财税英语专业词汇

财经英语词汇

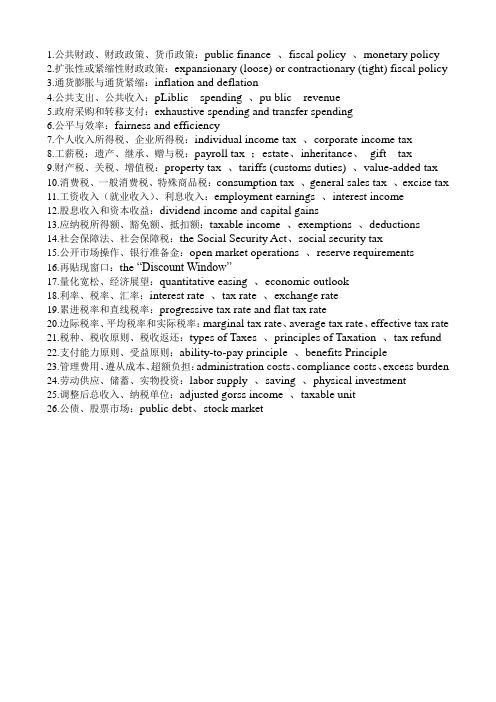

1.公共财政、财政政策、货币政策:public finance 、fiscal policy 、monetary policy2.扩张性或紧缩性财政政策:expansionary (loose) or contractionary (tight) fiscal policy3.通货膨胀与通货紧缩:inflation and deflation4.公共支出、公共收入:pLiblic spending 、pu blic revenue5.政府采购和转移支付:exhaustive spending and transfer spending6.公平与效率:fairness and efficiency7.个人收入所得税、企业所得税:individual income tax 、corporate income tax8.工薪税;遗产、继承、赠与税:payroll tax ;estate、inheritance、gift tax9.财产税、关税、增值税:property tax 、tariffs (customs duties) 、value-added tax10.消费税、一般消费税、特殊商品税:consumption tax 、general sales tax 、excise tax11.工资收入(就业收入)、利息收入:employment earnings 、interest income12.股息收入和资本收益:dividend income and capital gains13.应纳税所得额、豁免额、抵扣额:taxable income 、exemptions 、deductions14.社会保障法、社会保障税:the Social Security Act、social security tax15.公开市场操作、银行准备金:open market operations 、reserve requirements16.再贴现窗口:the “Discount Window”17.量化宽松、经济展望:quantitative easing 、economic outlook18.利率、税率、汇率:interest rate 、tax rate 、exchange rate19.累进税率和直线税率:progressive tax rate and flat tax rate20.边际税率、平均税率和实际税率:marginal tax rate、average tax rate、effective tax rate21.税种、税收原则、税收返还:types of Taxes 、principles of Taxation 、tax refund22.支付能力原则、受益原则:ability-to-pay principle 、benefits Principle23.管理费用、遵从成本、超额负担:administration costs、compliance costs、excess burden24.劳动供应、储蓄、实物投资:labor supply 、saving 、physical investment25.调整后总收入、纳税单位:adjusted gorss income 、taxable unit26.公债、股票市场:public debt、stock market。

税收专业术语

税收专业术语Accessions tax 财产增益税Admission tax 通行税,入场税advertisement tax 广告税agricultural(animal husbandry) tax 农(牧)业税alcohol tax 酒精税all-phase transaction tax 全阶段交易税amusement tax 娱乐税anchorage dues 停泊税anti-dumping duty 反倾销税anti-profiteering tax 暴力税anti-subsidy/bounty/duty 反补贴税assimilation tax 入籍税automobile acquisition tax 汽车购置税aviation fuel tax 航空燃料税bazaar transaction 市场交易税benefit tax 受益税betterment tax 改良税beverage tax 饮料税bonus tax 奖金税border tax 边境税bourse tax 证券交易所税bourse transaction tax(securities exchange tax)有价证券交易税building tax 建筑税business consolidated tax 综合营业税business income tax 营利所得税business profit tax 营业利润税business receipts tax 营业收入税business tax 营业税canal dues/tolls 运河通行税capital gain tax 财产收益税capital interest tax 资本利息税capital levy 资本税capital transfer tax 资本转移税capitation tax 人头税car license 汽车执照税car tax 汽车税church tax 教堂税circulation tax 流通税city planning tax 城市规划税collective-owned enterprise income tax 集体企业奖金税collective-owned enterprise income tax 集体企业所得税commercial business tax 商业营业税commodity circulation tax 商业流通税commodity excise tax 商品国内消费税commodity tax 货物税company income tax 公司所得税compensating tariff 补偿关税comprehensive income t ax 综合所得税consolidated tax 综合税consumption tax 消费税contingent duty 应变关税contract tax 契约税corn duty 谷物税corporate income tax 法人所得税corporate inhabitant tax 法人居民税corporate licensing tax 公司执照税corporate profit tax 公司利润税corporation franchise tax 法人登记税corporation tax 公司税,法人税coupon tax 息票利息税customs duties 关税death duty 遗产税deed tax 契税defense surtax 防卫附加税defense tax 国防税development land tax 改良土地税development tax 开发税direct consumption tax 直接消费税dividend tax 股息税document tax 凭证熟domestic rates 住宅税donation tax 赠与税earmarked tax 专用目的税earned income tax 劳物所得税easement tax 地役权税education duty 教育税electricity and gas tax 电力煤气税emergency import duties 临时进口税emergency special tax 非常特别税emergency tariff 非常关税employment tax 就业税enterprise income tax 企业所得税entertainment tax 娱乐税,筵席税entrepot duty 转口税environmental tax 环境税equalization charge/duty 平衡税estate tax 遗产税,地产税examination of deed tax 验契税excess profit tax 超额利润税excessive profit tax 过分利得税exchange tax 外汇税excise on eating, drinking and lodging 饮食旅店业消费税excise tax 国内消费税expenditure tax 消费支出税export duty(export tax)出口税extra duties 特税extra tax on profit increased 利润增长额特别税facilities services tax 设施和服务税factory tax 出厂税farm tax 田赋税feast tax 筵席税fixed assets betterment tax 固定资产改良税fixed assets tax 固定资产税foreign enterprise tax 外国公司税foreign personal holding company tax 外国私人控股公司税franchise tax 特许权税freight tax 运费税frontier tax 国境税gas tax 天然气税gasoline tax 汽油税general excise tax 普通消费税,一般消费税general property tax 一般财产税general sales tax 一般销售税gift and estate tax 赠与及财产税gift tax 赠与税good tax 货物税graduated income tax 分级所得税gross receipts tax 收入税harbor tax 港口税head tax/money 人头税highway hole tax 公路隧道通行税highway maintenance 养路税highway motor vehicle use tax 公路车辆使用税highway tax 公路税highway user tax 公路使用税house and land tax 房地产税house(property) tax 房产税household tax 户税hunter‘s license tax 狩猎执照税hunting tax 狩猎税immovable property tax 不动产税import duty 进口关税import surcharge/surtax 进口附加税import tax 进口税import turnover tax 进口商品流转税impost 进口关税incidental duties 杂捐income tax of urban and rural self-employed industrial and commercial household 城乡个体工商业户所得税income tax 所得税incorporate tax 法人税increment tax on land value 土地增值税indirect consumption tax 间接消费税indirect tax 间接税individual inhabitant tax 个人居民税individual/personal income tax 个人所得税industrial-commercial consolidated/unified tax 工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inhabitant income tax 居民所得税inheritance tax 遗产税,继承税insurance tax 保险税interest equilibrium tax 利息平衡税interest income tax 利息所得税interest tax 利息税internal revenue tax 国内收入税internal taxation of commodities 国内商品税internal taxes 国内税investment surcharge 投资收入附加税irregular tax(miscellaneous taxes)杂税issue tax 证券发行税joint venture with Chinese and foreign investment income tax 中外合资经营企业所得税keelage 入港税,停泊税land holding tax 地产税land tax 土地税land use tax 土地使用税land value increment tax 地价增值税land value tax 地价税landing tax 入境税legacy tax/duty 遗产税license tax 牌照税,执照税liquidation tax 清算所得税liquor tax 酒税livestock transaction/trade tax 牲畜交易税local benefit tax 地方收益税local entertainment tax 地方娱乐税,地方筵席税local improvement tax 地方改良税local income tax 地方所得税local inhabitant tax 地方居民税local road tax‘ 地方公路税local surcharge 地方附加local surtax 地方附加税local taxes/duties 地方各税luxury(goods) tax 奢侈品税manufacturer‘s excise tax 生产者消费税mine area/lot tax mine tax(mineral product tax)矿区税mineral exploitation tax 矿产税mining tax 矿业税motor fuel tax 机动车燃料税motor vehicle tonnage tax 汽车吨位税municipal inhabitants tax 市镇居民税municipal locality tax 市地方税municipal tax市政税municipal trade tax 城市交易税negotiable note tax 有价证券税net worth tax 资产净值税nuisance tax 小额消费品税object tax 目的税objective tax 专用税occupancy tax占用税occupation tax 开业税occupier‘s tax 农民所得税oil duties 石油进口税organization tax 开办税outlay tax 购货支出税passenger duty 客运税pavage 筑路税payroll tax 薪金工资税personal expenditures tax 个人消费支出税petrol duties 汽油税petroleum revenue tax 石油收益税pier tax 码头税plate tax 牌照税poll tax 人头税poor rate 贫民救济税port toll/duty 港口税,入港税premium tax 保险费税probate duty 遗嘱认证税processing tax 加工商品税product tax 产品税profit tax 利润税profit-seeking enterprise income tax 营利企业所得税progressive income tax 累进所得税progressive inheritance tax 累进遗产税property tax 财产税public utility tax 公用事业税purchase tax 购买税real estate tax 不动产税real estate transfer tax 不动产转让税real property acquisition tax 不动产购置税receipts tax 收入税recreation tax 娱乐税registration and license tax 登记及执照税registration tax 注册税regulation tax 调节税remittance tax 汇出税resident tax 居民税resource tax 资源税retail excise tax 零售消费税retail sales tax 零售营业税retaliatory tariff 报复性关税revenue tax/duty 营业收入税river dues 内河税rural land tax农业土地税,田赋rural open fair tax农村集市交易税salaries tax 薪金税sales tax 营业税,销售税salt tax 盐税scot and lot 英国教区税seabed mining tax 海底矿产税securities exchange tax 证券交易税securities issue tax 证券发行税securities transfer /transaction tax 证券转让税selective employment tax 对一定行业课征的营业税selective sales tax 对一定范围课征的营业税self-employment tax 从业税service tax 劳务税settlement estate duty 遗产税severance tax 开采税,采掘熟shipping tax 船舶税slaughtering tax 屠宰税social security tax 社会保险税special commodity sales tax 特殊商品销售税special fuel oil tax 烧油特别税special land holding tax特种土地税special motor fuel retailers tax 汽车特种燃料零售商税special purpose tax 特种目的税special sales tax 特种销售税,特种经营税special tonnage tax/duty 特别吨位税spirit duty 烈酒税split tax 股本分散转移税stamp tax 印花税state income tax 州所得税state unemployment insurance tax 州失业保险税state-owned enterprise bonus tax 国营企业奖金熟state-owned enterprise income tax 国营企业所得税state-owned enterprise regulation tax 国企营业调节税state-owned enterprise wages regulation tax 国营企业工资调节税stock transfer tax 股票交易税stock-holders income tax股票所有者所得税succession tax 继承税,遗产税sugar excise tax 糖类消费税sumptuary tax 奢侈取缔税super tax 附加税supplementary income tax 补充所得税target job tax 临时工收入税tariff equalization tax 平衡关税tariff for bargaining purpose 谈判目的的关税tariff for military security 军事按关税tariff 关税tax for the examination of deed 契约检验税tax of energy resource 能源税tax on aggregate income 综合所得税tax on agriculture 农业税tax on alcohol and alcoholic liquors 酒精饮料税tax on bank note 银行券发行税tax on beer 啤酒税tax on business 企业税tax on capital gain 资本利得税tax on communication 交通税tax on consumption at hotel and restaurant 旅馆酒店消费税tax on deposit 股息税tax on dividends 契税tax on earning from employment 雇佣收入税tax on enterprise 企业税tax on goods and possessions 货物急财产税tax on house 房屋税tax on income and profit 所得及利润税tax on income from movable capital 动产所得税tax on land and building 土地房产税tax on land revenue 土地收入税tax on land value 地价税tax on luxury 奢侈品税tax on mine 矿税tax on pari-mutuels 赛马税,赌博税tax on produce 产品税tax on property paid to local authority for local purpose 由地方征收使用的财产税tax on property 财产税tax on receipts from public enterprises 公营企业收入税tax on revaluation 资产重估税tax on sale and turnover 货物销售及周转税tax on sale of property 财产出让税tax on specific products 特种产品税tax on stalls 摊贩税tax on the acquisition of immovable property tax 不动产购置税tax on the occupancy or use of business property 营业资产占有或使用税tax on transaction (tax on transfer of goods)商品交易税tax on transfer of property 财产转移税tax on transport 运输税tax on undistributed profit 未分配利润税tax on urban land 城市地产税tax on value add 增值税edtea duty 茶叶税television duty 电视税timber delivery tax 木材交易税tobacco consumption tax 烟草消费税toll turn 英国的牲畜市场税toll(toll on transit)通行税tonnage duty (tonnage dues)吨位税,船税tourist tax(travel tax)旅游税trade tax 贸易税transaction tax 交易税transfer tax 证券过户税,证券交易税transit dues 过境税,转口税turnover tax 周转税,流通税undertaking unit bonus 事业单位奖金税unemployment compensation tax 州失业补助税unemployment insurance tax 失业保险税unemployment tax 失业税unemployment tax 州失业税unified income tax 统一所得税unified transfer tax 财产转移统一税unitary income tax 综合所得税unused land tax 土地闲置熟urban house tax 城市房产税urban house-land tax 城市房地产水urban maintenance and construction tax 城市维护建设税urban real estate tax 城市房地产税use tax 使用税users tax 使用人头税utility tax 公用事业税vacant land tax 土地闲置税value added tax 增值税variable levy 差额税,差价税vehicle and vessel license-plate tax 车船牌照税vehicle and vessel use tax 车船使用税wages regulation tax 工资调节税wages tax 工资税war profit tax 战时利润税water utilization tax 水利受益税wealth /worth tax 财富税whisky tax 威士忌酒税windfall profit tax 暴利税window tax 窗税wine and tobacco tax 烟酒税wine duty 酒税withholding income tax 预提所得税withholding tax 预提税yield tax 收益税。

