, so that a reduction in this stock’s beta of 50% implies, by the security market relation, that the required yield on Vo Giap is now 10%, so that its current share price rises by 3.64% to a new value of 51.82 dong.12. Suppose that you believe that the price of a share of IBM stock a year from today will be equal to the sumof the price of a share of General Motors stock plus the price of a share of Exxon, and further you believethat the price of a share of IBM stock in one year will be $100 whereas the price of a share of General Motors today is $30. If the annualized yield on 91-day T-bills (the riskless rate you use) is 5%, the expected yield on the market is 15%, the variance of the market portfolio is 1, and the beta of IBM is 2, what price would you be willing to pay for one share of Exxon stock today?SOLUTION:Expected return = .05 + 2(.15 - .05) = 25%; (100 - x)/x = .25 → x = $80Deduce that the current price of a share of IBM stock is $80, so that the upper bound on the price of a share of Exxon is ($80 - $30 = $50).13. Ascertain whether the following quotation is true or false, and state why:“When arbitrage is absent from financial markets, and investors are each concerned with only the risk and return to their portfolios, then each investor can eliminate all the riskiness of his investments through diversification, and as a consequence the expected yield on each available asset will depend only on the covariance of its yield with the covariance of the yield on the diversified portfolio of risky assets each investor holds.”SOLUTION:False. You cannot eliminate all risk through diversification, only the unsystematic risk.Application of CAPM to Measuring Portfolio Performance14. During the most recent 5-year period, the Pizzaro mutual fund earned an average annualized rate of return of 12% and had an annualized standard deviation of 30%. The average risk-free rate was 5% per year. The average rate of return in the market index over that same period was 10% per year and the standard deviation was 20%. How well did Pizzaro perform on a risk-adjusted basis?SOLUTION:Compute the ratio of average excess return to standard deviation for Pizzaro and compare it to that of the market portfolio:Pizzaro risk-adjusted performance ratio = (.12-.05)/.30 = .233Market portfolio risk-adjusted performance ratio = (.1-.05)/.2 = .250So, on a risk-adjusted basis, Pizzaro did worse than the market index.Challenge ProblemCAPM with only 2 Risky Assets15. There are only two risky assets in the economy: stocks and real estate and their relative supplies are 50% stocks and 50% real estate. Thus, the market portfolio will be half stocks and half real estate. The standard deviations are .20 for stocks, .20 for real estate, and the correlation between them is 0. The coefficient of relative risk aversion of the average market participant (A) is 3. r f is .08 per year.a.According to the CAPM what must be the equilibrium risk premium on the market portfolio, on stocks,and on real estate?b.Draw the Capital Market Line. What is its slope? Where is the point representing stocks located relativeto the CML?c.Draw the SML. What is its formula? Where is the point representing stocks located relative to the SML? SOLUTION:a.The market portfolio consists of half stocks and half real estate. It has a standard deviation of .1414, computedas follows:σ2M = w2σ2s + (1-w)2σ2r+ 2 w(1-w) cov s,rσ2M = 2 x (1/2)2 .22 = .02σM = .1414The equilibrium risk premium on the market portfolio is E(r M)-r f = Aσ2M = 3x.02 = .06.The market portfolio’s expected rate of return is also a weighted average of the expected rates of return on stocks and real estate, where the weights are each 1/2. Stocks and real estate must have the same risk premiumbecause they have the same standard deviation and correlation with the market. Therefore the risk premium on stocks and real estate must be .06, the same as the market portfolio’s risk premium.b.The slope of the CML is .06/.1414 = .424. The point representing stocks is M, it is to the right of the CML.equaling to 1.The formula is: E(r) = r f + (E(r M) –r f).。

