曼昆中级宏观经济学课后答案

宏观经济学曼昆第六版课后答案

答:股票分析师在确定股票的价值时应该考虑公司未来的盈利能力。公司的盈利能力取决于以下因素:市场对其产品的需求、所面临的顾客忠诚度、面对的政府管制和税收等。因此,股票分析师就要考虑所有上述因素以决定公司的一股股票价值为多少。

6.描述有效市场假说,并给出一个与这种理论一致的证据。

2.现值(present value)

答:现值指按现行利率为获得一个既定的未来货币量而在今天所需要的货币量。现值可用倒求本金的方法计算。由终值求现值,称为贴现。在贴现时使用的利息率称为贴现率。现值的计算公式可由终值的计算公式导出:fvn?pv?1?i?,则有:

pv?fvn?1n?1?i?n

上述公式中的1

5.风险厌恶(risk averse)

答:风险厌恶又称“风险规避”,指不喜欢不确定性。风险厌恶者总是以无风险或低风险作为衡量各种备选方案优劣的标准,把那些可能发生风险的备选方案拒之于外。

6.多元化(diversification)

答:多元化又称分散化,指通过分散投资于多项资产来降低投资风险的一种投资方式。从理论上来讲,一个证券组合只要包含了足够多的相关性较弱(甚至负相关)的证券,就完全可能消除所有风险,但是现实中,各证券收益率之间的正相关程度较高,因为各证券的收益率在一定程度上受同一因素影响(如经济周期、利率的变化等),因此分散化投资可以消除资产组合的非系统性风险,但是并不能消除系统性风险。也就是说,随着纳入同一资产组合的资产的收益率之间的相关系数(或协方差)的减小,该资产组合的收益率的方差(或标准差)也随之减小。各个证券之间的收益率变化的相关性越弱,分散投资降低风险的效果就越明显。

9.基本面分析(fundamental analysis)

曼昆《经济学原理(宏观经济学分册)》课后习题详解(开放经济的宏观经济理论)

曼昆《经济学原理(宏观经济学分册)》课后习题详解(开放经济的宏观经济理论)第32章开放经济的宏观经济理论一、概念题1.贸易政策(trade policy)答:贸易政策指直接影响一国进口或出口物品与劳务量的政府政策。

一国的对外贸易政策,是一国政府为实现一定的政策目标在一定时期内对本国进出口贸易所实行的政策,它是为国家最高利益服务的,是统治阶级意志的集中反映。

它包括:对外贸易总政策、国别对外贸易政策、进出口商品政策。

一个国家的对外贸易政策是这个国家的经济政策和对外政策的重要组成部分,它随着世界政治、经济形势的变化,国际政治、经济关系的发展而改变,同时它也反映各国经济发展的不同水平,反映各国在世界市场上的力量和地位,另外它还受到一国内部不同利益集团的影响。

一国的对外贸易政策有两种基本类型:自由贸易政策和保护贸易政策。

2.资本外逃(capital flight)答:资本外逃指出于安全或保值方面的考虑,短期资本持有者迅速将其从一国转移到另一国的行为或过程。

引起资本外逃的具体原因有三种:①一国政局动荡不稳,资本外逃以求安全。

②一国国内经济情况日益恶化,国际收支持续逆差,其货币可能发生贬值,资本逃至币值稳定的国家以期保值。

③一国加强外汇管制或颁布新法,使资本使用受到限制或资本收益减少,资本外逃以免遭受损失。

在本世纪发生的两次世界大战和20世纪30年代经济大萧条时期,欧美等国家曾出现过大规模的资本外逃现象。

近年来,发生大量资本外逃的主要是发展中国家,主要是因为这些国家的国内经济形势严峻,债务负担沉重,国际收支状况不断恶化以及国内政局动荡。

资本外逃对于一国的经济发展和国际收支稳定有着十分不利的影响。

它将降低该国的国内储蓄水平,从而造成投资下降和生产萎缩;它将加剧国际收支逆差,从而引起外汇储备的减少和国际清偿能力的恶化;大量资本外逃时,如果一国试图维持一定的生产和消费水平,势必引起外债负担的迅速积累。

因此,防止资本外逃是一国宏观经济政策的一项重要任务。

曼昆中级宏观经济学课后答案

曼昆中级宏观经济学课后答案【篇一:曼昆宏观经济学-课后答案第6、7版】txt>复习题1、由于整个经济的事件产生于许多家庭与许多企业的相互作用,所以微观经济学和宏观经济学必然是相互关联的。

当我们研究整个经济时,我们必须考虑个别经济行为者的决策。

由于总量只是描述许多个别决策的变量的总和,所以宏观经济理论必然依靠微观经济基础。

2、经济学家是用模型来解释世界,但一个经济学家的模型往往是由符号和方程式构成。

经济学家建立模型有助于解释gdp、通货膨胀和失业这类经济变量。

这些模型之所以有用是因为它们有助于我们略去无关的细节而更加明确地集中于重要的联系上。

模型有两种变量:内生变量和外生变量,一个模型的目的是说明外生变量如何影响内生变量。

3、经济学家通常假设,一种物品或劳务的价格迅速变动使得供给量与需求量平衡,即市场走向供求均衡。

这种假设称为市场出清。

在回答大多数问题时,经济学家用市场出清模型。

持续市场出清的假设并不完全现实。

市场要持续出清,价格就必须对供求变动作出迅速调整。

但是,实际上许多工资和价格调整缓慢。

虽然市场出清模型假设所有工资和价格都是有伸缩性的,但在现实世界中一些工资和价格是粘性的。

明显的价格粘性并不一定使市场出清模型无用。

首先偷格并不总是呆滞的,最终价格要根据供求的变动而调整。

市场出清模型并不能描述每一种情况下的经济,但描述了经济缓慢地趋近了均衡。

价格的伸缩性对研究我们在几十年中所观察到的实际gdp增长这类长期问题是一个好的假设。

第二章宏观经济学数据复习题1、gdp既衡量经济中所有人的收入,又衡量对经济物品与劳务的总支出。

gdp能同时衡量这两件事,是因为这两个量实际上是相同的:对整个经济来说,收入必定等于支出。

这个事实又来自于一个更有基本的事实:由于每一次交易都有一个买者和一个卖者,所以,一个买者支出的每一美元必然成为一个卖者的一美元收入。

2、cpi衡量经济中物价总水平。

它表示相对于某个基年一篮子物品与劳务价格的同样一篮子物品与劳务的现期价格。

曼昆《宏观经济学》课后习题及详解(宏观经济学科学)【圣才出品】

第1章宏观经济学科学一、概念题1.宏观经济学(macroeconomics)答:宏观经济学与微观经济学相对,是一种现代的经济分析方法。

它以国民经济总体作为考察对象,研究经济生活中有关总量的决定与变动,解释失业、通货膨胀、经济增长与波动、国际收支及汇率的决定与变动等经济中的宏观整体问题,所以又称之为总量经济学。

宏观经济学的中心和基础是总需求—总供给模型。

具体来说,宏观经济学主要包括总需求理论、总供给理论、失业与通货膨胀理论、经济增长与经济周期理论、开放经济理论、宏观经济政策等内容。

对宏观经济问题进行分析与研究的历史十分悠久,但现代意义上的宏观经济学直到20世纪30年代才得以形成和发展起来。

现代宏观经济学诞生的标志是凯恩斯于1936年出版的《就业、利息和货币通论》。

宏观经济学在20世纪30年代奠定基础,二战后逐步走向成熟并得到广泛应用,20世纪60年代后的“滞胀”问题使凯恩斯主义的统治地位受到严重挑战并形成了货币主义、供给学派、理性预期等学派对立争论的局面,20世纪90年代新凯恩斯主义的形成又使国家干预思想占据主流。

宏观经济学是当代发展最为迅猛,应用最为广泛,因而也是最为重要的经济学学科。

2.实际GDP(real GDP)答:实际GDP指用以前某一年的价格作为基期的价格计算出来的当年全部最终产品的市场价值。

它衡量在两个不同时期经济中的产品产量变化,以相同的价格或不变金额来计算两个时期所生产的所有产品的价值。

在国民收入账户中,以2010年的价格作为基期来计算实际GDP,意味着在计算实际GDP时,用现期的产品产量乘以2010年的价格,便可得到以2010年价格出售的现期产出的价值。

3.通货膨胀与通货紧缩(inflation and deflation)答:(1)通货膨胀是指在一段时期内,一个经济中大多数商品和劳务的价格水平持续显著地上涨。

它包含三层含义:①通货膨胀是经济中一般价格水平的上涨,而不是个别商品或劳务的价格上涨;②通货膨胀是价格的持续上涨,而非一次性上涨;③通货膨胀是价格的显著上涨,而非某些微小的上升,例如每年上升0.5%,不能视为通货膨胀。

曼昆宏观经济学第七版中文答案

曼昆宏观经济学第七版中文答案【篇一:曼昆宏观经济学-课后答案第6、7版】txt>复习题1、由于整个经济的事件产生于许多家庭与许多企业的相互作用,所以微观经济学和宏观经济学必然是相互关联的。

