国际会计chapter3

国际会计学(第三版)第3章 会计的国际趋同

3.2 会计国际趋同的动力与障碍

支持会计 国际趋同的 主要力量

1)跨国公司的日益壮大

2)资本市场主体的国际化

3)国际性会计职业团体 和组织机构的努力

4)国际性的会计教学科研活动

信息技术革命为会计国际化的发展提供了有力的技术支持, 并加速了会计国际趋同的进程。

3.2 会计国际趋同的动力与障碍

3.2.3 阻扰会计国际趋同的主要因素

3.3 推动会计国际趋同发展的主体

3.3.1 推动会计国际趋同发展的主体的类别与特征

2)按成员的地域分布的不同,可以分为地区性的与全球性的国际组织

推动地区性会计国际趋同的组织的

成员均为来自于同一地区的政府或者民 间的代表,主要有欧盟、非洲会计理事 会、欧洲财政经济会计专家联合会、泛 美会计师联合会、亚太地区会计师联盟、 东盟国家会计师联盟、北美会计师联盟 与西非会计团体联合会等。

种压力,协调不同集团的各种利益冲突,以期寻找可获得相关利益方都能够接受的准则。会计

国际趋同不仅在准则制定过程中存在着各种阻力,准则制定后的执行过程同样也是困难重重。

➢

会计准则制定中的阻力主要来自于政治、经济、文化等因素的影响。

➢

会计准则执行中的困难则主要来自于各国的会计“外环境”。环境因素是一个既能影

(2)国际性及地区性会计职业团体的努力。在会计国际趋同的过程中,有许多国际性和地 区性的会计职业团体都付出了艰辛的努力,为会计的国际趋同创造了有利条件,从而推动了会 计的国际趋同的发展。这些国际性的会计职业团体主要有联合国、经济合作与发展组织、欧盟、 非洲会计理事会、国际会计准则理事会、国际会计师联盟、欧洲财务经济会计专家联盟、泛美 会计师联合会、亚太地区会计师联盟、东南亚联盟国家会计师联合会、西非会计团体等。 会计国际趋同的最大利益在于会计信息的国际可比性; 会计国际趋同极大地降低了跨国公司生产会计信息的成本,节约了大量的时间和金钱; 会计的国际趋同可以使世界各国的会计准则或者会计制度发展到一个尽可能高的水平,与 当地的经济、法律和社会环境保持一致,进而提高各国的经济管理水平,更好地服务于经济社 会发展。

第3章国际会计

❖ 美国会计模式 ❖ 英国会计模式 ❖ 法国会计模式 ❖ 德国会计模式 ❖ 以利益维护主体为分类标志的阿伦的分类标

准

3.1 美国会计模式

❖ 影响最大的会计模式 ❖ 以公认会计原则为基本特征 ❖ 官方支持和干预由民间机构制定的会计准则 联邦政府根据《证券交易法》成立了证券交易委员会,被授权可对证券上市交易公司和证券公

3.2 英国会计模式

❖ 通过《公司法》管理公司事务,包括对公司财务会计和报告的要求,区别于美国 模式的最主要特征。

英国公司法中有关财务会计和报告的要求,构成英国会计准则制定的基础,会计准 则的要求不能违反公司法的规定。

❖ 在遵循公司法基础上由民间机构制定会计准则 会计标准委员会(ASC),英国会计准则委员会(ASB)发布“财务报告准则”(FRS) ❖ “真实和公允”——公司法提出的公司财务会计和报告要求的指导思想,英国模

❖ 德国会计职业界和会计准则建议 力量不强,建议不具权威性,职业门槛高。

❖ 一些独特的会计惯例 划分流动与长期负债的界限为四年 国外子公司排除在合并பைடு நூலகம்围之外(跨国公司按国际会计准则规定操作)

