外贸清关 澳大利亚和英国的清关知识汇总

商务部工作人员的外贸报关和清关流程

商务部工作人员的外贸报关和清关流程外贸报关和清关是国际贸易中的重要环节,涉及到商品的出口、进口手续以及海关和相关机构的合规要求。

作为商务部的工作人员,我们需要了解并掌握外贸报关和清关的流程与要点,以确保贸易顺利进行。

本文将介绍商务部工作人员的外贸报关和清关流程,以帮助大家更好地理解和执行相关工作。

一、客户合作与准备作为商务部工作人员,首先需要与客户进行合作,并在了解客户需求的基础上,提供相关的报关和清关服务。

在报关和清关前,我们需要从客户处收集以下信息:1. 商品名称和详细描述2. 商品品牌和型号3. 商品的产地和生产厂家4. 商品的毛重和净重5. 商品的申报价值和货币种类6. 运输方式和货物运抵日期7. 其他相关货物信息根据客户提供的信息,商务部工作人员需要准备报关和清关所需的文件,如发票、装箱单、合同等。

二、报关前准备工作在正式进行报关前,商务部工作人员需要开展以下准备工作:1. 完善的商务合同:确保合同中包含清晰的商品描述、价格、交货方式等重要条款,以便后续的报关和清关手续。

2. 出口许可证申请:根据商品类型和目的地国家的要求,及时向相关部门申请出口许可证,并确保获得许可证后方可继续进行后续的报关和清关手续。

3. 清关文件准备:商务部工作人员需要准备包括商业发票、装箱单、报关单、海关放行单、产地证书等在内的清关文件,以便后续的报关操作。

三、报关流程1. 填写报关单:根据商品的详细信息和海关要求,商务部工作人员需要准确地填写报关单,包括商品名称、数量、价值等重要信息。

2. 缴纳关税和税款:根据商品的分类以及目的地国家的关税政策,商务部工作人员需要计算关税和税款,并按时缴纳。

3. 提交报关材料:商务部工作人员需要将填写完整的报关单及相关文件提交给海关,并按照要求进行相关业务的申报。

4. 海关审查:海关将对提交的报关材料进行审查,并可能进行抽查、查验或要求补充材料等操作。

5. 放行和审批:根据海关的审查结果,如无异议,海关将给予放行并出具放行单。

干货!全球各国国际快递清关攻略!

干货!全球各国国际快递清关攻略!一、欧洲西欧、北欧、南欧:适合DHL国际快递、TNT,清关中的最强王者。

备注:一些西欧国家不适合发邮政小包,他们的网站不会及时更新,或许客户收到货了,他也说没收到,反而引起纠纷。

东欧:包括罗马尼亚、保加利亚、摩尔多瓦、匈牙利、斯洛伐克、捷克、波兰、爱沙尼亚、拉脱维亚、立陶宛,发DHL国际快递最好。

欧洲其他国家:俄罗斯、乌克兰、白俄罗斯,以及前苏联国家,格鲁吉亚、阿塞拜疆、乌兹别克斯坦、塔吉克斯坦、吉尔吉斯坦、哈萨克斯坦等等,都应该发EMS以及邮政大包小包。

希腊、土耳其:海关腐败,高额交税,除非客户有自己的清关代理公司,否则不推荐走DHL 国际快递,FedEx联邦快递,TNT和UPS四大快递,一般走EMS和邮政,清关小王子。

英国:申报价值大于18GBP的包裹时会征收关税。

爱尔兰、法国、西班牙、挪威、瑞典、比利时、丹麦等:属欧盟区,对价值高于22欧元的包裹会征收关税,从以往的资料看,有少数包裹被查到,EMS的安全系数高。

意大利:属欧盟区,对价值高于22欧元的包裏就征收关税,因免税申报金额较低,所以欧盟区包裹时常会因低申报而被查。

荷兰:属欧盟区,对价值高于22欧元的包裹会征收关税,从以往的资料看,有少数包裹被查到收了关税,对纺织品查得相对严,EMS的安全系数高。

德国:属欧盟区,对高于22欧元的包裹会交税,德国也是欧盟区相对特别的一个国家,海关的检验力度比其他欧盟区国家要大些,EMS时常因海关原因被退回。

俄罗斯:关于DHL国际快递和FedEx联邦快递基本上每件都会被检查到,但EMS很少被查到,邮政通路很正常。

乌克兰:乌克兰的海关也较为难缠,除邮政EMS和小包裹外的FedEx联邦快递和DHL国际快递的包裹都很难清关。

白俄罗斯:该国关于FedEx联邦快递和DHL国际快递的包裹容易出现问题,但如用是EMS 则没有问题。

白俄罗斯对包裹实行重量限制,货件单票不能超越250KG,单件不能超越50KG,假如货件抵达当地需转交第三方署理派送的货件(DHL效劳指南列表中有标明“F”的城市或邮编)单票不能逾越30KG,标准不逾越1.2*0.8*0.8M。

外贸知识点汇总

外贸知识点汇总在当今全球化的时代,外贸交流和贸易合作日益频繁。

作为从事外贸工作的人员,了解和掌握一些外贸知识点是非常重要的。

本文将以外贸知识点汇总为标题,总结一些与外贸相关的重要知识点,帮助读者更好地了解和应用外贸知识。

一、国际贸易基本概念国际贸易是指不同国家或地区之间的商品和服务的交流和交易。

国际贸易可以分为进口和出口,进口是指从国外购买商品或服务,出口是指向国外销售商品或服务。

国际贸易的主要形式有货物贸易、服务贸易和技术贸易等。

二、国际贸易的主要参与主体国际贸易的主要参与主体包括国家政府、贸易公司、生产企业和消费者等。

国家政府在国际贸易中起着重要的调控和监管作用,贸易公司负责国际贸易的具体操作,生产企业是商品的生产者和供应者,消费者是商品的购买者和使用者。

三、国际贸易的主要方式国际贸易的主要方式包括直接贸易和间接贸易。

直接贸易是指买卖双方直接进行商品和服务的交换和交易,间接贸易是指通过中间商或第三方进行商品和服务的交换和交易。

国际贸易的主要支付方式有汇票、信用证和电汇等。

四、国际贸易的主要贸易方式国际贸易的主要贸易方式包括一般贸易、加工贸易和转口贸易等。

一般贸易是指直接以货物交换为基础的贸易,加工贸易是指将进口原材料加工后再出口的贸易,转口贸易是指将进口商品再出口到第三国的贸易。

五、国际贸易的主要贸易条款国际贸易的主要贸易条款包括FOB、CIF和DDP等。

FOB是指卖方把货物交给海上运输工具的费用和风险转移给买方的贸易条款,CIF是指卖方承担货物运输和保险费用的贸易条款,DDP是指卖方负责将货物交付到买方指定的目的地的贸易条款。

