物料分类帐 没有被分摊原因

物料分类帐没有被分摊原因

没有被分摊的四个原因一. 库存覆盖范围检查CKMLPP-PBPOPO 收据: 期间中后继调整的数量> 累计库存数量,如果依然想把这部分差异分摊,那么在CKMVFM里将价格限制逻辑去掉Base quantity for stock coverage check, that is cumulated from all operations that result in a value-only postingwithout quantity (forexample material debits/credits, subsequent adjustments from invoices or account maintenance). Ifno stock coverage is given, the Not Distributed line appears in the material price analysis.比如MR22/采购订单后续差异输入/生产订单结算,实际上是不影响库存数量的,但是调整时可以输入一个数量,如果这个调整数量>累计的库存数量,那么他们的差异数量(调整数量-库存数量)部分的差异价值就会被放在”没有被分摊“中在CKMLCP的单层价格确定参数里,可以将”不含库存覆盖范围检查的价格确定“勾上。

If you set this indicator, then there isno stock coverage check for single-level price determination.可能会引起价格突变,最好是先不勾上,分析原因是否合理,排除错误因素后,再勾上运行!二.避免PUP为负fallback strategy:"Automatic Error Correction by the System"As a solution, you might check the postings of these materials if they really need to have such big negative pricedifferences or if there is some kind of error in the posting or the production structure. If you find such errors, you mightreverse the corresponding postings and post them in a correct way.Or, you might use transaction MR22 (debit/credit material) in order to post an appropriate positive amount of differencesto the concerned materials so that the resulting actual price would no longer be negative. This allows to perform theperiod closing regularly. In the next period, you might remove this manual posted value from the materials (again withMR22) in order to correct the overall stock values back to their original amounts. (如果负差异很大为正常情况,可以考虑用MR22输入一个正差异调整,下月再用MR22输入一个负差异调整回来)(一)Fallback strategy when price is negative (one-way step)It following casesa.that the quantity of the "cumulative inventory" is zero,b.or that the price determined is negative. For example, because a very large credit is posted into category"Other receipts/consumption".In these cases the system cannot determine a price or it cannot determine an allowed price. The system thereforemust use another calculation line instead of the cumulative inventory. This usage of anothercalculation line is called"fallback strategy". In this case you have the following levels:1. First, the system uses category "Receipts" as the calculation line. In this case the system generates message: C+135.2. If the price based on the receipt quantity is also negative or if the receipt quantity is zero, the system uses category"beginning inventory" as the calculation line. In this case the system generates message: C+138.3. If the price based on the beginning inventory is also negative or if the beginning inventory quantity is zero, the systemuses the periodic unit price of the previous period as the new price. In this case the system generates message: C+136.4. If the material for the previous period did not yet have any periodic unit price, the system uses the standard price ofthe current period as the new periodic unit price. In this case the system generates message: C+137.如果期初库存为负,累计差异=期初差异+本期收据差异*(本期累计数量/本期收据数量),然后PUP=(累计标准价值+累计差异)/累计数量(二)Fallback strategy when price is negative (cycle)The system issues error message C+723 and uses a fallback strategy.Here the following messages can be generated:CKMLMV034:Cycle &1 will be recosted with the reduced actual BOMIf the price of a material that is in a cycle becomes negative, the fallback strategy described above cannot be carried out.As an automatic fallback solution, all input materials that are also cycle materials are ignored. (三)Fallback strategy when value exceeds threshold (for one-way step)Here the following messages can be generated:CKMLMV020:Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:Multilevel price determination with a reduced actual BOM(四)Fallback strategy when value exceeds threshold (for cycle)Here the following messages can be generated:CKMLMV020:Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:Multilevel price determination with a reduced actual BOM(五)Fallback strategy when cycle does not convergeHere the following messages can be generated:CKMLMV005:Cycle &1 broken off after &2 repititionsCKMLMV012:Input material & 1 will be removed for the iteration (process &2)三. 执行了CKMM.When transaction CKMM is processed the system deletes the price differences for the material in the period and thesedifferences are not longer in the period record tables. CKMM会将差异删除,这些差异将不再被记录到物料分类帐记帐表里,放在了CKM3的没有被分摊里,这是CKM3显示错误,因为显示在CKM3里的“没有被分摊”在期间里是没有记录的了。

物料分类账详解(S4 HANA修订版)

物料分类账详解(S4 HANA修订版)一、业务介绍:中国会计准则规定,对存货的核算必须采用历史成本法(即实际成本法).如果企业采用计划成本法或者定额成本法进行日常核算的,应当按期结转其成本差异,将计划成本或者定额成本调整为实际成本。

物料的明细分类账平行于总账,每个物料在物料分类账中都视同一个明细科目,系统自动在该明细分类账中记录所有和该物料有关的业务从而可以按照期间计算该物料的实际成本(周期单位价格PUP即月末加权平均价)二、物料分类账的差异分摊原理(一) 启用物料分类账的意义各期间记录差异和分摊差异,在期末分摊差异后还原物料的实际成本。

(使用的标准价的月末还原实际成本所产生的凭证次月要冲销,S/4必须启用物料账,但可以不结算。

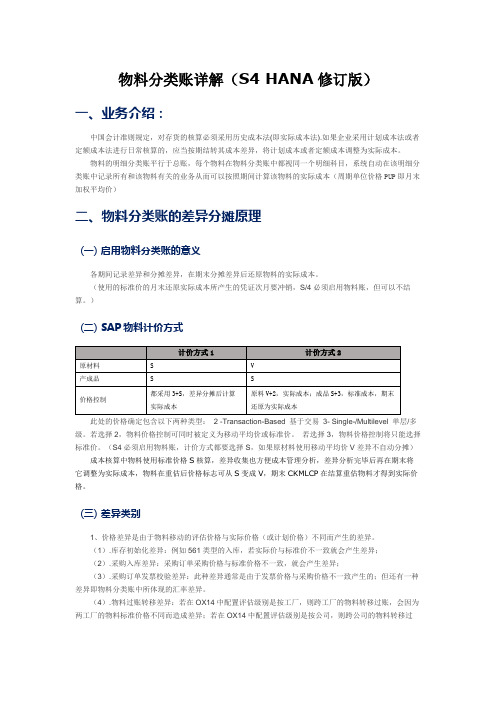

)(二) SAP物料计价方式此处的价格确定包含以下两种类型: 2 -Transaction-Based 基于交易3- Single-/Multilevel 单层/多级。

