怀尔德会计学原理答案Chapter_03

会计学原理--教材第三章复式记账答案

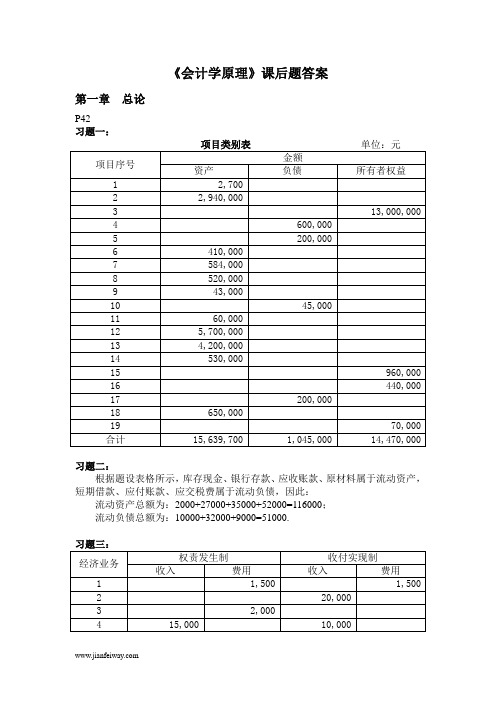

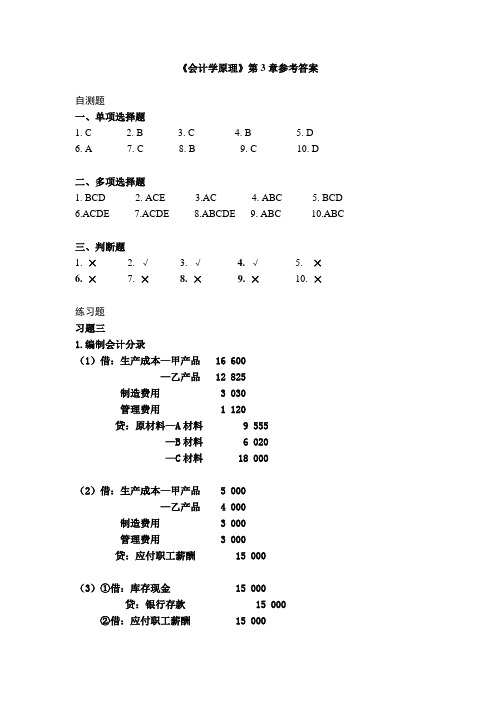

习题一数据依次为:1920; 6300; 6740;15100 ;11000; 9860;13200;43000习题二(1) AH(2) IB(3)AF(4)I B (假设本月工资已经支付)(5)AD(6)AD(7)I B (文具用品当时就被领用)(8)CB(9)AB(10)AD习题三(1)借:主营业务成本28000贷:银行存款28000 (2)借:银行存款100000贷:短期借款100000 (3)借:银行存款200000贷:实收资本200000 (4)借:固定资产370000贷:应付账款370000 (5)借:应付账款58000贷:银行存款58000 (6)借:库存现金96750贷:银行存款96750 借:主营业务成本96750贷:应付职工薪酬96750借:应付职工薪酬96750贷:库存现金96750 (7)借:原材料66700贷:银行存款66700 (8)借:银行存款294560贷:主营业务收入294560 (9)借:主营业务成本89600贷:银行存款89600(10)借:主营业务成本73200贷:原材料72300习题四(1)借:财务费用26600贷:银行存款26600 (2)借:固定资产54800贷:应付账款54800(3)借: 银行存款 54000贷:应收账款54000(4)借::原材料 47000贷:银行存款 47000(5)借: :银行存款350000贷:主营业务收入350000(6) 借:主营业务成本 10780贷:银行存款 10780 (假设本月工资本月支付)(7)借: 主营业务成本75800贷:银行存款75800(8) 借:主营业务成本 128900贷:原材料1289002.借方 银行存款 贷方期初余额 45600(3) 54000(1) 26600 (5) 350000(4)47000(6) 10780(7)75800本期发生额404000 期末余额:289420本期发生额160180借方应收账款 贷方(6)10780(7)75800(8)128900期末余额:215480借方财务费用贷方(1) 26600期末余额:26600至善公司8月份账户本期发生额对照表75000 7500027000 2700015000 15000 500005000050000 50000 128000 62000 190000习题五1①借:银行存款贷:实收资本投资者投入资本750000。

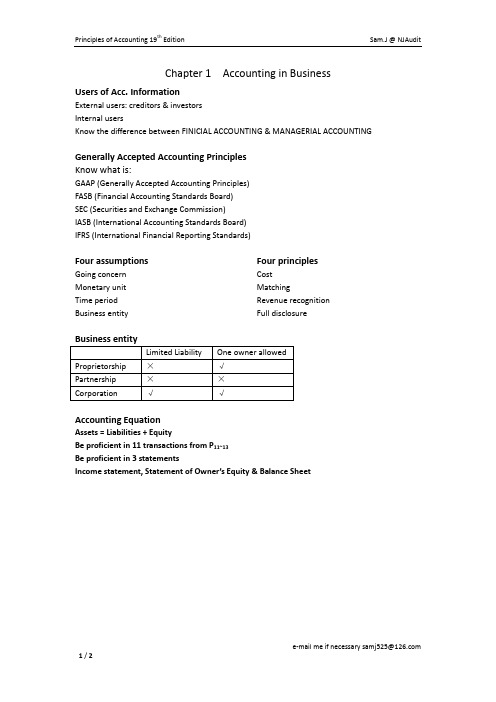

会计学原理 19版 怀尔德 复习提纲 Chapter 1~4

Accounting Equation

Assets = Liabilities + Equity Be proficient in 11 transactions from P11~13 Be proficient in 3 statements Income statement, Statement of Owner’s Equity & Balance Sheet

Accounting Байду номын сангаасrocess

1. 2. 3. 4. 5. 6. 7. Source documents Journal Ledger Adjusting Adjusted trial balance Statements Closing

Adjusting

*Depreciation

Dr. Depreciation Expenses; Cr. Accumulated Depreciation Accumulated Depreciation is a contra account

e-mail me if necessary samj525@ 1/2

Principles of Accounting 19 Edition

th

Sam.J @ NJAudit

Chapter 2 Analyzing and Recording Transactions Chapter 3 Adjusting Accounts and Preparing Financial Statements Chatper 4 Completing the Accounting Cycle

