公司理财 习题库 Chap002

公司理财》试题及答案

公司理财》试题及答案公司理财》试题及答案第一章公司理财概述单项选择题:1.在筹资理财阶段,公司理财的重点内容是(B)。

A。

有效运用资金B。

如何设法筹集到所需资金C。

研究投资组合D。

国际融资填空题:1.在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。

2.西方经济学家和企业家以往都以(利润最大化)作为公司的经营目标和理财目标。

3.现代公司的理财目标是(股东财富最大化)。

4.公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿债能力)。

5.公司筹资的渠道主要有两大类,一是(自有资本)的筹集,二是(借入资本)的筹集。

XXX:1.为什么以股东财富最大化作为公司理财目标?答:以股东财富最大化作为公司理财目标,考虑到了货币时间价值和风险价值,体现了对公司资产保值增值的要求,有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。

2.公司理财的具体内容是什么?答:公司理财的具体内容包括筹资决策、投资决策和股利分配决策。

第二章财务报表分析单项选择题:1.资产负债表为(B)。

A。

动态报表B。

静态报表C。

动态与静态相结合的报表D。

既不是动态报表也不是静态报表2.下列负债中属于长期负债的是(D)。

A。

应付账款B。

应交税金C。

预计负债D。

应付债券3.公司流动性最强的资产是(A)。

A。

货币资金B。

短期投资C。

应收账款D。

存货4.下列各项费用中属于财务费用的是(C)。

A。

广告费B。

劳动保险费C。

利息支出D。

坏账损失5.反映公司所得与所占用的比例关系的财务指标是(B)。

A。

资产负债率B。

资产利润率C。

销售利润率D。

成本费用利润率多项选择题:1.与资产负债表中财务状况的计量直接联系的会计要素有(ABC)。

A。

资产B。

负债C。

所有者权益D。

成本费用E。

收入利润2.与利润表中经营成果的计量有直接联系的会计要素有(BCD)。

A。

资产B。

收入C。

成本和费用D。

《公司理财》课后习题与答案

《公司理财》考试范围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。

书上例题比较重要,大家记得多多动手练练。

PS:书中课后例题不出,大家可以当习题练练~考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分注:第13章没有答案第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

公司理财》习题参考答案

《公司理财》习题参考答案第1章公司理财导论★案例分析1.股东之间的利益(1)作为内部股东,其利益与外部股东未必一致。

(2)内部股东拥有信息优势。

他们可能运用这种信息优势做出有利于自己但伤害外部股东利益的行为,例如延期发布预亏信息。

2.企业组织的经营目标(1)相同点:公司理财学教授与市场营销学教授从各自的职业特征出发,表述了企业的经营目标。

不同点:公司理财学教授表达的是企业经营的最终目标,市场营销学教授表达的是实现企业经营最终目标的手段。

手段与目标本身并不一致。

也就是说,顾客满意了,企业价值未必最大化。

(2)如果公司理财学教授与市场营销学教授分别代表企业的财务部门与营销部门,可以通过“顾客给企业带来利润率”这个指标来协调其认识差异。

企业为什么要最大限度地满足顾客要求呢?其目的在于,通过最大限度地满足顾客要求来实现企业价值最大化。

然而,并不是所有满意的顾客都能够为企业创造价值。

对于这种顾客,企业为什么要最大限度地满足其要求呢?通过“顾客给企业带来利润率”这个指标来协调企业的财务部门与营销部门的认识差异的实践意义在于,它能够使企业财务部门与营销部门“讲同一种语言”。

财务部门具有营销理念,营销部门具有财务理念,从而构建“和谐企业”,引导企业走上“创造价值”的轨道上来。

3.会计学观念与公司理财观念(1)Toms公司不能得到价值补偿。

(2)会计学与公司理财学的差异在于会计学关注利润,而公司理财学关注现金流量。

4.整合四流,创造一流(1)企业组织应该设置预算管理委员会来沟通、协调及有效整合企业组织的物流、资金流、信息流和人力资源。

(2)某些企业组织的财务总监或会计人员委派制只解决了会计的监督职能,没有解决会计的辅助管理决策乃至战略制定职能。

(3)企业组织的财务经理人(包括会计经理人)主要体现企业组织的经营权范畴。

第2章公司理财环境★案例分析1.利率市场化(1)如果利率市场化,那么,资金的供求关系会影响利率,从而影响金融市场。

公司理财学原理第2章习题答案

公司理财学原理第二章习题答案二、单项选择题1.以利润最大化作为理财目的的缺点不包括( A)。

A.利润最大化没有充分考虑风险问题B.利润的确定具有可操作性C.利润并不代表投资者的全部利益D.利润是按权责发生制计算而出的,很难与货币的时间价值相联系2.一般而言,公司获取资金的渠道不包括( C)。

A.发行普通股B.对外发行债券C.对其他公司进行债券投资D.向金融机构借款3.( D)是公司盈利和价值增值的基础。

A.发行普通股B.分配股利C.发行债券D.公司投资活动4.( B)就是根据公司理财的基本目标和具体目标的要求,运用专门的方法从多种备选方案中选择最优方案的过程。

A.财务计划B.财务决策C.财务分析D.财务控制5.公司所有者与其经营者之间的利益协调的主要途径是(C)。

A.契约限制B.终止合作C.监督与激励D.适当地增加职工的工资、福利和培训费用6.通过契约限制和终止合作可以协调公司所有者与(A)之间的利益。

A.公司债权人B.经营者C.公司职工D.客户7.(B),公司股权结构已经定型,产品也有了相对成熟的市场,公司理财的具体目的将从关注公司的生存转变为如何加快公司的发展之上。

A.公司初创时期B.公司成长期C.公司成熟期D.公司衰退期8.在(C)阶段,公司的一部分资金增值额流出了企业,不再参与公司资金的循环和周转。

A.资金筹集B.资金运转C.盈利分配D.提取法定盈余公积金9.( D)属于股权资金。

A.认股权证B.优先认股权C.可转换债券D.优先股票10."通过扩大无效生产、追加产成品的投入来降低会计账面成本,通过减少必要的维修成本、科技开发成本等等方法来减少会计账面成本,这种弊端是以(A)作为公司理财的目的引起的。

A.利润最大化B.企业价值最大化C.股东财富最大化D.每股市价最大化11." ( B)是根据财务活动的历史资料,考虑现实的要求和条件,对企业未来的财务活动和财务成果做出科学的预计和测算。