黄达《金融学》(第2版)(货币与货币制度)笔记和课后习题详解【圣才出品】

第1篇范畴第1章货币与货币制度1.1复习笔记一、经济生活中处处有货币市场经济不可能离开货币:家庭个人的日常收支、个体经营者的生产生活、企业生产流通的运转、机关团体职能的履行、政府财政收支及金融机构的业务都离不开货币,货币流通体系:以个人、企业、机关团体、银行等金融机构为中心的货币收支及对外货币收支构成国民经济的五大货币收支系统,这些收支紧密地结合在一起,构成了不可割裂的货币流通活动总和。

二、货币的起源研究货币的起源问题就是研究货币产生的问题,关于货币的起源或货币产生的理论有多种,我们对其可以归纳为三类。

1.马克思对货币起源的论证(1)价值及其形式根据马克思主义政治经济学的商品理论,任何商品都具有使用价值和价值两个属性。

商品首先必须是一个有用物,能够满足人们的某种需要,不同的物品有不同的用途,有不同的使用价值。

不同商品的使用价值在质上各不相同,但所含的价值是同质的。

价值是凝结在商品中的一般人类劳动,凝结在不同的商品体内,都是同质的,所以不同商品通过彼此体内凝结的不同劳动量即价值量进行衡量、对比。

马克思主义政治经济学的货币理论中讲到商品有两个属性,相应的也有两种表现形式,即使用价值形式和价值形式。

商品的使用价值形式就是商品的自然形式,人们可以看得见,摸得着,感觉到。

商品的价值形式就是商品的交换价值,是看不见,摸不着的,只有在交换中通过交换才能表现出来。

为了弄清货币的起源和本质,需要结合商品交换发展的历史进程,分析价值形式发展的过程。

(2)价值形式的发展与货币的产生价值形式的发展是同商品交换的发展历程相适应的。

它经历了简单的价值形式(或偶然的价值形式)、扩大的价值形式、一般价值形式和货币形式四个阶段。

货币形式是价值形式的完成形式,也是货币产生的阶段。

货币产生后,整个商品世界分为两极:一极是各种各样的商品,它们都作为特殊的使用价值存在,要求转化为价值;另一极是货币,它直接作为价值的化身而存在,随时可以转化为任何一种有特殊使用价值的商品。

