万科2011年度财务报表分析

万科A2005-2011年利润表

万科股份有限公司财务报表分析

万科股份有限公司财务报表分析作者:周蓓来源:《现代企业文化·理论版》2015年第24期中图分类号:F830 文献标识:A 文章编号:1674-1145(2015)12-000-02摘要我国自从住房制度改革后,从计划经济转向市场经济,伴随着经济的发展,房地产行业已经成为我国支柱产业。

在这十年中,房地产对GDP的贡献超过了7%,对我国固定资产投资的推动接近25%,对国家财政收入贡献高达30%。

但是,在房地产高速发展的同时也带来了经济泡沫和民生问题。

政府出台了很多房地产调控的政策如限购令,同时加大对于廉租房、保障房的投资建设,以此来解决房屋的供需问题,使更多的人“居者有屋”。

关键词财务报表分析在这样的宏观调控的背景下,房地产行业的发展如何?房地产企业的财务状况如何?本文主要研究分析万科2009-2011年的年报,对其各项财务指标进行分析中国房地产企业的发展现状以及存在的问题。

财务指标分析一、万科盈利能力分析企业的盈利能力的分析,主要是反映企业的盈利能力,从以下三个方面反映:资本盈利能力分析,资产的盈利能力分析,商品的盈利分析。

首先,资本的盈利分析。

资本的盈利能力反映的是企业所有者通过投入资本经营而获得的利润,反映了资本回报率。

从万科三大报表数据看出,2009-2011年三年净资产收益率在增加,从2009年的14.16%增加到17.1%,反映万科的盈利能力增强。

但盈利现金比率反映了2009-2010年从2009年143.9%降到2011年的29.22%,说明万科盈利质量在下降,销售收入导致的应收账款在增加。

其次,资产盈利能力分析。

资产的盈利能力主要是企业运营资产而产生的生产利润的能力。

从万科三大报表数据看出,总资产报酬率从2009年的6.7%到2011年的6.18%,总资产的盈利能力在下降。

同时,全部资产的现金回收率反映了企业资产的获取现金的能力,从2009年到2011年,企业全部资产获现能力在不断地下降,从2009年的7.205%下降到2011年的1.324%。

万科 2011年度报告

万科 2011年度报告引言本文将带您逐步思考,回顾万科2011年度报告的重要内容。

万科作为中国房地产行业的领导者之一,在2011年度取得了哪些值得关注的成绩和里程碑?本文将通过逐步展开的方式,带您了解万科在2011年度报告中的关键信息。

第一步:总体概述万科2011年度报告以公司的整体概述开始。

报告强调了公司在这一年所实现的可观收入和销售增长。

报告中还提到了万科在中国房地产市场的占有率以及公司对可持续发展的承诺。

这些内容都表明了万科在2011年度取得的良好业绩。

第二步:业务部门分析接下来,报告详细分析了万科的不同业务部门。

其中包括住宅开发、商业地产、物业管理和其他相关服务部门。

报告中提到了每个部门的销售额、收入贡献和市场份额。

通过这一步骤,我们可以更好地了解万科在不同业务领域的表现和发展。

第三步:财务绩效在这一步骤中,报告详细介绍了万科2011年度的财务绩效。

其中包括公司的总营收、净利润和每股收益等关键指标。

报告还提到了万科在这一年度的资产负债状况、现金流量和财务稳定性。

这些数据为投资者和利益相关者提供了对万科财务状况的全面了解。

第四步:可持续发展万科一直致力于可持续发展,并将其作为企业的核心价值之一。

在2011年度报告中,报告详细描述了万科在环境保护、社会责任和企业治理方面的努力和成果。

报告中还提到了万科的可持续发展战略和目标,并介绍了公司在这方面取得的重要成就。

第五步:风险管理在这一步骤中,报告重点介绍了万科在2011年度的风险管理措施和策略。

报告中提到了公司在市场风险、政策风险和金融风险等方面的应对措施。

此外,报告还涉及了万科在应对自然灾害和环境变化方面的风险管理计划。

这些细节为投资者提供了对万科风险管理能力的认识。

结论通过逐步思考万科2011年度报告的重要内容,我们可以了解到该公司在这一年度取得的重要成就和关键指标。

万科作为中国房地产行业的领导者,通过可持续发展和风险管理等方面的努力,取得了可喜的业绩。

万科A2011年报分析(管理用报表)

万科企业股份有限公司2011年度财务报告分析财务管理0901 吴思聪2012年6月30日万科企业股份有限公司2011年度财务报表分析一、公司基本情况简介(一)背景资料1.公司法定中文名称:万科企业股份有限公司2.公司英文名称:CHINA VANKE CO., LTD. (缩写为VANKE)3.法定代表人:王石4.联系地址:中国深圳市盐田区大梅沙环梅路33号万科中心5.注册地址:中国深圳市盐田区大梅沙环梅路33号万科中心6.股票上市地:深圳证券交易所7.股票简称及代码:万科A 000002、万科B 2000028.公司聘请的会计师事务所:毕马威华振会计师事务所(二)股东构成股份总数:10,995,210,218(股)截至2011年12月31日,公司共有股东948,934 户(其中A 股925,732 户,B股23,202 户)拥有公司股份前十名股东持股情况如下:(三)企业发展状况万科企业股份有限公司成立于1984年,1988年进入房地产行业,1991年成为深圳证券交易所第二家上市公司。

经过二十多年的发展,成为国内最大的住宅开发企业,目前业务覆盖珠三角、长三角、环渤海三大城市经济圈以及中西部地区,共计53个大中城市。

近三年来,年均住宅销售规模在6万套以上, 2011年公司实现销售面积1075万平米,销售金额1215亿元,销售规模居全球同行业首位。

1991年万科成为深圳证券交易所第二家上市公司,持续增长的业绩以及规范透明的公司治理结构,使公司赢得了投资者的广泛认可。

公司在发展过程中先后入选《福布斯》“全球200家最佳中小企业”、“亚洲最佳小企业200强”、“亚洲最优50大上市公司”排行榜;多次获得《投资者关系》等国际权威媒体评出的最佳公司治理、最佳投资者关系等奖项。

