罗斯公司理财第十版第十二章

罗斯《公司理财》笔记整理精编版

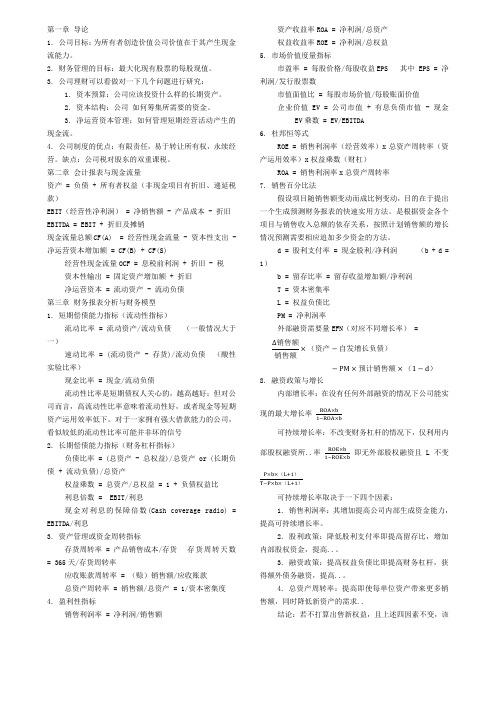

第一章导论1. 公司目标:为所有者创造价值,公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产= 负债+ 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润)= 净销售额- 产品成本- 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量- 资本性支出- 净运营资本增加额= CF(B) + CF(S) 经营性现金流量OCF = 息税前利润+ 折旧- 税资本性输出= 固定资产增加额+ 折旧净运营资本= 流动资产- 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率= 流动资产/流动负债(一般情况大于一)速动比率= (流动资产- 存货)/流动负债(酸性实验比率)现金比率= 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率= (总资产- 总权益)/总资产or (长期负债+ 流动负债)/总资产权益乘数= 总资产/总权益= 1 + 负债权益比利息倍数= EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率= 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率= (赊)销售额/应收账款总资产周转率= 销售额/总资产= 1/资本密集度4. 盈利性指标销售利润率= 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率= 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比= 每股市场价值/每股账面价值企业价值EV = 公司市值+ 有息负债市值- 现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

