Chap003金融机构管理课后题答案

Chap3财务管理,公司金融,罗斯第十版解答

计算市场价值I

• 市场价格= 87.65 美元/股 • 流通股数= 190.9 百万股million • 市盈率PE= 每股股价/每股盈余=87.65

/ 3.61 = 24.28 倍 • 市账比=每股市场价值/每股账面价值

3-2

章节概要

• 现金流量和财务报表:进一步观察 • 标准财务报表 • 比率分析 • 杜邦恒等式 • 利用财务报表信息

3-3

• 市盈率=股票价格/每股收益

点击Sample B/S可回到资产负债表示例。在资产负债表示例页面点击绿色小箭头可回到此页。

来源与使用

• 来源

· 现金流入-当我们卖出某些东西时会产生 · 资产账户价值的增加 (Sample B/S)

3-10

计算流动比率

• 流动比率= 流动资产 / 流动负债

· 2,256 / 1,995 = 1.13 倍

• 速动比率= (流动资产 – 存货) / 流动负债

· (2,256 – 301) / 1,995 = .98倍

• 现金比率= 现金 /流动负债

· 696 / 1,995 = .35 倍

• 净营运资本与总资产之比=净营运资本/总 资产

• 同比资产负债表(表3-5)

· 将所有项目表示为总资产的百分比

• 同比利润表(表3-6)

· 将所有项目表示为销售收入的百分比

• 标准化财务报表使得财务信息更容易被比较,尤其 是在公司成长的过程中。

• 也可用来比较不同规模的公司,尤其是当这些公司 处பைடு நூலகம்同一行业时。

3-8

实际生活中的财务报表可能并不像本章的那么直接易懂。

金融机构管理第九章中文版课后习题答案(1、2、3、6、11、12、13、16)

金融机构管理第九章课后习题部分答案(1、2、3、6、11、12、13、16)1. 有效期限衡量的是经济定义中资产和负债的平均期限。

有效期限的经济含义是资产价值对于利率变化的利率敏感性(或利率弹性)。

有效期限的严格定义是一种以现金流量的相对现值为权重的加权平均到期期限。

有效期限与到期期限的不同在于,有效期限不仅考虑了资产(或负债)的期限,还考虑了期间发生的现金流的再投资利率。

2.息票债券面值价值= $1,00利率= 0.10 每年付一次息到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.92593$92.59 $92.592 $1,100.00 0.85734$943.07 $1,886.15价格=$1,035.67分子= $1,978.74有效期限=1.9106= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.90909$90.91 $90.912 $1,100.00 0.82645$909.09 $1,818.18价格=$1,000.00分子= $1,909.09有效期限=1.9091= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $100.00 0.892$89.29 $89.292 $1,100.00 0.79719$876.91 $1,753.83价格=$966.20分子= $1,843.11有效期限=1.9076= 分子/价格b. 到期收益率上升时,有限期限减少。

c.零息债券面值价值= $1,00利率= 0.00到期收益率=0.08 期限= 2时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.92593$0.00 $0.002 $1,000.00 0.85734$857.34 $1,714.68价格=$857.34分子= $1,714.68有效期限=2.000= 分子/价格到期收益率=0.10时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.90909$0.00 $0.002 $1,000.00 0.82645$826.45 $1,652.89价格=$826.45分子= $1,652.89有效期限=2.000= 分子/价格到期收益率=0.12时间现金流PVIF PV ofCF PV*CF *T1 $0.00 0.892$0.00 $0.002 $1,000.00 0.79719 $797.19 $1,594.39价格 = $797.19分子 =$1,594.39有效期限 =2.0000= 分子/价格d.到期收益率的变化不影响零息债券的有效期限。

