金融专业名词翻译集锦

金融专业术语解释大全

金融专业术语解释大全一、货币与货币制度1. 货币(Money)- 货币是从商品中分离出来固定地充当一般等价物的商品。

它具有价值尺度、流通手段、贮藏手段、支付手段和世界货币五种职能。

例如,在日常生活中,我们用货币(如人民币)来购买商品和服务,货币在这里就充当了交换媒介(流通手段职能);同时,我们可以把货币储蓄起来,这时货币就发挥了贮藏手段职能。

2. 本位币(Standard Money)- 本位币又称主币,是一个国家的基本通货和法定的计价结算货币。

在金属货币制度下,本位币是用一定金属按照国家规定的货币单位铸成的铸币。

本位币的特点是具有无限法偿能力,即不论每次支付的数额多大,收款人都不得拒绝接受。

例如,在我国,人民币元就是本位币,商家不能拒绝接受顾客用人民币元进行的合法支付。

3. 辅币(Fractional Currency)- 辅币是本位币单位以下的小额货币,主要用于日常零星交易和找零。

辅币通常用贱金属铸造,其特点是有限法偿,即每次支付超过一定限额,收款人有权拒绝接受。

我国的角和分就是辅币,在大额交易中,如果只用角币支付且数量过多,商家可以拒绝接受。

4. 货币制度(Monetary System)- 货币制度是国家对货币的有关要素、货币流通的组织与管理等加以规定所形成的制度。

它主要包括货币金属(币材)的确定、货币单位的确定、流通中货币种类的确定、对不同种类货币的铸造和发行的管理、对不同种类货币的支付能力的规定等内容。

例如,金本位制就是一种货币制度,在这种制度下,黄金是货币金属,货币单位与一定重量和成色的黄金挂钩。

二、信用与信用工具1. 信用(Credit)- 信用是以偿还和付息为条件的借贷行为。

它反映了一种债权债务关系,其中债权人将商品或货币借出,债务人则承诺在未来的某个时间偿还本金并支付利息。

例如,银行向企业发放贷款,银行是债权人,企业是债务人,企业在规定的期限内需要偿还贷款本金并支付相应的利息。

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

经济金融术语英汉对照

经济金融术语英汉对照经济金融领域常常涉及大量的专业术语,对于学习和理解这些术语,将英文与中文对照是非常重要的。

下面是一些经济金融术语的英汉对照列表,希望对您有所帮助。

1. Gross Domestic Product (GDP) 国内生产总值GDP是一个国家或地区在特定时间内所生产的所有最终商品和服务的市场价值的总和。

2. Inflation 通货膨胀通货膨胀是指货币供应量增加导致物价水平上升的现象。

3. Deflation 通货紧缩通货紧缩是指货币供应量减少导致物价水平下降的现象。

4. Interest Rate 利率利率是指借贷资金所产生的利息与本金之间的比率。

5. Exchange Rate 汇率汇率是指一种货币与另一种货币之间的兑换比率。

6. Stock Market 股票市场股票市场是指买卖股票的场所,也是企业融资的重要途径。

7. Bond 债券债券是一种证券,表示借款人向债权人承诺在一定期限内支付利息和本金。

8. Foreign Direct Investment (FDI) 外商直接投资外商直接投资是指一个国家的企业在另一个国家的企业中进行的长期投资。

9. Taxation 税收税收是政府从个人和企业获得财政收入的一种方式。

10. Budget Deficit 预算赤字预算赤字是指政府支出超过收入的情况,需要通过借贷或印钞等方式来弥补。

11. Trade Surplus/Trade Deficit 贸易顺差/贸易逆差贸易顺差指一个国家的出口额大于进口额,贸易逆差则相反。

12. Monetary Policy 货币政策货币政策是由中央银行制定和执行的调控货币供应量和利率水平的政策。

13. Fiscal Policy 财政政策财政政策是由政府制定和执行的调控财政支出和税收的政策。

14. Central Bank 央行央行是一个国家的货币发行和货币政策的实施机构。

15. Market Economy 市场经济市场经济是一种以市场配置资源和决定价格的经济体制。

最全金融行业术语英文翻译

最全金融行业术语英文翻译本文档旨在为您提供最全面的金融行业术语的英文翻译,帮助您更好地理解和使用这些术语。

以下是我们整理的金融行业术语及对应的英文翻译:1. 金融市场:Financial market2. 资金流动:Capital flow3. 股票:Stock4. 债券:Bond5. 期权:Option6. 期货:Futures7. 衍生品:Derivative8. 投资组合:Portfolio9. 风险管理:Risk management10. 资产负债表:Balance sheet12. 现金流量表:Cash flow statement13. 财务分析:Financial analysis14. 贷款:Loan15. 存款:Deposit16. 利率:Interest rate17. 汇率:Exchange rate18. 银行业务:Banking business19. 保险业务:Insurance business20. 财富管理:Wealth management21. 资产管理:Asset management22. 投资银行:Investment banking23. 证券交易所:Stock exchange24. 资本市场:Capital market26. 风险投资:Venture capital27. 股票交易:Stock trading28. 期货交易:Futures trading29. 存款利率:Deposit rate30. 贷款利率:Loan rate这仅仅是金融行业术语的一小部分,更多术语可以根据实际需要进行进一步查询和研究。

