Computer-Assisted Audit Techniques计算机辅助审计技术

计算机辅助审计的工具和技术

计算机辅助审计的工具和技术计算机技术的不断发展与完善,为审计工作提供了更高效、准确的辅助手段。

计算机辅助审计(Computer Assisted Auditing)旨在利用计算机技术和相应的软件工具对审计过程中的数据分析、测试和确认进行有效管理和支持,以提高审计的质量和效率。

本文将介绍几种常见的计算机辅助审计工具和技术。

一、数据分析软件数据分析软件作为计算机辅助审计的基础工具,可以帮助审计师更好地对大量的审计数据进行处理和分析。

它可以快速地获取、整理、分析和展示数据,为审计工作提供了强有力的支持。

例如,ACL(Audit Command Language)是一种常用的数据分析软件,它具有强大的数据获取和分析功能。

通过使用ACL,审计师可以轻松地对大量数据进行筛选、过滤和排序,并进行复杂的数据计算和统计,以发现异常和潜在的问题。

另外,IDEA(Interactive Data Extraction and Analysis)也是一种常见的数据分析软件,它同样提供了强大的数据分析功能,可以帮助审计师更好地进行数据采样、统计和分析。

二、数字足迹技术数字足迹技术是指通过计算机工具和技术对电子数据进行追踪、检查和确认的方法。

它可以帮助审计师重建业务过程和交易流程,了解交易的完整性和准确性。

常见的数字足迹技术包括数据挖掘、数据透视和时间轴分析。

数据挖掘可以通过分析大量数据,发现其中的规律和异常,为审计师提供重要线索。

数据透视则可以将大量数据按照特定的维度和指标进行分组和汇总,从而更好地理解数据的含义和关系。

时间轴分析则可以帮助审计师分析交易的时间顺序和关联关系,进一步揭示交易的真相。

三、访问控制和安全审计技术随着信息技术的普及和应用,访问控制和安全审计成为了计算机辅助审计中不可或缺的环节。

访问控制是指通过授权和身份验证等手段对系统和数据的访问进行管理和控制。

安全审计则是通过监控、记录和分析系统和数据的访问行为,及时发现和防范安全威胁。

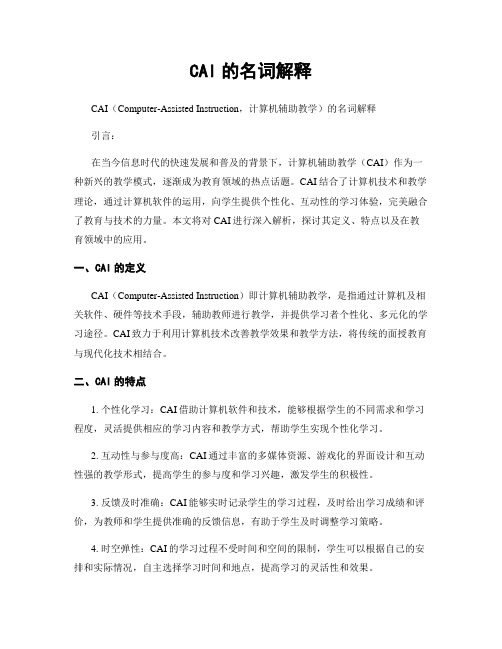

CAI的名词解释

CAI的名词解释CAI(Computer-Assisted Instruction,计算机辅助教学)的名词解释引言:在当今信息时代的快速发展和普及的背景下,计算机辅助教学(CAI)作为一种新兴的教学模式,逐渐成为教育领域的热点话题。

CAI结合了计算机技术和教学理论,通过计算机软件的运用,向学生提供个性化、互动性的学习体验,完美融合了教育与技术的力量。

本文将对CAI进行深入解析,探讨其定义、特点以及在教育领域中的应用。

一、CAI的定义CAI(Computer-Assisted Instruction)即计算机辅助教学,是指通过计算机及相关软件、硬件等技术手段,辅助教师进行教学,并提供学习者个性化、多元化的学习途径。

CAI致力于利用计算机技术改善教学效果和教学方法,将传统的面授教育与现代化技术相结合。

二、CAI的特点1. 个性化学习:CAI借助计算机软件和技术,能够根据学生的不同需求和学习程度,灵活提供相应的学习内容和教学方式,帮助学生实现个性化学习。

2. 互动性与参与度高:CAI通过丰富的多媒体资源、游戏化的界面设计和互动性强的教学形式,提高学生的参与度和学习兴趣,激发学生的积极性。

3. 反馈及时准确:CAI能够实时记录学生的学习过程,及时给出学习成绩和评价,为教师和学生提供准确的反馈信息,有助于学生及时调整学习策略。

4. 时空弹性:CAI的学习过程不受时间和空间的限制,学生可以根据自己的安排和实际情况,自主选择学习时间和地点,提高学习的灵活性和效果。

5. 资源共享性:CAI可以实现教学资源的共享,教师可以通过云端教学平台发布、分享各类教育资源,学生也能够随时随地获取所需资源,提高了教学效率和资源的利用率。

三、CAI在教育中的应用1. 优化学习体验:CAI通过多媒体、交互式教学资源等手段,提供丰富多样的学习内容和形式,使学习过程更生动、有趣,从而增强学生的学习兴趣和积极性。