★财税专业英语

Phrases:quid pro quo 补偿物,交换物,相等物,代用品additional allocation 增拨additional budget allocation 追加预算advance allocation 预付拨款[分配]appropriate for 拨出(款项)供…之用(be)tax system 税制tax collecting 征税ups and downs 盛衰的交替变换after-tax income 税后收入ballot box 投票箱the allocation function 配置职能the redistribution function 再分配职能the stabilization function 稳定职能tax allocation 税收分配tax code 税收法规tax avoidance 避税tax evasion 逃税tax exemption 免税tax reduction 减税tax refund 退税tax liability 纳税义务New words:aggregate n.合计, 总计, 集合体adj.合计的, 集合的, 聚合的v.聚集, 集合, 合计offset n.偏移量, 抵消, 弥补, 分支, 平版印刷, 胶印vt.弥补, 抵消, 用平版印刷vi.偏移, 形成分支presumption n.假定property n.财产, 所有物, 所有权, 性质, 特性, (小)道具expansion n.扩充, 开展, 膨胀, 扩张物, 辽阔, 浩瀚contraction n.收缩, 缩写式, 紧缩countercyclical adj.[经]反周期的(指与商业周期既定阶段发展方向相反的,如在商业周期高涨阶段采取通货紧缩政策,以防止通货膨胀等问题出现)philosophical adj.哲学的coercive adj.强制的, 强迫的valuation n.估价, 评价, 计算presupposition n.预想, 假设analogous adj.类似的, 相似的, 可比拟的Tax functions税收职能Taxes have four major functions: (1) to finance goods and services provided by the government; (2) to change the allocation of resources; (3) to redistribute income; and (4) to stabilize aggregate demand in the economy.税收拥有四项主要职能:(1)为政府提供公共服务和公共产品筹措资金;(2)调整资源的配置;(3)实现收入的再分配;(4)稳定经济总需求。

财务会计英文词汇

Accession Tax 财产增值税、财产增益税Additional Tax 附加税Admission Tax 入场税Allowable Tax Credit 税款可抵免税;准予扣除税额Amended Tax Return 修正后税款申报书Animal Slaughter Tax 动物屠宰税Annual Income Tax Return 年度所得税申报表Assessed Tax. 估定税额Assessment of Tax 税捐估定Asset Tax 资产税Back Tax 欠缴税款;未缴税额Business Tax (工商)营业税;工商税Capital Tax 资本税:<美>按资本额稽征;<英>指资本利得税和资本转让税(=[缩]CTT)<英>资本转让税Capital Transfer Tax 资本转移税;资本过户税Company Income Tax / Company Tax 公司所得税Corporate Profit Tax / Corporation Profit Tax 公司利润税;公司利得税Corporate Profits After Taxes <美>公司税后利润(额);公司税后收益(额)Corporate Profits Before Taxes <美>公司税前利润(额);公司税前收益(额)Corporation Tax Act <美>公司税法Corporation Tax Rate 公司税税率Deferred Income Tax 递延所得税Deferred Income Tax Liability 递延所得税负债Deferred Tax 递延税额;递延税额Development Tax 开发税;发展税Direct Tax 直接税Dividend Tax 股利税;股息税Earnings After Tax (=[缩]EAT)(纳)税后盈利;(纳)税后收益(额)Earnings Before Interest and Tax (=[缩]EBIT)缴付息税前收益额;息税前利润Effective Tax Rate 实际税率Employment Tax 就业税;职业税;雇用税Entertainment Tax 娱乐税;筵席捐Estate Tax 遗产税Estimated Income Tax Payable 估计应付所得税;预估应付所得税Estimated Tax 估计税金Exchange Tax 外汇税Excise Tax ①[国内]税;[国内]货物税②营业税;执照税Export Tax 出口税Export Tax Relief 出口税额减免Factory Payroll Taxes 工厂工薪税Factory Tax [产品]出厂税Fine for Tax Overdue 税款滞纳金Fine on Tax Makeup 补税罚款Franchise Tax 特许经营税;专营税Free of Income Tax (=[缩]f.i.t.)<美>免付所得税Import Tax 进口税Income Before Interest and Tax 利息前和税前收益Income After Taxes 税后收益;税后利润Income Tax ([缩]=IT)所得税Income Tax Benefit 所得税可退税款Income Tax Credit 所得税税额抵免Income Tax Deductions 所得税扣款;所得税减除额Income Tax Exemption 所得税免除额Income Tax Expense 所得税费用Income Tax Law 所得税法Income Tax Liability 所得税负债Income Tax on Enterprises 企业所得税Income Tax Payable 应付所得税Income Tax Prepaid 预交所得税Income Tax Rate 所得税率Income Tax Return 所得税申报表Income Tax Surcharge 所得附加税Income Tax Withholding 所得税代扣Increment Tax;Tax on Value Added 增值税Individual Income Tax Return 个人所得税申报表Individual Tax 个人税Inheritance Tax <美>继承税;遗产税;遗产继承税Investment Tax Credit (=[缩]ITC/I.T.C.)<美>投资税款减除额;投资税款宽减额;投资减税额Liability for Payroll Taxes 应付工薪税Local Tax / Rates 地方税Luxury Tax 奢侈(品)税Marginal Tax Rate 边际税率Notice of Tax Payment 缴税通知;纳税通知书Nuisance Tax <美>繁杂捐税;小额消费品税Payroll Tax 工薪税;工资税;<美>工薪税Payroll Tax Expense 工薪税支出;工资税支出Payroll Tax Return 工薪所得税申报书;工资所得税申报书Personal Income Tax 个人所得税Personal Income Tax Exemption 个人所得税免除Personal Tax 对人税;个人税;直接税Prepaid Tax 预付税捐Pretax Earnings 税前收益;税前盈余;税前盈利Pretax Income 税前收入;税前收益;税前所得Pretax Profit 税前利润Product Tax 产品税Production Tax 产品税;生产税Profit Tax 利得税;利润税Progressive Income Tax 累进所得税;累退所得税Progressive Income Tax rate 累进所得税率Progressive Tax 累进税Progressive Tax Rate 累进税率Property Tax 财产税Property Tax Payable 应付财产税Property Transfer Tax 财产转让税Rate of Taxation;Tax Rate 税率Reserve for Taxes 税捐准备(金)纳税准备(金)Retail Taxes 零售税Sales Tax 销售税;营业税Tax Accountant 税务会计师Tax Accounting 税务会计Tax Accrual Workpaper 应计税金计算表Tax Accruals 应计税金;应计税款Tax Accrued / Accrued Taxes 应计税收Tax Administration 税务管理Tax Audit 税务审计;税务稽核Tax Authority 税务当局Tax Benefit <美>纳税利益Tax Benefit Deferred 递延税款抵免Tax Bracket 税(收等)级;税别;税阶;税档Tax Collector 收税员Tax Credits <美>税款扣除数;税款减除数Tax Deductible Expense 税收可减费用Tax Deductions <美>课税所得额扣除数Tax Due (到期)应付税款Tax Evasion 逃税;漏税;偷税Tax Exemption / Exemption of Tax/ Tax Free 免税(额)Tax Law 税法Tax Liability 纳税义务Tax Loss 纳税损失;税损Tax on Capital Profit 资本利得税;资本利润税Tax on Dividends 股息税;红利税Tax Payment 支付税款;纳税Tax Penalty 税务罚款Tax Rate Reduction 降低税率Tax Rebate (出口)退税Tax Refund 退还税款Tax Return 税款申报书;纳税申报表Tax Savings 税金节约额Tax Withheld 扣缴税款;已预扣税款Tax Year 课税年度;纳税年度Taxable 可征税的;应纳税的Taxable Earnings 应税收入Taxable Income (=[缩]TI)可征税收入(额);应(课)税所得(额);应(课)税收益(额)Taxable Profit 应(课)税利润Taxation Guideline 税务方针;税务指南Taxes Payable 应缴税金,应付税款Tax-exempt Income 免税收入;免税收益;免税所得Tax-free Profit 免税利润Taxpayer 纳税人Transaction Tax 交易税;流通税Transfer Tax ①转让税;过户税②交易税Turnover Tax 周转税;交易税Undistributed Taxable Income 未分配课税所得;未分配应税收益Untaxed Income 未纳税所得;未上税收益Use Tax 使用税Value Added Tax (=[缩]VAT)增值税Wage Bracket Withholding Table 工新阶层扣税表Withholding Income Tax <美>预扣所得税;代扣所得税Withholding of Tax at Source 从源扣缴税款Withholding Statement 扣款清单;扣缴凭单Withholding Tax 预扣税款Withholding Tax Form (代扣所得税表)English Language Word or Term Chinese Language Word or TermINDIVIDUAL INCOME TAX WITHHOLDING RETURN 扣缴个人所得税报告表Withholding agent's file number 扣缴义务人编码Date of filing 填表日期Day 日Month 月Year 年Monetary Unit 金额单位RMB Yuan 人民币元This return is designed in accordance with the provisions of Article 9 of INDIVIDUAL I NCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA. The withholding agents should turn the tax withheld over to the State Treasury and file the return with the localtax authorities within seven days after the end of the taxable month.根据《中华人民共和国个人所得税法》第九条的规定,制定本表,扣缴义务人应将本月扣缴的税款在次月七日内缴入国库,并向当地税务机关报送本表。

财税英语专业词汇

政府赤字是指政府消耗的数额和它够胆征收的数目之间的差。——山姆·厄文(美国作家、记者)

——加尔文·库里奇

The payment of taxes gives a right to protection.纳税是为权利受保护付费。

——詹姆士·韦恩

The avoidance of tax may be lawful,but it is not yet a virtue.避税可能合法,但却不道德。

——劳德·邓宁

That which angers men most is to be taxed above their neighbors.最令人气愤的是要比自己的邻居多缴税。

——威廉·佩蒂

Don’t tax you,don’t tax me;Tax the fellow behind the tree.别对你征税,也别对我征税;对树后边那个家伙征税。

——拉塞尔·隆

Everyone who has anything to do with the tax code agrees it’s just an unbelievable mess .