当我们研究整个经济时,我们必须考虑个别经济行为者的决策。

由于总量只是描述许多个别决策的变量的总和,所以宏观经济理论必然依靠微观经济基础。

2、经济学家是用模型来解释世界,但一个经济学家的模型往往是由符号和方程式构成。

经济学家建立模型有助于解释gdp、通货膨胀和失业这类经济变量。

这些模型之所以有用是因为它们有助于我们略去无关的细节而更加明确地集中于重要的联系上。

模型有两种变量:内生变量和外生变量,一个模型的目的是说明外生变量如何影响内生变量。

3、经济学家通常假设,一种物品或劳务的价格迅速变动使得供给量与需求量平衡,即市场走向供求均衡。

这种假设称为市场出清。

在回答大多数问题时,经济学家用市场出清模型。

持续市场出清的假设并不完全现实。

市场要持续出清,价格就必须对供求变动作出迅速调整。

但是,实际上许多工资和价格调整缓慢。

虽然市场出清模型假设所有工资和价格都是有伸缩性的,但在现实世界中一些工资和价格是粘性的。

明显的价格粘性并不一定使市场出清模型无用。

首先偷格并不总是呆滞的,最终价格要根据供求的变动而调整。

市场出清模型并不能描述每一种情况下的经济,但描述了经济缓慢地趋近了均衡。

价格的伸缩性对研究我们在几十年中所观察到的实际gdp增长这类长期问题是一个好的假设。

第二章宏观经济学数据"复习题1、gdp既衡量经济中所有人的收入,又衡量对经济物品与劳务的总支出。

gdp能同时衡量这两件事,是因为这两个量实际上是相同的:对整个经济来说,收入必定等于支出。

这个事实又来自于一个更有基本的事实:由于每一次交易都有一个买者和一个卖者,所以,一个买者支出的每一美元必然成为一个卖者的一美元收入。

2、cpi衡量经济中物价总水平。

它表示相对于某个基年一篮子物品与劳务价格的同样一篮子物品与劳务的现期价格。

中级宏观经济学曼昆英文版第七版第三章习题答案重点

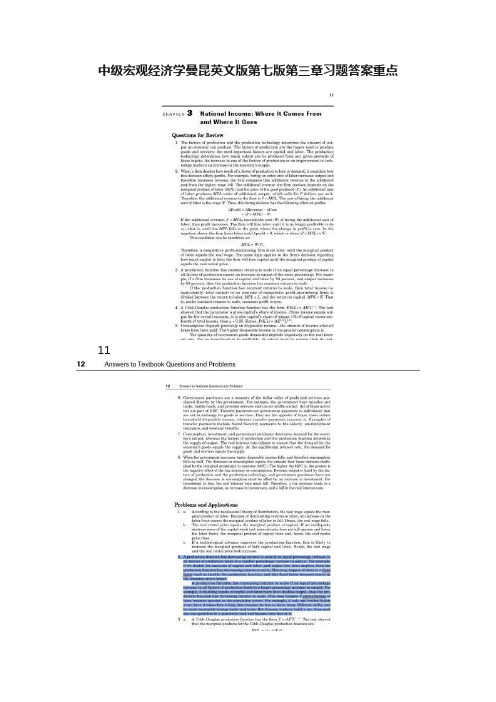

中级宏观经济学曼昆英文版第七版第三章习题答案重点11Chapter 3 National Income: Where It Comes From and Where It Goes 21 If consumption depends on the interest rate, then these conclusions about fiscal policy are modified somewhat. If consumption depends on the interest rate, then so does saving. The higher the interest rate, the greater the return to saving. Hence, it seems reasonable to think that an increase in the interest rate might increase saving and reduce consumption.Figure 3–6 shows saving as an increasing function of the interest rate. r S(r Figure 3–6 Real interest rate S Saving Consider what happens when government purchases increase. At any given level of the interest rate, national saving falls by the change in government purchases, as shown in Figure 3–7. The figure shows that if the saving function slopes upward, investment falls by less than the amount that government purchases rises by; this happens because consumption falls and saving increases in response to the higher interest rate. Hence, the more responsive consumption is to the interest rate, the less government purchases crowd out investment. r S2(r S1(r Figure 3–7 Real interest rate r1 r ?G I(r I1 II, S Investment, Saving 13. a. Figure 3–8 shows the case where the demand for loanable funds is stable but the supply of funds (the saving schedule fluctuates perhaps reflecting temporary shocks to income, changes in government spending, or changes in consumer confidence. In this case, when interest rates fall, investment rises; when interest rates rise, investment falls. We would expect a negative correlation between investment and interest rates.22 Answers to Textbook Questions and Problems S1 (r r S2 (r Figure 3–8 Real interest rate I(r I, S Investment, Saving b. Figure 3-9 shows the case where the supply of loanable funds (saving does not respond to the interest rate. Also suppose that this curve is stable, whereas the demand for loanable funds varies, perhaps reflecting fluctuations in firms’ expectations about the marginal product of capital. We would now fin d a positive correlation between investment and the interest rate—when demand for funds rises, this pushes up the interest rate, so we see investment increase and the real interest rate increase at thesame time. r S(r Figure 3–9 Real interest rate I 2 (r I 1 (r I, S Investment, SavingChapter 3 National Income: Where It Comes From and Where It Goes 23 c. If both curves shift, we might generate a scatter plot as in Figure 3–10, where the economy fluctuates among points A, B, C, and D. Depending on how often the economy is at each of these points, we might find little clear relationship between investment and interest rates. r S1 (r S2 (r D Real interest rate C A Figure 3–10 B I 1 (r I 2 (r I, S Investment, Saving d. Situation (c seems fairly reasonable—both the supply of and demand for loanable funds fluctuate over time in response to changes in the economy.。

宏观经济学课后习题答案(共9篇)

宏观经济学课后习题答案(共9篇)宏观经济学课后习题答案(一): 这是曼昆的宏观经济学的24章的课后习题,求高手解答,我要详细的计算过程!答案我已经知道,是变动0.4美元在长期中,糖果的价格从0.10美元上升到0.60美元。

在同一时期中,消费物价指数从150上升到300。

根据整体通货膨胀进行调整后,糖果的价格变动了多少我要详细的解答过程,怎么算的就行了!由CPI可知,通货膨胀率=(300-150)/150*100%=100%糖果的原始价格P=0.1在这段时间通过通货膨胀变为0.1*(1+通货膨胀率)=0.2实际上糖果在后来卖到了0.6,所以糖果实际价格变动了0.6-0.2=0.4美元宏观经济学课后习题答案(二): 曼昆宏观经济学26章课后题答案是不是错了假设政府明年借债比今年多了200亿美元,对于可贷资金市场的利率和投资,供给和需求曲线的变动,答案是不是有错答案说是供给曲线不变,需求曲线右移,我认为是需求曲线不动,供给曲线左移……财政政策当然变动的是需求,供给怎么可能变动,你可能是总供给和总需求有些混淆,我开始的时候也不是很清楚,多看几遍就明白了,供给曲线可能因为劳动力变动,而合财政货币政策无关.这些政策变动的都是需求.另外右移就是借钱多了,就是投资需求多了,就是G多了,那就是需求曲线右移了宏观经济学课后习题答案(三): 谁有高鸿业版《西方经济学》宏观部分——第十七章课后题答案第十七章总需求——总供给模型1、(1)总需求是经济社会对产品和劳务的需求总量,这一需求总量通常以产出水平来表示.一个经济社会的总需求包括消费需求、投资需求、.政府购买和国外需求.总需求量受多种因素的影响,其中价格水平是一个重要的因素.在宏观经济学中,为了说明价格对总需求量的影响,引入了总需求曲线的概念,即总需求量与价格水平之间关系的几何表示.在凯恩斯主义的总需求理论中,总需求曲线的理论来源主要由产品市场均衡理论和货币市场均衡理论来反映.(2)在IS—LM模型中,一般价格水平被假定为一个常数(参数).在价格水平固定不变且货币供给为已知的情况下,IS曲线和LM曲线的交点决定均衡的收入水平.现用图1—62来说明怎样根据IS—LM图形推导总需求曲线.图1—62分上下两部.上图为IS—LM图.下图表示价格水平和需求总量之间的关系,即总需求曲线.当价格P的数值为时,此时的LM曲线与IS曲线相交于点 , 点所表示的国民收入和利率顺次为和 .将和标在下图中便得到总需求曲线上的一点 .现在假设P由下降到 .由于P的下降,LM曲线移动到的位置,它与IS曲线的交点为点. 点所表示的国民收入和利率顺次为和 .对应于上图的点 ,又可在下图中找到 .按照同样的程序,随着P的变化,LM曲线和IS曲线可以有许多交点,每一个交点都代表着一个特定的y和p.于是有许多P与的组合,从而构成了下图中一系列的点.把这些点连在一起所得到的曲线AD便是总需求曲线.从以上关于总需求曲线的推导中看到,总需求曲线表示社会中的需求总量和价格水平之间的相反方向的关系.即总需求曲线是向下方倾斜的.向右下方倾斜的总需求曲线表示,价格水平越高,需求总量越小;价格水平越低,需求总量越大.2、财政政策是政府变动税收和支出,以便影响总需求,进而影响就业和国民收入的政策.货币政策是指货币当局即中央银行通过银行体系变动货币供应量来调节总需求的政策.无论财政政策还是货币政策,都是通过影响利率、消费和投资进而影响总需求,使就业和国民收入得到调节的,通过对总需求的调节来调控宏观经济,所以称为需求管理政策.3、总供给曲线描述国民收入与一般价格水平之间的依存关系.根据生产函数和劳动力市场的均衡推导而得到.资本存量一定时,国民收入水平碎就业量的增加而增加,就业量取决于劳动力市场的均衡.所以总供给曲线的理论来源于生产函数和劳动力市场均衡的理论.4、总供给曲线的理论主要由总量生产函数和劳动力市场理论来反映的.在劳动力市场理论中,经济学家对工资和价格的变化和调整速度的看法是分歧的.古典总供给理论认为,劳动力市场运行没有阻力,在工资和价格可以灵活变动的情况下,劳动力市场得以出清,使经济的就业总能维持充分就业状态,从而在其他因素不变的情况下,经济的产量总能保持在充分就业的产量或潜在产量水平上.因此,在以价格为纵坐标,总产量为横坐标的坐标系中,古典供给曲线是一条位于充分就业产量水平的垂直线.凯恩斯的总供给理论认为,在短期,一些价格是粘性的,从而不能根据需求的变动而调整.由于工资和价格粘性,短期总供给曲线不是垂直的,凯恩斯总供给曲线在以价格为纵坐标,收入为横坐标的坐标系中是一条水平线,表明经济中的厂商在现有价格水平上,愿意供给所需的任何数量的商品.作为凯恩斯总供给曲线基础的思想是,作为工资和价格粘性的结果,劳动力市场不能总维持在充分就业状态,由于存在失业,厂商可以在现行工资下获得所需劳动.因而他们的平均生产成本被认为是不随产出水平变化而变化.一些经济学家认为,古典的和凯恩斯的总供给曲线分别代表着劳动力市场的两种极端的说法.在现实中工资和价格的调整经常介于两者之间.在这种情况下以价格为纵坐标,产量为横坐标的坐标系中,总供给曲线是向右上方延伸的,这即为常规的总需求曲线.总之,针对总量劳动市场关于工资和价格的不同假设,宏观经济学中存在着三种类型的总供给曲线.5、解答:宏观经济学在用总需求—总供给说明经济中的萧条,高涨和滞涨时,主要是通过说明短期的收入和价格水平的决定来完成的.如图1—63所示. 从图1—63可以看到,短期的收入和价格水平的决定有两种情况.第一种情况是,AD是总需求曲线, 使短期供给曲线,总需求曲线和短期供给曲线的交点E决定的产量或收入为y,价格水平为P,二者都处于很低的水平,第一种情况表示经济处于萧条状态.第二种情况是,当总需求增加,总需求曲线从AD向右移动到时,短期总供给曲线和新的总需求曲线的交点决定的产量或收入为 ,价格水平为 ,二者都处于很高的水平,第二种情况表示经济处于高涨状态.现在假定短期供给曲线由于供给冲击(如石油价格和工资等提高)而向左移动,但总需求曲线不发生变化.在这种情况下,短期收入和价格水平的决定可以用图1—64表示.在图1—64中,AD是总需求曲线,是短期总供给曲线,两者的交点E决定的产量或收入为,价格水平为P.现在由于出现供给冲击,短期总供给曲线向左移动到,总需求曲线和新的短期总供给曲线的交点决定的产量或收入为,价格水平为,这个产量低于原来的产量,而价格水平却高于原来的价格水平,这种情况表示经济处于滞涨状态,即经济停滞和通货膨胀结合在一起的状态.6、二者在“形式”上有一定的相似之处.微观经济学的供求模型主要说明单个商品的价格和数量的决定.宏观经济中的AD—AS模型主要说明总体经济的价格水平和国民收入的决定.二者在图形上都用两条曲线来表示,在价格为纵坐标,数量为横坐标的坐标系中,向右下方倾斜的为需求曲线,向右上方延伸的为供给曲线.但二者在内容上有很大的不同:其一,两模型涉及的对象不同.微观经济学的供求模型是微观领域的事物,而宏观经济中的AD—AS模型是宏观领域的事物.其二,各自的理论基础不同.微观经济学中的供求模型中的需求曲线的理论基础是消费者行为理论,而供给曲线的理论基础主要是成本理论和市场理论,它们均属于微观经济学的内容.宏观经济学中的总需求曲线的理论基础主要是产品市场均衡和货币市场均衡理论,而供给曲线的理论基础主要是劳动市场理论和总量生产函数,它们均属于宏观经济学的内容.其三,各自的功能不同.微观经济学中的供求模型在说明商品的价格和数量的决定的同时,还可以来说明需求曲线和供给曲线移动对价格和商品数量的影响,充其量这一模型只解释微观市场的一些现象和结果.宏观经济中的AD—AS模型在说明价格和产出决定的同时,可以用来解释宏观经济的波动现象,还可以用来说明政府运用宏观经济政策干预经济的结果.7、(1)由得;2023 + P = 2400 - P于是 P=200, =2200即得供求均衡点.(2)向左平移10%后的总需求方程为:于是,由有:2023 + P = 2160 – PP=80 , =2080与(1)相比,新的均衡表现出经济处于萧条状态.(3)向右平移10%后的总需求方程为:于是,由有:2023 + P = 2640 – PP=320 , =2320与(1)相比,新的均衡表现出经济处于高涨状态.(4)向左平移10%后的总供给方程为:于是,由有:1800 + P = 2400 – PP=300 , =2100与(1)相比,新的均衡表现出经济处于滞涨状态.(5)总供给曲线向右上方倾斜的直线,属于常规型.宏观经济学课后习题答案(四): 宏观经济学问题题号:11 题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:一般把经济周期分为四个阶段,这四个阶段为().选项:a、兴旺,停滞,萧条和复苏b、繁荣,停滞,萧条和恢复c、繁荣,衰退,萧条和复苏d、兴旺,衰退,萧条和恢复题号:12 题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:“面粉是中间产品”这一命题()选项:a、一定是对的b、一定是不对的c、可能是对的也可能是不对的d、以上三种说法全对.题号:13 题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:下列哪种情况下执行财政政策的效果较好(选项:a、LM陡峭而IS平缓b、LM平缓而IS陡峭c、LM和IS一样平缓d、LM和IS一样陡峭题号:14 题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:政府财政政策通过哪一个变量对国民收入产生影响().选项:a、进口b、消费支出c、出口d、政府购买.题号:15 题型:单选题(请在以下几个选项中选择唯一正确答案)本题分数:5内容:在国民收入核算体系中,计入GDP的政府支出是指().选项:a、政府购买物品的支出b、政府购买物品和劳务的支出c、政府购买物品和劳务的支出加上政府的转移支出之和d、政府工作人员的薪金和政府转移支出题号:16 题型:是非题本题分数:5内容:长期总供给曲线所表示的总产出是经济中的潜在产出水平选项:1、错2、对题号:17 题型:是非题本题分数:5内容:GDP中扣除资本折旧,就可以得到NNP选项:1、错2、对题号:18 题型:是非题本题分数:5内容:在长期总供给水平,由于生产要素等得到了充分利用,因此经济中不存在失业选项:1、错2、对题号:19 题型:是非题本题分数:5内容:个人收入即为个人可支配收入,是人们可随意用来消费或储蓄的收入选项:1、错2、对题号:20 题型:是非题本题分数:5内容:GNP折算指数是实际GDP与名义GDP的比率选项:1、错2、对C,C,A,D,B对,对(NNP国民生产净值),错(可能还有摩擦失业),错,错宏观经济学课后习题答案(五): 一道宏观经济学的习题,求答案及解析7、将一国经济中所有市场交易的货币价值进行加总a、会得到生产过程中所使用的全部资源的市场价值b、所获得的数值可能大于、小于或等于GDP的值c、会得到经济中的新增价值总和d、会得到国内生产总值`b 正确市场交易的可能有中间产品,如此中间产品加上最终产品,则重复计算的结果大于GDP;不在国内市场交易,出口销往国外的漏算,则计算结果会小于gdp;如果重复的和漏算的正好相等,则结果可能等于gdp。

