中兴通讯股份有限公司财务报表分析

分析中兴通讯的财务报告(3篇)

第1篇一、前言中兴通讯(ZTE Corporation)是中国领先的通信设备和网络解决方案提供商,成立于1985年,总部位于深圳。

中兴通讯致力于为全球运营商、政企客户和消费者提供创新的产品、解决方案和服务。

本文将对中兴通讯的财务报告进行深入分析,旨在了解其财务状况、经营成果和发展趋势。

二、中兴通讯财务报告概述1. 财务报表中兴通讯的财务报表包括资产负债表、利润表和现金流量表。

以下是2019年度财务报表的主要数据:(1)资产负债表资产总计:人民币2,563.19亿元负债总计:人民币1,979.28亿元所有者权益:人民币583.91亿元(2)利润表营业收入:人民币1,020.7亿元营业利润:人民币-35.5亿元利润总额:人民币-7.6亿元净利润:人民币-2.7亿元(3)现金流量表经营活动产生的现金流量净额:人民币76.7亿元投资活动产生的现金流量净额:人民币-56.1亿元筹资活动产生的现金流量净额:人民币-21.3亿元2. 财务指标(1)资产负债率资产负债率=负债总额/资产总额×100%2019年资产负债率为:1,979.28/2,563.19×100%=77.18%(2)毛利率毛利率=(营业收入-营业成本)/营业收入×100%2019年毛利率为:(1,020.7-820.5)/1,020.7×100%=18.85%(3)净资产收益率净资产收益率=净利润/所有者权益×100%2019年净资产收益率为:-2.7/583.91×100%=-0.46%三、财务报告分析1. 资产负债状况(1)资产结构从资产负债表可以看出,中兴通讯的资产主要由流动资产和非流动资产构成。

流动资产占比最高,说明公司在日常运营中拥有充足的流动资金。

非流动资产主要包括固定资产、无形资产和长期投资等,表明公司在长期发展方面具备一定的实力。

(2)负债结构中兴通讯的负债主要由流动负债和非流动负债构成。

000063中兴通讯2023年上半年现金流量报告

中兴通讯2023年上半年现金流量报告一、现金流入结构分析2023年上半年现金流入为21,643,855.4万元,与2022年上半年的14,192,075.8万元相比有较大增长,增长52.51%。

企业当期新增借款总额为13,489,152万元,它是企业当期现金流入的最大项目,占企业当期现金流入总额的62.32%。

但这部分新增借款有97.99%用于偿还旧债。

全部需要依靠经营活动创造的现金净流量来偿还旧债。

销售商品、提供劳务收到的现金为6,482,386.9万元,约占企业当期现金流入总额的29.95%。

企业经营活动所需要的现金支出小于现金收入,经营活动为企业带来了现金净增加。

二、现金流出结构分析2023年上半年现金流出为20,880,104.6万元,与2022年上半年的13,719,082.5万元相比有较大增长,增长52.20%。

最大的现金流出项目为购买商品、接受劳务支付的现金,占现金流出总额的17.94%。

三、现金流动的稳定性分析2023年上半年,营业收到的现金有所减少,经营活动现金流入的稳定性下降。

2023年上半年,工资性支出有较大幅度增加,现金流出的刚性明显增强。

2023年上半年,现金流入项目从大到小依次是:取得借款收到的现金;销售商品、提供劳务收到的现金;收回投资收到的现金;收到其他与经营活动有关的现金。

现金流出项目从大到小依次是:偿还债务支付的现金;购买商品、接受劳务支付的现金;支付给职工以及为职工支付的现金;支付的其他与经营活动有关的现金。

四、现金流动的协调性评价2023年上半年中兴通讯投资活动需要资金150,643.7万元;经营活动创造资金642,589.7万元。

投资活动所需要的资金能够被企业经营活动所创造的现金净流量满足。

2023年上半年中兴通讯筹资活动产生的现金流量净额为271,804.8万元。

满足了投资活动的资金缺口。

五、现金流量的变化2023年上半年现金及现金等价物净增加额为787,456.9万元,与2022年上半年的501,058.2万元相比有较大增长,增长57.16%。

《2024年中兴通讯财务分析》范文

《中兴通讯财务分析》篇一一、引言随着中国通讯技术不断崛起,中兴通讯作为一家国内外知名通信企业,凭借其丰富的产品线和稳健的财务状况在市场中扮演着重要的角色。

本文将深入分析中兴通讯的财务状况,以期为投资者和相关研究人员提供参考。

二、财务报表分析1. 资产负债表分析根据中兴通讯最新的资产负债表,公司总资产保持稳定增长,负债水平合理。

其中,流动资产和非流动资产的比例保持平衡,有助于公司在市场波动时保持稳定的运营能力。

此外,公司的负债结构健康,短期债务得到有效控制,长期债务风险较低。

2. 利润表分析从利润表来看,中兴通讯的营业收入和净利润均保持增长态势。

公司通过持续创新和优化产品结构,实现了较高的毛利率和净利率。

同时,公司积极控制成本,提高运营效率,使得净利润持续增长。

3. 现金流量表分析现金流量表显示,中兴通讯经营活动产生的现金流量稳定,投资活动产生的现金流量有所波动。

这表明公司在保持稳健经营的同时,也在积极进行投资以拓展业务。

此外,公司的筹资活动现金流量健康,为公司提供了稳定的资金来源。

三、财务指标分析1. 盈利能力指标中兴通讯的盈利能力较强,主要表现在较高的毛利率、净利率以及资产收益率等方面。

这表明公司在激烈的市场竞争中具有较强的竞争优势和良好的成本控制能力。

2. 营运能力指标公司的营运能力良好,主要表现在存货周转率、应收账款周转率等方面。

这表明公司在供应链管理和客户关系管理方面具有较高的效率。

3. 偿债能力指标中兴通讯的偿债能力较强,主要表现在较低的资产负债率和较高的流动比率等方面。

这为公司提供了较强的抗风险能力和稳定的资金来源。

四、结论与建议通过对中兴通讯的财务分析,我们可以看出公司财务状况稳健,具有较好的盈利能力和成长潜力。

然而,在激烈的市场竞争中,公司仍需关注以下几个方面:1. 持续创新:随着通信技术的不断更新换代,中兴通讯应加大研发投入,持续创新产品和技术,以保持竞争优势。

2. 拓展市场:公司应积极拓展国内外市场,提高市场份额和品牌影响力。

中兴财务报表分析

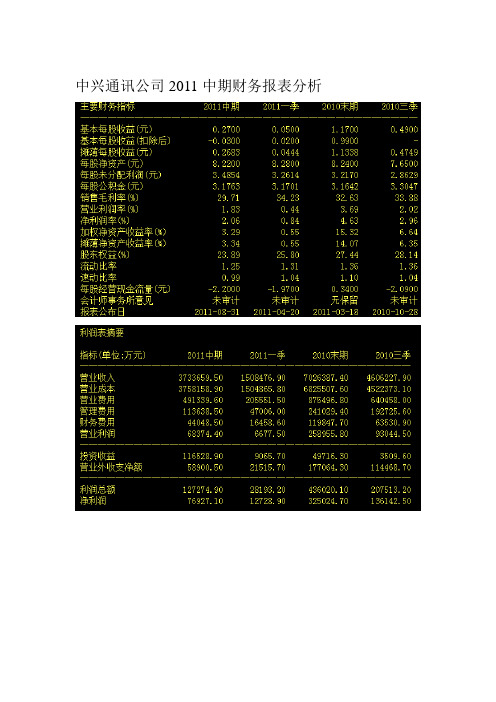

中兴通讯公司2011中期财务报表分析偿债能力分析1.流动比率:从表面看,2011年中期流动比率为1.25,也就是说每有一元的流动资产,就有1.25元的流动资产多为安全保障,这个数字相比来说偏低,而且经过和前几段时间的比较甚至还有下降趋势,因此中兴短期偿债能力需要提高。

2.速动比率:2011年中期,中兴的速动比率为0.99,在正常范围内,说明企业应收账款很容易收回,偿债能力很好,比较流动比率,两者判断方式不一,但考虑到速动比率撇开了存活问题,综合看来,中兴偿债能力中等。

3.现金流量比率:现金流量比率=经营活动产生的现金流量净额/流动负债=94191/4821414=1.95% 实在很低,11年偿还能力不高4.资产负债率:资产负债率=负债总额/资产总额=7170709/9648482=0.745.权益乘数:权益乘数=资产总额/股东权益总额=9648482/2305185=4.18 说明股东投入的资本在资产中所占比重小,财务杠杆大综上,中兴通讯的偿债能力很优秀,值得信赖。

营运能力分析1.存货周转率:存货周转率=销售成本/存货平均余额=3758158/((1514622+1405258)/2)=2.57次存货周转率说明2011年初到中期内企业存货周转的次数,反应变现速度。

可见销售能力处中等。

2.流动资产周转率=销售收入/流动资产平均余额=3733659/((7713569+7065317)/2)=0.5 资金效率太低综上,中兴通讯的营运能力偏差,需要提高管理层的素质和能力,以及提高资产的利用率。

