国际投资第二章课后习题答案

《国际投资》各章练习题答案

第2章练习

6. 被誉为国际直接投资理论先驱的是 B 。 A 纳克斯 B 海默 C 邓宁 D 小岛清

7. 下面哪一个不属于折衷理论的三大优势之一。C A 厂商所有权优势 B 内部化优势 C 垄断优势 D 区 位优势

8. 弗农提出的国际直接投资理论是 A 。 A 产品生命周期理论 B 垄断优势理论 C 折衷理论 D 厂商增长理论

9

第4章练习

4. 下面不属于跨国银行功能的是(C )。 A 跨国公司融资中介B 为跨国公司提供信息服务 C 证券承销D 支付中介

5. 下面不属于对冲基金特点的是(B )。 A 私募B 受严格管制C 高杠杆性D 分配机制更灵 活和更富激励性

6. 下面不属于共同基金特点的是(D )。 A 公募B 专家理财 C 规模优势 D 信息披露管制 较少

6. 近年来,跨国公司的数量急遽增长,跨国公司的集中 化程度也随着降低。( X )

7. 跨国购并是推动跨国公司规模日益扩大的重要原因。 (O )

8. 根据价值链原理,跨国公司国际化经营是根据价值链 上各环节要素配置的要求,匹配全球区位优势,实现 公司价值最大化的途径。( O )

7

第3章练习 9. 名词解释:跨国公司;网络分布指数

5. 下面描述不属于国外子公司特点的是( D)。

A 独立法人地位 B 独立公司名称

C 独立公司章程 D 与母公司合并纳税

15

第6章练习

6. 以下不属于非股权式国际投资运营的方式是( A )。 A 国际合资经营 B 国际合作经营 C 许可证安排 D 特许专营

7. 凡不涉及发行新股票的收购兼并都可以被认为是现金 收购。(O)

1

第1章练习

4.二次世界大战前,国际投资是以 A 为主。 A 证券投资 B 实业投资 C 直接投资 D 私人投资

国际投资学第二章国际投资理论课本精炼知识点含课后习题答案

第二章国际投资理论第一节国际直接投资理论一、西方主流投资理论(一)垄断优势论:市场不完全性是企业获得垄断优势的根源,垄断优势是企业开展对外直接投资的动因。

市场不完全:由于各种因素的影响而引起的偏离完全竞争的一种市场结构。

市场的不完全包括:1.产品市场不完全2..要素市场不完全3.规模经济和外部经济的市场不完全4.政策引致的市场不完全。

跨国公司具有的垄断优势:1.信誉与商标优势2.资金优势3.技术优势4.规模经济优势(内部和外部)5.信息与管理优势。

跨国公司的垄断优势主要来源于其对知识资产的控制。

垄断优势认为不完全市场竞争是导致国际直接投资的根本原因。

(二)产品生命周期论:产品在市场销售中的兴与衰。

(三)内部化理论:把外部市场建立在公司内部的过程。

(纵向一体化,目的在于以内部市场取代原来的外部市场,从而降低外部市场交易成本并取得市场内部化的额外收益。

)(1)内部化理论的基本假设:1.经营的目的是追求利润最大化2.企业可能以内部市场取代外部市场3.内部化跨越了国界就产生了国际直接投资。

(2)市场内部化的影响因素:1.产业因素(最重要)2.国家因素3.地区因素4.企业因素(最重要)(3)市场内部化的收益:来源于消除外部市场不完全所带来的经济效益,包括1.统一协调相互依赖的企业各项业务,消除“时滞”所带来的经济效益。

2.制定有效的差别价格和转移价格所带来的经济效益。

3.消除国际市场不完全所带来的经济效益。

4.防止技术优势扩散和丧失所带来的经济效益。

市场内部化的成本:1.资源成本(企业可能在低于最优化经济规模的水平上从事生产,造成资源浪费)2.通信联络成本3.国家风险成本4.管理成本当市场内部化的收益大于大于外部市场交易成本和为实现内部化而付出的成本时,跨国企业才会进行市场内部化,当企业的内部化行为超越国界时,就产生对外直接投资。

(四)国际生产折衷理论:决定跨国公司行为和对外直接投资的最基本因素有所有权优势、内部化优势和区位优势,即“三优势范式”。

国际投资学教程课后题答案(完整版) (2)(word文档良心出品)

第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

国际投资学习题

第七章 金融资产 四、名词解释 1.国际债券 2.外国债券 3.全球债券 4.欧洲债券 5.存托凭证 6.欧洲股权 7.QFII 8.QDII 9.红筹股 五、简答题 1.简述近年来国际债券市场大发展的原因。 2.简述近年来国际债券市场发展的主要特征。 3.简述国际股票发行的动机。 4.简述纳斯达克市场的特征。 5.简述金融衍生工具的特点。 6.简述近年来全球金融衍生工具市场发展的特点。 六、论述题 试述中国证券市场的国际化。

第九章 国际投资政策管理 四、名词解释 1.技术溢出效应 2.产业“空心化” 3.顺贸易型投资 4.逆贸易型投资 5.税收抵免 6.税收饶让 7.国际避税 五、简答题 1.简述外国直接投资对东道国的资本形成的影响。 2.简述外国直接投资对东道国的技术进步效应。 3.简述外国直接投资对投资国产业结构的影响。 4.简述外国直接投资对投资国的国际贸易效应。 5.简述外国直接投资对东道国的就业效应。 6.简述发达国家对外投资的政策支持。 六、论述题 试述优惠政策在吸收外国投资中的作用及局限性。

第十三章 中国对外投资 四、名词解释 1.股权投资 2.非股权投资 五、简答题 1.中国对外投资发展的特点有哪些? 2.简述中国开展对外投资的作用。 3.试述中国对外投资的基本原则。 六、论述题 试述目前中国对外投资中管理中存在的问题及相应对策。

参考答案 第一章 四、名词解释 1.答:国际投资是指各类投资主体,包括跨国公司、跨国金融机构、官方与半官方机构和居民个人等,将 其拥有的货币资本或产业资本,经跨国界流动与配置形成实物资产、无形资产或金融资产,并通过跨国运 营以实现价值增殖的经济行为。 2.答:国际直接投资又称为海外直接投资,指投资者参与企业的生产经营活动,拥有实际的管理、控制权 的投资方式,其投资收益要根据企业的经营状况决定,浮动性较强。 3.答:国际间接投资又称为海外证券投资,指投资者通过购买外国的公司股票、公司债券、政府债券、衍 生证券等金融资产,依靠股息、利息及买卖差价来实现资本增值的投资方式。 五、简答题 1. 答:统计研究表明,国际直接投资的波动性要低于国际间接投资,其原因如下: (1)国际直接投资者预期收益的视界要长于国际证券投资者; (2)国际直接投资者的投资动机更加趋于多样性; (3)国际直接投资客体具有更强的非流动性。 2. 答:国际投资的性质体现在以下五个方面: (1)国际投资是社会分工国际化的表现形式; (2)国际投资是生产要素国际配置的优化; (3)国际投资是一把影响世界经济的“双刃剑”; (4)国际投资是生产关系国际间运动的客观载体; (5)国际投资具有更为深刻的政治、经济内涵。 3. 答:国际投资形成与发展的历程大致可划分为四个阶段: (1)初始形成阶段(1914年以前):这一阶段以国际借贷资本流动为主; (2)低迷徘徊阶段(1914-1945):由于两次世界大战,这一期间的国际投资受到了较为严重的影响,发展 历程曲折迟缓,仍以国际间接投资为主; (3)恢复增长阶段(1945-1979):这一阶段国际直接投资的主导地位形成; (4)迅猛发展阶段(20世纪80年代以来):这一阶段出现了直接投资与间接投资齐头并进的大发展局面,成 为经济全球化至为关键的推动力。 4. 答:(1)发达国家国际直接投资的区域格局主要受下列因素的影响: a.经济衰退与增长的周期性因素; b.跨国公司的兼并收购战略因素; c.区域一体化政策因素。 (2)发展中国家国际直接投资的区域格局主要受下列因素的影响: a.经济因素; b.政治因素; c.跨国公司战略因素。 5. 答:(1)它们的联系在于:首先,两者的研究领域中都包括货币资本的国际间转移;其次,由于国际金 融活动和国际投资活动相互影响,因而在学科研究中必然要涉及对方因素。(2)它们的区别在于:首先, 两者在研究领域方面各自具有独立部分;其次,即使在其相互交叉的共同领域,两者的侧重点也有所不同。 六、论述题(提示) 1.答:(1)第一产业(初级产品部门)的趋势:总体来看,自20世纪80年代后半期以来,初级产品部门在国 际直接投资行业格局中的地位明显降低了。 (2)第二产业(制造业)的趋势:近年来,制造业部门的国际直接投资出现了三个变化: a.投资流向由原来的资源、劳动密集行业转向资本、技术密集行业;