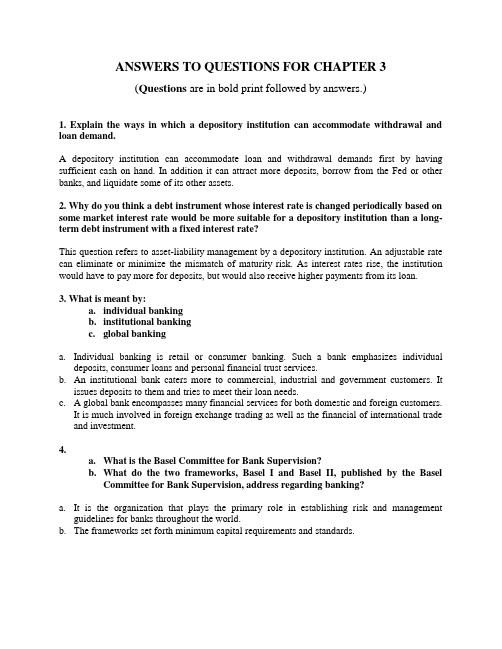

金融市场与金融机构基础(第3章)英文版答案

ANSWERS TO QUESTIONS FOR CHAPTER 3(Questions are in bold print followed by answers.)1. Explain the ways in which a depository institution can accommodate withdrawal and loan demand.A depository institution can accommodate loan and withdrawal demands first by having sufficient cash on hand. In addition it can attract more deposits, borrow from the Fed or other banks, and liquidate some of its other assets.2. Why do you think a debt instrument whose interest rate is changed periodically based on some market interest rate would be more suitable for a depository institution than a long-term debt instrument with a fixed interest rate?This question refers to asset-liability management by a depository institution. An adjustable rate can eliminate or minimize the mismatch of maturity risk. As interest rates rise, the institution would have to pay more for deposits, but would also receive higher payments from its loan.3. What is meant by:a.individual bankingb.institutional bankingc.global bankinga.Individual banking is retail or consumer banking. Such a bank emphasizes individualdeposits, consumer loans and personal financial trust services.b.An institutional bank caters more to commercial, industrial and government customers. Itissues deposits to them and tries to meet their loan needs.c. A global bank encompasses many financial services for both domestic and foreign customers.It is much involved in foreign exchange trading as well as the financial of international trade and investment.4.a.What is the Basel Committee for Bank Supervision?b.What do the two frameworks, Basel I and Basel II, published by the BaselCommittee for Bank Supervision, address regarding banking?a.It is the organization that plays the primary role in establishing risk and managementguidelines for banks throughout the world.b.The frameworks set forth minimum capital requirements and standards.5. Explain each of the following:a.reserve ratiob.required reservesa.The reserve ratio is the percentage of deposits a bank must keep in a non-interest-bearingaccount at the Fed.b.Required reserves are the actual dollar amounts based on a given reserve ratio.6. Explain each of the following types of deposit accounts:a.demand depositb.certificate of depositc.money market demand accounta.Demand deposits (checking accounts) do not pay interest and can be withdrawn at any time(upon demand).b.Certificates of Deposit (CDs) are time deposits which pay a fixed or variable rate of interestover a specified term to maturity. They cannot be withdrawn prior to maturity without a substantial penalty. negotiable CDs (large business deposits) can be traded so that the original owner still obtains liquidity when needed.c.Money Market Demand Accounts (MMDAs) are basically demand or checking accounts thatpay interest. Minimum amounts must be maintained in these accounts so that at least a 7-day interest can be paid. Since many persons find it not possible to maintain this minimum (usually around $2500) there are still plenty of takers for the non-interest-bearing demand deposits.7. How did the Glass-Steagall Act impact the operations of a bank?The Glass-Steagall Act prohibited banks from carrying out certain activities in the securities markets, which are principal investment banking activities. It also prohibited banks from engaging in insurance activities.28. The following is the book value of the assets of a bank:Asset Book Value (in millions)U.S. Treasury securities $ 50Municipal general obligationbonds50Residential mortgages 400Commercial loans 200Total book value $700a.Calculate the credit risk-weighted assets using the following information:Asset Risk WeightU.S. Treasury securities 0%Municipal general obligationbonds20Residential mortgages 50Commercial loans 100b.What is the minimum core capital requirement?c.What is the minimum total capital requirement?a.The risk weighted assets would be $410b.The minimum core capital is $28 million (.04X700) i.e., 4% of book value.c.Minimum total capital (core plus supplementary capital) is 32.8 million, .08X410, which is8% of the risk-weighted assets.9. In later chapters, we will discuss a measure called duration. Duration is a measure of the sensitivity of an asset or a liability to a change in interest rates. Why would bank management want to know the duration of its assets and liabilities?a.Duration is a measure of the approximate change in the value of an asset for a 1% change ininterest rates.b.If an asset has a duration of 5, then the portfolio’s value will change by approximately 5% ifinterest rate changes by 100 basis points.3-310.a.Explain how bank regulators have incorporated interest risk into capitalrequirements.b.Explain how S&L regulators have incorporated interest rate risk into capitalrequirements.a.The FDIC Improvement Act of 1991, required regulators of DI to incorporate interest raterisk into capital requirements. It is based on measuring interest rate sensitivity of the assets and liabilities of the bank.b.The OST adopted a regulation that incorporates interest rate risk for S&L. It specifies that ifthrift has greater interest rate risk exposure, there would be a deduction of its risk-based capital. The risk is specified as a decline in net profit value as a result of 2% change in market interest rate.11. When the manager of a bank’s portfolio of securities considers alternative investments, she is also concerned about the risk weight assigned to the security. Why?The Basel guidelines give weight to the credit risk of various instruments. These weights are 0%, 20%, 50% and 100%. The book value of the asset is multiplied by the credit risk weights to determine the amount of core and supplementary capital that the bank will need to support that asset.12. You and a friend are discussing the savings and loan crisis. She states that “the whole mess started in the early 1980s.When short-term rates skyrocketed, S&Ls got killed—their spread income went from positive to negative. They were borrowing short and lending long.”a.What does she mean by “borrowing short and lending long”?b.Are higher or lower interest rates beneficial to an institution that borrows shortand lends long?a.In this context, borrowing short and lending long refers to the balance sheet structure ofS&Ls. Their sources of funds (liabilities) are short-term (mainly deposits) and their uses (assets) are long-term in nature (e.g. residential mortgages).b.Since long-term rates tend to be higher than short-term ones, stable interest rates would bethe best situation. However, rising interest rates would increase the cost of funds for S&Ls without fully compensating higher returns on assets. Hence a decline in interest rate spread or margin. Thus lower rates, having an opposite effect, would be more beneficial.13. Consider this headline from the New York Times of March 26, 1933: “Bankers will fight Deposit Guarantees.” In this article, it is stated that bankers argue that deposit guarantees will encourage bad banking. Explain why.The barrier imposed by Glass-Steagall act was finally destroyed by the Gramm-Leach Bliley Act of 1999. This act modified parts of the BHC Act so as to permit affiliations between banks and insurance underwriters. It created a new financial holding company, which is authorized to4engage in underwriting and selling securities. The act preserved the right of state to regulate insurance activities, but prohibits state actions that have would adversely affected bank-affiliated firms from selling insurance on an equal basis with other insurance agents.14. How did the Gramm-Leach-Bliley Act of 1999 expand the activities permitted by banks?a.Deposit insurance provides a safety net and can thus make depositors indifferent to thesoundness of the depository recipients of their funds. With depositors exercising little discipline through the cost of deposits, the incentive of some banks owners to control risk-taking accrue to the owners. It becomes a “heads I win, tails you lose” situation.b.One the positive side, deposit insurance provides a comfort to depositors and thus attractsdepositors to financial institutions. But such insurance carries a moral hazard, it can be costly and, unless premiums are risk-based, it forces the very sound banks to subsidize the very risky ones.15. The following quotation is from the October 29, 1990 issue of Corporate Financing Week:Chase Manhattan Bank is preparing its first asset-backed debt issue, becomingthe last major consumer bank to plan to access the growing market, Street asset-backed officialsSaid…Asset-backed offerings enable banks to remove credit card or other loanreceivables from their balance sheets, which helps them comply with capitalrequirements.a.What capital requirements is this article referring to?b.Explain why asset securitization reduces capital requirements.a.The capital requirements mentioned are risk based capital as specified under the BaselAgreement, which forces banks to hold minimum amounts of equity against risk-based assets.b.Securitization effectively eliminates high risk based loans from the balance sheet. The capitalrequirements in the case of asset securitization are lower than for a straight loan.16. Comment on this statement: The risk-based guidelines for commercial banks attempt to gauge the interest rate risk associated with a bank’s balance sheet.This statement is incorrect. The risk-based capital guidelines deal with credit risk, not interest-rate risk, which is the risk of adverse changes of interest rates on the portfolio position.17.a.What is the primary asset in which savings and loan associations invest?b.Why were banks in a better position than savings and loan associations toweather rising interest rates?a.Savings and Loans invest primarily in residential mortgages.b.During 1980's, although banks also suffered from the effects of deregulation and rising3-5interest rates, relatively they were in a better position than S&L association because of their superior asset-liability management.618. What federal agency regulates the activities of credit unions?The principal federal regulatory agency is the National Credit Union Administration.3-7。

