财务决策FinancialforDecision-makingCHAPTER14

财务决策Financial for Decision-makingCHAPTER 4

CHAPTER 4Problem 4.4: SolutionFirstly, we can determine the cost of supplies used as follows:£Opening balance 3,400Supplies purchased 36,00039,400Less: returns 1,020Supplies made available 38,380Supplies used ?Closing balance 4,200As we have determined that the cost of supplies made available is £38,380 and we know that we have ended the year with a stock of £4,200, we can conclude that £34,180 (£38,380 - £4,200) of supplies must have been used during the year.The year-end adjusting and closing entries necessary in this situation can be managed in three stages. Firstly, the balances on the “cleaning supplies purchases” and the “cleaning supplies returns” accounts can be trans ferred to the cleaning supplies inventory account. This results in the “cleaning supplies purchases” and the “cleaning supplies returns” accounts commencing the new accounting year with zero balances.Cleaning Cleaning CleaningAs an alternative to this approach, the “cleaning supplies purchases” and the “cleaning supplies returns” accounts could be closed directly to the profit and loss account.Secondly, the cleaning supplies expense account can be debited with the £34,180 cost of cleaning supplies used that was calculated above. The corresponding credit entry is to the cleaning supplies inventory account. These entries result in the recognition of an expense (the supplies expense account will be closed to the profit & loss statement). They also result in a £4,200 debit balance in the supplies inventory account, which reflects the result of the year-end stock-count. This inventory account balance will comprise part of the total assets recorded in the year-end balance sheet.Thirdly, as a closing entry, the cleaning supplies expense account must be closed to the profit and loss account.Problem 4.5: Solutiona)(1) Sales revenue Unearned revenue2,500 420,000 2,500(2) Salaries & wage expense Accrued salaries & wages 145,000 4,0004,000(3) Depreciation expense Accumulated depreciation 82,000 10,00010,000(4) Rent expense Prepaid rent3,000 900 600600(5) Interest revenue Interest receivable11,000 1,0001,000(6) Insurance expense Prepaid insurance18,000 12,000 6,0006,000b)TranquilStay HotelRevised Profit and Loss Statementfor the year-ended 30 June 20X1€€Sales Revenue 417,500 Less: Cost of Sales 80,000 Gross Profit 337,500 Add: Interest revenue 12,000349,500 Less: ExpensesSalaries and wages expense 149,000Depreciation expense 92,000Car park rental expense 3,600Insurance expense 24,000Sundry expense 14,000282,600€ 66,900Problem 4.6: Solutiona)Unearned service revenue Service revenue1,000 1,000b) Insurance expense Prepaid insurance600 600 c)Interest receivable Interest revenue400 400 d)Supplies expense Supplies7,200 7,200 Problem 4.8: SolutionContribution would be owner putting more money into the business. Dividends are funds paid to the owners.The question wants to test your understanding of the Balance sheet equation,Assets = Liabilities + Owners EquityAssets increased by $140,000 = Liabilities increased 50,000 + (Owner Equity increased by 100,000 - Dividends Paid 10,000) keeps the equation in balance.。