..盈利能力分析1.资产利润率:资产利润率=利润总额/资产平均总额=68347/((9648482+9000173)/2)=0.73%和以往相比没什么提高..2.总资产周转率:总资产周转率=销售收入/资产平均总额=0.22 应该采取措施提高销售收入或处置资产3.销售净利率:销售净利率=净利润/营业收入净额=2.06% 该比率相对来说偏低,需要扩大销售获取利益。

中兴通讯企业财务分析

7 5 . 1

3 . 0 0 8 1 0

7 8 . 9 %

3 . 7 4 6 1 3

: - ・ — 一 r . - — _

{

0

-

̄ -流动 } } = 素 №

_ --

i ; ! } : : = 毫 鼍

—

奋 蜜声壹馈率

. g-声权 } £ 率

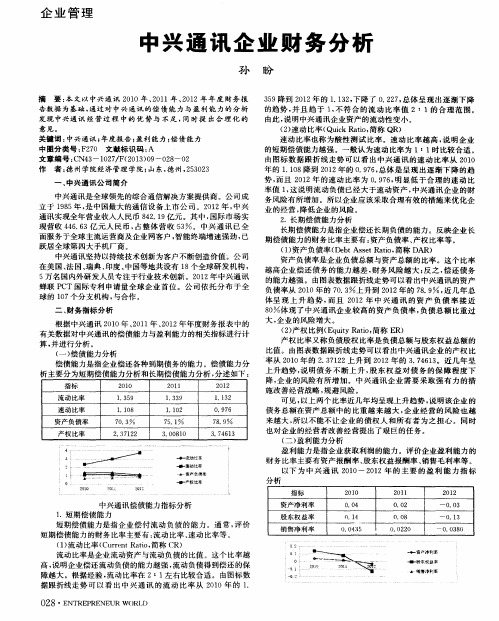

3 5 9降到 2 0 1 2年的 1 . 1 3 2 , 下 降了 0 . 2 2 7 , 总体呈现 出逐渐 下降 的趋势 , 并 且趋 于 1 , 不符合 的流 动 比率 值 2:1的合 理范 围 。 由此 , 说 明中兴通讯企业资产的流动性变小 。 ( 2 ) 速 动比率( Qu i c k R a t i o , 简称 Q R) 速动 比率也称为 酸性 测试 比率 。速 动 比率 越高 , 说 明企业 的短期偿债能力越强 。一般认 为速 动 比率为 l: l 时 比较合 适 。 由图标 数据 跟折线 走势 可以看 出中兴通 讯 的速动 比率从 2 0 1 0 年的 1 . 1 0 8降到 2 0 1 2 年的 0 . 9 7 6 , 总体是 呈现 出逐渐 下降 的趋 势, 而且 2 0 1 2年的 速动 比率 为 0 . 9 7 6 , 明显低于合 理 的速动 比 率值 1 , 这 说明流动 负债 已经大于速动 资产 , 中兴通讯企业 的财 务风险有所增加 。所 以企 业应该采取合理有效 的措施来优 化企 业 的经营 , 降低企业 的风险。 2 .长期偿 债能力分析 长期偿 债能力是指企业偿还长期负债 的能力 。反映企业长 期偿债能力 的财务 比率主要有 : 资产负债率 、 产权 比率等 。 ( 1 ) 资产负债率 ( D e b t As s e t R a t i o , 简称 D AR) 资产负债率是企业负债总额与 资产 总额 的比率 。这个 比率 越 高企业偿 还债务 的能力越差 , 财 务风险越 大 ; 反之, 偿 还债务 的能力越强 。由图表数据跟折线走势可 以看出中兴通讯的资产 负债率从 2 0 1 0 年的 7 0 . 3 %上升到 2 0 1 2 年的 7 8 . 9 , 近几年 总 体呈 现 上 升趋 势 , 而且 2 0 1 2年 中兴 通 讯 的 资 产 负债 率 接 近 8 0 体现 了中兴通讯企 业较 高的资产 负债率 , 负债总 额 比重过 大, 企业 的风险增大 。 ( 2 ) 产权 比例( E q u i t y R a t i o , 简称 E R) 产权 比率又 称负债股权 比率是负债总额与股东权益 总额 的 比值 。由图表数据跟折线走 势可以看出中兴通讯企业 的产权 比 率从 2 0 1 0年 的 2 . 3 7 1 2 2上 升 到 2 0 1 2年 的 3 . 7 4 6 1 3 。 近 几 年 呈 上 升趋 势 , 说 明债 务不 断 上升 , 股 东权 益对 债 务 的保 障 程度 下 降, 企业的风险有所增 加 。中兴 通讯企业 需要 采取强 有力 的措 施改善 经营战略 , 规避风险 。 可见 , 以 上 两 个 比率 近 几 年 均 呈 现上 升趋 势 , 说 明该 企 业 的 债 务总额在资产总额 中的比重越来 越大 , 企业 经 营的风险也 越 来 越大 , 所 以不 能 不 让 企 业 的 债 权 人 和 所 有 者 为 之 担 心 。 同 时 也对企业的经营者改善经营提 出了艰 巨的任 务 。 ( 二) 盈 利 能 力 分 析 盈 利 能 力 是 指 企 业 获 取 利 润 的能 力 。评 价 企业 盈 利 能 力 的 财务 比率主要有资产报酬率 、 股东权益报酬率 、 销售毛利率等 。 以下 为 中 兴 通 讯 2 0 1 0 —2 0 1 2年 的 主 要 的 盈 利 能 力 指 标 分析

关于中兴通讯公司的财务分析

中兴通讯公司财务分析一、基本指标对比分析(一)、总资产近年来国内通信行业继续保持较快的增长速度,中兴通讯公司紧抓市场脉搏,充分发挥产品多元化的优势,依靠以市场为导向的差异化策略,稳固国内市场,大力开拓国际市场。

总资产稳步增长,尤其在2004年有较大幅度的增长。

具体情况见图1:图1(二)净资产中兴公司深入贯彻国际化战略,生产经营规模不断扩大,积极研发新的增长点,不断提高产品的质量和科技含量,使企业净资产稳步增长。

图2(三)主营业务收入由于中兴的多元化战略,使其生产规模、市场规模都在国内居于领先的地位。

2002年市场环境严峻,公司制定了积极的市场策略,保证了主营业务收入的增长。

国际电信行业在2003年呈现总体复苏的势头,公司抓住机遇,业务发展迅速。

2004年在2003年的基础上,产品的知名度提升,国际市场的需求扩大,主营业务收入有了较大的增长。

图3(四)净利润净利润的发展趋势与主营业务收入基本保持一致。

图4二、财务能力分析(一)偿债能力分析1.流动比率中兴公司2003年的流动比率低于2002年,主要原因是短期借款和存货的增加,应付账款发生了较大幅度的变化,且流动资产和流动负债的增长幅度一致。

2003年中兴公司的生产规模和业务进一步扩大,预支了费用用于产品研发,存货增加主要是公司业务规模扩大相应增加分期收款发出商品所致。

图52.速动比率当存货本身存在销售以及压价的风险时,速动资产可立即用于偿还债务。

2003年的存货有较大的增长,导致该年的速动比率出现下降的趋势。

2004年有所回升是由于其应收账款的增加。

图63.资产负债率资产负债率可以用来衡量企业在清算时保护债权人利益的程度。

中兴公司的资产负债率基本保持稳定,位于60%左右,具有较强的偿债能力和资本结构。

图7(二)营运能力分析1.存货周转率存货的流动性直接影响企业的流动比率,对企业经营活动的变化具有特殊的敏感性,所以二者应当保持平衡。

随着中兴公司生产规模的不断扩大和销售收入的增长,存货也呈现增长,存货周转率逐年递增,说明其变现能力良好。

中兴通讯股份有限公司财务报表分析 杨金莲之欧阳引擎创编

西南财经大学天府学院欧阳引擎(2021.01.01)2012届本科毕业论文(设计)论文题目:中兴通讯股份有限公司财务报表分析学生姓名:杨金莲所在学院:西南财经大学天府学院专业:财务管理学号: 40804319指导教师:柳玉寿2012 年3月西南财经大学天府学院本科毕业论文(设计)原创性及知识产权声明本人郑重声明:所呈交的毕业论文(设计)是本人在导师的指导下取得的成果。

对本论文(设计)的研究做出重要贡献的个人和集体,均已在文中以明确方式标明。

因本毕业论文(设计)引起的法律结果完全由本人承担。

本毕业论文(设计)成果归西南财经大学所有特此声明。

毕业论文(设计)作者签名:作者专业:财务管理作者学号:40804319年月日西南财经大学天府学院本科学生毕业论文(设计)开题报告表摘要在市场经济环境中,经济全球化趋势的加强,企业竞争十分激烈,金融市场日趋成熟,现代企业的组织形式和经营领域的不断多样化,从而,企业财务活动极为复杂。

