金融英语

金融英语

Intermediaries

The primary distinction between the two channels is that, in the first case, i.e. direct financing, the investor is faced directly with the credit risk of the issuer, while in the second case, i.e. financing through financial intermediation, a financial institution, such as a bank, interjects itself between users and providers of funds. Any analysis of the sector of money market dominated by financial intermediaries must be very much concerned with these financial institutions themselves (their policies, financial conditions and official regulatory environment) in addition to those factors governing the suppliers and users of funds.

1.2

Functions

Apart from borrowing from banks, a firm or an individual can obtain funds in a financial market in two ways. The most common method is to issue a debt instrument, such as a bond or a mortgage, which is a contractual agreement by the borrower to pay the holder of the instrument fixed amounts at regular intervals (interest and principal payments) until a specified date (the maturity date), when a final payment is made.

金融英语

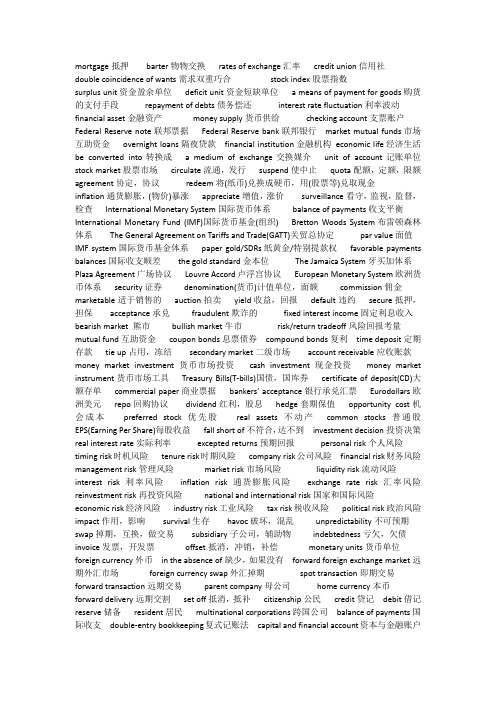

mortgage抵押barter物物交换rates of exchange汇率credit union信用社double coincidence of wants需求双重巧合stock index股票指数surplus unit资金盈余单位deficit unit资金短缺单位 a means of payment for goods购货的支付手段repayment of debts债务偿还interest rate fluctuation利率波动financial asset金融资产money supply货币供给checking account支票账户Federal Reserve note联邦票据Federal Reserve bank联邦银行market mutual funds市场互助资金overnight loans隔夜贷款financial institution金融机构economic life经济生活be converted into转换成 a medium of exchange交换媒介unit of account记账单位stock market股票市场circulate流通,发行suspend使中止quota配额,定额,限额agreement协定,协议redeem将(纸币)兑换成硬币,用(股票等)兑取现金inflation通货膨胀,(物价)暴涨appreciate增值,涨价surveillance看守,监视,监督,检查International Monetary System国际货币体系balance of payments收支平衡International Monetary Fund (IMF)国际货币基金(组织) Bretton Woods System布雷顿森林体系The General Agreement on Tariffs and Trade(GATT)关贸总协定par value面值IMF system国际货币基金体系paper gold/SDRs纸黄金/特别提款权favorable payments balances国际收支顺差the gold standard金本位The Jamaica System牙买加体系Plaza Agreement广场协议Louvre Accord卢浮宫协议European Monetary System欧洲货币体系security证券denomination(货币)计值单位,面额commission佣金marketable适于销售的auction拍卖yield收益,回报default违约secure抵押,担保acceptance承兑fraudulent欺诈的fixed interest income固定利息收入bearish market 熊市bullish market牛市risk/return tradeoff风险回报考量mutual fund互助资金coupon bonds息票债券compound bonds复利time deposit定期存款tie up占用,冻结secondary market二级市场account receivable应收账款money market investment货币市场投资cash investment现金投资money market instrument货币市场工具Treasury Bills(T-bills)国债,国库券certificate of deposit(CD)大额存单commercial paper商业票据bankers’ acceptance银行承兑汇票Eurodollars欧洲美元repo回购协议dividend红利,股息hedge套期保值opportunity cost机会成本preferred stock优先股real assets不动产common stocks普通股EPS(Earning Per Share)每股收益fall short of不符合,达不到investment decision投资决策real interest rate实际利率excepted returns预期回报personal risk个人风险timing risk时机风险tenure risk时期风险company risk公司风险financial risk财务风险management risk管理风险market risk市场风险liquidity risk流动风险interest risk利率风险inflation risk通货膨胀风险exchange rate risk汇率风险reinvestment risk再投资风险national and international risk国家和国际风险economic risk经济风险industry risk工业风险tax risk税收风险political risk政治风险impact作用,影响survival生存havoc破坏,混乱unpredictability不可预期swap掉期,互换,做交易subsidiary子公司,辅助物indebtedness亏欠,欠债invoice发票,开发票offset抵消,冲销,补偿monetary units货币单位foreign currency外币in the absence of缺少,如果没有forward foreign exchange market远期外汇市场foreign currency swap外汇掉期spot transaction即期交易forward transaction远期交易parent company母公司home currency本币forward delivery远期交割set off抵消,抵补citizenship公民credit贷记debit借记reserve储备resident居民multinational corporations跨国公司balance of payments国际收支double-entry bookkeeping复式记账法capital and financial account资本与金融账户investment income投资收益tangible trade有形贸易trade deficit贸易赤字trade surplus贸易盈余intellectual properties知识产权capital inflow资本流入capital outflow资本流出portfolio investment间接投资,(有价)证券投资money market instruments货币市场工具official reserve assets官方储备资产foreign direct investment(FDI)外国直接投资address开立order指定的人bearer来人affiliate分支机构remittance汇款collection托收present提示cash兑现withdraw提取protest做拒绝证书round整数的bill of exchange汇票sight draft即期汇票arrival draft货到付款汇票time draft远期汇票grace period宽限期be bound to一定的,必定的collecting bank代收行remitting bank托收行crossed cheque划线支票open cheque现金支票traveler’s cheque旅行支票in one’s presence当某人面Traveler’s Letter of Credit旅行信用证Economists define money(or equivalently, the money supply)as anything that is generally accepted in repayment for goods or services or in repayment for debts.经济学家将货币(或货币供给)定义为在商品或服务的支付中或在偿还债务中被普遍接受的任何东西。