曼昆宏观经济学第九版 课后习题答案

Answers to Textbook Questions and ProblemsCHAPTER 1 The Science of MacroeconomicsQuestions for Review1. Microeconomics is the study of how individual firms and households make decisions, andhow they interact with one another. Microeconomic models of firms and households are based on principles of optimization—firms and households do the best they can given the constraints they face. For example, households choose which goods to purchase in order to maximize their utility, whereas firms decide how much to produce in order to maximize profits. In contrast, macroeconomics is the study of the economy as a whole; it focuses on issues such as how total output, total employment, and the overall price level are determined. These economy-wide variables are based on the interaction of many households and many firms; therefore, microeconomics forms the basis for macroeconomics.2. Economists build models as a means of summarizing the relationships among economicvariables. Models are useful because they abstract from the many details in the economy and allow one to focus on the most important economic connections.3. A market-clearing model is one in which prices adjust to equilibrate supply and demand.Market-clearing models are useful in situations where prices are flexible. Yet in many situations, flexible prices may not be a realistic assumption. For example, labor contracts often set wages for up to three years. Or, firms such as magazine publishers change their prices only every three to four years. Most macroeconomists believe that price flexibility is a reasonable assumption for studying long-run issues. Over the long run, prices respond to changes in demand or supply, even though in the short run they may be slow to adjust.Problems and Applications1. Monetary policy in the United States and the European Union has been a big topic ofconversation in early 2015. The EU embarked upon a quantitative easing policy in March 2015 in an attempt to stimulate growth and prevent deflation. There has been some concern that the inflation rate in Europe will turn negative. In the United States, there is continued discussion and speculation concerning when the Federal Reserve might choose to increase the target federal funds rate. Also in the United States, the unemployment rate has declined to about 5.5 percent and this suggests that wages may begin to increase.The Federal Reserve will be watching for wage and price increases as they decide when to increase interest rates.2. Many philosophers of science believe that the defining characteristic of a science is theuse of the scientific method of inquiry to establish stable relationships. Scientists examine data, often provided by controlled experiments, to support or disprove a hypothesis.Economists are more limited in their use of experiments. They cannot conduct controlled experiments on the economy; they must rely on the natural course of developments in the economy to collect data. To the extent that economists use the scientific method of inquiry, that is, developing hypotheses and testing them, economics has the characteristics of a science.3. We can use a simple variant of the supply-and-demand model for pizza to answer thisquestion. Assume that the quantity of ice cream demanded depends not only on the price of ice cream and income, but also on the price of frozen yogurt:Q d = D(P IC, P FY, Y).We expect that demand for ice cream rises when the price of frozen yogurt rises, because ice cream and frozen yogurt are substitutes. That is, when the price of frozen yogurt goes up, I consume less of it and, instead, fulfill more of my frozen dessert urges through the consumption of ice cream.The next part of the model is the supply function for ice cream, Q s = S(P IC). Finally, in equilibrium, supply must equal demand, so that Q s = Q d. Y and P FY are the exogenous variables, and Q and P IC are the endogenous variables. Figure 1-1 uses this model to show that a fall in the price of frozen yogurt results in an inward shift of the demand curve for ice cream. The new equilibrium has a lower price and quantity of ice cream.4. The price of haircuts changes rather infrequently. From casual observation, hairstyliststend to charge the same price over a one- or two-year period irrespective of the demand for haircuts or the supply of cutters. A market-clearing model for analyzing the market for haircuts has the unrealistic assumption of flexible prices. Such an assumption isunrealistic in the short run when we observe that prices are inflexible. Over the long run, however, the price of haircuts does tend to adjust; a market-clearing model is therefore appropriate.Answers to Textbook Questions and ProblemsCHAPTER 2 The Data of MacroeconomicsQuestions for Review1. GDP measures the total income earned from the production of the new final goods and services in theeconomy, and it measures the total expenditures on the new final goods and services produced in the economy. GDP can measure two things at once because the total expenditures on the new final goods and services by the buyers must be equal to the income earned by the sellers of the new final goods and services. As the circular flow diagram in the text illustrates, these are alternative, equivalent ways of measuring the flow of dollars in the economy.2. The four components of GDP are consumption, investment, government purchases, and net exports.The consumption category of GDP consists of household expenditures on new final goods and services, such as the purchase of a new television. The investment category of GDP consists of business fixed investment, residential fixed investment, and inventory investment. When a business buys new equipment this counts as investment. Government purchases consists of purchases of new final goods and services by federal, state, and local governments, such as payments for new military equipment. Net exports measures the value of goods and services sold to other countries minus the value of goods and services foreigners sell us. When the U.S. sells corn to foreign countries, it counts in the net export category of GDP.3. The consumer price index (CPI) measures the overall level of prices in the economy. Ittells us the price of a fixed basket of goods relative to the price of the same basket in the base year. The GDP deflator is the ratio of nominal GDP to real GDP in a given year. The GDP deflator measures the prices of all goods and services produced, whereas the CPI only measures prices of goods and services bought by consumers. The GDP deflator includes only domestically produced goods, whereas the CPI includes domestic and foreign goods bought by consumers. Finally, the CPI is a Laspeyres index that assigns fixed weights to the prices of different goods, whereas the GDP deflator is a Paasche index that assigns changing weights to the prices of different goods. In practice, the two price indices tend to move together and do not often diverge.4. The CPI measures the price of a fixed basket of goods relative to the price of the samebasket in the base year. The PCE deflator is the ratio of nominal consumer spending to real consumer spending. The CPI and the PCE deflator are similar in that they both only include the prices of goods purchased by consumers, and they both include the price of imported goods as well as domestically produced goods. The two measures differ because the CPI measures the change in the price of a fixed basket whereas the goods measured by the PCE deflator change from year to year depending on what consumers are purchasing in that particular year.5. The Bureau of Labor Statistics (BLS) classifies each person into one of the following threecategories: employed, unemployed, or not in the labor force. The unemployment rate, which is the percentage of the labor force that is unemployed, is computed as follows:Unemployment Rate = Number of UnemployedLabor Force´100.Note that the labor force is the number of people employed plus the number of people unemployed.6. Every month, the Bureau of Labor Statistics undertakes two surveys to measureemployment. First, the BLS surveys about 60,000 households and thereby obtains an estimate of the share of people who say they are working. The BLS multiplies this share by an estimate of the population to estimate the number of people working. Second, the BLS surveys about 160,000 business establishments and asks how many people they employ. Each survey is imperfect; so the two measures of employment are not identical. Problems and Applications1. From the main Web page click on the interactive data tab at the top, select GDP,begin using the data, section 1, and then table 1.1.1. Real GDP grew at a rate of 2.2 percent in quarter 4 of 2014. When compared to growth rates of −2.1 percent, 4.6 percent, and 5 percent for the first three quarters of 2014, the rate of 2.2 percent was slightly below average. From the main Web page select the data tools tab, then top picks. Check the box for the unemployment rate and retrieve the data. The unemployment rate in March 2015 was 5.5 percent, which was about equal to the natural rate of unemployment, or the long run average rate. From the main page, select the economic releases tab, then inflation and prices. Access the report for the CPI. In February 2015, the inflation rate for all items was 0 percent, and if food and energy were excluded the rate was 1.7 percent. The inflation rate was below average and below the Federal Reserve’s target of 2 percent.2. Value added by each person is equal to the value of the good produced minus theamount the person paid for the materials needed to make the good. Therefore, the value added by the farmer is $1.00 ($1 – 0 = $1). The value added by the miller is $2: she sells the flour to the baker for $3 but paid $1 for the flour. The value added by the baker is $3: she sells the bread to the engineer for $6 but paid the miller $3 for the flour. GDP is the total value added, or $1 + $2 + $3 = $6. Note that GDP equals the value of the final good (the bread).3. When a woman marrie s her butler, GDP falls by the amount of the butler’s salary. Thishappens because GDP measures total income, and therefore GDP, falls by the amount of the butler’s loss i n salary. If GDP truly measures the value of all goods and services, then the marriage would not affect GDP since the total amount of economic activity is unchanged. Actual GDP, however, is an imperfect measure of economic activity because the value of some goods and services is left out. Once the butler’s work becomes part of his household chores, his services are no longer counted in GDP. As this example illustrates, GDP does not include the value of any output produced in the home.4. a. The airplane sold to the U.S. Air Force counts as government purchases because theAir Force is part of the government.b. The airplane sold to American Airlines counts as investment because it is a capitalgood sold to a private firm.c. The airplane sold to Air France counts as an export because it is sold to a foreigner.d. The airplane sold to Amelia Earhart counts as consumption because it is sold to aprivate individual.e. The airplane built to be sold next year counts as investment. In particular, the airplaneis counted as inventory investment, which is where goods that are produced in one year and sold in another year are counted.5. Data on parts (a) to (f) can be downloaded from the Bureau of Economic Analysis. Go tothe Website, click on the interactive data tab at the top, select GDP, begin using the data, section 1, and then table 1.1.5. Choose the “modify the data” option to select the years you in which you are interested. By dividing each component (a) to (f) by nominal GDP and multiplying by 100, we obtain the following percentages:1950 1980 2014a. Personal consumption expenditures 64.0% 61.3% 68.5%b. Gross private domestic investment 18.8% 18.5% 16.4%c. Government consumption purchases 16.9% 20.6% 18.2%d. Net exports 0.2% –0.5% 3.1%e. National defense purchases 7.6% 6.3% 4.4%f. Imports 3.9% 10.3% 16.5%(Note: The above data was downloaded April 3, 2015, from the BEA Web site.)Among other things, we observe the following trends in the economy over the period 1950–2015:a. Personal consumption expenditures have been around two-thirds of GDP between1980 and 2015.b. The share of GDP going to gross private domestic investment remained fairly steady.c. The share going to government consumption purchases rose sharply from 1950 to1980.d. Net exports, which were positive in 1950, have been negative since that time.e. The share going to national defense purchases has fallen.f. Imports have grown rapidly relative to GDP.6. a. GDP measures the value of the final goods and services produced, or $1,000,000. b. NNP is equal to GNP minus depreciation. In this example, GDP is equal to GNP because there areno foreign transactions. Therefore, NNP is equal to $875,000.c. National income is equal to NNP, or $875,000.d. Employee compensation is equal to $600,000.e. Proprietors’ income measures the income of the owner, and is equal to 150,000.f. Corporate profit is equal to corporate taxes plus dividends plus retained earnings, or $275,000.Retained earnings is calculated as sales minus wages minus dividends minus depreciation minus corporate tax, or $75,000.g. Personal income is equal to employee compensation plus dividends, or $750,000. h. Disposable personal income is personal income minus taxes, or $550,000.7. a. i. Nominal GDP is the total value of goods and services measured at current prices. Therefore,Nominal GDP 2010 = P hotdogs 2010´Q hotdogs 2010()+P burgers 2010´Q burgers 2010()= ($2 ⨯ 200) + ($3 ⨯ 200)= $400 + $600= $1,000.Nominal GDP 2015 = P hotdogs 2015´Q hotdogs 2015()+P burgers 2015´Q burgers 2015()= ($4 ⨯ 250) + ($4 ⨯ 500)= $1,000 + $2,000= $3,000.ii. Real GDP is the total value of goods and services measured at constant prices.Therefore, to calculate real GDP in 2015 (with base year 2010), multiply thequantities purchased in the year 2015 by the 2010 prices:Real GDP 2015 = P 2010hotdogs ´Q 2015hotdogs ()+P 2010burgers ´Q 2015burgers ()= ($2 ⨯ 250) + ($3 ⨯ 500)= $500 + $1,500= $2,000.Real GDP for 2010 is calculated by multiplying the quantities in 2010 by the pricesin 2010. Since the base year is 2010, real GDP 2010 equals nominal GDP 2010, which is$10,00. Hence, real GDP increased between 2010 and 2015.iii. The implicit price deflator for GDP compares the current prices of all goods and services produced to the prices of the same goods and services in a base year. It is calculated as follows:Implicit Price Deflator2015= Nominal GDP2010Real GDP2010= 1Using the values for Nominal GDP2015 and real GDP2015 calculated above:Implicit Price Deflator2015 = $3,000$2,000= 1.50.This calculation reveals that prices of the goods produced in the year 2015 increased by 50 percent compared to the prices that the goods in the economy sold for in 2010. (Because 2010 is the base year, the value for the implicit price deflator for the year 2010 is 1.0 because nominal and real GDP are the same for the base year.)iv. The consumer price index (CPI) measures the level of prices in the economy. The CPI is called a fixed-weight index because it uses a fixed basket of goods over time to weight prices. If the base year is 2010, the CPI in 2015 is measuring the cost of the basket in 2015 relative to the cost in 2010. The CPI2015 is calculated as follows:CPI 2015= (P2015hotdogs´Q2010hotdogs) + (P2015burgers´Q2010burgers)(P2010hotdogs´Q2010hotdogs) + (P2010burgers´Q2010burgers)= $16,000,000 $10,000,000= 1.6.This calculation shows that the price of goods purchased in 2015 increased by 60 percent compared to the prices these goods would have sold for in 2010. The CPI for 2010, the base year, equals 1.0.b. The implicit price deflator is a Paasche index because it is computed with a changingbasket of goods; the CPI is a Laspeyres index because it is computed with a fixed basket of goods. From (7.a.iii), the implicit price deflator for the year 2015 is 1.50, which indicates that prices rose by 50 percent from what they were in the year 2010.From (7.a.iv.), the CPI for the year 2015 is 1.6, which indicates that prices rose by 60percent from what they were in the year 2010.If prices of all goods rose by, for example, 50 percent, then one could say unambiguously that the price level rose by 50 percent. Yet, in our example, relative prices have changed. The price of hot dogs rose by 1020 percent; the price of hamburgers rose by 33.33 percent, making hamburgers relatively less expensive.As the discrepancy between the CPI and the implicit price deflator illustrates, the change in the price level depends on how the goods’ prices are weighted. The CPI weights the price of goods by the quantities purchased in the year 2010. The implicit price deflator weights the price of goods by the quantities purchased in the year 2015.Since the quantity of the two goods was the same in 2010, the CPI is placing equal weight on the two price changes. In 2015, the quantity of hamburgers was twice as large as hot dogs, so there is twice as much weight placed on the hamburger price relative to the hot dog price. For this reason, the CPI shows a larger inflation rate –more weight is placed on the good with the larger price increase.8. a. The consumer price index uses the consumption bundle in year 1 to figure out howmuch weight to put on the price of a given good:CPI2=$2´10()+$1´0() $1´10()+$2´0()=P2red´Q1red()+P2green´Q1green()P1red´Q1red()+P1green´Q1green()= 2.According to the CPI, prices have doubled.b. Nominal spending is the total value of output produced in each year. In year 1 andyear 2, Abby buys 10 apples for $1 each, so her nominal spending remains constant at $10. For example,Nominal Spending2 = P2red ´Q2red()+P2green´Q2green()= ($2 ⨯ 0) + ($1 ⨯ 10)= $10.c. Real spending is the total value of output produced in each year valued at the pricesprevailing in year 1. In year 1, the base year, her real spending equals her nominal spending of $10. In year 2, she consumes 10 green apples that are each valued at their year 1 price of $2, so her real spending is $20. That is,Real Spending2= P1red ´Q2red()+P1green´Q2green()= ($1 ⨯ 0) + ($2 ⨯ 10)= $20.Hence, Abby’s real spending rises from $10 to $20.d. The implicit price deflator is calculated by dividing Abby’s nominal spending in year2 by her real spending that year:Implicit Price Deflator2= Nominal Spending2 Real Spending2= $10 $20= 0.5.Thus, the implicit price deflator suggests that prices have fallen by half. The reason for this is that the deflator estimates how much Abby values her apples using prices prevailing in year 1. From this perspective green apples appear very valuable. In year 2, when Abby consumes 10 green apples, it appears that her consumption has increased because the deflator values green apples more highly than red apples. The only way she could still be spending $10 on a higher consumption bundle is if the price of the good she was consuming fell.e. If Abby thinks of red apples and green apples as perfect substitutes, then the cost ofliving in this economy has not changed—in either year it costs $10 to consume 10 apples. According to the CPI, however, the cost of living has doubled. This is because the CPI only takes into account the fact that the red apple price has doubled; the CPI ignores the fall in the price of green apples because they were not in the consumption bundle in year 1. In contrast to the CPI, the implicit price deflator estimates the cost of living has been cut in half. Thus, the CPI, a Laspeyres index, overstates the increase in the cost of living and the deflator, a Paasche index, understates it.9. a. The labor force includes full time workers, part time workers, those who run their ownbusiness,and those who do not have a job but are looking for a job. The labor force consists of 70 people. The working age population consists of the labor force plus those not in the labor force. The 10 discouraged workers and the 10 retired people are not in the labor force, but assuming they are capable of working, they are part of the adult population. The adult population consists of 90 people, so the labor force participation rate is equal to 70/90 or 77.8 percent.b. The number of unemployed workers is equal to 10, so the unemployment rate is10/70 or 14.3 percent.c. The household survey estimates total employment by asking a sample of householdsabout their employment status. The household survey would report 60 people employed. The establishment survey estimates total employment by asking a sample of businesses to report how many workers they are employing. In this case the establishment survey would report 55 people employed. The 5 people with 2 jobs would be counted twice, and the 10 people who run their own business would not be counted.10. As Senator Robert Kennedy pointed out, GDP is an imperfect measure of economicperformance or well-being. In addition to the left-out items that Kennedy cited, GDP also ignores the imputed rent on durable goods such as cars, refrigerators, and lawnmowers;many services and products produced as part of household activity, such as cooking and cleaning; and the value of goods produced and sold in illegal activities, such as the drug trade. These imperfections in the measurement of GDP do not necessarily reduce its usefulness. As long as these measurement problems stay constant over time, then GDP is useful in comparing economic activity from year to year. Moreover, a large GDP allows us to afford better medical care for our children, newer books for their education, and more toys for their play. Finally, countries with higher levels of GDP tend to have higher levels of life expectancy, better access to clean water and sanitation, and higher levels of education. GDP is therefore a useful measure for comparing the level of growth and development across countries.11. a. Real GDP falls because Disney World does not produce any services while it is closed.This corresponds to a decrease in economic well-being because the income of workers and shareholders of Disney World falls (the income side of the national accounts), and people’s consumption of Disney World falls (the expenditure side of the national accounts).b. Real GDP rises because the original capital and labor in farm production now producemore wheat. This corresponds to an increase in the economic well-being of society, since people can now consume more wheat. (If people do not want to consume more wheat, then farmers and farmland can be shifted to producing other goods that society values.)c. Real GDP falls because with fewer workers on the job, firms produce less. Thisaccurately reflects a fall in economic well-being.d. Real GDP falls because the firms that lay off workers produce less. This decreaseseconomic well-being because workers’ incomes fall (the income side), and there are fewer goods for people to buy (the expenditure side).e. Real GDP is likely to fall, as firms shift toward production methods that produce fewergoods but emit less pollution. Economic well-being, however, may rise. The economynow produces less measured output but more clean air. Clean air is not traded in markets and, thus, does not show up in measured GDP, but is nevertheless a good that people value.f. Real GDP rises because the high school students go from an activity in which they arenot producing market goods and services to one in which they are. Economic well-being, however, may decrease. In ideal national accounts, attending school would show up as investment because it presumably increases the future productivity of the worker. Actual national accounts do not measure this type of investment. Note also that future GDP may be lower than it would be if the students stayed in school, since the future work force will be less educated.g. Measured real GDP falls because fathers spend less time producing market goodsand services. The actual production of goods and services need not have fallen because but unmeasured production of child-rearing services rises. The well-being of the average person may very well rise if we assume the fathers and the children enjoy the extra time they are spending together.Answers to Textbook Questions and ProblemsCHAPTER3 National Income: Where It Comes From and Where It GoesQuestions for Review1. The factors of production and the production technology determine the amount ofoutput an economy can produce. The factors of production are the inputs used to produce goods and services: the most important factors are capital and labor. The production technology determines how much output can be produced from any given amounts of these inputs. An increase in one of the factors of production or an improvement in technology leads to an increase in the economy’s output.2. When a firm decides how much of a factor of production to hire or demand, it considershow this decision affects profits. For example, hiring an extra unit of labor increases output and therefore increases revenue; the firm compares this additional revenue to the additional cost from the higher wage bill. The additional revenue the firm receives depends on the marginal product of labor (MPL) and the price of the good produced (P).An additional unit of labor produces MPL units of additional output, which sells for P dollars per unit. Therefore, the additional revenue to the firm is P ⨯MPL. The cost of hiring the additional unit of labor is the wage W. Thus, this hiring decision has the following effect on profits:ΔProfit= ΔRevenue –ΔCost= (P ⨯MPL) –W.If the additional revenue, P ⨯MPL, exceeds the cost (W) of hiring the additional unit of labor, then profit increases. The firm will hire labor until it is no longer profitable to do so—that is, until the MPL falls to the point where the change in profit is zero. In the equation abov e, the firm hires labor until ΔP rofit = 0, which is when (P ⨯MPL) = W.This condition can be rewritten as:MPL = W/P.Therefore, a competitive profit-maximizing firm hires labor until the marginal product of labor equals the real wage. The same logic applies to the firm’s decision regarding how much capital to hire: the firm will hire capital until the marginal product of capital equals the real rental price.3. A production function has constant returns to scale if an equal percentage increase in allfactors of production causes an increase in output of the same percentage. For example, if a firm increases its use of capital and labor by 50 percent, and output increases by 50 percent, then the production function has constant returns to scale.If the production function has constant returns to scale, then total income (or equivalently, total output) in an economy of competitive profit-maximizing firms is divided between the return to labor, MPL ⨯L, and the return to capital, MPK ⨯K. That is, under constant returns to scale, economic profit is zero.4. A Cobb–Douglas production function has the form F(K,L) = AKαL1–α. The text showed thatthe parameter αgives capital’s share of income. So if capital earns one-fourth of total income, then α= 0.25. Hence, F(K,L) = AK0.25L0.75.5. Consumption depends positively on disposable income—i.e. the amount of income afterall taxes have been paid. Higher disposable income means higher consumption.The quantity of investment goods demanded depends negatively on the real interest rate. For an investment to be profitable, its return must be greater than its cost. Because the real interest rate measures the cost of funds, a higher real interest rate makes it more costly to invest, so the demand for investment goods falls.6. Government purchases are a measure of the value of goods and services purchaseddirectly by the government. For example, the government buys missiles and tanks, builds roads, and provides services such as air traffic control. All of these activities are part of GDP. Transfer payments are government payments to individuals that are not in exchange for goods or services. They are the opposite of taxes: taxes reduce household disposable income, whereas transfer payments increase it. Examples of transfer payments include Social Security payments to the elderly, unemployment insurance, and veterans’ benefits.7. Consumption, investment, and government purchases determine demand for theeconomy’s output, whereas the factors of production and the production function determine the supply of output. The real interest rate adjusts to ensure that the demand for the econo my’s goods equals the supply. At the equilibrium interest rate, the demand。