在多年的经营中,万科坚持“不囤地,不捂盘,不拿地王”的经营原则;实行快速周转、快速开发,依靠专业能力获取公平回报的经营策略。

产品始终定位于城市主流住宅市场,主要为城市普通家庭供应住房,2011年所销售的144平米以下户型占比89%。

万科2011-2012财务报表分析报告

财务管理作业万科房地产公司财务分析报告一、背景分析1.公司法定中文名称:万科企业股份有限公司公司法定英文名称:CHINA VANKE CO.,LTD.(缩写为VANKE)2.公司法定代表人:王石3.公司注册地址:中国深圳市盐田区大梅沙万科东海岸裙楼C02公司办公地址:中国深圳市盐田区大梅沙环梅路33 号万科中心4.公司股票上市交易所:深圳证券交易所股票简称:万科A股票代码:000002二、企业发展状况万科公司概况:万科企业股份有限公司成立于1984年5月,是目前中国最大的专业住宅开发企业。

2008年公司完成新开工面积523.3万平方米,竣工面积529.4万平方米,实现销售金额478.7亿元,结算收入404.9亿元,净利润40.3亿元。

总部设在深圳,至2009年,已在20多个城市设立分公司。

万科认为,坚守价值底线、拒绝利益诱惑,坚持以专业能力从市场获取公平回报,是万科获得成功的基石。

公司致力于通过规范、透明的企业文化和稳健、专注的发展模式,成为最受客户、最受投资者、最受员工、最受合作伙伴欢迎,最受社会尊重的企业。

凭借公司治理和道德准则上的表现,公司连续六次获得“中国最受尊敬企业”称号,2008年入选《华尔街日报》(亚洲版)“中国十大最受尊敬企业”。

万科1988年进入房地产行业,1993年将大众住宅开发确定为公司核心业务。

至2008年末,业务覆盖到以珠三角、长三角、环渤海三大城市经济圈为重点的31个城市。

当年共销售住宅42500套,在全国商品住宅市场的占有率从2.07%提升到2.34%,其中市场占有率在深圳、上海、天津、佛山、厦门、沈阳、武汉、镇江、鞍山9个城市排名首位。

万科1991年成为深圳证券交易所第二家上市公司,持续增长的业绩以及规范透明的公司治理结构,使公司赢得了投资者的广泛认可。

过去二十年,万科营业收入复合增长率为3 1.4.%,净利润复合增长率为36.2%;公司在发展过程中先后入选《福布斯》“全球200家最佳中小企业”、“亚洲最佳小企业200强”、“亚洲最优50大上市公司”排行榜;多次获得《投资者关系》等国际权威媒体评出的最佳公司治理、最佳投资者关系等奖项。

万科财务报表分析

万科上市公司财务报表的初步解读1 资产负债表分析图一:万科近三年资产结构及变动表近三年数据显示万科流动资产比例分别为95.4%,95.3%,94.7%,流动资产比例很高,资产的变现能力较强,流动资产中现金比例也较高,说明短期偿债能力较强。

在资产中存货的比例最大,2010年存货比例下降,但2011年存货上升了56.25%,主要原因是2010年大量开工的项目陆续竣工以及新获取项目以及在建开发产品的增加;资产总额增长37.36%,说明万科还在不断扩大规模,库存现金也有所下降说明资产变现能力减弱。

万科拥有巨大的存货量,这既是未来发展的保障,又是万科风险的主要来源,而2011年存货的大量积存主要受国家地产调控政策的影响,也是房地产开发企业最大的风险因素。

建议万科应步一步优化存货结构,适度控制好存货数量,并采取一定的促销手段,为企业筹措资金。

图二:万科近三年负债结构及变动表万科负债结构中主要以长期借款为主,原因主要在于房地产行业普遍存在以银行融资为主的单一融资渠道。

长期借款的筹资费用也比较低。

存货激增的同时,短期负债也出现大幅上升,持有的现金及现金等价物却大幅减少。

应付账款增加是由于工程量的增加。

一年内到期的非流动负债大幅上升,说明万科近期的还款压力很大。

流动比例近三年都大于1,说明资产流动性较好,有足够的能力偿还流动负债。

2 利润表分析图三:万科近四年销售收入趋势表图四:万科近四年净利润趋势表由图可知最近几年万科销售收入和净利润快速稳定增长,尽管业绩增长势头强劲,2011年受国家政策调控的影响,盈利能力开始减弱,2011年销售增长率为41.5%,净利润增长率为31.2%,净利润增速小于销售收入。

同时2011年的销售毛利率为39.78%,比上年下降0.9个百分点;销售净利率为16.16%,比上年下降了1.27个百分点,主要因为市场景气度下滑,企业打折促销行为增加。

3 现金流量表分析图五:万科近四年净现金流量趋势表但2010年的经营活动现金流入比2009年增加了53%,可以说经营活动现金流入增长非常迅速,企业在经营活动中创造现金能力大大增强,经营活动现金流入作为企业主要资金来源,增强了企业自身“造血”功能,企业具有较强的偿债能力和支付能力,增强了风险抵抗能力,有利于企业稳定和可持续发展,经营活动现金净流量减少的主要原因是购买商品、接受劳务支付的现金流量增加,2010年购买商品、接受劳务支付的现金流量比2009年增加了92%,但现金流入与2009年相比还是大幅增加的,现金流入比较充裕,总体看来,万科发展势头良好。

万科集团财务状况分析

摘要本文以上市公司万科集团对外披露的财务报表和年度审计报告为分析对象,依据财务报表分析的相关理论,选取万科最近三年的财务报表,从整个房地产行业的角度对万科的基本情况和战略进行分析,并逐次对万科的资产负债表、利润表、现金流量表进行趋势分析和结构分析,对相关财务指标进行了分析,结合杜邦分析法来了解和分析公司真实的财务状况、经营成果和现金流量;根据上述战略分析和财务分析,综合评价该公司的经营管理,指出该公司存在的一些问题,并提出相应的建议,供经营管理者决策参考;同时可以帮助投资者正确作出相关的投资决策。