《国际投资》各章练习题答案33页PPT

56、极端的法规,就是极端的不公。 ——西 塞罗 57、法律一旦成为人们的需要,人们 就不再 配享受 自由了 。—— 毕达哥 拉斯 58、法律规定的惩罚不是为了私人的 利益, 而是为 了公共 的利益 ;一部 分靠有 害的强 制,一 部分靠 榜样的 效力。 ——格 老秀斯 59、假如没有法律他们会更快乐的话 ,那么 法律作 为一件 无用之 物自己 就会消 灭。— —洛克

60、人民的幸福是的人,才不会再掉进坑里。——黑格尔 32、希望的灯一旦熄灭,生活刹那间变成了一片黑暗。——普列姆昌德 33、希望是人生的乳母。——科策布 34、形成天才的决定因素应该是勤奋。——郭沫若 35、学到很多东西的诀窍,就是一下子不要学很多。——洛克

国际投资学教程课后练习答案

第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

《国际投资》第六版作业课后练习答案

第一章15/16/20第二章4/6/9/15/16/19/20第三章3/5/9/16/18第四章8/13/15/16/17第五章2/7/10/15/17第六章6/8/10/12/13文本:人参淫家Fish 汉化:fish&MonkEy协力排版:MonkEy 校对:无时间:无后期:无本汉化由马骝鱼汉化组制作,本作品来源于互联网供学习爱好者使用禁止用于商业盈利行为若因私自散布造成法律纠纷汉化组概不负责第一章15.问:假设在某一时点,巴克莱银行每英镑的美元标价为英镑对美元=1.4570。

兴业银行每美元的目标价位为美元对日元=128.17,米德银行每英镑的日元的套算汇率的标价为英镑对日元=183.a.不考虑买卖价差,此处是否存在套利机会b.加入存在套利机会,你要通过哪些步骤以获得套利利润?如果你有100万美元,你可以获利多少?解:a.根据题目可以求得美元对日元的汇率:£:¥= $:¥⨯ £:$ = 128.17 ⨯ 1.4570 = 186.74。

然而,米德银行的标价为£:¥=1:183,因此存在套利机会b.在存在£:¥=186.74的同时,米德银行汇率标价为£:¥=1:183,即英镑对日元价值在米德银行被相对低估,因此,你的套利步骤应建立为使用日元从米德银行购买英镑,有100万美元情况下,具体步骤如下:a. 在兴业银行售出美元以取得日元: 售出$1,000,000 以取得$1,000,000 ⨯ ¥128.17 / $ =¥128,170,000.b. 在米德银行出售日元以购买英镑:售出l ¥128,170,000 以购买¥128,170,000/(¥183 / £) =£700,382.51.c. 在巴克莱银行将英镑兑换为美元: 卖出£700,382.51 ,得到£700,382.51 ⨯ ($1.4570 /k, £) =$1,020,457.32.因此,获利为:$1,020,457.32 - $1,000,000 = $20,457.3216.吉姆擅长与套算汇率套利,在某一个时点,他注意到如下标价:以瑞士法郎标价的美元价值= 1.5971 瑞士法郎/美元以澳大利亚元标价的美元价值=1.8215 澳大利亚/美元以澳大利亚元标价的瑞士法郎价值=1.1450 澳大利亚元/瑞士法郎不考虑交易成本,基于这些标价,吉姆有套利机会吗?他应该怎样做来获取套利利润?他用100万美元可以套利多少?解:由题可知,澳元跟瑞士法郎之间的隐形汇率为SFr:A$ = $:A$ ⨯ SFr:$ = ($:A$) ÷ ($:SFr) = 1.8215/1.5971 = 1.1405。

国际投资(第六版)在线解答手册(即课后习题答案) F01_SOLN8117_06_SM_TOC

Online Solutions Manualto accompanyGlobal InvestmentsSixth EditionBruno SolnikHEC ParisHong Kong University of Science & TechnologyDennis McLeaveyCFA InstituteUniversity of VirginiaEmeritus, University of Rhode IslandAuthored byBruno SolnikHEC ParisHong Kong University of Science & TechnologyDennis McLeaveyCFA InstituteUniversity of VirginiaEmeritus, University of Rhode IslandCopyright 2009, Pearson Prentice Hall. All Rights Reserved.Executive Editor: Donna BattistaEditorial Assistant: Kerri McQueenProduction Editor: Heather McNallyManufacturing Buyer: Carol MelvilleCopyright © 2009 Pearson Education, Inc., Upper Saddle River, New Jersey, 07458.Pearson Prentice Hall. All rights reserved. Printed in the United States of America. This publication is protectedby Copyright and permission should be obtained from the publisher prior to any prohibited reproduction,storage in a retrieval system, or transmission in any form or by any means, electronic, mechanical, photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department.This work is protected by United States copyright laws and is provided solely for the useof instructors in teaching their courses and assessing student learning. Dissemination or sale of any part of thiswork (including on the World Wide Web) will destroy theintegrity of the work and is not permitted. The work and materials from it should neverbe made available to students except by instructors using the accompanying text in their classes. All recipients ofthis work are expected to abide by these restrictions and tohonor the intended pedagogical purposes and the needs of other instructors who rely on these materials.Pearson Prentice Hall TM is a trademark of Person Education, Inc.ISBN-13: 978-0-321-52811-7ISBN-10: 0-321-52811-5ContentsChapter 1 Currency Exchange Rates (1)Chapter 2 Foreign Exchange Parity Relations (6)Chapter 3 Foreign Exchange Determination and Forecasting (14)Chapter 4 International Asset Pricing (19)Chapter 5 Equity: Markets and Instruments (24)Chapter 6 Equity: Concepts and Techniques (28)Chapter 7 Global Bond Investing (36)Chapter 8 Alternative Investments (41)Chapter 9 The Case for International Diversification (48)Chapter 10 Derivatives: Risk Management with Speculation, Hedging, and Risk Transfer (57)Chapter 11 Currency Risk Management (66)Chapter 12 Global Performance Evaluation (78)Chapter 13 Structuring the Global Investment Process (94)。

国际投资学习题及答案.doc

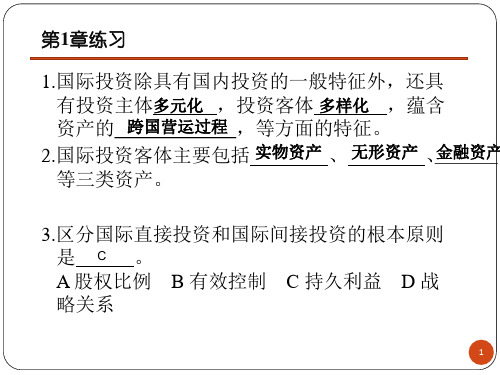

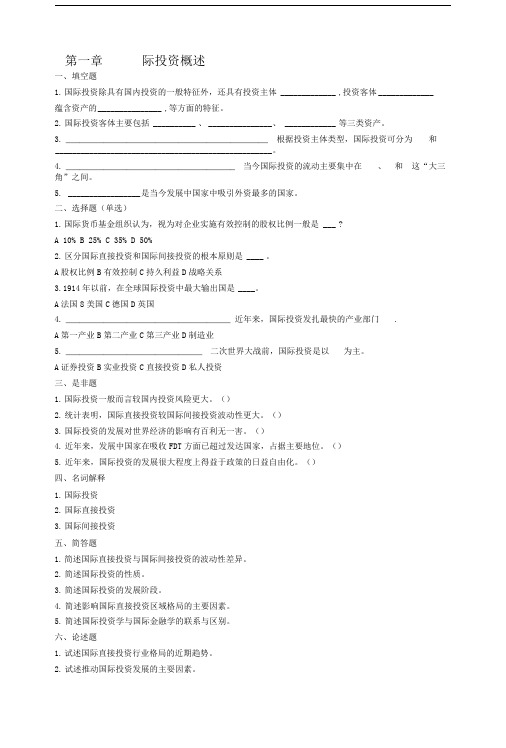

第一章际投资概述一、填空题1.国际投资除具有国内投资的一般特征外,还具有投资主体 _____________ ,投资客体_____________蕴含资产的_______________ ,等方面的特征。

2.国际投资客体主要包括 __________ 、_______________ 、 ____________ 等三类资产。

3. ___________________________________________ 根据投资主体类型,国际投资可分为和___________________________________________________ 。

