CGA罗斯公司理财第二章作业.

英文版罗斯公司理财习题答案Chap020

英文版罗斯公司理财习题答案Chap020 INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be bette r off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doesn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

公司理财(罗斯)第2章

重点掌握的内容

财务报表的三种类型 会计价值与市场价值 会计利润与现金流量 平均税率和边际税率 如何从财务报表中决定企业的现金流量。

一、资产负债表 (The Balance Sheet)

资产 时点报表:某一特定时 点会计人员对企业财务 状况(会计价值)所拍 的一张快照。 资产=负债+股东权益

反映某一特定时期内的经营成果 利润的会计定义为:收入-成本≡利润 利润表中首先报告的一般是收入,然后是扣除 本期间的各项费用。 配比原则 (GAAP )--先确认收入,然后将收 入与有关的制造成本相配成比。

表6.2 ABC公司20X2年预计损益表(万)

营业收入 (销售成本) (销售、一般费用及管理费用) (折旧费用) 营业所得 业外所得 息前税前利润(EBIT) (利息费用) 税前利润 (所得税费用) 当期所得税费用 递延所得税费用 净利润 8.6 226.2 (165.5)

营运资本变动

来自资产的现金流量=经营现金流量-资本性支出-净

流向债权人和股东的现金流量

流向债权人的现金流量 = 利息息支出 – 新的借 款净额 流向股东的现金流量 = 派发的股利 – 新筹集的 净权益

来自资产的现金流量 = 流向债权人的现金流 量 + 流向股东的现金流量

现金流量概要

来自资产的现金流量

资产=负债+股东权益 来自资产的现金流量3; 流向股东的现金流量 CF(S) ( A) CF ( B) CF ( S ) CF

来自资产的现金流量包括:1、经营现金流量, 2、净资本性支出,3、净营运资本变动

一、经营现金流量,来自企业日常生产和销售活动

CGA罗斯公司理财第二章作业.