2. 提高学习效果:CAI可根据学生的学习情况和反馈,针对性地进行教学策略的调整,帮助学生理解和掌握知识,提高学习效果和成绩。

CNAS-CC14-2008计算机辅助审核技术在获得认可的管理体系认证中的使用

CNAS—CC14计算机辅助审核技术在获得认可的管理体系认证中的使用The Use of Computer Assisted Auditing Techniques (“CAAT”) for Accredited Certification of ManagementSystems中国合格评定国家认可委员会目 录目 录 (1)前言 (2)0. 概述 (3)1. 要求 (3)前言CNAS作为国际认可论坛(IAF)成员,等同采用IAF发布的强制性文件IAF MD4:2008《强制性文件计算机辅助审核技术在获得认可的管理体系认证中的使用》制定本文件。

本文件旨在确保CNAS-CC01:2007《管理体系认证机构要求》(等同采用GB/T 27021-2007/ISO/IEC17021:2006)实施的一致性,并和CNAS-CC01共同作为CNAS 对管理体系认证机构的认可准则。

本文件中,用术语“应”表示相应的CNAS-CC14条款是强制性的,这些条款反映了CNAS-CC01的要求。

术语“宜”表示CNAS-CC14相应的条款提供了满足CNAS-CC01相应要求的公认方法;如果认证机构采用与CNAS-CC14等效的方式来满足CNAS-CC01的要求,需要向CNAS证实该方式确实能达到这一目的。

计算机辅助审核技术在获得认可的管理体系认证中的使用本文件是强制性的,旨在确保当审核方法中使用计算机辅助审核技术(CAAT)时,CNAS-CC01:2007《管理体系认证机构要求》实施的一致性。

本文件并不强制要求认证机构及其客户使用CAAT,但如果认证机构及其客户选择使用CAAT,则应符合本文件的要求,并应能向CNAS证实这种符合性。

0. 概述0.1 随着信息和通信技术日益发展和成熟,认证机构能够使用计算机辅助审核技术(CAAT)提高审核的有效性和效率,并为审核过程的完整性与可信性提供支持和保障是重要的。

注:关于使用计算机辅助审核技术的指南可以从国际标准化组织(ISO)和国际认可论坛(IAF)认证审核实践工作组(APG)网站/tc176/ISO9001AuditingPracticesGroup上获得。

计算机辅助审计技术在投资审计中的应用研究

计算机辅助审计技术在投资审计中的应用研究计算机辅助审计技术(Computer Assisted Audit Techniques,CAATs)是指使用计算机工具和软件来执行审计程序并分析审计证据的技术。

它可以提高审计的效率和准确性,减少人工错误,并提供更广泛的审计范围。

在投资审计中,CAATs可以应用于数据采集、数据分析和风险评估等方面。

CAATs可以帮助审计师收集投资审计所需的大量数据。

在过去,审计师可能需要手工抽样和记录投资交易数据,然后进行逐笔分析。

这种方法费时费力,并且容易出现错误。

而使用CAATs,审计师可以通过编程设置数据提取和导入规则,自动从投资机构的数据库中提取所需的数据。

这不仅可以节省时间,还可以减少数据提取和输入过程中的错误。

CAATs可以帮助审计师进行投资数据的分析。

投资审计通常涉及大量的数据,包括投资组合的变动情况、投资收益和损失的计算等。

使用CAATs,审计师可以利用数据分析软件进行快速而准确的计算和比较。

审计师可以使用数据挖掘技术来识别异常交易或潜在的欺诈行为。

这些分析结果不仅可以为审计师提供有效的审计证据,还可以帮助监管机构和投资者获得更好的投资决策依据。

CAATs还可以用于投资审计中的风险评估。

投资审计涉及的风险包括市场风险、信用风险和操作风险等。

使用CAATs,审计师可以通过模拟交易和市场情景来评估投资组合的风险水平。

它们可以利用历史数据和风险模型来预测投资组合的回报和波动性,并提供投资组合在不同市场环境下的风险分析报告。

这种风险评估有助于审计师更好地了解投资组合的风险状况,并为投资者提供风险管理建议。

计算机辅助审计技术在投资审计中具有重要的应用价值。

它可以提高审计效率、准确性和范围,并提供更好的审计证据和风险评估报告。

随着技术的不断发展,CAATs在投资审计中的应用将会越来越广泛。

要充分发挥CAATs的潜力,审计师需要具备相关的技术知识和技能,并且需要不断学习和更新自己的技术能力。

计算机辅助审计管理办法

计算机辅助审计管理办法计算机辅助审计管理办法第一条为了规范计算机辅助审计,全面提升审计工作质量和审计手段现代化水平,根据《国家审计基本准则》和山东省人民政府办公厅鲁政办发〔2002〕10号《关于贯彻国办发〔2001〕88号文利用计算机信息系统开展审计工作有关问题的通知的要求,制定本办法。

