公司理财(罗斯)第7章(英文)

罗斯《公司理财Corporate-Finance》(第七版)英文-Ch01课件

2750% Deb50t % 3D0e%bEt quity

The Capital Structure decision can be viewed as how best to slice up a the pie.

5705% Equity

If how you slice the pie affects the size of the pie, then the capital structure decision matters.

investments? 3. How much short-term cash flow does a company need

to pay its bills?

罗斯《公司理财Corporate-Finance》(第七版)英文-Ch01

4

The Balance-Sheet Model of the Firm

罗斯《公司理财Corporate-Finance》(第七版)英文-Ch01

9

Hypothetical Organization Chart

Board of Directors Chairman of the Board and Chief Executive Officer (CEO)

President and Chief Operating Officer (COO)

Shareholders’ Equity

罗斯《公司理财Corporate-Finance》(第七版)英文-Ch01

8

Capital Structure

The value of the firm can be thought of as a pie.

The goal of the manager is to increase the size of the pie.

公司理财-罗斯(完整版)

$F

支付给债权人 $F 企业价值 (X)

如果企业的价值大于$F, 股东的索 偿权是: Max[0,$X – $F] = $X – $F 债权人的索偿权是: Min[$F,$X] = $F. 两者之和 = $X

承诺支付给债权人的金额$F。

1.2 企业的三种基本法律形式

• 个体业主制 • 合伙制

– 一般合伙制 – 有限合伙制

企业和金融市场

企业

投资于资产 (B) 流动资产 固定资产 企业发行证券 (A)

金融市场

现金流量留存 (E)

短期负债

企业创造 现金流量(C) 税收 (D) 支付股利和 偿付债务 (F) 长期负债 股东权益

最终,企业必须创造现金 流量。

政府

企业创造的现金流量必须 超过从金融市场筹集的现 金流量。

企业和金融市场

法律责任(Liability) 存续期(Continuity)

有限责任 无限存续期

税收(Taxation)

对股东双重征税(公司所得 税和个人所得税)

个人所得税

资金筹集

易于筹集资金

难于筹集资金

1.2 公司制企业

1.2.3 公司制

对于解决所面临的筹集大规模资金的问题来说,公司制是一种标准 的方式。

1.3 公司制企业的目标

1.1.3 财务经理的职责

财务经理通过资本预算、融资和资产流动性管理为公司创造价值。

公司必须通过购买资产创造超过其成本的现金(因此,公司创造的 现金流量必须大于它所使用的现金流量)。 公司必须通过发行债券、股票和其他金融工具产生超过其成本的现 金(因此,公司支付给债权人和股东的现金流量必须大于债权人和股东 投入公司的现金流量)。

用数学公式表示,债权人的索偿 权是:Min[$F,$X]

Ross7eCh14Long-Term Financing An Introduction(公司理财,罗斯,第七版)

CHAPTER

14

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

Long-Term Financing: An Introduction

McGraw-Hill/Irwin Corporate Finance, 7/e

14-1

The articles of incorporation must state the number of shares of common stock the corporation is authorized to issue. The board of directors, after a vote of the shareholders, may amend the articles of incorporation to increase the number of shares.

McGraw-Hill/Irwin Corporate Finance, 7/e © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

14-11

Proxy Voting

A proxy is the legal grant of authority by a shareholder to someone else to vote his or her shares. For convenience, the actual voting in large public corporations is usually done by proxy.

The exact mechanism varies across companies.

罗斯《公司理财》笔记整理

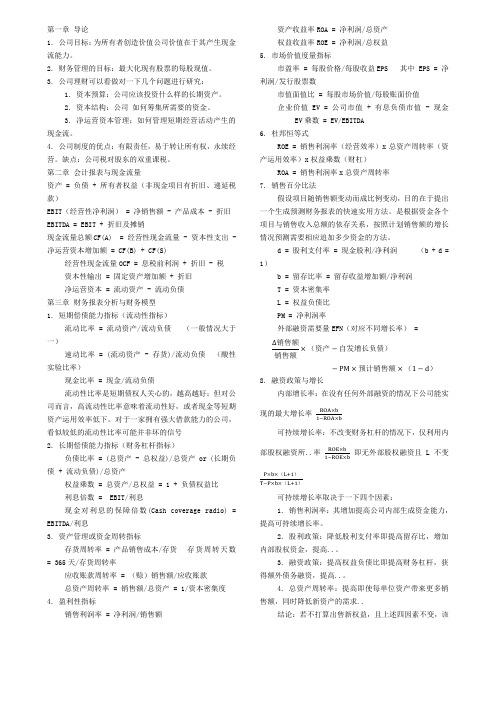

第一章导论1. 公司目标:为所有者创建价值,公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财能够看做对一下几个问题进行研究:1. 资本估量:公司应当投资什么样的长久财富。

2. 资本构造:公司怎样筹集所需要的资本。

3. 净营运资本管理:怎样管理短期经营活动产生的现金流。

4. 公司制度的长处:有限责任,易于转让所有权,永续经营。

弊端:公司税对股东的两重课税。

第二章会计报表与现金流量财富= 欠债+ 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润)= 净销售额-产品成本-折旧EBITDA = EBIT + 折旧及摊销现金流量总数CF(A) = 经营性现金流量-资天性支出-净营运资本增添额= CF(B) + CF(S)经营性现金流量OCF = 息税前利润+ 折旧-税资天性输出= 固定财富增添额+ 折旧净营运资本= 流动财富-流动欠债第三章财务报表剖析与财务模型1. 短期偿债能力指标(流动性指标)流动比率= 流动财富/流动欠债(一般状况大于一)速动比率= (流动财富-存货)/流动欠债(酸性实验比率)现金比率= 现金/流动欠债流动性比率是短期债权人关怀的,越高越好;但对公司而言,高流动性比率意味着流动性好,或许现金等短期财富运用效率低下。

关于一家拥有强盛借钱能力的公司,看似较低的流动性比率可能并不是坏的信号2. 长久偿债能力指标(财务杠杆指标)欠债比率= (总财富-总权益)/总财富or (长久欠债+ 流动欠债)/总财富权益乘数= 总财富/总权益= 1 + 欠债权益比利息倍数= EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 财富管理或资本周转指标存货周转率= 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率= (赊)销售额/应收账款总财富周转率= 销售额/总财富= 1/资本密集度4. 盈余性指标销售利润率= 净利润/销售额财富利润率ROA = 净利润/总财富权益利润率ROE = 净利润/总权益5. 市场价值胸怀指标市盈率= 每股价钱/每股利润EPS此中EPS = 净利润/刊行股票数市值面值比= 每股市场价值/每股账面价值公司价值EV = 公司市值+ 有息欠债市值-现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总财富周转率(财富运用效率)x权益乘数(财杠)ROA = 销售利润率x总财富周转率7. 销售百分比法假定项目随销售额改动而成比率改动,目的在于提出一个生成展望财务报表的迅速适用方法。

《公司理财》斯蒂芬A.罗斯..,机械工业出版社 英文课件

Copyright 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

27-11

Implications of the Miller-Orr Model

To use the Miller-Orr model, the manager must do four things:

– Borrowing is likely to be more expensive than selling marketable securities. – The need to borrow will depend on management’s desire to hold low cash balances.

McGraw-Hill/Irwin

Copyright 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

27-6

The Baumol Model

F = The fixed cost of selling securities to raise cash T = The total amount of new cash needed K = The opportunity cost of holding cash, a.k.a. the interest rate. As we transfer $C each period we incur a trading cost of F each period. If we need $T in total over the planning T period we will pay $F – C times. T The trading cost is – × F Time C

罗斯《公司理财》(第9版)课后习题(第1~3章)【圣才出品】

罗斯《公司理财》(第9版)课后习题第1章公司理财导论一、概念题1.资本预算(capital budgeting)答:资本预算是指综合反映投资资金来源与运用的预算,是为了获得未来产生现金流量的长期资产而现在投资支出的预算。

资本预算决策也称为长期投资决策,它是公司创造价值的主要方法。

资本预算决策一般指固定资产投资决策,耗资大,周期长,长期影响公司的产销能力和财务状况,决策正确与否影响公司的生存与发展。

完整的资本预算过程包括:寻找增长机会,制定长期投资战略,预测投资项目的现金流,分析评估投资项目,控制投资项目的执行情况。

资本预算可通过不同的资本预算方法来解决,如回收期法、净现值法和内部收益率法等。

2.货币市场(money markets)答:货币市场指期限不超过一年的资金借贷和短期有价证券交易的金融市场,亦称“短期金融市场”或“短期资金市场”,包括同业拆借市场、银行短期存贷市场、票据市场、短期证券市场、大额可转让存单市场、回购协议市场等。