合理的研究方法对于研究的科学与否起着至关重要的作用。

本文主要采取查阅资料法、案例分析法、图表分析法等一些基本的研究方法展开分析。

笔者主要通过书籍、网络、期刊等方式查阅了大量的相关资料以完成整个研究工作,在整个论文写作过程中,始终坚持理论联系实际的原则来研究和解决实际问题。

通过阅读相关的理论资料,搭建和确定了本文的财务报表分析理论框架,通过对万科企业股份有限公司近三年的财务数据进行具体的分析,以此得出相关的结论。

关键词:万科;财务报表分析;财务状况AbstractThispapertakeslistedcompaniesVankeGroupdisclosedfinancialstatemen tsandannualauditreportastheresearchobject,accordingtotherelevanttheoriesoffinancialstatementanalysis,choosesVankeinrecentthreeyearsoffinancialstatementsofVanke'sbasicsitu ationandstrategyfromtheentirerealestateindustryperspective,andthesuccessiveofVanke'sbalancesheet,profitstatementthecashflowstatement,trendanalysisandstructuralanalysis,therelevantfinancialindicatorswereanalyzed,combinedwithDuPontanalysistounderstandandanalyzethecompany'struefinan cialposition,operatingresultsandcashflow;accordingtothestrategicanalysisandfinanci alanalysis,comprehensiveevaluationofthemanagementofthecompany,thecompanysaidTherearesomeproblems,andputforwardcorrespondingsuggestionsformanagementdecision-making;atthesametimecanhelpinvestorsmaketherightinvestmentdecisionsrelated.Reas onablemethodsforthestudyofthescienceandplaysavitalrole,Thispapermainlyadoptsliteraturereview,caseanalysis,chartanalysisandsomebasicresearchmethodsareanalyzed.Theauthormainlyth roughbooks,work,consultingalotofrelevantinformationtocompletetheworkinthecourseofwrit ing,alwaysadheretotheprincipleofintegratingtheorywithpracticetostudyandso lvethepracticaltheproblem.Throughreadingtheorydata,buildanddeterminethetheoreticalframeworkoffinancialstatementanalysis,financialdatabyLimitedbyShareLtdofChinaVankenearlythreeyearsofdetaile danalysis,inordertodrawrelevantconclusions.Keywords:Vanke;financialstatementanalysis;financialsituation目录一、万科集团的现状 (1)(一)万科集团基本情况 (2)(二)万科集团公司的发展现状 (3)二、万科集团财务报表分析 (3)(一)万科集团的资产项目分析 (4)(二)万科集团的利润项目分析 (4)(三)万科集团的现金流量项目分析 (4)(四)万科集团的单项能力分析 (5)三、财务报表视角,万科集团存在的问题 (5)(一)资产中存货占较大的比重,资金流转受到影响 (6)(二)资产负债率逐年上升,企业面临较高的财务风险 (6)(三)资产周转率偏低,利润下降 (7)四、针对万科集团财务报表分析存在的问题的改进建议 (7)(一)采取促销策略,减少存货比例 (8)(二)开拓土地新市场,谨慎投资 (8)(三)制定资产管理措施,提高资产使用效率 (9)结论 (10)参考文献 (11)致谢 (12)万科集团财务状况分析一、万科集团的现状(一)万科集团基本情况万科企业股份有限公司,股票代码:000002,是王石于1984年5月创立,总部位于中国深圳,经过几十年的高速发展,业务范围覆盖到珠三角、长三角、环勸海三大城市经济圈以及中西部地区,共计53个大中城市,当之无愧成长为目前中国最大的专业住宅开发企业。

万科集团2011年度财务报表分析

万科股份有限公司2011年度财务报表分析学院:经济与管理学院班级:会计09-2班姓名:冀雪峰学号:0965114224万科股份有限公司2011年度财务报表分析1、背景分析(1)万科集团情况简介万科公司股份有限公司成立于 1984 年5 月,是目前中国最大的专业住宅开发公司。

万科1988 年进入房地产行业,1993 年将大众住宅开发确定为公司核心业务。

其市场占有率在深圳、上海、天津、佛山、厦门、沈阳、武汉、镇江、鞍山 9 个城市排名首位。

万科 1991 年成为深圳证券交易所第二家上市公司,持续增长的业绩以及规范透明的公司治理结构,使公司赢得了投资者的广泛认可。

公司在发展过程中先后入选《福布斯》“全球200 家最佳中小公司”、“亚洲最佳小公司 200强”、“亚洲最优50大上市公司”排行榜;多次获得《投资者关系》等国际权威媒体评出的最佳公司治理、最佳投资者关系等奖项。

(2)房地产行业特点房地产行业为资本密集型行业,其资产组成以投资性房地产为主。

房地产公司开发建造及直接经营的对象就是房地产。

房地产行业是国民经济的基本承载体,是在工业化、城市化和现代化过程中兴起、发展所形成的独立产业,同时又推动了工业化、城市化和现代化的进展,己经成为现代社会经济大系统中一个重要的有机组成都分。

房地产行业具有资金量大、回报率高、风险大、附加值高、产业关联性强等特点。

(3)现阶段国家对房地产行业的政策近几年来,房地产价格的增长率远远超出了GDP和人均收入的增长率。

在一些像上海这样的主要城市,在过去的十年里,居民住宅的平均价格增长了超过十倍。

根据非官方调查,上海的房地产价格的增长率大约是人均收入增长率的7倍。

在北京和深圳,这个数字分别是5倍和6倍。

为了缓和过热的房地产市场,中国在近几年实行了许多政策,包括收紧对房地产公司的信贷供应、提高居民购房的首付比率要求、限制房地产业的外商投资(包括房地产开发和投资项目)等,这些政策在一定程度上限制了房地产的发展。