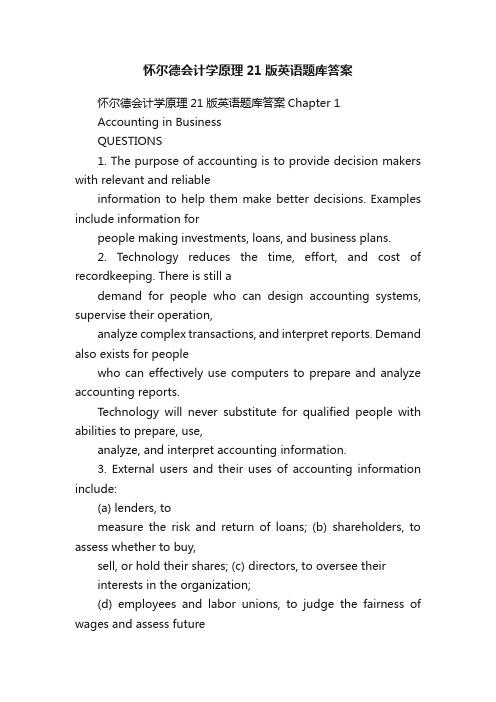

怀尔德会计学原理21版英语题库答案

怀尔德会计学原理21版英语题库答案怀尔德会计学原理21版英语题库答案Chapter 1Accounting in BusinessQUESTIONS1. The purpose of accounting is to provide decision makers with relevant and reliableinformation to help them make better decisions. Examples include information forpeople making investments, loans, and business plans.2. Technology reduces the time, effort, and cost of recordkeeping. There is still ademand for people who can design accounting systems, supervise their operation,analyze complex transactions, and interpret reports. Demand also exists for peoplewho can effectively use computers to prepare and analyze accounting reports.Technology will never substitute for qualified people with abilities to prepare, use,analyze, and interpret accounting information.3. External users and their uses of accounting information include:(a) lenders, tomeasure the risk and return of loans; (b) shareholders, to assess whether to buy,sell, or hold their shares; (c) directors, to oversee theirinterests in the organization;(d) employees and labor unions, to judge the fairness of wages and assess futureemployment opportunities; and (e) regulators, to determine whetherthe organizationis complying with regulations. Other users are voters, legislators, governmentofficials, contributors to nonprofits, suppliers and customers.4. Business owners and managers use accounting information to help answerquestions such as: What resources does an organization own? Whatdebts are owed?How much income is earned? Are expenses reasonable for the level of sales? Arecustomers‘ accounts being promptly collected?5. Service businesses include: Standard and Poor‘s, Dun & Bradstreet, Merrill Lynch,Southwest Airlines, CitiCorp, Humana, Charles Schwab, and Prudential. Businessesoffering products include Nike, Reebok, Gap, Apple Computer, Ford Motor Co.,Philip Morris, Coca-Cola, Best Buy, and Circuit City.6. The internal role of accounting is to serve the organization‘s internal ope ratingfunctions. It does this by providing useful information for internal users incompleting their tasks more effectively and efficiently. By providing this information,accounting helps the organization reach its overall goals.7. Accounting professionals offer many services including auditing, managementadvice, tax planning, business valuation, and money management.8. Marketing managers are likely interested in information such as sales volume,advertising costs, promotion costs, salaries of sales personnel, and salescommissions.9. Accounting is described as a service activity because it serves decision makers byproviding information to help them make better business decisions.10. Some accounting-related professions include consultant,financial analyst,underwriter, financial planner, appraiser, FBI investigator, market researcher, andsystem designer.11. Ethics rules require that auditors avoid auditing clients in which they have a directinvestment, or if the auditor‘s fee is dependent on the figures in the client‘s reports.This will prev ent others from doubting the quality of the auditor‘s report.12. In addition to preparing tax returns, tax accountants help companies and individualsplan future transactions to minimize the amount of tax to be paid. They are alsoactively involved in estate planning and in helping set up organizations. Some taxaccountants work for regulatory agencies such as the IRS or the various statedepartments of revenue. These tax accountants help to enforce tax laws. 13. The objectivity concept means that financial statement information is supported byindependent, unbiased evidence other than someone‘s opinion or imagination. Thisconcept increases the reliability and verifiability of financial statement information. 14. This treatment is justified by both the cost principle and the going-concernassumption.15. The revenue recognition principle provides guidance for managers and auditors sothey know when to recognize revenue. If revenue is recognized too early, thebusiness looks more profitable than it is. On the other hand, if revenue isrecognized too late the business looks less profitable than it is. This principledemands that revenue be recognized when it is both earned and can be measuredreliably. The amount of revenue should equal the value of the assets received orexpected to be received from the business‘s operating activities covering a specifictime period.16. Business organizations can be organized in one of three basic forms: soleproprietorship, partnership, or corporation. These forms have implications for legalliability, taxation, continuity, number of owners, and legal status as follows:Proprietorship Partnership CorporationBusiness entity yes yes yesLegal entity no no yesLimited liability no* no* yesUnlimited life no no yesBusiness taxed no no yesOne owner allowed yes no yes*Proprietorships and partnerships that are set up as LLCs provide limited liability.17. (a) Assets are resources owned or controlled by a company that are expected toyield future benef its. (b) Liabilities are creditors‘ claims on assets that reflectobligations to provide assets, products or services to others.(c) Equity is theowner‘s claim on assets and is equal to assets minus liabilities.(d) Net assets referto equity.18. Equity is increased by investments from the owner and by net income. It isdecreased by withdrawals by the owner and by a net loss (which is the excess ofexpenses over revenues).19. Accounting principles consist of (a) general and (b) specific principles. Generalprinciples are the basic assumptions, concepts, and guidelines for preparingfinancial statements. They stem from long-used accounting practices. Specificprinciples are detailed rules used in reporting on business transactions and events.They usually arise from the rulings of authoritative and regulatory groups such asthe Financial Accounting Standards Board or the Securities and ExchangeCommission.20. Revenue (or sales) is the amount received from selling products and services. 21. Net income (also called income, profit or earnings) equals revenues minus expenses(if revenues exceed expenses). Net income increases equity. If expenses exceedrevenues, the company has a Net Loss. Net loss decreases equity.22. The four basic financial statements are: income statement, statement of owner‘sequity, balance sheet, and statement of cash flows.23. An income statement reports a company‘s revenues and expenses along with theresulting net income or loss over a period of time.24. Rent expense, utilities expense, administrative expenses, advertising and promotionexpenses, maintenance expense, and salaries and wages expenses are someexamples of business expenses.25. The statement of owner‘s equity explains the changes in equity from net income orloss, and from any owner contributions and withdrawals over a period of time. 26. The balance sheet describes a company‘s financial position (types and amounts ofassets, liabilities, and equity) at a point in time.27. The statement of cash flows reports on the cash inflows and outflows from acompany‘s operating, investing, and financing activities.28. Return on assets, also called return on investment, is a profitability measure that isuseful in evaluating management, analyzing and forecasting profits, and planningactivities. It is computed as net income divided by the averagetotal assets. Forexample, if we have an average annual balance of $100 in a bank account and itearns interest of $5 for the year, then our return on assets is $5 / $100 or 5%. Thereturn on assets is a popular measure for analysis because it allows us to comparecompanies of different sizes and in different industries.A 29. Return refers to income, and risk is the uncertainty about the return we expect tomake. The lower the risk of an investment, the lower the expected return. Forexample, savings accounts pay a low return because of the low riskof a bank notreturning the principal with interest. Higher risk implies higher,but riskier, expectedreturns.B30. Organizations carry out three major activities: financing,investing, and operating.Financing provides the means used to pay for resources. Investing refers to theacquisition and disposing of resources necessary to carry out the organizat ion‘splans. Operating activities are the actual carrying out of these plans. (Planning is theglue that connects these activities, including the organization’s ideas, goals andstrategies.)B31. An organization‘s financing activities (liabilities and equity) pay for investingactivities (assets). An organization cannot have more or less assets than itsliabilities and equity combined and, similarly, it cannot have more or less liabilitiesand equity than its total assets. This means: assets = liabilities + equity. Thisrelation is called the accounting equation (also called the balance sheet equation),and it applies to organizations at all times.32. The dollar amounts in Best Buy‘s financial statements are rounded to the nearest$1,000,000. Bes t Buy‘s consolidated st atement of earnings (or income statement)covers the fiscal year (consisting of 53 weeks) ended March 3, 2007. Best Buy alsoreports comparative income statements for the previous two years (consisting of 52weeks).33. In thousa nds, Circuit City‘s accoun ting equation is:Assets = Liabilities + Equity$4,007,283 = $2,216,039 + $1,791,24434. At December 31, 2006, RadioShack had (in millions) assets of $2,070.0, liabilities of$1,416.2, and equity of $653.8.35. The independent auditor for Apple, Inc., is KPMG LLP. The auditor expressly statesthat ―our responsibility is to express an opinion on these consolidated financialstatements based on our audits.