其参加者为各种政府机构、各种银行和非银行金融机构及公司等。

货币市场具有四个基本特征:①融资期限短,一般在一年以内,最短的只有半天,主要用于满足短期资金周转的需要;②流动性强,金融工具可以在市场上随时兑现,交易对象主要是期限短、流动性强、风险小的信用工具,如票据、存单等,这些工具变现能力强,近似于货币,可称为“准货币”,故称货币市场;③安全性高,由于货币市场上的交易大多采用即期交易,即成交后马上结清,通常不存在因成交与结算日之间时间相对过长而引起价格巨大波动的现象,对投资者来说,收益具有较大保障;④政策性明显,货币市场由货币当局直接参加,是中央银行同商业银行及其他金融机构的资金连接的主渠道,是国家利用货币政策工具调节全国金融活动的杠杆支点。

货币市场的交易主体是短期资金的供需者。

需求者是为了获得现实的支付手段,调节资金的流动性并保持必要的支付能力,供应者提供的资金也大多是短期临时闲置性的资金。

公司理财被删除课后题第7章

10.Internal Rate of ReturnProjects A and B have the following cash flows:230YEAR PROJECT A PROJECT B 0Ϫ$1,000Ϫ$2,0001C1A C1B 2C2A C2B 3C3AC3BYEAR PROJECT A PROJECT B0Ϫ$7,500Ϫ$5,00014,0002,50023,5001,20031,5003,000a.If the cash flows from the projects are identical, which of the two projects would have a higher IRR? Why?b.If C1B ϭ2C1A, C2B ϭ2C2A, and C3B ϭ2C3A, then is IRR A ϭIRR B ? Present Value You are evaluating two projects, Project A and Project B . Project A has ashort period of future cash flows, while Project B has relatively long future cash flows. Which project will be more sensitive to changes in the required return? Why?12.Modified Internal Rate of Return One of the less flattering interpretations of the acronymMIRR is “meaningless internal rate of return.” Why do you think this term is applied to MIRR? Present Value One potential criticism of the net present value technique is that there is animplicit assumption that this technique assumes the intermediate cash flows of the project are reinvested at the required return. In other words, if you calculate the future value of theintermediate cash flows to the end of the project at the required return, sum the future values,and find the net present value of the two cash flows, you will get the same net present value as the original calculation. If the reinvestment rate used to calculate the future value is lower than the required return, the net present value will decrease. How would you evaluate this criticism?14.Internal Rate of Return One potential criticism of the internal rate of return technique is thatthere is an implicit assumption that this technique assumes the intermediate cash flows of the project are reinvested at the internal rate of return. In other words, if you calculate thefuture value of the intermediate cash flows to the end of the project at the required return, sum the future values, and calculate the internal rate of return of the two cash flows, you will get the same internal rate of return as the original calculation. If the reinvestment rate used to calculate the future value is different than the internal rate of return, the internal rate of return calculated for the two cash flows will be different. How would you evaluate this criticism?Q U E S T I O N S A N D P R O B L E M S1.Calculating Payback Period and NPV Fuji Software, Inc., has the following mutually exclusiveprojects.a.Suppose Fuji’s payback period cutoff is two years. Which of these two projects should be chosen?b.Suppose Fuji uses the NPV rule to rank these two projects. Which project should be chosen if the appropriate discount rate is 15 percent?/rwjBasic(Questions 1–10)17.Profitability Index versus NPV Hanmi Group, a consumer electronics conglomerate, isreviewing its annual budget in wireless technology. It is considering investments in three different technologies to develop wireless communication devices. Consider the following cashflows of the three independent projects for Hanmi. Assume the discount rate for Hanmi is10 percent. Further, Hanmi Group has only$30 million to invest in new projects this year.234Cash Flows (in $ millions)YEAR CDMA G4WI-FI0Ϫ$10Ϫ$20Ϫ$ 30125202021550403540100a.Based on the profitability index decision rule, rank these investments.b.Based on the NPV, rank these investments.c.Based on your findings in (a) and (b), what would you recommend to the CEO of Hanmi Groupand why?paring Investment Criteria Consider the following cash flows of two mutually exclusiveprojects for AZ-Motorcars. Assume the discount rate for AZ-Motorcars is 10 percent.a.Based on the payback period, which project should be taken?b.Based on the NPV, which project should be taken?c.Based on the IRR, which project should be taken?d.Based on the above analysis, is incremental IRR analysis necessary? If yes, please conductthe analysis.paring Investment Criteria The treasurer of Amaro Canned Fruits, Inc., has projected thecash flows of projects A, B, and C as follows.Suppose the relevant discount rate is 12 percent a year.pute the profitability index for each of the three projects.pute the NPV for each of the three projects.c.Suppose these three projects are independent. Which project(s) should Amaro acceptbased on the profitability index rule?d.Suppose these three projects are mutually exclusive. Which project(s) should Amaro acceptbased on the profitability index rule?e.Suppose Amaro’s budget for these projects is $300,000. The projects are not divisible. Whichproject(s) should Amaro accept?YEAR AZM MINI-SUV AZF FULL-SUV0Ϫ$200,000Ϫ$500,0001200,000200,0002150,000300,0003150,000300,000YEAR PROJECT A PROJECT B PROJECT C0Ϫ$100,000Ϫ$200,000Ϫ$100,000170,000130,00075,000270,000130,00060,000/rwj/rwjparing Investment Criteria Consider the following cash flows of two mutually exclusiveprojects for Tokyo Rubber Company. Assume the discount rate for Tokyo Rubber Company is10percent.YEAR DRY PREPREG SOLVENT PREPREG0Ϫ$1,000,000Ϫ$500,0001600,000300,0002400,000500,00031,000,000100,000a.Based on the payback period, which project should be taken?b.Based on the NPV, which project should be taken?c.Based on the IRR, which project should be taken?d.Based on the above analysis, is incremental IRR analysis necessary? If yes, please conductthe analysis.paring Investment Criteria Consider two mutually exclusive new product launch projectsthat Nagano Golf is considering. Assume the discount rate for Nagano Golf is 15 percent.Project A:Nagano NP-30Professional clubs that will take an initial investment of $100,000 at time 0.Next five years (years 1–5) of sales will generate a consistent cash flowof $40,000 per year.Introduction of new product at year 6 will terminate further cash flows fromthis project.Project B:Nagano NX-20High-end amateur clubs that will take an initial investment of $30,000 attime 0.Cash profit at year 1 is $20,000. In each subsequent year cash flow willgrow at 15 percent per year.Introduction of new product at year 6 will terminate further cash flows fromthis project.YEAR NP-30NX-200Ϫ$100,000Ϫ$30,000140,00020,000240,00023,000340,00026,450440,00030,418540,00034,980Please fill in the following table:NP-30NX-20IMPLICATIONSNPVIRRIncremental IRRPI235paring Investment Criteria Consider two mutually exclusive R&D projects that ADM isconsidering. Assume the discount rate for ADM is 15 percent.Project A:Server CPU .13 micron processing projectBy shrinking the die size to .13 micron, ADM will be able to offer server CPUchips with lower power consumption and heat generation, meaning fasterCPUs.Project B:New telecom chip projectEntry into this industry will require introduction of a new chip for cellphones.The know-how will require a large amount of upfront capital, but successof the project will lead to large cash flows later on.236YEAR A B0Ϫ$100,000Ϫ$200,000150,00060,000250,00060,000340,00060,000430,000100,000520,000200,000Please fill in the following table:paring Investment Criteria You are a senior manager at Poeing Aircrafts and have beenauthorized to spend up to $200,000 for projects. The three projects that you are considering have the following characteristics:Project A:Initial investment of$150,000.Cashflow of$50,000at year1and$100,000at year2.This is a plant expansion project,where the required rate of return is10percent.Project B:Initial investment of $200,000. Cash flow of $200,000 at year 1 and $111,000 atyear 2.This is a new product development project, where the required rate of return is20 percent.Project C:Initial investment of $100,000. Cash flow of $100,000 at year 1 and $100,000 atyear 2.This is a market expansion project,where the required rate of return is20percent.Assume the corporate discount rate is 10 percent.Please offer your recommendations, backed by your analysis.A B IMPLICATIONSNPVIRRIncremental IRRPIA B C IMPLICATIONSPaybackIRRIncremental IRRPINPV/rwj24.Payback and NPV An investment under consideration has a payback of seven years and acost of $483,000. If the required return is 12 percent, what is the worst-case NPV? The best-case NPV? Explain. Assume the cash flows are conventional.25.Multiple IRRs This problem is useful for testing the ability of financial calculators andcomputer software. Consider the following cash flows. How many different IRRs are there?(Hint:Search between 20 percent and 70 percent.) When should we take this project?237Challenge(Questions 24–30)YEAR CASH FLOW 0Ϫ$50412,8622Ϫ6,07035,7004Ϫ2,00026.NPV Valuation The Yurdone Corporation wants to set up a private cemetery business.Accordingto the CFO,Barry M.Deep,business is “looking up.”As a result,the cemetery project will provide a net cash inflow of $50,000for the firm during the first year,and the cash flows are projected to grow at a rate of 6percent per year forever.The project requires an initial investment of $780,000.a.If Yurdone requires a 13 percent return on such undertakings, should the cemetery business be started?b.The company is somewhat unsure about the assumption of a 6 percent growth rate in its cash flows. At what constant growth rate would the company just break even if it still required a 13 percent return on investment?27.Calculating IRR The Utah Mining Corporation is set to open a gold mine near Provo, Utah.According to the treasurer, Monty Goldstein, “This is a golden opportunity.” The mine will cost $600,000 to open and will have an economic life of 11 years. It will generate a cash inflow of $100,000 at the end of the first year and the cash inflows are projected to grow at 8 percent per year for the next 10 years. After 11 years, the mine will be abandoned. Abandonment costs will be $50,000 at the end of year 11.a.What is the IRR for the gold mine?b.The Utah Mining Corporation requires a 10 percent return on such undertakings. Should the mine be opened?28.Calculating IRR Consider two streams of cash flows, A and B . Stream A ’s first cash flow is$5,000 and is received three years from today. Future cash flows in stream A grow by 4 percent in perpetuity. Stream B ’s first cash flow is Ϫ$6,000 and is received two years from today and will continue in perpetuity. Assume that the appropriate discount rate is 12 percent.a.What is the present value of each stream?b.Suppose that the two streams are combined into one project, called C . What is the IRR of project C ?c.What is the correct IRR rule for project C ?29.Calculating Incremental Cash FlowsDarin Clay, the CFO of , has to decidebetween the following two projects:YEAR PROJECT MILLIONPROJECT BILLION0Ϫ$1,500Ϫ$I o 1I o ϩ200I o ϩ50021,2001,50031,5002,000/rwjThe expected rate of return for either of the two projects is 12 percent. What is the range of initial investment (I o ) for which Project Billion is more financially attractive than Project Million?30.Problems with IRR McKeekin Corp. has a project with the following cash flows:YEAR CASH FLOW 0$20,0001Ϫ26,000213,000What is the IRR of the project? What is happening here?W H AT ’S O N T H E W E B ? Present Value You have a project that has an initial cash outflow of Ϫ$20,000 and cash inflows of $6,000, $5,000, $4,000, and $6,000, respectively, for the next four years. Go to , and follow the “Online IRR NPV Calculator” link. Enter the cash flows. If the required return is 12 percent, what is the IRR of the project? The NPV?2.Internal Rate of Return Using the online calculator from the previous problem, find the IRR for a project with cash flows of Ϫ$500, $1,200, and Ϫ$400. What is going on here?B U L L OC K G O LD M I N I N GSeth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota.Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has esti-mated that the mine would be productive for eight years, after which the gold would be com-pletely mined. Dan has taken an estimate of the gold deposits to Alma Garrett, the company’s financial officer. Alma has been asked by Seth to perform an analysis of the new mine and pre-sent her recommendation on whether the company should open the new mine.Alma has used the estimates provided by Dan to determine the revenues that could be ex-pected from the mine. She has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $500 million today, and it will have a cash outflow of $80 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the table on the next page. Bullock Mining has a 12 percent required return on all of its gold mines.238C L O S I N G C A S E/rwjYEAR CASH FLOW0Ϫ$500,000,000160,000,000290,000,0003170,000,0004230,000,0005205,000,0006140,000,0007110,000,000870,000,0009Ϫ80,000,0001.Construct a spreadsheet to calculate the payback period, internal rate of return, modifiedinternal rate of return, and net present value of the proposed mine.2.Based on your analysis, should the company open the mine?3.Bonus question: Most spreadsheets do not have a built-in formula to calculate the paybackperiod. Write a VBA script that calculates the payback period for a project.239。

