国际支付与结算Exercise one

国际结算作业一答案

支票

本票

支付条款

付款命令

付款命令

付款的承诺

主要参与方

3个基本当事人

3个基本当事人

2个基本当事人

期限

即期或远期

即期

即期或远期

第一责任人

出票人(承兑前),承兑人(承兑后)

出票人

出票人

受票人

贸易对象,银行

银

一张

一张

特殊票据行为

承兑

划线

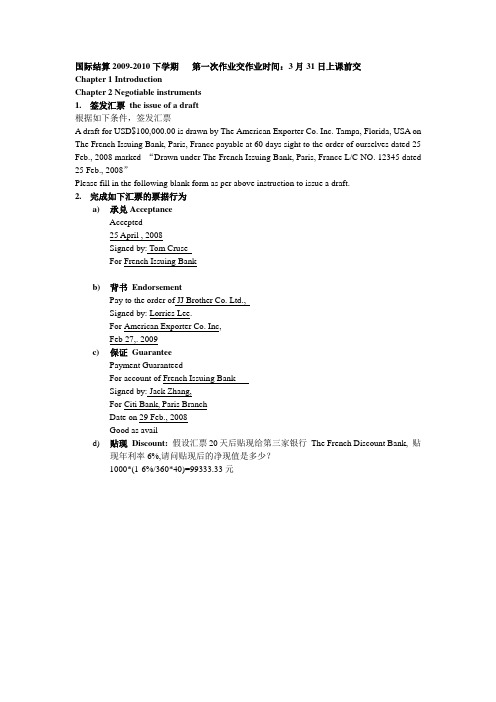

a)What’s the criteria for recourse, and explain it with an example.什么是票据的追索(recourse)行为?其追索条件是什么?请举例说明。

PaymentGuaranteed

For account ofFrench Issuing Bank

Signed by:JackZhang,

ForCiti Bank,ParisBranch

Date on29 Feb.,2008

Good asavail

d)贴现Discount:假设汇票20天后贴现给第三家银行The French Discount Bank,贴现年利率6%,请问贴现后的净现值是多少?

4)、追索金额:包括被拒付的票据金额、票据金额自到期日至付款日的利息、取得有关拒绝证明和发出通知书的费用。

b)What’s guarantee? What’s the responsibility of a guarantor?什么是票据的保证(guarantee/aval)行为?保证人的权利和义务是什么?

