中国SM苯乙烯的需求分析

2024年苯乙烯市场前景分析

2024年苯乙烯市场前景分析1. 引言苯乙烯是一种重要的化工原料,广泛应用于塑料、橡胶、纺织品和电子产品等领域。

本文将对苯乙烯市场的前景进行分析,探讨其发展趋势,供需情况以及影响因素。

2. 市场规模及增长趋势苯乙烯市场在过去几年中呈现稳步增长的趋势。

根据市场研究数据,预计未来几年内苯乙烯市场规模将继续扩大。

这主要得益于全球经济的增长以及各个行业对苯乙烯的需求增加。

3. 供需情况苯乙烯市场的供需情况是影响市场前景的重要因素之一。

目前,全球苯乙烯市场供应相对充裕,但需求也在不断增加。

特别是在电子产品和汽车制造行业的快速发展下,对苯乙烯的需求将进一步增加。

4. 主要影响因素(1)原材料供应情况:苯乙烯的主要原材料是苯和乙烯,因此苯乙烯市场的发展受到这两种原材料的供应情况的影响。

原材料价格的波动以及供应的紧张程度都会对苯乙烯市场的运行产生影响。

(2)行业发展趋势:随着全球各个行业的发展,对苯乙烯的需求将不断增加。

特别是在电子产品和塑料制品领域,苯乙烯的用途越来越广泛。

(3)政策环境:政府对于环保和可持续发展的倡导,也会对苯乙烯市场产生一定的影响。

加强环境保护限制某些原材料的生产,可能会对苯乙烯市场的供应情况产生一定的影响。

5. 市场竞争格局目前,苯乙烯市场竞争激烈,主要生产企业集中在一些发达国家和地区。

这些企业通常拥有先进的生产技术和专利,具有一定的市场竞争优势。

此外,新兴的生产国家和企业也在努力提升自身的竞争力。

6. 总结综上所述,苯乙烯市场具有良好的前景和发展潜力。

供需情况良好、原材料供应稳定以及行业发展趋势的支撑,将促使苯乙烯市场规模进一步扩大。

然而,也需要密切关注原材料供应情况和政策环境等因素对市场的影响。

2024年通用级聚苯乙烯市场分析现状

2024年通用级聚苯乙烯市场分析现状概述聚苯乙烯(Polystyrene,PS)是一种常用的塑料材料,在工业和消费品制造中广泛应用。

通用级聚苯乙烯是指未经特殊改性处理的聚苯乙烯产品,用途较为广泛,市场规模较大。

本文将对通用级聚苯乙烯市场的现状进行分析和总结。

市场规模及增长趋势通用级聚苯乙烯市场规模庞大,势头强劲。

根据市场调研数据显示,全球聚苯乙烯市场总体增长稳定。

其中,通用级聚苯乙烯占据了相当大的市场份额,且呈现稳定增长趋势。

市场增长的主要驱动因素包括:1.市场需求增加:随着全球经济发展和生活水平提高,对消费品和工业品的需求不断增加,进而推动了通用级聚苯乙烯市场的扩大和发展。

2.广泛应用领域:通用级聚苯乙烯具有较好的物理性能和成本效益,可在各个行业中广泛应用。

特别是在电子、建筑、包装、家居用品等领域,需求量较大,为市场的增长提供了强劲动力。

3.新技术和创新:随着科技的进步和新材料的开发,聚苯乙烯的性能不断改进和优化,满足了人们对产品外观、功能和环境友好性的要求,进一步推动了市场的发展。

4.地区经济增长:亚洲地区的经济快速增长,尤其是中国、印度等国家和地区,对通用级聚苯乙烯的需求量巨大,促进了市场的扩大。

市场竞争格局通用级聚苯乙烯市场竞争激烈,主要的竞争企业有:1.PS生产巨头:道康宁、巴斯夫、中化国际等世界知名化工巨头企业是市场的主要竞争者。

它们具有先进的生产技术、丰富的资金实力和全球化的销售渠道,具备较强的竞争力。

2.地区龙头企业:在各个地区,也出现了一些聚苯乙烯生产企业,如中国的华东石化、华南石化等。

这些地区龙头企业利用本土资源和市场优势,对传统巨头构成了一定的竞争压力。

3.中小型企业:除了大型化工企业外,许多地区还有一些中小型企业涉足聚苯乙烯生产领域。

这些企业在技术、资金和市场方面相对较弱,但通过降低成本、发展特色产品等方式,仍有一定的市场份额。

市场竞争格局复杂多样,各个企业通过不同的市场定位、产品差异化、技术创新等手段争夺市场份额。

苯乙烯常温自体聚合反应控制及其对储运要求的分析

苯乙烯苯乙烯结构式苯乙烯是用苯取代乙烯的一个氢原子形成的有机化合物,乙烯基的电子与苯环共轭,不溶于水,溶于乙醇、乙醚中,暴露于空气中逐渐发生聚合及氧化。