financial-accounting-习题答案文档

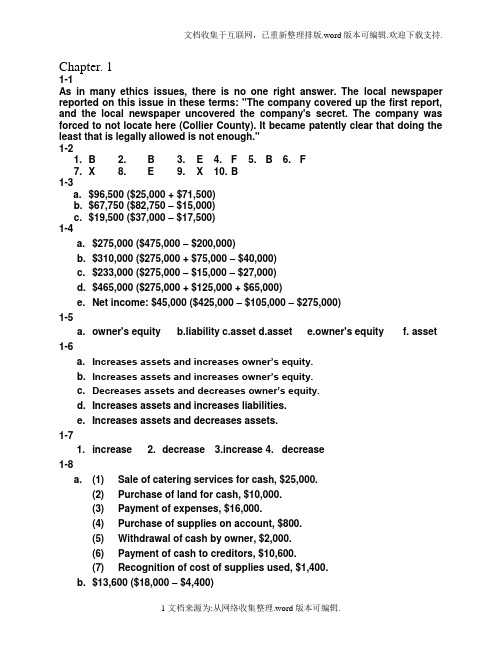

Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000)1-5a. owner's equityb.liabilityc.assetd.assete.owner's equityf. asset 1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ............................. $297,200 Net income for the month ........................................... $73,000Less withdrawals ........................................................ 12,000Increase in owner’s equity ......................................... 61,000Leo Perkins, capital, April 30, 2006 ........................... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................................................. $232,120 Operating expenses:Wages expense ........................................................ $100,100Rent expense ........................................................... 35,000Supplies expense .................................................... 4,550Miscellaneous expense ........................................... 3,150Total operating expenses ................................... 142,800 Net income ................................................................... $ 89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. T he ratio of liabilities to stockholders’ equity increased from 2002 to 2003,indicating an increase in risk for creditors. However, the assets of The Home Depot are more than sufficient to satisfy creditor claims. Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15 Equipment2. Liabilities21 Accounts Payable22 Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41 Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction Type Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash ...................................................................... 40,000Ira Janke, Capital ............................................ 40,000(2) Supplies ............................................................... 1,800Cash ................................................................ 1,800(3) Equipment ............................................................ 24,000Accounts Payable .......................................... 15,000Cash ................................................................ 9,000(4) Operating Expenses ............................................ 3,050Cash ................................................................ 3,050(5) Accounts Receivable .......................................... 12,000Service Revenue ............................................ 12,000(6) Accounts Payable ................................................ 7,500Cash ................................................................ 7,500(7) Cash ...................................................................... 9,500Accounts Receivable ..................................... 9,500(8) Ira Janke, Drawing ............................................... 5,000Cash ................................................................ 5,000(9) Operating Expenses ............................................ 1,050Supplies .......................................................... 1,050 2-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000 – $8,000). Such anega tive balance means that the liabilities of Seth’s busine ssexceed the assets.b. Yes. The balance sheet prepared at December 31 will balance, withSeth Fite, Capital, being reported in the owner’s equity section as anegative $1,500.2-9a. The increase of $28,750 in the cash account does not indicateearnings of that amount. Earnings will represent the net change inall assets and liabilities from operating transactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug. 1 Rent Expense ....................................................... 1,500Cash ................................................................ 1,5002 Advertising Expense (700)Cash (700)4 Supplies ............................................................... 1,050Cash ................................................................ 1,0506 Office Equipment ................................................. 7,500Accounts Payable .......................................... 7,5008 Cash ...................................................................... 3,600Accounts Receivable ..................................... 3,60012 Accounts Payable ................................................ 1,150Cash ................................................................ 1,15020 Gayle McCall, Drawing ........................................ 1,000Cash ................................................................ 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .......................................... 10,150Fees Earned .................................................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct. 27 Supplies .................................................. 15 1,320Accounts Payable .............................. 21 1,320 Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr. Dr. Cr. 2006Oct. 1 Balance ................................. ✓ ........... ........... 585 ...........27 ............................................... 43 1,320 ........... 1,905 ........... Accounts Payable 21 2006Oct. 1 Balance ................................. ✓ ........... ........... ........... 6,15027 ............................................... 43 ........... 1,320 ........... 7,4702-13Inequality of trial balance totals would be caused by errors described in(b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ................................................................... 13,375Accounts Receivable ......................................................... 24,600Prepaid Insurance .............................................................. 8,000Equipment .......................................................................... 75,000Accounts Payable .............................................................. 11,180 Unearned Rent ................................................................... 4,250 Erin Capelli, Capital ........................................................... 82,420 Erin Capelli, Drawing ......................................................... 10,000Service Revenue ................................................................ 83,750 Wages Expense .................................................................. 42,000Advertising Expense ......................................................... 7,200 Miscellaneous Expense ..................................................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ........................................ 15,000Wages Expense .............................................. 15,000b. Prepaid Rent ........................................................ 4,500Cash ................................................................ 4,500 2-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .................................................. $ 37,028 $ 35,925 $ 1,103 3.1%2. Cost of sales ..................................... (29,658) (28,111) 1,547 5.5%3. Selling, general, and admin.expenses ........................................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ...................................... $ (45) $ 1,300 $(1,345) (103.5%) b. The horizontal analysis of Kmart Corporation reveals deterioratingoperating results from 1999 to 2000. While sales increased by $1,103million, a 3.1% increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrative expenses alsoincreased by $901 million, a 13.8% increase. The end result was thatoperating income decreased by $1,345 million, over a 100%decrease, and created a $45 million loss in 2000. Little over a yearlater, Kmart filed for bankruptcy protection. It has now emerged frombankruptcy, hoping to return to profitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated. Net income willbe overstated.b. Prepaid insurance (or assets) will be overstated. Owner’s equity willbe overstated.3-5a.Insurance Expense ............................................................ 1,215Prepaid Insurance ............................................... 1,215 b.Insurance Expense ............................................................ 1,215Prepaid Insurance ............................................... 1,215 3-6Unearned Fees ...................................................................... 9,570Fees Earned ......................................................... 9,570 3-7a.Salary Expense .................................................................. 9,360Salaries Payable .................................................. 9,360 b.Salary Expense .................................................................. 12,480Salaries Payable .................................................. 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over- Under-stated stated stated stated1. Revenue for the year would be ............... $ 0 $6,900 $ 0 $ 02. Expenses for the year would be ............. 0 0 0 3,7403. Net income for the year would be .......... 0 6,900 3,740 04. Assets at December 31 would be ........... 0 0 0 05. Liabilities at December 31 would be ...... 6,900 0 0 3,7406. Owner’s equity at December 31would be ................................................... 0 6,900 3,740 0 3-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable ......................................................... 11,500Fees Earned ......................................................... 11,500 b. No. If the cash basis of accounting is used, revenues are recognizedonly when the cash is received. Therefore, earned but unbilledrevenues would not be recognized in the accounts, and no adjustingentry would be necessary.3-13a. Fees earned (or revenues) will be understated. Net income will beunderstated.b. Accounts (fees) receivable (or assets) will be understated. Owner’sequity will be understated.3-14Depreciation Expense .......................................................... 5,200Accumulated Depreciation ................................. 