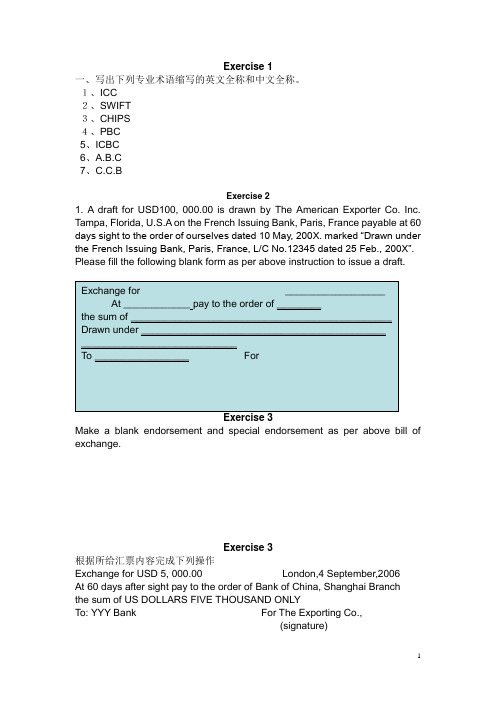

Question:Please draw a demand draft to make remittance by D/D.空白银行汇票如下

国际商务中的支付与结算方式

国际商务中的支付与结算方式在国际商务中,支付与结算方式是一项重要的环节。

随着全球化的推进,各国之间的贸易往来日益频繁,因此支付与结算方式的选择显得尤为重要。

本文将就国际商务中的支付与结算方式展开讨论,以帮助读者更好地了解其在国际贸易中的作用与应用。

一、现金支付现金支付是最常见的一种支付方式,也是最基础的支付方式。

它以货币流通形式来进行交易,便于双方交易的及时完成。

然而,在国际商务中,现金支付并不常见,主要原因有两点。

首先,现金支付需要双方实际交付现金,存在物流和安全隐患。

其次,涉及跨国交易时,存在不同货币之间的兑换问题,可能增加交易的复杂性和风险。

二、电汇电汇是一种通过银行进行资金的转移和结算的方式。

在电汇中,双方买卖双方的银行账户通过电子方式联系起来,实现资金的转账和结算。

电汇的优点在于快捷,可以在几分钟内完成资金的划转。

此外,电汇使用的是银行的信用,具备一定的安全性,适用于小额交易。

然而,电汇也有其缺点,比如手续费比较高,且转账过程中可能会出现延迟等问题。

三、托收托收是一种将买卖双方的交易文件和付款文件委托给银行处理的方式。

在托收中,卖方将出口商品的相关文件和收款指令提交给本地银行,由本地银行联系买方的银行进行结算。

托收的优点在于能够解决信用风险和货款获取问题,同时也减少了货物交付和货款付款之间的时间差。

然而,和电汇一样,托收也存在一些缺点,比如手续繁琐、周期较长等。

四、信用证信用证是一种由卖方指定的银行对买方发出的、保证在一定条件下支付一定金额给卖方的文件。

信用证的使用可以解决国际贸易中的付款和履约风险,保证双方交易的可靠性和安全性。

在信用证中,买方向银行开立信用证,卖方在交货后向银行索取货款。

尽管信用证增加了交易的复杂性和成本,但由于其可靠性和安全性,信用证在国际商务中得到了广泛应用。

五、票据票据是商业交易中常用的支付和结算工具,包括汇票、本票、支票等。

票据的使用便于双方之间的付款和结算,同时也有一定的法律保障。

跨境电商的国际支付和结算方式

跨境电商的国际支付和结算方式随着全球化的发展和互联网的普及,跨境电商逐渐成为了一种新型的商业模式,为消费者提供了更多选择和便利。

国际支付和结算方式作为跨境电商中至关重要的环节,既关乎商家的利润,也影响消费者的购物体验。

在跨境电商中,国际支付和结算方式的选择至关重要。

支付选择的合理性不仅直接影响到成交率和用户体验,还会涉及到资金安全和风险管理等方面。

目前主流的国际支付方式主要有信用卡支付、电子支付、支付宝、PayPal等。

每种支付方式都有其独特的优势和劣势,商家需要根据自身情况和目标市场选择合适的支付方式。

信用卡支付是最为传统和普遍的国际支付方式,在全球范围内被广泛接受。

信用卡支付方便快捷,适用范围广泛,但手续费较高,支付安全性也较差。

电子支付如支付宝和PayPal则在国际支付中逐渐崭露头角,其安全性和便捷性得到广泛认可。

尤其是亚洲市场对支付宝的接受度较高,PayPal则更受欧美市场青睐。

因此,选择适合目标市场的支付方式对于商家来说至关重要。

除了支付方式外,国际结算方式也是跨境电商中不可忽视的一个环节。

在进行国际结算时,商家可能面临不同币种间的兑换问题。

传统的结算方式如银行汇款虽然可靠,但手续费和时间成本较高。

随着区块链技术的发展,数字货币逐渐成为一种新型的国际结算方式。

使用数字货币进行跨境结算可以节省成本,加快结算速度,并提供更多的支付选择。

然而,由于数字货币的波动性较大,商家在使用数字货币进行结算时需要注意风险管理。

另外,了解目标市场的支付习惯和规定也是进行国际支付和结算的关键。

不同国家和地区有不同的支付习惯和规定,商家需要了解并遵守当地的法律法规。

同时,了解目标市场的消费者需求和习惯也有助于选择适合的支付方式和优化用户体验。

综上所述,国际支付和结算方式在跨境电商中起着举足轻重的作用。

商家需要根据自身情况和目标市场选择合适的支付方式,并在支付和结算过程中注意风险管理。

理解不同国家和地区的支付习惯和规定,以及关注新兴的支付技术趋势,都有助于提升跨境电商的竞争力和用户体验。

国际支付与结算答案-推荐下载

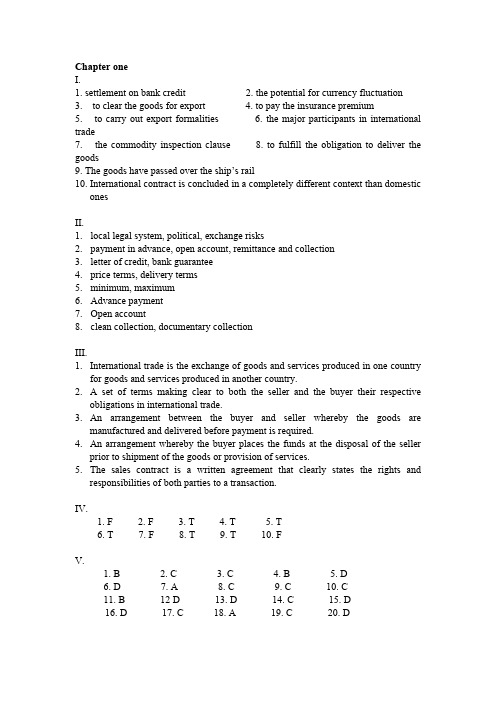

I.1. settlement on bank credit2. the potential for currency fluctuation3. to clear the goods for export4. to pay the insurance premium5. to carry out export formalities6. the major participants in international trade7. the commodity inspection clause 8. to fulfill the obligation to deliver the goods9. The goods have passed over the ship’s rail10.International contract is concluded in a completely different context than domesticonesII.1.local legal system, political, exchange risks2.payment in advance, open account, remittance and collection3.letter of credit, bank guarantee4.price terms, delivery terms5.minimum, maximum6.Advance payment7.Open account8.clean collection, documentary collectionIII.1.International trade is the exchange of goods and services produced in one countryfor goods and services produced in another country.2. A set of terms making clear to both the seller and the buyer their respectiveobligations in international trade.3.An arrangement between the buyer and seller whereby the goods aremanufactured and delivered before payment is required.4.An arrangement whereby the buyer places the funds at the disposal of the sellerprior to shipment of the goods or provision of services.5.The sales contract is a written agreement that clearly states the rights andresponsibilities of both parties to a transaction.IV.1. F2. F3. T4. T5. T6. T7. F8. T9. T 10. FV.1. B2. C3. C4. B5. D6. D7. A8. C9. C 10. C11. B 12 D 13. D 14. C 15. D16. D 17. C 18. A 19. C 20. DI.1.barter2.medium of exchange3.expensive, risky4.our5.Vostro6.vostro7.nostro8.specimen of authorized signatures,telegraphic test keys, terms and conditions,Swift authentic keysII.1. A bank having direct connection or friendly service relations with another bank.2.International settlements are financial activities conducted among differentcountries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them.3.Visible Trade is the importing / exporting of commodities and goods between thebuyers and the sellers.4.Financial transaction refers to all kinds of foreign exchange market transactions,government supported export credits, syndicated loans, international bond issues, etc.5.Vostro account is an account held by a bank on behalf of a correspondent bank.III.mercial credit2.control documents3.account relationship4.cash settlement5.financial intermediaryIV.1. T2. F3. F4. T5. FV.1. B2. C3. D4. A5. D6. B7. B8. D9. A 10. BChapter ThreeI.1. generally crossed check2. specially crossed check3. a check that is out of date4. post dated check5. amount in words6. blank endorsement7. special endorsement 8. restrictive endorsement9. documentary bill 10. sight draft11. usance/term bill 12. acceptance bill13. determinable future date 14. clean bill15. negotiable instrument 16. discounting house17. merchant bank 18. unconditional promise of payment19. joint and severally responsible 20. payable 90 days after dateII.1. A negotiable instrument is a chose in action, the full and legal title to which istransferable by delivery of the instrument (possibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.2. A bill of exchange is an unconditional order in writing, addressed by one personto another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer.3. A check is an unconditional order in writing addressed by the customer to a banksigned by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer.4.It is a bill with shipping documents attached thereto.5. A crossing is in effect an instruction to the paying bank from the drawer or holderto pay the fund to a bank only.III.1. T2. F3. T4. T5. T6. F7. T8. T9. T 10. T 11. T 12. T 13. T 14. F 15. T 16. T 17. T 18. F 19. F 20. FIV.1. C2. A3. C4. B5. C6. B7. A8. C9. B 10. B 11. B 12. D 13. C 14. C 15. C16. B 17. B 18. A 19. A 20. C V.1.China National Crafts Import & Export Corp.2.ABC Company3.the Bank of China4.Tenor draft5.In two sets6.ShanghaiVII.Chapter FourI.1. beneficiary2. payment order, mail advice or debit advice3. the remittance amount is large,the transfer of funds is subject to a time limittest key4. sell it to his own bank crediting his account5. debitscredits6.demand draft7. act of dishonor8. Swiftness, reliability, safety, inexpensiveness9. debiting remitting bank’s nostro account10. delivery of the goodsII.1. I nternational remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the remitting bank’s overseas branch or its correspondent with a nostro account.2. Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.3. A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.4. A banker’s demand draft is a negotiable instrument drawn by a bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.5. Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.III.1.remittance advice2.outward remittance3.international money order4.current account5.automated payment system6.in cover7.letter of indemnity8.mail advice9.non-negotiable copy of draft10. down paymentIV.1B 2C 3A 4B 5D6 D7 B8 C9 B 10 DChapter FiveI.1. presenting bank2.title documents, pays the draft, accepts the obligation to do so.3.legal, the exchange control authorities4. the payment is made5. open account, advance payment,5.inward collection7. the remitting bank8. trust receipt9. D/P at sight10.documents, draft, and collection orderII.1. Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one ofits correspondent banks located in the domicile of the buyer.2. The case of need is the representative appointed by the principal to act as case ofneed in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.3. Documentary collection is a collection of financial instruments being accompaniedby commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a billof exchange. Alternatively, the documentary collection is a payment mechanismthat allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.4. Outward collection is a banking business in which a bank acting as the remittingbank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.5. Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.III.1.cash against documents2. trade acceptance3. case of need4. bill purchased5. title document6. on consignment7.direct collection8. shipping documents9. documents against payment10. time/ tenor/term/ usance draftIV.1A 2B 3C 4A 5B6 A7 C 8A 9 A 10 D Chapter SixI.1.The Documentary Credit or letter of credit is an undertaking issued by a bank forthe account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with.2. A credit that carries the commitment to pay by both the issuing bank and theadvising bank.3. A credit by which, under the terms and conditions thereof, the amount is renewedor reinstated without specific amendments to the documentary credit being required.4.A bank, usually the advising bank, which adds its undertaking to those of theissuing bank and assumes liability under the credit.5.The applicant is always an importer or a buyer, who fills out and signs anapplication form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.II.1. F2. T3. T4. F5. T6. F7. F8. T9. T 10. F 11. T 12. T 13. F 14. F 15. TIII.1.silent confirmation2.to expire at the counters of the issuing bank3.to pay against documents presenting the goods4. A credit places a bank’s credit instead of commercial credit.5. A credit stands independent of the sales contract.IV.1. B2. C3. D4. B5. A6. D7. D8. C9. C 10. C 11. D 12. D 13. A 14. D 15. B 16. D 17. D 18. D 19. A 20. B Chapter SevenI.pleteness, correctness, consistency2.underlying transaction3.authorized signatures, test keyply with, be consistent5.ISO currency codeII.1.apparent authenticity of the credit2.international standard banking practice3.data communication network4.to have sufficient funds to cover the credit5.It is equally important that the buyer’s own requirements be taken into account. III.1. F2. F3. F4. T5. T6. T7. F8. T9. F 10. TIV.1. B2. D3. C4. B5. C6. C7. A8. A9. D 10. D 11. A 12. D 13. D 14. A 15. B Chapter EightI.1.The commercial invoice is the key accounting document describing thecommercial transaction between the buyer and the seller. It is a document giving details of goods, service, price, quantity, settlement terms and shipment.2.An export license is a document prepared by a government authority of a nationgranting the right to export a specific quantity of a commodity to a specified country.3. A bill of lading is a document issued by a carrier to a shipper, signed by thecaptain, agent, or owner of a vessel, providing written evidence regarding receipt of the goods, the conditions on which transportation is made, and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading.4. A document issued by an authority indicating that goods have been inspected priorto shipment and the results of the inspection.5. A consular invoice is an invoice covering a shipment of goods certified in thecountry of export by a local consul of the country for which the merchandise is destined.II.1.strategic commodity2.General System of Preference3.with reserved berth4.multi-modal transport bill of lading5.sampling methodologyIII.1. F2. F3. T4. T5. F6. F7. F8. T9. T 10. FIV.1. A2. B3. D4. A5. C6. C7. C8. C9. C 10. D11. A 12. D 13. D 14. A 15. A 16. A 17. B 18. A 19. C 20. D Chapter NineI.1.acceptable accounts receivablenon-recourse and notification2. collection as well as the risk of credit losses3. the level of sales4. changes in the world economic structure5. growing demands6. purchasing the client’s accounts receivables7.financial and administration8.the invoice datethe customer makes his payment.9.market conditions and his assessment of the risks involved in a particulartransaction.10. fluctuations in the exchange ratein the status of the debtorII.1. Factoring is a form of trade financing that allows sellers to sell their products to overseas buyers essentially on an open account basis. In simple terms, factoring is the purchase of claims, arising from sales of goods, by a specialized company known as factoring company or factor. Factoring