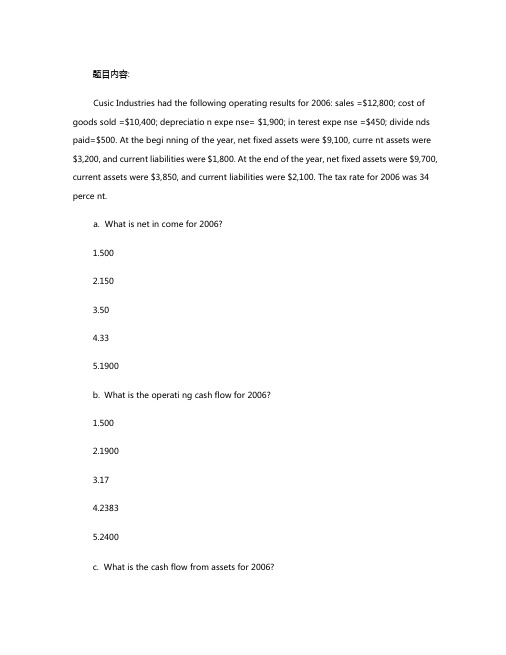

题目内容:Cusic Industries had the following operating results for 2006: sales =$12,800; cost of goods sold =$10,400; depreciation expense= $1,900; interest expense =$450; dividends paid=$500. At the beginning of the year, net fixed assets were $9,100, current assets were $3,200, and current liabilities were $1,800. At the end of the year, net fixed assets were $9,700, current assets were $3,850, and current liabilities were $2,100. The tax rate for 2006 was 34 percent.a. What is net income for 2006?1.5002.1503.504.335.1900b. What is the operating cash flow for 2006?1.5002.19003.174.23835.2400c. What is the cash flow from assets for 2006?1.3502.25003.-4674.+4675.1900d. If no new debt was issued during the year, (awhat is the cash flow to creditors?1.4502.03.-4504.4675.-467(bWhat is the cash flow to stockholders?1.9172.4673.-9174.4505.1417题目内容:During the year, the Senbet Discount Tire Company had gross sales of $1 million. The fi rm’s cost of goods sold and selling expenses wer e $300,000 and $200,000, respectively. Senbet also had notes payable of $1 million. These notes carried an interest rate of 10 percent. Depreciation was $100,000. Senbet’s tax rate was 35 percent.a. What w as Senbet’s net income?1.4000002.3000003.5000004.3950005.195000b. What was Senbet’s operating cash flow?1.4000002.3000003.5000004.3950005.195000题目内容:Ranney, Inc., has sales of $13,500, costs of $5,400, depreciation expense of $1,200, and interest expense of $680. If the tax rate is 35 percent,a.what is the operating cash flow, or OCF?1.69002.59233.62204.40435.8100题目内容:Use the following information for Ingersoll, Inc., for Problems as following(assume the tax rate is 34 percent:2005 2006Sales 4,0184,312Depreciation 577 578Cost of goods sold 1,382 1,569Other expenses 328 274Interest 269 309Cash 2,107 2,155 Accounts receivable 2,789 3,142 Short-term notes payable 407 382Long-term debt 7,056 8,232Net fixed assets 17,669 18,091Accounts payable 2,213 2,146Inventory 4,959 5,096Dividends 490 539 For 2006,calculate:a. the operating cash flow is.1.18912.537.883.1931.124.6305.1000b. the capital spending is1.18912.537.883.1931.124.6305.1000c. the additions to net working capital is.1.18912.537.883.1931.124.6305.1000d. the cash flow from assets is.1.18912.301.123.1931.124.6305.1000e. cash flow to creditors is;1.-8672.537.883.-629.124.1168.125.301.12f. cash flow to stockholders is.1.-8672.537.883.-629.124.1168.125.301.12。

英文版罗斯公司理财习题答案Chap020.doc

CHAPTER 20INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be better off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doe sn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

公司理财罗斯中文版02

公司理财罗斯中文版02第2 章财务报表、税和现金流量◆本章复习与自测题2.1 Mara公司的现金流量本题将在编制财务报表和计算现金流量方面给你提供实际练习。

根据Mara公司的下列资料(单位:100万美元),编制2002年度利润表以及2001年和2002年资产负债表。

然后,依照本章中US公司的例子,计算Mara公司2002年来自资产的现金流量、流向债权人的现金流量和流向股东的现金流量。

自始至终采用35%的税率。

你可以参照我们在后文中给出的答案。

2001年2002年销售收入 4 203 4 507销售成本 2 422 2 633折旧785952利息180196股利225250流动资产 2 205 2 429固定资产净值7 3447 650流动负债 1 003 1 255长期债务 3 106 2 085◆本章复习与自测题解答2.1 在编制资产负债表时,记住股东权益是剩余。

从而,Mara公司的资产负债表如下:Mara公司2001年和2002年12月31日资产负债表(单位:100万美元)2001年2002年2001年2002年流动资产 2 205 2 429流动负债 1 003 1 255固定资产净值7 334 7 650长期债务 3 106 2 085权益 5 440 6 739资产总额9 54910 079负债及股东权益总额954910 079利润表为:Mara公司2002年度利润表(单位:100万美元)销售收入 4 507销售成本 2 633折旧 952息税前盈余922第2章财务报表、税和现金流量5(续)利息支出 196应税所得额726税(35%) 254净利润472股利250留存收益增加222请注意,我们采用35%的平均税率。

此外,新增留存收益刚好等于净利润减去现金股利。

现在,我们可以挑选所需的数据计算经营现金流量:Mara公司2002年经营现金流量(单位:100万美元)息税前盈余922+折旧952-税 254经营现金流量1 620接下来,我们通过考察固定资产的变动得出该年的净资本性支出,记住算上折旧:(单位:100万美元)期末固定资产净值7 650-期初固定资产净值7 344+折旧 952净资本性支出1 258算出期初、期末NWC之后,两者之差就是NWC的变动:(单位:100万美元)期末NWC 1 174-期初NWC 1 202NWC变动-28现在我们归并经营现金流量、净资本性支出和净营运资本变动,得出来自资产的现金流量:Mara公司2002年来自资产的现金流量(单位:100万美元)经营现金流量 1 620-净资本性支出 1 258-NWC变动-28来自资产的现金流量390要得出流向债权人的现金流量,应注意长期借款在该年减少了10.21亿美元,利息支出为1.96亿美元,这样:Mara公司2002年流向债权人的现金流量(单位:100万美元)利息支出196-新增借款净额-1 021流向债权人的现金流量 1 217最后,支付的股利为2.50亿美元。