罗斯《公司理财CorporateFinance》(第七版)英文课件Ch

If how you slice the pie affects the size of the pie, then the capital struቤተ መጻሕፍቲ ባይዱture decision matters.

1-9

Hypothetical Organization Chart

Board of Directors Chairman of the Board and Chief Executive Officer (CEO)

Shareholders’ Equity

1-5

The Balance-Sheet Model

of the Firm

The Capital Budgeting Decision

Current

Current Assets

Liabilities

Long-Term Debt

Fixed Assets 1 Tangible 2 Intangible

Cost Accounting Data Processing

1-10

The Financial Manager

To create value, the financial manager should: 1. Try to make smart investment decisions. 2. Try to make smart financing decisions.

How much shortterm cash flow does a company need to pay its bills?

Shareholders’ Equity

1-8

Capital Structure

The value of the firm can be thought of as a pie.

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文课件

7 Net Present VCaolrupeoraantedFinance

Capital Budgeting Ross • Westerfield • Jaffe

Seventh Edition

Seventh Edition

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

Cash Flows—Not Accounting Earnings.

• Consider depreciation expense. • You never write a check made out to “depreciation”. • Much of the work in evaluating a project lies in taking accounting

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

Incremental Cash Flows

• Side effects matter. • Erosion and cannibalism are both bad things. If our new product causes existing customers to demand less of current products, we need to recognize that.

Cost of bowling ball machine: $100,000 (depreciated according to ACRS 5-year life).

• Later chapters will deal with the impact that the amount of debt that a firm has in its capital structure has on firm value.

