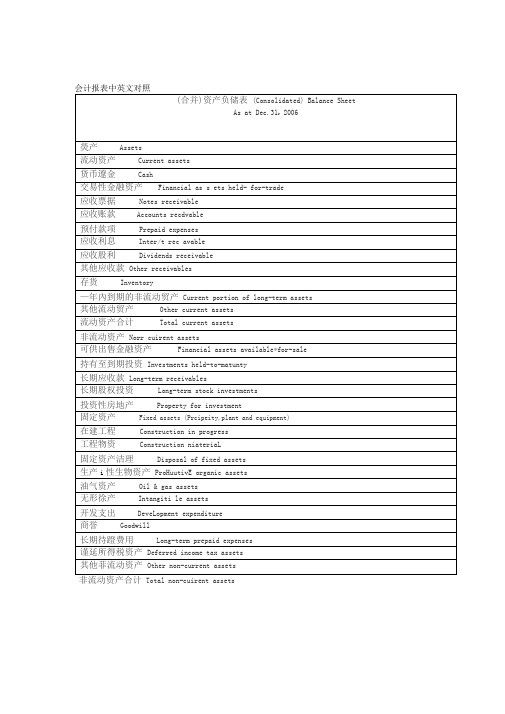

企业会计报表中英文对照

会计报表术语中英文对照

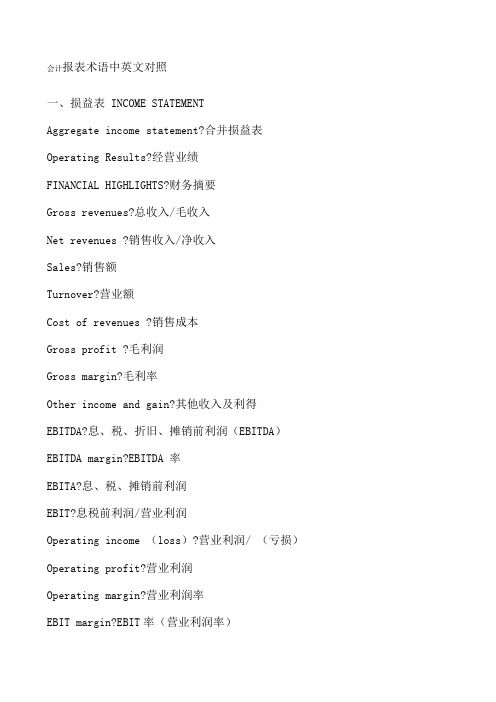

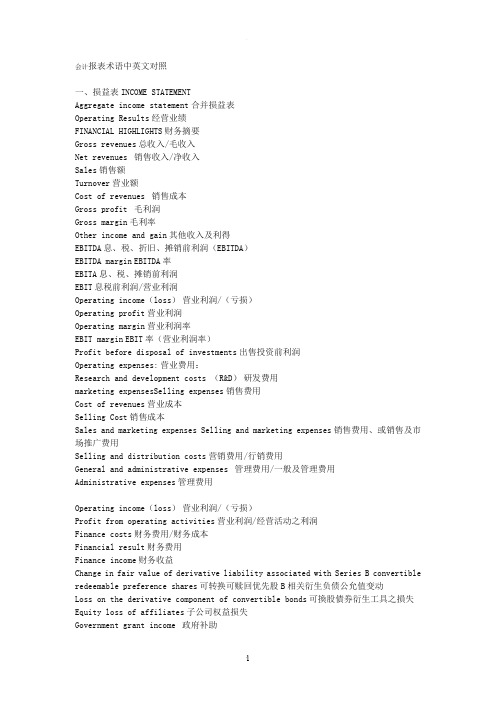

会计报表术语中英文对照一、损益表 INCOME STATEMENTAggregate income statement?合并损益表Operating Results?经营业绩FINANCIAL HIGHLIGHTS?财务摘要Gross revenues?总收入/毛收入Net revenues ?销售收入/净收入Sales?销售额Turnover?营业额Cost of revenues ?销售成本Gross profit ?毛利润Gross margin?毛利率Other income and gain?其他收入及利得EBITDA?息、税、折旧、摊销前利润(EBITDA)EBITDA margin?EBITDA 率EBITA?息、税、摊销前利润EBIT?息税前利润/营业利润Operating income (loss)?营业利润/ (亏损)Operating profit?营业利润Operating margin?营业利润率EBIT margin?EBIT率(营业利润率)Profit before disposal of investments?出售投资前利润Operating expenses:?营业费用:Research and development costs (R&D) ?研发费用marketing expensesSelling expenses?销售费用Cost of revenues?营业成本Selling Cost?销售成本Sales and marketing expenses Selling and marketing expenses?销售费用、或销售及市场推广费用Selling and distribution costs?营销费用/行销费用General and administrative expenses ?管理费用/一般及管理费用Administrative expenses?管理费用Operating income (loss)?营业利润/ (亏损)Profit from operating activities?营业利润/经营活动之利润Finance costs?财务费用/财务成本Financial result?财务费用Finance income?财务收益Change in fair value of derivative liability associated with Series B convertible redeemable preference shares?可转换可赎回优先股 B 相关衍生负债公允值变动Loss on the derivative component of convertible bonds可换股债券衍生工具之损失Equity loss of affiliates?子公司权益损失Government grant income ?政府补助Other (expense) / income ?其他收入/ (费用)Loss before income taxes ?税前损失Income before taxes?税前利润Profit before tax?税前利润Income taxes ?所得税taxes?税项Current Income tax?当期所得税Deferred Income tax?递延所得税Interest income?利息收入Interest income net?利息收入净额Profit for the period?本期利润Ordinary income?普通所得、普通收益、通常收入Comprehensive income?综合收益、全面收益Net income ?净利润Net loss?净损失Net Margin?净利率Income from continuing operations?持续经营收益或连续经营部门营业收益Income from discontinued operations?非持续经营收益或停业部门经营收益extraordinary gain and loss?特别损益、非常损益Gain on trading securities?交易证券收益Net Profit attributable to Equity Holders of the Company?归属于本公司股东所有者的净利润Net income attributed to shareholders归属于母公司股东的净利润或股东应占溢利(香港译法)Profit attributable to shareholders?归属于股东所有者(持有者)的利润或股东应占溢利(香港译法)Minority interests?少数股东权益/少数股东损益Change in fair value of exchangeable securities可交换证券公允值变动Other comprehensive income ——Foreign currency translation adjustment ?其他综合利润一外汇折算差异Comprehensive (loss) / income ?综合利润(亏损)Gain on disposal of assets?处分资产溢价收入Loss on disposal of assets?处分资产损失Asset impairments ?资产减值Gain on sale of assets?出售资产利得Intersegment eliminations?公司内部冲销Dividends?股息/股利/分红Deferred dividends?延派股利Net loss per share: ?每股亏损Earnings per share(EPS)?每股收益Earnings per share attributable to ordinaryequity holders of the parent?归属于母公司股东持有者的每股收益 -Basic ?-基本 -Diluted ?-稀释/摊薄(每股收益一般用稀释,净资产用摊薄)Diluted EPS?稀释每股收益Basic EPS?基本每股收益Weighted average number of ordinary shares: ?力□权平均股数:-Basic ?-基本-Diluted ?-稀释/摊薄Derivative financial instruments ?衍生金融工具Borrowings ?借贷Earnings Per Share, excluding the (loss)gain on the derivative component of convertible bonds and exchange difference?扣除可换股债券之衍生工具评估损益及汇兑损失后每股盈Historical Cost?历史成本Capital expenditures?资本支出revenues expenditure?收益支出Equity in earnings of affiliatesequity earnings of affiliates子公司股权收益附属公司股权收益联营公司股权收益equity in affiliates ?附属公司权益Equity Earning ?股权收益、股本盈利Non-operating income?营业外收入Income taxes-current?当期所得税或法人税、住民税及事业税等(日本公司用法)Income taxes-deferred?递延所得税或法人税等调整项(日本公司用法)Income (loss) before income taxes and minority 皿土0丫0${所得税及少数股东权益前利润(亏损)Equity in the income of investees?采权益法认列之投资收益Equity Compensation?权益报酬Weighted average number of shares outstanding?力口权平均流通股treasury shares?库存股票Number of shares outstanding at the end of the period"期末流通股数目Equity per share, attributable to equity holders of the Parent?归属于母公司所有者的每股净资产Dividends per share?每股股息、每股分红Cash flow from operations (CFFO)?经营活动产生的现金流量Weighted average number of common and common equivalent shares outstanding: ?加权平均普通流通股及等同普通流通股Equity Compensation?权益报酬Weighted Average Diluted Shares?稀释每股收益加权平均值Gain on disposition of discontinued operations?非持续经营业务处置利得(收益)Loss on disposition of discontinued operations?非持续经营业务处置损失participation in profit ?分红profit participation capital?资本红利、资本分红profit sharing?分红Employee Profit Sharing?员工分红(红利)Dividends to shareholders?股东分红(红利)Average basic common shares outstanding?普通股基本平均数Average diluted common shares outstanding?普通股稀释平均数 Securities litigation expenses, net?证券诉讼净支出 Intersegment eliminations ?部门间消减ROA (Return on assets) ?资产回报率/资产收益率ROE(Return on Equit)?股东回报率/股本收益率(回报率)净资产收益率Equit ratio?产权比率Current ration (times)?流动比率ROCE(Return on Capital Employed)?资本报酬率(回报率)或运营资本回报率或权益资本收益率或股权收益率RNOA (Return on Net Operating Assets)?净经营资产收益率(回报率)ROI (Return on Investment)?投资回报率OA (Operating Assets)?经营性资产OL (Operating Liabilites)?经营性负债NBC(Net Borrow禽$七?净借债费用OI(Operating Income)?经营收益NOA(Net Operating Assets)?净经营性资产NFE(Net Financial Earnings)?净金融收益NFO(Net Financial Owners)?净金融负债FLEV(Financial leverage)?财务杠杆OLLEV(Operating Liabilites leverage)?经营负债杠杆CSE(Common Stock Equity)?普通股权益SPREAD?差价RE(Residual Earning)?剩余收益二、资产负债表balance sheet ?资产负债表aggregate balance sheet ??合并资产负债表Assets ?资产Current assets ?流动资产Non-current assets?非流动资产Interests in subsidiaries?附属公司权益Cash and cash equivalents ?现金及现金等价物Hong Kong listed investments, at fair value ?于香港上市的投资,以公允价值列示Investment deposits ?投资存款Designated loan ?委托贷款Financial assets?金融资产Pledged deposits ?银行保证金/抵押存款Trade accounts receivable?应收账款Trade and bills receivables?应收账款及应收票据Inventories ?存货/库存Prepayments and other receivables ?预付款及其他应收款Prepayments, deposits and other receivables预付账款、按金及其它应收款Total current assets ?流动资产合计Tangible assets?有形资产Intangible assets?无形资产Investment properties ?投资物业Goodwill ?商誉Other intangible assets ?其他无形资产Available-for-sale investments ?可供出售投资Prepayments for acquisition of properties ?收购物业预付款项fair value?公允价值Property, plant and equipment ?物业、厂房及设备或财产、厂房及设备或固定资产Fixed Assets?固定资产Plant Assets?厂房资产Lease prepayments?预付租金Intangible assets?无形资产Deferred tax assets ?递延税/递延税项资产Total assets?资产合计Liabilities?负债Current liabilities?流动负债Short-term bank loans?短期银行借款Current maturities of long-term bank loans?一年内到期的长期银行借款Accounts and bills payable?应付账款及应付票据Accrued expenses and other payables?预提费用及其他应付款Total current liabilities?流动负债合计Long-term bank loans, less current maturities Deferred income Deferredtax liabilities?长期银行借款,减一年内到期的长期银行贷款Deferred income?递延收入Deferred tax liabilities?递延税Financial Net Debt?净金融负债Total liabilities?负债合计Commitments and contingencies?资本承诺及或有负债三、股东权益Donated shares ?捐赠股票Additional paid-in capital ?资本公积Statutory reserves ?法定公积Retained earnings ?未分配利润Accumulated other comprehensiveincome?累积其他综合所得Treasury shares?库存股票Total shareholders? equity?股东权益合计Equity?股东权益、所有者权益、净资产Shareholder?s EquityStockholder's EquityOwner's Equity?股东权益、所有者权益Total liabilities and shareholders? equity?负债和股东权益合计Capital and reserves attributable to the Company's equity holders?本公司权益持有人应占资本及储备Issued capital?已发行股本Share capital?股本Reserves?储备Cash reserves?现金储备Inerim dividend?中期股息Proposed dividend?拟派股息Proposed special dividend?拟派末期股息Proposed special dividend?拟派特别股息Proposed final special dividend?拟派末期特别股息Convertible bonds?可换股债券Shareholders? fund?股东资金四、现金流量表 STATEMENTS OF CASH FLOWSCash flow from operating activities ?经营活动产生的现金流Net cash provided by / (used in) operating activities经营活动产生的现金流量净额Net income /loss ?净利润或损失Adjustments to reconcile net loss to net cash provided by/(used in) operating activities: ?净利润之现金调整项:Depreciation and amortization ?折1 日及摊销Addition of bad debt expense ?坏账增加数/ (冲回数)Provision for obsolete inventories ?存货准备Share-based compensation ?股票薪酬Deferred income taxes ?递延所得税Exchange loss ?汇兑损失Loss of disposal of property,plant and equipment?处置固定资产损失Changes in operating assets and liabilities: ?经营资产及负债的变化Trade accounts receivable ?应收账款Inventories ?存货Prepayments and other receivables ?预付款及其他应收款Accounts and bills payable ?应付账款及应付票据Accrued expenses and other payables ?预提费用及其他应付款Net cash provided by / (used in) operating activities?经营活动产生/ (使用)的现金Free cash flow?自由现金流Cash flow from investing activities?投资活动产生的现金流Net cash used in investing activities?投资活动产生的现金流量净额Purchases of property, plant and equipment ?购买固定资产Payment of lease prepayment ?支付预付租金Purchases of intangible assets ?购买无形资产Proceeds from disposal of property, plant and equipment处置固定资产所得Government grants received ?政府补助Equity in the income of investees?采权益法认列之投资收益Cash flow from financing activities ?筹资活动产生的现金流Net cash provided by financing activities筹资活动产生的现金流量净额Proceeds from borrowings ?借款所得Repayment of borrowings ?还款Decrease / (increase) in pledged deposits ?银行保证金(增加)/ 减少Proceeds from issuance of capital stock?股本发行所得Net cash provided by financing activities?筹资活动产生的现金Effect of exchange rate changes on cash and cash equivalents ?现金及现金等价物的汇率变更的影响Net decrease in cash and cash equivalents ?现金及现金等价物的净(减少)/增加Cash and cash equivalents at the beginning of period?期初现金及现金等价物Cash and cash equivalents at the end of period 期末现金及现金等价物Investments (incl. financial assets)?金融资产投资 Investments inacquisitions?并购投资Net cash flow?现金流量净额。