开发行的非上市公司指定其在提供采取报告时应遵循的规则的官方机构。SEC将这一权力 委托给民间的会计职业界,自身保持监督和最终修订权。美国会计程序委员会,会计原则 委员会,财务会计准则委员会先后为制定主体。 ❖ 财务会计准则委员会与财务会计准则 就会计准则制定模式而言,美国大多数人认为,会计准则在全球主要资本市场上的国际协调是 最终目标,并支持原则导向的会计准则制定模式,这主要是因为美国的会计准则过于复杂、 过于详细,FASB在识别和处理紧急问题方面行动缓慢,并强烈要求主要的会计准则制定 机构(FASB)应承担大部分责任。 ❖ 年度审计和公布财务报告的法定要求主要适用于公众公司 美国公司财务报告目标主要是为证券投资者提供决策有用信息,公认会计准则的制定,也以维 护投资人利益为前提。 ❖ 强大的会计职业界组织 “看门狗” (WATCH DOG)的一度辉煌。

国际会计第3章3法国

法国经济制度环境

n 第二次世界大战期间,法国的工业遭到严重破 坏。

n 为了振兴经济,战后法国动用政府干预手段, 成立了以经济学家莫奈为首的国家计划总署, 制定、实施了著名的“现代化与装备计划”, 开创了此后延续教十年国家经济计划的先河, 为延续至今的法国经济模式打下了深深的烙印。

n 20世纪30年代,法国会计遵从的法律包括税法、 公营公司法。

n 二战之后,会计立法的来源同时转向《商法典》 和1967年的《公司法》

n 但法国会计模式以税务为导向的特色还是很突出 的。

n 法国在1914年通过的第一部所得税法就规定,所 得税会计必须同递交股东的财务报表一致。这样, 税法的任何变动都将影响公司财务报表的内容和 形式。

国际会计第3章3法国

3.3.2 由政府制定颁布全国统一的《会计方案》

n 第一个统一的《会计方案》是在1947年9月由国 家经济与财政部批准颁布的。1957年进行了修订, 在欧共体第4号指令的影响下,1982年又进一步 作了修订,1986年再次扩充,在合并财务报表领 域实施欧共体的第7号指令。

n 自1982年修订的会计方案开始,它成为对所有工 商企业强制执行的方案。

n 法国传统的会计模式是法国重商主义的产物。 n 拿破仑法典曾明确规定,会计的原则和方法必

须遵守国家的税法,因此,可称之为“以税务 为导向的会计”。 n 阿伦(1981)在对世界范围内的会计模式进 行分类时,把“服从税制需要”作为法国—西 班牙—意大利模式的基本特征。

国际会计第3章3法国

3.3.1 以税务为导向的会计

国际会计第3章3法国

法国的经济制度环境

n 在成熟的市场经济条件下,法国的经济计划以指 导性为主,规定经济发展的近期目标,对国民经 济各部门轻重缓急的发展顺序作出安排,并辅以 相应的政策和措施。

国际会计_第3章-2英国

3.2.1 通过《公司法》管理公司事务,包 括对公司财务会计和报告的要求

通过《公司法》对会计行为进行规范 ,是 英国会计模式区别于美国会计模式的最主 要特征。

《公司法》是全国性的法律,目前执行的 是2006年全面修订的《公司法》。 英国也像大多数欧洲国家一样,主要通过 法律规范来约束企业的会计行为。

英国传统文化的不强求统一和一致性也使得英 国会计实务处理具有可选择性,而不是生搬硬 套某些法律条文。 不列颠民族虽然某些方面相对美利坚民族比较 保守,但较之与东方民族他们更具有冒险精神 和乐观主义态度,表现在会计处理上,英国人 更侧重于激进的方法,而不是采取稳健主义原 则,比如对存货的处理,不同批次购进的存货 项目,税法和会计准则允许采用先进先出法确 定成本,但不允许后进先出法。

英国与爱尔兰共和国于1973年加入欧洲经济共同体, 此后,英国公司法的修订,就反映出与欧洲经济共同 体理事会指令的协调趋向。

3.2.1 通过《公司法》管理公司事务,包括对 公司财务会计和报告的要求

2、1981年修订的《公司法》

规定了资产负债表和损益表的格式,提出了与欧共体第4号指令提 出的十分类似的5项会计原则(1)持续经营假设;(2)一致性; (3)谨慎;(4)应用权责发生制;(5)分开确定任何总数的组 成部分