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of the equipment to theperiods benefiting from its use. It does not necessarily relate to valueor loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not a valuation method.That is, depreciation allocates the cost of a fixed asset over its usefullife. Depreciation does not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ....................................................... 7,500Accumulated Depreciation ................................. 7,500 b. (1) Depreciation expense would be understated. Net income wouldbe overstated.(2) Accumulated depreciation would be understated, and total assetswould be overstated. Owner’s equity would be ove rstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment (5)5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $ 2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $ 4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $ (511,242) (12.2)c. Dell is more profitable than Gateway. Specifically, Dell’s cost ofg oods sold of 82.1% is significantly less (4.3%) than Gateway’s costof goods sold of 86.4%. In addition, Gateway’s operating expensesare over one-fourth of sales, while Dell’s operating expenses are9.9% of sales. The result is that Dell generates an operating incomeof 8.0% of sales, while Gateway generates a loss of 12.2% of sales.Obviously, Gateway must improve its operations if it is to remain inbusiness and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr.1Cash 8 8 1 2Accounts Receivable 50 (a) 7 57 2 3Supplies 8 (b) 5 3 3 4Prepaid Insurance 12 (c) 6 6 4 5Land 50 50 5 6Equipment 32 32 6 7Accum. Depr.—Equip. 2 (d) 5 7 7 8Accounts Payable 26 26 8 9Wages Payable 0 (e) 1 1 9 10Terry Dagley, Capital 112 112 10 11Terry Dagley, Drawing 8 8 11 12Fees Earned 60 (a) 7 67 12 13Wages Expense 16 (e) 1 17 13 14Rent Expense 8 8 1415Insurance Expense 0 (c) 6 6 15 16Utilities Expense 6 6 16 17Depreciation Expense 0 (d) 5 5 17 18Supplies Expense 0 (b) 5 5 18 19Miscellaneous Expense 2 2 19 20Totals 200 200 24 24 213 213 20 ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1Cash 8 8 1 2Accounts Receivable 57 57 2 3Supplies 3 3 3 4Prepaid Insurance 6 6 4 5Land 50 50 5 6Equipment 32 32 6 7Accum. Depr.—Equip. 7 7 7 8Accounts Payable 26 26 8 9Wages Payable 1 1 9 10Terry Dagley, Capital 112 112 10 11Terry Dagley, Drawing 8 8 11 12Fees Earned 67 67 12 13Wages Expense 17 17 13 14Rent Expense 8 8 14 15Insurance Expense 6 6 15 16Utilities Expense 6 6 16 17Depreciation Expense 5 5 17 18Supplies Expense 5 5 18 19Miscellaneous Expense 2 2 19 20Totals 213 213 49 67 164 146 20 21Net income (loss) 18 1821 2267 67 164 164 22 4-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned ........................................................................ $67Expenses:Wages expense ........................................................... $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ........................................................49Net income ......................................................................... $18ITHACA SERVICES CO.Statemen t of Owner’s EquityFor the Year Ended January 31, 2006Terry Dagley, capital, February 1, 2005 ............................ $112Net income for the year ..................................................... $18Less withdrawals (8)Increase in owner’s equity................................................10Terry Dagley, capital, January 31, 2006 ........................... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............................. $ 8 Accounts payable ....... $26Accounts receivable ... 57 Wages payable (1)Supplies ....................... 3 Total liabilities ......... $ 27 Prepaid insurance . (6)Total current assets . $ 74Property, plant, and Owner’s E quity equipment: Terry Dagley, capital (122)Land ............................. $50Equipment ................... $32Less accum. depr........ 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ..................... $149 owner’s equity.......... $149 4-72006Jan. 31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment (5)31 Wages Expense (1)Wages Payable (1)4-82006Jan. 31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue .................................................................$103,850Operating expenses:Wages expense ........................................................... $56,800Rent expense .............................................................. 21,270Utilities expense ......................................................... 11,500Depreciation expense ................................................. 8,000Insurance expense ..................................................... 4,100Supplies expense ....................................................... 3,100Miscellaneous expense .............................................. 2,250Total operating expenses ............................ 107,020Net loss .............................................................................. $ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006Suzanne Jacob, capital, November 1, 2005 ..................... $173,750Net income for year ........................................................... $44,250Less withdrawals ............................................................... 12,000Increase in owner’s equity................................................32,250Suzanne Jacob, capital, October 31, 2006 ....................... $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 ×12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006Assets LiabilitiesCurrent assets Current liabilities:Cash $31,500 Accounts payable $9,500Accounts receivable ....................... 21,850 Salaries payable1,750Supplies................................................. 1,800 Unearned fees1,200Prepaid insurance ................................ 7,200 Total liabilities$12,450Prepaid rent ........................................... 4,800Total current assets $67,150 Owner’s EquityProperty, plant, and equipment: Vernon Posey, capital 114,200 Equipment ......................................... $80,600Less accumulated depreciation 21,100 59,500 Total liabilities andTotal assets $126,650 owner’s equity $126,6504-14Accounts Receivable ............................................................ 4,100Fees Earned .................................................... 4,100 Supplies Expense ................................................ 1,300Supplies .......................................................... 1,300 Insurance Expense .............................................. 2,000Prepaid Insurance .......................................... 2,000 Depreciation Expense ......................................... 2,800Accumulated Depreciation—Equipment ...... 2,800Wages Expense ................................................... 1,000Wages Payable ............................................... 1,000 Unearned Rent ..................................................... 2,500Rent Revenue ................................................. 2,500 4-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detecting and correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................................................... 167,550Sue Alewine, Capital ........................................... 167,550 Sue Alewine, Capital ............................................................. 25,000Sue Alewine, Drawing ......................................... 25,000 b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034) ($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December 31, 2002 and2001. In addition, the current ratio is below one at the end of bothyears. While the working capital and current ratios have improvedfrom 2001 to 2002, creditors would likely be concerned about theability of 7 Eleven to meet its short-term credit obligations. Thisconcern would warrant further investigation to determine whetherthis is a temporary issue (for example, an end-of-the-periodphenomenon) and the company’s plans to address its workingcapital shortcomings.4-20a. (1) Sales Salaries Expense ............................................. 6,480Salaries Payable ................................................... 6,480(2) Accounts Receivable ................................................. 10,250Fees Earned .......................................................... 10,250 b. (1) Salaries Payable ......................................................... 6,480Sales Salaries Expense ........................................ 6,480(2) Fees Earned ................................................................ 10,250Accounts Receivable ............................................ 10,250 4-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) Wages Expense .......................................................... 45,000Cash ....................................................................... 45,000(2) Wages Expense .......................................................... 18,000Wages Payable ...................................................... 18,000(3) Income Summary ....................................................... 1,120,800Wages Expense .................................................... 1,120,800(4) Wages Payable ........................................................... 18,000Wages Expense .................................................... 18,000(5) Wages Expense .......................................................... 43,000Cash ....................................................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number of credit salessupported by promissory notes, a notes receivable ledger should bemaintained. Failure to maintain a subsidiary ledger when there are asignificant number of notes receivable transactions violates theinternal control procedure that mandates proofs and security.Maintaining a notes receivable ledger will allow Fridley to operatemore efficiently and will increase the chance that Fridley will detectaccounting errors related to the notes receivable. (The total of theaccounts in the notes receivable ledger must match the balance ofnotes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation of duties isviolated. The accounts receivable clerk is responsible for too many。