罗斯《公司理财》英文习题答案DOCchap012

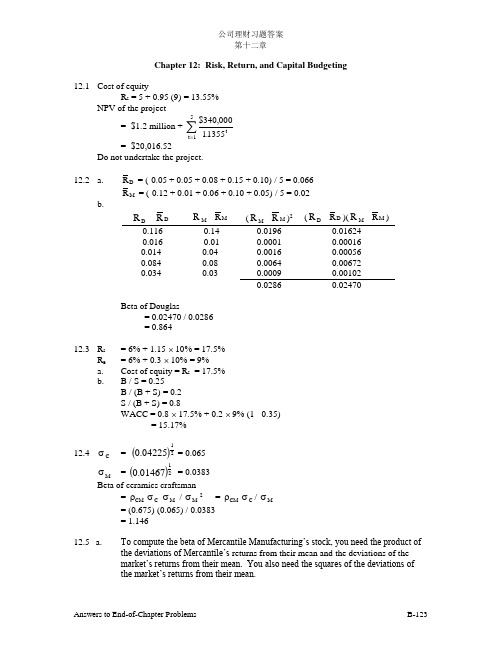

公司理财习题答案第十二章Chapter 12: Risk, Return, and Capital Budgeting12.1 Cost of equity R S = 5 + 0.95 (9) = 13.55% NPV of the project= -$1.2 million + $340,.0001135515tt =∑= -$20,016.52Do not undertake the project. 12.2 a. R D= (-0.05 + 0.05 + 0.08 + 0.15 + 0.10) / 5 = 0.066 R M = (-0.12 + 0.01 + 0.06 + 0.10 + 0.05) / 5 = 0.02b.DR- D R M R -R M(M R -M R )2 (D R -R D )(M R -R M )-0.116 -0.14 0.0196 0.01624 -0.016 -0.01 0.0001 0.00016 0.014 0.04 0.0016 0.00056 0.084 0.08 0.0064 0.00672 0.034 0.03 0.0009 0.001020.02860.02470Beta of Douglas = 0.02470 / 0.0286 = 0.86412.3 R S = 6% + 1.15 ⨯ 10% = 17.5% R B = 6% + 0.3 ⨯ 10% = 9% a. Cost of equity = R S = 17.5% b. B / S = 0.25 B / (B + S) = 0.2 S / (B + S) = 0.8WACC = 0.8 ⨯ 17.5% + 0.2 ⨯ 9% (1 - 0.35)= 15.17%12.4 C σ = ()2104225.0 = 0.065M σ = ()2101467.0 = 0.0383Beta of ceramics craftsman = CM ρC σ M σ / M σ2 = CM ρC σ/ M σ = (0.675) (0.065) / 0.0383 = 1.146 12.5a. To compute the beta of Mercantile Manufacturing’s stock, you need the product of the deviations of Mercantile’s returns from their mean and the deviations of the market’s returns from their mean. You also need the squares of the deviations ofthe market’s returns from their mean.The mechanics of computing the means and the deviations were presented in an earlier chapter.R T = 0.196 / 12 = 0.016333 R M = 0.236 / 12 = 0.019667 E(T R -R T ) (M R -R M ) = 0.038711 E(M R -R M )2 = 0.038588 β = 0.038711 / 0.038588= 1.0032b.The beta of the average stock is 1. Mercantile’s beta is close to 1, indicating that its stock has average risk.12.6 a.R M can have three values, 0.16, 0.18 or 0.20. The probability that M R takes one of these values is the sum of the joint probabilities of the return pair that include theparticular value of M R . For example, if M R is 0.16, R J will be 0.16, 0.18 or 0.22. The probability that M R is 0.16 and R J is 0.16 is 0.10. The probability that R M is 0.16 and R J is 0.18 is 0.06. The probability that M R is 0.16 and R J is 0.22 is 0.04. The probability that M R is 0.16 is, therefore, 0.10 + 0.06 + 0.04 = 0.20. The same procedure is used to calculate the probability that M R is 0.18 and the probability that M R is 0.20. Remember, the sum of the probability must be one.M RProbability 0.16 0.20 0.18 0.60 0.20 0.20 b. i.RM= 0.16 (0.20) + 0.18 (0.60) + 0.20 (0.20) = 0.18ii. 2M σ = (0.16 - 0.18) 2 (0.20) + (0.18 - 0.18) 2 (0.60) + (0.20 - 0.18) 2 (0.20)= 0.00016iii. M σ = ()2100016.0 = 0.01265c. R J Probability .18 .20 .20 .40 .22 .20 .24.10d. i. E j = .16 (.10) + .18 (.20) + .20 (.40) + .22 (.20) + .24(.10) = .20 ii. σj 2 = (.16 - .20)2 (.10) + (.18 - .20)2 (.20) + (.20 - .20)2 (.40)+ (.22 - .20)2 (.20) + (.24 - .20)2 (.10) = .00048公司理财习题答案第十二章iii. σj = ()21.0 = .0219100048e. Cov mj= (.16 - .18) (.16 - .20) (.10) + (.16 - .18) (.18 - .20) (.06)+ (.16 - .18) (.22 - .20) (.04) + (.20 - .18) (.18 - .20) (.02)+ (.20 - .18) (.22 - .20) (.04) + (.20 - .18) (.24 - .20) (.10)= .000176Corr mj = (0.000176) / (0.01265) (0.02191) = 0.635f. βj = (.635) (.02191) / (.01265) = 1.1012.7 i. The risk of the new project is the same as the risk of the firm without the project.ii. The firm is financed entirely with equity.12.8 a. Pacific Cosmetics should use its stock beta in the evaluation of the project only ifthe risk of the perfume project is the same as the risk of Pacific Cosmetics.b. If the risk of the project is the same as the risk of the firm, use the firm’s stock beta.If the risk differs, then use the beta of an all-equity firm with similar risk as theperfume project. A good way to estimate the beta of the project would be toaverage the betas of many perfume producing firms.12.9 E(R S) = 0.1 ⨯ 3 + 0.3 ⨯ 8 + 0.4 ⨯ 20 + 0.2 ⨯ 15 = 13.7%E(R B) = 0.1 ⨯ 8 + 0.3 ⨯ 8 + 0.4 ⨯ 10 + 0.2 ⨯ 10 = 9.2%E(R M) = 0.1 ⨯ 5 + 0.3 ⨯ 10 + 0.4 ⨯ 15 + 0.2 ⨯ 20 = 13.5%State {R S - E(R S)}{R M - E(R M)}Pr {R B - E(R B)}{R M - E(R M)}Pr1 (0.03-0.137)(0.05-0.135)⨯0.1 (0.08-0.092)(0.05-0.135)⨯0.12 (0.08-0.137)(0.10-0.135)⨯0.3 (0.08-0.092)(0.10-0.135)⨯0.33 (0.20-0.137)(0.15-0.135)⨯0.4 (0.10-0.092)(0.15-0.135)⨯0.44 (0.15-0.137)(0.20-0.135)⨯0.2 (0.10-0.092)(0.20-0.135)⨯0.2Sum 0.002056 0.00038= Cov(R S, R M) = Cov(R B, R M)σM 2= 0.1 (0.05 - 0.135)2 + 0.3 (0.10-0.135)2+ 0.4 (0.15-0.135)2 + 0.2 (0.20-0.135)2= 0.002025a. Beta of debt = Cov(R B, R M) / σM2 = 0.00038 / 0.002025= 0.188b. Beta of stock = Cov(R S, R M) / σM2 = 0.002055 / 0.002025= 1.015c. B / S = 0.5Thus, B / (S + B) = 1 / 3 = 0.3333S / (S + B) = 2 / 3 = 0.6667Beta of asset = 0.188 ⨯ 0.3333 + 1.015 ⨯ 0.6667= 0.73912.10 The discount rate for the project should be lower than the rate implied by the use ofthe Security Market Line. The appropriate discount rate for such projects is theweighted average of the interest rate on debt and the cost of equity. Since theinterest rate on the debt of a given firm is generally less than the firm’s cost ofequity, using only the stock’s beta yields a discount rate that is too high. Theconcept and practical uses of a weighted average discount rate will be in a laterchapter.12.11i. RevenuesThe gross income of the firm is an important factor in determining beta. Firmswhose revenues are cyclical (fluctuate with the business cycle) generally have highbetas. Firms whose revenues are not cyclical tend to have lower betas.ii. Operating leverageOperating leverage is the percentage change in earnings before interest and taxes(EBIT) for a percentage change in sales, [(Change in EBIT / EBIT) (Sales / Changein sales)]. Operating leverage indicates the ability of the firm to service its debt andpay stockholders.iii. Financial leverageFinancial leverage arises from the use of debt. Financial leverage indicates theability of the firm to pay stockholders. Since debt holders must be paid beforestockholders, the higher the financial leverage of the firm, the riskier its stock.The beta of common stock is a function of all three of these factors. Ultimately, theriskiness of the stock, of which beta captures a portion, is determined by thefluctuations in the income available to the stockholders. (As was discussed in thechapter, whether income is paid to the stockholders in the form of dividends or it isretained to finance projects are irrelevant as long as the projects are of similar riskas the firm.) The income available to common stock, the net income of the firm,depends initially on the revenues or sales of the firm. The operating leverageindicates how much of each dollar of revenue will become EBIT. Financialleverage indicates how much of each dollar of EBIT will become net income.12.12 a. Cost of equity for National Napkin= 7 + 1.29 (13 - 7)= 14.74%b. B / (S + B) = S / (S + B) = 0.5WACC = 0.5 ⨯ 7 ⨯ 0.65 + 0.5 ⨯ 14.74= 9.645%12.13 B = $60 million ⨯ 1.2 = $72 millionS = $20 ⨯ 5 million = $100 millionB / (S + B) = 72 / 172 = 0.4186S / (S + B) = 100 / 172 = 0.5814WACC = 0.4186 ⨯ 12% ⨯ 0.75 + 0.5814 ⨯ 18%= 14.23%12.14 S = $25 ⨯ 20 million = $500 millionB = 0.95 ⨯ $180 million = $171 million公司理财习题答案第十二章B / (S + B) = 0.2548 S / (S + B) = 0.7452 WACC = 0.7452 ⨯ 20% + 0.2548 ⨯ 10%⨯ 0.60 = 16.43%12.15 B / S = 0.75 B / (S + B) = 3 / 7 S / (S + B) = 4 / 7 WACC = (4 / 7) ⨯ 15% + (3 / 7) ⨯ 9%⨯ (1 - 0.35) = 11.08%NPV = -$25 million + $7(.)m illion tt 10110815+=∑= $819,299.04 Undertake the project.12.16 WACC = (0.5) x 28% + (0.5) x 10% x (1 - 0.35)= 17.25%NPV = - $1,000,000 + (1 - 0.35) $600,000 51725.0A = $240,608.50Mini Case: Allied ProductsAssumptionsPP&E Investment 42,000,000 Useful life of PP&E Investment (years) 7NEW GPWS price/unit (Year 1) 70,000 NEW GPWS variable cost/unit (Year 1) 50,000 UPGRADE GPWS price/unit (Year 1) 35,000 UPGRADE GPWS variable cost/unit (Year 1) 22,000Year 1 marketing and admin costs 3,000,000 Annual inflation rate 3.00% Corporate Tax rate 40.00%Beta (9/27 Valueline) 1.20 Rf (30 year U.S. Treasury Bond) 6.20%NEW GPWS Market Growth (Strong Growth) 15.00%NEW GPWS Market Growth (Moderate Growth) 10.00%NEW GPWS Market Growth (Mild Recession) 6.00%NEW GPWS Market Growth (Severe Recession state of economy) 3.00%Total Annual Market for UPGRADE GPWS (units) 2,500Allied Signal Market Share in each market 45.00%公司理财习题答案第十二章Year 0 1 2 3 4 5 SalesNEWUnits 97 107 118 130 144 Price 70,000 72,100 74,263 76,491 78,786 Total NEW 6,772,500 7,688,654 8,736,317 9,935,345 11,308,721 UPGRADEUnits 1,125 1,125 1,125 1,125 1,125 Price 35,000 36,050 37,132 38,245 39,393 Total UPGRADE 39,375,000 40,556,250 41,772,938 43,026,126 44,316,909 Total Sales 46,147,500 48,244,904 50,509,254 52,961,470 55,625,630 Variable CostsNEW 4,837,500 5,491,896 6,240,226 7,096,675 8,077,658 UPGRADE 24,750,000 25,492,500 26,257,275 27,044,993 27,856,343 Total Variable Costs 29,587,500 30,984,396 32,497,501 34,141,668 35,934,001SG&A 3,000,000 3,090,000 3,182,700 3,278,181 3,376,526 Depreciation 6,001,800 10,285,800 7,345,800 5,245,800 3,750,600EBIT 7,558,200 3,884,708 7,483,253 10,295,821 12,564,503 Interest 0 0 0 0 0 Tax 3,023,280 1,553,883 2,993,301 4,118,329 5,025,801 Net Income 4,534,920 2,330,825 4,489,952 6,177,493 7,538,702EBIT + Dep - Taxes 10,536,720 12,616,625 11,835,752 11,423,293 11,289,302 Less: Change in NWC 2,000,000 307,375 104,870 113,218 122,611 (2,648,074) Less: Captial Spending 42,000,000 (10,948,080) CF from Assets: (44,000,000) 10,229,345 12,511,755 11,722,534 11,300,682 24,885,455 Discounted CF from Assets 9,304,480 10,351,583 8,821,741 7,735,381 15,494,120Total Discounted CF from Assets 51,707,305Results。

(完整版)公司理财-罗斯课后习题答案

(完整版)公司理财-罗斯课后习题答案-CAL-FENGHAI-(2020YEAR-YICAI)_JINGBIAN第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