英国的文化因素

英国崇尚民主、自由、博爱、平等的价值观,倡导自 由灵活和个人主义。相对于集体主义倾向的国家来说, 英国会计理论和会计准则由会计职业团体阐释和发布, 政府控制很宽松,基本上不予干预。 比如对固定资产计量,英国会计有较大弹性。会计准 则建议企业至少每 5年对固定资产进行一次重新估价 并重新核定经济使用年限;重估增值列为业主权益, 不能作为当年收益;重估减值先从该项资产以前列为 业主权益的重估增值账户中抵补,不足部分再计入当 年损益。很多会计准则对会计实务的指导只是建议性 的意见,并不一定强制执行,这就为会计职业团体和 职业会计师执业提供了依据个人职业判断的充分空间。

国际会计3

Understand how financial reporting is regulated and enforced in five European countries: France, Germany, the Czech Republic, the Netherlands, and the U.K. Describe the key similarities and differences between the accounting systems of these five countries. Identify the use of International Financial Reporting Standards at the levels of the individual company and the consolidated financial statements in these five countries. Describe the audit-oversight mechanisms in these five countries.

8

Choi/Meek, 6/e

Choi/Meek, 6/e

9

France

Overview

“The Plan” – national uniform chart of accounts (national accounting code)

Objectives and principles of financial reporting Definitions of elements Recognition and valuation rules Standardized chart of accounts Model financial statements Commercial legislation (Code de Commerce) Tax laws

国际会计课件第3单元

3.Notes to financial statements

4. Director’s reports or Management report or Business report

5. Auditor’s report

6. cash flow statement

7. Comprehensive Income

Accounting measurements

Business combinations – purchase accounting

Goodwill – annual impairments test

Investments in associates – equity method

Translation of financial statements of foreign operations – functional currency concept

Deferred taxes

Depreciation(折旧)

Pensions(养老金)

Tax -Oriented Accounting

Private sector/ public sector

Choi/Meek, 6/e

4

IFRS in the European Union

Starting in 2005, all EU-listed companies must follow IFRS in their consolidated financial statements.

Describe the audit-oversight mechanisms in these four countries.