Chap002金融机构管理课后题答案

Chapter TwoThe Financial Services Industry: Depository InstitutionsChapter OutlineIntroductionCommercial Banks∙Size, Structure, and Composition of the Industry∙Balance Sheet and Recent Trends∙Other Fee-Generating Activities∙Regulation∙Industry PerformanceSavings Institutions∙Savings Associations (SAs)∙Savings Banks∙Recent Performance of Savings Associations and Savings BanksCredit Unions∙Size, Structure, and Composition of the Industry and Recent Trends∙Balance Sheets∙Regulation∙Industry PerformanceGlobal Issues: Japan, China, and GermanySummaryAppendix 2A: Financial Statement Analysis Using a Return on Equity (ROE) Framework Appendix 2B: Depository Institutions and Their RegulatorsAppendix 3B: Technology in Commercial BankingSolutions for End-of-Chapter Questions and Problems: Chapter Two1.What are the differences between community banks, regional banks, and money-centerbanks? Contrast the business activities, location, and markets of each of these bank groups. Community banks typically have assets under $1 billion and serve consumer and small business customers in local markets. In 2003, 94.5 percent of the banks in the United States were classified as community banks. However, these banks held only 14.6 percent of the assets of the banking industry. In comparison with regional and money-center banks, community banks typically hold a larger percentage of assets in consumer and real estate loans and a smaller percentage of assets in commercial and industrial loans. These banks also rely more heavily on local deposits and less heavily on borrowed and international funds.Regional banks range in size from several billion dollars to several hundred billion dollars in assets. The banks normally are headquartered in larger regional cities and often have offices and branches in locations throughout large portions of the United States. Although these banks provide lending products to large corporate customers, many of the regional banks have developed sophisticated electronic and branching services to consumer and residential customers. Regional banks utilize retail deposit bases for funding, but also develop relationships with large corporate customers and international money centers.Money center banks rely heavily on nondeposit or borrowed sources of funds. Some of these banks have no retail branch systems, and most regional banks are major participants in foreign currency markets. These banks compete with the larger regional banks for large commercial loans and with international banks for international commercial loans. Most money center banks have headquarters in New York City.e the data in Table 2-4 for the banks in the two asset size groups (a) $100 million-$1billion and (b) over $10 billion to answer the following questions.a. Why have the ratios for ROA and ROE tended to increase for both groups over the1990-2003 period? Identify and discuss the primary variables that affect ROA andROE as they relate to these two size groups.The primary reason for the improvements in ROA and ROE in the late 1990s may berelated to the continued strength of the macroeconomy that allowed banks to operate with a reduced regard for bad debts, or loan charge-off problems. In addition, the continued low interest rate environment has provided relatively low-cost sources of funds, and a shifttoward growth in fee income has provided additional sources of revenue in many product lines. Finally, a growing secondary market for loans has allowed banks to control the size of the balance sheet by securitizing many assets. You will note some variance inperformance in the last three years as the effects of a softer economy were felt in thefinancial industry.b. Why is ROA for the smaller banks generally larger than ROA for the large banks?Small banks historically have benefited from a larger spread between the cost rate of funds and the earning rate on assets, each of which is caused by the less severe competition in the localized markets. In addition, small banks have been able to control credit risk moreefficiently and to operate with less overhead expense than large banks.c. Why is the ratio for ROE consistently larger for the large bank group?ROE is defined as net income divided by total equity, or ROA times the ratio of assets to equity. Because large banks typically operate with less equity per dollar of assets, netincome per dollar of equity is larger.d. Using the information on ROE decomposition in Appendix 2A, calculate the ratio ofequity-to-total-assets for each of the two bank groups for the period 1990-2003. Whyhas there been such dramatic change in the values over this time period, and why isthere a difference in the size of the ratio for the two groups?ROE = ROA x (Total Assets/Equity)Therefore, (Equity/Total Assets) = ROA/ROE$100 million - $1 Billion Over $10 BillionYear ROE ROA TA/Equity Equity/TA ROE ROA TA/Equity Equity/TA1990 9.95% 0.78% 12.76 7.84% 6.68% 0.38% 17.58 5.69%1995 13.48% 1.25% 10.78 9.27% 15.60% 1.10% 14.18 7.05%1996 13.63% 1.29% 10.57 9.46% 14.93% 1.10% 13.57 7.37%1997 14.50% 1.39% 10.43 9.59% 15.32% 1.18% 12.98 7.70%1998 13.57% 1.31% 10.36 9.65% 13.82% 1.08% 12.80 7.81%1999 14.24% 1.34% 10.63 9.41% 15.97% 1.28% 12.48 8.02%2000 13.56% 1.28% 10.59 9.44% 14.42% 1.16% 12.43 8.04%2001 12.24% 1.20% 10.20 9.80% 13.43% 1.13% 11.88 8.41%2002 12.85% 1.26% 10.20 9.81% 15.06% 1.32% 11.41 8.76%2003 12.80% 1.27% 10.08 9.92% 16.32% 1.42% 11.49 8.70% The growth in the equity to total assets ratio has occurred primarily because of theincreased profitability of the entire banking industry and the encouragement of theregulators to increase the amount of equity financing in the banks. Increased fee income, reduced loan loss reserves, and a low, stable interest rate environment have produced the increased profitability which in turn has allowed banks to increase equity through retained earnings.Smaller banks tend to have a higher equity ratio because they have more limited assetgrowth opportunities, generally have less diverse sources of funds, and historically have had greater profitability than larger banks.3.What factors have caused the decrease in loan volume relative to other assets on thebalance sheets of commercial banks? How has each of these factors been related to the change and development of the financial services industry during the 1990s and early2000s? What strategic changes have banks implemented to deal with changes in thefinancial services environment?Corporations have utilized the commercial paper markets with increased frequency rather than borrow from banks. In addition, many banks have sold loan packages directly into the capital markets (securitization) as a method to reduce balance sheet risks and to improve liquidity. Finally, the decrease in loan volume during the early 1990s and early 2000s was due in part to the recession in the economy.As deregulation of the financial services industry continued during the 1990s, the position of banks as the primary financial services provider continued to erode. Banks of all sizes have increased the use of off-balance sheet activities in an effort to generate additional fee income. Letters of credit, futures, options, swaps and other derivative products are not reflected on the balance sheet, but do provide fee income for the banks.4.What are the major uses of funds for commercial banks in the United States? What are theprimary risks to the bank caused by each use of funds? Which of the risks is most critical to the continuing operation of the bank?Loans and investment securities continue to be the primary assets of the banking industry. Commercial loans are relatively more important for the larger banks, while consumer, small business loans, and residential mortgages are more important for small banks. Each of these types of loans creates credit, and to varying extents, liquidity risks for the banks. The security portfolio normally is a source of liquidity and interest rate risk, especially with the increased use of various types of mortgage backed securities and structured notes. In certain environments, each of these risks can create operational and performance problems for a bank.5.What are the major sources of funds for commercial banks in the United States? How isthe landscape for these funds changing and why?The primary sources of funds are deposits and borrowed funds. Small banks rely more heavily on transaction, savings, and retail time deposits, while large banks tend to utilize large, negotiable time deposits