第二条本办法所称计算机辅助审计,是指审计人员将计算机作为辅助审计工具,对被审计单位财政、财务收支及其计算机应用系统实施的审计。

第三条本办法所称计算机应用系统,是指被审计单位与财政、财务收支有关的计算机应用系统。

第四条审计人员将计算机作为辅助审计工具实施审计,主要包括下列内容:(一)审计业务所需法律、法规的辅助检索;(二)对被审计单位财务报表的辅助分析;(三)对被审计单位的计算机应用系统进行符合性检试;(四)分析审计风险和确定审计范围;(五)对被审计单位的财政、财务收支进行检查;(六)形成审计工作底稿、审计报告、审计意见书和审计决定;(七)对审计资料、审计项目计划、审计档案的管理;(八)对审计业务的综合、统计和分析;(九)其他内容。

第五条本局将组织审计人员积极参加人事部门组织的全国计算机软专业技术资格或水平的统一考试,以及专业进修和岗位培训,全面提升计算机理论水平和实务操作水平。

第六条在编制计算机辅助审计方案,实施计算机辅助审计时应做到:1、了解被审计单位计算机应用系统软、硬的设置和系统的基本功能.并要求被审计单位开发、使用的计算机信息系统要符合国家标准或行业标准的数据接口和必要的工作空间,该数据接口应将审计机关要求的数据转换成能够读取的格式输出;2、要求被审计单位报送计算机应用系统开发的验收报告、申请使用该系统的报告,以及与之配套的管理制度和措施以及计算机应用系统变动情况等资料;提供与财政收支、财务收支有关的电子数据和必要的计算机技术文档等资料以及所需要的原始技术资料和原始数据;3、检测被审计单位计算机应用系统相关的内部控制是否存在、有效,以保证对获取审计证据的可靠性,确保计算机处理的信息对其财政、财务收支的真实性、合法性。