任何与税收法典打交道的人都承认那是一团难以置信的烂摊子。

The marvel of all history is the patience with which men and women submit to burdens unnecessarily laid upon them by their governments.

财税常用专业词汇

财税常用专业词汇第一篇:财税常用专业词汇会计中的常用词汇 (1)机构名称 (3)税种名称(我国的29种) (4)通用术语 (5)会计中的常用词汇企业会计准则Accounting Standards for Enterprises权责发生制(应收应付制)accrual basis accounting system收付实现制cash basis accounting system账面价值book value公允价值fair value清算价值liquidation value置存价值carryingvalue残值scrape/salvage value历史成本historical cost重置成本replacement cost面值face value或par value资产负债表balance sheet利润表profit statement现金流量表 cash flow statement所有者权益变动表statement of changes in equity利润分配表statement of allocation of net income财务状况变动表statement ofchanges in financial position资金来源和运用表 statement of sources and uses of funds 折旧depreciation直线法straight-line method(SL)年数总和法sum-of-the-year's-digits method(SYD)双倍余额递减法double-declining-balance method(DDB)加速折旧法 accelerated depreciation method四大假设four accounting assumptions:会计主体accounting entity 持续经营going concern 货币计量measuring unit 会计分期accounting period可合理确定(95%~100%)reasonablecertain很可能(50%~95%)probable有可能(5%~50%)possible极小可能(0~5%)remote研发费R&D cost研究阶段research stage 开发阶段develop stage 资本化 capitalization 费用化 expensing成本的资本化与费用化有何不同?What is the difference between capitalizing and expensing a cost?交易性金融资产trading financial asset 持有至到期投资held-to-maturity investment 可供出售金额资产salable financial asset 投资性房地产 investment real estate无形资产 intangible assets商标权 trademarks专利权 patents 特许权 franchise著作权 copyright计算机软件 computer software商誉 goodwill开办费 organization costs机构名称全国人民代表大会the national people’s congress(NPC)常务委员会the standing committee全国人大常务委员会 the standing committee of the national people’s congress国务院the state council 财政部 the ministry of finance国家税务总局State Administration for Taxation地方税务局Local Taxation bureau当地主管税务机关the local competent tax authority税务局The Revenue Office工商行政管理administrative agency for industry and commerceAdministration for industry and commerce(AIC)中外合资企业Chinese-foreign equity joint ventures 中外合作企业Chinese-foreign contractual joint ventures 外商投资企业 foreign investment 外国企业 foreign enterprise外资企业foreign-capital enterprises 出口型企业export-oriented enterprise先进技术企业technologically advanced enterprise普通合伙企业general partnership(GP)有限合伙企业limited partnership(LP) 有限责任合伙limited liability partnership(LLP)企业经济特区Special Economic Zone沿海经济开发地区 in coastal economic open zones 边远不发达地区 remote underdeveloped areas税种名称(我国的29种)value added tax business tax consumption tax enterprise income tax;Income Tax for Enterprises customs taxindividual income tax resource taxurban and township land use taxcity maintenance and construction tax farmland occupation tax land appreciation tax stamp taxvehicle acquisition taxdeed tax fuel taxsecurity transaction tax social security taxhouse property tax slaughter tax urban real estate tax inheritance tax banquet tax vehicle and vessel usage taxvehicle and vessel license plate tax vessel tonnage tax agriculture tax animal husbandry taxincome tax on foreign enterprises and enterprises with foreign investment;增值税营业税消费税企业所得税关税个人所得税资源税城镇土地使用税城市维护扩建税耕地占用税土地增值税印花税车辆购置税契税燃油税证券交易税社会保障税房产税屠宰税城市房地产税遗产税筵席税车船使用税车船使用牌照税船舶吨税农业税牧业税外商投资及外国企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises fixed assets investment orientationregulation tax固定资产投资方向调节税The tax collection and administrative law税收征管法The detailed rules for the implementation of sh ……的实施细则通用术语tax returns filing 纳税申报 taxes payable 应交税金the assessable period for tax payment 纳税期限 the timing of tax liability arising 纳税义务发生时间 consolidate reporting 合并申报the outbound business activity 外出经营活动 Tax Inspection Report 纳税检查报告Tax Inspection Report 纳税检查报告tax avoidance 逃税 tax evasion 避税 tax base 税基refund after collection 先征后退 withhold and remit tax 代扣代缴 collect and remit tax 代收代缴 flat rate 比例税率withholding income tax 预提税 withholding at source 源泉扣缴 State Treasury 国库 tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税 the tax school大学里的税务学院 The Tax Institute一般作为机构的税务学院the national tax institute国家税务干部学院nominal tax rate 名义税率effective tax rate实际税率第二篇:财税英语专业词汇税务机关:国税局:State Administration of Taxation地税局:bureau of local taxation地方税务局:Local Taxation bureau外汇管理局:Foreign Exchange Control Board财政部:The Ministry of Finance财政局:finance bureau海关:the customs统计局: Statistics Bureau工商行政管理局:Administration of Industry and Commerce出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission(CSRS)劳动和社会保障部:Ministry of Labour and Social Security税种:营业税:Business tax增值税:VAT(value added tax)消费税:Excise印花税:Stamp tax/duty个人所得税:Personal(Individual)income tax城市维护建设税:City maintenance construction tax企业所得税:Corporate/enterprise/business income tax资源税:Resource tax土地增值税:Increment tax on land value 房产税:House property tax土地使用税:Land use tax车船使用税:Operation tax of vehicle and ship耕地占用税:Farmland use tax教育费附加:Extra charges of education funds税收的本质特征: the “three features” oftaxation 税收类型:课征目的:一般税(普通税)General T ax;特别税(目的税,特定目的税)Specific Tax计税依据:从价税 Ad valorem Tax;从量税Unit tax征收实体:实物税In Kind Tax;货币税Monetized Tax;劳役税 labor Tax 税收和价格关系:价内税 Tax With the Price;价外税Off-price Tax税负转嫁:直接税Direct Tax;间接税Indirect Tax 税收管理权限:中央税Central Tax;地方税Local Tax;中央地方共享税Shared Tax)课税对象:商品劳务税(销售税)Goods and Services Tax;所得税Income Tax;财产税Property Tax;资源税resource tax 税收要素:1、纳税人:纳税人(纳税义务人)Tax Payer;负税人Tax Bearer;扣缴义务人Withholding Agent2、课税对象Object of Taxation3、税基Tax Base4、税目Item of Tax5、税率:税率结构:Tax rate structure 税率等级:Tax bracket定额税率固定税率,Fixed Tax Rate;比例税率Proportional Tax Rate;累进税率Progressive Tax Rate全额累进税率(Progressive tax rate in excess of total amount)超额累进税率(Progressive tax rate in excess of specific amount)名义税率(表列税率)Nominal Tax Rate;实际税率(有效税率)、实际负担率,Effective Tax Rate累退税率Regressive tax rate边际税率marginal tax rate;平均税率average tax rate6、纳税环节impact point of taxation7、纳税期限tax day;the assessable period for tax payment、纳税地点tax payment place9、减免税(税收优惠),tax preference起征点tax threshold免征额(费用扣除)tax deduction税收中性tax neutrality预算约束线budget constraint无差异曲线indifference curve收入效应income effect替代效应substitution effect税收超额负担deadweight lose;Excess Burden:消费者剩余consumer surplus 生产者剩余producer surplus需求价格弹性price elasticity of demand供给价格弹性price elasticity of supply洛伦茨曲线lorenz curve基尼系数gini coefficient税收乘数Multiplier theory税收自动稳定机制automatic stabilizers——内在稳定器built-in stabilizers稳健的财政政策:Prudent fiscal policy积极的财政政策:Pro-active fiscal policy扩张性财政政策:Loose or expansionary policy紧缩性财政政策:Tight or contractionary policy税负转嫁和归宿:税收负担Tax Burden税负转嫁Tax Shifting税收归宿Tax Incidence:法定归宿Legal Incidence;经济归宿Economic Incidence 逃漏税T ax Evasion 偷税:tax dodging最优税收optimal taxation前转Forward Shifting;后转Backward Shifting;混转Diffused Shifting;税收资本化Capitalization of Taxation 税制结构structure of tax system:主体税种main tax;辅助税种subsidiary tax税式支出:税式支出 Tax Expenditure system :税收减免tax abatement and tax exemption税收抵免tax credit税前扣除pre-tax deduction优惠退税preferential tax refund(reinforcement)加速折旧accelerated depreciation盈亏互抵loss carry-forward and carry-backward延期纳税tax deferral税收豁免tax exemption税收饶让tax sparing优惠税率preferential tax rateThere is an old saying, “Nothing in life is certain except death and taxes.” The first part is true for everyone and the second certainly true for anyone in china who is of legal age, has a job, or ever buys anything.Income tax, business tax, and resource tax are just a few of the fees that government impose on its citizens.Tax is very important to our country, which can be used in the public services, such as education, road construction, public health and so on.As we all know, tax makes up a great part of our country's revenue, and the development of our country depends on it.From what has been discussed above, we can seethat it is everyone's legal duty to pay tax, because it means making contributions to the country and everyone can benefit from it.Those who try to dodge and evade taxation are sure to be punished, In a word, paying tax is our responsibility for society.I would be swollen with pride if I become a really tax payer..第三篇:材料学专业词汇8.Fracture :Microscopic Aspects fracturen 断裂microscopic a 微观的 macroscopic a 宏观的 crackn 裂纹nucleationn 形核 propagationn 扩展 ductilea 韧性的 brittlea 脆性的 brittlenessn 脆性 semi-brittle a 半脆性的 failure n 失效coalescence n 连接void n 空洞cross-sectional 横截面的 shear v 剪切transgranular a 穿晶的 preferentially adv 优先地 intergranular a 沿晶的 magnification n 放大 indentationn 凹陷8.1morphology n 组织,形态 dimple v 生微涡 rupturen 断裂 neckingn 颈缩 elastica 弹性的 ceramicsn 陶瓷 polymern 聚合物 tipn 尖端cleavage fracture 解理断裂 grain boundary晶界crystallographic plane 晶体学面 grainn 晶粒 crazen 微裂纹 tensilea 拉伸的stress concentration 应力集中 precursor n 预兆shearing banding 剪切带 flow stress流变应力 composite n 复合材料 fibrous a 纤维的 matrix n 基体 reinforcementn增强 bondingn 结合 compressionn 压缩 kinkingn 扭断 mechanismn 机制 plastica 塑性的 microbucklingn 微观弯曲8.2mobile dislocation可动位错 interatomic a 原子间的 bondn 键cohesive stress内聚应力 perfect crystal完整晶体Young’s modulus杨氏模量 defectn 缺陷 whiskern 晶须immobilea 不可动的 slip plane滑移面 restrictionn 限制 criterionn 判据 fibern 纤维 rollv 轧制heterogeneity n 不均匀性 striationn 擦痕 interiorn 内部 air bubble气泡 parametern 参数 inflexibilityn 不变性 dimplen 韧窝 triaxiala 三轴的 equiaxiala 等轴的 ellipticala 椭圆的 elastic-plastic弹塑性 qualitativea 定性的 stainless steel不锈钢interfacial bonding 界面结合 triaxiality n 三轴,cleavagev 解理,分裂 crystallographica.结晶学的 crystallinen 晶体orientationn.取向,排列方向facetn 倒角 screw dislocation螺旋位错cleavage step解理台阶 convergencen 会聚face-centered cubic面心立方体 body-centered cubic体心立方体 hexagonal close-packed 密排六方体 tungsten n钨molybdenumn 钼 chromiumn 铬 berylliumn 铍 magnesium n 镁 quenchv 淬火 tempern 回火 annealingn 退火 crystal lattice 结晶点阵 sensitizeda 激活 trajectoryn 轨迹 phosphorusn 磷.Recovery and Recrystallization recoveryn 回复recrystallizationn 再结晶 transformationn 转变 ,相变 alloy n 合金meltinga 熔化的cold-workeda冷加工的 terminal a 终点的 curvature n 曲线Gibbs free energy 吉布斯自由能 entropyn 熵10.1 stored energy储存能 subgrainn 亚晶 impurityn 杂质 extrusion n 挤压 thermala 热的inversely proportion 反比例10.2relaxation process驰豫过程 vacancyn 空位interstitial atom 间隙原子 vacancy motion 空位移动 hardnessn 硬度 resistivityn 电阻率 point-defect点缺陷self-explanatory a 不解自明的 elastic strain 弹性应变 stacking faults堆垛层错 lattice defect点阵缺陷 dislocation tangle 位错缠结 cellular a 多孔的misorienteda 取向错误的 two-dimensional二维的 diffusionn 扩散 Laue pattern劳厄斑 diffraction spot衍射斑点 etch-pit technique 点蚀坑技术10.3vacancy migration空位迁移 self-diffusion自扩散 dislocation climb位错攀移10.4statisticala统计的 fluctuationn波动 bulgev凸出来radiiradius pl 半径 sphericala球的, 球形的 protrudev(使)突出/伸出 incubation n孕育期velocityn速度、速率 coincident同时发生的 subboundary亚晶界10.5nucleation rate形核率 isothermallyad 等温地 impingevi 撞击 linear portion线形分配 nucleusn 核 phantomn模型integratev 求…的积分 negligiblea可以忽略的 modification n修正 sigmoida反曲的 decayv衰退 metallographica金属结构的 potentialn电势、电位 molen摩尔 volumen体积 coefficientn系数 criticala临界的10.6dashed curve点划线inverse relationship 反函数关系 brassn黄铜fine-graineda细晶的 optimizev优化10.7 rodn 棒 soft solder软焊剂 bendv 弯曲deformation texture 形变织构 annealing texture :退火织构recrystallization texture 再结晶织构 cube texture 立方织构 mismatchv 错配 meritn 优点anisotropyn 各向异性 magnetica 有磁性的 sheetn 薄板secondary recrystallization 二次再结晶bracket n方括弧的一边 intersectionn 交叉点,交点 grooven 沟槽 retardv 阻止 diametern 直径 concavea 凹的 steady-state 稳态的fascinatinga 吸引人的 tungstenn 钨 filamentn 灯丝 thorian 二氧化钍 creepv 蠕变 resistancen 阻力 undopeda 无搀杂的 sketchn 略图 interlockv 连接 dopev 掺入 dopantn 搀杂物 sinteringn 烧结物volatilizev(使)挥发 ingotn 铸锭fiber texture纤维织构 submicroscopic a 亚显微的 poren 气孔Chapter 14 Some Applications of Physical Metallurgy metallurgyn 冶金学 manipulatev 操作 optimizea 最佳化 weld jointn 焊点 solder jointn 焊接点 devicen 仪器14.1strengthening mechanism 强化机制 work hardening 加工硬化solid solution hardening 固溶硬化 particle hardening粒子硬化 burgers vector 柏氏矢量 virtuallyad 实际上 reciprocal倒易的 flow stress流动应力 foreign atom异类原子 misfitn 错配 interstiticala 间隙的 symmetricala 对称的octahedral void八面体空位 unsymmetrica不对称的 tetragonala正方形的 screw n螺钉dilatational a膨胀的 distortion n扭转,畸变 etch v侵蚀dilute hydrofluoric acid 稀释氢氟酸膜14.2nitrogen n氮 revealv 揭示 amorphous a非晶的gaugen标距 bulkn整体Charpy impact test 摆锤式冲击试验 torchn焊灯horizontala水平的synonymous a同义的cast iron 铸铁flake n薄片nodular a球状的 graphite n石墨 quote v引用homogenization n均匀性 corrosionn腐蚀 weldability n焊接性 formabilityn成形性 machinability n可加工性 reliability n可靠性 whisker 金属晶须pearlitic a珠光体的ultimate a基本的patent n专利lamellar a层状的 cellular a多孔的substructuren亚结构 latch n板条substitutional a代位的solid-solution hardening 固溶硬化octahedral a八面体的interstitial void 间隙空位 dipolar a两极的precipitation hardening 析出硬化sub zero 零度以下的negligible a可忽略的 millisecond n毫秒autotempering 自动回火structure hardening 结构硬化lath martensite 板条马氏体dislocation hardening 位错强化plate martensite 片状马氏体 residual a 残余的microcracking n显微裂变 substantially a实质上 redistribution n再分配spontaneous cracking 自发破裂 spheroidize v球化eutectoid temperature 共析温度Ostwald ripening process 奥斯特瓦尔德熟化过程Bainite n贝氏体retained austenite 残余奥氏体 regainn回伸率age-hardening 时效硬化vanadium n钒molybdenum n钼detrimental a有害的 retard v 延迟overaging n过时效 cohesion n内聚力ausformed steel 奥氏体钢 martensitic steel 马氏体钢high-hardenability 高硬化能力i inherited dislocation 遗传的位错 subsequently adv后续的 refinement n 细化 twinned a形成孪晶的 equivalent a相等的stress-true strain diagram 应力-应变曲线neck down 颈缩断开maraging steel 马氏体时效钢decomposition[化学]分解iron-nickel phase diagram 铁-镍相图binary a 二元的equilibrium n平衡 hysteresis n 迟滞现象heat-treat cycle 热处理循环ageing reaction 时效反应angstromn埃 deoxidatonn 脱氧 v-notchv 型缺口 siliconn硅postulatev视……为当然decarburization v脱去……的碳 preheating n预热 post-weld 焊接之后magnetic property 磁性性能 slant v(使)倾斜superconductor n超导体第四篇:专业词汇企业风险管理员相关概念一、企业全面风险管理的概念:企业全面风险管理是指企业在实现未来战略目标的过程中,试图将各类不确定因素产生的结果控制在预期可接受范围内的方法和过程,以确保和促进组织的整体利益实现。