六、国际贸易的主要贸易术语国际贸易的主要贸易术语包括FOB价、CIF价和清关等。

FOB价是指商品在出口港口的价格,CIF价是指商品到达目的港口时的价格,清关是指商品进出口时需要办理的报关手续和支付税费等。

七、国际贸易的主要贸易风险国际贸易的主要贸易风险包括汇率风险、信用风险和运输风险等。

报关单上常常会出现的英文单词和缩写

报关单上常常会出现的英文单词和缩写一.单证(Documents)进出口业务涉及的单证总的包括三大类:1。

金融单证(信用证、汇票、支票和本票)2.商业单证(发票、装箱单、运输单据、保险单等)3。

用于政府管制的单证(许可证、原产地证明、商检证等)·declaration form报关单ν·Three steps—declaration, examination of goods andνrelease of goods, are taken by the Customs to exercise control over general import and export goods.海关对进出境货物的监管一般经过申报、查验和放行三个环节。

·the person in chargeν of the declaration·invoice发票ν·ocean bill of lading提单ν·airν waybill空运提单·packing list或packing specification(装箱单)ν·shippingν order(装货单)·letter of credit(L|C)(信用证)ν·insurance policy(保险单)ν·salesν confirmation售货确认书·contract(合同)(commodity, quantity, unit price, totalν amount, country of origin and manufacturer, packing, shipping mark, date of shipment, port of shipment, port of destination, insurance, payment, shipment, shipping advice, guarantee of quality, claims, force majeure, late delivery and penalty, arbitration)certificate(commodity inspection certificate商检证·animal or plant quarantine certificate 动植物检疫证·certificate of origin原产地证)二.报关英语常用词汇·import进口 export出口·importν & export corporation(Corp.)·importν & export business(enterprise entitled to do import and export business)·export drawback出口退税ν·importν & export licence·processing with imported(supplied) materials进(来)料加工ν·buyer买方 seller卖方·The buyer requests his bank to issue a letter of credit in favor of the seller.·goods(import& export goods , All import and export goods shall be subject to Customs examination) ·cargo (bulk cargo,cargo in bulk, air cargo, sea cargo,bonded cargo, cargo-owner·What cargo is inside the container?·The cargo is now released.)·Commodity(commodity inspection)·merchandise泛指商品,不特指某一商品·article(smuggled goods and articles, inward and outward goods and articles)·luggage 行李物品·postal items 邮递物品·You don’t have to pay duty on personal belongings, but the other one is subject to duty.·means of transport(conveyance)运输工具(vessel, aircraft, train, vehicle):All inward and outward means of transport shall be subject to Customs control on arriving in or departing from the Customs territory. ·ocean vessel船名·packing(bag袋, bale包, bottle, coil圈,case, crate板条箱,dozen, package件:total packages合计件数, piece, roll, set, unit辆,台,单位,drum桶, carton纸箱, wooden cases木箱, pallet托盘, container ,in bulk)·weight重量·gross weight毛重 net weight净重·tare皮重·quantity数量:The minimum quantity of an order for the goods is 500 cases.·description of goods货名·name and specifications of commodity品名及规格·type类型·mode (term)of trade贸易方式·name of trading country贸易国·date of importation进口日期·value价值·total value of the contract commercial value, duty-paying value·The duty-paying value of an import item shall be its normal CIF price and the duty-paying value of an export item shall be its FOB price, minus the export duty.·The duty-paying value of an inward or outward article shall be fixed by the Customs.·price价格unit price单价 total price总价·total amount总价·consignor发货人 consignee收货人·While the examination is being carried out, the consignee of the import goods or the consignor of the export goods shall be present and responsible for moving the goods, opening and restoring the packing ·Declaration of import goods shall be made to the Customs by the consignee within 14 days of the declaration of the arrival of the means of transport; declaration of export goods shall be made by the consignor 24 hours prior to the loading unless otherwise approved by the Customs. 进口货物的收货人应当自运输工具申报进境之日起14日内,出口货物的发货人除海关特准的外应当在货物运抵海关监管区后装货的24小时以前,向海关申报。