财务管理分析必备—中英文对照

流程卓越

定义:“流程卓越”是指企业在最低成本、给客户带来最少不便的

情

况下,向客户提供标准化的、简捷的、可靠的产品和服务。 “流程卓越”需要优化企业从采购到分销整个增值链中的每

一

环节,并瞄准广阔的市场。

基本认知:

以最低成本创造最大价值的理念

“流程卓越” .以最低的价格提供最满足需求的产品 不会:

.因为价格低而提供低质量的产品

负债 Liability

贷款B Loan

负债 Liability

客户存款A Client Deposit

所有者权益 Owner’s Equity

所有者权益 Owner’s Equity

收入 Revenue

A的利息收入 Interest Income

收入 Revenue

B的利息收入 Interest Income

现 金

投 资

原 材 料

存货

人 工 及 服 务

材料

股 东

应付

固定资产

供 应 商

企业经济本质

• 资金流转和增值过程 Capital rotation & value creation process • 资金流转典型环节及机会/陷阱 Capital rotation & management opportunities • 企业价值取向特征 Company value proposition • 资本投入及资本扩张形式 Capital injection & expansion pattern

报告需求 Reporting Requirements 呈现的内容 Detail Presented

对于产品成本\收入\利润需要更具体 的数据

会计学 企业决策的基础 财务会计分册 版 章答案

Chapter 6Merchandising Activitie s Ex. 6.41PROBLEM 6.1AClaypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5Ac. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if itmust borrow money for a short period of time at an annual rate of 11%. Bytaking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods soldSupplementary ProblemChapter 91617。

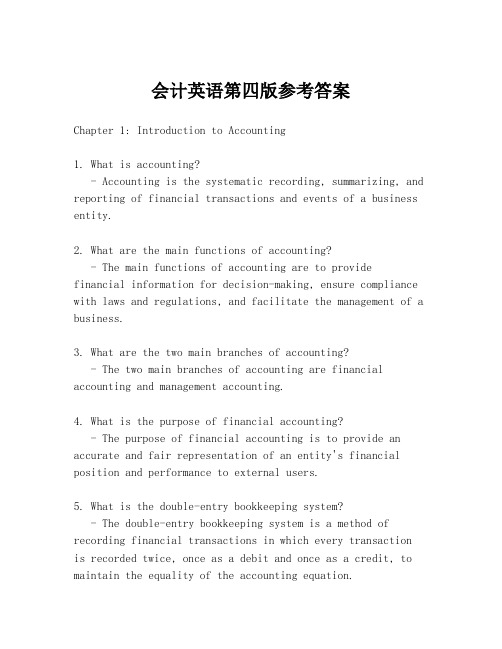

会计英语第四版参考答案

会计英语第四版参考答案Chapter 1: Introduction to Accounting1. What is accounting?- Accounting is the systematic recording, summarizing, and reporting of financial transactions and events of a business entity.2. What are the main functions of accounting?- The main functions of accounting are to providefinancial information for decision-making, ensure compliance with laws and regulations, and facilitate the management of a business.3. What are the two main branches of accounting?- The two main branches of accounting are financial accounting and management accounting.4. What is the purpose of financial accounting?- The purpose of financial accounting is to provide an accurate and fair representation of an entity's financial position and performance to external users.5. What is the double-entry bookkeeping system?- The double-entry bookkeeping system is a method of recording financial transactions in which every transactionis recorded twice, once as a debit and once as a credit, to maintain the equality of the accounting equation.Chapter 2: Accounting Concepts and Principles1. What are the fundamental accounting concepts?- The fundamental accounting concepts include the accrual basis of accounting, going concern, consistency, and materiality.2. What is the accrual basis of accounting?- The accrual basis of accounting records transactions when they occur, regardless of when cash is received or paid.3. What is the going concern assumption?- The going concern assumption is the premise that a business will continue to operate for the foreseeable future.4. What is the principle of consistency?- The principle of consistency requires that an entity should apply accounting policies consistently over time.5. What is the principle of materiality?- The principle of materiality states that only items that could potentially affect the decisions of users of financial statements are included in the financial statements.Chapter 3: The Accounting Equation and Financial Statements1. What is the accounting equation?- The accounting equation is Assets = Liabilities +Owner's Equity.2. What are the four main financial statements?- The four main financial statements are the balance sheet, income statement, statement of changes in equity, and cashflow statement.3. What is the purpose of the balance sheet?- The balance sheet provides a snapshot of an entity's financial position at a specific point in time.4. What is the purpose of the income statement?- The income statement reports the revenues, expenses, and net income of an entity over a period of time.5. What is the purpose of the cash flow statement?- The cash flow statement reports the cash inflows and outflows of an entity over a period of time.Chapter 4: Recording Transactions1. What is a journal entry?- A journal entry is the initial recording of atransaction in the general journal.2. What are the steps in the accounting cycle?- The steps in the accounting cycle are analyzing transactions, journalizing, posting, preparing a trial balance, adjusting entries, preparing financial statements, and closing entries.3. What is the difference between a debit and a credit?- A debit is an increase in assets or a decrease inliabilities or equity, while a credit is an increase in liabilities or equity or a decrease in assets.4. What are adjusting entries?- Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recorded in the correct period.5. What is the purpose of closing entries?- Closing entries are made to transfer the balances of temporary accounts to the owner's equity account and to prepare the accounts for the next accounting period.Chapter 5: Accounting for Merchandising Businesses1. What is a merchandise inventory?- A merchandise inventory is the stock of goods held by a business for sale to customers.2. What is the cost of goods sold?- The cost of goods sold is the direct cost of producing the merchandise sold during an accounting period.3. What is the gross profit?- The gross profit is the difference between the sales revenue and the cost of goods sold.4. What is the difference between a perpetual and a periodic inventory system?- A perpetual inventory system updates inventory records in real-time with each sale or purchase, while a periodicinventory system updates inventory records at specific intervals, such as at the end of an accounting period.5. What is the retail method of inventory pricing?- The retail method of inventory pricing is a method of estimating the cost of ending inventory by applying a cost-to-retail ratio to the retail value of the inventory.Chapter 6: Accounting for Service Businesses1. What are the main differences in accounting for service businesses compared to merchandise businesses?- Service businesses do not have inventory and their primary expenses are typically labor and overhead costs.2. What is the main source of revenue for service businesses? - The main source of revenue for service businesses is the fees charged for the services provided.3. What are the typical expenses。

