外文翻译模板(1)

外文文献翻译模板

外文文献翻译模板广东工业大学华立学院本科毕业设计(论文)外文参考文献译文及原文系部管理学部专业人力资源管理年级 2008级班级名称 08人力资源管理1班学号 150********学生姓名王凯琪指导教师2012年 5 月目录1 外文文献译文 (1)2 外文文献原文 (9)德国企业中老化的劳动力和人力资源管理的挑战本文的主要目的就是提供一个强加于德国公司的人力资源管理政策上的人口变化主要挑战的概况。

尽管更多方面的业务受到人口改变的影响,例如消费的改变或储蓄和投资,还有资金的花费,我们把注意力集中劳动力老龄化促使人事政策的变化上。

涉及广泛的人力资源管理政策,以有关进行创新和技术变化的招募问题为开端。

1 老化的劳动力及人力资源管理由于人口的变化,公司劳动力的平均年龄在未来将会更年长。

因此,劳动力高于50的年龄结构占主导地位的集团不再是一个例外,并将成为一个制度。

在此背景下,年长的工人的实际份额,以及最优份额,部分是由企业特征的差异加上外在因素决定的。

2 一般的挑战尽管增加公众对未来人口转型带来的各种挑战的意识,公司对于由一个老化劳动力引起的问题的意识仍然是相当低的。

事实上,只有25%的公司预计人口统计的变化在长远发展看来将会导致严重的问题。

然而,现在越来越多关于老化劳动力呈现的挑战和潜在的解决方案的文献。

布施提出了一种分析老员工一般能力的研究文集,并给出有关于年长工人的人力资源政策的实例。

目前,华希特和萨里提出一篇关于研究公司对于提前退休的态度和延长工作生涯的态度的论文。

在这些研究中,老员工的能力通常被认为是不同的,并不逊色,同时指出一个最优的劳动力取决于不同的公司的特殊要求。

一般来说,然而由于越来越缺少合格的员工,人口统计的变化将使得在各种人事政策方面上的压力逐渐增加。

特别是,没有内部人力资源部门的中小型企业,因此缺乏足够的特殊的基础设施,则面临着严峻的挑战。

与他们正常的大约两到五年的计划水平相反,他们将越来越多地要处理长期的个人问题和计划。

外文翻译模板

Rigid-flexible and economic - on the Beijing-controlled regulation block level awareness and considerAbstract: The article, through the traditional regulatory detailed planning analysis, pointing out that the planning results difficult to translate into public policy planning and management, in the face of a lack of adaptability to changes in the market can not be directly related to macroeconomic issues such as convergence planning. Then put forward in recent years through the Beijing neighborhood-level case-control regulatory interpretation, introduction and analysis, study the preparation of district level (2-3 square unit) of the control regulation in response to the traditional regulatory control problem often encountered when has the advantage and flexibility, in particular, to highlight it for the planning and management department can provide a new tool for management and coordination and more flexible to deal with complex changes in the market diversity, the protection of the Government of the characteristics of public service functions. Finally, the future also need to block-level control regulation of the legal status of the application of planning and management tools, the traditional elements of space control and guide and so on to conduct in-depth study and discussion.Key words: block-control regulations controlling the detailed planning of rigid and flexible planning1.Traditional control regulations in the preparation of the practical problems facingTraditional regulatory plan, since the emergence of the last century 90's has been in the interests of all of the game and balance problems are. The crux of the matter focused on how to coordinate the planning required to manage the rigid control and flexible response to market adaptability on:1.1Traditional regulatory control can not fully reflect the transformation of government functionsTraditional regulatory control can only be a direct reflection of the general land development and construction of the nature and intensity, as well as the embodiment of city space environment harmonization and unification of the core concerns are space andvision on the aesthetic effect, planners through a series of indicators to determine spatial form of land control. This form at all-fit-oriented government under the guidance of implementation, "a chess city" in the development and construction.With the deepening of reform, the government functions under the planned economic system by the all-around type to a service-oriented transformation of the functions of the Government focuses on government control and the provision of public services two aspects: First, we must deal with social activities in the various questions, function of maintaining social stability and order; two social development is to provide the necessary public goods, in particular, the market can not afford or are unwilling to provide public goods. At city-building, more and more real estate enterprises and industrial enterprises have become the mainstay of city development and construction, more and more with the right to speak, when the government must release the necessary permissions in order to play the role of market mechanisms, while at the same time be able to achieve maintaining the social function of stability, and ensure the supply of public goods, needed to reflect the Government represented by the maximization of public interest, this is not the original space-based content-control regulations can be reflected.1.2Traditional regulatory control results to the transformation of public policy have a considerable gapCity planning as a public policy, determined at the overall planning of urban and rural spatial distribution, the city's public resources to conduct an effective configuration of the living environment to make the corresponding request, the need for further construction of the city to conduct a comprehensive coordination, guidance and restraint, and made available to the management of the Town Planning Department of a management tool. Traditional control regulations although the preparation of a comprehensive set of control indicators and measures, but because of its factual findings to the block-type control chart is provided in the form of a lack of overall balance is always the aspect as well as the flexibility to respond to changes in the market.Common situation is: immediately after the recent construction sites will have to put in complicated and ever-changing market situation, often want to change the nature of the land, improve the rate of volume and height, adjust the layout of such request, then the planning and management department, the general Choose only the traditional outcome ofoutside regulatory control, through the block, the conditions for the demonstration, the addition of a planning conditions change and audited proof aspect, from the audited results, because of the lack of adequate planning at the restrictive conditions, improve lot of floor area ratio, a high degree of planning control to adjust the conditions of application can only "successfully" through. A lot of planning and management department have met with a similar dilemma: developer proposed to control the regulation of a plot to determine floor area ratio from 1.5 to 1.8 adjust, whether it is technically from the planning or management of policy, can not find the reasons for denying the application, and if these separate plots look all passed, up from the overall regulatory control is equivalent to waste a still, "there is no space under the management of poor-control regulation has been hard to manage."1.3 Changing market demand in the face of too rigidAccording to regulations covering the preparation of full-control regulation, in the face of long-term with no fixed pattern of development and development of the main city of the new area, can only rely on the experience and the limited regulatory requirements to set a blueprint for the ultimate, often required the assumption that the area will attract What is the nature of the industry, and what mode of transportation and living elements and so on. Often wait until the need to implement when the city-building mechanisms have taken place in very many changes in the main body of investment, development patterns, construction and operation of regional mechanisms and so on with the original planning assumptions are inconsistent, industry, transport, mode of living have been Ultra-out the original, this time charged with the regulation already completed will become very out of date.1.4 Upper face of the macro-planning difficult docking requirementsOverall planning in order to meet the needs of urban and rural economic and social comprehensive, coordinated and sustainable development requirements, tend to make some macro measures such as content development model. These property with public policy measures, in order to land for the purpose of the traditional regulatory control it is difficult to fully reflect and docking. Beijing Daxing Metro as an example:In accordance with the "Beijing Urban Master Plan (2004 -2020 years)", Daxing Beijing Metro are the future-oriented regional development important node, in Beijing, the development of an extremely important strategic position, will guide the development ofbiological medicine, modern manufacturing, as well as commercial logistics, culture, education and other functions, are carrying the future city of Beijing to ease the population centers and functions of one of 11 Metro. 2020 Metro style scale land use planning 65 square kilometers, population 600,000 people scale.Prior to this, as are Beijing's Daxing county, to carry out the construction of satellite towns, the status quo conditions and Metro Planning has a larger gap between the objectives, the lack of sufficiently attractive to the urban areas can not effectively alleviate the stress. For instance: the lack of public facilities, facilities standards have been too low, with the center city poor transport links and so on. How to achieve the status quo to the Metro from the blueprint for change? At "Daxing Metro Planning (2005 -2020 years)" from the Metro's construction to start the implementation process, identified through the construction of rail transit, urban road construction, public service facilities, the transfer of administrative functions, cultural and educational function of the introduction of the introduction of leading industries six elements of the main construction of the Metro guide: the role of these elements together, and based on their spatial characteristics influence the scope and timing on reasonable arrangements to promote the development of Metro's construction, so that Metro be able to at the planning blueprint for the status quo gradually on the foundation can be achieved.Epistasis plans face similar macro-planning requirements, is clearly not a specific plot plan can be fully reflected in, let alone to cope with up to 15 years in the planning of the implementation process of various elements of the Change.2. Block-level regulatory control of the preparation of the contents of the formIn recent years, Beijing made the preparation of block-level control rules to deal with from a certain extent on the traditional block-control regulations that prevail in question. Metro style neighborhoods to control regulation as an example:First of all, divided into blocks. At "Daxing Metro Planning (2005 -2020 years)" the division of seven patches, three groups on the basis of the General consider regional characteristics, the layout of public service facilities, municipal service capacity transport facilities and space environmental capacity and other influencing factors to the Neighborhood (between block and block units, with a river, natural obstacles, primary and secondary roads, street boundaries offices, special function areas such as border Kaifongboundary) for the division of units, divided into 38 blocks , each block 2 ~ 3 square kilometers.Then, in the Metro to determine the scope of the whole block of lead, construction and classification of the total construction scale, construction baseline height, strength of construction elements of the scope. Metro based planning, decomposition of the implementation of the dominant features of each block, that is blocks the function of positioning and the main direction of development to determine the largest block of land and has assumed a leading role in the nature of the land; from the overall economic strength and functions of the positioning of a comprehensive traffic capacity, public facilities Service capacity, municipal facilities, service capabilities, the capacity of the space environment in five aspects, such as integrated carrying capacity analysis, will be Metro's 600,000 population overall refinement scale decomposition to the block level, and to determine the total amount of block construction and classification of scale construction; in accordance with the Metro morphological characteristics of the overall space to determine the building height control framework and four baseline height, divided into low (18 m), Medium (18-45 meter), high (45-60 m) and 60 meters above 4, the implementation of each blocks range of benchmarks; to improve the living environment in accordance with the overall goals and other conditions, strength of construction will be divided into blocks of low-density, medium density, high-density third gear.And, through a comprehensive analysis of the status quo, implement the above decomposition of the conditions, separately for each block to determine the nature and scale, the configuration of the facilities and arrangements, a high degree of control elements, such as urban design, implementation timing, but also questions the need for further research, etc. specific content, which will eventually block the plans submitted in the form of results.3.1Effective extension of epistatic planning, for planning and management to facilitateTo block as a unit, decomposition and quantify the epistatic planning functions and development goals, and clearly the general character of each neighborhood and the development of intensity differences, in fact this job is to regulate, such as the total epistatic to quantify the macro-planning process. To block as a unit for total control andbalance, ease of basic facilities at all levels, public service facilities, urban safety facilities, transportation facilities, to conduct an overall balanced layout, more conducive to neighborhoods as a unit for analysis and monitoring. Beijing have been identified as a further refinement put blocks of land plots to control the minimum regulatory scope of the study and city planning and management of the basic unit.Dominant in determining the neighborhood function, construction and classification of the total construction scale, construction baseline height, strength of construction scope of the facilities after the configuration of such factors, whether developers are still at all levels of government to entrust the preparation of land-control regulations, planning and management departments have a strong public policy based on quantifiable and can be used to guide and monitor the preparation of regulatory control block content, can ensure the configuration of the various facilities such as the contents of rigidity to the implementation, but also be able to through the overall control and strength to the block classification must control regulations left behind the flexibility of space.3.2 Responding flexibly to market changesBlock-level control regulations after wide coverage, its construction and classification of the total construction scale of indicators as the preparation of the detailed planning of the next level of control conditions, the guidance of land development and construction of concrete blocks at the scope of activities carried out within the overall balance. Block unit through the benchmark land prices, ownership, facilities, supply capacity factors such as a comprehensive assessment can be reflected to some extent on location, infrastructure conditions, such as market-sensitive elements on the differences in regulatory control in the preparation of land, they can further study the market demand effectively adjust to allow the market to be able to in the government's macro-control of the allocation of resources to play its basic role.At the same time, district-level planning at the preparation of regulatory control after the completion of the management of the implementation process can also be quantified using a variety of control means to effectively deal with changes in the market. To floor area ratio as an example, at district level because of regulatory control, the set up of the neighborhood's population and the total construction volume of construction and classification of the concept of a land plot development and construction are necessary toadjust the strength of blocks related to the total changes and changes in the demand for associated facilities, so that at least from the district coordination framework to achieve the purpose of breaking the individual review of the original plot to control the lack of indicators adjust based on the embarrassment, from the process reflects on the changes in construction activity the surrounding urban environment brought about by the impact. On this basis, the study implemented a similar "transfer of development rights" of the administrative system before operational.3.3Highlight the protection of the Government's public service functionsBlock-level control regulations, all land classified as Class A land (for the city to provide basic support and services) and Class B land (Government under the guidance of the market development of land), as well as X-type sites (sites to be studied) three categories. One of, A-type sites are the main green space, infrastructure, public service facilities, etc. must have a public property, mainly by the Government as an investment and management entities of the public space, its emphasis on the priority the implementation of space, thereby protecting the public interest priority . Comparatively speaking, the original concern of the traditional regulatory control elements at street level space of the controlled regulation of "take a back seat," the.4.Also necessary to further explore the question:In general, block-level regulatory control to add a meso-level studies, preparation of regulatory control block provides a fresh discussion of the work platform, as well as planning and management provided some actionable public policy basis for improved traditional regulatory control of some problems. However, block-level control regulation as a new thing also have a number of issues need to be further explored and research:First of all, the necessary clarity of its legal status and recognition. Because ofblock-level control is a regulation relating to a variety of factors (population, the facilities and so on) the overall balance of technological achievements, in particular, are some of the priority the protection of the facilities involved in city construction and operation of other government departments, administrative actions, a reasonable decide the legal status of its coordination and control of the key. Moreover, as the capital of Beijing and municipalities, and other city planning and construction management system must have differences in this municipality in Beijing can well-established system should not be able to copy to the cityin general go. How to promote neighborhood-level control regulatory experience gained enhance the legitimacy of its reasonable, but also required further study.Secondly, the required supporting management measures on the corresponding.Block-level control regulation is not only a many-level planning so easy that it give planning and management in the overall planning and control regulation of traditional land between the development of a new management platform, therefore, should give full play to its role, from the can not be supporting the planning and management measures on innovation. Such as in the control plots on the regulation of convergence can be the implementation process for some of the demand, derived from "transfer of development rights" and other related management measures and control means.Finally, the traditional elements of how the matching Spaces guide. Block-level control regulations to strengthen the government's public service functions, improve the public benefits of priority, relatively speaking, the traditional elements of the shape is relatively weakened. Visual imagery, body mass, Feel places the elements of these traditional control regulations usually take into account urban design elements, not at street level regulatory control to be reflected, then the block-level control regulations should be space elements which control what should be done about the city on the block level design elements to guide them accordingly? Looking forward to the future as soon as possible answers to those questions.References1, Beijing City Master Plan (2004 -2020 years)2, Tai Hing Metro Planning (2005 -2020 years)3, Tai Hing New regulatory plan (block level) .2007 years4, WEN Zong-yong. Control the underlying causes of regulatory changes and countermeasures. Beijing plans to build 2007 (5) :11-135, Yang Chun. Beijing City Center, the preparation and implementation of regulatory control of the background. Beijing plans to build 2007 (5) :14-156, Yang Jun, Yang Ziming. Beijing-controlled regulation of 1999-2006. Beijing plans to build 2007 (5) :37-407,Guohui Cheng,Li Shi, HUANG Jie. Rigid-flexible and relief: for controlling theoperation of the detailed planning. Town Planning .2007 (7) :77-808, Lin audience. Public Management from the Perspective of the adaptive control consider the detailed planning. Planners .2007 (4) :71-749, Wang Yin, Jun Chen. "Sharpen come true" - Interpretation of the Beijing Municipal Area "Control Regulation", prepared yesterday and today .. Beijing plans to build .2007 (5) :23-2610, Lan Zhou, Ye Bin, Xu Yao. Explore the detailed planning of the management control system architecture. .2007 City planning (3) :14-1911, Li Tian. Our country controlled detailed planning and a way out of confusion. .2007 City planning (1) :16-2012, city planning approach to make People's Republic of China Ministry of Construction No. 146 2005-12-31刚柔并济——对北京街区层面控规的认识与思考摘要文章通过对传统的控制性详细规划进行分析,指出规划成果难以转化为规划管理的公共政策、面对市场变化缺乏应变能力、无法直接与宏观规划衔接等问题。