4. ____________________________________ 当今国际投资的流动主要集中在、和这“大三角”之间。

5. _________________ 是当今发展中国家中吸引外资最多的国家。

二、选择题(单选)1.国际货币基金组织认为,视为对企业实施有效控制的股权比例一般是 ___ ?A 10%B 25%C 35%D 50%2.区分国际直接投资和国际间接投资的根本原则是 ____ 。

A股权比例B有效控制C持久利益D战略关系3.1914年以前,在全球国际投资中最大输出国是____ 。

A法国8美国C德国D英国4. ___________________________________ 近年来,国际投资发扎最快的产业部门.A第一产业B第二产业C第三产业D制造业5. _____________________________ 二次世界大战前,国际投资是以为主。

A证券投资B实业投资C直接投资D私人投资三、是非题1.国际投资一般而言较国内投资风险更大。

()2.统计表明,国际直接投资较国际间接投资波动性更大。

()3.国际投资的发展对世界经济的影响有百利无一害。

()4.近年来,发展中国家在吸收FDT方面已超过发达国家,占据主要地位。

()5.近年来,国际投资的发展很大程度上得益于政策的日益自由化。

国际投资学教程课后题答案(完整版) (2)(word文档良心出品)

第一章1.名词解释:国际投资:是指以资本增值和生产力提高为目标的国际资本流动,是投资者将其资本投入国外进行的一阴历为目的的经济活动。

国际公共(官方)投资: 是指一国政府或国际经济组织为了社会公共利益而进行的投资,一般带有国际援助的性质。

国际私人投资:是指私人或私人企业以营利为目的而进行的投资。

短期投资:按国际收支统计分类,一年以内的债权被称为短期投资。

长期投资:一年以上的债权、股票以及实物资产被称为长期投资。

产业安全:可以分为宏观和中观两个层次。

宏观层次的产业安全,是指一国制度安排能够导致较合理的市场结构及市场行为,经济保持活力,在开放竞争中本国重要产业具有竞争力,多数产业能够沈村冰持续发展。

中观层次上的产业安全,是指本国国民所控制的企业达到生存规模,具有持续发展的能力及较大的产业影响力,在开放竞争中具有一定优势。

资本形成规模:是指一个经济落后的国家或地区如何筹集足够的、实现经济起飞和现代化的初始资本。

2、简述20世纪70年代以来国际投资的发展出现了哪些新特点?(一)投资规模,国际投资这这一阶段蓬勃发展,成为世纪经济舞台最为活跃的角色。

国际直接投资成为了国际经济联系中更主要的载体。

(二)投资格局,1.“大三角”国家对外投资集聚化 2.发达国家之间的相互投资不断增加 3.发展中国家在吸引外资的同时,也走上了对外投资的舞台(三)投资方式,国际投资的发展出现了直接投资与间接投资齐头并进的发展局面。

(四)投资行业,第二次世界大战后,国际直接投资的行业重点进一步转向第二产业。

3.如何看待麦克杜格尔模型的基本理念?麦克杜格尔模型是麦克杜格尔在1960年提出来,后经肯普发展,用于分析国际资本流动的一般理论模型,其分析的是国际资本流动对资本输出国、资本输入国及整个世界生产和国民收入分配的影响。

麦克杜格尔和肯普认为,国际间不存在限制资本流动的因素,资本可以自由地从资本要素丰富的国家流向资本要素短缺的国家。

资本流动的原因在于前者的资本价格低于后者。

课程资料:国际金融公司课后习题答案--第二章

第二章课后题库参考答案1. 金本位制下,国际收支的调节机制如何?金本位制度还可以自动矫正国际收支失衡。

例如,若英国对美国出现国际收支顺差,则英国对美国的净货物输出会导致黄金的净流入。

由于在金本位制下,一国的货币供给取决于其持有的黄金数量,黄金净流入即意味着英国货币供给的增加,这会导致英国的物价水平上扬,使它的出口商品因价格过高而受阻,同时从美国进口的货物相对便宜,最终使英国的国际收支顺差消失。

相反的情形出现在美国:由于国际收支逆差导致黄金外流,致使美国国内货币供给减少,从而物价下跌,较低的出口商品价格使其出口更有竞争力,美国的国际收支逆差逐渐减少,直至消失。

英国经济学家大卫·休谟把国际收支的这种自动调节机制归纳为“物价–现金–流动机制”理论2. 布雷顿森林体系的主要特点?布雷顿森林体系的核心是金汇兑本位,以双挂钩为特征,即美元与黄金挂钩——确定每盎司黄金价值为35美元;其他国家的货币与美元挂钩。

在与美元的比价确定后各国可计算出他们的货币与黄金的比价。

美国承诺各国可以以它们持有的美元无限制的按官价兑换黄金。

其他国家承诺维持其货币汇率的波动幅度在平价的一定范围内。

若波动幅度超出这个水平,各国有义务在外汇市场进行干预。

在布雷顿森林体系下,各国除了以黄金为储备资产外,美元成为主要的国际储备和支付手段。

3. 布雷顿森林体系崩溃的根本原因是什么?在金汇兑本位下,为满足各国储备资产增长的需要,充当储备货币的国家必然会出现国际收支持续的逆差,而这又将导致各国民众对储备货币的信心危机,从而引发体系的崩溃。

布雷顿森林体系的安排使美元处于这样的一种尴尬的境地:美元作为除黄金之外最重要的储备资产,需要美国向其他国家持续不断地供给美元,而大量美元资产的外流,不可避免地对美国造成极大的黄金兑换压力,最终致使美国不得不放弃它原先对其他国家做出的按官价自由兑换黄金的承诺。