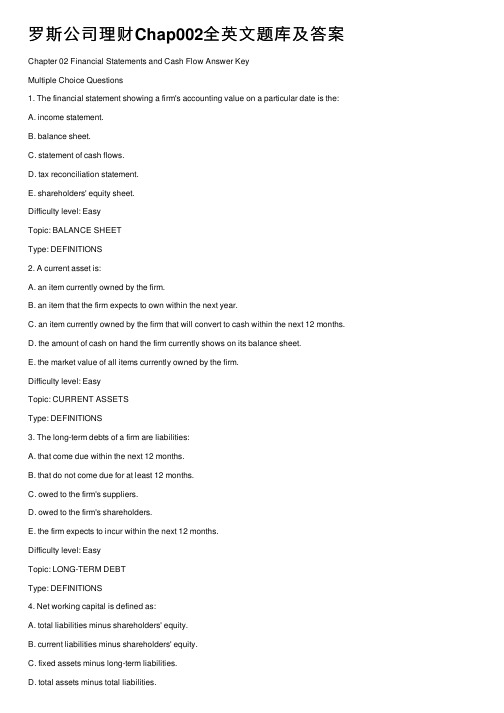

罗斯公司理财Chap002全英文试题库及答案

Chapter 02 Financial Statements and Cash Flow Answer KeyMultiple Choice Questions1.The financial statement showing a firm's accounting value on a particular date is the:A.income statement.B.balance sheet.C.statement of cash flows.D.tax reconciliation statement.E.shareholders' equity sheet.Difficulty level: EasyTopic: BALANCE SHEETType: DEFINITIONS2.A current asset is:A.an item currently owned by the firm.B.an item that the firm expects to own within the next year.C.an item currently owned by the firm that will convert to cash within the next 12 months.D.the amount of cash on hand the firm currently shows on its balance sheet.E.the market value of all items currently owned by the firm.Difficulty level: EasyTopic: CURRENT ASSETSType: DEFINITIONS3.The long-term debts of a firm are liabilities:A.that come due within the next 12 months.B.that do not come due for at least 12 months.C.owed to the firm's suppliers.D.owed to the firm's shareholders.E.the firm expects to incur within the next 12 months. Difficulty level: EasyTopic: LONG-TERM DEBTType: DEFINITIONS working capital is defined as:A.total liabilities minus shareholders' equity.B.current liabilities minus shareholders' equity.C.fixed assets minus long-term liabilities.D.total assets minus total liabilities.E.current assets minus current liabilities.Difficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS5.A(n) ____ asset is one which can be quickly converted into cash without significant loss in value.A.currentB.fixedC.intangibleD.liquidE.long-termDifficulty level: EasyTopic: LIQUID ASSETSType: DEFINITIONS6.The financial statement summarizing a firm's accounting performance over a period of time is the:A.income statement.B.balance sheet.C.statement of cash flows.D.tax reconciliation statement.E.shareholders' equity sheet.Difficulty level: EasyTopic: INCOME STATEMENTType: DEFINITIONS7.Noncash items refer to:A.the credit sales of a firm.B.the accounts payable of a firm.C.the costs incurred for the purchase of intangible fixed assets.D.expenses charged against revenues that do not directly affect cash flow.E.all accounts on the balance sheet other than cash on hand.Difficulty level: EasyTopic: NONCASH ITEMSType: DEFINITIONS8.Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn.A.deductibleB.residualC.totalD.averageE.marginalDifficulty level: EasyTopic: MARGINAL TAX RATESType: DEFINITIONS9.Your _____ tax rate is the total taxes you pay divided by your taxable income.A.deductibleB.residualC.totalD.averageE.marginalDifficulty level: EasyTopic: AVERAGE TAX RATESType: DEFINITIONS10._____ refers to the cash flow that results from the firm's ongoing, normal business activities.A.Cash flow from operating activitiesB.Capital spending working capitalD.Cash flow from assetsE.Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATING ACTIVITIESType: DEFINITIONS11._____ refers to the changes in net capital assets.A.Operating cash flowB.Cash flow from investing working capitalD.Cash flow from assetsE.Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM INVESTINGType: DEFINITIONS12._____ refers to the difference between a firm's current assets and its current liabilities.A.Operating cash flowB.Capital spending working capitalD.Cash flow from assetsE.Cash flow to creditorsDifficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS13._____ is calculated by adding back noncash expenses to net income and adjusting for changes in current assets and liabilities.A.Operating cash flowB.Capital spending working capitalD.Cash flow from operationsE.Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATIONSType: DEFINITIONS14._____ refers to the firm's interest payments less any net new borrowing.A.Operating cash flowB.Capital spending working capitalD.Cash flow from shareholdersE.Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW TO CREDITORSType: DEFINITIONS15._____ refers to the firm's dividend payments less any net new equity raised.A.Operating cash flowB.Capital spending working capitalD.Cash flow from creditorsE.Cash flow to stockholdersDifficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: DEFINITIONS16.Earnings per share is equal to: income divided by the total number of shares outstanding. income divided by the par value of the common stock.C.gross income multiplied by the par value of the common stock.D.operating income divided by the par value of the common stock. income divided by total shareholders' equity.Difficulty level: MediumTopic: EARNINGS PER SHAREType: DEFINITIONS17.Dividends per share is equal to dividends paid:A.divided by the par value of common stock.B.divided by the total number of shares outstanding.C.divided by total shareholders' equity.D.multiplied by the par value of the common stock.E.multiplied by the total number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: DEFINITIONS18.Which of the following are included in current assets?I. equipmentII. inventoryIII. accounts payableIV. cashA.II and IV onlyB.I and III onlyC.I, II, and IV onlyD.III and IV onlyE.II, III, and IV onlyDifficulty level: MediumTopic: CURRENT ASSETSType: CONCEPTS19.Which of the following are included in current liabilities?I. note payable to a supplier in eighteen monthsII. debt payable to a mortgage company in nine monthsIII. accounts payable to suppliersIV. loan payable to the bank in fourteen monthsA.I and III onlyB.II and III onlyC.III and IV onlyD.II, III, and IV onlyE.I, II, and III onlyDifficulty level: MediumTopic: CURRENT LIABILITIESType: CONCEPTS20.An increase in total assets:A.means that net working capital is also increasing.B.requires an investment in fixed assets.C.means that shareholders' equity must also increase.D.must be offset by an equal increase in liabilities and shareholders' equity.E.can only occur when a firm has positive net income.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS21.Which one of the following assets is generally the most liquid?A.inventoryB.buildingsC.accounts receivableD.equipmentE.patentsDifficulty level: MediumTopic: LIQUIDITYType: CONCEPTS22.Which one of the following statements concerning liquidity is correct?A.If you sold an asset today, it was a liquid asset.B.If you can sell an asset next year at a price equal to its actual value, the asset is highly liquid.C.Trademarks and patents are highly liquid.D.The less liquidity a firm has, the lower the probability the firm will encounter financial difficulties.E.Balance sheet accounts are listed in order of decreasing liquidity.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS23.Liquidity is:A.a measure of the use of debt in a firm's capital structure.B.equal to current assets minus current liabilities.C.equal to the market value of a firm's total assets minus its current liabilities.D.valuable to a firm even though liquid assets tend to be less profitable to own.E.generally associated with intangible assets.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS24.Which of the following accounts are included in shareholders' equity?I. interest paidII. retained earningsIII. capital surplusIV. long-term debtA.I and II onlyB.II and IV onlyC.I and IV onlyD.II and III onlyE.I and III onlyDifficulty level: MediumTopic: SHAREHOLDERS' EQUITYType: CONCEPTS25.Book value:A.is equivalent to market value for firms with fixed assets.B.is based on historical cost.C.generally tends to exceed market value when fixed assets are included.D.is more of a financial than an accounting valuation.E.is adjusted to market value whenever the market value exceeds the stated book value. Difficulty level: MediumTopic: BOOK VALUEType: CONCEPTS26.When making financial decisions related to assets, you should:A.always consider market values.B.place more emphasis on book values than on market values.C.rely primarily on the value of assets as shown on the balance sheet.D.place primary emphasis on historical costs.E.only consider market values if they are less than book values.Difficulty level: MediumTopic: MARKET VALUEType: CONCEPTS27.As seen on an income statement:A.interest is deducted from income and increases the total taxes incurred.B.the tax rate is applied to the earnings before interest and taxes when the firm has both depreciation and interest expenses.C.depreciation is shown as an expense but does not affect the taxes payable.D.depreciation reduces both the pretax income and the net income.E.interest expense is added to earnings before interest and taxes to get pretax income. Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS28.The earnings per share will:A.increase as net income increases.B.increase as the number of shares outstanding increase.C.decrease as the total revenue of the firm increases.D.increase as the tax rate increases.E.decrease as the costs decrease.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS29.Dividends per share:A.increase as the net income increases as long as the number of shares outstanding remains constant.B.decrease as the number of shares outstanding decrease, all else constant.C.are inversely related to the earnings per share.D.are based upon the dividend requirements established by Generally Accepted Accounting Procedures.E.are equal to the amount of net income distributed to shareholders divided by the number of shares outstanding.Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: CONCEPTS30.Earnings per shareA.will increase if net income increases and number of shares remains constant.B.will increase if net income decreases and number of shares remains constant.C.is number of shares divided by net income.D.is the amount of money that goes into retained earnings on a per share basis.E.None of the above.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS31.According to Generally Accepted Accounting Principles, costs are:A.recorded as incurred.B.recorded when paid.C.matched with revenues.D.matched with production levels.E.expensed as management desires.Difficulty level: MediumTopic: MATCHING PRINCIPLEType: CONCEPTS32.Depreciation:A.is a noncash expense that is recorded on the income statement.B.increases the net fixed assets as shown on the balance sheet.C.reduces both the net fixed assets and the costs of a firm.D.is a non-cash expense which increases the net operating income.E.decreases net fixed assets, net income, and operating cash flows.Difficulty level: MediumTopic: NONCASH ITEMSType: CONCEPTS33.When you are making a financial decision, the most relevant tax rate is the _____ rate.A.averageB.fixedC.marginalD.totalE.variableDifficulty level: MediumTopic: MARGINAL TAX RATEType: CONCEPTS34.An increase in which one of the following will cause the operating cash flow to increase?A.depreciationB.changes in the amount of net fixed capital working capitalD.taxesE.costsDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS35.A firm starts its year with a positive net working capital. During the year, the firm acquires more short-term debt than it does short-term assets. This means that:A.the ending net working capital will be negative.B.both accounts receivable and inventory decreased during the year.C.the beginning current assets were less than the beginning current liabilities.D.accounts payable increased and inventory decreased during the year.E.the ending net working capital can be positive, negative, or equal to zero.Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: CONCEPTS36.The cash flow to creditors includes the cash:A.received by the firm when payments are paid to suppliers.B.outflow of the firm when new debt is acquired.C.outflow when interest is paid on outstanding debt.D.inflow when accounts payable decreases.E.received when long-term debt is paid off.Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: CONCEPTS37.Cash flow to stockholders must be positive when:A.the dividends paid exceed the net new equity raised.B.the net sale of common stock exceeds the amount of dividends paid.C.no income is distributed but new shares of stock are sold.D.both the cash flow to assets and the cash flow to creditors are negative.E.both the cash flow to assets and the cash flow to creditors are positive. Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS38.Which equality is the basis for the balance sheet?A.Fixed Assets = Stockholder's Equity + Current AssetsB.Assets = Liabilities + Stockholder's EquityC.Assets = Current Long-Term Debt + Retained EarningsD.Fixed Assets = Liabilities + Stockholder's EquityE.None of the aboveDifficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS39.Assets are listed on the balance sheet in order of:A.decreasing liquidity.B.decreasing size.C.increasing size.D.relative life.E.None of the above.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS40.Debt is a contractual obligation that:A.requires the payout of residual flows to the holders of these instruments.B.requires a repayment of a stated amount and interest over the period.C.allows the bondholders to sue the firm if it defaults.D.Both A and B.E.Both B and C.Difficulty level: MediumTopic: DEBTType: CONCEPTS41.The carrying value or book value of assets:A.is determined under GAAP and is based on the cost of the asset.B.represents the true market value according to GAAP.C.is always the best measure of the company's value to an investor.D.is always higher than the replacement cost of the assets.E.None of the above.Difficulty level: MediumTopic: CARRYING VALUEType: CONCEPTS42.Under GAAP, a firm's assets are reported at:A.market value.B.liquidation value.C.intrinsic value.D.cost.E.None of the above.Difficulty level: MediumTopic: GAAPType: CONCEPTS43.Which of the following statements concerning the income statement is true?A.It measures performance over a specific period of time.B.It determines after-tax income of the firm.C.It includes deferred taxes.D.It treats interest as an expense.E.All of the above.Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS44.According to generally accepted accounting principles (GAAP), revenue is recognized as income when:A.a contract is signed to perform a service or deliver a good.B.the transaction is complete and the goods or services are delivered.C.payment is requested.D.income taxes are paid.E.All of the above.Difficulty level: MediumTopic: GAAP INCOME RECOGNITIONType: CONCEPTS45.Which of the following is not included in the computation of operating cash flow?A.Earnings before interest and taxesB.Interest paidC.DepreciationD.Current taxesE.All of the above are includedDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS capital spending is equal to: additions to net working capital.B.the net change in fixed assets. income plus depreciation.D.total cash flow to stockholders less interest and dividends paid.E.the change in total assets.Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: CONCEPTS47.Cash flow to stockholders is defined as:A.interest payments.B.repurchases of equity less cash dividends paid plus new equity sold.C.cash flow from financing less cash flow to creditors.D.cash dividends plus repurchases of equity minus new equity financing.E.None of the above.Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS48.Free cash flow is:A.without cost to the firm. income plus taxes.C.an increase in net working capital.D.cash that the firm is free to distribute to creditors and stockholders.E.None of the above.Difficulty level: MediumTopic: FREE CASH FLOWType: CONCEPTS49.The cash flow of the firm must be equal to:A.cash flow to stockholders minus cash flow to debtholders.B.cash flow to debtholders minus cash flow to stockholders.C.cash flow to governments plus cash flow to stockholders.D.cash flow to stockholders plus cash flow to debtholders.E.None of the above.Difficulty level: MediumTopic: CASH FLOWType: CONCEPTS50.Which of the following are all components of the statement of cash flows?A.Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activitiesB.Cash flow from operating activities, cash flow from investing activities, and cash flow from divesting activitiesC.Cash flow from internal activities, cash flow from external activities, and cash flow from financing activitiesD.Cash flow from brokering activities, cash flow from profitable activities, and cash flow from non-profitable activitiesE.None of the above.Difficulty level: MediumTopic: STATEMENT OF CASH FLOWSType: CONCEPTS51.One of the reasons why cash flow analysis is popular is because:A.cash flows are more subjective than net income.B.cash flows are hard to understand.C.it is easy to manipulate, or spin the cash flows.D.it is difficult to manipulate, or spin the cash flows.E.None of the above.Difficulty level: MediumTopic: CASH FLOW MANAGEMENTType: CONCEPTS52.A firm has $300 in inventory, $600 in fixed assets, $200 in accounts receivable, $100 in accounts payable, and $50 in cash. What is the amount of the current assets?A.$500B.$550C.$600D.$1,150E.$1,200Current assets = $300 + $200 + $50 = $550Difficulty level: MediumTopic: CURRENT ASSETSType: PROBLEMS53.Total assets are $900, fixed assets are $600, long-term debt is $500, and short-term debt is $200. What is the amount of net working capital?A.$0B.$100C.$200D.$300E.$400Net working capital = $900 - $600 - $200 = $100Difficulty level: MediumTopic: NET WORKING CAPITALType: PROBLEMS54.Brad's Company has equipment with a book value of $500 that could be sold today at a 50% discount. Its inventory is valued at $400 and could be sold to a competitor for that amount. The firm has $50 in cash and customers owe it $300. What is the accounting value of its liquid assets?A.$50B.$350C.$700D.$750E.$1,000Liquid assets = $400 + $50 + $300 = $750Difficulty level: MediumTopic: LIQUIDITYType: PROBLEMS55.Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's balance sheet but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. Assuming the equipment is the firm's only fixed asset, what is the book value of shareholders' equity?A.$200B.$800C.$1,200D.$1,400E.The answer cannot be determined from the information providedBook value of shareholders' equity = $1,800 + $200 - $800 = $1,200Difficulty level: MediumTopic: BOOK VALUEType: PROBLEMS56.Art's Boutique has sales of $640,000 and costs of $480,000. Interest expense is $40,000 and depreciation is $60,000. The tax rate is 34%. What is the net income?A.$20,400B.$39,600C.$50,400D.$79,600E.$99,600Taxable income = $640,000 - $480,000 - $40,000 - $60,000 = $60,000; Tax= .34($60,000) = $20,400; Net income = $60,000 - $20,400 = $39,600Difficulty level: MediumTopic: NET INCOMEType: PROBLEMS57.Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $126,500?A.21.38%B.23.88%C.25.76%D.34.64%E.39.00%Tax = .15($50,000) + .25($25,000) + .34($25,000) + .39($126,500 - $100,000) = $32,585; Average tax rate = $32,585 $126,500 = .2576 = 25.76%Difficulty level: MediumTopic: MARGINAL TAX RATEType: PROBLEMS58.The tax rates are as shown. Your firm currently has taxable income of $79,400. How much additional tax will you owe if you increase your taxable income by $21,000?A.$7,004B.$7,014C.$7,140D.$7,160E.$7,174Additional tax = .34($100,000 - $79,400) + .39($79,400 + $21,000 - $100,000) = $7,160 Difficulty level: MediumTopic: TAXESType: PROBLEMS59.Your firm has net income of $198 on total sales of $1,200. Costs are $715 and depreciation is $145. The tax rate is 34%. The firm does not have interest expenses. What is the operating cash flow?A.$93B.$241C.$340D.$383E.$485Earnings before interest and taxes = $1,200 - $715 - $145 = $340; Tax = [$198 (1- .34)] - $198 = $102; Operating cash flow = $340 + $145 - $102 = $383Difficulty level: MediumTopic: OPERATING CASH FLOWType: PROBLEMS60.Teddy's Pillows has beginning net fixed assets of $480 and ending net fixed assets of $530. Assets valued at $300 were sold during the year. Depreciation was $40. What is the amount of capital spending?A.$10B.$50C.$90D.$260E.$390Net capital spending = $530 - $480 + $40 = $90Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: PROBLEMS61.At the beginning of the year, a firm has current assets of $380 and current liabilities of $210. At the end of the year, the current assets are $410 and the current liabilities are $250. What is the change in net working capital?A.-$30B.-$10C.$0D.$10E.$30Change in net working capital = ($410 - $250) - ($380 - $210) = -$10Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: PROBLEMS62.At the beginning of the year, long-term debt of a firm is $280 and total debt is $340. At the end of the year, long-term debt is $260 and total debt is $350. The interest paid is $30. What is the amount of the cash flow to creditors?A.-$50B.-$20C.$20D.$30E.$50Cash flow to creditors = $30 - ($260 - $280) = $50Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: PROBLEMS63.Pete's Boats has beginning long-term debt of $ and ending long-term debt of $210. The beginning and ending total debt balances are $340 and $360, respectively. The interest paid is $20. What is the amount of the cash flow to creditors?A.-$10B.$0C.$10D.$40E.$50Cash flow to creditors = $20 - ($210 - $) = -$10Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: PROBLEMS64.Peggy Grey's Cookies has net income of $360. The firm pays out 40% of the net income to its shareholders as dividends. During the year, the company sold $80 worth of common stock. What is the cash flow to stockholders?A.$64B.$136C.$144D.$224E.$296Cash flow to stockholders = .40($360) - $80 = $64Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: PROBLEMS65.Thompson's Jet Skis has operating cash flow of $218. Depreciation is $45 and interest paid is $35. A net total of $69 was paid on long-term debt. The firm spent $ on fixed assets and increased net working capital by $38. What is the amount of the cash flow to stockholders?A.-$104B.-$28C.$28D.$114E.$142Cash flow of the firm = $218 - $38 - $ = $0; Cash flow to creditors = $35 - (-$69) = $104; Cash flow to stockholders = $0 - $104 = -$104Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: PROBLEMS66. What is the change in the net working capital from 2007 to 2008?A. $1,235B. $1,C. $1,335D. $3,405E. $4,740Change in net working capital = ($7,310 - $2,570) - ($6,225 - $2,820) = $1,335Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: PROBLEMS67.What is the amount of the non-cash expenses for 2008?A.$570B.$630C.$845D.$1,370E.$2,000The non-cash expense is depreciation in the amount of $1,370. Difficulty level: MediumTopic: NONCASH EXPENSESType: PROBLEMS68.What is the amount of the net capital spending for 2008?A.-$290B.$795C.$1,080D.$1,660E.$2,165Net capital spending = $10,670 - $10,960 + $1,370 = $1,080 Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: PROBLEMS69.What is the operating cash flow for 2008?A.$845B.$1,930C.$2,215D.$2,845E.$3,060Operating cash flow = $1,930 + $1,370 - $455 = $2,845 Difficulty level: MediumTopic: OPERATING CASH FLOWType: PROBLEMS70.What is the cash flow of the firm for 2008?A.$430B.$485C.$1,340D.$2,590E.$3,100Operating cash flow = $1,930 + $1,370 - $455 = $2,845; Change in net working capital = ($7,310 - $2,570) - ($6,225 - $2,820) = $1,335; Net capital spending = $10,670 - $10,960 + $1,370 = $1,080; Cash flow of the firm = $2,845 - $1,335 - $1,080 = $430Difficulty level: MediumTopic: CASH FLOW OF THE FIRMType: PROBLEMS71.What is the amount of net new borrowing for 2008?A.-$225B.-$25C.$0D.$25E.$225Net new borrowing = $8,100 - $7,875 = $225Difficulty level: MediumTopic: NET NEW BORROWINGType: PROBLEMS72.What is the cash flow to creditors for 2008?A.-$405B.-$225C.$225D.$405E.$630Cash flow to creditors = $630 - ($8,100 - $7,875) = $405 Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: PROBLEMS73.What is the net working capital for 2008?A.$345B.$405C.$805D.$812E.$1,005Net working capital = $75 + $502 + $640 - $405 = $812Difficulty level: MediumTopic: NET WORKING CAPITALType: PROBLEMS74.What is the change in net working capital from 2007 to 2008?A.-$93B.-$7C.$7D.$85E.$97Change in net working capital = ($75 + $502 + $640 - $405) - ($70 + $563 + $662 - $390) = -$93Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: PROBLEMS75.What is net capital spending for 2008?A.-$250B.-$57C.$0D.$57E.$477Net capital spending = $1,413 - $1,680 + $210 = -$57Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: PROBLEMS76.What is the operating cash flow for 2008?A.$143B.$297C.$325D.$353E.$367Earnings before interest and taxes = $785 - $460 - $210 = $115; Taxable income = $115 - $35 = $80; Taxes = .35($80) = $28; Operating cash flow = $115 + $210 - $28 = $297Difficulty level: MediumTopic: OPERATING CASH FLOWType: PROBLEMS。