is in fact a three-party transaction between the factor and a business entity, i.e. the exporter selling goods or providing services to foreign the importer.2. Forfaiting is the term generally used to denote the purchase of obligations falling due at some future date, arising from deliveries of goods and services----mostly export transactions---without recourse to any previous holder of the obligation. Simply speaking, forfaiting is the business of discounting medium-term promissory notes or drafts related to an international trade transaction.III.1. contingent liability2. credit limit3. supplier credit4. without recourse5. credit approval6. capital goods7. buyer credit guarantee8. forfait facility9. trade barrier10. bulk purchase discountIV.1. B2. A3. D4. C5. DChapter TenI.1.secure mechanism for paymentdefault instrument2.party tenderingthe contract has been awarded3. presentation of the beneficiary's demand and stipulated documentation4. issue a guarantee directly to the beneficiary5. Unconditional bonds6. withdraw its bidaccept the award of contract in its favorbetween 2% and 5%7.UCP for documentary creditsUniform Rules for Demand Guarantee.8.An advance payment9.borrower (the principal)the lender (the beneficiary)10. counter indemnityII.1. A bank guarantee is an instrument for securing performance or payment especially in international business. It is a written promise issued by a bank at the request of its customer, undertaking to make payment to the beneficiary within the limits of a stated sum of money in the event of default by the principal. It may also be defined as an independent obligation where the guarantor has to make a special agreement with its customer, ensuring that it will be refunded by him for any payment to be effected under the contract of guarantee.2. A beneficiary is the party in whose favor the guarantee is issued. He is secured against the risk of the principal’s not fulfilling his obligations towards the beneficiary in respect of the underlying transaction for which the demand guarantee is given. He will not obtain a sum of money if the obligations are not fulfilled.3. An indirect guarantee is a guarantee where a second bank, usually a foreign bank located in the beneficiary's country of domicile, will be requested by the initiating bank to issue a guarantee in return for the latter's counter-guarantee.4. A performance bond is an undertaking given by the guarantor at the request of a supplier of goods or services or a contractor to a buyer or beneficiary, whereby the guarantor undertakes to make payment to the beneficiary within the limit of a statedsum of money in the event of default by the supplier or the contractor in due performance of the terms of a contract between the principal and the beneficiary. 5. A standby letter of credit is a clean letter of credit that generally guarantees the payment to be made for an unfulfilled obligation on the part of the applicant. It is payable on presentation of a draft together with a signed statement or certificate by the beneficiary that the applicant has failed to fulfill his obligation.III.1.performance bond2. letter of guarantee3.counter indemnity4. accessory guarantee5.stand-by letter of credit6. engineering contracting7.underlying transaction8. demand guarantee9.deferred payment bond10. counter guaranteeIV.1. B2.A3. A4. D5. C6 B7 C8 D9 B 10 AChapter ElevenI.1.collection operations for drafts and for documentary collections2.all collections, “collection instruction”3.all Documentary Credits, Credit4.all Bank-to-Bank Reimbursements, Reimbursement Authorization.5.any demand guarantee and amendment thereto, Guarantee or any amendmentthereto.6.documents, goods, terms and conditions7.codification of rulesbanking practice regarding documentary credits8. international finance, trade, transportation and computer technology9.quite different from the practice of guarantee, banking and commercial10. bank-to-bank reimbursementsII.1.reimbursement claim2. arbitral award3. banking commission4. multi-transport5. reimbursement undertaking6. banking practices7. containerized traffic8. non-negotiable waybill9. tenor collection presentation10. International Chamber of CommerceⅢ.Time ofadoption/operationFull name Short name FeaturesICC Amsterdam Congress in 1929/ in 1930Uniform Rules forCommercialDocumentary CreditsICCpublicationNo.74.Put into practice by banks only in Paris andBelgium, yet still of great importance, giving auniform definition of documentary credit, andexplaining some terms and the rights andobligations of parties concerned.1933 ICC Vienna Congress /January 1, 1952Uniform Customs andPractice forCommercialDocumentary CreditsICCpublicationNo.82Accepted by banks throughout ContinentalEurope1951 ICC Lisbon Congress /in 1952.Uniform Customs andPractice forCommercialDocumentary CreditsICCpublicationNo.151Taking note of postwar American practice andthe necessity of altering certain matters.Securing the collective adherence of banks insome thirty countries. Published in French.1962 ICC Mexican City Congress/July 1, 1963Uniform Customsand Practice forDocumentary Credits(UCP)ICCpublicationNo.222Adopted by banks from more than 100countries. Published in English rather than inFrench, further making UCP become customsand practice worldwide.1974 ICC Madrid Congress/October 1, 1975Uniform Customsand Practice forDocumentary Credits(UCP)ICCpublicationNo.290Taking into account containerized traffic.Adopted by more than 160 countries.With 47articlesIn 1983/ October 1, 1984Uniform Customsand Practice forDocumentary Credits(UCP)ICCpublicationNo.400Reflecting the development of multi-transportation and containerized traffic, thefrequent use of non-negotiable waybills, theelectronic inter-bank communication and thedevelopment of stand-by letter of credit. With55 articles.In 1993/ January 1, 1994Uniform Customsand Practice forDocumentary Credits(UCP)ICCpublicationNo.500The current valid version with 49 articles.Ⅳ.1. B2. D3. C4. A5. DChapter TwelveI.1.payment information, transfer value2.confirmation number, confirmation help and notification3.for procedures and message formats, computer readablermation, value, net amount5. high speed and accuracy6. access to the system for the settlement of international money transfers7. faster, more reliable communication, lower transmission costs8. the international clearing house9. standardized formats10. inter-bank dollar-denominated, CHIPSII.1. cash positions2. bookkeeping entry3. financial intermediary4. customer transfers5. account reconciliation6. Fed Wire7. non-settlement bank8. fund transfer system9. secondary payment system10. reserve balance account11. automated clearing house12. financial institution transfers13. non-profit cooperative society14. foreign exchange deal and loan 15. Clearing House Inter-bank Payments SystemIII.1. A payment system is the means whereby cash value is transferred between a payer’s bank account and a payee’s bank account.2. SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) is a computerized international telecommunications system which, through standardized formatted messages, rapidly processes and transmits financial transactions and information among its members around the world.3. CHIPS (Clearing House Inter-bank Payment System) is a pseudo-wire system in New York City that handles an enormous volume of cash flow between local financial institutions. CHIPS is a settlement system involving primarily about 135 New York City financial institutions and is operated by the New York Clearing House Association.4. Clearing House Automated Payments System (CHAPS) is a system of sending and clearing payments on a same-day basis that is available nationwide in Britain and is operated by a number of settlement banks that communicate directly through computers.5. Fed Wire is a fund-transfer system operated nationwide in the USA by the Federal Reserve System (the Fed, Central Bank of the USA) that handles transfer from one financial institution to another with an account balance held with the Fed.IV.1. B2. A3. D4. B5. CV.1. T2. T3. F4. T5. FChapter ThirteenI.1.purchaser or the holderreplaced2.clerk or the tellera small commission3.the initial signaturethe countersignature4.banking instrumentsretailing5. (assigned) merchant6. annual income and the credit standing7. issuance, application and clearing8.consumer’s creditcurrent account9. separate listing of their cheque numbers10. paying the bill in fulldrawing revolving creditII.1. initial signature2. entrance fee3. selling agent4. assigned merchant5. traveler’s cheque6. purchase receipt7. current account8. sales slip9. paying agent10. membership dues11. consumer’s credit12. authorized signature13. American Express Card14. non-trade settlement15. retailing banking businessIII.1. A traveler’s cheque is a specially printed form of cheque issued by a financial institution, leading hotels, and other agencies in preprinted denominations for a fixed amount to a customer for use when he is going to travel abroad. A traveler’s cheque is actually a draft of a bank or other agency, which is self-identifying and may be cashed at banks, hotels, etc., either throughout the world or in particular areas only.2. A paying agent is one that undertakes by arrangement with the issuer to pay the latter’s traveler’s cheques when presented by the holder.3. Credit cards are instruments issued by banks to carefully selected customers with a line of credit ranging from several hundred to several thousand dollars based on the latter’s financial status for use in obtaining, on credit, consumer goods, services and other things when necessary.4. A cardholder is the customer who has a current account with the card-issuing bank and whose credit is good, and who based on his financial status can obtain, on credit, consumer goods, services and other things when necessary.5. A merchant is a store, hotel or restaurant that are bound to have a pre-arrangement with the card-issuing bank and are willing to accept the credit card for payment of commodities sold or services renderedIV.1. B2. D3. A4. C5. BV.1. T2.F3. T4. T5. FChapter FourteenI.1. medium of high-speed digital transactions2. business-to-business commerce, its breadth of coverage and ease of use3.Putting up a Web site, luring online shoppers in4. “e-cash”, “cyber-money”5. stored-value products and access products (such as a bank ATM card)6. transfer of financial value7. advertising purposes8. phone orders and credit card orders9. digital signatures10. debit card account.II.1. cyber-payment2. e-cash3. line of credit4. digital currency5. electronic wallet6. automated teller machine7.globalization of commerce8. personal identification number9. microchip-embedded smart card 10. Secured Electronic Transactions Standards 11. electronic commerce12. encoded magnetic stripe13. access device14.debit card15.virtual fingerprintIII.1. Electronic commerce is the ability to purchase goods and services electronically over the Internet from around the world at any time of day or night.2. Cyber-payment means the methods that have been implemented to transfer money, new methods of financial transactions as today banks already can transfer money with computers.3. SET is a single technical standard for safeguarding credit (and in the near future debit) card purchases made over the open networks of the Internet. It is an international protocol that details how credit card (and debit card) transactions on the Internet will be secured using encryption technology and digital certification.4. A digital signature is a way to encrypt a message so that the recipient can decode it and be certain of the authenticity of the transaction.5. Smart cards are micro- processor-equipped cards that work with card readers installed in the computers of consumers.IV.1. A2. B3. C4. D5. D6.C7. B8. A9. D 10. BV.1. F2.T3. T4. F5. T6. T7.T8. F9. F 10. F。