常见外贸英文术语汇总很详细的哦

常见外贸英文术语汇总很详细的哦1. Incoterms(国际贸易术语解释):一套国际贸易合同的标准术语,用以确定买卖双方之间的责任和义务,如FOB、CIF等。

2. Letter of Credit(信用证):国际贸易中的一种支付方式,以信用证为基础,由买方银行向卖方银行发出支付指令。

3. Bill of Lading(提单):一种货物交接的证明文件,由船公司或运输公司出具,发给发货人,用于证明货物的数量、品质和交货地点。

5. Proforma Invoice(形式发票):国外买主向卖主查询其中一货物价格时,卖主为了向买主提供表面销售细节的文件。

6. Packing List(装箱单):详细列出货物包装的清单,包括货物名称、数量、重量、体积等信息,用于海关报关和物流操作。

7. Certificate of Origin(原产地证明):证明货物产地的文件,通常由出口国的商会或贸易机构出具,有利于在目的地享受关税优惠。

8. Shipment(装运):指货物从出发地到目的地的运输过程。

9. Customs Clearance(海关清关):将货物合法出入境的手续,包括申报、报关、检验、缴税等。

10. Tariff(关税):对进口或出口货物征收的税款。

11. Export License(出口许可证):一种出口货物的许可证,通常由贸易部门或政府机构颁发。

12. Import License(进口许可证):一种进口货物的许可证,通常由贸易部门或政府机构颁发。

13. Free Trade Agreement(自由贸易协定):两个或以上国家之间达成的协议,旨在减少或取消双边贸易中的关税和非关税壁垒。

14. Trade Barrier(贸易壁垒):阻碍自由贸易发展的政策措施,包括关税、配额、进出口许可证等。

15. Trade Deficit(贸易逆差):指一个国家进口商品大于出口商品的情况。

16. Trade Surplus(贸易顺差):指一个国家出口商品大于进口商品的情况。

中国海运出口到澳大利亚的清关流程

中国海运出口到澳大利亚的清关流程一、出口前准备工作在进行中国海运出口到澳大利亚的清关流程之前,首先需要做一些出口前的准备工作。

这些准备工作包括:确定货物交付方式和贸易术语、制作出口发票、装箱单和运输文件、确认货物出口国政府的出口许可证、申请出口退税、办理报关手续等。

1.确定货物交付方式和贸易术语根据货物的实际情况和交易条件,确定货物的交付方式和贸易术语。

货物的交付方式可以是FOB、CIF等,贸易术语可以是Incoterms 2010中规定的任何一个术语。

2.制作出口发票、装箱单和运输文件出口商根据签订的合同和客户的要求,制作出口发票、装箱单和运输文件。

这些文件需要包括货物的详细信息、数量、价值、包装方式、运输路线等。

3.确认货物出口国政府的出口许可证根据澳大利亚政府对进口货物的管理要求,有些货物出口到澳大利亚需要办理出口许可证。

出口商需要按照要求向出口国政府申请相应的出口许可证。

4.申请出口退税出口商可以根据国家的相关政策,申请出口退税。

出口商需要准备好相关的申请材料,并按照规定的程序向海关申请退税。

5.办理报关手续出口商需要提前向中华人民共和国海关报关,并按照海关的要求提供相应的报关资料和申报信息。

二、货物装运货物装运是指将货物装载到货运工具上,准备运往目的地。

货物装运前,出口商需要做好以下几项工作:1.货物包装对货物进行合适的包装,确保货物在运输过程中不受损坏。

包装要符合国际运输的要求,并且标明货物的包装方式、数量、净重、毛重等信息。

2.货物运输选择合适的货运工具,根据货物的性质、运输距离等因素选择合适的运输方式,如海运、航空运输等。

3.申报报关在货物装运前,出口商需要准备好报关相关的资料和申报信息,并按照海关的要求进行报关。

三、到达澳大利亚清关当货物到达澳大利亚后,需要进行清关手续。

清关手续的主要内容包括进口商的货物的报关申报、缴纳进口关税和其他进口税费、接收货物等。

1.报关申报澳大利亚进口商需要向澳大利亚海关提交货物的报关申报,并提供相关的进口许可证、发票、提单等进口文件。

澳洲清关流程

澳洲清关流程下载温馨提示:该文档是我店铺精心编制而成,希望大家下载以后,能够帮助大家解决实际的问题。

文档下载后可定制随意修改,请根据实际需要进行相应的调整和使用,谢谢!并且,本店铺为大家提供各种各样类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,如想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by the editor. I hope that after you download them, they can help yousolve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you!In addition, our shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts,other materials and so on, want to know different data formats and writing methods, please pay attention!随着中澳贸易的持续增长,澳洲清关流程变得愈发重要。

海运货运代理澳洲清关基础知识

•GST(消费税) 10% 正常是本地费用(PSC,D/O,清关,拖车等) 的总和 X 7% (如果是中国这边付所有的费用,可以申请免10%GST)

关税组成

•DUTY(关税) 一般货物(家具,鞋子,陶瓷,建材类等)为5%,交易 条款为C&F时的计算方法为 货值X5%=关税,酒和衣服类的关税稍高, 需要特别询问代理。 •Remark: O/F预付,关税就是货值X5% • O/F到付,关税是:FOB(货值+海运费)X5% •CUSTOMS GST(增值税)10%,交易条款为C&F时的计算方法为 (货值+关税+运费)X10%=增值税

清关要求与关税组成

在澳洲经商的进口商,零售商甚至是餐厅,只要他们正当注册就会有一个ABN No.,简称为商 业注册号。只要有这个ABN号码,他们就可以从国外进口货物,进行营业,也通过这个 ABN号 码来报税,退税等等。

•所有木/竹子/草本制或含木/竹子/草本的东西都要做真实熏蒸;

清关要求

•冰箱/空调类要出示澳洲认可的检测报告; •船到24小时前要提供装箱单/提单做EDI申报; •申报时必须要有提单上的发货人提供的“包装声明”; •所有的货物标识都要求有清楚明了的英文说明;

为3小时/2人;

注意,以下产品澳洲海关是会查柜并有可能不接受而直接销毁: 1.粉末类,水草类制口,干花等; 2.未经处理的竹制品;(澳洲对竹制品特别敏感); 3.不符合澳洲要求的冰箱/空调; 4.仿牌;

澳洲进口清关文件要求

• 提单(HB/L,MB/L)

• 包装声明(packingKevin

L/O/G/O

目录

澳洲港口与海关情况

澳洲的DDU价格组成 清关要求与关税组成 澳洲私人操作重点

澳大利亚海关规定

澳大利亚海关规定澳大利亚海关规定主要是关于进出口货物和旅客的相关规定。

以下是澳大利亚海关规定的主要内容:一、进口货物1. 进口货物需要进行报关,以便对货物进行检查和征税。

2. 进口货物必须符合澳大利亚的进口标准和规定。

某些特殊货物可能需要额外的许可证或证书。

3. 进口货物需要缴纳相应的进口税和消费税。

税率根据货物的种类和价值确定。

4. 进口货物必须符合澳大利亚的食品安全和质量要求。

违规货物可能被退回或销毁。

二、出口货物1. 出口货物需要进行报关,以便进行检查和记录。

2. 出口货物必须符合目的地国家/地区的进口标准和规定。

3. 某些特殊货物可能需要额外的出口许可证或证书。

4. 出口货物如涉及军事和双重用途物品,可能需要特殊的出口许可证。

三、旅客1. 旅客进入澳大利亚需要进行入境检查。

检查包括身份验证、行李检查和可能的随机人身检查。

2. 旅客必须申报将携带的物品,包括现金、货币、食品、植物、动物等。

3. 某些物品是被禁止或限制携带进入澳大利亚的,如毒品、武器、珍稀动植物等。

4. 旅客离开澳大利亚时,需要进行出境检查,以确保他们符合澳大利亚的出境要求和目的地国家/地区的入境要求。

四、免税购物1. 澳大利亚的海关规定允许旅客在机场或港口免税购物。

2. 旅客购买的免税商品必须符合旅客自己的个人使用,并在离境时携带。

3. 免税购物额度有限,超过额度的商品需要缴纳相应的进口税和消费税。

五、违规行为与处罚1. 违反澳大利亚海关规定的行为可能导致严重的法律后果,包括罚款和刑事处罚。

2. 违反进口禁止或限制的货物可能导致没收、销毁或退回。

3. 欺诈、偷税漏税等行为可能导致刑事诉讼和重罚。

总之,澳大利亚的海关规定主要是为了确保进出口货物和旅客的合法性和安全性。

遵守海关规定是每个企业和个人的责任,也是保障国家和个人利益的重要举措。

各国进口所需清关文件和产地证(外贸篇)

各国进⼝所需清关⽂件和产地证(外贸篇)1、⼀般产地证(C/O),⼀般原产地证是证明货物原产于某⼀特定国家或地区,享受进⼝国正常关税(最惠国)待遇的证明⽂件,它的适⽤范围是:征收关税、贸易统计、歧视性数量限制、反倾销和反补贴、原产地标记、政府采购等⽅⾯。