财务分析主题必须以科学系统的财务分析,为有关分析主题的管理决策和控制提供必要的依据。

目前上市公司已多达千余家,挨个看的话,想必会消耗大量的精力,如果想要知道该公司是否值得投资,能够取得什么样的回报,看一个公司的财务报表是必不可少的。

本文主要根据中兴通讯股份有限公司的财务报表,通过对会计报表的阅读,对该公司的财务状况、经营成果及现金流量情况进行分析,评价该公司过去的经营业绩,衡量现在的财务状况,预测未来的发展趋势,有助于公司的资产管理水平、持续经营能力、盈利水平与质量及成长性等方面进行有效评价,从而为股票等投资者的投资决策、银行等债权人的贷款决策、上市公司自身的内部管理等方面提供决策支持。

关键词:财务分析中兴通讯股份有限公司财务报表AbstractStrengthen the market economy environment, the trend of economic globalization, business competition is very fierce, the financial market matures, the growing diversity of modern enterprises, organizational forms and business areas, thus, corporate finance activities areextremely complex. Financial analysis of the theme must be scientific and financial analysis to provide the necessary basis for the analysis of the theme of management decision-making and control. Listed companies up to more than one thousand, one by one to see, and presumably will consume a lot of energy and, if you want to know whether the company is worth the investment to achieve a return of what is essential to look at a company's financial statements. ZTE Corporation's financial statements through the reading of the accounting statements, the Company's financial position, operating results and cash flows analysis, evaluation of the company's past operating results, measure the state of the financial forecast future development trends, to help the company's asset management and continued viability, profitability and other aspects of quality and growth of effective evaluation, which stocks the investment decisions of investors, banks and other creditors of the lending decisions of listed companies own internal management decision support.Key Words:Financial AnalysisZTEFinancial statements目录一、前言1(一)、研究背景及意义1(二)、研究内容及方法11、比较分析法12、比率分析法23、综合分析法2二、财务报表案例解析4(一)、公司简介4(二)、公司的外部环境51、宏观环境52、行业环境5三、中兴通讯公司的财务分析6(一)、近年来收入、利润、成本变化情况6(二)、盈利能力分析71、资产净利率72、股本报酬率83、净资产收益率84、市盈率9(三)、经营能力分析101、存货周转率102、应收账款周转率103、总资产周转率11(四)、偿债能力分析111、短期偿债能力112、长期偿债能力13(五)、现金流情况分析141、经营活动产生的现金流量分析142、投资活动产生的现金流量分析153、筹资活动产生的现金流量分析15(六)、发展能力分析161、主营业务增长率162、净利润增长率16四、中兴通讯财务报表分析结论16(一)、盈利能力17(二)、营运能力17(三)、偿债能力17(四)、发展能力18(五)、现金流情况18五、总结19文献综述20参考文献29致谢30一、前言(一)、研究背景及意义近年来,国内外经济形势波澜起伏,所有通信厂商都经历了非常严酷的考验。

中兴通讯财务分析报告

中兴通讯财务分析报告1. 背景介绍中兴通讯是一家全球领先的通信设备和解决方案提供商,为全球运营商客户提供高质量、高性能的通信网络产品和服务。

本财务分析报告将对中兴通讯的财务状况进行综合分析,以揭示其企业运营的优势和问题,并为投资者提供决策参考。

2. 财务数据分析2.1 营业收入中兴通讯的营业收入在过去五年中持续增长,从2016年的100亿元增长到2020年的200亿元。

这表明公司在市场上的竞争力和客户需求的增加。

然而,需要注意的是,公司在2020年的营业收入增长速度相对较慢,这可能与行业竞争激烈和市场饱和度增加有关。

2.2 利润状况中兴通讯的净利润在过去五年中呈现波动趋势。

2016年至2018年,公司净利润增长迅速,但在2019年和2020年出现了下降。

这可能与行业竞争加剧以及公司的运营成本增加有关。

需要注意的是,公司的净利润率在过去五年中保持在较高水平,这表明公司的盈利能力较强。

2.3 资产负债状况中兴通讯的总资产在过去五年中持续增长,这表明公司的资产规模不断扩大。

然而,公司的总负债也在增加,尤其是在2020年,负债增长速度较快。

这可能与公司资金需求的增加有关,需要进一步关注公司的资金运作情况。

2.4 经营效率中兴通讯的存货周转率在过去五年中呈现下降趋势,这可能意味着公司存货管理方面存在问题。

需要关注公司的供应链管理和库存控制措施。

此外,公司的应收账款周转率和应付账款周转率相对稳定,表明公司与客户和供应商的经营关系较好。

3. 经营风险分析3.1 市场竞争风险中兴通讯所处的通信设备行业竞争激烈,主要竞争对手包括华为、诺基亚等知名企业。

这些公司在技术研发、产品质量和品牌影响力方面具有较大优势。

中兴通讯需要加大技术创新力度,提升产品质量,以保持在市场中的竞争力。

3.2 法律合规风险在国际经营中,中兴通讯需要遵守各国的法律法规,尤其是关于贸易禁运和知识产权保护方面的规定。

违反这些法律法规可能导致公司面临巨额罚款和声誉损失。

中兴通讯股份有限公司盈利能力分析

中兴通讯股份有限公司盈利能力分析[提要] 在新技术革命的推动下,在全球网络化发展和信息高速公路建设浪潮推动下,通信技术得到了飞速发展。

在这样的大环境下,作为中国通讯产业的老大哥——中兴通讯股份有限公司正面临着巨大的挑战。

本文主要从资产报酬率、净资产收益率和销售净利率三个方面分析中兴通讯股份有限公司的盈利能力,并提出改进建议。

关键词:中兴通讯;盈利能力一、中兴通讯股份有限公司简介公司总部位于广东省深圳市南山区科技南路55号。

中兴通讯是全球领先的综合通信解决方案提供商。

公司通过为全球140多个国家和地区的电信运营商提供创新技术与产品解决方案,让全世界用户享有语音、数据、多媒体、无线宽带等全方位沟通。

公司成立于1985年,在香港和深圳两地上市,是中国最大的通信设备上市公司。

中兴通讯拥有通讯业界最完整的产品线和融合解决方案,通过全系列的无线、有线、业务、终端产品和专业通信服务,灵活地满足全球不同运营商的差异化需求以及快速创新的追求。

公司依托分布于全球的107个分支机构,凭借不断增强的创新能力、突出的灵活定制能力、日趋完善的交付能力赢得全球客户的信任与合作。

多年来,中兴通讯牺牲利润,在海外投资发展、追求市场份额,最终使企业成为第五大电信设备商。

二、盈利能力分析盈利能力是指企业获取利润的能力。

利润是企业内外有关各方都关心的中心问题、利润是投资者取得投资收益、债权人收取本息的资金来源,是经营者经营业绩和管理效能的集中表现,也是职工集体福利设施不断完善的重要保障。

盈利是企业的重要目标,是企业生存和发展的物质基础。

盈利能力分析是企业财务分析重要组成部分,也是评价企业经营管理水平的重要依据。

评价企业盈利能力的财务比率主要有资产报酬率、净资产收益率、销售净利率等。

表1是中兴通讯2009~2012年的一些重要数据。

(表1)(一)资产报酬率。

资产报酬率,也称资产收益率,资产报酬率越高,表明资产利用效率越高,说明企业在增加收入、节约资金使用等方面取得了良好的效果;该指标越低,说明企业资产利用效率低,应分析差异原因,提高企业经营管理水平。

中兴通讯财务分析

中兴通讯股份有限公司财务分析第一章引言1.1 研究的背景和意义1.2 研究方法1.3 结构安排第二章公司概况与战略分析2.1 公司简介中兴通讯全称"中兴通讯股份有限公司",是全球领先的综合通信解决方案提供商。

公司通过为全球140多个国家和地区的电信运营商提供创新技术与产品解决方案,让全世界用户享有语音、数据、多媒体、无线宽带等全方位沟通。

公司成立于1985年,在香港和深圳两地上市,是中国最大的通信设备上市公司。

中兴通讯作为中国综合性的电信设备及服务提供商,拥有无线产品、网络产品、终端产品(手机)三大产品系列,在向全球用户提供多种通信网综合解决方案的同时,还提供专业化、全天候、全方位的优质服务,并逐步涉足国际电信运营业务。

2010年中兴通讯营业收入达人民币702.64亿元,国际市场实现营业收入380.66亿元人民币,同比增长27.45%,占整体营业收入的比重达54.18%。

其中欧美地区收入同比增长50%,占整体营业收入的比重提升至21%,首次成为中兴通讯海外收入比重最大区域,系统与终端产品均已全面服务于欧美日高端市场的顶级运营商。

中兴通讯坚持以持续技术创新为客户不断创造价值。

公司在美国、法国、瑞典、印度、中国等地共设有15个全球研发机构,3万多名国内外研发人员专注于行业技术创新,2010年凭借1863件国际专利申请总量,排名跃居全球第二位,通讯业第一位。

公司依托分布于全球的107个分支机构,凭借不断增强的创新能力、突出的灵活定制能力、日趋完善的交付能力赢得全球客户的信任与合作。

中兴通讯为联合国全球契约组织成员,坚持在全球范围内贯彻可持续发展理念,实现社会、环境及利益相关者的和谐共生。

我们运用通信技术帮助不同地区的人们享有平等的通信自由;我们将“创新、融合、绿色”理念贯穿到整个产品生命周期,以及研发、生产、物流、客户服务等全流程,为实现全球性降低能耗和二氧化碳排放不懈努力。