财务规划方案 英文

Financial Planning StrategyIntroductionFinancial planning plays a critical role in ensuring a secure financial future for individuals and businesses. It involves evaluating the current financial status, setting financial goals, and developing strategies to achieve those goals. In this document, we will discuss a comprehensive financial planning strategy that can be implemented to achieve long-term financial success.1. Assessing Current Financial StatusThe first step in creating a financial plan is to assess the current financial status. This includes evaluating income, expenses, assets, and liabilities. By understanding these factors, individuals or businesses can gain a clear picture of their financial standing.2. Setting Financial GoalsOnce the current financial status is assessed, the next step is to set financial goals. Financial goals can vary depending on individual or business needs and aspirations. They may include short-term goals like saving for a vacation or long-term goals like retirement planning or funding a child’s education.3. Creating a BudgetCreating a budget is an essential part of any financial planning strategy. A budget helps in tracking income and expenses, and ensures financial resources are allocated efficiently. It is important to prioritize expenses based on the financial goals set earlier.4. Emergency FundBuilding an emergency fund is crucial to handle unexpected expenses or emergencies. An emergency fund typically covers 3-6 months of living expenses. This provides a safety net to individuals or businesses during challenging times and helps avoid accumulating debt.5. Debt ManagementManaging debt is an integral part of financial planning. It is essential to evaluate existing debts, such as loans or credit card debt, and develop a plan to pay them off effectively. Minimizing or eliminating high-interest debts should be a priority to improve the overall financial situation.6. Investment StrategyDeveloping an investment strategy is vital for achieving long-term financial goals. It involves determining risk tolerance, understanding investment options, and creating a diversified portfolio. Investments can include stocks, bonds, real estate, mutual funds, or other suitable investment vehicles.7. Retirement PlanningRetirement planning is crucial to ensure financial stability during retirement years. It involves estimating retirement needs, considering pension plans or retirement accounts, and determining contribution amounts. Starting early and regularly reviewing the retirement plan can help ensure a comfortable retirement.8. Insurance CoverageInsurance coverage is an important aspect of financial planning. It protects individuals or businesses from unforeseen events or emergencies. Adequate insurance coverage, such as life insurance, health insurance, property insurance, or business insurance, should be considered to mitigate risks.9. Tax PlanningEfficient tax planning can help minimize tax liabilities and maximize savings. It is essential to stay updated with tax laws, deductions, and credits applicable to individuals or businesses. Consulting with a tax professional can provide valuable guidance in optimizing tax planning strategies.10. Regular Monitoring and ReviewFinancial planning should not be a one-time activity. It is crucial to regularly monitor and review the financial plan. Life circumstances, financial goals, or market conditions may change over time, necessitating adjustments to the financial plan. Regular reviews help keep the plan on track and ensure alignment with evolving needs and objectives.ConclusionA comprehensive financial planning strategy involves assessing the current financial status, setting clear goals, creating a budget, building an emergency fund, managing debt, developing an investment strategy, planning for retirement, obtaining adequate insurance coverage, efficient tax planning, and regular monitoring and review. By following this strategy, individuals or businesses can pave the way for a secure and prosperous financial future.。

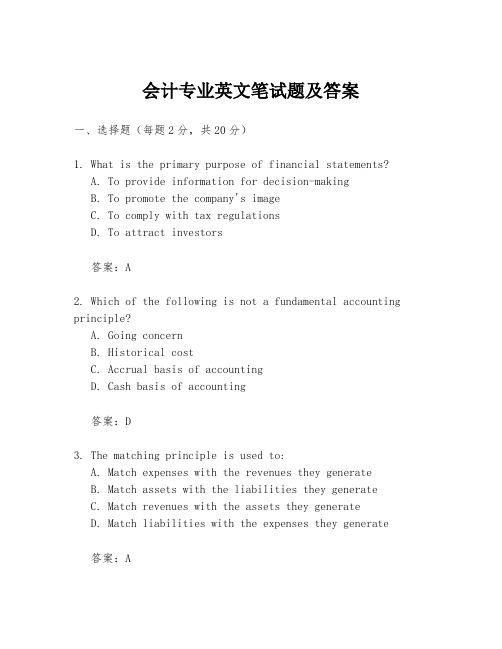

会计专业英文笔试题及答案

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计学企业决策的基础财务会计分册英文版第十七版教学设计 (3)