希望本文档对您有所帮助。

常见的金融词汇中英对照

常见的金融词汇中英对照1. 金融市场 (Financial Markets)金融市场是指用于实现资金交易和资金融通的场所,包括股票市场、债券市场、外汇市场和商品市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.•外汇市场 (Foreign Exchange Market): the market for trading foreign currencies.•商品市场 (Commodity Market): the market for trading commodities such as oil, gold, and agricultural products.2. 资本市场 (Capital Market)资本市场是指长期融资和投资的市场,包括股票市场和债券市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.3. 证券 (Securities)证券是指可以转让和交易的金融工具,包括股票、债券、证券投资基金等。

•股票 (Stocks): shares of ownership in a company that can be bought and sold on a stock market.•债券 (Bonds): debt securities issued by governments, corporations, or other organizations to raise capital.•证券投资基金 (Mutual Funds): investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, orother securities.4. 风险管理 (Risk Management)风险管理是指识别、评估和处理金融交易和投资中的各种风险,以减少损失和提高效益。

金融名词解释大全

金融名词解释大全1. 股票(Stocks)股票是公司向公众发行的所有权份额,每股代表对公司一定比例的所有权。

股票可以在证券交易市场上交易,投资者可通过购买股票成为公司的股东,并分享公司的利润和增值。

2. 债券(Bonds)债券是借款人向投资者发行的一种债务工具,代表借款人的债务承诺。

债券投资者向发行人提供资金,债券到期时,发行人以面值偿还本金,并支付利息作为回报。

3. 利率(Interest Rate)利率是指金融交易中借款者支付给贷款人的费用,即贷款利息的百分比。

利率通常反映了借款的成本与风险。

4. 黄金(Gold)黄金是一种贵重金属,被广泛用于投资和金融交易中。

其价值通常受供求关系、经济形势和市场情绪等因素影响。

5. 外汇(Foreign Exchange)外汇是指不同国家的货币进行兑换的过程,也是进行国际贸易和金融交易的基础。

外汇市场是全球最大、最活跃的金融市场之一。

6. 期货(Futures)期货是指以标准化合约形式约定按特定价格在未来某一日期交割的金融产品。

期货合约通常包括商品、股指或货币对等。

7. 期权(Options)期权是购买或出售一种资产的权利,但并不要求买方实施该权利。

期权合约由买方获得了在未来特定日期或之前执行交易的选择权。

8. 融资(Financing)融资是指获取资金的过程,企业或个人通过向金融机构借贷或发行债券来筹集资金,以满足业务或个人需求。

9. 风险投资(Venture Capital)风险投资是指投资者将资金投入于初创公司或具有高风险和高增长潜力的企业,在期待高回报的同时,承担创业失败的风险。

10. 金融衍生品(Financial Derivatives)金融衍生品是一种基于债券、股票、商品等资产的金融合约,其价值来自于基础资产的价格波动。

常见的金融衍生品包括期货、期权和掉期等。

11. 黑天鹅事件(Black Swan)黑天鹅事件是指罕见且难以预测的突发事件,对金融市场和全球经济产生重大影响。

金融专业英语词汇大全

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

常用金融术语

常用金融术语(中英对照)说明:部分对中小资金不太普及的术语未做具体解释。

金融资产组合(Portfolio) :指投资者持有的一组资产。

一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等。

证券投资(Portfolio Investment) :国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理。

证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金。

共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上。

头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标。

其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round Lot Trade) :指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(Repo Rate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

