Off-Balance Sheet Activities of Commercial Banks in the Philippines

Off-balance-sheet

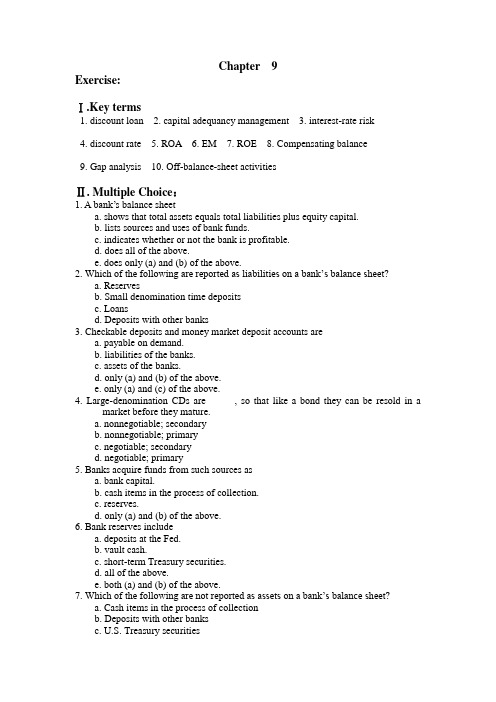

Chapter 9Exercise:Ⅰ.Key terms1. discount loan2. capital adequancy management3. interest-rate risk4. discount rate5. ROA6. EM7. ROE8. Compensating balance9. Gap analysis 10. Off-balance-sheet activitiesⅡ. Multiple Choice:1. A bank’s balance sheeta. shows that total assets equals total liabilities plus equity capital.b. lists sources and uses of bank funds.c. indicates whether or not the bank is profitable.d. does all of the above.e. does only (a) and (b) of the above.2. Which of the following are reported as liabilities on a bank’s balance sheet?a. Reservesb. Small denomination time depositsc. Loansd. Deposits with other banks3. Checkable deposits and money market deposit accounts area. payable on demand.b. liabilities of the banks.c. assets of the banks.d. only (a) and (b) of the above.e. only (a) and (c) of the above.4. Large-denomination CDs are _____, so that like a bond they can be resold in a _____ market before they mature.a. nonnegotiable; secondaryb. nonnegotiable; primaryc. negotiable; secondaryd. negotiable; primary5. Banks acquire funds from such sources asa. bank capital.b. cash items in the process of collection.c. reserves.d. only (a) and (b) of the above.6. Bank reserves includea. deposits at the Fed.b. vault cash.c. short-term Treasury securities.d. all of the above.e. both (a) and (b) of the above.7. Which of the following are not reported as assets on a bank’s balance sheet?a. Cash items in the process of collectionb. Deposits with other banksc. U.S. Treasury securitiesd. Checkable deposits8. Of the following bank assets, the most liquid isa. consumer loans.b. state and local government securities.c. physical capital.d. U.S. government securities.e. commercial loans.9. In general, banks make profits by selling _____ liabilities and buying _____ assets.a. long-term; shorter-termb. short-term; longer-termc. illiquid; liquidd. risky; risk-free10. When you deposit $50 in your account at First National Bank and a $100 check you have written on this account is cashed at Chemical Bank, thena. the liabilities of First National decrease by $50.b. the reserves at First National increase by $50.c. the liabilities at Chemical Bank increase by $50.d. only (a) and (b) of the above occur.11. When $1 million is deposited at a bank, the required reserve ratio is 20 percent, and the bank chooses not to hold any excess reserves but makes loans instead, then, in the bank’s final balance sheet,a. the assets at the bank increase by $800,000.b. the liabilities of the bank increase by $1,000,000.c. the liabilities of the bank increase by $800,000.d. reserves increase by $160,000.12. If a bank has $100,000 of deposits, a required reserve ratio of 20 percent, and it holds $30,000 in reserves, and then it has enough reserves to support a deposit outflow ofa. $20,000.b. $11,000.c. $5,000.d. either (a) or (b) of the above.e. either (b) or (c) of the above.13. Banks protect themselves from the disruption of deposit outflows bya. holding excess reserves.b. selling securities.c. “calling in” loans.d. doing all of the above.e. doing only (a) and (b) of the above.14. A bank holding insufficient reserves can meet its reserve requirements bya. borrowing federal funds.b. borrowing from other banks.c. selling secondary reserves.d. all of the above.e. both (a) and (b) of the above.15. One way for a bank to assure depositors that it is not taking on too much risk, and so obtain their deposits, is for it toa. diversify its loan portfolio.b. reduce its equity capital.c. lengthen the maturity of its assets.d. shorten the maturity of its liabilities.16. Compensating balancesa. are a particular form of collateral commonly required on commercial loans.b. are a required minimum amount of funds that a borrower (i.e., a firm receiving a loan) mustc. keep in a checking account at the bank.d. allow banks to monitor firms’ check payment practices which can yield information about their borrowers’ financial conditions.e. all of the above.17. Credit rationing occurs when a banka. refuses to make a loan of any amount to a borrower, even when she is willing to pay a higher interest rate.b. restricts the size of the loan to less than the borrower would like.c. does either (a) or (b) of the above.d. does neither (a) nor (b) of the above.18. Credit risk management tools include:a. compensating balances.b. collateral.c. restrictive covenants.d. all of the above.e. only (a) and (b) of the above.19. Examples of off-balance–sheet activities includea. loan sales.b. foreign exchange market transactions.c. trading in financial futures.d. all of the above.e. eonly (a) and (b) of the above.20. Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities with a duration of 1.05. The duration gap for this bank isa. 0.5 year.b. 1 year.c. 1.5 years.d. 2 years.e. 2.4 years.Ⅲ. Calculation1.Assets LiabilitiesRate-sensitive $20 million $50 millionFixed-rate $80 million $50 million(a)If interest rates rise by 5 percentage points, say, from 10 to 15%, bank profits (measured using gap analysis) will how to change?(b)Assuming that the average duration of its assets is five years, while the average duration of its liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of First National how to change?2. Suppose that you are the manager of a bank whose $100 billion of assets have an average duration of four years and whose $90 billion of liabilities have a n averageduration of six years. Conduct a duration analysis for the bank, and show what will happen to the net worth of the bank if interest rate by 2%?Ⅳ. Analyzing and explanation1.What happens to reserves at first National Bank if one person withdraws $1000 of cash and another person deposits $500 of cash? Use T-account to explain your answer.2.Assume a customer deposits $1000 in her bank. Show in a T-account the effect of this deposit. If the bank is subject to reserve requirements, show in a second T-account the banks balance sheet indicating required and excess reserve. In a third T-account, show the change in the bank’s balance sheet when the bank makes loans with the excess reserves.3.Rank the following bank assets from most to least liquid: a. Commercial b.Securities c.Reserve d.Physical capital.4.Explain the general principle of bank management.5.A bank almost always insists that the firms it lends to keep compensating balances at the bank, why?Ⅴ. Compiling and analyzing1. Assume the following balance sheet for the First National Bank:the effect of a 3 percent decrease in rates? Why is knowledge of interest-rate risk important? How might banks respond if rates are expected to change unfavorably?2. Explain the relationship between return on assets and return on equity. What incentives does this relationship give a bank manager? Is this the desired outcome preferred by regulators? Discuss.Answer:Ⅰ. Key terms1. A bank’s borrowings from the Federal Reserve System; also know as advanc e.2. A bank’s decision about the amount of capital it should maintain and then acquisition of needed capital.3. The possible reduction in returns associated with changes in interest rate.4. The interest rate that the Federal Reserve charges banks on discount loan.5. Net profit after taxes per dollar of asset.6. The amount of assets per dollar of equity capital.7. Net profit after taxes per dollar of equity capital.8. A required minimum amount of funds is that a firm receiving a loan must keep in a checking account at the lending bank.9. A measurement of the sensitivity of bank profit to changes in interest rates, calculated by subtracting the amount of rate-sensitive liabilities from the amount of rate-sensitive assets.10. Bank activities that involve trading financial instruments and the generation of income from fees and loan sales, all of which affect bank profit but are not visible on bank balance sheetsⅡ. Multiple Choice:1 e2 b3 d4 c5 a6 e7 d8 d9 b 10 a 11 b 12 e13 d 14 d 15 a 16 d 17 c 18 d 19 d 20 cⅢ. calculation1. Answer:(a) decline by $1.5 million.(= $20 million×5%-$50 million×5%)(b) decline by $10 million.(= $100 million×5%×5 years-$100 million×5%×3 years)2. Answer: The assets fall in value by $8million(=$100 million×-2%×4 years ) while the liabilities fall in value by $10.8 million(=$90 million×-2%×6 years).Since the liabilities fall in value by $2.8 million more than the assets do, the net worth of the bank rises by $2.8 million.Ⅳ. Analyzing and explanation1. Answer: Reserve drop by $500.The T-account for the First National Bank is as follows:First National BankLoans$9003. Answer: The rank from most to least liquid is (c),(b),(a),(d)4. Answer: The first is to make sure that the bank has enough ready cash to pay its depositors when there are deposit outflow, the bank must engage in liquidity management. Second, the bank manager must pursue an acceptably low level of risk by acquiring assets that have a low rate of default and by diversifying asset holding (asset management).The third concern is to acquire funds at low cost(liability management).5. Answer: Compensating balance can act as collateral. They also help establish long-term customer relation-ships, which make it easier for the bank to collect information about prospective borrowers, thus reducing the adverse selection problem. Compensating balances help the bank monitor the activities of a borrowing firm so that it can prevent the firm from taking on too much risk, thereby not acting in the interest of the bank.Ⅴ. Compiling and analyzing1. Answer: The gap is –$40 million. A 4 percent rate increase reduces profits by $1.6 million, while a 3 percent rate decrease increases profits by $1.2 million. Obviously, knowledge of interest-rate risk is important for understanding the impact of interest rate changes on bank profits. If an adverse change in interest rates is expect, banks can change their assets and liability mix to reduce or eliminate unfavorable gaps.2. Answer: For a given return on assets, the greater the amount of capital, the lower is the return on equity. Bank managers who seek to increase the return on equity must increase the asset base, purchase riskier assets, or reduce the amount of capital by paying dividends or buying back stock.Regulators (and depositors) prefer higher capital for bank safety. Managers typically prefer lower equity than regulators, resulting in regulatory bank capital requirements.。