(完整word版)会计报表中英文对照

•会计报表中英文对照Accounting1. Financial reporting(财务报告)includes not only financial statements but also other means of communicating information that relates,directly or indirectly,to the information provided by a business enterprise’s accounting system-———that is,information about an enterprise’s resources,obligations, earnings, etc.2. Objectives of financial reporting:财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions。

(2)Provide information that enables assessing future cash flows。

(3)Provide information that enables users to learn about economic resources, claims against those resources,and changes in them。

3. Basic accounting assumptions 基本会计假设(1) Economic entity assumption 会计主体假设This assumption simply says that the business and the owner of the business are two separate legal and economic entities. Each entity should account and report its own financial activities.(2) Going concern assumption 持续经营假设This assumption states that the enterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be amortized over time。

四大财务报表中英文对照

四大财务报表中英文对照全文共四篇示例,供读者参考第一篇示例:四大财务报表是每家公司每年都要制作的重要财务文件,它们记录着公司在一定期间内的财务业绩和资产负债状况。

这四大财务报表分别是资产负债表(Balance Sheet)、损益表(Income Statement)、现金流量表(Cash Flow Statement)和股东权益变动表(Statement of Changes in Equity)。

下面将为您详细介绍这四大财务报表的中英文对照。

一、资产负债表(Balance Sheet)资产负债表是衡量公司财务状况的重要指标,它展示了公司在特定日期的资产、负债和所有者权益的情况。

资产负债表的中英文对照如下:中文:资产负债表英文:Balance Sheet资产(Assets):1. 流动资产(Current Assets)2. 非流动资产(Non-current Assets)负债和所有者权益(Liabilities and Equity):1. 流动负债(Current Liabilities)2. 非流动负债(Non-current Liabilities)3. 所有者权益(Equity)资产负债表将公司的资产按照流动性和长期性分类,并将公司的负债和所有者权益细分为流动负债、非流动负债和所有者权益,以展示公司的资产负债结构。

二、损益表(Income Statement)损益表是公司在一定期间内的收入、成本和利润情况的总结,展示了公司的盈利能力。

损益表的中英文对照如下:中文:损益表英文:Income Statement收入(Revenue):1. 销售收入(Sales Revenue)2. 其他收入(Other Revenue)成本(Expenses):1. 销售成本(Cost of Goods Sold)2. 营业费用(Operating Expenses)3. 税前利润(Profit Before Tax)利润(Profit):1. 税后利润(Net Profit)损益表记录了公司在一段时间内的总收入、总成本和净利润,帮助投资者和管理层了解公司的盈利能力。