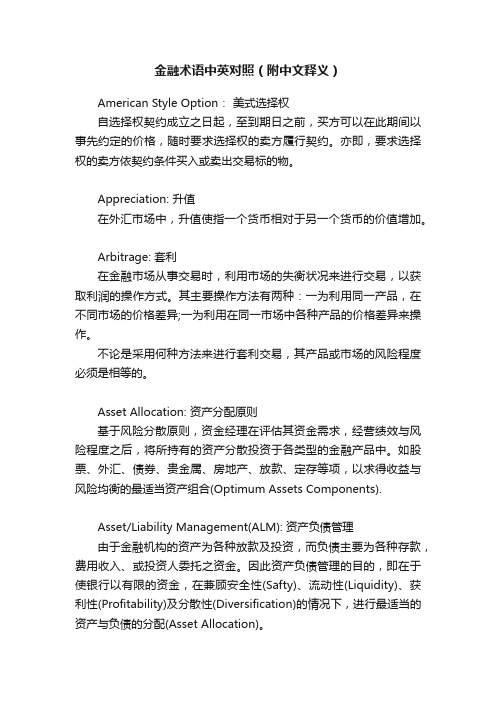

金融术语中英对照(附中文释义)

金融术语中英对照(附中文释义)American Style Option:美式选择权自选择权契约成立之日起,至到期日之前,买方可以在此期间以事先约定的价格,随时要求选择权的卖方履行契约。

亦即,要求选择权的卖方依契约条件买入或卖出交易标的物。

Appreciation: 升值在外汇市场中,升值使指一个货币相对于另一个货币的价值增加。

Arbitrage: 套利在金融市场从事交易时,利用市场的失衡状况来进行交易,以获取利润的操作方式。

其主要操作方法有两种:一为利用同一产品,在不同市场的价格差异;一为利用在同一市场中各种产品的价格差异来操作。

不论是采用何种方法来进行套利交易,其产品或市场的风险程度必须是相等的。

Asset Allocation: 资产分配原则基于风险分散原则,资金经理在评估其资金需求,经营绩效与风险程度之后,将所持有的资产分散投资于各类型的金融产品中。

如股票、外汇、债券、贵金属、房地产、放款、定存等项,以求得收益与风险均衡的最适当资产组合(Optimum Assets Components).Asset/Liability Management(ALM): 资产负债管理由于金融机构的资产为各种放款及投资,而负债主要为各种存款,费用收入、或投资人委托之资金。

因此资产负债管理的目的,即在于使银行以有限的资金,在兼顾安全性(Safty)、流动性(Liquidity)、获利性(Profitability)及分散性(Diversification)的情况下,进行最适当的资产与负债的分配(Asset Allocation)。

At The Money: 评价选择权交易中,履行价格等于远期价格时称之为评价。

Bear Market: 空头市场(熊市)在金融市场中,若投资人认为交易标的物价格会下降,便会进行卖出该交易标的物的操作策略。

因交易者在卖出补回前,其手中并未持有任何交易标的物,故称为:“空头”。

所谓空头市场就是代表大部分的市场参与者皆不看好后市的一种市场状态。

金融基础英语专业名词

1.Finance金融;筹资2.Finance Ministry财政部;财务部3.Facilitate使…..容易4.Undertake从事;经营5.Category 种类,分类6.Real assets实物资产7.Security 证券8.Savings deposits储蓄存款9.Credit risk信用风险10.Currency通货;货币11.Forward 远期12.Future期货13.Mortgage抵押,抵押贷款14.Maturity date到期日15.dividends股息、红利16.primary marke初级市场;初次市场17.Underwrite承销18.liquidity流动性19.Surplus剩余的;过剩的20.pension funds养老基金21.money market货币市场22.denomination面额23.default risk违约风险;拖欠风险24.warrant保证;担保;25.idle cash闲置资金26.opportunity cost机会成本27.tax revenues税收28.pay back偿还;报答29.revenues and expenses收入和支出30.Treasury bills国库券31.Inter-bank markets银行同业拆借市场mercial paper商业票据33.Negotiable certificatesof deposit可转让定期存单34.Banker’s acceptances银行承兑35.unsecured无担保的36.demand deposit活期存款37.diverse多种多样的38.Motivationn.动机;积极性;推动39.Productiveadj.生产性的;多产的40.investment in对…的投资;在…的投资41.pay off偿清42.risk premiums风险溢价;风险报酬43.despite尽管,不管44.distribution分布;分配45.initial public offering(IPO) n. 初始公开发行46.take place发生;举行47.Mortgage n.抵押48.Indenture n.契约49.Collateral n.抵押品50.Vary变化;改变51.residual claimant剩余索取权52.offshore financialmarket离岸金融市场53.Off-Balance SheetActivities表外业务54.foreign exchange外汇,国际汇兑55.discharge 偿还56.telegraphic transfer电汇57.bill账单;票据58.cheque支票59.quote报价,标价60.the forward price远期汇率61.premium溢价;保险费升水62.discount折扣;贴水63.swap互换,掉期64.securities exchanges证券交易所65.Call Option看涨期权66.strike price执行价;约定价67.Intermediary Services中间业务68.Trust Services信托业务69.Debtor-CreditorRelationship债权债务关系70.principal-agentRelationship委托代理关系71.reimburse偿还、报销72.loyalty忠诚;忠心73.Promissory Notes本票74.quote 报价,标价mercial account商业往来账户modity exchange商品交易77.hedge 套期保值,对冲78.direct quotationmethod 直接标价法79.favourable 顺差80.depreciate 贬值81.DocumentaryCollections 跟单托收82.Documentary Credit跟单信用证83.the letter of credit信用证。