我们还在全球范围内开展社区公益和救助行动,参加了印尼海啸、海地及汶川地震等重大自然灾害救助,并成立了中国规模最大的“关爱儿童专项基金”。

中兴通讯股份有限公司2018年度财务报表分析报告

中兴通讯股份有限公司2018 年度财务报表分析报告1财务报表数据3.1.2 长期偿债能力分析 ....... (31)3.2营运能力分析 ......... (34)1.1资产负债表 .......... (1)3.2.1 流动资产周转分析 ....... .. (34)1.2利润表 ............... (4)3.2.2 固定资产周转分析 ....... .. (36)1.3现金流量表 .......... (5)3.2.3 总资产周转分析 ......... .. (37)1.4所有者权益变动表 ........................ (7)3.3盈利能力分析 ......... (37)2会计报表分析3.3.1 资产经营盈利能力分析 (37)2.1资产负债表分析 ....... . (8)3.3.2 资本经营盈利能力分析 (38)2.1.1 水平趋势分析 .......... .. (8)3.3.3 商品经营盈利能力分析 (40)2.1.2 垂直结构分析 .......... .. (14)3.3.4 盈利质量分析 ........... ......462.2利润表分析 .......... (18)3.4发展能力分析 ......... (47)2.2.1 水平趋势分析 .......... (18)3.4.1 资产资本成长分析 ....... .. (47)2.2.2 垂直结构分析 .......... .. (21)3.4.2 营业收益成长分析 ....... .. (48)2.3现金流量表分析 ....... (24)3.4.3 每股净资产分析 ......... .. (49)2.3.1 水平趋势分析 .......... .. (24)4杜邦分析2.3.2 垂直结构分析 .......... .. (26)4.1 杜邦分析表 ........... (50)2.4所有者权益变动表分析 . (27)4.2 杜邦分析图 ........... (50)2.4.1 水平趋势分析 .......... .. (27)5数据来源及计算说明2.4.2 垂直结构分析 .......... .. (28)5.1 数据来源 .............. .. 523财务指标分析5.2计算说明 .............. .. 523.1偿债能力分析 ......... .. (29)3.1.1 短期偿债能力分析 ...... .. (29)1.1 资产负债表表格 1 2016-2018 年度资产负债表中兴通讯股份有限公司,简称中兴通讯,所属的行业是通信传输设备,公司总部位于广东省。

中兴通讯2019年财务状况报告

中兴通讯2019年财务状况报告一、资产构成1、资产构成基本情况中兴通讯2019年资产总额为14,120,213.5万元,其中流动资产为10,256,717.4万元,主要分布在货币资金、存货、应收账款等环节,分别占企业流动资产合计的32.48%、27%和19.28%。

非流动资产为3,863,496.1万元,主要分布在固定资产和无形资产,分别占企业非流动资产的24.29%、19.98%。

资产构成表项目名称2019年2018年2017年数值百分比(%) 数值百分比(%) 数值百分比(%)总资产14,120,213.5100.0012,935,074.9100.0014,396,221.5100.00流动资产10,256,717.472.64 9,284,765.3 71.7810,823,058.975.18长期投资710,413.6 5.03 587,072.3 4.54 1,041,083.4 7.23 固定资产938,348.8 6.65 889,806.8 6.88 869,445.6 6.04 其他2,214,733.7 15.68 2,173,430.5 16.80 1,662,633.6 11.552、流动资产构成特点企业持有的货币性资产数额较大,约占流动资产的33.02%,表明企业的支付能力和应变能力较强。

不过,企业的货币性资产主要来自于短期借款及应付票据,应当对偿债风险给予关注。

流动资产构成表项目名称2019年2018年2017年数值百分比(%) 数值百分比(%) 数值百分比(%)流动资产10,256,717.4100.00 9,284,765.3 100.0010,823,058.9100.00存货2,768,850.8 27.00 2,501,141.6 26.94 2,623,413.9 24.24 应收账款1,977,828 19.28 2,159,232.5 23.26 2,434,528.3 22.49 其他应收款101,930 0.99 199,728.1 2.15 362,993.3 3.35 交易性金融资产56,066.2 0.55 147,682.3 1.59 0 0.00 应收票据0 0.00 0 0.00 205,294.5 1.90 货币资金3,330,934.7 32.48 2,428,979.8 26.16 3,340,787.9 30.87 其他2,021,107.7 19.71 1,848,001 19.90 1,856,041 17.153、资产的增减变化2019年总资产为14,120,213.5万元,与2018年的12,935,074.9万元相比有所增长,增长9.16%。

中兴通讯公司财务报表分析与评价

中兴通讯公司财务报表分析与评价作者:解倩莹来源:《中国管理信息化》2016年第24期[摘要]本文通过对中兴通讯股份有限公司的财务报表进行分析,发现了中兴企业内部的经营状况和决策方面所存在的问题,并与华为技术有限公司进行了对比研究,并提出了解决方法。

[关键词]财务报表;中兴通讯公司;经营;决策doi:10.3969/j.issn.1673 - 0194.2016.24.016[中图分类号]F275 [文献标识码]A [文章编号]1673-0194(2016)24-00-020 引言与近年来发展迅速的电商行业相比,我国的通讯设施、网络、技术和服务的水平较为落后,其阻碍了我国经济的发展。

中兴通讯公司是我国电商行业中的领头羊,从分析中兴通讯公司的财务报表可以认识到我国电商行业的基本情况,且可以对其行业的资金运营、财务风险的控制等方面进行深入地了解。

1 中兴通讯股份有限公司财务报表的分析与评价本文选取了电子通信行业——中兴通讯股份有限公司(以下简称中兴)作为研究对象并对其财务进行了分析。

中兴成立于1985年,是目前为止中国最大的通信设备公司。

营运能力是以企业各项资产的周转速度来衡量企业资产利用的效率。

而常用的营运能力的指标有总资产周转率、应收账款周转率、存货周转率、流动资产周转率和固定资产周转率。

图1为中兴通讯2012-2014年盈利能力的指标。

从图1的各项指标可以看出,中兴的盈利能力在2012年呈现出负债。

而从2012-2014年中兴的盈利能力来看处于一个缓慢上升的趋势。

通过对中兴各项盈利能力指标的分析,总体来说在2012中兴处于一个改革的阶段,在2012年后各个指标基本上都呈现出上升的趋势,基于中兴公司拥有自己独特的企业管理模式以及创新能力,中兴的发展趋势也逐渐平稳的上升。

然而时代飞速发展,中兴企业的发展规划还应当与时俱进,实时观测各项数据的变化,及时调整管理政策,以便应对未来可能会出现的各种状况。

2 中兴与华为技术有限公司财务报表的对比分析华为技术有限公司(以下简称华为)和中兴都是我国电信行业的知名企业,且其产销量在国内都名列前茅。

中兴通讯公司财务报表分析报告毕业论文

摘要财务报表分析主要是以财务报表为依据,对经济活动与财务收支情况进行全面、系统的分析。

不同的人对于财务报表所关心的角度不同,本文主要从一个财务报表外部使用者的角度,以公司财务管理和财务报表分析的有关理论和研究方法,主要采用了比率分析法对上市公司中兴通讯股份有限公司对外公布的近五年的财务报表来分析公司的资本结构、盈利能力、偿债能力、营运能力和现金流量,同时阐述了公司的财务状况,指出了公司在现金流方面存在着短缺,这也是通讯行业的一个通病,并给出了一些建议和对策,希望给公司的管理人员提供有用的信息。

关键词:中兴通讯;报表分析;对策目录引言 (1)第一章长沙凯源珊珊商贸连锁有限公司简述 (1)1.1公司介绍 (1)1.2目标市场选择和目标市场分析 (2)第二章长沙凯源珊珊商贸连锁有限公司营销现状 (2)2.1长沙凯源珊珊连锁有限公司与超市营销对比分析 (3)2.2长沙凯源珊珊连锁有限公司营销现状 (3)第三章长沙凯源珊珊商贸连锁有限公司营销优化方案 (4)3.1找到最佳利润组合方式 (4)3.2慎重安排单项商品 (5)3.3促销及其他商品销售优化方案 (6)总结 (7)致谢 (8)参考文献 (9)引言财务报表分析是对企业的偿债能力、盈利能力做出评价并找出其中存在的问题,而这个分析是一个过程,把研究对象分解为一些简单的组成部分,找出这些部分本质属性和彼此之间的关系,从而到达认识对象本质的目的。

财务报表的分析主要是分析报表中的数据并找出之间所存在的关系,来认识企业的偿债能力、盈利能力等,但是在分析的过程中也要注意整体的分析企业,把分析过的各个部分、各个属性联合成一个统一的整体,从整体上把握公司的经营能力。

自从改革开放以来我国的经济得到了迅速的发展,电信行业也得到了迅猛的发展,通讯行业发生了巨大的变化,给人们的生活带来了历史性的改变,电信业已成为国民经济的先导产业。