金融词汇英汉详解词典

Asset Play资产隙Asset Redeployment资产重新配置Asset Swap资产互换Asset Valuation资产估值Assets Under Management管理资产额Assignment转让At the Money到价ATP套汇交易理论Auction Market拍卖市场Audit审计Auditor's Report审计师报告Authorized Stock授权股份Auto Sales汽车销售额Automated Bond System(ABS)自动债券系统Automated ConfirmationTransaction Service(ACT)自动确认交易系统Average Annual GrowthRate平均年度增长率Average Annual Return平均年度回报率Average Life平均时期Average Price Call平均价格买入期权权Average Price Put平均价格出售期权Average Up提高平均价格Back Door Listing后门上市/借壳上市Backlog订单积压Back Office后线Back Pricing往后定价Back-to-Back Loan背对背贷款Backstop最后担保Bad Debt不良贷款Balanced Fund平衡基金Balanced InvestmentStrategy平衡投资策略Balance Of Payments(BOP)国际收支差额Balance Of Trade (BOT)国际贸易差额Balance Sheet资产负债表Balloon Option气球型期权Bancassurance银行出售保险Bank Guarantee 银行担保Balloon Maturity 气球型期限Asset Turnover 资产周转率Average Price 平均价格Buy-Side买方Buyer's Market买方市场Buying Hedge买入对冲CD存款证CEDELCEDEL CEO首席行政官CFA 注册财务分析师CFO首席财务官COGS已售商品成本COO首席营运官CPA注册公共会计师CPI消费物价指数Calendar Year日历年Call买入期权Call Date买回日期Call Loan短期同业拆借,通知贷款Call Loan Rate短期同业拆借利率,通知贷款利率Call Option买入期权Call Warrant买入认股权证Callable Bond可买回债券Callable Preferred Stock可买回优先股CAMELS Rating System CAMELS评级制度Capital Account资本帐户Capital Adequacy Ratio(CAR)资本充足率Capital Appreciation资本升值Capital Asset资本资产Capital Budgeting资本预算Capital Expenditure资本开支Capital Gain 资本收益Capital Goods资本财货Capital Guarantee Fund资本保证基金Capital Intensive 资本密集Capital资本/资本金Capital Asset PricingModel (CAPM)资本资产计价模型Call Premium 买回溢价Capital Base资本金基础Capital Employed 运用资本Current Assets流动资产Current Liabilities流动负债Current Maturity现时年期Current Price现时价格Current Ratio流动比率Current Yield现时收益率Cushion Bond保收债券CUSIP Number美国证券库斯普号码Custodian保管人Cyclical Industry周期性行业Cyclical Stock周期性股票Cyclical Unemployment周期性失业DJIA道琼斯工业平均指数DJUA 道琼斯公用事业平均指数Data Mining 数据探索Days Payable Outstanding (DPO)应付账款天数Days Sales Outstanding (DSO)应收账款天数Debenture 公司债券Debit 借项、借方Debt 债务Debt Equity Ratio 债务股本比Debt Equity Swap债换股交易Debt Financing债务融资Debt Ratio负债比率Debt Restructuring债务重组Debt Security债务证券Debt Service还本付息Debt Service CoverageRatio债务偿付比率Debtor债务人Debt Overhang债务积压Declaration Date股息宣告日Default Risk违约风险Defeasance宣告(合约)无效、废止契约Defensive Buy防御性投资Defensive InvestmentStrategy防御性投资策略Deferred Account递延帐户Deferred Annuity递延年金Deferred Income Tax递延所得税Deferred Interest Bond递延利息债券Deferred Revenue 递延收入Custodial Account 保管帐户DJTA道琼斯交通平均指数Deep Discount Bond 高折扣债券Default违约,未能履行合约Valuation估值Value-Added增值Value-Based Pricing以价值为基础的定价Value Chain价值链Value at Risk (VAR)风险价值Value Investing价值投资Value Stock 价值股票Vanilla Option 单纯期权Variable Cost 可变成本Variable Life Insurance Policy可变寿险保单Vendor Financing供应商融资Venture创业项目Venture Capital创业资本Venture Capital Fund创业基金Venture Capitalist创业基金投资者Vertical Integration纵向整合Vertical Market纵向市场Vertical Merger纵向合并Volume Of Trade交易量、成交量Voting Right投票权Voting Shares投票股票Voting Trust投票信托Voting Trust Agreement投票信托协议Vulture Fund兀鹫基金WTO世界贸易组织War Bond战争债券Warrant认股权证Warrant Coverage认股权证比重Warrant Premium 认股权证溢价Vulture Capitalist 兀鹫投资者WACC 加权平均资本成本Volatility 波动性Wall Street 华尔街Wealth Added Index (WAI)财富增值指数Wealth Effect财富效应Wealth Management 财富管理Weighted Average MarketCapitalization加权平均总市值White Elephant白象White Knight白武士White Paper白皮书Wholesale Banking批发银行Wholly Owned Subsidiary全资拥有子公司Withholding预扣(税)Withholding Tax预扣(税)Working Capital营运资金Working Capital Turnover营运资金周转率Working Ratio流动比率Work in Progress在建项目World Trade Organization(WTO)世界贸易组织Write-Down减记Write-Off销记、注销Write-Up 增记Yankee Bond扬基债券Yankee CD扬基存款证Year To Date (YTD)本年迄今Yellow Knight黄武士Yield To Call 买回收益率Zero-Sum Game 零和游戏Yield To Maturity (YTM)到期收益率Yield 收益率Weighted Average Cost of Capital (WACC)加权平均资本成本由政府机构发行的债券Agency"。