财税英语税务专用词汇及税收英语.pdf

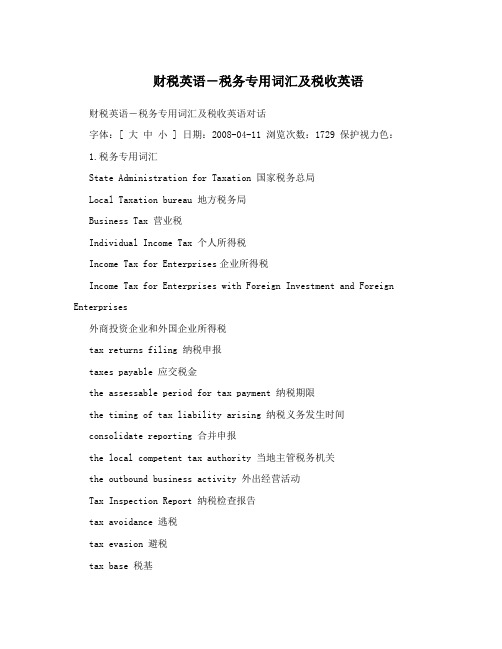

财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话1.税务专用词汇State Administration for Taxation国家税务总局Local Taxation bureau地方税务局Business Tax营业税Individual Income Tax个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing纳税申报taxes payable应交税金the assessable period for tax payment纳税期限the timing of tax liability arising纳税义务发生时间consolidate reporting合并申报the local competent tax authority当地主管税务机关the outbound business activity外出经营活动Tax Inspection Report纳税检查报告tax avoidance逃税tax evasion避税tax base税基refund after collection先征后退withhold and remit tax代扣代缴collect and remit tax代收代缴income from authors remuneration稿酬所得income from remuneration for personal service劳务报酬所得income from lease of property财产租赁所得income from transfer of property财产转让所得contingent income偶然所得resident居民non-resident非居民tax year纳税年度temporary trips out of临时离境flat rate比例税率withholding income tax预提税withholding at source源泉扣缴State Treasury国库tax preference税收优惠the first profit-making year第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise出口型企业technologically advanced enterprise先进技术企业Special Economic Zone经济特区2.税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC:Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer:my company will begin business soon,but I have little knowledgeabout the business tax.Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

财税英语专业词汇

Work and earn; pay tax and die. (Old German Proverb)工作,赚钱;纳税,死亡。

——德国古谚The government deficit is the difference between the amount of money the government spends and the amount it has the nerve to collect. (Sam Ewing)政府赤字是指政府消耗的数额和它够胆征收的数目之间的差。

——山姆·厄文(美国作家、记者)Our constitution is in actual operation; everything appears to promise that it will last; but nothing in this world is certain but death and taxes. (Benjamin Franklin)我们的宪法已开始实际运作起来;表面上一切都承诺会亘古不变,但事实上除了死亡和赋税,没有什么是确定无疑的。

——本杰明·富兰克林“The Internal Revenue Code” is about 10 times the size of the Bible ——and unlike the Bible ,contains no good news. (Don Nickles) 国内税收法典大概有《圣经》的10倍那么厚——然而不像《圣经》,它里面没有任何的福音。

——唐·尼科尔斯(俄克拉何马州民主党参议员)If you drive a car, I will tax the street.If you try a seat, I will tax your seat.If you get too cold , I will tax the heat.If you take a walk, I will tax your feet.Taxman !Well, I am the taxman.Yeah, I am the taxman.(The Beatles “Taxman”)如果你开车,我就对街道课税;如果你想坐,我就对你的座位课税;如果你觉得太冷,我就对暖气课税;如果你散步,我就对你的脚课税。

会计类英语单词

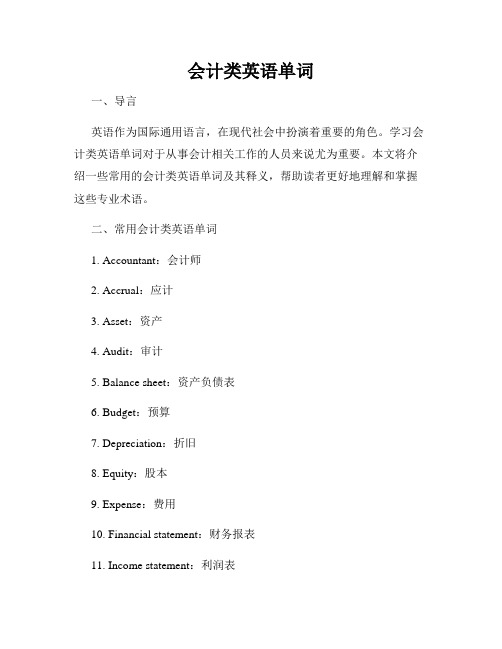

会计类英语单词一、导言英语作为国际通用语言,在现代社会中扮演着重要的角色。

学习会计类英语单词对于从事会计相关工作的人员来说尤为重要。

本文将介绍一些常用的会计类英语单词及其释义,帮助读者更好地理解和掌握这些专业术语。

二、常用会计类英语单词1. Accountant:会计师2. Accrual:应计3. Asset:资产4. Audit:审计5. Balance sheet:资产负债表6. Budget:预算7. Depreciation:折旧8. Equity:股本9. Expense:费用10. Financial statement:财务报表11. Income statement:利润表12. Interest:利息13. Ledger:总账14. Liabilities:负债15. Profit:利润16. Revenue:收入17. Tax:税收18. Trial balance:试算平衡表19. Wage:工资20. Working capital:营运资本三、对会计类英语单词的进一步解读1. Accountant(会计师)Accountant指的是负责处理和记录财务和税务事务的专业人员。