若选择2,物料价格控制可同时被定义为移动平均价或标准价。

若选择3,物料价格控制将只能选择标准价。

(S4必须启用物料账,计价方式都要选择S,如果原材料使用移动平均价V差异不自动分摊)成本核算中物料使用标准价格S核算,差异收集也方便成本管理分析,差异分析完毕后再在期末将它调整为实际成本,物料在重估后价格标志可从S变成V,期末CKMLCP在结算重估物料才得到实际价格。

(三) 差异类别1、价格差异是由于物料移动的评估价格与实际价格(或计划价格)不同而产生的差异。

(1).库存初始化差异:例如561类型的入库,若实际价与标准价不一致就会产生差异;(2).采购入库差异:采购订单采购价格与标准价格不一致,就会产生差异;(3).采购订单发票校验差异:此种差异通常是由于发票价格与采购价格不一致产生的;但还有一种差异即物料分类账中所体现的汇率差异。

(4).物料过账转移差异:若在OX14中配置评估级别是按工厂,则跨工厂的物料转移过账,会因为两工厂的物料标准价格不同而造成差异;若在OX14中配置评估级别是按公司,则跨公司的物料转移过账,会因为两公司的物料标准价格不同而造成差异(通常跨公司调拨也会视同销售和采购业务进行,若如此其差异如前2、3的差异);(5).标准价格变更差异:MR21/MR22或CK40N(CK11N)、CK24,以及CKMPRPN、CKME等方式的价格变更,都会造成差异(一般不允许修改标准价);(6).生产环节结算差异:生产订单的报工、生产收货都是按照标准价格或计划作业价格计算成本,在订单结算环节,会结转将投入与产出的差异(WIP也可以承担差异);此差异包括材料差异和制造费用(不同作业类型)差异;(7).其他类型业务差异:如退货、特殊库存间转储等。

关务帐、财务帐、物流帐难以平衡的原因

分析关务帐,财务帐,仓库帐三帐难以平衡的根本原因为加强对加工贸易企业的监管力度,海关出台了一系列的法律、法规、政策,同时,不断强化技术手段和现场稽查核查力度。

在实际运作过程中,诸多加工贸易企业缺乏对国家进出口法律、法规、政策的足够重视和全面系统的了解,其经营运作缺乏足够的规范性,保税加工货物的监管意识淡薄、管理混乱,与政府监管要求的脱节,企业内部海关帐、库存帐、财务帐管理混乱或者帐目不清,企业留有诸多隐患。

不少企业在"无知"或"知之甚少"的情况下,因无心走私违法而事实构成走私违法的事情屡有发生,严重影响到企业的生存、发展。

在此分析加工贸易企业三帐难以平衡的根本原因,是为了帮助广大加工贸易企业深入地认识到实现"三帐平衡"的细节要求、注意事项,有计划有针对地规范企业运作,建立帐务平衡体系和机制,从根本上消除关务作业风险和隐患!加工贸易企业要实现海关帐、仓库帐和会计帐帐务平衡,需要企业各部门加强对保税业务管理要求的理解和认识。

依据保税业务的管理要求,从业务源头着手,梳理企业业务流程,进行企业管理体系的优化、整合,方能解决企业帐务平衡,否则难免帐务不清、积重难返,甚至于给企业带来重大损失!从海关监管特色和企业经营运作模式来看,加工贸易企业三帐难以平衡有其根本的原因:1、海关监管执法数据与企业内部管理数据计算口径不同随着海关监管模式的改革,海关监管方向从原来的重单证轻实物逐步向重实物重过程转化;核销方式也从粗放核销逐步向链式管理、据实核销转化。

海关将逐步严格要求企业报送满足海关监管要求的物流、生产经营等数据。

对于联网企业,海关总署第 150 号令明确要求"联网企业应当如实向海关报送加工贸易货物物流、库存、生产管理以及满足海关监管需要的其它动态数据。

现阶段,海关的执法作业数据是依据海关商品分类编码的归并关系进行分类管理,也就是说海关进行核查作业和核销的计算口径主要是按照hscode 以及单耗来进行。

SAP咨询:SAP 物料分类账详解说明

SAP咨询:SAP 物料分类账详解说明SAP咨询:SAP 物料分类账详解说明SAP咨询:物料账(英文缩写ML)是按照物料的实际流向来分摊差异的,它支持每月物料收支业务采用标准价,期末核算物料的实际成本。

即在月内每天出、入库业务采用标准价记帐,期末计算物料实际成本并重估库存值。

一、业务背景:中国会计准则规定,对存货的核算必须采用历史成本法(即实际成本法).如果企业采用计划成本法或者定额成本法进行日常核算的,应当按期结转其成本差异,将计划成本或者定额成本调整为实际成本.“存货采用计划成本法核算,有利于简化财务会计处理工作,有利于考核采购部门的经营业绩,促使降低采购成本、节约支出”.完全成本法和变动成本法最核心、本质的差异在于对固定制造费用的处理上,比如生产设备的折旧被划分为固定制造费用,如受外界影响企业两个月份的产量差异很大,那么这种差异反映到产品的单位成本上的差异就会很大。

而事实上这种成本差异并不会被市场所认可。

所以,可以把当期产品该摊的部分(通过定额确定)以变动成本的形式计入产品,而不该摊的部分(与期间相关的)直接计入当期损益。

二、物料帐概念物料的明细分类账它平行于总账每个物料在物料分类账中都视同一个明细科目系统自动在该明细分类账中记录所有和该物料有关的业务从而可以按照期间计算该物料的实际成本(周期单位价格PUP即月末加权平均价)三、物料分类帐的差异分摊原理(一) 启用物料分类账的意义作用在于:1、记录差异2、分摊差异在期末分摊差异之后,以实现还原物料的实际成本。