第03章 资本市场(讲义)简易版

Section 3.1 Text⏹Purpose and ParticipantsFirms that issue capital market securities and the investors who buy them have very different motivations than they have when they operate in the money market. Firms and individuals use the money market primarily to warehouse funds for short periods of time until a more important need or a more productive use for the funds arises. By contrast, firms and individuals use the capital market for long-term investments. The capital markets provide an alternative to investment in asset such as real estate or gold. Meanwhile, the primary reason that individuals and firms choose to borrow long-term funds is to reduce the risk that interest rates will rise before they pay off their debt. This reduction in risk comes at a cost. However, most long-term interest rates are higher than short-term rates due to risk premiums. Despite the need to pay higher interest rates to borrow in the capital markets, these markets remain very active.The primary issuers of capital market securities are governments and corporations. However, governments never issue stocks.Corporations both issue bonds and stocks. One of the most difficult decisions a firm faces can be whether it should finance its growth with debt or equity. The distribution of a firm’s capital between debt and equity is its capital structure.⏹Trading in the Capital MarketCapital market trading occurs in either the primary market or the secondary market. Investment funds, corporations, and individual investors can all purchase securities offered in the primary market, where new issues of stocks and bonds are introduced. When firms sell securities for the first time, the issue is an initial public offering.The capital markets have well-developed secondary market. A secondary market is where the sale of previously issued securities takes place, and it is important because most investors plan to sell long-term bonds before they reach maturity and eventually to sell their holdings of stocks as well.1. BondsThe capital markets are where securities with original maturities of greater than one year trade. Capital market securities fall into three categories: bonds, stocks, and mortgages. In this section, we focus on bonds.Bonds are securities that represent a debt owed by the issuer to the investor. Bonds obligate the issuer to pay a specified amount at a given date.Treasury BondsThe government issues notes and bonds to finance the national debt. The difference between notes and bonds is that notes have an original maturity of 1 to 10 years while bonds have an original maturity of 10 to 30 years. (Recall from last chapter that Treasury bills mature in less than 1 year.)Government notes and bonds are free of default risk because the government can always print money to pay off debt if necessary.Corporate BondsWhen large corporations need to borrow funds for long periods of time, they may issue bonds. The bond indenture is a contract that states the lender’s rights and privileges and the borrower’s obligations. Any collateral offered as security to the bondholders will also be described in the indenture.The degree of risk varies widely among issues because the risk of default depends on the company’s health, which can be affected by a number of variables. The interest rate on corporate bonds varies with the level of risk. Bonds issued by a company with high credit rating has lower interest rates than those with poor ratings.2. StocksShares of stock in the firm represent ownership. A stockholder owns a percentage interest in a firm consistent with the percentage of outstanding stock held. The ownership is in contrast to a bondholder, who holds no ownership interest but is rather a creditor of the firm.Ownership of stocks gives the stockholder certain rights regarding the firm. One is the right of a residual claimant: Stockholders have a claim on all assets and income left over after all other claimants have been satisfied. If nothing is left over, they get nothing. As noted, however, it is possible to get rich as a stockholder if the firm does well.Investors can earn a return from stocks in one of two years. Either the price of the stock rises over time, or the firm pays the stockholder dividends. Frequently, investors earn a return from both sources. Stocks are more risky than bonds because stockholders have a lower priority than bondholders when the firm is in trouble. The returns to investors are less assured because dividends can be easily changed, and stock price increases are not guaranteed. Despite these risks, it is possible to make a great deal of money by investing in stocks, whereas it is very unlikely by investing in bonds. Another distinction between stocks and bonds is that stocks do not mature.Section 3.2 Specialized TermsAsset n.liquid(current、floating、working、circulating)assetsnon-performing assetnon-performing loaninvisible assets / intangible assetsassets management companyasset restructuring / assets reorganizationassets evaluation / assets appraisal / property assessment / capital ratingratio of liabilities to assets / asset-liability ratioFixed assets refer to assets bought by a company for its continued use for a number of years, rather than for resale. There are three categories of fixed assets: 1) tangible assets, such as land and equipment, 2) intangible assets, such as a company's logo or brand, 3) investments, such as stakes in joint ventures.Premium n.A premium of 2 per cent is paid on long-term investments.Your first premium is now due.Specific regulations governing the issue of share certificates at a premium are separately issued by the State Council.Obligate v.Bonds obligate the issuer to pay a specified amount at a given date.The regulation obligates listed companies to release information about their operations. Rating n.The United States held S&P's top rating for seventy years and never had a downgrade. However, last Friday one of the three major credit rating agencies — S&P, downgraded long-term United States government debt. S&P lowered its opinion of Treasury securities one step from the highest rating, triple-A, to AA-plus.The goal is to improve the country's credit rating so as to ease the concerns of investors and reduce borrowing costs.Stock n.preferred stock common stockStock holder = share holder Stock exchange = stock markettrash stock state-owned stockSpecial treatment stock performance stockblue chip red chip controlling shareholder / majority shareholder Corporations can sell stock as a way to raise money. Stock represents shares of ownership in a company. Investors who buy stock can trade their shares or keep them as long as the company is in business.Dividend n.A company might use some of its earnings to pay dividends as a reward to shareholders. Or the company might reinvest the money back into the business.For a growing company, it will have to keep most of its profit to buy more plants and equipment and thus its dividend payout ratio will be lowPrincipal n. adj.repay principal and interestPrincipal-Agent relationshipIn financial services, the principal mechanism of risk control is self-regulation by the sector.Outstanding adj.outstanding billoutstanding debt outstanding loan outstanding issueoutstanding balanceThe outstanding bill must be paid next week.The Bank or credit-card company settles the client's Bills, invoicing him monthly and charging interest on any outstanding debts.IPO= Initial Public OfferingsInitial public offering is a type of offering where the company sells its stock to the public in the securities market, to raise funds and to be listed.Seasoned equity offering is a type of offering where publicly traded companies issue new shares of stock because the capital raised from the previous offering did not meet the companies needs. Types of SEO include share allotment, public equity offerings,convertible corporate bonds offerings and private equity offerings.Bailout n.Bailout loan: Loan made to borrower whose ability to service outstanding indebtedness has become doubtful.Buyout n.The buyout negotiation lasted several days.The more profitable the company is, the easier to raise funds for the buyout.List v.We encouraged eligible large state-owned enterprises to get listed after the stockholding system was established.Withdrawal of state-owned stock helps optimize share-holding structure of listed company. Prior to the submission of IPO programs, the company had the intention to backdoor listing. Disclosure n.The CSRC required securities companies to provide risk disclosure statements.State proposed regulations to standardize the information disclosure.Unless assets are publicly disclosed, corruption is still going to be an issue. Derivative adj. n.Financial DerivativesDerivative SecuritiesFinancial derivative instruments Convertible bond is a hybrid derivative security that has characters of both stock and bond.Merge v.We have decided to merge these small firms into one large company.Please merge all these items together under the item of "incidental expenses".Merge and acquisition (M&A) is an important and effective way for enterprises to expand. Mergers and AcquisitionsAcquisition n.share acquisitionIts competitors have already begun the acquisition and integration work.Upon completion of this acquisition, the company will become the controlling shareholder.Section 3.3 Subject TopicThe Future Financial Centers of ChinaA: As we all know, both Hong Kong and Shanghai are going to be China’s future financial centers. But I think they have their respective characteristics. Do you think so? B: Yes. Hong Kong is a free port and one of the world’s most important markets for gold, foreign exchange and capital everyday. Capital from all over the world flows in and out freely. It has a highly advanced communication network. At the same time, It possesses a management advantage with advanced service industries and numerous qualified personnel. It also has a favorable market environment. However, Hong Kong has its difficulties, such as narrow space, high service cost and more challenges from new financial centers such as Singapore and Taiwan. However, as a financial center witha free capitalist system, Hong Kong would forever be a joint point of Sino-Europeancivilization. It is a bridge that links China with the rest of the world.A: That is true. Compared with Hong Kong, Shanghai also enjoys a great deal of advantages, like wider space and lower service cost. The production capacity of Shanghai is immense.If Shanghai fully exerts its production capacity, it would become incomparable in the future. Since Shanghai has a large population and is the economic center of the Yangtze Valley, its market is extensive. Moreover, in recent years, its investment environment has become more and more favorable. Therefore, a large number of multinational companies and foreign-funded institutions have been attracted to establish their branches there.There foreign investments have stimulated the economic development of Shanghai. In addition, Pudong has opened up and become the financial core of Shanghai.B: What you have said is right, but I think if Shanghai wants to become one of the top financial centers in Asia, it should further improve itself. First of all, it should maintain a sound socialist market-oriented economy with a complete legal system in thefinancial field as the basis. Secondly, it should form a highly advanced financial market system. The system should include an open market for foreign exchange, gold and capital.Next, it should attract more qualified personnel. They should be equipped with comprehensive knowledge in management, finance, trade and foreign languages. Its service industry and infrastructure construction should also be improved. Finally, Shanghai should fully exert its potential to become a highly developed financial center. A: I quite agree with you. Nowadays, with the opening up of China’s financial field, foreign-funded banks and domestic banks will become intense. Is this beneficial to China’s financial industry?B: Yes, the intense competition could in some way benefit China’s financial development.It will stimulate domestic banks to improve their management, operation and services.At the same time, foreign-funded banks in China will bring us advanced knowledge, experience and practice in management. Moreover, the intense competition will help to create a favorable investment environment in China. More opportunities would be provided for domestic banks to engage in international operations. Finally, it will promote fair competition in China’s economic field as well. However, the intense competition will also influence China’s financial environment. For one thing, compared with domestic banks, foreign-funded banks possess advantages in management, technology, service and qualified personnel. The competition will inevitably make domestic banks lose part of their traditional business to foreign-funded banks. The competition will also probably bring difficulties to the central bank’s financial supervision. Since foreign-funded bank s’ operation observes international practice, it differs from that of domestic banks. Therefore, it challenges the efficiency of the central bank’s supervision.Section 3.4 Questions and Answers1. What are the intermediate objectives of monetary policies?— a. Growth in money supplyb. Interest rate levelc. Growth in the volume of creditd. The exchange rate.2. Please point out the full name of SWIFT and its headquarter.— Society for World Inter-bank Financial Telecommunications. Brussels, Belgian.3. What is the biggest difference between off-balance sheet activities and intermediaryactivities of commercial banks?— Off-balance sheet activities constitute potential assets or liabilities and bear certain risk while intermediary activities don’t constitute risks in assets or liabilities.4. What is the main body of offshore financial market?— It is non-residents.。