宏观经济学习题答案(曼昆第五版)

第八篇宏观经济学的数据第二十三章一国收入的衡量复习题 1 .解释为什么一个经济的收入必定等于其支出? 答:对一个整体经济而言,收入必定等于支出。

因为每一次交易都有两方:买者和卖者。

一个买者的1 美元支出是另一个卖者的1 美元收入。

因此,交易对经济的收入和支出作出了相同的贡献。

由于GDP 既衡量总收入 135 又衡量总支出,因而无论作为总收入来衡量还是作为总支出来衡量,GDP 都相等。

2 .生产一辆经济型轿车或生产一辆豪华型轿车,哪一个对GDP 的贡献更大?为什么?答:生产一辆豪华型轿车对GDP 的贡献大。

因为GDP 是在某一既定时期一个国家内生产的所有最终物品与劳务的市场价值.由于市场价格衡量人们愿意为各种不同物品支付的量,所以市场价格反映了这些物品的市场价值。

由于一辆豪华型轿车的市场价格高于一辆经济型轿车的市场价格,所以一辆豪华型轿车的市场价值高于一辆经济型轿车的市场价值,因而生产一辆豪华型轿车对GDP 的贡献更大。

3 .农民以2 美元的价格把小麦卖给面包师。

面包师用小麦制成面包,以3 美元的价格出售。

这些交易对 GDP 的贡献是多少呢?答:对GDP 的贡献是3 美元。

GDP 只包括最终物品的价值,因为中间物品的价值已经包括在最终物品的价格中了.4 .许多年以前,Peggy 为了收集唱片而花了500 美元。

今天她在旧货销售中把她收集的物品卖了100 美元.这种销售如何影响现期GDP?答:现期GDP 只包括现期生产的物品与劳务,不包括涉及过去生产的东西的交易。

因而这种销售不影响现期GDP.5 .列出GDP 的四个组成部分。

各举一个例子。

答:GDP 等于消费(C)+投资(I)+政府购买(G)+净出口(NX) 消费是家庭用于物品与劳务的支出,如汤姆一家人在麦当劳吃午餐.投资是资本设备、存货、新住房和建筑物的购买,如通用汽车公司建立一个汽车厂.政府购买包括地方政府、州政府和联邦政府用于物品与劳务的支出,如海军购买了一艘潜艇。

中级宏观经济学曼昆英文版第七版第三章习题答案

3

National Income: Where It Comes From and Where It Goes

Questions for Review

1. The factors of production and the production technology determine the amount of output an economy can produce. The factors of production are the inputs used to produce goods and services: the most important factors are capital and labor. The production technology determines how much output can be produced from any given amounts of these inputs. An increase in one of the factors of production or an improvement in technology leads to an increase in the economy’s output. 2. When a firm decides how much of a factor of production to hire or demand, it considers how this decision affects profits. For example, hiring an extra unit of labor increases output and therefore increases revenue; the firm compares this additional revenue to the additional cost from the higher wage bill. The additional revenue the firm receives depends on the marginal product of labor (MPL) and the price of the good produced (P). An additional unit of labor produces MPL units of additional output, which sells for P dollars per unit. Therefore, the additional revenue to the firm is P × MPL. The cost of hiring the additional unit of labor is the wage W. Thus, this hiring decision has the following effect on profits: ∆Profit = ∆Revenue – ∆Cost = (P × MPL) – W. If the additional revenue, P × MPL, exceeds the cost (W) of hiring the additional unit of labor, then profit increases. The firm will hire labor until it is no longer profitable to do so—that is, until the MPL falls to the point where the change in profit is zero. In the equation above, the firm hires labor until ∆profit = 0, which is when (P × MPL) = W. This condition can be rewritten as: MPL = W/P. Therefore, a competitive profit-maximizing firm hires labor until the marginal product of labor equals the real wage. The same logic applies to the firm’s decision regarding how much capital to hire: the firm will hire capital until the marginal product of capital equals the real rental price. 3. A production function has constant returns to scale if an equal percentage increase in all factors of production causes an increase in output of the same percentage. For example, if a firm increases its use of capital and labor by 50 percent, and output increases by 50 percent, then the production function has constant returns to scale. If the production function has constant returns to scale, then total income (or equivalently, total output) in an economy of competitive profit-maximizing firms is divided between the return to labor, MPL × L, and the return to capital, MPK × K. That is, under constant returns to scale, economic profit is zero. 4. A Cobb-Douglas production function function has the form F(K,L) = AKαL1–α. The text showed that the parameter α gives capital’s share of income. (Since income equals output for the overall economy, it is also capital’s share of output.) So if capital earns onefourth of total income, then a = 0.25. Hence, F(K,L) = AK0.25L0.75. 5. Consumption depends positively on disposable income—the amount of income after all taxes have been paid. The higher disposable income is, the greater consumption is. The quantity of investment goods demanded depends negatively on the real interest rate. For an investment to be profitable, its return must be greater than its cost. Because the real interest rate measures the cost of funds, a higher real interest rate makes it more costly to invest, so the demand for investment goods falls. 11

曼昆宏观经济学__课后作业习题_部分答案(免费)

曼昆宏观经济学__课后作业习题_部分答案(免费)疾风知劲草,岁寒见后凋。

天若有情天亦老,人间正道是沧桑。

横眉冷对千夫指,俯首甘为孺子牛。

嘈嘈切切错杂弹,大珠小珠落玉盘。

博学之,审问之,慎思之,明辨之,笃行之。

宏观经济学课后习题作业 11.经济学的创始人是,现代宏观经济学是建立的。

2.亚当斯密在年出版了《》。

3.凯恩斯在年出版了《》。

4.当代经济学最主要流派有、和。

5.名词解释:经济学、宏观经济学。

6.简述宏观经济学的内容。

作业 21.名词解释:国内生产总值(GDP)、GDP平减指数、中间产品2.GDP与GNP的差别?P1092.生产一辆经济型轿车或生产一辆豪华型轿车,哪一个对GDP的贡献更大?为什么?答:生产一辆豪华型轿车对GDP的贡献大。

因为GDP是在某一既定时期一个国家内生产的所有最终物品与劳务的市场价值。

由于市场价格衡量人们愿意为各种不同物品支付的量,所以市场价格反映了这些物品的市场价值。

由于一辆豪华型轿车的市场价格高于一辆经济型轿车的市场价格,所以一辆豪华型轿车的市场价值高于一辆经济型轿车的市场价值,因而生产一辆豪华型轿车对GDP的贡献更大。

3.农民以2美元的价格把小麦卖给面包师。

面包师用小麦制成面包,以3美元的价格出售。

这些交易对GDP的贡献是多少呢?答:对GDP的贡献是3美元。

GDP只包括最终物品的价值,因为中间物品的价值已经包括在最终物品的价格中了。

4.许多年以前,佩吉为了收集唱片而花了500美元。

今天她在旧货销售中把她收集的物品卖了100美元。

这种销售如何影响现期GDP?答:现期GDP只包括现期生产的物品与劳务,不包括涉及过去生产的东西的交易。

因而这种销售不影响现期GDP。

P1101.下列每一种交易会影响GDP的哪一部分(如果有影响的话)?试解释之。

A.家庭购买了一台新冰箱。

答:家庭购买了一台新冰箱会增加GDP中的消费(C)部分,因为家庭用于家用电器的支出计算在消费的耐用品类中。

曼昆《宏观经济学》(第6、7版)笔记和课后习题详解

16.1复习笔记 16.2课后习题详解

第18章投资

第17章消费

第19章货币供给、 货币需求和银行体

系

第19章经济 周期理论的 进展(第6版

教材)