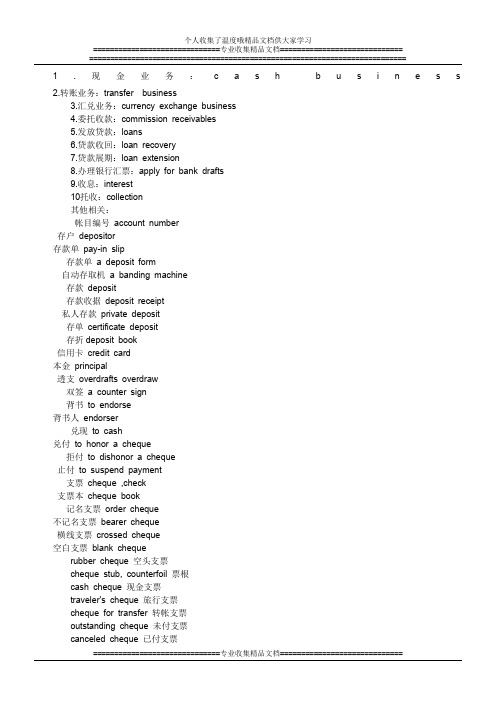

银行专业术语金融英语(中英文对照)

1.现金业务:c a s h b u s i n e s s2.转账业务:transfer business3.汇兑业务:currency exchange business4.委托收款:commission receivables5.发放贷款:loans6.贷款收回:loan recovery7.贷款展期:loan extension8.办理银行汇票:apply for bank drafts9.收息:interest10托收:collection其他相关:帐目编号account number存户depositor存款单pay-in slip存款单a deposit form自动存取机a banding machine存款deposit存款收据deposit receipt私人存款private deposit存单certificate deposit存折deposit book信用卡credit card本金principal透支overdrafts overdraw双签a counter sign背书to endorse背书人endorser兑现to cash兑付to honor a cheque拒付to dishonor a cheque止付to suspend payment支票cheque ,check支票本cheque book记名支票order cheque不记名支票bearer cheque横线支票crossed cheque空白支票blank chequerubber cheque 空头支票cheque stub, counterfoil 票根cash cheque 现金支票traveler's cheque 旅行支票cheque for transfer 转帐支票outstanding cheque 未付支票canceled cheque 已付支票forged cheque 伪支票Bandar's note 庄票,银票banker 银行家president 行长savings bank 储蓄银行Chase Bank 大通银行National City Bank of New York 花旗银行Hongkong Shanghai Banking Corporation 汇丰银行Chartered Bank of India, Australia and China 麦加利银行Banque de I'IndoChine 东方汇理银行central bank, national bank, banker's bank 中央银行bank of issue, bank of circulation 发行币银行commercial bank 商业银行,储蓄信贷银行member bank, credit bank 储蓄信贷银行discount bank 贴现银行exchange bank 汇兑银行requesting bank 委托开证银行issuing bank, opening bank 开证银行advising bank, notifying bank 通知银行negotiation bank 议付银行confirming bank 保兑银行paying bank 付款银行associate banker of collection 代收银行consigned banker of collection 委托银行clearing bank 清算银行local bank 本地银行domestic bank 国内银行overseas bank 国外银行unincorporated bank 钱庄branch bank 银行分行trustee savings bank 信托储蓄银行trust company 信托公司financial trust 金融信托公司unit trust 信托投资公司trust institution 银行的信托部credit department 银行的信用部commercial credit company(discount company) 商业信贷公司(贴现公司)neighborhood savings bank, bank of deposit 街道储蓄所credit union 合作银行credit bureau 商业兴信所self-service bank 无人银行land bank 土地银行construction bank 建设银行industrial and commercial bank 工商银行bank of communications 交通银行mutual savings bank 互助储蓄银行post office savings bank 邮局储蓄银行mortgage bank, building society 抵押银行industrial bank 实业银行home loan bank 家宅贷款银行reserve bank 准备银行chartered bank 特许银行corresponding bank 往来银行merchant bank, accepting bank 承兑银行investment bank 投资银行import and export bank (EXIMBANK) 进出口银行joint venture bank 合资银行money shop, native bank 钱庄credit cooperatives 信用社clearing house 票据交换所public accounting 公共会计business accounting 商业会计cost accounting 成本会计depreciation accounting 折旧会计computerized accounting 电脑化会计general ledger 总帐subsidiary ledger 分户帐cash book 现金出纳帐cash account 现金帐journal, day-book 日记帐,流水帐bad debts 坏帐investment 投资surplus 结余idle capital 游资economic cycle 经济周期economic boom 经济繁荣economic recession 经济衰退economic depression 经济萧条economic crisis 经济危机economic recovery 经济复苏inflation 通货膨胀deflation 通货收缩devaluation 货币贬值revaluation 货币增值international balance of payment 国际收支favourable balance 顺差adverse balance 逆差hard currency 硬通货soft currency 软通货international monetary system 国际货币制度the purchasing power of money 货币购买力money in circulation 货币流通量note issue 纸币发行量national budget 国家预算national gross product 国民生产总值public bond 公债stock, share 股票debenture 债券treasury bill 国库券。