他们负责准确地记录和分析财务数据,并根据法律法规进行合规处理。

2. Accrual(应计)Accrual是指在会计报表中记录收入和费用时,以实际发生的时间为准。

这意味着即使在现金流发生之前或之后,也要将相关项目计入账目。

3. Asset(资产)Asset是指企业所拥有的有形或无形的东西,具有经济价值。

资产可以包括现金、股票、土地、建筑物等。

4. Audit(审计)Audit是指对企业的财务记录进行全面检查和评估的过程。

审计的目的是确认财务数据的真实性和准确性,以及检查企业是否遵守财务相关法规和准则。

5. Balance sheet(资产负债表)Balance sheet是一份会计报表,用于呈现企业在特定时间点上的资产、负债和所有者权益的情况。

税务专用英语

税务词汇营业税:business tax or turnover tax消费税:excise tax or consumption tax增值税:value added tax关税:custom duty印花税:stamp tax土地增值税:land appreciation tax or increment tax on land value个人所得税:individual income tax企业所得税:income tax on corporate business外商投资企业所得税:income tax on foreign investment enterprises城市维护建设税:city maintenance construction tax资源税:resource tax房产税:house property tax土地使用税:land use tax车船使用税:operation tax of vehicle and ship耕地占用税:farmland use tax教育费附加:extra charges of education fundsState Administration for Taxation 国家税务总局Yangzhou Taxation Training College of State Administration of Taxation 国家税务总局税务进修学院Local Taxation bureau 地方税务局外汇管理局:Foreign Exchange Control Board海关:customs财政局:finance bureau统计局: Statistics Bureau工商行政管理局: Administration of Industry and Commerce出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission (CSRS)劳动和社会保障部:Ministry of Labour and Social Securitytax returns filing 纳税申报tax payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区accountant genaral 会计主任account balancde 结平的account bill 帐单account books 帐account classification 分类account current 往来帐account form of balance sheet 式资产负债表account form of profit and loss statement 式损益表account payable 应付帐款account receivable 应收帐款account of payments 支出表account of receipts 收入表account title 名称,会计科目accounting year 或financial year 会计年度accounts payable ledger 应付款分类帐accept 受理accounting software 会计核算软件affix 盖章application letter 申请报告apply for reimbursement 申请退税apply for a hearing 申请听证apply for nullifying the tax registration 税务登记注销apply for reimbursement of tax payment 申请退税ask for 征求audit 审核author’s remuneration 稿酬;稿费averment 申辩bill/voucher 票证bulletin 公告bulletin board 公告牌business ID number 企业代码business license 营业执照call one’s number 叫号carry out/enforce/implement 执行check 核对check on the cancellation of the tax return 注销税务登记核查checking the tax returns 审核申报表city property tax 城市房地产税company-owned 公司自有的conduct an investigation/investigate 调查construction contract 建筑工程合同]cconsult; consultation 咨询<consulting service/advisory service 咨询服务contact 联系contract 承包copy 复印;副本deduct 扣除delay in filing tax returns 延期申报(缴纳)税款describe/explain 说明document 文件;资料examine and approve 审批extend the deadline for filing tax returns 延期税务申报feedback 反馈file tax returns(online) (网上)纳税申报fill out/in 填写foreign-owned enterprise 外资企业hearing 听证ID(identification) 工作证`Identical with the original 与原件一样IIT(Individual income tax) 个人所得税Implementation 稽查执行income 收入;所得inform/tell 告诉information desk 咨询台inspect 稽查inspection notice 稽查通知书instructions 使用说明invoice book(purchase) 发票购领本invoice 发票invoice tax control machine 发票税控机legal person 法人代表letter of settlement for tax inspection 稽查处理决定书list 清单local tax for education 教育地方附加费lunch breakmake a supplementary payment 补缴make one’s debut in handling tax affairs 初次办理涉税事项manuscript 底稿materials of proof 举证材料material 资料modify 修改modify one’s tax return 税务变更登记Nanjing Local Taxation Bureau 市地方税务局Notice 告知nullify 注销office building 办公楼office stationery 办公用品on-the-spot service 上门服务on-the-spot tax inspection 上门稽查opinion 意见original value 原值pay an overdue tax bill 补缴税款pay 缴纳penalty 处罚penalty fee for overdue payment 滞纳金penalty fee 罚款personal contact 面谈post/mail/send sth by mail 邮寄procedure/formality 手续proof material to backup tax returns 税收举证资料purchase 购领real estate 房产receipt 回执;反馈单record 记录reference number 顺序号register outward business administration 外出经营登记relevant materials of proof 举证资料rent 出租reply/answer 答复sell and pay foreign exchange 售付汇service trade 服务业settlement 处理settle 结算show/present 出示special invoice books of service trade 服务业发票stamp 公章submit a written application letter 提供书面申请报告supervision hotline 监督tax inspection bureau 稽查局tax inspection permit 税务检查证tax inspection 税务稽查tax law 税法tax payable/tax applicable 应缴税tax payment assessment 纳税评估tax payment receipt 完税凭证tax payment 税款tax rate 税率tax reduction or exemption 减免税tax registration number 纳税登记号tax registration certificate 税务登记证tax registration 税务登记tax related documents 涉税资料tax return/tax bill 税单tax return forms and the acknowledgement of receipt 申报表回执tax returns 纳税申报表tax voucher 凭证the accounting software 会计核算软件the acknowledgement of receipt 送达回证the application for an income refund 收入退还清单the author’s remuneration 稿费the business ID number 企业代码the certificate for outward business administration 外出经营管理证明the certificate for exchange of invoice 换票证the deadline 规定期限the inspection statement/report 检查底稿the legal person 法人代表the letter of statement and averment 述申辩书the online web address for filling tax returns 纳税申报网络地址the penalty fee for the overdue tax payment 税款滞纳金the penalty notice 处罚告知书the real estate 房产the registration number of the tax returns 纳税登记号the special invoice of service trade 服务业专用发票the special nationwide special invoice stamp 发票专用章the special nationwide invoice stamp 发票专用章the State Administration of Taxation 国家税务局supervision of taxation 税收监督tax inspection department 税务稽查局tax inspection permit 税务检查证tax return form 纳税申报表格tax voucher application for the sale and purchase of foreign exchange 售付汇税务凭证申请审批表the use of invoice 发票使用trading contract 购销合同transportation business 运输业under the rate on value method 从价urban house-land tax 城市房地产税VAT(value-added tax, value added tax) 增值税Written application letter 书面申请报告资产负债表:balance sheet 可以不大写b利润表: income statements (or statements of income)利润分配表:retained earnings现金流量表:cash flows。

财税英语-税务专用词汇及税收英语

财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话字体:[ 大中小 ] 日期:2008-04-11 浏览次数:1729 保护视力色:1.税务专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区2. 税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledgeabout the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

财税专业英语

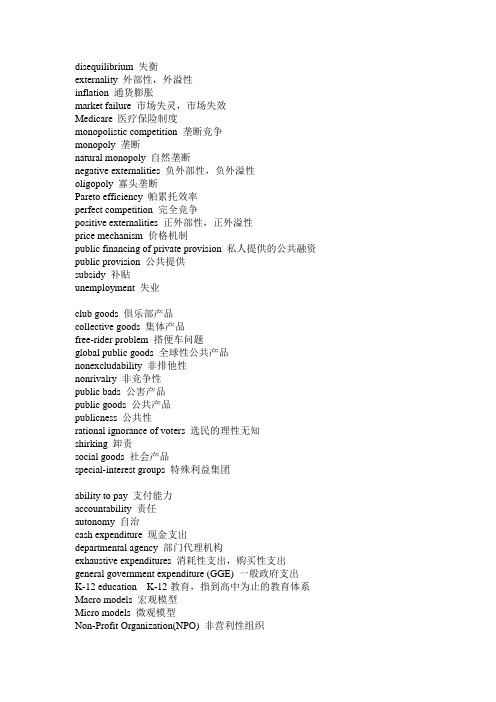

disequilibrium 失衡externality 外部性,外溢性inflation 通货膨胀market failure 市场失灵,市场失效Medicare 医疗保险制度monopolistic competition 垄断竞争monopoly 垄断natural monopoly 自然垄断negative externalities 负外部性,负外溢性oligopoly 寡头垄断Pareto efficiency 帕累托效率perfect competition 完全竞争positive externalities 正外部性,正外溢性price mechanism 价格机制public financing of private provision 私人提供的公共融资public provision 公共提供subsidy 补贴unemployment 失业club goods 俱乐部产品collective goods 集体产品free-rider problem 搭便车问题global public goods 全球性公共产品nonexcludability 非排他性nonrivalry 非竞争性public bads 公害产品public goods 公共产品publicness 公共性rational ignorance of voters 选民的理性无知shirking 卸责social goods 社会产品special-interest groups 特殊利益集团ability to pay 支付能力accountability 责任autonomy 自治cash expenditure 现金支出departmental agency 部门代理机构exhaustive expenditures 消耗性支出,购买性支出general government expenditure (GGE) 一般政府支出K-12 education K-12教育,指到高中为止的教育体系Macro models 宏观模型Micro models 微观模型Non-Profit Organization(NPO) 非营利性组织postsecondary education 高等教育public law administration(PLA) 公法行政实体public service delivery 公共服务提供real expenditure 实际支出school voucher 教育券state-owned enterprise 国有企业subsidiary 补助Tiebout-type competition 蒂布式竞争transfer payments/expenditures 转移性支出transition country 转型国家transparency 透明度user charging 使用者收费annuity 年金cohort life expectancy 群组预期寿命consumer price index 消费价格指数defined benefit 确定受益制defined contribution 确定供款制financial defined contribution(FDC) 融资的确定供款制fully funded system 完全基金制Great Depression 大萧条internal rate of return 内部收益率modified pay-as-you-go basis 修正的现收现付制non-financial DC 非融资的确定供款制national DC(NDC)scheme 名义确定供款制计划OASDHI(old age,survivors,disability and health insurance) 老年、遗嘱、残疾与健康保险项目OASDI 老年、遗嘱和残疾保险项目OASI(old age and survivors’ insurance) 老年与遗嘱保险pay-as-you-go(PAYG) 现收现付制portfolio 投资组合social security trust fund 社会保障信托基金social security 社会保障SSI(supplementary security income) 补充保障收入universal participation 普遍参与wage ceiling 工资封顶ability-to-pay principle 量能原则,支付能力原则average tax rate(ATR) 平均税率benefit principle 受益原则,利益原则customs duty 关税direct tax 直接税effective tax rates 实际税率(实际税率与法定税率可能不一样,可能是因为税收优惠的缘故,也可能是逃税引起的)estate and gift tax 遗产税与赠与税flat-rate tax 单一税gasoline tax 汽油税general tax 一般税horizontal equity 横向公平indirect tax 间接税individual income tax 个人所得税marginal tax rate(MTR) 边际税率payroll tax 工薪税poll tax 人头税progressive tax rate structure 累进税率结构proportional tax rate structure 比例税率结构regressive tax rate structure 累退税率sale tax 销售税selective tax 选择税statutory tax rate 法定税率tax 税taxation 税,税制tax base 税基tax bracket 税档tax fairness 税收公平tax principle 税收原则tax rate structure 税率结构user fee 使用费vertical equity 纵向公平carroussel 旋转木马避税法consumption tax 消费税corporate profit tax 公司利润税double taxation 重复征税exemption 免税general sales tax 一般销售税goods and services tax 商品劳务税indirect tax 间接税nuisance tax 小额消费品税payroll tax 工资薪金税personal income tax 个人所得税profit tax 利润税progressive tax 累进税refundable 可退税的regressive tax 累退税sales tax 销售税selective sales tax 选择性销售税sin tax 恶税turnover tax 周转税value-added tax(V AT) 增值税zero-rated 零增值税的(货物和劳务)adjusted gross income (AGI) 经调整的毛收入capital gain 资本利得deduction 扣除,扣除额Department of the Treasury (美国)财政部Ministry of Finance 中国财政部EGTRRA (the Economic Growth and Tax Relief Reconciliation Act of 2001) 《经济增长与减税法案》exemption 豁免,免税额flat tax 单一税fundamental tax reform 根本性税制改革itemized deduction 项目扣除joint return 联合申报表standard deduction 标准扣除tax competition 税收竞争tax liability 应付税款tax return 税收申报表taxable income 应税收入territorial taxation 属地税收withholding payment 预缴(税款)支出accelerated depreciation 加速折旧advance corporation tax (ACT) 预缴公司税classical tax system 古典税制capital stock (stock of capital) 资本存量corporate tax (corporation tax) 公司所得税depreciation allowance 折旧提存dividend 红利,股息dividend relief 股利免税double taxation 重复征税economic effective 经济效应excess-profits tax 超额利润税full integration 完全一体化imputation tax system 归集税制incidence 归宿(tax incidence 税收归宿)industrialized country 工业化国家outlays for research and development (R&D) 研发支出partial imputation system 部分归集制partnership method 合伙法split-rate system 分率制real (inflation-adjusted) income 实际收入(经济通货膨胀调整后的收入)shareholder 股东subnational government 中央一下政府,地方政府tax credit 税收抵免tax haven 避税港,税收天堂tax holiday 免税期tax jurisdiction 税收管辖权tax shelter 税务避难所bailout 援助clearing 承兑default 债券拖欠,到期不兑现external debt 外债hyperinflation 恶性通胀inflation 通货膨胀inflation-indexed bond 消除通胀指数的债券internal debt 内债issuance 发行Keynesian 凯恩斯主义municipal bond 市政债券national debt 公债,国债private debt 私债public debt (government debt or national debt) 公债sovereign bond 主权债券structure (债券)结构automatic stabilizers 自动稳定器backfire 事与愿违,产生反效果balanced budget 平衡预算business cycle 经济周期contractionary fiscal policy 紧缩性财政政策countercyclical fiscal policy 反周期财政政策countercyclically 反周期地(指与经济周期既定阶段发展方向相反的,如在经济周期高涨阶段采取通货紧缩政策,以防止通货膨胀鞥问题的出现)crowding out 挤出效应discretionary fiscal policy 相机抉择的财政政策exchange rate appreciation 汇率升值expansionary fiscal policy 扩张性财政政策gross domestic product (GDP) 国内生产总值inside lag 内部时滞macroeconomic policy 宏观经济政策natural rate of 自然······率Ricardian Equivalence 李嘉图等价(定理)supply-side economists 供给学派经济学家twin deficits (预算和贸易)双赤字categorical grant 分类拨款fiscal federalism 财政联邦制,财政联邦主义fiscal transfer 财政转移支付general unconditional grant 一般性的无条件拨款grant 拨款interjurisdictional externality 辖区间的外溢性local public goods 地方性公共产品matching grant 配套拨款national public goods 全国性公共产品Tiebout Model 蒂布模型vote with one’s feet 用脚投票网络资源:英文维基百科辞典网站关于公共部门的互联网杂志/het/经济思想史网站一个推动制度研究的网站/gpgn/topic04.php全球性公共产品研究网络/jbc詹姆斯·布坎南政治经济学研究中心公共选择学会网站/liberty/public_goods_fallacies.html关于公共产品理论不同看法的一个网站世界银行网站,该网站提供大量公共支出改革的文章和资料 OECD网站,该网站提供大量和公共支出有关的文章和资料美国政府网站/spending_review/spend_csr07/spend_csr07_index.cf m 英国财政部网站麻省理工学院经济系网站/feldstein NBER网站Martin Feldstein的文集世界银行网站卡图研究所网站美国国内收入署中国国家税务总局税收知识综合网站/business-and-economy/vat.html提供大量增值税的资料/state.html提供美国州和地方政府的税收材料提供税收政策方面的资料美国城市研究所和布鲁金斯学会合作机构税收政策中心的网站http://www.fourmilab.ch/ustax/ustax.html美国税法在线网站/taxstats/bustaxstats/article/0,,id=97145,00.html该网页提供大量公司所得税统计资料/一个税收新闻网站,提供大量最新税收资讯/美国财政部公债局网站/Services/Public+Debt+Management/index.html世界银行的该网站提供公债管理方面的资料大英百科全书电子版,提供各学科的知识和信息,在经济学科拥有丰富的知识库和最新资讯经济学科电子图书馆,拥有丰富的经济学电子图书资源北京大学中国经济研究中心:/cn/经济学阶梯教室:/国务院研究发展中心:/南京大学商学院斯密论坛:/xueshu。