银行工作中的国际支付与结算业务指南

银行工作中的国际支付与结算业务指南银行作为金融服务领域的重要组成部分,在国际贸易中扮演着关键的角色。

国际支付与结算业务是银行在全球范围内为客户提供的重要服务,本文将以指南的形式为读者介绍银行工作中的国际支付与结算业务。

一、国际支付与结算业务概述国际支付与结算业务是指银行为客户在国际贸易中进行款项支付和结算的活动。

随着全球经济的发展和贸易的增加,越来越多的企业需要进行国际交易,因此,国际支付与结算业务对于银行来说显得尤为重要。

二、国际支付与结算业务的流程1. 支付方式选择在进行国际支付时,银行和客户需要共同选择合适的支付方式。

常见的国际支付方式包括电汇、信用证、托收等,银行需要根据客户的需求和交易的具体情况给出相应的建议。

2. 外汇交易国际贸易涉及多种货币,因此进行国际支付时需要进行外汇交易。

银行会根据客户的指令,通过外汇市场进行买卖外汇,以完成支付。

3. 资金清算在国际支付完成后,银行需要对资金进行清算。

清算是指银行根据不同的支付方式,将款项从支付方的账户划转至收款方的账户的过程。

清算过程需要遵循国际清算规则,确保资金安全和交易的及时性。

4. 结算通知银行在完成清算后,会向客户发送结算通知,通知客户交易的金额、时间以及相关账户的变动情况。

结算通知是交易的重要凭证,客户可以通过结算通知核对交易记录,并进行后续的会计处理。

三、国际支付与结算业务的注意事项1. 遵循国际贸易规则国际支付与结算业务需要遵循国际贸易规则,如国际商会发布的《国际贸易术语解释通则(INCOTERMS)》等。

银行需要对这些规则进行了解,并指导客户按照规则进行支付和结算。

2. 建立良好的风险控制机制由于国际支付涉及多种货币和不同国家的法律法规,风险控制显得尤为重要。

银行需要建立有效的风险控制机制,包括对客户的信用评估、交易的实时监测等,以降低不良交易和违规行为的风险。

3. 提供优质的客户服务国际支付与结算业务是银行的核心服务之一,银行需要提供优质的客户服务,如及时回复客户的咨询、提供方便快捷的结算通知等,以增强客户的满意度和忠诚度。

国际结算练习一

国际结算练习题(一)Practices for International settlement1. Choose the true answer of the following sentences.(1).A bill shows: Pay to ABC Co. the sum of ten thousand US dollars on condition that shipment of the goods has been made.( )(A) acceptable (B) unacceptable (2).drawerpayee the first transferee the second transfereeD CE A(drawee)C ( ) is a(A) holder in due course (B) holder for value (C) holder(3)A holder of a crossed cheque wants to get payment by cash through presenting it at the counter of paying bank. ( )(A) yes (B)no(4)Draft is correctly endorsed if necessary. Draft ( ) bear restrictive endorsement “ withoutrecourse ”(A)should (B)should not(5) The person paying the money is a ( ) of the check.(A) payee (B) endorser (C) drawer (D) endorser(6) A check is valid for ( ) months from the date of issue. Unless a shorter period is written on the face of it.(A) six (B) nine (c) three (D) one(7) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2000, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(8) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2001, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(9) The effect of a blank endorsement is to make the check payable to the ( )(A) order of a specified person (B) specified person(C) bearer (D) named person(10) Banks usually ask for endorsement when checks in favor of ( ) payee are credited to a ( ) account.(A) joint , joint (B) joint , sole (C) bearer (D) sole ,joint(11) “ Payee James Smith endorsed James Smith pay to L. Green ”, This is a ( ) endorsement(A) specific (B) blank (C) general (D) restrictive(12) If a bill is payable “ 60 days after date ” the date of payment is decided according to ( )(A) the date of acceptance (B) the date of presentation( C ) the date of the bill (D) the date of maturity(13) A ( ) carries comparatively little risks and can be discounted at the finest rate of interest.(A) sight bill (B) bank bill (C) commercial bill (D) trade bill(14) A term bill may be accepted by the ( )(A) drawer (B) drawee (C) holder (D) payee(15) The party to whom the bill is addressed is called the ( )(A) drawer (B) drawee (C) holder (D) payee(16) When financing is without recourse, this means that the bank has no recourse to the ( ) if such drafts are dishonored.(17) Only by endorsement can the interest in the bill be transferred by ( )(A) drawer (B) drawee (C) holder (D) any person to the bill(18) A promissory note is “inchoate” until it has been delivered to the ( )(A) payer or bearer (B) payee or drawee (C) payee or bearer (D) holder or drawer(19) The ( ) of a promissory note has prime liability while the other parties have secondary liabilities(A) holder (B) drawee (C)maker (D) acceptor(20) An acceptance with the wording “ payable on delivery of bill of lading” is ( )(A) a general acceptance (B) qualified acceptance(C) non acceptance (D) partial acceptance(21) ( ) must be accepted by the drawee before payment(A) A sight bill (B) A bill payable xx days after sight(C )A promissory note (D) A bill payable xx days after date(22) A(n) ( ) is a financial document(A) bill of exchange (B) bill of lading (C) insurance policy (D) commercial invoice(23) In order to retain the liabilities of the other parties, a bill that has been dishonored must be( )(A) protested (B) given to the acceptor (C) retained in the file (D) presented to the advising bank2.Please fill the blanks of the following sentences.(1)A bill is payable at several days after sight. What date is the day from which time of payment begins to run?(2) A bill is payable at several days after date. What date is the day from which time of payment begins to run?(3)The maturity of a draft is one month after 31 Jan. It is .(4)Order of liability after acceptance is as follows: takes primary liability for payment. ________ takes second liability for payment.(5) The differences between a bill and a note are as followsA bill is an unconditional order to pay. A note is an unconditional to pay.A bill has three basic parties . A note has .(6) The differences between a bill and a cheque are as followsThe drawee of a bill may be any person. The drawee of a cheque must beThere are four kinds of tenor for the bills. The tenor is merely payableA bill can be drawn in a set. A cheque can not be drawn in a .(7)Remittance through a bank from one country to another may usually be made by one of the following methods: 1 2 3 .(8)Financial documents mean , promissory note and cheque. Commercial document mean , transport document and insurance document.(9) account means your account .(10) Control document are lists of and3、Decide whether the following statement are true or false(1) In a promissory note, the drawer and the payer are the same person. ( )(2) A promissory note is an unconditional order in writing. ( )(3) There is no acceptor in a promissory note. ( )(4) A bank draft is a check drawn by one bank on another. ( )(5) A trade bill is usually a documentary bill. ( )(6) The interest in the bill of exchange can only be transferred by endorsement. ( )(7) An endorser of a bill is liable on it to subsequent endorsers as holders of the bill. ( )(8) the person who draws the bill is called the drawer. ( )(9) Bills of exchange drawn by and accepted commercial firms are known as trade bills. (t )(10) Trade bills are usually documentary bills. ( )(11) Endorsements are needed when checks in favor of a sole payee are credited to a jointed account. ( )(12) An open check can be paid into a bank account. ( )(13) An open check can be cashed over the counter. ( )(14) A crossed check can be cashed over the counter. ( )(15) The payment of a check cannot depend upon certain conditions being met. ( t )(16) In a check, the drawer and the payer are the same person. ( )(17) If a check is presented un dated, the payee can insert a date ( )(18) A draft is a conditional order in writing. ( )(19) If a bill is payable “at 30 days after date”, the date of payment is decided according to the date of acceptance.(20) A bill payable “ at 90 days after sight” is a sight bill. ( )4.Draw a bill of exchange according to the requisite items as follows. (15 points) date: 24 Feb, 2003 amount: USD 4,242.00 tenor: 22 May, 2003drawer: Sherman Motor Incorporation, New Yorkdrawee: The Chase Bank N. A. , New Yorkpayee: Sherman Motor Incorporation’s order5..In accordance with the following conditions, please write a able text of remittance.(10 points)Remitting bank: Bank of China , Tianjin. Paying bank: Midland Bank Ltd., London.Date of cable : 10 June. Test: 3561 Ref No:208TT0992Amount: GBP 54,420.00 Value on:10 JunePayee: ABC Co., London. Account No.3698044 with Midland Bank Ltd.Message: Contract No. 201541 Remmitter: Tianjin Trust & Investment Corp., TianjinCover: Debit our H.O. account FM:TO:DA TETEST OUR REF PAY VALUE TOFOR CREDIT OF ACCOUNT NO. OFMESSAGEB/O。