本文选用中兴通讯公司财务报表进行分析,主要从公司的财务方面来分析公司的财务状况、经营成果,试指出该公司在经营管理方面存在的问题,并提出相应的建议,为管理决策者提供参考,并希望公司朝更好的方向发展。

中兴通讯财务风险问题分析

中兴通讯财务风险问题分析作者:胡永健来源:《今日财富》2019年第09期以中兴通讯为代表的高新技术产业更新迭代快、竞争压力大、海外市场扩展困难等特点,使其抵抗风险的能力较弱。

本文以中兴通讯股份有限公司为对象,通过对该公司四年的财务数据进行报表分析,结合相关资料和信息,分析中兴通讯的财务风险,并提出相应建议和措施。

财务风险是在企业生产经营过程中客观存在的,只能采取有效措施来降低但是无法避免。

一般来说,人们对于财务风险有广义和狭义两种定义,狭义的财务风险是指企业由于过度负债带来的偿债风险,例如某企业负债经营到期无法偿还本利而使公司陷入危机;而广义上的财务风险包含的内容更全面,是指企业在整个财务管理活动的过程中,受到未来结果不确定性的影响,使得实际背离预期所带来的发生损失的可能性。

本文采用财务风险的广义定义。

当今世界,以中兴华为为代表的电子通讯高新技术产业发展迅速,各个公司受到了来自国内外的多重竞争压力,企业需要投入大量的人力物力财力来加快研发更新,面临着越来越多的外部不确定性因素,同时内部控制也需要更加完善,否则很容易引发各种财务风险。

因此,针对企业发展状况及时对存在的以及潜在的财务风险进行分析处理,就显得尤为重要。

对此,企业应当加强财务风险的预防、分散、转移,及时分析企业的筹资、投资风险,流动性风险,收益分配风险等,加强监督管理,从而规避风险,实现公司价值最大化,利润最大化的目标。

一、中兴通讯股份有限公司简介中兴通讯公司成立于1985年,总部位于广东省深圳市南山区科技南路55号,是在香港和深圳两地上市的大型通讯设备公司,为全球160多个国家和地区的电信运营商和企业网客户提供创新技术与产品解决方案,让全世界用户享有语音、数据、多媒体、无线宽带等全方位沟通。

中兴通讯拥有通信业界完整的、端到端的产品线和融合解决方案,通过全系列的无线、有线、业务、终端产品和专业通信服务,灵活满足全球不同运营商和企业网客户的差异化需求以及快速创新的追求。