(二) 差异类别。

SAP将差异分为两大类:1、价格差异。

价格差异是由于物料移动的评估价格与实际价格(或者计划价格)不同而产生的差异。

2、汇率差异。

因汇率产生的差异。

价格差异又分类单层价格差异和多层价格差异,二者之和构成总的价格差异。

简单的讲,单层差异是由于物料本身而产生的差异;多层差异是由来自于物料所处BOM的下层物料的差异而引起的该物料的差异。

CKMM未分摊差异方案

一.业务背景:企业在2008/09期间运行完物料分类帐和手工差异调整后,Tcode:FS10N查看材料成本差异-原材料科目1232010000还剩980多万(主要为采购差异),剩余材料成本差异-原材料被放置在资产负债表存货项目下,根据当期物料查看材料成本差异明细发现主要是达混合油60090946造成,Tcode:CKM3造成1611千万多的”没有分配”差异,见下图。

根据总部规定材料成本差异-原材料不允许期末有余额,在2008/10期如何调整?二.原因分析:MM03查找到物料60090946在2008/09/04曾使用Tcode:CKMM修改价格控制标志,也就是说,2008/09/04前该料的价格确定和价格控制不是S+3,而根据物料分类帐逻辑只有S+3的物料的差异才能被分摊, 虽然物料最后被修改回S+3,但是2008/09/04前发生的差异将不被分摊。

上图为FS10N的2008/09期间交易明细根据物料60090946查找出的明细结果,2008/09/01->2008/09/04发生了4笔差异, 16,192,334.17-16,192,334.17+16,192,334.17-80,290.97=16,112,043.20元,正是CKM3看到的”没有分配”差异总数。

所以,在使用CKMM修改价格确定或价格控制时要非常注意可能的不能分摊走的差异。

三.解决方案:由于2008/09期材料成本差异被放置在存货项目下,所以考虑将材料成本差异在第9期还原到存货,这样不影响已上报的第9期的资产负债表和损益表,故考虑使用存货价格变更事务码MR22/MIRO将材料成本差异调整到存货,由于是在2008/10期做调整具体步骤如下:(1).OB52/OKP1打开2008/09期。

(2).CKMM修改价格控制S+3到V+2 ,在第10期将抛出此部分"未分摊差异"。

(3).MR22/MIRO将2008/09期的材料成本差异调整到库存。

单层未分配差异处理

业务背景:运行物料分类帐发现巨额原材料差异在单层差异后就未被正确分配。

解决步骤:1.快速定位异常物料(Tcode:FS10N| FAGLB03)也可以使用程序ZML_VALUE_FLOW_ANALYZER查看异常物料,在此使用FS10N快速查找差异异常的物料,理论上,运行物料分类帐后的最高境界是原材料差异和产品的生产成本差异全部分摊,差异科目当期余额为0,内控制度一般也可能要求月结完成后本期无差异(可允许差异带到下期期初),但实务中往往会存在一定的遗留差异,如果差异在可接受范围内,可以使用手工记帐的方式将当期差异结平。

FS10N(FAGLB03新总帐用)查找本期余额,双击进去查看明细,更改格式,如图1,将工厂,物料等重要字段拉出来。

通过按工厂+物料+评估类型(如果使用了分割评估)进行总计和小计,可以快速查找出差异特别巨大的物料,然后使用Tcode:CKM3去查看当期的物料移动历史。

注:如果格式中不能使用物料和评估类型等字段,可在后台配置“定义查找及排序数据的特殊字段”(Tcode:OBVU|Se16: V_T021S|V_FAGL_T021S新总帐用)中见字段MATNR 和BWTAR等字段放出,常用的排序字段还有原因代码和凭证用户名等。

2.CKM3查找原因通过步骤1的FS10N查找到物料60098887在单层结算时就出现4.84亿的未分配差异,如图3。

物料分类帐的逻辑简单地说,就是将物料的期初价差和本期平时交易使用标准价核算和实际价差产生的价格差异在本期的消耗和期末库存按数量加权分配。

差异分摊分单多层,单层就是差异分摊到该物料本身的消耗和期末库存,多层就是将消耗分到的单层差异再往上卷。

原理很简单,实务却很复杂,举个最简单的实例,原油标准价格5000元一吨,期初无库存也无差异,本期采购100,000吨,实际价格7000元一吨,产生价差2亿,本期消耗5000吨,遗留期末库存5000吨,则单层差异分配消耗层分配到差异1亿,还有1亿遗留在期末库存, 而多层差异分配是将消耗层的单层差异1亿再根据消耗(通常是发料到生产订单)分配到半成品和产成品上去,由于炼化企业是X型投入产出,产出涉及大量联副产品,而且还有回流,多层差异的循环分配异常复杂(关于究竟哪些业务涉及多层差异此处不细讲),也是最容易出现问题的地方,正因为如此,在业务处理中要尽量杜绝多层差异产生死循环的业务。

物料分类账详解(S4HANA修订版)

物料分类账详解(S4HANA修订版)物料分类账详解(S4 HANA修订版)一、业务介绍:中国会计准则规定,对存货的核算必须采用历史成本法(即实际成本法).如果企业采用计划成本法或者定额成本法进行日常核算的,应当按期结转其成本差异,将计划成本或者定额成本调整为实际成本。

物料的明细分类账平行于总账,每个物料在物料分类账中都视同一个明细科目,系统自动在该明细分类账中记录所有和该物料有关的业务从而可以按照期间计算该物料的实际成本(周期单位价格PUP即月末加权平均价)二、物料分类账的差异分摊原理(一)启用物料分类账的意义各期间记录差异和分摊差异,在期末分摊差异后还原物料的实际成本。

(使用的标准价的月末还原实际成本所产生的凭证次月要冲销,S/4必须启用物料账,但可以不结算。

)(二) SAP物料计价方式原材料产成品价格控制SS都采用3+S,差异分摊后计算实际成本计价方式1VS计价方式2原料V+2,实际成本;成品S+3,标准成本,期末还原为实际成本此处的价格肯定包含以下两品种型:2 -Transaction-Based基于交易3- XXX单层/多级。