如何平衡商业收益英语作文

如何平衡商业收益英语作文Title: Balancing Commercial Revenue: Strategies for Sustainable Growth。

In today's competitive business landscape, achieving a balance between generating revenue and maintaining ethical business practices is crucial for long-term success. While maximizing profits is essential, it should not come at the expense of compromising integrity or neglecting societal responsibilities. This essay will explore strategies for achieving this delicate balance.Firstly, diversifying revenue streams is key to mitigating risks associated with overreliance on a single source of income. By offering a variety of products or services tailored to different market segments, businesses can ensure steady cash flow even in fluctuating market conditions. Moreover, diversification fosters resilience and adaptability, enabling companies to navigate economic uncertainties with greater ease.Secondly, prioritizing customer satisfaction andloyalty can significantly enhance commercial revenue in the long run. Building strong relationships with customers through personalized experiences, attentive customer service, and quality products or services fosters brand loyalty and encourages repeat business. Additionally, satisfied customers are more likely to recommend the business to others, thereby expanding its customer base through word-of-mouth marketing.Furthermore, embracing innovation and technological advancements can unlock new revenue opportunities while streamlining operations. Investing in research and development allows businesses to stay ahead of competitors by continuously improving existing offerings or introducing innovative solutions to meet evolving consumer needs. Leveraging technology also enables businesses to optimize processes, reduce costs, and enhance productivity, ultimately driving profitability.However, while pursuing commercial success, it isimperative for businesses to uphold ethical standards and social responsibility. Engaging in transparent and ethical practices not only fosters trust and credibility among stakeholders but also mitigates the risk of reputational damage that could adversely affect revenue. Additionally, demonstrating commitment to environmental sustainability and community welfare can enhance brand reputation and attract socially conscious consumers.Moreover, maintaining financial prudence and exercising fiscal discipline are essential for ensuring long-term financial stability and sustainability. While it may be tempting to prioritize short-term gains, prudent financial management involves making strategic investments, managing debt responsibly, and maintaining adequate reserves for unforeseen circumstances. By avoiding excessive risk-taking and maintaining a healthy balance sheet, businesses can withstand economic downturns and capitalize on growth opportunities.In conclusion, achieving a balance between commercial revenue and ethical business practices requires a strategicapproach that prioritizes diversification, customer satisfaction, innovation, ethical conduct, social responsibility, and financial prudence. By adopting these strategies, businesses can not only drive sustainable growth and profitability but also contribute positively to society and the environment. Ultimately, the pursuit of commercial success should be guided by principles of integrity, accountability, and respect for stakeholders.。