毕业论文外文翻译格式【范本模板】

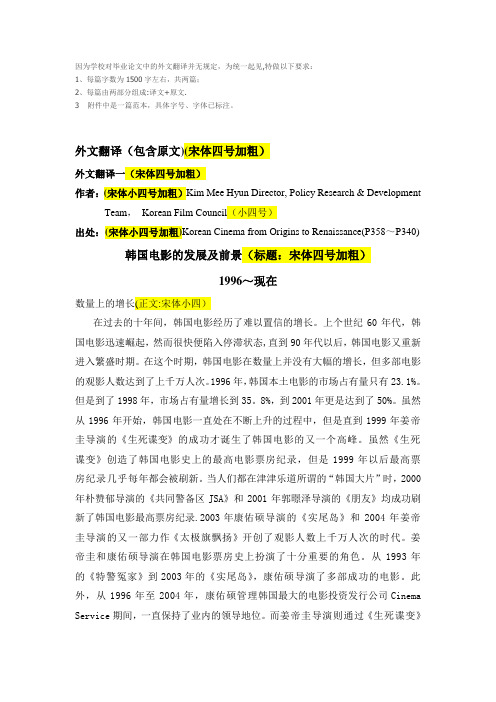

因为学校对毕业论文中的外文翻译并无规定,为统一起见,特做以下要求:1、每篇字数为1500字左右,共两篇;2、每篇由两部分组成:译文+原文.3 附件中是一篇范本,具体字号、字体已标注。

外文翻译(包含原文)(宋体四号加粗)外文翻译一(宋体四号加粗)作者:(宋体小四号加粗)Kim Mee Hyun Director, Policy Research & Development Team,Korean Film Council(小四号)出处:(宋体小四号加粗)Korean Cinema from Origins to Renaissance(P358~P340) 韩国电影的发展及前景(标题:宋体四号加粗)1996~现在数量上的增长(正文:宋体小四)在过去的十年间,韩国电影经历了难以置信的增长。

上个世纪60年代,韩国电影迅速崛起,然而很快便陷入停滞状态,直到90年代以后,韩国电影又重新进入繁盛时期。

在这个时期,韩国电影在数量上并没有大幅的增长,但多部电影的观影人数达到了上千万人次。

1996年,韩国本土电影的市场占有量只有23.1%。

但是到了1998年,市场占有量增长到35。

8%,到2001年更是达到了50%。

虽然从1996年开始,韩国电影一直处在不断上升的过程中,但是直到1999年姜帝圭导演的《生死谍变》的成功才诞生了韩国电影的又一个高峰。

虽然《生死谍变》创造了韩国电影史上的最高电影票房纪录,但是1999年以后最高票房纪录几乎每年都会被刷新。

当人们都在津津乐道所谓的“韩国大片”时,2000年朴赞郁导演的《共同警备区JSA》和2001年郭暻泽导演的《朋友》均成功刷新了韩国电影最高票房纪录.2003年康佑硕导演的《实尾岛》和2004年姜帝圭导演的又一部力作《太极旗飘扬》开创了观影人数上千万人次的时代。

