会计信息系统外文文献

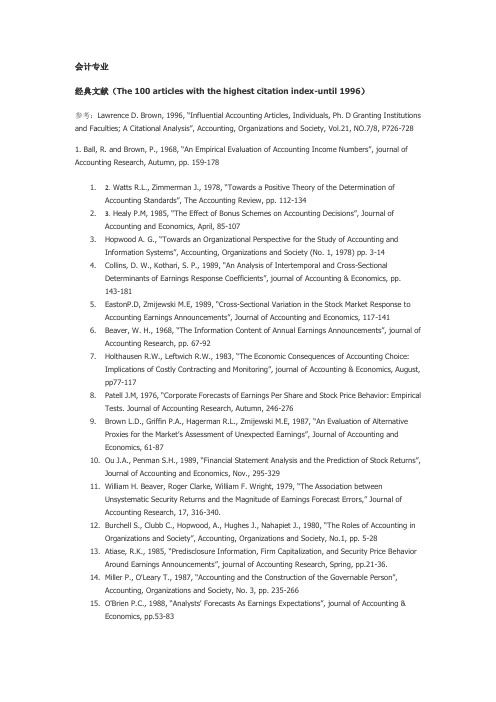

会计外文文献

作用:期刊论文是学术交流的重要方式,可以为学术界提供最新的研究成果和进展, 促进学术交流和合作。

定义:会议论文是指在学术会议上宣读或发表的论文 特点:具有时效性和针对性,能够及时反映学术研究的最新进展和热点问题 写作要求:结构清晰、逻辑严谨、语言准确,注重学术性和创新性 检索方式:可以通过学术搜索引擎、学术数据库等途径检索和获取

内容分析法:对文献内容进行客观、 量化的分析,为文献评价提供数据 支持。

添加标题

添加标题

添加标题

添加标题

案例分析法:选取典型案例进行深 入剖析,为文献评价提供实证支持。

专家评审法:邀请专家对文献进行 评价,为文献评价提供专业支持。

评价标准:提出了文献评价 的指标和方法

文献综述:总结了会计外文 文献的主要观点和研究进展

定义:学位论文是学术研究的重要成果之一,是衡量学术水平的重要标准 特点:具有较高的学术价值和理论意义,研究方法严谨,数据可靠 类型:硕士论文、博士论文等 作用:为学术界提供新的研究成果和理论支持,促进学术交流和发展

定义:专著是 对某一学科或 某一专题进行 系统研究的著

作

特点:内容深 入、全面,通 常由作者独立

优缺点分析:分析了文献的 优点和不足之处

改进建议:针对文献的不足 之处提出了具体的改进建议

Part Six

文献来源:学术期 刊、会议论文集、 学位论文等

文献类型:研究报 告、综述、案例分 析等

文献应用:为学术 研究提供理论支持 和实践经验

文献评价:评价文 献的学术价值、影 响力和贡献度

文献应用:提供理论支持和实践指 导

会计外文文献

File Management of Computerized AccountantXavier Bonus【Abstract】With the development of computerized accounting,the management of accounting files has changed as well. The manual accounting methods used in records management don’t meet computerize d accounting’s needs any more.Therefore, we need to improve computerized accounting files management, so as to speed up the accounting records management's information building to fit in with the new requirements of computerization.We also need to make a good record of computerized financial files to improve financial records management and to serve the enterprise's development better.【Key words】Accounting computerization The management of Accounting Archives Construction of Archives Electronic financial archivesComputerized accounting refers to the application to information technology in accounting, which uses computer to replace manual bookkeeping, reimbursement, and using information technology to analyze accounting matters. Computerized ac counting increases accounting files’ accuracy, standardization and efficiency, meanwhile reduces the burden of accountants, so they can have a better participation in management decision-making unit, strengthening financial management. Strengthening the accounting records management information is the need of computerized accounting reform and the modern times, it is inevitable, and the accounting development direction. Manage and use corporate financial accounting work file is an important prerequisite to the higher development of accounting work. In the traditional manual accounting environment, the subject matrix, debit and credit ,thebalance sheet, and related analysis of the financial statements are all required to calculate totals manually, making the financial staff workload, but also easily lead to the calculation of data error. In the computerized accounting environment, simply input the original data transfer mechanism or through an external system credentials and financial software in the computer under the guidance of accounting entries by the audit certificate, modify, confirm complete printout automatically by a computer, subjects summary, loan balance work done automatically by computer, at the same time it can generate accounting reports as required, which greatly reduces the workload for finance staff, but also avoid such work in computing the total error.As we all know, traditional accounting file is accounting documents, account booksandaccounting statements and other accounting-speci fíe material, it is to record and reflect the important historical and economic evidence of the business. These historical data and evidence with a strict balance, timing, and seriousness, not free to tamper with. In the enterprise information construction process, the expansion of the scope of financial security and management requirements increase, an urgent need to change the accounting file management tools and management performance improvement. Construction of electronic financial records, financial records to achieve network management, improve enterprise financial records management is the inevitable choice.The implementation of computerized accounting enterprises at all levels after a number attached to the computer because of its magnetic media data and documents, all the daily work of financial officers and accounting data calendar year access to all the computer to complete, followed accounting records to give a lot of new features. This practice, according to the work summarized Accounting file has the following notable features.First, compared to the traditional financial records, computerized accounting records storage areas and areas of expansion.Second, the traditional accounting files with intuitive visualization, and stored in the magnetic media on the accounting records must be in a particular computer hardware and software system environment before use. Accounting records of the calls that need a certain hardware and software environment.Third, computerized accounting records of the carrier is not only the output by printing the paper in the traditional sense, more important is the magnetic media or CD. Custody of the computerized accounting records accounting information not only information carriers, as the paper and more importantly, magnetic media or CD.Fourth, the electronic financial records to facilitate the calculation, analysis, fast access tothe desired result. If the electronic financial records online, through the exchange of computer operations and networks, not only meets the conditions of daily queries, statistical analysis, production data report, the need to carry out data exchange, to file sharing of information resources, paperless and convenient access to the purpose of saving the office costs and avoid reading the original file due to frequent wear and tear brought about, is also beneficial to professional management, easy integration of a unified file resources, greatly improve the efficiency and quality of work.Fifth, the electronic financial records easy to amend, copy and reset, easy error correction, carry and transfer.As mentioned above, the electronic financial records or financial records of information has many advantages, but there are enough side. If a system-dependent, that requires a certainhardware and software environment to support, only to open under certain conditions, do not have direct visibility of traditional archives, but also has easily been damaged, traces of the characteristics of difficult investigation, while they are also quality by the carrier, carrier storage environment, storage of information carriers conditions of validity, that the computerized accounting records to the security, integrity demanding. The longer the implementation of computerized accounting records and financial software version number of the more accounting records that need scientific management. Therefore, even if the implementation of financial records management information, the archive also needs to implement the so-called "Double",which means a file with the paper and electronic versions simultaneously record.We also use computerized accounting data files are conducive to the design data model management and decision-making; establish a more complete decision support system to achieve the accounting records of the