财务会计术语

财会术语表AAccelerated methods of depreciation 加速折旧法Accounting equation 会计等式Accounting period会计期间Accounts payable 应付账款Accounts payable turnover 应付账款周转Accounts receivable应收账款Accounts receivable turnover 应收账款周转Accrual accounting 权责发生制会计Accruals 应计项目Accrued payables 应付款项Accumulated depreciation累计折旧Activity method 作业方法Activity ratios 作业比率Actuary 精算师,精算Additional paid-in capital 资本公积Aging schedule 账龄分析表Allowance method 备抵法Amortization摊销Analytic review 分析性复核Annual report年报Annuity年金Appropriation of retained earnings 留存收益分配Asset 资产Asset depreciation range (ADR) 资产折旧范围Asset impairment 资产清理Asset retirement 资产报废Asset turnover 资产周转率Audit审计Audit committee 审计委员会Audit opinion 审计意见Audit report 审计报告Authorized shares 授权股本,注册股份Available-for-sale securities 短期投资BBad debts 坏账Balance sheet资产负债表Bank reconciliation 银行对账单Basic earnings per share 基本每股盈利Betterment 改良"Big 5"五大会计师事务所board of directors 董事会bond 债券契约bonds payable 应付债券book gain/loss 账面收益/损失book value账面价值borrowing capacity 融资能力business acquisition 企业兼并business combination 企业合并business segment 企业内部责任单位CCall provision 提前赎回条款Capital 资产Capital lease 资本租赁Capital structure资本结构Capital structure leverage 资本结构杠杆Capitalization ratios 资本比率Capitalize 资本化Cash discount现金折扣Cash equivalent 现金等价物Cash flow 现金流Cash flow accounting 现金流量法会计Cash flow from financing筹资产生的现金流量Cash flow from investing 投资产生的现金流量Cash flow from operations 经营产生的现金流量Cash flow projection 现金项目Cash management 现金管理Certificate of deposit 存款单Certified public accountant 注册会计师Classified balance sheet 分类资产负债闭Clean audit opinion 无保留意见Collateral 抵押品,担保品Collection period 商业票据Common earnings leverage 普通收入杠杆Common stock 普通股Common-size financial statements Compensating balance 抵销余额Conservatism稳健Consignment 寄销品Consistency 连续性Consolidated financial statements 合并财务报表Contingency 或有事项Contingent liability或有负债Contra account 对销账户Contributed capital 实缴资本Controlling interest 控股权益Convertible bonds 可转换债券Copyright 版权Corporation 公司Cost成本Cost expiration 成本耗用Cost method成本法Cost of capital 资金成本Cost of goods sold 销货成本Covenant 契约CPA certified public accountant 注册会计师Credit quality 信用程度Credit rating 信用评级Credit terms 信用条件Creditor 债权人Cumulative preferred stock 累积优先股Current assets流动资产Current cost现行成本Current liabilities流动负债Current maturity of long-term debts 即将到期的长期负债Current ratio 流动比率DDebenture 债券Debt 债务Debt covenant 债务契约Debt investment 债权性投资Debt ratio 负债比率Debt redemptions 债务清偿Debt/equity ratio 负债/权益比率Default 违约Deferred cost 递延成本Deferred income 递延收益Deferred income taxes 递延所得税Deferred revenue 递延收入Defined benefit pension plan 即定收益养老金方案Defined contribution pension plan 即定供款养老金方案Depletion 折耗Depreciation 折旧Depreciation base 折旧系数Depreciation expense 折旧费用Diluted earnings per share 摊薄后每股盈利Dilution 摊薄Dilutive securities 摊薄证券Direct method 直线法Direct write-off method 直接注销法Discount on bond payable 应付债券折价Discount rate 贴现率,折扣率Divestiture 风险Dividend yield 股息率Dividends 股息Dividends in arrears 应付股利Double taxation 双重征税Double-declining-balance method 双倍余额递减法DuPont Model杜邦体系EEarning power 盈利能力Earnings 盈利Earnings per share 每股利润Earning quality 收益质量Economic entity assumption 经济个体假定Economic value added 经济价值增加Effective interest method 实际利息法Effective interest rate 实际利率Equity 所有者权益Equity investment权益投资Equity issuance 发行股票Equity method权益法Equity security 股本证券Escrow 代管Exchange rate 汇率Expense 费用External financing外部融资Extraordinary item 非经常项目FFace value 面值Fair market value 公允市价Financial accounting 财务会计Financial accounting standards 财务会计Financial Accounting Standards Board财务会计标准委员会Financial condition 财务状况Financial flexibility 财务弹性Financial performance 财务业绩Financial ratio analysis 财务比率分析Financial statement analysis 财务报表分析Financial statements财务报表Financing activities 融资活动First-in, first-out 先进先出法Fiscal period assumption 会计期假设Fiscal year 会计年度Fixed asset turnover 固定资产周转Fixed assets固定资产FOB destination 离岸货价FOB shipping point 起运点交货Footnotes 附注Forward contract期货合同Freight-in 运费已付Frequent transactions 经常性交易GGain contingency 或有收益Generally accepted accounting principles一般会计原则Going concern 持续经营Goods in transit在途商品Goodwill商誉Government accounting 政府会计Gross margin 毛利,边际贡献Gross profit 毛利HHedging套期保值Hidden reserves 秘密准备Historical cost历史成本Human capital 人力资源Human resources 人力资源Hurdle rate 利率下限Hybrid security 混合证券IIncome 收益Income statement 损益表Independent auditor 独立审计Indirect method 间接法Industry 行业Inflation通货膨胀Input market 投入市场Installment obligation 分期付款Intangible asset 无形资产Interest利息Interest coverage ratio 利息保障比率Interest-bearing obligation 附息债务Internal control system 内部控制系统Internal financing 内部筹资Internal Revenue Code 国内税收法规Internal Revenue Service 国内税收总署Interperiod tax allocation 跨期税款分摊Intraperiod tax allocation所得税期内分摊Inventory存货Inventory turnover 存货周转Investing activities 投资活动LLand 土地,不动产Last-in, first-out 后进先出Lease 租赁Leverage 杠杆效应Liability 负债Life of a bond 年金期间LIFO conformity rule 后进先出法一致性规则LIFO liquidation 后进先出法清算LIFO reserve 后进先出法准备Line of credit 信用限额Liquidation 清算Liquidity 流动性Listed company上市公司Loan contract 贷款合同Loan covenant 贷款契约Long-lived assets 长期资产Long-term loan 长期负债Long-term debt ratio 长期债务率Long-term investments长期投资Loss 亏损Loss contingency 或有损失Lower-of-cost-or-market rule 成本与市价孰低原则MMACRS 加速成本回收法修正系统Maintenance expenditure 维修费用Management accounting管理会计Management discretion 管理决策Management letter 管理建议书Manufacturing company 制造公司Margin 毛利Mark-to-market accounting 按市场计价法会计Markdown 减低标价Market price 市场价格Market share 市场份额Market value 市价Market-to-book ratio 市价与账面值比率Marketable securities 有价证券Matching principle 配比原则Materiality 重要性Maturity date 到期日Maturity value 到期值Measurement theory 计量理论Merchandise inventory 商品盘存Merger 合并Mortgage 抵押,按揭Mortgage payable 应付抵押款Multinational corporation 跨国公司NNatural resource cost 自然资源成本Net assets 净资产Net book value 净账面价值Net credit sales 净赊销值Net earnings 净收益Net income 净收益Net of tax 税后净额Net operation income 净营业收入Net profit 净收益Net realizable value可实现净值Net sales 销售净额Net worth 资本净值Non-operating items 营业外项目nonparticipating preferred stock 非参加优先股nonprofit entity 非盈利实体not-for-profit accounting 非盈利账户notes payable应付票据notes receivable 应收票据OObsolescence 过时,陈旧Off-balance-sheet financing资产负债表外融资Open account 未清账户Operating activities 经营活动Operating cycle 营业周期Operating days 营业日Operating expenses 营业费用Operating income 营业收益Operating lease经营租赁Operating margin 营业毛利Operating performance 经营业绩Operating revenues 营业收入Opinion letter 审计报告Ordinary stock dividend 普通股股利Organizational forms 组织形式Original cost 原始成本Other gains and losses 其它收益和亏损Other revenues and expenses 其它收益和亏损Output market 输出市场Outstanding shares 发行在外的股份Overhead 管理费用Owner\'s equity 所有者权益PPaper profits 账面利润Per value 面值Parent company母公司Participating preferred stock 参与优先股Partnership 合伙Patent 专利Payments in advance 预付款Pension 养老金Percentage-of-credit-sales approach 赊销百分比法Periodic method 定期法Perpetual method 永续法Physical obsolescence 实物陈旧Portfolio 投资组合Postacquisition expenditures 收购后费用Postretirement costs 退休后成本Preemptive right 优先股权Premium on bonds payable应付债券溢价Prepaid expenses 准备成本Present value 现值Price/earnings ratio 价格/收益比Prime interest rate 优惠利率Principal 本金当事人Prior period adjustment 前期调整数Private company 私人公司Proceeds 收入Production capacity 生产能力Production efficiency 生产效率Profit 利润Profit and loss statement 损益表Profitability 获利能力Profitability ratios 获利能力比率Property 财产Property, plan, and equipment 财产,车间和设备Prospectus招股说明书Proxy statement 委托书Public accounting firms 会计师事务所Purchase method 购买法Purchasing power 购买力QQualified audit report 有保留意见的审计报告Quick ratio 速动比率RRate of return 回报率Realized gain or loss 已实现收益或损失Recognized gain or loss 确认收益或损失Redemption赎回Refinancing 再筹资Related party transaction 关联交易Replacement cost重置成本Restrictive covenant 约束性规定Restructuring charges 重组成本Retail company 零售公司Retained earnings 留存收益Retirement 退休,退股Return on assets 资产报酬率Return on equity 净资产收益率Return on equity from financial leverage 融资杠杆净资产收益率Return on investment 投资回报率Return on sales 销售利润率Revaluation adjustment 重估调整Revenue 收入Revenue recognition 收入确认Risk 风险Risk premium 风险报酬Risk-free return 无风险回报SSales 销售Sales growth 销售增长Sales returns 销售退回Salvage value 残值Secured note 有担保票据Securities and Exchange Commission 证券及期货事务监察委员会Security 证券Service company 服务公司Service revenue 服务收益SG & A 销售,一般和行政花费short-term liability 短期负债Short-term investment 短期投资Sole proprietorship 独资经营Solvency 偿债能力Solvency ratios 偿债比率Specific identification 个体辨认Standard audit report 标准审计报告Stated interest rate 票面利率Statement of cash flows 现金流量表Statement of retained earning 留存收益表Statement of stockholder\'s equity 股东权益表Stock 股票Stock dividend 股利Stock market 股票市场Stock opinions 股票价格Stock split股份拆细Stock split in the form of a dividend 股票股利的股票拆分Stockholders 股东Stockholders\' equity 股东权益Straight-line method 直线法Subsidiary 子公司Sum-of-the-years\'-digits method 年数总和法Supplies inventory 物料盘存TT-account analysis T形账户分析法Takeover 收购Taking a bath 冲销Tax accounting 税务会计Tax deductible 税款抵扣Taxable income 应税收入Technical default 技术性违约Technical obsolescence 技术陈旧Term loan 定期贷款Times interest earned 利息保障倍数Trade-in 以旧换新Trademark or trade name商号Trading securities 交易证券Transportation-in 在途运输Treasury notes 中期国库券Treasury stock库存股票UUncollectibles 坏账Unearned revenue 未获收入Uniformity 统一Unqualified audit report 在编审计报告Unrealized gain or loss 未实现收入或损失Unsecured notes 无担保票据Useful life 使用年限Usual transactions 普通交易VValuation base 计价基础WWarranty 认股权证Window dressing 粉饰Working capital 营运资金,周转资金。