若选择2,物料价格控制可同时被定义为移动平均价或标准价。

若选择3,物料价格控制将只能选择标准价。

(S4必须启用物料账,计价方式都要选择S,如果原材料使用移动平均价V差异不自动分摊)本钱核算中物料使用标准价格S核算,差异收集也方便本钱管理分析,差异分析完毕后再在期末将它调解为实践本钱,物料在重估后价格标志可从S酿成V,期末CKMLCP在结算重估物料才得到实践价格。

(三)差异类别1、价格差异是由于物料移动的评估价格与实际价格(或计划价格)不同而产生的差异。

(1).库存初始化差异:例如561类型的入库,若实际价与标准价不一致就会产生差异;(2).采购入库差异:采购订单采购价格与标准价格不一致,就会产生差异;(3).采购定单校验差异:此种差异通常是由于价格与采购价格不一致产生的;但还有一种差异即物料分类账中所体现的汇率差异。

物料分类账详解

物料分类账分析物料分类帐我将分为3块来讲,分别为:背景分析&启用物料分类帐的前提、前台操作、后台配置。

背景分析中国会计准则规定,对存货的核算必须采用历史成本法,即实际成本法,如果企业采用计划成本法,例如标准成本进行日常核算,应当在月末结算成本差异,或将计划成本调整为实际成本。

为了满足中国的会计准则,在传统的手工帐时代,人们更倾向采用“加权平均法”计算物料实际成本,即在物料发生业务时会计不做账,原因是不了解物料当时的实际成本,当月末收到发票后,才进行计算并补齐整月的凭证。

先不谈这种方式工作量如何,单从它的效果来看,个人认为,这种结算方式并没有真正的体现出财务管理的思想,只是机械的迎合会计准则的需要及自身条件的约束。

管理学认为,对企业财务的控制应当分为事前计划,事中控制及事后分析,而单一的事后核算对企业现代化发展,毫无帮助。

所以,采用标准成本法对物料进行管理,成为当今社会的主流。

在SAP系统中,如果物料的价格控制方式为标准价,当采购价与标准价不一致时,系统会自动生产材料采购差异,这部分差异通常我们会在月末时,将其分摊至销售成本或库存中。

但事实上我们并不能够知道每种物料的实际成本,因为分摊至库存的那部分差异并没有与物料相对应。

如何满足企业精益生产(JIT)的需求?如何在SAP中计算出库存物料的实际成本?如何才能将材料采购差异,分摊至每一种物料?带着这三个问题,我们进入下一阶段的讲述。

启用物料分类帐的前提对于采购差异的处理,SAP提供了多种解决方案,下面,我们将对比不同的处理方式,从而明确启用物料分类帐的前提。

采购进行发票校验时产生的会计凭证:当采购发票价与标准价的不一致,产生了材料采购差异,这部分差异在月末订单结算时,会根据产成品的销售情况,分别计入销售成本及库存商品中,我们可能采取的措施有以下几种。

结转至本年利润如果差异较小并且相对平稳,我们可以将所有差异直接通过手工帐的方式,转移至销售成本中,再通过资产负债表直接将差异转入本年利润科目。

物料分类帐 没有被分摊原因

没有被分摊的四个原因一. 库存覆盖范围检查CKMLPP-PBPOPO 收据: 期间中后继调整的数量> 累计库存数量,如果依然想把这部分差异分摊,那么在CKMVFM里将价格限制逻辑去掉Base quantity for stock coverage check, that is cumulated from all operations that result in a value-only postingwithout quantity (forexample material debits/credits, subsequent adjustments from invoices or account maintenance). Ifno stock coverage is given, the Not Distributed line appears in the material price analysis.比如MR22/采购订单后续差异输入/生产订单结算,实际上是不影响库存数量的,但是调整时可以输入一个数量,如果这个调整数量>累计的库存数量,那么他们的差异数量(调整数量-库存数量)部分的差异价值就会被放在”没有被分摊“中在CKMLCP的单层价格确定参数里,可以将”不含库存覆盖范围检查的价格确定“勾上。

If you set this indicator, then there isno stock coverage check for single-level price determination.可能会引起价格突变,最好是先不勾上,分析原因是否合理,排除错误因素后,再勾上运行!二.避免PUP为负fallback strategy:"Automatic Error Correction by the System"As a solution, you might check the postings of these materials if they really need to havesuch big negative pricedifferences or if there is some kind of error in the posting or the production structure. If you find such errors, you mightreverse the corresponding postings and post them in a correct way.Or, you might use transaction MR22 (debit/credit material) in order to post an appropriate positive amount of differencesto the concerned materials so that the resulting actual price would no longer be negative. This allows to perform theperiod closing regularly. In the next period, you might remove this manual posted value from the materials (again withMR22) in order to correct the overall stock values back to their original amounts. (如果负差异很大为正常情况,可以考虑用MR22输入一个正差异调整,下月再用MR22输入一个负差异调整回来)(一)Fallback strategy when price is negative (one-way step)It following casesa.that the quantity of the "cumulative inventory" is zero,b.or that the price determined is negative. For example, because a very large credit is posted into category"Other receipts/consumption".In these cases the system cannot determine a price or it cannot determine an allowed price. The system thereforemust use another calculation line instead of the cumulative inventory. This usage ofanother calculation line is called"fallback strategy". In this case you have the following levels:1. First, the system uses category "Receipts" as the calculation line. In this case the system generates message: C+135.2. If the price based on the receipt quantity is also negative or if the receipt quantity is zero, the system uses category"beginning inventory" as the calculation line. In this case the system generates message: C+138.3. If the price based on the beginning inventory is also negative or if the beginning inventory quantity is zero, the systemuses the periodic unit price of the previous period as the new price. In this case the system generates message: C+136.4. If the material for the previous period did not yet have any periodic unit price, the system uses the standard price ofthe current period as the new periodic unit price. In this case the system generates message: C+137.如果期初库存为负,累计差异=期初差异+本期收据差异*(本期累计数量/本期收据数量),然后PUP=(累计标准价值+累计差异)/累计数量(二)Fallback strategy when price is negative (cycle)The system issues error message C+723 and uses a fallback strategy.Here the following messages can be generated:CKMLMV034:Cycle &1 will be recosted with the reduced actual BOMIf the price of a material that is in a cycle becomes negative, the fallback strategy described above cannot be carried out.As an automatic fallback solution, all input materials that are also cycle materials are ignored.(三)Fallback strategy when value exceeds threshold (for one-way step)Here the following messages can be generated:CKMLMV020:Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:Multilevel price determination with a reduced actual BOM(四)Fallback strategy when value exceeds threshold (for cycle)Here the following messages can be generated:CKMLMV020:Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:Multilevel price determination with a reduced actual BOM(五)Fallback strategy when cycle does not convergeHere the following messages can be generated:CKMLMV005:Cycle &1 broken off after &2 repititionsCKMLMV012:Input material & 1 will be removed for the iteration (process &2)三. 执行了CKMM.When transaction CKMM is processed the system deletes the price differences for the material in the period and thesedifferences are not longer in the period record tables. CKMM会将差异删除,这些差异将不再被记录到物料分类帐记帐表里,放在了CKM3的没有被分摊里,这是CKM3显示错误,因为显示在CKM3里的“没有被分摊”在期间里是没有记录的了。