金融英语练习答案

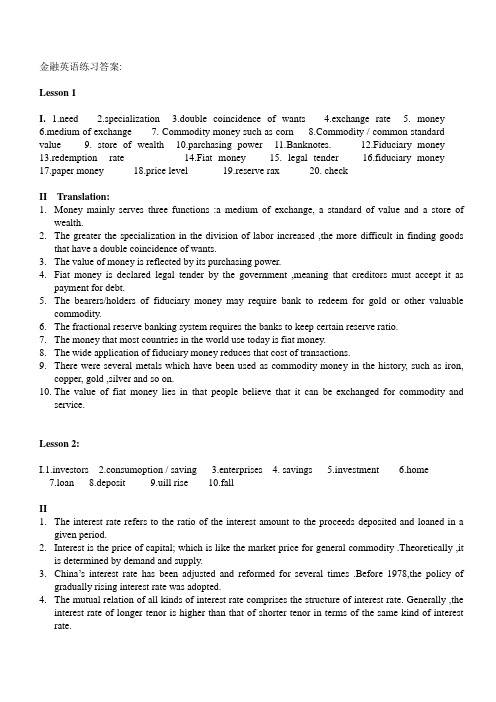

金融英语练习答案:Lesson 1I. 1.need 2.specialization 3.double coincidence of wants 4.exchange rate 5. money6.medium of exchange7. Commodity money such as cornmodity / common standard value9. store of wealth 10.parchasing power 11.Banknotes. 12.Fiduciary money 13.redemption rate 14.Fiat money 15. legal tender 16.fiduciary money 17.paper money 18.price level 19.reserve rax 20. checkII Translation:1.Money mainly serves three functions :a medium of exchange, a standard of value and a store ofwealth.2.The greater the specialization in the division of labor increased ,the more difficult in finding goodsthat have a double coincidence of wants.3.The value of money is reflected by its purchasing power.4.Fiat money is declared legal tender by the government ,meaning that creditors must accept it aspayment for debt.5.The bearers/holders of fiduciary money may require bank to redeem for gold or other valuablecommodity.6.The fractional reserve banking system requires the banks to keep certain reserve ratio.7.The money that most countries in the world use today is fiat money.8.The wide application of fiduciary money reduces that cost of transactions.9.There were several metals which have been used as commodity money in the history, such as iron,copper, gold ,silver and so on.10.The value of fiat money lies in that people believe that it can be exchanged for commodity andservice.Lesson 2:I.1.investors 2.consumoption / saving 3.enterprises 4. savings 5.investment 6.home7.loan 8.deposit 9.uill rise 10.fallII1.The interest rate refers to the ratio of the interest amount to the proceeds deposited and loaned in agiven period.2.Interest is the price of capital; which is like the market price for general commodity .Theoretically ,itis determined by demand and supply.3.China’s interest rate has been adjusted and reformed for several times .Before 1978,the policy ofgradually rising interest rate was adopted.4.The mutual relation of all kinds of interest rate comprises the structure of interest rate. Generally ,theinterest rate of longer tenor is higher than that of shorter tenor in terms of the same kind of interest rate.5.Among various interest rate, the interest rate for deposit is lower that for loan; the interest rate offeredby commercial bank is higher than discount rate offered by the central bank.6.At present ,China’s interest rate system consists of the interest rate of bank, non-bank financialinstitution, portfolio and market.7.The discount rate offered by central bank refers to the discount rate for the instrument held by thecommercial banks. it reflects the redemption rate for the amounts of rediscount instrument.8.Due to free competition ,the demand and supply of currency borrowing and lending tend to bebalanced out through market mechanism .in this case ,the market interest rate is called equilibrium rate.9.The bond interest rate is interest rate paid by the government, banks and corporation for theaccommodation in the form of issuing, securities in domestic or foreign financial markets.10.The interest rate for corporate bond is basically determined by the bond issuing corporation itself, butthe government exercises control by setting the ceiling.Lesson 3:I.1.Firrancial intermediary 2.demard deposit /checking account 3.savings and loan associations, mutual savings bank and credit union. 4.Federal reserve system ernment securities/require that member banks hold reserves equal to some fraction of their deposits. 6.Feder Reserve Board 7.Federal Open market committee 8.reserve requirements 9.the ceiling 10. interest rate level 11.portfolios 12.outstanding loans 13.were deregulated 14.deposit insurance 15.merge with other banks 16. automatic teller machines 17.By pooling funds of many share holders 18.branches 19.The banking holding company 20.financialII1.Federal Reserve System was established in 1914,with its aim to stabilize the banking system. thepower of the Federal Reserve System was enhanced and centralized after the failures of many American banks in the Great Depression. The Arts passed in1980s authorized the Federal Reserve System with the power to regulate all the saving institutions. The main powers of Federal Reserve System were:(1)guide the transactions of open market so to control supply of money by buying and selling government securities,(2)determine the reserve requirements for saving institution (3)setting rediscount rate.2.The banking regulations in Great Depression made bank a trade that closely controlled andpredictable. But the high interest rate in 1970s disturbed the peaceful days of saving institutions. But many banks still couldn’t survive in the transive period of keen competition.Lesson 4:1.as a result of /helped to /by the time2.concerned about/at the outset3.offerd to take/in dollars/departure fromTransaction account is checking account which can write checks on deposits balance. They have three forms, the first one is “Demand Deposit”which banks don’t pay explicit interest; the second one is “ other checkable deposits”, which includes NOW(Negotiable Order of Withdrawal)accounts; the third one is Money Market Deposit accounts. Although banks can’t pay explicit interest on demand deposit, they can pay implicit interest in the form of proving free services. Different from NOW accounts, commercial banks don’t need to maintain reserves, so banks pay higher interest on the NOW accounts. At present, transaction account is the second largest debt form of the commercial banks.Lesson 5I1.as well as 2.in total assets 3.intermediate 4. title 5.an agent 6.Financial instruments 7.pay 8.as par 9.documentary letters of credit 10.prof-of –shipment documents . 11. HedgingII. Translation:Lesson 6I.1.bank 2.discount 3.buyers/sellers 4.short-term 5.borrowing/lending 6.deposits7.brokers 8.loans 9.linked 10.marketII Translation:1.The activities of money market mainly aim at keeping the liquidity of assets so that they can bechanged into cash on demand.2.On one hand, the money market meets the demand for short-term money of borrowers, one the otherhand, it finds a way out for lenders who have temporary excessive money.3.The Financial instruments of money market mainly are short-term treasury bill, commercial bill, bankacceptance, certificate of deposits, the tenors of these instruments range from one day shortest to one year longest.4.The participants of buying and selling short-term assets in the money market are individuals, businessfirms, various financial institutions, and governments. They act either as the provider of funds or as the demander of funds.5.As the intermediary of money market, various financial institutions have different functions inaffecting the demand for and supply of funds in the capital market, because their stress of importance on business if different.6.The commercial banks provide the money market mainly with short-term loans mainly with themoney obtained from deposits and other sources.7.In many countries, commercial banks are in the position of key importance in the money market,while the central bank controls commercial banks by various means so as to control money market. 8.Just as a country can’t be without a government, the money market can’t be without a central bank,whose activities in money market will affect the volume of money and interest rate at any time.9.The inter-bank market refers to the market where financial institutions solve the problem of excessiveor short of money by financing one another.10.With the development of the reform of financial system in our country, the inter-bank markets startedto develop rapidly.Lesson 7I.1.firms 2.inter rate /exchange 3. regional exchange 4.negotiable 5.exchange6.bond7.funds8.outstanding9.brokers 10.dealers.II. Translation:1.According to the situation of various countries, the issuance of government bonds adopts the methodof raising money from public, which can be divided into direct and indirect ones.2.The government bonds outstanding are not all held by individuals, but by the government units,financial institutions and the public commonly.3.The government should keep a stable increase for the issuance of securities, if the market price for thegovernment bonds often fluctuate, the investors will be reluctant to hold the government bonds.4.Corporate bonds are the certificates that the business owes to the public, it is the issuing corporationthat makes a promise to pay certain amount of money plus interest at a fixed date in future.5.The better the credit standing of a company, the longer maturity of the bond is ,but the solvency ofcorporate bonds cannot be compared with that of government, so the longest tenor of corporate bond will not be very long.pared with stock investment, the holders of corporate bonds can only have the interest income asthe fixed reward for the investment, but they can’t share the profit of the corporation like share holders.pared with stocks, corporation bonds have lower risks, but the safety can’t be compared to that ofgovernments bonds, that’s why the return ration is always higher than government bonds.8.With the rapid development of capitalist industry, shareholding corporation system becomesirresistible trend.9.The price of stocks are of substantial fluctuation, which makes investment of stocks very speculative.10.The market price of stocks is subject to the status of operation, allocation of profits, as well as to theeconomical, political social factors that make the price of stocks more volatile.Lesson 8I. 1.foreign 2.activities/lend 3.standing 4.role 5.independent 6.consortium banks7.money 8.bond 9.subsidiary 10.EurocurrencyII. Translation:1.In most countries, commercial banks all establish international department or foreign department inorder to deal in foreign exchange or to raise money for foreign trade.2.Due to the development of international banking business and the establishment of the bank’soverseas network organization, commercial banks of western countries become real multinational banks.3.The international network of the multinational bank includes branch, subsidiary, correspondent,resident representative and so on.4.The activities of the multinational bank through exclusive international network are retail deposit,money market activities, foreign trade financing, corporation loans, foreign trade business, investment business, trust business and so on .5.Because most of the clients of the multinational bank are large corporations and banks, they mainlydeal in retail deposits with few retail loans.6.The multinational banks put surplus money into money market when the demand is low, but raisemoney when demand is on rise.7.The tenor of foreign trade financing is usually short with high return, mostly denominated in thecurrency other that of the country where the bank locates.8.Corporation loans refer to the loans given to private business, state-owned business, especially to themultinational corporation.9.Foreign exchange business includes buying and selling foreign exchange and hedging conducting inforeign exchange market for the clients.10.Investment business refers to the underwriting of international securities and the distribution activities,as well as advisory service for customers and governments in the issue of securities.Lesson 9I.1.short-term 2.medium-term /long-term 3.restrictions 4.deposits 5.absence6.Euro currencies7.borrowers abroad8.entities9.deposits 10. convertibleII. Translation:1.Eurodollar refers to the deposits denominated in US dollar in various banks outside USA andEuropean branches of American banks, as well as the loans obtained by these banks.2.Off-shore money market is concentrated by Eurocurrency market , which is habitually called theEurodollar market, because the currency traded in this market is mainly Eurodollar.3.Eurobanks deal in Eurocurrency business which is strictly separated from domestic banking.4.London in the largest Eurodollar market, engaging in both deposit and loan, with huge volume oftransactions.5.Eurobank’s business usually not subject to local banking rules, such as deposit rate and maturity,therefore, banks can compete freely to attract customers.6.The interest rate for Eurodollar deposit is higher than for US domestic deposit since there is noreserve requirement for Eurodollar deposit nor premium insurance.7.The emergence of Eurodollar is due to the deficit of American balance of payments The accumulationof huge deficit and the outflow of large amount of US dollar resulted in substantial increase of Eurodollar deposits.8.The brokers or dealers of American stock Exchange often borrow Eurodollars from Eurodollarmarket.9.The Eurodollar market is a short-term wholesale market of inter bank, it functions in Europe asproviding banks with liquidity like the federal fund market in USA.10.Banks put the money in the Eurodollar market when the liquidity is excessive and borrow moneywhen the liquidity is in squeeze.Lesson 10I. Part(1)1.the creation of money 2.cooperative /voluntarily 3.external/economic reforms4.the par value system5.on demand6.stable/predictable/disadvantages7.float8.quota subscriptions 9.needy/favorable 10.buying power/importsPart(2)1.subsidize 2. internal 3.bargain 4.peg 5.payments 6.assistance/sufficient7.stabilizing/strengthening 8.repay/repayment period 9.effectively11.lower/export/governmentII. Translation:1.The fund shows great concern over the internal economic policies of its member countries.2.The Fund is a cooperative institution, overseeing/supervising and monitoring the foreign exchangepolicies its member countries.3.The exchange of currency is the center of financial connection/relation among various countries, aswell as a dispensable tool of world trade.4.Due to constant fluctuation of exchange rate for major/leading currency, the dealers of foreignexchange may gain profit or suffer loss.5.The convertibility of currencies facilitates tourism, trade and investment in a worldwide scale.6.By analyzing the wealth and economic status of each member the fund determines the quotasubscription for each member. The richer the country is, the higher quota it Subscribes.7.Since the abandonment of the par value system, the membership of the Fund has agreed to allow eachmember to choose its own method of determine an exchange value for its money.8.Man large industrial nations allow their currencies to float, other countries peg the value of theircurrency to that of a major currency of a group of currencies so that, for example, as the U.S. dollar rises in value their own currencies rise too.9.The source of finance of the Fund mainly comes from the quota subscription of its member countriesat the same time, the Fund also borrows money from member governments or their monetary authorities.10.The Fund lends money according to regulation to the member countries with a payments problem,due to their expenditure in foreign exchange exceeding income.Lesson 11I. Part(1)1.catalyst 2.equity 3. creditworthy 4.reschedule/made 5.carry6.fourfold7.share8.foreign exchange9.attained 10.indexPart(2)1.productivity 2.affiliates 3.self-sustaining 4.call up 5.quota/economic strength6.a third/raised7.politicalitary/political9.enjoined 10.indexII Translation:1.The IBRD has more than 140 member countries, which all subscribe quotas to the bank.2.The IBRD gives loans only to creditworthy borrowing countries for the project that has a high realrates of economic return.3.The IDA gives loans only to poorest countries with a annual GNP per capita lower than $795.Actually, 80% of IDA’s loans are given to the countries with annual per capita GNP lower than $410.4.The IDA gives loans only to the government of the borrowing countries, with maturity of 50 years(repayable over 50 years) with grace period of 10 years, no interest.5.In the past decade, the volume of the IBRD’s loans have increased by fourfold.6.The IBRD has helped to develop agriculture, improve education, increase the output of energy,expand industry, create better urban facilities, promote family planning, extend telecommunications network, modernize transportation systems, improve water supply and sewerage facilities, and establish medical care.7.It’s hard to say that the IBRD’s decisions on loans are not influenced by the political character of theborrowing countries.8.Some of the earliest borrowing countries of the IBRD have graduated from the reliance on the IBRD’sloans, in return they become the provider of the IBRD’s finance source.9.The IBRD and IFC jointly provide funds for many projects.10.The more quota the member country subscribes, the more votes it gains.Lesson 12I . Part(1) 1.foster 2.raise 3.subregional/regional 4.multilateral 5.cost-effective6.evaluation7.weighted8.proportional9.paid in 10.developrnental Part(2) 1.equity 2.private 3.subscriptions 4.installment 5.subscribed6.coordinate7.procurement8.absorb9.pooling 10.bidsII. Translation:1.The purpose of the ADB is to provide fund and technical assistance to its developing membercountries in the Asia-Pacific region and to promote investment and foster economic growth.2.The shortage of capital, lack of skilled labor, poor technology, limited markets and the vagaries ofnature have impeded the economic development of the developing countries.3.The Bank’s Charter provides that the capital owned by the Asia-Pacific member countries should notbe less than 60% of total equity.4.Multilateral institution plays an important role in the economic development.5.The projects for bank financing are identified after strictly evaluated.6.The ADB keeps close working relationship with the United Nations as well as all kinds of specialinstitution.7.Some member countries in Asia-Pacific region voluntarily increase their subscriptions.8.The main subscribers of the ADB have no veto. In practice, decisions are reached by process ofdiscussion rather than by voting.9.The capital structure of the ADB is crucial/vital key to its loan/financing capacity.10.The ADB is authorized to make and guarantee loans to its member countries.Lesson 13I 1. surplus 2.surplus 3.deficit 4.capital 5.demand 6.supply 7.supply/demand8.outstanding 9.demand 10.supplyII. Translation:1.Just as a country’s domestic economy should have a financial record, a country’s authority should alsohave a statistical summery for all the external economic and financial transaction of its residents.2.The content of the balance of payments concept differs in different historical stage.3.In narrow sense, the balance of payments is defined as the receipts and payments arising frominternational trade or receipt and payments in foreign exchange.4.The balance of payments is a kind of statistic statement in the given period, which reflects thetransactions of goods, services and incomers of an economy.5.The statement of balance of payments is a kind of material that statistical financial transactions in thegiven period according to the form stipulated by IMF.6.The items entering into credit includes goods and services provided from abroad and so on.7.The items entering into debit includes goods and services obtained from abroad and so on.8.Receipts and payment arising from international trade is the most important item in current account,which comprise export and import of various commodities. Generally, the export and import of commodities account for the biggest proportion in the international transactions.9.Capital account reflects the changed of a country’s foreign assets and liabilities. The financial assethere doesn’t include monetary gold and Special Drawing Rights.10.In order to alter the deficits of our country’s balance of payments, the government adopts a series ofpolicies and measures, for examples, reduce domestic basis construction, adjust the structure of exporting and importing commodity, improve the environment for foreign investment, lower the exchange rate of our currency to the main currencies in the world, and so on.Lesson 14I .1.strike 2.The exchange rate 3.bank deposits 4.coordinates5.Arbitraggeurs6.discrepancies7.depreciation8.appreciation9.foreign exchange market 10.speculatorsII. Translation:1.It’s vitally important for those who are engaged in international finance to be aware of the tender offoreign exchange market.2.As long as the foreign exchange floats, there always exist the risks of change of foreign exchange rateand interest rate.3.The arbitrageurs make profits by taking advantage rate across markets to buy low and sell high.4.The buyers and sellers come to an agreement of transaction according to the exchange rate of twocurrencies.5. A greater demand for foreign goods and services means a greater demand for foreign exchange.6.The view that the price of us dollar will fall might note be wrong.7.If more people want to exchange pound into US dollar, the change of exchange rate is favorable to USdollar, and unfavorable to pound when the demand exceeds the supply.8.If the supply of certain goods is excessive, the demand for the goods will go down/decline.9.To devaluate a country’s currency can encourage export.10.There are tow ways to express foreign exchange rate.Lesson 15I. Part (1) 1. fluctuate 2.predictable 3.Capital flows 4.manufactured 5.speed6. refinements7.open/bonds/exchange8.devaluation9.nominal10.halvePart(2) 1.devalues 2.priced 3.demand 4.expectations 5.profit 6.fund7.closed 8.reduces 9.real 10.verticalII. Translation:。