re-use of computerized accounting. In the long-term process of Accounting, with the escalation of the software system, we have access to accounting records have the following two conditions: the access to the version number of the accounting records and accounting electric current consistent version of the system operator, this time only the files you need access to the system through computer software, access to the file (or data recovery) functions into the access to lines can be; the access to the accounting records of the version number and the current version number of computerized accounting system is inconsistent, and you only need to install another computer file corresponding to this version of Computing system, and then for access to.Financial records management information is continuously improved to optimize the process, staff has to rely on improving the quality of the file. Building a high-quality cadre of financial records, financial records management information is an important foundation. Financial sector to supplement the computer, communications, microelectronics and other academic backgrounds and technical personnel, to gradually change the structure of existing business workforce professional single case, to meet the information needs of the construction work; strengthening financial records staff, continuing education at different levels phases and in accordance with the principle of business needs for training. Focus on strengthening financial management personnel file information technology training and application of new technologies, new equipment, new methods of training to enhance their control and use of information technology and means of awareness and skills. Financial records to establish a rational management of performance appraisal evaluation provides information on the financial records management ability, good results in time units and individuals to recognize and encourage everyone to learn the information, and use information. In addition, also on the computer information technology staff must work files, financial management knowledge and skills introduction, to understand the objective laws of the financial records of work, and betterinformation for financial records management to provide technical support.Computerized accounting exits some problems in the file record:Firstly, after the implementation of computerized accounting, stored in the hard drive must be built on a floppy disk backup of accounting data.Under the "Accounting System Management System" and "reporting system management system" provides accounts data and report data by the data administrator to create a backup. Back not less than once per month; backup floppy disk with the file manager handling archiving procedures; used as a backup floppy disk must be well kept; backup floppy disk label should be affixed to protect and seal with a seal or seals; backup disk should be installed in the protection of seals and the box, stored in a safe, clean, heat, moisture, anti-magnetic place, and regularly turn storage; double back under the two sets of backup disk should be stored in different storage locations.Second, the implementation of computerized accounting system data and preserve the media the main security risks exist. The implementation of computerized accounting system data is the main computer. Computer system consists of hardware and software form. Because there is the physical vulnerability of hardware systems, once the hardware system failure or power failureand other non-human cause, will result in the data can not be processed, accounting can not. Data processing, accurate and efficient financial software depends on the quality and performance. Once the software quality problems will affect the accuracy and speed of data processing. Once the program a serious virus, it will seriously jeopardize the safety of the system, if we can not rule out the virus is likely to expand in time loss.Main accounting data stored in computer disk or external floppy, CD-ROM, once the magnetic medium due to heat, moisture meant loss and other reasons are damaged, save the accounting data will be lost, if not related to backup, then, will the accounting Computing system causing serious damage, seriously affecting the company's accounting. Magnetic media to store information on magnetic signals, if the data have been maliciously modified without leaving any traces. Therefore, we should also the entire computer system security and stability to do some work, such as computer virus prevention.Third, computing the need of expert management of accounting file. Accounting system implementation of the main "people", but no matter how good software quality, how to improve rules and regulations as the main body of Computerized Accounting System Implementation "person" can not play a role, there is a system not to perform, or even malicious modify the software program, modify the data in the database, illegally obtained a password, will not be tolerated. Therefore, managers should pay attention to the file selection and training of staff, enhanced staff files the standard of professional ethics and business standards to electronic dataprocessing accounting records management system, the main integrity. This requires the computerized accounting system to deal with business arising from the various books, reports, documents should be managed by hand, and to develop appropriate management system.Fourth, strengthening the computerized accounting system, management and maintenance of the network environment. Network security indicators include data security, access control, and identity recognition. Login using the password management and control of online financial data systems to read; only use the firewall, computerized accounting systems and external quarantine area to visit the link between the outside limits of accounting information systems through the firewall, unauthorized access to the database; use of data encryption, echo inspection techniques for network management in order to prevent the shading problems, equipment failures leading to data loss, and criminals of illegal interception of financial data theft and other security risks, protect the computerized accounting system, the safe operation of the network environment.With computer technology and network technology continues to evolve, the file management information to replace the traditional manual work is inevitable. At present, the file management information system has been developing in various enterprises, government departments widely. Strengthen and improve the computerized accounting records management will be the work of various enterprises in the financial and business management in the whole must be taken into account, financial records management directly affects the enterprise's management and efficiency. We believe that with computerized accounting development, computerized accounting records management work will become better and better.The original source: International Journal of Accounting and Information Management 2008.7。