物料帐常见的未分配、不包括差异的查询及分析

物料帐常见的未分配、不包括差异的查询及分析Note 908776 - Not included/not allocated and not distributedSummarySymptomYou would like to have further details about possible reasons which cause 'Not distributed' and 'Not included' variances.Other termsACTCONS CNACT 'Not distributed' 'Not allocated' 'Not included'Reason and PrerequisitesThe 'Not distributed' differences are variances posted to the material during periodic transactions which are not carried to line 'cumulative inventory' and therefore not considered to calculate Periodic Unit Price.In transaction CKM3 they are shown in an own line above 'cumulative inventory' line.The 'Not included' or 'Not allocated' variances are variances rolled from 'cumulative inventory' line to category 'consumption' which are not rolled further to the single-level or multi-level consumption alternatives.In transaction CKM3 these differences appear in an own line below category 'consumption' line.Solution**'Not distributed' price differences can be due to four reasons:A) System applied a 'Price limiter' logic (stock coverage check).You can analyse this case using the value flow monitor transaction:- for release 4.7 , transaction CKMVFM- for release 4.6C, program SAPRCKM_VERIFY_PRICE_DET (note 324754 is required).- for release < 4.6C: Program ZVERIFY_PRICE_DET (included in the note 324754) Or directly checking the field CKMLPP-PBPOPO manually.In this case the value CKMLPP-PBPOPO is bigger than cumulative inventory.If you still want these price differences to be distributed , you can switch off price limiter logic. Then all price differences are posted to stock, and the price difference account is cleared. You should decide for each material if you want to switch off price limiter logic or not. So you can achieve a compromise between realistic prices and clearing the balance of the price different account.Price limiter logic can be switched off in the following way: * Resetting the price limiter quantity:In release 4.7 this is done using transaction CKMVFM.In release <= 46C using the program ZREMOVE_PRICE_LIMITER (see note 325406).* Note 855387: Application of this note will create an additional selection parameter for step 'Single Level Price Determination' to switch on/off price limiter logic.This option is the better way, as it simplifies the process and provides more flexibility (see the note for more information).B) System applie*llback strategy during price determination (see note 579216) to avoid a negative periodic unit price (PUP).Please check the attached note 579216: If the regularly calculated PUP (based on 'Cumulative Inventory' line) would become negative, the system uses a different strategy to calculate the PUP:The PUP is calculated with these priorities:1. 'Cumulative Inventory' line (no fallback)2. Receipts ('ZU') line (Info message C+ 135 in the log)3. Beginning inventory ('AB') line (Info message C+ 138 in the log)4. PUP-price of previous period (Info message C+ 136 in the log)5. S-price (Info message C+ 137 in the log).The fallback strategy is active by default for Single-Level price determination.For multilevel price determination it must be activated with parameter 'Negative price: automatic error management'.As a solution, you might check the postings of these materials if they really need to have such big negative price differences or if there is some kind of error in the posting or the production structureIf you find such errors, you might reverse the corresponding postings and post them in a correct way.Or, you might use transaction MR22 (debit/credit material) in order to post an appropriate positive amount of differences to the concerned materials so that the resulting actual price would no longer be negative. This allows to perform the period closing regularly. In the next period, you might remove this manualposted value from the materials (again with MR22) in order to correct the overall stock values back to their original amounts.C) Execution of transaction CKMM.The above situation may be produced because transaction CKMM wa*ecuted during the corresponding period.When transaction CKMM is processed the system deletes the price differences for the material in the period and these differences are not longer in the period record tables.See note 384553 for further details.The fact is that the price differences are still visible in CKM3 (as not distributed). This is due to the missing reset of summarization records (MLCD).This error is just a problem of CKM3 display, because the differences shown as 'not distributed' do not exist in the periodic records. The PUPof the material is calculated correctly.The error is solved with note 838989:(Hotpackage 46C SAPKH46C51470 SAPKH47025500 SAPKH50010600 SAPKH60001).D) A subsequent price change (LTPC).In transaction CKM3 when a subsequent price change (LTPC) is carried out, the preliminary valuation and all differences are rescaled at category level. Additionally, the corresponding lines for price change documents are sorted and flagged with the text "Subsequent price change".If a late price change is run with transaction MR21 and there were not a previous reversal of the consumptions already postedin the period, these documents cannot be rescaled by transaction MR21.Therefore transaction CKM3 will show a "Not distributed line" although the PRDs are rescaled correctly. This is then a display side-effect in CKM3.**'Not included' or 'Not allocated' price differences:A) The material has multilevel consumption alternatives (processes).Possible causes:- Multilevel price determination was not carried out yet.- Not all subsequent materials were processed by multilevel price determination. If multilevel step has not been carried out (or resulted in an error etc.) the price differences remain on the input material in the 'not allocated' line.You can verify the Actual BOM for all consumption processes to find all output materials. You should check the status for multilevel in all output materials- the multi level document of one subsequent material is obsolet, because it is older than the single level or multi level document of the input material.You can check this by comparing the time stamps in the documents' header data.This situation occurs when the input material was reprocessed by single level and/or multi level price determination, but not all depending subsequent materials were reprocessed.To avoid such error SAP recommends to run multi level price determination generally with the option: 'materials already processed: process again'.- For some consumption processes there was no goodsreceipt of the output material in the period. In this case the price differences can not be rolled up by multi level price determination. They remain as 'not included' ('not allocated') at the input material.- For some consumption processes, that have different output materials (joint production) for one of the joint products (the materials that receive costs according to the apportionment structure) the goods receipt has not been posted yet. In this case the differences to be allocated to this joint product remain as 'not included' ('not allocated') at the input material- One output was calculated with reduced BOM. Typically this happens if input and output material are part of a cycle, and this cycle was cut off because it didn't converge. In this case the price differences of the input were not rolled-up along the cycle connections and therefore remain on the input material. To verify if this case applies check the multi level document of the output material. There must be a red light in the item line of the input material to indicate that no price differences have been rolled up. In the header data of the multi level document you can see the cycle number. Furthermore in the log of multi-level price determination there may be a message 'Cycle * cut off after * iterations'.B) Material has Single level consumption alternatives- For release 4.7 or higher, the step 'Revaluation of consumption' was not carried out. (This step is only available with Financials Extensions).- For releases < = 4.6C.The variances for single level consumption alternativesremain always as 'Not included'. In the standard there is no functionality to revaluate Single level consumption movements. Program ZSAPRCKML_COGS revaluates single level consumption movements but it does not create a Material Ledger document,therefore its postings are invisible in CKM3. So even after execution of program ZSAPRCKML_COGS the price differences posted by it are shown as, 'Not Included' in CKM3. Please see the note 722076 for more information.C) The material has consumption to folder 'WIP Production' and the step 'WIP Revaluation' has not been carried out yet. (This case applies only if the functionality 'WIP Revaluation' is used.)。