罗斯《公司理财》英文习题答案DOCchap

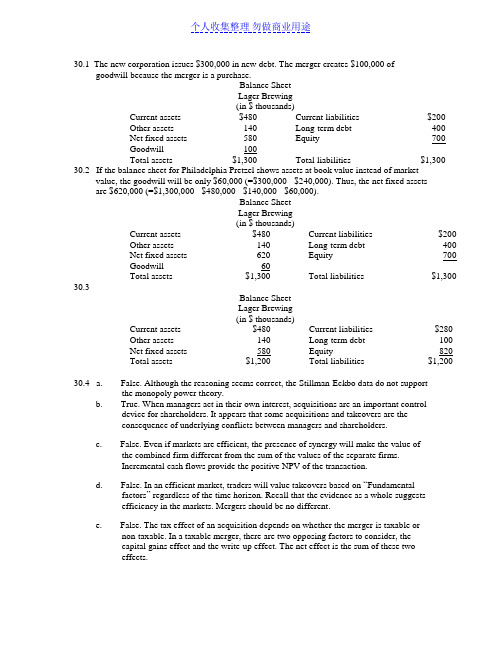

30.1 The new corporation issues $300,000 in new debt. The merger creates $100,000 ofgoodwill because the merger is a purchase.Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $200Other assets 140 Long-term debt 400Net fixed assets 580 Equity 700Goodwill 100Total assets $1,300 Total liabilities $1,300 30.2 If the balance sheet for Philadelphia Pretzel shows assets at book value instead of marketvalue, the goodwill will be only $60,000 (=$300,000 - $240,000). Thus, the net fixed assetsare $620,000 (=$1,300,000 - $480,000 - $140,000 - $60,000).Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $200Other assets 140 Long-term debt 400Net fixed assets 620 Equity 700Goodwill 60Total assets $1,300 Total liabilities $1,300 30.3Balance SheetLager Brewing(in $ thousands)Current assets $480 Current liabilities $280Other assets 140 Long-term debt 100Net fixed assets 580 Equity 820Total assets $1,200 Total liabilities $1,200 30.4 a. False. Although the reasoning seems correct, the Stillman-Eckbo data do not supportthe monopoly power theory.b. True. When managers act in their own interest, acquisitions are an important controldevice for shareholders. It appears that some acquisitions and takeovers are theconsequence of underlying conflicts between managers and shareholders.c. False. Even if markets are efficient, the presence of synergy will make the value ofthe combined firm different from the sum of the values of the separate firms.Incremental cash flows provide the positive NPV of the transaction.d. False. In an efficient market, traders will value takeovers based on “Fundamentalfactors” regardless of the time horizon. Recall that the evidence as a whole suggestsefficiency in the markets. Mergers should be no different.e. False. The tax effect of an acquisition depends on whether the merger is taxable ornon-taxable. In a taxable merger, there are two opposing factors to consider, thecapital gains effect and the write-up effect. The net effect is the sum of these twoeffects.f. True. Because of the coinsurance effect, wealth might be transferred from thestockholders to the bondholders. Acquisition analysis usually disregards this effectand considers only the total value.30.530.6 a. The weather conditions are independent. Thus, the joint probabilities are theproducts of the individual probabilities.Possible states Joint probabilityRain Rain 0.1 x 0.1=0.01Rain Warm 0.1 x 0.4=0.04Rain Hot 0.1 x 0.5=0.05Warm Rain 0.4 x 0.1=0.04Warm Warm 0.4 x 0.4=0.16Warm Hot 0.4 x 0.5=0.20Hot Rain 0.5 x 0.1=0.05Hot Warm 0.5 x 0.4=0.20Hot Hot 0.5 x 0.5=0.25Since the state Rain Warm has the same outcome (revenue) as Warm Rain, theirprobabilities can be added. The same is true of Rain Hot, Hot Rain and Warm Hot,Hot Warm. Thus the joint probabilities arePossibleJoint probabilitystatesRain Rain 0.01Rain Warm 0.08Rain Hot 0.10Warm Warm 0.16Warm Hot 0.40Hot Hot 0.25The joint values are the sums of the values of the two companies for the particularstate.Possible states Joint valueRain Rain $200,000Rain Warm 300,000Warm Warm 400,000Rain Hot 500,000Warm Hot 600,000Hot Hot 800,000b. Recall, if a firm cannot service its debt, the bondholders receive the value of the assets.Thus, the value of the debt is the value of the company if the face value of the debt isgreater than the value of the company. If the value of the company is greater than the value of the debt, the value of the debt is its face value. Here the value of the common stock is always the residual value of the firm over the value of the debt.Joint Prob. Joint Value Debt Value Stock Value0.01 $200,000 $200,000 $00.08 300,000 300,000 00.16 400,000 400,000 00.10 500,000 400,000 100,0000.40 600,000 400,000 200,0000.25 800,000 400,000 400,000c. To show that the value of the combined firm is the sum of the individual values, youmust show that the expected joint value is equal to the sum of the separate expected values.Expected joint value= 0.01($200,000) + 0.08($300,000) + 0.16($400,000) + 0.10($500,000) +0.40($600,000) + 0.25($800,000)= $580,000Since the firms are identical, the sum of the expected values is twice the expectedvalue of either.Expected individual value = 0.1($100,000) + 0.4($200,000) + 0.5($400,000) = $290,000 Expected combined value = 2($290,000) = $580,000d. The bondholders are better off if the value of the debt after the merger is greater thanthe value of the debt before the merger.Value of the debt before the merger:The value of debt for either company= 0.1($100,000) + 0.4($200,000) + 0.5($200,000) = $190,000Total value of debt before the merger = 2($190,000) = $380,000Value of debt after the merger= 0.01($200,000) + 0.08($300,000) + 0.16($400,000) + 0.10($400,000) +0.40($400,000) +0.25($400,000)= $390,000The bondholders are $10,000 better off after the merger.30.7 The decision hinges upon the risk of surviving. The final decision should hinge on thewealth transfer from bondholders to stockholders when risky projects are undertaken.High-risk projects will reduce the expected value of the bondholders’ claims on the firm.The telecommunications business is riskier than the utilities business. If the total value of the firm does not change, the increase in risk should favor the stockholder. Hence,management should approve this transaction. Note, if the total value of the firm dropsbecause of the transaction and the wealth effect is lower than the reduction in total value, management should reject the project.30.8 If the market is “smart,” the P/E ratio will not be constant.a. Value = $2,500 + $1,000 = $3,500b. EPS = Post-merger earnings / Total number of shares=($100 + $100)/200 =$1c. Price per share = Value/Total number of shares=$3,500/200 =$17.50d. If the market is “fooled,” the P/E ratio will be constant at $25.Value = P/E * Total number of shares= 25 * 200 = $5,000EPS = Post-merger earnings / Total number of shares=$5,000/200 = $25.0030.9 a. After the merger, Arcadia Financial will have 130,000 [=10,000 + (50,000)(6/10)]shares outstanding. The earnings of the combined firm will be $325,000. The earningsper share of the combined firm will be $2.50 (=$325,000/130,000). The acquisition will increase the EPS for the stockholders from $2.25 to $2.50.b. There will be no effect on the original Arcadia stockholders. No synergies exist in thismerger since Arcadia is buying Coldran at its market price. Examining the relativevalues of the two firms sees the latter point.Share price of Arcadia = (16 * $225,000) / 100,000=$36Share price of Coldran = (10.8 * $100,000) / 50,000=$21.60The relative value of these prices is $21.6/$36 = 0.6. Since Coldran’s shareholdersreceive 0.6 shares of Arcadia for every share of Coldran, no synergies exist.30.10 a. The synergy will be the discounted incremental cash flows. Since the cash flows areperpetual, this amount isb. The value of Flash-in-the-Pan to Fly-by-Night is the synergy plus the current marketvalue of Flash-in-the-Pan.V = $7,500,000 + $20,000,000= $27,500,000c. Cash alternative = $15,000,000Stock alternative = 0.25($27,500,000 + $35,000,000)= $15,625,000d. NPV of cash alternative = V - Cost=$27,500,000 - $15,000,000=$12,500,000NPV of stock alternative = V - Cost=$27,500,000 - $15,625,000=$11,875,000e. Use the cash alternative, its NPV is greater.30.11 a. The value of Portland Industries before the merger is $9,000,000 (=750,000x12). Thisvalue is also the discounted value of the expected future dividends.$9,000,000 =r = 0.1025 = 10.25%r is the risk-adjusted discount rate for Portland’s expected future dividends.the value of Portland Industries after the merger isThis is the value of Portland Industries to Freeport.b. NPV = Gain - Cost= $14,815,385 - ($40x250, 000)= $4,815,385c. If Freeport offers stock, the value of Portland Industries to Freeport is the same, but thecost differs.Cost = (Fraction of combined firm owned by Portland’s stockholders)x(Value of the combined firm)Value of the combined firm = (Value of Freeport before merger)+ (Value of Portland to Freeport)= $15x1,000,000 + $14,815,385= $29,815,385Cost = 0.375x$29,815,385= $11,180,769NPV= $14,815,385 - $11,180,769=$3,634,616d. The acquisition should be attempted with a cash offer since it provides a higher NPV.e. The value of Portland Industries after the merger isThis is the value of Portland Industries to Freeport.NPV = Gain-Cost=$11,223,529 - ($40x250,000)=$1,223,529If Freeport offers stock, the value of Portland Industries to Freeport is the same, but the cost differs.Cost = (Fraction of combined firm owned by Portland’s stockholders)x(Value of the combined firm)Value of the combined firm = (Value of Freeport before merger)+ (Value of Portland to Freeport)= $15x1,000,000 + $11,223,529= $26,223,529Cost = 0.375 * $26,223,529=$9,833,823NPV = $11,223,529 - $9,833,823=$1,389,706The acquisition should be attempted with a stock offer since it provides a higher NPV.30.12 a. Number of shares after acquisition=30 + 15 = 45 milStock price of Harrods after acquisition = 1,000/45=22.22 poundsb. Value of Selfridge stockholders after merger:α * 1,000 = 300α = 30%New shares issued = 12.86 mil12.86:20 = 0.643:1The proper exchange ratio should be 0.643 to make the stock offer’s value to Selfridgeequivalent to the cash offer.30.13 To evaluate this proposal, look at the present value of the incremental cash flows.Cash Flows to Company A(in $ million)Year 0 1 2 3 4 5Acquisition of B -550Dividends from B 150 32 5 20 30 45Tax-loss carryforwards 25 25Terminal value 600Total -400 32 30 45 30 645 The additional cash flows from the tax-loss carry forwards and the proposed level of debt should be discounted at the cost of debt because they are determined with very littleuncertainty.The after-tax cash flows are subject to normal business risk and must be discounted at anormal rate.Beta coefficient for the bond = 0.25 = [(8%-6%)/8%].Beta coefficient for the company = 1 = [(0.25)2 + (1.25)(0.75)]Discount rate for normal operations:r = 6% + 8% (1) = 14%Discount rate for dividends:The new beta coefficient for the company, 1, must be the weighted average of the debtbeta and the stock beta.1 = 0.5(0.25) + 0.5(βs)βs = 1.75r = 6% + 8%(1.75) = 20%Because the NPV of the acquisition is negative, Company A should not acquireCompany B.30.14 The commonly used defensive tactics by target-firm managers include:i. corporate charter amendments like super-majority amendment or staggering theelection of board members.ii. repurchase standstill agreements.iii. exclusionary self-tenders.iv. going private and leveraged buyouts.v. other devices like golden parachutes, scorched earth strategy, poison pill, ..., etc.Mini Case: U.S.Steel’s case.You have 3 choices: tender, or do not tender or sell in the market. If you do sell your shares in the market, at some point, somebody else would need to make a decision in “tender” or “not tender” as well.It is important to recognize that the firm has about 60 million shares outstanding (since 30 million shares will give US Steel 50.1% of Marathon shares). Let’s consider the possible sellingthe market price.If you choose not to tender, and 30 million shares were tendered US Steel succeeds to gain50.1% control, you will only receive $85 a share. If you do tender, the price you will receive will be no worse than $85 a share and can be as high as $125 a share. Depending on the number of shares tendered, you will receive one of the following prices.If only 50.1% tendered, you will get $125 per share.If the shares tendered exceed 50.1% but less than 100%, you will get more than $105 ashare.If all 60 million shares were tendered, you will get $105 per share. (which is )It is clear that, in the above 3 cases, when you are not sure about whether US Steel will succeed or not, you will be better off to tender your shares than not tender. This is because at best, you will only receive $85 per share if you choose not to tender.版权申明本文部分内容,包括文字、图片、以及设计等在网上搜集整理。

《公司理财》斯蒂芬A.罗斯..,机械工业出版社 英文课件

McGraw-Hill/Irwin

Copyright © 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

3-9

Financial Requirements

• The plan will include a section on financing arrangements. • Dividend policy and capital structure policy should be addressed. • If new funds are to be raised, the plan should consider what kinds of securities must be sold and what methods of issuance are most appropriate.