与上市公司会计信息披露有关的外文文献及翻译

与上市公司会计信息披露有关的外文文献及翻译Analysis of the Relationship between Listed Companies’ Earnings Quality and Internal Control Information Disclosure* Jianfei Leng, Lu LiSchool of Business, Hohai University, Nanjing, China1、IntroductionThe cases of financial fraud lead to incalculable losses in these years, which are related to firm’s weak system of internal control. Now, both domestic and foreign have issued a series of legal norms. For example, Sarbanes- Oxley (SOX) Act force listed Companies to disclose their internal control information, including internal control deficiencies and internal self-assessment report and external auditor’s audit opinion. We formulate two important files: “Shanghai Stock Exchange listed companies internal control guidelines”and “Shenzhen Stock Exchange listed companies internal control guidelines”. These files require companies to disclose internal control self-assessment report and comments of external auditor’s audit, which greatly improve company’s effectiveness of internal control and quality of financial information. Accounting earnings is the score and one of the most important elements in all of the accounting information, which mainly refers to the company’s ability of forecasting future net cash flow. Higher earnings quality is the key to the effective function of the market and the insurance of the company’s future cash flow. The better quality of company’s earnings inclined to disclose more internal control information and to get more outside investment. Therefore, earnings quality is one of the most important factorsto affect internal control information disclosure. In this article, with the analysis of multiple regressions, we examine the relationship of earnings quality and internal control disclosure of information in the sample of 1273 nonfinancial firms in shanghai and Shenzhen Stock Exchange in 2010.2. Prior Research on Internal Control Information DisclosureListed companies’ internal control information disclosure is mostly voluntary before 2002, but few companies are willing to do so. Since Sarbanes-Oxley (SOX) Act is enforced, many listed companies are forced to disclose their information of internal control, which providing more material and information to scholars who study listed companies’internal control. Researches on internal control information disclosure are mainly concentrated on the following four aspects:1) The current situation and solutions of internal control information disclosure.There are lots of researches on the current situation of internal control information disclosure,Mc. Mullen,Raghunandan and Rama [1] studied 4154 companies during 1989-1993, suggesting that only 26.5% companies are willing to disclose their internal control information, and that only 10.5% provide their internal control report among those companies with deficiencies on their financial reports. It shows that the proportion of companies voluntarily disclosing their internal control information is little, and that the companies with deficient financial report are more unwilling to provide the internal control self-assessment report. Hermanson [2] also did corresponding empirical research on listed company’s internal control information disclosure and got the same conclusion. Minghui Li[3] and Dongmei Qin [4] made related researches on the current situation of internal control information disclosure. They believed that current listed companies’ enthusiasm of disclosing internal control information is not strong, and much internal control information was not substantial but formal. Minghui Li [3] also drawn on the experiences of the United States in internal control information disclosure, and provided a series of suggestions and measures of improving internal control information disclosure. Hua Li, Lina Chen [5], Xiaofeng Dai and Jun Pan [6] analyzed the current situation of internal control information disclosure with internal control theories, and pointed out the problems and put forward the corresponding solution. Xinhua Dai and Qiang Zhang [7] mainly did the research on listed banks’internal control information disclosure, finding that our listed banks’system of internal control information disclosure is not standardized and sufficient. They interpreted the corresponding requirements of the US internal control information disclosure set by “Sarbanes-Oxley Act”, suggesting China to promote the improvement of listed banks’ internal control information step by step. According to relevant provisions of internal control information disclosure required by “Shanghai Stock Exchange Guidelines”and “The Notice on Listed Companies’Annual Report in 2006”, Youhong Yang and Wei Wang [8] analyzed the internal control information disclosure of listed companies on Shanghai Stock Exchange in 2006 with descriptive statistics, and found many problems.2) Impact factors of internal control information disclosure.Bronson, carcello, Raghunandan and Doyle, Ge, McVay suggested that there is a correlation between corporate identityand internal control information dis-closure. Company size, the proportion of institutional investor holding, the number of audit committee and the speed of earnings growth have impact on internal control information disclosure. Many other experts did empirical study on such question. Ge and McVay used a survey method to analyze the sample, discovering that the disclosure of material defects is related to the complexity of the company but there is no direct correlation with company size and profitability. Jifu Cai made a relevant empirical study of A-share listed companies to find impact factors of listed companies’ internal control information disclosure. The results showed that the companies with a better operating performance and higher reliability of financial report are more inclined to disclose its internal control information, and vice versa. This indicates that the company’s operating performance and reliability of financial report affect the listed companies’internal control information disclosure. Adrew J. Lcone selected listed companies who disclosed material defects of their internal control information in their annual reports as samples to study the impact factors of internal control information disclosure. The results show that the complexity of corporate structures, the changes in company structure and the inputs to internal control are all the impact factors of internal control information disclosure. Shaoqing Song and Yao Zhang studied A-share listed companies on Shanghai and Shenzhen Stock Exchange from 2006 to 2007, finding that there is a correlation between corporate governance characteristics and internal control information disclosure. Audit committee, annual statistics, company size and the place of listing have a significant impact on internal control information disclosure. Bin Wang andHuanhuan Liang [15] studied 1884 listed companies on Shenzhen Stock Exchange between 2001 and 2004. They made use of their rating reports of information disclosure quality to examine the inherent relationship between listed companies’corporate governance characteristics, characteristics of operating condition and information disclosure quality, finding that corporate governance characteristics and characteristics of operating condition have a certain impact on internal control information disclosure.3) The cost of internal control information disclosure.The studies on the cost of internal control information disclosure are not very much. J. Efrim, Boritz, Ping Zhang thought that the costs of disclosing internal control information is enormous, and the management did not believe that the benefits of internal control information disclosure would surpass the corresponding costs. Maria analyzed the sample which discloses their internal control information in accordance with SEC requirements, primarily study the relationship between the costs of disclosing internal control information and the effectiveness of the internal control system. It is found that the cost of disclosing deficiencies of internal control information is far more than that of defect-free.4) Correlation between internal control and earnings quality.There are many researches on the correlation between internal control and earnings quality. Doyle [11] studied the relationship between internal control and earnings quality, and found that internal control is a motivation of earnings quality. The studies of Chan [18] and Goh and Li [19] are similar. Chan [18] discovered that earnings management of those who disclose thematerial defects of internal control has a higher degree but the return on investment is very low. Goh and Li’s [19] also found that company’s earnings stability can be increased after improving the defects of internal control. Lobo and Zhou [20] made a comparison on companies’discretionary accruals between before implementing “Sarbanes-Oxley Act” and after implementing it, finding that companies’ discretionary accruals decreased a lot after the implementation of “Sarbanes-Oxley Act”. Doyle, Ge and Mcvay [10] divided the internal control defects into two aspects: corporate level and account level, finding that internal control defects on corporate level is influential to earnings quality, but there is no correlation between internal control defects on account level and earnings quality. Guoqing Zhang [21] selected nonfinancial A-share listed companies in 2007 as a research object to study the internal control quality on earnings quality. The results have shown that there is no close link between high quality internal control and earnings quality, but company’s characteristics and corporate governance factors may affect internal control quality and earnings quality systematically. Chunsheng Fang et al. [22] used questionnaire survey to examine the relationship between internal control system and financial reporting quality, finding that financial reporting quality improved after implementation of internal control system. Jun Zhang and Junzhi Wang [23] selected listed companies on Shanghai Stock Exchange in 2007 as sample, and used adjusted Jones model to calculate discretionary accruals and found that discretionary accruals significantly reduced after the review of internal control. Shengwen Xie and Wenhai Lai [24] selected A-share listed companies on Shanghai Stock Exchange in 2007 and 2008 as samples. They analyzed therelationship between internal control deficiencies and earnings quality by using a paired study, and found that listed companies’internal control information disclosure had an effect on earnings quality.Based on the above studies, we can see that internal control gets more attention after the promulgation of “Sarbanes-Oxley Act”. Current researches centralize on the defects of existing laws and regulations, the current situations of listed companies’internal control information disclosure, the relationship between listed companies’internal control information disclosure and their operating conditions, financial report quality and earnings quality. Among the current studies, most have focused on descriptive statistics and the relationship be-tween internal control quality and earnings quality, while there is no study use earnings quality as explanatory variable to reflect its effect on internal control information disclosure. Therefore, this article uses earnings quality as main explanatory variable and disclosure of internal control as the dependent variable to do empirical study, which compensate for the lack of current research to some extent.3. Method3.1. HypothesisHypothesis: the better the quality of earnings is, the higher the level of internal control information disclosure will be.According to agency theory and signaling theory, corporate trustee has obligation to report relevant information to the corporate capital owners, which give help to the operation of business. In the process of reporting, corresponding information is to pass the corporate relevant signal to the capital market. The signal can make the operator affect the flow of resources incapital market in a certain extent to improve the enterprise’s interests. There is the mutually reinforcing relationship between internal control information disclosure and the quality of earnings. A company that can fully disclose its information of internal control means that its managers have a good description of ethics. Meanwhile, a company that can take the initiative to show its internal control information in detail indicates that its company has a higher self-confidence, which will attract more capital market resources, increase its cash flow, enhance the quality of earnings, and improve management capabilities. Conversely, companies with good earnings quality will choose to voluntarily disclose their information of internal control in detail. They can distinguish themselves to the companies with inferior earnings quality and get more favor from investors.上市公司盈余质量与内部控制信息披露关系研究冷建飞,李璐(河海大学商学院,南京)1、前言近年来金融诈骗案件的发生带来了不可估量的损失,这与公司内部控制系统弱是有关系的。

有关会计专业的英文文献

以下是一些与会计专业相关的英文文献的例子:1. "The Role of Accounting in Corporate Governance: A Review of the Literature" - 作者:Scott, William R.这篇文献回顾了会计在企业治理中的作用,讨论了会计信息对企业决策和监管的重要性。

2. "IFRS Adoption and Financial Statement Effects: A Review of the Literature" - 作者:Nobes, Christopher这篇文献回顾了企业采用国际财务报告准则(IFRS)对财务报表的影响研究,探讨了IFRS对会计质量、报表透明度和投资者决策的影响。

3. "The Impact of Auditing on Corporate Governance: A Review of the Literature" - 作者:Abbott, Lawrence J.这篇文献回顾了审计在企业治理中的影响研究,讨论了审计对公司经营绩效、风险管理和内部控制的重要性。

4. "Earnings Management: A Literature Review" - 作者:Healy, Paul M.这篇文献回顾了盈余管理的研究文献,讨论了企业为达到特定目标而操纵财务报表的行为,以及其对投资者、监管机构和公司治理的影响。

5. "The Value Relevance of Accounting Information: A Review of the Literature" - 作者:Ohlson, James A.这篇文献回顾了会计信息的价值相关性研究,探讨了财务报表信息对股票价格、市场价值和投资者决策的影响。