至此,布雷顿森林体系的基础已经发生动摇。

从20世纪60年代中期开始,这个问题变得严重起来,最后布雷顿森林体系崩溃。

国际投资第二章课后习题答案

Chapter 2Foreign Exchange Parity Relations1. Because the interest rate in A is greater than the interest rate in B, α is expected to depreciate relativeto β, and should trade with a forward discount. Accordingly, the correct answer is (c).2. Because the exchange rate is given in €:$ terms, the appropriate expression for the interest rate parity relation is€+=+$11r F S r (r $ is a part of the numerator and r € is a part of the denominator).a. The one-year €:$ forward rate is given by €:==1.05$ 1.1795 1.19081.04b. The one-month €:$ forward rate is given by€:+==+1(0.04/12$ 1.1795 1.18051(0.03/12)Of course, these are central rates, and bid-ask rates could also be determined on the basis of bid-askrates for the spot exchange and interest rates.3. a. bid €:¥ = (bid $:¥) × (bid €:$) = 108.10 × 1.1865 = 128.2607.ask €:¥ = (ask $:¥) × (ask €:$) = 108.20 × 1.1870 = 128.4334.b. Because the exchange rate is in €:$ terms, the appropriate expression for the interest rate parityrelation is F /S = (1 + r $)/(1 + r €).€€€++==++=$1(ask )1(0.0525/4):$3-month ask (spot ask :$)1.18701(bid )1(0.0325/4)1.1929r rThus, the €:$3-month forward ask exchange rate is: 1.1929.c. bid $:€ = 1/ask €:$ = 1 / 1.1929 = 0.8383.Thus, the 3-month forward bid exchange rate is $:€ = 0.8383.Chapter 2 Foreign Exchange Parity Relations 7d. Because the exchange rate is in $:¥ terms, the appropriate expression for the interest rate parityrelation is F /S = (1 + r ¥ )/1 + r $.$++===+¥1(bid )1(0.0125/4)$:¥3-month bid (spot ask $:¥)108.10107.031(ask )(0.0325/4)r r $++===+¥1(ask )1(0.0150/4)$:¥3-month ask (spot ask $:¥)108.20107.261(bid )(0.0500/4)r rThus, the $:¥ 3-month forward exchange rate is: 107.03 – 107.26. Note : The interest rates one uses in all such computations are those that result in a lower forwardbid (so, bid interest rates in the numerator and ask rates in the denominator) and a higher forward ask (so, ask interest rates in the numerator and bid rates in the denominator).4. a. For six months, r SFr = 1.50% and r $ = 1.75%. Because the exchange rate is in $:SFr terms, the appropriate expression for the interest rate parity relation isSFr $SFr $1,or (1)(1)1r F F r r S r S+=+=++ The left side of this expression is$ 1.6558(1)(10.0175) 1.01331.6627F r S+=+= The right side of the expression is: 1 + r SFr = 1.0150. Because the left and right sides are not equal, IRP is not holding.b. Because IRP is not holding, there is an arbitrage possibility: Because 1.0133 < 1.0150, we cansay that the SFr interest rate quote is more than what it should be as per the quotes for the otherthree variables. Equivalently, we can also say that the $ interest rate quote is less than what itshould be as per the quotes for the other three variables. Therefore, the arbitrage strategy shouldbe based on borrowing in the $ market and lending in the SFr market. The steps would be asfollows:• Borrow $1,000,000 for six months at 3.5% per year. Need to pay back $1,000,000 ×(1 + 0.0175) = $1,017,500 six months later.• Convert $1,000,000 to SFr at the spot rate to get SFr 1,662,700.• Lend SFr 1,662,700 for six months at 3% per year. Will get back SFr 1,662,700 ×(1 + 0.0150) = SFr 1,687,641 six months later.• Sell SFr 1,687,641 six months forward. The transaction will be contracted as of the current date but delivery and settlement will only take place six months later. So, six months later,exchange SFr 1,687,641 for SFr 1,687,641/SFr 1.6558/$ = $1,019,230.The arbitrage profit six months later is 1,019,230 – 1,017,500 = $1,730.5. a. For three months, r $ = 1.30% and r ¥ = 0.30%. Because the exchange rate is in $:¥ terms, the appropriate expression for the interest rate parity relation is¥$¥$1,or (1)(1)1r F F r r S r S+=+=++8 Solnik/McLeavey • Global Investments, Sixth EditionThe left side of this expression is$107.30(1)(10.0130) 1.0064.108.00F r S+=+= The right side of this expression is: 1 + r ¥ = 1.0030. Because the left and right sides are not equal, IRP is not holding.b. Because IRP is not holding, there is an arbitrage possibility. Because 1.0064 > 1.0030, we cansay that the $ interest rate quote is more than what it should be as per the quotes for the otherthree variables. Equivalently, we can also say that the ¥ interest rate quote is less than what itshould be as per the quotes for the other three variables. Therefore, the arbitrage strategy shouldbe based on lending in the $ market and borrowing in the ¥ market. The steps would be asfollows:• Borrow the yen equivalent of $1,000,000. Because the spot rate is ¥108 per $, borrow$1,000,000 × ¥108/$ = ¥108,000,000. Need to pay back ¥108,000,000 × (1 + 0.0030) =¥108,324,000 three months later.• Exchange ¥108,000,000 for $1,000,000 at the spot exchange rate.• Lend $1,000,000 for three months at 5.20% per year. Will get back $1,000,000 ×(1 + 0.0130) = $1,013,000 three months later.• Buy ¥108,324,000 three months forward. The transaction will be contracted as of the current date, but delivery and settlement will only take place three months later. So, three monthslater, get ¥108,324,000 for ¥108,324,000 / (¥107.30 per $) = $1,009,543.The arbitrage profit three months later is 1,013,000 – 1,009,543 = $3,457.6. At the given exchange rate of 5 pesos/$, the cost in Mexico in dollar terms is $16 for shoes, $36 forwatches, and $120 for electric motors. Thus, compared with the United States, shoes and watches are cheaper in Mexico, and electric motors are more expensive in Mexico. Therefore, Mexico will import electric motors from the United States, and the United States will import shoes and watches from Mexico. Accordingly, the correct answer is (d).7. Consider two countries, A and B. Based on relative PPP,+=+1011A BS I S I where S 1 and S 0 are the expected and the current exchange rates between the currencies of A and B, and I A and I B are the inflation rates in A and B. If A and B belong to the group of countries thatintroduces the same currency, then one could think of both S 1 and S 0 being one. Then, I A and I B should both be equal for relative PPP to hold. Thus, introduction of a common currency by a group ofcountries would result in the convergence of the inflation rates among these countries. A similarargument could be applied to inflation among the various states of the United States.8. Based on relative PPP,+=+Switzerland 10US11I S S IChapter 2 Foreign Exchange Parity Relations 9where S 1 is the expected $:SFr exchange rate one year from now, S 0 is the current $:SFr exchange rate, and I Switzerland and I US are the expected annual inflation rates in Switzerland and the United States, respectively. So,1110.02and 1.60(1.02/1.05)SFr 1.55/$.1.6010.05S S +===+ 9. a. A Japanese consumption basket consists of two-thirds sake and one-third TV sets. The price ofsake in yen is rising at a rate of 10% per year. The price of TV sets is constant. The Japanese consumer price index inflation is therefore equal to+=21(10%)(0%) 6.67%33b. Relative PPP states thatFC 10DC1.1I S S I +=+ Because the exchange rate is given to be constant, we have S 0 = S 1, which implies S 1/S 0 = 1. As a result, in our example, PPP would hold if 1 + I FC = 1 + I DC (i.e., I FC = I DC ). Because the Japanese inflation rate is 6.67% and the American inflation rate is 0%, we do not have I FC = I DC , and PPP does not hold.10. a. i. The law of one price is that, assuming competitive markets and no transportation costs ortariffs, the same goods should have the same real prices in all countries after convertingprices to a common currency.ii. Absolute PPP, focusing on baskets of goods and services, states that the same basket ofgoods should have the same price in all countries after conversion to a common currency.Under absolute PPP, the equilibrium exchange rate between two currencies would be the ratethat equalizes the prices of a basket of goods between the two countries. This rate wouldcorrespond to the ratio of average price levels in the countries. Absolute PPP assumes noimpediments to trade and identical price indexes that do not create measurement problems.iii. Relative PPP holds that exchange rate movements reflect differences in price changes(inflation rates) between countries. A country with a relatively high inflation rate willexperience a proportionate depreciation of its currency’s value vis-à-vis that of a countrywith a lower rate of inflation. Movements in currencies provide a means for maintainingequivalent purchasing power levels among currencies in the presence of differing inflationrates.Relative PPP assumes that prices adjust quickly and price indexes properly measure inflationrates. Because relative PPP focuses on changes and not absolute levels, relative PPP is morelikely to be satisfied than the law of one price or absolute PPP.b. i. Relative PPP is not consistently useful in the short run because of the following:(1) Relationships between month-to-month movements in market exchange rates and PPPare not consistently strong, according to empirical research. Deviations between the ratescan persist for extended periods. (2) Exchange rates fluctuate minute by minute becausethey are set in the financial markets. Price levels, in contrast, are sticky and adjust slowly.(3) Many other factors can influence exchange rate movements rather than just inflation.ii. Research suggests that over the long term, a tendency exists for market and PPP rates tomove together, with market rates eventually moving toward levels implied by PPP.10 Solnik/McLeavey • Global Investments, Sixth Edition11. a. If the treasurer is worried that the franc might appreciate in the next three months, she couldhedge her foreign exchange exposure by trading this risk against the premium included in theforward exchange rate. She could buy 10 million Swiss francs on the three-month forward market at the rate of SFr 1.5320 per €. The transaction will be contracted as of the current date, butdelivery and settlement will only take place three months later.b. Three months later, the company received the 10 million Swiss francs at the forward rate ofSFr 1.5320 per € agreed on earlier. Thus, the company needed (SFr 10,000,000)/(SFr 1.5320per €), or €6,527,415. If the company had not entered into a forward contract, the companywould have received the 10 million Swiss francs at the spot rate of SFr 1.5101 per €. Thus, thecompany would have needed (SFr 10,000,000) / (SFr 1.5101 per €), or €6,622,078. Therefore,the company benefited by the treasurer’s action, because €6,622,078 – €6,527,415 = €94,663were saved.12. The nominal interest rate is approximately the sum of the real interest rate and the expected inflationrate over the term of the interest rate. Even if the international Fisher relation holds, and the realinterest rates are equal among countries, the expected inflation can be very different from one country to another. Therefore, there is no reason why nominal interest rates should be equal among countries.13. Because the Australian dollar is expected to depreciate relative to the dollar, we know from thecombination of international Fisher relation and relative PPP that the nominal interest rate inAustralia is greater than the nominal interest rate in the United States. Further, the nominal interest rate in the United States is greater than that in Switzerland. Thus, the nominal interest rate inAustralia has to be greater than the nominal interest rate in Switzerland. Therefore, we can say from the combination of international Fisher relation and relative PPP that the Australian dollar is expected to depreciate relative to the Swiss franc.14. According to the approximate version of the international Fisher relation, r Sweden − r US = I Sweden − I US . So, 8 − 7 = 6 − I US , which means that I US = 5%.According to the approximate version of relative PPP,−=−10Sweden US 0S S I I S where, S 1 and S 0 are in $:SKr terms. I Sweden − I U S = 6 − 5 = 1%, or 0.01. So, (6 − S 0)/S 0 = 0.01. Solving for S 0, we get S 0 = SKr 5.94 per $.According to the approximate version of IRP,−=−0Sweden US 0F S r r S where, F and S 0 are in $:SKr terms. r Sweden − r US = 8 − 7 = 1%, or 0.01. So, (F − 5.94)/5.94 = 0.01. Solving for F , we get F = SKr 6 per $.Because we are given the expected exchange rate, we could also have arrived at this answer by usingthe foreign exchange expectations relation.Chapter 2 Foreign Exchange Parity Relations 1115. According to the international Fisher relation,++=++Switzerland Switzerland UK UK1111r I r I So,++=++Switzerland 110.0410.1210.10r therefore, r Switzerland = 0.0589, or 5.89%.According to relative PPP,+=+Switzerland 10UK11I S S I where, S 1 and S 0 are in £:SFr terms.So,110.04.310.10S +=+ Solving for S 1 we get S 1 = SFr 2.8364 per £.According to IRP,+=+Switzerland 0UK11r F S r where, F and S 0 are in £:SFr terms.So,10.0589.310.12F +=+ Solving for F , we get F = SFr 2.8363 per £. This is the same as the expected exchange rate in oneyear, with the slight difference due to rounding.16. During the 1991–1996 period, the cumulative inflation rates were about 25 percent in Malaysia,61 percent in the Philippines, and 18 percent in the United States. Over this period, based on relative PPP, one would have expected the Malaysian ringgit to depreciate by about 7 percent relative to the United States dollar (the inflation differential). In reality, the Malaysian ringgit appreciated by about 8 percent. Similarly, in view of the very high inflation differential between the Philippines and the United States, one would have expected the Philippine peso to depreciate considerably relative to the dollar. But it did not. Thus, according to PPP, both currencies had become strongly overvalued.12 Solnik/McLeavey • Global Investments, Sixth Edition17. a. According to PPP, the current exchange rate should bePif Pif 1010$$10//PI PI S S PI PI == where subscript 1 refers to the value now, subscript 0 refers to the value 20 years ago, PI refers toprice index, and S is the $:pif exchange rate. Thus, the current exchange rate based on PPP should be1200/1002pif 1 per $.400/100S ⎛⎞==⎜⎟⎝⎠b. As per PPP, the pif is overvalued at the prevailing exchange rate of pif 0.9 per $.18. Exports equal 10 million pifs and imports equal $7 million (6.3 million pifs). Accordingly, the tradebalance is 10 − 6.3 = 3.7 million pifs.• Balance of services includes the $0.5 million spent by tourists (0.45 million pifs).• Net income includes $0.1 million or 0.09 million pifs received by Paf investors as dividends,minus 1 million pifs paid out by Paf as interest on Paf bonds (− 0.91 million pifs).• Unrequited transfers include $0.3 million (0.27 million pifs) received by Paf as foreign aid.• Portfolio investment includes the $3 million or 2.7 million pifs spent by Paf investors to buyforeign firms. So, portfolio investment = −2.7 million pifs.Based on the preceding,• Current account = 3.24 (= 3.70 + 0.45 − 0.91)• Capital account = 0.27• Financial account = −2.7The sum of current account, capital account, and financial account is 0.81. By definition of balance ofpayments, the sum of the current account, the capital account, the financial account, and the change in official reserves must be equal to zero. Therefore, official reserve account = −0.81.The following summarizes the effect of the transactions on the balance of payments.Current account 3.24Trade balance 3.70Balance of services 0.45Net income – 0.91Capital account 0.27Unrequited transfers 0.27Financial account – 2.70Portfolio investment – 2.70Official reserve account – 0.8119. a. A traditional flow market approach would suggest that the home currency should depreciatebecause of increased inflation. An increase in domestic consumption could also lead to increased imports and a deficit in the balance of trade. This deficit should lead to a weakening of the homecurrency in the short run.b. The asset market approach claims that this scenario is good for the home currency. Foreigncapital investment is attracted by the high returns caused by economic growth and high interestrates. This capital inflow leads to an appreciation of the home currency.Chapter 2 Foreign Exchange Parity Relations 13 20. a. i. The immediate effect of reducing the budget deficit is to reduce the demand for loanablefunds because the government needs to borrow less to bridge the gap between spending andtaxes.ii. The reduced public-sector demand for loanable funds has the direct effect of lowering nominal interest rates, because lower demand leads to lower cost of borrowing, iii. The direct effect of the budget deficit reduction is a depreciation of the domestic currency and the exchange rate. As investors sell lower yielding Country M securities to buy thesecurities of other countries, Country M’s currency will come under pressure andCountry M’s currency will depreciate.b. i. In the case of a credible, sustainable, and large reduction in the budget deficit, reducedinflationary expectations are likely because the central bank is less likely to monetize thedebt by increasing the money supply. Purchasing power parity and international Fisherrelationships suggest that a currency should strengthen against other currencies whenexpected inflation declines.ii. A reduction in government spending would tend to shift resources into private-sector investments, in which productivity is higher. The effect would be to increase the expectedreturn on domestic securities.。