计算机辅助审计的风险与防范措施

THANKS

谢谢您的观看

制定应急预案以应对突发情况

制定应急预案

针对可能出现的突发情况,如系统故障、数据泄露等 ,制定相应的应急预案。

定期进行演练

定期组织应急演练,提高审计人员应对突发情况的能 力。

建立快速响应机制

在发生突发情况时,能够迅速启动应急响应机制,最 大限度地减少损失。

05

案例分析与应用

案例一:某企业的数据安全防范措施

建立访问控制机制

对不同用户设置不同的访问权限,防止未经授权的访问和数据泄露 。

定期进行安全检查

对计算机辅助审计系统的安全性进行定期检查,及时发现并修复潜 在的安全漏洞。

合理选择审计软件

1 2

选择经过认证的审计软件

确保软件符合相关法规和标准,降低使用风险。

考虑软件的性能和功能

根据审计需求选择性能稳定、功能全面的审计软 件。

03

风险防范措施

数据安全防范措施

数据加密

采用数据加密技术,对审 计数据进行加密存储,确 保数据的安全性。

数据备份

定期对审计数据进行备份 ,以防止数据丢失或损坏 。

数据访问控制

设置严格的数据访问控制 ,只有授权人员才能访问 审计数据。

审计线索防范措施

审计日志

防止篡改

建立完善的审计日志,记录审计活动 和操作,以便追踪和审查。

总结词

数据加密与备份

详细描述

该企业采用了数据加密技术,确保数据在传输和存储过程中的安全性。同时,建立了完善的数据备份机制,避免 数据丢失和损坏。

案例二:某会计师事务所的审计线索防范措施

总结词

审计软件与权限管理

详细描述

该会计师事务所使用专业的审计软件,对审计过程进行详细记录和跟踪。同时,对审计人员的权限进 行严格管理,避免审计线索的泄露。

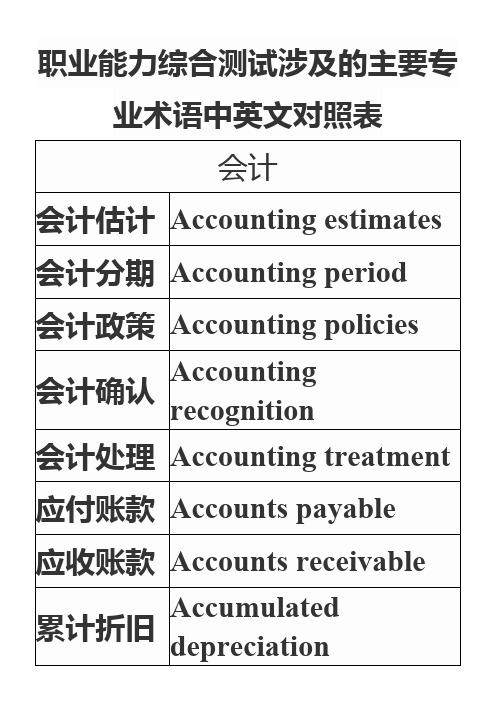

2014注会专业术语中英文对照表

Interest receivable

集团内部销售

Inter-group sales

中期财务报表

Interim financial statements

存货

Inventories

投资活动

Investing activities

投资成本

Investment cost

投资收益

Investment income

接触信息/审计工作底稿

Access to information / Audit documentation

否定意见

Adverse opinion

替代程序

Alternative procedures

分析程序

Analytical procedures

在集团层面实施的分析程序

Analytical procedures at group level

Balance sheet

银行存款

Bank deposit

基本每股收益

Basic earnings per share

应收票据

Bills receivable

账面价值

Book value

借款费用

Borrowing costs

企业合并

Business combination

营业税金及附加

Business taxes and surcharges

Impairment loss

减值准备

Impairment losses

利润表

Income statement

所得税

Income tax

间接法

Indirect method

保险费

企业审计之计算机辅助审计-2019年文档

企业审计之计算机辅助审计1 引言企业审计工作是企业正常运营中一个重要的环节,企业开展审计工作是以企业发展和管理工作为中心,做好监督与服务两项工作。

实现监督向监督与服务并重转变、查错纠弊向积极增加企业价值和防范风险转变、事后监督向事前事中控制转变。

立足纠弊功能、发挥监督作用;强化控制功能、发挥预防作用;体现评估功能、发挥防护作用;突出促进功能、发挥建设作用,切实肩负起保障企业健康运行“免疫系统”的重要防线作用。

做好审计工作有助于企业管理,对收支情况规范性、业务活动真实性等进行监督和评价。

在现代企业管理中企业的审计工作更加显得重要,为了更好的开展审计工作,将计算机辅助审计技术引入企业审计系统中,为审计工作的顺利进行提供了保障。

2 计算机辅助审计的优势2.1 连接各个部门互相协调和监督工作一般来说企业的审计工作很多都是由相关部门提供资料相互协作来完成的,但是要使得审计工作保质保量顺利的完成,就要求企业的相关各部门之间互相协调和配合工作。

计算机辅助审计技术的应用可以将部门之间联系在一起,通过内部局域网传达相关的资讯信息。

另外也能够对其他部门进行有效监督,这给审计工作的顺利执行提供了保障。

2.2 更加高效地处理财务数据在企业里每天都有经济往来,几乎每个操作流程都会和资金挂钩,这样一来每天审计系统里面就会有大量的数据需要财务进行处理。

引入计算机辅助审计技术后,对数据的处理效率就更加高效。

比如在Office 系列办公软件中的Excel 表格软件能够将各类数据分类汇总,然后进行有效的运算统计,再通过审计技术软件对各类数据进行整合,最终得到需要的处理结果。

3 计算机辅助审计在企业审计中的具体应用3.1 对企业物料管理审计企业审计部门在对物料管理进行审计的时候需要特别关注两个方面的内容,一方面是检查企业物料采购是否按照企业的相关要求,企业采购的物料在招标目录内,录入中标物料的价格是否正确;另一方面主要是对物料的加成率进行审计。

名词解释计算机辅助教学

名词解释计算机辅助教学

计算机辅助教学(Computer Assisted Instruction, CAI)是指利

用计算机和相关技术来提供教学支持和辅助教学活动的一种教育方法。

它通过将教学内容和活动与计算机软件、应用程序和互联网等技术结合,提供个性化、互动性强的学习环境,以促进学生的学习和教师的教学效果。

计算机辅助教学可以提供多种多样的学习资源和学习工具,包括教学课件、多媒体材料、模拟实验、互动教学软件等。

学生可以通过计算机进行自主学习,根据自身的学习进度和需求进行学习内容的选择和学习方式的调整。

同时,计算机辅助教学也为教师提供了教学设计、教学管理和评估学生学习效果的工具和平台。

计算机辅助教学具有许多优点,例如可以提高教学效率和学习效果、促进学生的主动学习和创造性思维、培养信息素养和技术能力。

它可以根据学生的个体差异进行个性化教学,满足学生多样化的学习需求。

此外,计算机辅助教学还具有互动性强、灵活性高、可扩展性和可追踪性等特点,有助于教师和学生之间的沟通交流和合作学习。

然而,计算机辅助教学也面临一些挑战和问题,例如技术设备和软件的成本、师生对技术的掌握程度、教学设计和内容的合理性等。

因此,在实施计算机辅助教学时,需要综合考虑教育目标、学生的学习需求和教学资源等方面的因素,合理选择和运用计算机辅助教学技术和方法,以提高教学质量和学习成果。

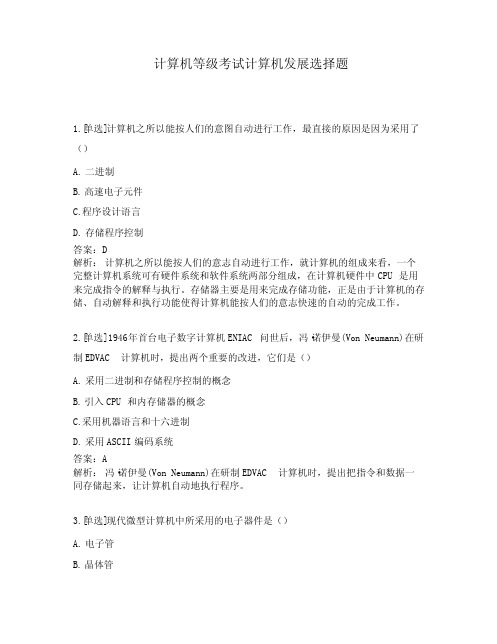

计算机等级考试计算机发展选择题

计算机等级考试计算机发展选择题1.[单选]计算机之所以能按人们的意图自动进行工作,最直接的原因是因为采用了()A. 二进制B. 高速电子元件C.程序设计语言D. 存储程序控制答案:D解析: 计算机之所以能按人们的意志自动进行工作,就计算机的组成来看,一个完整计算机系统可有硬件系统和软件系统两部分组成,在计算机硬件中CPU是用来完成指令的解释与执行。