工业上是合成树脂、离子交换树脂及合成橡胶等的重要单体。

苯乙烯,芳烃的一种。

存在于苏合香脂(一种天然香料)中。

无色、有特殊香气的液体。

主要由乙苯制得,是聚合物的重要单体。

苯乙烯自聚生成聚苯乙烯树脂,它还能与其他的不饱和化合物共聚,生成合成橡胶和树脂等多种产物。

苯乙烯还可以发生烯烃所特有的加成反应。

在工业上,苯乙烯可由乙苯催化去氢制得。

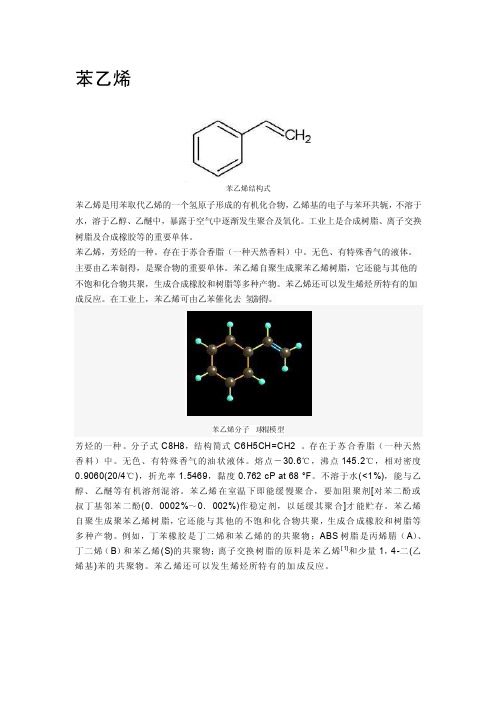

苯乙烯分子球棍模型芳烃的一种。

分子式C8H8,结构简式C6H5CH=CH2 。

存在于苏合香脂(一种天然香料)中。

无色、有特殊香气的油状液体。

熔点-30.6℃,沸点145.2℃,相对密度0.9060(20/4℃),折光率1.5469,黏度0.762 cP at 68 °F。

不溶于水(<1%),能与乙醇、乙醚等有机溶剂混溶。

苯乙烯在室温下即能缓慢聚合,要加阻聚剂[对苯二酚或叔丁基邻苯二酚(0.0002%~0.002%)作稳定剂,以延缓其聚合]才能贮存。

苯乙烯自聚生成聚苯乙烯树脂,它还能与其他的不饱和化合物共聚,生成合成橡胶和树脂等多种产物。

例如,丁苯橡胶是丁二烯和苯乙烯的的共聚物;ABS树脂是丙烯腈(A)、丁二烯(B)和苯乙烯(S)的共聚物;离子交换树脂的原料是苯乙烯[1]和少量1,4-二(乙烯基)苯的共聚物。

苯乙烯还可以发生烯烃所特有的加成反应。

在工业上,苯乙烯可由乙苯催化去氢制得。

实验室可以用加热肉桂酸的办法得到。

化学品名称化学品中文名称:苯乙烯化学品英文名称: phenyl ethyl ene ,Etheny lbenz ene, Styrol, Vinylbenzen e,Cinnam ene, Styrol ene, Cinnam ol?中文名称2:乙烯基苯,乙烯苯,苏合香烯,斯替林英文名称2: styren e技术说明书编码:236CAS No.:100-42-5分子式:C8H8分子量:104.14成分/组成信息≥99.5%;二级≥99.0%。

关于苯乙烯工艺技术及发展的研究

关于苯乙烯工艺技术及发展的研究摘要:苯乙烯(C8H8,SM)是近年来常用的一种重要化工原料,主要用来生产苯乙烯-丙烯腈共聚物(SAN)树脂,聚苯乙烯(PS)树脂,离子交换树脂,丙烯腈-丁二烯-苯乙烯树脂,可发性聚苯乙烯(EPS),丁苯橡胶(SBR)等。

此外,其在制造农药乳化剂,调制染料,选择矿种和制做药品等其他行业的应用也很广泛。

本文主要对苯乙烯的装置及购工艺技术发展进行了研究。

关键词:苯乙烯;技术;发展1苯乙烯概述苯乙烯分子式C8H8,结构简式C6H5CH=CH2,存在于苏合香脂中。

苯乙烯是一种无色、有特殊香气的油状液体,熔点-30.6℃,沸点145.2℃,相对密度0.9060(20/4℃),折光率1.5469,黏度0.762cpat68°F。

苯乙烯不溶于水(<1%),能与乙醇、乙醚等有机溶剂混溶。

苯乙烯在室温下即能缓慢聚合,要加阻聚剂对苯二酚或叔丁基邻苯二酚(0.0002%-0.002%)作稳定剂,以延缓其聚合才能贮存。

苯乙烯在高温下容易裂解和燃烧,生成苯、甲苯、甲烷、乙烷、碳、一氧化碳、二氧化碳和氢气等。

苯乙烯蒸气与空气能形成爆炸混合物,其爆炸范围为1.1%-6.01%。

苯乙烯具有乙烯基烯烃的性质,反应性能极强,如氧化、还原、氯化等反应均可进行,并能与卤化氢发生加成反应。

苯乙烯暴露于空气中,易被氧化成醛、酮类。

苯乙烯易自聚生成聚苯乙烯(PS)树脂。

也易与其他含双键的不饱和化合物共聚。

苯乙烯最大用途是生产聚苯乙烯,另外苯乙烯与丁二烯、丙烯腈共聚,其共聚物可用以生产ABS工程塑料;与丙烯腈共聚可得AS树脂;与丁二烯共聚可生成丁苯乳胶或合成丁苯橡胶。

此外,苯乙烯还广泛被用于制药、涂料、纺织等工业。

2苯乙烯工艺2.1苯乙烯装置工艺技术路线苯乙烯装置可分为乙苯,苯乙烯两个主要部分,其中乙苯部分的工艺技术路线可选择的技术分为:高浓度液相法、低浓度液相法、气相法、催化蒸馏法。