财税英语

Disposable adj. 可(任意)处理的;可自由使用 的, 用完即可丢弃的

The per capita disposable income increased by 8.5% in real terms for urban residents. 城镇居民人均可支配收入实际增长8.5%。 disposable business income: 企业可用收入 disposable capital: 闲置资本;游资 disposable weight : 飞机遇紧急情况时可以丢弃的物件重量 disposable chopsticks: 一次性筷子 disposable packaging: 不回收包装

surplus n.剩余 过剩 [会计 盈余 剩余, 会计]盈余 剩余 过剩, 会计 adj.过剩的 剩余的 过剩的, 过剩的 necessary labor and surplus labor 必要劳动与剩余劳动 Brazil has a big surplus of coffee. 巴西有很多剩余的咖啡

专业词汇

总需求 Aggregate demand : 税收乘数 Tax multiplier: Tax multiplier: Balanced budget multiplier: 平衡预算乘数 Expansionary fiscal policy: 扩张性财政政策 “Supply-side” economist: 供给学派的经济学家 Disposable income: 可支配收入

aggregate n.合计 总计 集合体 合计, 总计, 合计 adj.合计的 集合的, 聚合的 合计的, 集合的 合计的 vt.聚集 集合 合计 聚集, 聚集 集合, in the aggregate 总的说来, 总计

财会英语词汇

在财务和会计领域,有一些专业术语和词汇是经常使用的。

以下是一些常用的财会英语词汇:1. Accountant -会计师2. Accounting -会计3. Bookkeeping -记账4. Budget -预算5. Cash flow -现金流量6. Chart of accounts -账户表7. Cost accounting -成本会计8. Credit -信用9. Debit -借方10. Equity -股东权益11. Expense -费用12. Financial statement -财务报表13. Fixed asset -固定资产14. Income -收入15. Journal entry -日记账目16. Ledger -分户账17. Liability -负债18. Net income -净收入19. Payroll -工资单20. Profit -利润21. Tax -税收22. Trial balance -试算平衡表23. Audit -审计24. Bank reconciliation -银行对账25. Depreciation -折旧26. Earnings per share -每股收益27. Financial ratio -财务比率28. Forecasting -预测29. Internal controls -内部控制30. Journal -日志31. Noncurrent asset -非流动资产32. Nonoperating income -非经常性收入33. Operating expense -营业费用34. Operating income -营业收入35. Owner's equity -所有者权益36. Payable -应付账款37. Receivable -应收账款38. Revenue -营业收入39. Statement of cash flows -现金流量表40. Statement of financial position -财务状况表41. Statement of income -收入表42. Statement of retained earnings -未分配利润表43. Transaction -交易44. Trial balance sheet -试算平衡表这些词汇是财务和会计专业的基础词汇,对于从事这一领域的工作的人来说非常重要。

财税英语专用词汇

财税英语--税收专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Nationwide Taxation Departments 全国税务系统State Council 国务院Ministry of Finance 财政部Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税deed tax 契税stamp tax 印花税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 避税tax evasion 逃税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区tax transparency 税收透明度registration duties 注册税subscription tax 认购税foreign investment and foreign enterprises 外商投资和外国企业pre-tax deduction 税前扣除tax payment for loan repayment 以税还贷rational tax burden 合理税负proactive fiscal policy 积极财政政策rural tax for fee reform 农村税费改革。

财经英语

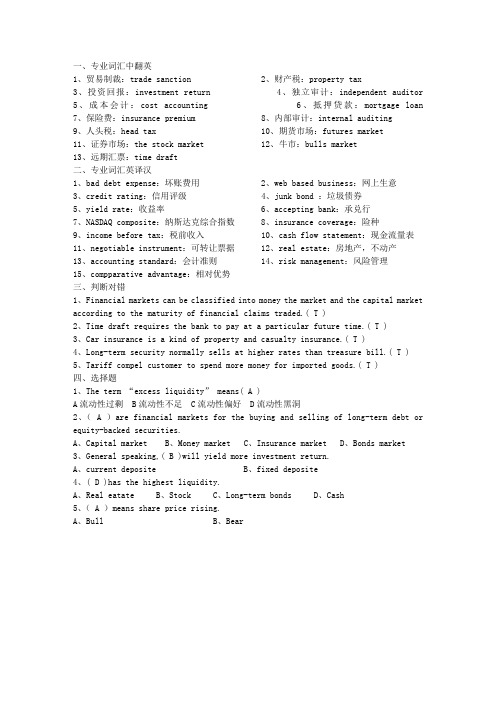

一、专业词汇中翻英1、贸易制裁:trade sanction2、财产税:property tax3、投资回报:investment return4、独立审计:independent auditor5、成本会计:cost accounting6、抵押贷款:mortgage loan7、保险费:insurance premium8、内部审计:internal auditing9、人头税:head tax 10、期货市场:futures market11、证券市场:the stock market 12、牛市:bulls market13、远期汇票:time draft二、专业词汇英译汉1、bad debt expense:坏账费用2、web based business:网上生意3、credit rating:信用评级4、junk bond :垃圾债券5、yield rate:收益率6、accepting bank:承兑行7、NASDAQ composite:纳斯达克综合指数 8、insurance coverage:险种9、income before tax:税前收入 10、cash flow statement:现金流量表11、negotiable instrument:可转让票据 12、real estate:房地产,不动产13、accounting standard:会计准则 14、risk management:风险管理15、compparative advantage:相对优势三、判断对错1、Financial markets can be classified into money the market and the capital marketaccording to the maturity of financial claims traded.( T )2、Time draft requires the bank to pay at a particular future time.( T )3、Car insurance is a kind of property and casualty insurance.( T )4、Long-term security normally sells at higher rates than treasure bill.( T )5、Tariff compel customer to spend more money for imported goods.( T )四、选择题1、The term “excess liquidity” means( A )A流动性过剩 B流动性不足 C流动性偏好 D流动性黑洞2、( A )are financial markets for the buying and selling of long-term debt orequity-backed securities.A、Capital marketB、Money marketC、Insurance marketD、Bonds market3、General speaking,( B )will yield more investment return.A、current depositeB、fixed deposite4、( D )has the highest liquidity.A、Real eatateB、StockC、Long-term bondsD、Cash5、( A )means share price rising.A、BullB、Bear(一)简历MINGJU FENGRoom 107 Building CYuxi Normal University,Yuxi 653100(0877)6127078Email:1098133239@ObjectiveTo obtain an accounting jobEducation2011.9—2015.7 Dept.of Financial management, Graduate School of Yuxi Normal UniversityAcademic Main CoursesBasic AccountingManagement ScienceStatisticsPolitical EconomicsWestern EconomicsFinancial Management,Financial AccountingCost AccountingElectronic CommerceAccounting Simulated TrainingFinancial Software TutorialComputer AbilitiesSkilled in use of the database, and access to the computer test "access" level two certificateEnglish SkillsHave a good command of both spoken and written English .Past CET-4:414 Scholarships and Awards2011.11 National Second Level Chinese Certificate2011.12 Two National Grants2013.4 Students Venture Competition the first prize at school2013.12To obtain a National GrantsQualificationsGeneral business knowledge relating to financial, Have a passion for the Internet, and an abundance of common senseWith registered certificate of qualified accountingApplication Form for Import/Export of Personal EffectsApplicant’s Name__________________ Status___________________ Nationality________________________ Dept.____________________ Rank______________________ Identity Card NO.________________________ Add.&Tel.No.in P.R.C___________________________________________________________ I hereby apply for import/export of Entry/Exit port______________ The following personal effects:。