国际支付与结算答案

I.1. settlement on bank credit2. the potential for currency fluctuation3. to clear the goods for export4. to pay the insurance premium5. to carry out export formalities6. the major participants in international trade7. the commodity inspection clause 8. to fulfill the obligation to deliver the goods9. The goods have passed over the ship’s rail10.International contract is concluded in a completely different context than domesticonesII.1.local legal system, political, exchange risks2.payment in advance, open account, remittance and collection3.letter of credit, bank guarantee4.price terms, delivery terms5.minimum, maximum6.Advance payment7.Open account8.clean collection, documentary collectionIII.1.International trade is the exchange of goods and services produced in one countryfor goods and services produced in another country.2. A set of terms making clear to both the seller and the buyer their respectiveobligations in international trade.3.An arrangement between the buyer and seller whereby the goods aremanufactured and delivered before payment is required.4.An arrangement whereby the buyer places the funds at the disposal of the sellerprior to shipment of the goods or provision of services.5.The sales contract is a written agreement that clearly states the rights andresponsibilities of both parties to a transaction.IV.1. F2. F3. T4. T5. T6. T7. F8. T9. T 10. FV.1. B2. C3. C4. B5. D6. D7. A8. C9. C 10. C11. B 12 D 13. D 14. C 15. D16. D 17. C 18. A 19. C 20. DI.1.barter2.medium of exchange3.expensive, risky4.our5.V ostro6.vostro7.nostro8.specimen of authorized signatures,telegraphic test keys, terms and conditions,Swift authentic keysII.1. A bank having direct connection or friendly service relations with another bank.2.International settlements are financial activities conducted among differentcountries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, claims, etc. emerged in the course of political, economic or cultural contracts among them.3.Visible Trade is the importing / exporting of commodities and goods between thebuyers and the sellers.4.Financial transaction refers to all kinds of foreign exchange market transactions,government supported export credits, syndicated loans, international bond issues, etc.5.V ostro account is an account held by a bank on behalf of a correspondent bank.III.mercial credit2.control documents3.account relationship4.cash settlement5.financial intermediaryIV.1. T2. F3. F4. T5. FV.1. B2. C3. D4. A5. D6. B7. B8. D9. A 10. BChapter ThreeI.1. generally crossed check2. specially crossed check3. a check that is out of date4. post dated check5. amount in words6. blank endorsement7. special endorsement 8. restrictive endorsement9. documentary bill 10. sight draft11. usance/term bill 12. acceptance bill13. determinable future date 14. clean bill15. negotiable instrument 16. discounting house17. merchant bank 18. unconditional promise of payment19. joint and severally responsible 20. payable 90 days after dateII.1. A negotiable instrument is a chose in action, the full and legal title to which istransferable by del ivery of the instrument (possibly with the transferor’s endorsement) with the result that complete ownership of the instrument and all the property it represents passes free from equities to the transferee, providing the latter takes the instrument in good faith and for value.2. A bill of exchange is an unconditional order in writing, addressed by one person toanother, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a sum certain in money, to or to the order of a specified person, or to bearer.3. A check is an unconditional order in writing addressed by the customer to a banksigned by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer.4.It is a bill with shipping documents attached thereto.5. A crossing is in effect an instruction to the paying bank from the drawer or holderto pay the fund to a bank only.III.1. T2. F3. T4. T5. T6. F7. T8. T9. T 10. T11. T 12. T 13. T 14. F 15. T16. T 17. T 18. F 19. F 20. FIV.1. C2. A3. C4. B5. C6. B7. A8. C9. B 10. B11. B 12. D 13. C 14. C 15. C16. B 17. B 18. A 19. A 20. C V.1.China National Crafts Import & Export Corp.2.ABC Company3.the Bank of China4.Tenor draft5.In two sets6.ShanghaiVII.Chapter FourI.1. beneficiary2. payment order, mail advice or debit advice3. the remittance amount is large,the transfer of funds is subject to a time limittest key4. sell it to his own bank crediting his account5. debitscredits6.demand draft7. act of dishonor8. Swiftness, reliability, safety, inexpensiveness9. debiting remitting bank’s nostro account10. delivery of the goodsII.1. I nternational remittance means a client (payer) asks his bank to send a sum of money to a beneficiary abroad by one of the transfer methods at his option while the beneficiary can be paid at the designated bank which is either the remitting bank’s overseas branch or its correspondent with a nostro account.2. Remitting bank is the bank transferring funds at the request of a remitter to its correspondent or its branch in another country and instructing the latter to pay a certain amount of money to a beneficiary.3. A mail transfer is to transfer funds by means of a payment order or a mail advice, or sometimes a debit advice issued by a remitting bank, at the request of the remitter.4. A banker’s demand draft is a negotiable instrument drawn by a bank on its overseas branch or its correspondent abroad ordering the latter to pay on demand the stated amount to the holder of the draft.5. Cancellation of the reimbursement under mail transfer or telegraphic transfer is usually done before its payment is made at the request of the remitter or the payee who refuses to receive the payment.III.1.remittance advice2.outward remittance3.international money order4.current account5.automated payment system6.in cover7.letter of indemnity8.mail advice9.non-negotiable copy of draft10. down paymentIV.1B 2C 3A 4B 5D6 D7 B8 C9 B 10 D Chapter FiveI.1. presenting bank2.title documents, pays the draft, accepts the obligation to do so.3.legal, the exchange control authorities4. the payment is made5. open account, advance payment,5.inward collection7. the remitting bank8. trust receipt9. D/P at sight10.documents, draft, and collection orderII.1. Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent banks located in the domicile of the buyer.2. The case of need is the representative appointed by the principal to act as case of need in the event of non-acceptance and/or non-payment, whose power should be clearly and fully stated in the collection.3. Documentary collection is a collection of financial instruments being accompanied by commercial documents or collection of commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange. Alternatively, the documentary collection is a payment mechanism that allows the exporters to retain ownership of the goods until they receive payment or are reasonably certain that they will receive it.4. Outward collection is a banking business in which a bank acting as the remitting bank sends the draft drawn against an export with or without shipping documents attached, to an appropriate overseas bank, namely, the collecting bank to get the payment or acceptance from the importer.5. Collection bill purchased is a kind of financing by banks for exporters under documentary collection methods. It means that the remitting bank purchases the documentary bill drawn by the exporter on the importer. It involves great risk for the remitting bank due to lack of a guarantee.III.1.cash against documents2. trade acceptance3. case of need4. bill purchased5. title document6. on consignment7.direct collection 8. shipping documents9. documents against payment 10. time/ tenor/term/ usance draftIV.1A 2B 3C 4A 5B 6 A 7 C 8A 9 A 10 D Chapter SixI.1.The Documentary Credit or letter of credit is an undertaking issued by a bank forthe account of the buyer (the applicant) or for its own account, to pay the beneficiary the value of the draft and/or documents provided that the terms and conditions of the documentary credit are complied with.2. A credit that carries the commitment to pay by both the issuing bank and theadvising bank.3. A credit by which, under the terms and conditions thereof, the amount is renewedor reinstated without specific amendments to the documentary credit being required.4.A bank, usually the advising bank, which adds its undertaking to those of theissuing bank and assumes liability under the credit.5.The applicant is always an importer or a buyer, who fills out and signs anapplication form, requesting the bank to issue a credit in favor of an exporter or a seller abroad.II.1. F2. T3. T4. F5. T6. F7. F8. T9. T 10. F 11. T 12. T 13. F 14. F 15. T III.1.silent confirmation2.to expire at the counters of the issuing bank3.to pay against documents presenting the goods4. A credit places a bank’s credit instead of commercial credit.5. A credit stands independent of the sales contract.IV.1. B2. C3. D4. B5. A6. D7. D8. C9. C 10. C 11. D 12. D 13. A 14. D 15. B16. D 17. D 18. D 19. A 20. B Chapter SevenI.pleteness, correctness, consistency2.underlying transaction3.authorized signatures, test keyply with, be consistent5.ISO currency codeII.1.apparent authenticity of the credit2.international standard banking practice3.data communication network4.to have sufficient funds to cover the credit5.It is equally important that the buyer’s own requirements be taken into account. III.1. F2. F3. F4. T5. T6. T7. F8. T9. F 10. TIV.1. B2. D3. C4. B5. C6. C7. A8. A9. D 10. D 11. A 12. D 13. D 14. A 15. B Chapter EightI.1.The commercial invoice is the key accounting document describing thecommercial transaction between the buyer and the seller. It is a document giving details of goods, service, price, quantity, settlement terms and shipment.2.An export license is a document prepared by a government authority of a nationgranting the right to export a specific quantity of a commodity to a specified country.3. A bill of lading is a document issued by a carrier to a shipper, signed by thecaptain, agent, or owner of a vessel, providing written evidence regarding receipt of the goods, the conditions on which transportation is made, and the engagement to deliver goods at the prescribed port of destination to the lawful holder of the bill of lading.4. A document issued by an authority indicating that goods have been inspected priorto shipment and the results of the inspection.5. A consular invoice is an invoice covering a shipment of goods certified in thecountry of export by a local consul of the country for which the merchandise is destined.II.1.strategic commodity2.General System of Preference3.with reserved berth4.multi-modal transport bill of lading5.sampling methodologyIII.1. F2. F3. T4. T5. F6. F7. F8. T9. T 10. FIV.1. A2. B3. D4. A5. C6. C7. C8. C9. C 10. D 11. A 12. D 13. D 14. A 15. A 16. A 17. B 18. A 19. C 20. D Chapter NineI.1.acceptable accounts receivablenon-recourse and notification2. collection as well as the risk of credit losses3. the level of sales4. changes in the world economic structure5. growing demands6. purchasing the client’s accounts receivables7.financial and administration8.the invoice datethe customer makes his payment.9.market conditions and his assessment of the risks involved in a particulartransaction.10. fluctuations in the exchange ratein the status of the debtorII.1. Factoring is a form of trade financing that allows sellers to sell their products to overseas buyers essentially on an open account basis. In simple terms, factoring is the purchase of claims, arising from sales of goods, by a specialized company known as factoring company or factor. Factoring is in fact a three-party transaction between the factor and a business entity, i.e. the exporter selling goods or providing services to foreign the importer.2. Forfaiting is the term generally used to denote the purchase of obligations falling due at some future date, arising from deliveries of goods and services----mostly export transactions---without recourse to any previous holder of the obligation. Simply speaking, forfaiting is the business of discounting medium-term promissory notes or drafts related to an international trade transaction.III.1. contingent liability2. credit limit3. supplier credit4. without recourse5. credit approval6. capital goods7. buyer credit guarantee 8. forfait facility9. trade barrier 10. bulk purchase discountIV.1. B2. A3. D4. C5. D Chapter TenI.1.secure mechanism for paymentdefault instrument2.party tenderingthe contract has been awarded3. presentation of the beneficiary's demand and stipulated documentation4. issue a guarantee directly to the beneficiary5. Unconditional bonds6. withdraw its bidaccept the award of contract in its favorbetween 2% and 5%7.UCP for documentary creditsUniform Rules for Demand Guarantee.8.An advance payment9.borrower (the principal)the lender (the beneficiary)10. counter indemnityII.1. A bank guarantee is an instrument for securing performance or payment especially in international business. It is a written promise issued by a bank at the request of its customer, undertaking to make payment to the beneficiary within the limits of a stated sum of money in the event of default by the principal. It may also be defined as an independent obligation where the guarantor has to make a special agreement with its customer, ensuring that it will be refunded by him for any payment to be effected under the contract of guarantee.2. A beneficiary is the party in whose favor the guarantee is issued. He is secured against the risk of the principal’s not fulfilling his obligations towards the beneficiary in respect of the underlying transaction for which the demand guarantee is given. He will not obtain a sum of money if the obligations are not fulfilled.3. An indirect guarantee is a guarantee where a second bank, usually a foreign bank located in the beneficiary's country of domicile, will be requested by the initiating bank to issue a guarantee in return for the latter's counter-guarantee.4. A performance bond is an undertaking given by the guarantor at the request of a supplier of goods or services or a contractor to a buyer or beneficiary, whereby the guarantor undertakes to make payment to the beneficiary within the limit of a stated sum of money in the event of default by the supplier or the contractor in due performance of the terms of a contract between the principal and the beneficiary.5. A standby letter of credit is a clean letter of credit that generally guarantees the payment to be made for an unfulfilled obligation on the part of the applicant. It is payable on presentation of a draft together with a signed statement or certificate by the beneficiary that the applicant has failed to fulfill his obligation.III.1.performance bond2. letter of guarantee3.counter indemnity4. accessory guarantee5.stand-by letter of credit6. engineering contracting7.underlying transaction 8. demand guarantee9.deferred payment bond 10. counter guaranteeIV.1. B2.A3. A4. D5. C6 B7 C8 D9 B 10 AChapter ElevenI.1.collection operations for drafts and for documentary collections2.all collections, “collection instruction”3.all Documentary Credits, Credit4.all Bank-to-Bank Reimbursements, Reimbursement Authorization.5.any demand guarantee and amendment thereto, Guarantee or any amendmentthereto.6.documents, goods, terms and conditions7.codification of rulesbanking practice regarding documentary credits8. international finance, trade, transportation and computer technology9.quite different from the practice of guarantee, banking and commercial10. bank-to-bank reimbursementsII.1.reimbursement claim2. arbitral award3. banking commission4. multi-transport5. reimbursement undertaking6. banking practices7. containerized traffic 8. non-negotiable waybill9. tenor collection presentation 10. International Chamber of CommerceⅢ.Ⅳ.1. B2. D3. C4. A5. DChapter TwelveI.1.payment information, transfer value2.confirmation number, confirmation help and notification3.for procedures and message formats, computer readablermation, value, net amount5.high speed and accuracy6. access to the system for the settlement of international money transfers7. faster, more reliable communication, lower transmission costs8. the international clearing house9. standardized formats10. inter-bank dollar-denominated, CHIPSII.1. cash positions2. bookkeeping entry3. financial intermediary4. customer transfers5. account reconciliation6. Fed Wire7. non-settlement bank 8. fund transfer system9. secondary payment system 10. reserve balance account11. automated clearing house 12. financial institution transfers 13. non-profit cooperative society 14. foreign exchange deal and loan 15. Clearing House Inter-bank Payments SystemIII.1. A payment system is the means whereby cash value is transferred between a payer’s bank account and a payee’s bank account.2. SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) is a computerized international telecommunications system which, through standardized formatted messages, rapidly processes and transmits financial transactions and information among its members around the world.3. CHIPS (Clearing House Inter-bank Payment System) is a pseudo-wire system in New York City that handles an enormous volume of cash flow between local financial institutions. CHIPS is a settlement system involving primarily about 135 New York City financial institutions and is operated by the New York Clearing House Association.4. Clearing House Automated Payments System (CHAPS) is a system of sending and clearing payments on a same-day basis that is available nationwide in Britain and is operated by a number of settlement banks that communicate directly through computers.5. Fed Wire is a fund-transfer system operated nationwide in the USA by the Federal Reserve System (the Fed, Central Bank of the USA) that handles transfer from one financial institution to another with an account balance held with the Fed.IV.1. B2. A3. D4. B5. CV.1. T2. T3. F4. T5. FChapter ThirteenI.1.purchaser or the holderreplaced2.clerk or the tellera small commission3.the initial signaturethe countersignature4.banking instrumentsretailing5. (assigned) merchant6. annual income and the credit standing7. issuance, application and clearing8.consumer’s creditcurrent account9. separate listing of their cheque numbers10. paying the bill in fulldrawing revolving creditII.1. initial signature2. entrance fee3. selling agent4. assigned merchant5. traveler’s cheque6. purchase receipt7. current account 8. sales slip9. paying agent 10. membership dues11. consumer’s credit12. authorized signature13. American Express Card 14. non-trade settlement15. retailing banking businessIII.1. A traveler’s cheque is a specially printed form of cheque issued by a financial institution, leading hotels, and other agencies in preprinted denominations for a fixed amount to a cu stomer for use when he is going to travel abroad. A traveler’s cheque is actually a draft of a bank or other agency, which is self-identifying and may be cashed at banks, hotels, etc., either throughout the world or in particular areas only.2. A paying agent is one that undertakes by arrangement with the issuer to pay the latter’s traveler’s cheques when presented by the holder.3. Credit cards are instruments issued by banks to carefully selected customers with a line of credit ranging from several hundred to several thousand dollars based on the latter’s financial status for use in obtaining, on credit, consumer goods, services and other things when necessary.4. A cardholder is the customer who has a current account with the card-issuing bank and whose credit is good, and who based on his financial status can obtain, on credit, consumer goods, services and other things when necessary.5. A merchant is a store, hotel or restaurant that are bound to have a pre-arrangement with the card-issuing bank and are willing to accept the credit card for payment of commodities sold or services renderedIV.1. B2. D3. A4. C5. BV.1. T2.F3. T4. T5. FChapter FourteenI.1. medium of high-speed digital transactions2. business-to-business commerce, its breadth of coverage and ease of use3.Putting up a Web site, luring online shoppers in4. “e-cash”, “cyber-money”5. stored-value products and access products (such as a bank ATM card)6. transfer of financial value7. advertising purposes8. phone orders and credit card orders9. digital signatures10. debit card account.II.1. cyber-payment2. e-cash3. line of credit4. digital currency5. electronic wallet6. automated teller machine7.globalization of commerce8. personal identification number9. microchip-embedded smart card 10. Secured Electronic Transactions Standards 11. electronic commerce 12. encoded magnetic stripe13. access device 14.debit card15.virtual fingerprintIII.1. Electronic commerce is the ability to purchase goods and services electronically over the Internet from around the world at any time of day or night.2. Cyber-payment means the methods that have been implemented to transfer money, new methods of financial transactions as today banks already can transfer money with computers.3. SET is a single technical standard for safeguarding credit (and in the near future debit) card purchases made over the open networks of the Internet. It is an international protocol that details how credit card (and debit card) transactions on the Internet will be secured using encryption technology and digital certification.4. A digital signature is a way to encrypt a message so that the recipient can decode it and be certain of the authenticity of the transaction.5. Smart cards are micro- processor-equipped cards that work with card readers installed in the computers of consumers.IV.1. A2. B3. C4. D5. D6.C7. B8. A9. D 10. BV.1. F2.T3. T4. F5. T6. T7.T8. F9. F 10. F。