苯乙烯部分的工艺技术路线可选择的技术分为:绝热脱氢法、氧化脱氢法、环氧丙烷制苯乙烯法。

我国苯乙烯市场分析

华北石油管理局石化厂

8.0 国内负压绝热技术

山东大王华星

8.0 国内负压绝热技术

广州石化

8.0 菲纳/巴杰尔

蓝星石油大庆分公司

8.0 催化干气制乙苯

兰州石化

6.0 国内负压绝热技术

抚顺石化

6.0 国内负压绝热技术

上海高桥石化

5.0 鲁姆斯乙苯技术

广东中山南荣化工

5.0 国内负压绝热技术

新加坡 SP 化学公司(泰兴) 32.0

受国家各类扶持政策影响, 国内苯乙烯下游 PS、ABS、 丁苯橡胶等生产企业均摆脱了 2008 年经 济危机时期的困境,从而增加对苯乙烯的消费,这是 2009 ~2010 年 国 内 苯 乙 烯 行 业 发 展 的 最 大 动 力 。 2010 年中国苯乙烯下游对苯乙烯需求总量达到 660 万吨,较 2008 年同期有较大增长,随着经济的好转 苯乙烯需求量将继续上升。

- 42 -

市场纵览 精细化工原料及中间体

2012 年第 1 期

我国苯乙烯市场分析

1. 产能 近年,我国苯乙烯生产加快发展,近期有不少装

置 投 产 。 2008 年 我 国 苯 乙 烯 主 要 企 业 总 产 能 为 317.4 万 吨/年 ,2009 年 主 要 企 业 总 产 能 为 382.4 万 吨/年, 截至 2010 年我国苯乙烯生产企 业 有 20 多 家 , 总 产 能 605.9 万 吨 /年 , 约 占 世 界 总 产 能 的 16.2%,主要生产企业状况见表 1。

研究表明,中国已成为世界上重要的 GDL 出口 国。 2010 年国内 GDL 出口量约 2,700 吨。 此外,2011 年 上 半 年 ,出 口 量 上 升 到 约 2,100 吨 ,比 2010 年 上 半年增长了 68%。 2010 年,埃及,德国和韩国是中国 GDL 出口的前三位国家。

2024年苯乙烯市场发展现状

2024年苯乙烯市场发展现状1. 简介苯乙烯(Styrene)是一种广泛应用于塑料、橡胶、异丁橡胶、纤维以及抗冲击材料等行业的重要化工原料。

近年来,随着全球经济的发展和人口的增长,苯乙烯市场呈现出稳步增长的趋势。

本文将对苯乙烯市场的发展现状进行分析和概述。

2. 市场规模根据市场研究数据,苯乙烯市场的规模不断扩大。

目前,全球苯乙烯市场总量稳定在XX万吨左右。

亚太地区是全球苯乙烯市场的主要消费地区,其市场占有率约为XX%。

欧洲和北美地区也是苯乙烯市场的重要消费地区。

3. 市场发展趋势3.1 技术进步随着化工技术的不断创新和进步,苯乙烯生产工艺得到了改进。

新的生产工艺可以提高苯乙烯的产量和质量,并降低生产成本,从而推动了苯乙烯市场的发展。

3.2 产品应用拓展苯乙烯广泛应用于塑料、橡胶等行业,而随着科技进步和消费升级,苯乙烯的应用领域也在不断拓展。

例如,苯乙烯被用于制造高性能聚合物材料,具有抗冲击、耐磨、耐高温等特性,满足不同行业的需求。

3.3 市场竞争格局苯乙烯市场存在激烈的竞争,主要由少数大型化工企业垄断。

这些企业拥有先进的生产技术和规模经济效应,使得市场竞争对手面临较大压力。

然而,随着新的市场参与者的进入,市场竞争格局可能会发生变化。

4. 影响因素苯乙烯市场的发展受到多种因素的影响。

4.1 经济环境全球经济的增长与发展对苯乙烯市场需求起到重要影响。

经济繁荣时期,消费者对塑料、橡胶等产品的需求增加,从而推动了苯乙烯市场的发展。

4.2 政策法规政府的政策法规对于苯乙烯市场的发展至关重要。

环保政策的实施和化工行业的限制性政策,可能对苯乙烯市场带来一定的影响。

4.3 原材料供应苯乙烯的主要原料为苯,苯的供应状况直接影响苯乙烯市场的发展。

原料供应紧张或价格波动可能导致苯乙烯市场的不稳定。

4.4 环保关注随着环境保护意识的提高,消费者对于环保产品的需求也在增加。

苯乙烯市场需要注重环境友好型产品的研发和生产,以满足市场需求。

苯乙烯的生产现状及工艺进展

苯乙烯的生产现状及工艺进展李建韬;金月昶;金熙俊【摘要】介绍了2013年国内外苯乙烯的生产和市场情况,简要分析和预测苯乙烯的市场发展趋势。

苯乙烯的3种主要生产方法为催化脱氢法,乙苯共氧化法,选择氧化脱氢法。

详细介绍了各种生产技术的流程及特点,并指出各自的不足之处。

%Production and market conditions of styrene in 2013 at home and abroad were introduced; the styrene market trend was analyzed and forecasted. The three main production methods of styrene are catalytic dehydrogenation, ethylbenzene co-oxidation and selective oxidative dehydrogenation. The process flows and technology characteristics of the three methods were discussed, and their disadvantages were pointed out.【期刊名称】《当代化工》【年(卷),期】2015(000)002【总页数】4页(P359-362)【关键词】苯乙烯;生产;市场;技术进展【作者】李建韬;金月昶;金熙俊【作者单位】辽宁石油化工大学,辽宁抚顺 113001;中国寰球工程公司辽宁分公司,辽宁沈阳 110000;中国寰球工程公司辽宁分公司,辽宁沈阳 110000【正文语种】中文【中图分类】TQ241苯乙烯(C8H8,SM)作为一种重要的基本有机化工原料,其应用十分广泛。