内部控制与会计信息质量 外文文献

The Quality of Accounting Information and The Accounting Information System through The Internal Control Systems: AStudy on Ministry and State Agencies of The Republic ofIndonesiaFardinalAccounting Doctoral Program Faculty of Economic and BusinessPadjadjaran University-IndonesiaE-mail: ferdinal@AbstractThe purpose of this study is an attempt to explain, but not empirically tested, the effect of the effectiveness of internal control system (general and application controls) on the quality of accounting information systems (ease of use, usefulness and usage) and its impact on the quality of accounting information (relevance, accuracy, and verifiability) in order to develop a theoretical framework as a basis of the hypothesis as an answer to the question of the study, that is, to the extent of which: (1) the effect of internal control on accounting information systems (AISs), (2) the effect of internal control on the quality of accounting information, and (3) the effect of the quality of accounting information systems on the quality of accounting information. This study will use a t test by α = 0.05 to test each of the proposed hypothesis. The study is scheduled to be conducted in 85 Ministries and State Agencies of the Republic of Indonesia. Also explained in this paper is the research methodology used. Keywords: Internal Control, Quality of Accounting Information Systems, Quality of Accounting Information 1. IntroductionAccounting information is the results of accounting processes, generally presented in a form of financial statement (Kieso et al, 2012:5) or an annual report (Maurice, 1994). If scrutinized, most of every definitions of accounting states that accounting information is the output of accounting processes.Organization of any kind always needs accounting information for economic decision making (Kieso et al, 2012). Accounting information is used for such things as investment decision, stewardes evaluation, monitoring activities and regulatory measures (Hansen & Mowen, 1995). By using accounting information, decision makers would obtain information on the future of their companies, such as forecasting that involves annual plans, strategic plans, and decision alternatives (Susanto, 2008). The users are interested in using the accounting information, becouse those information has fulfilled a decision-usefulness-information criterion (Kieso et al, 2012). In a strategic perspective, accounting information itself is one of the aspects of a company’s competitive advantage (Baltzan, 2012).Useful accounting information is an one that fits for used by the information user (Wang & Strong, 1996), or one that cause user take to desirable actions (Hall, 2011), or one that may help the users in making proper decisions (Gellinas et al, 2012). Accounting information quality is an information with characteristics/attributes that make the accounting information valuable for the users (O Brien, 1996).The quality of accounting information comes from the implementation of an accounting information systems quality (Sacer et al, 2006. Baltzan, 2012). Among of author use different terminologies when describing the quality of Accounting information system, such as: effectiveness, success, usefulness, efficiency, user satisfaction, and also the term of quality itself. Gelinas et al (1990) suggests that the effectiveness of AIS is a measure of an accounting information system success to meet the established goals. A quality of accounting information system concerned with the measurement of output the actual system that produces the ouput (Delon & McLeod, 2003). An accounting information system quality is an integration of quality hardware, software, brainware, telecommunication network, data base, and quality of work and user satisfaction (Sacer et al, 2006). The governement institutions of the Republic of Indonesia are until currently still faced with a problem of the quality of accounting information system. That is reflected by the weakness of quality of the financial statements of: central governments, the ministries and public institutions and the regionals. In the time period of 2004-2010, results of audit on the financial statements of central government’s, most of ministries and state agencies, and regional government still have a qualified opinion categories (Warta BPK, 2010). Gamawan Fauzi (2012) said, a target of 50% of the regional governments to attain the unqualified opinion categories in 2014 is hard to realize. The problem of low quality of the government financial statements, as a reflection of the poor quality of the accounting information system, is due to among others the weakness of internal controlling system (Warta BPK, 2011).The objective of accounting information systems is to provide the reliable accounting information on a timely basis (Guan, 2006). An internal control system is a series of procedures designed such that provide management with reasonable assurance that the accounting information that provide by an accounting information system presents is reliable and made available timely (Guan, 2006). An accounting information system and record keeping will not success in completely and accurately processing all transaction unless controls, known as internal control, are built into the system (Millchamp & Taylor, 2008).The purpose of this study is to develop a model to find out evidences or answers of the following problems: (1) how extent of which the effect of an internal control system on the quality of AIS, (2) how extent of which the effect of an internal control system on the quality of accounting information, and (3) how extent of which the effect of the quality of accounting information systems quality on the Accounting Information quality .2. Review of Literature2.1. Accounting Information QualityThe value of information is directly linked to how it helps decision makers achieve their organization’s goals. Valuable information can help people and their organizations perform their tasks more efficiently and effectively (Stair and Reynolds, 2012). Furthermore, information of high quality, that is, information product whose characteristics, attributes, or qualities help makes it valuable to them (O Briens, 2004).The quality of accounting information can be explained by several dimensions. Hall (2011) suggests that the dimensions of information quality consist of: relevance, timeliness, accuracy, completeness, and summarizing. Moreover, Gelinas et al (2012) and McLeod (2007) put forward that dimensions of the quality of information are: accurate, timely, relevance, and completeness. Far earlier, Hicks (1993) states relevance, timeliness, accuracy and verifiability as the criteria of information quality. Whereas Maurice (1994) and O’ Briens & Marakas (2010) summarizes the important of information and groups them into three dimensions, namely: time (consist of: timeliness, currency, frequency, time period); content (accuracy, relevance, completeness, conciseness, scope, performance); and form (clarity, detail, order, presentation, media) In this study, the dimensions of accounting information quality are: (1) Relevancy. The Extent to which data is applicable and helpul for the task at hand (Wang & Strong, 1996), the contents of a report or document must serve a purpose (Hall, 2011). (2) Accuracy. The Information must be free from material errors (Hall, 2011). (3) Verifiability, the ability of confirm the accuracy of information by tracing information to its original source (Hicks, 1993)2.2. Accounting Information System QualityAccounting information system is a collection of data and processing procedures that creates needed information for its users (Bagranof et al, 2011). Accounting information systems (AISs) is a collection of resources, such as people and equipment, designed to transform financial and other data into information. This information is communicated to a wide variety of decision makers. AISs perform this transformation whether they are essentially manual systems or thoroughly computerized (Bodnar & Hopwood, 2010).According to Stair & Reynolds (2010), an accounting information systems quality is usually flexible, efficient, accessible, and timely. Seddon (1997) state that an information system success thus conceptualized as a value judgment made by an one from stakeholders’ viewpoints. Moreover, Gelinas & Wriggins (1990) suggest that the effectiveness of an accounting information systems is a measures of accounting information system success to meet the established goals. Meanwhile, Delon & McLean (1992) state that the quality of system is concerned with the measurement of the actual system in producing output.D&M IS Success Model developed by Delon & McLean (1992) and The Technical Acceptance Model (TAM) developed by Fred Davis (1989) are widely used as references by many authors in measuring the dimensions of accounting information system success. In D&M IS Success Model, the quality of AIS is accounted for by using six dimensions, namely: (1) system quality, (2) information quality, (3) use, (4) user satisfaction, (5) individual impact and (6) organizational impact. In Technical