最新万科财务分析

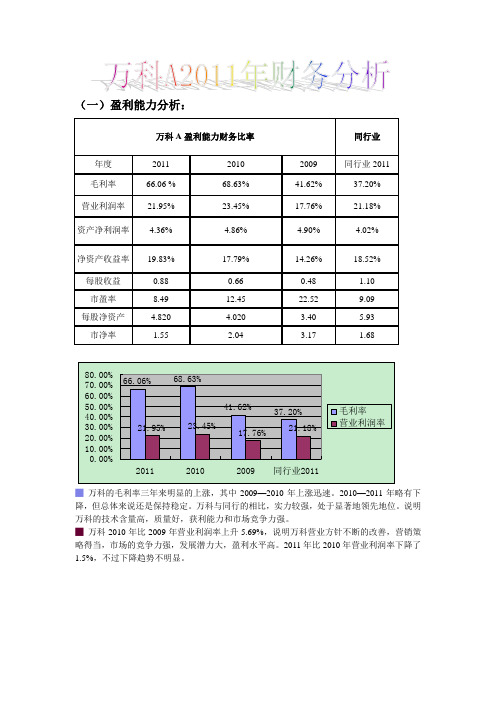

(一)盈利能力分析:█万科的毛利率三年来明显的上涨,其中2009—2010年上涨迅速。

2010—2011年略有下降,但总体来说还是保持稳定。

万科与同行的相比,实力较强,处于显著地领先地位。

说明万科的技术含量高,质量好,获利能力和市场竞争力强。

█万科2010年比2009年营业利润率上升5.69%,说明万科营业方针不断的改善,营销策略得当,市场的竞争力强,发展潜力大,盈利水平高。

2011年比2010年营业利润率下降了1.5%,不过下降趋势不明显。

█2009年—2011年万科A的资产净利润率有上升趋势不过不明显,反映了企业资产综合利用的效率上升。

到了2011年有略微的下降趋势,说明企业在增加收入和节约资产使用等方面效果不佳;与同行业综合实力30强相比,还是有前进的倾向。

█2011年,万科A的每股收益为0.88元,较前两年相比有明显的上升,根据利润表,净利润势必不变或减少,其值但仍高出同业高出28.86个百分比,这充分说明万科A11年的盈利能力较强,公司具有较好的经营和财务状况。

2011年万科A的净资产收益率为19.83%,比去年上升近2.04个百分比,下降幅度不大,表明股东投入资本的净收益水平不高,说明企业权益资本获取收益的能力提高,运营效率变好,对企业投资者保证程度提高。

与同行业综合实力相比,万科A的净资产收益率仍在房地产上市公司中处于绝对领先的地位。

█市盈率是通过公司股票价格的市场表现,间接地评价公司盈利能力。

2011年12月31日万科A的市盈率为8.49元,明显低于前两年同一时间的市盈率,也低于同行业的房地产企业的市盈率,这表明投资者对每股收益所愿支付的价格相对要低,2011年投资者对万科未来的盈利能力和发展前景不看好。

█每股净资产反映了每一股普通股所拥有的净资产,万科A在2011年的每股净资产为4.82元,比前两年的每股净资产要高,表明万科A每股拥有的净资产增加,公司的发展潜力变大。

其仍略低于同行房地产企业的平均值,表明该公司在同行业中实力下降,抵御外来因素影响和打击能力一般。

万科2011年财务分析报告

表1-3 2007年-2011年万科资产负债占比

(1)资产总规模及其变动趋势分析

万科资产总规模

30,000,000.00 25,000,000.00 20,000,000.00 单位:元 15,000,000.00 10,000,000.00

5,000,000.00 0.00

2007年 2008年 2009年 2010年 2011年

(1)资产总规模及其变动趋势分析

万科资产项目结构趋势图

120.00% 100.00%

80.00% 60.00% 40.00% 20.00%

0.00% 2007年 2008年 2009年 2010年 2011年

流动资产 长期投资 固定资产 其他长期资产

图1-3 2007年-2011年万科资产项目结构趋势图

,它的盈利能力和周转效率对公司的经营状况起决定性作用。其次是

长期股权投资,其所占比重近三年呈降-升-降的趋势,2008年有所

下降,2009年又上升到2.59%,但2011年下降至2.17%。

(2)流动资产结构变动情况分析

由于流动资产占资产的大部分,所以有必要对流动资产的结构进行分析。为此,选择几项代表性较强的 指标来分析,包括:货币资金、应收账款、预付款项、其他应收款和存货。

专业化

精细化

多元化

全球化?

E 行业背景分析

• 房地产行业是典型的资金密集型行业,具有投资 大、风险高、周期久、供应链长、地域性强的特 点。

• 国内房地产开发的资金来源几乎60-80%依赖外部 融资,近来政府出台了一系列宏观调控政策,对 房地产项目的发展提出了更高的要求。

• 限制房价过快上涨和更为严格的融资条件无异于 扼住了目前我国房地产业的主动脉,如何开辟新 的融资方式,建立新的融资平台,已成为众多房 地产商性命攸关的头等大事。

万科财务分析报告结论(3篇)

第1篇一、引言万科企业股份有限公司(以下简称“万科”或“公司”)成立于1984年,是中国最大的房地产开发企业之一,总部位于广东省深圳市。

经过多年的发展,万科已成为中国房地产行业的领军企业,业务范围涵盖房地产开发、物业管理、社区服务等。

本报告通过对万科近年来的财务报表进行分析,旨在全面评估公司的财务状况、盈利能力、偿债能力、运营能力和成长能力,为投资者提供决策参考。

二、财务状况分析1. 资产负债表分析(1)资产结构分析从万科的资产负债表可以看出,公司的资产主要由流动资产、非流动资产和负债构成。

其中,流动资产占比最高,达到65.71%,主要表现为货币资金、交易性金融资产、应收账款等;非流动资产占比为30.84%,主要包括固定资产、无形资产等;负债占比为3.45%,主要包括短期借款、长期借款等。

(2)负债结构分析万科的负债主要由流动负债和长期负债构成。

流动负债占比为57.06%,主要包括应付账款、预收账款等;长期负债占比为42.94%,主要包括长期借款、应付债券等。

2. 利润表分析(1)营业收入分析万科的营业收入呈现持续增长的趋势,从2016年的2,579.39亿元增长至2020年的4,724.89亿元,年均增长率达到15.22%。

这主要得益于公司不断拓展业务范围、提高市场份额以及优化产品结构。

(2)毛利率分析万科的毛利率在2016年至2020年间呈现波动趋势,从22.21%下降至16.21%。

这主要受到房地产市场调控政策的影响,以及公司加大土地储备和投资力度导致成本上升。

(3)净利率分析万科的净利率在2016年至2020年间呈现波动趋势,从7.21%下降至5.21%。

这主要受到毛利率下降、销售费用、管理费用和财务费用上升等因素的影响。

三、偿债能力分析1. 流动比率分析万科的流动比率在2016年至2020年间呈现波动趋势,从1.46下降至1.26。

这表明公司的短期偿债能力有所下降,但整体仍处于合理水平。

万科2011年审计报告

审计报告KPMG-D (2012) AR No.0004 万科企业股份有限公司全体股东:我们审计了后附的万科企业股份有限公司(以下简称“贵公司”)财务报表,包括2011年12月31日的合并资产负债表和资产负债表,2011年度的合并利润表和利润表、合并现金流量表和现金流量表、合并股东权益变动表和股东权益变动表以及财务报表附注。