会计报表中英文对照

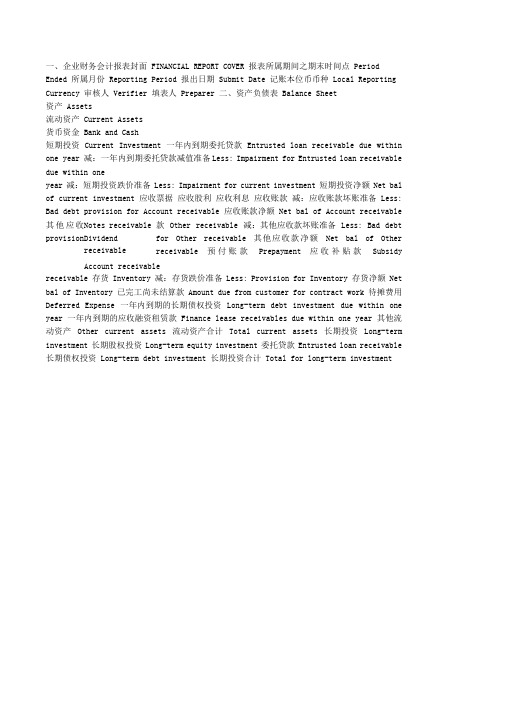

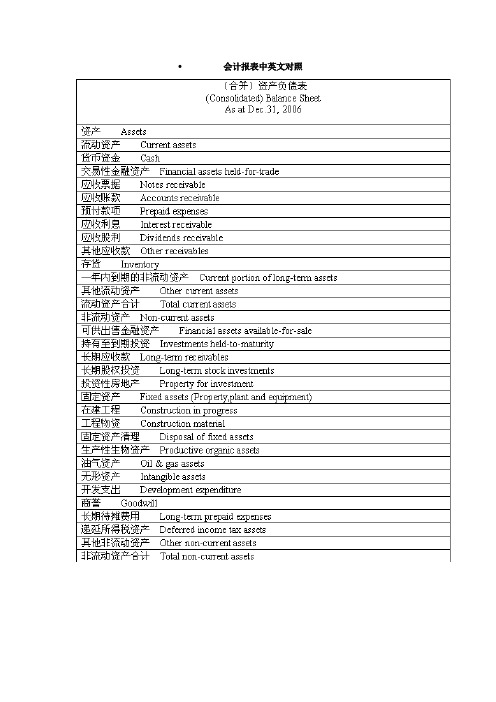

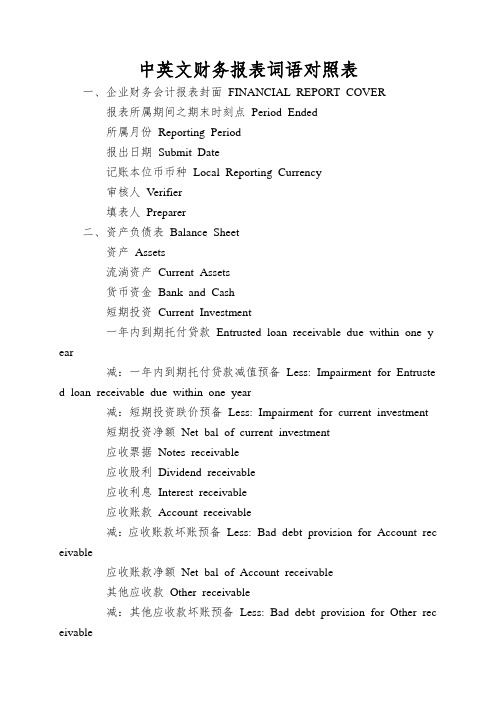

一、企业财务会计报表封面 FINANCIAL REPORT COVER 报表所属期间之期末时间点 PeriodEnded 所属月份 Reporting Period 报出日期 Submit Date 记账本位币币种 Local Reporting Currency 审核人 Verifier 填表人 Preparer 二、资产负债表 Balance Sheet资产 Assets流动资产 Current Assets货币资金 Bank and Cash短期投资 Current Investment 一年内到期委托贷款 Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备 Less: Impairment for Entrusted loan receivable due within oneyear 减:短期投资跌价准备 Less: Impairment for current investment 短期投资净额 Net bal of current investment 应收票据 应收股利 应收利息 应收账款 减:应收账款坏账准备 Less: Bad debt provision for Account receivable 应收账款净额 Net bal of Account receivable 其他应收款 Other receivable 减:其他应收款坏账准备 Less: Bad debtprovisionfor Other receivable 其他应收款净额 Net bal of Other receivable 预付账款 Prepayment 应收补贴款 Subsidy receivable 存货 Inventory 减:存货跌价准备 Less: Provision for Inventory 存货净额 Net bal of Inventory 已完工尚未结算款 Amount due from customer for contract work 待摊费用 Deferred Expense 一年内到期的长期债权投资 Long-term debt investment due within one year 一年内到期的应收融资租赁款 Finance lease receivables due within one year 其他流动资产 Other current assets 流动资产合计 Total current assets 长期投资 Long-term investment 长期股权投资 Long-term equity investment 委托贷款 Entrusted loan receivable长期债权投资 Long-term debt investment 长期投资合计 Total for long-term investmentNotes receivable Dividend receivable Account receivable减:长期股权投资减值准备 Less: Impairment for long-term equity investment 减:长期债权投资减值准备 Less: Impairment for long-term debt investment 减:委托贷款减值准备 Less: Provision for entrusted loan receivable 长期投资净额 Net bal of long-term investment 其中:合并价差 Include: Goodwill (Negative goodwill) 固定资产 Fixed assets 固定资产原值固定资产净值 减:固定资产减值准备 Less: Impairment for fixed assets 固定资产净额 NBVof fixed assets 工程物资 Material holds for construction of fixed assets 在建工程 Construction in progress 减:在建工程减值准备 Less: Impairment for construction in progress 在建工程净额 Net bal of construction in progress 固定资产清理 Fixed assets to be disposed of 固定资产合计 无形资产及其他资产 Other assets & Intangible assets 无形资产Intangibleassets 减:无形资产减值准备 Less: Impairment for intangible assets 无形资产净额 Net bal of intangible assets 长期待摊费用 Long-term deferred expense融资租赁 -- 未担保余值 Finance lease - Unguaranteed residual values融资租赁 -- 应收融资租赁款 Finance lease - Receivables其他长期资产 Other non-current assets无形及其他长期资产合计 Total other assets & intangible assets 递延税项 Deferred Tax 递延税款借项 Deferred Tax assets 资产总计 Total assets 负债及所有者(或股东)权益 Liability & Equity 流动负债 短期借款 应付票据 应付账款 已结算尚未完工款 预收账款 Advancefrom customers 应付工资 Payroll payable 应付福利费 Welfare payable 应付股利 Dividend payable 应交税金 Taxes payable 其他应交款 Other fees payable 其他应付款 Other payable 预提费用 Accrued Expense 预计负债 Provision Cost减:累计折旧 Less: AccumulatedDepreciationTotal fixed assetsCurrentliabilityShort-term loans Notes递延收益 Deferred Revenue 一年内到期的长期负债 Long-term liability due within one year 其他流动负债 Other current liability 流动负债合计 Total current liability 长期负债 Long-term liability 长期借款 Long-term loans 应付债券 Bonds payable 长期应付款Long-term payable 专项应付款 Grants & Subsidies received 其他长期负债 Other long-term liability 长期负债合计 Total long-term liability 递延税项 Deferred Tax 递延税款贷项 Deferred Tax liabilities 负债合计 Total liability 少数股东权益 Minority interests 所有者权益(或股东权益) Owners' Equity 实收资本(或股本) Paid in capital 减;已归还投资 Less: Capital redemption 实收资本(或股本)净额 Net bal of Paid in capital 资本公积 Capital Reserves 盈余公积 Surplus Reserves 其中:法定公益金Include: Statutory reserves 未确认投资损失 Unrealised investment losses 未分配利润Retained profits after appropriation 其中:本年利润 Include: Profits for the year 外币报表折算差额 Translation reserve 所有者(或股东)权益合计 Total Equity 负债及所有者(或股东)权益合计Total Liability & Equity三、利润及利润分配表 Income statement and profit appropriation 一、主营业务收入Revenue 减:主营业务成本 Less: Cost of Sales 主营业务税金及附加 Sales Tax二、主营业务利润(亏损以“—”填列)Gross Profit ( - means loss)加:其他业务收入 Add: Other operating income 减:其他业务支出 Less: Other operating expense 减:营业费用 Selling & Distribution expense 管理费用 G&A expense 财务费用Finance expense三、营业利润(亏损以“—”填列)加:投资收益(亏损以“—”填列)补贴收入 Subsidy Income 营业外收入 Non-operatingincome 减:营业外支出 Less: Non-operating expense Profit from operation ( - means loss) Add: Investment四、利润总额(亏损总额以“—”填列)减:所得税 Less: Income tax 少数股东损益 Minority interest 加:未确认投资损失 Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss)加:年初未分配利润 Add: Retained profits 其他转入 Other transfer-in六、可供分配的利润 Profit available for distribution( - means loss) 减:提取法定盈余公积 Less: Appropriation of statutory surplus reserves 提取法定公益金 Appropriation of statutory welfare fund 提取职工奖励及福利基金 Appropriation of staff incentive and welfare fund 提取储备基金 Appropriation of reserve fund 提取企业发展基金 Appropriation of enterprise expansion fund 利润归还投资 Capital redemption七、可供投资者分配的利润 Profit available for owners' distribution 减:应付优先股股利 Less: Appropriation of preference share's dividend 提取任意盈余公积 Appropriation of discretionary surplus reserve 应付普通股股利 Appropriation of ordinary share's dividend 转作资本(或股本)的普通股股利 Transfer from ordinary share's dividend to paid in capital八、未分配利润 Retained profit after appropriationSupplementary Information: 出售、处置部门或被投资单位收益 自然灾害发生损失 会计政策变更增加Profit before Tax补充资料:1. 2.Gains on disposal of operating divisions or investments Losses from natural disaster 或减少) 利润总额 Increase (decrease) in profit due to changes in accounting 3.policies4. 会计估计变更增加 或减少) 利润总额 Increase (decrease) in profit due to changes in accounting。