财务英语专业术语

流动资产CURRENT ASSETS:现金Cash on hand银行存款Cash in bank有价证券Marketable securitiea应收票据Notes receivable应收帐款Accounts receivable坏帐准备Provision for bad debts预付帐款Advances to suppliers其他应收款Other receivables待摊费用Deferred and prepaid expenses存货Inventories存货变现损失准备Provision for loss on realization of inventory一年内到期的长期债券投资Long-term investments maturing within one year 其他流动资产Other current assets长期投资Long-term in vestments一年以上的应收款项Receivables collectable after one year固定资产:FIXED ASSETS:固定资产原价Fixed assets-cost累计折旧Accumulated depreciation固定资产净值Fixed assets-net value固定资产清理Disposal of fixed assets在建工程Construction in progress无形资产INTANGIBLE ASSETS:场地使用权Land occupancy right工业产权及专有技术Proprietary technology and patents其他无形资产Other intangibles assets其他资产:OTHER ASSETS开办费Organization expenses筹建期间汇兑损失Exchange loss during start-up peried递延投资损失Deferred loss on investments递延税款借项Deferred taxes debit其他递延支出Other deferred expenses待转销汇兑损失Unamortized cxehange loss流动负债CURRENT LIABILITIES:短期借款Short term loans应付票据Notes payable应付帐款Accounts payable应付工资Accrued payroll应交税金Taxes payable应付利润Dividends payable预收货款Advances from customers其他应付款Other payables预提费用Accrued expenses应付福利费Staff and workers bonus and welfare fund一年内到期的长期负债Long-term liabitities due within one year其他流动负债Other current liabilities长期负债LING-TERMLIABILITIES长期借款Ling-term loans应付公司债Debentures payable应付公司债溢价(折价)Premium(discount)on debentures payable一年以上的应付款项Payables due after one year其他负债OTHER LIABILITES筹建期间汇兑收益Exchange gain during start-up period递延投资收益Deferred gain on investments递延税款贷项Deferred taxes credit其他递延贷项Other deferred credit待转销汇兑收益Unamortized exchange gain所有者权益:OWNERS' EQUITY实收资本Paid in capital其中:中方投资Including:Chinese investment其中:外方投资Including:Foreign investment已归还投资Investment returned资本公积Capital surplus储备基金Reserve fund企业发展基金Enterprise expansion fund利润归还投资Profits capitalised on return of investment本年利润current year profit未分配利润Undistributed profits主营业务收入Revenue from main operation主营业务成本Cost of main operation主营业务税金及附加Tax and additional duty of main operation主营业务利润Income from main operation其他业务利润Incom from other operation营业费用Operating expense管理费用General and administrative expense 财务费用Financial expense 利息支出Interest expense汇兑损失Exchange loss营业利润Operating Income投资收益Investment income营业外收入Non-operating income营业外支出Non operating expense利润总额Income before tax所得税income tax净利润 Net incomeAAA 美国会计学会Abacus 《算盘》杂志abacus 算盘Abandonment 废弃,报废;委付abandonment value 废弃价值abatement ①减免②冲销ability to service debt 偿债能力abnormal cost 异常成本abnormal spoilage 异常损耗above par 超过票面价值above the line 线上项目absolute amount 绝对数,绝对金额absolute endorsement 绝对背书absolute insolvency 绝对无力偿付absolute priority 绝对优先求偿权absolute value 绝对值absorb 摊配,转并absorption account 摊配账户,转并账户absorption costing 摊配成本计算法abstract 摘要表abuse 滥用职权abuse of tax shelter 滥用避税项目ACCA 特许公认会计师公会accelerated cost recovery system 加速成本收回制度accelerated depreciation method 加速折旧法,快速折旧法acceleration clause 加速偿付条款,提前偿付条款acceptance ①承兑②已承兑票据③验收acceptance bill 承兑票据acceptance register 承兑票据登记簿acceptance sampling 验收抽样access time 存取时间accommodation 融通accommodation bill 融通票据accommodation endorsement 融通背书account ①账户,会计科目②账簿,报表③账目,账项④记账accountability 经营责任,会计责任accountability unit 责任单位Accountancy 《会计》杂志accountancy 会计accountant 会计员,会计师accountant general 会计主任,总会计accounting in charge 主管会计师accountant,s legal liability 会计师的法律责任accountant,s report 会计师报告accountant,s responsibility 会计师职责account form 账户式,账式accounting ①会计②会计学accounting assumption 会计假定,会计假设accounting basis 会计基准,会计基本方法accounting changes 会计变更accounting concept 会计概念accounting control 会计控制accounting convention 会计常规,会计惯例accounting corporation 会计公司accounting cycle 会计循环accounting data 会计数据accounting doctrine 会计信条accounting document 会计凭证accounting elements 会计要素accounting entity 会计主体,会计个体accounting entry 会计分录accounting equation 会计等式accounting event 会计事项accounting exposure 会计暴露,会计暴露风险accounting firm 会计事务所Accounting Hall of Fame 会计名人堂accounting harmonization 会计协调化accounting identity 会计恒等式accounting income 会计收益accounting information 会计信息accounting information system 会计信息系统accounting internationalization 会计国际化accounting journals 会计杂志accounting legislation 会计法规accounting manual 会计手册accounting objective 会计目标accounting period 会计期accounting policies 会计政策accounting postulate 会计假设accounting practice 会计实务accounting principle 会计原则Accounting Principle Board 会计原则委员会accounting procedures 会计程序accounting profession 会计职业,会计专业accounting rate of return 会计收益率accounting records 会计记录,会计簿籍Accounting Review 《会计评论》accounting rules 会计规则Accounting Series Release 《会计公告文件》accounting service 会计服务accounting software 会计软件accounting standard 会计标准,会计准则accounting standardization 会计标准化Accounting Standards Board 会计准则委员会(英)Accounting Standards Committee 会计准则委员会(英) accounting system ①会计制度②会计系统accounting technique 会计技术accounting theory 会计理论accounting transaction 会计业务,会计账务Accounting Trend and Techniques 《会计趋势和会计技术》accounting unit 会计单位accounting valuation 会计计价accounting year 会计年度accounts 会计账簿,会计报表account sales 承销清单,承销报告单accounts payable 应付账款accounts receivable 应收账款accounts receivable aging schedule 应收账款账龄分析表accounts receivable assigned 已转让应收账款accounts receivable collection period 应收账款收款期accounts receivable discounted 已贴现应收账款accounts receivable financing 应收账款筹资,应收账款融资accounts receivable management 应收账款管理accounts receivable turnover 应收账款周转率,应收账款周转次数accretion 增殖accrual basis accounting 应计制会计,权责发生制会计accrued asset 应计资产accrued expense 应计费用accrued liability 应计负债accrued revenue 应计收入accumulated depreciation 累计折旧accumulated dividend 累计股利accumulated earnings tax 累积盈余税,累积收益税accumulation 累积,累计acid test ratio 酸性试验比率acquired company 被盘购公司,被兼并公司acquisition 购置,盘购acquisition accounting 盘购会计acquisition cost 购置成本acquisition decision 购置决策acquisition excess 盘购超支acquisition surplus 盘购盈余across-the-board 全面调整ACT 预交公司税act 法案,法规action 起诉,诉讼active account 活动账户active assets 活动资产activity 业务活动,作业activity account 作业账户activity accounting 作业会计activity ratio 业务活动比率activity variance 业务活动量差异act of bankruptcy 破产法act of company 公司法act of God 天灾,不可抗力actual capital 实际资本actual value 实际价值actual wage 实际工资added value 增值added value statement 增值表added value tax 增值税addition 增置,扩建additional depreciation 附加折旧,补提折旧additional paid-in capital 附加实缴资本additional tax 附加税adequate disclosure 充分披露adjunct account 附加账户adjustable-rate bond 可调整利率债券adjusted gross income 调整后收益总额,调整后所得总额adjusted trial balance 调整后试算表adjusting entry 调整分录adjustment 调整adjustment account 调整账户adjustment bond 调整债券administrative accounting 行政管理会计administrative budget 行政管理预算administrative expense 行政管理费用ADR 资产折旧年限幅度ad valorem tax 从价税advance 预付款,垫付款advance corporation tax 预交公司税advances from customers 预收客户款advance to suppliers 预付货款adventure 投机经营,短期经营adverse opinion 反面意见,否定意见adverse variance 不利差异,逆差advisory services 咨询服务affiliated company 联营公司affiliation 联营after closing trial balance 结账后试算表after cost 售后成本after date 出票后兑付after sight 见票后兑付after-tax 税后AGA 政府会计师联合会age 寿命,账龄,资产使用年限age allowance 年龄减免age analysis 账龄分析agency 代理,代理关系agency commission 代理佣金agency fund 代管基金agenda 议事日程,备忘录agent 代理商,代理人aggregate balance sheet 合并资产负债表aggregate income statement 合并损益表AGI 调整后收益总额,调整后所得总额aging of accounts receivable 应收账款账龄分析aging schedule 账龄表agio 贴水,折价agiotage 汇兑业务,兑换业务AGM 年度股东大会agreement 协议agreement of partnership 合伙协议AICPA 美国注册公共会计师协会AIS 会计信息系统all capital earnings rate 资本总额收益率all-inclusive income concept 总括收益概念allocation 分摊,分配allocation criteria 分配标准allotment ①分配,拨付②分配数,拨付数allowance ①备抵②折让③津贴allowance for bad debts 呆账备抵allowance for depreciation 折旧备抵账户allowance method 备抵法all-purpose financial statement 通用财务报表,通用会计报表alpha risk 阿尔法风险,第一种审计风险altered check 涂改支票alternative accounting methods 可选择性会计方法alternative proposals 替代方案,备选方案amalgamation 企业合并American Accounting Association 美国会计学会American depository receipts 美国银行证券存单,美国银行证券托存收据American Institute of Certified Public Accountants 美国注册会计师协会,美国注册公共会计师协会American option 美式期权American Stock Exchange 美国股票交易所amortization ①摊销②摊还amortized cost 摊余成本amount 金额,合计amount differ 金额不符amount due 到期金额amount of 1 dollar 1元的本利和analysis 分析analyst 分析师analytical review 分析性检查annual audit 年度审计annual closing 年度结账annual general meeting 年度股东大会annualize 按年折算annualized net present value 折算年度净现值annual report 年度报告annuity 年金annuity due 期初年金annuity in advance 预付年金annuity in arrears 迟付年金annuity method of depreciation 年金折旧法antedate 填早日期anticipation 预计,预列anti-dilution clause 防止稀释条款anti-pollution investment 消除污染投资anti-profiteering tax 反暴利税anti-tax avoidance 反避税anti-trust legislation 反拖拉斯立法A/P 应付账款APB 会计原则委员会APB Opinion 《会计原则委员会意见书》Application 申请,申请书applied overhead 已分配间接费用appraisal 估价appraisal capital 评估资本appraisal surplus 估价盈余appraiser 估价员,估价师appreciation 增值appropriated retained earnings 已拨定留存收益,已指定用途留存收益appropriation 拨款,指拨经费appropriation account ①拨款账户②留存收益分配账户appropriation budget 拨款预算approval 核定,审批approved account 核定账户approved bond 核定债券A/R 应收账款arbitrage 套利,套汇arbitrage transaction 套利业务,套汇业务arbitration 仲裁,公断arithmetical error 算术误差arm,s-length price 正常价格,公正价格arm,s-length transaction 一臂之隔交易,正常交易ARR 会计收益率arrears ①拖欠,欠款②迟付arrestment 财产扣押Authur Anderson & Co. 约瑟•安德森会计师事务所,安达信会计师事务所article 文件条文,合同条款articles of incorporation 公司章程articles of partnership 合伙契约articulate 环接articulated concept 环接观念artificial intelligence 人工智能ASB 审计准则委员会ASE 美国股票交易所Asian Development Bank 亚洲开发银行Asian dollar 亚洲美元asking price 索价,卖方报价assessed value 估定价值assessment ①估定,查定②特别税捐,特别摊派税捐asset 资产asset cover 资产担保,资产保证asset depreciation range 资产折旧年限幅度asset-liability view 资产—负债观念asset quality 资产质量asset retirement 资产退役,资产报废asset revaluation 资产重估价asset stripping 资产剥离,资产拆卖asset structure 资产结构asset turnover 资产周转率asset valuation 资产计价assignment of accounts receivable 应收账款转让associated company 联属公司,附属公司Association of Government Accounting 政府会计师协会assumed liability 承担债务,承付债务A T 税后at cost 按成本at par 按票面额,平价at sight 见票兑付,即期兑付attached account 被查封账户attachment 扣押,查封attest 证明,验证attestation 证明书,鉴定书audit 审核,审计auditability 可审核性audit committee 审计委员会audit coverage 审计范围audited financial statement 审定财务报表,审定会计报表audit evidence 审计证据,审计凭证Audit Guides 《审计指南》auditing ①审计②审计学auditing procedure 审计程序auditing process 审计过程auditing standard 审计标准,审计准则Auditing Standards Board 审计准则委员会Auditor 审计员,审计师auditor general 审计主任,总审计auditor,s legal liability 审计师法律责任auditor,s opinion 审计师意见书auditor,s report 审计师报告,查账报告audit program 审计工作计划audit report 审计报告audit risk 审计风险audit sampling 审计抽样audit software 审计软件audit test 审计抽查audit trail 审计脉络,审计线索audit working paper 审计工作底稿authorized capital stock 核定股本,法定股本automated clearing house 自动票据交换所automated teller machine 自动取款机automatic transfer service 自动转账服务available asset 可用资产available inventory 可用存货average balance 平均余额average collection period 平均收款期average cost 平均成本average-cost method 平均成本法average inventory 平均存货,平均库存average life 平均寿命,平均使用年限average payment period (of accounts payable) 应付账款平均付款期average rate of return 平均收益率averages 股票价格平均指数avoidable cost 可避免成本。