一、管理层对财务报表的责任编制和公允列报财务报表是贵公司管理层的责任,这种责任包括: (1) 按照中华人民共和国财政部颁布的企业会计准则的规定编制财务报表,并使其实现公允反映;(2) 设计、执行和维护必要的内部控制,以使财务报表不存在由于舞弊或错误导致的重大错报。

二、注册会计师的责任我们的责任是在执行审计工作的基础上对财务报表发表审计意见。

我们按照中国注册会计师审计准则的规定执行了审计工作。

中国注册会计师审计准则要求我们遵守中国注册会计师职业道德守则,计划和执行审计工作以对财务报表是否不存在重大错报获取合理保证。

审计工作涉及实施审计程序,以获取有关财务报表金额和披露的审计证据。

选择的审计程序取决于注册会计师的判断,包括对由于舞弊或错误导致的财务报表重大错报风险的评估。

在进行风险评估时,注册会计师考虑与财务报表编制和公允列报相关的内部控制,以设计恰当的审计程序。

审计工作还包括评价管理层选用会计政策的恰当性和作出会计估计的合理性,以及评价财务报表的总体列报。

我们相信,我们获取的审计证据是充分、适当的,为发表审计意见提供了基础。

三、审计意见我们认为,贵公司财务报表在所有重大方面按照中华人民共和国财政部颁布的企业会计准则的规定编制,公允反映了贵公司2011年 12 月 31 日的合并财务状况和财务状况以及 2011年度的合并经营成果和经营成果及合并现金流量和现金流量。

毕马威华振会计师事务所中国注册会计师李婉薇中国北京中国注册会计师温华新2012 年 3 月 9 日新时达:2011年度企业内部审计工作报告2012-4-17证券时报董事会审计委员会各委员:报告期内,审计部在董事会审计委员会的督促和指导下开展了相关内部控制和内部审计工作,现将有关工作情况报告如下:一、对公司定期财务报告的审核情况报告期内,审计部在董事会审计委员会的指导下,每一季度均对公司定期财务报告进行了审核。

万科集团财务报表分析

在逐年降低。可见,公司要加强对资产的长期以

及短期管理,以增强其经营效率。

应收账款周转率(次) 存货周转率(次) 总资产周转率(次)

16

四、对企业财务状况的总体评价

就现金流转状况而 就资产总体

言

状况而言

就盈利能力而言

17

同类公司比较 万科集团 保利集团 金地地产

万科集团

19

保利地产

20

金地地产

单元:万元

万科现金流量项目结构变化额

2,500,000.00 2,000,000.00 1,500,000.00 1,000,000.00

500,000.00 0.00

-500,000.00 2007年 -1,000,000.00 -1,500,000.投资活动产生的现金流 量净额 筹资活动产生的现金流 量净额 汇率变动对现金及现金 等价物的影响

1

总的来说,万科的 主营业务获利能力 近年来有所提升, 总资产和净资产的 获利能力在上升。

2

12

万科集团获利能力

万科投资收益趋势图

7 6 5 4 3 2 1 0

2007年 2008年 2009年 2010年 2011年

每股净资产(元)

有图表可见,该公司发展潜力较大,股票市值有望继续增加

13

5、万科短期偿债能力

对利润表及利润分配进行分析 三.对资产负债表以及资产大多结构、变化、

资产质量以及资本结构进行分析

一.对现金流量表以及现金流量质量进行分析

结论

7

1、营业利润

营业利润

1,600,000.00 1,400,000.00 1,200,000.00 1,000,000.00

800,000.00 600,000.00 400,000.00 200,000.00

万科财务报表分析,揭秘企业经营

万科财务报表分析,揭秘企业经营在进行万科财务报表分析之前,我想先介绍一下万科这家企业。

万科成立于1984年,是一家主要从事房地产开发的企业,经过多年的发展,已经成为我国房地产行业的领军企业。

万科的业务范围涵盖了住宅开发、商业地产、物业管理等多个领域。

在我国房地产市场的快速发展背景下,万科的业绩也实现了持续增长。

然而,随着市场环境的变化,万科也面临着一定的挑战。

本文将通过分析万科的财务报表,揭秘其企业经营状况。

一、万科财务报表分析1. 资产负债表分析资产负债表是反映企业某一特定时点财务状况的重要财务报表。

通过分析万科的资产负债表,可以了解到企业的资产结构、负债结构和所有者权益情况。

(1)资产结构分析截至2021年,万科的总资产约为1.1万亿元,同比增长约10%。

其中,流动资产约为2700亿元,非流动资产约为8300亿元。

万科的资产结构以流动资产为主,非流动资产占比较高,说明企业具有较强的经营实力。

(2)负债结构分析万科的负债总额约为7600亿元,其中流动负债约为2200亿元,非流动负债约为5400亿元。

万科的负债结构以长期负债为主,说明企业对未来发展的信心较强。

万科的资产负债率约为69%,相较于行业平均水平,企业的负债压力相对较大。

(3)所有者权益分析万科的所有者权益总额约为3400亿元,其中,实收资本约为2100亿元,资本公积约为400亿元,盈余公积约为300亿元,未分配利润约为600亿元。

所有者权益结构较为稳定,说明企业的盈利能力较强。

2. 利润表分析利润表是反映企业在一定时期内经营成果的财务报表。

通过分析万科的利润表,可以了解到企业的收入、成本、费用和利润情况。

(1)营业收入分析截至2021年,万科的营业收入约为4200亿元,同比增长约15%。

万科的营业收入增长速度较快,说明企业具有较强的市场竞争力。

(2)成本和费用分析万科的成本和费用总额约为3200亿元,其中,主营业务成本约为2600亿元,销售费用约为200亿元,管理费用约为150亿元,财务费用约为150亿元。

2010-2012年万科财务分析报告

一、企业简介万科集团股份有限公司成立于1984年5月,以房地产为核心业务,是中国大陆首批公开上市的企业之一。

公司于1988年介入房地产领域,1992年正式确定大众住宅开发为核心业务,截止2002年底已进入深圳、上海、北京、天津、沈阳、成都、武汉、南京、长春、南昌和佛山进行住宅开发,2003年上半年万科又先后进入鞍山、大连、中山、广州,目前万科业务已经扩展到15个大中城市凭借一贯的创新精神及专业开发优势,公司树立了住宅品牌,并获得良好的投资回报。

万科A (000002)、万科B(200002)3月12日晚间公布的2011年年报显示,2011年末公司资产总额2962.08亿元,比上年末增37.36%;期末归属于上市公司股东的股东权益529.67亿元,比上年末增19.75%。