《金融学(第二版)》讲义大纲及课后习题答案详解 第七章

《金融学〔第二版〕》讲义大纲及课后习题答案详解第七章CHAPTER 7PRINCIPLES OF ASSET VALUATIONObjectives? Understand why asset valuation is important in finance.? Explain the Law of One Price as the principle underlying all asset-valuation procedures. ? Explain the meaning and role of valuation models.? Explain how information gets reflected in security prices.Outline7.1 The Relation Between an Asset’s Value and Its Price 7.2 Value Maximization and Financial Decisions 7.3 The Law of One Price and Arbitrage7.4 Arbitrage and the Prices of Financial Assets 7.5 Exchange Rates and Triangular Arbitrage 7.6 Interest Rates and the Law of One Price 7.7 Valuation Using Comparables 7.8 Valuation Models7.9 Accounting Measures of Value7.10 How Information Gets Reflected in Security Prices 7.11 The Efficient Markets HypothesisSummary? In finance the measure of an asset’s value is the price it would fetch if it were sold in a competitive market. Theability to accurately value assets is at the heart of the discipline of finance because many personal and corporate financial decisions can be made by selecting the alternative that maximizes value.? The Law of One Price states that in a competitive market, if two assets are equivalent they will tend to have thesame price. The law is enforced by a process called arbitrage, the purchase and immediate sale of equivalent assets in order to earn a sure profit from a difference in their prices.? Even if arbitrage cannot be carried out in practice to enforce the Law of One Price, unknown asset values canstill be inferred from the prices of comparable assets whose prices are known.? The quantitative method used to infer an asset’s value from information about the prices of comparable assets iscalled a valuation model. The best valuation model to employ varies with the information available and the intended use of the estimated value. ? The book value of an asset or a liability as reported in a firm’s financial statements often differs from its currentmarket value.? In making most financial decisions, it is a good idea to start by assuming that for assets that are bought and soldin competitive markets, price is a pretty accurate reflection of fundamental value. This assumption is generally warranted precisely because there are many well-informed professionals looking for mispriced assets who profit by eliminating discrepancies between the market prices and the fundamental values of assets. The proposition that an asset’s current price fully reflects all publicly-available information about future economic fundamentals affecting the asset’s value is known as the Efficient Markets Hypothesis.? The prices of traded assets reflect information about the fundamental economic determinants of their value.Analysts are constantly searching for assets whose prices are different from their fundamental value in order to buy/sell these “bargains.〞 In deciding the best strategy for the purchase/sale of a “bargain,〞 theanalyst has to evaluate the accuracy of her information. The market price of an asset reflects the weighted average of all analysts opinions with heavier weights for analysts who control large amounts of money and for those analysts who have better than average information.Instructor’s ManualChapter 7 Page 106Solutions to Problems at End of ChapterLaw of One Price and Arbitrage1. IBX stock is trading for $35 on the NYSE and $33 on the Tokyo Stock Exchange. Assume that the costs of buying and selling the stock are negligible. a. How could you make an arbitrage profit?b. Over time what would you expect to happen to the stock prices in New York and Tokyo?c. Now assume that the cost of buying or selling shares of IBX is 1% per transaction. How does this affectyour answer?SOLUTION:a. Buy IBX stock in Tokyo and simultaneously sell them in NY. Your arbitrage profit is $2 per share.b. The prices would converge.c. Instead of the prices becoming exactly equal, there can remain a 2% discrepancy between them, roughly $.70 inthis case.2. Suppose you live in the state of Taxachusetts which has a 16% sales tax on liquor. A neighboring state called Taxfree has no tax on liquor. The price of a case of beer is $25 in Taxfree and it is $29 in Taxachusetts.a. Is this a violation of the Law of One Price?b. Are liquor stores in Taxachusetts near the border with Taxfree going to prosper?SOLUTION:a. This is not a violation of the Law of One Price because it is due to a tax imposed in one state but not in the other.Illegal arbitrage will probably occur, with lawbreakers buying large quantities of liquor in Taxfree and selling it in Taxachusetts without paying the tax.b. It is likely that liquor stores will locate in Taxfree near the border with