金融专业名词翻译汇总

金融专业名词翻译汇总为了帮助大家学好金融英语,提高金融水平,下面小编给大家带来金融专业名词翻译汇总,希望对大家有所帮助!金融专业名词翻译1一级市场primary market一致行动acting in concert一般性授权general mandate一般谘询及支援工作小组General Advisory and Support Working Team一般豁免general waiver; blanket waiver一般权证plain vanilla warrant一线多机multiple-work stations一篮子指数买卖盘index basket order一篮子货币basket of currencies; currency basket一篮子备兑证;一篮子权证basket warrant九龙证券交易所The Kowloon Stock Exchange金融专业名词翻译2上下限协议 ceiling-floor agreement上市 listing; flotation上市(复核)委员会 Listing (Review) Committee上市上诉委员会 Listing Appeals Committee《上市公司董事指引》Guide for Directors of Listed Companies 《上市公司董事进行证券交易的标准守则》Model Code for Securities Transactions by Directors of Listed Issuers上市公司资料库 Primary Market Database上市事宜谅解备忘录补篇(附件一) First Supplement to the Addendum to Memorandum of Understanding Governing Listing Matters上市事宜谅解备忘录补篇(重订版) Amended and Restated Addendum to Memorandum of Understanding Governing Listing Matters上市协议 Listing Agreement上市委员会 Listing Committee上市法团 listed corporation上市后的收购活动 post-listing acquisition上市规则 listing rules上市开放式基金 listed open-end fund (LOF)上市发行人 listed issuer上市证券 listed securities上市证券变动之月报 Monthly Return on Movement of Listed Securities上海市期货同业公会Shanghai Municipal Futures Industry Association金融专业名词翻译3上海联合产权交易所Shanghai United Assets and Equity Exchange上海证券中央登记结算公司Shanghai Securities Central Clearing and Registration Corporation上海证券交易所 Shanghai Stock Exchange上诉委员会(证监会) Appeals Panel (SFC)下一交收日到期/逾期数额报告(中央结算系统) Next Settlement Day Due/Overdue Position Report (CCASS)下载 download口头竞价 / 口头唱价(公开喊价) auction (=open outcry)大手交易 block trade大手交易机制;大手交易设施 Block Trade Facility; Block Trading Facility (BTF)大利市 Teletext大利市版页 Teletext page大利市资讯服务 Teletext Information Service大利市网络供应商费用 Teletext carrier charge大利市影像广播服务 Teletext video broadcast service大批登记服务 bulk registration service金融专业名词翻译4大宗交易 block trade大股东 substantial share holder; major share holder大型股 large cap stock大量户口转移指示 Mass Account Transfer Instruction (MassATI) 大量开盘 mass quote大额未平仓合约 large open position大额股票(中央结算系统)jumbo certificate(CCASS)大额持仓汇报协议 Large Exposure Report Agreement大额买卖盘 block order小型恒生指数期货合约 Mini-HSI Futures小型恒生指数期权合约 Mini-HSI Options已交收数额报告(中央结算系统)Settled Position Report(CCASS) 已停业公司 dormant company已终止经营之业务 discontinued operations已发行股份/股本/股票 issued shares;outstanding stock“已划分的买卖”制度(中央结算系统) isolated trades system(CCASS)。