Acceptance Model (TAM) (1989) the factors that can lead the best attitudes to a system and then receive and apply the system are used as the measure of accounting information system success, namely: (1) perceived usefulness, (2) perceived ease of use, and (3) actual use (usage). Then, a related model is also proposed by Seddon (1997) which includes: system quality, information quality, perceived usefulness, user satisfaction, and information systems (IS) use. Within the context of the current study, perceived usefulness, perceived ease of use and Information system (IS) use (usage) will be considered as a well-respected dimensions of Accounting Information Systems Quality.Perceived usefulness, refers to the degree to which a person believes that using a particular system would enhance his or her job performance (Davis, 1989). Whereas perceived ease of use refers to the degree to which a person believes that using a particular system would be free effort (Davis, 1989). As for an Information system(IS) use (usage) refers to and manner in which a person utilizes the capabilities of an information systems (Petter et al, 2008),2.3. Internal ControlAn internal control consists of policies and procedures designed to provide a reasonable assurance to management that the company has accomplished its goals and objectives (Elder et al, 2010). The reason for management to design an effective internal control system is so as to achieve three main goals, namely: (1) reliability of financial statements, (2) effectiveness and efficiency of company’s operations, and (3) compliance to laws and regulations (Messier et al, 2006).An internal control system consists of some components, namely: a) the control environment, (b) the entity’s risk assessment process, (c) the information systems and communications, (d) the control activities, and (e) the monitoring and controls (Bodnar & Hoopwod, 2010). The components of internal control are designed and implemented by management to assure reasonably that the goals of internal control will be achieved (Arens, 2008). Then, so as to assure that each component of an internal control system is implemented in a spesific application system contained in an organization’s every transaction cycle, the company designs a transaction processing internal control (Bodnar & Hoopwod, 2010). A transaction processing control consists of a general control and an application control.A general controls are designed to assure that information processing is undertaken in a reasonably control and consistent environment. These control have an impacts on the effectiveness of the application controls and processing functions that involves the use of the accounting information`system (Nash & Heagy, 1993). A general control consists of (Bodnar & Hoopwod, 2010:149)•The plan of data processing organization: Segretation of duties; responsibility for authorization, custody, and record keeping for handling and processing of transaction.•General operating procedures: definition of personel, reliability of personnel, training of personnel, competence of personnel, rotaion of duities, form design, prenumbered forms.•Equipment control features: Backup and recovery, transaction trail, error-sources statistics.Equipment and data-access controls: Secure custody, dual access/dual controlOn the other side, an application control is designed to control accounting applications so as to secure the completeness and accuracy, appropriate authorization, and transaction processing validation (Nash & Heagy, 1993). An application control consists of (Bodnar & Hoopwod, 2010):•Input controls, are designed to prevent or detect errors in the input stage of data processing. Typical input control include: Authorization, exception input, passwords, bacth serial number, control registers, amount control total, document control total, line control total, hash total, sequence cheking, completeness cheking, check digit, expiration etc.•Process controls, are designed to provide assurances that processing has occurred according to intended specifications and that no transactions have been lost or incorrectly inserted into the processing stream.Typical processing control include: Mechanization, default option, run-to-run totals, celaring account, summary processoing, automated error correction.•Output controls, are designed to check that input and processing resulted in valid output and that outputs are distributed properly. Typical ouput control include: Reconciliation, aging, suspense file, suspense account, periodic audit, discrepancy reports, upstream resubmission3. Theoretical Framework3.1. Internal Control and Accounting Information Systems SuccessAccounting information system success is influenced by the effectiveness of internal controlling system. An effective internal control can assure the appropriateness of data entry works, processing techniques, storage methods, and the accuracy of information produced (O Brien & Marakas, 2010). Internal controlling system is designed to monitor and keep the quality and security of information system activities in implementing input, process, and output activities (O Brien & Marakas, 2010). The development of an internal control in a computer-based accounting information system will help management protects corporate assets from suffering losses and embezzlement and keeps company financial data accuracy (Jones & Rama, 2003). Neither accounting information nor record keeping system will not success processing all transactions without an internal control system (Millchamp & Taylor, 2008).The results of prior study showed that an internal control has significant influence on the effectiveness of an accounting information system. A study by Iceman & Hilson (2012) concluded that, on average, accounting errors in weak internal control systems were reported more than in strong internal control systems. Guan (2006) offered an essential concept on the implementation of an internal control in an accounting information system toprotect integrally or to minimize the probability of occurrence of errors or frauds originated in accounting information systems.3.2. Internal Control and Quality of Accounting InformationThe goal of an internal control in an organization is to assure that all transactions are recorded in accurate numbers, in appropriate accounts, and in proper accounting periods so as to enable the presentation of financial statements in accordance with relevant accounting and legal standards (Millchamp & Taylor 2008). Companies are required to develop an internal control intended to provide a reasonable assurance that their financial statements have been presented fairly (Arens et al, 2008). A financial statement will probably not comply accounting standards (GAAP) if internal control over financial statements were inadequate (Arens, 2008).The effects of an internal control on the quality of accounting information are also substantiated by the results of some prior study. The result of Ronald & Houmes (2012) studied indicated that the students of two universities involved in their study increasingly understood that internal control has a significant effect on the reliability of a financial statement. A weak internal control results in weak revenue recognition, segretation of duties, and period end reports and inappropriate accounts reconciliation (Ge & McVay, 2005). The results of study by Doyle, Ge W & Mc Vay (2007) showed that the weakness of internal control has an effect on the low quality of accruals add more the evidences of the existence of an effect internal control on the quality of an accounting information.3.3. Accounting Information System Success and Quality of Accounting InformationAn accounting information system may help managers by providing information needed for them o implement managerial functions (O Brien, 1996). The purpose of an accounting information system is to produce financial statements designated for both external and internal users (Scot, 1986). Meanwhile, Hall (2010) suggested that, fundamentally, the purposes of an accounting information system are to: (a) present information on the organizational resources used, (b) present information related to management decision making, and (c) present information in order to help operational personnel successfully implement their duties in efficient and effective ways. Then, the main purpose of companies in building an accounting information system is to process accounting data so as to transform it into accounting information that is needed by many user to reduce risks in decision making (Azhar Susanto, 2008).The effectiveness of an accounting information system is related to the activities of data collection, inputing, p rocessing, and storage as well as to accounting information reporting management and control for organizations to obtain accounting information of high quality (Pairat, 2012). Accounting information system success may enhance the accuracy of financial statements (Salehi et al, 2000). Moreover, the effectiveness of an accounting information system may affect the increase of financial statement quality and accelerate corporate transaction