姜帝圭和康佑硕导演在韩国电影票房史上扮演了十分重要的角色。

从1993年的《特警冤家》到2003年的《实尾岛》,康佑硕导演了多部成功的电影。

外文文献翻译(图片版)

本科毕业论文外文参考文献译文及原文学院经济与贸易学院专业经济学(贸易方向)年级班别2007级 1 班学号3207004154学生姓名欧阳倩指导教师童雪晖2010 年 6 月 3 日目录1 外文文献译文(一)中国银行业的改革和盈利能力(第1、2、4部分) (1)2 外文文献原文(一)CHINA’S BANKING REFORM AND PROFITABILITY(Part 1、2、4) (9)1概述世界银行(1997年)曾声称,中国的金融业是其经济的软肋。

当一国的经济增长的可持续性岌岌可危的时候,金融业的改革一直被认为是提高资金使用效率和消费型经济增长重新走向平衡的必要(Lardy,1998年,Prasad,2007年)。

事实上,不久前,中国的国有银行被视为“技术上破产”,它们的生存需要依靠充裕的国家流动资金。

但是,在银行改革开展以来,最近,强劲的盈利能力已恢复到国有商业银行的水平。

但自从中国的国有银行在不久之前已经走上了改革的道路,它可能过早宣布银行业的改革尚未取得完全的胜利。

此外,其坚实的财务表现虽然强劲,但不可持续增长。

随着经济增长在2008年全球经济衰退得带动下已经开始软化,银行预计将在一个比以前更加困难的经济形势下探索。

本文的目的不是要评价银行业改革对银行业绩的影响,这在一个完整的信贷周期后更好解决。

相反,我们的目标是通过审查改革的进展和银行改革战略,并分析其近期改革后的强劲的财务表现,但是这不能完全从迄今所进行的改革努力分离。

本文有三个部分。

在第二节中,我们回顾了中国的大型国有银行改革的战略,以及其执行情况,这是中国银行业改革的主要目标。

第三节中分析了2007年的财务表现集中在那些在市场上拥有浮动股份的四大国有商业银行:中国工商银行(工商银行),中国建设银行(建行),对中国银行(中银)和交通银行(交通银行)。

引人注目的是中国农业银行,它仍然处于重组上市过程中得适当时候的后期。

第四节总结一个对银行绩效评估。

(范例)外文翻译格式

本科毕业设计(论文)外文翻译译文学生姓名:院(系):经济管理学院专业班级:市场营销0301班指导教师:完成日期:2007年3 月22 日日本的分销渠道——对于进入日本市场的挑战与机会Distribution Channels in JapanChallenges and Opportunities for theJapanese Market Entry作者:Hokey Min起止页码:P22-35出版日期(期刊号):0960-0035出版单位:MCB Univercity Press外文翻译译文:介绍尽管美国对日本的出口在过去两年已有大幅度的增长,然而美国对日本仍然存在着很大的贸易赤字。

尽管没有出现下降趋势,但越来越多的美国决策者及商务经理已经开始审查日本的贸易活动。

在这些人中,有一个很普遍的想法就是日本市场没有对美国产品开放,相反,美国市场对日本的贸易是开放的。

因此,克林顿政府试图采取强硬措施来反对日本的一系列贸易活动,包括商业习惯和政府政策,还企图通过贸易制裁的威胁来反对日本产品。

然而,这样的措施也会产生适得其反的结果。

它不仅会为美国消费者带来更高的商品价格和更少的商品选择,同时也会增加日本消费者的反美情绪。

最近Ginkota和Kotabe的调查表明:单独的贸易谈判不会提高美国商品进入日本市场的能力。

而对于提高美国公司进入日本市场能力的一个行之有效的方法就是研究日本近几个世纪以来所采用的商业活动。

由于法律障碍或者是日本公司对外封锁商业渠道,日本当地的分销渠道往往对外国公司不利,而这样的商业活动被认为是进入日本市场的主要障碍。

事实上,Yamawaki美国商品成功出口到日本市场在很大程度上取决于美国解决协议合同的能力。

尽管进入日本市场意义重大,然而对西方人而言,日本的经销体系经常会被人误以为是充满神秘感的。

这种误解源于日本复杂的分销惯例特征。

而这种分销惯例沿袭古老的而又严谨的建设体系。

在尝试美国贸易在日本市场成功获利减少不必要的贸易冲突过程中,我们揭露了日本分销中获利的事实,探索出了能成功进入日本市场的战略性武器。

南邮外文翻译一范例

南京邮电大学毕业设计(论文)外文资料翻译学院(系):经济与管理学院专业:学生姓名:班级学号:外文出处:Journal of Occupational Psychology,1977, Vol.50附件:1.外文资料翻译译文;2.外文原文附件:1.外文资料翻译译文重新评估工作满意度和工作生活质量——詹姆斯.C.泰勒有用的工作满意度的措施在评估工作的特点以及改善工作生活质量中是有问题的。

根据民意调查和组织调查显示,多年以来,虽然在高和稳定的工作满意度水平下,雇员的挫折感和异化迹象却一直在增加。

经过更密切的检查,这似是而非的调查导致的结论是:无论再严谨的工作满意度调查及测量,得到的只是修改工作和减少员工的挫折感方面的没必要的信息。

根据以往的经验以及对工作生活质量的研究表明,为了克服这个缺陷,在测量工作满意度的时候,雇员本身需要更多地参与测量。

工作满意度已经成为一个模糊不清的尴尬概念。

许多代表着工业人文主义利益的社会科学调查员都对工作满意度十分有兴趣,他们建议要去关注和改善人与职位的关系,提高工作满意度。

从20世纪30年代开始,这种关注已经从制造业扩展到服务和文职部门。

然而,我们可以断言,大部分对工作满意度的研究都无法仅通过对工作及工作本身的研究。

历史上曾经有过对工作满意度的研究,这或许可以支持或者攻击现状,这种趋势还将继续下去。

尴尬的是,在对美国雇员的工作满意度的继续调查研究中,用极高的百分比来衡量他们工作的满意程度,而在同一时间内降低对工人的承诺,雇员所表达的通过增加缺勤率(特别是部分周缺勤),罢工(因其他原因除了工资)而拒绝谈判达成的合同以及破坏产品的比率显然变得更大。

雇员异化的这些问题已经提起公众的注意,但是如果公众关注继续增长,为什么雇员安静的绝望与工作越来越被看作是与压力之间的和解,这些事实和精心准备将使对工作满意度的严格调查成为必然。

前言本文的目的是在不减少抽样误差和防范反应的情况下,使用更精密的统计测试,在不同的模式下对满意度数据进行界定和衡量。

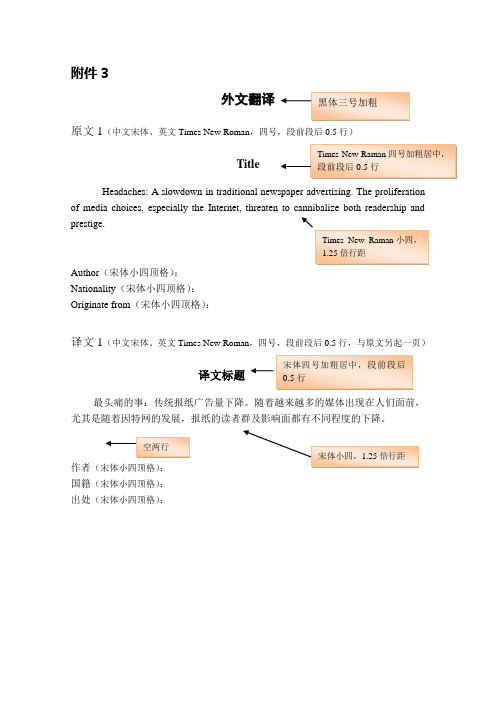

外文翻译格式

外文翻译原文1(中文宋体、英文Times New Roman Title of media choices, especially the Internet, prestige.Author (宋体小四顶格):Nationality (宋体小四顶格):Originate from (宋体小四顶格):译文1(中文宋体、英文Times New Roman译文标题作者国籍(宋体小四顶格):出处(宋体小四顶格):附件3外文翻译原文1Information technology capability and valueInformation technology (IT) has become an essential element of firm capability and a source of sustainable competitive advantage. Although it is widely accepted that IT resources contribute to performance and future growth potential of the firm, the empirical results of the relationship between IT capability and firm performance is still ambiguous [1,2]. The unavailability of publicly available data, the accelerated pace of IT innovation,the possible interactive effects betweenHypothesis 2 predicts that the relationship between human capital investment and firm performance will be positive and results from all the five models strongly support this hypothesis.Alternative Hypotheses 3A and 3B predict the possible interaction effects of IT capability and human capital investment on firm performance. Results from Models 1, 2 and 3 support Hypothesis 3B.……作者:Zorayda Ruth B.Andam国籍:菲律宾出处:Amercan Management Association译文1信息技术能力和价值创造:来自美国银行业的实证信息技术已成为企业能力的一个重要组成部分和可持续竞争优势的资源之一。