三大会计报表中英文对照

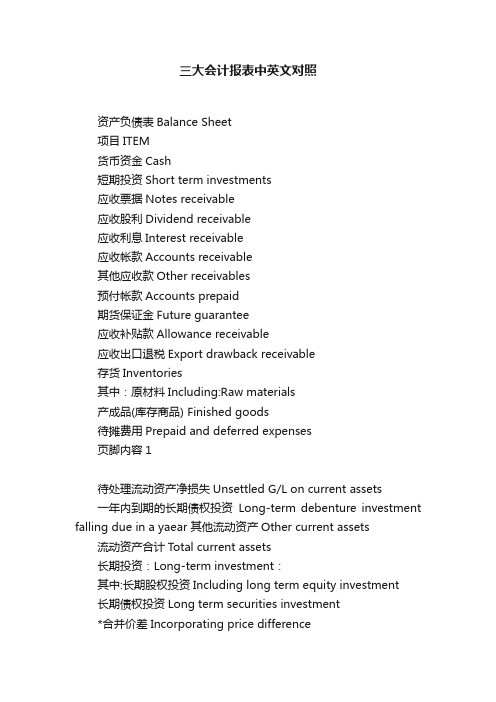

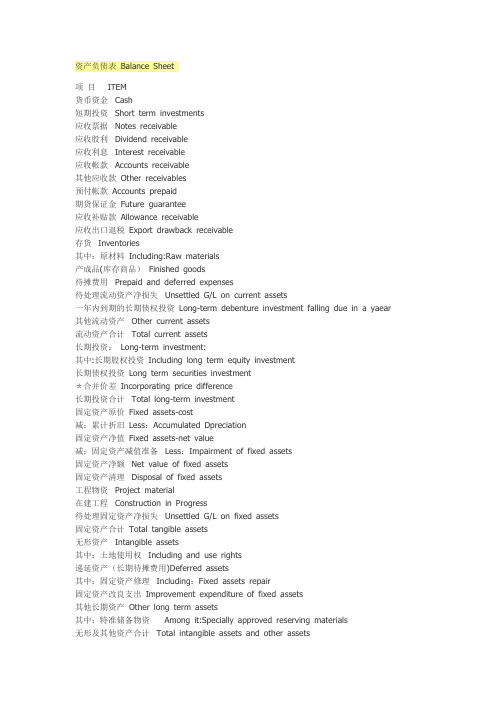

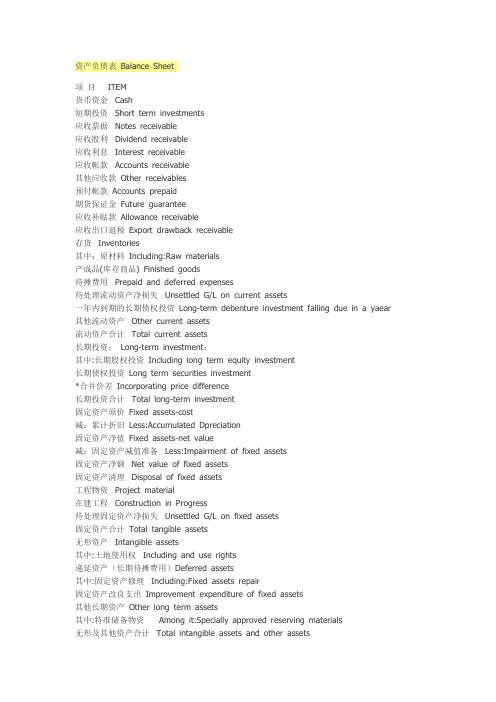

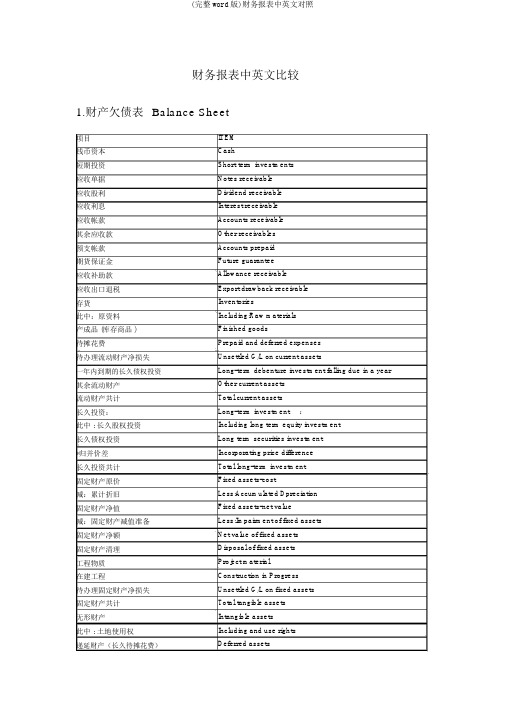

三大会计报表中英文对照资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses页脚内容1待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets 流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress页脚内容2待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets 其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable页脚内容3应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable页脚内容4其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve 页脚内容5。

四大财务报表中英文对照

四大财务报表中英文对照《四大财务报表 Financial Statements》财务报表是反映企业财务活动及财务状况的重要工具,通常包括资产负债表、利润表、现金流量表和股东权益变动表。

四大财务报表在中文和英文中有如下对照:1. 资产负债表(Balance Sheet)资产负债表是一张表格,用来呈现企业在特定日期的资产、负债和股东权益的情况。

资产负债表的结构如下:资产 = 负债 + 股东权益Assets = Liabilities + Equity2. 利润表(Income Statement)利润表是用来展示企业在特定期间内的收入、成本和利润情况。

利润表主要包括营业收入、营业成本、营业利润和净利润等项目。

利润表的结构如下:营业收入 - 营业成本 = 营业利润Operating Revenue - Operating Expenses = Operating Income3. 现金流量表(Cash Flow Statement)现金流量表是用来汇总企业特定期间内的现金流入和现金流出情况,以及现金的净增加或净减少情况。

现金流量表主要包括经营活动、投资活动和筹资活动产生的现金流量情况。

现金流量表的结构如下:经营活动 + 投资活动 + 筹资活动 = 现金净增加Operating Activities + Investing Activities + Financing Activities = Net Cash Increase4. 股东权益变动表(Statement of Changes in Equity)股东权益变动表是用来展示企业在特定期间内股东权益的变动情况,包括股本、资本公积、留存收益等项目的增减情况。

股东权益变动表的结构如下:期初股东权益 + 净利润 - 分红 = 期末股东权益Beginning Equity + Net Income - Dividends = Ending Equity以上是四大财务报表中文和英文对照的介绍,这些财务报表对于企业及投资者来说非常重要,能够全面展现企业的财务状况和经营业绩。

(完整word版)会计报表中英文对照

会计报表中英文对照Accounting1. Financial reporting(财务报告) includes not only financial statements but also other means of communicating information that relates, directly or indirectly, to the information provided by a business enterprise’s accounting system----that is, information about an enterprise’s resources, obligations, earnings, etc.2. Objectives of financial reporting: 财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions.(2) Provide information that enables assessing future cash flows.(3) Provide information that enables users to learn about economic resources, claims against those resources, and changes in them.3. Basic accounting assumptions 基本会计假设(1) Economic entity assumption 会计主体假设This assumption simply says that the business and the owner of the business are two separate legal and economic entities. Each entity should account and report its own financial activities.(2) Going concern assumption 持续经营假设This assumption states that the enterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be amortized over time.This assumption enables an accountant to use accrual accounting which records accrual and deferral entries as of each balance sheet date.(3) Time period assumption 会计分期假设This assumption assumes that the economic life of a business can be divided into artificial time periods.The most typical time segment = Calendar YearNext most typical time segment = Fiscal Year(4) Monetary unit assumption 货币计量假设This assumption states that only transaction data that can be expressed in terms of money be included in the accounting records, and the unit of measure remains relatively constant over time in terms of purchasing power.In essence, this assumption disregards the effects of inflation or deflation in the economy in which the entity operates.This assumption provides support for the "Historical Cost" principle.4. Accrual-basis accounting 权责发生制会计5. Qualitative characteristics 会计信息质量特征(1) Reliability 可靠性For accounting information to be reliable, it must be dependable and trustworthy. Accounting information is reliable to the extend that it is:Verifiable: means that information has been objectively determined, arrived at, or created. More than one person could consider the facts of a situation and reach a similar conclusion.Representationally faithful: that something is what it is represented to be. For example, if a machine is listed as a fixed asset on the balance sheet, then the companycan prove that the machine exists, is owned by the company, is in working condition, and is currently being used to support the revenue generating activities of the company.Neutral: means that information is presented in accordance with generally accepted accounting principles and practices, and without bias.(2) Relevance 相关性Relevant information is capable of making a difference in the decisions of users by helping them to evaluate the potential effects of past, present, or future transactions or other events on future cash flows (predictive value) or to confirm or correct their previous evaluations (confirmatory value).(3) Understandability 可理解性Understandability is the quality of information that enables users who have a reasonable knowledge of business and economic activities and financial reporting, and who study the information with reasonable diligence, to comprehend its meaning.(4) Comparability 可比性Comparability: suggests that accounting information that has been measured and reported in a similar manner by different enterprises should be capable of being compared because each of the enterprises is applying the same generally accepted accounting principles and practices.Consistency: suggests that an entity has used the same accounting principle or practice from one period to another, therefore, if the dollar amount reported for a category is different from one period to the next, then chances are that the difference is due to a change like an increase or decrease in sales volume rather than being due to a change in the method of calculating the dollar amount. (5) Substance over form 实质重于形式Substance over form emphasizes the economic substance of an event even though its legal form may provide a different result.It requires that business enterprise should perform accounting recognition, measurement and reporting in accordance with the economic substance rather than the legal form of an event or transaction.(6) Materiality 重要性Information is material if its omission or misstatement could influence the resource allocation decisions that users make on the basis of an entity’s financial report. Materiality depends on the nature and amount of the item judged in the particular circumstances of its omission or misstatement. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise.(7) Conservatism 谨慎性Conservatism dictates that when in doubt, choose the method that will be least likely to overstate assets and income, and understate liabilities and expenses.(8) Timeliness 及时性Timeliness means having information available to decision makers before it loses its capacity to influence decisions. If information becomes available only afterthe time that a decision must be made, it has no capacity to influence that decision and thus lacks relevance.6. Basic accounting elements 基本会计要素(1) Asset 资产An asset is a resource that is owned or controlled by an enterprise as a result of past transactions or events and is expected to generate economic benefits to the enterprise.(2) Liability 负债A liability is a present obligation arising from past transactions or events which are expected to give rise to an outflow of economic benefits from the enterprise.A present obligation is a duty committed by the enterprise under current circumstances. Obligations that will result from the occurrence of future transactions or events are not present obligations and shall not be recognized as liabilities.(3) owners’ equity 所有者权益Owners’ equity is the residual interest in the assets of an enterprise after deducting all its liabilities.Owners’ equity of a company is also known as shareholders’ equity.(4) Revenue 收入Revenue is the gross inflow of economic benefits derived from the course of ordinary activities that result in increases in equity, other than those relating to contributions from owners.(5) Expense 费用Expenses are the gross outflow of economic benefits resulted from the course of ordinary activities that result in decreases in owners’ equity, other than those relating to appropriations of profits to owners.(6) Profit 利润Profit is the operating result of an enterprise over a specific accounting period. Profit includes the net amount of revenue after deducting expenses, gains and losses directly recognized in profit of the current period, etc.7. Five measurement attributes 会计计量属性(1) Historical cost 历史成本Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition. Liabilities are recorded at the amount of proceeds or assets received in exchange for the present obligation, or the amount payable under contract for assuming the present obligation, or at the amount of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.(2) Current replacement cost 现时重置成本Assets are carried at the amount of cash or cash equivalents that would have to be paid if a same or similar asset was acquired currently. Liabilities are carried at the amount of cash or cash equivalents that would be currently required to settle the obligation.(3) Net realizable value 可实现净值Assets are carried at the amount of cash or cash equivalents that could be obtained by selling the asset in the ordinary course of business, less the estimated costs of completion, the estimated selling costs and related tax payments.(4) Present value 现值Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate from its continuing use and ultimate disposal. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities within the expected settlement period.(5) Fair value 公允价值Assets and liabilities are carried at the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.8. Financial statements 财务报表(1) Balance sheet 资产负债表A balance sheet is an accounting statement that reflects the financial position of an enterprise at a specific date.(2) Income statement 损益表An income statement is an accounting statement that reflects the operating results of an enterprise for a certain accounting period.(3) Statement of cash flows 现金流量表A cash flow statement is an accounting statement that reflects the inflows and outflows of cash and cash equivalents of an enterprise for a certain accounting period.(4) Statement of changes in owners’equity 所有者权益变动表A statement of changes in owners’ equity reports the changes in owners’ equity for a specific period of time.(5) Notes to financial statements 财务报表附注Notes to the accounting statements are further explanations of items presented in the accounting statements, and explanations of items not presented in the accounting statements, etc.9. Accounting entry 会计分录Debit: CashCredit: Common Stock10. Basic accounting equation 基本会计等式Assets = Liabilities + owners’ equity11. List of present and potential users of financial information 财务信息的使用者investors, creditors, employees, suppliers, customers, and governmental agencies. Definitions of Four Categories of Financial AssetsA financial asset or liability held for trading is one that was acquired or incurred principally for the purpose of generating a profit from short-term fluctuations in price or dealers margin. A financial asset should be classified as held for trading if, regardless of why it was acquired, it is part of a portfolio for which there is evidence of a recent actualpattern of short-term profit-taking. Derivative financial assets and derivative financial liabilities are always deemed held for trading unless they are designated and effective hedging instruments.Held-to-maturity investments are financial assets with fixed or determinable payments and fixed maturity that an enterprise has the positive intent and ability to hold to maturity other than loans and receivables originated by the enterprise.四类金融资产的定义为交易而持有的金融资产或金融负债,指主要为了从价格或交易商保证金的短期波动中获利而购置的金融资产或承担的金融负债。