公司理财2答案.doc

«公司理财>>作业2一、单项选择题(本类题共25小题,每小题1分,共25分)1、实质上是企业集团的组织形式,子公词具有法人资格,分公司则是相对独立的利润中心的企业组织体制是(B )。

A.U型组织B. H型组织C. M型组织D.事业部制组织结构2、下列说法不正确的是(D)oA.金融工具一般包括基本金融工具和衍生金融工具B.金融市场按期限分为短期金融市场和长期金融市场,即货币市场和资本市场C.金融市场按功能分为发行市场和流通市场D.资木市场所交易的金融工具具有较强的货币性3、集权与分权相结合型财务管理体制的核心内容是企业总部应做到制度统一、资金集中、信息集成和人员委派。

下列选项不属于应集中的权利是(B )。

A.筹资、融资权B.业务定价权C.财务机构设置权D.收益分配权4、下列计算等式中,不正确的是(C )。

A.某种材料采购量=某种材料耗用量+该种材料期末结存量一该种材料期初结存量B.预计生产量=预计销售量+预计期末结存量一预计期初结存量C.本期销售商品所收到的现金=本期的销碍收入+期末应收账款一期初应收账款D.本期购货付现=本期购货付现部分+以前期赊购本期付现的部分5、既可以作为全面预算的起点,乂可以作为其他业务预算的基础的是(B )。

A.生产预算B.销售预算C.材料采购预算D.现金预算6、某企业编制“材料采购预算”,预计第四手度期初存量456千克,手度生产需用量2120 千克,预计期末存量为350千克,材料单价为10元,若材料采购货款有50%在本手度内付清,另外50%在下季度付清,假设不考虑其他因素,则该企业预计资产负债表年末“应付账款”项目为(C )元。

A.11130B. 14630C. 10070D. 135607、企业筹资管理的基本目标是(B )。

A.合理选择筹资方式B.资本结构优化C.取得较好的经济效益D,带来杠杆效应8、下列关于混合筹资的说法中,不正确的是(A )。

A.可转换债券的持有人可以随时按事先规定的价格或转换比率,自由地选择转换为公司普通股B.可转换债券筹资在股价大幅度上扬时,存在减少筹资数量的风险C.认股权证具有实现融资和股票期权激励的双重功能D.认股权证本身是一种认购普通股的期权,它没有普通股的红利收入,也没有普通股相应的投票权9、下列关于认股权证的说法不正确的是(A )。

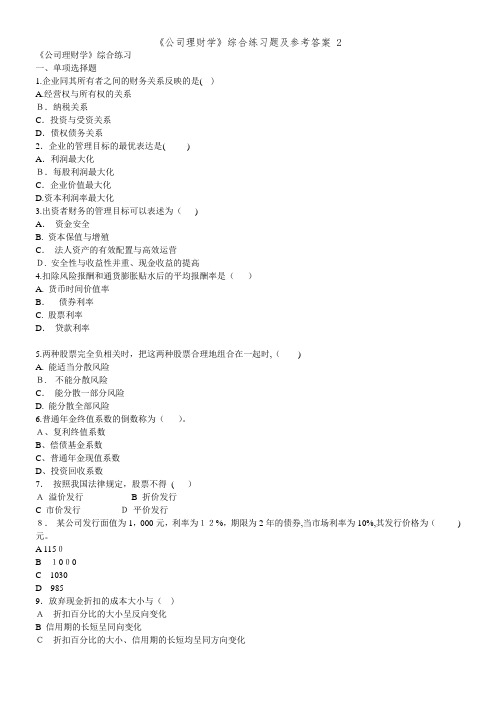

《公司理财学》综合练习题及参考答案 2

《公司理财学》综合练习一、单项选择题1.企业同其所有者之间的财务关系反映的是()A.经营权与所有权的关系B.纳税关系C.投资与受资关系D.债权债务关系2.企业的管理目标的最优表达是()A.利润最大化B.每股利润最大化C.企业价值最大化D.资本利润率最大化3.出资者财务的管理目标可以表述为()A.资金安全B. 资本保值与增殖C.法人资产的有效配置与高效运营D. 安全性与收益性并重、现金收益的提高4.扣除风险报酬和通货膨胀贴水后的平均报酬率是()A. 货币时间价值率B.债券利率C. 股票利率D.贷款利率5.两种股票完全负相关时,把这两种股票合理地组合在一起时,()A. 能适当分散风险B.不能分散风险C.能分散一部分风险D. 能分散全部风险6.普通年金终值系数的倒数称为()。

A、复利终值系数B、偿债基金系数C、普通年金现值系数D、投资回收系数7.按照我国法律规定,股票不得()A溢价发行 B 折价发行C 市价发行D平价发行8.某公司发行面值为1,000元,利率为12%,期限为2年的债券,当市场利率为10%,其发行价格为()元。

A 1150B1000C1030D9859.放弃现金折扣的成本大小与()A折扣百分比的大小呈反向变化B 信用期的长短呈同向变化C折扣百分比的大小、信用期的长短均呈同方向变化D折扣期的长短呈同方向变化10.在下列支付银行存款的各种方法中,名义利率与实际利率相同的是(A )。

A 收款法B 贴现法C 加息法D 余额补偿法11..最佳资本结构是指企业在一定时期最适宜其有关条件下( )。

A、企业价值最大的资本结构B、企业目标资本结构C、加权平均的资本成本最低的目标资本结构D、加权平均资本成本最低,企业价值最大的资本结构12.只要企业存在固定成本,那么经营杠杆系数必()A 恒大于1B 与销售量成反比C与固定成本成反比D 与风险成反比13.下列筹资方式中,资本成本最低的是()A发行股票B发行债券C 长期贷款D 保留盈余资本成本14假定某公司普通股雨季支付股利为每股1.8元,每年股利增长率为10%,权益资本成本为15%,则普通股市价为()A 10.9B25C19.4D 715. 筹资风险,是指由于负债筹资而引起的()的可能性A企业破产B资本结构失调C企业发展恶性循环D 到期不能偿债16..若净现值为负数,表明该投资项目()。

《公司理财》习题及答案.doc

《公司理财》习题答案第一章公司理财概论案例:华旗股份公司基本财务状况华旗股份有限公司,其前身是华旗饮料厂,创办于20世纪80年代,当时是当地最大的饮料企业,生产的“华旗汽水”是当地的名牌产品,市场占有率较高。

2003年改组为华旗股份有限公司,总股本2 500万股。

公司章程中规定,公司净利润按以下顺序分配:(1)弥补上一年度亏损;(2) 提取10%的法定公积金;(3)提取15%任意公积金;(4)支付股东股利。

公司实行同股同权的分配政策。

公司董事会在每年会计年度结束后提出分配预案,报股东大会批准实施。

除股东大会另有决议外,股利每年派发一次,在每个会计年度结束后六个月内,按股东持股比例进行分配。

当董事会认为必要时,在提请股东大会讨论通过后,可増派年度屮期股利。

随着市场经济的不断深化,我国饮品市场发展越来越迅猛,全球市场--体化趋势在饮品市场尤为突出,一些国内外知名饮品,如可口可乐、百事可乐、汇源等,不断涌入木地市场,饮品行业竞争日益激烈。

华旗公司的市场占有率不断降低,经营业绩也随之不断下降,公司管理层对此忧心忡忡,认为应该对华旗公司各个方面进行重新定位,其中包括股利政策。

华旗公司于2015年1月15 FI召开董事会会议,要求公司的总会计师对公司目前财务状况做出分析,同时提出新的财务政策方案,以供董事会讨论。

总会计师为此召集有关人员进行了深入细致的调查,获得了以下有关资料:(-)我国饮品行业状况近几年我国饮品行业发展迅速,在国民经济各行业中走在了前列,冃前市场竞争非常激烈,但市场并没有饱和。

从资料看,欧洲每年人均各类饮品消费量为200公斤,我国每年人均消费各种饮料还不到10公斤。

可见,我国饮品仍有着巨大的市场潜力。

果味饮料、碳酸饮料市场日趋畏缩,绿色无污染保健饮品、纯果汁饮品、植物蛋白饮品,以及茶饮品,正在成为饮品家族的新牛力量,在市场上崭露头角,市场潜力巨大。

(-)华旗公司目前经营状况公司目前的主要能力主要用于三大类产品,其中40%的生产能力用于生产传统产品——碳酸饮料和果味饮料;50%的生产能力用于生产第二大类产品——矿泉水和瓶装纯净水,是公司目前利润的主要来源。