山东建筑大学本科毕业设计说明书外文文献及翻译格式模版1.doc

山东建筑大学本科毕业设计说明书外文文献及翻译格式模版1附件3:(本科毕业论文)文献、资料题目:院(部)专班姓名:张三学号:指导教师:张九光翻译日期:2005.6.30,the National Institute of Standards and Technology (NIST) has been working to develop a new encryption standard to keep government information secure .The organization is in the final stages of an open process of selecting one or more algorithms ,or data-scrambling formulas ,for the new Advanced Encryption Standard (AES) and plans to make adecision by late summer or early fall .The standard is slated to go into effect next year .AES is intended to be a stronger ,more efficient successor to Triple Data Encryption Standard (3DES),which replaced the aging DES ,which was cracked in less than three days in July 1998.“Until we have the AES ,3DES will still offer protection for years to come .So there is no need to immediately switch over ,”says Edward Roback ,acting chief of the computer security division at NIST and chairman of the AES selection committee .“What AES will offer is a more efficient algorithm .It will be a federal standard ,but it will be widely implemented in the IT community .”According to Roback ,efficiency of the proposed algorithms is measured by how fast they can encrypt and decrypt information ,how fast they can present an encryption key and how much information they can encrypt .The AES review committee is also looking at how much space the algorithm takes up on a chip and how much memory it requires .Roback says the selection of a more efficient AES will also result in cost savings and better use of resources .“DES w as designed for hardware implementations ,and we are now living in a world of much more efficient software ,and we have learned an awful lot about the design of algorithms ,”says Roback .“When you start multiplying this with the billions of implementations done daily ,the saving on overhead on the networks will be enormous .”……山东建筑大学毕业设计(或毕业论文,二选一)外文文献及译文- 1 -以确保政府的信息安全。

外文翻译1

The platform can be distributed using various networks, independent video collection point for networking,different industries providing a unified multi-regional access, distributed memory,hierarchical management, video consultations,multi-mode alarm,resouce sharing video monitoring service. A new generation of remote video monitoring system network is able to meet the operator requirements of multimedia value-added core business platform. It can bulid various modules and subsystems through operating-type video surveillance platform for buliding ,security-based video surveillance platform,the implementation of video surveillance system project。

Keyword video surveillance system ;system design ;platform access;service processIntroductionWith the county’s “ Green City ” project continue to rise ,increaseing The number of video surveillance systems。

外文翻译范例

外文翻译范例在全球化日益加深的今天,外文翻译的重要性愈发凸显。

无论是学术研究、商务交流,还是文化传播,准确而流畅的外文翻译都起着至关重要的桥梁作用。

下面为大家呈现几个不同领域的外文翻译范例,以帮助大家更好地理解和掌握外文翻译的技巧与要点。

一、科技文献翻译原文:The development of artificial intelligence has brought about revolutionary changes in various fields, such as healthcare, finance, and transportation译文:人工智能的发展给医疗保健、金融和交通运输等各个领域带来了革命性的变化。

在这个范例中,翻译准确地传达了原文的意思。

“artificial intelligence”被准确地翻译为“人工智能”,“revolutionary changes”翻译为“革命性的变化”,“various fields”翻译为“各个领域”,用词准确、贴切,符合科技文献严谨、客观的语言风格。

二、商务合同翻译原文:This Agreement shall commence on the effective date and shall continue in force for a period of five years, unless earlier terminated in accordance with the provisions herein译文:本协议自生效日起生效,并将持续有效五年,除非根据本协议的规定提前终止。

商务合同的翻译需要格外注重准确性和专业性。

上述译文中,“commence”翻译为“生效”,“in force”翻译为“有效”,“terminated”翻译为“终止”,清晰准确地表达了合同条款的含义,避免了可能的歧义。

三、文学作品翻译原文:The sun was setting, painting the sky with hues of orange and pink, as if nature were a master artist at work译文:太阳正在西沉,把天空涂成了橙色和粉色,仿佛大自然是一位正在创作的艺术大师。

外文翻译模板

西安欧亚学院本科毕业论文(设计)外文翻译译文学生姓名:蔡阳分院(系):信息工程学院专业班级:通信工程0701指导教师:赵雨完成日期:2011 年1 月5 日不能触碰这个—无线电力传输Can't Touch This—Wireless power transmission作者:Bill Weaver, Ph.D.起止页码:出版日期(期刊号):2006年10月25日出版单位:(以上文字用小4号宋体,数字、字母用Times New Roman体)外文翻译译文:几年前,一个同事和我参加在校大学生团体的一个老式的实地考察,考察地位于新泽西州的爱迪生国家历史遗址的西橙。

我们随公众参观,并参观了设置于建筑物内的实验室,了解了白炽灯灯泡和电影技术的发展。

然而,令我最感动的是其中的两个复杂的附加功能。

首先,是配备了当时美国专利局的所有出版物的研究图书馆。

科学家和工程师的代表关注到适销对路的产品可能会在创造新技术中有所用途。

大学是随之而来的发现科学技术的伟大场所,但爱迪生的实验室却是作为一个企业而存在的。

在 19 世纪后期是没有互联网连接的,因此,图书馆便担任起了实验室的信息存储库。

就像今天,当研究人员所需要的信息是有关于化学反应、一个数学公式或他们最先进的工程解决方案而咨询目前的文献一样,只不过当时是通过纸张。

第二个令人印象深刻的事情是生产和加工设施的复杂性。

创建工具,使新的工具催化技术的发展,是爱迪生实验室的一个创新过程的早期代表性的例子。

通过快速采用标准,进一步简化此过程。

由于工具和设备大部分可以在本地发展,便可以在数英亩大小的校园中部署自己的标准并创造该设施。

这种标准之一是权力分配的方法。

最终已知的电网发展供电是著名的爱迪生灯泡,早期的爱迪生实验室使用的工具是由一个通用线路轴组成的机器。

组成一个类似于后轮驱动汽车传动轴的长旋转轴或像是一个海洋船只的螺旋桨轴,使整个工厂的旋转的势能形式分散了锅炉产生的机械能。

外文资料翻译(模板)

毕业设计(论文)外文资料翻译学院:专业:姓名:学号:外文出处:附件: 1.外文资料翻译译文;2.外文原文。

附件1:外文资料翻译译文(空一行)(小4号字,1.25倍行距,居中)××××××(3号黑体,加粗,1.25倍行距,居中)J.R.Cho,S.J. Moon(Times New Roman字体,小4号字,1.25倍行距,居中,作者不译,不要作者工作单位)(空一行)(小4号字,1.25倍行距,居中)摘要(黑体,5号字,1.25倍行距)××××。

(摘要内容为宋体,5号字,1.25倍行距)关键字(黑体,5号字,1.25倍行距)××××××××(各关键词为宋体,5号字,1.25倍行距,段后0.5行,各词间用分号或一个汉字空格隔开)1 前言(各级标题均用黑体,加粗,小4号字,1.25倍行距,顶格)××××××××××××。

(正文均用宋体,小4号字,1.25倍行距)参考文献(见原文)(顶格,黑体,小4号字,1.25倍行距)(参考文献略去,不翻译,与正文间空一行)注意:1文中图表中(包括表头和图题),除符号外均要译成中文,一般为5号字,单倍行间距;表头和图题要处在表格的正上方和正下方,单位要用字母符号表示;要采用三线制表格。

2字母和数字应采用Times New Roman字体。

3物理量和希腊字母要采用斜体。

4最后一页要有“附件2:外文原文(复印件)”字样,且单独占一页。

5页边距按本模板。

附件2:外文原文(复印件)(注意:必须单独占一页)。

外文文献翻译范例

StatusComplete

Type:Office

Location:Hong Kong

Construction started:18 April 1985

Completed:1990

Opening:17 May 1990

HeightAntenna spire:367.4 m (1,205.4 ft)

2011年6月8日

外文文献翻译(译成中文1000字左右):

【主要阅读文献不少于5篇,译文后附注文献信息,包括:作者、书名(或论文题目)、出 版 社(或刊物名称)、出版时间(或刊号)、页码。提供所译外文资料附件(印刷类含封面、封底、目录、翻译部分的复印件等,网站类的请附网址及原文)

原文网址:/TALLEST_TOWERS/t_sears.htm

译文

建筑师:Bruce Graham, design partner, Skidmore, Owings and Merrill

地点:Chicago

甲方:Sears Roebuck and Company

工程师:Fazlur Khan of Skidmore, Owings and Merrill.项目年份:2008

香港1985年4月18日开工建设1990年完成1990年5月17日开幕高度天线尖顶三百六十七点四米2418英尺屋顶三百一十五点米10335英尺顶层二百八十八点二米九百四十五点五英尺技术细节地上楼层数724层楼建筑面积一十三点五万平方米1450000平方英尺电梯数45由奥的斯电梯公司生产的设计与施工主要承建商香港建设控股有限公司引文需要熊谷组香港贝聿铭建筑师事务所建筑师事务所谢尔曼西贡有限公司sl的托马斯博阿达莱斯利罗伯逊结构工程师协会rllp参考文献对中国塔简称中银大厦银行是中环香港最知名的摩天大楼之一

外文翻译原文模板

1、外文资料翻译内容要求:外文资料的内容应为本学科研究领域,并与毕业设计(论文)选题相关的技术资料或专业文献,译文字数应不少于3000汉字以上,同时应在译文末注明原文的出处。