Accounting: The Basis for Business Decision Making, Financial Accounting, 17th Edition - Teaching Design IntroductionFinancial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making economic decisions. Financial statements are the primary output of financial accounting and are used by various stakeholders to make decisions. Accounting: The Basis for Business Decision Making, Financial Accounting, 17th Edition, is a textbook designed to help students understand the principles of financial accounting.This teaching design will focus on the key themes of the textbook and provide guidance on how to teach the material effectively. The design is suitable for instructors who teach financial accounting as a course at the undergraduate or graduate level.Key ThemesThe textbook covers a broad range of topics related to financial accounting. Some of the key themes that run through the book include: Financial StatementsThe primary objective of financial accounting is to provide information that is useful in making economic decisions. The financial statements are the primary output of financial accounting. They include the income statement, balance sheet, and cash flow statement. The income statement shows the amount of revenue, expenses, and net income or lossfor a specified period. The balance sheet shows the assets, liabilities, and equity at a particular point in time. The cash flow statement shows the inflow and outflow of cash for a specified period.Accounting CycleThe accounting cycle is the process of recording, classifying, and summarizing financial transactions to produce financial statements. The steps in the accounting cycle include analyzing transactions, recording journal entries, posting to the ledger, preparing a trial balance, adjusting entries, preparing an adjusted trial balance, preparing financial statements, and closing the books.Financial AnalysisFinancial analysis is the process of using financial information to make economic decisions. Techniques used in financial analysis include ratio analysis, trend analysis, and vertical and horizontal analysis. Financial analysis is used by various stakeholders, including investors, creditors, and management, to make decisions.Teaching DesignThe following section provides guidance on how to teach the material in Accounting: The Basis for Business Decision Making, Financial Accounting, 17th Edition.Learning ObjectivesBefore teaching each chapter, instructors should set clear learning objectives for their students. The learning objectives should be specific, measurable, achievable, relevant, and time-bound. By settingclear learning objectives, instructors can ensure that students understand what they need to accompli sh and track students’ progress effectively.Active LearningActive learning strategies such as group discussion, case studies, and problem-solving exercises should be incorporated into the teaching approach. Active learning helps students understand the material and apply the concepts they have learned.Real-World ExamplesInstructors should use real-world examples to help students understand how financial accounting is used in practice. Real-world examples can be drawn from various industries and sectors.TechnologyTechnology should be incorporated into the teaching approach. For instance, instructors can use online tools to reinforce the material covered in lectures. Technology can also be used to track students’ progress and provide instant feedback.AssessmentInstructors should use multiple assessment techniques to evaluate students’ understanding of the material. These can include quizzes, exams, assignments, and case studies. By using multiple assessment techniques, instructors can determine whether students have understood the material and identify areas where further instruction is required.ConclusionAccounting: The Basis for Business Decision Making, Financial Accounting, 17th Edition, is an essential textbook for students who wish to understand the principles of financial accounting. The teaching design outlined in this document provides guidance on how to teach the material effectively. By setting clear learning objectives, using active learning strategies, incorporating real-world examples, leveraging technology, and employing multiple assessment techniques, instructors can ensure that their students have a solid understanding of financial accounting.。

网中网财务决策(Netfinancialdecision)