and nondeposit liabilities such as federal funds and repurchase agreements. The supply of nontransaction deposits is shrinking, because of the increased use by small savers of higher-yielding money market mutual funds,6. What are the three major segments of deposit funding? How are these segments changingover time? Why? What strategic impact do these changes have on the profitable operation of a bank?Transaction accounts include deposits that do not pay interest and NOW accounts that pay interest. Retail savings accounts include passbook savings accounts and small, nonnegotiable time deposits. Large time deposits include negotiable certificates of deposits that can be resold in the secondary market. The importance of transaction and retail accounts is shrinking due to the direct investment in money market assets by individual investors. The changes in the deposit markets coincide with the efforts to constrain the growth on the asset side of the balance sheet.7. How does the liability maturity structure of a bank’s balance sheet compare with thematurity structure of the asset portfolio? What risks are created or intensified by thesedifferences?Deposit and nondeposit liabilities tend to have shorter maturities than assets such as loans. The maturity mismatch creates varying degrees of interest rate risk and liquidity risk.8. The following balance sheet accounts have been taken from the annual report for a U.S.bank. Arrange the accounts in balance sheet order and determine the value of total assets.Based on the balance sheet structure, would you classify this bank as a community bank, regional bank, or a money center bank?Assets Liabilities and EquityCash $ 2,660 Demand deposits $ 5,939Fed funds sold $ 110 NOW accounts $12,816Investment securities $ 5,334 Savings deposits $ 3,292Net loans $29,981 Certificates of deposit $ 9,853Intangible assets $ 758 Other time deposits $ 2,333Other assets $ 1,633 Short-term Borrowing $ 2,080Premises $ 1,078 Other liabilities $ 778Total assets $41,554 Long-term debt $ 1,191Equity $ 3,272Total liab. and equity $41,554This bank has funded the assets primarily with transaction and savings deposits. The certificates of deposit could be either retail or corporate (negotiable). The bank has very little ( 5 percent) borrowed funds. On the asset side, about 72 percent of total assets is in the loan portfolio, but there is no information about the type of loans. The bank actually is a small regional bank with $41.5 billion in assets, but the asset structure could easily be a community bank with $41.5 million in assets.9.What types of activities normally are classified as off-balance-sheet (OBS) activities?Off-balance-sheet activities include the issuance of guarantees that may be called into play at a future time, and the commitment to lend at a future time if the borrower desires.a. How does an OBS activity move onto the balance sheet as an asset or liability?The activity becomes an asset or a liability upon the occurrence of a contingent event,which may not be in the control of the bank. In most cases the other party involved with the original agreement will call upon the bank to honor its original commitment.b.What are the benefits of OBS activities to a bank?The initial benefit is the fee that the bank charges when making the commitment. If the bank is required to honor the commitment, the normal interest rate structure will apply to the commitment as it moves onto the balance sheet. Since the initial commitment does notappear on the balance sheet, the bank avoids the need to fund the asset with either deposits or equity. Thus the bank avoids possible additional reserve requirement balances anddeposit insurance premiums while improving the earnings stream of the bank.c.What are the risks of OBS activities to a bank?The primary risk to OBS activities on the asset side of the bank involves the credit risk of the borrower. In many cases the borrower will not utilize the commitment of the bank until the borrower faces a financial problem that may alter the credit worthiness of the borrower.Moving the OBS activity to the balance sheet may have an additional impact on the interest rate and foreign exchange risk of the bank.e the data in Table 2-6 to answer the following questions.a.What was the average annual growth rate in OBS total commitments over the periodfrom 1992-2003?$78,035.6 = $10,200.3(1+g)11 g = 20.32 percentb.Which categories of contingencies have had the highest annual growth rates?Category of Contingency or Commitment Growth RateCommitments to lend 14.04%Future and forward contracts 15.13%Notional amount of credit derivatives 52.57%Standby contracts and other option contracts 56.39%Commitments to buy FX, spot, and forward 3.39%Standby LCs and foreign office guarantees 7.19%Commercial LCs -1.35%Participations in acceptances -6.11%Securities borrowed 20.74%Notional value of all outstanding swaps 31.76%Standby contracts and other option contracts have grown at the fastest rate of 56.39 percent, and they have an outstanding balance of $214,605.3 billion. The rate of growth in thecredit derivatives area has been the second strongest at 52.57 percent, the dollar volumeremains fairly low at $1,001.2 billion at year-end 2003. Interest rate swaps grew at anannual rate of 31.76 percent with a change in dollar value of $41,960.7 billion. Clearly the strongest growth involves derivative areas.c.What factors are credited for the significant growth in derivative securities activities bybanks?The primary use of derivative products has been in the areas of interest rate, credit, andforeign exchange risk management. As banks and other financial institutions have pursuedthe use of these instruments, the international financial markets have responded byextending the variations of the products available to the institutions.11. For each of the following banking organizations, identify which regulatory agencies (OCC,FRB, FDIC, or state banking commission) may have some regulatory supervisionresponsibility.(a) State-chartered, nonmember, nonholding-company bank.(b)State-chartered, nonmember holding-company bank(c) State-chartered member bank(d)Nationally chartered nonholding-company bank.(e)Nationally chartered holding-company bankBank Type OCC FRB FDIC SBCom.(a) Yes Yes(b) Yes Yes Yes(c) Yes Yes Yes(d) Yes Yes Yes(e) Yes Yes Yes12. What factors normally are given credit for the revitalization of the banking industry duringthe decade of the 1990s? How is Internet banking expected to provide benefits in thefuture?The most prominent reason was the lengthy economic expansion in both the U.S. and many global economies during the entire decade of the 1990s. This expansion was assisted in the U.S. by low and falling interest rates during the entire period.The extent of the impact of Internet banking remains unknown. However, the existence of this technology is allowing banks to open markets and develop products that did not exist prior to the Internet. Initial efforts have focused on retail customers more than corporate customers. The trend should continue with the advent of faster, more customer friendly products and services, and the continued technology education of customers.13. What factors are given credit for the strong performance of commercial banks in the early2000s?The lowest interest rates in many decades helped bank performance on both sides of the balance sheet. On the asset side, many consumers continued to refinance homes and purchase new homes, an activity that caused fee income from mortgage lending to increase and remain strong. Meanwhile, the rates banks paid on deposits shrunk to all-time lows. In addition, the development and more comfortable use of new financial instruments such as credit derivatives and mortgage backed securities helped banks ease credit risk off the balance sheets. Finally, information technology has helped banks manage their risk more efficiently.14. What are the main features of the Riegle-Neal Interstate Banking and Branching EfficiencyAct of 1994? What major impact on commercial banking activity is expected from this legislation?The main feature of the Riegle-Neal Act of 1994 was the removal of barriers to inter-state banking. In September 1995 bank holding companies were allowed to acquire banks in other states. In 1997, banks were allowed to convert out-of-state subsidiaries into branches of a single interstate bank. As a result, consolidations and acquisitions have allowed for the emergence of very large banks with branches