Choi/Meek, 6/e

国际会计chapter3

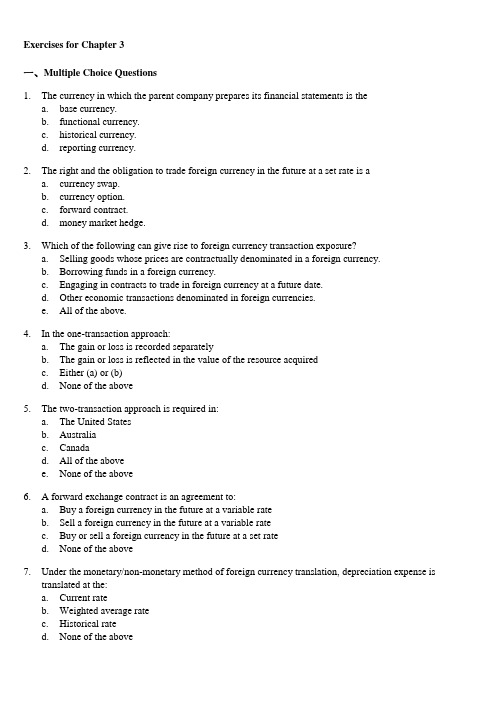

Exercises for Chapter 3一、Multiple Choice Questions1.The currency in which the parent company prepares its financial statements is thea. base currency.b. functional currency.c. historical currency.d. reporting currency.2. The right and the obligation to trade foreign currency in the future at a set rate is aa. currency swap.b. currency option.c. forward contract.d. money market hedge.3. Which of the following can give rise to foreign currency transaction exposure?a. Selling goods whose prices are contractually denominated in a foreign currency.b. Borrowing funds in a foreign currency.c. Engaging in contracts to trade in foreign currency at a future date.d. Other economic transactions denominated in foreign currencies.e. All of the above.4. In the one-transaction approach:a. The gain or loss is recorded separatelyb. The gain or loss is reflected in the value of the resource acquiredc. Either (a) or (b)d. None of the above5. The two-transaction approach is required in:a. The United Statesb. Australiac. Canadad. All of the abovee. None of the above6. A forward exchange contract is an agreement to:a. Buy a foreign currency in the future at a variable rateb. Sell a foreign currency in the future at a variable ratec. Buy or sell a foreign currency in the future at a set rated. None of the above7. Under the monetary/non-monetary method of foreign currency translation, depreciation expense istranslated at the:a. Current rateb. Weighted average ratec. Historical rated. None of the above8. Under the temporal method, translation gains and losses appear in:a. the stockholders' equity sectionb. the income statement as a normal operating itemc. the income statement as an extraordinary itemd. None of the above9. Under the current rate methoda. all assets and liabilities are translated at the current year's average exchange rate.b. foreign currency translation gains and losses do not affect the income statement.c. all revenues and expenses are translated using the current exchange rate.d. the income statement contains a cumulative translation adjustment amount.10. Under SFAS No. 52, the temporal method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.11. Under SFAS No. 52, the current rate method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.12. Under SFAS No. 52, a hyperinflationary economy is defined as one that has inflation of approximately:a. 100 percent per yearb. 100 percent or more over a three year periodc. 25 percent per yeard. None of the above13. Under SFAS No. 52, the primary currency in which a company conducts its business is called the:a. Core currencyb. Functional currencyc. Hard currencyd. Convertible currency14. Under which translation method is the foreign currency translation gain or loss taken to stockholders'equity?a. The current rate methodb. The temporal methodc. The conversion methodd. None of the above15. When a foreign subsidiary's functional currency is its local currency and its financial statements areprepared in the local currency then SFAS No. 52 requires that:a. The current method be used in translating financial statements.b. The temporal method be used in remeasuring financial statements.c. The temporal method be used in translating financial statements.d. The current method be used in remeasuring financial statements.16. According to SFAS No. 52, a self-sustaining, autonomous foreign subsidiarya. has a low volume of transactions with the parent.b. has sales mainly denominated in the parent's currency.c. has the U.S. dollar as its functional currency.d. obtains financing primarily from the parent.e. should be disclosed as a separate geographic segment.17. According to SFAS No. 52, an integral foreign subsidiarya. has a low volume of transactions with the parent.b. must be 100 percent owned by the parent.c. obtains most of its financing locally.d. depends on the parent for its revenues and expenses.e.has an active local sales market for its products.18.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is conside red to be India, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.19.