不可采用网络中直接有外文和原文的。

2、外文资料翻译格式要求:译文题目采用小二号黑体,居中;译文正文采用宋体小四号,段前、段后距为0行;行距:固定值20磅。

英文原文如果为打印的话用新罗马(Times New Roman)小四号字。

装订时原文在前,译文在后。

文章中有引用的地方在原文中也要体现。

参考文献也要翻译成中文!An Energy-Efficient Cooperative Algorithm for Data Estimation inWireless Sensor NetworksAbstract – In Wireless Sensor Networks (WSN), nodes operate on batteries and network’s lifetime depends on energy consumption of the nodes. Consider the class of sensor networks where all nodes sense a single phenomenon at different locations and send messages to a Fusion Center (FC) in order to estimate the actual information. In classical systems all data processing tasks are done in the FC and there is no processing or compression before transmission. In the proposed algorithm, network is divided into clusters and data processing is done in two parts. The first part is performed in each cluster at the sensor nodes after local data sharing and the second part will be done at the Fusion Center after receiving all messages from clusters. Local data sharing results in more efficient data transmission in terms of number of bits. We also take advantage of having the same copy of data at all nodes of each cluster and suggest a virtual Multiple-Input Multiple-Output (V-MIMO) architecture for data transmission from clusters to the FC. A Virtual-MIMO network is a set of distributed nodes each having one antenna. By sharing their data among themselves, these nodes turn into a classical MIMO system. In the previously proposed cooperative/virtual MIMO architectures there has not been any data processing or compression in the conference phase. We modify the existing VMIMO algorithms to suit the specific class of sensor networks that is of our concern. We use orthogonal Space-Time Block Codes (STBC) for MIMO part and by simulation show that this algorithm saves considerable energy compared to classical systems.I. INTRODUCTIONA typical Wireless Sensor Network consists of a set of small, low-cost and energy-limited sensor nodes which are deployed in a field in order to observe a phenomenon and transmit it to a Fusion Center (FC). These sensors are deployed close to one another and their readings of the environment are highly correlated. Their objective is to report a descriptive behavior of the environment based on all measurements to the Fusion Center. This diversity in measurement lets the system become more reliable and robust against failure. In general, each node is equipped with a sensing device, a processor and a communication module (which can be either a transmitter or transmitter/receiver).Sensor nodes are equipped with batteries and are supposed to work for a long period of time without battery replacement. Thus, they are limited in energy and one of the most important issues in designing sensor networks will be the energy consumption of the sensor nodes. To deal with this problem, we might either reduce the number of bits to be transmitted by source compression or reduce the required power for transmission by applying advanced transmission techniques while satisfying certain performance requirement.A lot of research has been done in order to take advantage of the correlation among sensors’ data for reducing the number of bits to be transmitted. Some are based on distributed source coding[1]while others use decentralized estimation[2-5]. In [1], authors present an efficient algorithm that applies distributed compression based on Slepian – Wolf[14] encoding technique and use an adaptive signal processing algorithm to track correlation among sensors data. In [2-5] the problem of decentralized estimation in sensor networks has been studied under different constraints. In these algorithms, sensors perform a local quantization on their data considering that their observations are correlated with that of other sensors. They produce a binary message and send it to the FC. FC combines these messages based on the quantization rules used at the sensor nodes and estimates the unknown parameter. Optimal local quantization and final fusion rules are investigated in these works. The distribution of data assumed for sensor observation in these papers has Uniform probability distribution function. In our model we consider Gaussian distribution introduced in [17] for sensor measurements which ismore likely to reality.As an alternative approach, some works have been done using energy-efficient communication techniques such as cooperative/virtual Multiple-Input Multiple-Output (MIMO) transmission in sensor networks [6-11]. In these works, as each sensor is equipped with one antenna, nodes are able to form a virtual MIMO system by performing cooperation with others. In [6] the application of MIMO techniques in sensor networks based on Alamouti[15] space-time block codes was introduced. In [8,9] energy-efficiency of MIMO techniques has been explored analytically and in [7] a combination of distributed signal processing algorithm presented and in [1] cooperative MIMO was studied.In this paper, we consider both techniques of compression and cooperative transmission at the same time. We reduce energy consumption in two ways; 1) processing data in part at the transmitting side, which results in removing redundant information thus having fewer bits to be transmitted and 2) reducing required transmission energy by applying diversity and Space-Time coding. Both of these goals will be achieved by our proposed two-phase algorithm. In our model, the objective is to estimate the unknown parameter which is basically the average of all nodes’ measurements. That is, exact measurements of individual nodes are not important and it is not necessary to spend a lot of energy and bandwidth to transmit all measured data with high precision to the FC. We can move some part of data processing to the sensors side. This can be done by local data sharing among sensors. We divide the network into clusters of ‘m’ members. The number of members in the cluster (m) is both the compression factor in data processing and also the diversity order in virtual-MIMO architecture. The remaining of this paper is organized as following: in section II we introduce our system model and basic assumptions. In section III we propose our collaborative algorithm. In section IV we present the mathematical analysis of the proposed algorithm and in section V we give some numerical simulations. Finally section VI concludes the paper.II. SYSTEM MODELA. Network ModelThe network model that we use is similar to the one presented in [2-5].Our network consists of N distributed Sensor Nodes (SN) and a Fusion Center (FC). Sensors are deployed uniformly in the field, close to one another and each taking observations on an unknown parameter (θ). Fusion Center is located far from the nodes. All nodes observe same phenomenon but with different measurements. These nodes together with the Fusion Center are supposed to find the value of the unknown parameter. Nodes send binary messages to Fusion Center. FC will process the received messages and estimate the unknown value.B. Data ModelIn our formulation we use the data model introduced in[17]. We assume that all sensors observe the same phenomenon (θ) which has Gaussian distribution with variance σx 2. They observe different versions of θ and we model this difference as an additive zero mean Gaussian noisewith variance σn 2. Therefore, sensor observations will be described byn i i θx += (1) Where θ ~ N (0, σx 2) and n i ~ N (0, σn 2) for i = 1, 2, … , N .Based on thisassumption the value of θ can be estimated by taking the numerical average of the nodes observations, i.e.∑==N i i x N 11θ(2)C. Reference System ModelOur reference system consists of N conventional Single Input Single Output (SISO) wireless links, each connecting one of the sensor nodes to the FC. For the reference system we do not consider any communication or cooperation among the sensors. Therefore each sensor quantizes its observation by an L-bit scalar quantizer designed for distribution of θ, generates a message of length L and transmits it directly to the FC. Fusion Center receives all messages and performs the processing, which is calculation of the numerical average of these messages.III. COOPERATIVE DATA PROCESSING ALGORITHMSensor readings are analog quantities. Therefore, each sensor has to compress its data into several bits. For data compression we use L -bit scalar quantizer [12,13].In our algorithm, network is divided into clusters, each cluster having a fixed and pre-defined number of members (m). Members of each cluster are supposed to cooperate with one another in two ways:1. Share, Process and Compress their data2. Cooperatively transmit their processed data using virtual MIMO.IV. ANALYSISThe performance metric considered in our analysis is the total distortion due to compression and errors occurred during transmission. The first distortion is due to finite length quantizer, used in each sensor to represent the analog number by L bits. This distortion depends on the design of quantizer.We consider a Gaussian scalar quantizer which is designed over 105 randomly generated samples. The second distortion is due to errors occurred during transmission through the channel. In our system, this distortion is proportional to the probability of bit error. Since the probability of bit error (Pe) is a function of transmission energy per bit (Eb), total distortion will be a function of Eb. In this section we characterize the transmission and total consumed energy of sensors and find the relationship between distortion and probability of bit error.V. SIMULATION AND NUMERICAL RESULTS To give a numerical example, we assume m = 4 members in each cluster. Therefore our Virtual-MIMO scheme will consist of 4 transmit antennas. We assume that network has N = 32 sensors. Sensor observations are Gaussian with σx2= 1 and are added to a Gaussian noise of σn2= 0.1 .Nodes are deployed uniformly in the field and are 2 meters apart from each other and the Fusion Center is located 100 meters away from the center of the field. The values for circuit parameters are quoted from [6] and are listed in Table I. These parameters depend on the hardware design and technological advances. Fig. 1 illustrates the performance (Distortion) of reference system and proposed two-phase V-MIMO scheme versus transmission energy consumption in logarithmic scale. As shown in the figures, depending on how much precision is needed in the system, we can save energy by applying the proposed algorithm.TABLE IFig. 2 illustrates the Distortion versus total energy consumption of sensor nodes. That is, in this figure we consider both the transmission and circuit energy consumption. The parameters that lead us to these results may be designed to give better performance than presented here. However, from these figures we can conclude that the proposed algorithm outperforms the reference system when we want to have distortion less than 10−3 and it can save energy as high as 10 dB.VI. CONCLUSIONIn this paper we proposed a novel algorithm which takes advantage of cooperation among sensor nodes in two ways: it not only compresses the set of sensor messages at the sensor nodes into one message, appropriate for final estimation but also encodes them into orthogonal space-time symbols which are easy to decode and energy-efficient. This algorithm is able to save energy as high as 10 dB.REFERENCES[1] J.Chou,D.Petrovic and K.Ramchandran “A distributed and adaptive signalprocessing approach to reducing energy consumption in sensornetworks,”Proc. IEEE INFOCOM,March 2003.[2] Z.Q.Luo, “Universal decentralized estimation in a bandwidth constrainedsensor network,” IEEE rmation The ory, vol.51,no.6,June 2005.[3] Z.Q.Luo,“An Isotropic Universal decentralized estimation scheme for abandwidth constrained Ad Hoc sensor network,”IEEEm. vol.23,no. 4,April 2005.[4] Z.Q.Luo and J.-J. Xiao, “Decentralized estimation i n an inhomogeneoussensing environment,” IEEE Trans. Information Theory, vol.51, no.10,October 2005.[5] J.J.Xiao,S.Cui,Z.-Q.Luo and A.J.Goldsmith, “Joint estimation in sensornetworks under energy constraints,” Proc.IEEE First conference on Sensor and Ad Hoc Communications and Networks, (SECON 04),October 2004.[6] S.Cui, A.J.Goldsmith, and A.Bahai,“Energy-efficiency of MIMO andcooperative MIMO techniques in sensor networks,”IEEEm,vol.22, no.6pp.1089–1098,August 2004.[7] S.K.Jayawe era and M.L.Chebolu, “Virtual MIMO and distributed signalprocessing for sensor networks-An integrated approach”,Proc.IEEEInternational Conf. Comm.(ICC 05)May 2005.[8] S.K.Jayaweera,"Energy efficient virtual MIMO-based CooperativeCommunications for Wireless Sensor Networks",2nd International Conf. on Intelligent Sensing and Information Processing (ICISIP 05),January 2005.[9] S.K.Jayaweera,“Energy Analysis of MIMO Techniques in Wireless SensorNetworks”, 38th Annual Conference on Information Sciences and Systems (CISS 04),March 2004.[10] S.K.Jayaweera and M.L.Chebolu,“Virtual MIMO and Distributed SignalProcessing for Sensor Networks - An Integrated Approach”,IEEEInternational Conf.on Communications (ICC 05),May 2005.[11] S.K.Jayaweera,“An Energy-efficient Virtual MIMO CommunicationsArchitecture Based on V-BLAST Processing for Distributed WirelessSensor Networks”,1st IEEE International Conf.on Sensor and Ad-hocCommunications and Networks (SECON 2004), October 2004.[12] J.Max,“Quantizing for minimum distortion,” IRE rmationTheory,vol.IT-6, pp.7 – 12,March 1960.[13] S.P.Lloyd,“Least squares quantization in PCM ,”IEEE rmationTheory,vol.IT-28, pp.129-137,March 1982.[14] D.Slepian and J.K.Wolf “Noiseless encoding of correlated inf ormationsources,” IEEE Trans. on Information Theory,vol.19, pp.471-480,July1973.[15] S.M.Alamouti,“A simple transmit diversity technique for wirelesscommunications,” IEEE m., vol.16,no.8,pp.1451–1458,October 1998.[16] V.Tarokh,H.Jafarkhani,and A.R.Calderbank. “Space-time block codesfrom orthogonal designs,’’IEEE rmationTheory,vol.45,no.5,pp.1456 -1467,July 1999.[17] Y.Oohama,“The Rate-Distortion Function for the Quadratic GaussianCEO Problem,” IEEE Trans. Informatio nTheory,vol.44,pp.1057–1070,May 1998.。