国际投资学(课后题)

第一章国际投资概述填空题1.国际投资除具有国内投资的一般特征外,还具有投资主体多元化,投资客体多样化,蕴含资产的跨国运营过程,等方面的特征。

2.国际投资客体主要包括实物资产、无形资产、金融资产等三类资产。

3.根据投资主体类型,国际投资可分为官方投资和海外私人投资。

4.当今国际投资的流动主要集中在美国、欧盟和日本这“大三角”之间。

5.中国是当今发展中国家中吸引外资最多的国家。

名词解释国际投资国际投资:指各类投资主体,包括跨国公司、跨国金融机构、官方与半官方机构和居民个人等,将其拥有的货币资本或产业资本,经跨国界流动与配置形成实物资产、无形资产或金融资产,并通过跨国运营以实现价值增殖的经济行为。

国际直接投资国际直接投资:又称为海外直接投资,指投资者参与企业的生产经营活动,拥有实际的管理、控制权的投资方式,其投资收益要根据企业的经营状况决定,浮动性较强。

国际间接投资国际间接投资:又称为海外证券投资,指投资者通过购买外国的公司股票、公司债券、政府债券、衍生证券等金融资产,依靠股息、利息及买卖差价来实现资本增值的投资方式。

简答题简述国际直接投资与国际间接投资的波动性差异。

(1)国际直接投资者预期收益的视界要长于国际证券投资者;(2)国际直接投资者的投资动机更加趋于多样性;(2)(3)国际直接投资客体具有更强的非流动性。

简述国际投资的性质。

(1)国际投资是社会分工国际化的表现形式;(2)国际投资是生产要素国际配置的优化;(3)国际投资是一把影响世界经济的“双刃剑”;(4)国际投资是生产关系国际间运动的客观载体;(5)国际投资具有更为深刻的政治、经济内涵。

简述国际投资的发展阶段。

(1)初始形成阶段(1914年以前):这一阶段以国际借贷资本流动为主;(2)低迷徘徊阶段(1914-1945):由于两次世界大战,这一期间的国际投资受到了较为严重的影响,发展历程曲折迟缓,仍以国际间接投资为主;(3)恢复增长阶段(1945-1979):这一阶段国际直接投资的主导地位形成;(4)迅猛发展阶段(20世纪80年代以来):这一阶段出现了直接投资与间接投资齐头并进的大发展局面,成为经济全球化至为关键的推动力。