商业银行的国际支付与结算服务

商业银行的国际支付与结算服务商业银行是金融体系中的重要组成部分,其在国际支付与结算领域发挥着关键的作用。

国际贸易和投资的快速增长使得商业银行的国际支付与结算服务变得尤为重要,本文将探讨商业银行在该领域的角色和功能。

一、商业银行的国际支付服务商业银行作为国际贸易和资本流动的中介,扮演着国际支付的重要角色。

商业银行提供的国际支付服务可以帮助企业和个人方便快捷地进行跨境交易。

这些服务包括电汇、信用证、托收和票据结算等。

1. 电汇电汇是商业银行提供的一种快速、安全的跨境支付方式。

通过电汇,付款人可以通过银行将资金直接转账至收款人的银行账户,实现国际货币的实时转移。

这种支付方式具有迅速、方便、可追溯的特点,特别适用于面对面交易和紧急支付情况。

2. 信用证信用证是商业银行为企业提供的一种国际贸易支付保障工具。

通过信用证,银行作为中介机构承诺在符合相应规定的条件下,向收款人支付一定金额的资金。

信用证方式能够提供可靠的支付保障,同时也促进了国际贸易的发展。

3. 托收托收是商业银行为企业提供的一种跨境支付方式。

商业银行代理企业将货款或票据托收给国外的银行,由该银行向收款人收取款项。

托收方式减轻了企业的支付风险,并且可以有效管理跨境交易的资金流动。

4. 票据结算商业银行为企业提供票据结算服务,使得企业可以通过汇票、本票和支票等方式进行国际贸易支付。

商业银行在票据结算过程中提供背书、贴现和保证等服务,确保交易的顺利进行。

二、商业银行的国际结算服务商业银行还提供国际结算服务,帮助企业解决跨境交易中的资金结算问题。

商业银行通过提供清算、结算和外汇兑换等服务,为企业完成国际交易提供支持。

1. 清算商业银行在国际结算中扮演着清算机构的角色。

它通过清算渠道和系统,为银行间和客户间的跨境交易提供清算服务。

商业银行的清算功能能够确保交易的安全性和准确性。

2. 结算商业银行为企业提供结算服务,帮助企业处理跨境交易中的资金结算问题。

商业银行利用国内外支付系统和结算机构,确保企业的资金能够按时到达收款方。

国际支付与结算考试题型

• 7. The term EXW represents the minimum

obligation for the importer (

F)