毕业论文外文翻译范例

外文原文(一)Savigny and his Anglo-American Disciple s*M. H. HoeflichFriedrich Carl von Savigny, nobleman, law reformer, champion of the revived German professoriate, and founder of the Historical School of jurisprudence, not only helped to revolutionize the study of law and legal institutions in Germany and in other civil law countries, but also exercised a profound influence on many of the most creative jurists and legal scholars in England and the United States. Nevertheless, tracing the influence of an individual is always a difficult task. It is especially difficult as regards Savigny and the approach to law and legal sources propounded by the Historical School. This difficulty arises, in part, because Savigny was not alone in adopting this approach. Hugo, for instance, espoused quite similar ideas in Germany; George Long echoed many of these concepts in England during the 1850s, and, of course, Sir Henry Sumner Maine also espoused many of these same concepts central to historical jurisprudence in England in the 1860s and 1870s. Thus, when one looks at the doctrinal writings of British and American jurists and legal scholars in the period before 1875, it is often impossible to say with any certainty that a particular idea which sounds very much the sort of thing that might, indeed, have been derived from Savigny's works, was, in fact, so derived. It is possible, nevertheless, to trace much of the influence of Savigny and his legal writings in the United States and in Great Britain during this period with some certainty because so great was his fame and so great was the respect accorded to his published work that explicit references to him and to his work abound in the doctrinal writing of this period, as well as in actual law cases in the courts. Thus, Max Gutzwiller, in his classic study Der einfluss Savignys auf die Entwicklung des International privatrechts, was able to show how Savigny's ideas on conflict of laws influenced such English and American scholars as Story, Phillimore, Burge, and Dicey. Similarly, Andreas Schwarz, in his "Einflusse Deutscher Zivilistik im Auslande," briefly sketched Savigny's influence upon John Austin, Frederick Pollock, and James Bryce. In this article I wish to examine Savigny's influence over a broader spectrum and to draw a picture of his general fame and reputation both in Britain and in the United States as the leading Romanist, legal historian, and German legal academic of his day. The picture of this Anglo-American respect accorded to Savigny and the historical school of jurisprudence which emerges from these sources is fascinating. It sheds light not only upon Savigny’s trans-channel, trans-Atlantic fame, but also upon the extraordinarily*M.H.Hoeflich, Savigny and his Anglo-American Disciples, American Journal of Comparative Law, vol.37, No.1, 1989.cosmopolitan outlook of many of the leading American and English jurists of the time. Of course, when one sets out to trace the influence of a particular individual and his work, it is necessary to demonstrate, if possible, precisely how knowledge of the man and his work was transmitted. In the case of Savigny and his work on Roman law and ideas of historical jurisprudence, there were three principal modes of transmission. First, there was the direct influence he exercised through his contacts with American lawyers and scholars. Second, there was the influence he exercised through his books. Third, there was the influence he exerted indirectly through intermediate scholars and their works. Let us examine each mode separately.I.INFLUENCE OF THE TRANSLATED WORKSWhile American and British interest in German legal scholarship was high in the antebellum period, the number of American and English jurists who could read German fluently was relatively low. Even those who borrowed from the Germans, for instance, Joseph Story, most often had to depend upon translations. It is thus quite important that Savigny’s works were amongst the most frequently translated into English, both in the United States and in Great Britain. His most influential early work, the Vom Beruf unserer Zeitfur Rechtsgeschichte und Gestzgebung, was translated into English by Abraham Hayward and published in London in 1831. Two years earlier the first volume of his History of Roman Law in the Middle Ages was translated by Cathcart and published in Edinburgh. In 1830, as well, a French translation was published at Paris. Sir Erskine Perry's translation of Savigny's Treatise on Possession was published in London in 1848. This was followed by Archibald Brown's epitome of the treatise on possession in 1872 and Rattigan's translation of the second volume of the System as Jural Relations or the Law of Persons in 1884. Guthrie published a translation of the seventh volume of the System as Private International Law at Edinburgh in 1869. Indeed, two English translations were even published in the far flung corners of the British Raj. A translation of the first volume of the System was published by William Holloway at Madras in 1867 and the volume on possession was translated by Kelleher and published at Calcutta in 1888. Thus, the determined English-speaking scholar had ample access to Savigny's works throughout the nineteenth century.Equally important for the dissemination of Savigny's ideas were those books and articles published in English that explained and analyzed his works. A number of these must have played an important role in this process. One of the earliest of these is John Reddie's Historical Notices of the Roman law and of the Progress of its Study in Germany, published at Edinburgh in 1826. Reddie was a noted Scots jurist and held the Gottingen J.U.D. The book, significantly, is dedicated to Gustav Hugo. It is of that genre known as an external history of Roman law-not so much a history of substantive Roman legal doctrine but rather a historyof Roman legal institutions and of the study of Roman law from antiquity through the nineteenth century. It is very much a polemic for the study of Roman law and for the Historical School. It imparts to the reader the excitement of Savigny and his followers about the study of law historically and it is clear that no reader of the work could possibly be left unmoved. It is, in short, the first work of public relations in English on behalf of Savigny and his ideas.Having mentioned Reddie's promotion of Savigny and the Historical School, it is important to understand the level of excitement with which things Roman and especially Roman law were greeted during this period. Many of the finest American jurists were attracted-to use Peter Stein's term-to Roman and Civil law, but attracted in a way that, at times, seems to have been more enthusiastic than intellectual. Similarly, Roman and Civil law excited much interest in Great Britain, as illustrated by the distinctly Roman influence to be found in the work of John Austin. The attraction of Roman and Civil law can be illustrated and best understood, perhaps, in the context of the publicity and excitement in the English-speaking world surrounding the discovery of the only complete manuscript of the classical Roman jurist Gaius' Institutes in Italy in 1816 by the ancient historian and German consul at Rome, B.G. Niebuhr. Niebuhr, the greatest ancient historian of his time, turned to Savigny for help with the Gaius manuscript (indeed, it was Savigny who recognized the manuscript for what it was) and, almost immediately, the books and journals-not just law journals by any means-were filled with accounts of the discovery, its importance to legal historical studies, and, of course, what it said. For instance, the second volume of the American Jurist contains a long article on the civil law by the scholarly Boston lawyer and classicist, John Pickering. The first quarter of the article is a gushing account of the discovery and first publication of the Gaius manuscript and a paean to Niebuhr and Savigny for their role in this. Similarly, in an article published in the London Law Magazine in 1829 on the civil law, the author contemptuously refers to a certain professor who continued to tell his students that the text of Gaius' Institutes was lost for all time. What could better show his ignorance of all things legal and literary than to be unaware of Niebuhr's great discovery?Another example of this reaction to the discovery of the Gaius palimpsest is to be found in David Irving's Introduction to the Study of the Civil Law. This volume is also more a history of Roman legal scholarship and sources than a study of substantive Roman law. Its pages are filled with references to Savigny's Geschichte and its approach clearly reflects the influence of the Historical School. Indeed, Irving speaks of Savigny's work as "one of the most remarkable productions of the age." He must have been truly impressed with German scholarship and must also have been able to convince the Faculty of Advocates, forwhom he was librarian, of the worth of German scholarship, for in 1820 the Faculty sent him to Gottingen so that he might study their law libraries. Irving devotes several pages of his elementary textbook on Roman law to the praise of the "remarkable" discovery of the Gaius palimpsest. He traces the discovery of the text by Niebuhr and Savigny in language that would have befitted an adventure tale. He elaborates on the various labors required to produce a new edition of the text and was particularly impressed by the use of a then new chemical process to make the under text of the palimpsest visible. He speaks of the reception of the new text as being greeted with "ardor and exultation" strong words for those who spend their lives amidst the "musty tomes" of the Roman law.This excitement over the Verona Gaius is really rather strange. Much of the substance of the Gaius text was already known to legal historians and civil lawyers from its incorporation into Justinian's Institutes and so, from a substantive legal perspective, the find was not crucial. The Gaius did provide new information on Roman procedural rules and it did also provide additional information for those scholars attempting to reconstruct pre-Justinianic Roman law. Nevertheless, these contributions alone seem hardly able to justify the excitement the discovery caused. Instead, I think that the Verona Gaius discovery simply hit a chord in the literary and legal community much the same as did the discovery of the Rosetta Stone or of Schliemann’s Troy. Here was a monument of a great civilization brought newly to light and able to be read for the first time in millenia. And just as the Rosetta Stone helped to establish the modern discipline of Egyptology and Schliemann's discoveries assured the development of classical archaeology as a modern academic discipline, the discovery of the Verona Gaius added to the attraction Roman law held for scholars and for lawyers, even amongst those who were not Romanists by profession. Ancillary to this, the discovery and publication of the Gaius manuscript also added to the fame of the two principals involved in the discovery, Niebuhr and Savigny. What this meant in the English-speaking world is that even those who could not or did not wish to read Savigny's technical works knew of him as one of the discoverers of the Gaius text. This fame itself may well have helped in spreading Savigny's legal and philosophical ideas, for, I would suggest, the Gaius "connection" may well have disposed people to read other of Savigny's writings, unconnected to the Gaius, because they were already familiar with his name.Another example of an English-speaking promoter of Savigny is Luther Stearns Cushing, a noted Boston lawyer who lectured on Roman law at the Harvard Law School in 1848-49 and again in 1851- 1852.Cushing published his lectures at Boston in 1854 under the title An Introduction to the Study of Roman Law. He devoted a full chapter to a description of the historical school and to the controversy betweenSavigny and Thibaut over codification. While Cushing attempted to portray fairly the arguments of both sides, he left no doubt as to his preference for Savigny's approach:The labors of the historical school have established an entirely new and distinct era in the study of the Roman jurisprudence; and though these writers cannot be said to have thrown their predecessors into the shade, it seems to be generally admitted, that almost every branch of the Roman law has received some important modification at their hands, and that a knowledge of their writings, to some extent, at least, is essentially necessary to its acquisition.译文(一)萨维尼和他的英美信徒们*M·H·豪弗里奇弗雷德里奇·卡尔·冯·萨维尼出身贵族,是一位出色的法律改革家,也是一位倡导重建德国教授协会的拥护者,还是历史法学派的创建人之一。