任何国家都可以做CO。

全称:CERTIFICATE OF ORIGIN 。

2、FORM A普惠制原产地证明书,是具有法律效⼒的我国出⼝产品在给惠国税率基础上进⼀步减免进⼝关税的官⽅凭证。

世界给予我国优惠的国家有38个(也就是说,只有出⼝到这些国家才做F/A):欧盟27国(⽐利时、丹麦、英国、德国、法国、爱尔兰、意⼤利、卢森堡、荷兰、希腊、葡萄⽛、西班⽛、奥地利、芬兰、瑞典、波兰、捷克、斯洛伐克、拉脱维亚、爱沙尼亚、⽴陶宛、匈⽛利、马⽿他、塞浦路斯、斯洛⽂尼亚、保加利亚、罗马尼亚)、挪威、瑞⼠、⼟⽿其、俄罗斯、⽩俄罗斯、乌克兰、哈萨克斯坦、⽇本、加拿⼤、澳⼤利亚和新西兰。

全称:GENERALIZED SYSTEM OF PREFERENCES CERTIFICATEOFORIGIN 。

3、FORM E 是中国-东盟⾃贸区使⽤的优惠性原产地证书。

⽬前,我国对外签发FORM E证书的国家包括⽂莱、柬埔寨、印度尼西亚、⽼挝、马来西亚、缅甸、菲律宾、新加坡、泰国、越南10国。

FORM D 是东盟⾃贸区原产地证书。

(FORM D等于FORM E,⼀般国外喜欢叫FORM D) 。

4、中国—智利⾃由贸易区原产地证书(FORM F) 中华⼈民共和国政府和智利共和国政府⾃由贸易协定 ,单个中国-智利⾃贸区FORM F原产地证书!5、《〈中国与巴基斯坦⾃由贸易区〉优惠原产地证明书》(FORM P) 对巴基斯坦可以签发《〈中国与巴基斯坦⾃由贸易区〉优惠原产地证明书》,2006年1⽉1⽇起双⽅先期实施降税的3000多个税⽬产品,分别实施零关税和优惠关税.原产于中国的486个8位零关税税⽬产品的关税将在2年内分3次逐步下降,2008年1⽉1⽇全部降为`零,原产于中国的486个8位零关税税⽬产品实施优惠关税,平均优惠幅度为22%.给予关税优惠的商品其关税优惠幅度从1%到10%不等。

外贸基本知识点总结

外贸基本知识点总结外贸是指国际间的商品贸易活动,是国际贸易的一部分。

在全球化的背景下,外贸已成为国民经济中极为重要的组成部分。

外贸基本知识是从事外贸工作的从业人员需要具备的基本知识,包括国际贸易的基本理论、国际贸易的基本流程、各种国际贸易术语、国际贸易的基本操作等内容。

下面我们就来对外贸基本知识点进行总结。

一、国际贸易的基本理论1. 绝对优势理论绝对优势理论是由英国经济学家亚当·斯密提出的,其核心观点是不同国家分工合作,各自依靠自己的优势生产特定的商品,然后进行贸易,以实现共同的利益。

绝对优势理论的提出,为国际贸易的理论研究奠定了基础。

2. 比较优势理论比较优势理论是由英国经济学家大卫·里卡多提出的,其核心观点是各国应该根据其比较优势生产和出口自己的商品,而不是努力在各个领域都做到最好。

比较优势理论的提出,为国际贸易的发展提供了理论支撑。

3. 国际贸易的基本原则国际贸易的基本原则包括平等互惠、互利共赢、自由贸易和非歧视待遇等。

4. 外贸政策外贸政策是指国家为了调节和控制对外贸易活动所制定的政策。

外贸政策包括保护主义政策和自由贸易政策等。

二、国际贸易的基本流程1. 外贸询盘与报价外贸询盘是指国外客户向外贸企业咨询商品的价格、规格、质量、包装等信息,外贸企业需要根据客户的要求,进行详细的报价。

2. 外贸签约外贸签约是指双方商定好合同内容,包括商品的名称、数量、质量标准、价格、付款方式、装运方式等,并签订正式合同。

3. 外贸生产外贸生产是指外贸企业根据合同要求进行生产,保证产品的质量和数量。

4. 外贸装运外贸装运是指外贸企业根据合同约定,将货物按照客户的要求装船或装车,并办理出口报关手续。

5. 外贸结汇外贸结汇是指外贸企业将货款汇入国内银行账户,并按照国家外汇管理政策进行合规操作。

6. 外贸支付外贸支付是指进口商根据合同要求将货款支付给外贸企业。

7. 外贸报关外贸报关是指进口商根据海关规定,对进口的货物办理报关手续。

进出口货物通关知识

进出口货物通关知识在全球化的经济环境中,进出口贸易日益频繁,而进出口货物通关则是这一贸易活动中的关键环节。

了解通关知识,对于企业和个人来说都至关重要,它不仅关系到货物能否顺利进出境,还直接影响到贸易成本和效率。

首先,我们来了解一下什么是进出口货物通关。

简单来说,就是指货物在进出一国关境时,依照各项法律法规和规定办理的手续。

这些手续包括向海关申报、提交相关单证、接受海关查验、缴纳税费等一系列流程,只有在完成这些流程并获得海关放行后,货物才能合法地进出境。

海关申报是通关的第一步,也是最为关键的环节之一。

申报时,需要准确填写货物的品名、数量、价值、原产地等详细信息。

如果申报信息不准确或不完整,可能会导致海关的查验和延误货物的通关时间。

为了确保申报的准确性,企业和个人应当熟悉相关的商品编码和海关规定,同时要保留好与货物相关的所有文件和记录,以备海关查验时提供。

在申报时,所提交的单证也是至关重要的。

常见的单证包括提单、发票、装箱单、合同等。

提单是货物运输的凭证,它证明了货物的所有权和运输情况;发票则反映了货物的交易价格;装箱单详细列出了货物的包装和数量;合同则规定了买卖双方的权利和义务。

这些单证必须真实、有效、完整,并且相互之间的信息要一致。

海关查验是通关过程中的一个重要环节。

海关有权对进出口货物进行查验,以核实申报的信息是否真实准确,是否存在走私、违规等情况。

查验的方式包括人工查验和设备查验。

人工查验通常会对货物进行开箱检查,查看货物的品名、数量、规格等是否与申报相符;设备查验则会使用X 光机、扫描仪等设备对货物进行检查。

在接受查验时,企业和个人应当积极配合海关的工作,提供必要的协助和资料。

缴纳税费是通关的另一个重要环节。

进出口货物需要缴纳的税费包括关税、增值税、消费税等。

税费的计算依据货物的种类、价值、原产地等因素确定。

企业和个人应当了解相关的税费政策和计算方法,按时足额缴纳税费,以避免产生滞纳金和其他法律后果。

英国清关流程个人

英国清关流程个人

个人在英国清关流程通常涉及从海外进口个人物品或邮寄物品到英国,或者从英国境外购买物品进口到英国。

以下是一般情况下的英国清关流程:

1.申报物品:个人需要准备好必要的文件和信息,如购买物品的发票、价值清单、物品描述等。

在物品进入英国前,需要在相关海关部门进行申报,提供必要的信息和文件。

2.支付关税和税费:根据英国的进口税制,可能需要支付进口关税和增值税(VAT)。

关税根据物品的种类、价值和来源国家不同而有所变化,而增值税一般适用于所有进口商品。

3.海关检查:海关会对进口的物品进行检查,以确保物品的合法性和符合相关法规。

可能会抽查或全面检查物品,检查的程度取决于物品的性质和海关的要求。

4.清关手续:在物品通过海关检查后,个人需要完成清关手续。

这可能涉及填写相关的申报表格或文件,并缴纳相应的关税和税费。

5.取件或交付:完成清关手续后,物品可以被释放并交付给个人。

这可能涉及到在海关指定的地点取件,或者直接将物品送达到个人指定的地址。

需要注意的是,不同类型的物品可能会有不同的清关流程和要求。

对于一些特殊物品,如食品、药品、化妆品等,可能需要额外的许可证或证明文件,并且可能会有更严格的监管和检查。

因此,在进

行个人物品进口时,最好提前了解清关流程和相关要求,以避免延误和不必要的麻烦。

英国清关流程

英国清关流程英国作为一个国际贸易大国,其清关流程非常重要。

清关是指将货物从一个国家运输到另一个国家时,需要通过海关进行检查和审批的过程。

下面将介绍英国清关流程的主要步骤。

一、货物报关货物到达英国之前,进口商需要提前向英国海关提交报关单和必要的文件。

这些文件包括进口商的身份证明、货物清单、发票、运输方式和运输工具的相关信息等。

报关单需要填写货物的数量、价值、原产地、商品编码等信息。

二、海关审查货物到达英国后,海关将对货物进行审查。

审查的目的是确保货物的合法性、安全性和合规性。

海关将检查货物清单、发票和其他相关文件,并与实际货物进行比对。

如果发现问题,海关可能会要求进一步提供证明文件或进行现场检查。

三、税费缴纳根据货物的性质和价值,进口商需要向海关缴纳相应的税费。

这些税费包括进口关税、增值税和其他可能的附加费用。

进口商需要根据货物的分类和价值计算应缴纳的税费,并在规定的时间内向海关缴纳。

四、安全检查为了确保货物的安全性,海关会对部分货物进行安全检查。

安全检查包括使用X光机、犬只等工具进行检查,以确保货物中没有违禁品或危险品。

如果货物引起了海关的怀疑,海关可能会要求进一步的安全检查或取样分析。

五、入境审批一旦货物通过海关的审查和检查,海关将对货物进行入境审批。

这意味着货物可以正式进入英国境内,可以进行配送或销售。

海关会在货物上盖上入境章或提供入境许可证,以便进口商可以合法地将货物进入英国市场。

六、监管和追踪一旦货物进入英国市场,海关将继续对货物进行监管和追踪。

海关会与进口商保持联系,了解货物的流向和销售情况。

如果发现问题,海关可能会进行调查,并要求进一步提供相关证据或文件。

总结起来,英国清关流程包括货物报关、海关审查、税费缴纳、安全检查、入境审批和监管追踪等步骤。

这些步骤确保了货物的合法性、安全性和合规性,为英国的进口贸易提供了保障。

进口商需要遵守相关规定,按照程序进行清关,以确保货物顺利进入英国市场。

澳大利亚-经验总结

澳大利亚-经验总结出口德国:优质杜伦麦适合做大单因为是麦子所以重德国离澳大利亚远运费贵出口日本:荔枝罐头这个也是比较适合做中大单POCIB百科里面有这个商品的示例单据千万不要报价报的比百科的示例还要低这个商品出口盈利率40-60%都是正常的出口美国:优质白小麦利润一般出口英国:珍珠项链差价最大适合做空运利润还可以出口古巴:手工地毯差价最大税较低出口中国:速冻草莓个人认为这是最适合出口中国的产品了差价大运费也不是很贵出口古巴:18K黄金项链空运出口(最好是做2笔空运出口单子)因我的出口只做了8笔且重复了一个优质杜伦麦所以产品较少前期做的杜伦麦9W的单子当然是FOB 赚了2W 多后期做了个125W的单子赚了近30W 所以这是大小单的差距我做的类别比较少,但是听说澳大利亚的牛肉出口日本,优质硬白麦出口俄罗斯,睡袋出口美国,羊皮女靴出口英国,转向柱出口中国都是比较赚钱的。

POCIB里面盈利很重要,据说封顶是1000 也就是初始资金的11倍。

利润和预算很拉分,需要注意些。

进口中国:阳绿貔貅摆件:这是我的第一笔赚上17W的单子以后就开始签大单了虽然税高但是差价也很大是难得的赚钱多的空运商品这笔合同金额是73W 但是我赚了17W5的澳元在中期来说真的是赚得很多的一单了所以值得考虑进口南非:裸钻空运这是一个单独的类别可以加个大类还可以赚钱同样适合做大单我是在后期做的这笔单子因为利润都已经赚的差不多了跟一个妹子做的小单39W赚了8W 也算是利润不错的进口美国:喇叭这笔单子应该说赚的还蛮多的但是后天听说进口俄罗斯的喇叭更赚钱进口巴西:沙滩巾咖啡豆这两笔单子我都不是很满意前期做的特别是咖啡豆赚的不多最好是考虑一下巴西的黄豆还是大豆的。

进口古巴:雪茄23004反正是最贵的那一个,虽然税高,但是差价大,特别大。

我做了个84W的单,赚了98W的澳元是初始资金的3倍多。

所以利润特别高,这是我的第八单,也是我最担心遇险的一笔,结果没有。

POCIB-澳大利亚-经验总结

POCIB带给我的收获和成长一、序(一)POCIB是一个模拟一般货物贸易流程的软件。

想做好pocib,你必须了解国贸的一些基础知识。

比如:1.各种术语的区别,FOB/FCA ,CFR/CPT,CIF/CIP;2.各种结算方式的区别,L/C,T/T,D/P,D/A;3.预算表的各项内容计算方法:退税收入,运费,保费,税费;4.货物贸易的基本流程,就是那个业务流程图。