存储器主要是用来完成存储功能,正是由于计算机的存储、自动解释和执行功能使得计算机能按人们的意志快速的自动的完成工作。

2.[单选]1946年首台电子数字计算机ENIAC问世后,冯·诺伊曼(Von Neumann)在研制EDVAC计算机时,提出两个重要的改进,它们是()A. 采用二进制和存储程序控制的概念B. 引入CPU和内存储器的概念C.采用机器语言和十六进制D. 采用ASCII编码系统答案:A解析: 冯·诺伊曼(Von Neumann)在研制EDVAC计算机时,提出把指令和数据一同存储起来,让计算机自动地执行程序。

3.[单选]现代微型计算机中所采用的电子器件是()A. 电子管B. 晶体管C.小规模集成电路D. 大规模和超大规模集成电路答案:D解析: 目前微机中所广泛采用的电子元器件是:大规模和超大规模集成电路。

电子管是第一代计算机所采用的逻辑元件(1946-1958)。

晶体管是第二代计算机所采用的逻辑元件(1959-1964)。

小规模集成电路是第三代计算机所采用的逻辑元件(1965-1971)。

大规模和超大规模集成电路是第四代计算机所采用的逻辑元件(1971-今)。

4.[单选]计算机网络最突出的优点是()A. 精度高B. 运算速度快C.容量大D. 共享资源答案:D解析: 建立计算机网络的目的主要是为了实现数据通信和资源共享。

计算机网络最突出的优点是共享资源。

5.[单选]办公室自动化(OA)按计算机应用的分类,它属于()A. 科学计算B. 辅助设计C.实时控制D. 数据处理答案:D解析: 信息处理是目前计算机应用最广泛的领域之一,信息处理是指用计算机对各种形式的信息(如文字、图像、声音等)收集、存储、加工、分析和传送的过程。

计算辅助审计实验报告(3篇)

第1篇一、实验目的随着信息技术的飞速发展,计算机在各个领域的应用日益广泛,审计领域也不例外。

计算机辅助审计(Computer-assisted Audit,简称CAA)作为一种新兴的审计方式,通过计算机技术辅助审计人员完成审计工作,提高了审计效率和质量。

本实验旨在让学生了解计算机辅助审计的基本原理、操作方法和应用优势,提高学生的审计实践能力。

二、实验内容1. 计算机辅助审计的基本原理计算机辅助审计是指利用计算机技术和审计软件,对被审计单位的财务信息进行收集、处理、分析和评价的过程。

其主要原理如下:(1)数据采集:审计人员通过计算机系统,从被审计单位的财务信息系统、数据库中采集相关数据。

(2)数据处理:审计软件对采集到的数据进行清洗、筛选、分类等处理,为后续分析提供基础。

(3)数据分析:审计人员利用审计软件对处理后的数据进行分析,识别潜在风险和异常情况。

(4)评价与报告:根据分析结果,审计人员对被审计单位的财务状况、经营成果和合规性进行评价,并形成审计报告。

2. 计算机辅助审计的操作方法(1)安装审计软件:根据审计项目需求,选择合适的审计软件,并安装到计算机上。

(2)数据采集:通过数据接口或手工录入的方式,将被审计单位的财务数据导入审计软件。

(3)数据处理:对导入的数据进行清洗、筛选、分类等处理,确保数据的准确性和完整性。

(4)数据分析:利用审计软件提供的功能,对数据进行分析,识别潜在风险和异常情况。

(5)评价与报告:根据分析结果,撰写审计报告,并提出改进建议。

3. 计算机辅助审计的应用优势(1)提高审计效率:计算机辅助审计可以快速处理大量数据,提高审计效率。

(2)降低审计风险:通过数据分析,可以发现潜在风险和异常情况,降低审计风险。

(3)提高审计质量:计算机辅助审计可以减少人为错误,提高审计质量。

(4)节约审计成本:计算机辅助审计可以降低审计人员的人工成本,节约审计成本。

三、实验过程1. 实验环境:准备一台装有审计软件的计算机,连接网络。

计算机辅助审计

第一节 计算机审计概述 第二节 计算机辅助审计技术 第三节 信息系统审计技术 第四节 大数据审计

什么是计算机辅助审计?