2011年公司经营活动产生的现金流量净额为33.89亿元,同比增51.50%。

报告期内,公司实现营业收入717.8亿元,同比增长41.5%,实现净利润96.2亿元,同比增长32.2%。

实现结算面积562.4万平方米,结算收入706.5亿元,同比分别增长24.4%和41.2%。

截至2011年末,公司合并报表范围内已销售未结算资源面积合计1085万平方米,对应合同金额1222亿元,较2010年末分别增长59.6%和49.0%。

在当前的中国房地产市场上,万科无疑已经成为中国房地产市场的领军人物。

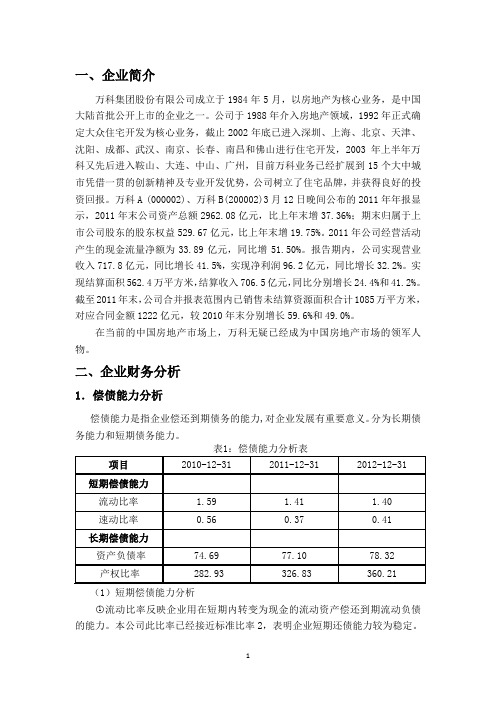

二、企业财务分析1.偿债能力分析偿债能力是指企业偿还到期债务的能力,对企业发展有重要意义。

分为长期债务能力和短期债务能力。

表1:偿债能力分析表项目2010-12-31 2011-12-31 2012-12-31 短期偿债能力流动比率 1.59 1.41 1.40速动比率0.56 0.37 0.41 长期偿债能力资产负债率74.69 77.10 78.32产权比率 282.93 326.83 360.21 (1)短期偿债能力分析○1流动比率反映企业用在短期内转变为现金的流动资产偿还到期流动负债的能力。

2011年万科年报-致股东

2011年致股东这是一个似曾相识的冬天。

或许太阳之下,本来并无新事。

经历过2006 年以来完整行业周期的我们,对冬日的再临,不应有任何诧异,亦无须任何惊惶——决定行业广阔前景与向上趋势的长期性因素,并未发生改变;而驱动市场短期波动和反复调整的深层次矛盾,其实也别无二致。

关于这一切,在过去历年的报告中,我们已经反复讨论过。

当然,市场周期的起伏跌宕,与天行有常的季节轮换,仍然存在差异。

对于季节,我们不仅能洞明其交替次序,也不难掌握精确的变换时点。

而要对市场周期的时间节点做出同样精准的预判,则困难得多。

市场是人类事务。

人类具有预期,懂得总结规律,并总会试图去运用它们。

人类的观察、判断、预期和行为,各自存在差异,却或多或少都会对这些事情的发展产生影响,因此人类事务,往往并不具备自然现象那种恒久不变的规律性。

变化与不变对于市场,也许变化是唯一的不变,不确定性是唯一的确定。

因此一直以来,我们主张“应变重于预测”,反对高估和迷信自身的预测能力,即使我们在这种能力上相对具有优势。

而比“应变”更重要的,可能是“不变”——不变的信念和理想,对永恒商业逻辑的理解,以及尽可能稳定的经营策略。

在过去的报告中,我们已经详细讨论过,企业存在的理由、职业经理人的使命,以及万科始终坚持的经营原则。

在这些问题上,不同个体、组织可能有不同的选择,但每种选择一旦作出,通常都具有其稳定性,甚至变成难以改变的路径依赖。

而经营策略通常则更为灵活,大部分企业会根据对市场环境变化的判断,选择自己认为当前更为适宜的策略。

但是,当环境短期变化高度复杂,甚至方向逆转的时间长度短于企业策略调整产生作用所需的时间长度时,频繁调整策略的结果可能恰得其反。

而当市场的长期发展方向远比短期波动趋势更易于判断时,经营策略的稳定性,则较其灵活性,可能更为重要。

万科的经营策略,相对是比较稳定的。

这些策略包括:坚持小户型和装修房;坚持快速周转和较少的土地储备;重视合作;稳健的投资策略;以及推动住宅产业化和绿色建筑。

万科利润表水平分析和垂直分析以及财务报表的比率分析

4.计算每股收益等指标,反映上市公司的盈利能力;

基本每股收益=(净利润-优先股股息)/发行在外的普通股加权平均数(流通股数)

2011年基本每股收益=0.88

2010年基本每股收益=0.66

每股收益是衡量上市公司盈利能力最常用的财务分析指标。对投资者来说,每股收益是一个综合性的盈利概念,能比较恰当地说明受益的增长或减少。每股收益越高,说明公司的盈利能力越强。2011年比2010年每股收益增长了0.22。