中兴通讯2008到2013年财务报表分析英文版

ZTEFINANCIAL ANALYSISREPORTGroup3胡希1206040204 (组长)ContentPART 1 BACKGROUND ANALYSIS (1)1.Corporate profile (1)2.Overview of the industry (1)PART 2 FINANCIAL STATEMENT ANALYSIS (2)1. Income Statement Analysis (2)2. Balance Sheet Analysis (4)3. Cash flow statement Analysis (9)PART 3 FINANCIAL RATIOS ANALYSIS (12)1. Profitability (12)2. Liquidity (15)3. Sufficiency (17)4. Solvency (21)5. Dividend policy ratios (23)6. Market-based ratios (23)PART 4 DUPONT ANALYSIS (25)PART 5 CONCLUSION (27)PART 6 REFERENCE (27)PART 1 BACKGROUND ANALYSIS1.Corporate profileZTE Corporation is a globally-leading provider of telecommunications equipment and network solutions. With operations in 160 countries, the company is a leader in technology innovation, delivering superior products and business solutions to clients all over the world. Founded in 1985, ZTE is listed on both the Hong Kong and Shenzhen Stock Exchanges and is China’s largest listed telecoms equipment company.Offering the industry’s most comprehensive product range and end-to-end solutions, ZTE delivers cutting-edge technology to telecommunications clients in wireless, access & bearer, value-added services, terminals, managed network services, and ICT solutions for enterprises and government agencies. The company’s expertise and flexibility in these areas enables telecommunications operators and enterprises globally to achieve business objectives and attain increased competitiveness. ZTE’s technology is deployed by leading international operators and Fortune-500 enterprises globally. The company is the world’s fourth-largest handset maker, offering stylish and intelligent devices for consumers around the world.ZTE believes in technology innovation as a core value of the company, investing more than 10% of annual revenue in R&D. The company has established 18 state-of-the-art R&D centers in the China, France, India and employs over 30,000 research professionals. With 107 subsidiaries devoted to innovation globally, ZTE was the world’s biggest originator of technology patents in each of the past two years, according to data from the World Intellectual Property Organization.As a member of the UN Global Compact, ZTE is committed to a vision of balanced, sustainable development in the social, environmental and economic arenas. Promoting freedom of communications around the world, the company has incorporated innovation, technological convergence and the concept of "going green" into the product life cycle. This includes R&D, production, logistics and customer service. The company also is committed to maximizing energy efficiency and minimizing the CO2 emissions.Active in community programs, ZTE participated in relief efforts related to the 2004 tsunami in Indonesia, the 2008 earthquake in Sichuan, China, and the 2010 earthquake in Haiti. ZTE also established the ZTE Special Children Care Fund, the largest charity fund in China.Looking forward, ZTE will continue to shape the global telecommunications industry, working with our customers and partners to stay on top of shifts in technology, business models and market needs.2.Overview of the industry2.1 Overview of the domestic telecommunications industry for the first half of 2014During the first six months of 2014, the Big Three domestic carriers stepped up with their investments in equipment mainly in connection with the large-scale deployment of 4G networksand the construction of related ancillary facilities. The rapid development of the Mobile Internet and the launch of 4G smart phones has accelerated the commercialization of 4G networks. While the wireless sector remained a heavily favored spot in the telecommunications industry, emerging new sectors such as the Mobile Internet, Cloud Computing, Big Data and Smart City were becoming new growth niches in the industry. According to statistics published by the Ministry of Industry and Information Technology, revenue from the telecommunication services amounted to RMB595.73 billion for the six months ended 30 June 2014, representing a year-on-year growth of 5.6%.2.2 Overview of the global telecommunications industry for the first half of 2014There was stable growth in equipment investment by the global telecommunications industry in the first half of 2014. The traditional telecommunications industry was facing opportunities as well as challenges in its development under the impact of comprehensive 4G applications, the integration of ICT industries and the trend of informationalization. While continuing to enhance network performance, global carriers were actively investigating new profit models, such as service innovations, flow business and applications for the government and corporate sectors, in a bid to realize effective transformation by exploring new opportunities for development.PART 2 FINANCIAL STATEMENT ANALYSIS1. Income Statement Analysis1.1 Horizontal AnalysisFrom the horizontal analysis table we can find that the company's annual net profit in 2013 is 1,433,636,000 yuan, which has increased 4,038,257,000 yuan. The growth rate is 155.04%, which is a dramatically rise.The increase of total profit is 3,811,043,000 yuan, and the growth rate is 192.17%, which mainly due to the increase of operating profit, whose growth rate is 70.15%.The increase of operating profit is 3,509,068,000 yuan, and the growth rate is 70.15%, which mainly due to the increase of operating revenue.Besides, the selling and distribution costs and R&D costs decrease sharply, and the financial expenses increased slightly.1.2Vertical AnalysisFrom the vertical analysis table, we can see the financial results of ZTE. The proportion operating profit in operating revenue was -1.98% in 2013 and it rose by 3.96% compared with the ratio in 2012. The net profit ratio was 2.43% in 2013 and it rose by 4.79% compared with the ratio in 2012. So in the view of profit, the profitability of ZTE promoted. The reason why the ZTE’s financial results change results from the descending of the selling and distribution costs and administrative expenses. However, the rise of operating costs also has a negative influence on profit.2. Balance Sheet Analysis2.1 Horizontal AnalysisOne of the goals of the horizontal analysis of balance sheet is to generally summarize the changes of assets and equity and to reveal the difference between changes in assets, liabilities and stockholder's equity, and analyzes the reason of the changes. In recent years the domestic communication industry continues to maintain a rapid growth rate. ZTE Corp grasps the pulse of the market and takes the advantages of the diversification of products and strengthens domestic market depending on the different market strategies. At the same time, ZTE vigorously explore the international market and total assets are improved steadily. According to the annual report of ZTE in 2013, we prepare the horizontal balance sheet as below:From the perspective of assets:The total assets of the company in the current period are reduced by 7,366,809,000 yuan, having subsequently declined by 6.86 percent. It suggests that the asset size of the company decreased.According to the further analysis:(1) The current assets decreased 6,213,729,000 yuan, which made the total asset be reduced by 5.78%. Non-current assets reduced 1,153,080,000 yuan, leading to the total asset be reduced by1.07%.(2) The main reason of the decrease of the total assets is the decrease of the current assets. The relevant changes mainly reflected in the following two aspects:To some degree, the drop of the current assets reflects that the liquidity of assets have declined. The change is mainly reflected in the following terms:A. Cash reduced 3,223,388,000 yuan, with a drop of total assets in 3%. It’s not desirable to improve the liquidity of the company. At the same time, we should do an in-depth analysis of the effectiveness of the use of funds.B. Decrease of the accounts receivables and the notes receivables. The accounts receivables decreased by 3.06%, which results in the drop of total assets. The project will have a certain impact on current capital. So the company need to do an in-depth analysis in the company's annual sales and credit policy, to control the collection of the accounts receivables.From the aspect of liabilities and stockholder’s equity:(1)The liabilities decreased by 8,396,659,000 yuan with a degree of 9.90%, which leaded to the 7.81% decline of total liabilities and stockholder’s equity. The stockholder’s equity increased 1,032,850,000 yuan, with a degree of 4.57%, leading to the 0.96% growth of total liabilities and stockholder’s equity. These two factors made the total liabilities and stockholder’s equity decreased by 7,363,809,000 yuan with a degree of 6.85%.(2)The main reason resulted in the decrease of total liabilities and stockholder’s equity is the decline of current liabilities. The current liabilities decreased by 11,985,122,000 yuan with a degree of 16.43%, which leaded to the 11.15% decline of total liabilities and stockholder’s equity. The decline of short-term loan leads to the decrease of current liabilities. This change may reduce the reimbursement of liabilities pressure and the financial risk.(3)The increase of undistributed profit is the main factor leading to the increase of stockholder’s equity. This indicates the good sales condition of the company in this term. Other changes may be caused by the changes of accounting policies.1.2Vertical AnalysisFrom the perspective of asset structure(1) From the static angle the current assets of this period accounted for 76.34% and the proportion of non-current assets is as high as 23.66%, suggesting that ZTE has an elastic asset structure which is conducive to quickly mobilize funds to lower the risk.(2) From the dynamic angle, the proportion of current-assets fell by 0.55% and the proportion of non-current assets increased by 0.55%. The narrow range of these assets adds up to explain that the stable asset structure of ZTE.From the aspect of capital structure(1) From the static point of view, the proportion of stockholder’s equity is 23.61%, but the proportion of liabilities is 76.39%. The high debt ratio implies the high financial risk. However, it requires to take the profitability into consideration when determine whether to optimize the capital structure.(2) From the dynamic angle, the proportion of stockholder’s equity increased by 2.58% and the proportion of liabilities decreased by 2.58% without great changes in other accounts. This indicates that the financial strength of ZTE declines mildly. But the capital structure of ZTE is stable.3. Cash flow statement Analysis3.1 Horizontal AnalysisFrom the chart above, we can calculate that the balance of the cash and cash equivalents was decreased by 25,413,600,000 yuan which with the percentage of difference reach 227.22%. The reason for the slump was the greater decreasing range than the operation revenue. The net cash inflow was equal to the amount of last year generally because the faster speed of decline in cash outflows than the cash inflows.Investing activities were stable while the financing activities caused the dramatically decreased in cash because of issuing the convertible debt which increased the more debt in this period.3.2 Vertical AnalysisAs we can see in the chart that the cash inflows of operation activities reached 78% while the percentages of investing and financing are 2% and 20%, respectively. From the proportion of cash inflows in the different activities we can easily conclude that the policy of their investing and financing actives are conservative especially the investing.From the aspect of cash outflows, the shares of three activities are similar to the cash inflows. The purchase of assets increased the cash outflows in investing activity.PART 3 FINANCIAL RATIOS ANALYSIS1. Profitability1.1 Gross Profit Margin= (sales-cost of sales)/salesIt gives a good indication of financial health. In general, a company's gross profit margin should be stable. It should not fluctuate much from one period to another, unless the industry it isFrom 2009 to 2011, the gross profit has increased steadily.In 2012, however, the gross profit has fallen considerably in 2012, which is the result of the adoption of a rather aggressive marketing strategy for fast breakthroughs of some key operators and markets, as well as the lack of rapid realignments in enhancing certain aspects, such as management efficiency and risk control, in response to changes in industry competition. What’s more, as the result of a larger number of low-margin contracts in Africa, South America, Asia and the domestic market recognized for 2012, the gross profit margin decreased obviously. It implies that the gross profit is not adequate to pay its operating and other expenses and build for the future.In 2013, the company finished selling some equity of two companies who had lower gross profit without being consolidated in the financial statements. In this way, the gross profit increased. During the year, the Group strengthened its management over contract profitability and exercised stringent control over the execution of low gross margin contracts, resulting in improved gross margin for international projects and the increase in operating revenue from domestic systems projects as a percentage of total revenue. So the gross profit margin increased, too. It means that the financial health is recovering.Cross-sectional AnalysisHowever, the gross profit of 2013 is much lower than Huawei which is 98,020 million yuanand the gross profit margin is much lower than that of Huawei which is 41.01%. It indicates the financial health is worse than that of Huawei.1.2 Return on stockholders’ equity=Earnings after taxes (EAT)/Stockholders’ equityIt measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.Trend AnalysisFrom 2009 to 2012, the ROE decreased from 15.02% to -11.53%, However, from 2012 to 2013, the ROE increased dramatically from -11.53% to 6.07%, which means ZTE’s return on equity has improved.Cross-sectional AnalysisBut the ratio is still below the average level of industry, which is 7.63%. And it is almost 4 times lower than Huawei, whose ROE is 24.35%. It suggests that the profitability of stock equity can still be improved.1.3 Return on Investment Ratio=EAT/Total assetsIt measures a firm’s net income in relation to the total assets investment.Trend AnalysisFrom 2009 to 2010, the ROI increased, but it decreased sharply in 2011 because of the substantial increase of period costs such as financial expense. In 2012, ROI decreased to -2.42%, which is the result of the lower gross profit and higher period cost. It indicates that some investments should not be undertaken.During the 2013, on the one hand, ZTE strengthened its management over contract profitability and exercised stringent control over the execution of low gross margin contracts, resulting in improved gross margin for international projects. On the other hand, total expenses (selling and distribution costs, administrative expenses and research and development costs) for the reporting period decreased significantly as compared to the same period last year, reflecting the Group’s effort to enhance cost management and improve efficiency.Cross Sectional AnalysisBut it is lower than the average level of the industry which is 3.16%. What’s worse, it is much lower than Huawei’ ROI which is 9.07%. It showed that ZTE should improve the efficiency of an investment.*Compare ROE with ROIThe trends of growth or decline of these two ratio are synchronous. Excepting the ration of 2012, the ROE is higher than ROI, for example, in 2013, ZTE managed to magnify a 1.43% return on total investment into a 6.07% return on stockholders’ equity, it suggested that ZTE made more extensive use of debt financing.1.4Return on Assets Ratio=EBIT/Total AssetsAn indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. Here it adds interest and tax expense back into EAT because it can better reflect operating returns before interest expense than ROI.Trend AnalysisThe trend is the same as ROI from 2009 to 2013, but the ratio is higher than ROI, which implies that the interest expense is too high, as a result of high loan.Cross Sectional AnalysisExcept to the interest expense, the operating ability is outstanding but the ROA is still lower than that of Huawei’s ROA which is 11.45%.2. Liquidity2.1 Current ratio=current assets/current liabilitiesThe current ratio is interpreted to satisfy the claims of short-term creditors exclusively from existing current assets.Trend analysisApparently, the current ratio of ZTE, which had declined gradually from 2009 to 2012, is slightly below the industry average, but it gone up a little in 2013. It means that the ability of ZTE to pay back the short-term liabilities was stable.Cross-sectional analysisThe Industry average for the current ratio is 1.49 times, meaning that the average firm in the industry convert only ¥0.67(¥1/1.49=¥0.671,or ¥0.67) of each yuan of current assets into cash to meet short-term obligations. The current ratio of Huawei at the end of 2013 is 1.67times. By comparing with industry average and Huawei, we can see that the short-term liquidity of ZTE is in a lower level.2.2 Quick ratio= (current assets-inventories)/current liabilitiesThis ratio, sometimes called the “acid test”, is a more stringent measure of liquidity than the current ratio. By subtracting inventory from current assets, this ratio recognizes that a firm’s inventories are often one of its least-liquid assets.Trend analysisFrom 2009 to 2013, the quick ratio of ZTE went down with each passing year. And in 2012 it drop dramatically. By analysis the change of total current assets and total liabilities, we can find that the sharp drop in 2012 may be caused by the increase of current liabilities, especially the increase of short-term loan. But the dramatic rise in 2013 shows that the short-term liquidity of ZTE was improved.Cross-Sectional analysisThe Industry average for the quick ratio is 1.19 times while the quick ratio of Huawei is 1.45 times. Apparently, the quick ratio of ZTE is quite low, which means the short-term liquidity is insufficient.2.3 Cash ratio= (Cash + Trading securities)/Current liabilitiesThe cash ratio of ZTE is stable during the past 5 years and it's higher than the empirical value. This indicates that the direct reimbursement ability of current liabilities is good.By the flow chart analysis, we can imply that the solvency of short-term liabilities of ZTE isn't good. The problem may lies in the management of inventory and the too liberal credit policy.3. Sufficiency3.1Avg. collection period=Accounts receivable/(Annual credit sales/365)If the credit policy is too liberal, it will take an enterprise a long time to turn it receivables into cash. The occupation of funds will limit its investment activity, affecting the profitability of the enterprise. In contrast, if the credit policy is too stringent, it will hurt sales by restricting credit to the very best customers.Trend analysisFrom 2009 to 2013, the average collection period of ZTE rose with fluctuations which is from 92.77 days to 103.79 days. It means that the management of receivables is weak.Cross-Sectional analysisThe Avg. collection period of Huawei is 90 days. An average collection period substantially above the industry norm is usually not desirable and may indicate too liberal a credit policy. Ultimately, ZTE’s managers must determine the proper credit policy to generate enough incremental sales and profits.3.2Inventory turnover= Cost of sales/Average inventoryInventory turnover is an activity ratio measuring the number of times per period, a business sells and replaces its entire batch of inventory again. In general, a higher value of inventory turnover indicates better performance and lower value means inefficiency in controlling inventory levels. A lower inventory turnover ratio may be an indication of over-stocking which may pose risk of obsolescence and increased inventory holding costs. However, a very high value of this ratio may be accompanied by loss of sales due to inventory shortage.Trend analysisFrom the picture above we can see that the inventory turnover ratio floated mildly around 4.5 times from 2009 to 2011. But it surged to 4.96 times in 2012 and plunged to 4.59 times in 2013. The main reason of the high ratio in 2012 is the increase of cost of sales.Cross-Sectional analysisThe inventory turnover of Huawei is 5.98 times, which is higher than ZTE’s ratio. Generally, a high ratio implies either strong sales or ineffective purchasing. A low turnover implies poor sales and, therefore, excess inventory. It suggests that the selling capacity of ZTE is insufficient.3.3Fixed-Assets Turnover Ratio=Sales/Net fixed assetsThe fixed-asset turnover ratio measures a company's ability to generate net sales from fixed-asset investments - specifically property, plant and equipment (PP&E) - net of depreciation.A higher fixed-asset turnover ratio shows that the company has been more effective in using the investment in fixed assets to generate revenues. When companies make these large purchases, prudent investors watch this ratio in following years to see how effective the investment in the fixed assets was.Trend analysisObviously, the fixed-assets turnover ratio of ZTE declined generally over the 5-year period, fluctuating around the number of 11. According to the analysis of the annual report, we can conclude that ZTE has invested in the fixed assets because of the aggressive marketing strategy, which leads to the decrease of this ratio.3.4Total Assets Turnover Ratio=Sales/Total assetsIt indicates how effectively a firm use its total resources to generate sales and is a summary measure influenced by each of the asset management ratios.Trend analysisThe lower total assets turnover ratio is, the less efficiently the company manages its assets. The total assets turnover ratio will not only affect the company's profitability, but also affect the dividend distribution of the listing corporation directly. Total assets turnover rate is an index of measuring the efficiency of the company operating asset. From the chart we can see that the total-asset turnover ratio declined generally during recent five years, from 88.19% to 75.17%. These data indicates that the company’s usage of assets is inefficient.Cross-Sectional analysisThe industry average for the total-asset turnover ratio was 78.76% while the total-asset turnover ratio of Huawei was 108%, which was much higher than ZTE’s ratio. These data show that the total-asset turnover ratio of ZTE is approximately equal to the industry average, but severely falls behind that of Huawei. The company can accelerate the turnover of the assets through puerile, in order to increase the total-asset turnover ratio.Flow chart analysis of short-term liquidity:Conclusion:By the flow chart analysis, we can imply that the solvency of short-term liabilities of ZTE isn't good. The problem may lies in the management of inventory and the too liberal credit policy.The liquidity of short-term is affected by the several aspects. The process starts from the current ratio, which is lower than the industry average and Huawei and indicates the insufficient liquidity of short-term. On the first stage, we compare the inventory turnover to the industry average and Huawei’s which is also in a lower situation. Then we minus the inventories on the denominator and get the quick ratio. However, it is also not desirable. So we estimate the average collection period then. It is in a bad situation, too. While apart from the accounts receivable factor we catch the cash ratio and by compared with the standard value, we can conclude the short-term liquidity is satisfactory. From the procedures above, we can distinguish the main reasons of the insufficient liquidity short-term are inventories and accounts receivable.4. Solvency4.1Debt ratio=Total debt/Total assetDebt ratio represents the proportion of debt in liabilities and stockholder's equity. It is a common used measure and target for financial leverage at firms. The ratio means the riskiness the enterprise meets and the solvency of the long-term loans.Trend analysisFrom 2009 to 2013, the debt ratio fluctuated slightly near 0.75 while it reached the peak in 2012. Through checking the statistic in the financial report, we found that the large amount of debt in 2012 caused the higher debt ratio.Cross-Sectional analysisIt is higher than the Huawei's debt ratio (0.63) in 2013. What’s more, compared to the industry average debt ratio, we found that it was near 0.54 year on year. It reflects potential threaten of its debt.As for creditors, it is the lower, the better. Too high level of this ratio may cause less creditors being willing to lend their money to the enterprise.As for stockholders, the high level of debt ratio implies the probability of being not able to pay back the debt and it will make them to loss the control of company and their investment. What’s more, it will bring the decline of the stock option price.4.2Debt-to-equity ratio=Total debt/Total equityThe debt-to-equity ratio represents the riskiness of financial situation and confirms that sufficient funds are in place to meet its debt repayment obligations as due.Trend analysisFrom 2009 to 2013, the debt-to-equity ratio fluctuated between 2.3 to 3.7, which reached a peak at 2012. The bad financial situation ZTE met in 2012 led to the higher debt and the higher debt-to-equity ratio.Cross-Sectional analysisIt is much higher than the Huawei's ratio whose was 1.7 in 2013. Furthermore, compared to the industry average debt-to-equity ratio, we found that it was near 1.2 year on year. The situation ZTE in was not safe enough to guarantee the creditors’ claims through the equity of the enterprise.4.3Times interest earned=EBIT (EBT + interest cost)/Interest charged (interest cost)It is a ratio that measures a firm's capacity to meet its debt obligation. The higher this ratio, the lower the default spread for a firm.Trend analysisFrom 2009 to 2013, the times interest earned was in a decline tendency in all, which reached a lowest point in 2012 because of the negative net profit in that year. However, due to the unbalanced performance the subsidiaries had with whose tax paid separately, the negative total EBT and positive tax expense existed together.Cross-Sectional analysisOn the whole, their interest coverage ratio is in a low level which is not safe enough for the creditors. It is lower than the Huawei's ratio whose was adjacent to 9.9 in recent years. This ratio is a further evidence of the fact that the company makes extensive use of creditor’ funds to finance its operations.Summary:Through the analysis before we can conclude that the solvency of long-term debt is in a worse tendency with the higher proportion of debt and the lower level of time interest earned.From the static point, the debt ratio was 0.76 and the debt-to-equity ratio was 3.2 in 2013. The debt ratio is high which means that ZTE has a high financial risk. But whether the structure needs to be optimized depends on profitability.From the dynamic point, both the debt ratio and debt-to-equity ratio declined in 2013. The debt declined by 2.54% and the equity rose by 2.54% and it’s a good phenomenon. We can see that these items changed slightly which means that the financial structure is stable and the financial strength declines slightly. The times interest earned declined year by year which indicated that the solvency of ZTE was weakened.5. Dividend policy ratios5.1 Payout ratio=Dividends per share/EPSThe payout ratio indicates the percentage of a firm’s earnings that are paid out as dividends. The payout ratio is a key financial metric used to determine the sustainability of a company’s dividend payments.Trend analysisAs can be seen from the chart, we can easily find that before 2012 it was in a relatively high level. Because of the deficit in 2012 net profit, no dividend was paid out. In 2013, the condition became better than last year, after covering the deficit, the company paid dividends, but still not catch up with past levels. A lower payout ratio is generally preferable to a higher payout ratio, with a lower ratio indicating the company is paying out less in dividends so the capital can stay in the enterprise to develop more profit. However, on the other hand, the stockholders’ are guaranteed by the higher payout ratio.6. Market-based ratios6.1 M/B=Market price per share/Book value per shareA lower M/B ratio could mean that the stock is undervalued. However, it could also mean。