McGraw-Hill/Irwin

Copyright © 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

3-10

Plug

• Compatibility across various growth targets will usually require adjustment in a third variable. • Suppose a financial planner assumes that sales, costs, and net income will rise at g1. Further, suppose that the planner desires assets and liabilities to grow at a different rate, g2. These two rates may be incompatible unless a third variable is adjusted. For example, compatibility may only be reached is outstanding stock grows at a third rate, g3.

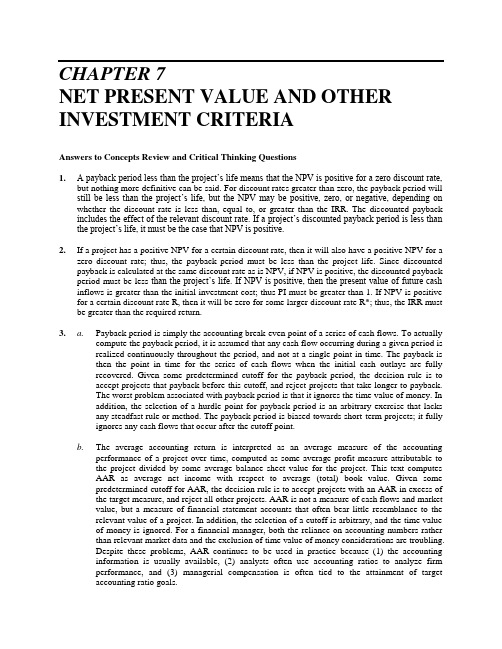

英文版罗斯公司理财习题答案

CHAPTER 7NET PRESENT VALUE AND OTHER INVESTMENT CRITERIAAnswers to Concepts Review and Critical Thinking Questions1. A payback period less than the project’s life means that the NPV is positive for a zero discount rate,but nothing more definitive can be said. For discount rates greater than zero, the payback period will still be less than the project’s life, but the NPV may be positive, zero, or negative, depending on whether the discount rate is less than, equal to, or greater than the IRR. The discounted payback includes the effect of the relevant discount rate. If a project’s discounted payback period is less than the project’s life, it must be the case that NPV is positive.2.If a project has a positive NPV for a certain discount rate, then it will also have a positive NPV for azero discount rate; thus, the payback period must be less than the project life. Since discounted payback is calculated at the same discount rate as is NPV, if NPV is positive, the discounted payback period must be less than the project’s life. If NPV is positive, then the present value of future cash inflows is greater than the initial investment cost; thus PI must be greater than 1. If NPV is positive for a certain discount rate R, then it will be zero for some larger discount rate R*; thus, the IRR must be greater than the required return.3. a.Payback period is simply the accounting break-even point of a series of cash flows. To actuallycompute the payback period, it is assumed that any cash flow occurring during a given period isrealized continuously throughout the period, and not at a single point in time. The payback isthen the point in time for the series of cash flows when the initial cash outlays are fullyrecovered. Given some predetermined cutoff for the payback period, the decision rule is toaccept projects that payback before this cutoff, and reject projects that take longer to payback.The worst problem associated with payback period is that it ignores the time value of money. Inaddition, the selection of a hurdle point for payback period is an arbitrary exercise that lacksany steadfast rule or method. The payback period is biased towards short-term projects; it fullyignores any cash flows that occur after the cutoff point.b.The average accounting return is interpreted as an average measure of the accountingperformance of a project over time, computed as some average profit measure attributable tothe project divided by some average balance sheet value for the project. This text computesAAR as average net income with respect to average (total) book value. Given somepredetermined cutoff for AAR, the decision rule is to accept projects with an AAR in excess ofthe target measure, and reject all other projects. AAR is not a measure of cash flows and marketvalue, but a measure of financial statement accounts that often bear little resemblance to therelevant value of a project. In addition, the selection of a cutoff is arbitrary, and the time valueof money is ignored. For a financial manager, both the reliance on accounting numbers ratherthan relevant market data and the exclusion of time value of money considerations are troubling.Despite these problems, AAR continues to be used in practice because (1) the accountinginformation is usually available, (2) analysts often use accounting ratios to analyze firmperformance, and (3) managerial compensation is often tied to the attainment of targetaccounting ratio goals.c.The IRR is the discount rate that causes the NPV of a series of cash flows to be identically zero.IRR can thus be interpreted as a financial break-even rate of return; at the IRR discount rate,the net value of the project is zero. The acceptance and rejection criteria are:If C0 < 0 and all future cash flows are positive, accept the project if the internal rate ofreturn is greater than or equal to the discount rate.If C0 < 0 and all future cash flows are positive, reject the project if the internal rate ofreturn is less than the discount rate.If C0 > 0 and all future cash flows are negative, accept the project if the internal rate ofreturn is less than or equal to the discount rate.If C0 > 0 and all future cash flows are negative, reject the project if the internal rate ofreturn is greater than the discount rate.IRR is the interest rate that causes NPV for a series of cash flows to be zero. NPV is preferred in all situations to IRR; IRR can lead to ambiguous results if there are non-conventional cash flows, and it also ambiguously ranks some mutually exclusive projects. However, for stand-alone projects with conventional cash flows, IRR and NPV are interchangeable techniques. The IRR decision rule for projectsd.The profitability index is the present value of cash inflows relative to the project cost. As such,it is a benefit/cost ratio, providing a measure of the relative profitability of a project. The profitability index decision rule is to accept projects with a PI greater than one, and to reject projects with a PI less than one. The profitability index can be expressed as: PI = (NPV + cost)/cost = 1 + (NPV/cost). If a firm has a basket of positive NPV projects and is subject to capital rationing, PI may provide a good ranking measure of the projects, indicating the “bang for the buck” of each particu lar project.e.NPV is simply the present value of a project’s cash flows. NPV specifically measures, afterconsidering the time value of money, the net increase or decrease in firm wealth due to the project. The decision rule is to accept projects that have a positive NPV, and reject projects with a negative NPV. NPV is superior to the other methods of analysis presented in the text because it has no serious flaws. The method unambiguously ranks mutually exclusive projects, and can differentiate between projects of different scale and time horizon. The only drawback to NPV is that it relies on cash flow and discount rate values that are often estimates and not certain, but this is a problem shared by the other performance criteria as well. A project with NPV = $2,500 implies that the total shareholder wealth of the firm will increase by $2,500 if the project is accepted.4.For a project with future cash flows that are an annuity:Payback = I / CAnd the IRR is:0 = – I + C / IRRSolving the IRR equation for IRR, we get:IRR = C / INotice this is just the reciprocal of the payback. So:IRR = 1 / PBFor long-lived projects with relatively constant cash flows, the sooner the project pays back, the greater is the IRR.5.There are a number of reasons. Two of the most important have to do with transportation costs andexchange rates. Manufacturing in the U.S. places the finished product much closer to the point of sale, resulting in significant savings in transportation costs. It also reduces inventories because goods spend less time in transit. Higher labor costs tend to offset these savings to some degree, at least compared to other possible manufacturing locations. Of great importance is the fact that manufacturing in the U.S. means that a much higher proportion of the costs are paid in dollars. Since sales are in dollars, the net effect is to immunize profits to a large extent against fluctuations in exchange rates. This issue is discussed in greater detail in the chapter on international finance.6.The single biggest difficulty, by far, is coming up with reliable cash flow estimates. Determining anappropriate discount rate is also not a simple task. These issues are discussed in greater depth in the next several chapters. The payback approach is probably the simplest, followed by the AAR, but even these require revenue and cost projections. The discounted cash flow measures (discounted payback, NPV, IRR, and profitability index) are really only slightly more difficult in practice.7.Yes, they are. Such entities generally need to allocate available capital efficiently, just as for-profitsdo. However, it is frequently the case that the “revenues” from not-for-profit ventures are not tangible. For example, charitable giving has real opportunity costs, but the benefits are generally hard to measure. To the extent that benefits are measurable, the question of an appropriate required return remains. Payback rules are commonly used in such cases. Finally, realistic cost/benefit analysis along the lines indicated should definitely be used by the