罗斯公司理财题库全集

Chapter 12 An Alternative View of Risk and Return: The Arbitrage Pricing TheoryMultiple Choice Questions1. In the equation R = + U, the three symbols stand for:A. average return, expected return, and unexpected return.B. required return, expected return, and unbiased return.C. actual total return, expected return, and unexpected return.D. required return, expected return, and unbiased risk.E. risk, expected return, and unsystematic risk.2. The acronym APT stands for:A. Arbitrage Pricing Techniques.B. Absolute Profit Theory.C. Arbitrage Pricing Theory.D. Asset Puting Theory.E. Assured Price Techniques.3. The acronym CAPM stands for:A. Capital Asset Pricing Model.B. Certain Arbitrage Pressure Model.C. Current Arbitrage Prices Model.D. Cumulative Asset Price Model.E. None of the above.4. The unexpected return on a security, U, is made up of:A. market risk and systematic risk.B. systematic risk and unsystematic risk.C. idiosyncratic risk and unsystematic risk.D. expected return and market risk.E. expected return and idiosyncratic risk.5. Systematic risk is defined as:A. a risk that specifically affects an asset or small group of assets.B. any risk that affects a large number of assets.C. any risk that has a huge impact on the return of a security.D. the random component of return.E. None of the above.6. The term Corr(ε R, ε T) = 0 tells us that:A. all error terms of company R and T are 0.B. the unsystematic risk of companies R and T is unrelated or uncorrelated.C. the correlation between the returns of companies R and T is -1.D. the systematic risk of companies R and T is unrelated.E. None of the above.7. A factor is a variable that:A. affects the returns of risky assets in a systematic fashion.B. affects the returns of risky assets in an unsystematic fashion.C. correlates with risky asset returns in a unsystematic fashion.D. does not correlate with the returns of risky assets in an systematic fashion.E. None of the above.8. A security that has a beta of zero will have an expected return of:A. zero.B. the market risk premium.C. the risk free rate.D. less than the risk free rate but not negative.E. less than the risk free rate which can be negative.9. Which of the following is true about the impact on market price of a security when a company makes an announcement and the market has discounted the news?A. The price will change a great deal; even though the impact is primarily in the future, the future value is discounted to the present.B. The price will change little, if at all, since the impact is primarily in the future.C. The price will change little, if at all, since the market considers this information unimportant.D. The price will change little, if at all, since the market considers this information untrue.E. The price will change little, if at all, since the market has already included this information in the security's price.10. Shareholders discount many corporate announcements because of their prior expectations. If an announcement causes the price to change it will mostly be driven by:A. the expected part of the announcement.B. market inefficiency.C. the unexpected part of the announcement.D. the systematic risk.E. None of the above.11. A company owning gold mines will probably have a _____ inflation beta because an ___ increase in inflation is usually associated with an increase in gold prices.A. negative; anticipatedB. positive; anticipatedC. negative; unanticipatedD. positive; unanticipatedE. None of the above.12. If company A, a medical research company, makes a new product discovery and their stock rises 5%, this will have:A. no effect on Company B's, a newspaper, stock price because it is a systematic risk element.B. no effect on Company B's, a newspaper, stock price because it is an unsystematic risk element.C. a large effect on Company B's, a newspaper, stock price because it is a systematic risk element.D. a large effect on Company B's, a newspaper, stock price because it is an unsystematic risk element.E. None of the above.13. What would not be true about a GNP beta?A. If a stock's βGNP = 1.5, the stock will experience a 1.5% increase for every 1% surprise increase in GNP.B. If a stock's β GNP = -1.5, the stock will experience a 1.5% decrease for every 1% surprise increase in GNP.C. It is a measure of risk.D. It measures the impact of systematic risk associated with GNP.E. None of the above.14. If the expected rate of inflation was 3% and the actual rate was 6.2%; the systematic response coefficient from inflation, β, would result in a change inI.any security return of ___ βIA. 9.2B. 3.2C. -3.2D. 3.0E. 6.215. In a portfolio of risky assets, the response to a factor, Fi, can be determined by:A. summing the weightedi s and multiplying by the factor Fi.B. summing the Fis.C. adding the average weighted expected returns.D. summing the weighted random errors.E. All of the above.16. In the one factor (APT) model, the characteristic line to estimate i passes through the origin, unlike the estimate used in the CAPM because:A. the relationship is between the actual return on a security and the market index.B. the relationship measures the change in the security return over time versus the change in the market return.C. the relationship measures the change in excess return on a security versus GNP.D. the relationship measures the change in excess return on a security versus the return on the factor about its mean of zero.E. Cannot be determined without actual data.17. The betas along with the factors in the APT adjust the expected return for:A. calculation errors.B. unsystematic risks.C. spurious correlations of factors.D. differences between actual and expected levels of factors.E. All of the above.18. The single factor APT model that resembles the market model uses _________ as the single factor.A. arbitrage feesB. GNPC. the inflation rateD. the market returnE. the risk-free return19. For a diversified portfolio including a large number of stocks, the:A. weighted average expected return goes to zero.B. weighted average of the betas goes to zero.C. weighted average of the unsystematic risk goes to zero.D. return of the portfolio goes to zero.E. return on the portfolio equals the risk-free rate.20. Which of the following statements is true?A. A well-diversified portfolio has negligible systematic risk.B. A well-diversified portfolio has negligible unsystematic risk.C. An individual security has negligible systematic risk.D. An individual security has negligible unsystematic risk.E. Both A and D.21. Assuming that the single factor APT model applies, the beta for the market portfolio is:A. zero.B. one.C. the average of the risk free beta and the beta for the highest risk security.D. impossible to calculate without collecting sample data.E. None of the above.22. In normal market conditions if a security has a negative beta:A. the security always has a positive return.B. the security has an expected return above the risk-free return.C. the security has an expected return less than the risk-free rate.D. the security has an expected return equal to the market portfolio.E. Both A and B.23. A criticism of the CAPM is that it:A. ignores the return on the market portfolio.B. ignores the risk-free return.C. requires a single measure of systematic risk.D. utilizes too many factors.E. None of the above.24. To estimate the cost of equity capital for a firm using the CAPM, it is necessary to have:A. company financial leverage, beta, and the market risk premium.B. company financial leverage, beta, and the risk-free rate.C. beta, company financial leverage, and the industry beta.D. beta, company financial leverage, and the market risk premium.E. beta, the risk-free rate, and the market risk premium.25. An advantage of the APT over CAPM is:A. APT can handle multiple factors.B. if the factors can be properly identified, the APT may have more explanation/predictive power for returns.C. the APT forces unsystematic risk to be negative to offset systematic risk; thus making the total portfolio risk free, allowing for an arbitrage opportunity for the astute investor.D. Both A and B.E. All of the above.26. Parametric or empirical models rely on:A. security betas explaining systematic factor relationships.B. finding regularities and relations in past market data.C. there being no true explanations of pricing relationships.D. always being able to find the exception to the rule.E. None of the above27. A growth stock portfolio and a value portfolio might be characterized:A. each by their P/E relative to the index P/E; high P/E for growth and lower for value.B. as earning a high rate of return for a growth security and a low rate of return for value security irrespective of risk.C. low unsystematic risk and high systematic risk respectively.D. moderate systematic risk and zero systematic risk respectively.E. None of the above.28. Style portfolios are characterized by:A. their stock attributes; P/Es less than the market P/E are value funds.B. their systematic factors, higher systematic factors are benchmark portfolios.C. their stock attributes; higher stock attribute factors are benchmark portfolios.D. their systematic factors, P/Es greater than the market are value portfolios.E. There is no difference between systematic factors and stock attributes.29. The most realistic APT model would likely include:A. multiple factors.B. only one factor.C. a factor to measure inflation.D. Both A and C.E. Both B and C.30. Which of the following statements is/are true?A. Both APT and CAPM argue that expected excess return must be proportional to the beta(s).B. APT and CAPM are the only approaches to measure expected returns in risky assets.C. Both CAPM and APT are risk-based models.D. Both A and B.E. Both A and C.31. Three factors likely to occur in the APT model are:A. unemployment, inflation, and current rates.B. inflation, GNP, and interest rates.C. current rates, inflation and change in housing prices.D. unemployment, college tuition, and GNP.E. This cannot be determined or even estimated.32. Both the APT and the CAPM imply a positive relationship between expected return and risk. The APT views risk:A. very similarly to the CAPM via the beta of the security.B. in terms of individual intersecurity correlation versus the beta of the CAPM.C. via the industry wide or marketwide factors creating correlation between securities.D. as the standardized deviation of the covariance.E. None of the above.33. The Fama-French three factor model includes the following factors:A. beta, expected return on the market, risk free rate of interest, a size factor, and a value factor.B. the market risk premium, a volume factor, and a size factor.C. beta, expected return on the market, risk free rate of interest, a volume factor, and a value factor.D. the yield on corporate bonds, a size factor, and a market factor.E. None of the above.34. A value company is defined as one that:A. tends to have a lower average return than a growth company.B. tends to have higher average return than a growth company.C. has a high ratio of book equity to market equity.D. a and b.E. a and c.35. The Fama-French three factor model predicts the expected return on a portfolio increases:A. linearly with its factor loading of the size factor.B. linearly with its factor loading of the volume.C. exponentially with its factor loading of the size factor.D. exponentially with its factor loading of the volume factor.E. None of the above.36. The systematic response coefficient for productivity, β, would produce anpif the expected rate of unexpected change in any security return of __ βPproductivity was 1.5% and the actual rate was 2.25%.A. 0.75%B. -0.75%C. 2.25%D. -2.25%E. 1.5%37. Assume that the single factor APT model applies and a portfolio exists such that 2/3 of the funds are invested in Security Q and the rest in the risk-free asset. Security Q has a beta of 1.5. The portfolio has a beta of:A. 0.00B. 0.50C. 0.75D. 1.00E. 1.5038. Suppose the JumpStart Corporation's common stock has a beta of 0.8. If the risk-free rate is 4% and the expected market return is 9%, the expected return for JumpStart's common stock is:A. 3.2%.B. 4.0%.C. 7.2%.D. 8.0%.E. 9.0%.39. Suppose the MiniCD Corporation's common stock has a return of 12%. Assume the risk-free rate is 4%, the expected market return is 9%, and no unsystematic influence affected Mini's return. The beta for MiniCD is:A. 0.89.B. 1.60.C. 2.40.D. 3.00.E. It is impossible to calculate beta without the inflation rate.Suppose that we have identified three important systematic risk factors given by exports, inflation, and industrial production. In the beginning of the year, growth in these three factors is estimated at -1%, 2.5%, and 3.5% respectively. However, actual growth in these factors turns out to be 1%, -2%, and 2%. The factor betas are given by βEX = 1.8, βI = 0.7, and βIP = 1.0.40. If the expected return on the stock is 6%, and no unexpected news concerning the stock surfaces, calculate the stock's total return.A. 2.95%B. 4.95%C. 6.55%D. 7.40%E. 8.85%41. Calculate the stock's total return if the company announces that an important patent filing has been granted sooner than expected and will earn the company 5% more in return.A. 7.95%B. 9.95%C. 11.55%D. 7.90%E. 9.35%42. Calculate the stock's total return if the company announces that they had an