投资学 第二章 答案

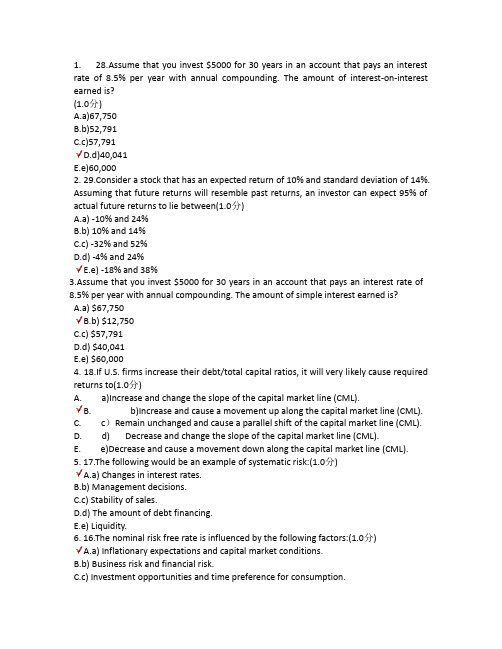

1. 28.Assume that you invest $5000 for 30 years in an account that pays an interest rate of 8.5% per year with annual compounding. The amount of interest-on-interest earned is?(1.0分)A.a)67,750B.b)52,791C.c)57,791D.d)40,041E.e)60,0002. 29.Consider a stock that has an expected return of 10% and standard deviation of 14%. Assuming that future returns will resemble past returns, an investor can expect 95% of actual future returns to lie between(1.0分)A.a) -10% and 24%B.b) 10% and 14%C.c) -32% and 52%D.d) -4% and 24%E.e) -18% and 38%3.Assume that you invest $5000 for 30 years in an account that pays an interest rate of8.5% per year with annual compounding. The amount of simple interest earned is?A.a) $67,750B.b) $12,750C.c) $57,791D.d) $40,041E.e) $60,0004. 18.If U.S. firms increase their debt/total capital ratios, it will very likely cause required returns to(1.0分)A. a)Increase and change the slope of the capital market line (CML).B. b)Increase and cause a movement up along the capital market line (CML).C. c)Remain unchanged and cause a parallel shift of the capital market line (CML).D. d) Decrease and change the slope of the capital market line (CML).E. e)Decrease and cause a movement down along the capital market line (CML).5. 17.The following would be an example of systematic risk:(1.0分)A.a) Changes in interest rates.B.b) Management decisions.C.c) Stability of sales.D.d) The amount of debt financing.E.e) Liquidity.6. 16.The nominal risk free rate is influenced by the following factors:(1.0分)A.a) Inflationary expectations and capital market conditions.B.b) Business risk and financial risk.C.c) Investment opportunities and time preference for consumption.D.d) All of the above.E.e) None of the above.7. 15.If a significant change is noted in the yield of a T-bill, the change is most likely attributable to:(1.0分)A.a) A downturn in the economy.B.b) A static economy.C.c) A change in the expected rate of inflation.D.d) A change in the real rate of interest.E.e) A change in risk aversion.8. 14.The real risk free rate is influenced by the following factors:(1.0分)A.a) Inflationary expectations and capital market conditions.B.b) Business risk and financial risk.C.c) Investment opportunities and time preference for consumption.D.d) All of the above.E.e) None of the above.9. 13.The coefficient of variation is a measure of(1.0分)A.a) Central tendency.B.b) Absolute variability.C.c) Absolute dispersion.D.d) Relative variability.E.e) Relative return.10. The nominal risk-free rate is influenced by the relative ease or tightness in the capital markets and the unexpected rate of inflation.A.a)TrueB.b)False11. 24.Assume that you invest $1000 for 15 years in an account that pays an interest rate of 7% per year with annual compounding. Calculate the proportion of the total value of the account that can be attributed to interest-on-interest, at the end of 15 years.(1.0分)A.a) 100%B.b) 38.06%C.c) 36.24%D.d) 25.70%E.e) 0%12. 12.When rates of return on a security have a high standard deviation then(1.0分)A.a) Arithmetic mean will equal geometric meanB.b) The difference between arithmetic mean and geometric mean will be large.C.c) The difference between arithmetic mean and geometric mean will be small.D.d) Geometric mean will exceed arithmetic mean.E.e) None of the above.13. 11.The return relative is calculated as(1.0分)A.a) (1 – HPR)B.b) (1 + HPR)C.c) (1 – HPR)^nD.d) (1 + HPR)^nE.e) (1 – (Income + Price Change))14. 10.The risk premium is a function of sales volatility, financial leverage, and inflation.(1.0分)A.TureB.False15. 9.Widening interest rate spreads indicate a flight to quality.(1.0分)A.TureB.False16. Two measures of risk are the standard deviation and the variance.A.a)TrueB.b)False17. 8.Historically return relatives are used to measure the risk for a series of historical rates of return.(1.0分)A.TureB.False18. 7.The coefficient of variation is the expected return divided by the standard deviation of the return.(1.0分)A.TureB.False19. 6.When rates of return are the same for all years,the geometric mean and the arithmetic mean will be the same. (1.0分)A.TureB.False20. 5.The geometric mean of a series of returns is always larger than the arithmetic mean and the difference increases with the volatility of the series.(1.0分)A.TureB.False21. 4.The geometric mean is the nth root of the product of the annual holding period returns for N years minus one.(1.0分)A.TureB.False22. The expected rate of return is the summation of the possible returns divided by the probability of each return in the summation.A.a)TrueB.b)False23. 3.The holding period return (HPR) is equal to the return relative stated as a percentage.(1.0分)A.TureB.False24. 2.The sources of investment returns are dividends and interest.(1.0分)A.TureB.False25. An investor should expect to receive higher returns from taking on lower risks(1.0分)A.TureB.False26. The the variance of returns, everything else remaining constant, the dispersion of expectations and the risk.A. a) Smaller, greater, lowerB. b) Smaller, greater, greaterC. c) Larger, greater, lowerD. d) Larger, smaller, higherE. e) Larger, greater, higher27. Which of the following conditions would not lead an investor to seek a risk premium?A.a) A low level of liquidity in the chosen investment instrumentB. b)A high level of volatility in the sales of the firm invested inC. c) A high level future investment opportunitiesD. d) A high standard deviation in possible returnsE. e) A large investment in risk-free assets28. The risk premium formulated as a function ofbusiness risk,liquidity risk, financial risk,exchange rate risk, and country risk is the risk premium formulated as a function of systematic market risk.A. Greater thanB. Less thanC. Approximately equal toD. TwiceE. One half29. Which of the following is not a component of the risk premium?A. a) Business riskB. b) Financial riskC. c) Unsystematic market riskD. d) Exchange rate riskE. e) Liquidity risk30. If there is a significant change (increase or decrease) in the yield spread between Baa and Aaa rated bonds, it will very likely cause a change in the required rate of return forcommon stocks, thus resulting in(1.0分)A. a) A change in the slope of the security market line (SML).B. b) A movement along the security market line (SML)C. c) A parallel shift of the security market line (SML)D. d) All of the aboveE. e) None of the above31. If there is a change in the expected rate of inflation, it will very likely cause a change in the required rate of return for various assets, thus resulting in:(1.0分)A. a) A change in the slope of the security market line (SML).B. b) A movement along the security market line (SML)C. c) A parallel shift of the security market line (SML)D. d) All of the aboveE. e) None of the above32. At the beginning of the year a U.K. investor purchased shares of a U.S. company at $25 per share. At this time the exchange rate was ₤0.69 per dollar. At the end of the year, the investor sold the shares at $22 per share, and the exchange rate is ₤0.85 per dollar. What is the home country (U.K.) HPR?(1.0分)A.a)-8.41%B.b)-12%C.c)23.19%D.d)13.64%E.e)-18.82%33. At the beginning of the year a U.S. investor purchased shares of a U.K. company at ₤15per share. At this time the exchange rate was $1.44 per pound. At the end of the year, the investor sold the shares at ₤20 per share, and the exchange rate is $1.15 per pound. What is the home country (U.S.) HPR?A.a)33%B.b)79.86%C.c)6.48%D.d)1.33%E.e)1.048%34.The table provided below provides the probability of outcomes for various states of the economy and the corresponding rates of return for a securityEconomic Status Probability Rate of ReturnWeak Economy 0.10 -5%Static Economy 0.65 5%Strong Economy 0.25 10%What is your coefficient of variation (CV) for the next year?A.a)0.576B.b)0.676C.c)0.766D.d)0.876E.e)0.97635.The table provided below provides the probability of outcomes for various states of the economy and the corresponding rates of return for a securityEconomic Status Probability Rate of ReturnWeak Economy 0.10 -5%Static Economy 0.65 5%Strong Economy 0.25 10%What is your standard deviation (SD) for the next year?(1.0分)A.a)2.042%B.b)4.023%C.c)8.250%D.d)16.750%E.e)32.500%36.The table provided below provides the probability of outcomes for various states of the economy and the corresponding rates of return for a securityEconomic Status Probability Rate of ReturnWeak Economy 0.10 -5%Static Economy 0.65 5%Strong Economy 0.25 10%What is your expected rateof return [E(R i)]for next year?A.a)4.25%B.b)5.25%C.c)6.25%D.d)7.25%E.e)8.25%37. 26. Assume that you invest $5000 for 30 years in an account that pays an interest rate of 8.5% per year with annual compounding. The total value of your investment at the end of 30 years is?(1.0分)A.a) $67,750B.b) $52,791C.c) $57,791D.d) $40,041E.e) $60,00038.25.Given the following returns and return relatives over the past four years, compute the arithmetic mean (AM) and geometric mean (GM) rates of return.Period Returns Return Relativet10.05 1.05t2-0.10 0.90t30.11 1.11t4-0.02 0.98(1.0分)A.a) AM = 4.000%, GM = 1.010%B.b) AM = 1.000%, GM = 0.692%C.c) AM = 0.692%, GM = 4.000%D.d) AM = 1.000%, GM = 1.0692%E.e) AM = 4.000%, GM = 0.0692%39. 