(二)贸易就是买卖东西,在国际贸易里,这个货物买卖其实就是单据的买卖,货物的所有权体现在单据上,双方就认单据。

1.首先你要搞清单据流转的基本流程,包含:(1)进口商填制单据:不可撤销信用证开证申请书、信用证修改申请书、境外汇款申请书、索赔申请书、入境货物报检单、进口货物报关单;(2)出口商填制单据:合同、商业发票、装箱单、国际海运委托书、国际空运委托书、出境货物报检单、一般原产地证、普惠制产地证、申请鉴定表、货物运输投保单、出口货物报关单、托收委托书、出口押汇申请书、汇票、境内汇款申请书。

(3)可以提前去看看这些单据的填制,比赛的时候尽量做到100%的正确率,检查第一次的时候发现多处错误,一定要全部修改完了在检查,检查2次以上是会扣分的。

2.其次做好心理准备Pocib期间是非常非常的忙的,根本没有任何时间做别的事情,除了上课和睡觉就是POCIB.自己在这儿期间有别的安排的话,最好还是推一推。

因为这是团队性的比赛,个人决定着团体。

说一天在电脑面前坐五六个小时都是根本不够的,除了有必要的专业课,选修公共课的时间通通贡献出来了,没有午休没有周末,参赛这些天没有出过出校门没去过超市,忙起来的时候饭都顾不上吃。

所以必须要有心理准备在参赛期间,除了pocib还是pocib。

3.最后充分利用试用账号开赛前我们会拿到一两个试用账号,这个账号非常有用,里面的东西跟正式比赛的是一样的。

很多同学可能觉得不以为然,没怎么看,没去自己试着做一两笔单子,所以开赛初期还在摸索。

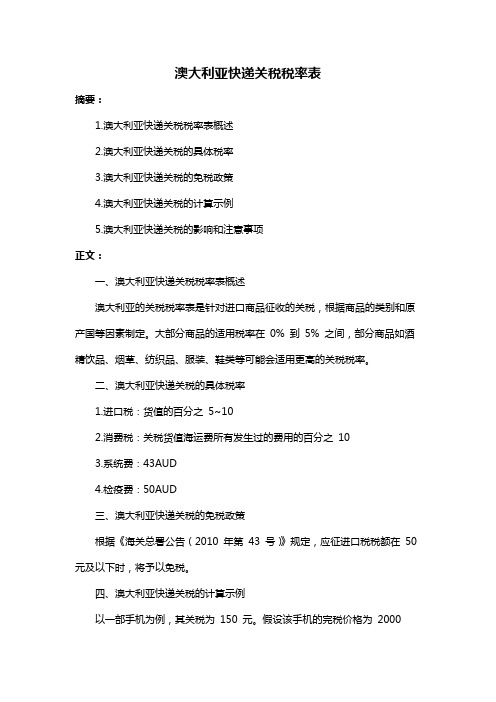

澳大利亚快递关税税率表

澳大利亚快递关税税率表

摘要:

1.澳大利亚快递关税税率表概述

2.澳大利亚快递关税的具体税率

3.澳大利亚快递关税的免税政策

4.澳大利亚快递关税的计算示例

5.澳大利亚快递关税的影响和注意事项

正文:

一、澳大利亚快递关税税率表概述

澳大利亚的关税税率表是针对进口商品征收的关税,根据商品的类别和原产国等因素制定。

大部分商品的适用税率在0% 到5% 之间,部分商品如酒精饮品、烟草、纺织品、服装、鞋类等可能会适用更高的关税税率。

二、澳大利亚快递关税的具体税率

1.进口税:货值的百分之5~10

2.消费税:关税货值海运费所有发生过的费用的百分之10

3.系统费:43AUD

4.检疫费:50AUD

三、澳大利亚快递关税的免税政策

根据《海关总署公告(2010 年第43 号)》规定,应征进口税税额在50 元及以下时,将予以免税。

四、澳大利亚快递关税的计算示例

以一部手机为例,其关税为150 元。

假设该手机的完税价格为2000

元,那么其进口关税税率为150/2000=7.5%。

五、澳大利亚快递关税的影响和注意事项

1.澳大利亚的关税税率对商品的价格有一定影响,消费者在购买进口商品时需考虑关税成本。

2.在向澳大利亚发送包裹时,务必向快递公司提供海关发票,以确保包裹能够顺利通关。

3.对于澳大利亚的关税税率,消费者需要关注政策变化,以便及时调整购买策略。

总之,澳大利亚的关税税率表对进口商品征收一定的关税,但同时也存在免税政策。

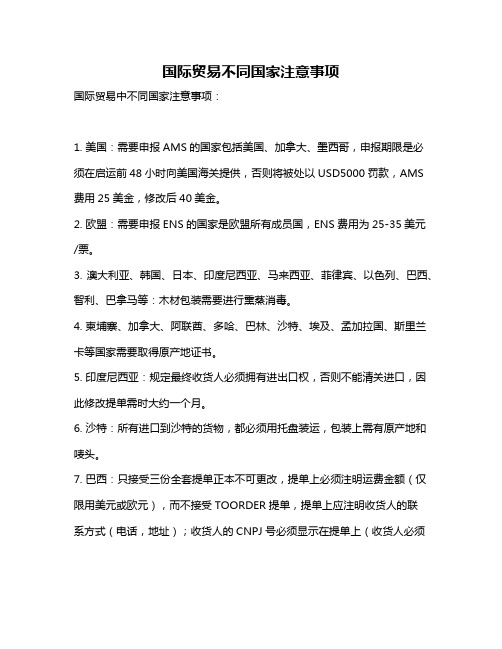

国际贸易不同国家注意事项

国际贸易不同国家注意事项国际贸易中不同国家注意事项:1. 美国:需要申报AMS的国家包括美国、加拿大、墨西哥,申报期限是必须在启运前48小时向美国海关提供,否则将被处以USD5000罚款,AMS 费用25美金,修改后40美金。

2. 欧盟:需要申报ENS的国家是欧盟所有成员国,ENS费用为25-35美元/票。

3. 澳大利亚、韩国、日本、印度尼西亚、马来西亚、菲律宾、以色列、巴西、智利、巴拿马等:木材包装需要进行熏蒸消毒。

4. 柬埔寨、加拿大、阿联酋、多哈、巴林、沙特、埃及、孟加拉国、斯里兰卡等国家需要取得原产地证书。

5. 印度尼西亚:规定最终收货人必须拥有进出口权,否则不能清关进口,因此修改提单需时大约一个月。

6. 沙特:所有进口到沙特的货物,都必须用托盘装运,包装上需有原产地和唛头。

7. 巴西:只接受三份全套提单正本不可更改,提单上必须注明运费金额(仅限用美元或欧元),而不接受TOORDER提单,提单上应注明收货人的联系方式(电话,地址);收货人的CNPJ号必须显示在提单上(收货人必须是已注册注册的公司),收货人必须是在目的地海关注册的公司;不能到付,不能在目的港收取更多的费用,木包要熏蒸,所以更要多注意合箱报价。