会计报表术语中英文对照

会计报表术语中英文对照一、损益表INCOME STATEMENTOperating Results 经营业绩Gross revenues 总收入/毛收入Net revenues 销售收入/净收入Sales 销售额Turnover 营业额Cost of revenues 销售成本Gross profit 毛利润Gross margin 毛利率EBITDA 息、税、折旧、摊销前利润(EBITDA)EBITDA margin EBITDA率EBITA 息、税、摊销前利润EBIT 息税前利润/营业利润Operating profit 营业利润Operating margin 营业利润率EBIT margin EBIT率(营业利润率)Profit before disposal of investments 出售投资前利润Operating expenses: 营业费用:Research and development costs (R&D)研发费用marketing expensesSelling expenses 销售费用Cost of revenues 营业成本Selling Cost 销售成本Sales and marketing expenses Selling and marketing expenses 销售费用、或销售及市场推广费用Selling and distribution costs 营销费用/行销费用General and administrative expenses 管理费用/一般及管理费用Administrative expenses 管理费用Profit from operating activities 营业利润/经营活动之利润Finance costs 财务费用/财务成本Financial result 财务费用Change in fair value of derivative liability associated with Series B convertible redeemable preference shares 可转换可赎回优先股B相关衍生负债公允值变动Equity loss of affiliates 子公司权益损失Profit before tax 税前利润taxes 税项Profit for the period 本期利润Net loss 净损失Net Margin 净利率extraordinary gain and loss 特别损益、非常损益Gain on trading securities 交易证券收益Net Profit attributable to Equity Holders of the Company 归属于本公司股东所有者的净利润Profit attributable to shareholders 归属于股东所有者(持有者)的利润或股东应占溢利(香港译法)Minority interests 少数股东权益/少数股东损益Change in fair value of exchangeable securities 可交换证券公允值变动Gain on disposal of assets 处分资产溢价收入Loss on disposal of assets 处分资产损失Asset impairments 资产减值Gain on sale of assets 出售资产利得Intersegment eliminations 公司内部冲销Dividends 股息/股利/分红Deferred dividends 延派股利Net loss per share: 每股亏损Earnings per share(EPS)每股收益Earnings per share attributable to ordinaryequity holders of the parent 归属于母公司股东持有者的每股收益-Basic -基本-Diluted -稀释/摊薄(每股收益一般用稀释,净资产用摊薄)Diluted EPS 稀释每股收益Basic EPS 基本每股收益Weighted average number of ordinary shares: 加权平均股数:-Basic -基本-Diluted -稀释/摊薄Derivative financial instruments 衍生金融工具Borrowings 借貸Historical Cost 历史成本Capital expenditures 资本支出revenues expenditure 收益支出Equity in earnings of affiliatesequity earnings of affiliates 子公司股权收益附属公司股权收益联营公司股权收益equity in affiliates 附属公司权益Equity Earning 股权收益、股本盈利Equity Compensation 权益报酬Weighted average number of shares outstanding 加权平均流通股treasury shares 库存股票Number of shares outstanding at the end of the period 期末流通股数目Equity per share, attributable to equity holders of the Parent 归属于母公司所有者的每股净资产Dividends per share 每股股息、每股分红Cash flow from operations (CFFO)经营活动产生的现金流量Equity Compensation 权益报酬Weighted Average Diluted Shares 稀释每股收益加权平均值Gain on disposition of discontinued operations 非持续经营业务处置利得(收益)Loss on disposition of discontinued operations 非持续经营业务处置损失participation in profit 分红profit participation capital 资本红利、资本分红profit sharing 分红Employee Profit Sharing 员工分红(红利)Dividends to shareholders 股东分红(红利)Securities litigation expenses, net 证券诉讼净支出Intersegment eliminations 部门间消减ROA(Return on assets)资产回报率/资产收益率ROE(Return on Equit) 股东回报率/股本收益率(回报率)净资产收益率Equit ratio 产权比率Current ration (times) 流动比率ROCE(Return on Capital Employed)资本报酬率(回报率)或运营资本回报率或权益资本收益率或股权收益率RNOA(Return on Net Operating Assets)净经营资产收益率(回报率)ROI(Return on Investment)投资回报率OA(Operating Assets)经营性资产OL(Operating Liabilites)经营性负债NBC(Net Borrow Cost) 净借债费用NOA(Net Operating Assets) 净经营性资产NFE(Net Financial Earnings) 净金融收益NFO(Net Financial Owners) 净金融负债FLEV(Financial leverage) 财务杠杆OLLEV(Operating Liabilites leverage) 经营负债杠杆CSE(Common Stock Equity) 普通股权益SPREAD 差价RE(Residual Earning) 剩余收益二、资产负债表balance sheet 资产负债表aggregate balance sheet 合并资产负债表Assets 资产Current assets 流动资产Non-current assets 非流动资产Interests in subsidiaries 附属公司权益Cash and cash equivalents 现金及现金等价物Hong Kong listed investments, at fair value 于香港上市的投资,以公允价值列示Investment deposits 投资存款Designated loan 委托贷款Financial assets 金融资产Pledged deposits 银行保证金/抵押存款Trade accounts receivable 应收账款Trade and bills receivables 应收账款及应收票据Inventories 存货/库存Prepayments and other receivables 预付款及其他应收款Prepayments, deposits and other receivables 预付账款、按金及其它应收款Total current assets 流动资产合计Tangible assets 有形资产Intangible assets 无形资产Investment properties 投资物业Goodwill 商誉Other intangible assets 其他无形资产Available-for-sale investments 可供出售投资Prepayments for acquisition of properties 收购物业预付款项fair value 公允价值Property, plant and equipment 物业、厂房及设备或财产、厂房及设备或固定资产Fixed Assets 固定资产Plant Assets 厂房资产Lease prepayments 预付租金Intangible assets 无形资产Deferred tax assets 递延税/递延税项资产Total assets 资产合计Liabilities 负债Current liabilities 流动负债Short-term bank loans 短期银行借款Current maturities of long-term bank loans 一年内到期的长期银行借款Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Total current liabilities 流动负债合计Deferred tax liabilities 递延税Financial Net Debt 净金融负债Total liabilities 负债合计Commitments and contingencies 资本承诺及或有负债三、股东权益Donated shares 捐赠股票Additional paid-in capital 资本公积Statutory reserves 法定公积Retained earnings 未分配利润Treasury shares 库存股票Total shareholders’ equity股东权益合计Equity 股东权益、所有者权益、净资产Shareholder’s EquityStockholder's EquityOwner's Equity股东权益、所有者权益Total liabilities and shareholders’ equity负债和股东权益合计Capital and reserves attributable to the Company’s equity holders本公司权益持有人应占资本及储备Issued capital 已发行股本Share capital 股本Reserves 储备Cash reserves 现金储备Inerim dividend 中期股息Proposed dividend 拟派股息Proposed special dividend 拟派末期股息Proposed special dividend 拟派特别股息Proposed final special dividend 拟派末期特别股息Convertible bonds 可换股债券Shareholders’ fund股东资金四、现金流量表STATEMENTS OF CASH FLOWSCash flow from operating activities 经营活动产生的现金流Net cash provided by / (used in) operating activities 经营活动产生的现金流量净额Adjustments to reconcile net loss to net cash provided by/(used in) operating activities: 净利润之现金调整项:Depreciation and amortization 折旧及摊销Addition of bad debt expense 坏账增加数/(冲回数)Provision for obsolete inventories 存货准备Exchange loss 汇兑损失Loss of disposal of property,plant and equipment 处置固定资产损失Changes in operating assets and liabilities: 经营资产及负债的变化Trade accounts receivable 应收账款Inventories 存货Prepayments and other receivables 预付款及其他应收款Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Net cash provided by / (used in) operating activities 经营活动产生/(使用)的现金Free cash flow 自由现金流Cash flow from investing activities 投资活动产生的现金流Net cash used in investing activities 投资活动产生的现金流量净额Purchases of property, plant and equipment 购买固定资产Payment of lease prepayment 支付预付租金Purchases of intangible assets 购买无形资产Proceeds from disposal of property, plant and equipment 处置固定资产所得Government grants received 政府补助Cash flow from financing activities 筹资活动产生的现金流Net cash provided by financing activities 筹资活动产生的现金流量净额Proceeds from borrowings 借款所得Repayment of borrowings 还款Decrease / (increase) in pledged deposits 银行保证金(增加)/ 减少Proceeds from issuance of capital stock 股本发行所得Net cash provided by financing activities 筹资活动产生的现金Effect of exchange rate changes on cash and cash equivalents 现金及现金等价物的汇率变更的影响Net decrease in cash and cash equivalents 现金及现金等价物的净(减少)/ 增加Cash and cash equivalents at the beginning of period 期初现金及现金等价物Cash and cash equivalents at the end of period 期末现金及现金等价物Investments (incl. financial assets)金融资产投资Investments in acquisitions 并购投资Net cash flow 现金流量净额11 / 11。