across the country.15. What happened in 1979 to cause the failure of many savings associations during the early1980s? What was the effect of this change on the operating statements of savingsassociations?The Federal Reserve changed its reserve management policy to combat the effects of inflation, a change which caused the interest rates on short-term deposits to increase dramatically more than the rates on long-term mortgages. As a result, the marginal cost of funds exceeded the average yield on assets that caused a negative interest spread for the savings associations. Further, because savings associations were constrained by Regulation Q on the amount of interest which could be paid on deposits, they suffered disintermediation, or deposit withdrawals, which led to severe liquidity pressures on the balance sheets.16. How did the two pieces of regulatory legislation, the DIDMCA in 1980 and the DIA in1982, change the operating profitability of savings associations in the early 1980s? What impact did these pieces of legislation ultimately have on the risk posture of the savingsassociation industry? How did the FSLIC react to this change in operating performance and risk?The two pieces of legislation allowed savings associations to offer new deposit accounts, such as NOW accounts and money market deposit accounts, in an effort to reduce the net withdrawal flow of deposits from the institutions. In effect this action was an attempt to reduce the liquidity problem. In addition, the savings associations were allowed to offer adjustable-rate mortgages and a limited amount of commercial and consumer loans in an attempt to improve the profitability performance of the industry. Although many savings associations were safer, more diversified, and more profitable, the FSLIC did not foreclose many of the savings associations which were insolvent. Nor did the FSLIC change its policy of assessing higher insurance premiums on companies that remained in high risk categories. Thus many savings associations failed, which caused the FSLIC to eventually become insolvent.17. How do the asset and liability structures of a savings association compare with the assetand liability structures of a commercial bank? How do these structural differences affect the risks and operating performance of a savings association? What is the QTL test?The savings association industry relies on mortgage loans and mortgage-backed securities as the primary assets, while the commercial banking industry has a variety of loan products, including mortgage products. The large amount of longer-term fixed rate assets continues to cause interestrate risk, while the lack of asset diversity exposes the savings association to credit risk. Savings associations hold considerably less cash and U.S. Treasury securities than do commercial banks. On the liability side, small time and saving deposits remain as the predominant source of funds for savings associations, with some reliance on FHLB borrowing. The inability to nurture relationships with the capital markets also creates potential liquidity risk for the savings association industry.The acronym QTL stands for Qualified Thrift Lender. The QTL test refers to a minimum amount of mortgage-related assets that a savings association must hold. The amount currently is 65 percent of total assets.18. How do savings banks differ from savings and loan associations? Differentiate in terms ofrisk, operating performance, balance sheet structure, and regulatory responsibility.The asset structure of savings banks is similar to the asset structure of savings associations with the exception that savings banks are allowed to diversify by holding a larger proportion of corporate stocks and bonds. Savings banks rely more heavily on deposits and thus have a lower level of borrowed funds. The banks are regulated at both the state and federal level, with deposits insured by t he FDIC’s BIF.19. How did the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of1989 and the Federal Deposit Insurance Corporation Improvement Act of 1991 reversesome of the key features of earlier legislation?FIRREA rescinded some of the expanded thrift lending powers of the DIDMCA of 1980 and the Garn-St Germain Act of 1982 by instituting the qualified thrift lender (QTL) test that requires that all thrifts must hold portfolios that are comprised primarily of mortgages or mortgage products such as mortgage-backed securities. The act also required thrifts to divest their portfolios of junk bonds by 1994, and it replaced the FSLIC with a new thrift deposit insurance fund, the Savings Association Insurance Fund, which was managed by the FDIC.The FDICA of 1991 amended the DIDMCA of 1980 by introducing risk-based deposit insurance premiums in 1993 to reduce excess risk-taking. FDICA also provided for the implementation of a policy of prompt corrective actions (PCA) that allows regulators to close banks more quickly in cases where insolvency is imminent. Thus the ill-advised policy of regulatory forbearance should be curbed. Finally, the act amended the International Banking Act of 1978 by expanding the regulatory oversight powers over foreign banks.20. What is the “common bond” membership qualification under which credit unions havebeen formed and operated? How does this qualification affect the operational objective ofa credit union?The common bond policy allows any one who meets a specific membership requirement to become a member of the credit union. The requirement normally is tied to a place of employment. Because the common bond policy has been loosely interpreted, implementation has allowed credit union membership and assets to grow at a rate that exceeds similar growth inthe commercial banking industry. Since credit unions are mutual organizations where the members are owners, employees essentially use saving deposits to make loans to other employees who need funds.21. What are the operating advantages of credit unions that have caused concern bycommercial bankers? What has been the response of the Credit Union NationalAssociation to the bank criticisms?Credit unions are tax-exempt organizations that often are provided office space by employers at no cost. As a result, because non-interest operating costs are very low, credit unions can lend money at lower rates and pay higher rates on savings deposits than can commercial banks. CUNA has responded that the cost to tax payers from the tax-exempt status is replaced by the additional social good created by the benefits to the members.22. How does the asset structure of credit unions compare with the asset structure ofcommercial banks and savings and loan associations? Refer to Tables 2-5, 2-9, and 2-12 to formulate your answer.The relative proportions of credit union assets are more similar to commercial banks than savings associations, with 20 percent in investment securities and 63 percent in loans. However, nonmortgage loans of credit unions are predominantly consumer loans. On the liability side of the balance sheet, credit unions differ from banks in that they have less reliance on large time deposits, and they differ from savings associations in that they have virtually no borrowings from any source. The primary sources of funds for credit unions are transaction and small time and savings accounts.23. Compare and contrast the performance of the U.S. depository institution industry withthose of Japan, China, and Germany.The entire Japanese financial system was under increasing pressure from the early 1990s as the economy suffered from real estate and other commercial industry pressures. The Japanese government has used several financial aid packages in attempts to avert a collapse of the Japanese financial system. Most attempts have not been successful.The deterioration in the banking industry in China in the early 2000s was caused by nonperforming loans and credits. The remedies include the opportunity for more foreign bank ownership in the Chinese banking environment primarily via larger ownership positions, less restrictive capital requirements for branches, and increased geographic presence.German banks also had difficulties in the early 2000s, but the problems were not universal. The large banks suffered from credit problems, but the small banks enjoyed high credit ratings and low cast of funds because of government guarantees on their borrowing. Thus while small banks benefited from growth in small business lending, the large banks became reliant on fee and trading income.。