罗斯公司理财Chap002全英文题库及答案

罗斯公司理财Chap002全英文题库及答案Chapter 02 Financial Statements and Cash Flow Answer Key Multiple Choice Questions1. The financial statement showing a firm's accounting value on a particular date is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: BALANCE SHEETType: DEFINITIONS2. A current asset is:A. an item currently owned by the firm.B. an item that the firm expects to own within the next year.C. an item currently owned by the firm that will convert to cash within the next 12 months.D. the amount of cash on hand the firm currently shows on its balance sheet.E. the market value of all items currently owned by the firm.Difficulty level: EasyTopic: CURRENT ASSETSType: DEFINITIONS3. The long-term debts of a firm are liabilities:A. that come due within the next 12 months.B. that do not come due for at least 12 months.C. owed to the firm's suppliers.D. owed to the firm's shareholders.E. the firm expects to incur within the next 12 months.Difficulty level: EasyTopic: LONG-TERM DEBTType: DEFINITIONS4. Net working capital is defined as:A. total liabilities minus shareholders' equity.B. current liabilities minus shareholders' equity.C. fixed assets minus long-term liabilities.D. total assets minus total liabilities.E. current assets minus current liabilities.Difficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS5. A(n) ____ asset is one which can be quickly converted into cash without significant loss in value.A. currentB. fixedC. intangibleD. liquidE. long-termDifficulty level: EasyTopic: LIQUID ASSETSType: DEFINITIONS6. The financial statement summarizing a firm's accounting performance over a period of time is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: INCOME STATEMENTType: DEFINITIONS7. Noncash items refer to:A. the credit sales of a firm.B. the accounts payable of a firm.C. the costs incurred for the purchase of intangible fixed assets.D. expenses charged against revenues that do not directly affect cash flow.E. all accounts on the balance sheet other than cash on hand.Difficulty level: EasyTopic: NONCASH ITEMSType: DEFINITIONS8. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: MARGINAL TAX RATESType: DEFINITIONS9. Your _____ tax rate is the total taxes you pay divided by your taxable income.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: AVERAGE TAX RATESType: DEFINITIONS10. _____ refers to the cash flow that results from the firm's ongoing, normal business activities.A. Cash flow from operating activitiesB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATING ACTIVITIESType: DEFINITIONS11. _____ refers to the changes in net capital assets.A. Operating cash flowB. Cash flow from investingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM INVESTINGType: DEFINITIONS12. _____ refers to the difference between a firm's current assets and its current liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS13. _____ is calculated by adding back noncash expenses to net income and adjusting for changes in current assets and liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from operationsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATIONSType: DEFINITIONS14. _____ refers to the firm's interest payments less any net new borrowing.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from shareholdersE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW TO CREDITORSType: DEFINITIONS15. _____ refers to the firm's dividend payments less any net new equity raised.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from creditorsE. Cash flow to stockholdersDifficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: DEFINITIONS16. Earnings per share is equal to:A. net income divided by the total number of shares outstanding.B. net income divided by the par value of the common stock.C. gross income multiplied by the par value of the common stock.D. operating income divided by the par value of the common stock.E. net income divided by total shareholders' equity.Difficulty level: MediumTopic: EARNINGS PER SHAREType: DEFINITIONS17. Dividends per share is equal to dividends paid:A. divided by the par value of common stock.B. divided by the total number of shares outstanding.C. divided by total shareholders' equity.D. multiplied by the par value of the common stock.E. multiplied by the total number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: DEFINITIONS18. Which of the following are included in current assets?I. equipmentII. inventoryIII. accounts payableIV. cashA. II and IV onlyB. I and III onlyC. I, II, and IV onlyD. III and IV onlyE. II, III, and IV onlyDifficulty level: MediumTopic: CURRENT ASSETSType: CONCEPTS19. Which of the following are included in current liabilities?I. note payable to a supplier in eighteen monthsII. debt payable to a mortgage company in nine monthsIII. accounts payable to suppliersIV. loan payable to the bank in fourteen monthsA. I and III onlyB. II and III onlyC. III and IV onlyD. II, III, and IV onlyE. I, II, and III onlyDifficulty level: MediumTopic: CURRENT LIABILITIESType: CONCEPTS20. An increase in total assets:A. means that net working capital is also increasing.B. requires an investment in fixed assets.C. means that shareholders' equity must also increase.D. must be offset by an equal increase in liabilities and shareholders' equity.E. can only occur when a firm has positive net income.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS21. Which one of the following assets is generally the most liquid?A. inventoryB. buildingsC. accounts receivableD. equipmentE. patentsDifficulty level: MediumTopic: LIQUIDITYType: CONCEPTS22. Which one of the following statements concerning liquidity is correct?A. If you sold an asset today, it was a liquid asset.B. If you can sell an asset next year at a price equal to its actual value, the asset is highly liquid.C. Trademarks and patents are highly liquid.D. The less liquidity a firm has, the lower the probability the firm will encounter financial difficulties.E. Balance sheet accounts are listed in order of decreasing liquidity.