附录指定曼 昆《宏观经 济学》教材 为考研参考 书目的院校 列表

17.1复习笔记 17.2课后习题详解

18.1复习笔记 18.2课后习题详解

19.1复习笔记 19.2课后习题详解

7.1复习笔记 7.2课后习题详解

8.1复习笔记 8.2课后习题详解

第9章经济波动导论

第10章总需求Ⅰ:建 立IS-LM模型

第11章总需求Ⅱ:应 用IS-LM模型

第12章重访开放经济: 蒙代尔-弗莱明模型 与汇率制度

第13章总供 给与通货膨 胀和失业之 间的短期权

衡

第14章一个 总供给和总 需求的动态 模型

第3章国民收 入:源自何 处,去向何 方

第4章货币与 通货膨胀

第5章开放的 经济

第6章失业

3.1复习笔记 3.2课后习题详解

4.1复习笔记 4.2课后习题详解

5.1复习笔记 5.2课后习题详解

6.1复习笔记 6.2课后习题详解

第7章经济增 长Ⅰ:资本 积累与人口

增长

第8章经济增 长Ⅱ:技术、 经验和政策

曼昆《宏观经济学》(第6、7版) 笔记和课后习题详解

读书笔记模板

01 思维导图

03 读书笔记 05 作者介绍

目录

02 内容摘要 04 目录分析 06 精彩摘录

思维导图

关键字分析思维导图

笔记

第章

习题

复习

理论

第版

政策

笔记

教材

习题 习题

教材

曼昆宏观经济学英语课后题答案

CHAPTER 23: MEASURING A NATION’S INCOMETrue/FalseIndicate whether the statement is true or false.1. T he circular flow diagram describes all transactions between households and firms in a simpleeconomy and shows the equality of expenditures and income.ANSWER: TPOINTS: 0 / 12. G ross domestic product includes most items produced and sold illicitly.ANSWER: FPOINTS: 0 / 13. N et national product is the total in come of a nation’s residents minus losses from depreciation.ANSWER: TPOINTS: 0 / 14. D isposable personal income is the income that households and unincorporated business haveleft after satisfying all their obligations to the government. It equals personal income minuspersonal taxes and certain non-tax payments to government.ANSWER: TPOINTS: 0 / 15. T he purchase of new houses by households is included in the calculation of personalconsumption expenditures of GDP.ANSWER: FPOINTS: 0 / 1Multiple ChoiceIdentify the choice that best completes the statement or answers the question.1. W hen GDP falls,a. income and expenditure must both fall.b. income and expenditure can both rise.c. income must fall, but expenditure may rise or fall.d. expenditure must fall, but income may rise or fall.ANSWER: APOINTS: 0 / 12. I ncome equals expenditure becausea. firms always pay out all their revenue as income to someone.b. each time a sale is made, there is a buyer and a seller.c. households own the factors of production used to generate incomes.d. All of the above are correct.ANSWER: BPOINTS: 0 / 13. I f a province makes the production and sale of illicit drugs legal, then GDPa. must increase.b. must decrease.c. wouldn't change.d. may increase or decrease.ANSWER: APOINTS: 0 / 14. W hen a government provides subsidies to encourage growth of small businesses, the subsidieswoulda. be included in GDP because they are invested by businesses.b. be included in GDP because they are a form of government spending.c. not be included in GDP because they are transfer payments.d. may or may not be included in GDP, depending on how the funds are used.ANSWER: CPOINTS: 0 / 15. D iesel fuel isa. always considered a final good.b. counted as an intermediate good if a company uses it to provide transportation services.c. counted as a final good if a farmer uses it to run a tractor to grow crops.d. Both b and c are correct.ANSWER: BPOINTS: 0 / 16. G ross domestic producta. is the market value of all final goods and services produced within a country in a givenperiod (usually a year)b. is the income in the hands of individuals after deducting income taxes; income availableto households to spend and savec. is the value of goods and services purchased by all levels of government— federal,provincial, and local—in a given periodd. is the market value of all final goods and services produced by permanent residents of anation in a given time periodANSWER: APOINTS: 0 / 17. M acroeconomics is that branch of economics that studiesa. the conditions of individual marketsb. the influence of governments on individual marketsc. economy-wide phenomenad. only the private sector of the economyANSWER: CPOINTS: 0 / 18. S uppose that nominal GDP is $6,000 billion and real GDP is $3,000. What is the GDP pricedeflator?a. 125b. 150c. 200d. 250ANSWER: CPOINTS: 0 / 19. T he purchase of final goods and services by households is calleda. investmentb. public sector expenditurec. consumptiond. net exportsANSWER: CPOINTS: 0 / 110. I nvestment is the purchase of capital equipment, inventories, anda. structuresb. non-durable goodsc. depreciationd. import investmentANSWER: APOINTS: 0 / 111. T ransfer paymentsa. are included in GDP because they are forms of incomeb. are included in GDP because goods and services have been produced in the transferc. are NOT included in the GDP because goods and services have not been produced inthe transferd. are included in GDP because they represent the production of transfers of goods andservices to foreign countriesANSWER: CPOINTS: 0 / 112. W hich of the following would be considered consumption expenditure?a. The Smiths buy a home built in 1990.b. The federal government pays the salary of a captain in the Armed Forces.c. The Hostlers buy a new car that was manufactured in Germany.d. The government buys food for its armed forces.ANSWER: CPOINTS: 0 / 113. T he method that measures GDP in relationship to the size of the population is calleda. GNPb. worker GDPc. GDP per persond. capital GDPANSWER: CPOINTS: 0 / 114. T he components of GDP area. C + I + Gb. NX + G + Cc. C + G + NXd. C + I + G + NXANSWER: DPOINTS: 0 / 115. S uppose nominal GDP is $7700 and the GDP deflator is 110. Real GDP isa. $7700b. $7000c. $847,000d. $8470ANSWER: BPOINTS: 0 / 1Short Answer1. W hat are the components of gross domestic product (GDP)?RESPONSE:ANSWER: The components of GDP are: (1) consumption spending by households on goods and services, with the exception of purchases of new housing; (2) Investmentspending on capital equipment, inventories, and structures, including householdpurchases of new housing; (3) government purchases or spending on goods andservices by the local, provincial, and federal levels governments; and (4) netexports which is spending on domestically produced goods and services byforeigners (exports) minus spending on foreign goods and services by domesticresident (imports).POINTS: -- / 12. D ifferentiate between gross domestic product (GDP) and gross national product (GNP).RESPONSE:ANSWER: GDP is the value of all final goods and services produced within a country in a given year; while GNP is the total income earned by a nation’s permanent residents ornationals (that is, Canadians). GNP differs from GDP by including income thatcitizens of the nation (Canada) earned aboard, and excluding income thatforeigners earn in the particular country (E.g. in Canada).POINTS: -- / 13. D ifferentiate between real GDP and nominal GDP.RESPONSE:ANSWER: Nominal GDP is the value of all final goods and services produced within a country in a year and valued at current prices; and real GDP is the GDP valued at constantbase year prices. Real GDP is not affected by changes in the level of prices, so itreflects only changes in the amounts being produced.POINTS: -- / 14. E xplain why GDP is not considered a perfect measure of well- being?RESPONSE:ANSWER: GDP is not considered a perfect measure of well-being because some of thefactors that contribute to a good life are omitted. These would include: leisure time,the quality of the environment, the distribution of income, and the production ofgoods and services that did not pas through the market (for example, houseworkdone by the homemaker, and volunteer work)POINTS: -- / 15. H ow do economists measure economic growth?RESPONSE:ANSWER: Economists measure economic growth as the percentage change in real GDP from one period to another. This is because changes in real GDP reflect only changes inthe amounts being produced.POINTS: -- / 1CHAPTER 24: MEASURING THE COST OF LIVINGTrue/FalseIndicate whether the statement is true or false.1. T he GDP deflator reflects the prices of goods and services bought by consumers, and the consumerprice index reflects the price of all final goods and services produced domestically.ANSWER: FPOINTS: 0 / 12. T he consumer price index compares the price of a fixed basket of goods and services to the price ofthe basket in the base year. On the other hand, the GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base years.ANSWER: TPOINTS: 0 / 13. I ndexation refers to the automatic correction of a dollar amount for the effects of inflation by law orcontract.ANSWER: TPOINTS: 0 / 14. L ong term contracts between firms and unions will sometimes include partial or complete indexationof the wage to the consumer price index. This is called a cost-of-living allowance clause.ANSWER: TPOINTS: 0 / 15. T he core inflation rate is the consumer price index with the exclusion of the most volatilecomponents such as energy and food.ANSWER: TPOINTS: 0 / 1Multiple ChoiceIdentify the choice that best completes the statement or answers the question.1. I n the CPI, goods and services are weighted according toa. how much a typical consumer buys of each item.b. whether the items are necessities or luxuries.c. how much of each item is produced in the domestic economy.d. how much is spent on them in the national income accounts.ANSWER: APOINTS: 0 / 12. B y not taking into account the possibility of consumer substitution, the CPIa. understates the standard of living.b. overstates the cost of living.c. neither overstates nor understates the cost of living.d. doesn't accurately reflect the cost of living, but it is unclear if it overstates or understates thecost of living.ANSWER: BPOINTS: 0 / 13. I f the prices of Brazilian-made shoes imported into Canada increases, thena. both Canada’s GDP deflator and it’s consumer price index will increase.b. neither Canada’s GDP deflator nor it’s consumer pri ce index will increase.c. Canada’s GDP deflator will increase but its CPI will not increase.d. Canada’s consumer price index will increase, but its GDP deflator won’t change.ANSWER: DPOINTS: 0 / 14. I f increases in the prices of Canadian car insurance causes the CPI to increase by 3 percent, theGDP deflator will likely increase bya. more than 3 percent.b. 3 percent.c. less than 3 percent.d. All of the above are correct.ANSWER: CPOINTS: 0 / 15. T he real interest rate tells youa. how quickly your savings account will grow.b. how quickly the purchasing power of your savings account will grow.c. the size of your savings account.d. the purchasing power of your savings account.ANSWER: BPOINTS: 0 / 16. I nflation refers toa. a temporary increase in the price level due to higher tax ratesb. a large increase in food and gasoline pricesc. a situation in which the economy's overall price level is risingd. an increase in the purchasing power of the dollarANSWER: CPOINTS: 0 / 17. I f nominal interest rates increase from 8 percent to 10 percent while inflation increases from 3percent to 12 percenta. the real interest rate falls from 5 percent to –2 percentb. the real interest rate rises from –2 percent to 5 percentc. the real interest rate falls from 8 percent to 12 percentd. the real interest rate rises from 8 percent to 12 percentANSWER: APOINTS: 0 / 18. I f the nominal rate of interest is 10 percent and the rate of inflation is 3 percent, what is the real rateof interest?a. 13 percentb. 7 percentc. 3 percentd. –7 percentANSWER: BPOINTS: 0 / 19. T he consumer price index:a. measures price changes of raw materialsb. adjusts all prices of goods and services for five-year periodsc. measures the cost of goods and services bought by a typical consumerd. cannot measure price changes of intangible production such as servicesANSWER: CPOINTS: 0 / 110. I f the consumer price index (CPI) at the end of 1996 was 125 and the CPI at the end of 1997 was131, then the rate of inflation during 1997 wasa. zero – prices were stable during 1997b. 4.8 percentc. 6.0 percentd. 