金融名词解释大全

金融名词解释大全以下是一些常见的金融名词及其解释:1. 资产(Asset):指一项可提供经济利益的资源或权益。

2. 负债(Liability):指一个企业或个人欠他人的款项或义务。

3. 资本(Capital):企业用于投资的资金,包括拥有者的权益和负债。

4. 利润(Profit):一个企业在销售产品或提供服务后的净收入。

5. 利息(Interest):借款人向贷款人支付的资金,作为借款的成本。

6. 股票(Stock):表示一个企业所有权的一种证券。

7. 债券(Bond):企业或政府借钱的一种方式,发行债券给债券持有人,承诺在未来支付利息并偿还本金。

8. 指数基金(Index Fund):一种投资基金,追踪特定金融指数的投资组合。

9. 期货(Futures):一种金融合约,约定在特定日期购买或销售某种资产,以特定价格交付。

10. 期权(Options):拥有者可以在特定时间内购买或销售某种资产的权利,但没有义务。

11. 信用评级(Credit Rating):信用评级机构对企业或债券的信用风险进行评估的等级。

12. 投资组合(Investment Portfolio):一个人或机构所有的投资项目的集合。

13. 资产管理(Asset Management):管理个人或机构投资组合的活动。

14. 风险管理(Risk Management):识别、评估和应对风险的活动,以保护资金。

15. 财务比率(Financial Ratio):用来分析和比较企业财务状况的指标。

16. 摩擦成本(Frictional Cost):指金融交易的各种成本,如手续费、税费等。

17. 市场价格(Market Price):基于买卖双方的交易行为确定的某一资产的价格。

18. 经济周期(Economic Cycle):一国或一地区经济活动的周期性波动。

19. 流动性(Liquidity):指资产可以迅速变现为现金的能力。

20. 预算(Budget):在特定时期内,按计划制定的收入和支出的金额。

金融行业中英文词汇对照汇总

金融行业中英文词汇对照汇总在金融行业中,掌握和了解中英文词汇的对照非常重要。

本文将汇总一些常见的金融行业词汇,以便读者可以更好地理解和运用这些术语。

1. 金融市场•Financial Market(金融市场)•Stock Market(股票市场)•Bond Market(债券市场)•Foreign Exchange Market(外汇市场)•Commodity Market(商品市场)•Derivatives Market(衍生品市场)2. 金融产品•Stocks(股票)•Bonds(债券)•Mutual Funds(共同基金)•ETFs (Exchange-Traded Funds)(交易所交易基金)•Options(期权)•Futures(期货)•Swaps(掉期协议)•Currencies(货币)•Commodities(商品)3. 金融机构•Bank(银行)•Commercial Bank(商业银行)•Investment Bank(投资银行)•Central Bank(中央银行)•Insurance Company(保险公司)•Brokerage Firm(经纪公司)•Asset Management Company(资产管理公司)4. 财务指标•Net Income(净利润)•Revenue(营业收入)•Expenses(费用)•Assets(资产)•Liabilities(负债)•Equity(股东权益)•Return on Investment(投资回报率)•Profit Margin(利润率)•Cash Flow(现金流)•Earnings per Share(每股收益)5. 金融服务•Banking Services(银行服务)•Investment Services(投资服务)•Insurance Services(保险服务)•Financial Planning(财务规划)•Wealth Management(财富管理)•Risk Management(风险管理)•Retirement Planning(退休规划)•Tax Services(税务服务)6. 金融专业名词•Economics(经济学)•Finance(金融学)•Accounting(会计学)•Portfolio Management(投资组合管理)•Asset Allocation(资产配置)•Risk Assessment(风险评估)•Hedge Fund(对冲基金)•Interest Rate(利率)•Inflation(通胀)•Capital(资本)7. 国际金融相关词汇•International Monetary Fund(国际货币基金组织)•World Bank(世界银行)•Export(出口)•Import(进口)•Balance of Trade(贸易差额)•Foreign Direct Investment(外国直接投资)•Exchange Rate(汇率)•Trade Surplus(贸易顺差)•Trade Deficit(贸易逆差)•Sovereign Debt(主权债务)以上仅为一些常见的金融行业中英文词汇对照,读者可以根据需要进一步扩充和学习。

(完整word版)金融术语中英文对照(word文档良心出品)

Back-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balance sheet date 年结日Balloon maturity 到期大额偿还Balloon payment 期末大额偿还Bank, Banker, Banking 银行;银行家;银行业国际结算银行Bank forInternational Settlements(BIS)Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis Point (BP) 基点;点子一个基点等如一个百分点(%)的百分之一。