‖ The auditor also states that ―these consolidatedfinancial statements are the responsibility of the Com pany‘s management.‖Chapter 21EXERCISESExercise 21-1 (25 minutes)1. Allocation of Indirect Expenses to Four Operating DepartmentsSupervision expensesDepartment Employees % of Total CostMaterials ................................ 40 20% $16,000Personnel .............................. 22 11 8,800Manufacturing ....................... 104 52 41,600Packaging .............................. 34 17 13,600Totals ..................................... 200 100% $80,000 Utilities expensesDepartment Square Feet % of Total CostMaterials ................................ 27,000 27% $16,470 Personnel .............................. 5,000 5 3,050Manufacturing ....................... 45,000 45 27,450Packaging .............................. 23,000 23 14,030Totals ..................................... 100,000 100% $61,000 Insurance expensesDepartment Asset Value % of T otal CostMaterials ................................ $ 60,000 50% $ 8,350 Personnel .............................. 1,200 1 167Manufacturing ....................... 42,000 35 5,845Packaging .............................. 16,800 14 2,338Totals .....................................$120,000 100% $16,7002. Report of Indirect Expenses Assigned to Four Operating DepartmentsSupervision Utilities Insurance TotalMaterials ................................$16,000 $16,470 $ 8,350 $ 40,820 Personnel ..............................8,800 3,050 167 $ 12,017 Manufacturing .......................41,600 27,450 5,845 $ 74,895 Packaging .............................. 13,600 14,030 2,338 $ 29,968 Totals ................................$80,000..... $61,000 $16,700 $157,700 Exercise 21-2 (30 minutes)Calculation of predetermined overhead rates to apply ABC Overhead Cost TotalCategory (Activity Total Amount ofCost Pool) Cost Cost Driver Predetermined Overhead Rate Supervision ........................$ 5,400 $36,000 15% of direct labor costDepreciation .......................56,600 2,000 MH $28.30 per machine hourLine preparation ................46,000 250 setups $184.00 per setup1. Assignment of overhead costs to the two products usingABCRounded edgeCost Cost per AssignedDriver Driver Unit CostSupervision ........................... $12,200 15% $ 1,830Machinery depreciation ........ 500 hours $ 28.30 14,150Line preparation.................... 40 setups $184.00 7,360Total overhead assigned ...... $23,340Squared edgeCost Cost per AssignedDriver Driver Unit CostSupervision ........................... $23,800 15% $ 3,570Machinery depreciation ........ 1,500 hour$ 28.30 42,450sLine preparation....................210 setups $184.00 38,640Total overhead assigned ...... $84,6602. Average cost per foot of the two productsRounded edge Squared edgeDirect materials .......................... $19,000 $ 43,200Direct labor ................................. 12,200 23,800Overhead (using ABC) ............... 23,340 84,660Total cost ................................... $54,540 $151,660Quantity produced ..................... 10,500 ft. 14,100 ft.Average cost per foot (ABC) ...... $5.19 $10.763. The average cost of rounded edge shelves declines and the average cost of squared edge shelves increases. Under the current allocation method, the rounded edge shelving was allocated 34% of all of the overhead cost ($12,200 direct labor/$36,000 total direct labor). However, it does not use 34% of all of the overhead resources. Specifically, it uses only 25% ofmachine hours (500 MH/2,000 MH), and 16% of the setups (40/250). Activity based costing allocated the individual overhead components in proportion to the resources used.Exercise 21-7 (15 minutes)(1) Items included in performance reportThe following items definitely should be included in the performance report for the auto service department manager because they arecontrolled or strongly influenced by the manager‘s decisions and activities:, Sales of parts, Sales of services, Cost of parts sold, Supplies, Wages (hourly)(2) Items excluded from performance reportThe following items definitely should be excluded from the performance report because the department manager cannot control or strongly influence them:, Building depreciation, Income taxes allocated to the department, Interest on long-term debt, Manager‘s salary(3) Items that may or may not be included in performance report The following items cannot be definitely included or definitely excluded from the performance report because they may or may not be completely under the manager‘s control or strong influence:, Payroll taxes Some portion of this expense relates to themanager‘s salary and is not controllable by themanager. The portion that relates to hourly wagesshould be treated as a controllable expense., Utilities Whether this expense is controllable depends on the design of the auto dealership. If the auto servicedepartment is in a separate building or has separateutility meters, these expenses are subject to themanager‘s control. Otherwise, th e expense probablyis not controllable by the manager of the auto servicedepartment.Exercise 21-9 (20 minutes)(1)Investment Center Net Income Average Assets Return on AssetsElectronics ................... $750,000 $3,750,000 20%Sporting Goods ............ 800,000 5,000,000 16%Comment: Its Electronics division is the superior investment center on the basis of the investment center return on assets.Exercise 21-9 (continued)(2)Investment Center Electronics Sporting GoodsNet income ................... $750,000 $800,000Target net income$3,750,000 x 12% ....... (450,000)5,000,000 x 12% ........ (600,000)Residual income……. $300,000 $200,000Comment: Its Electronics division is the superior investment center on the basis of investment center residual income.(3) The Electronics division should accept the new opportunity, since it will generate residual income of 3% (15% - 12%) of the investment‘s investedassets.Exercise 21-10 (15 minutes)Investment Center Net Income Sales Profit MarginElectronics ................... $750,000 $10,000,000 7.50%Sporting Goods ............ 800,000 8,000,000 10.0%InvestmentInvestment Center Sales Average Assets TurnoverElectronics ...................$10,000,000 $3,750,000 2.67Sporting Goods ............ 8,000,000 5,000,000 1.6Comments: Its Sporting goods division generates the most net income per dollar of sales, as shown by its higher profit margin. The Electronics division however is more efficient at generating sales from invested assets, based on its higher investment turnover.PROBLEM SET AProblem 21-1A (60 minutes)Part 1Average occupancy cost = $111,800 / 10,000 sq. ft. = $11.18 per sq. ft.Occupancy costs are assigned to the two departments as follows Department Square Footage Rate TotalLanya‘s Dept. ............... 1,000 $11.18 $11,180Jimez‘s Dept. ................ 1,700 $11.18 $19,006**A total of $30,186 ($11,180 + $19,006) in occupancy costs is charged to these departments. The company would follow a similar approach in allocating the remaining occupancy costs ($81,614, computed as $111,800 - $30,186) to its other departments (not shown in this problem).Part 2Market rates are used to allocate occupancy costs fordepreciation, interest, and taxes. Heating, lighting, and maintenance costs are allocated to the departments on both floors at the average rate per square foot. These costs are separately assigned to each class as follows:Total Value-Based Usage-BasedCosts Costs CostsDepreciation—Building...................$ 31,500 $31,500Interest—Building mortgage .......... 47,000 47,000Taxes—Building and land............... 14,000 14,000Gas (heating) expense .................... 4,425 $ 4,425Lighting expense ............................ 5,250 5,250Maintenance expense ..................... 9,625 ______ 9,625Total .................................................$111,800 $92,500 $19,300Problem 21-1A (Continued)Value-based costs are allocated to departments in two steps(i) Compute market value of each floorSquare Value perFloor Footage Sq. Ft. TotalFirst floor ...............................5,000 $40 $200,000Second floor ..........................5,000 10 50,000Total market value................. $250,000(ii) Allocate $92,500 to each floor based on its percent of market valueMarket % of Allocated Cost perFloor Value T otal Cost Sq. Ft.First floor ...............................$200,000 80% $74,000$14.80Second floor .......................... 50,000 20 18,500 3.70Totals ................................$250,000..... 100% $92,500 Usage-based costs allocation rate = $19,300 / 10,000 sq. ft.= $1.93 per sq. ft.We can then compute total allocation rates for the floors FloorValue Usage TotalFirst floor ............................... $14.80 $1.93 $16.73Second floor .......................... 3.70 1.93 $ 5.63These rates are applied to allocate occupancy costs to departments SquareDepartment Footage Rate TotalLanya‘s Department ........................ 1,000 $16.73 $16,730Jim ez‘s Department ........................ 1,700 5.63 $ 9,571Part 3A second-floor manager would prefer allocation based on market value. This is a reasonable and logical approach to allocation of occupancy costs. The current method assumes all square footage has equal value. This is not logical for this type of occupancy. It also means the。