• 计算机审计:是与传统审计相对称的概念,它是随着计算机技术的发展而 产生的一种新的审计方式,其内容包括利用计算机进行审计和对计算机系 统进行审计。即计算机审计的含义包括计算机系统作为审计的对象和作为 审计的工具。

AO中字段分层分析实例

23

重号分析实例 ——AO中“重号分析”功能

重号分析用来查找被审计数据某个字段(或某些字段)中重复的 数据。例如,检查一个数据表中是否存在相同的发票被重复多次记账。

24

断号分析实例 ——AO中“断号分析”功能

断号分析主要是分析被审计数据中的某字段在数据记录中是否连续。

25

11

审计数据分析思路

总体分析,如:账表核对、表表核对、指标分析等,掌 握总体情况,寻找薄弱环节,确定审计重点。

具体分析,建立审计分析模型,再利用审计软件或通用 软件进行复算、核对等。

财务数据的勾稽关系 业务数据的业务逻辑关系 法律法规的数量规定 审计人员的经验和专业判断

12

常用审计数据分析方法

数据清理

也称数据清洗(data cleaning, data cleaning or scrubbing)。 利用有关技术如数理统计、数据挖掘或预定义的清理规则等,从数据中 检测和消除错误数据、不完整数据和重复数据等,从而提高数据的质量。

名称转换、数据类型转换、日期/时间格式转换、 代码转换、横向合并、纵--案例

采用Access作为分析工具

采用AO作为分析工具

19

审计抽样实例 ——AO中的审计抽样功能

20

统计分析实例

计算机辅助教学(computer-assisted.

计算机辅助教学(computer-assisted instruction)CAI广义指教育领域利用计算机进行各种辅助活动,包括军队、商业等部门利用计算机作为教学辅助工具,通过传统的方法促进某种教学目标的实现。

狭义指利用计算机帮助学生进行学习的活动,与“计算机辅助学习”(简称CAL)同。

随着微型机的日益普及,内涵日益扩大。

起初;计算机在学校主要用作教学机器或多种用途的视听设备,帮助学生学习正规课程中的事实。

概念或技能。

实为程序教学的延续。

20世纪80年代以来,其方式除了传统的操练和练习、个别辅导、演示、测验等形式外,还扩大到一此非传统的形式。

一般有以下六种:(l)操练和练习。

利用计算机程序使学生完成数学、阅读等基本技能中一些特定的、可分解的技能的训练和练习。

是CAI中最普遍和较低级的一种形式。

(2)个别辅导。

计算机像教师一样向学习者传授某些知识和技能,作一对一的辅导。

此类教学程序在编制时考虑到学生的学习规律,知识本身的内在结构,可在一定程度上具备人类教师的特点,但不能避免机器的局限性。

(3)演示。

可进行数理学科教学中的复杂演示,提高演示效果,减少教师的大量工作。

如比较不同变量的正弦曲线、行星的运动、原子结构、循环路线等等。

(4)模拟。

模仿一个真实的或是想象的系统;从而使学生在课堂情景下达到许多教学目标,从技能的掌握到内容的学习、概念的发展以及激发学生对学科的兴趣等等。

(5)解决问题和教学游戏。

通过人机对话,启发学生探究问题的积极性,培养学生解决问题的能力。

计算机化的教学游戏设计得很有趣,能提高学生学习知识技能的动机。

(6)教和学的工具。

计算机用于教学过程的重要方面,诸如文字处理、电子表格和数据库等工具软件,可作为学习工具帮助学生促进学习活动。

以上六种形式,教学效果取决于教学软件的质量。

计算机辅助审计研究

计算机辅助审计研究随着信息技术的迅速发展,计算机辅助审计已成为现代审计工作中不可或缺的一部分。

本文将探讨计算机辅助审计的重要性和应用价值,分析当前研究现状和存在的问题,并展望未来的发展趋势。

一、计算机辅助审计的背景和意义计算机辅助审计(Computer-Assisted Audit,简称CAA)是指审计人员利用计算机及相关信息技术工具,对被审计单位进行审计的过程。

自20世纪80年代以来,随着计算机技术的不断发展,计算机辅助审计得到了广泛应用。

计算机辅助审计可以提高审计效率,减少人为错误,降低审计风险,为审计工作带来诸多便利。

二、计算机辅助审计的研究现状和存在的问题1、技术手段不断进步计算机辅助审计的技术手段不断推陈出新,包括数据挖掘、机器学习、云计算等一系列先进技术的运用,使得审计人员可以更加快速、准确地发现潜在风险和异常交易。