industrial accident and the operating facilities will close down for some time thus resulting in a loss by the company of 7% in return.A. -4.05%B. -2.05%C. 4.55%D. 0.40%E. 1.85%43. What would the stock's total return be if the actual growth in each of the factors was equal to growth expected? Assume no unexpected news on the patent.A. 4%B. 5%C. 6%D. 7%E. 8%Essay Questions44. An investor is considering the three stocks given below:Calculate the expected return and beta of a portfolio equally weighted between stocks B and C. Demonstrate that holding stock A actually reduces risk by comparing the risk of a portfolio equally weighted between stock B and T-Bills with a portfolio equally weighted between stocks B and A.45. Explain the conceptual differences in the theoretical development of the CAPM and APT.46. You have a 3 factor model to explain returns. Explain what a factor represents in the context of the APT? Each factor is multiplied by a beta. What do these represent and how do they relate to the actual return?47. Discuss the Fama-French three factor model; both what it means and the factors of the model.Chapter 12 An Alternative View of Risk and Return: The Arbitrage Pricing Theory Answer KeyMultiple Choice Questions1. In the equation R = + U, the three symbols stand for:A.average return, expected return, and unexpected return.B.required return, expected return, and unbiased return.C.actual total return, expected return, and unexpected return.D.required return, expected return, and unbiased risk.E.risk, expected return, and unsystematic risk.Difficulty level: EasyTopic: ARBITRAGE PRICING THEORYType: DEFINITIONS2. The acronym APT stands for:A.Arbitrage Pricing Techniques.B.Absolute Profit Theory.C.Arbitrage Pricing Theory.D.Asset Puting Theory.E.Assured Price Techniques.Difficulty level: EasyTopic: ARBITRAGE PRICING THEORYType: DEFINITIONS3. The acronym CAPM stands for:A.Capital Asset Pricing Model.B.Certain Arbitrage Pressure Model.C.Current Arbitrage Prices Model.D.Cumulative Asset Price Model.E.None of the above.Difficulty level: EasyTopic: CAPITAL ASSET PRICING MODELType: DEFINITIONS4. The unexpected return on a security, U, is made up of:A.market risk and systematic risk.B.systematic risk and unsystematic risk.C.idiosyncratic risk and unsystematic risk.D.expected return and market risk.E.expected return and idiosyncratic risk.Difficulty level: MediumTopic: UNEXPECTED RETURNType: DEFINITIONS5. Systematic risk is defined as:A. a risk that specifically affects an asset or small group of assets.B.any risk that affects a large number of assets.C.any risk that has a huge impact on the return of a security.D.the random component of return.E.None of the above.Difficulty level: EasyTopic: SYSTEMATIC RISKType: DEFINITIONS6. The term Corr(ε R, ε T) = 0 tells us that:A.all error terms of company R and T are 0.B.the unsystematic risk of companies R and T is unrelated or uncorrelated.C.the correlation between the returns of companies R and T is -1.D.the systematic risk of companies R and T is unrelated.E.None of the above.Difficulty level: MediumTopic: CORRELATIONType: DEFINITIONS7. A factor is a variable that:A.affects the returns of risky assets in a systematic fashion.B.affects the returns of risky assets in an unsystematic fashion.C.correlates with risky asset returns in a unsystematic fashion.D.does not correlate with the returns of risky assets in an systematic fashion.E.None of the above.Difficulty level: EasyTopic: FACTORSType: DEFINITIONS8. A security that has a beta of zero will have an expected return of:A.zero.B.the market risk premium.C.the risk free rate.D.less than the risk free rate but not negative.E.less than the risk free rate which can be negative.Difficulty level: MediumTopic: ZERO BETAType: DEFINITIONS9. Which of the following is true about the impact on market price of a security when a company makes an announcement and the market has discounted the news?A.The price will change a great deal; even though the impact is primarily in the future, the future value is discounted to the present.B.The price will change little, if at all, since the impact is primarily in the future.C.The price will change little, if at all, since the market considers this information unimportant.D.The price will change little, if at all, since the market considers this information untrue.E.The price will change little, if at all, since the market has already included this information in the security's price.Difficulty level: EasyTopic: ANNOUNCEMENT EFFECTSType: CONCEPTS10. Shareholders discount many corporate announcements because of their prior expectations. If an announcement causes the price to change it will mostly be driven by:A.the expected part of the announcement.B.market inefficiency.C.the unexpected part of the announcement.D.the systematic risk.E.None of the above.Difficulty level: MediumTopic: ANNOUNCEMENT EFFECTSType: CONCEPTS11. A company owning gold mines will probably have a _____ inflation beta because an ___ increase in inflation is usually associated with an increase in gold prices.A.negative; anticipatedB.positive; anticipatedC.negative; unanticipatedD.positive; unanticipatedE.None of the above.Difficulty level: MediumTopic: INFLATION AND BETAType: CONCEPTS12. If company A, a medical research company, makes a new product discovery and their stock rises 5%, this will have:A.no effect on Company B's, a newspaper, stock price because it is a systematic risk element.B.no effect on Company B's, a newspaper, stock price because it is an unsystematic risk element.C. a large effect on Company B's, a newspaper, stock price because it is a systematic risk element.D. a large effect on Company B's, a newspaper, stock price because it is an unsystematic risk element.E.None of the above.Difficulty level: EasyTopic: UNSYSTEMATIC RISKType: CONCEPTS13. What would not be true about a GNP beta?A.If a stock's βGNP = 1.5, the stock will experience a 1.5% increase for every 1% surprise increase in GNP.B.If a stock's β GNP = -1.5, the stock will experience a 1.5% decrease for every 1% surprise increase in GNP.C.It is a measure of risk.D.It measures the impact of systematic risk associated with GNP.E.None of the above.Difficulty level: MediumTopic: BETAType: CONCEPTS14. If the expected rate of inflation was 3% and the actual rate was 6.2%; the, would result in a change in systematic response coefficient from inflation, βI.any security return of ___ βIA.9.2B. 3.2C.-3.2D. 3.0E. 6.2Difficulty level: EasyTopic: FACTORS AND INFLATIONType: CONCEPTS15. In a portfolio of risky assets, the response to a factor, Fi, can be determined by:A.summing the weighted βi s and multiplying by the factor Fi.B.summing the Fis.C.adding the average weighted expected returns.D.summing the weighted random errors.E.All of the above.Difficulty level: MediumTopic: FACTORSType: CONCEPTS16. In the one factor (APT) model, the characteristic line to estimate βi passes through the origin, unlike the estimate used in the CAPM because:A.the relationship is between the actual return on a security and the market index.B.the relationship measures the change in the security return over time versus the change in the market return.C.the relationship measures the change in excess return on a security versus GNP.D.the relationship measures the change in excess return on a security versus the return on the factor about its mean of zero.E.Cannot be determined without actual data.Difficulty level: ChallengeTopic: APT AND CAPMType: CONCEPTS17. The betas along with the factors in the APT adjust the expected return for:A.calculation errors.B.unsystematic risks.C.spurious correlations of factors.D.differences between actual and expected levels of factors.E.All of the above.Difficulty level: ChallengeTopic: BETAS AND FACTORSType: CONCEPTS18. The single factor APT model that resembles the market model uses _________ as the single factor.A.arbitrage feesB.GNPC.the inflation rateD.the market returnE.the risk-free returnDifficulty level: EasyTopic: SINGLE FACTOR APTType: CONCEPTS19. For a diversified portfolio including a large number of stocks, the:A.weighted average expected return goes to zero.B.weighted average of the betas goes to zero.C.weighted average of the unsystematic risk goes to zero.D.return of the portfolio goes to zero.E.return on the portfolio equals the risk-free rate.Difficulty level: EasyTopic: UNSYSTEMATIC RISK AND DIVERSIFICATIONType: CONCEPTS20. Which of the following statements is true?A. A well-diversified portfolio has negligible systematic risk.B. A well-diversified portfolio has negligible unsystematic risk.C.An individual security has negligible systematic risk.D.An individual security has negligible unsystematic risk.E.Both A and D.Difficulty level: EasyTopic: UNSYSTEMATIC RISK AND DIVERSIFICATIONType: CONCEPTS21. Assuming that the single factor APT model applies, the beta for the market portfolio is:A.zero.B.one.C.the average of the risk free beta and the beta for the highest risk security.D.impossible to calculate without collecting sample data.E.None of the above.Difficulty level: EasyTopic: SINGLE FACTOR APTType: CONCEPTS22. In normal market conditions if a security has a negative beta:A.the security always has a positive return.B.the security has an expected return above the risk-free return.C.the security has an expected return less than the risk-free rate.D.the security has an expected return equal to the market portfolio.E.Both A and B.Difficulty level: MediumTopic: NEGATIVE BETAType: CONCEPTS23. A criticism of the CAPM is that it:A.ignores the return on the market portfolio.B.ignores the risk-free return.C.requires a single measure of systematic risk.D.utilizes too many factors.E.None of the above.Difficulty level: EasyTopic: CAPMType: CONCEPTS24. To estimate the cost of equity capital for a firm using the CAPM, it is necessary to have:pany financial leverage, beta, and the market risk premium.pany financial leverage, beta, and the risk-free rate.C.beta, company financial leverage, and the industry beta.D.beta, company financial leverage, and the market risk premium.E.beta, the risk-free rate, and the market risk premium.Difficulty level: EasyTopic: CAPMType: CONCEPTS25. An advantage of the APT over CAPM is:A.APT can handle multiple factors.B.if the factors can be properly identified, the APT may have more explanation/predictive power for returns.C.the APT forces unsystematic risk to be negative to offset systematic risk; thus making the total portfolio risk free, allowing for an arbitrage opportunity for the astute investor.D.Both A and B.E.All of the above.Difficulty level: EasyTopic: APT AND CAPMType: CONCEPTS26. Parametric or empirical models rely on:A.security betas explaining systematic factor relationships.B.finding regularities and relations in past market data.C.there being no true explanations of pricing relationships.D.always being able to find the exception to the rule.E.None of the aboveDifficulty level: ChallengeTopic: EMPIRICAL MODELINGType: CONCEPTS27. A growth stock portfolio and a value portfolio might be characterized:A.each by their P/E relative to the index P/E; high P/E for growth and lower for value.B.as earning a high rate of return for a growth security and a low rate of return for value security irrespective of risk.C.low unsystematic risk and high systematic risk respectively.D.moderate systematic risk and zero systematic risk respectively.E.None of the above.Difficulty level: MediumTopic: PORTFOLIOSType: CONCEPTS28. Style portfolios are characterized by:A.their stock attributes; P/Es less than the market P/E are value funds.B.their systematic factors, higher systematic factors are benchmark portfolios.C.their stock attributes; higher stock attribute factors are benchmark portfolios.D.their systematic factors, P/Es greater than the market are value portfolios.E.There is no difference between systematic factors and stock attributes. Difficulty level: MediumTopic: STYLE PORTFOLIOSType: CONCEPTS29. The most realistic APT model would likely include:A.multiple factors.B.only one factor.C. a factor to measure inflation.D.Both A and C.E.Both B and C.Difficulty level: MediumTopic: APTType: CONCEPTS30. Which of the following statements is/are true?A.Both APT and CAPM argue that expected excess return must be proportional to the beta(s).B.APT and CAPM are the only approaches to measure expected returns in risky assets.C.Both CAPM and APT are risk-based models.D.Both A and B.E.Both A and C.Difficulty level: MediumTopic: APT AND CAPMType: CONCEPTS31. Three factors likely to occur in the APT model are:A.unemployment, inflation, and current rates.B.inflation, GNP, and interest rates.C.current rates, inflation and change in housing prices.D.unemployment, college tuition, and GNP.E.This cannot be determined or even estimated.Difficulty level: MediumTopic: APT FACTORSType: CONCEPTS32. Both the APT and the CAPM imply a positive relationship between expected return and risk. The APT views risk:A.very similarly to the CAPM via the beta of the security.B.in terms of individual intersecurity correlation versus the beta of the CAPM.C.via the industry wide or marketwide factors creating correlation between securities.D.as the standardized deviation of the covariance.E.None of the above.Difficulty level: EasyTopic: ARBITRAGE PRICING THEORYType: CONCEPTS。