《会计学原理》习题答案共99页

51、没有哪个社会可以制订一部永远 适用的 宪法, 甚至一 条永远 适用的 法律。 ——杰 斐逊 52、法律源于人的自卫本能。——英 格索尔

53、人们通常会发现,法律就是这样 一种的 网,触 犯法律 的人, 小的可 以穿网 而过, 大的可 以破网 而出, 只有中 等的才 会坠入 网中。 ——申 斯通 54、法律就是法律它是一座雄伟的大 夏,庇 护着我 们大家 ;它的 每一块 砖石都 垒在另 一块砖 石上。 ——高 尔斯华 绥 55、今天的法律未必明天仍是法律。 ——罗·伯顿

பைடு நூலகம்

1、最灵繁的人也看不见自己的背脊。——非洲 2、最困难的事情就是认识自己。——希腊 3、有勇气承担命运这才是英雄好汉。——黑塞 4、与肝胆人共事,无字句处读书。——周恩来 5、阅读使人充实,会谈使人敏捷,写作使人精确。——培根

会计学原理Financial-Accounting-by-Robert-Libby第八版-第三章-答案

会计学原理Financial-Accounting-by-Rob ert-Libby第八版-第三章-答案Chapter 3Operating Decisions andthe Accounting SystemANSWERS TO QUESTIONS1. A typical business operating cycle for a manufacturer would be as follows:inventory is purchased, cash is paid to suppliers, the product is manufactured and sold on credit, and the cash is collected from the customer.2. The time period assumption means that the financial condition andperformance of a business can be reported periodically, usually every month, quarter, or year, even though the life of the business is much longer.3. Net Income = Revenues + Gains - Expenses - Losses.Each element is defined as follows:Revenues -- increases in assets or settlements of liabilities from ongoing operations.Gains -- increases in assets or settlements of liabilities from peripheral transactions.Expenses -- decreases in assets or increases in liabilities from ongoingoperations.Losses -- decreases in assets or increases in liabilities from peripheraltransactions.4. Both revenues and gains are inflows of net assets. However, revenuesoccur in the normal course of operations, whereas gains occur from transactions peripheral to the central activities of the company. An example is selling land at a price above cost (at a gain) for companies not in the business of selling land.Both expenses and losses are outflows of net assets. However, expenses occur in the normal course of operations, whereas losses occur from transactions peripheral to the central activities of the company. An example is a loss suffered from fire damage.5. Accrual accounting requires recording revenues when earned andrecording expenses when incurred, regardless of the timing of cash receipts or payments. Cash basis accounting is recording revenues when cash is received and expenses when cash is paid.Financial Accounting, 8/e 3-2 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Financial Accounting, 8/e3-3© 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.6. The four criteria that must be met for revenue to be recognized under theaccrual basis of accounting are (1) delivery has occurred or services have been rendered, (2) there is persuasive evidence of an arrangement for customer payment, (3) the price is fixed or determinable, and (4) collection is reasonably assured.7. The expense matching principle requires that expenses be recorded whenincurred in earning revenue. For example, the cost of inventory sold during a period is recorded in the same period as the sale, not when the goods are produced and held for sale.8. Net income equals revenues minus expenses. Thus revenues increase netincome and expenses decrease net income. Because net income increases stockholders’ equity, revenues increase stockholders’ equity and expenses decrease it.9. Reve nues increase stockholders’ equity and expenses decreasestockholders’ equity. To increase stockholders’ equity, an account must be credited; to decrease stockholders’ equity, an account must be debited. Thus revenues are recorded as credits and expenses as debits. 10.11.12.13. Total net profit margin ratio is calculated as Net Income Net Sales (orOperating Revenues). The net profit margin ratio measures how much of every sales dollar is profit. An increasing ratio suggests that the company is managing its sales and expenses effectively.ANSWERS TO MULTIPLE CHOICE1. c2. a3. b4. b5. c6. c7. d8. b9. a10. bFinancial Accounting, 8/e 3-4 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Authors' Recommended Solution Time(Time in minutes)* Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries.Financial Accounting, 8/e 3-5 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Financial Accounting, 8/e 3-6© 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.MINI-EXERCISESM3–1.TERMG (1) LossesC (2) Expense matching principle F (3) RevenuesE (4) Time period assumption B(5) Operating cycleM3–2.Cash Basis Income StatementAccrual Basis Income StatementRevenues: Cash sales Customer deposits$8,000 5,000 Revenues: Sales to customers$18,000 Expenses:Inventory purchases Wages paid 1,000 900 Expenses: Cost of sales Wages expense Utilities expense 9,000 900 300Net Income$11,100Net Income $7,800Revenue Account Affected Amount of Revenue Earned in JulyM3–4.Expense Account Affected Amount of Expense Incurred in JulyFinancial Accounting, 8/e 3-7 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.a. Cash (+A) ............................................................................ 15,000Games Revenue (+R, +SE) .......................................... 15,000 b. Cash (+A) ............................................................................ 3,000Accounts Receivable (+A) ................................................ 5,000 Sales Revenue (+R, +SE) ............................................. 8,000 c. Cash (+A) ............................................................................ 4,000Accounts Receivable (-A) ........................................... 4,000 d. Cash (+A) ............................................................................ 2,500Unearned Revenue (+L) ............................................... 2,500 M3–6.e. Cost of Goods Sold (+E, -SE)........................................... 6,800Inventory (-A) ............................................................... 6,800 f. Accounts Payable (–L) (800)Cash (-A) (800)g. Wages Expense (+E, -SE) ................................................. 3,500Cash (-A) ...................................................................... 3,500 h. Insurance Expense (+E, -SE) . (500)Prepaid Expenses (+A) ...................................................... 1,00 Cash (-A) ...................................................................... 1,500 i. Repairs Expense (+E, -SE) .. (700)Cash (-A) (700)j. Utilities Expense (+E, -SE) (900)Accounts Payable (+L) (900)Financial Accounting, 8/e 3-8 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Transaction (c) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets.M3–8.Transaction (h) results in an increase in an asset (prepaid expenses) and a decrease in an asset (cash). Therefore, the net effect on assets is 500.Financial Accounting, 8/e 3-9 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Craig’s Bowling, Inc.Income StatementFor the Month of July 2014Revenues:Games revenue $15,000Sales revenue 8,000Total revenues 23,000Expenses:Cost of goods sold 6,800Utilities expense 900Wages expense 3,500Insurance expense 500Repairs expense 700Total expenses 12,400Net income $ 10,600M3–10.Financial Accounting, 8/e 3-10 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.M3–11.These results suggest that Jen’s Jewelry Company earned approximately $0.31 for every dollar of revenue in 2015, and over time, the ratio has improved. Jen’s has become more effective at managing sales and expenses.As additional analysis:Between 2013 to 2014 and 2014 to 2015, sales have increased at a lower percentage than net income. This suggests that the company has been more effective at controlling expenses than generating revenues.EXERCISESE3–1.TERMK (1) ExpensesE (2) GainsG (3) Revenue realization principleI (4) Cash basis accountingM (5) Unearned revenueC (6) Operating cycleD (7) Accrual basis accountingF (8) Prepaid expensesJ (9) Revenues - Expenses = Net IncomeL (10) Ending Retained Earnings =Beginning Retained Earnings + Net Income - Dividends DeclaredE3–2.Req. 1Cash Basis Income StatementAccrual Basis Income StatementRevenues:Cash sales Customer deposits $500,00070,000Revenues:Sales tocustomers$750,000Expenses:Inventory purchases Wages paidUtilities paid90,000180,30017,200Expenses:Cost of salesWages expenseUtilities expense485,000184,00019,130Net Income $282,500 Net Income $61,870Req. 2Accrual basis financial statements provide more useful information to external users. Financial statements created under cash basis accounting normally postpone (e.g., $250,000 credit sales) or accelerate (e.g., $70,000 customer deposits) recognition of revenues and expenses long before or after goods andservices are produced and delivered (until cash is received or paid). They also do not necessarily reflect all assets or liabilities of a company on a particular date.Activity Revenue AccountAmount of RevenueActivity Expense AccountAmount of ExpenseE3–5.Transaction (k) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets.* A loss affects net income negatively, as do expenses.E3–6.Transaction (f) results in an increase in an asset (property, plant, and equipment) and a decrease in an asset (cash). Therefore, there is no net effect on assets.E3–7.(in thousands)a. Plant and equipment (+A) (636)Cash ( A) (636)Debits equal credits. Assets increase and decrease by the same amount.b. Cash (+A) (181)Short-term notes payable (+L) (181)Debits equal credits. Assets and liabilities increase by the same amount.c. Cash (+A) ..........................................................................Accounts receivable (+A) ................................................ 10,765 28,558Service revenue (+R, +SE) ........................................ 39,323 Debits equal credits. Revenue increases retained earnings (part of stockholders' equity). Stockholders' equity and assets increase by the same amount.E3–7. (continued)d. Accounts payable (-L) ..................................................... 32,074Cash (-A) ................................................................... 32,074 Debits equal credits. Assets and liabilities decrease by the same amount.e. Inventory (+A) ................................................................... 32,305Accounts payable (+L) .............................................. 32,305 Debits equal credits. Assets and liabilities increase by the same amount.f. Wages expense (+E, -SE) ............................................... 3,500Cash (-A) ................................................................... 3,500 Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.g. Cash (+A) .......................................................................... 39,043Accounts receivable (-A) ....................................... 39,043 Debits equal credits. Assets increase and decrease by the same amount.h. Fuel expense (+E, -SE) (750)Cash (-A) (750)Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.i. Retained earnings (-SE) (597)Cash (-A) (597)Debits equal credits. Assets and stock holders’ equity decrease by thesame amount.j. Utilities expense (+E, -SE) (68)Cash (-A) ................................................................... Accounts payable (+L) .............................................. 55 13Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Together, stockholders' equity and liabilities decrease by the same amount as assets.E3–8.Req. 1a.Cash (+A) ................................................................... 2,300,000Short-term note payable (+L) ........................ 2,300,000 Debits equal credits. Assets and liabilities increase by the same amount.b.Equipment (+A) ......................................................... 98,000Cash (-A) ........................................................ 98,000 Debits equal credits. Assets increase and decrease by the same amount.c.Merchandise inventory (+A) .................................... 35,000Accounts payable (+L) .................................. 35,000 Debits equal credits. Assets and liabilities increase by the same amount.d.Repairs (or maintenance) expense (+E, -SE) ......... 62,000Cash (-A) ........................................................ 62,000 Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.e.Cash (+A) ................................................................... 