主要用来生产聚苯乙烯(PS)树脂,丙烯腈-丁二烯-苯乙烯(ABS)树脂,苯乙烯-丙烯腈共聚物(SAN)树脂,丁苯橡胶(SBR),不饱和聚酯,离子交换树脂等。

国内外苯乙烯市场概况

国内外苯乙烯市场概况1.现状及发展趋势中国苯乙烯产业近年来得到迅速发展,成为世界上最大的苯乙烯消费国和第二大生产国。

中国苯乙烯年产能已达到3000万吨以上,产能利用率持续提高。

苯乙烯市场表现出稳定增长的趋势。

2.产能和产量中国苯乙烯产能快速增长,主要集中在东部沿海地区。

目前,中国苯乙烯年产能已超过3000万吨。

随着新建项目的不断投产,产能进一步增加。

同时,中国苯乙烯年产量也持续增长,已超过2000万吨。

3.占有率和市场份额中国苯乙烯消费市场规模持续扩大,占据了全球苯乙烯消费市场的重要份额。

中国苯乙烯对国际市场的需求量巨大,其对全球苯乙烯市场的影响力不断增强。

4.进出口情况5.价格波动中国苯乙烯市场价格受到全球市场供需状况、原油价格以及国内产能利用率影响较大。

价格波动较为频繁,但总体呈现稳定增长趋势。

6.应用领域苯乙烯是一种广泛应用于化工行业的重要化工原料,被广泛用于合成聚苯乙烯、合成橡胶、合成纤维、合成塑料等领域。

其中,聚苯乙烯是最主要的应用领域,占据了苯乙烯总需求量的较大比例。

1.现状及发展趋势国际苯乙烯市场也呈现出稳步增长的趋势。

全球苯乙烯产能已经超过6000万吨,产能利用率较高。

各国不断加大苯乙烯生产能力和扩大市场规模的投资。

2.产能和产量全球苯乙烯产能主要集中在亚洲地区,其中中国是最大的苯乙烯生产国。

其他重要苯乙烯生产国包括美国、韩国、日本和中国台湾等。

全球苯乙烯产量持续增长,已超过5000万吨。

3.市场份额亚洲地区是全球苯乙烯市场的重要区域,中国苯乙烯消费量占据了亚洲市场的较大份额。

除了亚洲地区,欧洲和北美地区也是苯乙烯市场的重要消费地区。

4.进出口情况全球苯乙烯贸易量较大,进出口量都达到一定规模。

主要进口国包括中国、美国、荷兰和韩国等,主要出口国包括美国、韩国和中国等。

5.价格波动全球苯乙烯市场价格受到全球市场供需关系、原油价格以及地缘政治等因素的影响。

价格波动较大,但总体呈现稳步增长的趋势。

国内外苯乙烯的供需现状与发展前景

苯乙烯单体(Styrene Monomer,简称SM)是石油化工的基本原料,主要用来生产各种合成树脂和弹性体。

聚苯乙烯(PS)是苯乙烯最大的下游衍生物,分为通用级聚苯乙烯(GPPS)、高抗冲级聚苯乙烯(HIPS)、可发性聚苯乙烯(EPS)。

其他的下游衍生物包括丙烯腈-丁二烯-苯乙烯(ABS)树脂、苯乙烯-丙烯腈(SAN)树脂,不饱和聚酯树脂(UPR),丁二烯-苯乙烯橡胶(SBR)以及丁二烯苯乙烯乳液(SBL)等。

这些产品广泛用于汽车制造、家用电器、玩具制造、纺织、造纸、制鞋等工业部门。

此外,它还可以作为医药、农药、染料和选矿剂的中间体,用途十分广泛。

一、世界苯乙烯的供需现状及预测(一)生产现状由于PS和ABS树脂等苯乙烯下游产品消费的强劲增长,近年来世界苯乙烯的生产发展很快。

苯乙烯生产能力的增长远高于需求的增长。

这一方面是受到亚洲地区新建能力不断增加的影响,同时也是中东地区大力发展石化业,乙烯配套大型苯乙烯装置不断所导致,苯乙烯的发展重心不断向亚洲及中东地区转移。

2011年,世界苯乙烯产能约为3243万吨/年。

预计2012年世界苯乙烯总生产能力将超过3255万吨/年,主要分布在东北亚、北美及西欧地区,具体产能分布情况见图1。

中国是世界上最大的苯乙烯生产国家,截至2012年10月,中国苯乙烯生产能力为655.6万吨/年,占世界总生产能力的20%;其次是美国,生产能力约489万吨/年,占总生产能力的15%;第三和第四分别是日本和韩国,其生产能力分别为300万吨/年和287万吨/年,各占世界总生产能力的9.2%和8.8%。