会计报表术语中英文对照

会计报表术语中英文对照一、损益表INCOME STATEMENTAggregate income statement合并损益表Operating Results经营业绩FINANCIAL HIGHLIGHTS财务摘要Gross revenues总收入/毛收入Net revenues 销售收入/净收入Sales销售额Turnover营业额Cost of revenues 销售成本Gross profit 毛利润Gross margin毛利率Other income and gain其他收入及利得EBITDA息、税、折旧、摊销前利润(EBITDA)EBITDA margin EBITDA率EBITA息、税、摊销前利润EBIT息税前利润/营业利润Operating income(loss)营业利润/(亏损)Operating profit营业利润Operating margin营业利润率EBIT margin EBIT率(营业利润率)Profit before disposal of investments出售投资前利润Operating expenses:营业费用:Research and development costs (R&D)研发费用marketing expensesSelling expenses销售费用Cost of revenues营业成本Selling Cost销售成本Sales and marketing expenses Selling and marketing expenses销售费用、或销售及市场推广费用Selling and distribution costs营销费用/行销费用General and administrative expenses 管理费用/一般及管理费用Administrative expenses管理费用Operating income(loss)营业利润/(亏损)Profit from operating activities营业利润/经营活动之利润Finance costs财务费用/财务成本Financial result财务费用Finance income财务收益Change in fair value of derivative liability associated with Series B convertible redeemable preference shares可转换可赎回优先股B相关衍生负债公允值变动Loss on the derivative component of convertible bonds可換股債券衍生工具之損失Equity loss of affiliates子公司权益损失Government grant income 政府补助Other (expense) / income 其他收入/(费用)Loss before income taxes 税前损失Income before taxes税前利润Profit before tax税前利润Income taxes 所得税taxes税项Current Income tax当期所得税Deferred Income tax递延所得税Interest income利息收入Interest income net利息收入净额Profit for the period本期利润Ordinary income普通所得、普通收益、通常收入Comprehensive income综合收益、全面收益Net income 净利润Net loss净损失Net Margin净利率Income from continuing operations持续经营收益或连续经营部门营业收益Income from discontinued operations非持续经营收益或停业部门经营收益extraordinary gain and loss特别损益、非常损益Gain on trading securities交易证券收益Net Profit attributable to Equity Holders of the Company归属于本公司股东所有者的净利润Net income attributed to shareholders归属于母公司股东的净利润或股东应占溢利(香港译法)Profit attributable to shareholders归属于股东所有者(持有者)的利润或股东应占溢利(香港译法)Minority interests少数股东权益/少数股东损益Change in fair value of exchangeable securities可交换证券公允值变动Other comprehensive income — Foreign currency translation adjustment 其他综合利润—外汇折算差异Comprehensive (loss) / income 综合利润(亏损)Gain on disposal of assets处分资产溢价收入Loss on disposal of assets处分资产损失Asset impairments 资产减值Gain on sale of assets出售资产利得Intersegment eliminations公司内部冲销Dividends股息/股利/分红Deferred dividends延派股利Net loss per share: 每股亏损Earnings per share(EPS)每股收益Earnings per share attributable to ordinaryequity holders of the parent归属于母公司股东持有者的每股收益-Basic -基本-Diluted -稀释/摊薄(每股收益一般用稀释,净资产用摊薄)Diluted EPS稀释每股收益Basic EPS基本每股收益Weighted average number of ordinary shares: 加权平均股数:-Basic -基本-Diluted -稀释/摊薄Derivative financial instruments 衍生金融工具Borrowings 借貸Earnings Per Share, excluding the (loss)gain on the derivative component of convertible bonds and exchange difference扣除可换股债券之衍生工具评估损益及汇兑损失后每股盈Historical Cost历史成本Capital expenditures资本支出revenues expenditure收益支出Equity in earnings of affiliatesequity earnings of affiliates子公司股权收益附属公司股权收益联营公司股权收益equity in affiliates 附属公司权益Equity Earning 股权收益、股本盈利Non-operating income营业外收入Income taxes-current当期所得税或法人税、住民税及事业税等(日本公司用法)Income taxes-deferred递延所得税或法人税等调整项(日本公司用法)Income (loss) before income taxes and minority interest所得税及少数股东权益前利润(亏损)Equity in the income of investees采权益法认列之投资收益Equity Compensation权益报酬Weighted average number of shares outstanding加权平均流通股treasury shares库存股票Number of shares outstanding at the end of the period期末流通股数目Equity per share, attributable to equity holders of the Parent归属于母公司所有者的每股净资产Dividends per share每股股息、每股分红Cash flow from operations (CFFO)经营活动产生的现金流量Weighted average number of common and common equivalent shares outstanding:加权平均普通流通股及等同普通流通股Equity Compensation权益报酬Weighted Average Diluted Shares稀释每股收益加权平均值Gain on disposition of discontinued operations非持续经营业务处置利得(收益)Loss on disposition of discontinued operations非持续经营业务处置损失participation in profit 分红profit participation capital资本红利、资本分红profit sharing分红Employee Profit Sharing员工分红(红利)Dividends to shareholders股东分红(红利)Average basic common shares outstanding普通股基本平均数Average diluted common shares outstanding普通股稀释平均数Securities litigation expenses, net证券诉讼净支出Intersegment eliminations 部门间消减ROA(Return on assets)资产回报率/资产收益率ROE(Return on Equit)股东回报率/股本收益率(回报率)净资产收益率Equit ratio产权比率Current ration (times)流动比率ROCE(Return on Capital Employed)资本报酬率(回报率)或运营资本回报率或权益资本收益率或股权收益率RNOA(Return on Net Operating Assets)净经营资产收益率(回报率)ROI(Return on Investment)投资回报率OA(Operating Assets)经营性资产OL(Operating Liabilites)经营性负债NBC(Net Borrow Cost)净借债费用OI(Operating Income)经营收益NOA(Net Operating Assets)净经营性资产NFE(Net Financial Earnings)净金融收益NFO(Net Financial Owners)净金融负债FLEV(Financial leverage)财务杠杆OLLEV(Operating Liabilites leverage)经营负债杠杆CSE(Common Stock Equity)普通股权益SPREAD差价RE(Residual Earning)剩余收益二、资产负债表balance sheet 资产负债表aggregate balance sheet 合并资产负债表Assets 资产Current assets 流动资产Non-current assets非流动资产Interests in subsidiaries附属公司权益Cash and cash equivalents 现金及现金等价物Hong Kong listed investments, at fair value 于香港上市的投资,以公允价值列示Investment deposits 投资存款Designated loan 委托贷款Financial assets金融资产Pledged deposits 银行保证金 /抵押存款Trade accounts receivable应收账款Trade and bills receivables应收账款及应收票据Inventories 存货/库存Prepayments and other receivables 预付款及其他应收款Prepayments, deposits and other receivables预付账款、按金及其它应收款Total current assets 流动资产合计Tangible assets有形资产Intangible assets无形资产Investment properties 投资物业Goodwill 商誉Other intangible assets 其他无形资产Available-for-sale investments 可供出售投资Prepayments for acquisition of properties 收购物业预付款项fair value公允价值Property, plant and equipment 物业、厂房及设备或财产、厂房及设备或固定资产Fixed Assets固定资产Plant Assets厂房资产Lease prepayments预付租金Intangible assets无形资产Deferred tax assets 递延税/递延税项资产Total assets资产合计Liabilities负债Current liabilities流动负债Short-term bank loans短期银行借款Current maturities of long-term bank loans一年内到期的长期银行借款Accounts and bills payable应付账款及应付票据Accrued expenses and other payables预提费用及其他应付款Total current liabilities流动负债合计Long-term bank loans, less current maturities Deferred income Deferred tax liabilities长期银行借款,减一年内到期的长期银行贷款Deferred income递延收入Deferred tax liabilities递延税Financial Net Debt净金融负债Total liabilities负债合计Commitments and contingencies资本承诺及或有负债三、股东权益Donated shares 捐赠股票Additional paid-in capital 资本公积Statutory reserves 法定公积Retained earnings 未分配利润Accumulated other comprehensiveincome累积其他综合所得Treasury shares库存股票Total shareholders’ equity股东权益合计Equity股东权益、所有者权益、净资产Shareholder’s EquityStockholder's EquityOwner's Equity股东权益、所有者权益Total liabilities and shareholders’ equity负债和股东权益合计Capital and reserves attributable to the Company’s equity holders本公司权益持有人应占资本及储备Issued capital已发行股本Share capital股本Reserves储备Cash reserves现金储备Inerim dividend中期股息Proposed dividend拟派股息Proposed special dividend拟派末期股息Proposed special dividend拟派特别股息Proposed final special dividend拟派末期特别股息Convertible bonds可换股债券Shareholders’ fund股东资金四、现金流量表STATEMENTS OF CASH FLOWSCash flow from operating activities 经营活动产生的现金流Net cash provided by / (used in) operating activities经营活动产生的现金流量净额Net income /loss 净利润或损失Adjustments to reconcile net loss to net cash provided by/(used in) operating activities: 净利润之现金调整项:Depreciation and amortization 折旧及摊销Addition of bad debt expense 坏账增加数/(冲回数)Provision for obsolete inventories 存货准备Share-based compensation 股票薪酬Deferred income taxes 递延所得税Exchange loss 汇兑损失Loss of disposal of property,plant and equipment处置固定资产损失Changes in operating assets and liabilities: 经营资产及负债的变化Trade accounts receivable 应收账款Inventories 存货Prepayments and other receivables 预付款及其他应收款Accounts and bills payable 应付账款及应付票据Accrued expenses and other payables 预提费用及其他应付款Net cash provided by / (used in) operating activities经营活动产生/(使用)的现金Free cash flow自由现金流Cash flow from investing activities投资活动产生的现金流Net cash used in investing activities投资活动产生的现金流量净额Purchases of property, plant and equipment 购买固定资产Payment of lease prepayment 支付预付租金Purchases of intangible assets 购买无形资产Proceeds from disposal of property, plant and equipment处置固定资产所得Government grants received 政府补助Equity in the income of investees采权益法认列之投资收益Cash flow from financing activities 筹资活动产生的现金流Net cash provided by financing activities筹资活动产生的现金流量净额Proceeds from borrowings 借款所得Repayment of borrowings 还款Decrease / (increase) in pledged deposits 银行保证金(增加)/ 减少Proceeds from issuance of capital stock股本发行所得Net cash provided by financing activities筹资活动产生的现金Effect of exchange rate changes on cash and cash equivalents 现金及现金等价物的汇率变更的影响Net decrease in cash and cash equivalents 现金及现金等价物的净(减少)/ 增加Cash and cash equivalents at the beginning of period期初现金及现金等价物Cash and cash equivalents at the end of period 期末现金及现金等价物Investments (incl. financial assets)金融资产投资Investments in acquisitions并购投资Net cash flow现金流量净额欢迎您的下载,资料仅供参考!致力为企业和个人提供合同协议,策划案计划书,学习资料等等打造全网一站式需求。