财税英语专业词汇

税务机关:国税局:State Administration of Taxation地税局:bureau of local taxation地方税务局:Local Taxation bureau外汇管理局:Foreign Exchange Control Board财政部:The Ministry of Finance 财政局:finance bureau海关:the customs统计局: Statistics Bureau工商行政管理局: Administration of Industry and Commerce出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission (CSRS) 劳动和社会保障部:Ministry of Labour and Social Security税种:营业税:Business tax增值税:VAT (value added tax)消费税:Excise印花税:Stamp tax/duty个人所得税:Personal(Individual) income tax城市维护建设税:City maintenance construction tax企业所得税:Corporate/enterprise/business income tax资源税:Resource tax土地增值税:Increment tax on land value房产税:House property tax土地使用税:Land use tax车船使用税:Operation tax of vehicle and ship耕地占用税:Farmland use tax教育费附加:Extra charges of education funds税收的本质特征: the “three features” of taxation 税收类型:课征目的:一般税(普通税)General Tax;特别税(目的税,特定目的税)Specific Tax计税依据:从价税 Ad valorem Tax;从量税Unit tax征收实体:实物税In Kind Tax;货币税Monetized Tax;劳役税 labor Tax 税收和价格关系:价内税 Tax With the Price;价外税Off-price Tax税负转嫁:直接税Direct Tax;间接税Indirect Tax 税收管理权限:中央税Central Tax;地方税Local Tax;中央地方共享税Shared Tax)课税对象:商品劳务税(销售税)Goods and Services Tax;所得税Income Tax;财产税Property Tax;资源税resource tax税收要素:1、纳税人:纳税人(纳税义务人)Tax Payer;负税人Tax Bearer;扣缴义务人Withholding Agent2、课税对象 Object of Taxation3、税基 Tax Base4、税目 Item of Tax5、税率:税率结构:Tax rate structure 税率等级:Tax bracket定额税率固定税率,Fixed Tax Rate;比例税率Proportional Tax Rate;累进税率Progressive Tax Rate全额累进税率(Progressive tax rate in excess of total amount)超额累进税率(Progressive tax rate in excess of specific amount)名义税率(表列税率)Nominal Tax Rate;实际税率(有效税率)、实际负担率,Effective Tax Rate累退税率Regressive tax rate边际税率marginal tax rate;平均税率average tax rate6、纳税环节impact point of taxation7、纳税期限tax day;the assessable period for tax payment8 、纳税地点tax payment place9、减免税(税收优惠),tax preference起征点tax threshold免征额(费用扣除)tax deduction税收中性tax neutrality预算约束线budget constraint无差异曲线indifference curve收入效应income effect替代效应substitution effect税收超额负担deadweight lose; Excess Burden:消费者剩余consumer surplus 生产者剩余producer surplus需求价格弹性price elasticity of demand供给价格弹性price elasticity of supply洛伦茨曲线lorenz curve基尼系数gini coefficient税收乘数Multiplier theory税收自动稳定机制automatic stabilizers——内在稳定器built-in stabilizers稳健的财政政策:Prudent fiscal policy积极的财政政策:Pro-active fiscal policy扩张性财政政策:Loose or expansionary policy紧缩性财政政策:Tight or contractionary policy税负转嫁和归宿:税收负担Tax Burden税负转嫁Tax Shifting税收归宿Tax Incidence:法定归宿Legal Incidence;经济归宿Economic Incidence 逃漏税Tax Evasion 偷税:tax dodging最优税收optimal taxation前转Forward Shifting;后转Backward Shifting;混转Diffused Shifting;税收资本化Capitalization of Taxation税制结构structure of tax system:主体税种main tax;辅助税种subsidiary tax税式支出:税式支出 Tax Expenditure system :税收减免tax abatement and tax exemption税收抵免tax credit税前扣除pre-tax deduction 优惠退税preferential tax refund(reinforcement)加速折旧accelerated depreciation盈亏互抵loss carry-forward and carry-backward延期纳税tax deferral税收豁免tax exemption税收饶让tax sparing 优惠税率preferential tax rateThere is an old saying, "Nothing in life is certain except death and taxes." The first part is true for everyone and the second certainly true for anyone in china who is of legal age, has a job, or ever buys anything. Income tax, business tax, and resource tax are just a few of the fees that government impose on its citizens.Tax is very important to our country, which can be used in the public services, such as education, road construction, public health and so on. As we all know, tax makes up a great part of our country's revenue, and the development of our country depends on it. From what has been discussed above, we can see that it is everyone's legal duty to pay tax, because it means making contributions to the country and everyone can benefit from it. Those who try to dodge and evade taxation are sure to be punished, In a word, paying tax is our responsibility for society.I would be swollen with pride if I become a really tax payer ..。

专业术语-财务英语词汇A5-财会英语

专业术语-财务英语词汇A5air passenger departure tax 飞机乘客离境税Air Services Negotiations Unit [Economic Services Bureau] 民航运输谈判组〔经济局〕airport tax 机场税alcohol duty 酒精税alienation 让与;让渡;转让alimony ⽣活费;赡养费All Ordinaries Index [AOI] 所有普通股指数all risks 全险;综合险All Sales Record for Stock Market 《股票市场成交报告》Allied Capital Resources Limited 新联财务有限公司all-items index [Consumer Price Index] 总指数〔消费物价指数〕allocation letter 拨款信件allocation of fund 分配款项;预留款项allocation of profit 利润分配;溢利分配allocation warrant 拨款令allotment 分配;配股allotment notice 股份配售通知;配股通知allotment of shares 股份分配allowable 可获宽免;免税的allowable business loss 可扣除的营业亏损allowable expenses 可扣税的⽀出allowance 免税额;津贴;备抵;准备⾦allowance for debts 债项的免税额allowance for depreciation by wear and tear 耗损折旧免税额allowance for funeral expenses 殡殓费的免税额allowance for inflation 为通货膨胀⽽预留的款项;通胀准备⾦allowance for repairs and outgoings 修葺及⽀出⽅⾯的免税额allowance to debtor 给债务⼈的津贴alteration of capital 资本更改alternate trustee 候补受托⼈。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

税务机关:

国税局:State Administration of Taxation地税局:bureau of local taxation地方税务局:Local Taxation bureau

外汇管理局:Foreign Exchange Control Board财政部:The Ministry of Finance 财政局:finance bureau

海关:the customs统计局: Statistics Bureau工商行政管理局: Administration of Industry and Commerce

出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission (CSRS) 劳动和社会保障部:Ministry of Labour and Social Security

税种:

营业税:Business tax增值税:VAT (value added tax)消费税:Excise印花税:Stamp tax/duty

个人所得税:Personal(Individual) income tax城市维护建设税:City maintenance construction tax

企业所得税:Corporate/enterprise/business income tax资源税:Resource tax土地增值税:Increment tax on land value

房产税:House property tax土地使用税:Land use tax车船使用税:Operation tax of vehicle and ship

耕地占用税:Farmland use tax教育费附加:Extra charges of education funds税收的本质特征: the “three features” of taxation 税收类型:

课征目的:一般税(普通税)General Tax;特别税(目的税,特定目的税)Specific Tax

计税依据:从价税 Ad valorem Tax;从量税Unit tax征收实体:实物税In Kind Tax;货币税Monetized Tax;劳役税 labor Tax 税收和价格关系:价内税 Tax With the Price;价外税Off-price Tax税负转嫁:直接税Direct Tax;间接税Indirect Tax 税收管理权限:中央税Central Tax;地方税Local Tax;中央地方共享税Shared Tax)

课税对象:商品劳务税(销售税)Goods and Services Tax;所得税Income Tax;财产税Property Tax;资源税resource tax

税收要素:

1、纳税人:纳税人(纳税义务人)Tax Payer;负税人Tax Bearer;扣缴义务人Withholding Agent

2、课税对象 Object of Taxation

3、税基 Tax Base

4、税目 Item of Tax

5、税率:税率结构:Tax rate structure 税率等级:Tax bracket

定额税率固定税率,Fixed Tax Rate;比例税率Proportional Tax Rate;

累进税率Progressive Tax Rate全额累进税率(Progressive tax rate in excess of total amount)

超额累进税率(Progressive tax rate in excess of specific amount)

名义税率(表列税率)Nominal Tax Rate;实际税率(有效税率)、实际负担率,Effective Tax Rate

累退税率Regressive tax rate边际税率marginal tax rate;平均税率average tax rate

6、纳税环节impact point of taxation

7、纳税期限tax day;the assessable period for tax payment

8 、纳税地点tax payment place9、减免税(税收优惠),tax preference起征点tax threshold

免征额(费用扣除)tax deduction税收中性tax neutrality预算约束线budget constraint

无差异曲线indifference curve收入效应income effect替代效应substitution effect

税收超额负担deadweight lose; Excess Burden:消费者剩余consumer surplus 生产者剩余producer surplus

需求价格弹性price elasticity of demand供给价格弹性price elasticity of supply

洛伦茨曲线lorenz curve基尼系数gini coefficient税收乘数Multiplier theory

税收自动稳定机制automatic stabilizers——内在稳定器built-in stabilizers

稳健的财政政策:Prudent fiscal policy积极的财政政策:Pro-active fiscal policy

扩张性财政政策:Loose or expansionary policy紧缩性财政政策:Tight or contractionary policy

税负转嫁和归宿:

税收负担Tax Burden税负转嫁Tax Shifting税收归宿Tax Incidence:法定归宿Legal Incidence;经济归宿Economic Incidence 逃漏税Tax Evasion 偷税:tax dodging最优税收optimal taxation

前转Forward Shifting;后转Backward Shifting;混转Diffused Shifting;税收资本化Capitalization of Taxation

税制结构structure of tax system:主体税种main tax;辅助税种subsidiary tax

税式支出:

税式支出 Tax Expenditure system :税收减免tax abatement and tax exemption税收抵免tax credit税前扣除pre-tax deduction 优惠退税preferential tax refund(reinforcement)加速折旧accelerated depreciation

盈亏互抵loss carry-forward and carry-backward延期纳税tax deferral税收豁免tax exemption税收饶让tax sparing 优惠税率preferential tax rate

There is an old saying, "Nothing in life is certain except death and taxes." The first part is true for everyone and the second certainly true for anyone in china who is of legal age, has a job, or ever buys anything. Income tax, business tax, and resource tax are just a few of the fees that government impose on its citizens.

Tax is very important to our country, which can be used in the public services, such as education, road construction, public health and so on. As we all know, tax makes up a great part of our country's revenue, and the development of our country depends on it. From what has been discussed above, we can see that it is everyone's legal duty to pay tax, because it means making contributions to the country and everyone can benefit from it. Those who try to dodge and evade taxation are sure to be punished, In a word, paying tax is our responsibility for society.

I would be swollen with pride if I become a really tax payer ..。