OFF-BALANCESHEETEXPOSURE

3020012000ASSETS 資產Cash 現金49,819,193.7957,701,552.86Deposits with AMCM (liquidity account)AMCM 存款(流動資產)76,835,567.2781,123,003.84Other funds with AMCM AMCM 其他資金1,130,500,000.00862,500,000.00Liquid assets with other credit institutions 其他信用機構流動資產38,717,937.3959,950,631.04Loans and advances to other credit institutions 對其他信用機構放款2,744,394,358.052,727,511,074.38Loans and advances to customers 對客戶放款2,456,054,989.482,643,538,375.91Specific provisions for possible credit losses 呆壞賬備用金(40,945,569.32)(32,038,808.44)Bonds and other fixed income securities 債券及其他固定收益證券87,230,200.0042,434,800.00Debtors 債務人540,865.00445,360.00Equity holdings portfolio 持有股份38,032,602.0435,114,450.30Other financial fixed assets 其他財務固定資產3,560,000.003,560,000.00Intangible fixed assets (net of amortization)無形固定資產(除卻折舊撥款)5,248,688.577,512,125.94Tangible fixed assets (net of depreciation)有形固定資產(除卻折舊撥款)96,600,249.3676,013,664.36Other fixed assets 其他固定資產2,825,431.5924,608,049.03Accrued income and prepaid expenses 應計收益及預付費用39,306,666.4354,642,926.74Other assets 其他資產1,566,967.931,597,992.93TOTAL ASSETS (NET)總資產淨值6,730,288,147.586,646,215,198.89LIABILITIES AND SHAREHOLDERS'EQUITY 負債及股東權益Due to other credit institutions on demand 其他信用機構活期存款1,401,332.464,032,135.95Due to other credit institutions with agreed maturity 其他信用機構定期存款28,296,203.90335,767,147.77Customer current accounts 客戶活期存款424,432,065.75433,650,517.56Customer savings accounts 客戶儲蓄存款718,649,977.80631,747,989.52Customer time deposit accounts 客戶定期存款4,938,913,108.594,555,474,580.09Creditors 債權人794,685.89830,886.48Other liabilities 其他負債13,606,051.3822,944,859.62Accrued expenses and deferred income 應計費用及遞延收益19,585,629.5369,401,900.82Provisions for general banking risks 各項風險備用金43,813,423.2355,001,698.51Share capital 股本225,000,000.00225,000,000.00Share premium 發行溢價50,000,000.0050,000,000.00Legal reserve 法定儲備83,000,696.9167,904,422.17Other reserves 其他儲備122,752,785.66118,977,686.68Results carried forward 營業結果結轉0.000.00Net income for the year 本年度營業結果60,042,186.4875,481,373.72TOTAL LIABILITIES AND SHAREHOLDERS'EQUITY 負債及股東權益總額6,730,288,147.586,646,215,198.89B A L A NC E S H E E T (MOP 澳門幣)3120012000Guarantees given 保證及擔保付款297,060,280.77197,783,314.76Documentary credits 信用狀128,413,978.77244,261,840.19Foreign exchange exposure 外匯持盤355,484.41364,453.71Other contingencies 其他備查賬472,950.001,494,000.0020012000INCOME 收益Interest and similar income 利息收益345,087,368.29464,195,642.67Dividends and income from other equity interests 股息及其他股權收益5,071,551.745,051,558.95Fees and commissions 佣金收益17,239,772.3417,635,101.58Gains from financial transactions 財務活動收益8,850,069.649,396,563.15Other operating revenues 其他業務收益10,666,833.599,831,499.89Recoveries of provisions for possible credit losses 呆壞賬備用金撥回19,611,785.354,820,999.15Extraordinary income 特別利潤4,664,941.15720,092.64TOTAL INCOME 收益總額411,192,322.10511,651,458.03EXPENSE 費用Interest and similar expense 利息費用194,255,714.71285,973,205.16Fees and commissions 佣金費用437,895.75412,900.34Losses on financial transactions 財務活動虧損154,500.000.00Staff expenses 人事費用66,958,946.0367,278,632.90Other administrative costs 其他行政費用33,449,412.5536,812,394.17Other operating costs 其他業務費用786,397.531,263,796.26Taxes other than income tax 所得稅以外之稅項1,367,764.201,352,821.30Amortization and depreciation of fixed assets 固定資產折舊撥款16,505,494.8020,022,841.99Provisions for possible credit losses 呆壞賬備用金撥款34,714,910.6718,030,603.55Extraordinary expense 特別費用1,629,733.251,091,434.01TOTAL EXPENSE 費用總額350,260,769.49432,238,629.68NET INCOME BEFORE TAX 稅前利潤60,931,552.6179,412,828.35Provision for income tax (*)營業利潤之稅項撥款(*)889,366.133,931,454.63NET INCOME FOR THE YEAR 營業結果60,042,186.4875,481,373.72(*)Dividends are paid in gross terms,therefore Income Tax on profits distributed as dividends is paid by Shareholders.股息以毛額分配,因此,有關股息分配之營業利潤稅由股東支付。