《金融英语》习题答案unit1-10

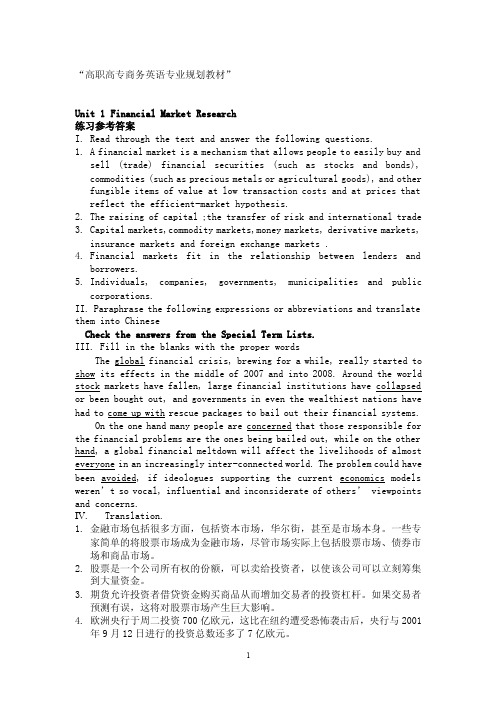

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

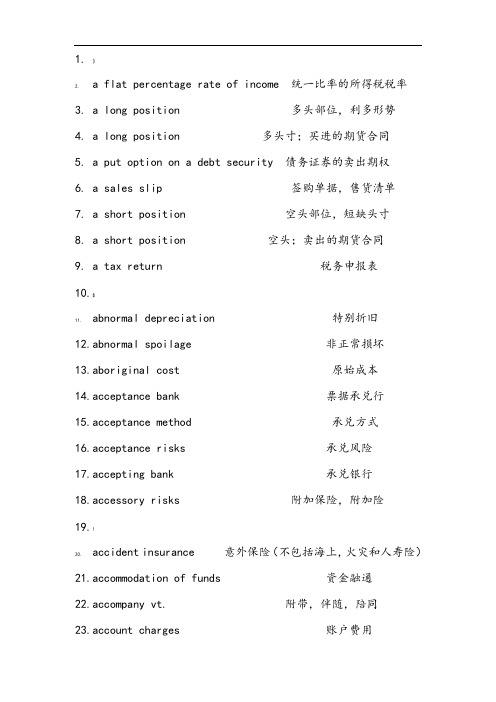

金融英语词汇大全

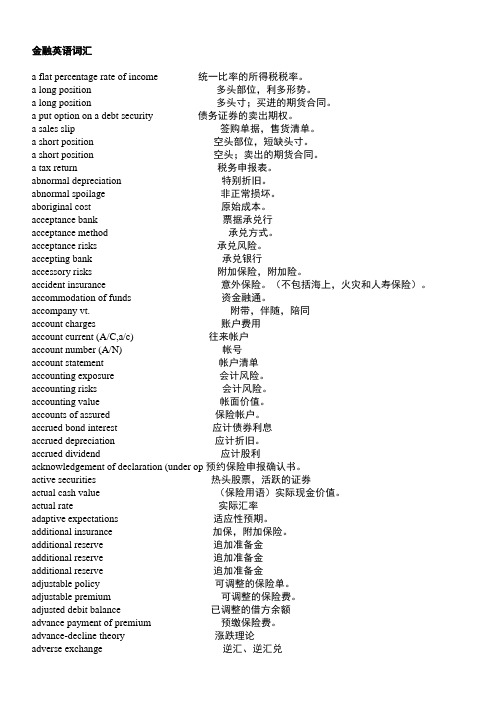

金融英语词汇a flat percentage rate of income 统一比率的所得税税率。

a long position 多头部位,利多形势。

a long position 多头寸;买进的期货合同。

a put option on a debt security 债务证券的卖出期权。

a sales slip 签购单据,售货清单。

a short position 空头部位,短缺头寸。

a short position 空头;卖出的期货合同。

a tax return 税务申报表。

abnormal depreciation 特别折旧。

abnormal spoilage 非正常损坏。

aboriginal cost 原始成本。

acceptance bank 票据承兑行acceptance method 承兑方式。

acceptance risks 承兑风险。

accepting bank 承兑银行accessory risks 附加保险,附加险。

accident insurance 意外保险。

(不包括海上,火灾和人寿保险)。

accommodation of funds 资金融通。

accompany vt. 附带,伴随,陪同account charges 账户费用account current (A/C,a/c) 往来帐户account number (A/N) 帐号account statement 帐户清单accounting exposure 会计风险。

accounting risks 会计风险。

accounting value 帐面价值。

accounts of assured 保险帐户。

accrued bond interest 应计债券利息accrued depreciation 应计折旧。

accrued dividend 应计股利acknowledgement of declaration (under op预约保险申报确认书。

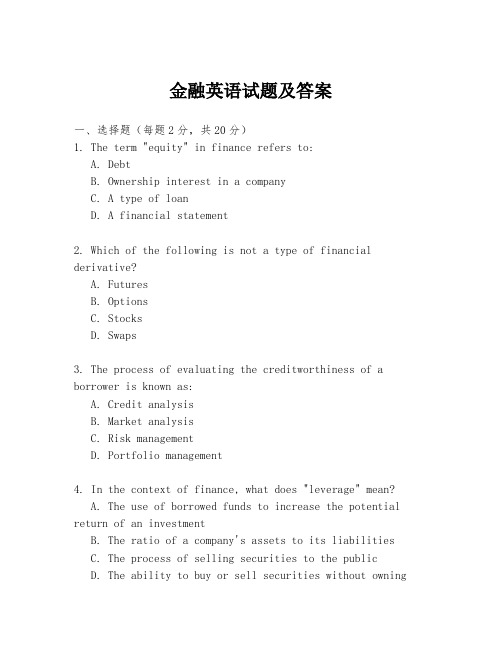

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. The term "equity" in finance refers to:A. DebtB. Ownership interest in a companyC. A type of loanD. A financial statement2. Which of the following is not a type of financial derivative?A. FuturesB. OptionsC. StocksD. Swaps3. The process of evaluating the creditworthiness of a borrower is known as:A. Credit analysisB. Market analysisC. Risk managementD. Portfolio management4. In the context of finance, what does "leverage" mean?A. The use of borrowed funds to increase the potential return of an investmentB. The ratio of a company's assets to its liabilitiesC. The process of selling securities to the publicD. The ability to buy or sell securities without owningthem5. A bond that pays no periodic interest but is issued at a discount to its face value is called:A. A zero-coupon bondB. A coupon bondC. A convertible bondD. A junk bond6. Which of the following is a measure of a company's ability to meet its short-term obligations?A. Current ratioB. Debt-to-equity ratioC. Return on equity (ROE)D. Earnings per share (EPS)7. The term structure of interest rates refers to the relationship between:A. The risk of an investment and its expected returnB. The maturity of a debt instrument and its yieldC. The size of a company and its market shareD. The economic cycle and the stock market performance8. A financial instrument that allows the holder to buy or sell an asset at a specified price within a specific time period is known as:A. A futureB. A forwardC. An optionD. A swap9. In finance, the term "carry trade" refers to:A. Borrowing money at a low interest rate to invest in a higher-yielding assetB. The practice of selling securities shortC. The strategy of buying and holding stocks for long periodsD. The process of hedging against currency fluctuations10. The primary market is where:A. Securities are first offered to the publicB. Securities are traded after they have been issuedC. Companies buy back their own sharesD. Investors can purchase commodities二、填空题(每空1分,共10分)11. The ________ is the difference between the bid price and the ask price of a security.12. A ________ is a financial institution that accepts deposits and provides loans.13. The ________ is the process of buying and selling securities on the same day.14. The ________ is the risk that the value of an asset will decrease due to market conditions.15. A ________ is a financial statement that shows a company's financial performance over a specific period.16. The ________ is the risk that a borrower will not repay a loan.17. A ________ is a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets.18. The ________ is the potential for an asset's value toincrease or decrease.19. The ________ is the process of determining the value of a business or business assets.20. A ________ is a financial instrument that represents ownership in a company.三、简答题(每题5分,共30分)21. Explain the concept of "leverage" in finance.22. What is the difference between a "mutual fund" and a "hedge fund"?23. Describe the role of a "stock exchange" in the financial markets.24. What is "risk management" and why is it important in finance?四、论述题(每题20分,共40分)25. Discuss the impact of "inflation" on different types of investments.26. Analyze the importance of "corporate governance" in ensuring the long-term success of a company.答案:一、1. B2. C3. A4. A5. A6. A7. B8. C9. A10. A二、11. Spread12. Bank13. Day trading14. Market risk15. Income statement16. Credit risk17. Mutual fund18. Volatility19. Valuation20. Stock三、21. Leverage in finance refers to the use of borrowed money to finance investments, with the goal of increasing potential returns. However, it。

金融英语翻译

金融用英语怎么说finance和banking都是金融的英语。

1、finance。

读音:英[ˈfaɪnæns];美[fəˈnæns, faɪ-, ˈfaɪˌnæns]。

词性:n.和vt.。

做名词时意为金融,作动词时意为为…供给资金,从事金融活动;赊货给…;掌握财政。

变形:过去式:financed;过去分词:financed;现在分词:financing;第三人称单数:finances。

例句:The finance minister will continue to mastermind Poland's eco nomic reform.翻译:财政部长将继续策划波兰的经济改革。

2、banking。

读音:英[ˈbæŋkɪŋ];美[ˈbæŋkɪŋ]。

词性:n.和v.。

做名词时意为金融,做动词时意为堆积(bank的现在分词);筑(堤);将(钱)存入银行;(转弯时)倾斜飞行。

例句:His government began to unravel because of a banking scand al.翻译:他的政府由于一起金融丑闻而开始瓦解。

扩展资料金融的常见英文词组:financial ratios、financial stringency、financial ref orm。

1、financial ratios。

释义:财务比率。

中文解释:财务比率是财务报表上两个数据之间的比率,这些比率涉及企业管理的各个方面。

例句:Ratio analysis is the process of determining and evaluating fin ancial ratios.翻译:比率分析是指对财务比率进行决定和评价的过程。