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is considered to be the United States, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.Use the following information to answer questions 20-25.The Comfy Couch Co. purchases raw materials on account from a Mexican company on June 2, 2004. The total amount of the invoice is 3 million Mexican pesos and is due on August 2, 2004. Comfy Couch Co.’s fiscal year ends on June 30, 2004. Listed below is the exchange rate between the Mexican peso and the US dollar on the relevant dates.Spot rate on June 2 MP 9.50 = US$1Spot rate on June 30 MP 9.60 = US$1Spot rate on August 2 MP 9.65 = US$1Forward rate for August 2 (on June 2) MP 9.70 = US$1In questions 20-23, assume that Comfy Couch Co. did not have a forward contract and that it does its accounting in accordance with SFAS No. 52.20.What is the US dollar value of the payable on June 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.21.How much will Comfy Couch Co. pay (in US$) on August 2, 2004?a. US$315,789$312,500$310,881$309,278e.None of the above.22.What is the foreign currency gain or loss that Comfy Couch must recognize on June 30, 2004?a.Gain of US$3,289b.Gain of US$4,908c.Gain of US$6,511d.Gain of US$3,222e.None of the above.23.What is the foreign currency gain or loss that Comfy Couch must recognize on August 2, 2004?a.Gain of US$6,511b.Gain of US$3,222c.Gain of US$1,603d.Gain of US$1,619e.None of the above.24.If Comfy Couch entered into a forward contract on June 2, 2004, what is the dollar value of the payable?$315,789$312,500$310,881$309,278e.None of the above.25.If Comfy Couch entered into a forward contract on June 2, 2004, what amount in US dollars will it pay onAugust 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.二、True/False Questions1. A currency option is a contract that provides the right and the obligation to trade a foreign currency at a setexchange rate on or before a given date.2. An indirect foreign currency quote represents how much of the foreign currency can be purchased for oneunit of the domestic currency.3. The bid rate represents the price at which a financial institution is willing to buy a currency.4. If the spot rate is higher than the forward rate for a particular currency, then that currency would be sellingat a premium.5. Quotation exposure, backlog exposure, and billing exposure are various stages of foreign currencytranslation exposure.6. All foreign transactions are also foreign currency transactions.7. Under the one-transaction approach, the transaction is not considered to be completed until the finalsettlement.8. Under the two-transaction approach, a company's foreign currency receivable or payable are considered aseparate transaction distinct from the transaction to buy goods or services.9. Under the current rate method of translation, all current assets are translated at the year end rate andnon-current assets are translated at the applicable historical rates.10. Under the current rate method, gains or losses from translation are shown in the cumulative translationadjustment account in the balance sheet.11. In the foreign currency context, there is no distinction between the terms conversion and translation.12. Using the current exchange rate to translate current assets and liabilities (under the current/non-currentmethod) is based on the false premise that they are similarly affected by exchange rate changes.13. The temporal method accommodates current market valuation of non-monetary assets (e.g., inventories)while the monetary/non-monetary method does not.14. A major criticism of SFAS No. 8 was that it required foreign currency translation gains and losses to beincluded in the income statement.15. Under the temporal method, translation gain or loss for the period appears in the stockholders' equitysection of the balance sheet.16. Cost of goods sold, depreciation expense, and amortization expense are translated at the average exchangerate under the temporal method and the year end exchange rate under the current rate method.17. SFAS No. 52 requires the use of the current rate method for foreign subsidiaries located inhyperinflationary environments.18. Under SFAS No. 52, functional currency is the currency of the primary operating environment in which theforeign subsidiary operates and generates cash flows.19. According to SFAS No. 52, a hyperinflationary economy is deemed to be one in which the annual inflationrate is greater than 100 percent.20. If the U.S. dollar is deemed to be the functional currency, then SFAS No. 52 requires that the current ratemethod be used.21. Since the current rate method of foreign currency translation uses a constant exchange rate to translatebalance sheet items, it preserves the original financial statement relationships in the consolidated financial statements.22. An advantage of the current rate method of foreign currency translation is that a foreign subsidiary'sfinancial statement ratios are the same before and after translation.23. IAS No. 21 requires the use of the temporal method of foreign currency translation for foreign operationsthat are integral to the operations of the reporting enterprise.24. As of June 30, 2003, Britain, Denmark and Sweden were among the European countries that adopted theeuro as their currency.25. Between January 1, 1999, and January 1, 2002, companies doing business in Euroland can enter into andsettle transactions in the national currency or the euro and must have the ability to process transactions in both currencies.。