Taxachusetts. Residents of both stateswill buy their liquor in the stores located in Taxfree, and liquor stores in Taxachusetts will go out of business.Triangular Arbitrage3. Suppose the price of gold is 155 marks per ounce.a. If the dollar price of gold is $100 per ounce, what should you expect the dollar price of a mark to be?b. If it actually only costs $0.60 to purchase one mark, how could one make arbitrage profits?SOLUTION:a. $100 buys the same amount of gold (1 ounce) as 155 DM, so 1 DM should cost 100/155 or $.645.b. The marks are “cheaper〞 than they should be, so the arbitrage transaction requires you to buy marks at thecheap price, use them to purchase gold, and sell the gold for dollars. Example:1. Start with $1 million, which you borrow for only enough time to carry out the arbitrage transaction.2. Use the million dollars to buy 1,666,667 marks (1,000,000 / 0.60)3. Buy 10,752.69 ounces of gold (1,666,667 / 155)4. Sell the gold for $1,075,269 (10752.69 x 100)Your risk-free arbitrage profit is $75,269.4. You observe that the dollar price of the Italian lira is $0.0006 and the dollar price of the yen is $0.01. What must be the exchange rate between lira and yen for there to be no arbitrage opportunity?SOLUTION:.0006$/lira?.06Yen/lira.01$/YenInstructor’s ManualChapter 7 Page 1075. Fill in the missing exchange rates in the following table: US dollar British pound German mark Yen US dollar $1 $1.50 $.5 $.01 British pound £0.67 German mark DM2.0 Japanese ¥100 Yen SOLUTION: US dollar British pound German mark Japanese Yen US dollar $1 $1.50 $.5 $.01 British pound £0.67 1 = .67 / 2 = .67 / 100 German mark DM2.0 = 2 / .67 1 = 2 / 100 Japanese ¥100 = 100 / .67 = 100 / 2 1 Yen US dollar British pound German mark Japanese Yen US dollar $1 $1.50 $.5 $.01 British pound £0.67 £1 £.33 £.0067 German mark DM2.0 DM3.0 DM1.0 DM.02 Japanese ¥100 ¥150 ¥50 ¥1 Yen Valuation Using Comparables6. Suppose you own a home that you purchased four years ago for $475,000. The tax assessor’s office has just informed you that they are increasing the taxable value of your home to $525,000. a. How might you gather information to help you appeal the new assessment?b. Suppose the house next door is comparable to yours except that it has one fewer bedroom. It just sold for$490,000. How might you use that information to argue your case? What inference must you make about the value of an additional bedroom?SOLUTION:a. You should retrieve as much information as you can about recent sales of comparable homes. If you canconvince the assessor’s office that your home is comparable (and the market value of the recent sales is less than $525,000) you should have a good case. You can gather the information about home sales from a real estate broker.b. The difference between your house’s assessed value and the actual market value of the home next door is$35,000 ($525,000 - $490,000). If you can convince the tax assessor’s office that the value of a bedroom is less than $35,000, then the assessor must agree that your home is worth less than $525,000. For example, if comparable sales figures show that one additional bedroom (all else reasonably equivalent) is worth only $10,000, then you should be able to argue that your home is worth $500,000 rather than $525,000.7. The P/E ratio of ITT Corporation is currently 6 while the P/E ratio of the S&P 500 is 10. What might account for the difference? SOLUTION: There are several possible reasons:? ITT may be riskier than the S&P500 either because it is in a relatively risky industry or has a relatively higherdebt ratio.? ITT’s reported earnings may be higher than they are expected to be in the future, or they may be inflated due tospecial accounting methods used by ITT.Instructor’s ManualChapter 7 Page 1088. Suppose you are chief financial officer of a private toy company. The chief executive officer has asked you to come up with an estimate for the company’s price per share. Your company’s earnings per share were $2.00 in the year just ended. You know that you should look at public company comparables, however, they seem to fall into two camps. Those with P/E ratios of 8x earnings and those with P/E ratios of 14x earnings. You are perplexed at the difference until you notice that on average, the lower P/E companies have higher leverage than the higher P/E group. The 8x P/E group has a debt/equity ratio of 2:1. The 14x P/E group has a debt/equityratio of 1:1. If your toy company has a debt/equity ratio of 1.5:1, what might you tell the CEO about your company’s equity value per share? SOLUTION:It would be reasonable to apply a P/E of 11x earnings (= (8 + 14) / 2) because your leverage is midway between the two groups. Hence, your company’s price per share