390,000Unearned pass revenue (+L) ......................... 390,000 Debits equal credits. Since the season passes are sold before Vail Resorts provides service, revenue is deferred until it is earned. Assets andliabilities increase by the same amount.f.Two transactions occur:(1) Accounts receivable (+A) (800)Ski shop sales revenue (+R, +SE) (800)Debits equal credits. Revenue increases retained earnings (a part ofstockholders' equity). Stockholders' equity and assets increase by thesame amount.(2) Cost of goods sold (+E, -SE) (500)Merchandise inventory (-A) (500)Debits equal credits. Expenses decrease retained earnings (a part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.E3–8. (continued)g.Cash (+A) ................................................................... 320,000Lift revenue (+R, +SE) .................................... 320,000 Debits equal credits. Revenue increases retained earnings (a part ofstockholders' equity). Stockholders' equity and assets increase by thesame amount.h.Cash (+A) ................................................................... 3,500Unearned rent revenue (+L) .......................... 3,500 Debits equal credits. Since the rent is received before the townhouse isused, revenue is deferred until it is earned. Assets and liabilities increase by the same amount.i. Accounts payable (-L) ............................................. 17,500Cash (-A) ........................................................ 17,500 Debits equal credits. Assets and liabilities decrease by the same amount. j.Cash (+A) . (400)Accounts receivable (-A) (400)Debits equal credits. Assets increase and decrease by the same amount. k.Wages expense (+E, -SE) ........................................ 245,000Cash (-A) ........................................................ 245,000 Debits equal credits. Expenses decrease retained earnings (a part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.Req. 22/1 Rent expense (+E, -SE) (275)Cash (-A) (275)2/2 Fuel expense (+E, -SE) (490)Accounts payable (+L) (490)2/4 Cash (+A) (820)Unearned revenue (+L) (820)2/7 Cash (+A) (910)Transport revenue (+R, +SE) (910)2/10 Advertising expense (+E, -SE) (175)Cash (-A) (175)2/14 Wages payable (-L) ......................................................... 2,300Cash (-A) ......................................................... 2,3002/18 Cash (+A) ..........................................................................Accounts receivable (+A) ................................................ 1,600 2,200Transport revenue (+R, +SE) ......................... 3,800 2/25 Parts supplies (+A) .......................................................... 2,550Accounts payable (+L) ................................... 2,550 2/27 Retained earnings (-SE) .. (200)Dividends payable (+L) (200)Req. 1 and 2Accounts Unearned Fee NoteAdditional Paid-inRebuilding Fees RentItem (f) is not a transaction; there has been no exchange.E3–10. (continued)Req. 3Net income using the accrual basis of accounting:Revenues $19,850 ($19,000 + $850)– Expenses 16,900 ($16,500 + $400)Net Income $ 2,950Assets = Liabilities + Stockholders’ Equity$12,090 $ 7,700 $ 1,70024,800 4,440 7,8202,460 48,500 9,36010,420 2,950 netincome7,40025,300$82,470 $60,640 $21,830Req. 4Net income using the cash basis of accounting:Cash receipts $27,650 (transactions a through d)–Cash disbursements 19,760 (transactions g, i, and k)Net Income $ 7,890Cash basis net income ($7,890) is higher than accrual basis net income ($2,950) because of the differences in the timing of recording revenues versus receipts and expenses versus disbursements between the two methods. The $7,800 higher amount in cash receipts over revenues includes cash received prior to being earned (from (b), $600) and cash received after being earned (in (d), $7,200). The $2,860 higher amount in cash disbursements over expenses includes cash paid after being incurred in the prior period (in (g), $2,300), plus cash paid for supplies to be used and expensed in the future (in (k), $960), less an expense incurred in January to be paid in February (in (e), $400).STACEY’S PIANO REBUILDING COMPANYIncome Statement (unadjusted)For the Month Ended January 31, 2014 Operating Revenues:Rebuilding fees revenue $ 19,000 Total operating revenues 19,000 Operating Expenses:Wages expense 16,500 Utilities expense 400 Total operating expenses 16,900 Operating Income 2,100 Other Item:Rent revenue 850 Net Income $ 2,950Req. 1 and 2Common Additional RetainedFood Sales Revenue Catering Sales RevenueE3–14.Req. 1TRAVELING GOURMET, INC.Income Statement (unadjusted)For the Month Ended March 31, 2014 Revenues:Food sales revenueCatering sales revenueTotal revenues Expenses:Supplies expenseUtilities expenseWages expenseFuel expenseTotal costs and expenses $ 11,9004,20016,10010,8304206,28036317,893Net Loss $ (1,793) Req. 2Transaction O, I, or F Activity (or No Effect) on Statement ofDirection and AmountReq. 3The company generated a small loss of 1,793 during its first month of operations, before making any adjusting entries. The adjusting entries for use of the building and equipment and interest expense on the borrowing will increase the loss. Cash flows from operating activities were also negative at $2,973 (= + 11,900 + 2,600 –10,830 –363 –6,280) . So far the company does not appear to be successful, but it is only in its first month of operating a retail store. If sales can be increased without inflating fixed costs (particularly salaries expense), the company may soon turn a profit. It is not unusual for small businesses to report a loss or have negative cash flows from operations as they start up operations.E3–15.Req. 1Transaction Brief Explanationa Issued 10,000 shares of common stock to shareholders for $82,000cash.b Purchased store fixtures for $15,400 cash.c Purchased $24,800 of inventory, paying $6,200 cash and thebalance on account.d Sold $14,000 of goods or services to customers, receiving $9,820cash and the balance on account. The cost of the goods sold was$7,000.e Used $1,480 of utilities during the month, not yet paid.f Paid $1,300 in wages to employees.g Paid $2,480 in cash for rent, $620 related to the current month and$1,860 related to future months.h Received $3,960 cash from customers, $1,450 related to currentsales and $2,510 related to goods or services to be provided in thefuture.Req. 2Kate’s Kite CompanyIncome StatementFor the Month Ended April 30, 2014Sales Revenue Expenses:Cost of salesWages expenseRent expenseUtilities expenseTotal expenses $ 15,4507,0001,3006201,48010,400Net Income $ 5,050Kate’s Kite CompanyBalance SheetAt April 30, 2014Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities:Cash $70,400 Accounts payable $20,080 Accounts receivable 4,180 Unearned revenue 2,510 Inventory 17,800 Total current liabilities 22,590 Prepaid expenses 1,860 Shareholders’ Equity:Total current assets 94,240 Common stock 10,000 Store fixtures 15,400 Additional paid-in capital 72,000Retained earnings 5,050Total shareholders’equity87,050Total Assets $109,640 Total Liabilities &Shareholders’ Equity$109,640E3–16.Req. 1Assets = Liabilities + Stockholders’ Equity $ 3,200 $ 2,400 $ 800 8,000 5,600 4,0006,400 1,600 3,200 $17,600 $9,600 $ 8,000Req. 2Accounts Long-TermAccounts Unearned Long-TermAdditionalConsulting Fee InvestmentRent ExpenseE3–16. (continued)Req. 3Revenues $58,400 ($58,000 from sales + $400 on investments)– Expenses 56,400 ($36,000 + $12,000 + $800 + $7,600)Net Income $ 2,000Assets = Liabilities + Stockholders’ Equity$ 1,120 $ 1,600 $ 80012,400 7,200 4,0006,400 1,600 2,7202,000 net income $19,920 $10,400 $ 9,520 Req. 4Net Profit Margin = Net Income = $2,000 = 0.0345Ratio Sales (Operating) Revenues $58,000* or 3.45% * The $400 of investment income is not an operating revenue and is not included in the computation.The increasing trend in the net profit margin ratio (from 2.5% in 2013 to 2.9% in 2014 and then to 3.45% in 2015) suggests that the company is managing its sales and expenses more effectively over time.E3–17.Req. 1Accounts receivable increases with customer sales on account and decreases with cash payments received from customers.Prepaid expenses increase with cash payments of expenses related to future periods and decrease as these expenses are incurred over time.Unearned subscriptions increase with cash payments received from customers for goods or services to be provided in the future and decreases when those goods or services are provided.Req. 2Trade Accounts ReceivablePrepaidExpensesUnearnedSubscriptionsComputations:Beginning + “+”-“-”= EndingTrade accounts receivable 717 + 5,240 -??==6935,264Prepaid expenses 95 + 203 -??==107191Unearned subscriptions 224 + 2,690 -??==2312,683E3–18.ITEM LOCATION1. Description of a company’sprimary business(es). Letter to shareholders;Management’s Discussion and Analysis; Summary of significant accounting policies note2. Income taxes paid. Notes; Statement of cash flows3. Accounts receivable. Balance sheet4. Cash flow from operatingactivities.Statement of cash flows5. Description of a company’srevenue recognition policy. Summary of significant accounting policies note6. The inventory sold during theyear.Income statement (Cost of Goods Sold)7. The data needed to compute thenet profit margin ratio.Income statementPROBLEMSP3-1.Transactions Debit Credita. Example: Purchased equipment for use in the business;5 1, 8paid one-third cash and signed a note payable for thebalance.b. Paid cash for salaries and wages earned by employees thisperiod.15 1 c. Paid cash on accounts payable for expensesincurred last period.7 1d. Purchased supplies to be used later; paid cash. 3 1e. Performed services this period on credit. 2 14f. Collected cash on accounts receivable for servicesperformed last period. 1 2g. Issued stock to new investors. 1 11, 12h. Paid operating expenses incurred this period.15 1i. Incurred operating expenses this period to be paidnext period.15 7 j. Purchased a patent (an intangible asset); paid cash. 6 1 k. Collected cash for services performed this period. 1 14 l. Used some of the supplies on hand for operations.15 3 m. Paid three-fourths of the income tax expense for the year;the balance will be paid next year.16 1, 10 n. Made a payment on the equipment note in (a); the paymentwas part principal and part interest expense.8, 17 1 o. On the last day of the current period, paid cash for aninsurance policy covering the next two years. 4 1a. Cash (+A) ........................................................................... 40,000Common stock (+SE) (20)Additional paid-in capital (+SE) ................................ 39,980 b. Cash (+A) ........................................................................... 60,000Note payable (long-term) (+L) ..................................... 60,000 c. Rent expense (+E, -SE) .................................................... 1,500Prepaid rent (+A) ............................................................... 1,500 Cash (-A) ...................................................................... 3,000 d. Prepaid insurance (+A) ..................................................... 2,400Cash (-A) ..................................................................... 2,400 e. Furniture and fixtures (or Equipment) (+A) ..................... 15,000Accounts payable (+L) ............................................... 12,000Cash (-A) ..................................................................... 3,000 f. Inventory (+A) .................................................................... 2,800Cash (-A) ..................................................................... 2,800 g. Advertising expense (+E, -SE) .. (350)Cash (-A) (350)h. Cash (+A) (850)Accounts receivable (+A) (850)Sales revenue (+R, +SE) ............................................ 1,700 Cost of goods sold (+E, -SE) . (900)Inventory (-A) (900)i. Accounts payable (-L) ...................................................... 12,000Cash (-A) ..................................................................... 12,000 j. Cash (+A) (210)Accounts receivable (-A) (210)。