processes (Sajadi et al, 2008).4. Study Models and HypothesisBased on the prior literature discussion, the conceptual model is shown in figure below:Figure: Theoretical Framework ModelTo test this model, the following hypothesis were proposed as follows:H.1: Internal control system affects the quality of an accounting information systemH.2: Internal control system affects the quality of accounting informationH.3: The quality of accounting information system affects the quality of accounting information5. MethodologyThe research objects are the internal control system, the quality of accounting information system, and thequality of accounting information. The population in this study is consists of 85 ministries and public institutions of Republic of Indonesia. The observation unit consists of those personnel that are involved in implementing accounting activities, namely: input data processing personnel, financial statement providers, and the heads of accounting departments. The sample is picked up randomly by a random sample technique. This study uses primary data collected by spreading questionnaire by mail (mail survey) to each of the respondents. The data collected is then tested for its validity and reliability so that the data is valid to be processed. Then, the data is analyzed descriptively in order to describe the characteristics of each research variable. The data will be analyzed is by using path analysis with consideration of the pattern of relationships between variables that are correlative, causality and recursive. Each hypothesis to be tested by a statistical t test: Ho is rejected if tcount> tcritical, α = 0.05 level.6. ConclusionsThe model developed in this study may explain the influence of the internal control system on the quality of accounting information systems and the quality of accounting information. The model will enable we examine and predict whether the components of internal control systems have been adequately applied in accounting information systems. The results of this study later, is specifically will show the components or dimensions of any system of internal control which is the main cause of weak internal control systems of ministries and state agencies of the Republic of Indonesia. Thus, based on the findings of this study, the author will propose some suggestions for improving the effectiveness of internal control system so that the quality of accounting information systems for the better. Accordingly, the financial statements of the ministries and state agencies of the Republic Indonesia can be provided in accordance with high quality standards.ReferencesAllan Millchamp & John Taylor, (2008). Auditing, 9th ed., South Western, P. 85, 86Alvin A. Arens, Randal J. Elder, & Mark S. Beasly, (2008). Auditing dan Jasa Assurance, Pendekatan Terintegrasi, Edisi ke-12, Jilid 1, Bahasa Indonesia language edition published by Penerbit Erlangga. Jakarta. P. 371, 373, 375Azhar Susanto, (2008). Sistem Informasi Akuntansi: Struktur Pengendalian Risiko Pengembangan. Edisi Perdana, Lingga Jaya, Bandung, P.8Azhar Susanto, (2009). Sistem Informasi Manajemen: Pendekatan Terstruktur Resiko Pengembangan. Edisi Perdana, Lingga Jaya, Bandung.Baltzan, Paige, (2012). Business Driven Information System. 3rd Edition NY: McGraw-Hill, P. 14)Delon, W.H. & Mclean, E.R., (1992). Information Success The Quest For Dependent Variable, Information System Research, Vol. 3. No. 1, Pp. 60-95Dellon, W.H. Delon & Ephraim R. Mclean, 2003. The Delon and McLean Model of Information Systems Succes: A Ten Years Update, Journal Of Management Information Systems/ Spring 2003. Vol. 19, No. 4. Pp. 9-30. F. Davis, (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quartely, 13, September, Pp. 319-340Donald E. Kieso, Jerry Weygandt, & Terry D. Warfield, (2012). Intermediate Accounting. 14th Edition. UK: John Willey and Sons, Inc. Pp.5-6Don R. Hansen, & Maryanne M. Mowen, (1995). Cost Management Accounting And Control. South Western College Publishing. P.35Doyle, J., Ge W, and McVay, S., (2007). Accrual Quality and Internal Control Over Financial Reporting. Accounting Review, Vol 82. No. 5. Pp. 1141-1170.Frederich L. Jones and Dasaratha V. Rama., (2003). Accounting Information Systems,A Business Process Approach. :South Western, P. 7Gamawan Fauzi, (2012). Target 50% Daerah WTP Pada Tahun 2014 Sulit Dicapai. Harian Kompas, Rabu, 25 Juli, P. 4.George Scot, (1996Ge W and McVay, S., (2005). The Disclosure of Material Weakness in Internal Control After The Sarbanes-Oxley Act. Accounting Horizons, Vol. 19. No. 3. Pp. 137-158.Gelinas, Ulrich, A. Oram & W. Wriggins, (1990). Accounting Information Systems. Boston: Pwskent Publishing Company.Gelinas, Ulrich & Dull , B. Richard, (2012). Accounting Information Systems, 9th ed. South Western Cengage Learning. 5191 Natorp Boulevard Mason, USA. P. 19George H. Bodnar , William S. Hoopwood, (2010). Accounting Information Systems, 10th ed. NJ: Prentice Hall. P.1, 49, 133 &151.George M. Scott, (1986). Principles Of Management Information Systems. NY: Mc-Graw-Hill. P.Glover Messier & Prawitt, (2006). Auditing and Assurance Services: A Systematic Approach. 4th ed. NY: McGraw-Hill. P.220-----------------------, (2011). LKPP (2010 Wajar Dengan Pengecualian. Warta BPK, edisi 05-Vol Mei, pp. 12-13. Halim Alamsyah, (2011). Bank Indonesia Akui Banyak Bank Dibobol Karena Pengawasan Internal Memble. /2011/07/07/bi-akui-banyak-bank-dibobol- karena- pengawasan-internal- memble/ Jakarta,Rabu (22/06).Iceman & Hillson, (1990). Distribution of Audited Detected Errors Parttioned by Internal Control. Journal of Accounting, Auditing & Finance. Vol. 5. No. 4. Pp. 527-548.James A. Hall, (2011). Accounting Information System. 7th ed, South-Western Publishing Co. p. 11-14James A. O’Brien & George M. Marakas, (2010). Management Information Systems: Managing Information Technology In The Bussiness Enterprise.15th ed. NY: McGraw-Hill. P.353, 495James A. O’Brien & George M. Marakas, (2004). Management Information Systems: Managing Information Technology In The Bussiness Enterprise. 10th ed. NY: McGraw-Hill.James A. O’Brien & George M. Marakas, 1996. Management Information Systems: Managing Information Technology In The Bussiness Enterprise. 13rd Ed. NY: McGraw-Hill. P. 365James O. Hickss Jr., (1993). Management Information Systems: A User Perspective. 3rd ed: West Publishing Co. P. 67-68John F. Nash & Cynthia D. Heagy, (1993). Accounting Information Systems, 3rd ed, South-Western Publisihing Co. P. 484 & 497Mahdi Salehi, Vahab Rostami, & Abdolkarim Mogadam, (2000). Usefulness of Accounting Information in Emerging Economy: Emperical Evidence of Iran, Journal Revista De Contabilidad-Spanish Accounting Review (pp.Maurice L. Hirsch, Jr., (1994). Advanced Management Accounting, 2nd: South Western Publishing. P. 17 McLeod Raymond, (2007). Sistem Informasi Manajemen. Edisi Ke-7, Versi Bahasa Indonesia, Jakarta: PT. PrenhallindoNancy A. Bagranof, Mark G. Simkin, & Carolyn S. Norman, (2010). Accounting Information Systems. Seventh Edition: South-Western. P. 5Pornpandejwittaya & Pairat, (2012). Effectiveness of AIS: Effect on Performance of Thai-Listed Firms In Thailand, International Journal Of Business Research, July, 2012. Vol 12 Issue 3.Randal J. Elder, Mark S. Beasley, & Alvin A. Arens, (2010). Auditind and Assurance Sevices An Integrated Approach. NJ: Prentice-Hall. P . 290Romuald A. Stone, (1994). Leadership and information System Management: A Literatur review, Computers In Human Behavior. Vol. 10, Issue 4, Winter. pp. 559-568.Ronald F. Premuroso, Robert Houmes, (2012). Financial Statement Risk Assessment Following the COSO Framework: An Instructional Case Study. International Journal of Accounting and Information Management, Vol. 20. No. 1. Pp. 26-48.Sacer, Ivana M., Zager K., and Tusek B. (2006). Accounting Information System’s Quality as The Ground For Quality Business Reporting, IAIDS International Conference e-commerce, ISBN: 972-8924-23-2. P. 6, 62 Sajadi, H. M. Dastgir, & H. Hashem Nejad, (2008). Evaluation of The Effectiveness of Accounting Information Systems, International Journal Of Information & Technology Science, Vol. 6, No. 2, July & Dec.Seddon P, (1997). Respecification and Extension of The delone and McLean Model of IS Success”, Information Systems Research, Vol. 8 Issue 3, pp. 240-253.Soesilo Bambang Yudhoyono, (2013). Masih Ada Kebocoran Pajak, Berat Capai Target Pajak 2013.Harian Kompas. Jum’at, 22 Maret, Hal. 17Stacie Petter, William DeLone, & Ephraim McLean, (2008). Measuring information systems success: models, dimensions, measures, and interrelationships. European Journal of Information Systems, pp. 236-263Stair, Ralph M. & George W. Reynolds, (2010). Principles Of Information Systems, Course Technology. 9th Editions. NY: Mc-Graw-Hill. P. 7, 57Wang, R. Y. and Strong, D.M., (1996). Beyond accuracy: What data quality means to data consumers. Journal of Management Information Systems, Vol. 12, No. 4, pp. 5-33.Yuhong Guan, Yuhong Guan, (2006). A Study on The Internal Control of Accounting Information Systems. International Confrence on Computer and Communication Technologies in Argiculture Engineering, Januari, 12.。