2、financial stringency。

发音:[faɪˈnænʃ(ə)l ˈstrindʒənsi]。

释义:金融呆滞。

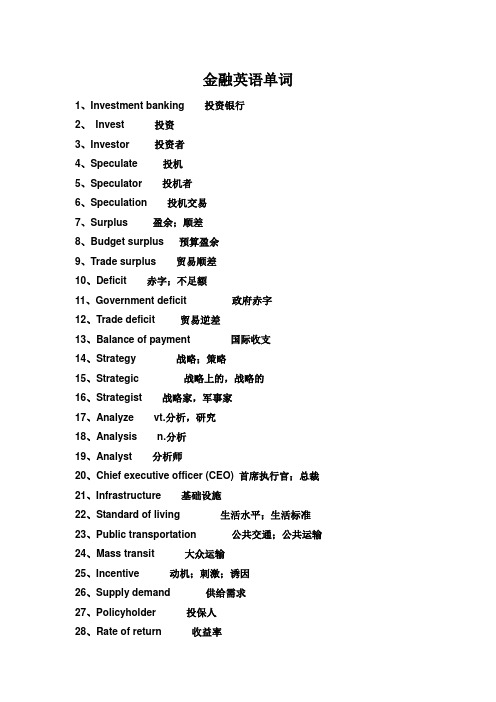

金融英语单词

金融英语单词1、Investment banking 投资银行2、Invest 投资3、Investor 投资者4、Speculate 投机5、Speculator 投机者6、Speculation 投机交易7、Surplus 盈余;顺差8、Budget surplus 预算盈余9、Trade surplus 贸易顺差10、Deficit 赤字;不足额11、Government deficit 政府赤字12、Trade deficit 贸易逆差13、Balance of payment 国际收支14、Strategy 战略;策略15、Strategic 战略上的,战略的16、Strategist 战略家,军事家17、Analyze vt.分析,研究18、Analysis n.分析19、Analyst 分析师20、Chief executive officer (CEO) 首席执行官;总裁21、Infrastructure 基础设施22、Standard of living 生活水平;生活标准23、Public transportation 公共交通;公共运输24、Mass transit 大众运输25、Incentive 动机;刺激;诱因26、Supply demand 供给需求27、Policyholder 投保人28、Rate of return 收益率29、Expected rate of return 预期收益率30、Interest 利息31、Interest rate 利率32、Dividend 股息,红利33、Profit 利润34、Loss 缺失35、Financial intermediary 金融中介机构36、Primary market 一级市场37、Secondary market 二级市场38、Financial instrument 金融工具39、Trust company 信托公司40、Credit union 信用合作社41、Mutual funds 共同基金42、Mortgage broker 贷款经纪人43、Pension fund 养老基金44、Insurance company 保险公司45、Venture capital Company 风险投资公司46、Joint venture 合资企业,联合经营47、Stock exchange 证券交易所48、Transaction 交易49、Listed company 上市公司50、Commodity 商品;期货51、Crude oil 原油52、Physical market 现货市场53、Intangible (notional) market 无形市场54、Nasdaq 纳斯达克55、Over the counter market OTC 场外交易场所56、Debt 债务;负债57、Equity 权益;股本58、Share 股份59、Stock 股票60、Common share 一般股61、Preferred share 优先股62、Money market 货币市场63、Capital market 资本市场64、Banker’s acceptance 银行承兑65、Commercial paper 商业票据66、Operating bank loan 营业贷款67、Marketability 适销性68、Liquidity 流淌性;变现能力69、Liquid 流淌70、Security 证券71、Broker 经纪人72、Brokerage 回扣;佣金73、Capital structure 资本结构74、Corporation 股份公司75、Default 违约76、Derivatives 金融衍生品77、Market maker 做市商78、Market risk 市场风险79、Offer (ask) 出售报价80、Bid 买入81、Portfolio 投资组合[pɔ:t'fəuljəu, ,pəut-]82、Price transparency 价格透亮度83、Private placement 私募配售84、Risk averse 规避风险85、Risk premium 风险溢价86、Risk profile 风险分析图87、Bankrupt 破产88、Bankruptcy 破产89、Asset 总资产90、Liability 责任;负债91、Face value, par 面值92、Principal 本金93、Maturity 到期94、Coupon rate 票面利率95、Discount 贴现96、Premium 溢价;盈利;升水['pri:miəm]97、Current yield 当期收益率98、Yield to maturity YTM 到期收益率99、Issuer 发行人;证券发行者100、Rating agency 评级公司101、Standard & Poor’s 标普102、Moody’s 穆迪103、Fitch 惠誉评级104、Bonds 债券105、Corporate bond 公司债券106、Municipal bond 市政债券;地点债券107、Convertible bond 可转债108、Zero coupon bonds 零息债券109、Junk bonds 垃圾债券110、Bull market 牛市111、Bear market 熊市112、Capital gain 资本利得113、Capital loss 资本缺失114、Credit risk 信用风险115、Fixed interest rate 固定利率116、Floating interest rate 浮动利率117、Foreign bonds 外国债券118、International bonds 国际债券119、Yield 收益(率)120、Yield curve 收益曲线121、Initial public offering IPO 首次公布发行122、American depositary shares ADS 美国存托股票123、American depositary receipt ADR 美国存托凭证124、Blue chip 蓝筹股125、Red chip 红筹股126、Growth stock 增长型股票127、Value stock 价值型股票128、Over valued 高估129、Under valued 低估130、Fundamental analysis 差不多分析131、Technical analysis 技术分析132、Business cycle 经济周期;商业周期133、Recovery 复苏时期134、Booming 繁荣时期135、Recession 衰退时期136、Depression 萧条时期137、The Great Depression 大萧条138、Financial statement (report) 财务报表139、Balance sheet 资产负债表140、Income statement 损益表141、Revenue 收入142、Outstanding 逾期未付143、Earnings per share EPS 每股收益144、Gross domestic product GDP 国内生产总值145、Gross national product GNP 国民生产总值146、Inflation rate 通胀率147、Merger and acquisition 并购148、Multinational Corporation 跨国公司149、Payout ratio 派息率150、Price earnings ratio P/E ratio 市盈率,本益比151、Private company 私人持股公司152、Public company 股票上市公司153、Stock symbols 证券交易代码154、Listing 挂牌;上市155、Delisting 退市156、Index 指数157、Indicator 指标158、Syndicate 银团159、Underwriting 承销160、Future 期货161、Option 期权162、Put option 看跌期权163、Call option 看涨期权164、Forward 远期165、Swap 互换;掉期166、Underlying commodity 基础商品167、Counterparty risk 交易对手违约风险168、Foreign exchange risk 外汇风险169、Sovereign risk 主权风险;政治风险170、Insurance 保险171、Life insurance 人身保险;人寿险172、Property insurance 财产保险173、Automobile insurance 汽车保险174、Money laundering 洗钱['lɔ:ndəriŋ, 'lɑ:n-]。

金融英语课件

金融英语

• 8.The system of keeping one’s money on deposit with the goldsmith was safer than leaving money where it could be easily stolen, but it was a bit nuisance to have to visit the goldsmith each time money needed.

• 交易中介是交换所出售商品和服务时被 普遍接受的任何东西。玉米不是最终的 交换物而是最终交换物的中介。

金融英语

• 5 . Rather than having to quote rate of exchange for each good in terms of every other good, as was the case in the barter economy, the price of everything could be measured in terms of corn.

• rate of inflation 通货膨胀率 scarce resources 稀缺资源

• social cost of funds 资 金 的 社 会 成 本 credit institution 信贷机构

• principal 资金 本金 基本财产 denomination

面值

金融英语

• 1. In any economy in which decision by individual economic units play a major role, interest rates perform several important function through which they exercise a pervasive influence over economic decision and performance, similar in scope to the influence of other economy-wide prices such as the exchange rate and the basic wage rate.

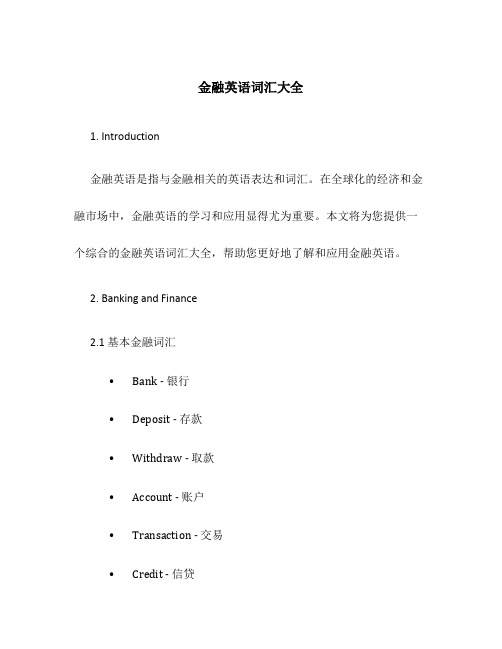

金融英语词汇大全

金融英语词汇大全1. Introduction金融英语是指与金融相关的英语表达和词汇。

在全球化的经济和金融市场中,金融英语的学习和应用显得尤为重要。

本文将为您提供一个综合的金融英语词汇大全,帮助您更好地了解和应用金融英语。

2. Banking and Finance2.1 基本金融词汇•Bank - 银行•Deposit - 存款•Withdraw - 取款•Account - 账户•Transaction - 交易•Credit - 信贷•Debit - 借记•Interest - 利息•Loan - 贷款•Invest - 投资•Exchange - 兑换•Stock - 股票•Bond - 债券•Mortgage - 抵押贷款•Insurance - 保险•Asset - 资产•Liability - 负债•Interest Rate - 利率•Inflation - 通货膨胀•Market - 市场•Economy - 经济•Currency - 货币•Exchange Rate - 汇率2.2 金融机构和职位•Banker - 银行家•Investor - 投资者•Broker - 经纪人•Accountant - 会计师•Economist - 经济学家•Trader - 交易员•Analyst - 分析师•Auditor - 审计员•Financial Planner - 理财规划师•Risk Manager - 风险经理•Asset Manager - 资产经理•Underwriter - 承销商•Teller - 出纳员2.3 金融活动和操作•Open an Account - 开户•Close an Account - 销户•Make a Deposit - 存款•Withdraw Money - 取钱•Transfer Funds - 转账•Take out a Loan - 借款•Pay off a Loan - 还款•Invest in Stocks - 投资股票•Buy Bonds - 购买债券•Trade on the Stock Market - 在证券市场交易•Issue Shares - 发行股票•Apply for Insurance - 申请保险•Calculate Interest - 计算利息•Analyze Financial Statements - 分析财务报表•Audit Financial Records - 审计财务记录•Manage Risk - 管理风险•Plan for Retirement - 规划退休3. Investment and Trading3.1 投资和交易相关词汇•Portfolio - 投资组合•Dividend - 股息•Capital Gain - 资本收益•Hedge Fund - 对冲基金•Short Sell - 卖空•Day Trading - 日内交易•Leverage - 杠杆•Margin - 保证金•Diversification - 分散化投资•Blue-chip Stock - 蓝筹股•Bull Market - 牛市•Bear Market - 熊市•Volatility - 波动性•Volatility Index (VIX) - 波动率指数•Option - 期权•Futures - 期货•Commodity - 商品•Exchange-traded Fund (ETF) - 交易所交易基金3.2 金融市场•Stock Market - 股票市场•Bond Market - 债券市场•Forex Market - 外汇市场•Commodity Market - 商品市场•Derivatives Market - 衍生品市场•Cryptocurrency Market - 加密货币市场4. Risk Management4.1 风险管理相关词汇•Risk - 风险•Risk Assessment - 风险评估•Risk Tolerance - 风险承受能力•Risk Appetite - 风险偏好•Risk Mitigation - 风险缓解•Risk Diversification - 风险分散•Credit Risk - 信用风险•Market Risk - 市场风险•Operational Risk - 运营风险•Systemic Risk - 系统性风险•Liquidity Risk - 流动性风险•Reputation Risk - 声誉风险•Counterparty Risk - 对手方风险•Risk Management Plan - 风险管理计划•Risk Control - 风险控制5. Conclusion通过阅读和学习这个金融英语词汇大全,您已经了解了金融英语中最常用的词汇和表达方式。

金融英语词汇(超全版)