• 8. The trade term DES should be followed by

named port of destination( T

)

• 9.Clean collection is collection for financial documents without commercial documents being attached( T )

• 3.Documentary credit affords a high degree of

safety for both the buyer and seller ( T

)

• 4.Advance payment, open account, documentary collection and letter of credit are the usual means of payment to settle international trade tractions ( T )

• 10.

If a bill is payable “60 days

after date”, the date of payment is

decided according to__ C ___.

• A. the date of acceptance

• B. the date of presentation

• 4、In a documentary collection,the buyer’s bank is called (A D )

国际支付与结算Exercise three

10. Trade bills are usually documentary bills(F )

11. Endorsements are needed when checks in favor of a sole payee are credited to a joint account ( F )

C. beraer

D. named person

6. Banks usually ask for endorsements when checks in favor of __ B ___payees are credited to a _____account.

A. joint- joint B. joint-sole

Exercise three

一、Translate the following terms into English 1、一般划线支票: General crossing check 2、特殊划线支票:Special crossing check 3、过期支票:check is out of date 4、未到期支票:Undated check 5、大小写金额:words and figures 6、空白背书:blank endorsement 7、特别背书:special endorsement 8、限制性背书:Restrictive endorsement: 9、跟单汇票:documentary bill 10、即期汇票:sight bill

18. A draft is a conditional order in writing(F )

国际支付与结算 期考 清晰修改版

国际支付与结算期考名解与简答决战毅毅流水制作(一)名词解释1.一般划线支票general crossed check :Where a check bears across its face an addition of : (1)the worlds “and company”,or any abbreviation thereof, between two parallel transverse lines, either with or without the words “not negotiable”; (2) two parallel tranverse lines simply, either with or without the words “not negotiable”, that addition constitutes a crossing, and the check is crossed genelly.The effect of a general crossing si to make the check payable only through another banker.2. 特殊划线支票special crossed check :When a check bears across its face the name of a bank,either with or without the two parallel tranberse lines,that addition constitudes a special crossing. If a check is acrossed specially, only the bank mentioned in the check can receive payment from the drawee bank.3.空白背书general(blank) endorsement是指背书人只在票据背后签名,而不注明付给某一特定人或特定人的指示人的背书。

2024版国际支付与结算教学设计

课程目标与要求

掌握国际支付与结算的基本概念、 原理和流程

了解国际支付与结算的法律法规和 国际惯例

熟悉主要国际支付系统和结算工具 的使用

培养学生分析问题和解决问题的能 力,以及团队合作精神

教学内容与方法

教学内容

国际支付与结算基础知识、国际支付系 统、国际结算工具、风险管理等

教学方法

讲授、案例分析、小组讨论、模拟操作 等

教学手段

多媒体演示、网络教学平台、实验教学 等

考核方式

平时成绩、期中考试、期末考试等综合 评价

02

国际支付基础知识

国际支付概念及特点

01

国际支付概念

02

国际支付特点

指不同国家之间因商品、劳务、金融等交易活动而引发的债权债务清 偿行为,通过一定的支付系统和支付方式实现跨国资金转移。

涉及多个国家、货币和法律制度;受国际政治、经济因素影响;支付 方式和手段多样化;风险管理和合规性要求高。

外汇兑换与风险管理案例

分析企业在跨境支付中如何管理外汇 风险,选择合适的兑换时机和方式, 降低汇兑损失。

国际贸易结算案例

探讨在国际贸易中,如何运用不同的 结算工具和方式,确保交易双方的利 益和资金安全。

模拟操作练习

1 2

模拟跨境电商平台支付流程 让学生在模拟环境中体验跨境电商支付的整个流 程,包括选择支付方式、填写支付信息、确认支 付等。

02

托收

包括付款交单和承兑交单,适用 于跟单托收,风险相对较大,但

成本较低。

03

信用证

由银行信用介入,具有较高的安 全性和可靠性,但手续繁琐、费 用较高,适用于大额交易和长期

合作。

国际结算风险及防范

信用风险

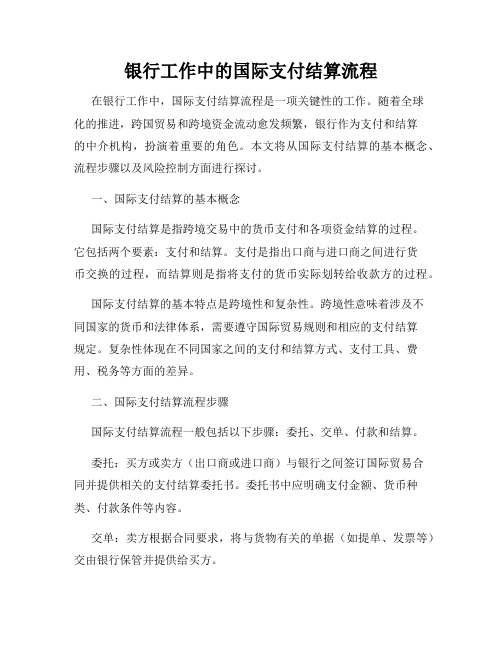

银行工作中的国际支付结算流程

银行工作中的国际支付结算流程在银行工作中,国际支付结算流程是一项关键性的工作。

随着全球化的推进,跨国贸易和跨境资金流动愈发频繁,银行作为支付和结算的中介机构,扮演着重要的角色。

本文将从国际支付结算的基本概念、流程步骤以及风险控制方面进行探讨。

一、国际支付结算的基本概念国际支付结算是指跨境交易中的货币支付和各项资金结算的过程。

它包括两个要素:支付和结算。

支付是指出口商与进口商之间进行货币交换的过程,而结算则是指将支付的货币实际划转给收款方的过程。

国际支付结算的基本特点是跨境性和复杂性。

跨境性意味着涉及不同国家的货币和法律体系,需要遵守国际贸易规则和相应的支付结算规定。

复杂性体现在不同国家之间的支付和结算方式、支付工具、费用、税务等方面的差异。

二、国际支付结算流程步骤国际支付结算流程一般包括以下步骤:委托、交单、付款和结算。

委托:买方或卖方(出口商或进口商)与银行之间签订国际贸易合同并提供相关的支付结算委托书。

委托书中应明确支付金额、货币种类、付款条件等内容。

交单:卖方根据合同要求,将与货物有关的单据(如提单、发票等)交由银行保管并提供给买方。

付款:买方根据合同约定和银行的指示,通过银行将支付货款的金额划转至卖方的账户。

结算:银行将买方的支付款项划转给卖方,并向双方提供有关支付和结算的通知和凭证。

三、国际支付结算风险控制国际支付结算过程中存在着一定的风险,包括信用风险、汇率风险和违约风险等。

银行在进行国际支付结算时要注意以下几个方面的风险控制:信用风险:银行要评估买方和卖方的信用状况,并在支付结算过程中采取相应的信用证操作、保函和担保等措施,确保支付的安全性和可行性。

汇率风险:由于涉及不同货币之间的兑换,银行和参与国际贸易的主体都要面临汇率波动的风险。

银行可以通过与客户签订外汇合约或使用外汇衍生品等方式对汇率风险进行管理。

违约风险:如果出现买方或卖方无法按时支付或无法履行合同的情况,银行需要采取相应的措施来防范违约风险。

3 国际支付与结算

3.2.3 跟单托收的种类

2.承兑交单 承兑交单(Documents Against Acceptance,简称 D/A)系指出口人的交单以进口人的承兑为条件。 进口人承兑汇票后,即可向银行取得全部货运单 据,待汇票到期日才付款。承兑交单只适用于远 期汇票的托收。

15

3.2.1 3.2.2 3.2.3 3.2.4 3.2.5

(3)寄汇票通知书(票根) (7)付讫借记通知

汇入行 (付款人)