金融机构管理 课后习题答案

Chapter OneWhy Are Financial Intermediaries Special?Chapter OutlineIntroductionFinancial Intermediaries’ Specialness•Information Costs•Liquidity and Price Risk•Other Special ServicesOther Aspects of Specialness•The Transmission of Monetary Policy•Credit Allocation•Intergenerational Wealth Transfers or Time Intermediation •Payment Services•Denomination IntermediationSpecialness and Regulation•Safety and Soundness Regulation•Monetary Policy Regulation•Credit Allocation Regulation•Consumer Protection Regulation•Investor Protection Regulation•Entry RegulationThe Changing Dynamics of Specialness•Trends in the United States•Future Trends•Global IssuesSummarySolutions for End-of-Chapter Questions and Problems: Chapter One1. Identify and briefly explain the five risks common to financial institutions.Default or credit risk of assets, interest rate risk caused by maturity mismatches between assets and liabilities, liability withdrawal or liquidity risk, underwriting risk, and operating cost risks.2. Explain how economic transactions between household savers of funds and corporate users of funds would occur in a world without financial intermediaries (FIs).In a world without FIs the users of corporate funds in the economy would have to approach directly the household savers of funds in order to satisfy their borrowing needs. This process would be extremely costly because of the up-front information costs faced by potential lenders. Cost inefficiencies would arise with the identification of potential borrowers, the pooling of small savings into loans of sufficient size to finance corporate activities, and the assessment of risk and investment opportunities. Moreover, lenders would have to monitor the activities of borrowers over each loan's life span. The net result would be an imperfect allocation of resources in an economy.3. Identify and explain three economic disincentives that probably would dampen the flow offunds between household savers of funds and corporate users of funds in an economic world without financial intermediaries.Investors generally are averse to purchasing securities directly because of (a) monitoring costs, (b) liquidity costs, and (c) price risk. Monitoring the activities of borrowers requires extensive time, expense, and expertise. As a result, households would prefer to leave this activity to others, and by definition, the resulting lack of monitoring would increase the riskiness of investing in corporate debt and equity markets. The long-term nature of corporate equity and debt would likely eliminate at least a portion of those households willing to lend money, as the preference of many for near-cash liquidity would dominate the extra returns which may be available. Third, the price risk of transactions on the secondary markets would increase without the information flows and services generated by high volume.4. Identify and explain the two functions in which FIs may specialize that enable the smoothflow of funds from household savers to corporate users.FIs serve as conduits between users and savers of funds by providing a brokerage function and by engaging in the asset transformation function. The brokerage function can benefit both savers and users of funds and can vary according to the firm. FIs may provide only transaction services, such as discount brokerages, or they also may offer advisory services which help reduce information costs, such as full-line firms like Merrill Lynch. The asset transformation function is accomplished by issuing their own securities, such as deposits and insurance policies that are more attractive to household savers, and using the proceeds to purchase the primary securities ofcorporations. Thus, FIs take on the costs associated with the purchase of securities.5. In what sense are the financial claims of FIs considered secondary securities, while thefinancial claims of commercial corporations are considered primary securities? How does the transformation process, or intermediation, reduce the risk, or economic disincentives, to the savers?The funds raised by the financial claims issued by commercial corporations are used to invest in real assets. These financial claims, which are considered primary securities, are purchased by FIs whose financial claims therefore are considered secondary securities. Savers who invest in the financial claims of FIs are indirectly investing in the primary securities of commercial corporations. However, the information gathering and evaluation expenses, monitoring expenses, liquidity costs, and price risk of placing the investments directly with the commercial corporation are reduced because of the efficiencies of the FI.6. Explain how financial institutions act as delegated monitors. What secondary benefitsoften accrue to the entire financial system because of this monitoring process?By putting excess funds into financial institutions, individual investors give to the FIs the responsibility of deciding who should receive the money and of ensuring that the money is utilized properly by the borrower. In this sense the depositors have delegated the FI to act as a monitor on their behalf. The FI can collect information more efficiently than individual investors. Further, the FI can utilize this information to create new products, such as commercial loans, that continually update the information pool. This more frequent monitoring process sends important informational signals to other participants in the market, a process that reduces information imperfection and asymmetry between the ultimate sources and users of funds in the economy.7. What are five general areas of FI specialness that are caused by providing various servicesto sectors of the economy?First, FIs collect and process information more efficiently than individual savers. Second, FIs provide secondary claims to household savers which often have better liquidity characteristics than primary securities such as equities and bonds. Third, by diversifying the asset base FIs provide secondary securities with lower price-risk conditions than primary securities. Fourth, FIs provide economies of scale in transaction costs because assets are purchased in larger amounts. Finally, FIs provide maturity intermediation to the economy which allows the introduction of additional types of investment contracts, such as mortgage loans, that are financed with short-term deposits.8. How do FIs solve the information and related agency costs when household savers investdirectly in securities issued by corporations? What are agency costs?Agency costs occur when owners or managers take actions that are not in the best interests of the equity investor or lender. These costs typically result from the failure to adequately monitor theactivities of the borrower. If no other lender performs these tasks, the lender is subject to agency costs as the firm may not satisfy the covenants in the lending agreement. Because the FI invests the funds of many small savers, the FI has a greater incentive to collect information and monitor the activities of the borrower.9. What often is the benefit to the lenders, borrowers, and financial markets in general of thesolution to the information problem provided by the large financial institutions?One benefit to the solution process is the development of new secondary securities that allow even further improvements in the monitoring process. An example is the bank loan that is renewed more quickly than long-term debt. The renewal process updates the financial and operating information of the firm more frequently, thereby reducing the need for restrictive bond covenants that may be difficult and costly to implement.10. How do FIs alleviate the problem of liquidity risk faced by investors who wish to invest inthe securities of corporations?Liquidity risk occurs when savers are not able to sell their securities on demand. Commercial banks, for example, offer deposits that can be withdrawn at any time. Yet the banks make long-term loans or invest in illiquid assets because they are able to diversify their portfolios and better monitor the performance of firms that have borrowed or issued securities. Thus individual investors are able to realize the benefits of investing in primary assets without accepting the liquidity risk of direct investment.11. How do financial institutions help individual savers diversify their portfolio risks? Whichtype of financial institution is best able to achieve this goal?Money placed in any financial institution will result in a claim on a more diversified portfolio. Banks lend money to many different types of corporate, consumer, and government customers, and insurance companies have investments in many different types of assets. Investment in a mutual fund may generate the greatest diversification benefit because of the fund’s investment in a wide array of stocks and fixed income securities.12. How can financial institutions invest in high-risk assets with funding provided by low-riskliabilities from savers?Diversification of risk occurs with investments in assets that are not perfectly positively correlated. One result of extensive diversification is that the average risk of the asset base of an FI will be less than the average risk of the individual assets in which it has invested. Thus individual investors realize some of the returns of high-risk assets without accepting the corresponding risk characteristics.13. How can individual savers use financial institutions to reduce the transaction costs ofinvesting