网中网财务决策(Net financial decision)Notebook computer, printer and copier need to buy in the initial month within 10 days.The production line to buy or lease second days after delivery, the installation time of the production line is 10 days. The purchase or lease of real estate can be immediately put into use without installation. The arrival of other assets within 5 days after the purchase, no need to install.The inventory of raw materials for the lower limit of 10 sets, the production and development of the material can not make inventory stock is less than the lower limit. the excess raw materials can be sold in accordance with the prevailing market price.Three, the cost of the product?(1) the cost of the product by direct materials, direct labor and manufacturing cost. ?(2) the product cost calculation and transfer at the end of the month. The finished product storehouse cost. The monthly weighted average method. The finished products and methods in product cost allocation method for equivalent production. Equivalent units according to the platform interface on the upper right corner of the "business information" - "production information" in the finished product ratio calculationStorage of raw materials costs by the actual cost calculation method. Raw materials, using the weighted moving average methodwith the cost of raw materials in the production at the beginning of one-time investment, the consumption of raw materials and finished products in the product cost is equal to the cost of raw materials and finished products according to the number of products in the distribution.(4) direct labor by salary structure. Salary imputation to all kinds of products, and finished products and10??In the distribution of products. According to the end of the month to get the work summary table, wage summary and salary cost calculation and fill in the salary costs allocation table.1) operation: responsible for procurement, production, orders, staff recruitment, R & D investment, advertising investment and daily production operation. Each operation action execution when the financial controller for approval decision. ?(2): responsible for accounting enterprises obtain invoices, invoices, cost calculation sheet for the filling, salary confirmation, electronic filing, accounting and other financial matters handled. ?(3): responsible for cashier cash and bank deposit receipts, bank transfers and other internal cash flow management. ?(4) Financial Manager: responsible for the daily businessenterprise payment approval; stocks, bonds, entrusted loans, short-term loans and other investment financing business; accounting voucher, posting, node processing gains and losses, the financial statements issued such as computerized business. ?(5) financial director: responsible for the overall financial management, enterprise operation and planning, operation month action decision approval, the approval of the electronic filing enterprise comprehensive financial operation plan.Click on "market" - "product information" into the information query interface, listed enterprises can produce products information, and can view a variety of product price chart."Advertising": whether the enterprise to advertising, how much, what products put on the market, required by the chief financial officer in 5 per month (with [] R & D expenses) before planning decision making plans and operations. This interface director can see corporate advertising fee history. 15 days before the month to invest in R & D, after 20 days per month to terminate development.Always pay attention to changes in the market, including macroeconomic policy, experts predict, the securities market price etc.,1.2.12 rules?(1) the decision-making process: operations or financial manager, chief financial officer for approval to operate orfinancial manager. ? (2): the payment process operation, financial manager for approval to cashier for payment, such as the amount of more than 1 million pending approval is subject to approval of the financial controller. ?(3) chief financial officer needs to pay attention to "my approval matters"? Bar displays, "I need to pay attention to the operation of matters of approval" and "today matters" column shows, accountant and cashier should pay attention to "to-do" and "today matters" column shows the items "to-do" column mainly involves is the payment business, today is related to other matters "column payment business in addition to outside. ?(4) "my approval form" in the decision to be the day for approval. The "to-do" column does not need to finish that day,But the letter marked matters must be completed on the same day. ?(5) operations, financial manager, accounting and cashier click "off" after the financial director can click on the "next day" to complete the work task, enter the next day's operation. Director of finance at the end of the day according to the work need to click the "overtime" for other roles that day to return to work. Other roles after work can click the "overtime" to work overtime. The finance director can work for several days.Grading system?(1) sales net interest rate?? (2) flow ratio (3) Net cashflow?(4)? With bank deposits and cash and system? (5). The amount of raw materials and systems?? (6) the number of finished products and consistent? System? (7)? Business decisions? (8) payment decisions?? (9)? Check adjusting entries number (10)? Check back taxes, fines, finesThe contract system according to the selected customer reputation value payment, customer credit value is lower than 50, the system can be random (probability of non payment, non payment for? 5?%) enterprise bad debts.(2) when the total investment in R & D expenses reached a certain level of R & D, can increase technology content of products, the main business of the products in the order price will rise accordingly.(8) R & D projects total investment cost to achieve the annual sales income of more than 6% (less than the annual income of 50 million), R & D personnel reached 10% of the total number of employees, may apply for the qualification of high tech Enterprises15?1.2.8 or a matter of rules?A product quality margin?The quality of products enterprises in the platform margin of3.5% withholding in monthly income, included in the estimated liabilities. The quality of the products need to pay the deposit at the end of the quarter, calculated according to the quarterly revenue amount x 3%. ?(2) pending litigation?The platform in the course of business enterprises may encounter pending litigation, on the balance sheet date, according to the advice of counsel to determine whether included in the expected liabilities, according to the court verdict, do the relevant accounting treatment. In the process of litigation will produce the processing fee for each 500 yuan, calculated according to the amount of litigation costs 1%. ?1.2.9 exchange of non monetary assets?(1) the enterprise platform can barter trade, production of finished goods in exchange for the raw materials needed in the market, but not available raw materials and finished product exchange. ?(2) do not allow the use of raw materials and finished product production of the product exchange. For example, air conditioning air conditioning compressor is not available to the exchange. ? (3) the payment of the premium can not exceed the total amount of exchange (including tax) 5% (the ratio of system settings). ? (4) the two sides clearing the way for the exchange of non monetary assets, each invoice, one party pays the premium.Production personnel, R & D personnel, cooks, drivers can be fired under certain conditions. Production personnel in the production process is completed, the developers in the development level and leap in the "idle" state can be dismissed. The cook and the driver in the "idle" state can be dismissed. Fire need to pay one month salary as compensation.Tax declaration?Provide business tax declaration approval function. At the beginning of next month (115 day) by the accounting tax returns (state and local), submitted to the approval of the financial controller to declare. Click on the "online reporting tax" into the reporting interface, select the reporting time, enter the approval interface. Here you can also view the historical record tax declaration.[15]Travel expenses:Reimbursement before entryBorrow: other receivables 300Credit: cash 300200 yuan travel is included in the management fee to 100 yuan (increase) also increased in the course included in cash, the reimbursement of the other receivables is reducedBorrow: management fees 200Cash 100Credit: other receivables 300[] consider another choice of R & D investment can improve the product price; choose stocks and bonds, loans and other investment activities, can improve the efficiency in the use of funds.Director of finance []The choice of the production line according to the production standard and the rejection rate is considered,Property to select the combination of the production line occupied area size and number of employees hired for considerationIn the development of production and operation planning, the first choice to produce products, according to the principle of decision to order acceptance plan, and then determine the production quantity. According to the procurement of raw materials and feed production plan and material stock quantity, attention. If you want to pick up more bigger orders can be considered into advertising. If you want to improve the quality of the products, thereby winning more market advantage and sales, R & D investment can. If you want to expand the scope of business, do other business, can plan in this respect.Finance Manager []Financial department: finance investmentStock investment?Stock investment limit of 100 thousand hands, each hand 100. The stock can only be sold in the first month and at the end of the month, the purchase information in the financial manager interface will prompt. The date of the balance sheet to adjust changes in fair value.Bond investment?(1) three - year treasury bonds and five year bonds two, were purchased in two markets, does not hold to hold to maturity for the purpose. The bonds can be purchased at any time. ?(2) the amount of debt purchase price x = current purchase quantity, purchase no related expenses. ?(3) outstanding bonds can be sold, the sale of treasury bonds amount = price * * current sold amount (1- cost rate), the current price on a monthly basis. ?(4) the Treasury bonds bond price = value (1+ * * interest rate maturity), treasury bonds sold no related expenses.[operation]For high tech enterprises"The Department of materials, the physical inventory query: accounts?System events, task list[accounting]Outside body, bank statement"Business administration" is used to handle the change of business scope registration. Enterprises to expand production, development of catering, transportation, required by management certification, followed by accounting for business scope registration. Accounting to the tax bureau for tax registration. Both of the two approved can be used only for the catering and transport services.The Department of materials -- the management of fixed assets: surrender?Financial department - see operation planning, obtain invoices, sales invoices issued, the original document query and other business operations. If the invoice is issued or request, click on the corresponding menu to view. In business accounting should be done promptly after the claim and invoice, otherwise will not be able to carry out subsequent accounting.At the end of the month [fill cost table]Tax declaration![case 1]?The growth of China limited selection of main production of air conditioning, the first production planning 1? 000 units, 000 units, 1 orders? The procurement of raw materials - the air conditioning compressor and 1 auxiliary materials? 300 sets, 1010 sets of feed production; recruitment staff of 200 people, 10 R & D personnel;Advertising costs 1 million yuan into the "a class of senior market",In order to improve the technological content of products, increase product sales price, intends to invest 500 thousand yuan for product development. ?Considering the financial situation, the number of employees, business area and other factors to lease 1 production lines, plant A1, mortgage purchase office buildings B1.In order to maintain normal production and operation, combined with the company's reputation, intends to apply for short-term bank loans 5 million yuan, to improve capital efficiency, the use of surplus funds to buy bonds of 500 thousand yuan, 1 million yuan loan principal.。