125 percentANSWER: BPOINTS: 0 / 111. F rank's nominal income in 1998 is $45,000. Suppose the CPI in 1998 is 150. What is Frank's realincome?a. $51,750b. $45,000c. $38,250d. $30,000ANSWER: DPOINTS: 0 / 112. A change in the price of imports bought by consumers will bea. reflected in the GDP deflatorb. reflected in GDPc. reflected in the CPId. reflected in net national incomeANSWER: CPOINTS: 0 / 113. A ll of the following but one are problems associated with the CPIa. substitution biasb. the introduction of new goods and servicesc. unmeasured quality changesd. The CPI is not based on a fixed basket of goods and servicesANSWER: DPOINTS: 0 / 114. W hich of the following is correct?a. The CPI is not based on a fixed basket of goods and services.b. The GDP deflator reflects the prices of all domestically produced goods and services.c. The GDP deflator is based on a fixed basket of goods and services.d. The GDP deflator is subject to substitution bias.ANSWER: BPOINTS: 0 / 115. T he inflation ratea. is a measure of the cost of a basket of goods and services bought by firmsb. is the absolute change in prices between yearsc. is the percentage change in the price index from the preceding periodd. measures changes in incomes from one year to the nextANSWER: CPOINTS: 0 / 1Short Answer1. W hat is the consumer price index (CPI)? What are the three major items included in the CPI?RESPONSE:ANSWER: The CPI is a measure of the overall cost of the goods and services bought by a typical consumer. The three major items included in the CPI are shelter, transportation andfood.POINTS: -- / 12. H ow is the CPI computed?RESPONSE:ANSWER: First the basket of goods and services must be determined and also the relative importance of the various items to be included in the basket. Then the prices of thevarious items in the basket are determined. The cost of the basket is then determinedusing the data on prices and quantity. The base year is chosen, and the index for thebase year is computed using the quantities in the basket and the base year prices.The index is calculated by taking the price of the basket in the each year and dividingthis by the price of the basket in the base year. This ratio is then multiplied by 100. POINTS: -- / 13. D ifferentiate between the nominal rate of interest and the real rate of interest.RESPONSE:ANSWER: The nominal interest rate is the interest rate as usually reported without a correction for the effects of inflation. The real interest rate is the interest rate corrected for theeffects of inflation. The real interest rate = nominal interest rate minus the inflationrate.POINTS: -- / 14. W hat is meant by the inflation rate? If the CPI in 1996 was 107.6 and in 1995 was 105.9, calculatethe inflation rate for 1996.RESPONSE:ANSWER: The inflation rate is the percentage change in the price index from the preceding period. The inflation rate for 1996 would be:POINTS: -- / 15. W hat are the problems associated with using the consumer price index to measure the cost ofliving?RESPONSE:ANSWER: The problems are: (1) Prices do not change proportionately. Consumers respond by buying less of the goods whose prices have risen by large amounts and by buyingmore of the goods whose price have risen by less, or even fallen. The index iscomputed using a fixed basket of items, so theses changes in quantity would not bereflected in the basket. This is referred to as the substitution bias. (2) The CPI isdeveloped using a fixed basket of goods and services, when new products areintroduced during the time period that a particular fixed basket is being used, thesenew products will not be included in calculation of the index. (3) The CPI does notmeasure quality changes. If the quality of a good deteriorates from one year to thenext, the value of the dollar falls, even if the price of the good stays the same.Likewise, if the quality of the good increases from one year to the next, the value of adollar also rises. Statistics Canada will try to adjust the price of the good to account forthe quality change, but it is very difficult to measure quality.POINTS: -- / 1CHAPTER 25: PRODUCTION AND GROWTHTrue/FalseIndicate whether the statement is true or false.1. O ne way to raise future productivity is to invest less current resources in the production of capital.ANSWER: FPOINTS: 0 / 12. D iminishing returns occur when the benefits from an extra unit of output declines as the quantityof output declines.ANSWER: FPOINTS: 0 / 13. M althusian theory states that an ever-increasing population would continually strain society’sability to provide for itself. This doomed human beings to forever live in poverty.ANSWER: TPOINTS: 0 / 14. P roductivity growth is measured by real output per worker.ANSWER: TPOINTS: 0 / 15. T he primary reason that living standards are higher today than they were a century ago is thattechnological knowledge has advanced.ANSWER: TPOINTS: 0 / 1Multiple ChoiceIdentify the choice that best completes the statement or answers the question.1. O f the following countries, which grew the slowest over the last 100 years?a. Brazil.b. Mexico.c. Singapore.d. United States.ANSWER: DPOINTS: 0 / 12. O n average, each year of schooling raises a person's wage in Canada by abouta. 3 percent.b. 10 percent.c. 15 percent.d. 25 percent.ANSWER: BPOINTS: 0 / 13. T he primary reason that Canadian living standards are higher today than they were a century agois thata. more productive natural resources have been discovered.b. physical capital per worker has increased.c. technological knowledge has increased.d. human capital has increased.ANSWER: CPOINTS: 0 / 14. M any countries in Africa have low growth rates. This is partly due toa. few natural resourcesb. high trade barriers.c. low incomes, making it very difficult for them to grow.d. All of the above are correct.ANSWER: BPOINTS: 0 / 15. A government can encourage growth and, in the long run, raise the economy’s standard of livingby encouraginga. population growth.b. consumption spending.c. saving and investment.d. trade restrictions.ANSWER: CPOINTS: 0 / 16. D iminishing returns is the notion thata. as the stock of capital ages, the extra output produced decreasesb. as the stock of capital is increased, the extra output produced from an additional unit ofcapital fallsc. as resources are used to produce capital goods, fewer additional capital goods can beproducedd. you always get what you pay forANSWER: BPOINTS: 0 / 17. C ompared with richer countries, poorer countries are generally characterized bya. high real GDP per personb. political stabilityc. rapid population growthd. strongly enforced property rightsANSWER: CPOINTS: 0 / 18. W hich one of the following countries would most likely be considered a poorer nation, using realGDP/person?a. Canadab. Germanyc. Japand. IndiaANSWER: DPOINTS: 0 / 19. W hich of the following factors would be most likely to encourage capital formation in a poorernation?a. the expectation of sustained high rates of inflation in the futureb. the expectation that property rights will remain securec. the expectation that a struggle between capitalist and socialist forces will lead to majorstructural change in the economyd. an increase in corporate taxes in order to finance an expanded government welfareprogramANSWER: BPOINTS: 0 / 110. W hich of the following is most likely to cause the productivity of labour to increase?a. higher money wage ratesb. a higher rate of investment in human and physical capitalc. more flexible working hours and improved retirement plansd. none of the aboveANSWER: BPOINTS: 0 / 111. S uppose that factory output rose from 50,000 units to 55,000 units while labour hours rose from1100 to 1200. Which of the following is true?a. Labour productivity remained unchanged.b. Labour productivity increased slightly.c. Labour productivity decreased slightly.d. Labour productivity increased sharply.ANSWER: BPOINTS: 0 / 112. W hich of the following would be most likely to cause the real income per person of poorercountries to rise?a. a more rapid population growthb. a rapid rate of inflationc. an international minimum-wage lawd. an increase in foreign investment that enhanced the productivity of the labour forceANSWER: DPOINTS: 0 / 113. I f a production function has constant returns to scale, then:a. doubling inputs will double output.b. doubling inputs will triple output.c. doubling inputs will cause output to increase, but the increase in output will be less thanthe increase in inputs.d. doubling inputs will decrease output.ANSWER: APOINTS: 0 / 114. T he most important source of rising living standards over time is:a. the increase in the size of the labour force.b. the increase in the labour force participation rate.c. the increase in productivity.d. the increase in human capital—the skills embodied in the work force.ANSWER: CPOINTS: 0 / 1Short Answer1. W hat is productivity and why is it important?RESPONSE:ANSWER: Productivity is the amount of goods and services produced from each hour of a worker’s time. It is the major determinant of the standard of livi ng of a country.POINTS: -- / 12. H ow is productivity determined?RESPONSE:ANSWER: Productivity is determined by a country’s physical capital, human capital, natural resources and technological knowledge.POINTS: -- / 13. W hat is the World Bank and what are its functions?RESPONSE:ANSWER: The World Bank is an international organization that among other thingsencourages the flow of capital to poor countries. It obtains funds from the world’sadvance counties and loans them to less developed countries so that they caninvest in capital infrastructure. The World Bank offers advice to developingcountries on how the funds might best be used.POINTS: -- / 14. W hat are property rights? What role does property rights play in economic growth?RESPONSE:ANSWER: Property rights refer to the ability of people to exercise authority over the resources they own. There must be an economy-wide respect for property rights for the pricesystem or the free market to work. Lack of respect for property rights or theenforcement of property rights would not only cause political instability but wouldalso discourage savings and investment. These are necessary for economicgrowth.POINTS: -- / 15. D ifferentiate between inward-oriented policies and outward-oriented policies.RESPONSE:ANSWER: Inward-oriented policies are aimed at raising productivity and living standards withina county by avoiding interaction with the rest of the world. This approach involvesthe protection of domestic industries to allow them to develop and grow withoutcompetition from foreign firms. Outward-oriented policies are designed to integratecountries into the world economy as international trade is considered to be a factorin generating economic growth.POINTS: -- / 1CHAPTER 26: SAVING, INVESTMENT, AND THE FINANCIAL SYSTEMTrue/FalseIndicate whether the statement is true or false.1. P rivate savings are the tax revenue that the government has left after paying for its spending; andpublic savings is the income that households have left after paying for taxes and consumption.ANSWER: FPOINTS: 0 / 12. A budget deficit is an excess of tax revenue over government spending; and a budget surplus is ashortfall of tax revenue from government spending.ANSWER: FPOINTS: 0 / 13. A budget surplus decreases the supply of loanable funds, increases the interest rate, andstimulates investment.ANSWER: FPOINTS: 0 / 14. T he financial system is the group of institutions in the economy that help to match one person’ssavings with another person’s investment.ANSWER: TPOINTS: 0 / 15. A mutual fund is an institution that sells shares to the public and uses the proceeds to buy aselection, or portfolio, of various types of stocks, bonds, or both stocks and bonds.ANSWER: TPOINTS: 0 / 1Multiple ChoiceIdentify the choice that best completes the statement or answers the question.1. W hich of the following is correct?a. Lenders buy bonds and borrowers sell them.b. Long-term bonds usually pay a lower interest rate than do short-term bonds becauselong-term bonds are riskier.c. Junk bonds refer to bonds that have been resold many times.d. None of the above are correct.ANSWER: APOINTS: 0 / 12. I n a closed economy, national saving equalsa. investment.b. income minus the sum of consumption and government expenditures.c. private saving plus public saving.d. All of the above are correct.ANSWER: DPOINTS: 0 / 13. I f the current market interest rate for loanable funds is below the equilibrium level, then there is aa. shortage of loanable funds and the interest rate will rise.b. surplus of loanable funds and the interest rate will rise.c. shortage of loanable funds and the interest rate will fall.d. surplus of loanable funds and the interest rate will fall.ANSWER: APOINTS: 0 / 14. S uppose that Parliament were to introduce a new investment tax credit. What would happen in themarket for loanable funds?a. The demand for loanable funds would shift left and interest rates fall.b. The demand for loanable funds would shift right and interest rates rise.c. The supply of loanable funds would shift left and interest rates rise.d. The supply of loanable funds would shift right and interest rates fall.ANSWER: BPOINTS: 0 / 15. I f Canada increases its budget deficit, it will reducea. private saving and so shift the supply of loanable funds left.b. investment and so shift the demand for loanable funds left.c. public saving and so shift the supply of loanable funds left.d. None of the above are correct.ANSWER: CPOINTS: 0 / 16. C rowding out refers toa. the increase in national saving that occurs when government runs a deficitb. the decrease in the real interest rates due to government borrowingc. a reduction in investment spending resulting from government borrowingd. a decrease in consumption spending resulting from government borrowingANSWER: CPOINTS: 0 / 17. F or a bank to be profitable, the loans it makes must _____ than the _____ obtaining funds.a. cost more; price ofb. pay less interest; total revenue fromc. make more interest; total cost ofd. be less profitable; total revenue fromANSWER: CPOINTS: 0 / 18. L arge budget deficits will likelya. increase the nation's pool of savingb. decrease the nation's pool of savingc. have no impact on the nation's pool of savingd. improve the nation's trade balanceANSWER: BPOINTS: 0 / 19. T he supply curve of loanable funds isa. upward-sloping, reflecting the fact that savers need a higher rate of interest to coax theminto lending moreb. downward-sloping, reflecting the fact that savers will increase their supply for loanablefunds at lower rates of interestc. upward-sloping, reflecting the fact that savers will increase their saving at lower rates ofinterestd. None of the aboveANSWER: APOINTS: 0 / 1。