000063中兴通讯2021年财务分析详细报告

中兴通讯2021年财务分析详细报告一、资产结构分析1.资产构成基本情况中兴通讯2021年资产总额为16,876,342.5万元,其中流动资产为12,787,108.5万元,主要以货币资金、存货、应收账款为主,分别占流动资产的39.66%、28.4%和13.69%。

非流动资产为4,089,234万元,主要以固定资产、无形资产、其他非流动资产为主,分别占非流动资产的27.97%、19.79%和14.8%。

资产构成表(万元)项目名称2019年2020年2021年数值百分比(%) 数值百分比(%) 数值百分比(%)总资产14,120,213.5 100.00 15,063,490.6100.00 16,876,342.5100.00流动资产10,256,717.4 72.64 10,697,727.571.02 12,787,108.575.77货币资金3,330,934.7 23.59 3,565,983.2 23.67 5,071,331 30.05 存货2,768,850.8 19.61 3,368,930.6 22.36 3,631,675.3 21.52应收账款1,977,828 14.01 1,589,102 10.55 1,750,905.9 10.37 非流动资产3,863,496.1 27.36 4,365,763.1 28.98 4,089,234 24.23 固定资产938,348.8 6.65 1,191,394.2 7.91 1,143,701.1 6.78 无形资产771,882 5.47 936,728.2 6.22 809,454.2 4.80 其他非流动资产582,410.8 4.12 627,985.7 4.17 605,035.7 3.592.流动资产构成特点企业持有的货币性资产数额较大,约占流动资产的40.72%,表明企业的支付能力和应变能力较强。