会计英语词汇

会计英语词汇 Prepared on 22 November 2020C h a p t e r 1 Accounting 会计,会计学Accountant 会计师,会计人员Accounting information 会计信息Financial data 财务数据Business 企业,经营,商业,业务Business transaction 经济业务,经济交易Enterprise 企业Economic information 经济信息Business organization 经济组织Financial activity 财务活动,筹资活动Profitability 获利能力,盈利能力End product 最终产品Creditor 债权人Performance 业绩Favorable 有利的Unfavorable 不利的Accounting system 会计系统,会计制度Financial condition 财务状况Investor 投资人Result of operations 经营成果Financial report 财务报告To make decision 制定决策Accounting principles 会计原则Business activity 经济活动Accounting concepts 会计概念Financial accounting 财务会计Economic unit 经济单位Owner 业主,拥有者Governmental agency 政府机构Generally accepted accounting principles 公认会计原则Employ 采用Prepare 准备,编制Annual report 年度报告Stockholder 股东Audit 审计,审查,查帐Auditing 审计,审计学Accounting records 会计记录Public accountant 公共会计师Fairness 公正性,公允性Reliability 可靠性Periodic audit 定期审计Corporation 股份有限公司Internal auditor 内部审计人员Cost accounting 成本会计Cost data 成本数据Management accounting 管理会计Selling price 销售价格Management advisory service 管理咨询服务Management service 管理服务Tax accounting 税务会计Tax returns 纳税申报单,税单Budgetary accounting 预算会计International accounting 国际会计International trade 国际贸易Not-for-profit accounting 非盈利组织会计Not-for-profit organization 非盈利组织Social accounting 社会会计Measurement 计量Chapter2Accounting practice 会计实务Accounting theory 会计理论Decline 方针,指南Assumption 假设Business entity 经济主体Accounting entity 会计主体Economic activity 经济活动Bookkeeping 簿记Double-entry bookkeeping system 复试记账系统Entry分录,记录Single proprietorship独资Partnership合伙Accounting purpose会计目的Separate entity独立主体Asset资产Going-concern持续经营Historical cost历史成本Current market value 当前市场价值Accounting period会计期间Stable-monetary-unit货币计量单位Objective principle客观性原则Operating result经营成果Cost principle成本原则Actual cost实际成本Book value账面价值Equivalent当量,约当量Depreciation折旧Consistency principle一贯性原则Accounting method会计方法Financial statement 财务报告Comparability可比性Materiality principle重要性原则Conservatism principle谨慎性原则Revenue收入Expense费用Cost of goods商品成本Net income净收入Net loss净损失Accrual-basis 权责发生制Cash-basis 现金收付制Journal 日记账Realization principle 实现原则Matching principle 配比原则Recognize 确认Transfer转让,转帐,过户Income statement收益表,损益表Full-disclosure principle充分揭示原则Chapter3Accounting element会计要素Accounting equation会计等式Liability负债Owner s’ equity业主权益,所有者权益Current asset长期资产Long-term asset长期资产Operating cycle 经营周期Bank deposit 银行存款Short-term investment短期投资Long-term investment长期投资Accounts receivable应收账款Note receivable应收票据Prepayment 预付款项Inventory 存货Fixed asset 固定资产Plant and equipment 厂房和设备Intangible asset 无形资产Store fixtures店面装置Office equipment办公设备Delivery equipment运输设备Creditors’ equity债权人权益Obligation责任,义务Debt债务Current liability流动负债Long-term liability长期负债Short-time loans payable应付短期贷款Long-term loans payable长期应付贷款Notes payable应付票据Accounts payable应付账款Accrued expense应计费用Bonds payable应付债券Long-term accounting payable长期应付账款Interest 股份,利息Claim 要求权Net assets 净资产Capital资本Stockholder’s equity 股东权益Cost of goods sold 商品销售成本Administrative expenses 管理费用Selling expenses销售费用Financial expense 财务费用Occur 发生Dividend payable 应付股利Retained earnings留存收益Chapter4Classification分类,分级Day-to-day 随时Account title 账户名称Ledger 分类帐Debit side 借方Credit side 贷方Charge借记,收取费用Memorandum 摘要,备忘录Insert 插入,嵌入,写入Cash on hand 库存现金subgrouping子目,细目supplies 物料用品prepaid expenses 预付费用face value 面值check 支票bank draft 银行汇票money order 汇款单debtor 债务人bearer 持票人salaries payable 应付工资taxes payable 应付税费interest payable 应付利息long-term notes payable 长期应付票据mortgage payable 应付抵押借款bonds payable 应付公司债券drawing提款income summary收益汇总professions fees职业服务费commissions revenues 佣金收入interest income利息收入chart of accounts账户一览表executive salaries主管人员薪金office salaries办公人员薪金sales salaries销售人员薪金prepaid rent预付租金accumulated depreciation累计折旧depreciation expense折旧费用sales销售收入sales returns and allowance销售退回与折让purchases returns and allowance购买退回与折让Chapter5Accounting cycle会计循环Accounting procedures会计程序,会计方法Trial balance试算平衡表Post-closing trial balance结算后试算平衡表Journalize 做分录,记账Post to the ledger过入分类帐Assemble汇集Work sheet工作底表Adjusting entry调整分录close结账,结清,关闭ledger accounts分类账户general ledger总分类帐two-column account两栏式账户source document原始凭证check stub支票存根journal日记帐journal entry日记帐分录records(book) of original entry原始记录簿transcribe抄录post过账,誊帐manually手工的chronological按时间顺序的enter登记,计入general journal普通日记账special journal特殊日记帐sales journal销售日记帐purchases journal购买日记帐cash receipts journal现金收入日记帐cash disbursements journal现金支出日记帐division of labor分工Chapter6Adjusting procedures调整程序Accrual(basis) accounting权责发生制Align调整,使成一线,(转做)使一致Apportion(按比例)分配,摊配Accrue自然积累(如利息等),计提Outlay支出Expire期满,耗尽,失效Insurance expense保险费用Prepaid insurance 预付保险费Supplies expense物料用品费Supplies on hand在用物料Subscription预订Deferred credit递延贷项Accrued salaries payable应计应付工薪Accrued revenue应计收入Closing entry结账分录Closing procedure结账程序Temporary account临时性账户,名义账户,虚账户Permanent account 永久性账户,实账户Withdrawals提款Statement of cash flow现金流量表Financial position财务状况Portray描绘Dispose处理Inflows流入Outflows流出Chapter7Working paper工作底稿Adjusted trial balance调整后试算平衡表Cross-reference交叉参考Occasion需要,机会,工作场合Salaries accrued应计薪金Combine结合,联合Extend(会计)将数字转入。

Finance(国际金融)关键术语名词解释