国际会计_第3章-1美国-2

美国制定会计准则的经验与启示

(1)重视会计理论对会计准则的指导作用 会计准则绝不是会计实务的简单归集或众多规 则的堆积 (2)致力于高质量会计准则的建设 (3)采用公开、透明、充分的会计准则制定 程序 (4)积极推进会计准则的国际趋同

SEC在美国会计准则制定中的重要角色

会计准则具有经济后果,各利益集团都会在准 则出台或修订前,针对自己的利益变动情况, 采取相应的行动,利用政治手段来影响会计准 则的制定。 因此,会计准则的制定就变成了一个利益相关 者相互博弈的政治过程。 在美国会计准则七十多年的历史上,SEC既授 权并支持会计准则的制定,又有过多次的干预 会计准则的事例,从而更加显示出会计准则制 定过程的又产生了一些新的会计问题,当时 的准则制定机构(CAP)主要采用归纳法汇集当时流行的 会计实务,并试图推荐最佳实务,因为缺乏基本理论的指 导,CAP不能有效地对各种会计备选方法进行选择,一时 导致了会计方法的超额供应。 当时CAP认为,采用当期收益观可以提高不同公司和同一 公司在不同年份的损益表可比,它指出任何非常项目的利 得和损失,在当期收益观下都应排除在净收益之外。于是 CAP发布了会计研究公报第32号,推荐采用当期收益观。 而SEC不认同这种观点,1950年,SEC在修订S—X规则 时,反而建议采用总括收益观。 最后CAP和SEC达成了一份妥协性协议。这件事表明准 则的制定受到SEC监督。