票汇业务程序

7

3.1.3 汇付方式的性质及其在进出口贸易中的使用

在我国的外贸实践中,除对本企业的联号或分支机构和 个别的极可靠客户用以预付货款以及交货后付款(Cash on Delivery——C.O.D.)、随订单付现(Cash with Order——C.W.O.),统称赊账交易(Open Account Trade——O/A)外,主要用于定金、货款尾数,以及 佣金、费用等的支付。大宗交易使用分期付款或延期付 款办法时,其货款支付也常采用汇付方式。

22

3.2.5 跟单托收方式下的进出口押汇

1.托收出口押汇

托收出口押汇是托收银行采用买入出口人向进口人开出 的跟单汇票的办法向出口人融通资金的一种方式。

2.托收进口押汇

托收进口押汇是代收银行给予进口人凭信托收据(Trust Receipt:T/R)提货便利的一种向进口人融通资金的方 式。

23

33

(3) 汇 款 通 知

(4) 收 据

(5) 付

款

(2)电/信汇委托通知 汇出行 (6)付讫借记通知 汇入行

电/信汇业务程序图

5

3.1.2 汇付方式的种类及其业务程序

3.票汇(Remittance by Banker's Demand Draft, D/D)

国际支付与结算总结

1.国际支付与结算是各国之间进行的金融活动,它涉及一个国家向另一个国家支付款项或转移资金以清算各国在政治、经济、文化往来过程中产生的账户和债权、债务。

2.Characteristics of Modern International Payments and Settlements 现代国际支付与结算的特点(1)广泛运用各种金融工具(2)商业银行成为结算和融资的中心(3)电子工具被广泛运用(4)国际借贷与国际支付的融合(5)交易货币多样化3.Major Points Concerning International Payments and Settlements国际支付与结算应注意的问题1)国际支付与结算的方法2)国际支付与结算使用的金融工具3)国际支付与结算使用的单据4)国际支付与结算使用的货币5)国际支付与结算使用的准则4.Definition of correspondent bank 代理行的定义所谓代理行可以定义为“与另一家银行有着直接的或友好的服务关系的一家银行。

”5.控制文件包括:(1)授权签字样本的表单(2)电报加押密码(3)条款和条件(4)SWIFT真实密码6. 往来账户(Nostro account & Vostro)往账,英文Nostro account为了方便国际间的支付与结算,本国国内的一家银行在外国国内另一银行所开立的以外国货币为单位的账户。

来账,英文Vostro account为了方便国际间的支付与结算,外国国内的某一银行在本国国内另一银行所开立的以本国货币为单位的账户。

简单理解,“往账”就是“我在国外某银行开立一个外币账户,账户属于我,只是以外币为单位”;“来账”就是“国外某银行在我这边开立一个本币账户,账户属于它,只是以本币为单位”。

7.Services provided by correspondents 往来银行所提供的服务(1)接收支票、汇票和其他信用工具,即普通的业务收支结算。

国际支付与结算Exercise four

4. The same methods of transfer may be used both in business: advance payment and open account business: remitting the bank’s payment by a bank s draft, by mail transfer, by ____. telegraphic transfer, by SWIFT message, by a(n)__ B ____. A. postal money order B. international money order C. payment order D. reimbursement 5. If the paying bank opens a current account with the remitting bank, the reimbursement may be effected by ___ ___. D ___. A. Instructing the paying bank to claim reimbursement from another branch of the same bank or another bank which the remitting bank opens an account B. Debiting remitting bank s nostro account bank’s C. Instructing a reimbursing bank to paying bank by bank’s debiting the remitting bank s nostro account D. Crediting vostro account of the paying bank

国际结算 Exercise 1

Exercise 1一、写出下列专业术语缩写的英文全称和中文全称。

1、ICC2、SWIFT3、CHIPS4、PBC5、ICBC6、A.B.C7、C.C.BExercise 21. A draft for USD100, 000.00 is drawn by The American Exporter Co. Inc. T ampa, Florida, U.S.A on the French Issuing Bank, Paris, France payable at 60 days sight to the order of ourselves dated 10 May, 200X. marked “Drawn under the French Issuing Bank, Paris, France, L/C No.12345 dated 25 Feb., 200X”. Please fill the following blank form as per above instruction to issue a draft.Exercise 3Make a blank endorsement and special endorsement as per above bill of exchange.Exercise 3根据所给汇票内容完成下列操作Exchange for USD 5, 000.00 London,4 September,2006At 60 days after sight pay to the order of Bank of China, Shanghai Branchthe sum of US DOLLARS FIVE THOUSAND ONLYT o: YYY Bank For The Exporting Co.,(signature)(1)如果中国银行上海分行要将此汇票背书给中国银行纽约分行(Bank of China, New Y ork Branch)请你为之作一个限制性背书。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一、Put the following into English

1、以银行信用为基础的结算 Settlement on bank credit 2、货币波动的可能性 the potential for currency fluctuation 出口清关: export. 3、出口清关:clear the goods for export. 支付保费: 4、支付保费:payment insurance premium 办理出口手续: 5、办理出口手续:responsibility for export formalities

三、define the following terms

trade: 1.international trade:国际贸易 International trade is the exchange of goods and services produced in one country for those produced in country. another country. In most cases countries do not trade services. the actual goods and services.Rather they use the income or money from the sale of their products to buy country. the products of another country.

4.Trade terms are also called price terms or terms. delivery terms. 5.While the EXW(Ex Word)term represents the minimum obligation for the seller, DDP represents the maximum obligation. 6. Payment in advance is most advantageous to seller. the seller. 7. Open account is least advantageous to the seller. seller. 8.Collection can be divided into Documentary collection and Clean collection

6.The term FAS can only be used for sea or inland waterway transport ( T ) 7. The term EXW represents the minimum obligation for the importer ( F ) 8. The trade term DES should be followed by named port of destination( T ) 9.Clean collection is collection for financial documents without commercial documents being attached( T ) 10.Trade on open account terms usually satisfies the seller’s desire for cash and the importer’s desire for credit( F )

account: 3.open between the buyer and seller whereby the goods are manufactured and delivered before payment is required.Open account provides . for payment at Some stated specific future date and without the buyer issuing any negotiable instrument evidencing his legal commitment.The seller must . have absolute trust that he will be paid at the agreed date. It provides the least risk for the buyer,and . , the greatest risk for the seller. . 这是一种在买方没有支付货款之前卖方先交货的支付 安排。 安排。赊销一般允许买方在规定的未来某一天付款而 不需要发行任何议付工具来表明其法定许诺。卖方必 不需要发行任何议付工具来表明其法定许诺。 须对买方在约定日期付款有绝对自信。 须对买方在约定日期付款有绝对自信。这种支付方式 对买方风险最小,对卖方风险最大。 对买方风险最小,对卖方风险最大。

contract: 5.sales contract:销售合同 The sales contract is a written agreement that clearly states the rights and responsibilities of both parties to a transaction. . 销售合同是一个书面协议, 销售合同是一个书面协议 ,它清楚规定 交易双方的权利和责任。 交易双方的权利和责任。

二、Fill in the blanks to complete each sentence 1.An international sales contract is not merely a document setting forth quantity, price, delivery arrangement of the product; it must also take into account the local 1egal system and political and exchange risks in the country involved. 2.Settlement on commercial credit usually includes Payment in advance ,Open account , Remittanceand Collection. and 3. Settlement on bank credit includes Letter of Credit and Bank guarantee .

国际贸易是以一国的产品和劳务交换另一国 的产品和劳务。通常情况下, 的产品和劳务。通常情况下,国与国之间并 不直接用产品和劳务相交换, 不直接用产品和劳务相交换,而是以销售产 品所得的收入来购买另一国的产品和劳务。 品所得的收入来购买另一国的产品和劳务。

terms: 2.trade terms:贸易术语 Trade terms are also called “price terms”/ “delivery terms”. Trade terms are key elements of international contract of sale, since they tell the parties what to do with respect to: Delivery terms, Price terms, Delivery obligation, the popular trade terms are developed and issued by ICC “Incoterms2000” incluedes 13 trade terms. 贸易术语又称为价格术语、交货术语, 贸易术语又称为价格术语、交货术语,它是国际销售 合同的重要组成部分, 合同的重要组成部分,用简洁语言告诉各个参与方该 做重要事项:如交货条件、价格条件、交货义务等。 做重要事项:如交货条件、价格条件、交货义务等。 最常见的贸易术语是国际商会ICC “Incoterms2000” , 最常见的贸易术语是国际商会 它包括13种贸易术语 种贸易术语。 它包括 种贸易术语。

6、国际贸易的主要参与者 The major participants in international trade 商品检验条款: 7、商品检验条款: Commodity inspection clause 8 、 履 行 交 货 责 任 : fulfills his obligation to deliver 货物已越过船舷: ship’s 9 、 货物已越过船舷 :the goods passed the ship s rail 10、 10、国际贸易合同是在与国内贸易合同完全不同的环 境下进行的 International contracts must be prepared and negotiated in a completely different context than domestic ones

四、decide whether the following statements are true or false

1.Incoterms set out the obligation of the buyer( F ) seller’s 2.Under the term CFR, it is the seller s responsibility to procure the insurance for the goods transport ( F ) 3.Documentary credit affords a high degree of safety for both the buyer and seller ( T ) 4.Advance payment, open account, documentary collection and letter of credit are the usual means of payment to settle international trade tractions ( T ) 5.To the seller of the goods, the most satisfactory arrangement as far as payment is concerned is to receive it in advance ( T )