2012年世界主要苯乙烯生产厂家情况见表1。

表1 2012年世界苯乙烯主要生产厂家及生产能力截至2012年10月,东北亚(产能占比为44%,下同)、东南亚(6%)、北美(18%)和西欧(17%)合计占全球苯乙烯生产能力的85%。

近年来,中国苯乙烯产能的迅速扩大和北美、西欧装置的不断关闭,使得亚洲的苯乙烯产能占据世界产能的一半。

PO_SM项目前景浅析

PO/SM项目前景浅析发布时间:2021-04-22T12:30:57.010Z 来源:《科学与技术》2021年3期作者:杨涛宁继伟[导读] 环氧丙烷/苯乙烯共氧化法(PO/SM工艺)是生产环氧丙烷的主要路线之杨涛宁继伟(天津大沽化工股份有限公司,天津 300450)摘要:环氧丙烷/苯乙烯共氧化法(PO/SM工艺)是生产环氧丙烷的主要路线之一,该工艺采用乙苯过氧化物作为中间产物,以丙烯和乙苯为原料生产环氧丙烷和苯乙烯,本文通过对环氧丙烷和苯乙烯产品的市场情况摸底,结合成本、区位以及效益方面的优势分析,对PO/SM项目前景进行浅析。

关键词:环氧丙烷;苯乙烯;项目前景Prospect analysis of PO/SM projectYang Tao Ning Jiwei(Tianjin Dagu Chemical Co., Ltd, Tianjin 300450)Abstract:Propylene Oxide and Styrene Monomer co-oxidation (PO/SM process) is one of the main routes of PO production; the process uses EBHP as an intermediate product, propylene and EB as raw materials to produce PO and SM. By this article, we analyze the prospect of the PO/SM project based on the market of PO and SM, combined with the analysis of advantages in cost, location and benefit.Key words: Propylene Oxide; Styrene Monomer; Prospect of the project1 POSM产品简介环氧丙烷(PO)作为重要的基本有机化工原料,其最大用途是生产聚醚多元醇作为泡沫体和非泡沫体聚氨酯原料,其次是用于生产丙二醇、非离子表面活性剂、油田破乳剂、农药乳化剂和显影剂等,其上下游产业链较长且终端应用覆盖面广。

2024年发泡聚苯乙烯市场需求分析

2024年发泡聚苯乙烯市场需求分析1. 引言发泡聚苯乙烯(Expanded Polystyrene,EPS)是一种重要的塑料材料,具有良好的绝缘性能、轻质和耐腐蚀性等特点。

随着全球经济的不断发展,发泡聚苯乙烯市场需求也逐渐增加。

本文将对发泡聚苯乙烯市场需求进行分析,以帮助相关企业了解市场趋势,制定合理的经营策略。

2. 市场需求概况发泡聚苯乙烯广泛应用于包装、建筑、交通工具、电子电器等领域。

目前,市场对发泡聚苯乙烯的需求主要集中在以下几个方面:2.1 包装行业需求发泡聚苯乙烯在包装行业具有良好的缓冲和保护性能,能够有效保护商品在运输和仓储过程中不受损。

随着电子电器、家具、日用品等行业的发展,对包装材料的需求也在不断增加,因此在包装行业的需求将持续增长。

2.2 建筑行业需求发泡聚苯乙烯在建筑行业中被广泛用于保温材料、隔热材料和装饰材料等方面。

近年来,随着人们对生活品质要求的提高和节能环保意识的增强,建筑行业对发泡聚苯乙烯的需求快速增长。

尤其是在一些寒冷地区,发泡聚苯乙烯保温材料的需求更为旺盛。

2.3 交通工具行业需求发泡聚苯乙烯在交通工具制造过程中常用于制造座椅、内饰和保温材料等部位。

随着汽车、航空和船舶等交通工具行业的快速发展,对发泡聚苯乙烯的需求也在不断增加。

2.4 电子电器行业需求发泡聚苯乙烯在电子电器行业中被广泛应用于包装材料、保护材料和绝缘材料等方面。

随着电子电器产品的持续创新和智能化趋势的加强,对发泡聚苯乙烯的需求也在稳步增长。

3. 市场需求驱动因素市场对发泡聚苯乙烯的需求增长主要受以下几个因素驱动:3.1 经济发展经济发展水平的提高将带动包装、建筑、交通工具和电子电器等行业的发展,从而增加对发泡聚苯乙烯的需求。

尤其是在发展中国家,经济增长的速度更为迅猛,对发泡聚苯乙烯的市场需求将继续保持高增长。

3.2 环保要求发泡聚苯乙烯作为一种轻质材料,符合节能环保的要求。

随着全球环保意识的提高,对节能减排和碳足迹的关注度不断增强,对发泡聚苯乙烯的需求将进一步增长。

苯乙烯生产技术及国内外市场前景

专论・综述弹性体,2005206225,15(3):53~59CHINA ELASTOMERICS收稿日期:2004-11-24作者简介:崔小明(1966-),男,江西宁都县人,高级工程师,学士,主要从事情报调研和信息研究工作,E -mail :cui1966@ 。

苯乙烯生产技术及国内外市场前景崔小明,李 明(中国石化北京燕山石油化工公司研究院,北京102500)摘 要:介绍了苯乙烯的生产方法,分析了国内外苯乙烯的供需情况,提出了发展我国苯乙烯生产的建议。