会计学原理课后习题及答案(完整资料).doc

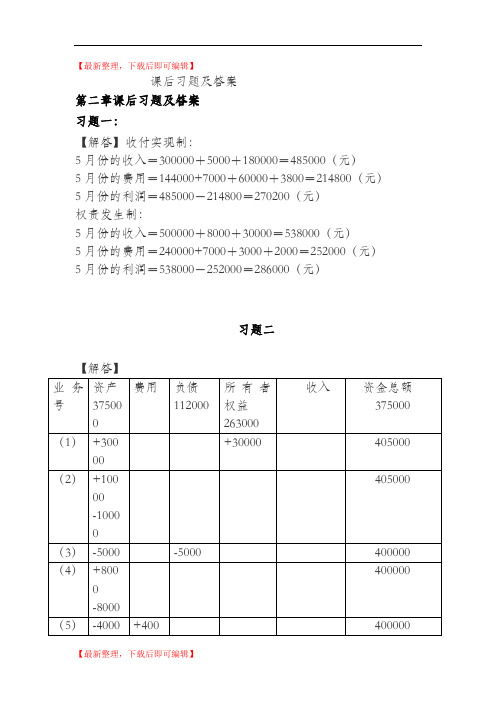

【最新整理,下载后即可编辑】课后习题及答案第二章课后习题及答案习题一:【解答】收付实现制:5月份的收入=300000+5000+180000=485000(元)5月份的费用=144000+7000+60000+3800=214800(元)5月份的利润=485000-214800=270200(元)权责发生制:5月份的收入=500000+8000+30000=538000(元)5月份的费用=240000+7000+3000+2000=252000(元)5月份的利润=538000-252000=286000(元)习题二2016年9月末资产总额=476000 元负债总额=107000 元所有者权益=343000+(30000-4000)=369000 元第三章课后习题及答案习题一【解答】A=350000-450000+320000=220000(元)B=680000+410000-360000=730000(元)C=6000000-1500000+500000=5000000(元)D=600000+200000-400000=400000(元)E=950000+1050000-1460000=540000(元)习题二【解答】1.登记期初余额(2)借:生产成本40000贷:原材料40000(3)借:原材料10000贷:银行存款10000(4)借:固定资产100000贷:银行存款100000(5)借:应付账款13000贷:银行存款13000(6)借:生产成本25000贷:原材料25000(7)借:银行存款3000贷:应收账款3000(8)借:短期借款12000应付账款4000贷:银行存款16000(9)借:银行存款20000贷:实收资本20000(10)借:银行存款14000贷:应收账款14000(2)登记账户,计算发生额及期末余额(见上述T字账)(3)编制总分类账发生额和余额试算平衡表某公司总分类账发生额和余额试算平衡表习题三【解答】1.编制会计分录(1)借:原材料——乙 48000 ——丙 25000 贷:应付账款——红光工厂 73000 (2)借:应付账款——兴华工厂 20000贷:银行存款 20000 (3)借:原材料——丙1500 贷:应付账款——新飞工厂 1500 (4)借:生产成本179000贷:原材料——甲 140000——乙 36000 ——丙 30002.用丁字账开设并登记“原材料”和“应付账款”总分类账及所属明细分类账,计算各账户的发生额和期末余额。

会计学原理第3章习题答案

会计学原理第3章习题答案会计学原理第3章习题答案第一节:会计的基本概念和会计要素在会计学中,会计的基本概念和会计要素是非常重要的。

会计的基本概念包括会计的定义、会计的目的、会计的对象以及会计的特征等。

会计要素则是指会计中用于记录和反映企业经济活动的基本要素,包括资产、负债、所有者权益、收入和费用等。

在本章的习题中,我们需要回答一些关于会计的基本概念和会计要素的问题。

例如,什么是会计的定义?会计的目的是什么?会计的对象是指什么?以及会计的特征有哪些?答案如下:- 会计的定义:会计是一门研究经济活动及其结果,以及对其进行记录、分类、汇总和报告的学科。

- 会计的目的:会计的目的是为了提供有关企业经济活动的信息,以便于管理者、投资者、债权人等利益相关方做出决策。

- 会计的对象:会计的对象是指企业的经济活动,包括资源的获取、使用和交换等。

- 会计的特征:会计的特征包括客观性、准确性、完整性、时效性、可比性和可理解性等。

第二节:会计等式和会计方程式会计等式和会计方程式是会计学中的重要概念。

会计等式是指资产等于负债加所有者权益的关系,即A = L + OE。

会计方程式则是指资产减去负债等于所有者权益的关系,即A - L = OE。

在本章的习题中,我们需要回答一些关于会计等式和会计方程式的问题。

例如,会计等式和会计方程式的含义是什么?为什么会计等式和会计方程式是平衡的?以及如果会计等式和会计方程式不平衡,会有什么影响?答案如下:- 会计等式和会计方程式的含义:会计等式和会计方程式表示了企业的资源来源和运用的平衡关系,即企业的资产来源于负债和所有者权益。

- 会计等式和会计方程式的平衡:会计等式和会计方程式之所以是平衡的,是因为每一笔经济活动都会对资产、负债和所有者权益产生影响,使得会计等式和会计方程式保持平衡。

- 会计等式和会计方程式不平衡的影响:如果会计等式和会计方程式不平衡,会导致会计记录的错误,进而影响到财务报表的准确性和可靠性。

18版会计学原理书后习题答案 怀德尔 詹姆斯 卡尔 乔纳森 (2)