宏观经济学习题答案(曼昆第五版)

宏观经济学习题答案(曼昆第五版)第⼋篇宏观经济学的数据第⼆⼗三章⼀国收⼊的衡量复习题 1 .解释为什么⼀个经济的收⼊必定等于其⽀出? 答:对⼀个整体经济⽽⾔,收⼊必定等于⽀出。

因为每⼀次交易都有两⽅:买者和卖者。

⼀个买者的1 美元⽀出是另⼀个卖者的1 美元收⼊。

因此,交易对经济的收⼊和⽀出作出了相同的贡献。

由于GDP 既衡量总收⼊ 135 ⼜衡量总⽀出,因⽽⽆论作为总收⼊来衡量还是作为总⽀出来衡量,GDP 都相等.2 .⽣产⼀辆经济型轿车或⽣产⼀辆豪华型轿车,哪⼀个对GDP 的贡献更⼤?为什么? 答:⽣产⼀辆豪华型轿车对GDP 的贡献⼤。

因为GDP 是在某⼀既定时期⼀个国家内⽣产的所有最终物品与劳务的市场价值。

由于市场价格衡量⼈们愿意为各种不同物品⽀付的量,所以市场价格反映了这些物品的市场价值。

由于⼀辆豪华型轿车的市场价格⾼于⼀辆经济型轿车的市场价格,所以⼀辆豪华型轿车的市场价值⾼于⼀辆经济型轿车的市场价值,因⽽⽣产⼀辆豪华型轿车对GDP 的贡献更⼤.3 .农民以2 美元的价格把⼩麦卖给⾯包师。

⾯包师⽤⼩麦制成⾯包,以3 美元的价格出售。

这些交易对 GDP 的贡献是多少呢? 答:对GDP 的贡献是3 美元。

GDP 只包括最终物品的价值,因为中间物品的价值已经包括在最终物品的价格中了.4 .许多年以前,Peggy 为了收集唱⽚⽽花了500 美元。

今天她在旧货销售中把她收集的物品卖了100 美元.这种销售如何影响现期GDP? 答:现期GDP 只包括现期⽣产的物品与劳务,不包括涉及过去⽣产的东西的交易。

因⽽这种销售不影响现期GDP.5 .列出GDP 的四个组成部分。

各举⼀个例⼦.答:GDP 等于消费(C)+投资(I)+政府购买(G)+净出⼝(NX) 消费是家庭⽤于物品与劳务的⽀出,如汤姆⼀家⼈在麦当劳吃午餐.投资是资本设备、存货、新住房和建筑物的购买,如通⽤汽车公司建⽴⼀个汽车⼚.政府购买包括地⽅政府、州政府和联邦政府⽤于物品与劳务的⽀出,如海军购买了⼀艘潜艇.净出⼝等于外国⼈购买国内⽣产的物品(出⼝)减国内购买的外国物品(进⼝)。