1.》2. a flat percentage rate of income 统一比率的所得税税率3.a long position 多头部位,利多形势4.a long position 多头寸;买进的期货合同5.a put option on a debt security 债务证券的卖出期权6.a sales slip 签购单据,售货清单7.a short position 空头部位,短缺头寸8.a short position 空头;卖出的期货合同9.a tax return 税务申报表10.$11.abnormal depreciation 特别折旧12.abnormal spoilage 非正常损坏13.aboriginal cost 原始成本14.acceptance bank 票据承兑行15.acceptance method 承兑方式16.acceptance risks 承兑风险17.accepting bank 承兑银行18.accessory risks 附加保险,附加险19.!20.accident insurance 意外保险(不包括海上,火灾和人寿险)21.accommodation of funds 资金融通22.accompany vt. 附带,伴随,陪同23.account charges 账户费用24.account current (A/C,a/c) 往来帐户25.account number (A/N) 帐号26.account statement 帐户清单27.accounting exposure 会计风险28.'29.accounting risks 会计风险30.accounting value 帐面价值31.accounts of assured 保险帐户32.accrued bond interest 应计债券利息33.accrued depreciation 应计折旧34.accrued dividend 应计股利35.acknowledgement of declaration (under op预约保险申报确认书36.active securities 热头股票,活跃的证券37.!38.actual cash value (保险用语)实际现金价值39.actual rate 实际汇率40.adaptive expectations 适应性预期41.additional insurance 加保,附加保险42.additional reserve 追加准备金43.adjustable policy 可调整的保险单44.adjustable premium 可调整的保险费45.adjusted debit balance 已调整的借方余额46.*47.advance payment of premium 预缴保险费48.advance-decline theory 涨跌理论49.adverse exchange 逆汇、逆汇兑50.advice of drawing 提款通知书51.advising bank 通知银行52.affiliated bank 联行53.affiliated person 关联人54.aftermarket 次级市场55.@56.agent for collection 托收代理银行57.Agricultural Bank of China 中国农业银行58.agricultural loans 农业贷款59.agricultural(animal husbandry)tax 农(牧)业税60.allowance for doubtful debt 备抵呆帐款项61.alternative (either/or) order 选择指令62.American Express card 运通卡63.American terms 美国标价法64.;65.amount in figures 小写金额66.amount in words 大写金额67.annual membership dues 年费68.application form for a banking account 银行开户申请书69.appointed bank 外汇指定银行70.appreciation of exchange rate 汇率升值71.arbitrage 套利72.arbitrage 套购,套利,套汇73.:74.arbitrage of exchange 套汇75.arbitrage of exchange or stock 套汇或套股76.arbitrage opportunity 套价机会77.arbitrage risks 套汇风险78.as agent 做代理79.as principal 做自营n Development Fund (ADB) 亚洲开发银行81.ask price = asking price = offer price 出售价,报价,开价,出价82.¥83.ask-bid system 竞价系统84.assessment of loss 估损85.assets insurance 资产保险86.assignment of policy 保单转让87.assumption of risk 承担风险88.asymmetry 不对称89.at owner's risk 风险由货主负担90.at-the-close order 收盘指令91.{92.at-the-market 按市价93.at-the-money 平值期权94.at-the-opening (opening only) order 开盘指令95.auction marketplace 拍卖市场96.automated teller machines (24 hours a day) 自动取款机(24小时服务)97.automatic transfers between accounts 自动转帐98.average 平均数99.baby bond 小额债券100.%101.back spreads 反套利102.back wardation 现货溢价103.balance n. 结余,差额,平衡104.bank balance 存款余额105.bank balance over required reserves 超出法定(必备)储备的银行存款余额106.bank deposit 银行存款107.Bank of China 中国银行108.Bank of Communications 交通银行109.,110.bank of deposit 存款银行111.bank of the government 政府的银行112.banker's association 银行协会113.banker's bank 中央银行114.banker's guarantee 银行担保115.bank's buying rate 银行买入价116.bank's selling rate 银行卖出价117.banks with business dealing with the center中央银行的往来银行118.:119.Barclay card 巴克莱银行信用卡120.base rate 基本汇价121.basis order 基差订单122.basis risk 基差风险123.bear market 熊市124.bear operation 卖空行为125.bear raiders 大量抛空者126.beneficial owner 受益所有人127.、128.beneficiary of insurance 保险金受益人129.best-efforts offering 尽力推销(代销)发行130.bid and ask prices 买入和卖出价131.bid and ask spread 买卖差价132.bid price = buying price 买价133.bid-ask spread 递盘虚盘差价134.big board 大行情牌135.big slump 大衰退(暴跌)136.:137.bill-paying services 代付帐款138.black market 黑市139.black market financing 黑市筹资140.black money 黑钱141.blanket mortgage 总括抵押142.block positioner 大宗头寸商143.blowout 畅销144.blue-chip stocks 蓝筹股145.(146.board of arbitration 仲裁委员会147.board of governors 理事会148.bond fund 债券基金149.borrowing from affiliates 向联营公司借款150.borrowing power of securities 证券贷款能力151.borrowing risks 借款风险152.bought deal 包销153.bread and butter business 基本业务154.-155.breadth index 宽度指数156.break-even 不亏不盈,收支相抵157.breakout 突破158.bridging finance 过渡性融资159.broker 经纪人,掮客160.brokerage 经纪人佣金161.brokerage 经纪业;付给经纪人的佣金162.brokerage firm 经纪商(号)163.,164.broker's loan 经纪人贷款165.broking house 经纪人事务所166.building agreement 具有约束力的协定167.building tax (tax on construction)建筑税168.bullish 行情看涨169.business insurance 企业保险170.business risk 营业风险171.business savings 企业储蓄172.《173.business tax 营业税174.business term loan 企业长期贷款175.bust-up risks 破产风险176.buyer's risks 买方风险177.call (option) 买方期权,看涨期权178.call and put options 买入期权和卖出期权179.call for funds 控股、集资180.call loan transaction 短期拆放往来181.、182.call market 活期存款市场183.call money 拆放款184.call options on an equity 权益(证券)的买入期权185.call-options 认购期权186.cancellation 取消187.cancellation money 解约金188.cap 带利率上限的期权189.capital assets 资本资产190.(191.capital lease 资本租赁192.capital market 信贷市场、资本市场193.capital resources 资本来源194.capital surplus 资本盈余195.capital transfer 资本转移196.capital turnover rate 资本周转率197.card issuing institution 发卡单位198.carefully selected applicant 经仔细选定的申请人199.、200.cargo insurance 货物保险201.cash 现金,现款v.兑现,付现款202.cash a cheque 支票兑现203.cash account 现金帐户204.cash advance 差旅预支款205.cash against bill of lading 凭提单付现206.cash against documents()凭单付现,凭单据付现金=document against cash207.cash and carry 付现自运;现金交易和运输自理;现购自运商店208.{209.cash and carry wholesale 付现自运批发210.cash assets 现金资产211.cash audit 现金审核212.cash audit 现金审核,现金审计213.cash balance 现金余额,现款结存214.cash basis 现金制215.cash basis 现金制,现金基础216.cash basis accounting 现金收付会计制217."218.cash before delivery()空货前付款,付款后交货,付现款交货219.cash bonus 现金红利220.cash book 现金簿;现金帐;现金出纳帐221.cash boy 送款员222.cash budget 现金预算223.cash card1 (银行)自动提款卡224.cash card2 现金卡225.cash claim 现金索赔226.【227.cash collection basis 收现法,收现制228.cash credit 活期信用放款,现金付出229.cash credit slip 现金支出传票230.cash currency 现金通货231.cash cycle 现金循环,现金周期232.cash day 付款日233.cash debit slip 现金收入传票234.cash department (商业机构中的)出纳部=counting-house235.]236.cash deposit 现金存款;保证金237.cash deposit as collateral 保证金,押金238.cash desk (商店、饭馆的)付款处239.cash disbursements 现金支出240.cash discount .) 现金折扣,付现折扣=settlement discount241.cash dispenser (美)自动提款机=cashomat242.cash dividend 现金股利243.cash down 即付,付现244.}245.cash equivalent value 现金等值,现金相等价值246.cash flow 资金流动247.cash flow 现金流动248.cash flow stream 现金流(量)249.cash holdings 库存现金250.cash holdings 库存现金251.cash in advance 预付现金252.cash in bank 存银行现金,银行存款253.;254.cash in hand (商行的)手头现金,库存现金=cash on hand 255.cash in transit 在途现金,在运现金256.cash in transit policy 现金运送保险单257.cash in treasury 库存现金258.cash invoice 现购发票259.cash items 现金帐项,现金科目260.cash journal 现金日记簿261.cash liquidity 现金流动(情况);现金周转262.$263.cash loan 现金贷款264.cash management services 现金管理业务265.cash market 现金交易市场,现货市场,付现市场266.cash nexus 现金交易关系267.cash on arrival 货到付现,货到付款268.cash on bank 银行存款;银行付款;现金支票付款269.cash on deliver (英)交货付款,现款交货=collect on delivery270.cash on delivery (COD) 交割付款271.》272.cash order(C/O)现金订货273.cash paid book 现金支出簿274.cash payment 现金支付275.cash payment 现金付款,现付276.cash payments journal 现金支出日记帐277.cash position 头寸278.cash position 现金状况,现金头寸279.cash price 现金售价,现金付款价格280.】281.cash purchase 现购,现金购买282.cash railway (商店中的)货款传送线283.cash ratio 现金比率284.cash receipts (CR) 现金收入285.cash receipts journal 现金收入日记帐286.cash records 现金记录287.cash register 现金登记机,现金收入记录机,收银机288.cash remittance 汇款单;解款单289.【290.cash remittance note 现金解款单,解款单291.cash requirement 现金需要量292.cash reserve 现金储备(金)293.cash resources 现金资源,现金来源294.cash resources (reserves) 现金准备295.cash sale 现售,现金销售=sale by real cash 296.cash sale invoice 现销发票,现售发票297.cash settlement 现金结算,现汇结算298.|299.cash short and over 现金尾差,清点现金余差;现金短溢300.cash slip 现金传票301.cash statement 现金报表,(现金)库存表302.cash ticket 现销票,门市发票303.cash transaction 现金交易304.cash verification 现金核实,现金核查305.cash voucher 现金凭单;现金收据306.cash with order (订货时付款,订货付现,落单付现307.¥308.cash without discount 付现无折扣309.cash yield discount 现金获利率,现金收益率310.cash-and-carry arbitrage 现货持有套利311.cashier 出纳员,收支员312.cashier's cheque .) 银行本票=cashier's order 313.central rate 中心汇率(一国货币对美元的汇率,并据此计算对其他货币的汇率)314.certificate of balance 存款凭单315.Certificate of Deposits (CDs) 大额定期存款单316.:317.certificated security 实物证券318.certificates of deposit (CDs) 大面额存款单319.certifying bank 付款保证银行320.change hands 交换,换手321.chartered bank 特许银行322.chattel 动产323.chattel mortgage 动产抵押324.chattel mortgage 动产抵押325./326.chattel mortgage bond (美)动产抵押(公司)债券327.chattel personal (私人)动产328.chattel real 准不动产(土地权等)329.check certificate 检验证明书330.check deposit 支票存款331.check list (核对用的)清单332.check sheet 对帐单333.checking account 支票帐户334.—335.checking deposits 支票存款,活期存款336.checking reserve 支票现金储备337.checkstand (超级市场的)点货收款台338.cheque (payable) to bearer 来人支票,不记名支票339.cheque book 支票簿340.cheque book stub 支票簿存根341.cheque card 支票卡342.cheque collection 支票兑取343.*344.cheque collector 支票兑取人345.cheque crossed 划线支票346.cheque crossed generally 普通划线支票347.cheque crossed specially 特别划线支票348.cheque deposit 支票存款349.cheque drawer 支票出票人350.cheque holder 支票执票人351.cheque only for account 转帐支票352.)353.cheque payable at sight 见票即付支票354.cheque protector 支票银码机355.cheque rate 票据汇兑汇率,票汇价格=sight rate ,short rate356.cheque register 支票登记簿357.cheque returned 退票,退回的支票358.cheque signer 支票签名机359.cheque stub 支票存根360.cheque to order 记名支票,指定人支票361./362.China Investment Bank 中国投资银行363.circulation risks 流通风险364.circulation tax (turnover tax)流转税365.city bank 城市银行366.claim a refound 索赔367.clean collections 光票托收368.clearing bank 清算银行369.clearing house 清算所370.|371.clearinghouse 清算公司,票据交换所372.close out 平仓,结清(账)373.closed and mortgage 闭口抵押374.closing order 收市价订单375.closing rate 收盘价376.closing transaction 平仓交易377.collar 带利率上下限的期权378.collateral loan 抵押借款379.*380.collecting bank 托收银行381.collecting bank 托收银行382.collecting bank 代收行383.collection instructions 委托(托收的)单据384.collection items 托收业务,托收项目385.collection of trade charges 托收货款386.collection on clean bill 光票托收387.collection on documents 跟单托收388.!389.collection order 托收委托书390.collection risk 托收风险391.collection risks 托收风险392.collection service 托收服务393.collective-owned enterprise bonus tax 集体企业奖金税394.collective-owned enterprise income tax 集体企业所得税mercial and industrial loans 工商贷款mercial deposit 商业存款397.…mercial paper 商业票据mercial paper house 经营商业票据的商号mercial risk 商业风险mercial terms 商业条件mission 佣金modity futures 商品期货modity insurance 商品保险mon collateral 共同担保406.!mon fund 共同基金mon stock 普通股mon trust fund 共同信托基金pensatory financing 补偿性融资petitive risks 竞争风险posite depreciation 综合折旧pound interest 复利pound rate 复利率415.¥pound rate deposit 复利存款prehensive insurance 综合保险418.condominium 公寓私有共有方式419.confirming bank 保兑银行420.congestion area 震荡区421.congestion tape 统一自动行情显示422.conservatism and liquidity 稳健性与流动性423.consortium bank 银团银行424.(425.constructure risk 建设风险426.consumer financing 消费融资427.contingent risks 或有风险428.contract money 合同保证金429.contract size 合约容量430.contracts of difference 差异合约431.contractual value 合同价格432.controlled rates 控制的汇率433.(434.converge 集聚,(为共同利益而)结合一起435.conversion 汇兑、兑换436.convertible currency 可兑换的货币437.cooling-off period 等待期438.cooperative financing 合作金融439.cornering the market 操纵市场440.corners 垄断441.corporate deposits 法人存款442.:443.correspondent 代理行444.cost of maintenance 维修费445.counter-inflation policy 反通货膨胀对策446.cover 弥补,补进(卖完的商品等)447.cover 弥补(损失等);负担(开支);补进(商品或股票等);保险448.coverage 承保险别;保险总额;范围保险449.coverage ratio 偿债能力比率450.cover-note 暂保单;投保通知单451.%452.credit 信用,信贷453.credit account ., C/A) 赊帐=open account2 454.credit agreement 信贷协定455.credit amount 信贷金额;赊帐金额;信用证金额456.credit analysis 信用分析457.credit balance 贷方余额,结欠,贷余458.credit bank 信贷银行459.credit beneficiary 信用证受益人460.@461.credit business 赊售,信用买卖462.credit buying 赊购463.credit capital 信贷资本464.credit cards 信用卡465.credit control 信用控制466.credit control instrument 信用调节手段467.credit expansion 信用扩张468.credit extending policy 融资方针469.;470.credit facility 信用透支471.credit limit 信用额度472.credit restriction 信用限额473.credit risk 信用风险474.credit union 信用合作社475.creditor bank 债权银行476.crop up (out) 出现,呈现477.cross hedge 交叉套做478.·479.cross hedging 交叉保值480.cum dividend 附息481.cum rights 含权482.cumulative preferred stock 累积优先股483.currency futures 外币期货484.currency futures contract 货币期货合约485.current fund 流动基金486.current futures price 现时的期货价格487.(488.current ratio 流动比率489.customize 按顾客的具体要求制作490.customs duty(tariffs)关税491.D/D (Banker's Demand Draft) 票汇492.daily interest 日息493.daily limit 每日涨(跌)停板494.date of delivery 交割期495.dealers 批发商496.'497.death and gift tax 遗产和赠与税498.debt of honour 信用借款499.debtor bank 借方银行500.decision-making under risk 风险下的决策501.deed 契约502.deed tax 契税503.deferred savings 定期存款504.deficit covering 弥补赤字505.:506.deficit-covering finance 赤字财政507.deflation 通货紧缩508.delivery date 交割日509.demand pull inflation 需求拉动通货膨胀510.demand-deposit or checking-accounts 活期存款或支票帐户511.deposit account (D/A) 存款帐户512.deposit at call 通知存款513.deposit bank 存款银行514.