会计报表项目中英文对照(三张主表)

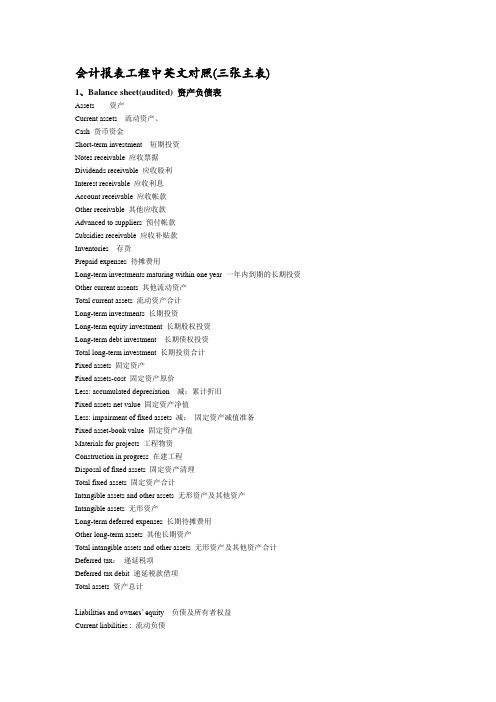

会计报表工程中英文对照(三张主表)1、Balance sheet(audited) 资产负债表Assets 资产Current assets 流动资产、Cash 货币资金Short-term investment 短期投资Notes receivable 应收票据Dividends receivable 应收股利Interest receivable 应收利息Account receivable 应收帐款Other receivable 其他应收款Advanced to suppliers 预付帐款Subsidies receivable 应收补贴款Inventories 存货Prepaid expenses 待摊费用Long-term investments maturing within one year 一年内到期的长期投资Other current assents 其他流动资产Total current assets 流动资产合计Long-term investments 长期投资Long-term equity investment 长期股权投资Long-term debt investment 长期债权投资Total long-term investment 长期投资合计Fixed assets 固定资产Fixed assets-cost 固定资产原价Less: accumulated depreciation 减:累计折旧Fixed assets net value 固定资产净值Less: impairment of fixed assets 减:固定资产减值准备Fixed asset-book value 固定资产净值Materials for projects 工程物资Construction in progress 在建工程Disposal of fixed assets 固定资产清理Total fixed assets 固定资产合计Intangible assets and other assets 无形资产及其他资产Intangible assets 无形资产Long-term deferred expenses 长期待摊费用Other long-term assets 其他长期资产Total intangible assets and other assets 无形资产及其他资产合计Deferred tax:递延税项Deferred tax debit 递延税款借项Total assets 资产总计Liabilities and owners’ equity负债及所有者权益Current liabilities : 流动负债Short-term loans 短期借款Notes payable 应付票据Account payable 应付帐款Advance from customers 预收帐款Accrued payroll 应付工资Accrued employee’s welfare expenses应付福利费Dividends payable 应付股利Taxes payable 应交税金Other taxes and expense payable 其他应交款Other payable 其他应付款Accrued expenses 预提费用Provisions 预计负债Long-term liabilities due within one year 一年内到期的长期负债Other current liabilities 其他流动负债Total current liabilities 流动负债合计Long-term liabilities:长期负债Long-term loans 长期借款Bonds payable 应付债券Long-term accounts payable 长期应付款Specific account payable 专项应付款Other long-term liabilities 其他长期负债Total long-term liabilities 长期负债合计Deferred tax: 递延税项Deferred tax credits 递延税款贷项Total other liabilities : 负债合计Owner’s equity:所有者权益〔股东权益〕Paid-in capital 实收资本Less :investment returned 减:已归还投资Pain-in capital-net 实收资本净额Capital surplus 资本公积Surplus from profits 盈余公积Including: statutory public welfare fund 其中:法定公益金Undistributed profit 未分配利润Total owner’s equity所有者权益〔股东权益〕Total liabilities and owner’s equities负债及所有者权益Total liabilities and owner’s equiti es 负债及所有者权益2、Income statement (audited) 利润表Item 工程Sales 产品销售收入Including :export sales 其中:出口产品销售收入Less: sales discounts and allowances 减:销售折扣与折让Net sales 产品销售净额Less: sales tax 减:产品销售税金Cost of sales 产品销售本钱Including :cost of export sales 出口产品销售本钱Gross profit 产品销售毛利Less : selling expense 减:销售费用General and administrative expense 管理费用Financial expense 财务费用Including :interest expense(less interest income) 其中:利息支出〔减利息收入〕Exchange loss (less exchange gain) 汇兑损失〔减汇兑收益〕Income from main operation 产品销售利润Add :income from other operations 加:其他业务利润Operating income 营业利润Add : investment income 加:投资收益Non-operating expense 营业外收入Less: non-operating expense 减:营业外支出Add: adjustment to pripr year’s income and expense加:以前年度损益调整Income before tax 利润总额Less: income tax 减:所得税Net income 净利润Statement of profit apropriation and distribution (audited) 利润分配表Item 工程Net income 净利润Add: undistributed profit at beginning of year 加:年初未分配利润Other transferred in 其他转入Profit available for distribution 可供分配的利润Less: statutory surplus from profits 减:提取法定盈余公积Statutory public welfare fund 提取法定公益金Staff and workers’ bonus and welfare fund职工奖励及福利基金Reserve fund 提取储藏基金Enterprise expansion fund 提取企业开展基金Profit capitalized on return of investments 利润归还投资Profit available for distribution to owners 可供投资者分配的利润Less: dividends payable for preferred stock 应付优先股股利V oluntary surplus from profits 提取任意盈余公积Dividends payable for common stock 应付普通股股利Dividends transferred to capital 转作股本的普通股股利Undistributed profit 未分配利润3、Cash flows statement 现金流量表工程 Item NO。

三大会计报表中英文对照

资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品)Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表)Balance Sheet项目ITEM短期借款Short—term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long—term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities*少数股东权益Minority interests实收资本(股本)Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person”s capital其中:国有法人资本Including:State-owned legal person”s capital 集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“—”号填列) Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder”s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入)Including:Interest expenses (minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non—operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1。