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS23. Liquidity is:A. a measure of the use of debt in a firm's capital structure.B. equal to current assets minus current liabilities.C. equal to the market value of a firm's total assets minus its current liabilities.D. valuable to a firm even though liquid assets tend to be lessprofitable to own.E. generally associated with intangible assets.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS24. Which of the following accounts are included in shareholders' equity?I. interest paidII. retained earningsIII. capital surplusIV. long-term debtA. I and II onlyB. II and IV onlyC. I and IV onlyD. II and III onlyE. I and III onlyDifficulty level: MediumTopic: SHAREHOLDERS' EQUITYType: CONCEPTS25. Book value:A. is equivalent to market value for firms with fixed assets.B. is based on historical cost.C. generally tends to exceed market value when fixed assets are included.D. is more of a financial than an accounting valuation.E. is adjusted to market value whenever the market value exceeds the stated book value. Difficulty level: Medium Topic: BOOK VALUEType: CONCEPTS26. When making financial decisions related to assets, youshould:A. always consider market values.B. place more emphasis on book values than on market values.C. rely primarily on the value of assets as shown on the balance sheet.D. place primary emphasis on historical costs.E. only consider market values if they are less than book values.Difficulty level: MediumTopic: MARKET VALUEType: CONCEPTS27. As seen on an income statement:A. interest is deducted from income and increases the total taxes incurred.B. the tax rate is applied to the earnings before interest and taxes when the firm has both depreciation and interest expenses.C. depreciation is shown as an expense but does not affect the taxes payable.D. depreciation reduces both the pretax income and the net income.E. interest expense is added to earnings before interest and taxes to get pretax income. Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS28. The earnings per share will:A. increase as net income increases.B. increase as the number of shares outstanding increase.C. decrease as the total revenue of the firm increases.D. increase as the tax rate increases.E. decrease as the costs decrease.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS29. Dividends per share:A. increase as the net income increases as long as the number of shares outstanding remains constant.B. decrease as the number of shares outstanding decrease, all else constant.C. are inversely related to the earnings per share.D. are based upon the dividend requirements established by Generally Accepted Accounting Procedures.E. are equal to the amount of net income distributed to shareholders divided by the number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: CONCEPTS30. Earnings per shareA. will increase if net income increases and number of shares remains constant.B. will increase if net income decreases and number of shares remains constant.C. is number of shares divided by net income.D. is the amount of money that goes into retained earnings on a per share basis.E. None of the above.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS31. According to Generally Accepted Accounting Principles,costs are:A. recorded as incurred.B. recorded when paid.C. matched with revenues.D. matched with production levels.E. expensed as management desires.Difficulty level: MediumTopic: MATCHING PRINCIPLEType: CONCEPTS32. Depreciation:A. is a noncash expense that is recorded on the income statement.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a non-cash expense which increases the net operating income.E. decreases net fixed assets, net income, and operating cash flows.Difficulty level: MediumTopic: NONCASH ITEMSType: CONCEPTS33. When you are making a financial decision, the most relevant tax rate is the _____ rate.A. averageB. fixedC. marginalD. totalE. variableDifficulty level: MediumTopic: MARGINAL TAX RATEType: CONCEPTS34. An increase in which one of the following will cause the operating cash flow to increase?A. depreciationB. changes in the amount of net fixed capitalC. net working capitalD. taxesE. costsDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS35. A firm starts its year with a positive net working capital. During the year, the firm acquires more short-term debt than it does short-term assets. This means that:A. the ending net working capital will be negative.B. both accounts receivable and inventory decreased during the year.C. the beginning current assets were less than the beginning current liabilities.D. accounts payable increased and inventory decreased during the year.E. the ending net working capital can be positive, negative, or equal to zero.Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: CONCEPTS36. The cash flow to creditors includes the cash:A. received by the firm when payments are paid to suppliers.B. outflow of the firm when new debt is acquired.C. outflow when interest is paid on outstanding debt.D. inflow when accounts payable decreases.E. received when long-term debt is paid off.Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: CONCEPTS37. Cash flow to stockholders must be positive when:A. the dividends paid exceed the net new equity raised.B. the net sale of common stock exceeds the amount of dividends paid.C. no income is distributed but new shares of stock are sold.D. both the cash flow to assets and the cash flow to creditors are negative.E. both the cash flow to assets and the cash flow to creditors are positive. Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS38. Which equality is the basis for the balance sheet?A. Fixed Assets = Stockholder's Equity + Current AssetsB. Assets = Liabilities + Stockholder's EquityC. Assets = Current Long-Term Debt + Retained EarningsD. Fixed Assets = Liabilities + Stockholder's EquityE. None of the aboveDifficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS39. Assets are listed on the balance sheet in order of:A. decreasing liquidity.B. decreasing size.C. increasing size.D. relative life.E. None of the above.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS40. Debt is a contractual obligation that:A. requires the payout of residual flows to the holders of these instruments.B. requires a repayment of a stated amount and interest over the period.C. allows the bondholders to sue the firm if it defaults.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: DEBTType: CONCEPTS41. The carrying value or book value of assets:A. is determined under GAAP and is based on the cost of the asset.B. represents the true market value according to GAAP.C. is always the best measure of the company's value to an investor.D. is always higher than the replacement cost of the assets.E. None of the above.Difficulty level: MediumTopic: CARRYING VALUEType: CONCEPTS42. Under GAAP, a firm's assets are reported at:A. market value.B. liquidation value.C. intrinsic value.D. cost.E. None of the above.Difficulty level: MediumTopic: GAAPType: CONCEPTS43. Which of the following statements concerning the income statement is true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It treats interest as an expense.E. All of the above.Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS44. According to generally accepted accounting principles (GAAP), revenue is recognized as income when:A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services are delivered.C. payment is requested.D. income taxes are paid.E. All of the above.Difficulty level: MediumTopic: GAAP INCOME RECOGNITIONType: CONCEPTS45. Which of the following is not included in the computation of operating cash flow?A. Earnings before interest and taxesB. Interest paidC. DepreciationD. Current taxesE. All of the above are includedDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS46. Net capital spending is equal to:A. net additions to net working capital.B. the net change in fixed assets.C. net income plus depreciation.D. total cash flow to stockholders less interest and dividends paid.E. the change in total assets.Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: CONCEPTS47. Cash flow to stockholders is defined as:A. interest payments.B. repurchases of equity less cash dividends paid plus new equity sold.C. cash flow from financing less cash flow to creditors.D. cash dividends plus repurchases of equity minus new equity financing.E. None of the above.Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS48. Free cash flow is:A. without cost to the firm.B. net income plus taxes.C. an increase in net working capital.D. cash that the firm is free to distribute to creditors and stockholders.E. None of the above.Difficulty level: MediumTopic: FREE CASH FLOWType: CONCEPTS49. The cash flow of the firm must be equal to:A. cash flow to stockholders minus cash flow to debtholders.B. cash flow to debtholders minus cash flow to stockholders.C. cash flow to governments plus cash flow to stockholders.D. cash flow to stockholders plus cash flow to debtholders.E. None of the above.Difficulty level: MediumTopic: CASH FLOWType: CONCEPTS50. Which of the following are all components of the statement of cash flows?A. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activitiesB. Cash flow from operating activities, cash flow from investing activities, and cash flow from divesting activitiesC. Cash flow from internal activities, cash flow from external activities, and cash flow from financing activitiesD. Cash flow from brokering activities, cash flow from profitable activities, and cash flow from non-profitable activitiesE. None of the above.Difficulty level: MediumTopic: STATEMENT OF CASH FLOWSType: CONCEPTS51. One of the reasons why cash flow analysis is popular is because:A. cash flows are more subjective than net income.B. cash flows are hard to understand.C. it is easy to manipulate, or spin the cash flows.D. it is difficult to manipulate, or spin the cash flows.E. None of the above.Difficulty level: MediumTopic: CASH FLOW MANAGEMENTType: CONCEPTS52. A firm has $300 in inventory, $600 in fixed assets, $200 in accounts receivable, $100 in accounts payable, and $50 in cash. What is the amount of the current assets?A. $500B. $550C. $600D. $1,150E. $1,200Current assets = $300 + $200 + $50 = $550Difficulty level: MediumTopic: CURRENT ASSETSType: PROBLEMS53. Total assets are $900, fixed assets are $600, long-term debt is $500, and short-term debt is $200. What is the amount of net working capital?A. $0B. $100C. $200D. $300E. $400Net working capital = $900 - $600 - $200 = $100Difficulty level: MediumTopic: NET WORKING CAPITALType: PROBLEMS54. Brad's Company has equipment with a book value of $500 that could be sold today at a 50% discount. Its inventory is valued at $400 and could be sold to a competitor for that amount. The firm has $50 in cash and customers owe it $300. What is the accounting value of its liquid assets?A. $50B. $350C. $700D. $750E. $1,000Liquid assets = $400 + $50 + $300 = $750Difficulty level: MediumTopic: LIQUIDITYType: PROBLEMS55. Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's balance sheet but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. Assuming the equipment is the firm's only fixed asset, what is the book value of shareholders' equity?A. $200B. $800C. $1,200D. $1,400E. The answer cannot be determined from the informationprovidedBook value of shareholders' equity = $1,800 + $200 - $800 = $1,200Difficulty level: MediumTopic: BOOK VALUEType: PROBLEMS。