物料分类账详解

物料分类账分析物料分类帐我将分为3块来讲,分别为:背景分析&启用物料分类帐的前提、前台操作、后台配置。

背景分析中国会计准则规定,对存货的核算必须采用历史成本法,即实际成本法,如果企业采用计划成本法,例如标准成本进行日常核算,应当在月末结算成本差异,或将计划成本调整为实际成本。

为了满足中国的会计准则,在传统的手工帐时代,人们更倾向采用“加权平均法”计算物料实际成本,即在物料发生业务时会计不做账,原因是不了解物料当时的实际成本,当月末收到发票后,才进行计算并补齐整月的凭证。

先不谈这种方式工作量如何,单从它的效果来看,个人认为,这种结算方式并没有真正的体现出财务管理的思想,只是机械的迎合会计准则的需要及自身条件的约束。

管理学认为,对企业财务的控制应当分为事前计划,事中控制及事后分析,而单一的事后核算对企业现代化发展,毫无帮助。

所以,采用标准成本法对物料进行管理,成为当今社会的主流。

在SAP系统中,如果物料的价格控制方式为标准价,当采购价与标准价不一致时,系统会自动生产材料采购差异,这部分差异通常我们会在月末时,将其分摊至销售成本或库存中。

但事实上我们并不能够知道每种物料的实际成本,因为分摊至库存的那部分差异并没有与物料相对应。

如何满足企业精益生产(JIT)的需求?如何在SAP中计算出库存物料的实际成本?如何才能将材料采购差异,分摊至每一种物料?带着这三个问题,我们进入下一阶段的讲述。

启用物料分类帐的前提对于采购差异的处理,SAP提供了多种解决方案,下面,我们将对比不同的处理方式,从而明确启用物料分类帐的前提。

采购进行发票校验时产生的会计凭证:当采购发票价与标准价的不一致,产生了材料采购差异,这部分差异在月末订单结算时,会根据产成品的销售情况,分别计入销售成本及库存商品中,我们可能采取的措施有以下几种。

结转至本年利润如果差异较小并且相对平稳,我们可以将所有差异直接通过手工帐的方式,转移至销售成本中,再通过资产负债表直接将差异转入本年利润科目。

物料分类帐基本原理

物料分类帐基本原理首先要介绍一下物料分类帐的大致原理:物料账(英文缩写ML)是按照物料的实际流向来分摊差异的,它支持每月物料收支业务采用标准价,期末核算物料的实际成本。

即在月内每天出、入库业务采用标准价记帐,期末计算物料实际成本并重估库存值。

详细见附件的例子:1.这里假设有个原料(ROM)标准价格为10;期初数量为80,2.本月入库为20个,单价为12,这是系统按标准价记录库存价值增加(20*10)200元;同时在物料账中记录该物料产生的差异为40。

3.假设出库50个,系统按标准价格记录材料消耗(50*10)500元;4.此时期末库存为505.在期末做该物料单层评估时,系统将将步骤2产生的40元的差异在本期消耗(步骤2消耗的50个)和期末库存间分摊(50个)。

所以将20元的差异分给该原料的存货价值,同时将20元的差异分给使用该原料的半成品(WIP)。

6.同样该半成品(wip)接收了20元的差异,该半成品在月底也要将差异在期末库存和本月消耗直接分配。

存在的问题:其中一个工厂的物料分类帐不能运行问题原因:物料分类帐是只有在物料采用标准价S的时候才会有物料分类帐,原先的工厂中的物料都是使用移动平均价V的,但是后来由于生产订单中有一些副产品使得成本为负而不能结生产订单,所以就把成品和半成品的价格控制由V改成了S,但是在上个月进行月结的时候忘记了做这个工厂的物料分类帐,所以本月的物料分类帐也不能运行,造成了现在这个局面.解决方法1.强行打开所要处理的那个期间的物料帐期和财务帐期然后进行月结,把所有的差异都记在那个期间中,这样也会影响资产负债表和损益表,运行完之后再对上一期间进行物料分类帐.2.重新设立一个工厂,把原来的工厂停掉,在新的一个月使用新的工厂,把原先的差异也都留在原来的工厂,最后把差异都结出来.经验:以后切不能忘了把每个工厂进行物料分类帐,否则后果很严重按照物料的特点选择不同的价格控制,标准价是对物料价格波动不是很大的,移动平均价是对物料价格波动大的物料帐(2010-03-09 19:43:50)转载分类:sap标签:杂谈如果企业选用了物料帐作成本核算的方法,物料结算流程是必需的步骤,这也是月结的一部分。