23.At the beginning of theyear an investor purchased 100 shares of common stock from ABC Corporation at $10 per share. During the year, the firm paid dividends of $1 per share. At theend of the year, the investor sold the 100 shares at $11 per share. What is the HPR?(1.0分)A.a) 1.20%B.b) 5.50%C.c) 12.00%D.d) 20.00%E.e) 30.00%40. 22.The HPR on a security is 3%. If the holding period is 4 weeks , the annualized HPR is (1.0分)A.a) 39.15%B.b) 78.87%C.c) 46.85%D.d) 158.25%E.e) 52.25%41. 21.The HPR on a security is 6.5%. If the holding period is 1 month, the annualized HPR is (1.0分)A.a) 113%B.b) 78%C.c) 65%D.d) 6.5%E.e) 1.129%42. 20.A parallel shift in the capital market line (CML) is caused by changes in the following factors: (1.0分)A.a) Expected real growth in the economy.B.b) Capital market conditions.C.c) Expected rate of inflation.D.d) All of the above.E.e) None of the above.43. 19.An increase in the slope of the Capital Market Line (CML) is caused by(1.0分)A.a) Changes in business risk.B.b) Changes in financial risk.C. c) Changes in the attitudes of investors toward riskD.d) Changes in systematic risk.E.e) Changes in unsystematic risk.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 2Foreign Exchange Parity Relations1. Because the interest rate in A is greater than the interest rate in B, α is expected to depreciate relativeto β, and should trade with a forward discount. Accordingly, the correct answer is (c).2. Because the exchange rate is given in €:$ terms, the appropriate expression for the interest rate parity relation is€+=+$11r F S r (r $ is a part of the numerator and r € is a part of the denominator).a. The one-year €:$ forward rate is given by €:==1.05$ 1.1795 1.19081.04b. The one-month €:$ forward rate is given by€:+==+1(0.04/12$ 1.1795 1.18051(0.03/12)Of course, these are central rates, and bid-ask rates could also be determined on the basis of bid-askrates for the spot exchange and interest rates.3. a. bid €:¥ = (bid $:¥) × (bid €:$) = 108.10 × 1.1865 = 128.2607.ask €:¥ = (ask $:¥) × (ask €:$) = 108.20 × 1.1870 = 128.4334.b. Because the exchange rate is in €:$ terms, the appropriate expression for the interest rate parityrelation is F /S = (1 + r $)/(1 + r €).€€€++==++=$1(ask )1(0.0525/4):$3-month ask (spot ask :$)1.18701(bid )1(0.0325/4)1.1929r rThus, the €:$3-month forward ask exchange rate is: 1.1929.c. bid $:€ = 1/ask €:$ = 1 / 1.1929 = 0.8383.Thus, the 3-month forward bid exchange rate is $:€ = 0.8383.Chapter 2 Foreign Exchange Parity Relations 7d. Because the exchange rate is in $:¥ terms, the appropriate expression for the interest rate parityrelation is F /S = (1 + r ¥ )/1 + r $.$++===+¥1(bid )1(0.0125/4)$:¥3-month bid (spot ask $:¥)108.10107.031(ask )(0.0325/4)r r $++===+¥1(ask )1(0.0150/4)$:¥3-month ask (spot ask $:¥)108.20107.261(bid )(0.0500/4)r rThus, the $:¥ 3-month forward exchange rate is: 107.03 – 107.26. Note : The interest rates one uses in all such computations are those that result in a lower forwardbid (so, bid interest rates in the numerator and ask rates in the denominator) and a higher forward ask (so, ask interest rates in the numerator and bid rates in the denominator).4. a. For six months, r SFr = 1.50% and r $ = 1.75%. Because the exchange rate is in $:SFr terms, the appropriate expression for the interest rate parity relation isSFr $SFr $1,or (1)(1)1r F F r r S r S+=+=++ The left side of this expression is$ 1.6558(1)(10.0175) 1.01331.6627F r S+=+= The right side of the expression is: 1 + r SFr = 1.0150. Because the left and right sides are not equal, IRP is not holding.b. Because IRP is not holding, there is an arbitrage possibility: Because 1.0133 < 1.0150, we cansay that the SFr interest rate quote is more than what it should be as per the quotes for the otherthree variables. Equivalently, we can also say that the $ interest rate quote is less than what itshould be as per the quotes for the other three variables. Therefore, the arbitrage strategy shouldbe based on borrowing in the $ market and lending in the SFr market. The steps would be asfollows:• Borrow $1,000,000 for six months at 3.5% per year. Need to pay back $1,000,000 ×(1 + 0.0175) = $1,017,500 six months later.• Convert $1,000,000 to SFr at the spot rate to get SFr 1,662,700.• Lend SFr 1,662,700 for six months at 3% per year. Will get back SFr 1,662,700 ×(1 + 0.0150) = SFr 1,687,641 six months later.• Sell SFr 1,687,641 six months forward. The transaction will be contracted as of the current date but delivery and settlement will only take place six months later. So, six months later,exchange SFr 1,687,641 for SFr 1,687,641/SFr 1.6558/$ = $1,019,230.The arbitrage profit six months later is 1,019,230 – 1,017,500 = $1,730.5. a. For three months, r $ = 1.30% and r ¥ = 0.30%. Because the exchange rate is in $:¥ terms, the appropriate expression for the interest rate parity relation is¥$¥$1,or (1)(1)1r F F r r S r S+=+=++8 Solnik/McLeavey • Global Investments, Sixth EditionThe left side of this expression is$107.30(1)(10.0130) 1.0064.108.00F r S+=+= The right side of this expression is: 1 + r ¥ = 1.0030. Because the left and right sides are not equal, IRP is not holding.b. Because IRP is not holding, there is an arbitrage possibility. Because 1.0064 > 1.0030, we cansay that the $ interest rate quote is more than what it should be as per the quotes for the otherthree variables. Equivalently, we can also say that the ¥ interest rate quote is less than what itshould be as per the quotes for the other three variables. Therefore, the arbitrage strategy shouldbe based on lending in the $ market and borrowing in the ¥ market. The steps would be asfollows:• Borrow the yen equivalent of $1,000,000. Because the spot rate is ¥108 per $, borrow$1,000,000 × ¥108/$ = ¥108,000,000. Need to pay back ¥108,000,000 × (1 + 0.0030) =¥108,324,000 three months later.• Exchange ¥108,000,000 for $1,000,000 at the spot exchange rate.• Lend $1,000,000 for three months at 5.20% per year. Will get back $1,000,000 ×(1 + 0.0130) = $1,013,000 three months later.• Buy ¥108,324,000 three months forward. The transaction will be contracted as of the current date, but delivery and settlement will only take place three months later. So, three monthslater, get ¥108,324,000 for ¥108,324,000 / (¥107.30 per $) = $1,009,543.The arbitrage profit three months later is 1,013,000 – 1,009,543 = $3,457.6. At the given exchange rate of 5 pesos/$, the cost in Mexico in dollar terms is $16 for shoes, $36 forwatches, and $120 for electric motors. Thus, compared with the United States, shoes and watches are cheaper in Mexico, and electric motors are more expensive in Mexico. Therefore, Mexico will import electric motors from the United States, and the United States will import shoes and watches from Mexico. Accordingly, the correct answer is (d).7. Consider two countries, A and B. Based on relative PPP,+=+1011A BS I S I where S 1 and S 0 are the expected and the current exchange rates between the currencies of A and B, and I A and I B are the inflation rates in A and B. If A and B belong to the group of countries thatintroduces the same currency, then one could think of both S 1 and S 0 being one. Then, I A and I B should both be equal for relative PPP to hold. Thus, introduction of a common currency by a group ofcountries would result in the convergence of the inflation rates among these countries. A similarargument could be applied to inflation among the various states of the United States.8. Based on relative PPP,+=+Switzerland 10US11I S S IChapter 2 Foreign Exchange Parity Relations 9where S 1 is the expected $:SFr exchange rate one year from now, S 0 is the current $:SFr exchange rate, and I Switzerland and I US are the expected annual inflation rates in Switzerland and the United States, respectively. So,1110.02and 1.60(1.02/1.05)SFr 1.55/$.1.6010.05S S +===+ 9. a. A Japanese consumption basket consists of two-thirds sake and one-third TV sets. The price ofsake in yen is rising at a rate of 10% per year. The price of TV sets is constant. The Japanese consumer price index inflation is therefore equal to+=21(10%)(0%) 6.67%33b. Relative PPP states thatFC 10DC1.1I S S I +=+ Because the exchange rate is given to be constant, we have S 0 = S 1, which implies S 1/S 0 = 1. As a result, in our example, PPP would hold if 1 + I FC = 1 + I DC (i.e., I FC = I DC ). Because the Japanese inflation rate is 6.67% and the American inflation rate is 0%, we do not have I FC = I DC , and PPP does not hold.10. a. i. The law of one price is that, assuming competitive markets and no transportation costs ortariffs, the same goods should have the same real prices in all countries after convertingprices to a common currency.ii. Absolute PPP, focusing on baskets of goods and services, states that the same basket ofgoods should have the same price in all countries after conversion to a common currency.Under absolute PPP, the equilibrium exchange rate between two currencies would be the ratethat equalizes the prices of a basket of goods between the two countries. This rate wouldcorrespond to the ratio of average price levels in the countries. Absolute PPP assumes noimpediments to trade and identical price indexes that do not create measurement problems.iii. Relative PPP holds that exchange rate movements reflect differences in price changes(inflation rates) between countries. A country with a relatively high inflation rate willexperience a proportionate depreciation of its currency’s value vis-à-vis that of a countrywith a lower rate of inflation. Movements in currencies provide a means for maintainingequivalent purchasing power levels among currencies in the presence of differing inflationrates.Relative PPP assumes that prices adjust quickly and price indexes properly measure inflationrates. Because relative PPP focuses on changes and not absolute levels, relative PPP is morelikely to be satisfied than the law of one price or absolute PPP.b. i. Relative PPP is not consistently useful in the short run because of the following:(1) Relationships between month-to-month movements in market exchange rates and PPPare not consistently strong, according to empirical research. Deviations between the ratescan persist for extended periods. (2) Exchange rates fluctuate minute by minute becausethey are set in the financial markets. Price levels, in contrast, are sticky and adjust slowly.