关键词:苯乙烯;生产;消费;市场分析中图分类号:TQ 241.2 文献标识码:A 文章编号:100523174(2005)0320053207 苯乙烯(SM )是一种重要的基本有机化工原料,主要用于生产聚苯乙烯(PS )树脂、丙烯腈-丁二烯-苯乙烯(ABS )树脂、苯乙烯-丙烯腈共聚物树脂(SAN )、丁苯橡胶(SBR )和丁苯胶乳(SBR 胶乳)、离子交换树脂、不饱和聚酯以及苯乙烯系热塑性弹性体(如SBS )等。

此外,还可用于制药、染料、农药以及选矿等行业,用途十分广泛。

1 苯乙烯的生产方法目前,世界上苯乙烯的生产方法主要有乙苯脱氢法、环氧丙烷-苯乙烯联产法、热解汽油抽提蒸馏回收法以及丁二烯合成法等。

1.1 乙苯脱氢法[1,2]乙苯脱氢法是目前国内外生产苯乙烯的主要方法,其生产能力约占世界苯乙烯总生产能力的90%。

它又包括乙苯催化脱氢和乙苯氧化脱氢两种生产工艺。

1.1.1 乙苯催化脱氢工艺乙苯催化脱氢是工业上生产苯乙烯的传统工艺,由美国Dow 化学公司首次开发成功。

目前典型的生产工艺主要有Fina/Badger 工艺、ABB Lummus/UOP 工艺以及BASF 工艺等。

1.1.1.1 ABB Lummus/UOP 工艺用超加热器将蒸汽过热至800℃,与原料乙苯一起进入绝热反应器。

脱氢条件为:反应温度550~650℃;常压或负压;蒸汽和乙苯质量比为(1.0∶1)~(1.5∶1)。

MSDS 苯乙烯

张明亮(广东寰球广业工程有限公司,广东广州510130)摘要:苯乙烯是不饱和芳烃,在常温下就能发生缓慢热激发的聚合反应,此聚合过程是一个放热反应,如果物料温度不能控制,聚合反应速度将加快,生成更多的聚合物,由此可见,苯乙烯的这些负面反应将会影响苯乙烯的存储和运输安全,同时影响苯乙烯的质量.所以,正确的设计苯乙烯的储运工艺系统非常重要.本文从苯乙烯的特性出发,分析影响苯乙烯储运各种因素,全面总结了苯乙烯储运应采取的切实可行的措施.关键词:苯乙烯;储运;措施;聚合;阻聚剂1 概述苯乙烯,简称SM,是合成高分子材料的重要原料,也是石油化学工业行业的基础原料.其主要用于生产苯乙烯系系树脂及丁苯橡胶也是生产离子交换树脂及医药品的原料之一,此外,苯乙烯还可以用于制药、染料、农药以及选矿等行业.可以说苯乙烯是化学工业中最重要的单体之一,应用广泛,近年来的需求发展增加旺盛.2 苯乙烯的物性及危险性苯乙烯分子式C8H8,分子量104.14,是无色透明带有强烈的令人不愉快气味的液体,易燃.比重0.909,沸点145.2℃,闪点31 ℃(开杯法),燃点490 ℃,爆炸极限 1.1~6.1%(体积),蒸气压1.3mmHg(13 ℃),粘度0.781cP(20 ℃).不溶于水,能与乙醇、乙醚、丙酮、二硫化碳等各种烃类、氯代烷等互溶.在空气中受氧气的作用,容易产生聚合,在引发剂和热作用下聚合为聚苯乙烯.苯乙烯对人体有较严重影响,如大气中苯乙烯的浓度超过400ppm,对人的眼睛和呼吸系统有强烈的刺激作用,如浓度超过1000ppm则会破坏人的神经功能,严重损坏肺功能,人在这种环境中停留30-60秒即可引起死亡.苯乙烯属于易燃易爆液体,当环境温度高于31 ℃可形成爆炸性蒸汽和空气混合物.苯乙烯单体在氧气或空气存在下会形成一种较强引发活性的过氧化物,它能有在较低温度下、短时间内引发聚后.同时苯乙烯受热自身也会发生聚合.3 苯乙烯储运存在的问题苯乙烯在储运过程中由于发生聚合反应,聚合反应是放热反应,如果热量不能迅速得到释放,苯乙烯会继续升高,聚合物就会增加,同时放出更多的热量,使反应更加剧烈,最后发展到反应无法自控,一般认为反应能自控的最高温度为65℃,温度超过65℃后由于反应不能自控,温度将持续上升,温度升高到110 ℃左右时反应急剧进行,容易形成暴聚,快速的暴聚过程可能使苯乙烯储罐爆裂危及储存的安全.随着分子量的增大苯乙烯粘度也随之增大并逐渐变成粘稠物,并沉积在储罐底部,容易堵塞储罐管线出口及输送管道,造成生产运输困难,严重还会影响罐区安全.苯乙烯的聚合还会影响产品的质量.按照工业用苯乙烯标准(GB3915-1998)对苯乙烯质量的要求(见表1),聚合物含量是产品主要质量指标,优级品的聚合物含量应小于10mg/kg,合格品的聚物含量应小于50mg/kg,当聚合物含量超过15mg/kg时,将对苯乙烯的色度和透明度产生不利影响,并且由聚合物含量高的苯乙烯单体做原料,经其空形式聚合反应生产的聚合产品其韧性会降低,直接冲击下游产品质量.因此,苯乙烯的安全储运对于安全生产及从经济角度来说有着重大的意义.表1 苯乙烯产品主要质量指标(GB3915-1998)图片14 苯乙烯储运过程中应采取的重要措施苯乙烯的储存主要是防止苯乙烯发生聚合发应,控制好苯乙烯的质量,同时由于苯乙烯具有毒性,设计时应选用密封性能较好的泵、阀设备材料,避免苯乙烯因泄漏造成对环境的污染以及泄漏的苯乙烯发生聚合反应产生的聚合物堵塞管道及阀件.