8. 墨西哥:申报AMS提单时,应显示商品编码,以及需要的AMS资料及装箱单发票;Notify指第三方通知人,通常为货代公司或CONSIGNEE代理;SHIPPER显示真实的收货人和CONSIGNEE的收货人;品名不能显示总称,要显示货物的详细名称;件数要求提供详细件数;提单应标明货物的原产地,在开航后改用提单至少应处以USD200的罚款。

9. 智利:注意智利不接受电放提单,木材包装需熏蒸。

10. 巴拿马:不接受电放提单,木包包需熏蒸,需提供装箱单和发票;经COLONFREEZONE(科隆自由贸易区)中转至巴拿马(PANAMA)的货物,必须是可重叠堆放及叉车作业的,单件重量不能超过2000KGS。

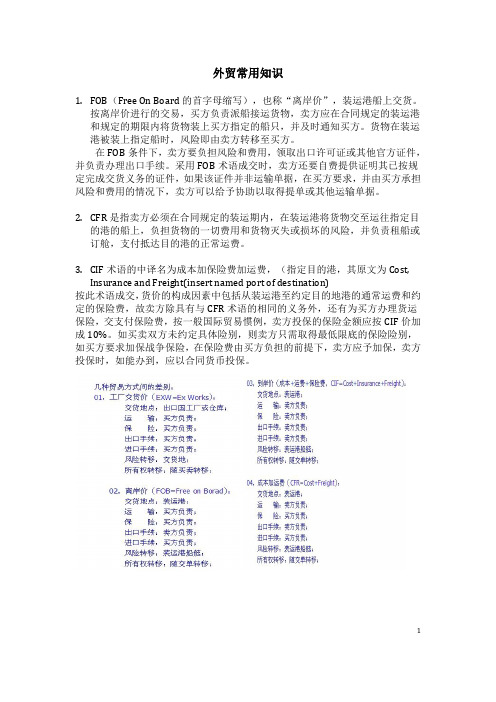

外贸的一些常识

外贸常用知识1.FOB(Free On Board的首字母缩写),也称“离岸价”,装运港船上交货。

按离岸价进行的交易,买方负责派船接运货物,卖方应在合同规定的装运港和规定的期限内将货物装上买方指定的船只,并及时通知买方。

货物在装运港被装上指定船时,风险即由卖方转移至买方。

在FOB条件下,卖方要负担风险和费用,领取出口许可证或其他官方证件,并负责办理出口手续。

采用FOB术语成交时,卖方还要自费提供证明其已按规定完成交货义务的证件,如果该证件并非运输单据,在买方要求,并由买方承担风险和费用的情况下,卖方可以给予协助以取得提单或其他运输单据。

2.CFR是指卖方必须在合同规定的装运期内,在装运港将货物交至运往指定目的港的船上,负担货物的一切费用和货物灭失或损坏的风险,并负责租船或订舱,支付抵达目的港的正常运费。

3.CIF术语的中译名为成本加保险费加运费,(指定目的港,其原文为Cost,Insurance and Freight(insert named port of destination)按此术语成交,货价的构成因素中包括从装运港至约定目的地港的通常运费和约定的保险费,故卖方除具有与CFR术语的相同的义务外,还有为买方办理货运保险,交支付保险费,按一般国际贸易惯例,卖方投保的保险金额应按CIF价加成10%。

如买卖双方未约定具体险别,则卖方只需取得最低限底的保险险别,如买方要求加保战争保险,在保险费由买方负担的前提下,卖方应予加保,卖方投保时,如能办到,应以合同货币投保。

1FOB、CIF、CFR共同点: 1.卖方负责装货并充分通知,买方负责接货。

DDP “完税后交货(……指定目的地)”是指卖方在指定的目的地,办理完进口清关手续,将在交货运输工具上尚未卸下的货物交与买方,完成交货。

卖方必须承担将货物运至指定的目的地的一切风险和费用,包括在需要办理海关手续时在目的地应交纳的任何“税费”(包括办理海关手续的责任和风险,以及交纳手续费、关税、税款和其他费用)。

外贸出口清关需要准备的资料表格

3

熏蒸证书

澳洲.欧美国家

澳洲.欧美国家不允许进口原木,若非 夹板包装,需要安排熏蒸

4

包装声明

澳洲

1.建议使用出口公司抬头的格式制作 包装声明, 下面加盖公司章。 2.澳大利亚对进口包装极其严格, 实 木包装必须熏蒸并有熏蒸证书。包装 不合格可导致货物销毁或付款。

1.沙特阿拉伯、阿联酋、埃及等还要

5

CO(一般产原地证书)

瑞士

出口瑞士需要办理中瑞原产地证书 FORM S

新加坡 新西兰 香港、澳门

东盟

出口瑞士需要办理中瑞原产地证书 FORM S

出口到新西兰需要办理中新原产地证 书FORM N

1.证书的有效期自签发起120天内。 2.一份证书只能对应一批同时进入内 地的货物,可包括不多于5项产品。

目前给予我国普惠制待遇的国家共38 个: 欧盟27国(比利时、丹麦、英国 、德国、法国、爱尔兰、意大利、卢 森堡、荷兰、希腊、葡萄牙、西班牙 、奥地利、芬兰、瑞典、波兰、捷克 、斯洛伐克、拉脱维亚、爱沙尼亚、 立陶宛、匈牙利、马耳他、塞浦路斯 、斯洛文尼亚、保加利亚、罗马尼 亚)、挪威、瑞士、土耳其、俄罗斯 、白俄罗斯、乌克兰、哈萨克斯坦、 日本、加拿大、澳大利亚和新西兰

17

贸促会商事认证(快件)

18

SABER认证

19

Form U

智利 巴基斯坦

沙特 澳大利亚

必须在报关前,即开船前办理。

注意现在不能做底值商业发票

可以是产地证,也可以是商业 invoice,委托书,授权书,自由销售 证明书,装箱单,价格单,报关单 等;需要认证的报关单必须是海关放 行后已经盖章的,无海关章的报关单 一律不得认证。报关单可认证正本, 也可认证正本复印件,但不可认证预 录单或者无海关章的报关单。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