(3) Many other factors can influence exchange rate movements rather than just inflation.ii. Research suggests that over the long term, a tendency exists for market and PPP rates tomove together, with market rates eventually moving toward levels implied by PPP.10 Solnik/McLeavey • Global Investments, Sixth Edition11. a. If the treasurer is worried that the franc might appreciate in the next three months, she couldhedge her foreign exchange exposure by trading this risk against the premium included in theforward exchange rate. She could buy 10 million Swiss francs on the three-month forward market at the rate of SFr 1.5320 per €. The transaction will be contracted as of the current date, butdelivery and settlement will only take place three months later.b. Three months later, the company received the 10 million Swiss francs at the forward rate ofSFr 1.5320 per € agreed on earlier. Thus, the company needed (SFr 10,000,000)/(SFr 1.5320per €), or €6,527,415. If the company had not entered into a forward contract, the companywould have received the 10 million Swiss francs at the spot rate of SFr 1.5101 per €. Thus, thecompany would have needed (SFr 10,000,000) / (SFr 1.5101 per €), or €6,622,078. Therefore,the company benefited by the treasurer’s action, because €6,622,078 – €6,527,415 = €94,663were saved.12. The nominal interest rate is approximately the sum of the real interest rate and the expected inflationrate over the term of the interest rate. Even if the international Fisher relation holds, and the realinterest rates are equal among countries, the expected inflation can be very different from one country to another. Therefore, there is no reason why nominal interest rates should be equal among countries.13. Because the Australian dollar is expected to depreciate relative to the dollar, we know from thecombination of international Fisher relation and relative PPP that the nominal interest rate inAustralia is greater than the nominal interest rate in the United States. Further, the nominal interest rate in the United States is greater than that in Switzerland. Thus, the nominal interest rate inAustralia has to be greater than the nominal interest rate in Switzerland. Therefore, we can say from the combination of international Fisher relation and relative PPP that the Australian dollar is expected to depreciate relative to the Swiss franc.14. According to the approximate version of the international Fisher relation, r Sweden − r US = I Sweden − I US . So, 8 − 7 = 6 − I US , which means that I US = 5%.According to the approximate version of relative PPP,−=−10Sweden US 0S S I I S where, S 1 and S 0 are in $:SKr terms. I Sweden − I U S = 6 − 5 = 1%, or 0.01. So, (6 − S 0)/S 0 = 0.01. Solving for S 0, we get S 0 = SKr 5.94 per $.According to the approximate version of IRP,−=−0Sweden US 0F S r r S where, F and S 0 are in $:SKr terms. r Sweden − r US = 8 − 7 = 1%, or 0.01. So, (F − 5.94)/5.94 = 0.01. Solving for F , we get F = SKr 6 per $.Because we are given the expected exchange rate, we could also have arrived at this answer by usingthe foreign exchange expectations relation.Chapter 2 Foreign Exchange Parity Relations 1115. According to the international Fisher relation,++=++Switzerland Switzerland UK UK1111r I r I So,++=++Switzerland 110.0410.1210.10r therefore, r Switzerland = 0.0589, or 5.89%.According to relative PPP,+=+Switzerland 10UK11I S S I where, S 1 and S 0 are in £:SFr terms.So,110.04.310.10S +=+ Solving for S 1 we get S 1 = SFr 2.8364 per £.According to IRP,+=+Switzerland 0UK11r F S r where, F and S 0 are in £:SFr terms.So,10.0589.310.12F +=+ Solving for F , we get F = SFr 2.8363 per £. This is the same as the expected exchange rate in oneyear, with the slight difference due to rounding.16. During the 1991–1996 period, the cumulative inflation rates were about 25 percent in Malaysia,61 percent in the Philippines, and 18 percent in the United States. Over this period, based on relative PPP, one would have expected the Malaysian ringgit to depreciate by about 7 percent relative to the United States dollar (the inflation differential). In reality, the Malaysian ringgit appreciated by about 8 percent. Similarly, in view of the very high inflation differential between the Philippines and the United States, one would have expected the Philippine peso to depreciate considerably relative to the dollar. But it did not. Thus, according to PPP, both currencies had become strongly overvalued.12 Solnik/McLeavey • Global Investments, Sixth Edition17. a. According to PPP, the current exchange rate should bePif Pif 1010$$10//PI PI S S PI PI == where subscript 1 refers to the value now, subscript 0 refers to the value 20 years ago, PI refers toprice index, and S is the $:pif exchange rate. Thus, the current exchange rate based on PPP should be1200/1002pif 1 per $.400/100S ⎛⎞==⎜⎟⎝⎠b. As per PPP, the pif is overvalued at the prevailing exchange rate of pif 0.9 per $.18. Exports equal 10 million pifs and imports equal $7 million (6.3 million pifs). Accordingly, the tradebalance is 10 − 6.3 = 3.7 million pifs.• Balance of services includes the $0.5 million spent by tourists (0.45 million pifs).• Net income includes $0.1 million or 0.09 million pifs received by Paf investors as dividends,minus 1 million pifs paid out by Paf as interest on Paf bonds (− 0.91 million pifs).• Unrequited transfers include $0.3 million (0.27 million pifs) received by Paf as foreign aid.• Portfolio investment includes the $3 million or 2.7 million pifs spent by Paf investors to buyforeign firms. So, portfolio investment = −2.7 million pifs.Based on the preceding,• Current account = 3.24 (= 3.70 + 0.45 − 0.91)• Capital account = 0.27• Financial account = −2.7The sum of current account, capital account, and financial account is 0.81. By definition of balance ofpayments, the sum of the current account, the capital account, the financial account, and the change in official reserves must be equal to zero. Therefore, official reserve account = −0.81.The following summarizes the effect of the transactions on the balance of payments.Current account 3.24Trade balance 3.70Balance of services 0.45Net income – 0.91Capital account 0.27Unrequited transfers 0.27Financial account – 2.70Portfolio investment – 2.70Official reserve account – 0.8119. a. A traditional flow market approach would suggest that the home currency should depreciatebecause of increased inflation. An increase in domestic consumption could also lead to increased imports and a deficit in the balance of trade. This deficit should lead to a weakening of the homecurrency in the short run.b. The asset market approach claims that this scenario is good for the home currency. Foreigncapital investment is attracted by the high returns caused by economic growth and high interestrates. This capital inflow leads to an appreciation of the home currency.Chapter 2 Foreign Exchange Parity Relations 13 20. a. i. The immediate effect of reducing the budget deficit is to reduce the demand for loanablefunds because the government needs to borrow less to bridge the gap between spending andtaxes.ii. The reduced public-sector demand for loanable funds has the direct effect of lowering nominal interest rates, because lower demand leads to lower cost of borrowing, iii. The direct effect of the budget deficit reduction is a depreciation of the domestic currency and the exchange rate. As investors sell lower yielding Country M securities to buy thesecurities of other countries, Country M’s currency will come under pressure andCountry M’s currency will depreciate.b. i. In the case of a credible, sustainable, and large reduction in the budget deficit, reducedinflationary expectations are likely because the central bank is less likely to monetize thedebt by increasing the money supply. Purchasing power parity and international Fisherrelationships suggest that a currency should strengthen against other currencies whenexpected inflation declines.ii. A reduction in government spending would tend to shift resources into private-sector investments, in which productivity is higher. The effect would be to increase the expectedreturn on domestic securities.。