would be: 11x $2.00 = $22.00 per share.9. Assume that you have operated your business for 15 years. Sales for the most recent fiscal year were $12,000,000. Net income for the most recent fiscal year was $1,000,000. Your book value is $10,500,000. A similar company recently sold for the following statistics: Multiple of Sales: 0.8x Multiple of Net Income 12x Multiple of Book Value 0.9xa. What is an appropriate range of value for your company?b. If you know that your company has future investment opportunities that are far more profitable than thecompany above, what does that say about your company’s likely valuation? SOLUTION:a. Multiple of Sales: .8x = $12 million x .8 Multiple of Net Income 12x = $1 million x 12 Multiple of Book Value .9x = $10.5 million x .9 An appropriate range might be 9 to 12 millionb. Higher end of the range = $9.6 million = $12 million = $9.45 millionEfficient Markets Hypothesis10. The price of Fuddy Co. stock recently jumped when the sudden unexpected death of its CEO was announced. What might account for such a market reaction?SOLUTION:Investors may believe that the company’s future prospects look better(i.e., either higher earnings or less risky) without the deceased CEO.11. Your analysis leads you to believe that the price of Outel’s stock should be $25 per share. Its current market price is $30.a. If you do not believe that you have access to special information about the company, what do you do?b. If you are an analyst with much better than average information, what do you do?SOLUTION:a. If you believe that the market for Outel stock is an informationally efficient one then the $30 market price(which is a weighted average of the valuations of all analysts) is the best estimate of the stock’s true value. You should question whether your own analysis is correct.b. You sell the stock because you think you have superior information. Real Interest Rate Parity12. Assume that the world-wide risk-free real rate of interest is 3% per year. Inflation in Switzerland is 2% per year and in the United States it is 5% per year. Assuming there is no uncertainty about inflation, what are the implied nominal interest rates denominated in Swiss francs and in US dollars?SOLUTION: Switzerland: (1.03 x 1.02) =1.0506 hence nominal interest rate = 5.06% US: (1.03 x 1.05) = 1 .0815 hence nominal interest rate = 8.15%Instructor’s ManualChapter 7 Page 109Integrative Problem13. Suppose an aunt has passed away and bequeathed to you and your siblings (one brother, one sister) a variety of assets. The original cost of these assets follows:ITEM COST WHEN PURCHASEDJewelry $500 by Grandmother 75 years ago House 1,200,000 10 years ago Stocks and Bonds 1,000,000 3 years ago Vintage (used) Car 200,000 2 months ago Furniture 15,000 various dates during last 40 yearsBecause you are taking a course in finance, your siblings put you in charge of dividing the assets fairly among the three of you. Before you start, your brother approaches you and says: “I’d really like the car for myself, so when you divide up the assets, just give me the car and deduct the $200,000 from my share.〞Hearing that, your sister says: “That sounds fair, because I really like the jewelry and you can assign that to me and deduct the $500 from my share.〞You have always loved your aunt’s house and its furnishings, so you would like to keep the house and the furniture.a. How do you respond to your brother and sister’s requests? Justify your responses.b. How would you go about determining appropriate values for each asset?SOLUTION:a. Because the market price of the car is close to the what your brother is willing to give up for it, your brother’srequest is reasonable. It is, however, quite possible (even likely), that the antique jewelry is worth much more today than what your relative’s grandmother paid for it in the past. Assigning only its acquisition cost to your sister’s share is quite likely a gross miscalculation. If she wants the jewelry, she should be “charged〞 an amount equal to today’s market value. It does not matter that your sister does not want to sell the jewelry for a profit, because the jewelry has VALUE even if you do not sell it. Fairness is all about equal VALUE.b. You would probably have to hire a professional appraiser for the furniture and the jewelry. You can look up thevalue of the stocks and bonds in a financial newspaper. You can estimate the value of the house by inquiring for how much similar houses in the same neighborhood have recently been sold. The car was purchased only twomonths ago, so it is probably reasonable to assume that the current market price is very close to what your distant relative paid for the car. Instructor’s ManualChapter 7 Page 110。