Viney8e_IRM_ch02

Financial Institutions, Instruments and Markets8th EditionInstructor's Resource ManualChristopher Viney and Peter PhillipsChapter 2Commercial banksLearning objective 2.1: Evaluate the functions and activities of commercial banks within the financial system∙Commercial banks are the largest group of financial institutions within a financial system and therefore they are very important in facilitating the flow of funds between savers and borrowers. ∙The core business of banks is often described as the gathering of savings (deposits) in order to provide loans for investment.∙The traditional image of banks as passive receivers of deposits through which they fund their various loans and other investments has changed since deregulation. For example, banks providea wide range of off-balance-sheet transactions.Learning objective 2.2: Identify the main sources of funds of commercial banks, including current deposits, demand deposits, term deposits, negotiable certificates of deposit, bill acceptance liabilities, debt liabilities, foreign currency liabilities and loan capital∙Banks now actively manage their sources of funds (liabilities).∙They offer a diversity of products with different return, risk, liquidity and cash-flow attributes to attract new and diversified funding sources.∙Sources of funds include current deposits, call or demand deposits, term deposits, negotiable certificates of deposit, bills acceptance liabilities, debt liabilities, foreign currency liabilities, loan capital and shareholder equity.Learning objective 2.3: Identify the main uses of funds by commercial banks, including personal and housing lending, commercial lending, lending to government, and other bank assets∙Commercial banks now apply a liability management approach to funding growth in their balance sheets.∙Under this approach a bank will (1) encourage depositors to lodge savings with the bank, and (2) borrow in the domestic and international money markets and capital markets to obtain sufficient funds to meet forecast loan demand.∙The use of funds is represented as assets on a bank's balance sheet.∙Bank lending is categorised as personal and housing lending, commercial lending and lending to government.∙Personal finance is provided to individuals and includes housing loans, investment property loans, fixed-term loans, personal overdrafts and credit card finance.∙Banks invest in the business sector by granting commercial loans. Commercial loan assets include overdraft facilities, commercial bills held, term loans and lease finance.∙While banks may lend some funds directly to government, their main claim is through the purchase of government securities such as Treasury notes and Treasury bonds.Learning objective 2.4: Outline the nature and importance of banks’ off-balance-sheet business, including direct credit substitutes, trade- and performance-related items, commitments and market-rate-related contracts∙Viewing banks only in terms of their assets and liabilities greatly underestimates their role in the financial system. Banks also conduct significant off-balance-sheet business.∙The national value of off-balance-sheet business is over four times the value of the accumulated assets of the banking sector.∙Off-balance-sheet business is categorised as direct credit substitutes, trade- and performance-related items, commitments, and foreign exchange, interest rate and other market-rate-related contracts.∙Over 94 per cent of banks’ off-balance-sheet business is in market-rate-related contracts such as foreign exchange and interest-rate-based futures, forwards, options and swap contracts.Learning objective 2.5: Consider the regulation and prudential supervision of banks∙One of the main influences of change in the banking sector has been the regulatory environment within which banks operate.∙Commercial banks are now said to operate in a deregulated market. Relative to previous regulatory periods this is a reasonable description; however, there still remains quite a degree ofregulation that affects participants in the financial markets, including the banks.∙Each nation-state is responsible for the regulation and supervision of its own financial system. In particular, central banks and prudential supervisors are responsible for the maintenance offinancial system stability and the soundness of the payments system.Learning objective 2.6: Understand the background and application of Basel II and Basel III ∙At the global level, the Bank for International Settlements takes an active interest in the stability of the international financial system. To this end, the Basel Committee on Banking Supervision has developed an international standard on capital adequacy for banks.∙Under Basel II banks were required to maintain a minimum risk-based capital ratio of8.00 per cent. Basel III increased the amount of Tier 1 capital that must be included in abank’s capital ratio.∙Basel III enhances the capital requirements of Basel II and introduces additional liquidity requirements. In particular, banks will be required to maintain a ratio of High QualityLiquid Assets (HQLA) to net cash outflows per month of at least 100 per cent. This iscalled the Liquidity Coverage Ratio (LCR).∙Capital is categorised as either Tier 1 capital, Upper Tier 2 capital or Lower Tier 2 capital.Under Basel III, at least 6.00 per cent of a bank’s 8.00 per cent risk-based capitalrequirement must be held in Tier 1 capital. This has been increased from 4.00 per centunder Basel II.∙As part of the calculation process, risk weights are applied to balance-sheet assets using specified risk weights. These weights may be based on the counterparty to an asset, or onan external rating provided by an approved credit rating agency.∙Off-balance-sheet items are converted to a balance-sheet equivalent using credit conversion factors before applying the specified risk weights.∙The Basel II capital accord comprises three pillars, which are enhanced under Basel III.∙Pillar 1 relates to the calculation of the minimum capital requirement. Pillar 1 considers three areas of risk: credit risk, operational risk and market risk. Within each of these riskcategories banks have a choice of applying a standardised approach or an internalapproach to measuring their capital requirement. Subject to approval from the banksupervisor, an internal approach method allows a bank to use its own risk managementmodels.∙Pillar 2 provides for a supervisory review process and includes four basic principles: (1) the assessment of total capital requirements by a bank, (2) the review of capital levels andthe monitoring of banks’ compliance by supervisors, (3) the ability of a supervisor toincrease the capital requirement of a bank, and (4) the intervention of a supervisor at anearly stage to maintain capital levels.∙Pillar 3 seeks to achieve market discipline through a process of transparency and disclosure. Banks are required to provide information and data on a periodic basis to thesupervisor. Some of these reports may be made public.Learning objective 2.7: Examine liquidity management and other supervisory controls applied by APRA in the context of Basel III∙The bank regulator, APRA, applies a number of important prudential controls on commercial banks. These include liquidity management policies, risk management systems certification, business continuity management, audit (external auditors, on-site visits), disclosure andtransparency, large credit exposures, foreign currency exposures, subsidiaries and ownership and control.Essay questionsThe following suggested answers incorporate the main points that should be recognised by a student. An instructor should advise students of the depth of analysis and discussion that is required for a particular question. For example, an undergraduate student may only be required to briefly introduce points, explain in their own words and provide an example. On the other hand, a post-graduate student may be required to provide much greater depth of analysis and discussion.1. ‘Deregulation has changed banking practices in Australia.' Discuss this statement with reference to banks’ asset and liability management. (LO2.1)∙Asset management relates to the practice of a bank only giving loans (assets) when it had sufficient deposits—that is, asset growth is managed, and often constrained by, the bank’s deposit base.∙Liability management relates to the practice of raising funds (liabilities) in the capital markets sufficient to meet expected forecast loan demand—that is, lending is not constrained by the liability side of the balance sheet.∙Modern banking practice is the application of liability management. The removal of regulation has facilitated this change. Banks are no longer constrained by the size of their deposits in determining how much to lend.∙After deregulation, banks operate by estimating their total loan demand in the next period and accessing different capital markets to obtain the necessary funds. Before deregulation, the deposits held by a bank would determine how much it could lend. Once this amount was depleted in a given period, no more loans would be issued. This is one way in which deregulation has changed banking practices.2. ‘Decades after the commencement of deregulation in the financial markets, the international capital markets remain a relatively unimportant source of funds for commercial banks.' Analyse and discuss this statement.(LO 2.1)∙Banks source their funds from a variety of sources, including deposits, bills acceptances, debt liabilities and shareholder equity.∙Foreign currency liabilities are also an important source of funds. These funds are sourced on the international capital markets.∙Deregulation of the financial system in Australia and around the world, including the floating of exchange rates, opened up these international capital markets as never before.∙It is now routine for Australian commercial banks to issue liabilities into the international capital markets in order to raise large amounts of capital. The international capital markets have become an important source of funds for commercial banks and deregulation of the global financial system played a significant role in opening up these opportunities.3. A customer has approached your commercial bank seeking to invest funds for a period of six months. The customer is particularly worried about risk following the GFC and the market volatility that continues to characterise world financial markets. Explain the features of call deposits, term deposits and CDs to the customer and provide advice on risk-reward trade-offs that might be associated with each product.(LO 2.2)Term deposit:∙pays a fixed interest rate for the nominated fixed investment period∙rate of interest will be bank’s carded rate for that term and amount∙interest may be payable periodically (e.g. monthly) or at maturity∙principal is repaid at maturity.Certificate of deposit:∙discount security issued by a bank∙an investor will purchase the CD at less than the face value∙the investor will receive the full face value back at maturity∙price is the face value discounted by the yield∙yield/price relationship will vary with changes in market rates.Risk-reward trade-offs:∙ a call deposit will pay a very low rate of interest but will be essentially risk free∙ a CD is a highly liquid form of investment that will pay a higher rate than the call deposit∙ a CD can easily be sold into the money market to obtain funds, whereas with a term deposit there is a loss of liquidity as the funds are locked-up for the fixed period∙however, a term deposit may pay a higher rate of return.4. Discuss the four main uses of funds by commercial banks and identify the role that the purchase of government securities plays in commercial banks’ management of their asset portfolios. (LO 2.3)∙Personal and housing finance∙Commercial lending∙Lending to government∙Other bank assets∙For banks, government securities are a primary source of liquidity:o government securities easily converted into casho invest short-term surplus funds—securities provide a return, cash does noto augment investment earnings—another source of incomeo use as collateral for future borrowings—security to support bank’s own borrowingso use for repurchase agreements to raise exchange settlement account funds—sell securities back to central bank and receive cleared fundso improve the quality of the overall balance sheet—lower risk government securities offset higher risk loans to customerso manage the maturity structure of the overall balance sheet—average maturity structure of government security portfolio will be less than the loan portfolioo manage the interest rate sensitivity of the overall balance sheet—purchase government securities with interest rate structures that offset interest rate risk within the overall loan portfolio.5. Commercial banks are the principal providers of loan finance to the household sector. Identify five different types of loan finance that a bank offers to individuals. Briefly explain the structure and operation of each of these types of loans.(LO 2.3)∙Owner-occupied housing finance—loans to purchase residential property such as a house or unit.Security is a mortgage taken over the land and property thereon. Mortgage registered on title of land. Loan may have a fixed or variable interest rate. Loan instalments paid periodically (monthly) and typically amortised (interest and principal components).∙Investment property finance—very similar to above, except property is usually leased to a third party. Interest rate generally higher reflecting higher risk of lease agreement.∙Fixed-term loans—used to finance non-property transactions such as buying a car. Bank will seek security such as a guarantee from the borrower or a third party. Higher interest rate reflects higher credit risk associated with borrower and lower quality security.∙Personal overdrafts—allows an individual to place their account into debit up to an agreed limit.Used for managing cash flow mismatches over time. Should be fully fluctuating. Pay interest on the debit amount; also unused limit fee.∙Credit card finance—plastic card issued with an available credit limit, that is, the cardholder can make purchases or obtain cash advances up to the amount of the credit limit. High interest rate charged on used credit.6. ABC Limited plans to purchase injection moulding equipment to manufacture its new range of plastics products. The company approaches its bank to obtain a term loan. Identify and discuss important issues that the company and the bank will need to negotiate in relation to the term loan.(LO 2.3)∙The bank and the borrow will structure the loan and negotiate the terms and conditions of the loan∙Period of the loan—consider matching principal; what are the funds being used for∙Interest rate—fixed versus variable interest rate; if variable, what is the reference interest rate(e.g. BBSW) and the margin above the reference rate∙Security—will the lender be able to take a mortgage over property or a charge over the other assets of the borrower∙Timing of repayments—how frequently will loan instalments occur; will the loan be amortised (interest and principal components), or an interest only loan with principal repaid at maturity.7. The off-balance-sheet business of banks has expanded significantly and, in notional dollar terms, now represents over seven times the value of balance-sheet assets. (LO 2.4)(a) Define what is meant by the off-balance-sheet business of banks.∙ a transaction that is conducted by a bank that is not recorded on the balance sheet∙ a contingent liability that will only be recorded on the balance sheet if some specified condition or event occurs.(b) Identify the four main categories of off-balance-sheet business and use an example to explain each category.∙Direct credit substitutes—support a client’s financial obligations, such as a stand-by letter of credit or a financial guarantee∙Trade and performance related items—support a client’s non-financial obligations, such as a performance guarantee or a documentary letter of credit∙Commitments—a financial commitment of the bank to advance funds or underwrite a debt or equity issue. For example, the unused credit limit on a credit card, or a housing loan approval where the funds have not yet been used∙Foreign exchange, interest rate and other market rate related contracts—principally derivative products such as futures, forwards, options and swaps used to manage f/x and interest rate risk exposures.8. Following the GFC, the off-balance-sheet activities of commercial banks attracted a great deal of attention among commentators. With reference to the size and composition of commercial banks’ off-balance-sheet activities, outline some of the possible reasons for this concern.(LO 2.4)∙The notional value of the off-balance sheet activities of banks is five times the total value of the assets held by the banks.∙Because this off-balance sheet activity is less transparent, it is difficult for regulators to assess the financial health of financial institutions.∙Also of concern is the type of securities that constitute off-balance sheet activities. These may include the types of derivative securities that played such an important role in the GFC.9. Bank regulators impose minimum capital adequacy standards on commercial banks. (LO 2.5)(a) Briefly explain the main functions of capital.∙equity and quasi-equity capital is a source of long-term funds for an institution∙it provides the equity funding base that enables on-going growth in a business∙it is a source of profits∙it may be necessary to use capital to write-off periodic abnormal business losses.(b) What is the minimum capital requirement under the Basel III capital accord?∙The prudential standard requires an institution, at a minimum, to maintain a risk-based capital ratio of 8.00 per cent at all times.∙At least three-quarters or 6.00 per cent of the risk-based capital ratio must take the form of tier 1 capital. The remainder of the capital requirement may be held as tier 2 (upper and lower) capital. ∙Where considered appropriate, a regulator may require an institution to maintain a minimum capital ratio above 8.00 per cent.(c) Identify and define the different types of acceptable capital under the Basel II and Basel III capital accords. Remember that Basel II continues to function, with Basel III acting to strengthen its main pillars.∙Capital, within the context of the Basel II capital accord, is measured in two tiers∙Tier 1 capital, or core capital, comprise the highest quality capital elements: o provide a permanent and unrestricted commitment of fundso are freely available to absorb losseso do not impose any unavoidable servicing charge against earningso rank behind the claims of depositors and other creditors in the event of winding-up.∙Tier 1 capital must constitute at least three-quarters of a bank’s minimum required capital base∙Tier 2, or supplementary, capital includes other elements which also contribute to the overall strength of an institution as a going concern∙Tier 2 capital is divided into two parts:o upper tier 2 capital—comprising elements that are essentially permanent in nature, including some hybrid capital instruments which have the characteristics of both equity and debt o lower tier 2 capital—comprising instruments which are not permanent; that is, dated or limited life instruments.∙Examples:o tier 1 capital: ordinary shares; retained earningso tier 2 capital (upper): mandatory convertible notes; perpetual subordinated debto tier 2 capital (lower): term subordinated debt approved by the regulator.10. Pillar 1 of the Basel II capital accord includes an operational risk component.(LO 2.6)(a) Define operational risk.The Bank for International Settlements categorises operational risk as:∙internal and external fraud∙employment practices and workplace safety∙clients, products and business practices∙damage to physical assets∙business disruption and system failures∙execution, delivery and process management.(b) Using the standardised approach, explain how a commercial bank is required to measure the operational risk component of its minimum capital adequacy requirement.∙Basel II requires banks to hold additional capital to support their exposure to operational risk∙With the standardized approach to operational risk an institution is required to map and divide its activities into two areas of business:o retail/commercial bankingo all other activity.∙An institution must document its mapping process, detailing the policy and procedures used to map the full range of business activities. This process must be subject to independent review.∙The retail/commercial banking area capital requirement is determined using a proportion of an institution’s total gross outstanding loans and advances as an indicator of that area’s operational risk exposure. This also includes the book value of securities held in the banking book.∙The operational risk capital requirement for the all other activity area of business is determined using a propo rtion of an institution’s net income as an indicator of that area’s operational riskexposure. Net income is defined as profit from ordinary activities before goodwill, amortization and income tax.∙Operational risk capital for retail/commercial banking is calculated by taking the last six consecutive half-yearly observations of total gross outstanding loans and advances, then multiplying a proportion, being 3.5 per cent, of total gross outstanding loans and advances at each observation point, by a factor of 15 per cent, to produce a result in respect of each observation, then determining an average result for the six observations.∙The operational risk capital for all other activity is calculated by taking the last six consecutive half-yearly observations of net income earned over a six month period, multiplying each observation point by a factor of 18 per cent to produce a result in respect of each observation, then determining an average result for the six observations.∙The total operational risk capital requirement under the standardised approach to operational risk is the sum of the two average results determined above.11. Provide an overview and rationale for the two new liquidity standards introduced by Basel III.∙The two new liquidity standards are: (1) a liquidity coverage ratio or LCR; and (2) a net stable funding ratio or NSFR.∙The LCR is supposed to ensure that banks have a ‘buffer’ that will help them to withstand a period of acute financial stress for a period of one month. The LCR is the ratio between a financial institution’s High Quality Liquid Assets (HQLA) and net cash outflows over a 30-day (one month) period.∙The NSFR, which will take longer to implement, aims to foster longer-term stability by requiring financial institutions to fund their activities with stable sources of funding.∙The rationale for these two new liquidity standards is to ensure banks do not face capital shortages and liquidity problems during times of extreme market volatility. The new standards directly address some of the problems that emerged during the GFC.12. With reference to liquidity management, outline the implications of Basel III and the associated changes to APRA’s APS 210 for the boards of directors of Australia’s financial institutions.∙In addition to the quantitative requirements of Basel III, APRA will introduce several qualitative prudential requirements.∙The most important of these relates to the responsibilities of the board of directors of a financial institution.∙Liquidity risk management is identified as the responsibility of the board of a financial institution. The board is responsible for setting the institution’s risk tolerance levels and clearly articulating it.∙The board must also approve a formal funding strategy.∙These measures are designed to improve board oversight of liquidity risk management. APRA’s APS 210 prudential standards incorporate these Basel III enhancements of good practice and governance.13. As part of the prudential supervision of banks the regulator requires banks to use an internal model such as VaR to estimate potential gains and losses. Outline some of the strengths and weaknesses of VaR models and briefly explain why regulators have moved to implement a ‘stressed VaR’ requirement for Australian banks.(LO 2.7)Strengths:∙enable inferences to be drawn about potential losses with a given degree of statistical confidence, for example a 99 per cent probability of a certain dollar amount loss.∙recognise correlations between different portfolio components (i.e. the model allows for market price changes that move together or offset each other)∙account for the effects of portfolio diversification∙consider the liquidity of different portfolio instruments—that is, the ease or ability of an institution to liquidate (sell) securities or close out an open risk position.Weaknesses:∙are based on a limited set of historical data which may not be a correct reflection of future data∙assume liquidity in all markets—that is, the ability of an institution to trade all components of its portfolio. This will not always be the case, particularly in times offinancial stress∙assume that all instruments can be liquidated in one day. This is not possible. Contractual constraints also mean that some items cannot be liquidated∙do not include excessive intra-day price volatility—that is, unusually large short-term exchange rate or interest rate movements∙assume a normal distribution, when data indicate that in some markets prices may be volatile and a normal distribution is not always evident.The ‘stressed’ VaR aims to ensure that banks are prepared for events that would normally have a very low probability, especially when the models are based on historical data and normal distributions.Extended learning questions14. The Basel II capital accord comprises a framework of three pillars. Pillar 1 established the minimum capital required by a commercial bank and incorporates three risk components: credit risk, operational risk and market risk.(LO 2.8)(a) Define credit risk.∙credit risk is the risk that counterparties to a transaction will default on their commitments∙for example, the risk that a borrower may default on the payment of interest and/or repayment of loan principal.(b) What approaches may be used to measure the credit risk capital adequacy component of Pillar 1?∙Basel II provides three alternative ways for a bank to measure credit risk:1.the standardised approach2.the foundation internal ratings-based approach,or3.the advanced internal ratings-based approach.(c) Using the standardised approach to credit risk, explain how a commercial bank will use this method to calculate its minimum capital requirement.∙The standardised approach to credit risk requires banks to assign each balance sheet asset and off-balance sheet item a risk weight.∙The risk weight must be based on an external rating published by an approved credit rating agency (such as Standard and Poor’s), or a fixed weight specified by the prudential supervisor.∙The risk weighted amount of a balance sheet asset is calculated by multiplying its current book value by the relevant risk weight.。