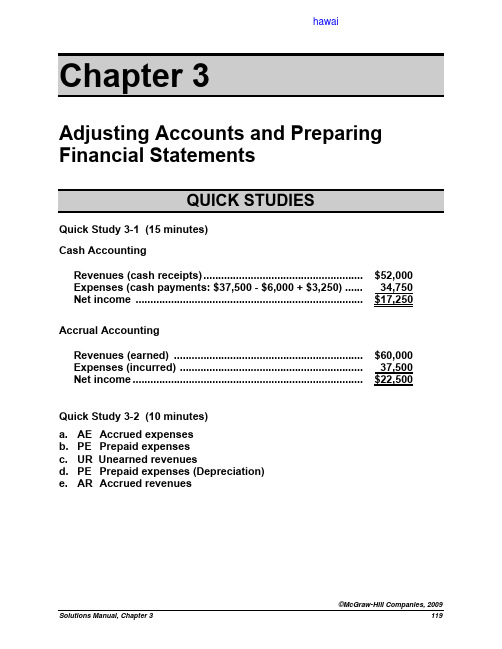

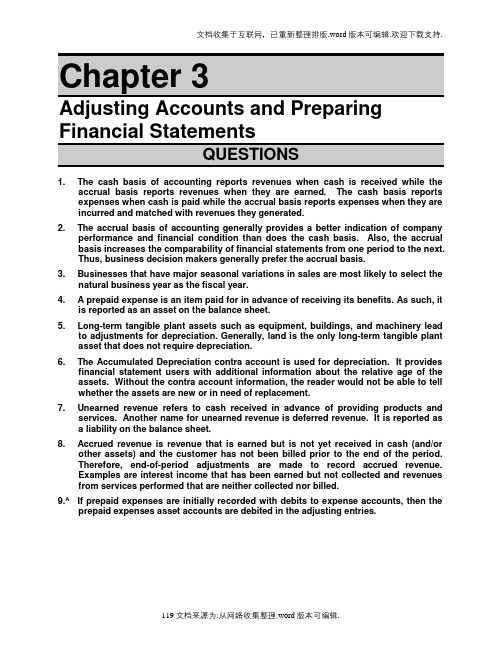

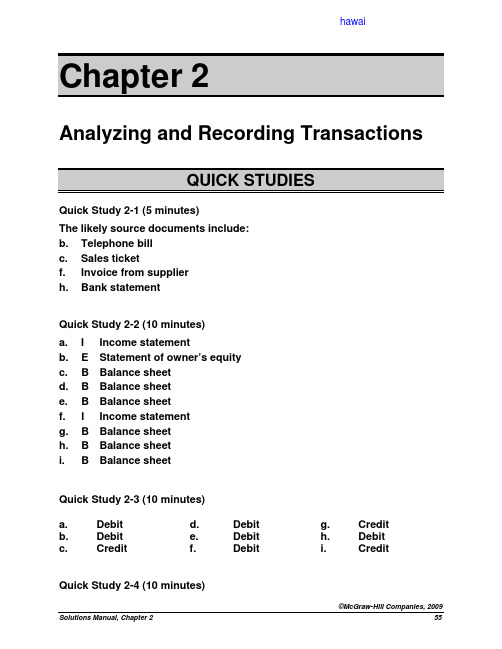

hawai Chapter 3Adjusting Accounts and Preparing Financial StatementsQUICK STUDIESQuick Study 3-1 (15 minutes)Cash AccountingRevenues (cash receipts)......................................................$52,000Expenses (cash payments: $37,500 - $6,000 + $3,250)...... 34,750 income .............................................................................$17,250NetAccrual Accounting(earned) ................................................................$60,000RevenuesExpenses(incurred) .............................................................. 37,500 income..............................................................................$22,500NetQ uick Study 3-2 (10 minutes)a. AE Accrued expensesb. PE Prepaid expensesc. UR Unearned revenuesd. PE Prepaid expenses (Depreciation)e. AR Accrued revenues©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 3 119Accounts Debited and Credited Financial Statement a. Debit Unearned Revenue Balance Sheet Credit Revenue Earned Income Statement b. Debit Wages Expense Income Statement Credit Wages Payable Balance Sheet c. Debit Accounts Receivable Balance Sheet Credit Revenue Earned Income Statement d. Debit Insurance Expense Income Statement Credit Prepaid Insurance Balance Sheet e. Debit Depreciation Expense Income Statement Credit Accumulated Depreciation Balance SheetQuick Study 3-4 (15 minutes)a. Insurance Expense....................................................... 3,000 Prepaid Insurance ................................................. 3,000To record 6-month insurance coverage expired.b. Supplies Expense......................................................... 4,150 Supplies..................................................................4,150To record supplies used during the year.($900 + $4,000 – [?] = $750)Quick Study 3-5 (15 minutes) a. Depreciation Expense—Equipment............................ 8,400 Accumulated Depreciation—Equipment............. 8,400To record depreciation expense for the year.($45,000 - $3,000) / 5 years = $8,400b. No depreciation adjustments are made for land as it is expected to last indefinitely.©McG 120SalariesExpense (400)Salaries Payable (400)To record salaries incurred but not yet paid.[One student earns $100 x 4 days, Mondaythrough Thursday]Q uick Study 3-7 (15 minutes)a. Unearned Revenue........................................................ 22,500Legal Revenue....................................................... 22,500 To recognize legal revenue earned (30,000 x 3/4).b. Unearned Subscription Revenue................................ 1,200Subscription Revenue........................................... 1,200 To recognize subscription revenue earned.[100 x ($24 / 12 months) x 6 months]Quick Study 3-8 (15 minutes)Adjusting entry Debit Credit1. Accrue salaries expense e ga f2. Adjust the Unearned Services Revenue accountto recognize earned revenueb f3. Record the earning of services revenue for whichcash will be received the following periodQuick Study 3-9 (10 minutes)T he answer is a.ExplanationThe debit balance in Prepaid Insurance was reduced by $400, implying a $400 debit to Insurance Expense. The credit balance in Interest Payable increased by $800, implying an $800 debit to Interest Expense.©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 3 121Quick Study 3-10 (15 minutes)T he answer is 2.ExplanationI nsurance premium errorUnderstates expenses (and overstates assets) by..........$1,600A ccrued salaries errorUnderstates expenses (and understates liabilities) by.... 1,000T he collective effects from this company’s errors follow:Understates expenses by....................................................$2,600Overstates assets by............................................................$1,600Understates liabilities by.....................................................$1,000Quick Study 3-11 (10 minutes)Profit margin = $78,750 / $630,000 = 12.5%Interpretation: For each dollar that Miller Company records as revenue, it earns 12.5 cents in net income. Miller’s 12.5% is markedly lower than competitors’ average profit margin of 15%—it must improve performance.EXERCISESExercise 3-1 (10 minutes)1. B 4. A2. F 5. D3. C 6. E©McG122Exercise 3-2 (25 minutes)a. Depreciation Expense—Equipment...............................16,000Depreciation—Equipment...................16,000 AccumulatedTo record depreciation expense for the year.b. Insurance Expense..........................................................5,360Insurance*......................................................5,360 PrepaidTo record insurance coverage that expired($6,000 - $640).c. Office Supplies Expense.................................................3,422Supplies**........................................................... 3,422 OfficeTo record office supplies used ($325 + $3,480 - $383).d. Unearned Fee Revenue...................................................3,000Revenue.................................................................3,000 FeeTo record earned portion of fee received in advance($15,000 x 1/5).e. Insurance Expense..........................................................6,160Insurance........................................................6,160 PrepaidTo record insurance coverage that expired.f. Wages Expense................................................................2,700Payable.............................................................2,700 WagesTo record wages accrued but not yet paid.Notes:Prepaid Insurance*Office Supplies**Bal. Bal. 6,000 Beg. Bal. 325Purch. 3,480UsedUsed ??End. Bal. 640 End. Bal. 383©McGraw-Hill Companies, 2009Solutions Manual, Chapter 3 123a. Adjusting entry2009Dec. 31 825Wages Expense...................................................Wages Payable (825)To record accrued wages for one day.(5 workers x $165)b. Payday entry2010Jan. 4Wages Expense...................................................2,475Wages Payable (825)Cash.................................................................3,300To record accrued and current wages.Wages expense = 5 workers x 3 days x $165Cash = 5 workers x 4 days x $165Exercise 3-4 (15 minutes)a. $ 2,000b. $ 6,607c. $11,987d. $ 1,375(c)(d)(b)Proof: (a)Supplies available – prior year-end.........$ 350 $1,855 $ 1,576 $1,375Supplies purchased in current year........ 2,450 6,307 11,987 6,907Total supplies available............................2,8008,162 13,563 8,282Supplies available – current year-end..... (800) (6,607) (2,056) (800)Supplies expense for current year...........$2,000$1,555$11,507 $7,482©McGraw-Hill Companies, 2009124Fundamental Accounting Principles, 19th Editiona.Apr. 30 Legal Fees Expense...........................................4,500Payable.....................................4,500 FeesLegalTo record accrued legal fees.May 12 Legal Fees Payable............................................ 4,500Cash.............................................................4,500 To pay accrued legal fees.b.Apr. 30 Interest Expense.................................................1,900Payable..........................................1,900 InterestTo record accrued interest expense($5,700 x 10/30).May 20 Interest Payable..................................................1,900Expense.................................................3,800InterestCash.............................................................5,700 To record payment of accrued and currentinterest expense ($5,700 x 20/30).c.Apr. 30 Salaries Expense................................................4,800Payable..........................................4,800 SalariesTo record accrued salaries($12,000 x 2/5 week).May 3 Salaries Payable.................................................4,800Salaries Expense................................................ 7,200Cash.............................................................12,000 To record payment of accrued andcurrent salaries ($12,000 x 3/5 week)., 2009125Balance Sheet Prepaid Insurance Asset usingInsurance Expense usingAccrual Basis Cash Basis Accrual Basis CashBasis ***Dec. 31, 2007....$14,450 $0 2007......$ 850 $15,300Dec. 31, 2008....9,350 0 2008......5,100 0 2009...... 5,100 0Dec. 31, 2009....4,2500 2010...... 4,250Dec. 31, 2010....Total.....$15,300$15,300Explanations:*Accrual asset balance equals months left in the policy x $425 per month (monthly cost is computed as $15,300 / 36 months). Months Left Balance 12/31/2007.. 34 $14,450 12/31/2008.. 22 9,350 12/31/2009.. 104,25012/31/2010.. 0 0 **Accrual insurance expense equals months covered in the year x $425 per month. Months Covered Expense 2007........ 2 $ 8502008........12 5,1002009........12 5,100 4,2502010.. (10)$15,300©McG 126Dec. 31 Accounts Receivable.............................................1,980Fees Earned.....................................................1,980 To record earned but unbilled fees (30% x $6,600).31 Unearned Fees........................................................4,620Earned.....................................................4,620 FeesTo record earned fees collected in advance(70% x $6,600).31 Depreciation Expense—Computers..................... 1,650Depreciation-Computers........1,650 AccumulatedTo record depreciation on computers.31 Depreciation Expense—Office Furniture.............. 