in financial assets?By pooling the assets of many small investors, FIs can gain economies of scale in transaction costs. This benefit occurs whether the FI is lending to a corporate or retail customer, or purchasing assets in the money and capital markets. In either case, operating activities that are designed to deal in large volumes typically are more efficient than those activities designed for small volumes.14. What is maturity intermediation? What are some of the ways in which the risks ofmaturity intermediation are managed by financial intermediaries?If net borrowers and net lenders have different optimal time horizons, FIs can service both sectors by matching their asset and liability maturities through on- and off-balance sheet hedging activities and flexible access to the financial markets. For example, the FI can offer the relatively short-term liabilities desired by households and also satisfy the demand for long-term loans such as home mortgages. By investing in a portfolio of long-and short-term assets that have variable- and fixed-rate components, the FI can reduce maturity risk exposure by utilizing liabilities that have similar variable- and fixed-rate characteristics, or by using futures, options, swaps, and other derivative products.15. What are five areas of institution-specific FI specialness, and which types of institutions aremost likely to be the service providers?First, commercial banks and other depository institutions are key players for the transmission of monetary policy from the central bank to the rest of the economy. Second, specific FIs often are identified as the major source of finance for certain sectors of the economy. For example, S&Ls and savings banks traditionally serve the credit needs of the residential real estate market. Third, life insurance and pension funds commonly are encouraged to provide mechanisms to transfer wealth across generations. Fourth, depository institutions efficiently provide payment services to benefit the economy. Finally, mutual funds provide denomination intermediation by allowing small investors to purchase pieces of assets with large minimum sizes such as negotiable CDs and commercial paper issues.16. How do depository institutions such as commercial banks assist in the implementation andtransmission of monetary policy?The Federal Reserve Board can involve directly the commercial banks in the implementation of monetary policy through changes in the reserve requirements and the discount rate. The open market sale and purchase of Treasury securities by the Fed involves the banks in the implementation of monetary policy in a less direct manner.17. What is meant by credit allocation regulation? What social benefit is this type ofregulation intended to provide?Credit allocation regulation refers to the requirement faced by FIs to lend to certain sectors of the economy, which are considered to be socially important. These may include housing and farming. Presumably the provision of credit to make houses more affordable or farms moreviable leads to a more stable and productive society.18. Which intermediaries best fulfill the intergenerational wealth transfer function? What isthis wealth transfer process?Life insurance and pension funds often receive special taxation relief and other subsidies to assist in the transfer of wealth from one generation to another. In effect, the wealth transfer process allows the accumulation of wealth by one generation to be transferred directly to one or more younger generations by establishing life insurance policies and trust provisions in pension plans. Often this wealth transfer process avoids the full marginal tax treatment that a direct payment would incur.19. What are two of the most important payment services provided by financial institutions?To what extent do these services efficiently provide benefits to the economy?The two most important payment services are check clearing and wire transfer services. Any breakdown in these systems would produce gridlock in the payment system with resulting harmful effects to the economy at both the domestic and potentially the international level.20. What is denomination intermediation? How do FIs assist in this process?Denomination intermediation is the process whereby small investors are able to purchase pieces of assets that normally are sold only in large denominations. Individual savers often invest small amounts in mutual funds. The mutual funds pool these small amounts and purchase negotiable CDs which can only be sold in minimum increments of $100,000, but which often are sold in million dollar packages. Similarly, commercial paper often is sold only in minimum amounts of $250,000. Therefore small investors can benefit in the returns and low risk which these assets typically offer.21. What is negative externality? In what ways do the existence of negative externalities justifythe extra regulatory attention received by financial institutions?A negative externality refers to the action by one party that has an adverse affect on some third party who is not part of the original transaction. For example, in an industrial setting, smoke from a factory that lowers surrounding property values may be viewed as a negative externality. For financial institutions, one concern is the contagion effect that can arise when the failure of one FI can cast doubt on the solvency of other institutions in that industry.22. If financial markets operated perfectly and costlessly, would there be a need forfinancial intermediaries?To a certain extent, financial intermediation exists because of financial market imperfections. If information is available costlessly to all participants, savers would not need intermediaries to act as either their brokers or their delegated monitors. However, if there are social benefits tointermediation, such as the transmission of monetary policy or credit allocation, then FIs would exist even in the absence of financial market imperfections.23. What is mortgage redlining?Mortgage redlining occurs when a lender specifically defines a geographic area in which it refuses to make any loans. The term arose because of the area often was outlined on a map with a red pencil.24. Why are FIs among the most regulated sectors in the world? When is netregulatory burden positive?FIs are required to enhance the efficient operation of the economy. Successful financial intermediaries provide sources of financing that fund economic growth opportunity that ultimately raises the overall level of economic activity. Moreover, successful financial intermediaries provide transaction services to the economy that facilitate trade and wealth accumulation.Conversely, distressed FIs create negative externalities for the entire economy. That is, the adverse impact of an FI failure is greater than just the loss to shareholders and other private claimants on the FI's assets. For example, the local market suffers if an FI fails and other FIs also may be thrown into financial distress by a contagion effect. Therefore, since some of the costs of the failure of an FI are generally borne by society at large, the government intervenes in the management of these institutions to protect society's interests. This intervention takes the form of regulation.However, the need for regulation to minimize social costs may impose private costs to the firms that would not exist without regulation. This additional private cost is defined as a net regulatory burden. Examples include the cost of holding excess capital and/or excess reserves and the extra costs of providing information. Although they may be socially beneficial, these costs add to private operating costs. To the extent that these additional costs help to avoid negative externalities and to ensure the smooth and efficient operation of the economy, the net regulatory burden is positive.25. What forms of protection and regulation do regulators of FIs impose to ensuretheir safety and soundness?Regulators have issued several guidelines to insure the safety and soundness of FIs:a. FIs are required to diversify their assets. For example, banks cannot lend morethan 10 percent of their equity to a single borrower.b. FIs are required to maintain minimum amounts of capital to cushion anyunexpected losses. In the case of banks, the Basle standards require a minimum core and supplementary capital of 8 percent of their risk-adjusted assets.c. Regulators have set up guaranty funds such as BIF for commercial banks, SIPCfor securities firms, and state guaranty funds for insurance firms to protectindividual investors.d. Regulators also engage in periodic monitoring and surveillance, such as on-siteexaminations, and request periodic information from the FIs.26. In the transmission of monetary policy, what is the difference between insidemoney and outside money? How does the Federal Reserve Board try to control the amount of inside money? How can this regulatory position create a cost for the depository financial institutions?Outside money is that part of the money supply directly produced and controlled by the Fed, for example, coins and currency. Inside money refers to bank deposits not directly controlled by the Fed. The Fed can influence this amount of money by reserve requirement and discount rate policies. In cases where the level of required reserves exceeds the level considered optimal by the FI, the inability to use the excess reserves to generate revenue may be considered a tax or cost of providing intermediation.27. What are some