【515.deposit money 存款货币516.deposit rate 存款利率517.deposit turnover 存款周转率518.depreciation risks 贬值风险519.derivative deposit 派生存款520.derived deposit 派生存款521.designated currency 指定货币522.deutsche marks (=DM) 西德马克523.;524.devaluation of dollar 美元贬值525.developer 发展商526.Development Bank 开发银行527.development financing 发展融资528.devise 遗赠529.die intestate 死时没有遗嘱530.Diners card 大莱信用卡531.direct exchange 直接汇兑532.!533.direct financing 直接融资534.direct hedging 直接套做535.direct leases 直接租赁536.direct taxation 直接税537.discount credit 贴现融资538.discount market 贴现市场539.discount on bills 票据贴现540.discount paid 已付贴现额541.|542.discounted cash flow 净现金量543.discounting bank 贴现银行544.dishonour risks 拒付风险545.disintermediation 脱媒546.distant futures 远期期货547.diversification 分散投资548.dividends 红利549.document of title 物权单据550.[551.documentary collection 跟单托收552.Documents against Acceptance,D/A 承兑交单553.Documents against Payment,D/P 付款交单554.domestic correspondent 国内通汇银行555.domestic deposit 国内存款556.domestic exchange 国内汇兑557.double leasing 双重租赁558.double mortgage 双重抵押559.'560.double option 双向期权561.Dow Jones average 道·琼斯平均数562.down payment 首期563.downgrade 降级564.downside 下降趋势565.downtick 跌点交易566.Dragon card 龙卡567.draw 提款568.:569.draw cheque 签发票据570.drawee bank 付款银行571.drawing account 提款帐户572.dual exchange market 双重外汇市场573.dual trading 双重交易574.due from other funds 应收其他基金款575.due to other funds 应付其他基金款576.dumping 抛售577.{578.early warning system 预警系统579.easy credit 放松信贷580.economic exposure 经济风险581.efficient portfolio 有效证券组合582.electronic accounting machine 电子记帐机583.electronic cash 电子现金584.electronic cash register 电子收款机585.electronic debts 电子借贷586.—587.electronic funds transfer 电子资金转帐588.electronic transfer 电子转帐589.emergency tariff 非常关税590.encumbrance 债权(在不动产上设定的债权)591.endorsement for collection 托收背书592.engage in arbitrage (to) 套汇593.entity n. 单位,整体,个体594.entrance fee 申请费595./596.equalization fund (外汇)平衡基金597.equipment leasing services 设备租赁业务598.equity portfolio 股票资产599.establishing bank 开证银行600.ethics risks 道德风险601.Euro-bank 欧洲银行602.Eurocard 欧洲系统卡603.European terms 欧洲标价法604.~605.evaluation of property 房产估价606.evasion of foreign currency 逃汇607.exception clause 免责条款608.excess insurance 超额保险609.exchange adjustment 汇率调整610.exchange alteration 更改汇率611.exchange arbitrage 外汇套利612.exchange bank 外汇银行613.!614.exchange broker 外汇经纪人615.exchange brokerage 外汇经纪人佣金616.exchange business 外汇业务617.exchange clearing agreement 外汇结算协定618.exchange clearing system 汇结算制619.exchange competition 外汇竞争620.exchange contract 外汇成交单621.exchange control 外汇管制622.,623.exchange convertibility 外汇兑换624.exchange customs 交易所惯例625.exchange depreciation 外汇下降626.exchange dumping 汇率倾销627.exchange fluctuations 汇价变动628.exchange for forward delivery 远期外汇业务629.exchange for spot delivery 即期外汇业务630.exchange freedom 外汇自由兑换631.-632.exchange loss 汇率损失633.exchange parity 外汇平价634.exchange position 外汇头寸635.exchange position 外汇头寸;外汇动态636.exchange premium 外汇升水637.exchange profit 外汇利润638.exchange proviso clause 外汇保值条款639.exchange quota system 外汇配额制640.(641.exchange rate 汇价642.exchange rate fluctuations 外汇汇价的波动643.exchange rate parity 外汇兑换的固定汇率644.exchange rate risks 外汇汇率风险645.exchange reserves 外汇储备646.exchange restrictions 外汇限制647.exchange risk 外汇风险648.exchange risk 兑换风险649.)650.exchange settlement 结汇651.exchange speculation 外汇投机652.exchange stability 汇率稳定653.exchange surrender certificate 外汇移转证654.exchange transactions 外汇交易655.exchange value 外汇价值656.exchange war 外汇战657.excise 货物税,消费税658.*659.exercise date 执行日660.exercise price, striking price 履约价格,认购价格661.expenditure tax 支出税662.expenditure tax regime 支出税税制663.expenses incurred in the purchase 购买物业开支664.expiration date 到期日665.export and import bank 进出口银行666.export gold point 黄金输出点667.¥668.exposure 风险669.external account 对外帐户670.extraneous risks 附加险671.extrinsic value 外在价值672.face value 面值673.facultative insurance 临时保险674.fair and reasonable 公平合理675.far future risks 长远期风险676.、677.farm subsidies 农产品补贴678.farmland occupancy tax 耕地占用税679.favourable exchange 顺汇680.fax base 税基681.feast tax 筵席税682.feathered assets 掺水资产683.fee 不动产684.fee interest 不动产产权685.'686.fictions payee 虚构抬头人687.fictitious assets 虚拟资产688.fictitious capital 虚拟资本689.fiduciary a. 信托的,信用的,受信托的(人)690.fiduciary field 信用领域,信托领域691.finance broker 金融经纪人692.financial advising services 金融咨询服务693.financial arrangement 筹资安排694.!695.financial crisis 金融危机696.financial forward contract 金融远期合约697.financial futures 金融期货698.financial futures contract 金融期货合约699.financial insolvency 无力支付700.financial institutions' deposit 同业存款701.financial lease 金融租赁702.financial risk 金融风险703.%704.financial statement analysis 财务报表分析705.financial system 金融体系706.financial transaction 金融业务707.financial unrest 金融动荡708.financial world 金融界709.first mortgage 第一抵押权710.fiscal and monetary policy 财政金融政策711.fixed assets 固定资产712.|713.fixed assets ratio 固定资产比率714.fixed assets turnover ratio 固定资产周转率715.fixed capital 固定资本716.fixed costs 固定成本717.fixed deposit (=time deposit) 定期存款718.fixed deposit by installment 零存整取719.fixed exchange rate 固定汇率720.fixed par of exchange 法定汇兑平价721.[722.fixed savings withdrawal 定期储蓄提款723.fixed-rate leases 固定利率租赁724.flexibility and mobility 灵活性与机动性725.flexibility of exchange rates 汇率伸缩性726.flexible exchange rate 浮动汇率727.floating exchange rate 浮动汇率728.floating policy 流动保险单729.floating-rate leases 浮动利率租赁730.>731.floor 带利率下限的期权732.floor broker 场内经纪人733.fluctuations in prices 汇率波动734.foregift 权利金735.foreign banks 外国银行736.foreign correspondent 国外代理银行737.foreign currency futures 外汇期货738.foreign enterprises income tax 外国企业所得税739.}740.foreign exchange certificate 外汇兑换券741.foreign exchange crisis 外汇危机742.foreign exchange cushion 外汇缓冲743.foreign exchange dumping 外汇倾销744.foreign exchange earnings 外汇收入745.foreign exchange liabilities 外汇负债746.foreign exchange loans 外汇贷款747.foreign exchange parity 外汇平价748.)749.foreign exchange quotations 外汇行情750.foreign exchange regulations 外汇条例751.foreign exchange reserves 外汇储备752.foreign exchange restrictions 外汇限制753.foreign exchange retaining system 外汇留存制754.foreign exchange risk 外汇风险755.foreign exchange services 外汇业务756.foreign exchange transaction centre 外汇交易中心757.…758.forward exchange 期货外汇759.forward exchange intervention 期货外汇干预760.forward exchange sold 卖出期货外汇761.forward foreign exchange 远期外汇汇率762.forward operation 远期(经营)业务763.forward swap 远期掉期764.fraternal insurance 互助保险765.free depreciation 自由折旧766.、767.free foreign exchange 自由外汇768.freight tax 运费税769.fringe bank 边缘银行770.full insurance 定额保险771.full payout leases 充分偿付租赁772.full progressive income tax 全额累进所得税773.fund 资金、基金774.fund account 基金帐户775.…776.fund allocation 基金分配777.fund appropriation 基金拨款778.fund balance 基金结存款779.fund demand 资金需求780.fund for relief 救济基金781.fund for special use 专用基金782.fund in trust 信托基金783.fund liability 基金负债784.^785.fund obligation 基金负担786.fund raising 基金筹措787.fundamental insurance 基本险788.funds statement 资金表789.futures commission merchants 期货经纪公司790.futures contract 期货合约791.futures delivery 期货交割792.futures margin 期货保证金793.—794.futures market 期货市场795.futures price 期货价格796.futures transaction 期货交易797.FX futures contract 外汇期货合约798.galloping inflation 恶性通货膨胀799.gap 跳空800.general endorsement 不记名背书801.general fund 普通基金802.…803.general mortgage 一般抵押804.Giro bank 汇划银行805.given rate 已知汇率806.go long 买进,多头807.go short 短缺;卖空,空头808.going away 分批买进809.going rate 现行汇率810.Gold Ear Credit Card 金穗卡811.、ernment revenue 政府收入813.graduated reserve requirement 分级法定准备金814.Great Wall card 长城卡815.gross cash flow 现金总流量816.guarantee of payment 付款保证817.guaranteed fund 保证准备金818.hammering the market 打压市场819.handling charge 手续费820.[821.harmony of fiscal and monetary policies 财政政策和金融政策的协调822.hedge 套头交易823.hedge against inflation 为防通货膨胀而套购824.hedge buying 买进保值期货825.hedge fund 套利基金826.hedging mechanism 规避机制827.hedging risk 套期保值风险828.hire purchase 租购829.~830.hit the bid 拍板成交831.hoarded money 储存的货币832.holding the market 托盘833.horizontal price movement 横盘834.hot issue 抢手证券835.hot money deposits 游资存款836.hot stock 抢手股票837.house property tax 房产税838.(839.hypothecation 抵押840.idle capital 闲置资本841.idle cash (money) 闲散现金,游资842.idle demand deposits 闲置的活期存款843.immobilized capital 固定化的资产844.immovable property 不动产845.import regulation tax 进口调节税846.imposition 征税;税;税款847.;848.imprest bank account 定额银行存款专户849.in force (法律上)有效的850.in the tank 跳水851.inactive market 不活跃市场852.income in kind 实物所得853.income tax liabilities 所得税责任,所得税债务854.income taxes 所得税855.indemnity 赔偿,补偿856.*857.indirect arbitrage 间接套汇858.indirect finance 间接金融859.indirect hedging 间接套做860.indirect leases 间接租赁(即:杠杆租赁)861.indirect rate 间接汇率862.indirect taxation 间接税863.individual income regulation tax 个人调节税864.individual income tax 个人所得税865.}866.individual savings 私人储蓄867.Industrial and Commercial Bank of China 中国工商银行868.industrial financing 工业融资869.industrial-commercial consolidated tax 工商统一税870.industrial-commercial income tax 工商所得税871.industrial-commercial tax 工商税872.inflation 通货膨胀873.inflation rate 通货膨胀率874.、875.inflationary spiral 螺旋式上升的通货膨胀876.inflationary trends 通货膨胀趋势877.infrastructure bank 基本建设投资银行878.initial margin 初始保证金879.initial margin 期初保证权880.initial margins 初始保证金881.initial reserve 初期准备金882.insider 内幕人883.》884.installment savings 零存整取储蓄885.institution 机构投资者886.insurance appraiser 保险损失评价人887.insurance broker 保险经纪人888.insurance contract 保险契约,保险合同889.insurance saleman 保险外勤890.insurance services 保险业务891.insure against fire 保火险892./893.insured 被保险人894.interbank market 银行同业市场895.inter-business credit 同行放帐896.interest on deposit 存款利息897.interest per annum 年息898.interest per month 月息899.interest rate futures contract 利率期货合约900.interest rate policy 利率政策901..902.interest rate position 利率头寸903.interest rate risk 利率风险904.interest restriction 利息限制905.interest subsidy 利息补贴906.interest-rate risk 利息率风险907.interim finance 中间金融908.intermediary bank 中间银行909.intermediate account 中间帐户910.,911.internal reserves 内部准备金912.international banking services 国际银行业务913.International Investment Bank (IIB) 国际投资银行914.international leasing 国际租赁915.in-the-money 有内在价值的期权916.intraday 日内917.intrinsic utility 内在效用918.intrinsic value 实际价值,内部价值919.}920.inward documentary bill for collection 进口跟单汇票,进口押汇(汇票)921.isolation of risk 风险隔离922.issue bank 发行银行923.JCB card JCB卡924.joint financing 共同贷款925.key risk 关键风险926.kill a bet 终止赌博nd use tax 土地使用税928.)rge deposit 大额存款rge leases 大型租赁tent inflation 潜在的通货膨胀tent inflation 潜在的通货膨胀933.lease agreement 租约934.lease and release 租借和停租935.lease broker 租赁经纪人936.lease financing 租赁筹租937.、938.lease immovable 租借的不动产939.lease in perpetuity 永租权940.lease insurance 租赁保险941.lease interest insurance 租赁权益保险942.lease land 租赁土地943.lease mortgage 租借抵押944.lease out 租出945.lease property 租赁财产946.¥947.lease purchase 租借购买948.lease rental 租赁费949.lease territory 租借地950.leaseback 回租951.leasebroker 租赁经纪人952.leased immovable 租借的不动产953.leasehold 租赁土地954.leasehold 租借期,租赁营业,租赁权955.-956.leasehold property 租赁财产957.leaseholder 租赁人958.leaseholder 承租人,租借人959.leases agent 租赁代理960.leases arrangement 租赁安排961.leases company 租赁公司962.leases structure 租赁结构963.leasing 出租964.\965.leasing agreement 租赁协议966.leasing amount 租赁金额967.leasing asset 出租财产,租赁财产968.leasing clauses 租赁条款969.leasing consultant 租赁顾问970.leasing contract 租赁合同971.leasing cost 租赁成本972.leasing country 承租国973.·974.leasing division 租赁部975.leasing equipment 租赁设备976.leasing industry 租赁业977.leasing industry (trade) 租赁业978.leasing money 租赁资金979.leasing period 租赁期980.leasing regulations 租赁条例981.legal interest 法定利息982.,983.legal tender 法定货币984.legal tender 本位货币,法定货币985.lessee 承租人,租户986.lessor 出租人987.letter of confirmation 确认书988.letter transfer 信汇989.leveraged leases 杠杆租赁990.lien 扣押权,抵押权991.》992.life insurance 人寿保险993.life of assets 资产寿命994.limit order 限价指令995.limited floating rate 有限浮动汇率996.line of business 行业,营业范围,经营种类997.liquidation 清仓998.liquidity 流动性999.liquidity of bank 银行资产流动性1000.!1001.listed stock 上市股票1002.livestock transaction tax 牲畜交易税1003.loan account 贷款帐户1004.loan amount 贷款额1005.loan at call 拆放1006.loan bank 放款银行1007.loan volume 贷款额1008.loan-deposit ratio 存放款比率1009.?1010.loans to financial institutions 金融机构贷款1011.loans to government 政府贷款1012.local bank 地方银行1013.local income tax (local surtax) 地方所得税1014.local surtax 地方附加税1015.local tax 地方税1016.long arbitrage 多头套利1017.long position 多头头寸1018.、1019.long position 多头寸;买进的期货合同1020.long-term certificate of deposit 长期存款单1021.long-term credit bank 长期信用银行1022.long-term finance 长期资金融通1023.loss leader 特价商品,亏损大项1024.loss of profits insurance 收益损失保险1025.loss on exchange 汇兑损失1026.low-currency dumping 低汇倾销1027..1028.low-currency dumping 低汇倾销1029.M/T (= Mail Transfer) 信汇1030.main bank 主要银行1031.maintenance margin 最低保证金,维持保证金1032.major market index 主要市场指数1033.management risk 管理风险1034.managing bank of a syndicate 财团的经理银行1035.manipulation 操纵1036.;1037.margin 保证金1038.margin call 保证金通知1039.margin call 追加保证金的通知1040.margin money 预收保证金,开设信用证保证金1041.margin rate 保证金率1042.markdown 跌价1043.market discount rate 市场贴现率。