U.S. government and would go a long way toward balancing the budget!8.The statement is false. If the cash flows of Project B occur early and the cash flows of Project Aoccur late, then for a low discount rate the NPV of A can exceed the NPV of B. Observe the following example.C0C1C2IRR NPV @ 0% Project A –$1,000,000 $0 $1,440,000 20% $440,000 Project B –$2,000,000 $2,400,000 $0 20% 400,000However, in one particular case, the statement is true for equally risky Projects. If the lives of the two Projects are equal and the cash flows of Project B are twice the cash flows of Project A in every time period, the NPV of Project B will be twice the NPV of Project A.9. Although the profitability index (PI) is higher for Project B than for Project A, Project A should bechosen because it has the greater NPV. Confusion arises because Project B requires a smaller investment than Project A requires. Since the denominator of the PI ratio is lower for Project B than for Project A, B can have a higher PI yet have a lower NPV. Only in the case of capital rationing could the company’s decision have been incorrect.10. a.Project A would have a higher IRR since initial investment for Project A is less than that ofProject B, if the cash flows for the two projects are identical.b.Yes, since both the cash flows as well as the initial investment are twice that of Project B.11.Project B would have a more sensitive NPV to changes in the discount rate. The reason is the timevalue of money. Cash flows that occur further out in the future are always more sensitive to changes in the interest rate. This is similar to the interest rate risk of a bond.12.The MIRR is calculated by finding the present value of all cash outflows, the future value of all cashinflows to the end of the project, and then calculating the IRR of the two cash flows. As a result, the cash flows have been discounted or compounded by one interest rate (the required return), and then the interest rate between the two remaining cash flows is calculated. As such, the MIRR is not a true interest rate. In contrast, consider the IRR. If you take the initial investment, and calculate the future value at the IRR, you can replicate the future cash flows of the project exactly.13.The criticism is incorrect. It is true that if you calculate the future value of all intermediate cashflows to the end of the project at the required return, then calculate the NPV of this future value and the initial investment, you will get the same NPV. However, NPV says nothing about reinvestment of intermediate cash flows. The NPV is the present value of the project cash flows. The fact that the reinvestment works is an artifact of the time value of money.14.The criticism is incorrect for several reasons. It is true that if you calculate the future value of allintermediate cash flows to the end of the project at the IRR, then calculate the IRR of this future value and the initial investment, you will get the same IRR. This only occurs if the intermediate cash flows are reinvested at the IRR. However, similar to the previous question, IRR deals with the present value of the cash flows, not the future value. There is also another important point. This criticism deals with the reinvestment of the intermediate cash flows. As we will see in the next chapter, any reinvestment assumption concerning the intermediate cash flows is incorrect. The reason is that when we are calculating the cash flows for a project, we are concerned with the incremental cash flows from the project, that is, the cash flows the project creates. Reinvestment violates this principal. Consider the following example:C0C1C2IRR Project A –$100 $10 $110 10% Suppose this is a deposit into a bank account. The IRR of the cash flows is 10 percent. Does it the IRR change if the Year 1 cash flow is reinvested in the account, or if it is withdrawn and spent on pizza? No. Finally, think back to the yield to maturity calculation on a bond. The YTM is the IRR of the bond investment, but no mention of a reinvestment assumption of the bond coupons is inferred.The reason is that the reinvestment assumption is irrelevant to calculating the YTM on a bond; in the same way, the reinvestment assumption is irrelevant in the IRR calculation.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basic1. a.The payback period is the time that it takes for the cumulative undiscounted cash inflows toequal the initial investment.Project A:Cumulative cash flows Year 1 = €4,000 = €4,000Cumulative cash flows Year 2 = €4,000 +3,500 = €7,500 Payback period = 2 yearsProject B:Cumulative cash flows Year 1 = €2,500 = €2,500Cumulative cash flows Year 2 = €2,500 + 1,200 = €3,700Cumulative cash flows Year 3 = €2,500 + 1,200 + 3,000 = €6,700 Companies can calculate a more precise value using fractional years. To calculate the fractionalpayba ck period, find the fraction of year 3’s cash flows that is needed for the company to have cumulative undiscounted cash flows of €5,000. Divide the difference between the initial investment and the cumulative undiscounted cash flows as of year 2 by the undiscounted cashflow of year 3.Payback period = 2 + (€5,000 –€3,700) / €3,000Payback period = 2.43Since project A has a shorter payback period than project B has, the company should chooseproject A.b.Discount each project’s cash flows at 15 percent. Choose the project with the highest NPV.Project A:NPV = –€7,500 + €4,000 / 1.15 + €3,500 / 1.152 + €1,500 / 1.153NPV = –€388.96Project B:NPV = –€5,000 + €2,500 / 1.15 + €1,200 / 1.152 + €3,000 / 1.153NPV = €53.83The firm should choose Project B since it has a higher NPV than Project A has.2.To calculate the payback period, we need to find the time that the project has recovered its initialinvestment. The cash flows in this problem are an annuity, so the calculation is simpler. If the initial cost is £3,000, the payback period is:Payback = 3 + (£300 / £900) = 3.33 yearsThere is a shortcut to calculate the payback period if the future cash flows are an annuity. Just divide the initial cost by the annual cash flow. For the £3,000 cost, the payback period is:Payback = £3,000 / £900 = 3.33 yearsFor an initial cost of £5,000, the payback period is:Payback = 5 + (£500 / £900) = 5.55 yearsThe payback period for an initial cost of £10,000 is a little trickier. Notice that the total cash inflows after nine years will be:Total cash inflows = 8(£900) = £7,200If the initial cost is £10,000, the project never pays back. Notice that if you use the shortcut forannuity cash flows, you get:Payback = £10,000 / £900 = 11.11 years.This answer does not make sense since the cash flows stop after nine years, so the payback period is never.3.When we use discounted payback, we need to find the value of all cash flows today. The value todayof the project cash flows for the first four years is:Value today of Year 1 cash flow = $7,000/1.14 = $6,140.35Value today of Year 2 cash flow = $7,500/1.142 = $5,771.01Value today of Year 3 cash flow = $8,000/1.143 = $5,399.77Value today of Year 4 cash flow = $8,500/1.144 = $5,032.68To find the discounted payback, we use these values to find the payback period. The discounted first year cash flow is $6,140.35, so the discounted payback for an $8,000 initial cost is:Discounted payback = 1 + ($8,000 – 6,140.35)/$5,771.01 = 1.32 yearsFor an initial cost of $13,000, the discounted payback is:Discounted payback = 2 + ($13,000 – 6,140.35 – 5,771.01)/$5,399.77 = 2.20 yearsNotice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Year 1 and Year 2 cash flows from the initial cost.This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Year 3 to get the fractional portion of the discounted payback.If the initial cost is $18,000, the discounted payback is:Discounted payback = 3 + ($18,000 – 6,140.35 – 5,771.01 – 5,399.77) / $5,032.68 = 3.14 years4.To calculate the discounted payback, discount all future cash flows back to the present, and use thesediscounted cash flows to calculate the payback period. Doing so, we find:R = 0%: 4 + (£1,100 / £2,100) = 4.52 yearsDiscounted payback = Regular payback = 4.52 yearsR = 5%: £2,100/1.05 + £2,100/1.052 + £2,100/1.053 + £2,100/1.054 + £2,100/1.055 = £9,091.90 £2,100/1.056 = £1,567.05Discounted payback = 5 + (£9,500 – 9,091.90) / £1,567.05 = 5.26 years R = 15%: £2,100/1.15 + £2,100/1.152 + £2,100/1.153 + £2,100/1.154 + £2,100/1.155 + £2,100/1.156 = £7,947.41; The project never pays back.5. a.The average accounting return is the average project earnings after taxes, divided by theaverage book value, or average net investment, of the machine during its life. The book value of the machine is the gross investment minus the accumulated depreciation.Average book value = (Book Value0 + Book Value1 + Book Value2 + Book Value3 +Book Value4 + Book Value5) / (Economic Life)Average book value = ($16,000 + 12,000 + 8,000 + 4,000 + 0) / (5 years)Average book value = $8,000Average Project Earnings = $4,500To find the average