[整理版]会计外文文献

![[整理版]会计外文文献](https://img.taocdn.com/s3/m/1d430d1bf02d2af90242a8956bec0975f465a482.png)

The relationship between tax and accounting rules - the Swedish case作者:John Blake, Katarina Akerfeldt , Hilary J. Fortes , Catherine Gowthorpe作者单位:Professor in the Department of Accounting and Financial Services , University of Central Lancashire , Preston , UK , Skattemyndigheteni Stockholms lan , Haninge , Sweden , Schoolof Accounting and Finance , Middlesex University Business School , The Burroughs , LondonNW4 4BT , UK , Department of Accounting and Financial Services , University of CentralLancashire , Preston , UK期刊:European Business Review, 1997, V ol.97 (2), pp.85-91来源数据库:Emerald JournalDOI:10.1108/09555349710162599全文下载路径:Emerald (合作)查找更多免费版本分享到:关键词:Accounting; Rules ; Sweden ; Taxation英文摘要:Traces the history of the imposition of a comprehensive tax-accounting link in Sweden, identifying ways in which professional a关键词:accounting harmonization; globalization ; classification ; national rules differences ; influencing factors ; Europe英文摘要:The goal of this study is to describe and summarize how the harmonized international accounting system can promote business decisions and influence economic environment. The unified, harmonized accounting system will lead to new types of analysis and data, furthermore with the possible integration of new indicators from the business management of certain countries. Especially the multinational companies whose subsidiaries had to report for some purposes using national accounting rules convert an d consolidate their different framework for unified financial statement where they are listed. A suitable international accounting system can help multinational enterprises accomplish their managerial functions on a global basis. Meanwhile the interpretation and adoption of the financial information based on the different accounting methods are also expensive for the users of these reports. Therefore an authentic and harmonized international accounting system could form that business language, which would allow the comparison of the accounting information of each country. The accounting system differences matter even to financial analysts who specialize in collecting, measuring and disseminating business information about the covered companies suggests that there are potential economic costs, associated with variation in national rules across countries. Besides, it is very important task for managers and researchers the valuation and analyzing the effects of harmonized accounting system on the business environment, especially their contribution to globalization. According to the business practice it is obvious that the usage of harmonized international accounting system leads to a reduction of the information asymmetry between the owners and the managers.收缩相似文献:(说明:与本文内容上较为接近的文献)[1]Parmod Chand. A critique of the influence of globalization and convergence of accounting standards in Fiji. [J].Critical Perspectives on Accounting,2006,18(5)[2]Ian Cobb. Management accounting change in a bank. [J].Management Accounting Research,1995,6(2)[3]Yin Chen. Problems of accounting reform in the People's Republic of China. [J].International Journal of Accounting,1997,32(2)[4]Sivakumar Velayutham. Recent developments in the accounting profession in New Zealand: A case of deprofessionalization?. [J].International Journal of Accounting,1996,31(4)[5]Amy Hing-Ling Lau. Contemporary accounting issues in China—An analytical approach. [J].International Journal of Accounting,1998,33(5)[6]Robin Cooper. Management accounting: European perspectives. [J].International Journal of Accounting,1998,33(5)[7]Hema Wijewardena. Colonialism and accounting education in developing countries: The experiences of Singapore and Sri Lanka. [J].International Journal of Accounting,1998,33(2)[8]Jeffrey R. Cohen. A methodological note on cross-cultural accounting ethics research. [J].International Journal of Accounting,1996,31(1)[9]Hendrik Vollmer. Management accounting as normal social science. [J].Accounting,Organizations and Society,2008,34(1)[10]Alan Roberts. The very idea of classification in international accounting. [J].Accounting, Organizations and Society,1995,20(7)[11]Christopher Nobes. On accounting classification and the international harmonisation debate. [J].Accounting, Organizations and Society,2003,29(2)[12]Garry D. Carnegie. Traditional accountants and business professionals: Portraying the accounting profession after Enron. [J].Accounting, Organizations and Society,2009,35(3)[13]Fouad K. AlNajjar. Perceptions of Fortune 500 controllers on internationalizing the accounting curriculum. [J].Journal of International Accounting, Auditing and Taxation,1995,4(1)[14]J.A. Breembroek. Environmental farm accounting: The case of the dutch nutrients accounting system. [J].Agricultural Systems,1996,51(1)[15]Naoko Komori. Visualizing the negative space: Making feminine accounting practices visible by reference to Japanese women's household accounting practices. [J].Critical Perspectives on Accounting,2012,23(6)[16]Philip D. Bougen. Fair value accounting: Simulacra and simulation. [J].Critical Perspectives on Accounting,2011,23(4-5)[17]Lee D. Parker. Qualitative management accounting research: Assessing deliverables and relevance. [J].Critical Perspectives on Accounting,2011,23(1)[18]Levi Gårseth-Nesbakk. Accrual accounting representations in the public sector—A case of autopoiesis. [J].Critical Perspectives on Accounting,2010,22(3)[19]Eva Heidhues. A critique of Gray's framework on accounting values using Germany asa case study. [J].Critical Perspectives on Accounting,2010,22(3)[20]Jan Mouritsen. The operation of representation in accounting: A small addition to Dr. Macintosh's theory of accounting truths. [J].Critical Perspectives on Accounting,2010,22(2)Research on the Structure of China’s Enterprise Income Tax Law System作者:Yinying Wang作者单位:S.J.D. , Law School , University of Wisconsin-Madison期刊:Beijing Law Review, 2011, V ol.02 (02), pp.63-73来源数据库:Scientific Research Publishing JournalDOI:10.4236/blr.2011.22007全文下载路径:PDF下载Scientific Research Publishing (合作)查找更多免费版本分享到:关键词:Enterprise; Income Tax Law ; Restructure ; Comparison英文摘要:The PRC enterprise income tax law was enacted on January 1, 2008, with accordance to which the enterprise income tax law system has been changing. It took a long time to promulga te the law just as it takes and will take certain period to integrate the system from the constitutional law to tax polices. The lack of taxing power under constitutional law, the silence of a basic tax law, and the arbitrary of tax policy issuance lead to an unstable structure of enterprise income tax law system. Lawmak ers shall announce the taxing power under the constitutional law, form a general tax law, and take time to screen tax policies to improve the system.收缩相似文献:(说明:与本文内容上较为接近的文献)[1]Pall completes tax inquiry, terminates 4 employees. [J].Filtration Industry Analyst,2008,2008(2)[2]Pierre Pestieau. The value of explicit randomization in the tax code. [J].Journal of Public Economics,1998,67(1)[3]Richard M. Bird. Dual Income Taxation: A Promising Path to Tax Reform for Developing Countries. [J].World Development,2011,39(10)[4]Karin Edmark. Identifying strategic interactions in Swedish local income tax policies. [J].Journal of Urban Economics,2007,63(3)[5]Silvia Fedeli. Joint income-tax and VAT-chain evasion. [J].European Journal of Political Economy,1999,15(3)[6]Mohamed Belhaj. Risk taking under heterogenous revenue sharing. [J].Journal of Development Economics,2011,98(2)[7]Federica Maiorano. Institutions and telecommunications infrastructure in low and middle-income countries: The case of mobile telephony. [J].Utilities Policy,2007,15(3)[8]Henk Elffers. Influencing the prospects of tax evasion. [J].Journal of Economic Psychology,1997,18(2)[9]Bashar H. Malkawi. The case of income tax evasion in Jordan: symptoms and solutions. [J].Journal of Financial Crime,2008,15(3)[10]Kurt Schmidheiny. Income segregation from local income taxation when households differ in both preferences and incomes. [J].Regional Science and Urban Economics,2005,36(2)[11]X. Ruiz del Portal. Is the optimal income tax regressive?. [J].Economics Letters,2008,100(3)[12]Wendy Heltzer. The book–tax divide: Perceptions from the field. [J].Research in Accounting Regulation,2011,23(2)[13]Wiersema. Tips on the new tax laws. [J].Electrical Apparatus,2013,66(2)[14]Christian Bellak. Do low corporate income tax rates attract FDI? - Evidence from Central- and East European countries. [J].Applied Economics,2009,41(21)[15]Foad Farid. COMPOSITE CORPORATE INCOME TAX. [J].The Engineering Economist,33(2)[16]Jon Gruber. The elasticity of taxable income: evidence and implications. [J].Journal of Public Economics,2002,84(1)[17]Ferro's sales and income fall sharply in first quarter of 2012. [J].Additives for Polymers,2012,2012(7)[18]Bin Ke. What insiders know about future earnings and how they use it: Evidence from insider trades. [J].Journal of Accounting and Economics,2003,35(3)[19]Marcel Gérard. T ax interactions among Belgian municipalities: Do interregional differences matter?. [J].Regional Science and Urban Economics,2010,40(5)[20]Oriol Carbonell-Nicolau. Voting over income taxation. [J].Journal of Economic Theory,2006,134(1)。

会计学外文经典文献

会计学外文经典文献摘要:一、引言1.会计学的重要性2.外文经典文献的意义二、会计学外文经典文献概述1.文献分类2.重要学术观点与贡献三、代表性外文经典文献解析1.文献一:《会计学原理》2.文献二:《财务会计理论》3.文献三:《管理会计》四、我国会计学外文经典文献的研究现状1.研究概况2.研究热点与趋势五、外文经典文献对我国会计学研究的启示1.理论体系建设2.研究方法与技术3.实践应用与创新六、结论1.外文经典文献在会计学领域的价值2.我国会计学研究的未来发展正文:一、引言会计学作为一门重要的经济管理学科,其理论体系和实践应用在全球范围内得到了广泛认可。

外文经典文献在会计学领域的研究成果丰富,为我国会计学研究提供了宝贵的理论依据和实践经验。

本文将对会计学外文经典文献进行梳理,以期为我国会计学研究提供参考。

二、会计学外文经典文献概述1.文献分类会计学外文经典文献主要包括财务会计、管理会计、审计、税收等方面的著作。

这些文献涵盖了会计学的理论体系、方法论、实践应用等各个方面。

2.重要学术观点与贡献在外文经典文献中,许多学者提出了具有影响力的学术观点,如会计要素、会计等式、财务报表分析、现金流量预测等。

这些观点为会计学理论体系的构建奠定了基础,并对实际应用产生了深远影响。

三、代表性外文经典文献解析1.文献一:《会计学原理》这本书是由美国会计学家佩顿(Paton)和利特尔顿(Littleton)共同撰写的。

该书系统地阐述了会计学的基本原理和方法,强调了会计信息的真实性和可靠性。

这本书对我国会计学研究的理论体系建设具有重要的指导意义。

2.文献二:《财务会计理论》该书由美国学者布里曼(Bromwich)和瓦茨(Watts)合著。

该书对财务会计理论进行了全面梳理,对会计准则、会计信息质量、会计假设等方面进行了深入探讨。

这本书对我国会计学研究具有很高的参考价值。

3.文献三:《管理会计》这本书是由英国学者亨德里克森(Hendrickson)所著。

关于会计的英文文献原文(带中文翻译)