2011年利润表比率分析

报表日期

单位

元

元

一、营业总收入

营业收入

二、营业总成本

营业成本

营业税金及附加

销售费用

管理费用

财务费用

资产减值损失

公允价值变动收益

-2868570

投资收益

其中:对联营企业和合营企业的投资收益

三、营业利润

营业外收入

营业外支出

非流动资产处置损失

1144280

1211780

利润总额

所得税费用

-8719230

0.0000

-0.0001

投资收益

0.0074

0.0090

其中:对联营企业和合营企业的投资收益

0.0074

0.0086

三、营业利润

0.1792

0.2038

营业外收入

0.0009

0.0014

营业外支出

0.0007

0.0008

非流动资产处置损失

6820070

6068870

0.0001

0.0001

4.写出分析报告。

万科公司2011年利润表分析

趋势分析

Page 20

趋势分析

07年 营 业 收 入 35,526,611, 301.94 08年 09年 10年 11年

40,991,77 48,881,013,14 50,713,851,4 71,782,749,8 9,214.96 3.49 42.63 00.68

营 业 总 成 本

28,059,491,7 34855663 41122442525. 288.39 36 14.41

万科公司利润表分析

第六组

分析构架

3 1

2 3 4 5 企业基本概况 结构分析 比率分析 趋势分析 分析问题及改进方法

P 3

企业基本概况

上市公司:万科 1984年成立于中国深圳,从事进出口业务 。 1991年通过公开竞拍土地,进入上海房地产市场, 开始跨地域发展。

结构分析

对共同比利润表的分析

企业2009、2010、2011年度营业利润占营业收入的比重分别为 17.77%,23.45%,21.96%;10年度比09年度增长5.69%,但11年度比 10年度下降1.5%;2009、2010、2011年度利润总额构成比分别是 17.63%,23.55%,22.02%;10年度比09年度增长5.92%,11年度比10年 度下降1.53%;2010年度净利润比2009年上升4.28%,11年度比10年度 下降1.27%。 该企业在2011和2010年营业利润占营业收入的比重较之2009年都有 上升,但是2010年比2011年的比例出现了下降,具分析主要是2011年营 业总收入较2010年的增长比约为41.55%,而总成本的增长比约为 43.29%所导致其2011年营业利润的下降。而总成本的主要增长原因是营 业成本的增长所致,其期间成本还略有下降。 由于营业利润的下降,其利润总额,2011和2010虽然都比2009年高, 但2011年的利润总额低于2010年近1个百分点。其净利润也受营业成本 影响,其2011年的净利润还是低于2010年的净利润。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Vanke's profit statement2011 2010 2009 % %Gross revenue 71,782,749,800.6 50,713,851,442. 48,881,013,143. 0.42 0.04 operating cost 56,716,379,546.6 39,581,842,880.9 41,122,442,525. 0.43 -0.04 operating cost 43,228,163,602.1 30,073,495,231.1 34,514,717,705. 0.44 -0.13 Business tax andadditional 7,778,786,086.49 5,624,108,804.74 3,602,580,351. 0.38 0.56 Sales cost 2,556,775,062.26 2,079,092,848.94 1,513,716,869.3 0.23 0.37 Management 2,578,214,642.30 1,846,369,257.59 1,441,986,772.2 0.40 0.28 Finance costs 509,812,978.62 504,227,742.57 573,680,423.04 0.01 -0.12 Assetimpairment loss 64,627,174.84 (545,451,004.) (524,239,596.) -1.12 0.04 Add:losses onthe changesin the fairprice (2,868,565.33) (15,054,493.43) 2,435,350.77 -0.18 -7.18 Return oninvestment 699,715,008.48 777,931,240.02 924,076,829.10 -0.10 -0.16 Investments inassociatedenterprises andjoint ventures 643,987,754.62 291,703,045.44 541,860,864.681.21 -0.46Operating profit 15,763,216,697. 11,894,885,308.2 8,685,082,798.0 0.33 0.37 Add:non-operatingincome 76,186,678.42 71,727,162.82 70,678,786.74 0.06 0.01 Reduction:non-businessexpenses 33,520,955.29 25,859,892.03 138,333,776.6 0.30 -0.81 Disposal ofnon-currentassets loss 1,144,283.45 1,211,776.17 1,577,638.38 -0.06 -0.23 The total profit 15,805,882,420.3 11,940,752,579. 8,617,427,808.0 0.32 0.39 Reduction: theincome taxexpenses 4,206,276,208.55 3,101,142,073.98 2,187,420,269.4 0.36 0.42 Net profit 11,599,606,211.7 8,839,610,505.04 6,430,007,538. 0.31 0.37 Owner's netprofit attributableto parentcompany 9,624,875,268.23 7,283,127,039.15 5,329,737,727.0 0.32 0.37 Minority interests 1,974,730,943.54 1,556,483,465.89 1,100,269,811. 0.27 0.41Earnings per shareBasic earningsper share 0.88 0.66 0.480.33 0.38Dilutedearnings pershare 0.88 0.66 0.480.33 0.38Othercomprehensiveincome 183,017,341.02 6,577,300.53 62,370,848.23 26.83 -0.89 Totalcomprehensiveincome 11,782,623,552.7 8,846,187,805.57 6,492,378,386. 0.33 0.36 The total amountofcomprehensiveincome belongsto parentcompany owners9,807,892,609.25 7,289,704,339.68 5,392,108,575.0.35 0.35Total comprehensive income attributable tothe minorityshareholders1,974,730,943.54 1,556,483,465.89 1,100,269,811.60.27 0.41Analysis of total operating revenue: main business is real estate and property management, in which the real estate revenue accounted for about 98% years, 09-11 has been in a rising state, 11 years compared with 10 years of growth in terms of a sales structure from 42% companies to disclose their mainly in Beijing and the Guangzhou region caused by the extension of real estate business. Description of the main business advantages, continue to expand market share, is a very rare but also in the macro environment is not good situation of sustained high growth,Analysis of total operating costs: 11 years compared with 10 years grew 43% except for the 11 years the company business growth and material cost increases and rising wages, increase of 40% combined statements can know the rise cost management is mainly due to the rise of corporate executive compensation from the management cost is 10 years.Profit analysis: from the table we can see that, in operating profit in 2011 than in 2010 increased by 3868300000, a growth rate of 32.50%, increase in operating profit was mainly due to an increase in operating income, and the financial cost of relative income savings. Changes in financial costs during the period of no with significant growth in operating income and the corresponding increase, its growth rate is very small, the growth rate of 1.10%, compared to last year, basically unchanged, the reason from the financialcost of the table can be seen, a sharp lower interest payments fall, there is one capital the increase of expenditure.Sales cost analysis: from the completion of sales cost analysis table can be seen, the cost of sales than last year increased by 477682213 yuan, a growth rate of 22.98%. The main reason sales cost changes: one is the brand marketing and promotion expenses have bigger growth, an increase of 31.71% over the previous year, followed by other changes, an increase of 32.29% over the previous year. At the same time, from the structure proportion, each share is relatively uniform sales expenses.Net profit analysis: net profit is the owner of the enterprise achieve financial results for the owners, or distribution or use of financial results. In 2011 net profit growth of 2759990000 in 2010, a growth rate of 31.20%, net profit growth is due to a total profit growth, two is due to the fact that the income tax of pay growth.As can be seen from the table of the financial results.Operating profit accounted for revenues accounted for 21.96%, relatively on year drop 1.50%. Constitute the total profit for the year is 22.02%, relatively on year fell 1.53%; constitute a net profit for the year is 16.16%, relatively on year drop 1.27%. Visible from the enterprise profit structure, profitability relatively on year drop.The cash flow statement2011年2010年2009年Business activities generated cashflowSelling goods, providing labor10,364,900.00 8,811,970. 