accounting return, we divide the average project earnings by the average book value of the machine to calculate the average accounting return. Doing so, we find:Average Accounting Return = Average Project Earnings / Average Book ValueAverage Accounting Return = $4,500 / $8,000Average Accounting Return = 0.5625 or 56.25%6.First, we need to determine the average book value of the project. The book value is the grossinvestment minus accumulated depreciation.Purchase Date Year 1 Year 2 Year 3 Gross Investment €8,000 €8,000 €8,000 €8,000Less: Accumulated Depreciation 0 4,000 6,500 8,000Net Investment €8,000 €4,000 €1,500 €0 Now, we can calculate the average book value as:Average book value = (€8,000 + 4,000 + 1,500 + 0) / (4 years)Average book value = €3,375To calculate the average accounting return, we must remember to use the aftertax average netincome when calculating the average accounting return. So, the average aftertax net income is:Average aftertax net income = (1 – t c) Annual pretax net incomeAverage aftertax net income = (1 – 0.25) €2,000Average aftertax net income = €1,500The average accounting return is the average after-tax net income divided by the average book value, which is:Average accounting return = €1,500 / €3,375Average accounting return = 0.4444 or 44.44%7.The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equation that definesthe IRR for this project is:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = –¥8,000,000 + ¥4,000,000/(1 + IRR) + ¥3,000,000/(1 + IRR)2 + ¥2,000,000/(1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that: IRR = 6.93%Since the IRR is less than the required return we would reject the project.8.The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equation that definesthe IRR for this Project A is:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = – £2,000 + £1,000/(1 + IRR) + £1,500/(1 + IRR)2 + £2,000/(1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that: IRR = 47.15%And the IRR for Project B is:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = – £1,500 + £500/(1 + IRR) + £1,000/(1 + IRR)2 + £1,500/(1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that: IRR = 36.19%9.The profitability index is defined as the PV of the cash inflows divided by the PV of the cashoutflows. The cash flows from this project are an annuity, so the equation for the profitability index is:PI = C(PVIFA R,t) / C0PI = €41,000(PVIFA15%,7) / €160,000PI = 1.066110. a.The profitability index is the present value of the future cash flows divided by the initial cost.So, for Project Alpha, the profitability index is:PI Alpha = [$300 / 1.10 + $700 / 1.102 + $600 / 1.103] / $500 = 2.604And for Project Beta the profitability index is:PI Beta = [$300 / 1.10 + $1,800 / 1.102 + $1,700 / 1.103] / $2,000 = 1.519b.According to the profitability index, you would accept Project Alpha. However, remember theprofitability index rule can lead to incorrect decision when ranking mutually exclusive projects.Intermediate11. a.To have a payback equal to the project’s life, given C is a constant cash flow for N years:C = I/Nb.To have a positive NPV, I < C (PVIFA R%, N). Thus, C > I / (PVIFA R%, N).c.Benefits = C (PVIFA R%, N) = 2 × costs = 2IC = 2I / (PVIFA R%, N)12. a.The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equationthat defines the IRR for this project is:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)3 + C4 / (1 + IRR)40 = ₩5,000 –₩2,500 / (1 + IRR) –₩2,000 / (1 + IRR)2–₩1,000 / (1 + IRR)3–₩1,000 / (1 +IRR)4Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that:IRR = 13.99%b.This problem differs from previous ones because the initial cash flow is positive and all futurecash flows are negative. In other words, this is a financing-type project, while previous projects were investing-type projects. For financing situations, accept the project when the IRR is less than the discount rate. Reject the project when the IRR is greater than the discount rate.IRR = 13.99%Discount Rate = 12%IRR > Discount RateReject the offer when the discount rate is less than the IRR.ing the same reason as part b., we would accept the project if the discount rate is 20 percent.IRR = 13.99%Discount Rate = 19%IRR < Discount RateAccept the offer when the discount rate is greater than the IRR.d.The NPV is the sum of the present value of all cash flows, so the NPV of the project if thediscount rate is 10 percent will be:NPV = ₩5,000 –₩2,500 / 1.12 –₩2,000 / 1.122–₩1,000 / 1.123–₩1,000 / 1.124NPV = –₩173.83When the discount rate is 12 percent, the NPV of the offer is –₩359.95. Reject the offer.And the NPV of the project is the discount rate is 19 percent will be:NPV = ₩5,000 –₩2,500 / 1.19 –₩2,000 / 1.192–₩1,000 / 1.193–₩1,000 / 1.194NPV = ₩394.75When the discount rate is 19 percent, the NPV of the offer is ₩466.82. Accept the offer.e.Yes, the decisions under the NPV rule are consistent with the choices made under the IRR rulesince the signs of the cash flows change only once.13. a.The IRR is the interest rate that makes the NPV of the project equal to zero. So, the IRR foreach project is:Deepwater Fishing IRR:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = –$600,000 + $270,000 / (1 + IRR) + $350,000 / (1 + IRR)2 + $300,000 / (1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that:IRR = 24.30%Submarine Ride IRR:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = –$1,800,000 + $1,000,000 / (1 + IRR) + $700,000 / (1 + IRR)2 + $900,000 / (1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that:IRR = 21.46%Based on the IRR rule, the deepwater fishing project should be chosen because it has the higher IRR.b.To calculate the incremental IRR, we s ubtract the smaller project’s cash flows from the largerproject’s cash flows. In this case, we subtract the deepwater fishing cash flows from the submarine ride cash flows. The incremental IRR is the IRR of these incremental cash flows. So, the incremental cash flows of the submarine ride are:Year 0Year 1Year 2 Year 3 Submarine Ride –$1,800,000 $1,000,000 $700,000 $900,000Deepwater Fishing –600,000 270,000 350,000 300,000Submarine – Fishing –$1,200,000 $730,000 $350,000 $600,000 Setting the present value of these incremental cash flows equal to zero, we find the incremental IRR is:0 = C0 + C1 / (1 + IRR) + C2 / (1 + IRR)2 + C3 / (1 + IRR)30 = –$1,200,000 + $730,000 / (1 + IRR) + $350,000 / (1 + IRR)2 + $600,000 / (1 + IRR)3Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that:Incremental IRR = 19.92%For investing-type projects, accept the larger project when the incremental IRR is greater than the discount rate. Since the incremental IRR, 19.92%, is greater than the required rate of return of 15 percent, choose the submarine ride project. Note that this is the choice when evaluating only the IRR of each project. The IRR decision rule is flawed because there is a scale problem.That is, the submarine ride has a greater initial investment than does the deepwater fishing project. This problem is corrected by calculating the IRR of the incremental cash flows, or by evaluating the NPV of each project.c.The NPV is the sum of the present value of the cash flows from the project, so the NPV of eachproject will be:Deepwater fishing:NPV = –$600,000 + $270,000 / 1.15 + $350,000 / 1.152 + $300,000 / 1.153NPV = $96,687.76Submarine ride:NPV = –$1,800,000 + $1,000,000 / 1.15 + $700,000 / 1.152 + $900,000 / 1.153NPV = $190,630.39Since the NPV of the submarine ride project is greater than the NPV of the deepwater fishingproject, choose the submarine ride project. The incremental IRR rule is always consistent withthe NPV rule.14. a.The profitability index is the PV of the future cash flows divided by the initial investment. Thecash flows for both projects are an annuity, so:PI I = 元15,000(PVIFA10%,3 ) / 元30,000 = 1.243PI II = 元2,800(PVIFA10%,3) / 元5,000 = 1.393The profitability index decision rule implies that we accept project II, since PI II is greater thanthe PI I.b.The NPV of each project is:NPV I = –元30,000 + 元15,000(PVIFA10%,3) = 元7,302.78NPV II = –元5,000 + 元2,800(PVIFA10%,3) = 元1,963.19The NPV decision rule implies accepting Project I, since the NPV I is greater than the NPV II.ing the profitability index to compare mutually exclusive projects can be ambiguous whenthe magnitudes of the cash flows for the two projects are of different scale. In this problem,project I is roughly 3 times as large as project II and produces a larger NPV, yet the profit-ability index criterion implies that project II is more acceptable.15. a.The equation for the NPV of the project is:NPV = –₦28,000,000 + ₦53,000,000/1.11 –₦8,000,000/1.112 = ₦13,254,768.28The NPV is greater than 0, so we would accept the project.b.The equation for the IRR of the project is:0 = –₦28,000,000 + ₦53,000,000/(1+IRR) –₦8,000,000/(1+IRR)2From Descartes rule of signs, we know there are two IRRs since the cash flows change signstwice. From trial and error, the two IRRs are:IRR = 72.75%, –83.46%。