The Optimization Method of Financial Statements Based on Accounting Management TheoryABSTRACTThis paper develops an approach to enhance the reliability and usefulness of financial statements. International Financial Reporting Standards (IFRS) was fundamentally flawed by fair value accounting and asset-impairment accounting. According to legal theory and accounting theory, accounting data must have legal evidence as its source document. The conventional “mixed attribute” accounting system should be re placed by a “segregated” system with historical cost and fair value being kept strictly apart in financial statements. The proposed optimizing method will significantly enhance the reliability and usefulness of financial statements.I.. INTRODUCTIONBased on international-accounting-convergence approach, the Ministry of Finance issued the Enterprise Accounting Standards in 2006 taking the International Financial Reporting Standards (hereinafter referred to as “the International Standards”) for reference. The Enterprise Accounting Standards carries out fair value accounting successfully, and spreads the sense that accounting should reflect market value objectively. The objective of accounting reformation following-up is to establish the accounting theory and methodology which not only use international advanced theory for reference, but also accord with the needs of China's socialist market economy construction. On the basis of a thorough evaluation of the achievements and limitations of International Standards, this paper puts forward a stand that to deepen accounting reformation and enhance the stability of accounting regulations.II. OPTIMIZA TION OF FINANCIAL STATEMENTS SYSTEM: PARALLELING LISTING OF LEGAL FACTS AND FINANCIAL EXPECTA TIONAs an important management activity, accounting should make use of information systems based on classified statistics, and serve for both micro-economic management and macro-economic regulation at the same time. Optimization of financial statements system should try to take all aspects of the demands of the financial statements in both macro and micro level into account.Why do companies need to prepare financial statements? Whose demands should be considered while preparing financial statements? Those questions are basic issues we should consider on the optimization of financial statements. From the perspective of "public interests", reliability and legal evidence are required as qualitative characters, which is the origin of the traditional "historical cost accounting". From the perspective of "private interest", security investors and financial regulatory authoritieshope that financial statements reflect changes of market prices timely recording "objective" market conditions. This is the origin of "fair value accounting". Whether one set of financial statements can be compatible with these two different views and balance the public interest and private interest? To solve this problem, we design a new balance sheet and an income statement.From 1992 to 2006, a lot of new ideas and new perspectives are introduced into China's accounting practices from international accounting standards in a gradual manner during the accounting reform in China. These ideas and perspectives enriched the understanding of the financial statements in China. These achievements deserve our full assessment and should be fully affirmed. However, academia and standard-setters are also aware that International Standards are still in the process of developing .The purpose of proposing new formats of financial statements in this paper is to push forward the accounting reform into a deeper level on the basis of international convergence.III. THE PRACTICABILITY OF IMPROVING THE FINANCIAL STATEMENTS SYSTEMWhether the financial statements are able to maintain their stability? It is necessary to mobilize the initiatives of both supply-side and demand-side at the same time. We should consider whether financial statements could meet the demands of the macro-economic regulation and business administration, and whether they are popular with millions of accountants.Accountants are responsible for preparing financial statements and auditors are responsible for auditing. They will benefit from the implementation of the new financial statements.Firstly, for the accountants, under the isolated design of historical cost accounting and fair value accounting, their daily accounting practice is greatly simplified. Accounting process will not need assets impairment and fair value any longer. Accounting books will not record impairment and appreciation of assets any longer, for the historical cost accounting is comprehensively implemented. Fair value information will be recorded in accordance with assessment only at the balance sheet date and only in the annual financial statements. Historical cost accounting is more likely to be recognized by the tax authorities, which saves heavy workload of the tax adjustment. Accountants will not need to calculate the deferred income tax expense any longer, and the profit-after-tax in the solid line table is acknowledged by the Company Law, which solves the problem of determining the profit available for distribution.Accountants do not need to record the fair value information needed by security investors in the accounting books; instead, they only need to list the fair value information at the balance sheet date. In addition, because the data in the solid line table has legal credibility, so the legal risks of accountants can be well controlled. Secondly, the arbitrariness of the accounting process will be reduced, and the auditors’ review process will be greatly simplified. The independent auditors will not have to bear the considerable legal risk for the dotted-line table they audit, because the risk of fair value information has been prompted as "not supported by legalevidences". Accountants and auditors can quickly adapt to this financial statements system, without the need of training. In this way, they can save a lot of time to help companies to improve management efficiency. Surveys show that the above design of financial statements is popular with accountants and auditors. Since the workloads of accounting and auditing have been substantially reduced, therefore, the total expenses for auditing and evaluation will not exceed current level as well.In short, from the perspectives of both supply-side and demand-side, the improved financial statements are expected to enhance the usefulness of financial statements, without increase the burden of the supply-side.IV. CONCLUSIONS AND POLICY RECOMMENDATIONSThe current rule of mixed presentation of fair value data and historical cost data could be improved. The core concept of fair value is to make financial statements reflect the fair value of assets and liabilities, so that we can subtract the fair value of liabilities from assets to obtain the net fair value.However, the current International Standards do not implement this concept, but try to partly transform the historical cost accounting, which leads to mixed using of impairment accounting and fair value accounting. China's accounting academic research has followed up step by step since 1980s, and now has already introduced a mixed-attributes model into corporate financial statements.By distinguishing legal facts from financial expectations, we can balance public interests and private interests and can redesign the financial statements system with enhancing management efficiency and implementing higher-level laws as main objective. By presenting fair value and historical cost in one set of financial statements at the same time, the statements will not only meet the needs of keeping books according to domestic laws, but also meet the demand from financial regulatory authorities and security investorsWe hope that practitioners and theorists offer advices and suggestions on the problem of improving the financial statements to build a financial statements system which not only meets the domestic needs, but also converges with the International Standards.基于会计管理理论的财务报表的优化方法摘要本文提供了一个方法,以提高财务报表的可靠性和实用性。

2024年会计论文外文参考文献

[18] 王斌,李苹莉. 关于企业预算目标确定及其分解的理论分析[J]. 会计研究. 2001(08)

[19] 《管理会计应用与发展的典型案例研究》课题组,林斌,刘运国,谭光明,张玉虎. 作业成本法在我国铁路运输企业应用的案例研究[J]. 会计研究. 2001(02)

[6] 余绪缨. 关于培养高层次管理会计人才的认识与实践[J]. 财会月刊. 2007(22)

[7] 余绪缨. 管理会计学科建设的方向及其相关理论的新认识[J]. 财会通讯(综合版). 2007(02)

[8] 于增彪,王竞达,袁光华. 中国管理会计的未来发展:研究方法、热点实务和人才培养[J]. 首都经济贸易大学学报. 2006(01)

2024年会计论文外文参考文献

会计论文外文参考文献1

[1]徐静.我国企业社会责任会计信息披露探析[J].企业导报.2012(15) :22-25.

[2]张明霞.李云鹏.企业社会责任会计信息披露问题研究[J].经济研究导刊.2011(20):40-43.

[3] 路秀平.任会来.我国社会责任会计信息披露模式现实选择 [J]. 会计之友 (上旬刊).2012(12):89-92.

[20] 胡玉明. 21世纪管理会计主题的转变--从企业价值增值到企业核心能力培植[J]. 外国经济与管理. 2001(01)

本文来源:网络收集与整理,如有侵权,请联系作者删除,谢谢!

[4]林斌,饶静.上市公司为什么自愿披露内部控制鉴证报告.一基于信号传递理论的实证研宄[J].会计研究,2009 (2): 45-52.

会计信息披露外文文献翻译