《公司理财》罗斯笔记(已矫正)

第一篇综述企业经营活动中三类不同的重要问题:1、资本预算问题〔长期投资工程〕2、融资:如何筹集资金?3、短期融资和净营运资本管理第一章公司理财导论1.1什么是公司理财?资产负债表()流动资产固定资产有形无形流动负债长期负债+所有者权益++=+流动资产-流动负债净营运资本=短期负债:那些必须在一年之内必须归还的代款和债务;长期负债:不必再一年之内归还的贷款和债务。

资本结构:公司短期债务、长期债务和股东权益的比例。

资本结构债权人和股东V(公司的价值)=B(负债的价值)+S(所有者权益的价值)如何确定资本结构将影响公司的价值。

财务经理财务经理的大局部工作在于通过资本预算、融资和资产流动性管理为公司创造价值。

两个问题:1.现金流量确实认:财务分析的大量工作就是从会计报表中获得现金流量的信息〔注意会计角度与财务角度的区别〕2.现金流量的时点3.现金流量的风险1.2公司证券对公司价值的或有索取权负债的根本特征是借债的公司承诺在某一确定的时间支付给债权人一笔固定的金额。

债券和股票时伴随或依附于公司总价值的收益索取权。

个体业主制合伙制公司制有限责任、产权易于转让和永续经营是其主要优点。

公司制企业力图通过采取行动提高现有公司股票的价值以使股东财富最大化。

代理本钱和系列契约理论的观点代理本钱:股东的监督本钱和实施控制的本钱管理者的目标管理者的目标可能不同于股东的目标。

Donaldson提出的管理者的两大动机:①〔组织的〕生存;②独立性和自我满足。

所有权和控制权的别离——谁在经营企业?股东应控制管理者行为吗?促使股东可以控制管理者的因素:①股东通过股东大会选举董事;②报酬方案和业绩鼓励方案;③被接管的危险;④经理市场的剧烈竞争。

有效的证据和理论均证明股东可以控制公司并追求股东价值最大化。

一级市场:首次发行二级市场:拍卖市场和经销商市场上市公司股票的交易挂牌交易第二章会计报表和现金流量重点介绍现金流量的实务问题。

资产负债股东权益≡+股东权益资产-负债≡股东权益被定义为企业资产与负债之差,原那么上,权益是指股东在企业清偿债务以后所拥有的剩余权益。

罗斯《公司理财》笔记整理.docx

第一章导论1. 公司目标:为所有者创造价值,公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产= 负债+ 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润)= 净销售额- 产品成本- 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量- 资本性支出- 净运营资本增加额= CF(B) + CF(S) 经营性现金流量OCF = 息税前利润+ 折旧- 税资本性输出= 固定资产增加额+ 折旧净运营资本= 流动资产- 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率= 流动资产/流动负债(一般情况大于一)速动比率= (流动资产- 存货)/流动负债(酸性实验比率)现金比率= 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率= (总资产- 总权益)/总资产or (长期负债+ 流动负债)/总资产权益乘数= 总资产/总权益= 1 + 负债权益比利息倍数= EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率= 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率= (赊)销售额/应收账款总资产周转率= 销售额/总资产= 1/资本密集度4. 盈利性指标销售利润率= 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率= 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比= 每股市场价值/每股账面价值企业价值EV = 公司市值+ 有息负债市值- 现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

罗斯公司理财第九版第十二章课后答案1

第十二章:套利定价理论1. Systematic risk is risk that cannot be diversified away through formation of a portfolio. Generally, systematic risk factors are those factors that affect a large number of firms in the market, however, those factors will not necessarily affect all firms equally. Unsystematic risk is the type of risk that can be diversified away through portfolio formation. Unsystematic risk factors are specific to the firm or industry. Surprises in these factors will affect the returns of the firm in which you are interested, but they will have no effect on the returns of firms in a different industry and perhaps little effect on other firms in the same industry.2. Any return can be explained with a large enough number of systematic risk factors. However, for a factor model to be useful as a practical matter, the number of factors that explain the returns on an asset must be relatively limited.3. The market risk premium and inflation rates are probably good choices. The price of wheat, while a risk factor for Ultra Products, is not a market risk factor and will not likely be priced as a risk factor common to all stocks. In this case, wheat would be a firm specific risk factor, not a market risk factor. A better model would employ macroeconomic risk factors such as interest rates, GDP, energy prices, and industrial production, among others.4. a. Real GNP was higher than anticipated. Since returns are positively related to the level of GNP, returns should rise based on this factor.b. Inflation was exactly the amount anticipated. Since there was no surprise in this announcement, it will not affect Lewis-Striden returns.c. Interest rates are lower than anticipated. Since returns are negatively related to interest rates, the lower than expected rate is good news. Returns should rise due to interest rates.d. The President 's death is bad news. Although the president was expected to retire, his retirement would not be effective for six months. During that period he would still contribute to the firm. His untimelydeath means that those contributions will not be made. Since he was generally considered an asset to the firm, his death will cause returns to fall. However, since his departure was expected soon, the drop might not be very large.e. The poor research results are also bad news. Since Lewis-Striden must continue to test the drug, it will not go into production as earlyas expected. The delay will affect expected future earnings, and thus it will dampen returns now.f. The research breakthrough is positive news for Lewis Striden. Since it was unexpected, it will cause returns to rise.g. The competitor ‘ s announcement is also unexpected, but it is not a welcome surprise. This announcement will lower the returns on Lewis- Striden.。