sap物料帐的未分配字段的理论

MATERIAL PRICE ANALYSIS:"NOT DISTRIBUTED LINE"After multi-level price determination, a line "not distributed" appears in the material price analysis. Read here why and how this is happens:The Material Price Analysis shows a "Not Distributed" line - what is that?Posting ExamplesExternal ProcurementInternal ProductionBackground, Helpful InformationWorkaroundsThe Material Price Analysis shows a "Not Distributed" line - what is that?Actual Costing follows various rules, among which are the following two:Only costs that are covered by the inventory are assigned to the material.Costs that are not covered by the inventory remain as price differences.If in a period values are posted for a quantity larger than the cumulative quantity, only a portion of the values is distributed to material. The portion that is not distributed to material is displayed in the Material Price Analysis in the line "Not Distributed" (Figure 1). This ensures that the price determination considers only values that belong to the period's cumulated quantity (stock coverage).Internally, the calculation of the Not Distributed line is controlled with a price limiter quantity.Figure 1Posting ExamplesThe Not Distributed line occurs in a number of situations. The two examples below explain the concept of and the need for it.External ProcurementYou realize external procurement with purchase orders.In the current period, you buy and receive a total of 100pc of a raw material (thatis, you post the goods receipts and the invoices).As the beginning inventory of the period is zero, the cumulative inventory is100pc.At the end of the period, you receive further invoices for the purchased goods:Your forwarding agent invoices the shipments.The Custom's invoices the import duties.Tax Authorities invoices Luxury Tax.To post these invoices, you use the function "Debit/Credit Material" (MR22) - yousubsequently debit the quantity the invoices refer to: 100pc each time.As you enter the reference quantity (100pc) with each posting you realize, the price limiter quantity increases to a total of 300pc: 100pc of the shipment, 100pc of the duties, and 100pc of the tax.During price determination, Material Ledger finds that the price limiter quantity exceeds the cumulative quantity of that period (100pc). It prorates the values posted with Debit/Credit Material: Two thirds of the value are not covered by stock and thus are categorized as "not to be distributed". You can see this value in the line Not Distributed.In-house ProductionIn period 1, you create a production order for 100pc of a finished material.Of this quantity, you finish and take on stock 90pc in period 1, all of which are sold immediately.The ending inventory of period 1 is zero, as is the beginning inventory of period 2.The remaining quantity of the production order is finished and taken on stock in period2. No other goods receipts are posted during this period; the cumulative inventory is10pc.Only now you settle the order and post the variances of the production order (100pc) to the material; posting date is in period 2. Theses variances show as single-level price differences.During the order settlement, Material Ledger has set the price limiter quantity to 100pc (the quantity for which the order was settled).During price determination of period 2, Material Ledger finds that the price limiter quantity exceeds the cumulative quantity (10pc) and prorates its value: the value that belongs to the 90pc which were taken on stock and sold in the previous period is displayed in the Not Distributed line.If the whole amount of price differences would be considered for the price determination, incorrect values would be incorporated into the price.Similar postings occur with external procurement, when materials are received and used up in one period, but invoiced in a second.Other examples for the Not Distributed line can be found in Note 323719Background, Helpful InformationThe following statements help to understand the Not Distributed Line:The price limiter is build up by transactions which post only values (no quantities),such asOrder Settlement.Invoice Verification.Debit/Credit Material.Not Distributed values are calculated during single-level price determinationThe Not Distributed line is located above the "Cumulative Inventory", and contains only price/exchange rate differences.The line is not the same as the Not Allocated line, which is located in the category"Consumption" below the Cumulative Inventory.As with all other data above the Cumulated Inventory, Not Distributed values effect the price determination.After Period End Postings, the Not Distributed values remain on the price difference accounts; they are not distributed neither to ending inventory, nor to consumption.You can not correct the not distributed value with a correction posting with debit/credit material, as this correction posting would again build up the price limiter. WorkaroundsThe calculation of the Not Distributed line is not a bug: it is essential for the correct calculation of the Periodic Unit Price of a material.Especially in a multi-level environment (Multi-Level Actual Costing), the effect of incorrect material prices can be hazardous: Prices are not only used for the valuation of the individual materials but are rolled up throughout the materials´ quantity structures.However, in some situations you might want to control or correct the Not Distributed values. To do that, you have the following possibilities:With external procurement, use the Logistic Invoice Verification / document typesubsequent debit instead of the transaction Debit/Credit Material. The Logistic InvoiceVerification does not alter the price limiter quantity to a value higher than the invoice value.If you use the transaction Debit/Credit Material, enter a quantity of zero manually.Note 335670 will change the default value from current quantity to zero.If for you are in a repetitive manufacturing scenario and use periodic settlement (instead of full settlement) price differences are posted to material in each period, and to acertain degree you avoid the situation described above.If you have Not Distributed values and want to analyze how they are calculated, you can apply Note 324754. This note describes a report which lists all documents that effect the calculation of the price limiter quantity of a material.If you find that the price limiter should be modified to include or exclude further values, you can apply the report described in Note 325406.Note 207189 describes the +/- sign of the Not distributed values.If these workarounds do not dispel your concerns and you need further assistance, please contact SAP GBU Financials.。

SAP FICO-物料分类账-差异-采购价差

物料分类账其实就是归集和分摊差异,从而还原物料的实际成本。

那么首先我们就来了解一下差异~1.差异的分类差异如果按照性质来分,可以分为价格差异和汇率差异。

价格差异就是标准成本如实际成本之间的差异,汇率差异是收货与发票校验时汇率不同引起的差异。

如果按照来源来分,可以分为单阶差异和多阶差异。

单阶差异就是物料自身引起的差异,例如物料采购入库的价差;多阶差异为BOM下阶带来的差异,即别人给的差异,例如原材料的价差会带给工单的半成品或者成品。

单阶差异和多阶差异,我们在后面会多次提到哈,大家要先有个概念哦~如果按照内容来分,可以分为采购价差、委外采购价差、发票校验价差、发票检验汇差、工单差异、转料号差异、转工厂差异、标准成本修改差异、库存重估差异。