外文翻译格式范例

由于这种类型的脆弱性所造成的损害,可以很深刻的,尽管这会取决于该应用软 件与数据库关联的特权级别。如果该软件以管理者类型权限访问数据,然后恶意 运行命令也会是这一级别的访问权限,此时系统妥协是不可避免的。还有这个问 题类似于操作系统的安全规则,在那里,项目应该以最低的权限运行,而且这是 必要的。如果是正常的用户访问,然后启用这个限制。 同样的问题,SQL 的安全也不完全是一个数据库的问题。特定的数据库命令或 要求,不应该允许通过应用层。这是可以通过"安全码"的方式加以预防的。这是 一个场外话题,但应该被应用的一些基本步骤的详细设计是有必要的。 第一步,在获取任何申请时须验证和控制用户输入。可能的情况下,严格的 类型应被设定以控制具体数据(例如,期望得到数值数据,字符串类型数据等), 并在可能实现的情况下,如果数据是以字符型为基础的,需要禁止特定的非字母 数字字符。如果这是不能实现的,应该做出争取使用替代字符的考虑(例如,使 用单引号,这在 SQL 命令中时通常被使用的)。 在使用您的组织时具体的与安全有关的编码技术应加入编码标准。如果所有 开发商都使用相同的基线标准,特定具体的安全措施,这将大大减少 SQL 注入妥 协的风险。 能够使用的另一种简单的方法,是清除数据库中不再需要的所有程序。这些 限制了数据库中不再需要的或者多于过剩的被恶意利用的程度。这类似于消除操 作系统内不需要的服务程序,是一种常见的安全实践。

◆

Common sense security

Before we discuss the issues relating to database security it is prudent to high- light the

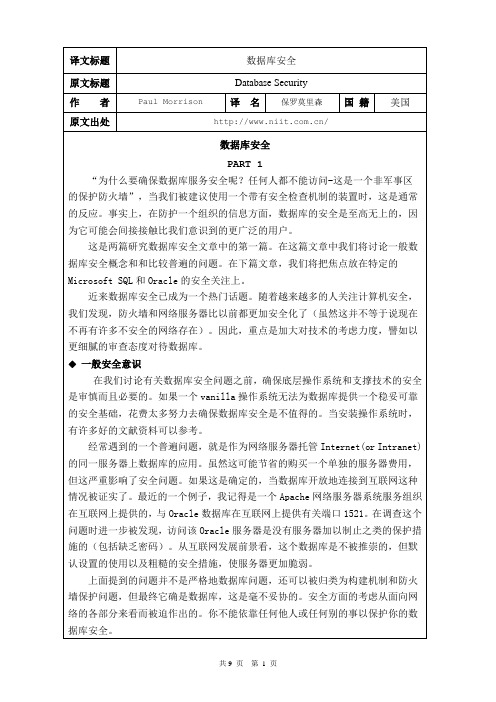

译文标题 原文标题 作 者

外文翻译模板

外文翻译模板(总12页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--杭州电子科技大学毕业论文外文文献翻译要求根据《普通高等学校本科毕业设计(论文)指导》的内容,特对外文文献翻译提出以下要求:一、翻译的外文文献可以是一篇,也可以是两篇,但总字符要求不少于万(或翻译成中文后至少在3000字以上)。

二、翻译的外文文献应主要选自学术期刊、学术会议的文章、有关着作及其他相关材料,应与毕业论文(设计)主题相关,并作为外文参考文献列入毕业论文(设计)的参考文献。

并在每篇中文译文标题尾部用“脚注”形式注明原文作者及出处,中文译文后应附外文原文(全文,格式为word)。

不能翻译中国学者的文章,不能翻译准则等有译文的着作。

三、中文译文的基本撰写格式1.题目:采用小三号、黑体字、居中打印;段前二行,段后二行。

2.正文:采用小四号、宋体字,行间距一般为固定值20磅,标准字符间距。

页边距为左3cm,右,上下各,页面统一采用A4纸。

四、外文原文格式1.题目:采用小三号、Times New Roman、居中打印;段前二行,段后二行。

2.正文:采用小四号、Times New Roman,行间距一般为固定值20磅,标准字符间距。

页边距为左3cm,右,上下各,页面统一采用A4纸。

五、封面格式由学校统一制作(注:封面上的“翻译题目”指中文译文的题目),并按“封面、封面、译文、外文原文、考核表”的顺序统一装订。

毕业论文外文文献翻译毕业论文题目Xxx翻译题目指翻译后的中文译文的题目学院会计学院(以本模板为准)专业XXXXXX(以本模板为准)姓名XXXXXX(以本模板为准)班级XXXXXX(以本模板为准)学号XXXXXX(以本模板为准)指导教师XXXXXX(以本模板为准)译文管理者过度乐观与债务、股权融资之间的选择1本文采取了一家成长较快速的公司作为样本,比较债务融资和股权融资后的长期股票业绩。

毕业论文外文翻译样例

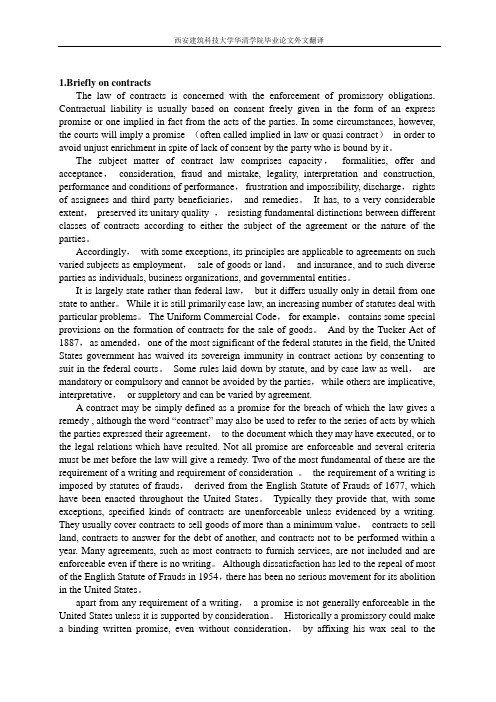

1.Briefly on contractsThe law of contracts is concerned with the enforcement of promissory obligations. Contractual liability is usually based on consent freely given in the form of an express promise or one implied in fact from the acts of the parties. In some circumstances, however, the courts will imply a promise (often called implied in law or quasi contract)in order to avoid unjust enrichment in spite of lack of consent by the party who is bound by it。

The subject matter of contract law comprises capacity,formalities, offer and acceptance,consideration, fraud and mistake, legality, interpretation and construction, performance and conditions of performance,frustration and impossibility, discharge,rights of assignees and third party beneficiaries,and remedies。

It has, to a very considerable extent,preserved its unitary quality ,resisting fundamental distinctions between different classes of contracts according to either the subject of the agreement or the nature of the parties。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