举例:25个基点=0.25%Basis swap 基准掉期Basket of currencies 一揽子货币Basket warrant 一揽子备兑证Bear market 熊市;股市行情看淡Bear position 空仓;空头Bear raid 疯狂抛售Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Benchmark mortgage pool 按揭贷款基准组合Beneficiary 受益人Bermudan option 百慕大期权百慕大期权介乎美式与欧式之间,持有人有权在到期日前的一个或多个日期执行期权。

Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买入的一个价格。

与金融相关的英语名词解释

与金融相关的英语名词解释Introduction(引言)金融作为现代社会不可或缺的重要组成部分,涉及到众多专业术语和名词。

熟悉和理解这些金融术语对于从事金融行业的专业人士以及普通投资者都至关重要。

本篇文章将为您解释一些与金融相关的英语名词,旨在帮助读者更好地理解金融领域的术语。

1. Assets(资产)Assets refer to anything of value that is owned by an individual, company, or organization. These can include tangible assets such as property, equipment, and cash, as well as intangible assets like patents, copyrights, and brand reputation. Understanding the value and composition of assets is crucial for evaluating financial health and making investment decisions.2. Liabilities(负债)Liabilities are the opposite of assets, representing the obligations or debts owed by an individual, company, or organization. These can include loans, mortgages, payables, or any other financial obligations. Managing liabilities is essential for maintaining financial stability and evaluating one's ability to meet financial obligations.3. Stocks(股票)Stocks, also known as shares or equities, represent ownership in a company. By owning shares of stock, individuals become partial owners of the company, sharing in its profits and losses. Stocks are traded on stock exchanges, and their prices are influenced by various factors such as company performance, market conditions, and investor sentiment.4. Bonds(债券)Bonds are financial instruments issued by governments, municipalities, or corporations to borrow money from investors. When an investor buys a bond, they are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are often considered less risky investments compared to stocks, as they offer fixed income and are generally less influenced by market fluctuations.5. Mutual Funds(共同基金)Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. Professional fund managers handle the investments and make decisions based on the fund's investment objective. Mutual funds provide individuals with opportunities to access a wide range of investment options without requiring large amounts of capital.6. Hedge Funds(对冲基金)Hedge funds are investment partnerships that employ various sophisticated strategies to generate high returns for their investors. Unlike mutual funds, hedge funds typically target wealthy individuals and institutional investors due to higher minimum investment requirements. Hedge funds often use leverage, short-selling, and derivatives to hedge risks and seek greater profits.7. Derivatives(衍生品)Derivatives are financial instruments whose value is derived from an underlying asset or index. Examples of derivatives include futures contracts, options, and swaps. Derivatives are used for hedging against price fluctuations, speculating on future price movements, or managing risks in financial markets.8. IPO(Initial Public Offering)(首次公开募股)IPO refers to the process through which a private company offers its shares to the public for the first time and becomes a publicly traded company. This allows the company to raise capital by selling ownership stakes to investors. IPOs are closelymonitored by investors and analysts as they provide an opportunity to invest in potentially high-growth companies at an early stage.Conclusion(结论)本篇文章介绍了与金融相关的一些英语名词的解释,希望能够帮助读者更好地理解金融领域的术语。

金融专业名词翻译(九十)

金融专业名词翻译(九十)学金融专业的同学们可能不知道相关专业的英语单词怎么读吧,下面是小编为您收集整理的金融专业名词翻译,供大家参考!金融专业名词翻译(九)公平竞争level playing field(cfunevenplayingfield)公正交易arm'slength transaction公告板bulletin board公众利益public interest公众利益董事Public Interest Director公众持股市值public float capitalisation公众持股量public float;free float公开叫价交易open outcry trading公开市场活动open market operations公开作价call-over公开招股offer to the public公开售股open offer公开密码匙基础建设Public Key Infrastructure(PKI)公开喊价/叫价(= 口头竞价)openout cry(=auction)公开发售offer for sale;open offer公开认购offer for subscription公开谴责public censure公开权益disclosure of interests《公认会计原则》Generally Accepted Accounting Principles(GAAP)公积金计划Provident Fund Scheme分包销商sub-underwriter分列登记册Split Register分行证明书branch certificate分拆/ 分拆上市spin-off分派distribution分销distribution分类指数sub-index分类账sub-ledger金融专业名词翻译(十)午市afternoon session反向可转换产品reverse convertibles反收购reverse takeover反收购文件defence document反通货膨胀disinflation反驳交易rejected sales反弹rally反馈测试模式betatest mode太平洋区资本市场研究中心Pacific-Basin Capital Markets Research Center太平洋经济合作会议Pacific Economic Cooperation Council(PECC)太平洋证券交易所Pacific Stock Exchange(PSE)少数股东minority shareholder少数股东权益minority interest巴塞尔协定Basel Concordat巴塞尔协议Basel Agreement巴塞尔银行监管委员会(巴塞尔委员会)Basel Committeeon Banking Supervision(Basel Committee)引伸波幅implied volatility户口结单statement of account户口结余月结单(中央结算系统) Monthly Balance Statement(CCASS)户口转移指示Account Transfer Instruction(ATI)。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