那么接下来,我们就按照内容来看看具体的差异是如何产生的。

不会一次讲完,分几次讲哦~2. 差异的产生--采购价差采购价差=实际收货成本-收货库存价值=PO单价*入库数量-标准价格*入库数量采购收货时产生差异,由于采购订单的价格和物料当期的标准成本不同引起的差异举个例子:原材料LYNN-RM-111,在系统中的标准成本为2000CNY/1000PC,采购价格为2500CNY/1000PC。

在系统创建了PO,数量为1000PC,收货数量为1000PC。

收货时,产生的会计分录为:Dr:原材料2000CNY物料价格差异-原材料-采购价差500CNY (科目通过OBYC-PRD-空配置)Cr:GR/IR 2500CNY1)ME21N创建PO,MIGO做完收货之后,我们去CKM3看一下物料账。

这个事务代码后面我们会经常使用到哦双击具体的采购订单,可以查看单据2)在此处我们归集了采购价差。

那采购价差如何进行分摊呢?会根据消耗以及结存的数量进行分摊。

例如此处我们做两笔操作,一笔是工单耗用20PC,一笔是成本中心领用耗用10PC工单耗用:CO01创建工单,MIGO发料20PC到工单成本中心领用:MIGO 201领用10PC到工单做完以上操作后,我们再来看一下CKM3物料账的变化:此处可以一层一层点开目录查看明细。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

没有被分摊的四个原因一. 库存覆盖范围检查???? CKMLPP-PBPOPO 收据: 期间中后继调整的数量> 累计库存数量,如果依然想把这部分差异分摊,那么在CKMVFM里将价格限制逻辑去掉???? Base quantity for stock coverage check, that is cumulated from all operations that result in a value-only postingwithout quantity (forexample material debits/credits, subsequent adjustments from invoices or account maintenance). Ifno stock coverage is given, the Not Distributed line appears in the material price analysis.???? 比如MR22/采购订单后续差异输入/生产订单结算,实际上是不影响库存数量的,但是调整时可以输入一个数量,如果这个调整数量>累计的库存数量,那么他们的差异数量(调整数量-库存数量)部分的差异价值就会被放在”没有被分摊“中??? 在CKMLCP的单层价格确定参数里,可以将”不含库存覆盖范围检查的价格确定“勾上。

If you set this indicator, then there isno stock coverage check for single-level price determination.??? 可能会引起价格突变,最好是先不勾上,分析原因是否合理,排除错误因素后,再勾上运行!二.避免PUP为负???? fallback strategy:"Automatic Error Correction by the System"As a solution, you might check the postings of these materials if they really need to have such big negative pricedifferences or if there is some kind of error in the posting or the production structure. If you find such errors, you mightreverse the corresponding postings and post them in a correct way.Or, you might use transaction MR22 (debit/credit material) in order to post an appropriate positive amount of differencesto the concerned materials so that the resulting actual price would no longer be negative. This allows to perform theperiod closing regularly. In the next period, you might remove this manual posted value from the materials (again withMR22) in order to correct the overall stock values back to their original amounts. (如果负差异很大为正常情况,可以考虑用MR22输入一个正差异调整,下月再用MR22输入一个负差异调整回来)(一)Fallback strategy when price is negative (one-way step)???? It following cases?a.that the quantity of the "cumulative inventory" is zero,?b.or that the price determined is negative. For example, because a very large credit is posted into category"Other receipts/consumption".???? In these cases the system cannot determine a price or it cannot determine an allowed price. The system thereforemust use another calculation line instead of the cumulative inventory. This usage of another calculationline is called"fallback strategy". In this case you have the following levels:1. First, the system uses category "Receipts" as the calculation line. In this case the system generates message: C+135.2. If the price based on the receipt quantity is also negative or if the receipt quantity is zero, the system uses category"beginning inventory" as the calculation line. In this case the system generates message: C+138.3. If the price based on the beginning inventory is also negative or if the beginning inventory quantity is zero, the systemuses the periodic unit price of the previous period as the new price. In this case the system generates message: C+136.4. If the material for the previous period did not yet have any periodic unit price, the system uses the standard price ofthe current period as the new periodic unit price. In this case the system generates message: C+137.如果期初库存为负,累计差异=期初差异+本期收据差异*(本期累计数量/本期收据数量),然后PUP=(累计标准价值+累计差异)/累计数量(二)Fallback strategy when price is negative (cycle)The system issues error message C+723 and uses a fallback strategy.Here the following messages can be generated:CKMLMV034:?????????? Cycle &1 will be recosted with the reduced actual BOMIf the price of a material that is in a cycle becomes negative, the fallback strategy described above cannot be carried out.As an automatic fallback solution, all input materials that are also cycle materials are ignored.(三)Fallback strategy when value exceeds threshold (for one-way step)Here the following messages can be generated:CKMLMV020:?????????? Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:?????????? Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:?????????? Multilevel price determination with a reduced actual BOM(四)Fallback strategy when value exceeds threshold (for cycle)Here the following messages can be generated:CKMLMV020:?????????? Step &1: Packet & 2 is first costed with the actual BOMCKMLMV018:?????????? Step &1: Packet & 2 costed again with a reduced BOMCKMLMV021:?????????? Multilevel price determination with a reduced actual BOM(五)Fallback strategy when cycle does not convergeHere the following messages can be generated:CKMLMV005:?????????? Cycle &1 broken off after &2 repititionsCKMLMV012:?????????? Input material & 1 will be removed for the iteration (process &2)三. 执行了CKMM.When transaction CKMM is processed the system deletes the price differences for the material in the period and thesedifferences are not longer in the period record tables. CKMM会将差异删除,这些差异将不再被记录到物料分类帐记帐表里,放在了CKM3的没有被分摊里,这是CKM3显示错误,因为显示在CKM3里的“没有被分摊”在期间里是没有记录的了。