1,925A ccumulated Depreciation—Office Furniture...1,925To record depreciation on office furniture.31 Salaries Expense....................................................2,695Payable..............................................2,695 SalariesTo record accrued salaries.31 Insurance Expense..................................................1,430PrepaidInsurance...........................................1,430 To record expired prepaid insurance.31 Rent Expense (700)Rent Payable (700)To recor d accrued rent expense.31 Office Supplies Expense (528)Supplies (528)OfficeTo record use of office supplies.31 Advertising Expense (500)Advertising Payable (500)To record accrued advertising expense.31 Utilities Expense (77)Payable (77)UtilitiesTo record incurred and unpaid utility costs., 2009127PROBLEM SET AProblem 3-1A (10 minutes)1. I 5. G 9. H2. D 6. C 10. E3. F 7. I 11. H4. B 8. A 12. BProblem 3-2A (35 minutes)Part 1Adjustment (a)Dec. 31 Office Supplies Expense................................ 12,325OfficeSupplies......................................... 12,325 To record cost of supplies used($2,900 + $11,977 - $2,552).Adjustment (b)31InsuranceExpense..........................................12,280PrepaidInsurance.................................... 12,280 To record annual insurance coverage cost.Policy Cost per Month Months Activein 2009 2009 CostA $485 ($11,640/24 mo.) 12 $ 5,820B 290 ($10,440/36 mo.) 9 2,610C 770 ($ 9,240 /12 mo.) 5 3,850Total $12,280Adjustment (c)31SalariesExpense.............................................3,660SalariesPayable....................................... 3,660 To record accrued but unpaid wages(2 days x $1,830).©McG128Problem 3-2A −concludedAdjustment (d)Dec. 31 Depreciation Expense—Building................... 18,875Depreciation—Building... 18,875 AccumulatedTo record annual depreciation expense[($800,000 -$45,000) / 40 years = $18,875]Adjustment (e)Receivable............................................3,00031RentEarned...........................................3,000 RentTo record earned but unpaid Dec. rent.Adjustment (f)Rent..............................................5,43631UnearnedEarned...........................................5,436 RentTo record the amount of rent earned forNovember and December (2 x $2,718).Part 2Cash Payment for (c)Jan. 6 Salaries Payable...........................................3,660Expense*........................................5,490SalariesCash.......................................................9,150 To record payment of accrued andcurrent salaries. *(3 days x $1,830)Cash Payment for (e)15Cash............................................................... 6,000Receivable....................................3,000 RentEarned...........................................3,000 RentTo record past due rent for two months.©McGraw-Hill Companies, 2009Solutions Manual, Chapter 3 129Parts 1 and 2Cash EquipmentUnadj. Bal. Unadj. Bal.28,064 75,800Accumulated Depreciation— Accounts Receivable EquipmentUnadj. Bal. Unadj. Bal.0 15,000(f) 4,000 (c) 10,000 Adj. Bal. Adj. Bal.4,000 25,000 Teaching Supplies Accounts PayableUnadj. Bal. Bal.11,000 39,500(b)9,000Adj. Bal. Salaries Payable2,000Unadj. Bal.0 Prepaid Insurance (g) 480 Unadj. Bal. Adj. Bal.16,000 4803,000(a)Adj. Bal. Unearned Training Fees 13,000Unadj. Bal.12,500 Prepaid Rent (e) 5,000Unadj. Bal. Adj. Bal.2,178 7,5002,178(h)Adj. Bal. T. Wells, CapitalBal.71,000 Professional LibraryBal. T. Wells, Withdrawals33,000Bal.44,000Accumulated Depreciation—Professional LibraryUnadj. Bal.10,0005,000(d)Adj. Bal.15,000©McG130Tuition Fees Earned Rent ExpenseUnadj. Bal. Unadj. Bal.111,00023,9582,1784,000(h)(f)Adj. Bal. Adj. Bal.115,00026,136Training Fees Earned Teaching Supplies ExpenseUnadj. Bal.Unadj. Bal.41,00009,000(e)5,000(b)Adj. Bal. Adj. Bal.46,0009,000Depreciation Expense—Professional Library Advertising ExpenseUnadj. Bal. Bal.0 8,000(d) 5,000Adj. Bal.5,000Depreciation Expense—Equipment Utilities ExpenseUnadj. Bal. Bal.0 6,000(c) 10,000Adj. Bal.10,000Salaries ExpenseUnadj. Bal.52,000(g) 480Adj. Bal.52,480Insurance ExpenseUnadj. Bal.(a) 3,000Adj. Bal.3,000©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 3 131Part 2Adjustment (a)Dec. 31 Insurance Expense...........................................3,000Insurance....................................... 3,000 PrepaidTo record the insurance expired.Adjustment (b)31 Teaching Supplies Expense............................9,000Supplies...................................... 9,000 TeachingTo record supplies used ($11,000 - $2,000).Adjustment (c)31 Depreciation Expense—Equipment................10,000Accumulated Depreciation—Equipment........10,000 To record equipment depreciation.Adjustment (d)31 Depreciation Expense—Profess. Library.......5,000A ccumul. Depreciation—Profess. Library..... 5,000To record professional library depreciation.Adjustment (e)31 Unearned Training Fees...................................5,000Training Fees Earned................................. 5,000 To record 2 months’ training fees earnedthat were collected in advance.Adjustment (f)31 Accounts Receivable........................................4,000Tuition Fees Earned................................... 4,000 To record tuition earned($1,600 x 2 1/2 months).Adjustment (g)31 Salaries Expense (480)Payable (480)SalariesTo record accrued salaries(2 days x $120 x 2 employees).Adjustment (h)31 Rent Expense....................................................2,178Rent................................................ 2,178 PrepaidTo record expiration of prepaid rent.©McG132Part 3WELLS TEACHING INSTITUTEAdjusted Trial BalanceDecember 31, 2009Debit CreditCash..........................................................................$ 28,064Accounts receivable................................................4,000Teaching supplies ...................................................2,000Prepaid insurance....................................................13,000Prepaid rent 0Professional library.................................................33,000$ 15,000 Accumulated depreciation—Professional library... Equipment................................................................75,800Accumulated depreciation—Equipment................25,000Accounts payable....................................................39,500Salaries payable (480)Unearned training fees............................................7,500T. Wells, Capital.......................................................71,000T. Wells, Withdrawals..............................................44,000Tuition fees earned..................................................115,000Training fees earned................................................46,000Depreciation expense—Professional library........5,000Depreciation expense—Equipment.......................10,000Salaries expense .....................................................52,480Insurance expense...................................................3,000Rent expense............................................................26,136Teaching supplies expense....................................9,000Advertising expense................................................8,000Utilities expense....................................................... 6,000 _______Totals........................................................................$319,480 $319,480©McGraw-Hill Companies, 2009 Solutions Manual, Chapter 3 133Part 4WELLS TEACHING INSTITUTEIncome StatementFor Year Ended December 31, 2009RevenuesTuition fees earned............................................ $115,000Training fees earned.......................................... 46,000Total revenues.................................................... $161,000ExpensesDepreciation expense—Professional library... 5,000Depreciation expense—Equipment.................. 10,000Salaries expense................................................ 52,480Insurance expense............................................. 3,000Rent expense...................................................... 26,136Teaching supplies expense............................... 9,000Advertising expense.......................................... 8,000Utilities expense................................................. 6,000Total expenses................................................... 119,616Net income............................................................ $ 41,384WELLS TEACHING INSTITUTEStatement of Owner’s EquityFor Year Ended December 31, 2009T. Wells, Capital, December 31, 2008................................. $ 71,000Plus: Net income.................................................................. 41,384112,384 Less: Withdrawals by owner............................................... 44,000T. Wells, Capital, December 31, 2009................................. $ 68,384©McGraw-Hill Companies, 2009134Fundamental Accounting Principles, 19th EditionWELLS TEACHING INSTITUTESheetBalanceDecember 31, 2009Assets Cash................................................................................. $ 28,064 Accounts receivable...................................................... 4,000 Teaching supplies.......................................................... 2,000 Prepaid insurance.......................................................... 13,000 Professional library........................................................ $33,00018,000 Accumulated depreciation—Professional library....... (15,000) Equipment....................................................................... 75,800Accumulated depreciation—Equipment...................... (25,000) 50,800 Total assets..................................................................... $115,864Liabilities Accounts payable........................................................... $ 39,500 Salaries payable. (480)Unearned training fees.................................................. 7,500 Total liabilities................................................................ 47,480EquityT. Wells, Capital.............................................................. 68,384 Total liabilities and equity............................................. $115,864, 2009135。

怀尔德会计学原理答案Chapter-03