让知识带有温度。

金融专业名词翻译集锦

为了关心大家学好(金融英语),提高金融水平,下面我给大家带来金融专业名词翻译集锦,盼望对大家有所关心!

金融专业名词翻译集锦1

“不公正损害”补救unfair prejudice remedy不公正竞争uneven playing field不行抗力force majeure不定额供款variable contribution 不活跃公司dormant company不派息欧式认沽期权non-dividend paying European put option不派息欧式认购期权non-dividend paying European call option不限量发行tap issue不记名式国库券(中国内地) Bearer Treasury (Mainland China)不记名证券bearer securities不停电电源装置;不间断电源装置uninterrupted power supply (ups)不动盘inactive order不当行为misconduct中小企业板块(深圳证券交易所) SME Board (Shenzhen Stock Exchange)中介人财务规管制度工作小组Working Group on Review of Financial Regulatory Framework for Intermediaries

金融专业名词翻译集锦2

中介控股公司intermediate holding company中介现象intermediation中介机构/团体intermediary中午资料传送服务

Mid-day Data File Transfer Service中文资讯系统Chinese News System中外合资企业Sino-foreign equity joint venture中心代理人central nominee中心交易纪录central transaction log中心存管处central depository中心股份借贷系统centralised borrowing and lending system中心国债登记结算有限责任公司(中心国债登记结算公

司)China Government Securities Depository Trust Clearing Co.Ltd.(CDC)中心掌握工作站controller workstation中心结算及交收系统(中心结算系统)Central Clearing and Settlement System(CCASS)《中心结算系统一般规章》General Rules of CCASS中心结算系统互联网系统CCASS Internet System中心结算系统保证基金CCASS Guarantee

第1页/共3页

千里之行,始于足下

Fund中心结算系统强制证券借贷服务Compulsory Stock Borrowing and Lending Service in CCASS中心结算系统参加者及指定银行名录CCASS Participant Designated Bank List中心结算系统参加者保荐户口CCASS Participant Sponsored Account中心结算系统登记册CCASS Register

金融专业名词翻译集锦3

《中心结算系统运作程序规章》CCASS Operational Procedures 中心结算系统证券存管处CCASS Depository中心结算对手central counter party(CCP)中心买卖盘纪录central orderbook中心证券存管处国际会议Conference of Central Securities Depositories(CCSD)中位价期权middle-price doption中型股mid-cap stock中国人民银行Peoples Bank of China(PBOC)中国内地发行人PRC issuer《中国公司在香港上市指南》(刊物) Listing Chinese Companies in

HongKong(publication)中国存托凭证China depository receipt(CDR)中国投资进展促进会China Association for the Promotion of Investment(CAPI)中国(保险)监督管理委员会(中国保监会)China Insurance Regulatory Commission(CIRC)中国国际经济贸易仲裁委员会China International Economic and Trade Arbitration Commission中国注册会计师协会Chinese Institute of Certified Public Accountants(CICPA)中国会计学会Accounting Society of China(ASC)中国证券市场网页China Stock Markets Web中国预托证券China depository receipt(CDR)中国银行业监督管理委员会(中国银监会) China Banking Regulatory Commission (CBRC)中国证券登记结算有限责任公司(中国结算公司)China Securities Depository Clearing Corporation Limited(CSDCC)中国证券业协会The Securities Association of China(SAC)中国证券业协会基金公会The Chinese Association of Securities Investment Funds(CASIF)中国证券业协会证券分析师专业委员会Securities Analysts Association of China(SAAC)中国证券监督管理委员会(中国证监会)China Securities Regulatory Commission(CSRC)

金融专业名词翻译集锦4

第2页/共3页

让知识带有温度。

《公司(上市公司的财务

文档内容到此结束,欢迎大家下载、修改、丰富并分享给更多有需要的人。

第3页/共3页。