主要可以采取以下措施:4.1加入适量的阻聚剂根据国标GB3915-1998,苯乙烯中阻聚剂的含量可控制在10-50ppm的范围内,南方地区气温较高,夏天控制在20-30ppm范围内,冬天控制在15-25ppm范围内,最底含量不应低于10ppm.从理论上说,在理想条件下,10-15ppm的阻聚剂(TBC)含量足可以使苯乙烯储存3个月.阻聚剂能降低苯乙烯的自聚速率,但其本身也有消耗,应定其检测产品中阻聚剂的含量,如阻聚剂含量降低应及时进行补充.4.2控制储存温度苯乙烯储存时应控制的诸多因素中,温度是最重要的,温度升高聚合物产生的速度明显加快,阻聚剂消耗显著增加,储存时间缩短.图1显示的是阻聚剂(TBC)的含量与温度和储存时间的关系图.图中可看出,储存温度越低,所需的阻聚剂含量越低,储存时间越长.苯乙烯储罐要有冷冻和保温措施使苯乙烯在低温下储存,综合考虑储运成本,在实际储运中,苯乙烯储存温度为18℃比较适宜.苯乙烯储运的温度控制应从以下几个方面着手:a. 苯乙烯储罐及管道应做保冷;苯乙烯储罐及管道可采用聚氨酯或玻璃棉作为保冷材料,防止冷量的散失.b. 设置苯乙烯外循环冷冻系统;苯乙烯采用外循环冷却系统通过外部换热器冷却循环,对储罐内的苯乙烯进行制冷.苯乙烯采用7℃循环冷冻水进行冷冻,冷冻换热器宜采用列管式,苯乙烯走管程,冷冻水走壳程.苯乙烯外循环冷冻系统图见图2:为了避免储罐内的苯乙烯冷却不均匀,储罐上循环管线的进口应远离出口,并最好把进口设置于罐顶.4.3 苯乙烯储罐氮气保护苯乙烯所用的阻聚剂是需氧型阻聚剂,氧气的存在有利于阻聚剂发挥作用,然而,过多的氧又使苯乙烯生成过氧化物,这些过氧化物在一定条件下分解成自由基和醛类,因此过氧化物不仅可以促进苯乙烯聚合还可以使产品中的醛含量增加.苯乙烯遇水也会更速自聚的速率,所以有必要采取氮气保护的措施,控制储罐内的氧气含量,隔离空气中的水份进入储罐.氮封系统采用氮气纯度为95%,而苯乙烯阻聚剂所需的氧可通过进罐前与空气的接触获得.苯乙烯储罐一般采用常压固定顶罐,设计压力为-490~1960Pa,罐顶设置呼吸阀.氮气从罐顶引入,通过安装于氢气管道上的自力式调节阀控制氮气进入储罐的压力.苯乙烯储罐氮封系统图见图3.从界区来的0.6MPa氮气经过减压阀后减压到0.2MPa,外后进入自力式调节阀,从自力式调节出来的氮气压力不高于1960Pa.苯乙烯储罐采用氮气保护,有效地阻止了空气中的氧气与储罐内的苯乙烯进行接触,防止苯乙烯冷凝聚合物对呼吸阀或安全阀积聚而造成堵塞,同时,氮封还减少苯乙烯蒸气挥发而污染环境,起到安全环保的作用.4.4减少铁锈对苯乙烯产品质量的影响铁锈对苯乙烯产品中聚合物生成量影响较大,这是因为在有氧存在的条件下,苯乙烯通过Fe2+离子的催化作用,产生过氧化物,随着温度的升高过氧化物又促进聚合物的生成.苯乙烯的储罐及管道的材质多是采用碳钢,为减少苯乙烯产品铁锈的含量,储罐及管道在施工时应彻底做好除锈工作,最好储罐做内防腐,苯乙烯在进罐前设置过滤器.4.5 苯乙烯长距离管线输送应注意问题化工储运项目的液体化工品一般是通过化工船从码头运进,部份项目由于地理位置的限制,码头与库区的距离较远,造成化工品装卸管线较长,当输送苯乙烯时,冷量损失较大,使管道内苯乙烯的温度升高发生聚合反应而影响流动性及产品质量,所以在应进一步提高苯乙烯的冷冻能力,控制苯乙烯输送温度.苯乙烯管道输送完毕后应尽快对管线进行吹扫干净,避免残留在管道上的苯乙烯发生聚合反应而堵塞管道.苯乙烯管线的吹扫可以采用氮气作为推动价质,用隔离清扫球将管道中的苯乙烯顶出,反复多次,直至管道清理干净为止.结论苯乙烯是一种较特殊的化工产品,其储存条件较为复杂,但只要控制好储存及运输的温度、适当加入阻聚剂、控制含氧量和铁锈含量,就能有效防止苯乙烯发生聚合、保证产品的质量、防止安全事故的发生.参考文献[1] 国家医药管理局上海医药设计院,化工工艺设计手册,化学工业出版社,1991.[2]宣征南、韩建宇,苯乙烯储存及设备改良,广东石油化工高等专科学校学报,1999年11月.[3]王梅海、范建伟、石永军、高洪波、周建民,苯乙烯储存过程中聚合原因分析及对策,齐鲁石油化工,2003,31(2).。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

5

SM prices and margins very strong in 2013

1850

1800

1750

1700

1650

$/mt

1600 Break even FOB Korea 1550

1500

1450

1400

Source: Platts

6

2014: Fundamentals change

• Japan will lose at least 340,000-400,000 mt/year of SM exports from March 2016, with the closure of a combined 745,000 mt/year production capacity at Chiba and Mizushima.