英文版罗斯公司理财习题答案Chap002

CHAPTER 2ACCOUNTING STATEMENTS, TAXES AND CASH FLOWAnswers to Concepts Review and Critical Thinking Questions1.Liquidity measures how quickly and easily an asset can be converted to cash without significant lossin value. It’s desirable for firms to have high liquidity so that they have a large factor of safety in meeting short-term creditor demands. However, since liquidity also has an opportunity cost associated with it - namely that higher returns can generally be found by investing the cash into productive assets - low liquidity levels are also desirable to the firm. It’s up to the firm’s financial management staff to find a reasonable compromise between these opposing needs2.The recognition and matching principles in financial accounting call for revenues, and the costsassociated with producing those revenues, to be “booked” when the revenue process is essentially complete, not necessarily when the cash is collected or bills are paid. Note that this way is not necessarily correct; it’s the way accountants have chosen to do it.3.The bottom line number shows the change in the cash balance on the balance sheet. As such, it is nota useful number for analyzing a company.4. The major difference is the treatment of interest expense. The accounting statement of cash flowstreats interest as an operating cash flow, while the financial cash flows treat interest as a financing cash flow. The logic of the accounting statement of cash flows is that since interest appears on the income statement, which shows the operations for the period, it is an operating cash flow. In reality, interest is a financing expense, which results from the company’s choice of debt/equity. We will have more to say about this in a later chapter. When comparing the two cash flow statements, the financial statement of cash flows is a more appropriate measure of the company’s performance because of its treatment of interest.5.Market values can never be negative. Imagine a share of stock selling for –$20. This would meanthat if you placed an order for 100 shares, you would get the stock along with a check for $2,000.How many shares do you want to buy? More generally, because of corporate and individual bankruptcy laws, net worth for a person or a corporation cannot be negative, implying that liabilities cannot exceed assets in market value.6.For a successful company that is rapidly expanding, for example, capital outlays will be large,possibly leading to negative cash flow from assets. In general, what matters is whether the money is spent wisely, not whether cash flow from assets is positive or negative.7.It’s probably not a good sign for an established company, but it would be fairly ordinary for a start-up, so it depends.8.For example, if a company were to become more efficient in inventory management, the amount ofinventory needed would decline. The same might be true if it becomes better at collecting its receivables. In general, anything that leads to a decline in ending NWC relative to beginning would have this effect. Negative net capital spending would mean more long-lived assets were liquidated than purchased.9.If a company raises more money from selling stock than it pays in dividends in a particular period,its cash flow to stockholders will be negative. If a company borrows more than it pays in interest and principal, its cash flow to creditors will be negative.10.The adjustments discussed were purely accounting changes; they had no cash flow or market valueconsequences unless the new accounting information caused stockholders to revalue the derivatives. Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basic1.To find owner’s equity, we must construct a balance sheet as follows:Balance SheetCA $5,000 CL $4,500NFA 23,000 LTD 13,000OE ??TA $28,000 TL & OE $28,000We know that total liabilities and owner’s equity (TL & OE) must equal total assets of $28,000. We also know that TL & OE is equal to current liabilities plus long-term debt plus owner’s equity, so owner’s equity is:O E = $28,000 –13,000 – 4,500 = $10,500N WC = CA – CL = $5,000 – 4,500 = $5002. The income statement for the company is:Income StatementSales S/.527,000Costs 280,000Depreciation 38,000EBIT S/.209,000Interest 15,000EBT S/.194,000Taxes (35%) 67,900Net income S/.126,100One equation for net income is:Net income = Dividends + Addition to retained earningsRearranging, we get:Addition to retained earnings = Net income – DividendsAddition to retained earnings = S/.126,100 – 48,000Addition to retained earnings = S/.78,1003.To find the book value of current assets, we use: NWC = CA – CL. Rearranging to solve for currentassets, we get:CA = NWC + CL = $900K + 2.2M = $3.1MThe market value of current assets and fixed assets is given, so:Book value CA = $3.1M Market value CA = $2.8MBook value NFA = $4.0M Market value NFA = $3.2MBook value assets = $3.1M + 4.0M = $7.1M Market value assets = $2.8M + 3.2M = $6.0M 4.Taxes = 0.15(€50K) + 0.25(€25K) + 0.34(€25K) + 0.39(€273K – 100K)Taxes = €89,720The average tax rate is the total tax paid divided by net income, so:Average tax rate = €89,720 / €273,000Average tax rate = 32.86%.The marginal tax rate is the tax rate on the next €1 of earnings, so the marginal tax rate = 39%.5.To calculate OCF, we first need the income statement:Income StatementSales 元13,500Costs 5,400Depreciation 1,200EBIT 元6,900Interest 680Taxable income 元6,220Taxes (35%) 2,177Net income 元4,043OCF = EBIT + Depreciation – TaxesOCF = 元6,900 + 1,200 – 2,177OCF = 元5,923 capital spending = NFA end– NFA beg + DepreciationNet capital spending = £4,700,000 – 4,200,000 + 925,000 Net capital spending = £1,425,0007.The long-term debt account will increase by $8 million, the amount of the new long-term debt issue.Since the company sold 10 million new shares of stock with a $1 par value, the common stock account will increase by $10 million. The capital surplus account will increase by $16 million, the value of the new stock sold above its par value. Since the company had a net income of $7 million, and paid $4 million in dividends, the addition to retained earnings was $3 million, which will increase the accumulated retained earnings account. So, the new long-term debt and stockholders’ equity portion of the balance sheet will be:Long-term debt $ 68,000,000Total long-term debt $ 68,000,000Shareholders equityPreferred stock $ 18,000,000Common stock ($1 par value) 35,000,000Accumulated retained earnings 92,000,000Capital surplus 65,000,000Total equity $ 210,000,000Total Liabilities & Equity $ 278,000,0008.Cash flow to creditors = Interest paid – Net new borrowingCash flow to creditors = €340,000 – (LTD end– LTD beg)Cash flow to creditors = €340,000 – (€3,100,000 – 2,800,000)Cash flow to creditors = €340,000 – 300,000Cash flow to creditors = €40,0009. Cash flow to stockholders = Dividends paid – Net new equityCash flow to stockholders = €600,000 – [(Common end + APIS end) – (Common beg + APIS beg)]Cash flow to stockholders = €600,000 – [(€855,000 + 7,600,000) – (€820,000 + 6,800,000)]Cash flow to stockholders = €600,000 – (€7,620,000 – 8,455,000)Cash flow to stockholders = –€235,000Note, APIS is the additional paid-in surplus.10. Cash flow from assets = Cash flow to creditors + Cash flow to stockholders= €40,000 – 235,000= –€195,000Cash flow from assets = –€195,000 = OCF – Change in NWC – Net capital spending= OCF – (–€165,000) – 760,000= –€195,000Operating cash flow = –€195,000 – 165,000 + 760,000= €400,000Intermediate11. a.The accounting statement of cash flows explains the change in cash during the year. Theaccounting statement of cash flows will be:Statement of cash flowsOperationsNet income ZW$125Depreciation 75Changes in other current assets (25)Total cash flow from operations ZW$175Investing activitiesAcquisition of fixed assets ZW$(175)Total cash flow from investing activities ZW$(175)Financing activitiesProceeds of long-term debt ZW$90Current liabilities 10Dividends (65)Total cash flow from financing activities ZW$35Change in cash (on balance sheet) ZW$35b.Change in NWC = NWC end– NWC beg= (CA end– CL end) – (CA beg– CL beg)= [(ZW$45 + 145) – 70] – [(ZW$10 + 120) – 60)= ZW$120 – 70= ZW$50c.To find the cash flow generated by the firm’s assets, we need the operating cash flow, and thecapital spending. So, calculating each of these, we find:Operating cash flowNet income ZW$125Depreciation 75Operating cash flow ZW$200Note that we can calculate OCF in this manner since there are no taxes.Capital spendingEnding fixed assets ZW$250Beginning fixed assets (150)Depreciation 75Capital spending ZW$175Now we can calculate the cash flow generated by the firm’s assets, which is:Cash flow from assetsOperating cash flow ZW$200Capital spending (175)Change in NWC (50)Cash flow from assets ZW$(25)Notice that the accounting statement of cash flows shows a positive cash flow, but the financial cash flows show a negative cash flow. The cash flow generated by the firm’s assets is a better number for analyzing the firm’s performance.12.With the information provided, the cash flows from the firm are the capital spending and the changein net working capital, so:Cash flows from the firmCapital spending $(3,000)Additions to NWC (1,000)Cash flows from the firm $(4,000)And the cash flows to the investors of the firm are:Cash flows to investors of the firmSale of short-term debt $(7,000)Sale of long-term debt (18,000)Sale of common stock (2,000)Dividends paid 23,000Cash flows to investors of the firm $(4,000)13. a. The interest expense for the company is the amount of debt times the interest rate on the debt.So, the income statement for the company is:Income StatementSales £1,000,000Cost of goods sold 300,000Selling costs 200,000Depreciation 100,000EBIT £400,000Interest 100,000Taxable income £300,000Taxes (35%) 105,000Net income £195,000b. And the operating cash flow is:OCF = EBIT + Depreciation – TaxesOCF = £400,000 + 100,000 – 105,000OCF = £395,00014.To find the OCF, we first calculate net income.Income StatementSales Au$145,000Costs 86,000Depreciation 7,000Other expenses 4,900EBIT Au$47,100Interest 15,000Taxable income Au$32,100Taxes 12,840Net income Au$19,260Dividends Au$8,700Additions to RE Au$10,560a.OCF = EBIT + Depreciation – TaxesOCF = Au$47,100 + 7,000 – 12,840OCF = Au$41,260b.CFC = Interest – Net new LTDCFC = Au$15,000 – (–Au$6,500)CFC = Au$21,500Note that the net new long-term debt is negative because the company repaid part of its long-term debt.c.CFS = Dividends – Net new equityCFS = Au$8,700 – 6,450CFS = Au$2,250d.We know that CFA = CFC + CFS, so:CFA = Au$21,500 + 2,250 = Au$23,750CFA is also equal to OCF – Net capital spending – Change in NWC. We already know OCF.Net capital spending is equal to:Net capital spending = Increase in NFA + DepreciationNet capital spending = Au$5,000 + 7,000Net capital spending = Au$12,000Now we can use:CFA = OCF – Net capital spending – Change in NWCAu$23,750 = Au$41,260 – 12,000 – Change in NWC.Solving for the change in NWC gives Au$5,510, meaning the company increased its NWC by Au$5,510.15.The solution to this question works the income statement backwards. Starting at the bottom:Net income = Dividends + Addition to ret. earningsNet income = $900 + 4,500Net income = $5,400Now, looking at the income statement:EBT –EBT × Tax rate = Net incomeRecognize that EBT × tax rate is simply the calculation for taxes. Solving this for EBT yields: EBT = NI / (1– tax rate)EBT = $5,400 / 0.65EBT = $8,308Now we can calculate:EBIT = EBT + interestEBIT = $8,308 + 1,600EBIT = $9,908The last step is to use:EBIT = Sales – Costs – DepreciationEBIT = $29,000 – 13,000 – DepreciationEBIT = $9,908Solving for depreciation, we find that depreciation = $6,092.16.The balance sheet for the company looks like this:Balance SheetCash ¥175,000 Accounts payable ¥430,000 Accounts receivable 140,000 Notes payable 180,000 Inventory 265,000 Current liabilities ¥610,000 Current assets ¥580,000 Long-term debt 1,430,000Total liabilities ¥2,040,000 Tangible net fixed assets 2,900,000Intangible net fixed assets 720,000 Common stock ??Accumulated ret. earnings 1,240,000 Total assets ¥4,200,000 Total liab. & owners’ equity¥4,200,000Total liabilities and owners’ equity is:TL & OE = CL + LTD + Common stockSolving for this equation for equity gives us:Common stock = ¥4,200,000 – 1,240,000 – 2,040,000Common stock = ¥920,00017.The market value of shareholders’ equity cannot be zero. A negative market va lue in this case wouldimply that the company would pay you to own the stock. The market value of shareholders’ equity can be stated as: Shareholders’ equity = Max [(TA – TL), 0]. So, if TA is 元4,000,000 equity is equal to 元1,000,000 and if TA is 元2,500,000 equity is equal to 元0. We should note here that the book value of shareholders’ equity can be negative.18. a. Taxes Growth = 0.15($50K) + 0.25($25K) + 0.34($10K) = $17,150Taxes Income = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) + 0.34($8.165M)= $2,890,000b. Each firm has a marginal tax rate of 34% on the next $10,000 of taxable income, despite theirdifferent average tax rates, so both firms will pay an additional $3,400 in taxes.19.Income StatementSales ₦850,000COGS 630,000A&S expenses 120,000Depreciation 130,000EBIT (₦30,000)Interest 85,000Taxable income (₦115,000)Taxes (30%) 0 income (₦115,000)b.OCF = EBIT + Depreciation – TaxesOCF = (₦30,000) + 130,000 – 0OCF = ₦100,000 income was negative because of the tax deductibility of depreciation and interest expense.However, the actual cash flow from operations was positive because depreciation is a non-cash expense and interest is a financing expense, not an operating expense.20. A firm can still pay out dividends if net income is negative; it just has to be sure there is sufficientcash flow to make the dividend payments.Change in NWC = Net capital spending = Net new equity = 0. (Given)Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = ₦100,000 – 0 – 0 = ₦100,000Cash flow to stockholders = Dividends – Net new equityCash flow to stockholders = ₦30,000 – 0 = ₦30,000Cash flow to creditors = Cash flow from assets – Cash flow to stockholdersCash flow to creditors = ₦100,000 – 30,000Cash flow to creditors = ₦70,000Cash flow to creditors is also:Cash flow to creditors = Interest – Net new LTDSo:Net new LTD = Interest – Cash flow to creditorsNet new LTD = ₦85,000 – 70,000Net new LTD = ₦15,00021. a.The income statement is:Income StatementSales $12,800Cost of good sold 10,400Depreciation 1,900EBIT $ 500Interest 450Taxable income $ 50Taxes (34%) 17Net income $33b.OCF = EBIT + Depreciation – TaxesOCF = $500 + 1,900 – 17OCF = $2,383c.Change in NWC = NWC end– NWC beg= (CA end– CL end) – (CA beg– CL beg)= ($3,850 – 2,100) – ($3,200 – 1,800)= $1,750 – 1,400 = $350Net capital spending = NFA end– NFA beg + Depreciation= $9,700 – 9,100 + 1,900= $2,500CFA = OCF – Change in NWC – Net capital spending= $2,383 – 350 – 2,500= –$467The cash flow from assets can be positive or negative, since it represents whether the firm raised funds or distributed funds on a net basis. In this problem, even though net income and OCF are positive, the firm invested heavily in both fixed assets and net working capital; it had to raise a net $467 in funds from its stockholders and creditors to make these investments.d.Cash flow to creditors = Interest – Net new LTD= $450 – 0= $450Cash flow to stockholders = Cash flow from assets – Cash flow to creditors= –$467 – 450= –$917We can also calculate the cash flow to stockholders as:Cash flow to stockholders = Dividends – Net new equitySolving for net new equity, we get:Net new equity = $500 – (–917)= $1,417The firm had positive earnings in an accounting sense (NI > 0) and had positive cash flow from operations. The firm invested $350 in new net working capital and $2,500 in new fixed assets. The firm had to raise $467 from its stakeholders to support this new investment. It accomplished this by raising $1,417 in the form of new equity. After paying out $500 of this in the form of dividends to shareholders and $450 in the form of interest to creditors, $467 was left to meet the firm’s cash flow needs for investment.22. a.Total assets 2005 = ¥650,000 + 2,900,000 = ¥3,550,000Total liabilities 2005 = ¥265,000 + 1,500,000 = ¥1,765,000Owners’ equity 2005 = ¥3,550,000 – 1,765,000 = ¥1,785,000Total assets 2006 = ¥705,000 + 3,400,000 = ¥4,105,000Total liabilities 2006 = ¥290,000 + 1,720,000 = ¥2,010,000Owners’ equity 2006 = ¥4,105,000 – 2,010,000 = ¥2,095,000b.NWC 2005 = CA05 – CL05 = ¥650,000 – 265,000 = ¥385,000NWC 2006 = CA06 – CL06 = ¥705,000 – 290,000 = ¥415,000Change in NWC = NWC06 – NWC05 = ¥415,000 – 385,000 = ¥30,000c.We can calculate net capital spending as:Net capital spending = Net fixed assets 2006 – Net fixed assets 2005 + DepreciationNet capital spending = ¥3,400,000 – 2,900,000 + 800,000Net capital spending = ¥1,300,000So, the company had a net capital spending cash flow of ¥1,300,000. We also know that net capital spending is:Net capital spending = Fixed assets bought – Fixed assets sold¥1,300,000 = ¥1,500,000 – Fixed assets soldFixed assets sold = ¥1,500,000 – 1,300,000 = ¥200,000To calculate the cash flow from assets, we must first calculate the operating cash flow. The operating cash flow is calculated as follows (you can also prepare a traditional income statement):EBIT = Sales – Costs – DepreciationEBIT = ¥8,600,000 – 4,150,000 – 800,000EBIT = ¥3,650,000EBT = EBIT – InterestEBT = ¥3,650,000 – 216,000EBT = ¥3,434,000Taxes = EBT ⨯ .35Taxes = ¥3,434,000 ⨯ .35Taxes = ¥1,202,000OCF = EBIT + Depreciation – TaxesOCF = ¥3,650,000 + 800,000 – 1,202,000OCF = ¥3,248,000Cash flow from assets = OCF – Change in NWC – Net capital spending.Cash flow from assets = ¥3,248,000 – 30,000 – 1,300,000Cash flow from assets = ¥1,918,000 new borrowing = LTD06 – LTD05Net new borrowing = ¥1,720,000 – 1,500,000Net new borrowing = ¥220,000Cash flow to creditors = Interest – Net new LTDCash flow to creditors = ¥216,000 – 220,000Cash flow to creditors = –¥4,000Net new borrowing = ¥220,000 = Debt issued – Debt retiredDebt retired = ¥300,000 – 220,000 = ¥80,00023.Balance sheet as of Dec. 31, 2005Cash €2,107 Accounts payable €2,213Accounts receivable 2,789 Notes payable 407Inventory 4,959 Current liabilities €2,620Current assets €9,855Long-term debt €7,056 Net fixed assets €17,669 Owners' equity €17,848Total assets €27,524 Total liab. & equity €27,524Balance sheet as of Dec. 31, 2006Cash €2,155 Accounts payable €2,146Accounts receivable 3,142 Notes payable 382Inventory 5,096 Current liabilities €2,528Current assets €10,393Long-term debt €8,232 Net fixed assets €18,091 Owners' equity €17,724Total assets €28,484 Total liab. & equity €28,4842005 Income Statement 2006 Income Statement Sales €4,018.00 Sales €4,312.00 COGS 1,382.00 COGS 1,569.00 Other expenses 328.00 Other expenses 274.00 Depreciation 577.00 Depreciation 578.00 EBIT €1,731.00 EBIT €1,891.00 Interest 269.00 Interest 309.00 EBT €1,462.00 EBT €1,582.00 Taxes (34%) 497.08 Taxes (34%) 537.88 Net income € 964.92 Net income €1,044.12 Dividends €490.00 Dividends €539.00 Additions to RE €474.92 Additions to RE €505.12 24.OCF = EBIT + Depreciation – TaxesOCF = €1,891 + 578 – 537.88OCF = €1,931.12Change in NWC = NWC end– NWC beg = (CA – CL) end– (CA – CL) begChange in NWC = (€10,393 – 2,528) – (€9,855 – 2,620)Change in NWC = €7,865 – 7,235 = €630Net capital spending = NFA end– NFA beg+ DepreciationNet capital spending = €18,091 – 17,669 + 578Net capital spending = €1,000Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = €1,931.12 – 630 – 1,000Cash flow from assets = €301.12Cash flow to creditors = Interest – Net new LTDNet new LTD = LTD end– LTD begCash flow to creditors = €309 – (€8,232 – 7,056)Cash flow to creditors = –€867Net new equity = Common stock end– Common stock begCommon stock + Retained earnings = T otal owners’ equityNet new equity = (OE – RE) end– (OE – RE) begNet new equity = OE end– OE beg + RE beg– RE endRE end= RE beg+ Additions to RE04Net new equity = OE end– OE beg+ RE beg– (RE beg + Additions to RE06)= OE end– OE beg– Additions to RENet new equity = €17,724 – 17,848 – 505.12 = –€629.12Cash flow to stockholders = Dividends – Net new equityCash flow to stockholders = €539 – (–€629.12)Cash flow to stockholders = €1,168.12As a check, cash flow from assets is €301.12.Cash flow from assets = Cash flow from creditors + Cash flow to stockholdersCash flow from assets = –€867 + 1,168.12Cash flow from assets = €301.12Challenge25.We will begin by calculating the operating cash flow. First, we need the EBIT, which can becalculated as:EBIT = Net income + Current taxes + Deferred taxes + InterestEBIT = £192 + 110 + 21 + 57EBIT = £380Now we can calculate the operating cash flow as:Operating cash flowEarnings before interest and taxes £380Depreciation 105Current taxes (110)Operating cash flow £375The cash flow from assets is found in the investing activities portion of the accounting statement of cash flows, so:Cash flow from assetsAcquisition of fixed assets £198Sale of fixed assets (25)Capital spending £173The net working capital cash flows are all found in the operations cash flow section of the accounting statement of cash flows. However, instead of calculating the net working capital cash flows as the change in net working capital, we must calculate each item individually. Doing so, we find:Net working capital cash flowCash £140Accounts receivable 31Inventories (24)Accounts payable (19)Accrued expenses 10Notes payable (6)Other (2)NWC cash flow £130Except for the interest expense and notes payable, the cash flow to creditors is found in the financing activities of the accounting statement of cash flows. The interest expense from the income statement is given, so:Cash flow to creditorsInterest £57Retirement of debt 84Debt service £141Proceeds from sale of long-term debt (129)Total £12And we can find the cash flow to stockholders in the financing section of the accounting statement of cash flows. The cash flow to stockholders was:Cash flow to stockholdersDividends £94Repurchase of stock 15Cash to stockholders £109Proceeds from new stock issue (49)Total £60 capital spending = NFA end– NFA beg + Depreciation= (NFA end– NFA beg) + (Depreciation + AD beg) – AD beg= (NFA end– NFA beg)+ AD end– AD beg= (NFA end + AD end) – (NFA beg + AD beg) = FA end– FA beg27. a.The tax bubble causes average tax rates to catch up to marginal tax rates, thus eliminating thetax advantage of low marginal rates for high income corporations.b.Assuming a taxable income of $100,000, the taxes will be:Taxes = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) = $113.9KAverage tax rate = $113.9K / $335K = 34%The marginal tax rate on the next dollar of income is 34 percent.For corporate taxable income levels of $335K to $10M, average tax rates are equal to marginal tax rates.Taxes = 0.34($10M) + 0.35($5M) + 0.38($3.333M) = $6,416,667Average tax rate = $6,416,667 / $18,333,334 = 35%The marginal tax rate on the next dollar of income is 35 percent. For corporate taxable income levels over $18,333,334, average tax rates are again equal to marginal tax rates.c.Taxes = 0.34($200K) = $68K = 0.15($50K) + 0.25($25K) + 0.34($25K) + X($100K);X($100K) = $68K – 22.25K = $45.75KX = $45.75K / $100KX = 45.75%。