但应当关注货币性资产的投向。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

西南财经大学天府学院2012届本科毕业论文(设计)论文题目:中兴通讯股份有限公司财务报表分析学生姓名:杨金莲所在学院:西南财经大学天府学院专业:财务管理学号:40804319指导教师:柳玉寿2012 年3月西南财经大学天府学院本科毕业论文(设计)原创性及知识产权声明本人郑重声明:所呈交的毕业论文(设计)是本人在导师的指导下取得的成果。

对本论文(设计)的研究做出重要贡献的个人和集体,均已在文中以明确方式标明。

因本毕业论文(设计)引起的法律结果完全由本人承担。

本毕业论文(设计)成果归西南财经大学所有特此声明。

毕业论文(设计)作者签名:作者专业:财务管理作者学号:40804319年月日西南财经大学天府学院本科学生毕业论文(设计)开题报告表摘要在市场经济环境中,经济全球化趋势的加强,企业竞争十分激烈,金融市场日趋成熟,现代企业的组织形式和经营领域的不断多样化,从而,企业财务活动极为复杂。

财务分析主题必须以科学系统的财务分析,为有关分析主题的管理决策和控制提供必要的依据。

目前上市公司已多达千余家,挨个看的话,想必会消耗大量的精力,如果想要知道该公司是否值得投资,能够取得什么样的回报,看一个公司的财务报表是必不可少的。

本文主要根据中兴通讯股份有限公司的财务报表,通过对会计报表的阅读,对该公司的财务状况、经营成果及现金流量情况进行分析,评价该公司过去的经营业绩,衡量现在的财务状况,预测未来的发展趋势,有助于公司的资产管理水平、持续经营能力、盈利水平与质量及成长性等方面进行有效评价,从而为股票等投资者的投资决策、银行等债权人的贷款决策、上市公司自身的内部管理等方面提供决策支持。

关键词:财务分析中兴通讯股份有限公司财务报表AbstractStrengthen the market economy environment, the trend of economic globalization, business competition is very fierce, the financial market matures, the growing diversity of modern enterprises, organizational forms and business areas, thus, corporate finance activities are extremelycomplex. Financial analysis of the theme must be scientific and financial analysis to provide the necessary basis for the analysis of the theme of management decision-making and control. Listed companies up to more than one thousand, one by one to see, and presumably will consume a lot of energy and, if you want to know whether the company is worth the investment to achieve a return of what is essential to look at a company's financial statements. ZTE Corporation's financial statements through the reading of the accounting statements, the Company's financial position, operating results and cash flows analysis, evaluation of the company's past operating results, measure the state of the financial forecast future development trends, to help the company's asset management and continued viability, profitability and other aspects of quality and growth of effective evaluation, which stocks the investment decisions of investors, banks and other creditors of the lending decisions of listed companies own internal management decision support.Key Words:Financial AnalysisZTEFinancial statements目录一、前言1(一)、研究背景及意义1(二)、研究内容及方法11、比较分析法12、比率分析法23、综合分析法2二、财务报表案例解析3(一)、公司简介3(二)、公司的外部环境41、宏观环境42、行业环境4三、中兴通讯公司的财务分析5(一)、近年来收入、利润、成本变化情况5 (二)、盈利能力分析61、资产净利率62、股本报酬率73、净资产收益率84、市盈率8(三)、经营能力分析91、存货周转率92、应收账款周转率103、总资产周转率10(四)、偿债能力分析111、短期偿债能力112、长期偿债能力13(五)、现金流情况分析141、经营活动产生的现金流量分析142、投资活动产生的现金流量分析143、筹资活动产生的现金流量分析15(六)、发展能力分析151、主营业务增长率162、净利润增长率16四、中兴通讯财务报表分析结论16(一)、盈利能力17(二)、营运能力17(三)、偿债能力17(四)、发展能力18(五)、现金流情况18五、总结19文献综述20参考文献28致谢29一、前言(一)、研究背景及意义近年来,国内外经济形势波澜起伏,所有通信厂商都经历了非常严酷的考验。

经过多年的大浪淘沙,通信制造业发生了翻天覆地的变化。

从最早时候的爱立信、摩托罗拉等国际传统电信设备巨头独领风骚,到今天中兴通讯、华为等中国龙头企业逆势上扬、挺立潮头,世界通信制造业的格局被一次又一次地改写。

弱肉强食,更残酷、更惨烈的竞争将是今后全球电信设备市场的主旋律之一。

本文以中兴通讯公司对外公布的财务报表和年度报告为分析对象,依据财务报表分析相关理论,结合实际,对该公司的财务状况、经营业绩进行分析,试指出该公司在经营、管理方面存在的问题,并提出相关建议,供企业管理者作决策参考,使企业管理人员更好的管理企业,同时希望对财务报表信息外部使用者起到有益的参考作用。

(二)、研究内容及方法1、比较分析法比较分析法的作用在于揭示指标间客观存在的差距,并为进一步分析指出方向。

它是通过比较不同的数据,从而发现规律性的东西并找出预备比较对象差别的一种分析法①。

比较形式可以是本期实际与①李岚、《财务报表分析方法探索》、《经济师》、2009年第11期-计划或定额指标的比较、本期实际与以前各期的比较,可以了解企业经济活动的变动情况和变动趋势;也可以将企业相关项目和指标与国内外同行业进行比较。

比较分析法主要包括纵向比较法和横向比较法方法。

2、比率分析法比率分析法是指利用会计报表中两个相关数值的比率来反映和揭示企业财务状况和经营成果的一种分析方法。

比率分析法是报表分析中常用的一种分析方法,运用比率分析法可以分析评价企业偿债能力、盈利能力、营运能力等内容②。

财务比率最主要的好处就是可以消除规模的影响,用来比较不同企业的收益与风险,从而帮助投资者和债权人做出理智的决策。

它可以评价某项投资在各年之间收益的变化,也可以在某一时点比较某一行业的不同企业。

3、综合分析法所谓综合分析法就是将各项财务指标作为一个整体,系统、全面、综合的对企业财务状况和经营成果进行剖析和评价,说明企业整体财务状况和效益的好坏。

一般采用的综合分析评价方法有杜邦分析体系、标准财务比率分析、财务状况综合评分析。

运用这些方法可以综合考察企业各方面的能力及其对所有者获利水平的影响,便于揭示企业存在的问题,根据该综合分值的大小对该企业的总体财务状况做出判断。

②刘平、《财务报表分析方法与运用》、《商场现代化》、2007年第20期二、财务报表案例解析(一)、公司简介中兴通讯全称"中兴通讯股份有限公司",公司英文全称"ZTE CORPORATION",缩写“ZTE”。

成立于1985年,是全球领先的综合通信解决方案提供商,是中国最大的通信设备上市公司,是全球第四大手机生产制造商,股票代码000063。

中兴通讯是中国通信设备制造业的开拓者、中国综合性的电信设备及服务提供商,拥有无线产品、网络产品、终端产品(手机)三大产品系列,在向全球用户提供多种通信网综合解决方案的同时,还可以提供专业化、全天候、全方位的优质服务,并逐步涉足国际电信运营业务。

2011年,中兴通讯实现全年营业收入人民币862.54亿元,同比增长23.39%,增速位居行业首位。

其中,国际市场实现营收467.58亿元人民币,占整体营收54.21%,同比增长24%。

中兴通讯系统设备已全面服务于全球高端市场的顶级运营商,智能终端增速强劲,已跃居全球第四大手机厂商。

中兴通讯坚持以持续技术创新为客户不断创造价值。

公司在美国、法国、瑞典、印度、中国等地共设有18个全球研发机构,近3万名国内外研发人员专注于行业技术创新,2011年中兴通讯PCT国际专利申请量跃居全球企业第一位,国内发明专利授权量与申请量也均列国内企业第一位。

公司依托分布于全球的107个分支机构,凭借不断增强的创新能力、突出的灵活定制能力、日趋完善的交付能力赢得全球客户的信任与合作。

未来,中兴通讯将继续致力于引领全球通信产业的发展,应对全球通信领域更趋日新月异的挑战。

(二)、公司的外部环境1、宏观环境国内市场方面,受益于国家“十二五”规划的政策支持与运营商积极部署,本集团国内市场收入实现较快增长;国际市场方面,国际电信行业竞争激烈,知识产权摩擦有所增加,本集团结合竞争格局变化致力提升市场地位,在巩固新兴市场的同时,持续突破全球主流运营商。

2、行业环境随着通信设备技术的高速发展,在3G通信技术正处于酝酿之中时,更高的技术应用已经在实验室进行研发。

因此在人们期待第三代移动通信系统所带来的优质服务的同时,第四代移动通信系统的最新技术也在实验室悄然进行当中。