《公司理财》斯蒂芬A.罗斯..,机械工业出版社 英文课件

McGraw-Hill/Irwin

Copyright © 2004 by The McGraw-Hill Companies, Inc. All rights reserved.

5-7

Pure Discount Bonds

Information needed for valuing pure discount bonds:

5-6

5.2 How to Value Bonds

• Identify the size and timing of cash flows. • Discount at the correct discount rate.

– If you know the price of a bond and the size and timing of cash flows, the yield to maturity is the discount rate.

– Time to maturity (T) = Maturity date - today’s date – Face value (F) – Discount rate (r)

$0

0

$0

$0

T 1

$F

T

1

2

Present value of a pure discount bond at time 0:

• To value bonds and stocks we need to:

– Estimate future cash flows:

• Size (how much)ຫໍສະໝຸດ and • Timing (when)

– Discount future cash flows at an appropriate rate:

罗斯—公司理财第七版中文PPT—第七章

折旧按成本加速回收制度( Accelerated Cost Recovery System,ACRS,具体折旧比例如 右边所示) 本例中基础成本为$100,000 第4年的折旧费用= $100,000×(.1152) = $11,520.

• 通货膨胀是经济生活中的一个重要事实,而且在资本预 算中必须考虑。 • 考虑利率和通货膨胀之间的关系,即所谓的费雪关系 (Fisher relationship): (1 + 名义利率) = (1 + 实际利率) × (1 + 通货膨胀率) • 如果通货膨胀率不高,此式经常写为近似式: 实际利率 ≅ 名义利率 – 通货膨胀率 • 虽然在美国的名义利率一直在随通货膨胀波动,但与名 义利率相比,实际利率的方差大多数时间里要小得多。 • 在资本预算中考虑通货膨胀的时候,所比较的对象必须 是用实际利率贴现的实际现金流量或用名义利率贴现的 名义现金流量。

$39.80 $54.19 $66.86 $59.87 $224.66 NPV = −$260 + + + + + 2 3 4 (1.10) (1.10) (1.10) (1.10) (1.10)5 NPV = $51,588.05

Dr. Xiao Ming USTB

17

7.3 通货膨胀和资本预算

13

鲍德温公司现金流量计算表(续)

(单位:千元) (所有现金流量均发生在年末)

第0年 利润: (8)销售收入 (9)经营成本

第1年

第2年 第Leabharlann 年第4年第5年 129.90 87.84

(完整版)罗斯《公司理财》重点知识整理

第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出 - 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值 + 有息负债市值 - 现金EV乘数 = EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

公司理财罗斯中文版07

第7 章利率◆本章复习与自测题7.1 债券价值Microgates产业公司的债券票面利率为10%,面值为1 000美元,每半年支付一次利息,而且该债券的到期期限为20年。

如果投资者要求12%的收益率,那么,该债券的价值是多少?有效年收益率是多少?7.2 债券收益率Macrohard公司的债券票面利率为8%,每半年付息一次,面值为1 000美元,而且到期期限为6年。

如果目前这张债券卖911.37美元,则到期收益率是多少?有效年收益率是多少?◆本章复习与自测题解答7.1 因为债券的票面利率是10%,而投资者要求12%的报酬,因此我们知道此债券必须折价出售。

注意,因为债券每半年付息一次,因此每6个月的票面利息是100美元/2 = 50美元,每6个月的必要报酬率是12%/2 = 6%。

最后,债券的到期期限是20年,因此,共有40期。

债券的价值等于在接下来的40期中,每期50美元的现值,加上20年后的1 000美元面值的现值:债券价值= 50美元×[1-1/1.0640 ]/0.06 + 1 000美元/1.0640= 50美元×15.04630 + 1 000美元/10.2857= 849.54美元请注意,我们以每期6%的贴现率将1 000美元贴现了40期,而不是以12%的贴现率贴现20期。

因为此债券的有效年收益率是1.062 -1 = 12.36%,而不是12%。

因此,我们也可以以每年12.36%将1 000美元贴现20期,答案是一样的。

7.2 债券的现金流量的现值就是它的目前价格911.37美元。

票面利息是每半年40美元,共12期,而且面值是1 000美元,因此,债券的收益率就是下式中的未知贴现率:911.37美元= 40美元×[1-1/(1 + r)12 ]/r+ 1 000美元/(1 + r)12这张债券以折价出售,因为票面利率为8%,收益率必定大于8%。

如果利用逐次测试法,我们可能会用12%(即每6个月6%)进行测试:债券价值= 40美元×[1-1/1.0612]/0.06 + 1 000美元/1.0612= 832.32美元结果小于实际价值,因此贴现率太高了。

罗斯公司理财Chpt007ppt课件

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

7-3

Cash Flows—Not Accounting Earnings.

• Consider depreciation expense. • You never write a check made out to “depreciation”. • Much of the work in evaluating a project lies in taking

• For now, it’s enough to assume that the firm’s level of debt (hence interest expense) is independent of the project at hand.

Method 7.5 Summary and Conclusions

McGraw-Hill/Irwin

Copyright © 2002 by The McGraw-Hill Companies, Inc. All rights reserved.

7-2

7.1 Incremental Cash Flows

• Side effects matter.

– Erosion and cannibalism are both bad things. If our new product causes existing customers to demand less of current products, we need to recognize that.

7-0

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

McGraw-Hill/Irwin Corporate Finance, 7/e © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

McGraw-Hill/Irwin Corporate Finance, 7/e © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-7

The Tuft Company is generating cash flow of $333,000 per year. If they invest in a new press, they expect to increase their cash flow to $400,000 per year. The cash outflow for the new press is $250,000; to accept or reject the investment they have to consider the A) press cost of $250,000 and total cash flow of $400,000 per year. B) press cost of $250,000 and incremental cash flow of $67,000 per year. C) current cash flow of $333,000 and the cost of $250,000 D) opportunity cost of the facility of $333,000. E) None of the above.

7.5 Investments of Unequal Lives: The Equivalent Annual Cost Method 7.6 Summary and Conclusions

McGraw-Hill/Irwin Corporate Finance, 7/e © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-0

CHAPTER

7

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

Net Present Value and Capital Budgeting

McGraw-Hill/Irwin Corporate Finance, 7/e

7-1

Corporate Finance, 7/e

7-3

Cash Flows—Not Accounting Earnings

Consider depreciation expense. You never write a check made out to ―depreciation‖. Much of the work in evaluating a project lies in taking accounting numbers and generating cash flows.

McGraw-Hill/Irwin Corporate Finance, 7/e

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-5

Opportunity costs do matter. If the asset is used in a new project, potential revenues from alternative uses are lost. These lost revenues are called opportunity cost

Recall that: Operating Cash Flow = EBIT – Taxes + Depreciation

Net Capital Spending

Don’t forget salvage value (after tax, of course).

Changes in Net Working Capital

McGraw-Hill/Irwin Corporate Finance, 7/e

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-11

7.2 The Baldwin Company: An Example(p180-182)

Costs of test marketing (already spent): $250,000. Current market value of proposed factory site (which we own): $150,000. Cost of bowling ball machine: $100,000 (depreciated according to ACRS 5-year life). Production (in units) by year during 5-year life of the machine: 5,000, 8,000, 12,000, 10,000, 6,000. Price during first year is $20; price increases 2% per year thereafter. Production costs during first year are $10 per unit and increase 10% per year thereafter. Annual inflation rate: 5% Working Capital: initially $10,000 changes with sales.

McGraw-Hill/Irwin Corporate Finance, 7/e

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-4

Incremental Cash Flows

Sunk costs are not relevant

7-2

7.1 Incremental Cash Flows

We first go over the concept of incremental cash flows. The easiest way to determine whether a cash flow item is incremental is by asking two questions: What will this cash flow be with the project? What will this cash flow be without the project? If the answers differ then this cash flow item is incremental, otherwise, it is irrelevant. Cash flows matter—not accounting earnings. Sunk costs don’t matter. Incremental cash flows matter. Opportunity costs matter. Side effects like cannibalism and erosion matter. Taxes matter: we want incremental after-tax cash flows. Inflation McGraw-Hill/Irwin matters. © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

McGraw-Hill/Irwin Corporate Finance, 7/e

© 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-8

Estimating Cash Flows

CcGraw-Hill/Irwin Corporate Finance, 7/e © 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

7-10

Interest Expense

Later chapters will deal with the impact that the amount of debt that a firm has in its capital structure has on firm value. For now, it’s enough to assume that the firm’s level of debt (hence interest expense) is independent of the project at hand.

A sunk cost is a cost that has already occurred. Because sunk costs are in the past, they cannot be changed by the decision to accept or reject the project. Just because ―we have come this far‖ does not mean that we should continue to throw good money after bad.

Chapter Outline

7.1 Incremental Cash Flows