罗斯公司理财Chap002全英文题库及答案

罗斯公司理财Chap002全英⽂题库及答案Chapter 02 Financial Statements and Cash Flow Answer KeyMultiple Choice Questions1. The financial statement showing a firm's accounting value on a particular date is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: BALANCE SHEETType: DEFINITIONS2. A current asset is:A. an item currently owned by the firm.B. an item that the firm expects to own within the next year.C. an item currently owned by the firm that will convert to cash within the next 12 months.D. the amount of cash on hand the firm currently shows on its balance sheet.E. the market value of all items currently owned by the firm.Difficulty level: EasyTopic: CURRENT ASSETSType: DEFINITIONS3. The long-term debts of a firm are liabilities:A. that come due within the next 12 months.B. that do not come due for at least 12 months.C. owed to the firm's suppliers.D. owed to the firm's shareholders.E. the firm expects to incur within the next 12 months.Difficulty level: EasyTopic: LONG-TERM DEBTType: DEFINITIONS4. Net working capital is defined as:A. total liabilities minus shareholders' equity.B. current liabilities minus shareholders' equity.C. fixed assets minus long-term liabilities.D. total assets minus total liabilities.E. current assets minus current liabilities.Difficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS5. A(n) ____ asset is one which can be quickly converted into cash without significant loss in value.A. currentB. fixedC. intangibleD. liquidE. long-termDifficulty level: EasyTopic: LIQUID ASSETSType: DEFINITIONS6. The financial statement summarizing a firm's accounting performance over a period of time is the:A. income statement.B. balance sheet.C. statement of cash flows.D. tax reconciliation statement.E. shareholders' equity sheet.Difficulty level: EasyTopic: INCOME STATEMENTType: DEFINITIONS7. Noncash items refer to:A. the credit sales of a firm.B. the accounts payable of a firm.C. the costs incurred for the purchase of intangible fixed assets.D. expenses charged against revenues that do not directly affect cash flow.E. all accounts on the balance sheet other than cash on hand.Difficulty level: EasyTopic: NONCASH ITEMSType: DEFINITIONS8. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: MARGINAL TAX RATESType: DEFINITIONS9. Your _____ tax rate is the total taxes you pay divided by your taxable income.A. deductibleB. residualC. totalD. averageE. marginalDifficulty level: EasyTopic: AVERAGE TAX RATESType: DEFINITIONS10. _____ refers to the cash flow that results from the firm's ongoing, normal business activities.A. Cash flow from operating activitiesB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATING ACTIVITIESType: DEFINITIONS11. _____ refers to the changes in net capital assets.A. Operating cash flowB. Cash flow from investingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM INVESTINGType: DEFINITIONS12. _____ refers to the difference between a firm's current assets and its current liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from assetsE. Cash flow to creditorsDifficulty level: EasyTopic: NET WORKING CAPITALType: DEFINITIONS13. _____ is calculated by adding back noncash expenses to net income and adjusting for changes in current assets and liabilities.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from operationsE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW FROM OPERATIONSType: DEFINITIONS14. _____ refers to the firm's interest payments less any net new borrowing.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from shareholdersE. Cash flow to creditorsDifficulty level: MediumTopic: CASH FLOW TO CREDITORSType: DEFINITIONS15. _____ refers to the firm's dividend payments less any net new equity raised.A. Operating cash flowB. Capital spendingC. Net working capitalD. Cash flow from creditorsE. Cash flow to stockholdersDifficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: DEFINITIONS16. Earnings per share is equal to:A. net income divided by the total number of shares outstanding.B. net income divided by the par value of the common stock.C. gross income multiplied by the par value of the common stock.D. operating income divided by the par value of the common stock.E. net income divided by total shareholders' equity.Difficulty level: MediumTopic: EARNINGS PER SHAREType: DEFINITIONS17. Dividends per share is equal to dividends paid:A. divided by the par value of common stock.B. divided by the total number of shares outstanding.C. divided by total shareholders' equity.D. multiplied by the par value of the common stock.E. multiplied by the total number of shares outstanding. Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: DEFINITIONS18. Which of the following are included in current assets?I. equipmentII. inventoryIII. accounts payableIV. cashA. II and IV onlyB. I and III onlyC. I, II, and IV onlyD. III and IV onlyE. II, III, and IV onlyDifficulty level: MediumTopic: CURRENT ASSETSType: CONCEPTS19. Which of the following are included in current liabilities?I. note payable to a supplier in eighteen monthsII. debt payable to a mortgage company in nine monthsIII. accounts payable to suppliersIV. loan payable to the bank in fourteen monthsA. I and III onlyB. II and III onlyC. III and IV onlyD. II, III, and IV onlyE. I, II, and III onlyDifficulty level: MediumTopic: CURRENT LIABILITIESType: CONCEPTS20. An increase in total assets:A. means that net working capital is also increasing.B. requires an investment in fixed assets.C. means that shareholders' equity must also increase.D. must be offset by an equal increase in liabilities and shareholders' equity.E. can only occur when a firm has positive net income.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS21. Which one of the following assets is generally the most liquid?A. inventoryB. buildingsC. accounts receivableD. equipmentE. patentsDifficulty level: MediumTopic: LIQUIDITYType: CONCEPTS22. Which one of the following statements concerning liquidity is correct?A. If you sold an asset today, it was a liquid asset.B. If you can sell an asset next year at a price equal to its actual value, the asset is highly liquid.C. Trademarks and patents are highly liquid.D. The less liquidity a firm has, the lower the probability the firm will encounter financial difficulties.E. Balance sheet accounts are listed in order of decreasing liquidity.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS23. Liquidity is:A. a measure of the use of debt in a firm's capital structure.B. equal to current assets minus current liabilities.C. equal to the market value of a firm's total assets minus its current liabilities.D. valuable to a firm even though liquid assets tend to be less profitable to own.E. generally associated with intangible assets.Difficulty level: MediumTopic: LIQUIDITYType: CONCEPTS24. Which of the following accounts are included in shareholders' equity?I. interest paidII. retained earningsIII. capital surplusIV. long-term debtA. I and II onlyB. II and IV onlyC. I and IV onlyD. II and III onlyE. I and III onlyDifficulty level: MediumTopic: SHAREHOLDERS' EQUITYType: CONCEPTS25. Book value:A. is equivalent to market value for firms with fixed assets.B. is based on historical cost.C. generally tends to exceed market value when fixed assets are included.D. is more of a financial than an accounting valuation.E. is adjusted to market value whenever the market value exceeds the stated book value. Difficulty level: Medium Topic: BOOK VALUEType: CONCEPTS26. When making financial decisions related to assets, you should:A. always consider market values.B. place more emphasis on book values than on market values.C. rely primarily on the value of assets as shown on the balance sheet.D. place primary emphasis on historical costs.E. only consider market values if they are less than book values.Topic: MARKET VALUEType: CONCEPTS27. As seen on an income statement:A. interest is deducted from income and increases the total taxes incurred.B. the tax rate is applied to the earnings before interest and taxes when the firm has both depreciation and interest expenses.C. depreciation is shown as an expense but does not affect the taxes payable.D. depreciation reduces both the pretax income and the net income.E. interest expense is added to earnings before interest and taxes to get pretax income. Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS28. The earnings per share will:A. increase as net income increases.B. increase as the number of shares outstanding increase.C. decrease as the total revenue of the firm increases.D. increase as the tax rate increases.E. decrease as the costs decrease.Difficulty level: MediumTopic: EARNINGS PER SHAREType: CONCEPTS29. Dividends per share:A. increase as the net income increases as long as the number of shares outstanding remains constant.B. decrease as the number of shares outstanding decrease, all else constant.C. are inversely related to the earnings per share.D. are based upon the dividend requirements established by Generally Accepted Accounting Procedures.E. are equal to the amount of net income distributed to shareholders divided by the number of shares outstanding. Difficulty level: MediumTopic: DIVIDENDS PER SHAREType: CONCEPTS30. Earnings per shareA. will increase if net income increases and number of shares remains constant.B. will increase if net income decreases and number of shares remains constant.C. is number of shares divided by net income.D. is the amount of money that goes into retained earnings on a per share basis.E. None of the above.Topic: EARNINGS PER SHAREType: CONCEPTS31. According to Generally Accepted Accounting Principles, costs are:A. recorded as incurred.B. recorded when paid.C. matched with revenues.D. matched with production levels.E. expensed as management desires.Difficulty level: MediumTopic: MATCHING PRINCIPLEType: CONCEPTS32. Depreciation:A. is a noncash expense that is recorded on the income statement.B. increases the net fixed assets as shown on the balance sheet.C. reduces both the net fixed assets and the costs of a firm.D. is a non-cash expense which increases the net operating income.E. decreases net fixed assets, net income, and operating cash flows.Difficulty level: MediumTopic: NONCASH ITEMSType: CONCEPTS33. When you are making a financial decision, the most relevant tax rate is the _____ rate.A. averageB. fixedC. marginalD. totalE. variableDifficulty level: MediumTopic: MARGINAL TAX RATEType: CONCEPTS34. An increase in which one of the following will cause the operating cash flow to increase?A. depreciationB. changes in the amount of net fixed capitalC. net working capitalD. taxesE. costsDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS35. A firm starts its year with a positive net working capital. During the year, the firm acquires more short-term debt than it does short-term assets. This means that:A. the ending net working capital will be negative.B. both accounts receivable and inventory decreased during the year.C. the beginning current assets were less than the beginning current liabilities.D. accounts payable increased and inventory decreased during the year.E. the ending net working capital can be positive, negative, or equal to zero.Difficulty level: MediumTopic: CHANGE IN NET WORKING CAPITALType: CONCEPTS36. The cash flow to creditors includes the cash:A. received by the firm when payments are paid to suppliers.B. outflow of the firm when new debt is acquired.C. outflow when interest is paid on outstanding debt.D. inflow when accounts payable decreases.E. received when long-term debt is paid off.Difficulty level: MediumTopic: CASH FLOW TO CREDITORSType: CONCEPTS37. Cash flow to stockholders must be positive when:A. the dividends paid exceed the net new equity raised.B. the net sale of common stock exceeds the amount of dividends paid.C. no income is distributed but new shares of stock are sold.D. both the cash flow to assets and the cash flow to creditors are negative.E. both the cash flow to assets and the cash flow to creditors are positive. Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS38. Which equality is the basis for the balance sheet?A. Fixed Assets = Stockholder's Equity + Current AssetsB. Assets = Liabilities + Stockholder's EquityC. Assets = Current Long-Term Debt + Retained EarningsD. Fixed Assets = Liabilities + Stockholder's EquityE. None of the aboveDifficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS39. Assets are listed on the balance sheet in order of:A. decreasing liquidity.B. decreasing size.C. increasing size.D. relative life.E. None of the above.Difficulty level: MediumTopic: BALANCE SHEETType: CONCEPTS40. Debt is a contractual obligation that:A. requires the payout of residual flows to the holders of these instruments.B. requires a repayment of a stated amount and interest over the period.C. allows the bondholders to sue the firm if it defaults.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: DEBTType: CONCEPTS41. The carrying value or book value of assets:A. is determined under GAAP and is based on the cost of the asset.B. represents the true market value according to GAAP.C. is always the best measure of the company's value to an investor.D. is always higher than the replacement cost of the assets.E. None of the above.Difficulty level: MediumTopic: CARRYING VALUEType: CONCEPTS42. Under GAAP, a firm's assets are reported at:A. market value.B. liquidation value.C. intrinsic value.D. cost.E. None of the above.Difficulty level: MediumTopic: GAAPType: CONCEPTS43. Which of the following statements concerning the income statement is true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It treats interest as an expense.E. All of the above.Difficulty level: MediumTopic: INCOME STATEMENTType: CONCEPTS44. According to generally accepted accounting principles (GAAP), revenue is recognized as income when:A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services are delivered.C. payment is requested.D. income taxes are paid.E. All of the above.Difficulty level: MediumTopic: GAAP INCOME RECOGNITIONType: CONCEPTS45. Which of the following is not included in the computation of operating cash flow?A. Earnings before interest and taxesB. Interest paidC. DepreciationD. Current taxesE. All of the above are includedDifficulty level: MediumTopic: OPERATING CASH FLOWType: CONCEPTS46. Net capital spending is equal to:A. net additions to net working capital.B. the net change in fixed assets.C. net income plus depreciation.D. total cash flow to stockholders less interest and dividends paid.E. the change in total assets.Difficulty level: MediumTopic: NET CAPITAL SPENDINGType: CONCEPTS47. Cash flow to stockholders is defined as:A. interest payments.B. repurchases of equity less cash dividends paid plus new equity sold.C. cash flow from financing less cash flow to creditors.D. cash dividends plus repurchases of equity minus new equity financing.E. None of the above.Difficulty level: MediumTopic: CASH FLOW TO STOCKHOLDERSType: CONCEPTS48. Free cash flow is:A. without cost to the firm.B. net income plus taxes.C. an increase in net working capital.D. cash that the firm is free to distribute to creditors and stockholders.E. None of the above.Difficulty level: MediumTopic: FREE CASH FLOWType: CONCEPTS49. The cash flow of the firm must be equal to:A. cash flow to stockholders minus cash flow to debtholders.B. cash flow to debtholders minus cash flow to stockholders.C. cash flow to governments plus cash flow to stockholders.D. cash flow to stockholders plus cash flow to debtholders.E. None of the above.Difficulty level: MediumTopic: CASH FLOWType: CONCEPTS50. Which of the following are all components of the statement of cash flows?A. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activitiesB. Cash flow from operating activities, cash flow from investing activities, and cash flow from divesting activitiesC. Cash flow from internal activities, cash flow from external activities, and cash flow from financing activitiesD. Cash flow from brokering activities, cash flow from profitable activities, and cash flow from non-profitable activitiesE. None of the above.Difficulty level: MediumTopic: STATEMENT OF CASH FLOWSType: CONCEPTS51. One of the reasons why cash flow analysis is popular is because:A. cash flows are more subjective than net income.B. cash flows are hard to understand.C. it is easy to manipulate, or spin the cash flows.D. it is difficult to manipulate, or spin the cash flows.E. None of the above.Difficulty level: MediumTopic: CASH FLOW MANAGEMENTType: CONCEPTS52. A firm has $300 in inventory, $600 in fixed assets, $200 in accounts receivable, $100 in accounts payable, and $50 in cash. What is the amount of the current assets?A. $500B. $550C. $600D. $1,150E. $1,200Current assets = $300 + $200 + $50 = $550Difficulty level: MediumTopic: CURRENT ASSETSType: PROBLEMS53. Total assets are $900, fixed assets are $600, long-term debt is $500, and short-term debt is $200. What is the amount of net working capital?A. $0B. $100C. $200D. $300E. $400Net working capital = $900 - $600 - $200 = $100Difficulty level: MediumTopic: NET WORKING CAPITALType: PROBLEMS54. Brad's Company has equipment with a book value of $500 that could be sold today at a 50% discount. Its inventory is valued at $400 and could be sold to a competitor for that amount. The firm has $50 in cash and customers owe it $300. What is the accounting value of its liquid assets?A. $50B. $350C. $700D. $750E. $1,000Liquid assets = $400 + $50 + $300 = $750Difficulty level: MediumTopic: LIQUIDITYType: PROBLEMS55. Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's balance sheet but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. Assuming the equipment is the firm's only fixed asset, what is the book value of shareholders' equity?A. $200B. $800C. $1,200D. $1,400E. The answer cannot be determined from the information providedBook value of shareholders' equity = $1,800 + $200 - $800 = $1,200Difficulty level: MediumTopic: BOOK VALUEType: PROBLEMS。

罗斯《公司理财》英文习题答案DOCchap022