(完整版)罗斯《公司理财》重点知识整理

第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出 - 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数= 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值 + 有息负债市值 - 现金EV乘数 = EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

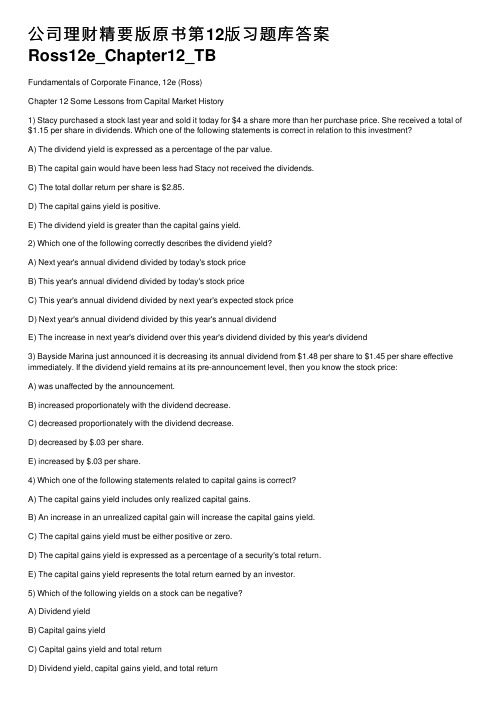

公司理财精要版原书第12版习题库答案Ross12e_Chapter12_TB

公司理财精要版原书第12版习题库答案Ross12e_Chapter12_TBFundamentals of Corporate Finance, 12e (Ross)Chapter 12 Some Lessons from Capital Market History1) Stacy purchased a stock last year and sold it today for $4 a share more than her purchase price. She received a total of $1.15 per share in dividends. Which one of the following statements is correct in relation to this investment?A) The dividend yield is expressed as a percentage of the par value.B) The capital gain would have been less had Stacy not received the dividends.C) The total dollar return per share is $2.85.D) The capital gains yield is positive.E) The dividend yield is greater than the capital gains yield.2) Which one of the following correctly describes the dividend yield?A) Next year's annual dividend divided by today's stock priceB) This year's annual dividend divided by today's stock priceC) This year's annual dividend divided by next year's expected stock priceD) Next year's annual dividend divided by this year's annual dividendE) The increase in next year's dividend over this year's dividend divided by this year's dividend3) Bayside Marina just announced it is decreasing its annual dividend from $1.48 per share to $1.45 per share effective immediately. If the dividend yield remains at its pre-announcement level, then you know the stock price:A) was unaffected by the announcement.B) increased proportionately with the dividend decrease.C) decreased proportionately with the dividend decrease.D) decreased by $.03 per share.E) increased by $.03 per share.4) Which one of the following statements related to capital gains is correct?A) The capital gains yield includes only realized capital gains.B) An increase in an unrealized capital gain will increase the capital gains yield.C) The capital gains yield must be either positive or zero.D) The capital gains yield is expressed as a percentage of a security's total return.E) The capital gains yield represents the total return earned by an investor.5) Which of the following yields on a stock can be negative?A) Dividend yieldB) Capital gains yieldC) Capital gains yield and total returnD) Dividend yield, capital gains yield, and total returnE) Dividend yield and total return6) Small-company stocks, as the term is used in the textbook, are best defined as the:A) 500 newest corporations in the U.S.B) companies whose stock trades OTC.C) smallest 20 percent of the companies listed on the NYSE.D) smallest 25 percent of the companies listed on NASDAQ.E) companies whose stock is listed on NASDAQ.7) The historical record for the period 1926–2016 supports which one of the following statements?A) When large-company stocks have a negative return, they will have a negative return for at least two consecutive years.B) The return on U.S. Treasury bills exceeds the inflation rate by at least .5 percent each year.C) There was only one year during the period when double-digit inflation occurred.D) Small-company stocks have lost as much as 50 percent and gained as much as 100 percent in a single year.E) The inflation rate was positive each year throughout the period.8) Which one of the following time periods is associated with low rates of inflation?A) 1941–1942B) 1973–1974C) 2014–2015D) 1979–1980E) 1946–19479) For the period 1926–2016, U.S. Treasury bills always:A) provided an annual rate of return that exceeded the annual inflation rate.B) had an annual rate of return in excess of 1.2 percent.C) provided a positive annual rate of return.D) earned a higher annual rate of return than long-term government bonds.E) had a greater variation in returns year-over-year than did long-term government bonds.10) Which one of the following statements is a correct reflection of the U.S. financial markets for the period 1926–2016?A) U.S. Treasury bill returns never exceeded a return of 9 percent in any one year.B) U.S. Treasury bills had an annual return in excess of 10 percent in three or more years.C) Inflation equaled or exceeded the return on U.S. Treasury bills every year during the period.D) Long-term government bonds outperformed U.S. Treasury bills every year during the period.E) National deflation occurred in at least one year during every decade during the period.11) For the period 2009–2016, U.S. Treasury bills had an annual rate of return that was:A) between .5 and 1 percent.B) between 1 and 2 percent.C) negative in at least one year.D) negative for two or more years.E) between 0 and .25 percent.12) Which one of the following categories of securities had the highest average annual return for the period 1926–2016?A) U.S. Treasury billsB) Large-company stocksC) Small-company stocksD) Long-term corporate bondsE) Long-term government bonds13) Which one of the following categories of securities had the lowest average risk premium for the period 1926–2016?A) Long-term government bondsB) Small-company stocksC) Large-company stocksD) Long-term corporate bondsE) U.S. Treasury bills14) The rate of return on which type of security is normally used as the risk-free rate of return?A) Long-term Treasury bondsB) Long-term corporate bondsC) Treasury billsD) Intermediate-term Treasury bondsE) Intermediate-term corporate bonds15) For the period 1926–2016, the average risk premium on large-company stocks was about:A) 12.7 percent.B) 10.4 percent.C) 8.6 percent.D) 6.9 percent.E) 7.3 percent.16) Assume that last year T-bills returned 2.8 percent while your investment in large-company stocks earned an average of7.6 percent. Which one of the following terms refers to the difference between these two rates of return?A) Risk premiumB) Geometric average returnC) Arithmetic average returnD) Standard deviationE) Variance17) Which one of the following statements correctly applies to the period 1926–2016?A) Large-company stocks earned a higher average risk premium than did small-company stocks.B) The average inflation rate exceeded the average return on U.S. Treasury bills.C) Large-company stocks had an average annual return of 14.7 percent.D) Inflation averaged 2.6 percent for the period.E) Long-term corporate bonds outperformed long-term government bonds.18) The excess return is computed as the:A) return on a security minus the inflation rate.B) return on a risky security minus the risk-free rate.C) risk premium on a risky security minus the risk-free rate.D) risk-free rate plus the inflation rate.E) risk-free rate minus the inflation rate.19) Which one of the following earned the highest risk premium over the period 1926–2016?A) Long-term corporate bondsB) U.S. Treasury billsC) Small-company stocksD) Large-company stocksE) Long-term government bonds20) What was the average rate of inflation over the period of 1926–2016?A) Less than 2.0 percentB) Between 2.0 and 2.4 percentC) Between 2.4 and 2.8 percentD) Between 2.8 and 3.2 percentE) Greater than 3.2 percent21) Assume you invest in a portfolio of long-term corporate bonds. Based on the period 1926–2016, what average annual rate of return should you expect to earn?A) Less than 5 percentB) Between 5 and 6 percentC) Between 6 and 7 percentD) Between 7 and 8 percentE) More than 8 percent22) The average annual return on small-company stocks was about ________ percent greater than the average annual return on large-company stocks over the period 1926–2016.A) 3B) 5C) 7D) 9E) 1123) Based on the period 1926-2016, the actual real return on large-company stocks has been around:A) 9 percent.B) 10 percent.C) 6 percent.D) 7 percent.E) 8 percent.24) To convince investors to accept greater volatility, you must:A) decrease the risk premium.B) increase the risk premium.C) decrease the real return.D) decrease the risk-free rate.E) increase the risk-free rate.25) Which one of the following best defines the variance of an investment's annual returns over a number of years?A) The average squared difference between the arithmetic and the geometric average annual returnsB) The squared summation of the differences between the actual returns and the average geometric returnC) The average difference between the annual returns and the average return for the periodD) The difference between the arithmetic average and the geometric average return for the periodE) The average squared difference between the actual returns and the arithmetic average return26) Which one of the following categories of securities had the most volatile annual returns over the period 1926–2016?A) Long-term corporate bondsB) Large-company stocksC) Intermediate-term government bondsD) U.S. Treasury billsE) Small-company stocks27) If the variability of the returns on large-company stocks were to decrease over the long-term, you would expect which one of the following as related to large-company stocks to occur as a result?A) Increase in