2、应用实践日益广泛计算机辅助审计在应用实践方面日益广泛,涉及领域包括财务审计、绩效审计、风险评估等。

例如,通过数据分析技术对海量财务数据进行审查,以发现可能的舞弊行为;通过机器学习算法对项目管理进行分析,以评估组织的绩效水平。

3、不足与局限性然而,计算机辅助审计也存在一些问题和局限性。

首先,对计算机辅助审计技术的理解和掌握程度参差不齐,可能影响审计质量和效果。

其次,数据安全性和隐私保护问题突出,如何在利用计算机辅助审计的同时确保数据安全和隐私保护,是一个亟待解决的问题。

最后,相关法规和准则的制定滞后于技术的发展,使得计算机辅助审计在实践过程中缺乏统一的规范和指导。

三、计算机辅助审计的未来发展1、智能化发展未来,计算机辅助审计将朝着智能化方向发展,通过更加深入地运用人工智能、机器学习等技术,实现审计全过程的自动化和智能化。

例如,利用智能算法进行异常检测和风险评估,提高审计的准确性和效率。

2、数据挖掘与风险管理数据挖掘技术在计算机辅助审计中的应用将进一步深化,帮助审计人员从海量数据中发掘潜在风险和异常交易。

计算机辅助审计研究

计算机辅助审计研究一、本文概述随着信息技术的飞速发展,计算机辅助审计已经逐渐成为审计领域的重要工具。

本文旨在深入研究和探讨计算机辅助审计的理论基础、技术应用以及发展趋势,以期提高审计工作的效率和准确性,为企业的风险管理和内部控制提供有力支持。

文章首先对计算机辅助审计的基本概念进行界定,阐述其在现代审计工作中的重要地位。

接着,分析计算机辅助审计的理论依据,包括审计信息化理论、数据分析理论等,为后续研究奠定理论基础。

在此基础上,文章将详细介绍计算机辅助审计的技术方法,如数据挖掘、模式识别、人工智能等,并探讨这些技术在审计工作中的实际应用案例。

文章还将对计算机辅助审计的发展趋势进行展望,探讨其在云计算、大数据、区块链等新兴技术背景下的创新发展。

文章将总结计算机辅助审计的实践经验,提出优化建议,以期为我国审计工作的现代化和智能化提供有益参考。

通过本文的研究,我们期望能够为审计领域的理论和实践提供新的思路和方法,推动计算机辅助审计在我国的广泛应用和发展。

二、计算机辅助审计的基本概念计算机辅助审计(Computer Assisted Audit Techniques,简称CAATs)是指利用计算机和相关软件工具,以辅助审计人员进行审计活动的一种技术手段。

它涵盖了从简单的数据检索到复杂的数据分析等一系列过程,显著提高了审计工作的效率和准确性。

数据处理:计算机辅助审计使用计算机来处理和分析大量的财务数据,如账户余额、交易记录等。

通过自动化处理,审计人员能够更快速、更准确地识别出潜在的错误或异常。

审计软件:审计软件是计算机辅助审计的核心工具。

这些软件能够执行数据抽取、转换、分析和报告等多种功能,帮助审计人员完成复杂的审计任务。

数据分析:通过数据分析,审计人员可以发现数据中的模式、趋势和异常,从而揭示潜在的风险和问题。

数据分析可以采用多种方法,如统计分析、数据挖掘和机器学习等。

数据可视化:数据可视化是计算机辅助审计的一个重要组成部分。

信息技术辅助审计工作(上)

信息技术辅助审计工作(上)(来源:《中国注册会计师》,2018-11-15)【编者按】在信息化环境下,企业运用信息技术编制财务报表,设计和执行内部控制。

注册会计师在对企业的财务报表进行审计时,必须考虑信息技术的影响。

同时,信息化也对注册会计师的审计技术和方法带来革命性变化。

为了帮助注册会计师应对信息化带来的挑战,中国注册会计师协会资助普华永道中天会计师事务所研究编写了《财务报表审计中对信息系统的考虑》一书,已经出版发行。

本刊约请作者加以摘编,分期连载,以飨读者。

计算机辅助审计技术(Computer Assisted Audit Techniques,简称CAATs),是通过运用计算机技术使审计程序自动化的方法。

计算机辅助审计技术的应用最早可以追溯至二十世纪六十年代,而随着信息技术越来越广泛的应用,传统纸质的审计数据正在逐步消失,为了应对财务会计流程信息化、数字化的浪潮,计算机辅助审计技术得以迅速发展。

广义上讲,计算机辅助审计技术包括审计工作中运用的一切计算机技术;在本期以及下一期,我们将主要阐述实务中应用较为广泛的信息系统数据审计方法。

一、CAATs在财务报表审计中的作用(一)CAATs的主要功能随着企业的快速发展以及信息时代的到来,原有脱机进行的审计程序已经无法适应新时代的审计环境:一方面,企业逐步依赖系统进行业务的处理,交易信息均存储于信息系统之中,财务数据也不再被记录在纸质账簿之中;另一方面企业的规模越来越大,交易量级数上升,审计人员很难再依赖人工对如此大量的数据进行审计工作。

为了处理基于系统产生的财务数据,同时提升审计工作的效率,审计团队开始依赖计算机辅助审计工具实现相应的审计目标。

计算机辅助审计工具能够帮助审计团队实现以下功能:1. 快速准确地完成海量重复计算;2. 反映数据异常体现潜在内控缺口;3. 清晰反映异常高风险的交易;4. 行业关键指标对比,有助于了解公司业务,为审计计划制定提供支持依据。

计算机辅助审计PPT课件

第三节 数据需求的提出

(一)了解源数据

按性质划分 源数据

按来源划分

财务数据 业务数据 内部数据 外部关联数据

(二)提出数据需求

1、内部数据需求 审计组根据审计工作的需要和调查了解到的被审计单位信

息,确定需向被审计单位采集的源数据的范围及方法,撰 写内部数据需求说明书,提交被审计单位。

2、外部数据需求

2、目的性

目的性是指审计数据采集是为进行审计数据分析,发现审 计线索,获取审计证据做基础数据准备的

3、可操作性

可操作性是指审计人员在进行数据采集时,需根据被审计 单位的实际情况选择最合适的审计数据采集方案。

4、复杂性

信息休环境下,被审计单位信息化程度差异较大,一些小 的单位多采用一些自己开发的应用软件,数据库系统也一 般采用单机的,如Access、Foxpro等;而一些重要的单位, 如银行等部门、信息化程度高,采用的应用软件和数据库 系统层次比较高,数据库系统多采用Oracle数据库。