金融专业英语词汇大全

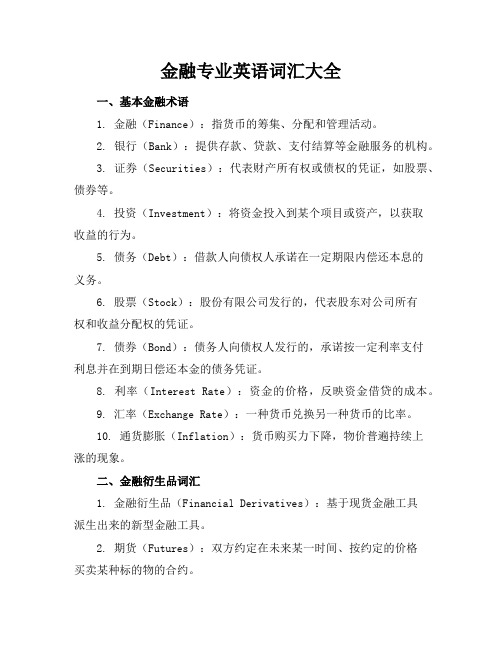

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

金融英语第六章答案

Chapter 6The Foreign Exchange MarketExercisesⅠ. Answer the following questions in English.1. How many common methods to express a foreign exchange rate?Answer:There are two common methods to express a foreign exchange rate.2. What is usefulness of settling account?Answer:Business people will pay and recieive different currencies.Therefore, they must convert the currencies that they received into the currencies thatthey could buy commodities.3. How does stop order work?Answer: Stop orders can be used to enter the market on momentuma or to limit the potential loss of a position.4. What do you think about single currency system? Is it possible to establishsingle currency system in the world now?Answer:I think a single currency system,it means no foreign exchange market,no foreign exchange rates,no foreign exchange.It is no possible to establish single currency system in the world now. Because in our world of mainly national currencies,the foreign exchange market plays the indispensable role of providing the essential machinery for making payments across borders,transferring funds and purchasing powerfrom one currency to another,and determining that singularly important price,the exchange rate.5. What is limit order?Answer: A limit is an order to buy or sell a currency at a specified price or better.6. How to make money for many traders through foreign exchange market?Answer:(一)You should have trading currencies with a strategy.(1) Currency Trading is Only For Part of Your Investment Money(2)You Must Limit Your Losses in Currency Trading(3)Know the Trends of the Foreign Currency Market Before Trading(二)Decide What Type of Currency Trader You Will be.(1)Trade currendes in multiple lots(2)Lose the urge to trade currencies every day(3)Stick to your trading planⅡ.Fill in the each blank with an appropriate word or expression.l. The currency trader should also decide the time __frame__ that he will be using to trade in order to determine which trend will be the most important. 2. The bid is the price at which dealers are willing to __buy__ dollars (basecurrency) in terms of yen (quote currency) and users of our trading platform can __sell__ dollars in terms of yen.3. The order remains active until the end of the trading day (5:00 PM EST),unless it is __executed__ or canceled by the trader.4. A GTC order remains active until it is canceled by the currency trader or untilthe order is executed. It is the __trade’s__ responsibility to __cancel__ aGTC order.5. The Foreign Exchange Market is where the majority of buying and selling ofworld __currencies__ takes place.6. When placing a limit order, the trader also specifies the__duration__ for whichthe order is to remain active while it is not executed.Ⅲ.Translate the following sentences into English.1.外汇交易市场,也称为“Forex”或“FX”市场,是世界上最大的金融市场,平均每天超过1兆美元的资金在当中周转——相当于美国所有证券市场交易额总和的30倍。