examples of credit allocation regulation? How can this attemptto create social benefits create costs to the private institution?The qualified thrift lender test (QTL) requires thrifts to hold 65 percent of their assets in residential mortgage-related assets to retain the thrift charter. Some states have enacted usury laws that place maximum restrictions on the interest rates that can be charged on mortgages and/or consumer loans. These types of restrictions often create additional operating costs to the FI and almost certainly reduce the amount of profit that could be realized without such regulation.28. What is the purpose of the Home Mortgage Disclosure Act? What are thesocial benefits desired from the legislation? How does the implementation of this legislation create a net regulatory burden on financial institutions?The HMDA was passed by Congress to prevent discrimination in mortgage lending. The social benefit is to ensure that everyone who qualifies financially is provided the opportunity to purchase a house should they so desire. The regulatory burden has been to require a written statement indicating the reasons why credit was or was not granted. Since 1990, the federal regulators have examined millions of mortgage transactions from more than 7,700 institutions each calendar quarter.29. What legislation has been passed specifically to protect investors who use investment banksdirectly or indirectly to purchase securities? Give some examples of the types of abuses for which protection is provided.The Securities Acts of 1933 and 1934 and the Investment Company Act of 1940 were passed byCongress to protect investors against possible abuses such as insider trading, lack of disclosure, outright malfeasance, and breach of fiduciary responsibilities.30. How do regulations regarding barriers to entry and the scope of permitted activities affectthe charter value of financial institutions?The profitability of existing firms will be increased as the direct and indirect costs of establishing competition increase. Direct costs include the actual physical and financial costs of establishing a business. In the case of FIs, the financial costs include raising the necessary minimum capital to receive a charter. Indirect costs include permission from regulatory authorities to receive a charter. Again in the case of FIs this cost involves acceptable leadership to the regulators. As these barriers to entry are stronger, the charter value for existing firms will be higher.31. What reasons have been given for the growth of investment companies at the expense of“traditional” banks and insurance companies?The recent growth of investment companies can be attributed to two major factors: a. Investors have demanded increased access to direct securities markets.Investment companies and pension funds allow investors to take positions indirect securities markets while still obtaining the risk diversification, monitoring, and transactional efficiency benefits of financial intermediation. Some experts would argue that this growth is the result of increased sophistication on the part of investors; others would argue that the ability to use these markets has caused the increased investor awareness. The growth in these assets is inarguable.b. Recent episodes of financial distress in both the banking and insuranceindustries have led to an increase in regulation and governmental oversight,thereby increasing the net regulatory burden of “traditional” companies. Assuch, the costs of intermediation have increased, which increases the cost ofproviding services to customers.32. What are some of the methods which banking organizations have employed to reduce thenet regulatory burden? What has been the effect on profitability?Through regulatory changes, FIs have begun changing the mix of business products offered to individual users and providers of funds. For example, banks have acquired mutual funds, have expanded their asset and pension fund management businesses, and have increased the security underwriting activities. In addition, legislation that allows banks to establish branches anywhere in the United States has caused a wave of mergers. As the size of banks has grown, an expansion of possible product offerings has created the potential for lower service costs. Finally, the emphasis in recent years has been on products that generate increases in fee income, and the entire banking industry has benefited from increased profitability in recent years.33. What characteristics of financial products are necessary for financial markets to becomeefficient alternatives to financial intermediaries? Can you give some examples of the commoditization of products which were previously the sole property of financial institutions?Financial markets can replace FIs in the delivery of products that (1) have standardized terms, (2) serve a large number of customers, and (3) are sufficiently understood for investors to be comfortable in assessing their prices. When these three characteristics are met, the products often can be treated as commodities. One example of this process is the migration of over-the-counter options to the publicly traded option markets as trading volume grows and trading terms become standardized.34. In what way has Regulation 144A of the Securities and Exchange Commission provided anincentive to the process of financial disintermediation?Changing technology and a reduction in information costs are rapidly changing the nature of financial transactions, enabling savers to access issuers of securities directly. Section 144A of the SEC is a recent regulatory change that will facilitate the process of disintermediation. The private placement of bonds and equities directly by the issuing firm is an example of a product that historically has been the domain of investment bankers. Although historically private placement assets had restrictions against trading, regulators have given permission for these assets to trade among large investors who have assets of more than $100 million. As the market grows, this minimum asset size restriction may be reduced.Chapter TwoThe Financial Services Industry: Depository InstitutionsChapter OutlineIntroductionCommercial Banks•Size, Structure, and Composition of the Industry•Balance Sheet and Recent Trends•Other Fee-Generating Activities•Regulation•Industry PerformanceSavings Institutions•Savings Associations (SAs)•Savings Banks•Recent Performance of Savings Associations and Savings BanksCredit Unions•Size, Structure, and Composition of the Industry and Recent Trends•Balance Sheets•Regulation•Industry PerformanceGlobal Issues: Japan, China, and GermanySummaryAppendix 2A: Financial Statement Analysis Using a Return on Equity (ROE) FrameworkAppendix 2B: Depository Institutions and Their RegulatorsAppendix 3B: Technology in Commercial BankingSolutions for End-of-Chapter Questions and Problems: Chapter Two1.What are the differences between community banks, regional banks, andmoney-center banks? Contrast the business activities, location, and markets of each of these bank groups.Community banks typically have assets under $1 billion and serve consumer and small business customers in local markets. In 2003, 94.5 percent of the banks in the United States were classified as community banks. However, these banks held only 14.6 percent of the assets of the banking industry. In comparison with regional and money-center banks, community banks typically hold a larger percentage of assets in consumer and real estate loans and a smaller percentage of assets in commercial and industrial loans. These banks also rely more heavily on local deposits and less heavily on borrowed and international funds.Regional banks range in size from several billion dollars to several hundred billion dollars in assets. The banks normally are headquartered in larger regional cities and often have offices and branches in locations throughout large portions of the United States. Although these banks provide lending products to large corporate customers, many of the regional banks have developed sophisticated electronic and branching services to consumer and residential customers. Regional banks utilize retail deposit bases for funding, but also develop relationships with large corporate customers and international money centers.Money center banks rely heavily on nondeposit or borrowed sources of funds. Some of these banks have no retail branch systems, and most regional banks are major participants in foreign currency markets. These banks compete with the larger regional banks for large commercial loans and with international banks for international commercial loans. Most money center banks have headquarters in New York City.e the data in Table 2-4 for the banks in the two asset size groups (a) $100million-$1 billion and (b) over $10 billion to answer the following questions.a. Why have the ratios for ROA and ROE tended to increase for both groupsover the 1990-2003 period? Identify and discuss the primary variables thataffect ROA and ROE as they relate to these two size groups.The primary reason for the improvements in ROA and ROE in the late 1990smay be related to the continued strength of the macroeconomy that allowedbanks to operate with a reduced regard for bad debts, or loan charge-offproblems. In addition, the continued low interest rate environment hasprovided relatively low-cost sources of funds, and a shift toward growth in fee income has provided additional sources of revenue in many product lines.。

Chap004金融机构管理课后题答案