曼昆_宏观经济学_第五版答案(可直接复制)

曼昆_宏观经济学_第五版答案(可直接复制)第一篇导言复习题第一章宏观经济学的科学1、解释宏观经济学和微观经济学之间的差距,这两个领域如何相互关联?【答案】微观经济学研究家庭和企业如何作出决策以及这些决策在市场上的相互作用。

微观经济学的中心原理是家庭和企业的最优化——他们在目的和所面临的约束条件下可以让自己的境况更好。

而相对的,宏观经济学研究经济的整体情况,它主要关心总产出、总就业、一般物价水平和国际贸易等问题,以及这些宏观指标的波动趋势与规律。

应该看到,宏观经济学研究的这些宏观经济变量是以经济体系中千千万万个体家庭和企业之间的相互作用所构成的。

因此,微观经济决策总是构成宏观经济模型的基础,宏观经济学必然依靠微观经济基础。

2、为什么经济学家建立模型?【答案】一般来说,模型是对某些具体事物的抽象,经济模型也是如此。

经济模型可以简洁、直接地描述所要研究的经济对象的各种关系。

这样,经济学家可以依赖模型对特定的经济问题进行研究;并且,由于经济实际不可控,而模型是可控的,经济学家可以根据研究需要,合理、科学的调整模型来研究各种经济情况。

另外,经济模型一般是数学模型,而数学是全世界通用的科学语言,使用规范、标准的经济模型也有利于经济学家正确表达自己的研究意图,便于学术交流。

3、什么是市场出清模型?什么时候市场出清的假设是适用的?【答案】市场出清模型就是供给与需求可以在价格机制调整下很快达到均衡的模型。

市场出清模型的前提条件是价格是具有伸缩性的(或弹性)。

但是,我们知道价格具有伸缩性是一个很强的假设,在很多实际情况下,这个假设都是不现实的。

比如:劳动合同会使劳动力价格在一段时期内具有刚性。

因此,我们必须考虑什么情况下价格具有伸缩性是合适的。

现在一般认为,在研究长期问题时,假设价格具有伸缩性是合理的;而在研究短期问题时,最好假设价格具有刚性。

因为,从长期看,价格机制终将发挥作用,使市场供需平衡,即市场出清,而在短期,价格机制因其他因素制约,难以很快使市场出清。

曼昆《经济学原理(宏观经济学分册)》(第6版)课后习题详解

内容摘要

本书特别适用于参加研究生入学考试指定考研参考书目为曼昆《经济学原理(宏观经济学分册)》的考生, 也可供各大院校学习曼昆《经济学原理(宏观经济学分册)》的师生参考。曼昆的《经济学原理》是世界上最流 行的初级经济学教材,也被众多院校列为经济类专业考研重要参考书目。为了帮助学生更好地学习这本教材,我 们有针对性地编著了它的配套辅导用书(均提供免费下载,免费升级):1.曼昆《经济学原理(微观经济学分 册)》(第6版)笔记和课后习题详解(含考研真题)[视频讲解]2.曼昆《经济学原理(微观经济学分册)》 【教材精讲+考研真题解析】讲义与视频课程【35小时高清视频】3.曼昆《经济学原理(微观经济学分册)》 (第6版)课后习题详解4.曼昆《经济学原理(微观经济学分册)》(第5版)课后习题详解5.曼昆《经济学原 理(微观经济学分册)》配套题库【名校考研真题(视频讲解)+课后习题+章节练习+模拟试题】6.曼昆《经济 学原理(宏观经济学分册)》(第6版)笔记和课后习题详解(含考研真题)[视频讲解]7.曼昆《经济学原理 (宏观经济学分册)》【教材精讲+考研真题解析】讲义与视频课程【27小时高清视频】8.曼昆《经济学原理 (宏观经济学分册)》(第6版)课后习题详解9.曼昆《经济学原理(宏观经济学分册)》(第5版)课后习题 详解10.曼昆《经济学原理(宏观经济学分册)》配套题库【名校考研真题(视频讲解)+课后习题+章节练习+ 模拟试题】本书是曼昆《经济学原理(宏观经济学分册)》(第6版)教材的配套e书,参考国外教材的英文答案 和相关资料对曼昆《经济学原理(宏观经济学分册)》(第6版)教材每章的课后习题进行了详细的分析和解答, 并对个别知识点进行了扩展。课后习题答案久经修改,非常标准,特别适合应试作答和临考冲刺。另外,部分高 校,如武汉大学、深圳大学等,研究生入学考试部分真题就来自于该书课后习题,因此建议考生多加重视。

曼昆宏观经济学答案(1)

曼昆宏观经济学答案第一章:经济学的十大原则1.原则一:人们面临权衡取舍经济学研究的基本前提是人们面临有限的资源,需做出选择。

人们需要在不同的选择之间进行权衡取舍,以实现最佳的效益。

2.原则二:无论是个人还是集体,都面临成本无论是个人还是集体,决策都需要考虑成本。

成本可以是货币成本,也可以是机会成本,即放弃的最佳选择。

3.原则三:理性人在边际上做出选择理性人会在边际效益和边际成本之间做出选择。

边际效益是指做出一项决策后,对于个体效益的增量。

边际成本是指做出一项决策时,对个体成本的增量。

4.原则四:人们对刺激作出反应人们受到刺激会做出相应的反应。

经济学家通过研究人们对经济变化的反应,来预测经济活动的变化。

5.原则五:贸易会使每个参与者都受益贸易是通过互相交换商品和服务来实现的。

贸易可以使参与者从中获得益处,因为每个人都可以比自己独自生产更多的东西。

6.原则六:市场通常是组织经济活动的最好方式市场机制通过价格调节供求关系,使资源的配置更为高效。

市场经济能够有效地调动资源,满足人们需求。

7.原则七:政府也可以通过干预市场来改善社会福利市场机制并不是完美的,有时政府需要干预市场来纠正市场失灵、提高社会福利。

8.原则八:一国的生活水平取决于经济生产经济发展对一国的生活水平有着重要影响。

经济生产的增加能够提供更多的商品和服务,提高人们的生活水平。

9.原则九:通货膨胀会侵蚀购买力高通货膨胀会导致货币购买力下降,危害人们的生活水平。

经济学家研究通货膨胀的原因及其对经济的影响。

10.原则十:社会面临长期经济增长的关系社会的长期经济增长能够改善人们的生活水平,提供更多的机会和福利。

第二章:生产可能性前沿和经济增长生产可能性前沿(Production Possibility Frontier,PPF)是一种图形表示,用于显示在特定的资源和技术条件下,经济体能够生产的各种产品和服务的最大数量。

•PPF曲线凸出表示了边际成本递增的原理。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

曼昆中级宏观经济学课后答案【篇一:曼昆宏观经济学-课后答案第6、7版】txt>复习题1、由于整个经济的事件产生于许多家庭与许多企业的相互作用,所以微观经济学和宏观经济学必然是相互关联的。

当我们研究整个经济时,我们必须考虑个别经济行为者的决策。

由于总量只是描述许多个别决策的变量的总和,所以宏观经济理论必然依靠微观经济基础。

2、经济学家是用模型来解释世界,但一个经济学家的模型往往是由符号和方程式构成。

经济学家建立模型有助于解释gdp、通货膨胀和失业这类经济变量。

这些模型之所以有用是因为它们有助于我们略去无关的细节而更加明确地集中于重要的联系上。

模型有两种变量:内生变量和外生变量,一个模型的目的是说明外生变量如何影响内生变量。

3、经济学家通常假设,一种物品或劳务的价格迅速变动使得供给量与需求量平衡,即市场走向供求均衡。

这种假设称为市场出清。

在回答大多数问题时,经济学家用市场出清模型。

持续市场出清的假设并不完全现实。

市场要持续出清,价格就必须对供求变动作出迅速调整。

但是,实际上许多工资和价格调整缓慢。

虽然市场出清模型假设所有工资和价格都是有伸缩性的,但在现实世界中一些工资和价格是粘性的。

明显的价格粘性并不一定使市场出清模型无用。

首先偷格并不总是呆滞的,最终价格要根据供求的变动而调整。

市场出清模型并不能描述每一种情况下的经济,但描述了经济缓慢地趋近了均衡。

价格的伸缩性对研究我们在几十年中所观察到的实际gdp增长这类长期问题是一个好的假设。

第二章宏观经济学数据复习题1、gdp既衡量经济中所有人的收入,又衡量对经济物品与劳务的总支出。

gdp能同时衡量这两件事,是因为这两个量实际上是相同的:对整个经济来说,收入必定等于支出。

这个事实又来自于一个更有基本的事实:由于每一次交易都有一个买者和一个卖者,所以,一个买者支出的每一美元必然成为一个卖者的一美元收入。

2、cpi衡量经济中物价总水平。

它表示相对于某个基年一篮子物品与劳务价格的同样一篮子物品与劳务的现期价格。

3、劳工统计局把经济中每个人分为三种类型:就业、失业以及不属于劳动力。

一失业率是失业者在劳动力中所占的百分比,其中劳动力为就业者和失业者之和。

一问题和应用一1、大量经济统计数字定期公布,包括gdp、失业率、公司收益、消费者物价指数及贸易结余。

gdp是一年内所有最终产品与劳务的市场价值。

失业率是要工作的人中没有工作的人的比例。

公司利润是所有制造企业税后会计利润,它暗示公司一般的财务健康情况。

消费者物价指数是衡量消费者购买的物品的平均价格,它是通货膨胀的衡量指标。

贸易结余是出口物品与进口物品之间的价差。

一2、每个人的增值是生产的物品的价值减去生产该物品所需的原材料的价值。

因此,农夫增值是1美元,面粉厂的增值是2美元,面包店的增值是3美元。

gdp就是总的增值,即为6 美元,它正好等于最终物品的价值。

一3、妇女与她的男管家结婚,gdp减少量等于男管家的工资。

这是由于gdp是衡量经济中所有人的收入,此时男管家没有工资收入。

如果gdp是真正衡量所有物品与劳务的价值,既然经济活动总量不变,那结婚是不会影响gdp的。

但是,由于有些物品及劳务的价值没忽略,实际gdp是经济活动不完善的衡量。

一旦男管家的工作成为他家务劳动的一部分,他的劳务就不再计入gdp。

这例子说明,gdp不包括任何在家里产出的价值。

同样,gdp也不包括耐用品(汽车以及电冰箱等)的估算租金和非法贸易等物品或劳务。

一_i、政府采购、投资、净出口、消费、投资一6、(1)2000年名义gdp-10000000,2010年名义gdp-15200000,2010年实际gdp-iooooooo 2010年gdp隐含的价格平减指数-1. 52,2010年(’pi-1.6一(2)隐含的价格平减指数是帕氏指数,因为它是用一篮子可变物品计算的。

cpi是拉斯派尔指数,因为它是用一篮子固定物品计算的。

由(1)中计算得2010年隐含的价格平减指数是1.52,它表示物价从2000年到2010年上涨了5)0,o;而(1pi是1.6,它表示物价从2000年到2010年上涨了600.o。

假设所有物品价格都上涨50%,毫无疑问物价水平应该上涨500,o,一然而例子中相对物价发生变化。

汽车价格上涨20%,面包价格上涨1000/o。

(’pi和隐含的价格平减指数的差异说明,物价水平变动依赖于如何加权物品价格。

(’pi是用2000年购买数量加权物品价格,隐含的价格平减指数用2010年购买数量加权物品价格。

一 2000年消费的面包数量多于201 0年,cpi对面包加高其权重。

由于面包价格上涨幅度高于汽车,cpi就显示出物价水平较高的上涨。

一(3)这问题没有清晰的答案。

理想的是,能有一个准确衡量生活成本的物价水平的指标。

当一种物品价格相对较昂贵时,人们会少买该种物品而多买其它物品。