审前调查报告是编制审计实施方案的重要依据之一。

(三)数据需求说明书

数据需求说明书应当包括: 1、需采集数据的信息系统的名称和功能; 2、数据采集范围及方法; 3、数据提供时间; 4、双方责任; 5、其他相关事项。

范例:A航空一节 审计数据采集的理论分析

审计组在确定数据需求的过程中,应加强与相关单位数据 库管理人员的沟通,从技术角度分析采集所需数据的可能 性,选择数据采集的最佳方案,并决定具体的数据格式、 传输介质、采集时间等事项,以免发生提出的数据需求不 合理的问题。

特别是在数据格式、数据采集等方面,如果提出的需求不 现实或没有采用最佳方式,将直接影响数据采集工作的开 展。

目前正在探索的 其它新技术

湖北省如何进行计算机辅助审计

湖北省如何进行计算机辅助审计介绍计算机辅助审计 (Computer-ded Audit Techniques,CAATs) 是指利用计算机技术、软件工具和数据分析技术,辅助审计师进行审计工作的一种方法。

湖北省作为一个经济发展较快的地区,审计工作对于监督和保障资金的使用和管理至关重要。

本文将介绍湖北省在进行计算机辅助审计方面的做法。

数据收集和整理在进行计算机辅助审计之前,首先需要收集和整理相关的数据。

湖北省审计部门通过与相关部门和单位进行合作,获取各种类型的数据,包括财务数据、行政管理数据、交易数据等。

这些数据通常以数据库的形式存储,审计师需要使用相应的数据提取和处理工具,对数据进行整理和清洗,以便后续的分析和审计工作。

数据分析和审计技术湖北省审计部门利用多种数据分析和审计技术来辅助审计工作。

例如:•数据挖掘:通过应用数据挖掘技术,湖北省审计部门可以从大量的数据中发现异常、趋势和模式,并提供审计师需要的有关风险和问题的信息。

•数据抽样:湖北省审计部门使用数据抽样技术来选择需要审计的样本数据,以便对整个数据集的合规性和准确性进行评估。

•数据比对:通过将不同数据源的数据进行比对,湖北省审计部门能够发现数据错误、漏洞和欺诈行为。

•数据可视化:湖北省审计部门使用数据可视化技术,将审计结果以图表、图形等形式展示,以便审计师和相关部门更直观地理解和利用这些数据。

审计软件工具的应用为了更高效地进行计算机辅助审计工作,湖北省审计部门使用各种审计软件工具,提高审计的准确性和效率。

以下是湖北省常用的审计软件工具:•数据提取工具:用于从数据库中提取数据,并以合适的格式进行存储和处理。

•数据分析工具:用于进行数据分析、数据抽样、数据比对等审计工作,如 ACL、IDEA 等。

•审计管理工具:用于管理审计项目、案例和文档,如审计管理系统等。

•数据可视化工具:用于将审计结果以可视化方式展示,如 Tableau、Power BI 等。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Computer-Assisted Audit Techniques计算机辅助审计技术ACCA F8考试:Computer-Assisted Audit Techniques

Computer-assisted audit techniques (CAATs)—computer programs and data (e.g. transactions data) used as part of the auditor's procedures to process data of audit significance contained in an entity's information system. They may consist of package programs, purpose-written programs, utility programs or system management programs.

General Advantages

Enable the auditor to test program/application controls. If CAATs were not used, those (non-manual) controls could not be tested.

Enable the auditor to test a greater number of items (e.g. 100%) quickly and accurately. This will also increase the overall confidence for the audit opinion.

Allow effective and efficient in-depth analysis of data for analytical review and trend analysis (i.e. data-mining).

Dealing with such data would not be a practical option if approached manually.

Are an effective and efficient means of testing where the systems are fully integrated (e.g. data files and processes can easily be compared).

Allow the auditor to test the actual accounting system (program functions) and records (raw data) rather than printouts, which are only a copy of those records and could be incorrect.

Are cost-effective after they have been set up, as long as the company does not change its systems.

Allow the results from using CAATs to be compared with "traditional" testing; if the two sources of evidence agree, this will increase overall audit confidence.

General Difficulties

Substantial setup costs in developing bespoke CAAT programs and testing them. However, once established, providing the client's system does not change, they can be used as many times as necessary with only the parameters being changed.

Standard audit software may not be available for the specific systems set up by the client, espe cia lly if those systems are bespoke. The cost of writing audit software to test those systems may be difficult to justify against the possible benefits on the audit.

The software may produce too much output either due to poor design or using inappropriate parameters on a test. The auditor may waste considerable time checking what appear to be transactions with errors in them when the fault is actually in the audit software.

When checking the client's files in a live situation, there is a danger that the client's systems or data may be disrupted by the audit program. Any changes made during testing must be reversed and removed from history files (otherwise they will appear in data printouts).

live files.。