12

• • • • •

Japan cuts back on SM capacity

Japanese SM plants to shut (in '000 mt/year): COMPANY • Nihon Oxirane • Asahi Kasei LOCATION CAP. Chiba 425 Mizushima 320 Shutting May 2015 March 2016

9

Many turnarounds should trim supply.

• At least 14 planned maintenances at Asian SM plants in the first half of 2014 leading to estimated production loss of about 400,000 mt. • Including unexpected outages in Q1, the loss should be close to at least 430,000 mt. • 5 of Japan’s 6 SM producers to shut 9 out of a total 10 plants this year. • But not as many turnarounds in the US and Europe planned as in 2013, meaning global tightness unlikely to be as severe as last year.

13

Conclusion

• Due to the enormous consuming power of China, any slowdown in its property market or wider economy is likely to affect the global market for SM as well as many other petrochemical products. • The outlook for China’s economy is unclear. • China is likely to become more self-sufficient in the years to come if planned SM expansions become a reality. • As Japan shuts SM plants, China expands its capacity, potentially leading to a change in trade flows.

7

Bearish factors: High China inventory

200000 180000 160000 140000 120000 100000 East China inventory 80000 60000 40000 20000 0

Source: Platts

8

Bearish factors: Benzene and the economy

• China imported relatively large amounts of arbitrage cargoes which arrived around the Lunar New Year holidays. • Low demand during Lunar New year combined with large imports led to a sharp rise in the inventory levels of SM in China – total over 300,000 mt in March. • Relatively much lower benzene and SM prices in China’s domestic market in February and March led to weak demand for imports. • But a relatively heavy TA season over Mar/Apr lends some support to prices, and domestic prices have been rising in April.

• Benzene prices could weaken on the back of additional supply from new paraxylene plants starting up in Asia. This could drag SM prices down as well. • Unclear outlook for China’s economy and the property market. • The World Bank recently revised its 2014 growth forecast for China down from 7.7% to 7.6% following a “bumpy start to the year”.

2

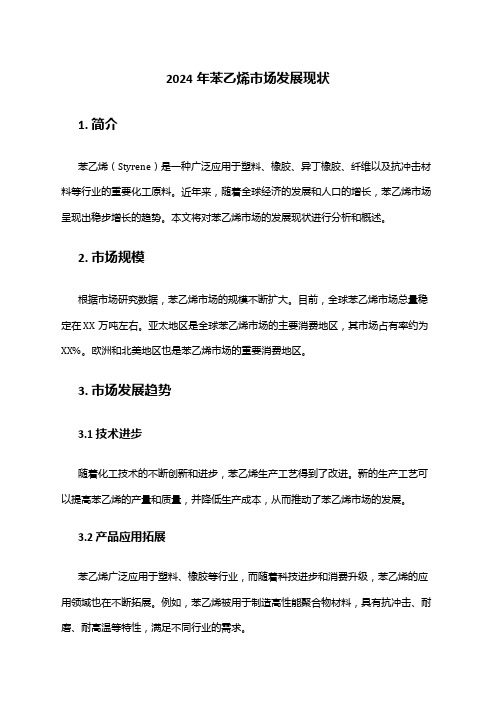

China is the engine of Asia SM demand

• China imported 3.7 million metric tonnes (mt) of SM in 2013, up 10% from 3.3 million in 2012. • Main sources of China’s imports are South Korea, Japan and the Middle East. • China demand is also important for US exporters: In February 2014, China imported over 75,000 mt from the US. • China is short of SM, but its domestic production is set to expand by 1.8 million mt/year by end of 2016.

3

China imports

China SM imports 2007-2013

4,000,000

3,500,000

3,000,000

2,500,000

2,000,000

China imports

1,500,000

1,000,000

500,000

0 2007 2008 2009 2010 2011 2012 2013

Source: China customs

4

Downstream grew more than SM recently

• China’s downstream production capacity for expandable polystyrene (EPS), acrylonitrilebutadiene-styrene (ABS) and polystyrene (GPPS and HIPS) has increased over the last few years. • More ABS, PS and EPS capacities to start up in 2014 as well. • But Asian SM production capacity has been relatively stable last few years. • This contributed to supply tightness in 2013.

Will China slowdown impact SM demand?

By Gustav Holmvik, Editor April 16, 2014

© 2013 Platts, McGraw Hill Financial. All rights reserved.

Outline

• • • • • • • • China import demand Stable SM capacity vs. expanding downstream 2013: A very strong year for SM 2014: High inventory in China Bearish factors Bullish factors Outlook: Japan cuts back, China expands Conclusion

14

Thank you! 谢谢!

Gustav Holmvik, Editor, Asian Styrenics Markets

© 2013 Platts, McGraw Hill Financial. All rights reserved.

15

10

US to Asia arbitrage shut until recently

1900 1850

1800

1750 1700 1650 CFR China 1600 1550 1500 1450 1400 FOB US Gulf