金融用英语怎么说

金融用英语怎么说金融指货币的发行、流通和回笼,贷款的发放和收回,存款的存入和提取,汇兑的往来等经济活动。

那么你知道金融用英语怎么说吗?下面来学习一下吧。

金融英语说法1:finance金融英语说法2:banking金融的相关短语:金融机构financial institution ; banking institution ; The Financial Institutions ; monetary institution金融市场 Financial market ; money market ; monetary market ; ING Financial Markets金融危机 financial crisis ; monetary crisis ; Economic crisis ; financial turmoil金融资产 Financial asset ; Monetary assets ; Capital markets ; FVTPL金融工具financial instruments ; Derivative Financial Instruments ; monetary instrument ; financial tool金融区 Financial District ; Canary Wharf金融学 Finance ; MSc Finance ; MSc in Finance ; fianc金融期货financial futures ; FITF ; haha financial futures ; Financial Ftres金融信用 credit ; Consumer Credit ; Lending industry ; Bank credit金融的英语例句:1. His government began to unravel because of a banking scandal.他的政府由于一起金融丑闻而开始瓦解。

金融术语英语

金融英语(术语)inflation 通货膨胀deflation 通货紧缩tighter credit 紧缩信贷monetary policy 货币政策foreign exchange 外汇spot transaction 即期交易forward transaction 远期交易option forward transaction 择期交易swap transaction 调期交易quote 报价settlment and delivery 交割Treasury bond 财政部公债current—account 经常项目pickup in rice 物价上涨Federal Reserve 美联储buying rate 买入价selling rate 卖出价spread 差幅contract 合同at par 平价premium 升水discount 贴水direct quoation method 直接报价法indirect quoation method 间接报价法dividend 股息domestic currency 本币floating rate 浮动利率parent company 母公司credit swap 互惠贷款venture capital 风险资本book value 帐面价值physical capital 实际资本IPO(initial public offering) 新股首发;首次公开发行job machine 就业市场welfare capitalism 福利资本主义collective market cap 市场资本总值glolbal corporation 跨国公司transnational status 跨国优势transfer price 转让价格consolidation 兼并leverage 杠杆financial turmoil/meltdown 金融危机file for bankruptcy 申请破产bailout 救助take over 收购buy out 购买(某人的)产权或全部货物go under 破产take a nosedive (股市)大跌tumble 下跌falter 摇摇欲坠on the hook 被套住shore up confidence 提振市场信心stave off 挡开, 避开,liquidate assets 资产清算at fire sale prices 超低价sell-off 证券的跌价reserve 储备note 票据discount贴现circulate流通central bank 中央银行the Federal Reserve System联邦储备系统credit union 信用合作社paper currency 纸币credit creation 信用创造branch banking 银行分行制unit banking 单一银行制out of circulation 退出流通capital stock股本at par以票面价值计electronic banking电子银行banking holding company 公司银行the gold standard金本位the Federal Reserve Board 联邦储备委员会the stock market crash 股市风暴reserve ratio 准备金比率division of labor 劳动分工commodity money 商品货币legal tender 法定货币fiat money 法定通货a medium of exchange交换媒介legal sanction法律制裁face value面值liquid assets流动资产illiquidl assets非流动资产the liquidity scale 流动性指标real estate 不动产checking accounts,demand deposit,checkable deposit 活期存款time deposit 定期存款negotiable order of withdrawal accounts 大额可转让提款单money market mutual funds 货币市场互助基金repurchase agreements 回购协议certificate of deposits存单bond 债券stock股票travelers’checks 旅行支票small-denomination time deposits小额定期存款large-denomination time deposits大额定期存款bank overnight repurchase agreements 银行隔夜回购协议bank long-term repurchase agreements 银行长期回购协议thrift institutions 存款机构financial institution 金融机构commercial banks商业银行a means of payment 支付手段a store of value储藏手段a standard of value价值标准deficit 亏损roll展期wholesale批发default不履约auction拍卖collateralize担保markup价格的涨幅dealer交易员broker经纪人pension funds 养老基金face amount面值commerical paper商业票据banker's acceptance银行承兑汇票Fed fund 联邦基金eurodollar欧洲美元treasury bills 国库券floating—rate 浮动比率fixed-rate 固定比率default risk 拖欠风险credit rating信誉级别tax collection税收money market货币市场capital market资本市场original maturity 原始到期期限surplus funds过剩基金syndication辛迪加underwrite包销,认购hedge对冲买卖、套期保值innovation到期交易spread利差principal本金swap掉期交易eurobond market 欧洲债券市场euronote欧洲票据Federal Reserve Bank (FRB)联邦储备银行unsecured credit无担保贷款fixed term time deposit定期支付存款lead bank牵头银行neogotiable time deposit议付定期存款inter-bank money market银行同业货币市场medium term loan 中期贷款syndicated credit银团贷款merchant bank商业银行portfolio management 有价债券管理lease financing租赁融资note issurance facility票据发行安排bearer note不记名票价underwriting facility包销安排floating—rate note 浮动利率票据bond holder债券持持有者London Interbank Offered Rate(LIBOR)伦敦同业优惠利率back—up credit line备用信贷额promissory note(P.N.。

金融英语 chapter 3 interest rate

What would you learn?

Interest and interest rate are two basic categories coming with the concept of credit. What we mainly should learn from interest rate theories is how to determine the interest rate. By looking through this chapter, you should be able to grasp the essence and the calculation of interest rate, the types of interest rate and interest rate system and its reform of our country

Inflation

So far in our discussion of interest rates, we have ignored the effects of inflation on the cost of borrowing. What we have up to now been calling the interest rate makes no allowance for inflation, and it is more precisely referred to as the nominal interest rate, which is to distinguish it from the real interest rate, the interest rate that is adjusted by subtracting expected changes in the price level so that it more accurately reflects the true cost of borrowing.

金融英语词汇(超全版)

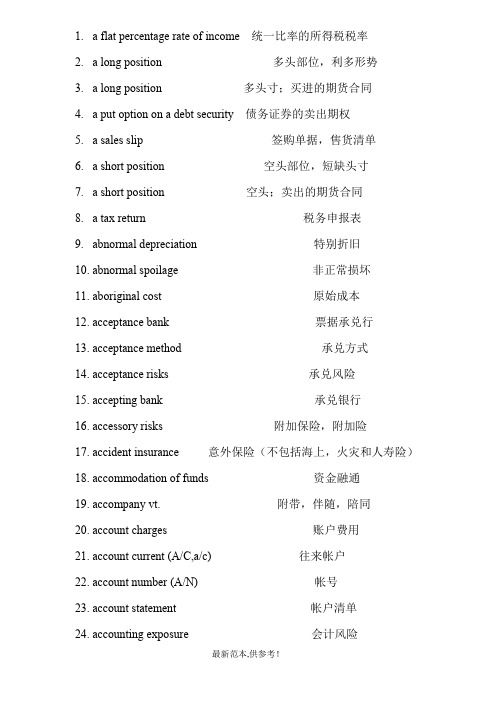

1. a flat percentage rate of income 统一比率的所得税税率2. a long position 多头部位,利多形势3. a long position 多头寸;买进的期货合同4. a put option on a debt security 债务证券的卖出期权5. a sales slip 签购单据,售货清单6. a short position 空头部位,短缺头寸7. a short position 空头;卖出的期货合同8. a tax return 税务申报表9.abnormal depreciation 特别折旧10.abnormal spoilage 非正常损坏11.aboriginal cost 原始成本12.acceptance bank 票据承兑行13.acceptance method 承兑方式14.acceptance risks 承兑风险15.accepting bank 承兑银行16.accessory risks 附加保险,附加险17.accident insurance 意外保险(不包括海上,火灾和人寿险)18.accommodation of funds 资金融通19.accompany vt. 附带,伴随,陪同20.account charges 账户费用21.account current (A/C,a/c) 往来帐户22.account number (A/N) 帐号23.account statement 帐户清单24.accounting exposure 会计风险25.accounting risks 会计风险26.accounting value 帐面价值27.accounts of assured 保险帐户28.accrued bond interest 应计债券利息29.accrued depreciation 应计折旧30.accrued dividend 应计股利31.acknowledgement of declaration (under op预约保险申报确认书32.active securities 热头股票,活跃的证券33.actual cash value (保险用语)实际现金价值34.actual rate 实际汇率35.adaptive expectations 适应性预期36.additional insurance 加保,附加保险37.additional reserve 追加准备金38.adjustable policy 可调整的保险单39.adjustable premium 可调整的保险费40.adjusted debit balance 已调整的借方余额41.advance payment of premium 预缴保险费42.advance-decline theory 涨跌理论43.adverse exchange 逆汇、逆汇兑44.advice of drawing 提款通知书45.advising bank 通知银行46.affiliated bank 联行47.affiliated person 关联人48.aftermarket 次级市场49.agent for collection 托收代理银行50.Agricultural Bank of China 中国农业银行51.agricultural loans 农业贷款52.agricultural(animal husbandry)tax 农(牧)业税53.allowance for doubtful debt 备抵呆帐款项54.alternative (either/or) order 选择指令55.American Express card 运通卡56.American terms 美国标价法57.amount in figures 小写金额58.amount in words 大写金额59.annual membership dues 年费60.application form for a banking account 银行开户申请书61.appointed bank 外汇指定银行62.appreciation of exchange rate 汇率升值63.arbitrage 套利64.arbitrage 套购,套利,套汇65.arbitrage of exchange 套汇66.arbitrage of exchange or stock 套汇或套股67.arbitrage opportunity 套价机会68.arbitrage risks 套汇风险69.as agent 做代理70.as principal 做自营n Development Fund (ADB) 亚洲开发银行72.ask price = asking price = offer price 出售价,报价,开价,出价73.ask-bid system 竞价系统74.assessment of loss 估损75.assets insurance 资产保险76.assignment of policy 保单转让77.assumption of risk 承担风险78.asymmetry 不对称79.at owner's risk 风险由货主负担80.at-the-close order 收盘指令81.at-the-market 按市价82.at-the-money 平值期权83.at-the-opening (opening only) order 开盘指令84.auction marketplace 拍卖市场85.automated teller machines (24 hours a day) 自动取款机(24小时服务)86.automatic transfers between accounts 自动转帐87.average 平均数88.baby bond 小额债券89.back spreads 反套利90.back wardation 现货溢价91.balance n. 结余,差额,平衡92.bank balance 存款余额93.bank balance over required reserves 超出法定(必备)储备的银行存款余额94.bank deposit 银行存款95.Bank of China 中国银行96.Bank of Communications 交通银行97.bank of deposit 存款银行98.bank of the government 政府的银行99.banker's association 银行协会100.banker's bank 中央银行101.banker's guarantee 银行担保102.bank's buying rate 银行买入价103.bank's selling rate 银行卖出价104.banks with business dealing with the center中央银行的往来银行105.Barclay card 巴克莱银行信用卡106.base rate 基本汇价107.basis order 基差订单108.basis risk 基差风险109.bear market 熊市110.bear operation 卖空行为111.bear raiders 大量抛空者112.beneficial owner 受益所有人113.beneficiary of insurance 保险金受益人114.best-efforts offering 尽力推销(代销)发行115.bid and ask prices 买入和卖出价116.bid and ask spread 买卖差价117.bid price = buying price 买价118.bid-ask spread 递盘虚盘差价119.big board 大行情牌120.big slump 大衰退(暴跌)121.bill-paying services 代付帐款122.black market 黑市123.black market financing 黑市筹资124.black money 黑钱125.blanket mortgage 总括抵押126.block positioner 大宗头寸商127.blowout 畅销128.blue-chip stocks 蓝筹股129.board of arbitration 仲裁委员会130.board of governors 理事会131.bond fund 债券基金132.borrowing from affiliates 向联营公司借款133.borrowing power of securities 证券贷款能力134.borrowing risks 借款风险135.bought deal 包销136.bread and butter business 基本业务137.breadth index 宽度指数138.break-even 不亏不盈,收支相抵139.breakout 突破140.bridging finance 过渡性融资141.broker 经纪人,掮客142.brokerage 经纪人佣金。

金融 英语写作 样题+范文