the risk premiumB) Increase in the average long-term rate of returnC) Decrease in the 68 percent probability range of returnsD) Increase in the standard deviationE) Increase in the geometric average rate of return28) Which one of the following statements is correct based on the historical record for the period 1926–2016?A) The standard deviation of returns for small-company stocks was double that of large-company stocks.B) U.S. Treasury bills had a zero standard deviation of returns because they are considered to be risk-free.C) Long-term government bonds had a lower return but a higher standard deviation on average than did long-term corporate bonds.D) Inflation was less volatile than the returns on U.S. Treasury bills.E) Long-term government bonds were less volatile than intermediate-term government bonds.29) What is the probability that small-company stocks will produce an annual return that is more than one standard deviation below the average?A) 1.0 percentB) 2.5 percentC) 5.0 percentD) 16 percentE) 32 percent30) Which one of the following is a correct ranking of securities based on the volatility of their annual returns over the period of 1926–2016? Rank from highest to lowest.A) Large-company stocks, U.S. Treasury bills, long-term government bondsB) Small-company stocks, long-term corporate bonds, large-company stocksC) Long-term government bonds, long-term corporate bonds, intermediate-term government bondsD) Large-company stocks, small-company stocks, long-term government bondsE) Intermediate-term government bonds, long-term corporate bonds, U.S. Treasury bills31) Which one of the following had the least volatile annual returns over the period of 1926–2016?A) Large-company stocksB) InflationC) Long-term corporate bondsD) U.S. Treasury billsE) Intermediate-term government bonds32) Which one of the following statements is correct based on the period 1926–2016?A) Long-term government bonds had more volatile annual returns than did the long-term corporate bonds.B) The standard deviation of the annual rate of inflation was less than 3 percent.C) U.S Treasury bills have a zero variance in returns because they are risk-free.D) The risk premium on small-company stocks was less than 10 percent.E) The risk premium on all U.S. government securities is 0 percent.33) Generally speaking, which of the following best correspond to a wide frequency distribution?A) High standard deviation, low rate of returnB) Low rate of return, large risk premiumC) Small risk premium, high rate of returnD) Small risk premium, low standard deviationE) High standard deviation, large risk premium34) Standard deviation is a measure of which one of the following?A) Average rate of returnB) VolatilityD) Risk premiumE) Real returns35) Which one of the following is defined by its mean and its standard deviation?A) Arithmetic nominal returnB) Geometric real returnC) Normal distributionD) VarianceE) Risk premium36) Which of the following statements are true based on the historical record for 1926–2016?A) Risk-free securities produce a positive real rate of return each year.B) Bonds are generally a safer, or less risky, investment than are stocks.C) Risk and potential reward are inversely related.D) The normal distribution curve for large-company stocks is narrower than the curve for small-company stocks.E) Returns are more predictable over the short term than they are over the long term.37) Estimates of the rate of return on a security based on the historical arithmetic average will probably tend to ________ the expected return for the long-term and estimates using the historical geometric average will probably tend to ________ the expected return for the short-term.A) overestimate; overestimateB) overestimate; underestimateC) underestimate; overestimateD) underestimate; underestimateE) accurately estimate; accurately estimate38) The primary purpose of Blume's formula is to:A) compute an accurate historical rate of return.B) determine a stock's true current value.C) consider compounding when estimating a rate of return.D) determine the actual real rate of return.E) project future rates of return.39) The average compound return earned per year over a multiyear period is called the ________ average return.A) arithmeticB) standardC) variantD) geometricE) real40) The return earned in an average year over a multiyear period is called the ________ average return.B) standardC) variantD) geometricE) real41) Assume all stock prices fairly reflect all of the available information on those stocks. Which one of the following terms best defines the stock market under these conditions?A) Riskless marketB) Evenly distributed marketC) Zero volatility marketD) Blume's marketE) Efficient capital market42) Which one of the following statements best defines the efficient market hypothesis?A) Efficient markets limit competition.B) Security prices in efficient markets remain steady as new information becomes available.C) Mispriced securities are common in efficient markets.D) All securities in an efficient market are zero net present value investments.E) All securities provide the same positive rate of return when the market is efficient.43) Which one of the following is the most likely reason why a stock price might not react at all on the day that new information related to the stock's issuer is released? Assume the market is semistrong form efficient.A) Company insiders were aware of the information prior to the announcement.B) Investors do not pay attention to daily news.C) Investors tend to overreact.D) The news was positive.E) The information was expected.44) Which one of the following is most indicative of a totally efficient stock market?A) Extraordinary returns earned on a routine basisB) Positive net present values on stock investments over the long-termC) Zero net present values for all stock investmentsD) Arbitrage opportunities which develop on a routine basisE) Realizing negative returns on a routine basis45) Which one of the following statements is correct concerning market efficiency?A) Real asset markets are more efficient than financial markets.B) If a market is efficient, arbitrage opportunities should be common.C) In an efficient market, some market participants will have an advantage over others.D) A firm will generally receive a fair price when it issues new shares of stock if the market is efficient.E) New information will gradually be reflected in a stock's price to avoid any sudden price changes in an efficient market.46) Efficient financial markets fluctuate continuously because:A) the markets are continually reacting to old information as that information is absorbed.B) the markets are continually reacting to new information.C) arbitrage trading is limited.D) current trading systems require human intervention.E) investments produce varying levels of net present values.47) Inside information has the least value when financial markets are:A) weak form efficient.B) semiweak form efficient.C) semistrong form efficient.D) strong form efficient.E) inefficient.48) Evidence seems to support the view that studying public information to identify mispriced stocks is:A) effective as long as the market is only semistrong form efficient.B) effective provided the market is only weak form efficient.C) ineffective.D) effective only in strong form efficient markets.E) ineffective only in strong form efficient markets.49) Which one of the following statements related to market efficiency tends to be supported by current evidence?A) It is easy for investors to earn abnormal returns.B) Short-run price movements are easy to predict.C) Markets are most likely only weak form efficient.D) Mispriced stocks are easy to identify.E) Markets tend to respond quickly to new information.50) Which form of market efficiency would most likely offer the greatest profit potential to an outstanding professional stock analyst?A) WeakB) SemiweakC) SemistrongD) StrongE) Perfect51) You are aware that your neighbor trades stocks based on confidential information he overhears at his workplace. This information is not available to the general public. This neighborcontinually brags to you about the profits he earns on these trades. Given this, you would tend to argue that the financial markets are at best ________ form efficient.A) weakB) semiweakC) semistrongD) strongE) perfect52) The U.S. Securities and Exchange Commission periodically charges individuals with insider trading and claims those individuals have made unfair profits. Given this, you would be most apt to argue that the markets are less than ________ form efficient.A) weakB) semiweakC) semistrongD) strongE) perfect53) Individual investors who continually monitor the financial markets seeking mispriced securities:A) earn excess profits on all of their investments.B) make the markets increasingly more efficient.C) are never able to find a security that is temporarily mispriced.D) are overwhelmingly successful in earning abnormal profits.E) are always quite successful using only historical price information as their basis of