5,759,530.00 services received cashOther related to business activities of689,467.00 297,605.00 188,979.00 cash receivedOperating activities cash inflow11,054,400.00 9,109,570. 5,948,510.00 subtotalsTo purchase goods, accept labor pay8,491,820.00 6,664,590. 3,456,020.00 in cashPayment to workers and cash to pay248,085.00 184,883.00 119,752.00for the workerPay the various taxes and fees1,469,810.00 938,158.00 653,731.00Other related to business activities of505,690.00 1,098,220. 793,673.00 cash paymentOperating activities cash outflows 10,715,400.00 8,885,850. 5,023,180.00subtotalsOperating activities net cash flow338,942.00 223,726.00 925,335.00 Investment activities generated cash0.00 0.00 0.00flow:Withdraw cash received by the20,789.40 28,245.40 21,042.20 investmentObtain investment income received in1,875.80 36,776.90 39,206.00 cashThe disposal of fixed assets,111.58 46.22 14,245.10 intangible assets and other long-termassets net back by cashNet disposal subsidiary and other0.00 1,717.92 11,916.50 business units to receive cashCash received from the other relating63,760.20 203,286.00 30,471.40to investment activitiesInvestment activities cash flow into86,537.00 270,072.00 116,881.00 the subtotalAnd construction of fixed assets,intangible assets and other long-term26,156.10 26,193.90 80,606.20assets that pay cashPay in cash by the investment119,507.00 218,385.0 157,747.00In net cash on the subsidiary and407,584.00 136,406.0 297,594.00 other business unitsOther related to investment activities98,546.60 108,254.0 0.00cash paymentInvestment activities cash outflows651,794.00 489,238. 535,947.00 subtotalsNet investment activities generated-565,257.00 -219,166. -419,066.00 cash flowFinancing activities generated cash0.00 0.00 0.00flow:Absorb the investment cash received390,494.00 197,902. 82,908.50Minority shareholders investment390,494.00 197,902. 82,908.50 subsidiary received in cashBorrow money received in cash2,357,460.00 2,707,010 2,073,150.00Issue bonds receive cash0.00 0.00 0.00Financing activities of cash inflows2,747,950.00 2,904,910 2,156,060.00 subtotalsPay cash to repay the debt1,997,460.00 1,198,540 2,164,050.00Distribution of dividends, profits, or669,805.00 403,921. 294,875.00 meet the interest paid in cashMinority shareholders investment142,645.00 63,854.10 12,763.40 subsidiary received in cashSubtotal financing activities of cashoutflow2,667,270.00 1,602,460 2,458,930.00 The net cash flow generated byfinancing activities80,685.80 1,302,450 -302,866.00 The net cash flow generated byfinancing activities-2,653.90 2,403.46 -954.65Net increase in cash and cashequivalents-148,282.00 1,309,420 202,449.00 Add: the beginning balance of cashand cash equivalents3,509,690.00 2,200,280 1,997,830.00 Add: the beginning balance of cashand cash equivalents3,361,410.00 3,509,690 2,200,280.00From the table, you can see that the company's cash flow structure, the business activities of cash inflows, the biggest and continuous rise in nearly three years, to 79.59% in 2011.Investment activities cash flow ratio showed a trend of fluctuations, respectively in 2010 reached 2.20%, fell to 0.62% in 2011. Financing activities of cash inflows in recent years continued to decline, from 26.22% in 2009 to 19.79% in 2011. Company business income increased year after year, gradually reduce dependence on the financing activities of cash inflows, reflects the good development momentum.Operating activities cash flow ratio between 2009 and 2010 have larger growth peak of 80.95% in 2010, a slight drop in 2011, the proportion of investment activities cash flow in recent years continuous slightly decreased, and financing activities of cash outflow rate from 2009 to 2010, a larger decline, to 30.67% in 2009, 2010, that proportion fell rapidly, modest growth in 2011, the company in recent years business promotion activities in cash to a certain extent, reduce the investment, the company's business.The balance sheet2011-12-31 2010-12-31 2009-12-31The amount % The amount% Theamount%Monetaryfunds3423951 11.5 3781693 17.5 2300192 16.7Accountsreceivable2974581 10.0 1692377 7.8 713,19 0.5Theinventory20833549 70.3 13333345 61.8 9008529 65.4 Currentassets282,646,65 95.4 20552073 95.3 13032327 94.7 Total assets296,208,44 21563755 13760855Analysis of the overall situation of the corporate balance sheets. Assets Overall, the total assets of the enterprise to a higher growth rate continued to grow, you can see from the figure, Vanke asset size of the overall upward trend since 2009, 2009,2010 and 2011, respectively, an increase of 15.41% , 56.70% and 37.36%, total assets increased for the following reasons: current assets 7,712,600.00 million increase over 2010, the long-term equity investment growth 193,274.00 million, fixed assets of 37,628.00 million, an increase of $ 113,598.00 million in other long-term assets; among which the current assets increased by 37.53%, 43.01% increase in long-term equity investment, an increase of 771.76% investment real estate, fixed assets increased by 30.85%.Total assets in non-current assets 13,561,785,174.86, mainly for long-term equity investment; current assets 282,646,654,855.19 inventory 208,335,493,569.16 visible accounted for 73.7% of the current assets Current assets Inventories accounted for a large proportion of very unfavorable for the funds flow.The net profit increase in nearly three years, show that vanke's profit ability have improved, but on the macro economy will have such a good operating performance, and in the same industry in a leading position, fully explain profit quality is good.In terms of cash flow situation. from 2010 in 2011, although monetary fund has decreased but that is largely because the government strengthen the regulation of real estate, the difficulty is increased in the period in the whole business process, especially the implementation of the restrictions, in terms of cash flow brought a heavy burden to the real estate industry, combined with the above mentioned and compared to peers, poly gold base can be out of the conclusion, cash flow quality is better.In terms of asset quality, as a result of the macroeconomic policy influence the real estate industry asset of the severely affected, and, in turn, affect the cash flow, the performance for the great amount of inventory on the balance sheet, in terms of assets structure of enterprises has strong ability of debt than in the same industry.。