博迪莫顿版金融学(第二版)课后习题答案,DOC

金融学(第二版)答案博迪默顿第一章课后习题答案一.我的生活目标:●完成学业●退休3,当我结5,?2,现在消费更多为以后比如买房,买车或储蓄留置很少的钱还是现在消费很少,甚至少于我的许多朋友二.答案样例:净值=资产-负债$__________(很可能会被低估)资产包括:经常帐户余额储蓄存款帐户余额家具设备,首饰类(如表)车(如果有的话)负债包括:学生贷款信用卡结余的差额各种租用金的协定(不包括转租)应付车款在计算净值时学生会特别地排除了他们一生潜在的赚钱能力的价值三.一个单身汉之需要养活他自己,所以他可以独立自主的作出金融决策。

如果他不想购买健康保险(而愿意承担由这个决定而带来的金融风险)那么除了这个单身汉自身,没谁会受这个决定的影响。

另外,他不需要在家庭成员之间分配收入这件事上做任何决定。

单身汉是很灵活自由的,可以选择住在几乎任何地方。

他主要是在今天的消费(开支)和为明天储蓄之间做出权衡决策。

既然他只需要养活他自己,那么他储蓄的重要性就比对一家之主的重要性小。

有许多孩子的一家之长必须在这些家庭成员中分配资源[或者说是收入].他们必须随时准备着处理各种风险,比如说潜在财政危机的突然发生[诸如家庭成员经历的严重健康问题,或者因为火灾和其他疏忽导致的保险问题].因为在一般一个家庭里人会比较多,有些人生病或受伤的风险就会更大.并且因为家庭中有许多依赖性的个体,所以薪水收入者得认真地考虑生活和残疾保险.还有,家庭并不像个体那样富有机动性,这是因为有了适龄儿童的缘b.1银行借贷2汽车经销商借贷或租赁3个人储蓄C(略)d你应该从可选择的融资方式中选择成本最小的一种。

当你分析的时候,你应该考虑以下方面:1你是否有足够的现金储蓄去购买?为了买车,你必须放弃的利息?你付现金和贷款所付是否不同?2对于不同的贷款方式,首付金额是多少?月付多少?付多久?相关利息是多少?整个贷款是按月还清,还是期末一次还清?税收和保险费是否包括在月付款中?3对于不同的租赁方式,首付金额是多少?月付多少?付多久?在租赁期末你是否拥有车?如果不拥有,买车要花多少?在租赁期末你是否必须得买车?你是否拥有优先购买权?如果你不买车你是否得付钱?相关利息是多少?税收和保险费是否包括在月付款中?是否有里程限制?七.a为学生们提供个人服务可能是个低成本的选择。

金融学课后习题答案第二版

金融学课后习题答案第二版【篇一:王重润公司金融学第二版课后答案】业有几种组织方式?各有什么特点?( 1)有两种,有限责任公司和股份有限责任公司( 2)有限责任公司特点:有限责任公司是指股东以其出资额为限对公司承担责任,公司以其全部资产对公司的债务承担责任的企业法人;有限责任公司注册资本的最低限额为人民币3万元;其资本并不必分为等额股份,也不公开发行股票,股东持有的公司股票可以再公司内部股东之间自由转让,若向公司以外的人转让,须经过公司股东的同意;公司设立手续简便,而且公司无须向社会公开公司财务状况。

( 3)股份有限责任公司特点:1、有限责任2、永续存在3、股份有限责任公司的股东人数不得少于法律规定的数目,我国规定设立股份有限公司,应当有2人以上200人以下为发起人4、股份有限责任公司的全部资本划分为等额的股份,通过向社会公开发行的办法筹集资金,任何人在缴纳了股款之后,都可以成为公司股东,没有资格限制。

5、可转让性6、易于筹资2题:为什么我国《公司法》允许存在一人有限责任公司?一人有限责任公司与个人独资企业有何不同?答:1.就立法初衷而言,许可自然人投资设立一人有限责任公司的重要考虑是减少实质上的一人公司的设立,简化和明晰股权归属,减少纷争。

以往由于我国《公司法》禁止设立一人公司,使得投资人通过各种途径设立或形成的实质上的一人公司大量存在,挂名股东与真实股东之间的投资权益纠纷以及挂名股东与公司债权人之间的债务纠纷不断,令工商行政管理部门和司法机关无所适从。

在修订《公司法》的过程中,法律委员会、法制工作委员会会同国务院法制办、工商总局、国资委、人民银行和最高人民法院反复研究认为:从实际情况看,一个股东的出资额占公司资本的绝大多数而其他股东只占象征性的极少数,或者一个股东拉上自己的亲朋好友作挂名股东的有限责任公司,即实质上的一人公司,已是客观存在,也很难禁止。

根据我国的实际情况,并研究借鉴国外的通行做法,应当允许一个自然人投资设立有限责任公司。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。