外贸清关澳大利亚和英国的清关知识汇总澳大利亚清关知识汇总1.澳大利亚海关信息海关上班工作时间Mon-Fri 07:00-17:00 周一至周五07:00-17:00Sat & Sun Closed 周六和周日休息2.澳大利亚清关手续澳大利亚清关时间估计Documents 3 文件:3小时Low Value 3 低值货物:3小时High Value 24 高值货物:24小时如果货值超过1000AUD,在发货时最好附上全套的商业文件,包括发票、产品说明、以及收货人授权DHL代为清关的授权书。

正常情况下,一二天之内应该清完。

如果是普通空运的货,我们经常是在当天就清关结束。

这种快递的货有一些区别。

Additional Information 附加说明1 MAWB Clearance Charges: 主单清关费用包括:As of June 7th all DIRECT MAWBs (not going through a network hub) into Australia origin would be charged USD 100.00 per MAWB Clearance Fee which includes:自6月7日起,所有进入澳大利亚的主单(不经过网络中转站)。

每个主单需缴纳100美元的清关费,这个费用包括:1). International Document Fee. 国际文件费用2). International Terminal Fee. 国际终点站费用3). Handling Charge. 手续费用2 Shipment Clearance Charges: 货物清关费用1). High Value Shipments of value over AUD 250.00 or the shipments Duty & Tax greater than AUD 50.00 would be charged thefollowing:价值高于250澳元的高值货物或者税费高于50澳元的货物必须缴纳一下费用:a. Customs Clearance & Entry Fee AUD 33.89 An automactic charge for formal entry by customs报关费用33.89澳元由海关收取正式报关货物的费用b. Brokerage Fee AUD 82.5 A charge for formal clearance by customs broker报关员佣金82.5 澳元报关员正式报关所收取的费用c. Duty % of value of goods based on commodity按照货物价值所征的关税,征税比例取决于货物d. GST 10% of the value of goods + duty消费税,10% 的货物价值+关税2). Quarantine Commodity Shipments would be have the additional charges:检疫货物还需缴纳以下费用:a. Quarantine Inspection AUD 85.00 检疫费用85澳元b. Quarantine Processing AUD 30.00 检疫处理30澳元c. Storage AUD 25.00 min + $0.20 per kg 储存费用25澳元+每公斤0.2美元3. Warranty Return Shipments must be declared clearly on the manifest for customs as for those shipment neither duty nor GST is paid against the shipment.保单退回货物必须在递交海关的载货清单上说明,因为这些货物不需要缴纳关税或者消费税Those shipment charges will be billed to consignee, and if consignee refused then they will be charged to shipper/origin. An example to clear the above:这些货物费用将有收件人支付。

如果收件人拒绝和支付,将由发件人支付,以下为实例:If you send clothingvalued at AUD 200 this is lower than the high level value, however customs will calculate the duty and see if it is more that AUD 50.00, Duty for clothing is 25%,GST is always 10% of value of goods + duty amount 10 % of AUD 250 = AUD 25.00如果寄价值200澳元的衣服,(价值低于高值货物的价值),但是海关会计算该货物需缴纳的关税,看是否超过50澳元(25%×200 澳元=50澳元),消费税是货物价值×10% + 关税,10%×250澳元=25澳元Commodity Information 货物信息National Tax Rate -1 国税税率-1Low Value Limit 1000 USD 低值货物最高限额1000USDHigh Value Limit -1 USD 高值货物最低限额-1USDNon Dutiables 不纳税货物Airline tickets, validated 有效的航空机票Checks, blanks 空白支票Checks, cancelled 注销支票Checks, payroll 工资支票Checks, travellers 旅游支票Computer printouts 电脑打印品Credit cards 信用卡Credit card blanks 空白信用卡Documents 文件Invoices 发票Magazines 杂志Manuscripts 手稿Dutiables 纳税货物Alcohol 含酒精类饮料Books 书Brochures 小册子Business cards 名片Diskettes(with data or blank) 空白或有数据的磁盘Film, photos, slides 胶卷,照片,幻灯片Manuals 手册Parts, aircraft 飞机零件Parts, computer 电脑零件Parts, electronic 电器零件Parts, machine 机器零件Software/CD ROM 软盘CDVideo tapes 录像带Newspaper 报纸Passports护照Catalogs 商品目录And all other goods. 其他类似物品Unacceptables 不可接受货物Acids 酸类Drugs, prescription 处方药Oxidisers Alcoholic beverages 酒Explosives 爆炸品Paints, non-haz. 不含的油画Animals 动物Firearms 枪械Paints, haz. 油画Artwork, fine 艺术品Flammables 易燃物Perfume, haz. 香水Batteries, haz. 电池Personal effects 私人物品Biological products, non-haz. 生物制品Food (5) 食物Plants (5) 植物Furs 皮毛Poisons 有毒物质Blood 血液Gambling devices 赌具Cash 现金Gases 气体Precious metals 贵重金属Chemicals, non-haz. 非危险化学品Ice, dry 干的冰块Precious stones 贵重的石器Radioactives 有放射性的物质Corrosives 有腐蚀性的物质Ivory 象牙Seeds 种子Cosmetics, haz. 化妆品Jewellery 珠宝Soil 土壤Dangerous goods 危险物品Knives 刀具Tobacco 烟草Liquids, haz. 液体Liquor 酒Weapons 武器Magnetized materials 有磁性的物品Foodstuffs 食物Additional Information 附加说明Australian Quarantine and Customs strictly adhere to guidelines. For a comprehensive list of prohibited and restricted items, please visit.au . When sending Personal Effects, please ensure that the senders / receivers passports are attached as well as the "Unaccompanied Personal EffectsStatement located at .au/resources/Files/b534.pdf .澳大利亚的海关检疫程序严格遵守规定。

关于禁运和限制物品的详情请参考网站.au 。

运送私人物品是,请将发件人和收件人的护照随同货物一起寄出,另外请附上“没有随货物基础的私人物品说明”,此表格请从.au/resources/Files/b534.pdf 下载。

这些文件很重要,可以加快清关的速度。

英国清关知识1.英国基本介绍英国的全称是“大不列颠和北爱尔兰联合王国”,领土面积包括四部分:英格兰,苏格兰,威尔士和北爱尔兰。

首都伦敦(London)。

英国第一大城市及第一大港,欧洲最大的都会区之一兼世界三大金融中心之一。

英国虽然是欧盟国家,但是为了维护其金融中心地位,依然使用英镑。

2.英国海关上班时间Customs working hours from Mon to Sun, 24 hours run excepting bank holidays.除了银行假日以外,英国海关从周一到周日,每天24小时工作。

由于GMT是根据英国格林威治天文台的时间来确定的,所以英国的时刻如下:冬季时间GMT;夏季时间GMT+1(BST),冬季和北京相差8个小时,夏季相差7个小时。