三大会计报表中英文对照

资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

会计报表各科目的中英文对照

资产负债表 Balance Sheet项目 ITEM货币资金 Cash短期投资 Short term investments应收票据 Notes receivable应收股利 Dividend receivable应收利息 Interest receivable应收帐款 Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货 Inventories其中:原材料 Including:Raw materials产成品(库存商品) Finished goods待摊费用 Prepaid and deferred expenses待处理流动资产净损失 Unsettled G/L on current assets一年内到期的长期债权投资 Long-term debenture investment falling due in a yaear其他流动资产 Other current assets流动资产合计 Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计 Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备 Less:Impairment of fixed assets固定资产净额 Net value of fixed assets固定资产清理 Disposal of fixed assets工程物资 Project material在建工程 Construction in Progress待处理固定资产净损失 Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产 Intangible assets其中:土地使用权 Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理 Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets其他长期资产 Other long term assets其中:特准储备物资 Among it:Specially approved reserving materials 无形及其他资产合计 Total intangible assets and other assets递延税款借项 Deferred assets debits资产总计 Total Assets资产负债表(续表) Balance Sheet项目 ITEM短期借款 Short-term loans应付票款 Notes payable应付帐款 Accounts payab1e预收帐款 Advances from customers应付工资 Accrued payro1l应付福利费 Welfare payable应付利润(股利) Profits payab1e应交税金 Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用 Provision for expenses预计负债 Accrued liabilities一年内到期的长期负债 Long term liabilities due within one year其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期借款 Long-term loans payable应付债券 Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债 Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计 Total long term liabilities递延税款贷项 Deferred taxation credit负债合计 Total liabilities* 少数股东权益 Minority interests实收资本(股本) Subscribed Capital国家资本 National capital集体资本 Collective capital法人资本 Legal person"s capital其中:国有法人资本 Including:State-owned legal person"s capital集体法人资本 Collective legal person"s capital个人资本 Personal capital外商资本 Foreign businessmen"s capital资本公积 Capital surplus盈余公积 surplus reserve其中:法定盈余公积 Including:statutory surplus reserve公益金 public welfare fund补充流动资本 Supplermentary current capital* 未确认的投资损失(以“-”号填列) Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额 Converted difference in Foreign Currency Statements 所有者权益合计 Total shareholder"s equity负债及所有者权益总计 Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入 Including:Export sales减:销售折扣与折让 Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本 Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利 Gross profit on sales减:销售费用 Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years 利润总额 Total profit减:所得税 Less:Income tax净利润 Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents。

会计报表中英文对照

Total non-cuirent assetsAcco un ti ng投赞活动产生的淨现金流量Net cash flow from investment acti5fities1. Financial reporting (财务报告) includes not only financial statements but also other means of communicating information that relates, directly or indirectly, to the information provided by a business enterprise ' s accounting system --------------------------------------- that is, information about an enterprise ' s resources, obligations, earnings, etc.2. Objectives of financial reporting: 财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions.(2) Provide information that enables assessing future cash flows.(3) Provide information that enables users to learn about economic resources, claimsagainst those resources, and changes in them.3. Basic accounting assumptions(1) Economic entity assumption(2) Going concern assumption This assumption states that theenterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be amortized over time.This assumption enables an accountant to use accrual accounting which records accrual and deferral entries as of each balance sheet date.(3) Time period assumption会计分期假设 This assumption assumes that the economic life of a business can be divided into artificial time periods.The most typical time segment = Calendar Year Next most typical time segment = Fiscal Year(4) Monetary unit assumption 货币计量假设This assumption states that only transaction data that can be expressed in terms of money be included in the accounting records, and the unit of measure remains relatively constant over time in terms of purchasing power.In essence, this assumption disregards the effects of inflation or deflation in the economy in which the entity operates.This assumption provides support for the "Historical Cost" principle.4. Accrual-basis accounting 权责发生制会计5. Qualitative characteristics会计信息质量特征(1) Reliability 可靠性For accounting information to be reliable, it must be dependable and trustworthy. Accounting information is reliable to the extend that it is:Verifiable: means that information has been objectively determined, arrived at, or created. More than one person could consider the facts of a situation and reach a similar conclusion.Representationally faithful: that something is what it is represented to be. For example, if a machine is listed as a fixed asset on the balance sheet, then the company can prove that the machine exists, is owned by the company, is in working condition, and is currently being used to support the revenue generating activities of the company.Neutral: means that information is presented in accordance with generally accepted accounting 基本会计假设 This assumption simply saysthat the business and the owner of the business separate legal and economic entities.financial activities.Each entity should account and report are two its own 持续经营假设principles and practices, and without bias.(2)Relevance 相关性Relevant information is capable of making a difference in the decisions of users by helping them to evaluate the potential effects of past, present, or future transactions or other events on future cash flows (predictive value) or to confirm or correct their previous evaluations (confirmatory value).(3)Understandability 可理解性Understandability is the quality of information that enables users who have a reasonable knowledge of business and economic activities and financial reporting, and who study the information with reasonable diligence, to comprehend its meaning.(4)Comparability 可比性Comparability: suggests that accounting information that has been measured and reported in a similar manner by different enterprises should be capable of being compared because each of the enterprises is applying the same generally accepted accounting principles and practices. Consistency: suggests that an entity has used the same accounting principle or practice from one period to another, therefore, if the dollar amount reported for a category is different from one period to the next, then chances are that the difference is due to a change like an increase or decrease in sales volume rather than being due to a change in the method of calculating the dollar amount.(5)Substance over form 实质重于形式Substance over form emphasizes the economic substance of an event even though its legal form may provide a different result.It requires that business enterprise should perform accounting recognition, measurement and reporting in accordance with the economic substance rather than the legal form of an event or transaction.(6)Materiality 重要性Information is material if its omission or misstatement could influence the resource allocation decisions that users make on the basis of an entity 's financial report. Materiality depends on the nature and amount of the item judged in the particular circumstances of its omission or misstatement. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise.(7)Conservatism 谨慎性Conservatism dictates that when in doubt, choose the method that will be least likely to overstate assets and income, and understate liabilities and expenses.(8)Timeliness 及时性Timeliness means having information available to decision makers before it loses its capacity to influence decisions. If information becomes available only after the time that a decision must be made, it has no capacity to influence that decision and thus lacks relevance.6.Basic accounting elements 基本会计要素(1)Asset 资产An asset is a resource that is owned or controlled by an enterprise as a result of past transactions or events and is expected to generate economic benefits to the enterprise.(2)Liability 负债A liability is a present obligation arising from past transactions or events which are expectedto give rise to an outflow of economic benefits from the enterprise.A present obligation is a duty committed by the enterprise under current circumstances. Obligations that will result from the occurrence of future transactions or events are not present obligations and shall not be recognized as liabilities.(3)owners ' equity 所有者权益Owners' equity is the residual interest in the assets of an enterprise after deducting all its liabilities.Owners' equity of a company is also known as shareholders ' equity.(4)Revenue 收入Revenue is the gross inflow of economic benefits derived from the course of ordinary activities that result in increases in equity, other than those relating to contributions from owners. (5)Expense 费用Expenses are the gross outflow of economic benefits resulted from the course of ordinary activities that result in decreases in owners ' equity, other than those relating to appropriations of profits to owners.(6)Profit 利润Profit is the operating result of an enterprise over a specific accounting period. Profit includes the net amount of revenue after deducting expenses, gains and losses directly recognized in profit of the current period, etc.7.Five measurement attributes 会计计量属性(1)Historical cost 历史成本Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition.Liabilities are recorded at the amount of proceeds or assets received in exchange for the present obligation, or the amount payable under contract for assuming the present obligation, or at the amount of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.(2)Current replacement cost 现时重置成本Assets are carried at the amount of cash or cash equivalents that would have to be paid if a same or similar asset was acquired currently. Liabilities are carried atthe amount of cash or cash equivalents that would be currently required to settle the obligation.(3)Net realizable value 可实现净值Assets are carried at the amount of cash or cash equivalents that could be obtained by selling the asset in the ordinary course of business, less the estimated costs of completion, the estimated selling costs and related tax payments.(4) Present value 现值Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate from its continuing use and ultimate disposal. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities within the expected settlement period.(5) Fair value 公允价值Assets and liabilities are carried at the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm ' s length transaction.8. Financial statements 财务报表(1) Balance sheet 资产负债表A balance sheet is an accounting statement that reflects the financial position of an enterprise at a specific date.(2) Income statement 损益表An income statement is an accounting statement that reflects the operating results of an enterprise for a certain accounting period.(3) Statement of cash flows 现金流量表A cash flow statement is an accounting statement that reflects the inflows and outflows of cash and cash equivalents of an enterprise for a certain accountingNotes to the accounting statements are further explanations of items presented in the accounting statements, and explanations of items not presented in the accounting statements, etc.9. Accounting entry 会计分录 Debit: CashCredit: Common Stock10. Basic accounting equation 基本会计等式 Assets = Liabilities + owners ' equity11. List of present and potential users of financial information 财务信息的使用 者investors, creditors, employees, suppliers, customers, and governmental agencies. Definitions of Four Categories of Financial AssetsA financial asset or liability held for trading is one that was acquired or incurredprincipally for the purpose of generating a profit from short-term fluctuations in price ordealers margin. A financial asset should be classified as held for trading if, regardless of why it was acquired, it is part of a portfolio for which there is evidence of a recent actual pattern of short-term profit-taking. Derivative financial assets and derivative financialliabilities are always deemed held for trading unless they are designated and effective hedging instruments.Held-to-maturity investments are financial assets with fixed or determinable payments and fixed maturity that an enterprise has the positive intent and ability to hold to maturity other period.(4) Statement of changes in ownersA statement of changes in ownersfor a specific period of time.(5) Notes to financial statements ' equity 所有者权益变动表 equity reports the changes in owners 财务报表附注 equitythan loans and receivables originated by the enterprise.四类金融资产的定义为交易而持有的金融资产或金融负债,指主要为了从价格或交易商保证金的短期波动中获利而购置的金融资产或承担的金融负债。

中英文财务报表对照