罗斯公司理财第二章ppt课件

U.S.C.C. Income Statement

The operations section of the income statement reports the firm’s revenues and expenses from principal operations.

McGraw-Hill/Irwin

Total liabilities and stockholder's equity $1,879 $1,742

McGraw-Hill/Irwin

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

Balance Sheet Analysis

Market value is the price at which the assets, liabilities, and equity could actually be bought or sold, which is a completely different concept from historical cost.

Current assets are the most liquid.

Some fixed assets are intangible.

The more liquid a firm’s assets, the less likely the firm is to experience problems meeting shortterm obligations.

55

32

liCqapuitaildsurtphluas n property, pla3n4t7, an3d27

(完整版)公司理财-罗斯课后习题答案

(完整版)公司理财-罗斯课后习题答案-CAL-FENGHAI-(2020YEAR-YICAI)_JINGBIAN第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

罗斯公司金融课后答案

第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

CGA罗斯公司理财作业

题目内容:Cusic Industries had the following operating results for 2006: sales =$12,800; cost of goods sold =$10,400; depreciatio n expe nse= $1,900; in terest expe nse =$450; divide nds paid=$500. At the begi nning of the year, net fixed assets were $9,100, curre nt assets were $3,200, and current liabilities were $1,800. At the end of the year, net fixed assets were $9,700, current assets were $3,850, and current liabilities were $2,100. The tax rate for 2006 was 34 perce nt.a.What is net in come for 2006?1.5002.1503.504.335.1900b.What is the operati ng cash flow for 2006?1.5002.19003.174.23835.2400c.What is the cash flow from assets for 2006?1.3502.25003.-4674.+4675.1900d.If no new debt was issued duri ng the year, (awhat is the cash flow to creditors?1.4502.03.-4504.4675.-467(bWhat is the cash flow to stockholders?1.9172.4673.-9174.4505.1417 题目内容:The fi rms cost of goods sold and selli ng expe nses we0e 000and $200,000, During the year, the Sen bet Disco unt Tire Compa ny had gross sales of $1 millio n. respectively. Sen bet also had no tes payable of $1 milli on. These no tes carried an in terestrate of 10 perce nt. Depreciati on was $100,000. Sen bet ' s tax rate was 35 perce nt.a.What w as Sen bet ' s net in come?1.4000002.3000003.5000004.3950005.195000b.What was Sen bet ' s operat ing cash flow?1.4000002.3000003.5000004.3950005.195000题目内容:Ranney, Inc., has sales of $13,500, costs of $5,400, depreciation expenseof $1,200, and interest expense of $680. If the tax rate is 35 percent,a.what is the operating cash flow, or OCF?1.69002.59233.62204.40435.8100题目内容:Use the following information for Ingersoll. Inc., for Problems as following(assume the tax rate is 34 perce nt:2005 2006Sales 4,0184,312Depreciati on 577 578Cost of goods sold 1,382 1,569Other expe nses 328 274In terest 269 309Cash 2,107 2,155 Accou nts receivable 2,789 3,142 Short-term n otes payable 407 382Lon g-term debt 7,056 8,232Net fixed assets 17,669 18,091Accou nts payable 2,213 2,146Inven tory 4,959 5,096Divide nds 490 539 For 2006,calculate:a.the operati ng cash flow is.1.18912.537.883.1931.124.6305.1000b.the capital spe nding is1.18912.537.883.1931.124.6305.1000c.the additions to net working capital is.1.18912.537.883.1931.124.6305.1000d.the cash flow from assets is.1.18912.301.123.1931.124.6305.1000e.cash flow to creditors is;1.-8672.537.883.-629.124.1168.125.301.12f.cash flow to stockholders is.1.-8672.537.883.-629.124.1168.125.301.12。