原则导向问题是由SOX法案提出来的。如果仔细推敲, SOX法案本身也不乏规则导向。 比如,针对安达信销毁档案,明确规定所有审计档案 必须保存7年;针对安然很多高级雇员来自安达信, 规定如果审计单位的雇员在被审计单位担任高管,必 须要有5年的“冷却期”:事务所对同一个审计客户, 其签约合伙人强制轮换,其标准是5年;等等。 实际上,这些规定的核心是:保证审计师的充分独立, 而充分独立本身也是一种原则导向。 当原则性的准则在应用到实践中时,需要大量的主观 判断。而人们的主观判断往往会受到个人利益倾向的 影响,很难做到真正意义上的“不偏不倚”,这使得 一些理论上非常完美的准则,在实务操作中并不能满 足需要。

国际会计第三章

6)《商法典》与《会计方案》

3.3.3 法国证券交易委员会的影响

法国企业传统上较少依靠资本市场,与美国和英国相

比,法国和欧洲大陆国家的证券市场都不够发达。

法国证券交易委员会是要求法国企业编制合并报表的 较早倡导者,并力图使法国接受国际会计和报告准则。为

此,它致力于改进法国上市公司的会计和报告,并成功地

3.1.4 强大的会计职业界组织

注册会计师对企业财务报表的审查,是以“公允表 述”和“一贯遵循公认会计原则”为前提的,企业总是希 望注册会计师能对审查的财务报表提出无保留意见,以证 实报表的可信性。美国注册会计师协会的以上立场也是对 公认会计准则的权威性的有力支持。

3.1.4 强大的会计职业界组织

从“趋同”中理解国际会计协调化的动向,为继续学

习第5章“国际会计协调化”打好基础。

3.1 美国会计模式

美国的会计实务体系被公认为当今在世界范围内影 响最大的会计模式。阿伦把“公认会计原则”作为美国 会计模式的基本特征,应该说是恰当的。

3.1.1 在官方的支持和干预下由 民间机构制定会计准则

美国是世界上着手制定会计准则最早的国家。

3.3.6 积极推广社会责任会计

早在1975年,法国在《关于公司法改革的报告》中就建 议公司每年公布“社会资产负债表”即“社会报告”。 1977年又先后颁布有关法令,要求拥有300人以上的企 业必须提供有关信息。 此外,要求提供的信息非常详细和具体,在西方国家处 于领先地位。

些投资人的利益为前提。

3.1.3 年度审计和公布财务报告的法定 要求主要适用于公众公司

• 很少数企业必须进行年度审计和公布财务报告 • 绝大多数企业自愿编制经过审计的年报

– 银行、金融机构要求 – 董事会或企业高管要求 – 良好商业惯例的响应

国际会计学第六版chapter(3)PPT课件

▪ More specific requirements ▪ More detailed implementation guidance ▪ May result in more comparability ▪ May foster “check-the-box” mentality

Private-sector organization that determines accounting standards The Securities and Exchange Commission (SEC) – a governmental

agency – underpins FASB’s authority

4

United States (contin)

Accounting regulation and enforcement

Securities and Exchange Commission

Has jurisdiction over listed companies Relies on private sector (FASB) to set accounting standards Pressures FASB on the direction of accounting standards

from the American Institute of Certified Public Accountants (AICPA)

Financial statements “present fairly”

Compliance with GAAP is the test for fair presentation

Describe the key similarities and differences among the accounting systems of these five countries.

国际会计chapter3

e.g. cash, payables, inventories Cause: When domestic currency weakens, price of inventory can be increased to protect its value from the decline in the domestic currency. But that is not the case with cash, payables etc. 它是正在被淘汰的方法。只有少数国家New Zealand, Pakistan, Iran, South Africa 等使用。

5、currency swap货币掉期 (p58) ----It is a transaction that involves a simultaneous purchase and sale of two different currencies.