湖北知行学院金融专业英语外文文献译文本2014届原文出处:____ Companies Law Commons, SecuritiesLaw Commons_____________________ 译文题目:______调和税法和证券监管____院(系)经济与管理学院专业名称金融专业学生姓名王倩学生学号1211340073任课教师张真RECONCILING TAX LAW AND SECURITIES REGULATIONOmri Marian*Issuers in registered securities offerings must disclose the expected tax consequencesto investors investing in the offered securities (“nonfinancial tax disclosure”). ThisArticle advances three arguments regarding nonfinancial tax disclosures. First,nonfinancial tax disclosure practice, as the Securities and Exchange Commission(the SEC) has sanctioned it, does not fulfill its intended regulatory purposes. Cur-rently, nonfinancial tax disclosures provide irrelevant information, sometimes failto provide material information, create unnecessary transaction costs, and divertvaluable administrative resources to the enforcement of largely-meaningless require-ments. Second, the practical reason for this failure is the SECand tax practitioners’unsuccessful attempt to address investors’heterogeneous tax preferences. Specifi-cally, nonfinancial tax disclosure practice assumes the existence of a “reasonableinvestor”who is also an “average taxpayer,”and tax disclosures are drafted for thebenefit of this average taxpayer. The concept of an “average taxpayer,”however, isnot defensible. Third, the theoretical reason for the regulatory regime’s dysfunction-ality is the misapplication of mandatory disclosure theory to nonfinancial taxdisclosure requirements. Mandatory disclosure theory, even if accepted at facevalue, does not support the current regulatory framework, due to the special natureof tax laws. To remedy this failure, this Article describes the types of tax-relateddisclosures that mandatory disclosure theory would support. Under the proposedregulatory reform, nonfinancial tax disclosures will only includeissuer-level taxitems (namely, tax items imposed on the issuing entity) that affect how “reasonableinvestors”calculate their own individual tax liabilities. Under such a regime, thereis no need to rely on the “average taxpayer”construct. INTRODUCTION: APPLE’S BOND OFFERING AS AN ALLEGORYOn May 1, 2013, Apple, Inc. (Apple) made financial history wi its $17 billion bond offering,1 the largest-ever debt issuance by* Assistant Professor of Law, University of Florida Levin College of Law. For helpguidance, comments and critique, I am grateful to Jennifer Bird-Pollan, Stu Cohen, DaGamage, Joan Heminway, Michael Knoll, Leandra Lederman, Tom Lin, Randle PollaDexter Samida, Doug Shackelford, Danny Sokol, Emily Satterthwaite, and participantsconferences and workshops at the Northwestern University School of Law, the UniversityTennessee College of Law, the 2013 SEALS Annual Conference,the 2013 Law and SocAnnual Meeting, and the 8th Annual Junior Tax Scholars Workshop. For invaluable reseaassistance, I am indebted to Gus Gari. Any errors or omissions are my own.1. See generally Apple, Inc., Prospectus Supplement (Form 424B2), at S-15 (May 1, 20[hereinafter Apple’s Prospectus], available at /secfiling.cfm?filid=1193125-13-184506&cik=320193.12 University of Michigan Journal of Law Reform [VOL. 48:1 non-financial institution at the time.2 On page S-15 of the offeringdocument is a section titled “Certain U.S. Federal Income Tax Con-siderations.”3 This section provides information concerning the “U.S. federal income tax considerations of the ownership and dis-position”of the bonds.4Issuers in registered securities offerings are required to disclose all information that a reasonable investor would deem materialwhen making an informed investment decision.5 Since investorscare about their after-tax returns on investments,6 informationabout the tax costs associated with an investment could be consid-ered material.7 Indeed, registrants are required to disclose toinvestors all material tax consequences and to qualify the tax disclo-sure with an opinion.8 The tax opinion must address each materialtax issue discussed in the disclosure, express a legal conclusion about how the tax law applies to the facts of the particular offeringand its effect on investors’tax consequences, and explain the basis2. John Balassi & Josie Cox, Apple Wows Market With Record $17 Billion Bond Deal,REUTERS (Apr. 30, 2013), /article/2013/04/30/us-apple-debt-idUS BRE93T10B20130430. In September of the same year, VerizonCommunications smashedthis record with a $49 billion bond offering. John Atkins, Verizon Smashes Record with $49B, 8-Part Bond Offering, (Sept. 11, 2013), /sites/spleverage/2013/09/11/verizon-smashes-records-with-49b-8-part-bond-offe ring/ (last visited Aug. 21,2014).3. Apple Prospectus, supra note 1, at S-15.4. Id.5. See Zohar Goshen & Gideon Parchomovsky, The Essential Role of Securities Regulation,55 DUKE L. J. 711, 741 (2006). The disclosure documents the SEC regulates “disclose infor-mation about the companies’financial condition and business practices to help investorsmake informed investment decisions.”SEC, The Investor’s Advocate: How the SEC Protects Inves-tors, Maintains Market Integrity, and Facilitates Capital Information, /about/whatwedo.shtml (last visited Aug. 1, 2014); see also Goshen & Gideon, supra, at 740 (providingSEC disclosure regulations allow for greater “public disclosure”and “leads to fewer instancesof asymmetric information between traders”and more informed traders).6. See MYRON S. SCHOLES ET AL., TAXES AND BUSINESS STRATEGY 2 (3d ed. 2004) (discuss-ing why taxes influence investment decisions).7. See, e.g., SEC Staff Legal Bulletin No. 19, 2011 WL 4957889 11–13 (Oct. 14, 2011),available at /interps/legal/cfslb19.htm (discussing when tax conse-quences are “material”to investors) [hereinafter SEC Legal Bulletin]; see also William B.Barker, SEC Registration of Public Offerings Under the Securities Act of 1933, 52 BUS. LAW. 65,105–06 (1996) (discussing the proper disclosure of federal income tax consequences in regis-tered offering as part of a general discussion on the system of mandatory disclosure, which isintended to deliver investors with “accurate and current information”to support “fair andhonest securities market”). At the time of publication, Barkerwas a Senior Counsel to theSEC’s Division of Corporate Finance. William B. Barker, SEC Registration of Public OfferingsUnder the Securities Act of 1933, 52 BUS. LAW 65, 65 (1996).8. SEC Regulation S-K, 17 C.F.R. §229.601(b)(8) (requiring issuers to disclose to inves-tors the “material”tax consequences associated with purchasing, holding and disposing ofthe offered securitieFALL 2014] Reconciling Tax Law and Securities Regulation 3for such a conclusion.9 Apple’s tax disclosure section responds tothis regulatory framework.This Article suggests, however, that Apple’s tax disclosure in theoffering document does not provide any information that a “rea-sonable investor”would deem material. In fact, the disclosure provides little information at all, notwithstanding that the disclo- sure comprises four densely written pages. Specifically, the third sentence in Apple’s tax disclosure makes it clear that any tax conse-quences discussed therein are only applicable to investors purchasing the bonds in the initial offering.10 Investors in the sec-ondary market received no guidance concerning the tax consequences of investing in the bonds.In addition, Apple’s tax disclosure explicitly excludes certain classes of investors, including—among others—dealers in securi-ties, financial institutions, insurance companies, and other types ofinstitutional investors.11 It is well documented, however, that securi-ties in initial offerings are mostly allocated to the classes of institutional investors excepted from Apple’s tax disclosure. 12The result is rather remarkable: Apple’s tax disclosure does not describe the tax consequences to the investors that—as a practicalmatter—are expected to purchase the bonds in the initial offering.The tax disclosure also does not describe the tax consequences toany investor that purchases the bonds in the secondary market. Thelogical inference is that Apple’s tax disclosure section describes taxconsequences that are applicable to no one (or at least to only veryfew). It is hard to imagine, therefore, that Apple’s tax disclosure responds meaningfully to the rationales underlying mandatory tax9. SEC Legal Bulletin, supra note 7, at 12.10. See Apple Prospectus, supra note 1, at S-15 (“Except where noted, this summary dealsonly with a note held as a capital asset by a beneficial owner who purchases the note onoriginal issuance at the first price . . . .”).11. Id. (“This summary does not address all aspects of U.S. federal income taxes anddoes not deal with all tax consequences that may be relevant to holders in light of theirpersonal circumstances or particular situations, such as . . . tax consequences to dealers insecurities or currencies, financial institutions, regulatedinvestment companies, real estateinvestment trusts, tax-exempt entities, insurance companies and traders in securities thatelect to use a mark-to-market method of tax accounting for their securities.”).12. See SEC, Initial Public Offerings: Why Individual Investors Have Difficulty Getting Shares?,/answers/ipodiff.htm (last visited Aug. 1, 2014). There is ample evidencethat institutional investors are allocated most of the shares in IPOs (specifically on so called“hot”IPOs). See, e.g., Jay R. Ritter & Ivo Welch, A Review of IPO Activity, Pricing, and Allocations,57 J. FIN. 1795, 1808–15 (2002); see also Reena Aggarwal, Nagpurnanand R. Prabhala &Manju Puri, Institutional Allocations in Initial Public Offerings: Empirical Evidence, 57 J. FIN. 1421,1422 (2002) (finding that “institutions dominate IPO allocations”); Leland E. Crabbe &Christopher M. Turner, Does Liquidity of a Debt Issue Increase With Its Size? Evidence from theCorporate Bond and Medium-Term Note Markets, 50 J. FIN.1719, 1722 (1995) (finding both cor-porate bonds and medium-term notes “sold primarily to institutional investors”).s, and to support such disclosure with a legal opinion).调和税法和证券监管欧米- 玛丽安*证券发行的发行人在登记时必须披露预期的税收后果,提供给投资者投资于证券(“非金融税披露”)。