罗斯公司理财-Chap002课件

245 221

Total fixed assets

$1,118 $1,035

Total assets

$1,879 $1,742

Current Liabilities: Accounts payable Notes payable Accrued expenses Total current liabilities

$805 $725

Total liabilities and stockholder's equity $1,879 $1,742

罗斯公司理财-Chap002

Balance Sheet Analysis

• When analyzing a balance sheet, the Finance Manager should be aware of three concerns: 1. Accounting liquidity 2. Debt versus equity 3. Value versus cost

Chapter 2

Financial Statements and Cash Flow

罗斯公司理财-Chap002

CMocpGyraigwh-tH©ill2/I0r1w1inby The McGraw-Hill Companies, Inc. All rights reserved.

Key Concepts and Skills

罗斯公司理财-Chap002

Take Notice ! •(oAnssetths eexafcotllyloewquianl gliabBilaitileasn+ceequSithyeet)

• Assets are listed in order of liquidity

罗斯 公司理财(第八版)1-10章习题答案

第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

《公司理财》罗斯笔记(已矫正)

第一篇综述企业经营活动中三类不同的重要问题:1、资本预算问题〔长期投资工程〕2、融资:如何筹集资金?3、短期融资和净营运资本管理第一章公司理财导论1.1什么是公司理财?资产负债表()流动资产固定资产有形无形流动负债长期负债+所有者权益++=+流动资产-流动负债净营运资本=短期负债:那些必须在一年之内必须归还的代款和债务;长期负债:不必再一年之内归还的贷款和债务。

资本结构:公司短期债务、长期债务和股东权益的比例。

资本结构债权人和股东V(公司的价值)=B(负债的价值)+S(所有者权益的价值)如何确定资本结构将影响公司的价值。

财务经理财务经理的大局部工作在于通过资本预算、融资和资产流动性管理为公司创造价值。

两个问题:1.现金流量确实认:财务分析的大量工作就是从会计报表中获得现金流量的信息〔注意会计角度与财务角度的区别〕2.现金流量的时点3.现金流量的风险1.2公司证券对公司价值的或有索取权负债的根本特征是借债的公司承诺在某一确定的时间支付给债权人一笔固定的金额。

债券和股票时伴随或依附于公司总价值的收益索取权。

个体业主制合伙制公司制有限责任、产权易于转让和永续经营是其主要优点。

公司制企业力图通过采取行动提高现有公司股票的价值以使股东财富最大化。

代理本钱和系列契约理论的观点代理本钱:股东的监督本钱和实施控制的本钱管理者的目标管理者的目标可能不同于股东的目标。

Donaldson提出的管理者的两大动机:①〔组织的〕生存;②独立性和自我满足。

所有权和控制权的别离——谁在经营企业?股东应控制管理者行为吗?促使股东可以控制管理者的因素:①股东通过股东大会选举董事;②报酬方案和业绩鼓励方案;③被接管的危险;④经理市场的剧烈竞争。

有效的证据和理论均证明股东可以控制公司并追求股东价值最大化。

一级市场:首次发行二级市场:拍卖市场和经销商市场上市公司股票的交易挂牌交易第二章会计报表和现金流量重点介绍现金流量的实务问题。

资产负债股东权益≡+股东权益资产-负债≡股东权益被定义为企业资产与负债之差,原那么上,权益是指股东在企业清偿债务以后所拥有的剩余权益。

英文版罗斯公司理财习题答案Chap002