金融基本知识--汇总--1

表外业务(Off-Balance Sheet Activities,OBS)所谓表外业务(Off-Balance Sheet Activities,OBS),是指商业银行所从事的,按照通行的会计准则不列入资产负债表内,不影响其资产负债总额,但能影响银行当期损益,改变银行资产报酬率的经营活动。

狭义的表外业务指那些未列入资产负债表,但同表内资产业务和负债业务关系密切,并在一定条件下会转为表内资产业务和负债业务的经营活动。

通常把这些经营活动称为或有资产和或有负债,它们是有风险的经营活动,应当在会计报表的附注中予以揭示。

狭义的表外业务包括:(1)贷款承诺,这种承诺又可分为可撤销承诺和不可撤销承诺两种;(2)担保;(3)金融衍生工具,如期货、互换、期权、远期合约、利率上下限等;(4)投资银行业务,包括证券代理、证券包销和分销、黄金交易等广义的表外业务则除了包括狭义的表外业务,还包括结算、代理、咨询等无风险的经营活动,所以广义的表外业务是指商业银行从事的所有不在资产负债表内反映的业务。

按照巴塞尔委员会提出的要求,广义的表外业务可分为两大类:一是或有债权(债务),即狭义的表外业务。

二是金融服务类业务,包括:(1)信托与咨询服务;(2)支付与结算;(3)代理人服务;(4)与贷款有关的服务,如贷款组织、贷款审批、辛迪加贷款代理等;(5)进出口服务,如代理行服务、贸易报单、出口保险业务等。

通常我们所说的表外业务一般是指狭义表外业务。

表内业务表内业务指资产负债表中,资产和负债栏目可以揭示的业务;例如贷款、贸易融资、票据融资、融资租赁、透支、各项垫款等。

表外业务是指资产负债表不能揭示的业务,例如保证、银行承兑汇票等。

资产业务包括:贷款业务、票据业务、证券投资业务、现金资产业务。

负债业务包括:存款业务、借入款业务。

表外业务主要以各类中间业务为主,不是简单资产或负债业务可以刻画的,可以看成是表内业务衍生出的业务。

表内业务与表外业务的区别:表外业务的风险管理与表内业务有很大差异。