(同时买卖两种不同货币的交易。购买行为当即生效,而回卖给同一 方的行为则是按照今天约定的价格在特定的未来日完成。 (合同 组合))

e.g. Consider a US company sells some products to a customer in Australia with an invoice amount of AU$16 million when the exchange rate is AU$1.6 per US$. The customer is allowed 60 days’ credit. At the settlement date, the exchange rate is AU$1.65=US$1. (That is, US$ is strengthening and the US company will receive fewer US$) Sol:1. Entry at transaction date Dr: Accounts Receivable Cr: Revenues 2. Entry at settlement date Dr:cash US$ 9,696,970(=AU$16000000/1.65) US$ 303,030 US$ 10,000,000 Exchange gains and losses Cr: Accounts Receivable Another,see p64. US$10,000,000 US$ 10,000,000

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Exercises for Chapter 3一、Multiple Choice Questions1.The currency in which the parent company prepares its financial statements is thea. base currency.b. functional currency.c. historical currency.d. reporting currency.2. The right and the obligation to trade foreign currency in the future at a set rate is aa. currency swap.b. currency option.c. forward contract.d. money market hedge.3. Which of the following can give rise to foreign currency transaction exposure?a. Selling goods whose prices are contractually denominated in a foreign currency.b. Borrowing funds in a foreign currency.c. Engaging in contracts to trade in foreign currency at a future date.d. Other economic transactions denominated in foreign currencies.e. All of the above.4. In the one-transaction approach:a. The gain or loss is recorded separatelyb. The gain or loss is reflected in the value of the resource acquiredc. Either (a) or (b)d. None of the above5. The two-transaction approach is required in:a. The United Statesb. Australiac. Canadad. All of the abovee. None of the above6. A forward exchange contract is an agreement to:a. Buy a foreign currency in the future at a variable rateb. Sell a foreign currency in the future at a variable ratec. Buy or sell a foreign currency in the future at a set rated. None of the above7. Under the monetary/non-monetary method of foreign currency translation, depreciation expense istranslated at the:a. Current rateb. Weighted average ratec. Historical rated. None of the above8. Under the temporal method, translation gains and losses appear in:a. the stockholders' equity sectionb. the income statement as a normal operating itemc. the income statement as an extraordinary itemd. None of the above9. Under the current rate methoda. all assets and liabilities are translated at the current year's average exchange rate.b. foreign currency translation gains and losses do not affect the income statement.c. all revenues and expenses are translated using the current exchange rate.d. the income statement contains a cumulative translation adjustment amount.10. Under SFAS No. 52, the temporal method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.11. Under SFAS No. 52, the current rate method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.12. Under SFAS No. 52, a hyperinflationary economy is defined as one that has inflation of approximately:a. 100 percent per yearb. 100 percent or more over a three year periodc. 25 percent per yeard. None of the above13. Under SFAS No. 52, the primary currency in which a company conducts its business is called the:a. Core currencyb. Functional currencyc. Hard currencyd. Convertible currency14. Under which translation method is the foreign currency translation gain or loss taken to stockholders'equity?a. The current rate methodb. The temporal methodc. The conversion methodd. None of the above15. When a foreign subsidiary's functional currency is its local currency and its financial statements areprepared in the local currency then SFAS No. 52 requires that:a. The current method be used in translating financial statements.b. The temporal method be used in remeasuring financial statements.c. The temporal method be used in translating financial statements.d. The current method be used in remeasuring financial statements.16. According to SFAS No. 52, a self-sustaining, autonomous foreign subsidiarya. has a low volume of transactions with the parent.b. has sales mainly denominated in the parent's currency.c. has the U.S. dollar as its functional currency.d. obtains financing primarily from the parent.e. should be disclosed as a separate geographic segment.17. According to SFAS No. 52, an integral foreign subsidiarya. has a low volume of transactions with the parent.b. must be 100 percent owned by the parent.c. obtains most of its financing locally.d. depends on the parent for its revenues and expenses.e.has an active local sales market for its products.18.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is conside red to be India, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.19.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is considered to be the United States, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.Use the following information to answer questions 20-25.The Comfy Couch Co. purchases raw materials on account from a Mexican company on June 2, 2004. The total amount of the invoice is 3 million Mexican pesos and is due on August 2, 2004. Comfy Couch Co.’s fiscal year ends on June 30, 2004. Listed below is the exchange rate between the Mexican peso and the US dollar on the relevant dates.Spot rate on June 2 MP 9.50 = US$1Spot rate on June 30 MP 9.60 = US$1Spot rate on August 2 MP 9.65 = US$1Forward rate for August 2 (on June 2) MP 9.70 = US$1In questions 20-23, assume that Comfy Couch Co. did not have a forward contract and that it does its accounting in accordance with SFAS No. 52.20.What is the US dollar value of the payable on June 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.21.How much will Comfy Couch Co. pay (in US$) on August 2, 2004?a. US$315,789$312,500$310,881$309,278e.None of the above.22.What is the foreign currency gain or loss that Comfy Couch must recognize on June 30, 2004?a.Gain of US$3,289b.Gain of US$4,908c.Gain of US$6,511d.Gain of US$3,222e.None of the above.23.What is the foreign currency gain or loss that Comfy Couch must recognize on August 2, 2004?a.Gain of US$6,511b.Gain of US$3,222c.Gain of US$1,603d.Gain of US$1,619e.None of the above.24.If Comfy Couch entered into a forward contract on June 2, 2004, what is the dollar value of the payable?$315,789$312,500$310,881$309,278e.None of the above.25.If Comfy Couch entered into a forward contract on June 2, 2004, what amount in US dollars will it pay onAugust 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.二、True/False Questions1. A currency option is a contract that provides the right and the obligation to trade a foreign currency at a setexchange rate on or before a given date.2. An indirect foreign currency quote represents how much of the foreign currency can be purchased for oneunit of the domestic currency.3. The bid rate represents the price at which a financial institution is willing to buy a currency.4. If the spot rate is higher than the forward rate for a particular currency, then that currency would be sellingat a premium.5. Quotation exposure, backlog exposure, and billing exposure are various stages of foreign currencytranslation exposure.6. All foreign transactions are also foreign currency transactions.7. Under the one-transaction approach, the transaction is not considered to be completed until the finalsettlement.8. Under the two-transaction approach, a company's foreign currency receivable or payable are considered aseparate transaction distinct from the transaction to buy goods or services.9. Under the current rate method of translation, all current assets are translated at the year end rate andnon-current assets are translated at the applicable historical rates.10. Under the current rate method, gains or losses from translation are shown in the cumulative translationadjustment account in the balance sheet.11. In the foreign currency context, there is no distinction between the terms conversion and translation.12. Using the current exchange rate to translate current assets and liabilities (under the current/non-currentmethod) is based on the false premise that they are similarly affected by exchange rate changes.13. The temporal method accommodates current market valuation of non-monetary assets (e.g., inventories)while the monetary/non-monetary method does not.14. A major criticism of SFAS No. 8 was that it required foreign currency translation gains and losses to beincluded in the income statement.15. Under the temporal method, translation gain or loss for the period appears in the stockholders' equitysection of the balance sheet.16. Cost of goods sold, depreciation expense, and amortization expense are translated at the average exchangerate under the temporal method and the year end exchange rate under the current rate method.17. SFAS No. 52 requires the use of the current rate method for foreign subsidiaries located inhyperinflationary environments.18. Under SFAS No. 52, functional currency is the currency of the primary operating environment in which theforeign subsidiary operates and generates cash flows.19. According to SFAS No. 52, a hyperinflationary economy is deemed to be one in which the annual inflationrate is greater than 100 percent.20. If the U.S. dollar is deemed to be the functional currency, then SFAS No. 52 requires that the current ratemethod be used.21. Since the current rate method of foreign currency translation uses a constant exchange rate to translatebalance sheet items, it preserves the original financial statement relationships in the consolidated financial statements.22. An advantage of the current rate method of foreign currency translation is that a foreign subsidiary'sfinancial statement ratios are the same before and after translation.23. IAS No. 21 requires the use of the temporal method of foreign currency translation for foreign operationsthat are integral to the operations of the reporting enterprise.24. As of June 30, 2003, Britain, Denmark and Sweden were among the European countries that adopted theeuro as their currency.25. Between January 1, 1999, and January 1, 2002, companies doing business in Euroland can enter into andsettle transactions in the national currency or the euro and must have the ability to process transactions in both currencies.。