evaluation.54) One year ago, you purchased a stock at a price of $43.20 per share. The stock pays quarterly dividends of $.18 per share. Today, the stock is selling for $45.36 per share. What is your capital gain on this investment?A) $1.44B) $2.16C) $2.80D) $1.74E) $2.3455) Six months ago, you purchased 300 shares of stock in Global Trading at a price of $26.19 a share. The stock pays a quarterly dividend of $.12 a share. Today, you sold all of your shares for $27.11 per share. What is the total amount of your dividend income on this investment?A) $36B) $72C) $348D) $144E) $20456) One year ago, you purchased 200 shares of SL Industries stock at a price of $18.97 a share. The stock pays an annual dividend of $1.42 per share. Today, you sold all of your shares for $17.86 per share. What is your total dollar return on this investment?A) $50B) $91C) $58D) $62E) $8257) You own 850 shares of Western Feed Mills stock valued at $53.15 per share. What is the dividend yield if your total annual dividend income is $1,256?A) 2.67 percentB) 2.78 percentC) 1.83 percentD) 2.13 percentE) 2.54 percent58) West Wind Tours stock is currently selling for $52.30 a share. The stock has a dividend yield of 2.48 percent. How much dividend income will you receive per year if you purchase 600 shares of this stock?A) $824.96B) $836.20C) $724.80D) $762.00E) $778.2259) One year ago, you purchased a stock at a price of $38.22 a share. Today, you sold the stock and realized a total loss of11.09 percent on your investment. Your capital gain was –$4.68 a share. What was your dividend yield?A) 1.15 percentB) .88 percentC) 1.02 percentD) .67 percentE) .38 percent60) You just sold 427 shares of stock at a price of $19.07 a share. You purchased the stock for $18.83 a share and have received total dividends of $614. What is the total capital gain on this investment?A) $716.48B) $511.52C) $102.48D) $618.48E) $476.5261) Last year, you purchased 400 shares of Analog stock for $12.92 a share. You have received a total of $136 in dividends and $4,301 in proceeds from selling the shares. What is your capital gains yield on this stock?A) 9.09 percentB) 6.73 percentC) ?16.78 percentD) ?14.14 percentE) ?11.02 percent62) Today, you sold 540 shares of stock and realized a total return of 7.3 percent. You purchased the shares one year ago ata price of $24 a share and have received a total of $86 in dividends. What is your capital gains yield on this investment?A) 5.68 percentB) 6.64 percentC) 6.39 percentD) 7.26 percentE) 7.41 percent63) Four months ago, you purchased 900 shares of LBM stock for $7.68 a share. Last month, you received a dividend payment of $.12 a share. Today, you sold the shares for $9.13 a share. What is your total dollar return on this investment?A) $1,305B) $1,413C) $1,512D) $1,394E) $1,08064) One year ago, you purchased 100 shares of Best Wings stock at a price of $38.19 a share. The company pays an annual dividend of $.46 per share. Today, you sold for the shares for $37.92 a share. What is your total percentage return on this investment?A) 2.62 percentB) 1.93 percentC) 2.72 percentD) 1.08 percentE) .50 percent65) Suppose a stock had an initial price of $76 per share, paid a dividend of $1.42 per share during the year, and had an ending share price of $81. What was the capital gains yield?A) 6.17 percentB) 6.69 percentC) 7.05 percentD) 6.58 percentE) 5.44 percent66) Suppose you bought a $1,000 face value bond with a coupon rate of 5.6 percent one year ago. The purchase price was $987.50. You sold the bond today for $994.20. If the inflation rate last year was 2.6 percent, what was your exact real rate of return on this investment?A) 4.88 percentB) 5.32 percentC) 3.65 percentD) 3.78 percentE) 4.47 percent67) Leo purchased a stock for $63.80 a share, received a dividend of $2.68 a share and sold the shares for $59.74 each. During the time he owned the stock, inflation averaged 2.8 percent. What is his approximate real rate of return on this investment?A) ?.64 percentB) ?4.96 percentC) ?2.16 percentD) 2.16 percentE) 4.96 percent68) Christina purchased 500 shares of stock at a price of $62.30 a share and sold the shares for $64.25 each. She also received $738 in dividends. If the inflation rate was 3.9 percent, what was her exact real rate of return on this investment?A) 4.20 percentB) 1.54 percentC) 1.60 percentD) 3.95 percentE) 5.50 percent69) What is the amount of the risk premium on a U.S. Treasury bill if the risk-free rate is 3.1 percent, the inflation rate is 2.6 percent, and the market rate of return is 7.4 percent?A) 0 percentB) 2.8 percentC) .5 percentD) 1.7 percentE) 4.3 percent70) You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 7 percent, 13 percent, 19 percent, ?8 percent, and 15 percent. Suppose the average inflation rate over this time period was 2.6 percent and the average T-bill rate was 3.1 percent. Based on this information, what was the average nominal risk premium?A) 6.6 percentB) 6.1 percentC) 9.2 percentD) 1.2 percentE) 3.5 percent71) You bought one of Shark Repellant's 6 percent coupon bonds one year ago for $867. These bonds pay annual payments, have a face value of $1,000, and mature 12 years from now. Suppose you decide to sell your bonds today when the required return on the bonds is 7.4 percent. The inflation rate over the past year was 2.9 percent. What was your total real return on this investment?A) 6.48 percentB) 6.61 percentC) 8.18 percentD) 7.44 percentE) 9.70 percent72) You find a certain stock that had returns of 8 percent, ?3 percent, 12 percent, and 17 percent for four of the last five years. The average return of the stock for the past five-year period was 6 percent. What is the standard deviation of the stock's returns for the five-year period?A) 10.39 percentB) 4.98 percentC) 7.16 percentD) 9.25 percentE) 5.38 percent73) A stock had returns of 5 percent, 14 percent, 11 percent, ?8 percent, and 6 percent over the past five years. What is the standard deviation of these returns?A) 7.74 percentB) 8.21 percentC) 9.68 percentD) 8.44 percentE) 7.49 percent74) The common stock of Air Express had annual returns of 11.7 percent, 8.8 percent,16.7 percent, and ?7.9 percent over the last four years, respectively. What is thestandard deviation of these returns?A) 8.29 percentB) 9.14 percentC) 11.54 percentD) 7.78 percentE) 10.66 percent75) A stock had annual returns of 5.3 percent, ?2.7 percent, 16.2 percent, and 13.6 percentover the past four years. Which one of the following best describes the probability that this stock will produce a return of 20 percent or more in a single year?A) Less than 2.5 percent but more than .5 percentB) More than 16 percentC) Less than .5 percentD) Less than 1 percent but more than .5 percentE) Less than 16 percent but more than 2.5 percent76) A stock has an expected rate of return of 9.8 percent and a standard deviation of 15.4 percent. Which one of the following best describes the probability that this stock will lose at leasthalf of its value in any one given year?A) less than 16 percentB) less than .5 percentC) less than 1.0 percentD) less than 2.5 percentE) less than 5.0 percent77) A stock had annual returns of 11.3 percent, 9.8 percent, ?7.3 percent, and 14.6percent for the past four years. Based on this information, what is the 95 percentprobability range of returns for any one given year?A) ?2.4 to 17.5 percentB) ?2.60 to 11.80 percentC) ?12.5 to 26.7 percentD) ?10.4 to 12.3 percentE) ?10.9 to 25.1 percent78) Aimee is the owner of a stock with annual returns of 17.6 percent, ?11.7 percent, 5.6 percent, and 9.7 percent for the past four years. She thinks the stock may achieve a returnof 17 percent again this coming year. What is the probability that your friend is correct?A) Less than .5 percentB) Greater than .5 percent but less than 1 percentC) Greater than 1 percent but less than 2.5 percentD) Greater than 2.5 percent but less than 16 percentE) Greater than 16 percent79) A stock had returns of 3 percent, 12 percent, 26 percent, ?14 percent, and ?1 percent for the past five years. Based on these returns, what is the approximate probability that this stock will return at least 20 percent in any one given year?A) Approximately .1 percentB) Approximately 5 percentC) Approximately 2.5 percentD) Approximately .5 percentE) Approximately 16 percent80) A stock had returns of 14 percent, 13 percent, ?10 percent, and 7 percent for thepast four years. Which one of the following best describes the probability that this stockwill lose no more than 10 percent in any one year?A) Greater than .5 but less than 1.0 percentB) Greater than 1 percent but less than 2.5 percentC) Greater than 2.5 percent but less than 16 percentD) Greater than 84 percent but less than 97.5 percentE) Greater than 95 percent81) Over the past five years, a stock produced returns of 11 percent, 14 percent, 4percent, ?9 percent, and 5 percent. What is the probability that an investor in this stockwill not lose more than 10 percent in any one given year?。

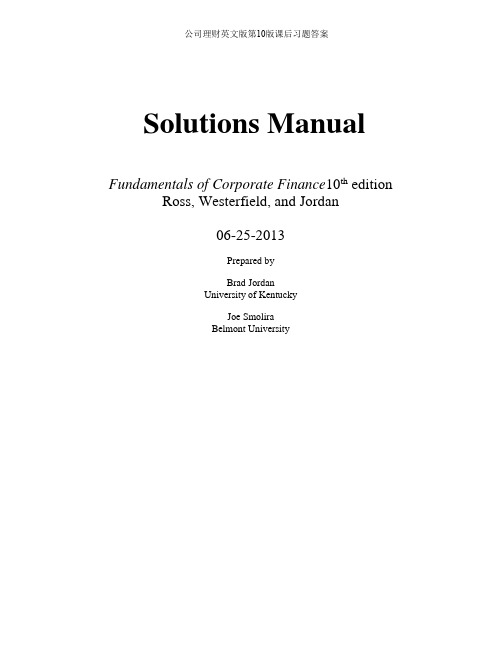

公司理财英文版第10版课后习题答案